Amazon's 16,000 Job Cuts Explained: The Second Wave of Tech Workforce Restructuring [2025]

Let's be real. Amazon just announced it's cutting 16,000 jobs. That's more than a small city worth of people losing their livelihoods. And it's the second massive wave in ninety days. The first? 14,000 people in October. Before that? Another round in 2022.

What's happening at Amazon isn't unique to Amazon anymore. It's become the playbook for Big Tech in the 2020s. Hire aggressively during the boom, then cut hard when growth slows or priorities shift. But there's something worth understanding here that goes deeper than just numbers and press releases. This is about how trillion-dollar companies restructure themselves, what signals it sends to the rest of the industry, and whether this is actually smart business or just reactive panic.

I'm going to walk you through what we know, what it means, and what comes next. Because if you work in tech—or any industry where automation and AI are changing things—this matters to you.

TL; DR

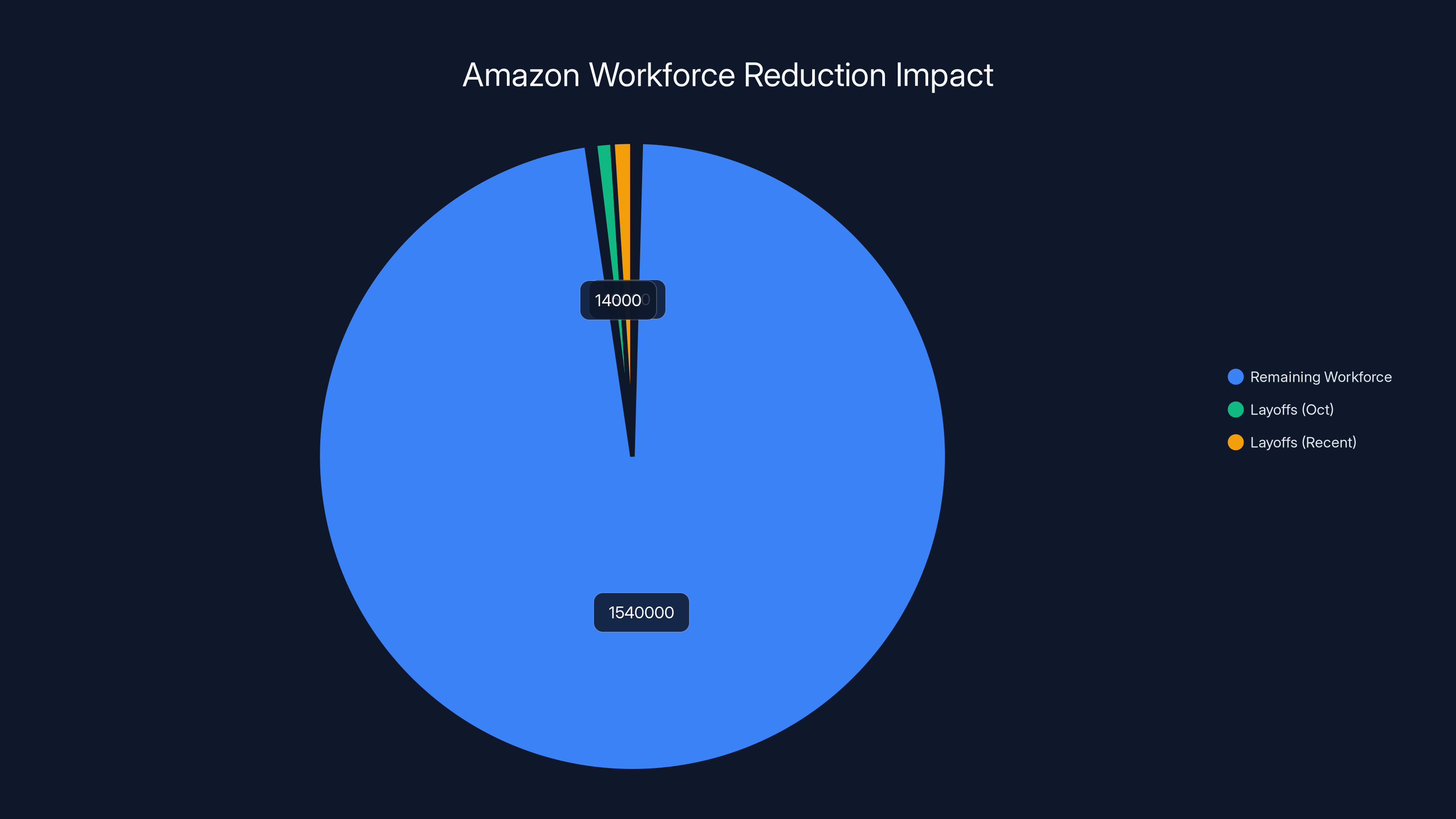

- Amazon is cutting 16,000 jobs in its second layoff wave within three months, representing roughly 1% of its 1.57 million total workforce, as reported by Amazon's official announcement.

- The restructuring focuses on reducing layers and bureaucracy, not closing specific business units, suggesting a fundamental reorganization of how work gets done, according to GeekWire.

- AI investment is reshaping roles, with leadership publicly stating the company needs fewer people in traditional positions and more in AI-related ones, as highlighted by Crypto Briefing.

- The company is still hiring selectively in strategic areas, particularly around artificial intelligence and customer-focused initiatives, as noted in Reuters.

- This trend reflects broader tech industry patterns where rapid hiring cycles are followed by aggressive cuts as companies reassess priorities, according to NerdWallet.

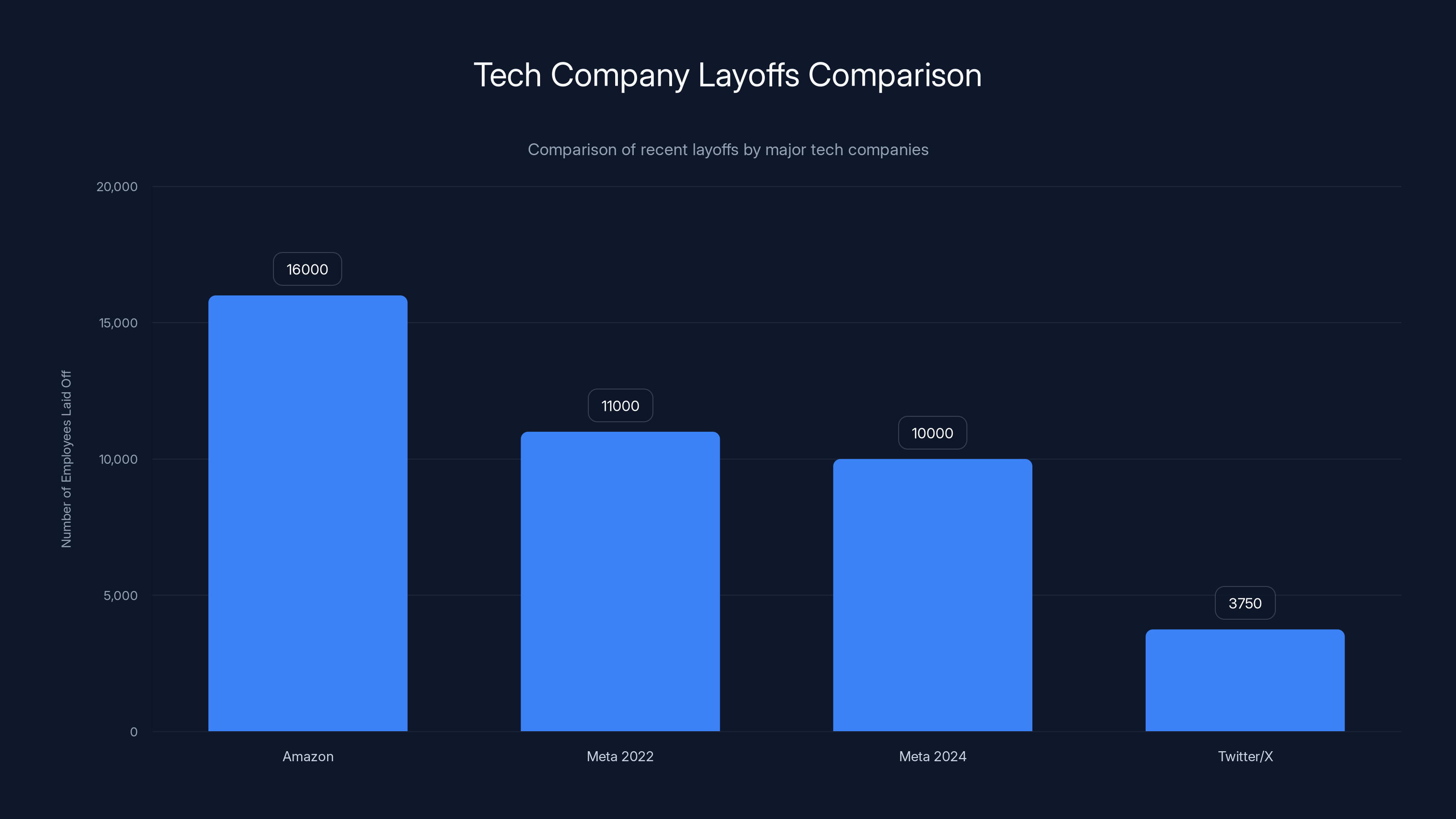

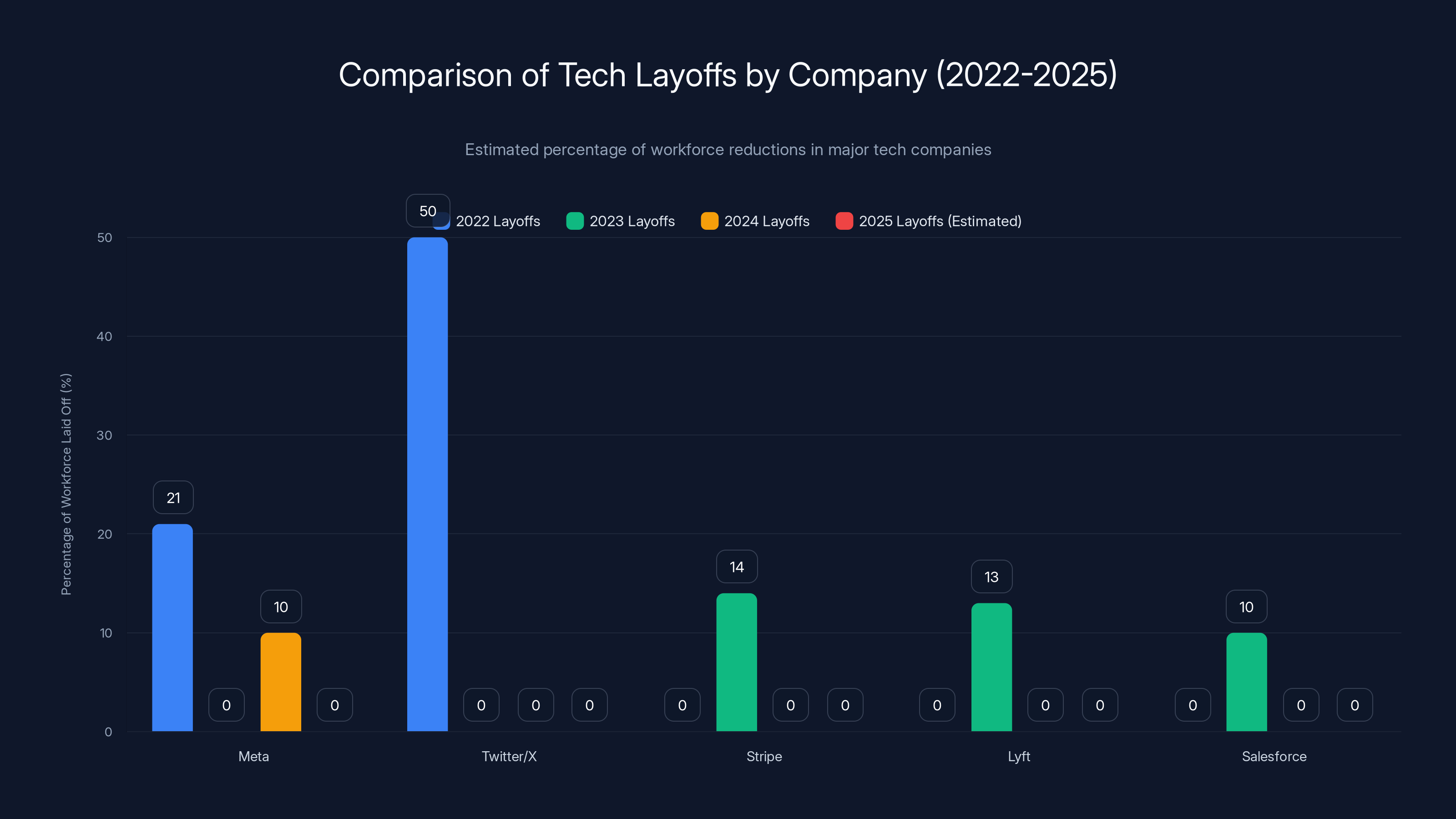

Amazon's 16,000 layoffs are significant but represent only 1% of its workforce, compared to Meta's and Twitter's higher proportional cuts.

The Announcement: What Amazon Actually Said

On January 28, 2025, Beth Galetti, Amazon's Senior VP of People Experience and Technology, sent a memo to employees explaining the cuts. This wasn't some buried announcement in an investor call. It was direct communication to the people who still had jobs and those who were about to lose them.

Galetti's language was careful. The cuts were framed as necessary for "reducing layers, increasing ownership, and removing bureaucracy." Translation: Amazon thinks it has too much middle management, too many approval processes, and too many people standing between decision-makers and the actual work.

What's interesting—and this matters—is what she said about timing. When employees inevitably asked, "Are these layoffs becoming a regular thing?", Galetti acknowledged the anxiety directly. She said the company wasn't planning to make massive cuts every few months as a new operating rhythm. But then she added: "every team will continue to evaluate the ownership, speed, and capacity to invent for customers, and make adjustments as appropriate."

That last part? That's not a commitment. That's a hedge. It means Amazon reserves the right to cut again whenever it decides "adjustments" are needed, as detailed in Amazon's official news release.

The memo arrived after a chaotic internal incident that leaked to Business Insider. Amazon had accidentally sent a meeting invite to AWS employees discussing job cuts and "Project Dawn," some kind of internal initiative that workers still don't fully understand. The invite was pulled back almost immediately, but the damage was done. People knew something was coming, as reported by Business Insider.

Amazon's layoffs show a shift from correcting over-hiring in 2022-2023 to restructuring for AI in 2024-2025. Estimated data.

The Numbers: What 16,000 Really Means

Amazon reported 1.57 million employees as of October 2024. That number is massive, so let's put 16,000 in perspective.

One percent might not sound like much. But when you're talking about a single company cutting that many people in one announcement, the ripple effects compound. Add the October layoff of 14,000, and you're looking at 30,000 jobs eliminated in three months—roughly 1.9% of the total workforce.

Here's what matters: These aren't frontline warehouse workers being reduced through automation or attrition. These are primarily corporate, technology, and management roles. The people who design systems, make decisions, and shape how the company operates, as noted in Amazon's official announcement.

Galetti did mention that the company had experienced single-digit growth over the prior five quarters. Translation: The explosive growth phase that justified hiring thousands of people isn't happening anymore. Amazon's core e-commerce business is mature. AWS is profitable but stabilizing. The company needs to rationalize its cost structure, as highlighted in Amazon's official news release.

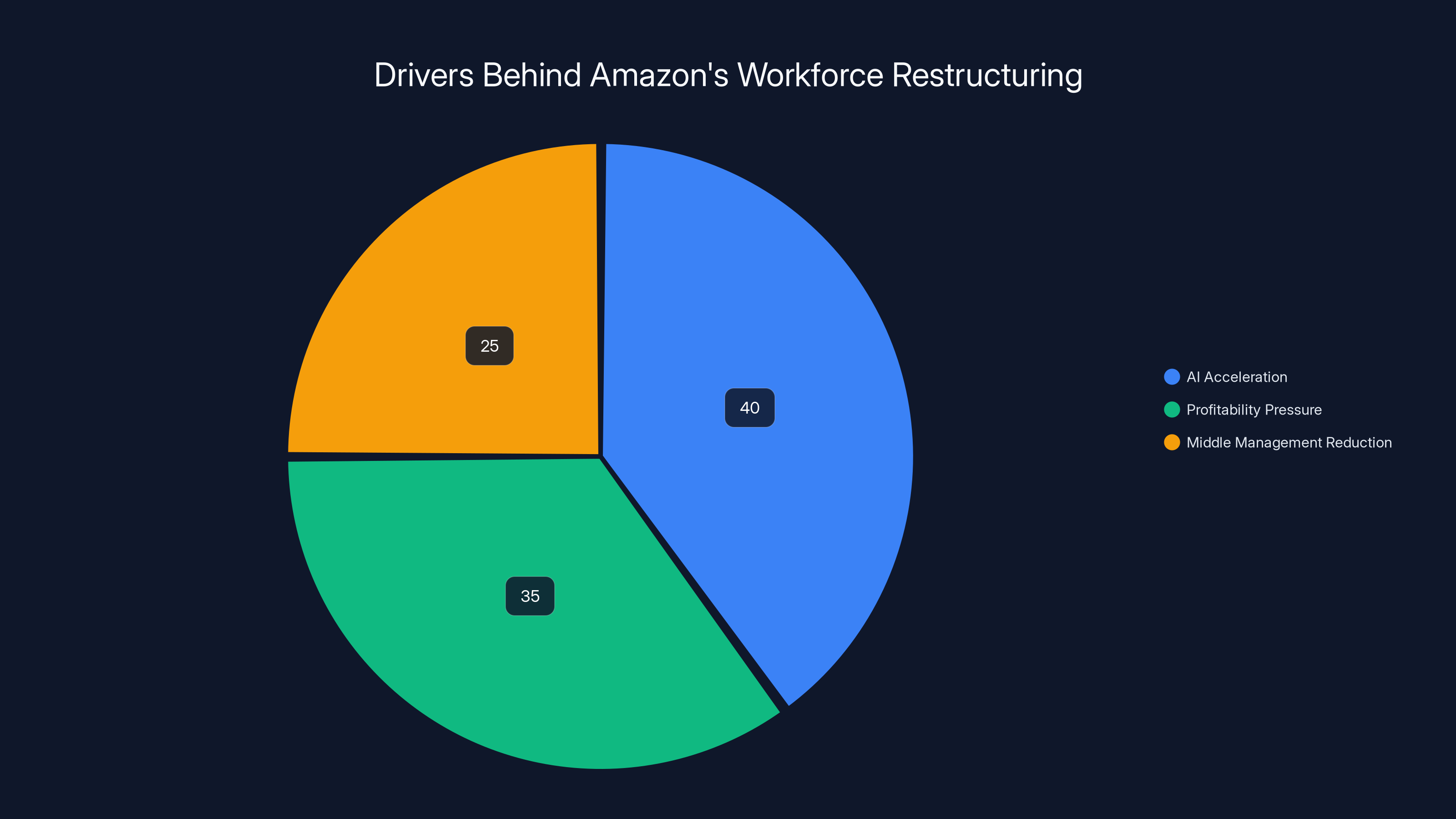

Why Now? The Real Drivers Behind the Cuts

Beth Galetti could have cited any number of reasons for the layoffs, but she landed on the concept of "restructuring." Some teams, she said, hadn't finished reorganizing from the previous round of cuts. That's the public explanation.

But let's look at what's actually happening below the surface.

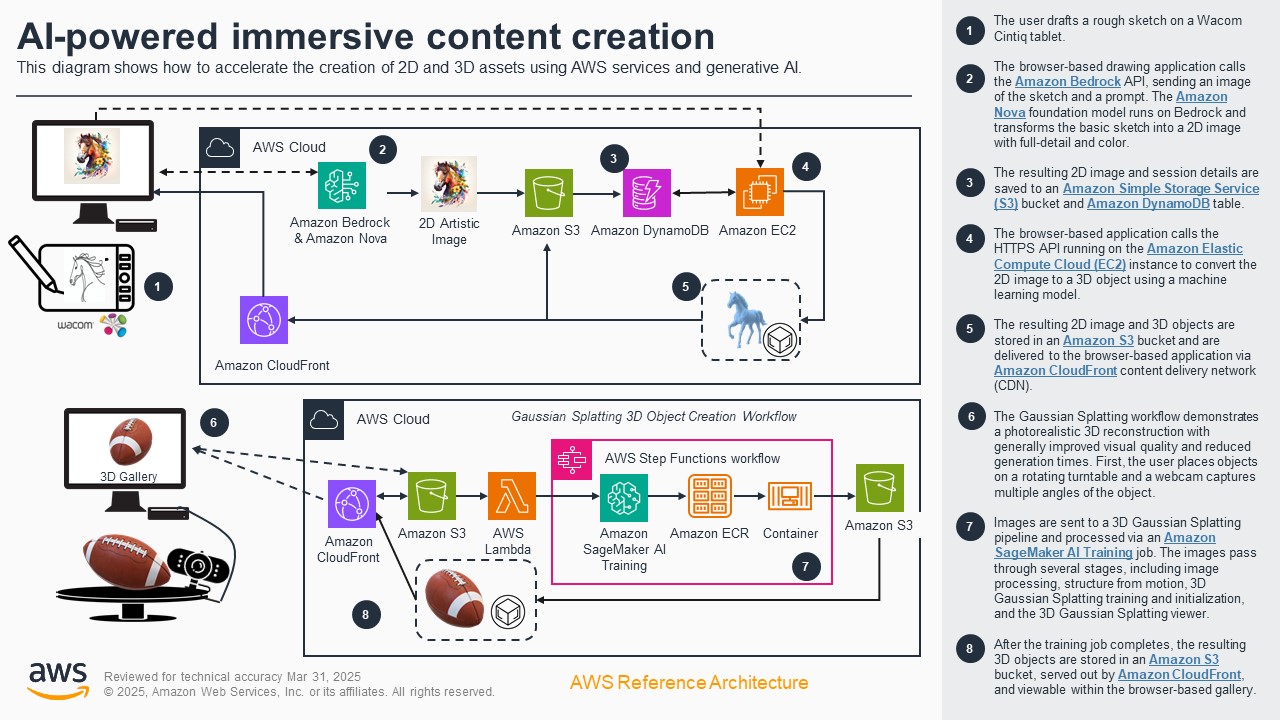

The AI Acceleration Reality

CEO Andy Jassy has been explicit about this. In internal memos from last year, he stated clearly that artificial intelligence will fundamentally change how many roles are staffed at Amazon. The company will need fewer people doing some jobs that exist today. The people who remain will work on different types of jobs—presumably those more aligned with AI development, deployment, and oversight, as reported by Crypto Briefing.

This isn't new thinking. Every major tech company is grappling with the same question: If AI can do the work, why keep paying humans to do it? But Amazon is one of the first to announce the implications so directly.

The Profitability Pressure

Amazon's Q3 2025 financials showed growth, but the margins are what matter. Cloud computing (AWS) has been the company's profit engine, but e-commerce—the flagship business—carries thinner margins. Investors have been pushing for higher profitability. Fewer people means lower operating costs. Lower costs mean higher margins. Higher margins mean stock prices go up, as analyzed by Reuters.

This is basic math, not strategy. And it's the math that drives every quarter's decision-making at the C-suite level.

The Middle Management Problem

Larger companies tend to accumulate organizational layers. What starts as a healthy span of control (one manager overseeing 5-8 people) becomes bloated over time. You end up with managers managing managers managing managers. Communication slows. Decision-making gets bureaucratic. Innovation stalls.

Amazon's tagline has always been "Day 1." The idea that the company operates with startup-like agility and focus. But after decades of growth, that's become harder to maintain. The layoffs are partly Amazon trying to recapture that feeling, as noted in Amazon's official news release.

Recent layoffs account for approximately 1.9% of Amazon's workforce, highlighting significant cuts in corporate and management roles. Estimated data.

The October Layoffs: Context for the Second Wave

Four months before this announcement, Amazon laid off 14,000 people. That came after CEO Andy Jassy took over and signaled the company needed to become leaner. The 2023 and early 2024 period had seen aggressive hiring, and Jassy decided that was a mistake.

But here's what's revealing: The October cuts didn't stick. Teams didn't actually complete their restructuring. People retired. Roles reorganized. And now, four months later, Amazon is essentially saying, "We need to do this again to finish the job," as reported by GeekWire.

That's not a well-executed restructuring. That's two half-baked layoffs instead of one well-planned one. It suggests internal confusion about what the company actually needs.

When leadership can't complete a restructuring in a single pass, it usually means either they don't have clarity on what they're trying to achieve, or the organization is more complex than anyone realized. Probably both.

The Layoff Memo: What Galetti Actually Meant

Galetti's memo is worth reading between the lines. She emphasized that despite the cuts, Amazon will continue hiring in "strategic areas." That's not contradiction. It's clarification.

Amazon isn't pulling back from all spending. It's reallocating. The company is likely hiring fewer mid-level managers and coordinators, but more machine learning engineers, data scientists, and AI researchers. It's hiring fewer content moderators and more automation specialists, as noted in Crypto Briefing.

The net result is fewer total jobs, but a different skills mix. This is how large companies modernize without completely shutting down.

Galetti also said the company is not planning large layoffs "every few months" as some kind of new rhythm. But the language there is important. She didn't say there won't be more cuts. She said they're not planning them as a regular cycle, as highlighted in Amazon's official news release.

In Big Tech, that distinction matters.

The chart highlights the varying strategies of tech companies in workforce reduction from 2022 to 2025, with Twitter/X making the most significant single cut of 50% in 2022, while Meta has had multiple rounds of layoffs totaling 30% by 2025. Estimated data for 2025.

How This Compares to Other Tech Layoffs

Amazon isn't alone. Between 2022 and 2025, the tech industry shed hundreds of thousands of jobs.

- Meta: Cut 21% of its workforce (about 11,000 people) in November 2022, then another 10% (about 10,000 people) in March 2024

- Twitter/X: Elon Musk cut roughly 50% of staff after taking over in late 2022

- Stripe: Laid off 14% of its workforce in 2023

- Lyft: Cut 13% of staff in 2023

- Salesforce: Reduced headcount by 10% in 2023

The pattern is consistent: Hire aggressively in boom years. Cut aggressively when growth slows. Repeat.

But Amazon's approach has been different. Instead of one massive cut, the company is doing staged reductions. October. January. Possibly more. It's like a slow bleed instead of a sudden shock, as reported by NerdWallet.

The difference between Amazon's approach and, say, Twitter's approach is revealing. Twitter cut 50% all at once and learned the hard way that you lose institutional knowledge and can't operate effectively with that kind of shock. Amazon is taking a more measured approach, which should theoretically be better planned. Except the fact that they're doing it in multiple rounds suggests the planning still isn't great, as analyzed by Business Insider.

The AI Factor: Why This Matters More Than Previous Layoffs

Here's what makes the 2025 wave different from the 2022-2023 layoffs: The previous waves happened during a period of tech boom and bust. Companies hired too much, then corrected. That's a normal cycle.

This layoff wave is happening alongside massive AI investment. The subtext is clear: The jobs Amazon is cutting aren't coming back. They're being eliminated and replaced with AI systems or AI-augmented roles that require fewer human workers, as reported by Crypto Briefing.

When a company announces cuts during a period of AI acceleration, the message changes. It's not "we over-hired." It's "we're restructuring because technology has changed."

That has implications for:

Career Planning: If you're in a role that could be automated, your job security is lower. You need to develop skills around AI, not alongside it. If you're a data analyst, you need to learn prompt engineering. If you're in customer service, you need to understand chatbot systems.

Organizational Design: Companies are going to have fewer managers and more specialists. The organizational pyramid is flattening. That means fewer promotion opportunities for people who've been climbing the ladder.

Vendor Relationships: If you sell to big tech companies, your customer might be cutting 1% of headcount but also implementing AI systems that replace 10-20% of the work. That changes how they buy from you.

Industry Ripple Effects: When Amazon cuts 16,000 people, those people are available to competitors or startups. Some will move to other companies. Some will start their own. The talent distribution changes.

Estimated data shows AI acceleration as the primary driver behind Amazon's restructuring, followed by profitability pressure and middle management reduction.

What This Means for AWS and Cloud Growth

Amazon Web Services is Amazon's most profitable business. The cloud infrastructure side of the company generates the margins that subsidize everything else.

Are the layoffs hitting AWS particularly hard? Not necessarily. In fact, the company has signaled it's hiring more engineers and infrastructure specialists. But it's possible some AWS roles are being consolidated. Middle managers on the AWS side might be experiencing the biggest hit, as noted in Crypto Briefing.

Why does this matter? Because AWS pricing and feature velocity have been under pressure from competitors. Google Cloud is more aggressive. Azure is bundled with enterprise software Microsoft already owns. AWS needs to be leaner but also more innovative. That's a hard balance to strike while cutting staff.

The real risk: Cut too much and innovation slows. Keep too much overhead and margins compress. Amazon's trying to find that sweet spot, as analyzed by Reuters.

The Employee Experience: What Actually Happens During These Cuts

Let's talk about what it's like to work at a company that just announced 16,000 layoffs when you have 1.57 million employees.

First, the uncertainty. Galetti's memo didn't say which teams or departments would be most affected. So everyone wonders: Is my team safe? Do I need to look for a new job? Most employees won't know for 2-3 weeks, as reported by Amazon's official news release.

Second, the morale hit. Even if your specific job is safe, you probably know people who aren't. Productivity drops. People spend energy updating resumes and networking instead of working.

Third, the institutional knowledge drain. Some of the people being cut have been at Amazon for 10+ years. They know how things work. When they leave, that knowledge leaves with them. Future projects will move slower because someone new has to figure out why a system was built a certain way.

Fourth, the survival guilt. People who keep their jobs often feel grateful but also guilty that others didn't make it. That can create tension in teams.

Galetti tried to address this in her memo by emphasizing the company's commitment to those staying. But words don't fix the reality that 16,000 people are getting severance packages instead of paychecks, as noted in Amazon's official news release.

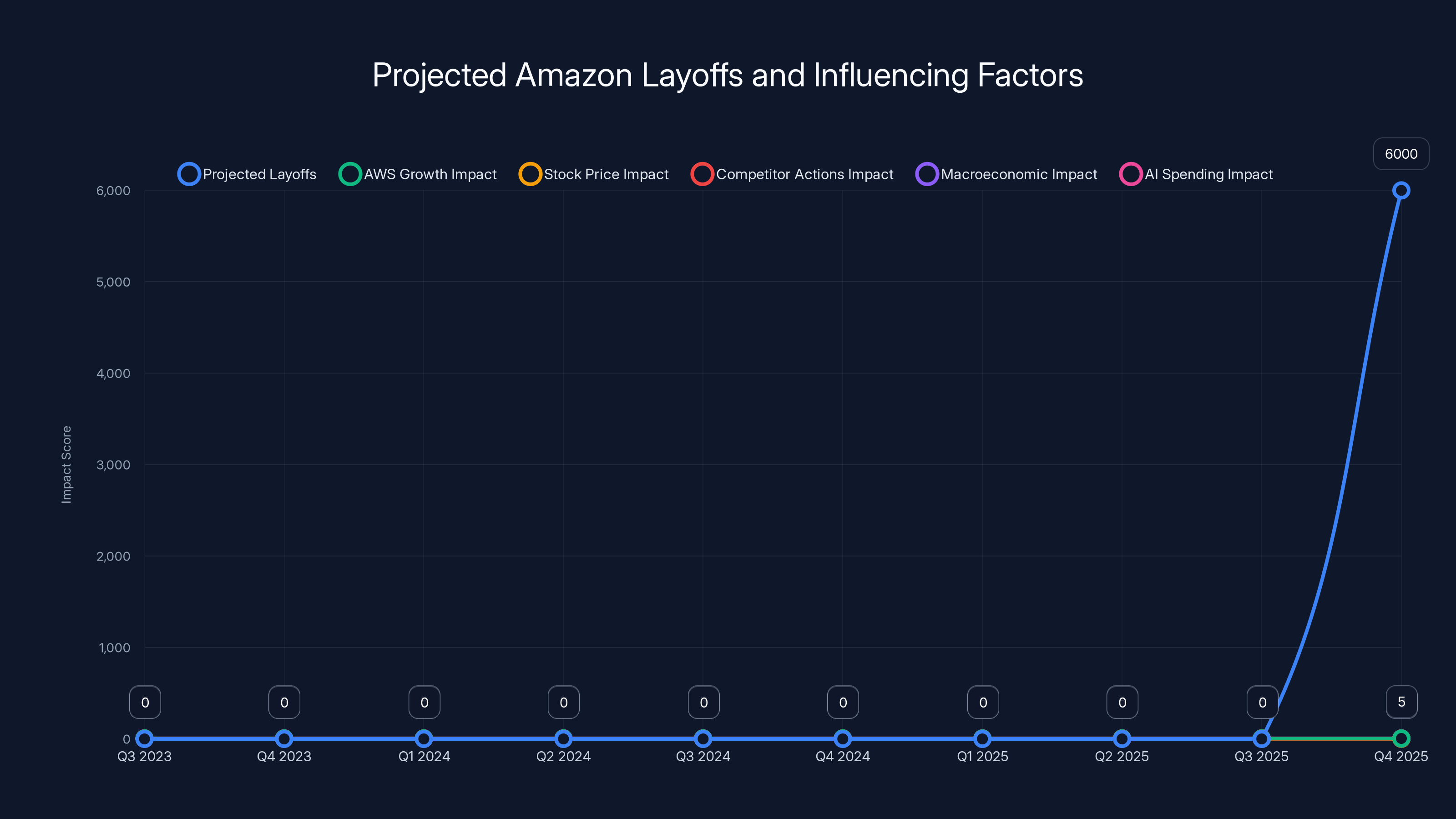

Projected layoffs by Q4 2025 could reach 6,000, influenced by AWS growth, stock price, competitor actions, macroeconomic conditions, and AI spending priorities. Estimated data.

The Broader Tech Industry Implications

When Amazon moves, the rest of tech watches. The company sets patterns that others follow.

So what pattern is this setting?

First: Expect more layoffs. If Amazon is cutting 1% of its workforce after relatively modest growth issues, other companies with slower growth will cut more. We're probably seeing Q1 2025 as the beginning of another major layoff cycle across tech, as analyzed by NerdWallet.

Second: Layoffs will be framed around AI, not just cost reduction. Companies will say they're restructuring for AI-ready organizations, not admitting they're cutting because growth slowed.

Third: Cuts will be selective, not broad. Instead of across-the-board 5-10% reductions, companies will target specific departments and roles while hiring in others. That creates organizational chaos but also concentration of power.

Fourth: Remote work will be pressured again. Tech companies that allow remote work are easier to cut because you don't have to relocate people. Companies that forced people back to offices (like Elon Musk at Twitter) did it partly to make layoffs easier. Expect more pressure on remote teams.

Fifth: Contract and freelance work will grow. Why hire permanent employees when you can hire contractors who don't get benefits or severance? We'll see the rise of gig-based software engineering and AI prompt engineering.

What About Amazon's Competitors?

Google, Microsoft, Meta, and Apple have all gone through their own layoff cycles. So how does Amazon's 16,000 compare?

Google hasn't had a single massive layoff like Twitter. Instead, it's done smaller targeted cuts. Sundar Pichai has been publicly disciplined about spending. But Google also has much higher profit margins than Amazon, so the pressure to cut is lower, as noted in Business Insider.

Microsoft has been the most restrained. The company has mostly kept headcount stable while reallocating resources. That's partly because Microsoft's cloud business (Azure) is growing faster than AWS, so the pressure to cut isn't as intense, as reported by The Seattle Times.

Meta has been the most aggressive in restructuring. Mark Zuckerberg's "Year of Efficiency" led to massive cuts in 2024, and the company has continued trimming in 2025. But Meta's stock has recovered and advertising business is growing, so maybe the cuts are working?

Apple rarely announces layoffs publicly, but the company has been reducing hiring and consolidating teams. The iPhone business is mature and needs fewer people.

The trend across all of them: Mature companies with slowing growth are right-sizing their organizations. Amazon is just more public about it than most, as noted in NerdWallet.

The Geographic Impact: Where Are These 16,000 Jobs?

Amazon didn't specify in the Galetti memo, but we can make some educated guesses.

Amazon has major office concentrations in Seattle (headquarters), Northern Virginia (AWS headquarters and offices), New York City, Los Angeles, and various international locations. The layoffs are likely concentrated in those areas, particularly in white-collar roles, as reported by Amazon's official news release.

Warehouse workers and fulfillment center staff probably aren't being cut as significantly. Those roles have turned over naturally, and Amazon's invested in automation in those areas already.

The geographic concentration matters because tech job loss has outsized impact in specific cities. Seattle's tech job market could see meaningful disruption if Amazon is cutting thousands of corporate roles there. Same with Northern Virginia, which is heavily dependent on AWS jobs, as noted in Amazon's official news release.

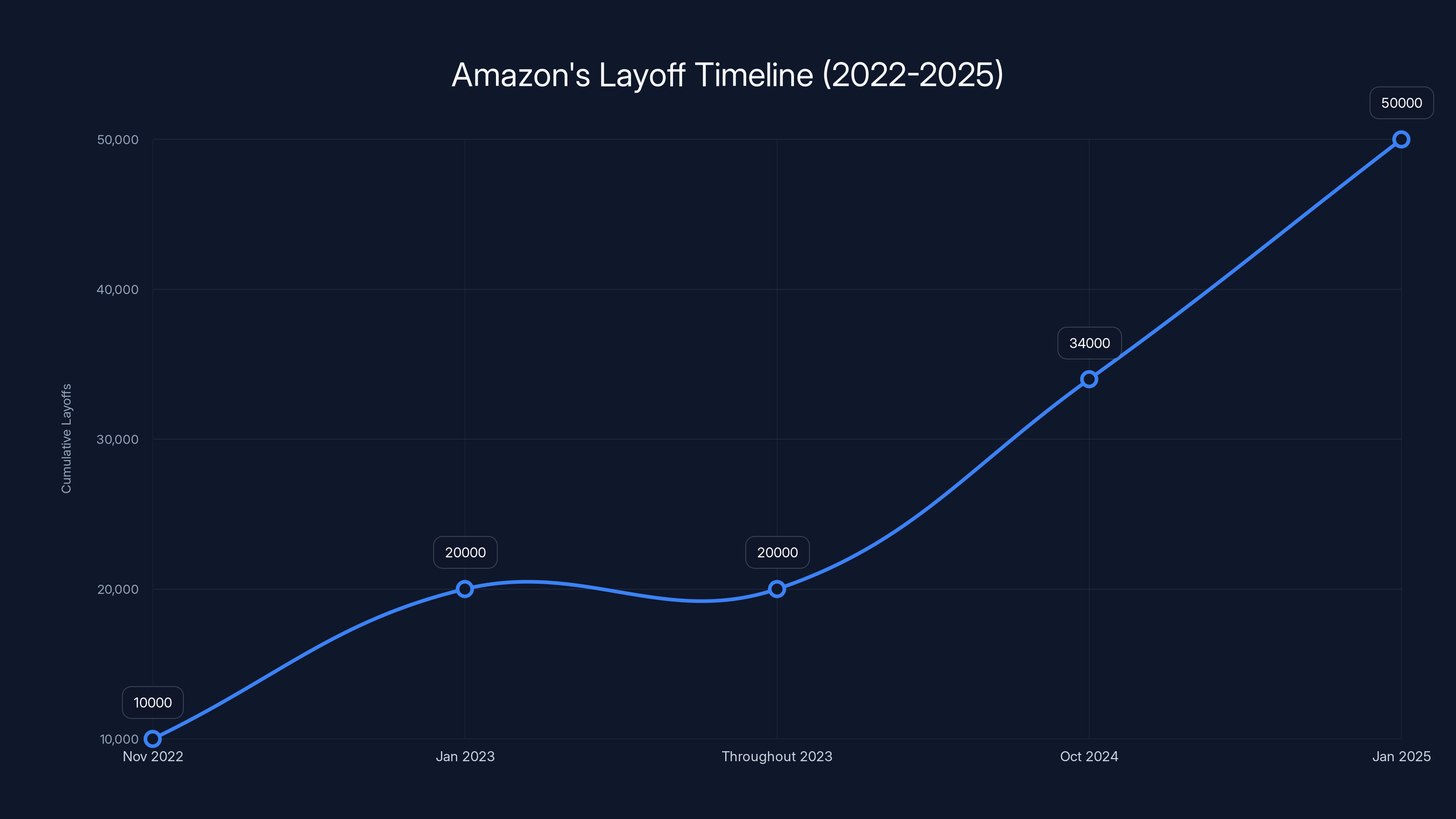

A Timeline of Amazon's Recent Layoff History

To understand what's happening now, it helps to see the pattern:

November 2022: Amazon announces first major layoff wave of 10,000 people, with Andy Jassy citing "over-hiring" during the pandemic. This was roughly 1% of workforce at the time.

January 2023: Amazon announces second wave of layoffs targeting 10,000 more positions. Total cuts: 20,000 in two months.

Throughout 2023: No major announced layoffs, but continuous smaller cuts and role consolidations. The company hires selectively in AWS and AI.

Q1-Q3 2024: Amazon reports growth and relatively stable headcount. Some hiring resumes in strategic areas.

October 2024: Jassy announces 14,000-person layoff, attributing it to "efficiency" and need to accelerate AI investments. This triggers surprise because the company had been hiring.

January 2025: Beth Galetti announces 16,000 more layoffs, saying teams hadn't completed restructuring from October cuts. This rounds out roughly 30,000 jobs eliminated in three months.

The pattern here is important. Cuts in 2022-2023 were about correcting over-hiring. Cuts in 2024-2025 are about restructuring for AI. Different drivers, but similar outcomes: Fewer people doing more work, as reported by GeekWire.

What Happens to the 16,000 People Being Cut?

This is the human side of the story.

Amazon typically offers severance ranging from a few weeks to several months of pay depending on tenure and level. The company also offers extended health insurance coverage for those being terminated, as noted in Amazon's official news release.

For senior people (directors, VPs), the financial cushion is usually enough to take 3-6 months to find a new role. For individual contributors and early-career people, the severance is tighter. Many will need to find a new job quickly.

Where do they go?

- Other big tech companies: Google, Microsoft, and Meta are also leaner but sometimes hiring in specific areas. These people become candidates.

- Startups: A lot of AWS engineers and product people will move to startups. Cloud startups especially benefit from hiring ex-AWS talent.

- Private equity and consulting firms: Companies like Bain, McKinsey, and TPG have technology practices looking for people with AI and cloud experience.

- Starting their own companies: Some will do what they should have done years ago and start their own ventures. A few will succeed wildly.

- Geographic relocation: Some will move to lower cost-of-living areas and take remote roles at smaller companies. San Francisco and Seattle talent will redistribute.

The economy will absorb these people. Tech has moved through multiple boom-bust cycles. But the personal disruption for 16,000 individuals and their families shouldn't be minimized, as noted in NerdWallet.

The AWS Outage Irony

Timing matters in the news cycle. The day after Amazon announced the layoffs, there was an AWS outage affecting multiple services. No connection? Probably not. But it looked bad—Amazon cutting people while infrastructure fails. The perception damage compounds the practical damage, as reported by Crypto Briefing.

When you lay off infrastructure engineers and operations people, you increase the risk that systems fail. That's not guaranteed, but the probability goes up. And when it does fail, people remember that the company just cut 16,000 people.

Looking Forward: What Comes Next?

Beth Galetti said this isn't the beginning of a new pattern of regular layoffs. But in tech, what leaders say and what actually happens are often different things.

If Amazon's growth remains in the single-digit range (as mentioned in Q3 filings), we'll probably see continued pressure to cut costs. The next opportunity would be mid-2025 or Q4 2025. Whether another cut happens depends on:

- AWS growth: If cloud growth accelerates, it buys Amazon time. If it stalls, expect more cuts.

- Stock price: Investors drive a lot of CEO behavior. If Amazon's stock stays strong despite the cuts, that signals the market approves. Expect more cuts.

- Competitor actions: If Google, Microsoft, or Meta announce new hiring in AI, Amazon might feel forced to cut less. If they cut more, Amazon might follow.

- Macroeconomic conditions: A recession would trigger more cuts immediately. Strong economy might slow them.

- AI spending priorities: The more Amazon commits to AI infrastructure, the more it needs to cut elsewhere to fund it.

My prediction? We'll see another, smaller round of cuts by Q4 2025. Not another 16,000. Maybe 5,000-8,000. Enough to be meaningful but not shocking. Enough to gradually reshape the organization without causing complete chaos, as analyzed by Reuters.

But that's speculation based on patterns. What's certain is that Amazon's done restructuring. The company is beginning a new phase of its life where it's smaller, leaner, and organized around AI instead of general growth.

The Bigger Picture: Tech Industry Transformation

Amazon's layoffs aren't really about Amazon. They're about what's happening across the entire tech industry.

For twenty years, the tech industry was in growth mode. Companies hired aggressively. Profitability wasn't always the priority. Growth was. More users. More revenue. More market share.

But that era is ending. Markets are saturated. User growth is slowing. Profitability is now required. And artificial intelligence is forcing companies to rethink what roles actually need humans, as noted in Crypto Briefing.

The layoffs are that transition from growth phase to mature phase. Amazon, Google, Meta, Microsoft—all the mature tech giants are figuring out what their organizations actually need when growth isn't a default excuse anymore.

For workers in tech, that means:

- Job security is lower than it was: Even successful companies will cut people regularly.

- Skills matter more than loyalty: Your tenure doesn't protect you anymore. Your ability to do work that's hard to automate does.

- Specialization is better than generalization: If you're a generalist, you're more replaceable. Be expert at something specific.

- Networking is more valuable than ever: When layoffs happen, your external network is your safety net.

- Geographic arbitrage is real: Remote work lets you live cheaply and earn tech salaries. That's a genuine advantage.

FAQ

Why is Amazon laying off 16,000 people when the company is profitable?

Profitability and layoffs aren't contradictory. Companies often cut people to increase profitability further. Amazon's core e-commerce business has slowed to single-digit growth, and while AWS is healthy, the company wants higher margins. Fewer people means lower operating costs, which means higher profit ratios—something investors reward. Additionally, CEO Andy Jassy has positioned these cuts as part of a restructuring around artificial intelligence, where the company believes it needs fewer traditional roles and more AI-focused ones, as reported by Crypto Briefing.

Is this the beginning of a new pattern of regular layoffs at Amazon?

According to Beth Galetti's memo, Amazon isn't planning large layoffs every few months as a new operating rhythm. However, her language was careful—she said it's "not our plan," not "we will never do this again." Given that Amazon has already cut 30,000 people in three months and this represents the company's third major layoff cycle in two years, the pattern suggests continued restructuring is likely. Most tech companies that have gone through one aggressive cost-cutting phase continue with smaller cuts over subsequent quarters or years, as noted in Amazon's official news release.

How do these 16,000 layoffs compare to layoffs at other tech companies?

In absolute numbers, Amazon's 16,000 is significant but not unprecedented. Meta cut 21% of its workforce (about 11,000) in 2022 and another 10% in 2024. Twitter/X cut roughly 50% after Elon Musk's acquisition. However, Amazon's 16,000 represents only about 1% of its 1.57 million-person workforce, making it proportionally smaller than what some competitors have done. Amazon's approach of staged cuts over several months is more measured than Meta's or Twitter's approach of single massive cuts, though it also suggests less decisive planning, as analyzed by NerdWallet.

What happens to Amazon employees affected by these layoffs?

Amazon typically provides severance packages ranging from several weeks to several months of pay depending on tenure and employee level, plus extended health insurance coverage. Employees receive notice periods and a transition period. Many affected employees will move to other tech companies, startups, consulting firms, or use the opportunity to start their own ventures. The tech job market, while competitive, has historically absorbed large numbers of workers from major tech company layoffs, though timing and individual circumstances vary significantly, as reported by Amazon's official news release.

How does Amazon's AI investment relate to these layoffs?

Amazon CEO Andy Jassy has explicitly stated that the company will need fewer people doing traditional jobs and more people working on AI-related roles. The layoffs are framed as part of a restructuring to position the company for artificial intelligence. However, total job reduction (30,000 cut vs. unknown number of new AI-focused hires) suggests the company expects AI to reduce total headcount needed. This is different from the 2022-2023 layoffs, which were framed as correcting over-hiring; the 2024-2025 cuts are about strategic transformation around emerging technology, as noted in Crypto Briefing.

Will there be more Amazon layoffs after this announcement?

While Galetti stated the company isn't planning to make large layoffs every few months, the reality is that Amazon's organizational efficiency goals, growth trajectory, and AI investment priorities will likely require continued adjustments. Historically, when tech companies implement large restructurings, they often do so in phases. Another smaller round of cuts (perhaps 5,000-8,000 people) in late 2025 or early 2026 is plausible if growth remains flat or if AWS growth doesn't accelerate. The language Galetti used—"every team will continue to evaluate... and make adjustments as appropriate"—suggests Amazon reserves the right to cut again whenever deemed necessary, as reported by Amazon's official news release.

How does this affect Amazon customers and products?

Short-term, the impact on Amazon's customer-facing services is likely minimal. The company has largely focused layoffs on corporate and internal teams, not frontline service or warehouse roles. However, longer-term, having fewer people working on product innovation, customer experience improvements, and infrastructure maintenance could slow the company's ability to evolve quickly. Some services might see slower feature releases or reduced attention. AWS infrastructure stability could be at slight risk if the company cut too many operations and reliability engineers, though this depends on specific implementation details Amazon hasn't disclosed, as noted in Crypto Briefing.

What does this mean for the tech industry overall?

Amazon's actions typically set patterns other large tech companies follow. We can expect to see more announcements of layoffs or hiring freezes from competitors in Q1 and Q2 2025. The broader signal is that the tech industry has transitioned from a growth-focused era to a profitability-and-efficiency era. This means continued pressure on worker job security, more selective hiring, and emphasis on skills that are harder to automate. For tech professionals, this reinforces the need to develop specialized expertise, maintain external networks, and stay current with emerging technologies like AI, as analyzed by NerdWallet.

Conclusion: The End of Tech's Growth Era

Amazon's 16,000 job cuts aren't really about Amazon. They're a signal that the technology industry's era of aggressive, consequence-free growth is over.

For twenty years, tech companies operated with different rules than the rest of the economy. Burn more money than you make? That's growth investing. Hire faster than you have work? That's scaling for the future. Build products nobody's using yet? That's innovation.

But that era has closed. Market saturation, slower growth rates, and artificial intelligence forcing fundamental rethinking of which jobs actually need humans—these are the new realities. Companies are resizing from growth-phase organizations to mature-phase organizations, as reported by Crypto Briefing.

For Amazon specifically, this restructuring makes sense. The company is moving from "how do we grow faster?" to "how do we stay competitive and profitable while technology changes?" That requires fewer middle managers, different skills, and leaner operations.

For the people being cut, it's obviously painful. Sixteen thousand is more than a statistic. It's disrupted careers, moved families, and forced people to figure out what comes next. But that's the cost of transformation.

For the tech industry, it signals that the moment of reckoning has arrived. Companies can't hide unprofitable growth behind venture capital anymore. They need returns. They need efficiency. They need to look like real businesses, not startups playing with unlimited money.

That's actually healthy in the long term. Industries that avoid facing reality eventually face collapse. Tech is choosing managed transition instead.

What comes next? Expect three things:

First, more layoffs from other tech companies in the coming months. Amazon rarely moves alone. When Amazon restructures, the rest of tech usually follows.

Second, a shift in the jobs being created. We'll see hiring in AI, infrastructure, and specialized roles. We won't see hiring in the traditional middle-management and generalist positions that are disappearing.

Third, a changed experience for tech workers. Job security will be lower. Specialization will be more important. Geographic arbitrage through remote work will remain valuable. And loyalty to any one company will matter less than ever.

The Amazon that emerges from this restructuring will be smaller, leaner, and organized entirely differently. That might be better. It might be worse. But it will definitely be different. And that difference will shape not just Amazon, but the entire trajectory of the technology industry for the next decade.

Stay sharp. Learn AI. Build your network. The era of guaranteed tech job security is over.

Key Takeaways

- Amazon's 16,000 layoffs (1% of workforce) represent the company's second major cut in 90 days, totaling 30,000 jobs—marking a shift from growth-phase to efficiency-phase organization, as reported by Amazon's official news release.

- The restructuring focuses on eliminating organizational layers and middle management roles while selectively hiring in AI-related positions, signaling fundamental technology-driven workforce transformation, as noted in Crypto Briefing.

- CEO Andy Jassy has explicitly stated Amazon will need fewer people in traditional roles and more in AI-focused positions, making this restructuring different from 2022-2023 corrections of over-hiring, as reported by Crypto Briefing.

- Amazon's 1% layoff rate is proportionally smaller than Meta's 21% cuts or Twitter/X's 50% elimination, but staged over multiple quarters suggests ongoing efficiency pressures rather than one-time adjustment, as analyzed by NerdWallet.

- Tech industry patterns suggest this Amazon restructuring will trigger similar actions from competitors, continuing pressure on tech worker job security and accelerating demand for specialized AI and infrastructure skills, as noted in NerdWallet.

Related Articles

- Amazon's 16,000 Layoffs: What It Means for Tech Workers [2025]

- AI Discovers 1,400 Cosmic Anomalies in Hubble Archive [2025]

- Is AI Adoption at Work Actually Flatlining? What the Data Really Shows [2025]

- State Crackdown on Grok and xAI: What You Need to Know [2025]

- Pinterest Layoffs 15% Staff Redirect Resources AI [2025]

- Gemini 3 Becomes Google's Default AI Overviews Model [2025]

![Amazon's 16,000 Job Cuts: What It Means for Tech [2025]](https://tryrunable.com/blog/amazon-s-16-000-job-cuts-what-it-means-for-tech-2025/image-1-1769611097981.jpg)