AI Replacing Enterprise Software: The 50% Replatforming Shift [2025]

Let's talk about something that's probably keeping enterprise software leaders up at night. A year ago, this would've sounded like hype. Today? It's starting to look inevitable.

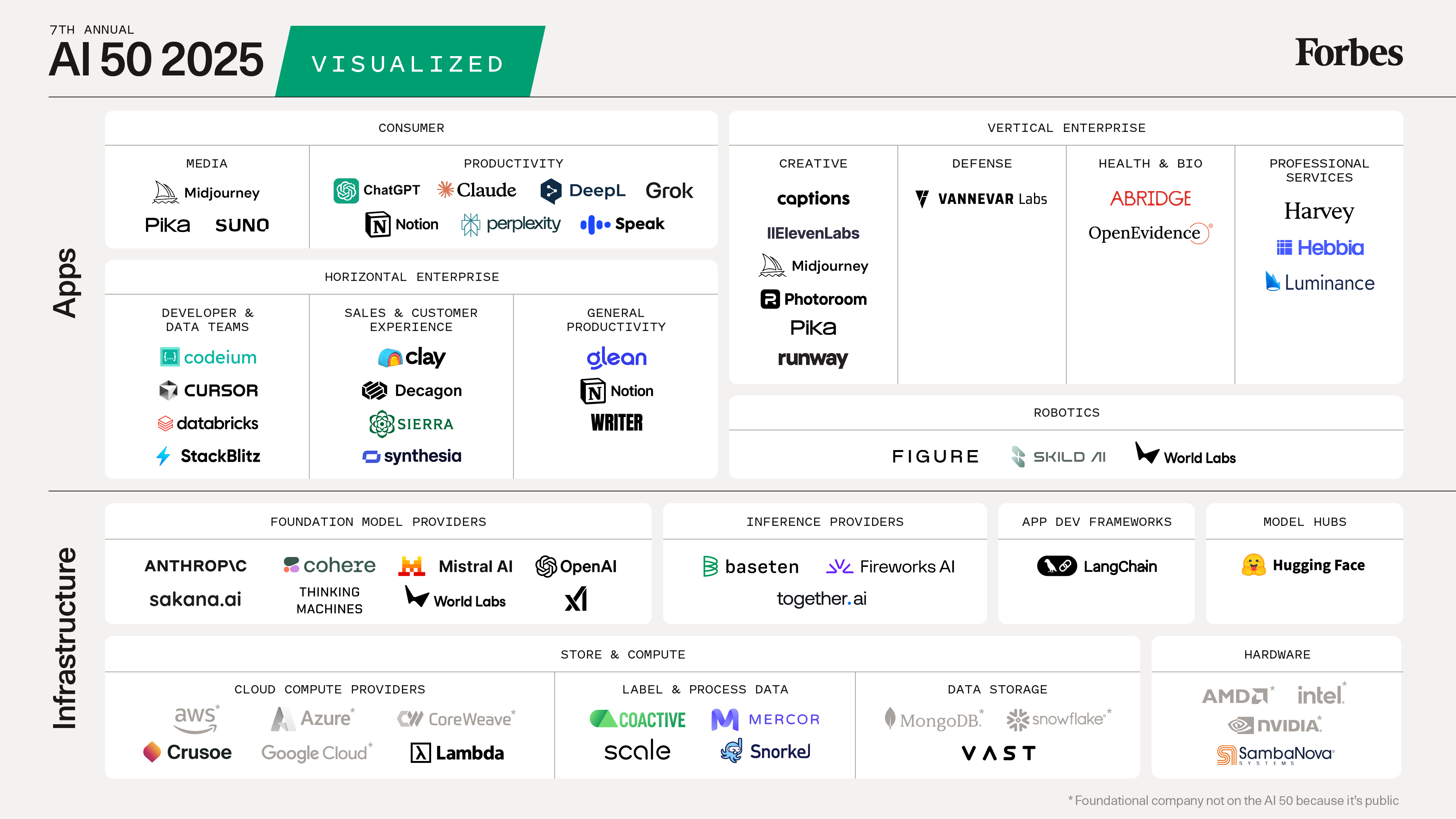

Mistral AI CEO Arthur Mensch recently claimed that more than half of current enterprise SaaS software could be replaced by AI-powered custom applications. Not augmented. Not enhanced. Replaced.

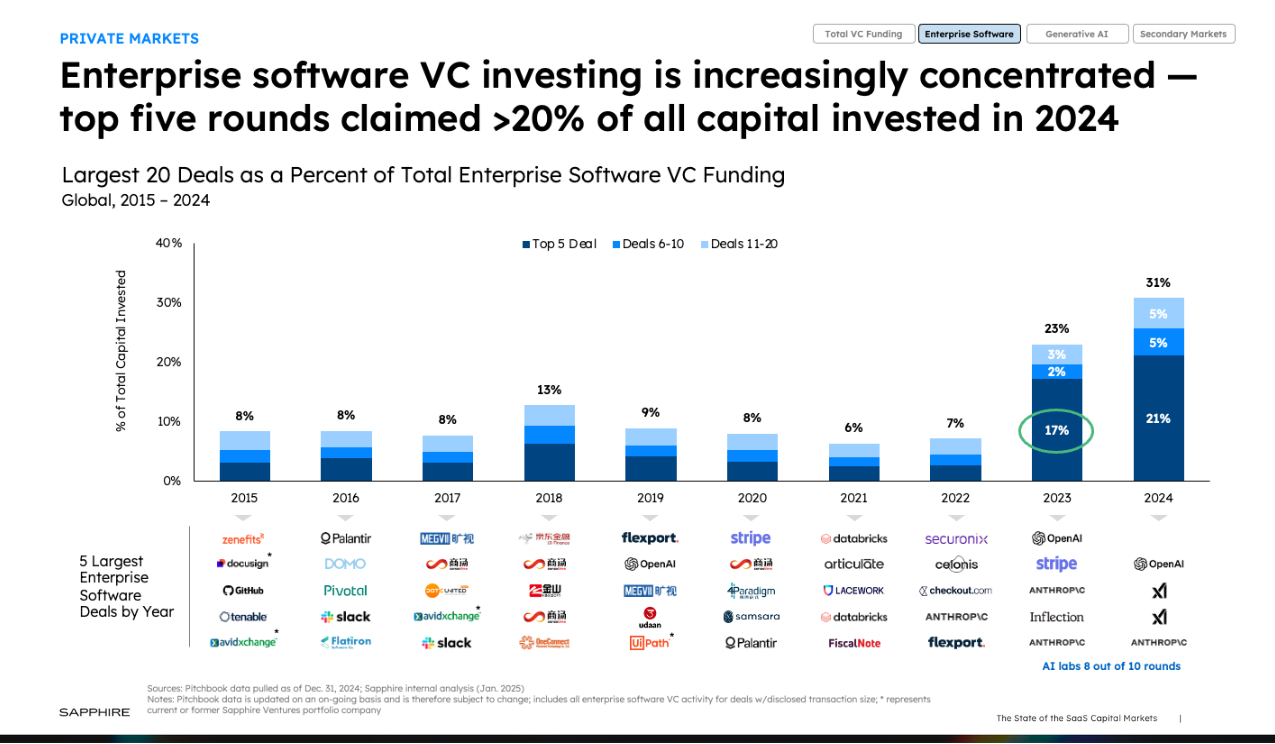

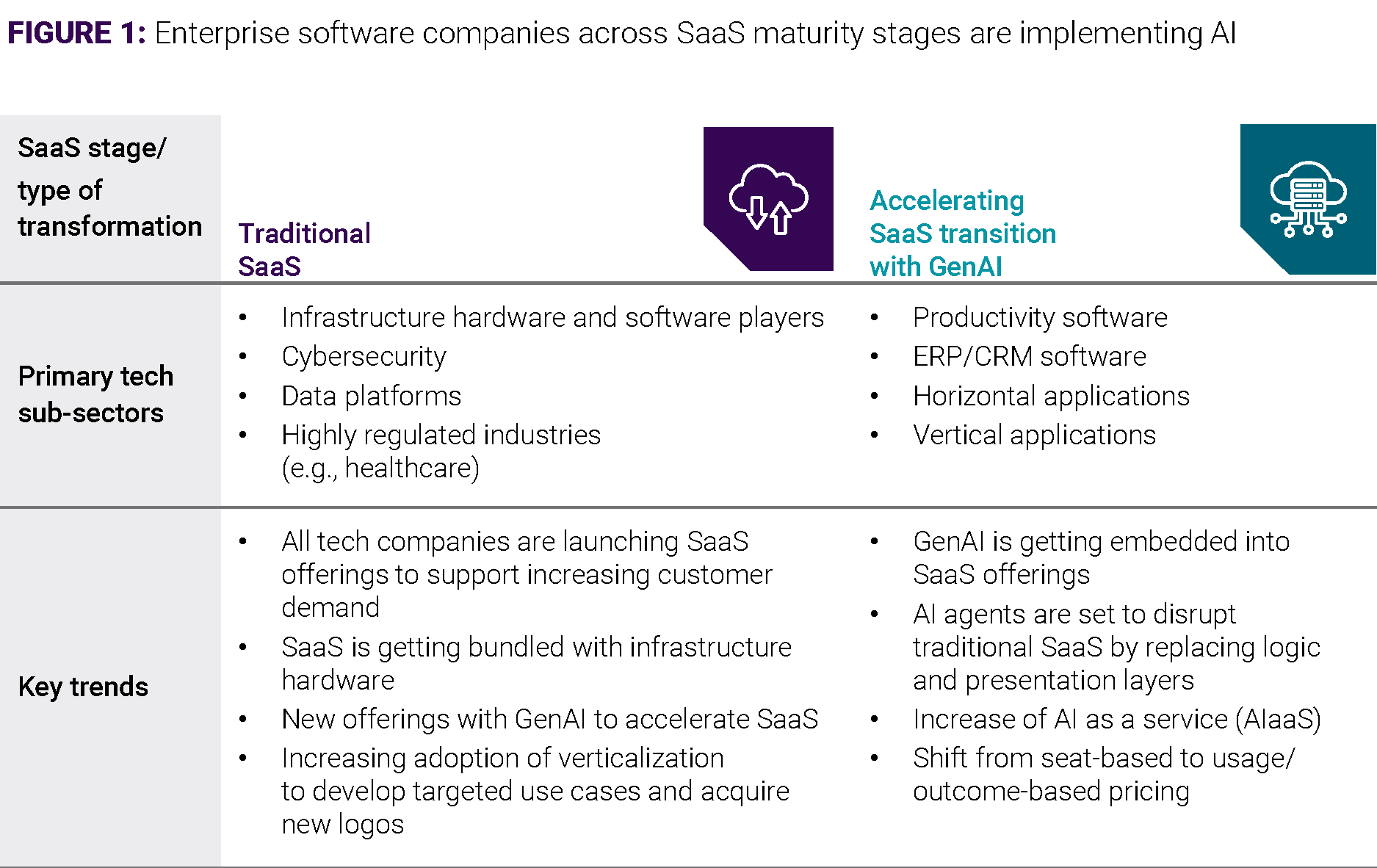

Here's the thing: this isn't some venture capitalist's fever dream. This is a fundamental shift in how enterprises will build, deploy, and maintain their software infrastructure. The traditional SaaS model, which has dominated enterprise IT for the past fifteen years, is about to face its biggest existential threat since cloud computing disrupted on-premise software.

But here's where it gets complicated. It's not just about AI being smarter or faster. It's about infrastructure, data quality, security, organizational readiness, and the growing gap between companies that can pull this off and those that can't.

Let me break down what's actually happening, why it matters, and what it means for the future of enterprise software.

TL; DR

- AI is accelerating development cycles: Custom AI applications can be built and deployed 10-100x faster than traditional software, fundamentally changing ROI calculations

- The 50% replacement thesis is credible: Enterprise workflows around data processing, customer service, reporting, and automation are prime candidates for AI-driven alternatives

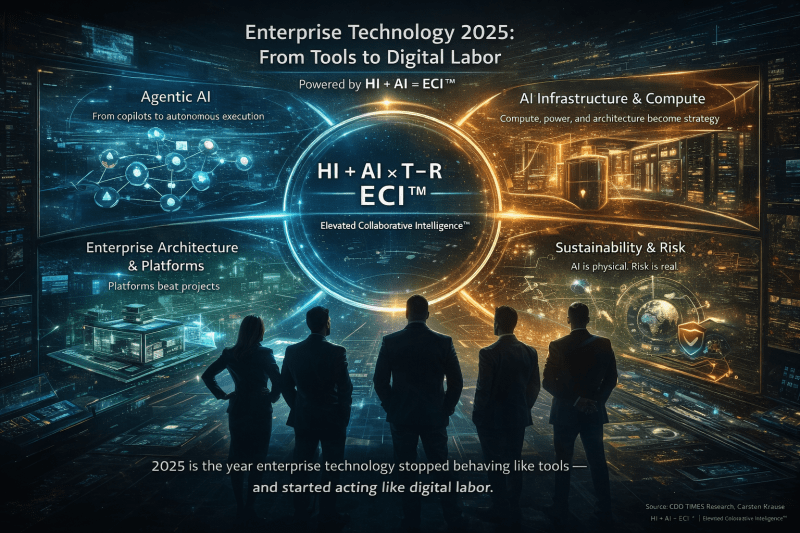

- Infrastructure becomes the moat: Success depends on having clean data, cloud infrastructure, security frameworks, and skilled teams—not just AI models

- A two-tier system is emerging: Companies with the right foundation will outcompete legacy SaaS users, creating significant competitive pressure

- Replatforming is expensive but unavoidable: The switching cost from traditional SaaS to AI is high upfront, but the long-term ROI could justify it

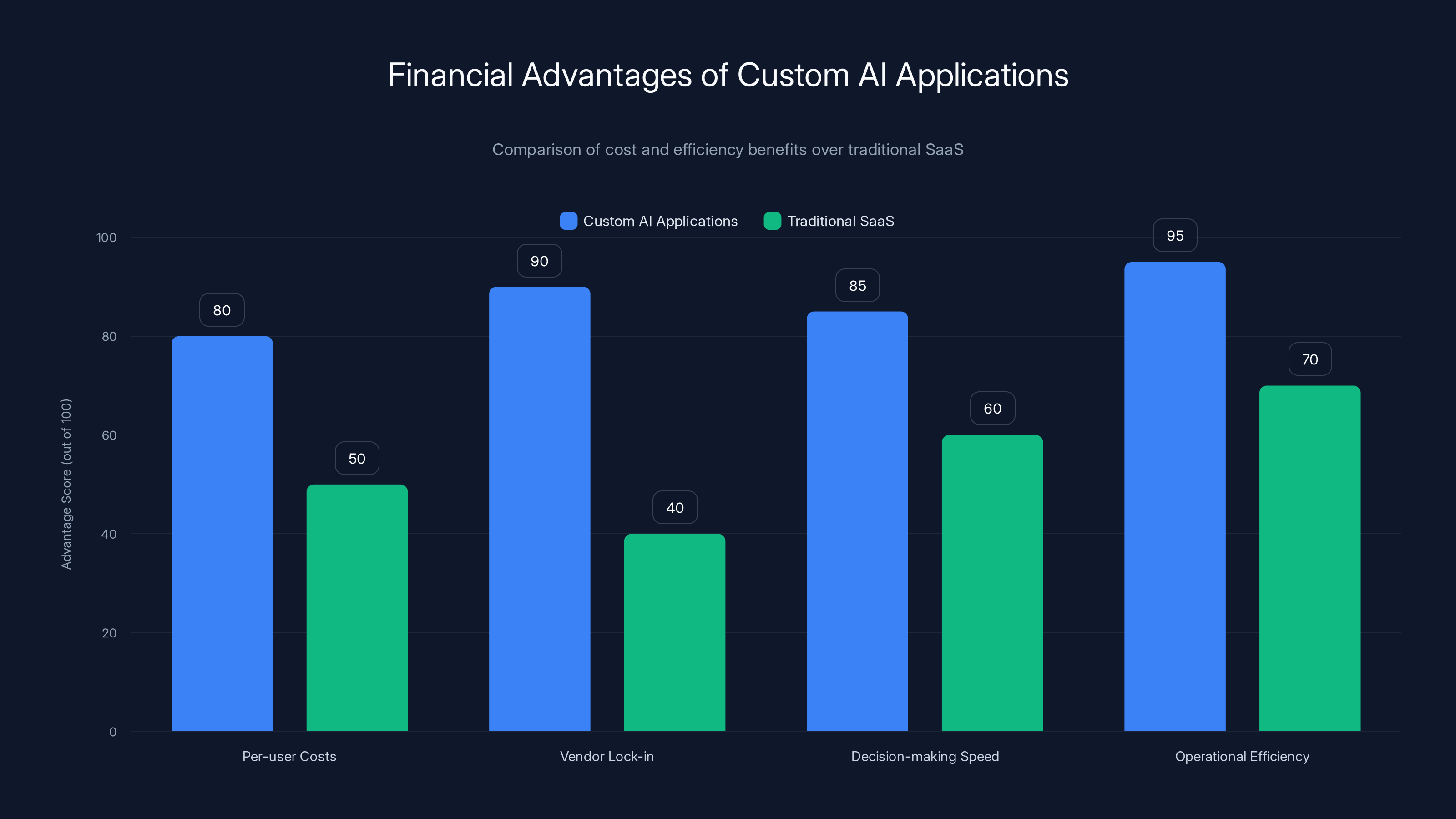

Custom AI applications offer significant advantages in reducing per-user costs, avoiding vendor lock-in, enhancing decision-making speed, and improving operational efficiency compared to traditional SaaS. (Estimated data)

Understanding the Mistral CEO's Bold Claim

When Mensch says "more than 50% of enterprise SaaS could be replaced," he's not saying all software will disappear. He's identifying a specific category of enterprise applications that are particularly vulnerable to AI disruption.

Think about what enterprise SaaS typically does: it standardizes workflows, applies business logic, processes data, and generates reports. These are exactly the tasks that AI excels at. A CRM that manages customer interactions? AI can do that. A scheduling tool that optimizes resource allocation? AI's got it. A document workflow system that routes approvals? AI can learn those patterns in minutes.

The difference is speed and flexibility. Traditional SaaS requires months of implementation, integration with your existing systems, training thousands of employees, and paying vendor lock-in taxes forever. A custom AI application, with the right infrastructure in place, can be built and deployed in weeks.

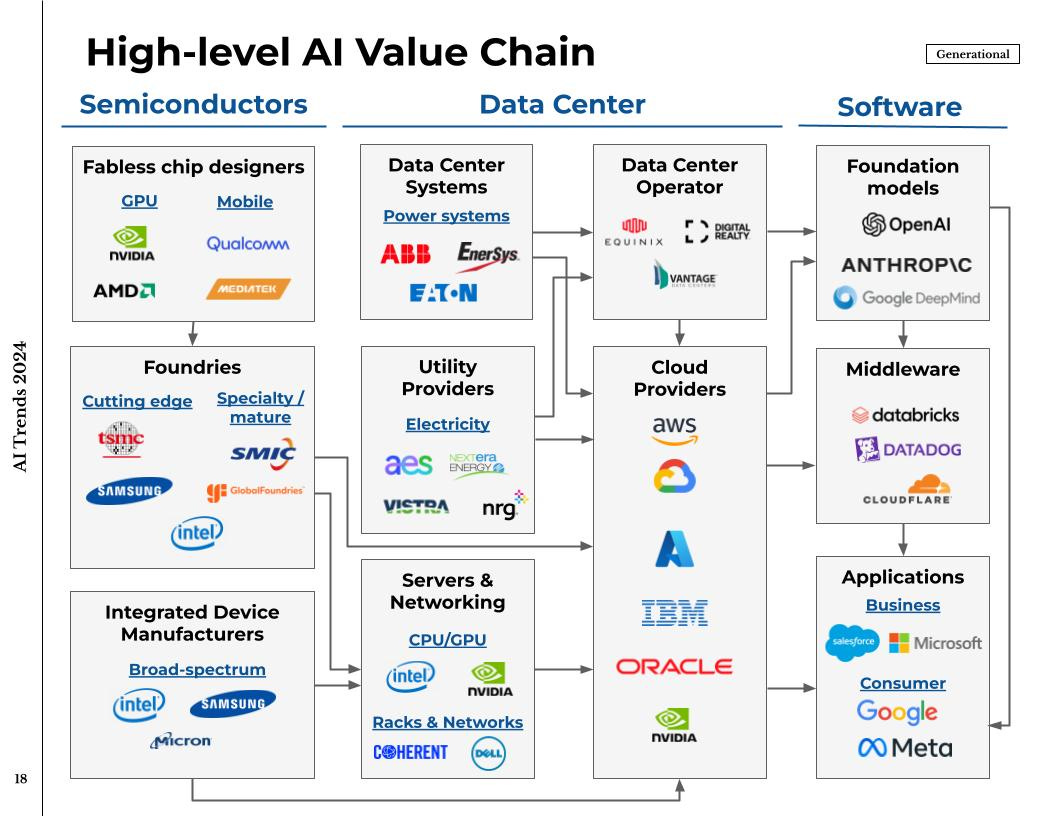

Mensch notes that enterprises need the "right infrastructure in place" to make this work. This is critical. It's not just about having access to OpenAI's API or Claude. Infrastructure means:

- Clean, well-organized data foundations

- Scalable cloud compute and storage

- Robust security and compliance frameworks

- Teams with AI literacy and technical depth

- Governance policies for AI model management

This is where the real competition emerges. It's not between Salesforce and custom AI apps. It's between companies prepared to build AI-driven infrastructure and those still running on legacy systems.

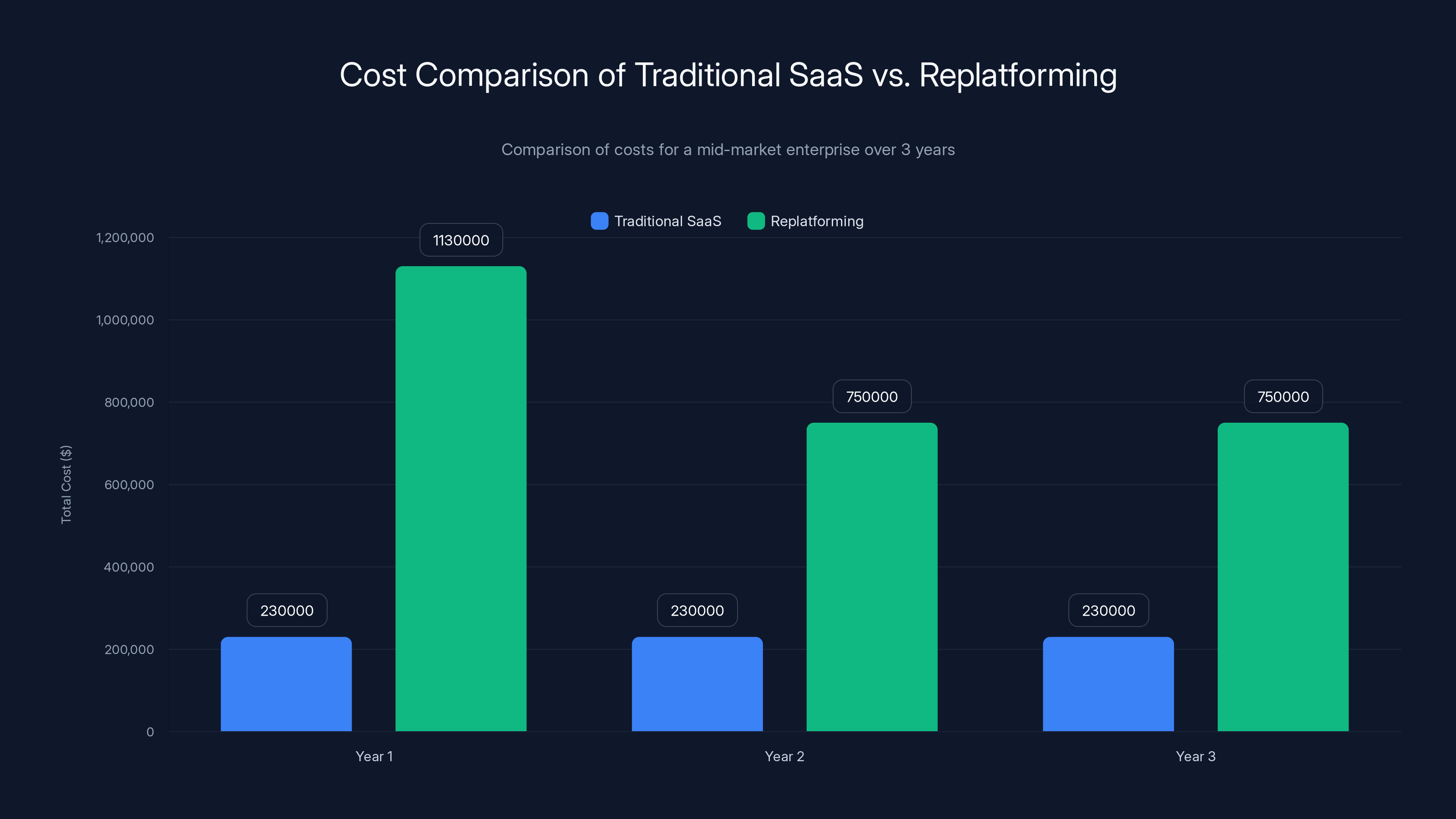

Replatforming incurs higher initial costs, with a 3-year TCO of

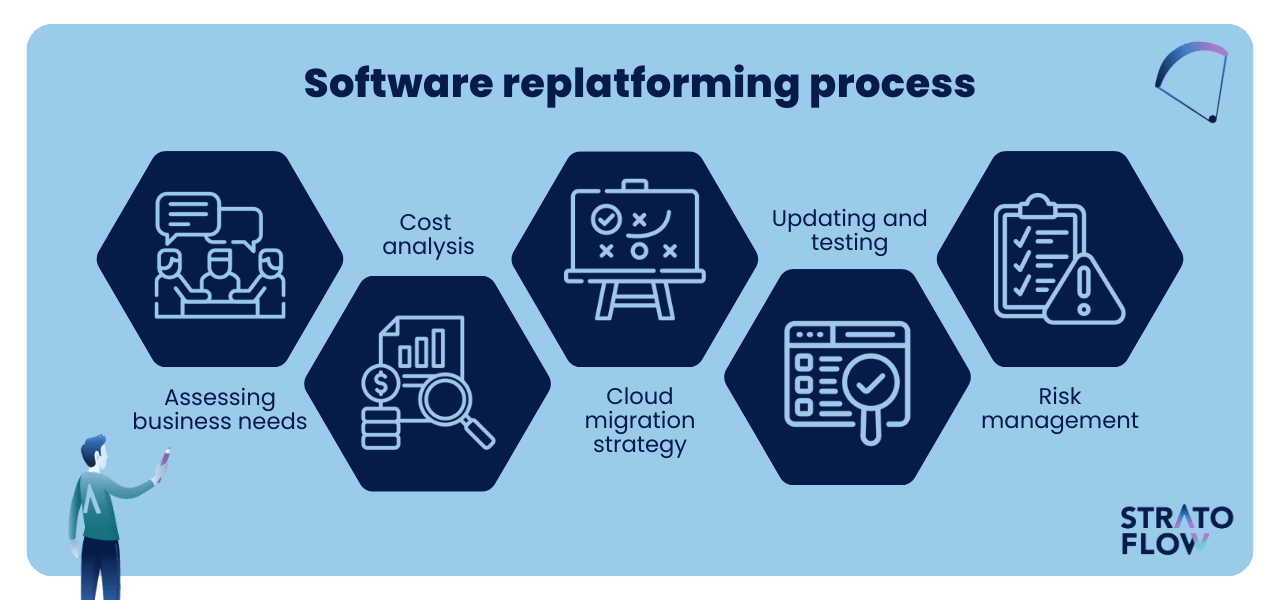

The Replatforming Megatrend Explained

"Replatforming" is an interesting word choice. It doesn't mean ripping out all your software overnight. It means gradually, strategically shifting from vendor-provided solutions to custom, AI-powered alternatives built in-house or by specialized vendors.

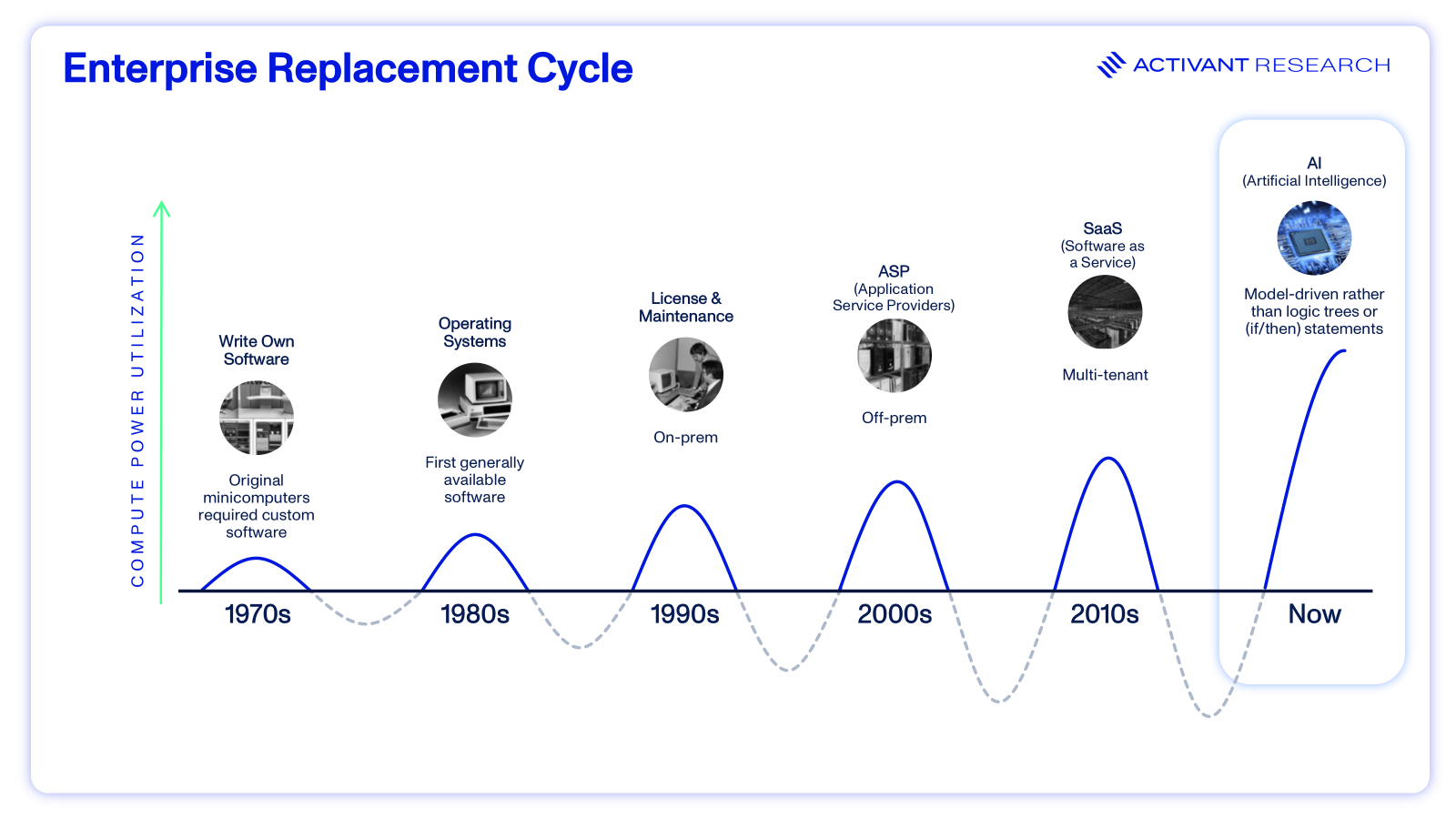

This happened before. Remember when enterprises moved from on-premise software to SaaS? That was replatforming. It took a decade, but it fundamentally changed how software was purchased, implemented, and managed.

We're about to see that transition again, except faster and messier.

Why Enterprises Are Considering the Switch

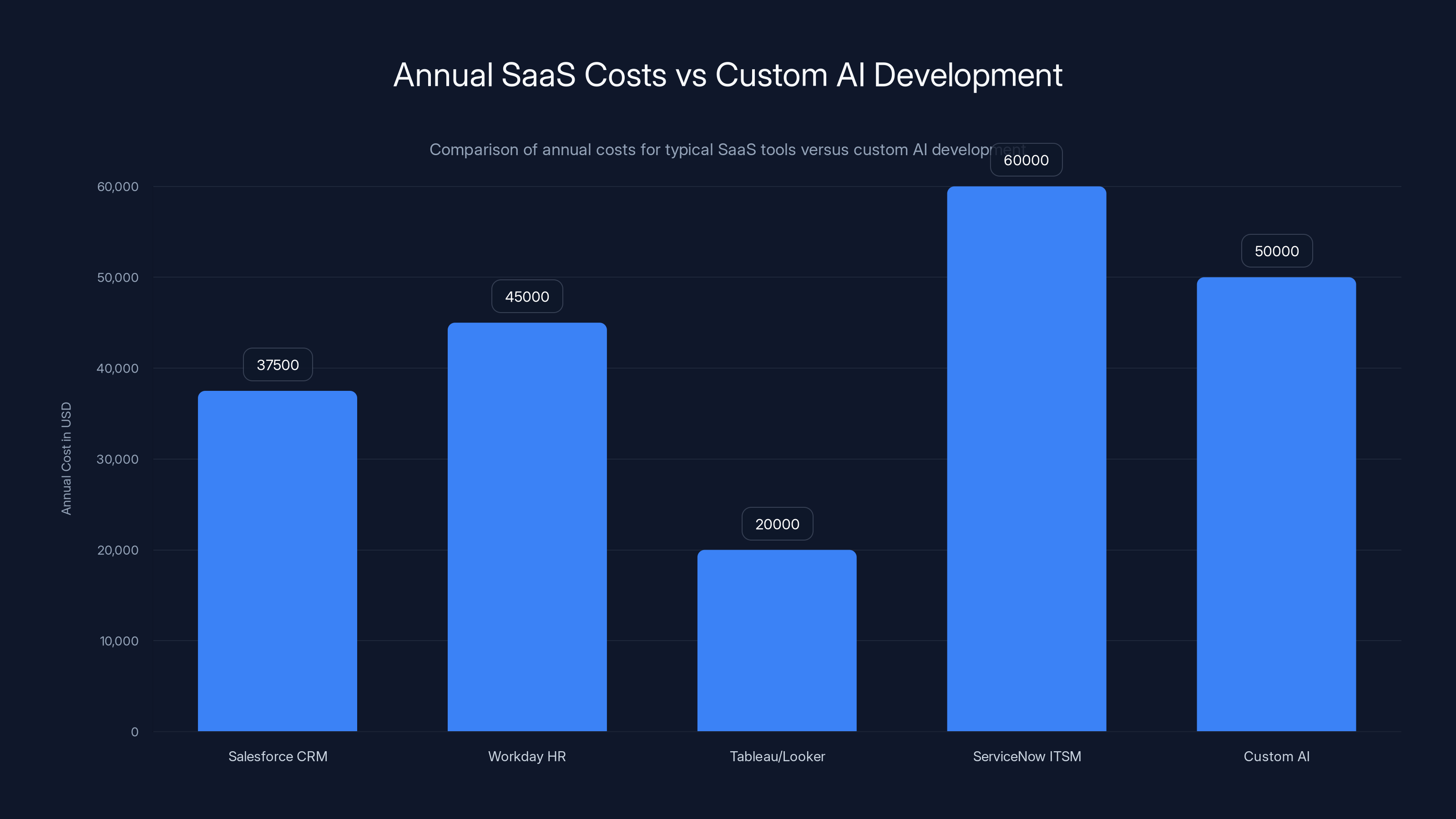

The math is getting compelling. A typical enterprise might spend:

- Salesforce CRM: 50,000 annually (per 100 users)

- Workday HR: 60,000 annually (per 100 users)

- Tableau or Looker: 30,000 annually (per 50 users)

- ServiceNow ITSM: 80,000 annually (per 100 users)

That's easily

Now imagine building a custom AI application that handles your specific workflows rather than forcing your workflows into a vendor's template. The upfront cost might be

The payback period is getting short enough that CFOs are taking this seriously.

Where the Gap Emerges

Here's what Mensch understands that most vendors won't say: replatforming creates a winner-take-most dynamic. The companies that move first and build the right infrastructure will see massive competitive advantages. Everyone else falls behind.

Imagine two financial services firms:

Company A builds an AI-powered financial modeling system that ingests their data, learns their workflows, and generates accurate forecasts in real time. They reduce their reporting cycle from five days to five hours. That's a competitive advantage in how fast they can react to market conditions.

Company B uses a traditional BI tool, goes through their standard monthly reporting process, and always operates on stale data. Their decision-making cycle is a week behind Company A.

Over time, that gap compounds. Company A is making better decisions, faster. They're also spending less on software licenses. They're reinvesting that savings into better analytics and data infrastructure. The gap gets wider.

This is what Mensch means when he talks about infrastructure creating separation. It's not just about the AI model itself. It's about having the data, the technical team, the security frameworks, and the organizational culture to leverage AI effectively.

How Fast Can Enterprise Development Actually Move?

Mensch's claim that "AI is making us able to develop software at the speed of light" isn't metaphorical. It's measurable.

Traditional enterprise software development follows roughly this timeline:

- Requirements gathering: 2-4 weeks

- Design and architecture: 2-4 weeks

- Development sprint cycles: 8-16 weeks (typically 2-4 sprints)

- QA and testing: 3-6 weeks

- Staging and deployment: 2-4 weeks

- Stabilization and fixes: 2-4 weeks

Total: 4-6 months for a moderately complex enterprise application.

With AI-assisted development:

- Requirements gathering: 1 week (AI helps document and clarify)

- Code generation and scaffolding: 1 week (AI generates 60-70% of boilerplate)

- Customization and integration: 2-3 weeks

- Testing and QA: 1-2 weeks (AI finds edge cases and generates test cases)

- Deployment: 1 week

Total: 6-8 weeks. That's 6-8x faster.

The acceleration comes from several places:

AI code generation eliminates the most tedious, repetitive work. Standard CRUD operations, API integrations, database schemas, error handling, and boilerplate code are generated automatically. This is probably 40-50% of traditional enterprise software development.

Faster documentation: AI can write documentation as the code is being written, and generate it automatically from the code itself. No waiting for engineers to document things after launch.

Automated testing: AI can generate test cases, identify edge cases, and perform regression testing faster than manual QA teams. This cuts QA time by 50-70%.

Continuous intelligence: As the application runs, AI monitors performance, identifies bugs, suggests optimizations, and flags security issues. This happens in real time, not in quarterly review cycles.

The speed improvement is real, and it compounds. If you can deploy updates 6-8x faster, you can iterate, learn from customer feedback, and improve your application at a fundamentally different pace than traditional software.

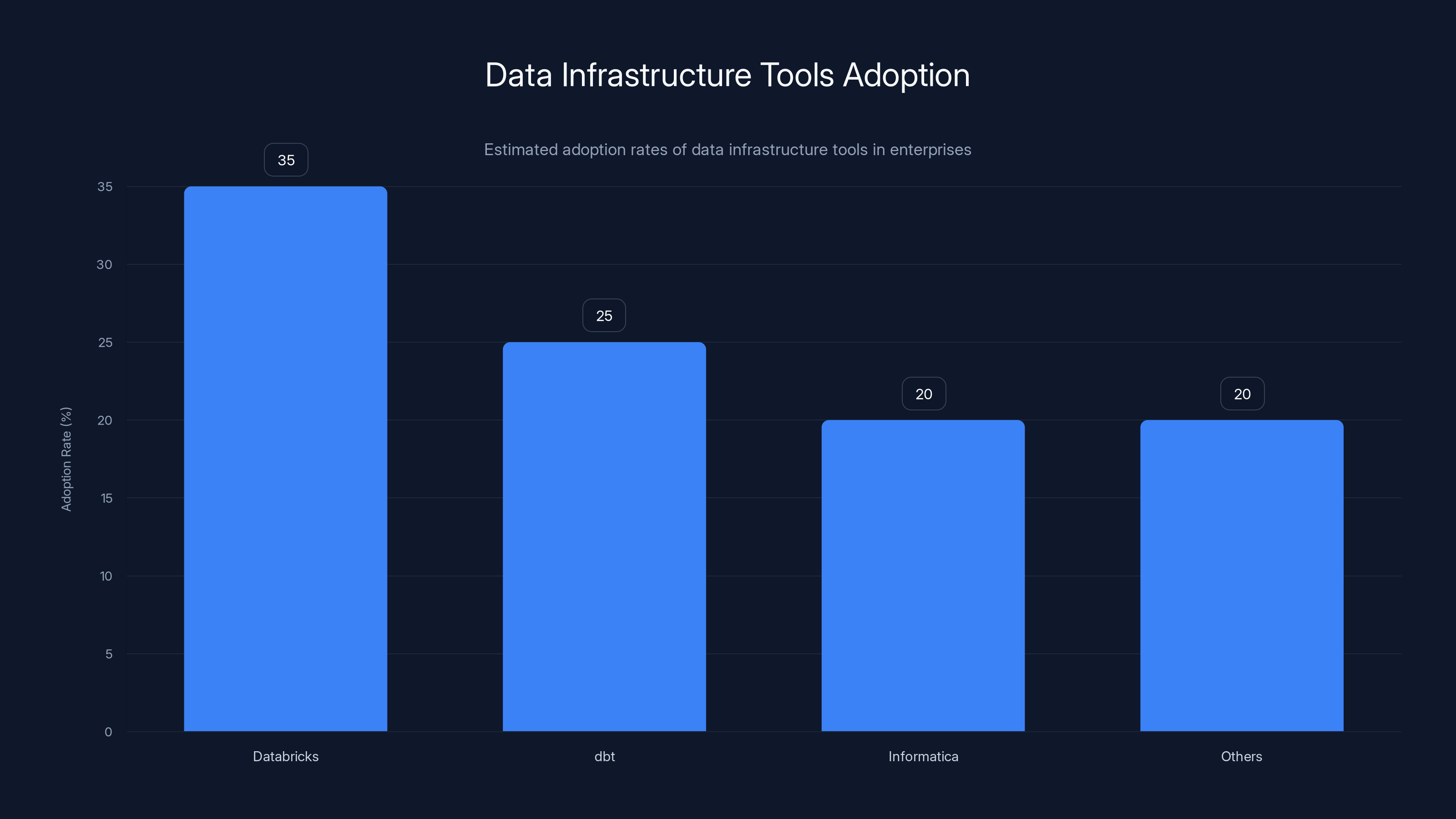

Estimated data shows Databricks leading in adoption among enterprises, followed by dbt and Informatica. Investing in these tools can enhance data infrastructure, crucial for AI scalability.

The 50% Replacement Thesis: Which Enterprise Apps Are Actually at Risk?

Not all enterprise SaaS is created equal. Some categories are far more vulnerable to AI replacement than others.

High-Risk Applications (Likely to Be Replaced)

Customer Service and Support: This is probably the most vulnerable category. Zendesk, Salesforce Service Cloud, and similar platforms handle ticketing, routing, and knowledge management. AI can learn your support patterns, respond to routine inquiries, route complex issues, and build knowledge bases automatically.

Replacement probability: Very High (80-90%)

Report Generation and Business Intelligence: Tools like Tableau, Looker, and Power BI spend significant money helping enterprises turn data into insights. AI can do this faster and more accurately. It can generate reports automatically, identify anomalies without being explicitly programmed to look for them, and provide insights that wouldn't occur to a human analyst.

Replacement probability: High (70-80%)

Human Resources Management: Systems like Workday and BambooHR handle recruiting, onboarding, performance management, and benefits administration. These are workflows that AI can learn and optimize. AI can screen resumes, conduct initial interviews, identify high performers, and predict attrition risk. Much of this is already happening through point solutions, but a fully integrated AI alternative is entirely feasible.

Replacement probability: High (70-80%)

Document and Process Automation: UiPath, Blue Prism, and similar RPA tools handle repetitive, rules-based processes. AI can do this better and without the brittleness of traditional RPA. As soon as the process changes slightly, traditional RPA breaks. AI adapts.

Replacement probability: Very High (85-95%)

Marketing Automation: Platforms like Marketo and HubSpot manage campaigns, lead scoring, and personalization. AI can do all of this more effectively. It can generate copy, optimize send times, predict which leads will convert, and personalize content at scale.

Replacement probability: High (75-85%)

Medium-Risk Applications (Partially Replaceable)

CRM (Sales Management): This is trickier. Salesforce does a lot of things. The core CRM functionality—managing customer interactions, pipeline tracking, deal management—can definitely be handled by AI. But Salesforce also provides a massive ecosystem of integrations, third-party applications, and customization options. Complete replacement is less likely, but competitive alternatives will emerge.

Replacement probability: Medium (50-60%)

Enterprise Resource Planning (ERP): SAP, Oracle, and Microsoft Dynamics manage incredibly complex business processes across finance, supply chain, manufacturing, and more. These are hard problems. AI can improve optimization and decision-making, but the sheer complexity and industry-specific requirements make full replacement unlikely in the near term.

Replacement probability: Medium (40-50%)

Low-Risk Applications (Unlikely to Be Replaced)

Security Information and Event Management (SIEM): Tools like Splunk and Microsoft Sentinel handle security monitoring and threat detection. While AI will definitely improve these capabilities, the regulatory requirements, compliance needs, and audit trails make it unlikely that enterprises will replace them entirely. Enhancement is more likely than replacement.

Replacement probability: Low (20-30%)

Financial Management and Accounting: NetSuite, SAP Financial Management, and similar tools handle complex financial processes. The compliance and regulatory requirements are intense. Full replacement is unlikely, though AI will enhance forecasting, anomaly detection, and reporting.

Replacement probability: Low (20-30%)

Adding up the "high-risk" categories: customer service, BI/reporting, HR, document automation, and marketing automation make up roughly 50-60% of the enterprise SaaS market by spend. This aligns closely with Mensch's 50% claim.

Infrastructure as the True Competitive Moat

Here's what separates Mensch's prediction from fantasy: he understands that having access to a powerful AI model isn't enough. The real differentiator is infrastructure.

Infrastructure isn't sexy. It doesn't make for good press releases. But it determines whether you can actually build and run custom AI applications at enterprise scale.

Data Infrastructure and Quality

You can't build a good AI application without good data. And most enterprises have a data problem.

Your data is probably scattered across:

- Legacy on-premise systems that run custom code from 2003

- Multiple cloud platforms (AWS, Azure, Google Cloud)

- SaaS platforms with proprietary data formats

- Data lakes that nobody quite understands

- Spreadsheets in people's email

Data quality issues are endemic: inconsistent formatting, missing values, duplicate records, outdated information, privacy concerns, compliance violations.

Building a unified data layer—what enterprises call a "data mesh" or "data fabric"—is a 6-18 month project for a moderately complex enterprise. Tools like Databricks, dbt, and Informatica help, but it's still hard.

Companies that have invested in data infrastructure over the past 5-10 years are positioned to move fast with AI. Everyone else is blocked.

Cloud and Compute Infrastructure

Running AI applications at enterprise scale requires compute capacity. AWS, Google Cloud, and Microsoft Azure have made this more accessible, but it's not trivial.

You need:

- GPU or TPU capacity for model inference

- High-performance networking

- Low-latency storage for real-time applications

- Multi-region redundancy for reliability

- Capacity planning that accounts for variable load

A mid-sized enterprise running multiple AI applications might spend

This creates a barrier to entry. Smaller enterprises or those still running mostly on-premise can't easily build custom AI applications. Larger enterprises with existing cloud infrastructure have a significant advantage.

Security and Compliance Frameworks

Enterprise customers care deeply about security. Building custom AI applications means you're responsible for:

- Data encryption at rest and in transit

- Access control and identity management

- Audit logging and compliance reporting

- Model security (adversarial attacks, model poisoning)

- Privacy preservation (not training on sensitive customer data)

- Regulatory compliance (GDPR, HIPAA, SOX, etc.)

This is non-trivial. Many AI application frameworks and libraries don't have enterprise-grade security built in. You need to add it yourself, which is expensive and error-prone.

Vendor-provided SaaS tools have already solved many of these problems (or at least claim to have). Building custom applications means building it again from scratch.

Companies with mature security and compliance teams can do this. Everyone else needs to hire or partner with specialists.

Skilled Technical Workforce

This is probably the biggest constraint. Building and operating AI applications requires:

- ML Engineers: 250,000+ annually

- Data Engineers: 200,000+ annually

- DevOps/Platform Engineers: 200,000+ annually

- AI/ML Product Managers: 220,000+ annually

That's a team of 4-6 people costing

A mid-sized enterprise might need 2-3 of these teams. That's

Not every enterprise can support that. And in today's labor market, finding experienced ML and data engineers is genuinely hard.

This creates a two-tier system:

-

Tier 1: Large enterprises and well-funded startups with access to capital and talent. They build custom AI applications and get significant competitive advantages.

-

Tier 2: Small and mid-market enterprises that can't afford the upfront investment. They continue using vendor SaaS and gradually fall behind.

Over time, Tier 1 companies grow faster and take market share from Tier 2. Eventually, Tier 2 has to make a choice: invest heavily in building internal capabilities, or partner with specialized vendors who provide AI applications as a service.

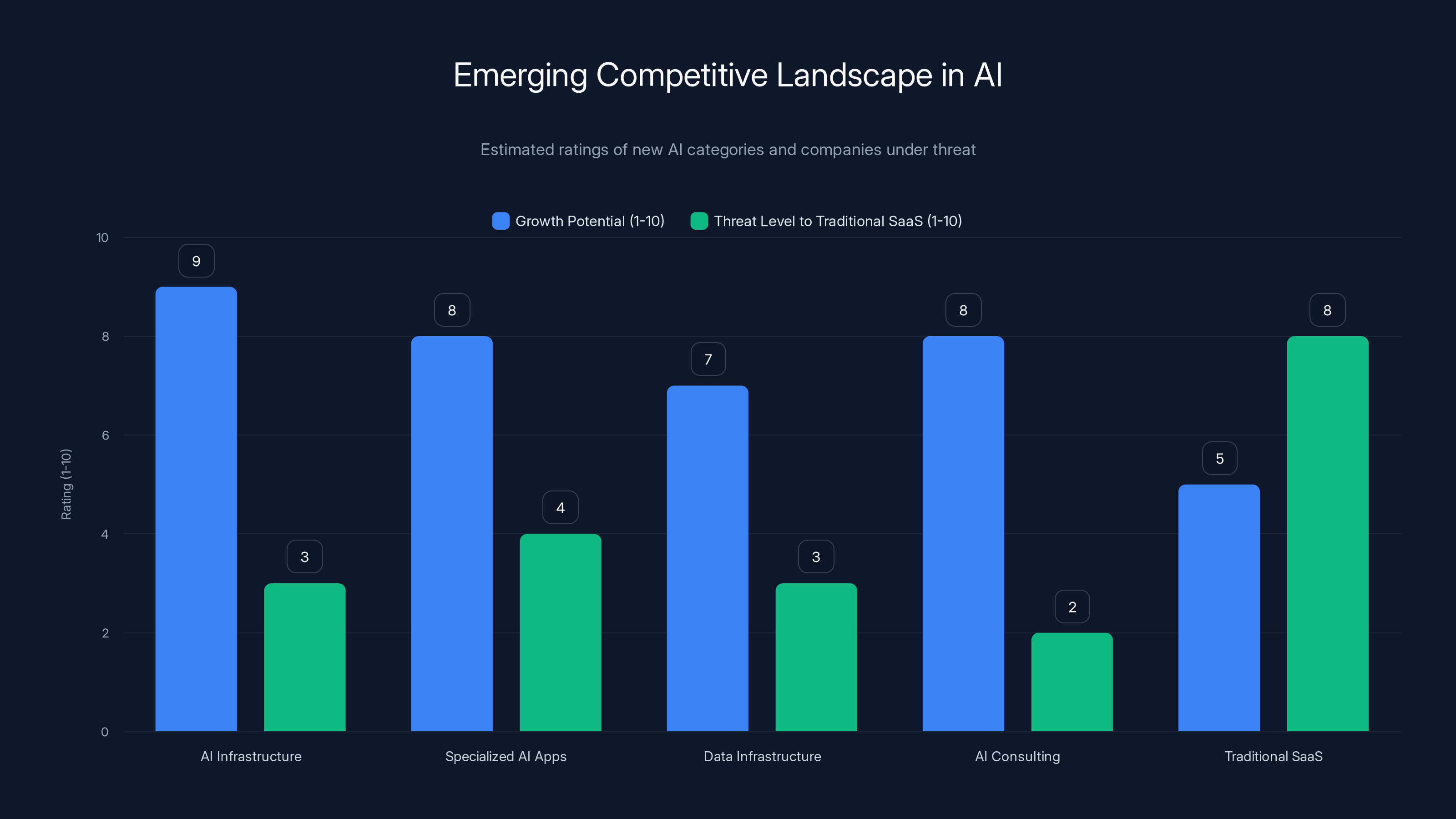

AI infrastructure platforms and specialized AI applications are poised for significant growth, while traditional SaaS vendors face high threat levels due to emerging AI solutions. Estimated data.

The Business Case for Replatforming

Let's build a concrete financial model to understand when replatforming makes sense.

Assume a mid-market enterprise with 500 employees using a typical SaaS stack:

Current State (Traditional SaaS)

| Category | Annual Cost | Notes |

|---|---|---|

| CRM (Salesforce) | $50,000 | 200 users at $25/month |

| HR (Workday) | $40,000 | 500 users at $8/month |

| BI/Analytics (Tableau) | $25,000 | 50 power users |

| Support (Zendesk) | $20,000 | 30 agents |

| Marketing Automation | $15,000 | HubSpot at 200 contacts |

| RPA Tool | $30,000 | 5 processes, 3 developers |

| Total Software Spend | $180,000 | Per year |

| Implementation/Customization | $50,000 | Estimated annual |

| Total Year 1 Cost | $230,000 | |

| 3-Year TCO | $690,000 |

Replatforming Scenario (Custom AI Applications)

| Category | Cost | Notes |

|---|---|---|

| Initial Infrastructure Setup | $80,000 | Data warehouse, cloud setup, security |

| Development Team (Annual) | $700,000 | 4 senior engineers |

| Initial Development (6 months) | $350,000 | Half the team's time |

| Ongoing Operations | $50,000 | Cloud infrastructure, monitoring |

| Year 1 Total Cost | $1,130,000 | |

| Years 2-3 Annual Cost | $750,000 | Operations + maintenance + enhancements |

| 3-Year TCO | $2,630,000 | |

| Breakeven Timeline | 4+ years |

At first glance, replatforming looks expensive and doesn't make sense. You're spending 4x more for 3 years with no payoff.

But the model changes if you account for:

Adjusted Model with Benefits

Operational Efficiency Gains: Custom AI applications are typically 40-50% more efficient at their primary task compared to generic SaaS tools. For support, that means 40-50% fewer support staff needed. For reporting, 60% faster time to insight.

Let's model just the support function:

- Traditional: 30 support agents, 1 support manager, $1.5M annual cost

- AI-powered: AI handles 60% of inquiries, reducing to 12 agents, 1 manager, $600K annual cost

- Savings: $900K annually

Faster Decision-Making: Custom AI applications provide better data and faster insights, enabling better decisions.

- Traditional: Monthly reporting cycle, strategic planning based on old data

- AI-powered: Real-time dashboards, AI-generated insights, decisions based on current data

- Business impact: Estimated 5-10% improvement in conversion rates, customer retention, supply chain efficiency

- Value: For a mid-market enterprise with 5M additional revenue

Reduced Vendor Lock-In: You own your code and data. No more paying premium pricing for new features or paying to move your data out.

- Savings: Estimated 15-20% of software spend as you renegotiate or eliminate vendor contracts

Updated 3-Year ROI

| Year | Traditional Spend | AI Spend | Support Savings | Other Benefits | Net Cost |

|---|---|---|---|---|---|

| Year 1 | $230K | $1,130K | $0 | $0 | $900K additional |

| Year 2 | $240K | $750K | $900K | $500K (efficiency gains) | -$410K (savings!) |

| Year 3 | $250K | $750K | $900K | $500K (efficiency gains) | -$400K (savings!) |

| 3-Year Total | $720K | $2,630K | $1,800K | $1,000K | -$810K (savings) |

Once you account for operational improvements and business benefits, the ROI flips dramatically. Year 1 is expensive, but Years 2-3 show significant savings.

For enterprises with higher spend on the vulnerable categories (support, BI, marketing automation), the economics are even more favorable. A large enterprise might save $5-10M annually on the same applications.

The Data and Talent Bottleneck

Mensch's comment about needing "the right infrastructure in place" is diplomatic. What he's really saying is: "Most enterprises don't have it, and building it is hard."

Let's be concrete about the bottlenecks:

Data Quality Challenge

Studies consistently show that enterprises rate their data quality as "fair" or "poor." Only about 30-40% of enterprises report high-confidence in their data quality.

Why? Because data quality is boring and doesn't make anyone's career, so it gets deprioritized. Data scientists spend 60-80% of their time cleaning and preparing data. They hate it. But it's essential.

Building an enterprise-grade data foundation requires:

- Data governance: Defining who owns data, how it's classified, who can access it

- Data quality processes: Automated validation, cleansing, deduplication

- Data lineage: Knowing where every piece of data came from and how it's used

- Privacy controls: Ensuring sensitive data is properly protected

This is a 12-24 month project for a moderately complex enterprise. You need dedicated people. And even then, it's never truly "done." It's an ongoing program.

Most enterprises haven't committed to this. They're trying to build AI applications on top of poor data, which means the AI applications are also poor.

Technical Talent Shortage

The job market for ML engineers is extremely competitive. Senior ML engineers in major tech hubs are getting offers from Google, Amazon, Meta, and startups offering

A mid-market enterprise competing for the same talent is usually offering

- Pay premium salaries: Putting pressure on your budget

- Hire junior engineers: Takes longer to be productive, requires mentorship

- Outsource to vendors: Reduces control, increases ongoing costs

Many enterprises are choosing option 3: partnering with specialized vendors (like Databricks, Palantir, or consulting firms) to build and operate AI infrastructure.

This is a valid strategy, but it means you're not truly replatforming. You're just replacing one vendor (Salesforce) with a different vendor (a consulting firm or AI infrastructure company). The cost structure is different, but you're still vendor-dependent.

Only about 30-40% of enterprises report high-confidence in their data quality, highlighting a significant challenge in data management.

Mistral's Opportunity in the Replatforming Wave

Why is Mistral making this claim? Because replatforming is good for Mistral and other AI model companies.

If 50% of enterprise SaaS gets replaced, enterprises will need access to frontier AI models. They'll use GPT-4, Claude, Mistral's models, or others.

They'll probably use multiple models for different purposes:

- Large models for complex reasoning and creative tasks

- Small models for real-time, latency-sensitive applications

- Specialized models for domain-specific tasks (medical imaging, code generation, etc.)

Mistral claims to have over 100 enterprise customers already exploring this transition. That's meaningful validation.

But here's the important nuance: Mistral's success doesn't depend on the replatforming thesis being 100% correct. It just needs to be true enough that enterprise customers are willing to invest in building AI infrastructure. And that's clearly happening.

For an AI model company like Mistral, enterprise customers building custom applications is better than enterprise customers using OpenAI through chat.openai.com. Custom applications create:

- Higher volumes of API calls: Enterprise applications often make millions of API calls per day

- Longer commitment periods: Once integrated into your application, switching models is expensive

- Competitive defensibility: You build specific features on top of the model, making competitors less relevant

From Mistral's perspective, 50% enterprise replatforming means potentially $10-50 billion in API spend (conservative estimate). That's a massive opportunity.

The Emerging Competitive Landscape

As replatforming accelerates, we'll see new categories of companies emerge:

New Winners

AI Infrastructure Platforms: Tools that make it easier to build, deploy, and operate AI applications at scale.

- Runable offers AI-powered automation for creating presentations, documents, reports, images, videos, and slides starting at $9/month, enabling teams to automate routine content generation workflows

- LangChain, LlamaIndex, and similar frameworks for building LLM applications

- Ray for distributed computing

- MLflow for model management

Specialized AI Applications: Point solutions that solve specific enterprise problems better than generic SaaS.

- AI-powered customer support

- AI-powered recruiting

- AI-powered financial forecasting

Data Infrastructure: The foundation that makes custom AI possible.

AI Consulting and Implementation: Companies that help enterprises build and deploy custom AI applications.

- McKinsey, Boston Consulting Group, Deloitte (established firms)

- Specialized boutiques focusing on AI

Companies Under Threat

Traditional SaaS vendors in high-risk categories will face increasing pressure:

- Zendesk (customer support)

- Salesforce (CRM, for certain use cases)

- Workday (HR, for certain processes)

- Tableau/Looker (BI/analytics)

- Marketing automation vendors (HubSpot, Marketo)

These companies aren't going away overnight. But they'll see:

- Slower growth as enterprises pause new implementations

- Lower net retention as enterprises migrate workloads

- Pressure on pricing as enterprises compare custom AI alternatives

- Need to invest heavily in AI capabilities to remain competitive

The companies that successfully integrate AI into their platforms will survive. Those that don't will become legacy systems, slowly losing market share to custom alternatives.

While traditional SaaS tools can cost between

How to Prepare for the Replatforming Wave

If you're in an enterprise, you probably need to make decisions about this in the next 12-24 months. Here's a pragmatic roadmap:

Phase 1: Assessment (Months 1-3)

Audit your SaaS spend: Which tools are you spending the most on? Which ones handle routine, rule-based processes? Start with a spreadsheet.

Evaluate your data infrastructure: How clean is your data? Can you confidently export all customer data from your core systems? If it takes weeks to get clean data, that's a problem.

Assess your technical team: Do you have ML/data engineering talent? If not, can you hire them? What's your willingness to upskill existing engineers?

Calculate TCO for your highest-spend applications: Use the framework from earlier in this article. What's the real three-year cost of your current SaaS stack?

Phase 2: Pilot Projects (Months 4-9)

Pick one non-critical application and try replatforming it:

-

Customer support automation: Build an AI-powered chatbot using an LLM API. See if it can handle 30-50% of your support volume. This costs

50K and teaches you a lot. -

Report automation: Take your most time-consuming monthly report and automate it with an AI agent. Time how long it takes. Compare to your current process.

-

Document automation: Use AI to automatically generate standard documents (contracts, proposals, etc.). Measure accuracy and time savings.

These pilots shouldn't try to be production-ready. They should be learning exercises. The goal is to understand:

- What does custom AI development actually look like?

- How good are the results?

- What are the hidden costs and challenges?

- Does the business case hold up?

Phase 3: Strategic Planning (Months 10-12)

Based on your pilot results, decide:

- Go all-in: Invest in building internal AI engineering capabilities and begin systematic replatforming

- Partner approach: Work with consulting firms or specialized vendors to build and operate AI infrastructure

- Incremental approach: Replace one application at a time, learning as you go

- Wait and see: Stay with current SaaS for now, but invest in data infrastructure to be ready when you do move

Each approach is valid. The key is making an informed decision based on your specific situation.

Phase 4: Execution (Year 2+)

Execute on your chosen strategy. Budget 12-24 months for significant progress.

The Reality Check: Why 50% Might Be Overconfident

Mensch's prediction is bold, and there are legitimate reasons to question it:

Enterprise Software is Stickier Than Expected

Companies are locked into their current tools by:

-

Integration complexity: Your CRM is integrated with your ERP, your marketing automation, your billing system, etc. Ripping it out means rebuilding all those integrations.

-

User training: 500 people are trained on Salesforce. Switching them to a custom application means 500 people need to learn new tools. This is disruptive and expensive.

-

Process standardization: You've optimized your processes around your current tools. New tools mean rethinking and potentially disrupting those processes.

-

Risk aversion: Enterprise IT tends to be conservative. Choosing an unproven custom application over a vendor-backed solution is risky. Executives who make bad decisions get fired. Executives who choose IBM (or Salesforce, or SAP) are less likely to be blamed.

Custom Applications Have Hidden Costs

Building something once is different from maintaining it for 10 years. You need:

- Ongoing development: New features, bug fixes, optimizations

- Monitoring and operations: 24/7 uptime requires investment

- Technical debt: Your initial 6-month build accumulates complexity. By year 3, it's harder to modify and maintain.

- Dependency management: Libraries you use today will become deprecated. You need to maintain and update constantly.

Many enterprises will start the replatforming journey but get bogged down in maintenance costs and give up.

AI Models Will Continue to Improve Dramatically

The AI models available today are good, but they'll be vastly better in 2-3 years. An enterprise that invests heavily in building on today's models might find those investments obsolete when a breakthrough happens.

This creates a "wait and see" dynamic. Companies postpone investments because they expect better models to emerge.

Regulatory and Compliance Challenges

Building custom applications means you're responsible for compliance. That's not trivial:

- Data residency: Some industries require data to stay in specific geographic regions

- Audit trails: You need comprehensive logs of who accessed what, when

- Model explainability: In some industries (finance, healthcare, lending), you need to explain why the AI made a decision. Many models can't do that

- Liability: If your AI makes a bad decision, who's liable? You are.

Vendor SaaS shifts much of this responsibility to the vendor. Custom applications put it all on you.

The 50% Claim Might Be About Potential, Not Reality

It's possible Mensch is describing what could happen under ideal circumstances, not what will happen in reality.

The actual replatforming adoption rate might be:

- Year 1-2: 5-10% of eligible applications (early adopters, high-ROI use cases)

- Year 3-5: 15-25% of eligible applications (mainstream adoption)

- Year 5+: 30-40% of eligible applications (majority adoption)

That's still massive disruption. But it's different from "50% by 2027."

What This Means for Different Personas

For CIOs and IT Leaders

You need to start planning now. Replatforming is coming, and you want to be on the leading edge, not the trailing edge.

Action items:

- Commission a formal assessment of your SaaS stack and data infrastructure

- Start recruiting for AI/ML engineering talent

- Invest in data quality improvements (this takes time, start now)

- Pilot one or two AI-based replacements for non-critical applications

- Develop a 3-year replatforming roadmap

For SaaS Vendors

Your traditional moat (switching costs, network effects) isn't enough anymore. You need to:

- Invest heavily in AI: Integrate AI into your core product, not as an afterthought

- Become more flexible: Custom SaaS with industry-standard APIs is one defense

- Partner with AI providers: If you can't beat them, integrate their models into your platform

- Focus on integration and ecosystem: The applications that become indispensable are those that integrate with everything else

For AI Model Companies

The opportunity is enormous. Enterprise customers building custom applications will consume massive amounts of API tokens.

- Invest in go-to-market: Help enterprises understand how to use your models

- Develop domain-specific models: General-purpose models are table stakes. Domain expertise creates competitive advantage

- Build developer tools and infrastructure: Make it as easy as possible to build with your models

- Establish long-term relationships: Once an enterprise integrates your model into their core application, switching is expensive

For Startups and Entrepreneurs

This is the best time in a decade to start an enterprise software company. The opportunity landscape is completely open:

- Point solutions: Build an AI-powered application that solves one specific problem better than anything else

- Infrastructure plays: Build tools that make it easier to build and operate AI applications

- Industry-specific solutions: Build deep expertise in one industry (healthcare, financial services, manufacturing) and own that space

- Implementation services: Help enterprises navigate the replatforming transition

The Long-Term Implications

If Mensch's thesis is even partially correct, we're looking at a fundamental shift in how enterprise software works.

In 5-10 years, the enterprise software landscape might look like:

-

Tier 1 applications (systems of record): ERP, CRM, financial management. These remain vendor-provided because of complexity and regulatory requirements. But they'll be much more AI-native.

-

Tier 2 applications (systems of engagement): Customer support, marketing, HR processes. These are increasingly custom or AI-specialized point solutions. Vendors that can't adapt will be disrupted.

-

Tier 3 applications (systems of intelligence): Reporting, forecasting, anomaly detection, optimization. These are almost entirely AI-powered and often custom.

-

Infrastructure and integration layer: The real value creation for vendors will be in making it easy to integrate all these different applications. This is where Zapier, Workato, and similar platforms become critical.

The companies that thrive will be those that understand this shift and position themselves accordingly. The companies that ignore it will become slowly irrelevant.

Conclusion: A Decade of Change

Mensch's claim that "more than 50% of enterprise SaaS could be replaced" isn't just hyperbole. It's a reasonable prediction based on:

- The dramatic speed improvements that AI enables

- The attractive economics of custom applications vs. vendor SaaS

- The maturity of infrastructure, tooling, and models

- The growing pool of technical talent

- The increasing frustration enterprises have with vendor lock-in

But—and this is crucial—replatforming will be selective, not universal. Some applications will be replaced. Others will evolve and integrate AI. And some will be sticky enough to survive largely unchanged.

The companies best positioned to win this transition are those that:

-

Build strong data foundations now: Data is the new moat. Clean, well-organized data that can be accessed and analyzed quickly is what enables all successful AI applications.

-

Invest in talent early: ML and data engineering talent is scarce and expensive. But getting ahead of the curve means you can hire before salaries explode.

-

Develop AI-native infrastructure: Don't bolt AI onto legacy systems. Build cloud-native, AI-first infrastructure from the ground up.

-

Be willing to make bold decisions: Choosing custom AI over proven SaaS is risky. But the enterprises that do it and succeed will have massive competitive advantages.

The next 3-5 years will determine which companies win the replatforming transition. Start planning today.

Use Case: Automating your weekly reports and presentations with AI-powered document generation

Try Runable For Free

FAQ

What does "replatforming" mean in the context of enterprise software?

Replatforming refers to the strategic shift from using traditional, vendor-provided SaaS applications to building custom applications powered by AI. This is distinct from simple upgrades or migrations. Replatforming involves rethinking core business processes and choosing to build in-house solutions rather than adopt off-the-shelf software, often resulting in significant changes to how teams work and how systems are organized. It's similar to the transition from on-premise software to cloud-based SaaS that happened over the past 15 years.

Why is data infrastructure so critical for AI-powered applications?

Data infrastructure is critical because AI models are only as good as the data they're trained on and the data they process. Enterprises with fragmented, poor-quality data will produce unreliable AI applications, even if they use the best models available. Clean, well-organized data allows AI to learn accurate patterns, make better predictions, and provide actionable insights. Without solid data foundations, enterprises waste money building AI applications that don't deliver value. This is why many enterprises are investing 12-24 months in data infrastructure before attempting significant AI initiatives.

What are the main financial advantages of custom AI applications over traditional SaaS?

The financial advantages include dramatically reduced per-user costs (no licensing fees), elimination of vendor lock-in premium pricing, faster decision-making through real-time insights, and operational efficiency gains from AI automation. While upfront costs are higher (

Which enterprise applications are most vulnerable to AI replacement?

Applications handling routine, rule-based, data-driven processes are most vulnerable. This includes customer support (chatbots can handle 40-60% of inquiries), business intelligence and reporting (AI can generate insights automatically), HR processes (recruiting, onboarding, performance management), document automation and RPA (AI learns workflow patterns), and marketing automation (AI optimizes campaigns and generates content). Conversely, applications requiring complex regulatory compliance, deep industry expertise, or significant customization (like comprehensive ERP systems) are less likely to be fully replaced. The "vulnerable" category represents about 50-60% of enterprise SaaS spending, aligning with the Mistral CEO's prediction.

How long does it typically take to replatform from traditional SaaS to custom AI applications?

The timeline varies significantly based on complexity and organizational readiness. A small pilot project (single application, limited scope) takes 3-6 months and costs

What should an enterprise prioritize first when considering replatforming?

Start with data infrastructure assessment and improvement. This takes time but is foundational to everything that follows. Simultaneously, recruit or hire 1-2 senior ML/data engineers to lead assessment and strategy. In parallel, pick one non-critical application for a pilot project (3-6 month investment) to learn what custom AI development actually looks like. Only after these foundational pieces are in place should you commit to systematic replatforming of your core applications. This sequencing takes 12-18 months but dramatically increases the probability of success compared to rushing directly to building core applications on inadequate infrastructure.

How does this impact the traditional enterprise software vendors like Salesforce or Workday?

Traditional SaaS vendors face significant pressure but won't disappear overnight. They're responding by investing heavily in AI capabilities to make their platforms more competitive with custom alternatives. The vendors that successfully integrate AI into their core products and become more flexible (through APIs and integrations) will survive. Those that don't will gradually lose market share to specialized AI point solutions and custom applications. We're likely to see a 10-15 year transition period where both coexist, with increasing pressure on vendors' growth rates and pricing power as more enterprises complete successful replatforming projects and demonstrate the superior economics of custom AI applications.

What are the key risks of replatforming to custom AI applications?

Major risks include underestimating ongoing maintenance and operational costs (custom applications require continuous development and monitoring), difficulty hiring and retaining specialized talent, regulatory and compliance challenges (you become responsible for audit trails, explainability, and regulatory compliance rather than delegating to a vendor), technical debt accumulation (the initial 6-month build becomes increasingly complex and expensive to modify), and disruption to employee workflows and organizational processes. Additionally, AI model capabilities will improve significantly in coming years, potentially making today's implementations suboptimal. Many enterprises will start replatforming and then abandon projects partway through when reality doesn't match initial projections.

Can small and mid-market enterprises compete with large enterprises in the AI replatforming transition?

Large enterprises have clear advantages: access to capital, talent, and existing cloud infrastructure. However, small and mid-market enterprises have advantages in agility and focus. Many successful replatforming strategies involve niche plays where a smaller enterprise becomes the specialist in a specific industry or use case. Additionally, specialized vendors and consulting firms will emerge to help smaller enterprises navigate replatforming, reducing the barrier to entry. A small or mid-market company with strong data fundamentals and focused strategy can absolutely compete effectively in AI replatforming. Size is less important than execution quality and strategic clarity.

How should IT leaders evaluate replatforming readiness for their organization?

Evaluate across four dimensions. First, data readiness: can you access clean, well-organized data from your core systems? Second, technical talent: do you have or can you hire engineers capable of building AI applications? Third, financial capacity: can you sustain

Key Takeaways

- AI enables 6-8x faster software development cycles, making custom applications economically competitive with vendor SaaS after 2-3 years

- Approximately 50-60% of enterprise SaaS spending is vulnerable to replacement, primarily in customer support, BI, HR, marketing automation, and RPA categories

- Infrastructure becomes the true competitive moat: companies with clean data, cloud infrastructure, security frameworks, and skilled talent will outpace those without

- Replatforming creates a two-tier system where prepared enterprises gain 5-10% efficiency improvements while others fall behind, widening competitive gaps

- CFOs should begin ROI analysis on high-spend SaaS categories; replatforming payback periods are often 18-24 months when accounting for operational improvements

Related Articles

- Sarvam AI's Open-Source Models Challenge US Dominance [2025]

- Heron Power's $140M Bet on Grid-Altering Solid-State Transformers [2025]

- AI Memory Crisis: Why DRAM is the New GPU Bottleneck [2025]

- SurrealDB 3.0: One Database to Replace Your Entire RAG Stack [2025]

- Adani's $100B AI Data Center Bet: India's Infrastructure Play [2025]

- Infosys and Anthropic Partner to Build Enterprise AI Agents [2025]

![AI Replacing Enterprise Software: The 50% Replatforming Shift [2025]](https://tryrunable.com/blog/ai-replacing-enterprise-software-the-50-replatforming-shift-/image-1-1771422018383.png)