Introduction: From Vegas Rain to Manufacturing Revolution

Matt Puchalski wasn't planning to become a logistics coordinator. But when his startup's first major trade show loomed and weather forecasts turned ominous, he did what founders do: he rented a Hyundai Santa Fe, packed it with booth materials, and drove 12 hours through Nevada rain to get his company to CES 2026.

It sounds unglamorous. And it was. But that decision tells you almost everything you need to know about Bucket Robotics and why it's worth paying attention to.

Bucket Robotics is a San Francisco-based startup that emerged from Y Combinator's recent batch. On the surface, it solves a specific manufacturing problem: automating visual quality inspection on production lines without requiring massive datasets or hardware overhauls. That sounds niche. It is. But the market is enormous, the technology is genuinely novel, and the team's execution at CES proved something important about startup instincts versus typical corporate thinking.

Puchalski's background tells part of the story. He spent the last decade at some of the most sophisticated autonomous vehicle companies on the planet: Uber, Argo AI, Ford's Latitude AI subsidiary, and SoftBank-backed Stack AV. That's not a random collection of resume entries. That's a curriculum in how to build complex robotic systems, manage stakeholder relationships in conservative industries, and understand what large manufacturers actually need versus what vendors think they need.

What matters now isn't where Puchalski came from. It's where Bucket Robotics is going. CES 2026 was just the first public test, and the results suggest the startup's timing, technology, and team alignment might actually be exceptional.

This article breaks down what happened in Las Vegas, why it matters, and what the next chapter looks like for a company trying to solve a problem that manufacturing has struggled with for decades.

TL; DR

- YC-backed Bucket Robotics debuted at CES 2026 with AI-powered quality inspection technology that eliminates the need for massive training datasets by generating synthetic defects from CAD files

- The startup's tech integrates into existing production lines without new hardware, addressing a critical pain point for manufacturers hesitant about automation costs

- Puchalski's decade of experience at Uber, Argo AI, and Latitude AI gave the team deep industry relationships and credibility with automotive and defense manufacturers

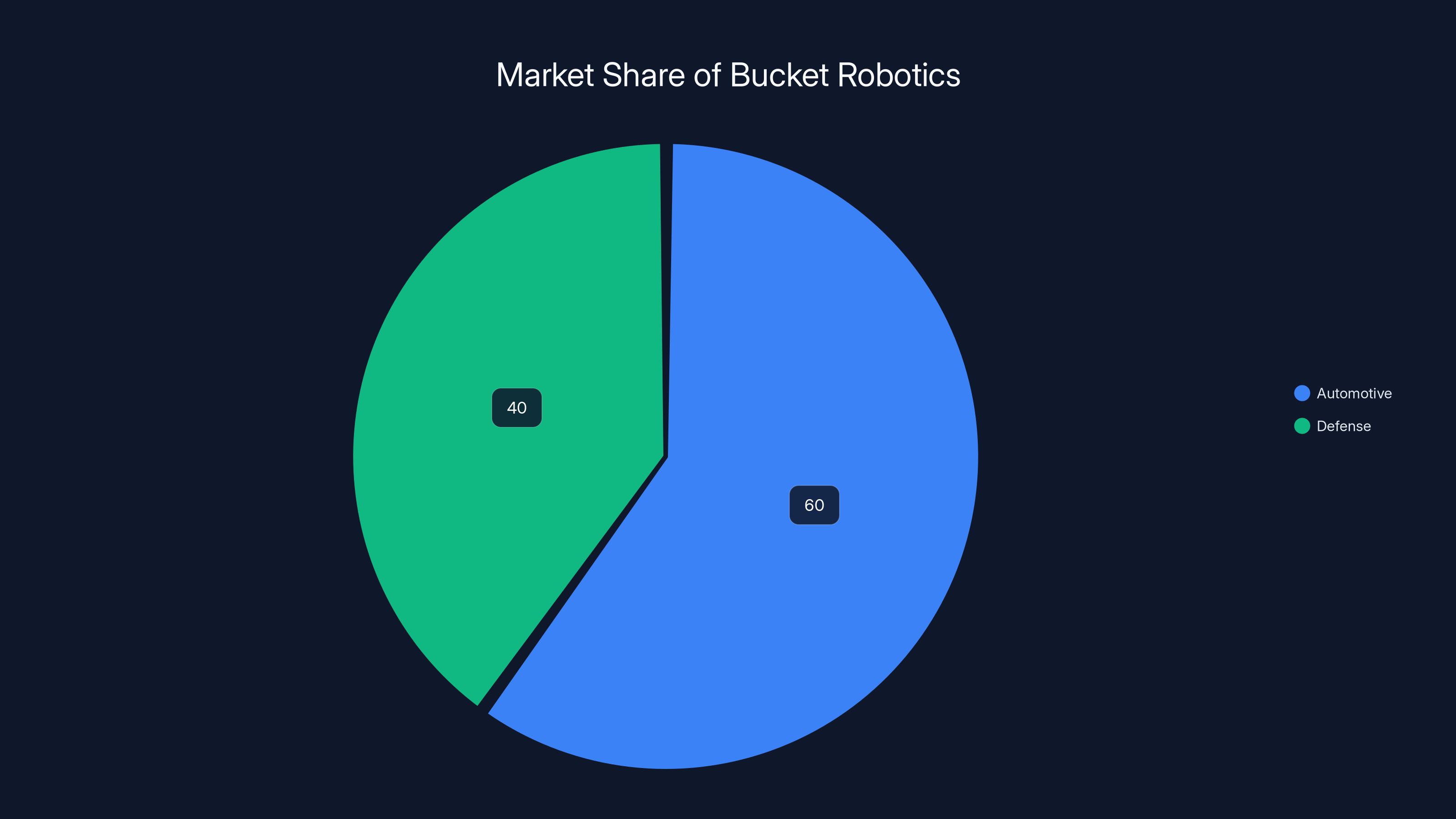

- Early traction includes customers in automotive and defense sectors, positioning Bucket Robotics as a "dual-use" company with broader addressable market

- The next phase requires capital, scaling, and converting CES leads into commercial contracts rather than relying on tech demos and industry networking

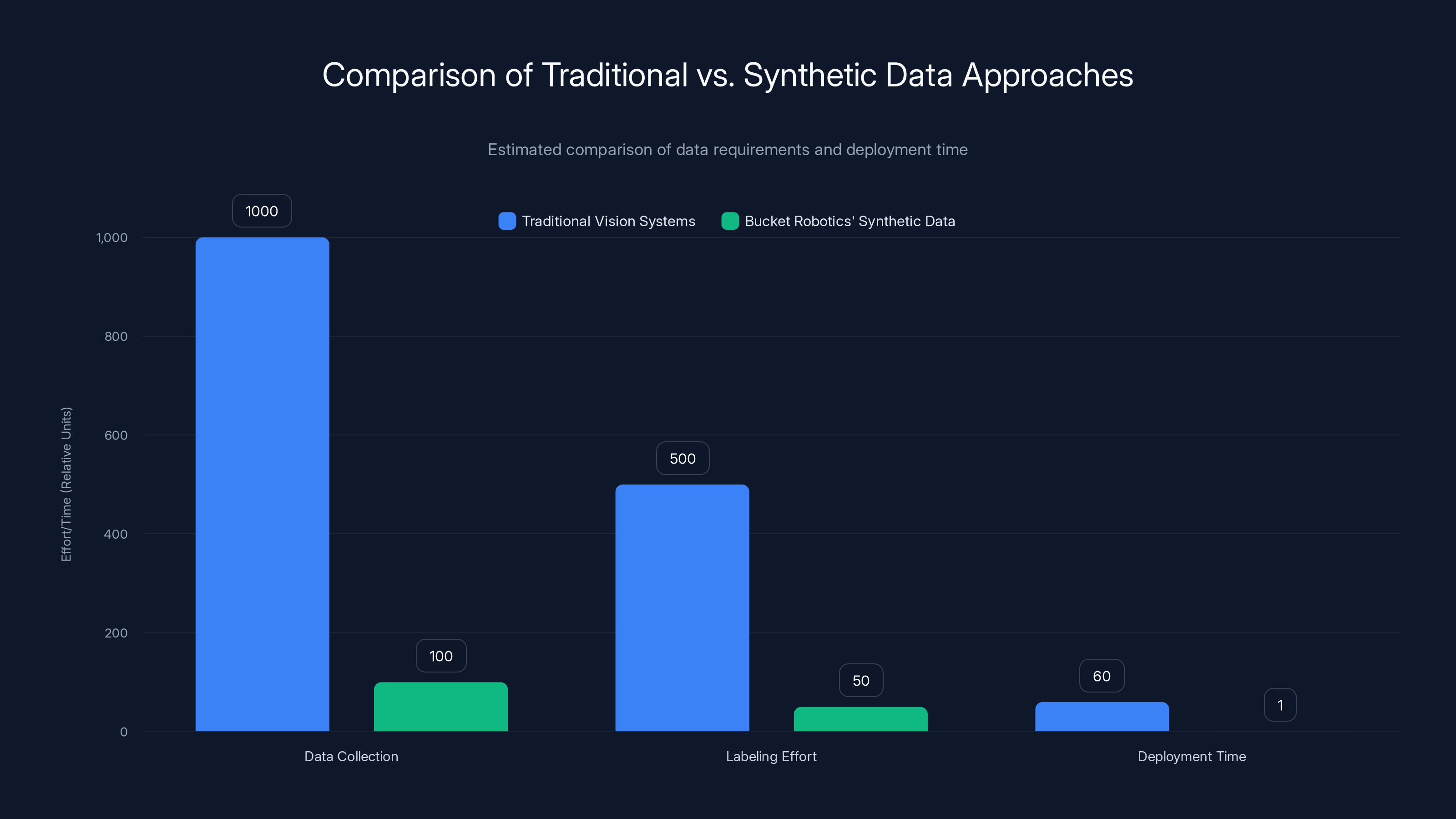

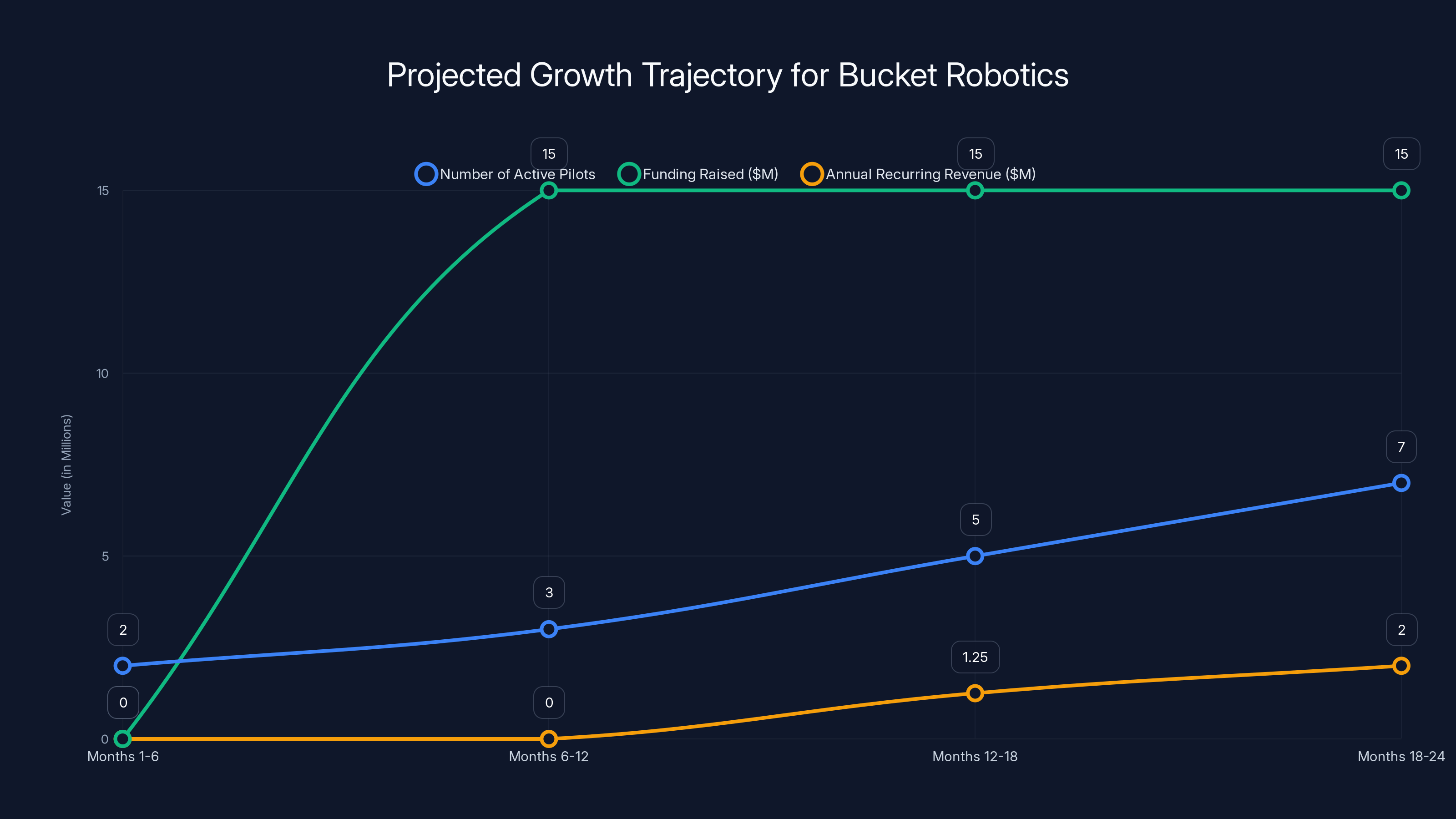

Bucket Robotics' synthetic data approach significantly reduces data collection and labeling efforts, and dramatically shortens deployment time from months to minutes. Estimated data.

The Problem Nobody Thought Was Solvable

Here's a fact that sounds obvious once you hear it: someone has to look at every car door handle made in the United States and decide if it's acceptable for sale.

That's not metaphorical. There are actual people in manufacturing facilities whose job is visual quality inspection. They examine parts under controlled lighting. They check for burn marks, scuff marks, color inconsistencies, surface defects. They do this thousands of times per shift. The work is meticulous, repetitive, and deeply difficult to automate at scale.

Why hasn't this been solved yet? The obstacle is data. Computer vision systems need examples of good parts and bad parts to learn what to detect. In high-volume manufacturing, generating thousands of labeled examples of defects is expensive, time-consuming, and often impractical. For a new part design or a production line change, you essentially start from scratch.

Bucket Robotics approached this from a completely different angle. Instead of collecting real defects, they start with the part's CAD file. Their software synthetically generates thousands of variations: a door handle with a burn mark in location X, another with a scuff mark in location Y, another with a color shift. These aren't photos of real handles. They're computational representations generated from the original design specifications.

Then their vision models train on these synthetic examples. When deployed to an actual production line, the system can detect anomalies "in minutes" rather than weeks, and it adapts when the part design changes because the CAD file is the source of truth.

Puchalski explained it this way during breakfast at the CES hotel: "It's deeply hard to automate these types of challenges without huge volumes of data, so auto manufacturers just throw dudes in Wisconsin at this problem." The vernacular might be casual, but the insight is precise. Manufacturing companies know visual inspection is expensive. They've simply never had a better alternative until now.

The technology addresses a specific type of defect: surface quality. It's not about structural integrity or dimensional accuracy—those problems have mostly been solved with other automation tools. Surface quality is the aesthetic and tactile layer. It's what customers touch. It's harder to quantify, easier to miss, and impossible to automate without solving the data problem first.

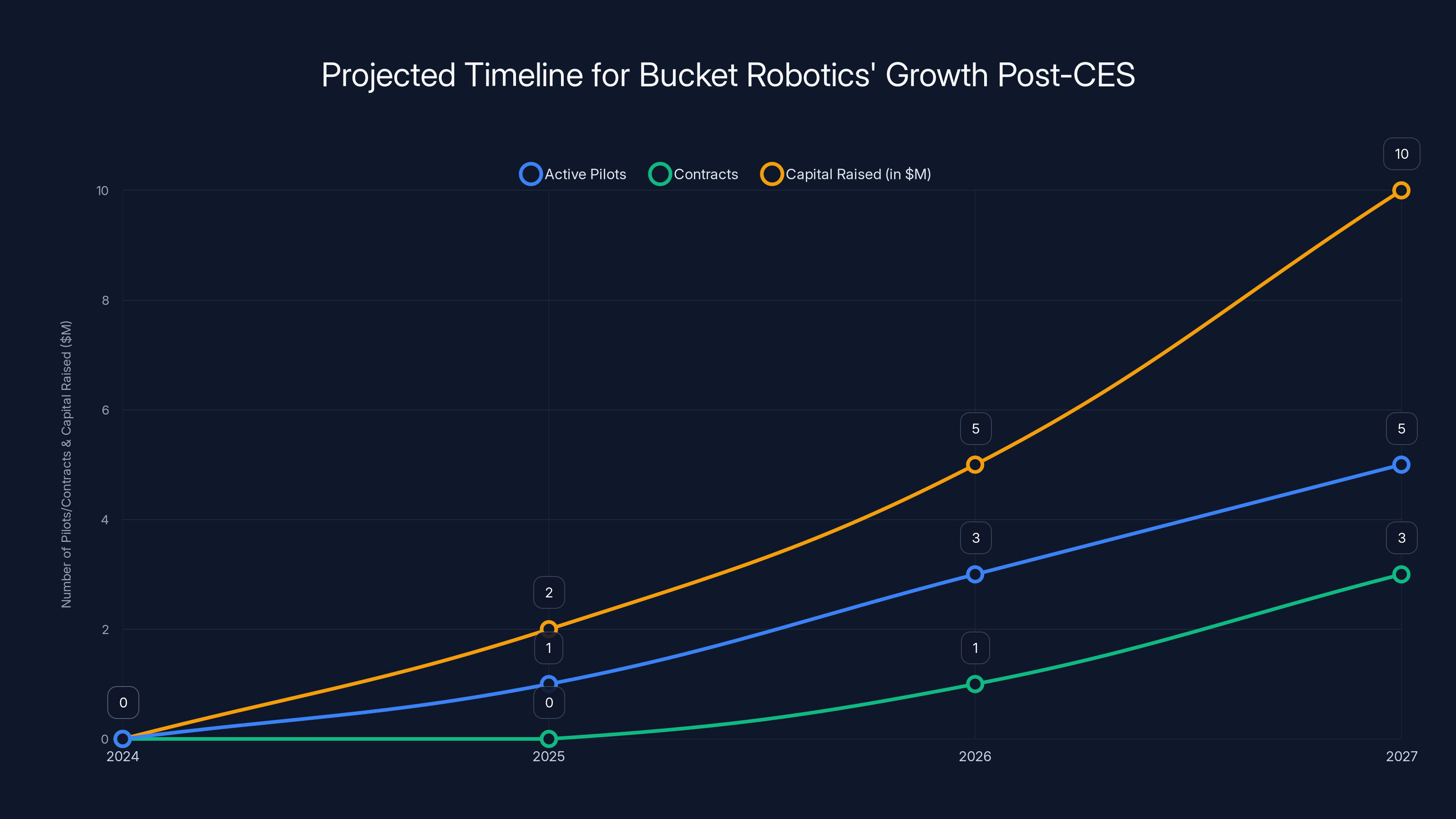

Estimated data shows Bucket Robotics aiming for 3-5 active pilots by 2026, converting to contracts by 2027, with capital raising following successful pilot outcomes.

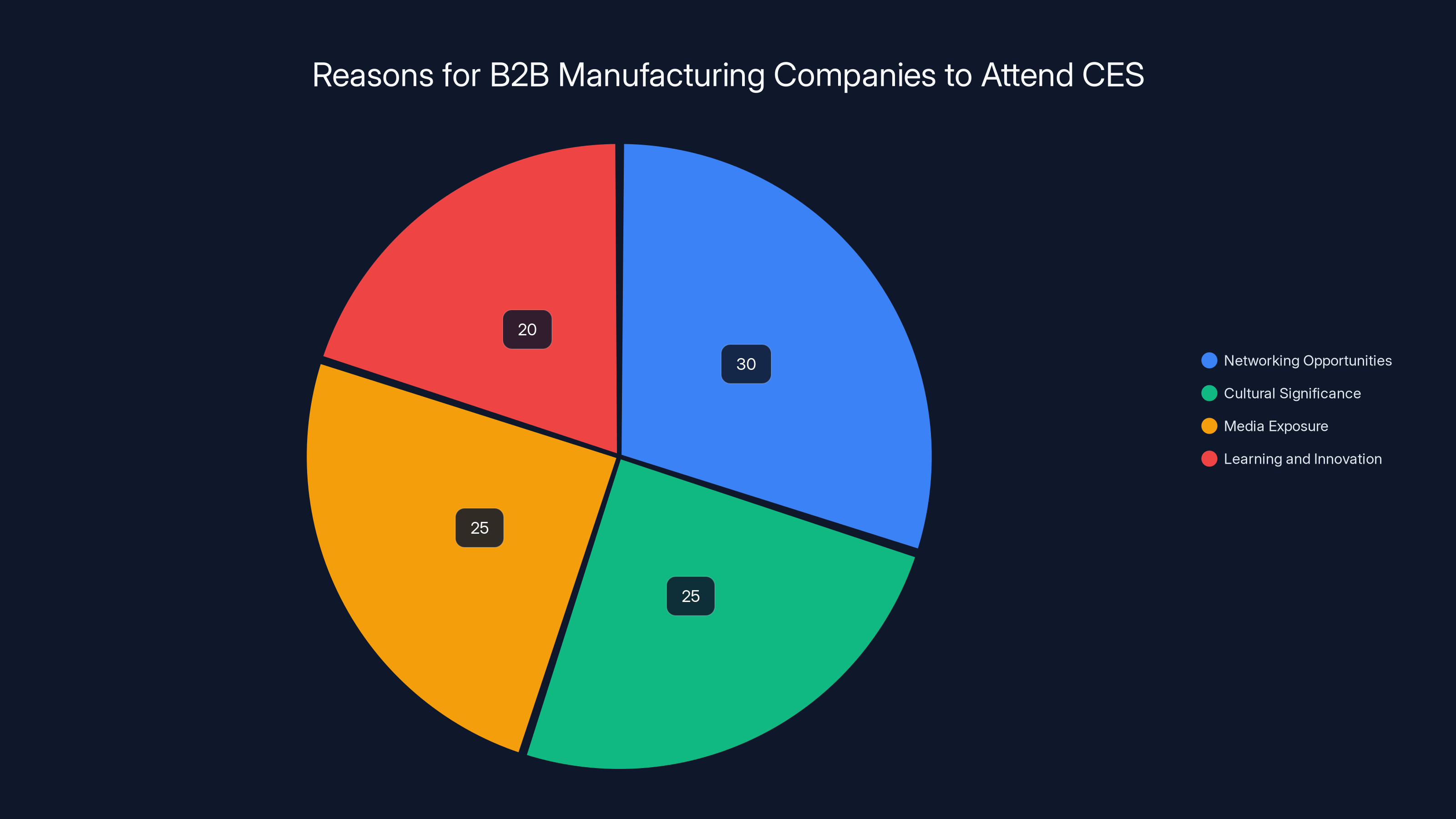

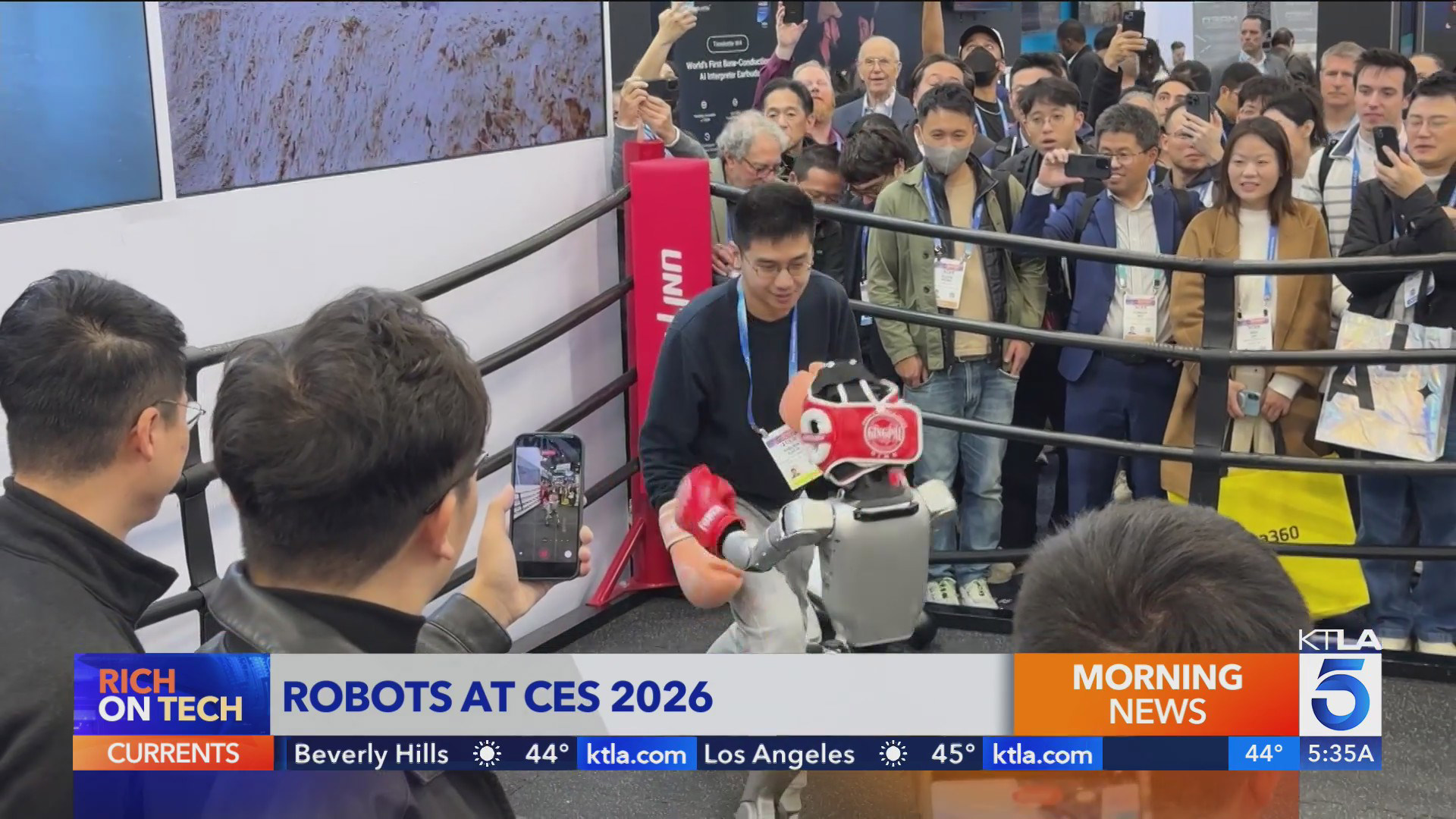

Why CES for a B2B Manufacturing Company?

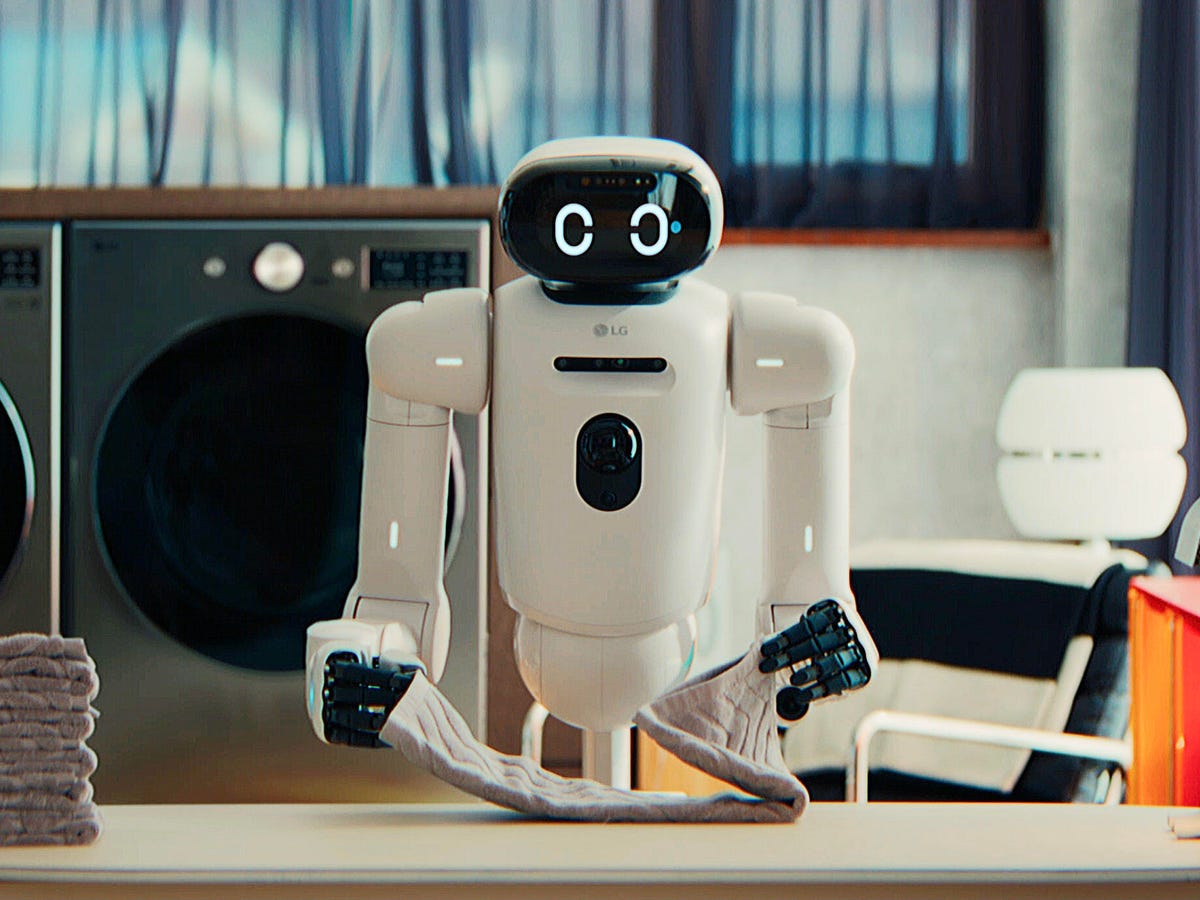

On the surface, it's strange. Bucket Robotics builds vision systems for car door handles and aerospace components. CES is where consumer electronics companies showcase devices you might put in your home. Why would a B2B manufacturing tech startup spend the resources to exhibit?

There are good reasons. First, CES hosts thousands of people from the automotive and manufacturing sectors. Major OEM decision-makers attend. Robotics companies, automation vendors, and component suppliers are everywhere. It's one of the few events where you'll find CEOs, engineers, and procurement directors from companies that manufacture millions of parts annually.

Second, CES still carries cultural weight. Exhibiting there signals something about a company's ambitions and legitimacy, especially for startups. YC companies often use CES as a benchmark event for validating product-market fit and investor credibility. The media coverage alone—interviews, product mentions, social validation—is difficult to replicate through traditional B2B marketing.

Third, Puchalski recognized something important: CES attendees are information-seekers. They're not shopping with budgets allocated. They're learning what's possible. That's ideal for a startup with novel technology. You're not competing for procurement dollars. You're competing for attention and follow-up conversations.

Puchalski's strategy was methodical. He didn't rely on flashy booth design. The startup's presence was modest, positioned in the automotive-focused West Hall. Instead, he focused on what he could control: being available, being knowledgeable, and being ready to pitch.

That meant being in the hotel lobby at 10 p.m. discussing manufacturing yield with Skip founder Sanjay Dastoor. It meant running through Media Day prep over breakfast. It meant constantly refining the pitch based on feedback from each conversation. It meant treating CES not as a trade show attendance checkbox, but as a week-long sales and relationship-building sprint.

The First 48 Hours: When Everything Matters

The show floor opened and the first two hours were, Puchalski said, "intense." Attendees in business attire gravitated toward the Bucket Robotics booth. Some were curious. Others were problem-hunting, mentally running through their own manufacturing challenges and asking whether Bucket's technology could apply.

What made those hours valuable wasn't the volume of interactions. It was the consistency of intelligent questions. People weren't asking "What does your robot do?" They were asking structural questions about integration complexity, model adaptation speed, and how the system handled lighting variations across different production facilities.

That indicates something: the attendees who stopped were pre-qualified in some sense. They worked in manufacturing or automation. They understood the problem space. Bucket's modest booth position didn't attract casual browsers. It attracted people with actual manufacturing infrastructure and actual pain.

Puchalski had prepared for this. He carried small physical examples. One was a bright yellow Pelican case containing a piece of plastic—a sample part. Being able to hand someone a tangible example of what "surface quality" means changes the conversation from abstract to concrete. It grounds the problem in reality. It lets them imagine their own parts, their own production lines.

The orange stickers with the Bucket Robotics logo became artifacts. People took them. They became prompts for conversations back at offices. "I saw this company at CES..." is how many business relationships start in manufacturing.

What surprised Puchalski wasn't that the event was tiring. It was that the level of genuine interest remained consistent throughout the entire week. He didn't see the typical CES pattern of strong opening hours followed by Thursday afternoon fatigue. Every day brought real technical discussions with people from manufacturing, robotics, and automation. That consistency suggested strong product-market signal.

Networking opportunities and cultural significance are top reasons for B2B manufacturing companies to attend CES, followed closely by media exposure and learning opportunities. (Estimated data)

Deep Industry Relationships: The Real Competitive Advantage

Puchalski's decade at autonomous vehicle companies wasn't just job experience. It was relationship infrastructure.

Think about the career path: Autonomous vehicles require deep collaboration with automotive manufacturers. You work with engineers at Ford. You work with procurement teams at major suppliers. You understand the decision-making structures at OEMs. You learn how automotive companies evaluate new technology, what concerns they prioritize (safety, regulatory compliance, cost), and how long their sales cycles actually are.

When Puchalski left AV companies and founded Bucket Robotics, he brought that relationship capital with him. During CES week, he wasn't meeting strangers. He was meeting people he already knew, or who knew his reputation. He ran into Skip founder Sanjay Dastoor in his hotel lobby. They're both YC alumni. They have mutual networks. That's not luck. That's ecosystem density.

Those connections matter because automotive manufacturers are traditionally skeptical of unproven technology. They move slowly. They conduct extensive pilots. They evaluate every vendor through deep technical due diligence. Being an unknown startup proposing a new inspection system? That would take years to convert into revenue.

Being a founder with a decade of AV experience who already has relationships with decision-makers at major automotive companies? That compresses the sales cycle significantly. People return Puchalski's calls. They take meetings seriously. They introduce him to other departments within their organization.

This is one of the most underappreciated advantages in startup fundraising and early traction. It's not about the technology alone. It's about credibility shortcuts. Puchalski walked into CES with credibility already established through prior work. That's why his conversations were "real technical discussions" instead of explanatory pitches.

From YC to the Stage: What Batch Membership Provides

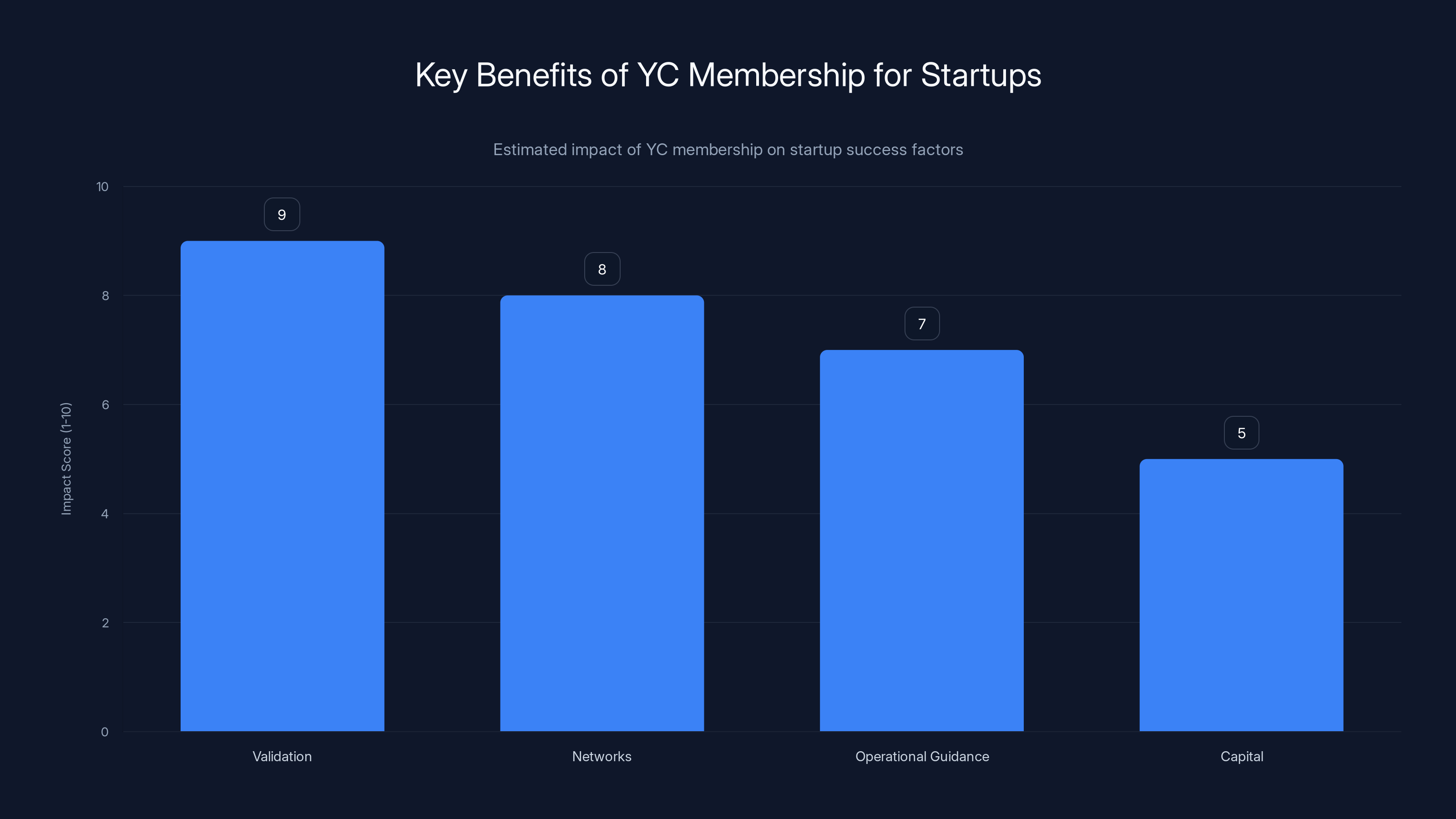

Bucket Robotics is YC-backed, which is a status signal worth examining. Y Combinator's most valuable output isn't capital (the investment is modest, typically $500K). It's validation, networks, and operational guidance.

YC alumni networks are dense in specific industries. In manufacturing technology and robotics, there are dozens of successful YC companies: Formlabs (3D manufacturing), Velo 3D (metal 3D printing), Relativity Space (autonomous rocket manufacturing), Bright Machines (autonomous manufacturing). When a YC company enters a market, it inherits access to that alumni network.

That means Bucket Robotics could potentially talk to operators of other YC companies who've dealt with similar manufacturing challenges. It means investor introductions are easier. It means technical partnerships with hardware companies might move faster because the YC brand carries implicit trustworthiness.

But YC membership also structures thinking in specific ways. The program teaches founders to obsess over product-market fit. It teaches velocity and iteration. It teaches founder discipline around metrics. Puchalski's approach at CES reflected that: minimal booth design, maximum interaction, rapid iteration on the pitch based on feedback.

That's a YC-influenced playbook: test, learn, adapt, repeat. Compare it to a traditional corporate product launch with expensive booth design, scripted demos, and fixed messaging. YC founders typically optimize for learning over impression management.

Bucket Robotics is projected to grow from initial pilot programs to achieving $2M ARR and preparing for Series B funding within 24 months. Estimated data based on typical industry trajectories.

The Synthetic Data Advantage: Why It Matters

Most computer vision systems in manufacturing work the same way your brain learns to recognize things: through exposure to examples. Show the system millions of images of good parts and bad parts, and eventually it learns the difference.

That approach works beautifully when you have infinite examples. It doesn't work when you're introducing a new part, a new production line, or a new manufacturer with unique quality standards.

Bucket's synthetic data approach inverts the problem. Instead of needing examples, you need the CAD file. Any modern manufacturing operation has CAD files for every part they make. It's the digital source of truth from which parts are designed and specified.

From a CAD file, Bucket's software can procedurally generate defects. It can add burn marks at specific locations. It can vary surface finishes. It can simulate the variations that actually occur in real production. The generated images aren't photos—they're rendered representations. But they're sufficient for the vision model to learn distinguishing features.

Why does this matter? Speed and adaptation. A traditional CV system might take weeks to generate enough labeled data. Bucket's system can be ready in "minutes." If the part design changes, you regenerate synthetic data from the new CAD file. If production variables shift (different ambient light, different equipment), you can adapt without retraining from scratch.

This is genuinely novel. Computer vision vendors in manufacturing have tried to solve this with transfer learning (using models trained on one part and adapting them to another). Transfer learning helps, but it still requires substantial real-world data for fine-tuning. Bucket's synthetic data approach bypasses much of that.

The limitation? Surface quality is relatively straightforward to synthesize. Structural defects, dimensional tolerances, and functional failures are harder. But Puchalski chose well: surface quality is worth billions in manufacturer spending and human labor annually. It's a real problem. The synthetic data approach is genuinely better than anything else currently available.

Hardware-Agnostic Integration: The Practical Genius

One of Bucket Robotics' biggest selling points isn't the vision system itself. It's that the system integrates into existing production lines without requiring new hardware.

That might sound like a minor detail. It's actually revolutionary from a customer adoption perspective.

Most manufacturing automation requires capital investment. New cameras, new lighting, new mounting hardware, new cabling. For a facility running millions of dollars in equipment, adding inspection infrastructure means downtime, installation costs, integration testing, operator retraining. The total cost of implementation can be substantial.

Bucket's approach: use your existing cameras, your existing production line infrastructure, whatever you currently have for documentation or quality reference. The software layer does the heavy lifting. You're adding intelligence to infrastructure you already own.

From a customer perspective, this is transformative. The barrier to trying the technology drops dramatically. The time to deployment shrinks. The capital required is minimal. The risk is lower because you're not changing physical infrastructure.

This is how you accelerate customer acquisition in manufacturing. You reduce friction, especially capital friction. A company can run a pilot on existing equipment, see results, then make a capital decision. Instead of approving the capital first and hoping it works.

Puchalski understood this intuitively. He emphasized hardware-agnostic integration repeatedly at CES. It's not sexy. It's not a technical breakthrough. But it's how you move manufacturing companies from curiosity to implementation.

YC membership provides significant validation, networking opportunities, and operational guidance, with capital being a less impactful benefit. (Estimated data)

The Dual-Use Opportunity: Beyond Automotive

Bucket Robotics has already attracted customers in automotive and defense sectors. That's significant because it touches on a strategic advantage: dual-use technology.

Defense and aerospace manufacturers face similar quality inspection challenges as automotive companies. They might actually face stricter standards. The parts they produce are mission-critical. A defect isn't just a warranty cost. It's a potential failure in a combat environment or a spacecraft.

Defense budgets are also less constrained by cost-minimization than automotive. The financial barriers to adoption are lower. That means defense customers might actually be faster to deploy than automotive, which is notorious for extended evaluation periods.

Being positioned in both automotive and defense is strategic. It diversifies revenue. It provides proof points in multiple industries. It creates potential for cross-selling within the defense ecosystem (suppliers to major defense primes might implement Bucket's technology and reference it when pitching other work).

The defense angle also matters for venture fundraising. Defense tech is a growing category. VCs are more interested in companies with defense revenue because it de-risks the business. Defense budgets are allocated multi-year. Procurement cycles are long but predictable. Churn is low.

Puchalski was explicit about not seeing Bucket Robotics as a threat to manufacturing jobs. The "dudes in Wisconsin" doing inspection aren't going to disappear. Visual inspection is as much about problem-solving—identifying why a defect occurred—as it is about detecting defects. Bucket handles the detection. Humans handle the analysis and correction.

That framing matters. It defuses a common fear about manufacturing automation: that it eliminates jobs. The more accurate narrative is that it eliminates tedious, repetitive work while creating demand for higher-skill analysis and troubleshooting.

Post-CES Strategy: Converting Buzz Into Revenue

CES is a milestone, not an outcome. The real test starts after the show ends.

Puchalski spent the week following CES on follow-up calls with prospective customers and investors. That's the right instinct. Trade show momentum dissipates quickly. The companies that actually convert show interest into revenue are the ones that follow up within 48 hours, not weeks.

Now Bucket Robotics faces the actual hard part: building a business. This is where many startups struggle. They nail product-market fit. They generate interest. They prove the technology works. And then they stumble on operations, sales, customer implementation, and capital raising.

For Bucket Robotics, the priorities are likely:

1. Customer Acquisition and Pilots

The next 6-12 months should focus on converting CES interest into pilots. Not immediate sales—pilots. A manufacturing company is going to want to run Bucket's system on a small subset of their production for 2-4 weeks before making a capital decision. That's normal. Bucket needs to excel at managing pilots: fast deployment, clear metrics, rapid problem-solving.

Successful pilots become case studies. Case studies become sales acceleration. By the end of 2026, Bucket should have 3-5 active pilots with well-known manufacturers. By 2027, those should convert into contracts.

2. Capital Raising

YC provides seed funding. Bucket Robotics will need Series A funding to scale sales, hire manufacturing engineers for customer implementation, and build out infrastructure. The timing for Series A is typically 12-18 months after YC demo day, once the company has validated some initial customer traction.

CES performance helps Series A conversations. Investors want proof that the market cares. Lead generation from a major trade show is that proof. The companies Puchalski met will likely become investor conversation points: "We have interest from Ford," or "We're piloting with Lockheed Martin." Those names matter in investor meetings.

3. Operational Scaling

Every customer implementation is unique. Production lines vary. Lighting conditions vary. Part complexity varies. Bucket's software might be "deploy in minutes" for straightforward applications, but real-world manufacturing is messier. The company needs to hire manufacturing engineers who can handle the complexity of customer-specific implementations.

This is where the margin between "interesting technology" and "sustainable business" gets determined. If every customer requires three weeks of engineering support, unit economics break. If the team can enable pilots with minimal handholding, scaling becomes possible.

4. Product Expansion

Right now, Bucket focuses on surface quality inspection. That's wise—focus is clarity. But manufacturing has dozens of other inspection problems. Dimensional accuracy, structural integrity, assembly correctness. Over time, Bucket could expand into those domains, using the same synthetic data generation approach.

Expansion comes later, after the core product is repeatable. But the founder's vision probably extends that far. Puchalski likely sees Bucket as a platform for AI-powered manufacturing inspection, not just surface quality. That matters for long-term venture value.

Estimated data shows that Bucket Robotics has a significant presence in both automotive (60%) and defense (40%) sectors, highlighting its strategic dual-use technology advantage.

Why Manufacturing Automation Is Hot Right Now

There's a macro context that makes Bucket Robotics' timing excellent.

Manufacturing is automation-hungry. Labor scarcity, rising wages, and reshoring initiatives mean companies can't rely on cheap labor anymore. Automation isn't optional. It's strategic necessity. But most automation targets repetitive, well-structured tasks. Visual inspection is harder—it's where AI and computer vision actually matter.

At the same time, AI funding is massive. Companies that apply AI to boring, practical problems—not just chatbots and image generators—are attracting capital. Bucket Robotics fits that profile perfectly. It's not the most exciting elevator pitch. But it solves a billion-dollar problem using novel technology.

Supply chain risks also matter. Companies that automated inspection during the pandemic saw fewer disruptions when shipping delays occurred. Automation reduces dependency on individual workers. It creates redundancy. In a volatile world, that's valuable.

Software adoption in manufacturing is still low compared to other industries. Legacy systems dominate. That means there's enormous runway for companies solving problems the traditional way. Bucket doesn't have to displace sophisticated existing solutions. It has to displace manual inspection and basic machine vision systems that haven't evolved in a decade.

The YC Advantage in Manufacturing: Why Startup Approaches Work

Traditional manufacturing vendors move slowly. They sell to procurement departments. They emphasize stability and long-term support. They're risk-averse. That's appropriate for their market.

Bucket Robotics operates differently. YC mentality emphasizes speed, iteration, customer feedback. That's harder in manufacturing than in software, but it's still possible. Puchalski's willingness to drive a rental car 12 hours, his comfort in hotel lobbies making pitches, his focus on real conversations over booth theater—that's startup mentality applied to manufacturing sales.

It works because manufacturing engineers are tired of vendor bureaucracy. They'd rather talk to a founder directly than navigate enterprise sales processes. They appreciate technical candor. They respect hustle. Bucket Robotics' approach appeals to that mindset.

This is a long-term advantage. Even after the company scales and hires professional sales staff, the founder's involvement in early customers creates loyalty. Those customers will push Bucket's technology internally. They'll introduce the company to other divisions. They'll become advocates.

That's the underrated benefit of startup intensity: it creates emotional investment from customers. You don't get that from traditional enterprise sales.

Technology Moats: How Long Is the Advantage Sustainable?

One question any technology investor asks: can competitors copy this?

For Bucket Robotics, the moat isn't just the synthetic data generation technique. That's replicable. The moat is customer relationships, implementation expertise, and the dataset of real-world production variations that the company accumulates over time.

Every successful implementation teaches Bucket something about how different production lines, different materials, different part types behave. That knowledge accumulates. It becomes implicit in the product. A competitor starting from scratch wouldn't have that institutional understanding.

Additionally, winning customers creates switching costs. A manufacturer that has integrated Bucket's system into their production workflow, trained their teams, and established quality metrics around it won't switch easily. Changing vendors means operational disruption.

Puchalski was also smart about positioning the technology as hardware-agnostic. That reduces the temptation for major camera companies or robotics vendors to build competing solutions. If Bucket integrates with their hardware, they have less incentive to disrupt the relationship. A camera company benefits from Bucket's growth because it means more of their cameras are being utilized intelligently.

The real risk is a major manufacturer deciding to build this capability internally. Ford or GM have the engineering talent to create synthetic data generation for quality inspection. They just haven't prioritized it. If Bucket succeeds and validates the market, they might. That's when being acquired by a major OEM becomes a realistic exit for Puchalski.

The Path Forward: 12-24 Month Horizon

If Bucket Robotics executes well, the trajectory looks like this:

Months 1-6 Post-CES (Q1-Q2 2026): Convert CES leads into pilots. Target 2-3 active pilot programs with known automotive suppliers or OEMs. Refine the product based on real-world deployment feedback. Begin Series A fundraising conversations.

Months 6-12 (Q3-Q4 2026): Close Series A funding. The target is likely $10-20M based on typical manufacturing tech rounds. Use funding to hire manufacturing engineers, expand customer success, and build go-to-market infrastructure. First pilots should be generating results.

Months 12-18 (Q1-Q2 2027): Convert successful pilots into contracts. Achieve ARR (annual recurring revenue) of

Months 18-24 (Q3-Q4 2027): Expand to new customer segments. Show sustainable unit economics. Series B conversations begin if growth is strong.

That's ambitious but realistic for a well-executed manufacturing tech startup with founder credibility, proven product-market fit, and industry relationships.

Lessons for Other B2B Startups: What Bucket Robotics Did Right

Bucket Robotics' CES execution offers lessons for other B2B founders:

1. Choose Your Venue by Audience, Not Prestige

CES works for Bucket because manufacturers attend. It would be wrong for a startup building developer tools. Know where your customers actually go.

2. Prepare Relentlessly, Execute Flexibly

Puchalski drove through rain to ensure his booth materials arrived. That's the opposite of flexible—it's obsessive preparation. But his pitch was flexible, adapting based on each conversation. Prepare the conditions for success. Adapt the execution.

3. Emphasize Relationships Over Transactions

He spent time in hotel lobbies, in breakfast meetings, in evening conversations. He wasn't gunning for immediate sales. He was building relationships that might convert to revenue in 12 months. That's the right mindset for B2B sales.

4. Solve Real Problems for Skeptical Customers

Manufacturing companies are skeptical of new technology. Bucket's value proposition addresses actual pain: integrates with existing hardware, deploys quickly, adapts to change. These are boring differentiators. They're also the differentiators that matter most to customers.

5. Leverage Your Unique Credentials

Puchalski's decade at AV companies gave him credibility no other founder could manufacture. He used that advantage by being present and accessible. That compressed sales cycles and built trust faster.

The Broader Implications: AI in Manufacturing

Bucket Robotics is one data point in a larger trend: AI moving from entertainment and information services into actual physical infrastructure.

Manufacturing AI is less showy than Chat GPT. It doesn't go viral. It doesn't get the same venture funding per company. But it matters more economically. Improving manufacturing efficiency by even 1% across the global economy saves hundreds of billions in costs and resources.

Bucket's specific approach—synthetic data generation—is going to become more common. As companies realize you don't need millions of real-world examples to train vision systems, barriers to AI adoption in hardware-dependent industries drop significantly.

The next five years will see dozens of manufacturing tech startups using similar approaches. Some will focus on quality inspection like Bucket. Others will focus on predictive maintenance, inventory optimization, yield prediction. The underlying principle is the same: apply AI to the actual constraints of physical production.

Bucket Robotics might be acquired, might go public, might remain a profitable private company. Those are secondary details. The more important fact is that the company is demonstrating that there's genuine, urgent demand for AI-powered manufacturing optimization, and that founders with both technical depth and industry credibility can build valuable companies by solving specific, unsexy problems really well.

Conclusion: Ambition, Execution, and Unglamorous Problems

Matt Puchalski drove through Nevada rain because he was unwilling to risk his company's first major trade show appearance on logistics luck. He spent time in hotel lobbies pitching to potential customers because he understood that venture success in B2B is built on relationships, not booth theater. He positioned his startup as the solution to a problem that manufacturing has struggled with for decades: automating visual quality inspection without massive datasets or hardware overhauls.

None of that is revolutionary. But execution of fundamentals is what actually builds valuable companies.

Bucket Robotics' CES 2026 appearance wasn't about winning an award for booth design or generating viral media coverage. It was about validation: proving that customers care, building relationships that convert to revenue, and demonstrating that the team can execute at the level required for scale.

If the company converts its CES momentum into pilots, closes Series A funding, and implements successfully for early customers, it will establish a defensible position in a market worth billions. If it stumbles on follow-up or customer implementation, it will become a case study in why great technology sometimes doesn't translate to great businesses.

Right now, the momentum is there. The team is executing. The timing is right. The next 12 months will determine whether Bucket Robotics becomes an acquihire or an actual business. Based on what I saw at CES—a founder willing to sweat the details, a team that actually understands the problem space, and genuine customer interest—I'd bet on the latter.

Manufacturing automation is unglamorous. It's not going to get the same venture attention as generative AI or quantum computing. But it's where some of the most valuable companies of the next decade will be built. Bucket Robotics looks like it could be one of them. Not because the technology is the most sophisticated. But because the team understands that solving real problems for skeptical customers requires relentless execution on the boring details.

That's how you survive your first CES. That's also how you build a billion-dollar company.

FAQ

What is Bucket Robotics and what problem does it solve?

Bucket Robotics is a YC-backed startup that develops AI-powered visual quality inspection software for manufacturing production lines. The company specifically targets surface quality defects—burn marks, scuffs, color inconsistencies—that are currently identified by manual human inspection. Their core innovation is using synthetic data generation from CAD files to train vision models, eliminating the need for massive real-world labeled datasets that traditional computer vision requires.

How does Bucket Robotics' synthetic data approach work differently than traditional computer vision systems?

Traditional vision systems require thousands of real-world examples of good and defective parts to learn detection patterns. Bucket's approach generates synthetic defects computationally from the original CAD file—simulating burn marks, scuffs, color variations at different locations and intensities. This eliminates the time-consuming and expensive process of collecting and labeling real defects while allowing rapid adaptation when part designs change or production lines shift. The system can deploy "in minutes" rather than the weeks or months typical vision systems require.

Why did Bucket Robotics choose to exhibit at CES despite being a B2B manufacturing company?

CES 2026 provided access to thousands of automotive and manufacturing decision-makers in one venue, including OEM executives, robotics engineers, and procurement specialists. For Bucket Robotics, CES offered a concentrated opportunity for relationship building with potential customers and investors, plus media visibility that validates the startup's credibility. Founder Matt Puchalski's strategy focused on genuine technical conversations rather than booth theater, which resonated with attendees from manufacturing who appreciate direct founder engagement.

What are the key advantages of Bucket Robotics' hardware-agnostic integration approach?

Bucket's software integrates into existing production line infrastructure without requiring new cameras, lighting, or mounting hardware. This dramatically reduces adoption barriers for customers—no capital-intensive equipment changes, minimal downtime for implementation, and lower risk for pilots. Manufacturers can test the technology on existing infrastructure before making capital decisions, which accelerates the evaluation-to-deployment cycle compared to traditional manufacturing automation solutions that require complete infrastructure replacement.

Who are Bucket Robotics' target customers and why are they attracted to this solution?

Initial customers span automotive and defense manufacturing sectors—both industries with high-volume production where surface quality directly impacts customer satisfaction and compliance. These manufacturers have historically relied on manual visual inspection with human workers, which is labor-intensive and inconsistent. They're attracted to Bucket's solution because it addresses a genuine pain point (labor scarcity, quality consistency), integrates with existing equipment, and represents significantly lower implementation risk than traditional automation approaches.

What is the competitive advantage Bucket Robotics maintains beyond its core technology?

Founder Matt Puchalski's decade of experience at autonomous vehicle companies (Uber, Argo AI, Ford Latitude AI, Stack AV) provides deep relationships within automotive and manufacturing ecosystems. This credibility shortens sales cycles and increases customer trust beyond what technology alone would provide. Additionally, each successful customer implementation generates institutional knowledge about production variations, defect patterns, and implementation best practices that competitors couldn't easily replicate. Customer lock-in emerges from integrated workflows and trained teams, not just switching costs.

What is Bucket Robotics' business model and pricing strategy?

Bucket Robotics operates on a software licensing model, likely with per-production-line or annual subscription pricing common in manufacturing tech. Specific pricing wasn't disclosed at CES, but unit economics likely improve with customer scale—implementation costs are highest for first pilots, then decline for subsequent production lines within the same customer. Revenue per customer varies widely based on the number of production lines inspected and integration complexity, ranging potentially from

What are the next critical milestones for Bucket Robotics following CES 2026?

Immediate priorities include converting CES leads into active pilot programs (2-3 should be underway within 6 months), closing Series A funding by mid-2026, and hiring manufacturing engineers to support customer implementations. Success looks like 2-3 major pilot programs generating measurable results by Q4 2026, leading to contract conversions in 2027. Achieving

How does the YC batch membership influence Bucket Robotics' strategic positioning?

Y Combinator provides institutional structure around product-market fit validation, unit economics discipline, and founder accountability. The YC alumni network is particularly valuable in manufacturing—successful portfolio companies like Formlabs and Velo 3D created precedent for manufacturing-focused startups and provided peer learning opportunities. YC membership also accelerates investor interest during fundraising, as the "YC company" label signals that founders have been vetted and the business model has been pressure-tested against YC's operational framework.

Is Bucket Robotics' technology vulnerable to being replicated by larger competitors?

While the synthetic data generation approach itself is replicable, competitive moats emerge from customer relationships, accumulated implementation expertise, and embedded workflows. Major camera manufacturers or robotics vendors could theoretically build competing solutions, but they benefit more from partnering with Bucket since integrated solutions increase hardware utilization. The real competitive threat would be a major OEM (Ford, GM) building this capability internally—which represents a potential acquisition scenario for Puchalski rather than a failure scenario.

Internal Resources & Recommendations

Topics for future in-depth articles:

- "Synthetic Data Generation in Computer Vision: How AI Startups Are Solving the Training Data Problem"

- "Manufacturing Tech Trends 2026: Why Automation Investment Is Accelerating"

- "The Founder Advantage: How Industry Experience Compresses Sales Cycles in B2B Startups"

- "Y Combinator Startups in Hardware: Success Patterns and Capital Requirements"

Key Takeaways

- Bucket Robotics demonstrates that solving unglamorous manufacturing problems with focused technology can generate significant venture value and customer interest

- Synthetic data generation from CAD files eliminates the traditional barrier to computer vision adoption in manufacturing: the need for massive labeled datasets

- Hardware-agnostic integration dramatically reduces adoption friction for manufacturing customers hesitant about capital investment in new infrastructure

- Founder credibility in target industries (Puchalski's AV background) directly compresses sales cycles and increases customer trust beyond technical capabilities alone

- The "dual-use" positioning in automotive and defense provides revenue diversification and reduces dependence on single-industry cycles

- B2B startup success in manufacturing requires relentless execution on boring details: customer relationship building, reliable implementation, and disciplined unit economics

- AI and automation are reshaping manufacturing in ways less visible than consumer AI, but economically more significant across the global economy

Related Articles

- Skild AI Hits $14B Valuation: Robotics Foundation Models Explained [2025]

- Elon Musk's $134B OpenAI Lawsuit: What's Really at Stake [2025]

- ClickHouse Hits $15B Valuation: How an Open-Source Database is Challenging Snowflake and Databricks [2025]

- IKEA's Viral Varmblixt Smart Light & 2026 Smart Home Game-Changers [2025]

- Higgsfield's $1.3B Valuation: Inside the AI Video Revolution [2025]

- Type One Energy Raises $87M: Inside the Stellarator Revolution [2025]

![How Bucket Robotics Conquered CES 2026: YC Startup's First Big Show [2026]](https://tryrunable.com/blog/how-bucket-robotics-conquered-ces-2026-yc-startup-s-first-bi/image-1-1768754177941.jpg)