Apple's Chinese Memory Gambit: Why DRAM and NAND Diversification Matters

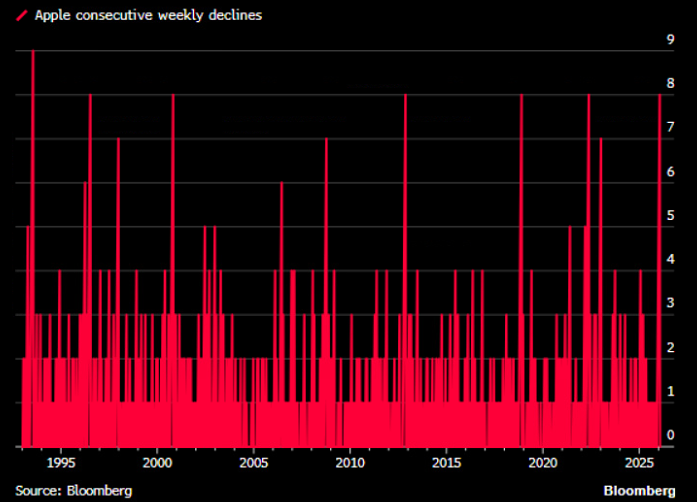

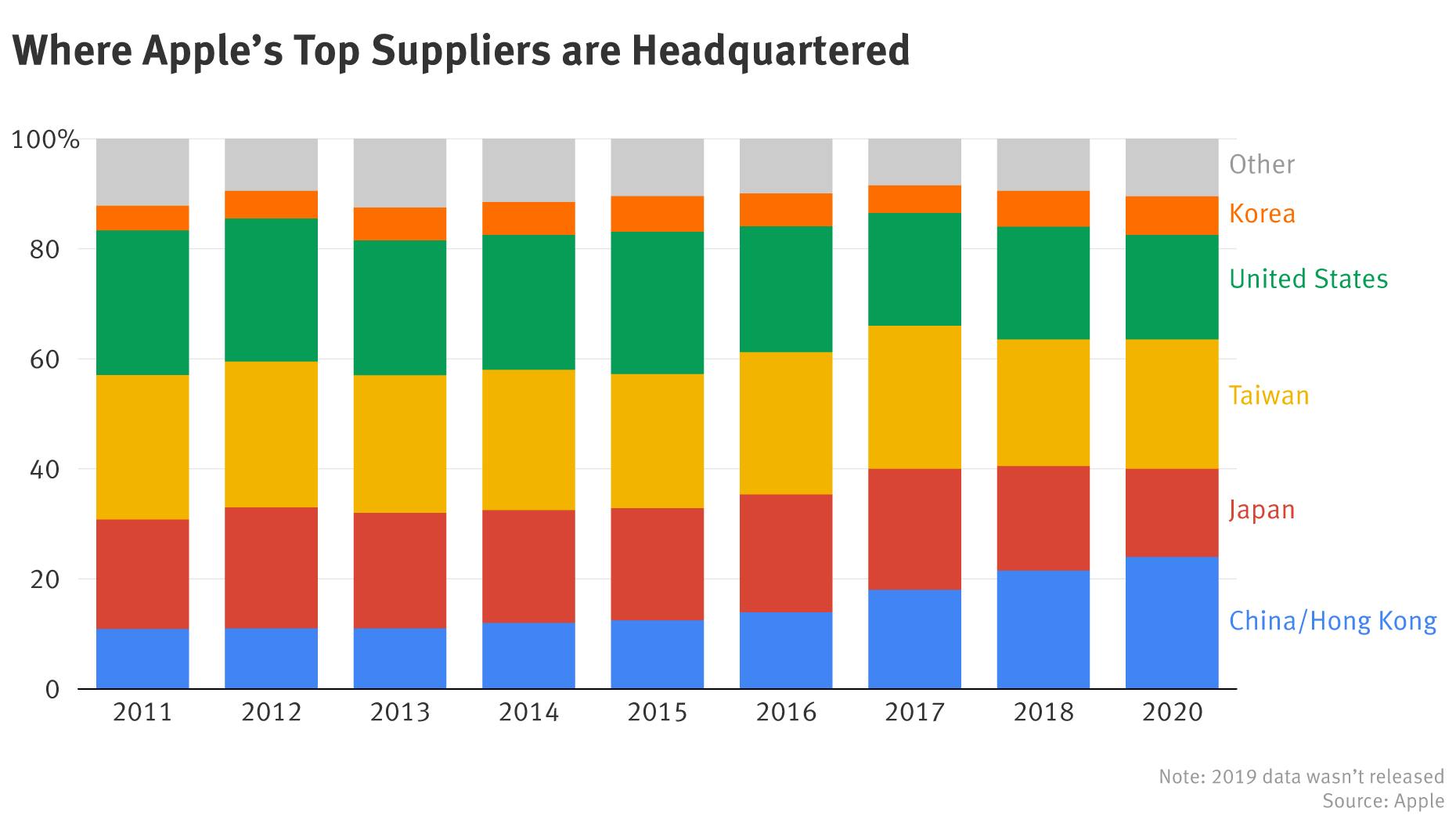

Apple's shopping list just got complicated. The company that famously controls every detail of its supply chain is now seriously eyeing Chinese memory manufacturers. Not because it wants to—but because it has to.

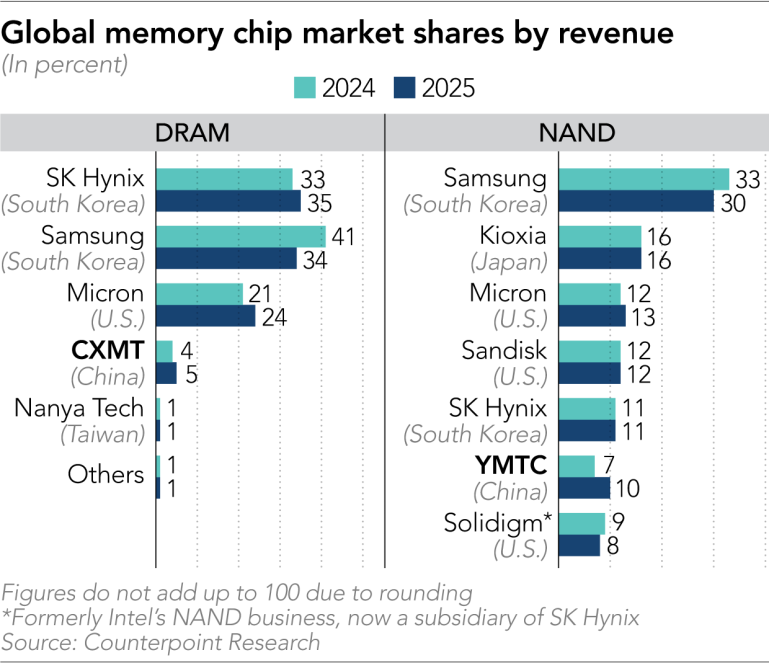

Reports have surfaced that Apple is exploring partnerships with Yangtze Memory Technologies (YMTC) and Changxin Storage (CXMT) as negotiations with its traditional suppliers—Samsung, SK Hynix, and Micron—have become increasingly contentious. We're talking about quarterly price discussions that are pushing Apple's margins thinner, stockpile costs that are climbing, and supply constraints that are throwing production schedules into chaos.

This isn't a minor shuffling of vendor lists. This is Apple fundamentally reconsidering how it sources the memory that powers everything from iPhones to MacBook Pros. And the ripple effects? They'll reshape the semiconductor industry for years.

Let me walk you through what's really happening here, why it matters, and what it tells us about the future of tech manufacturing.

TL; DR

- Apple is diversifying away from Samsung, SK Hynix, and Micron to Chinese suppliers YMTC and CXMT due to pricing pressure and quarterly negotiation complexity

- Memory costs have doubled in certain quarters, creating margin pressure that forces Apple to seek alternatives and negotiate more aggressively

- Chinese memory makers have expanded capacity significantly, with CXMT preparing mass production of HBM3 chips, narrowing the technology gap

- Geopolitical and regulatory risks loom, with both YMTC and CXMT having faced Pentagon restrictions, complicating any formal partnerships

- This shift signals a broader supply chain restructuring across the entire semiconductor industry, potentially disrupting years of established supplier relationships

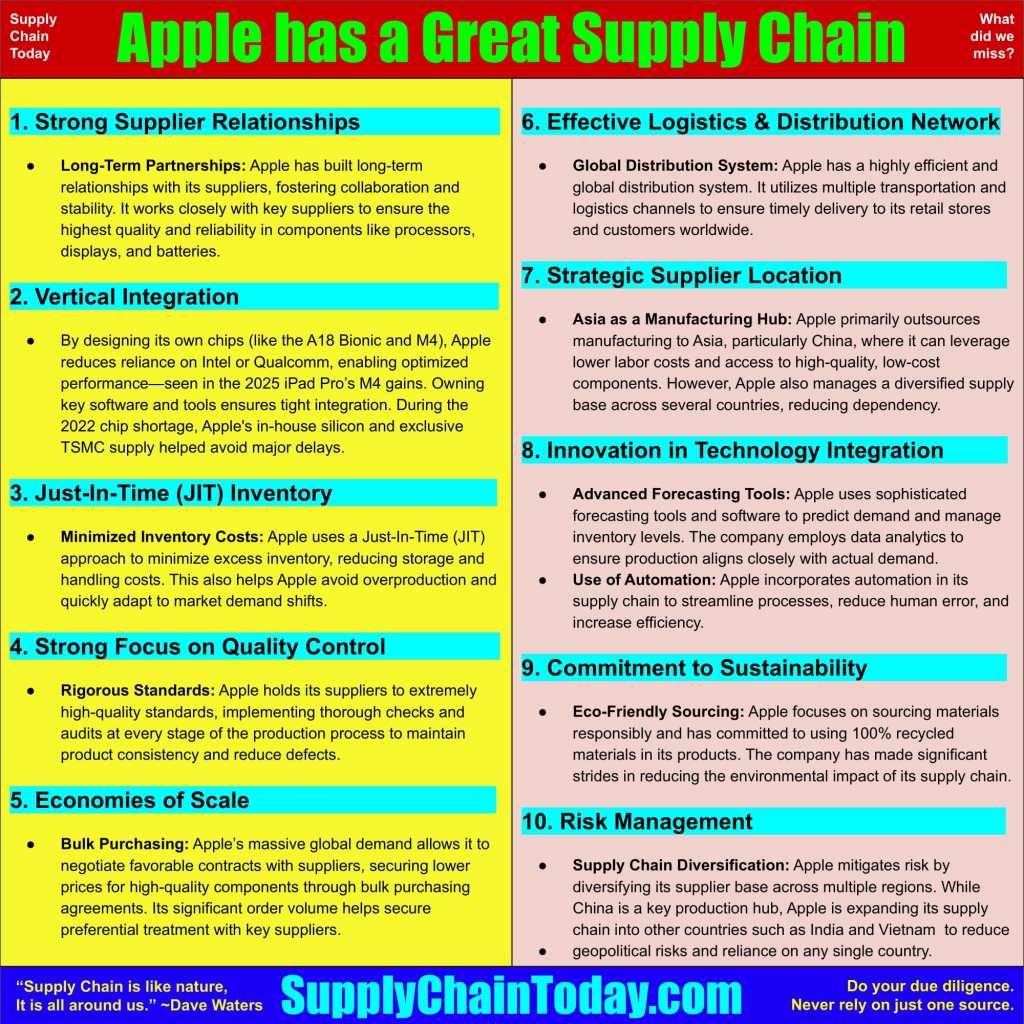

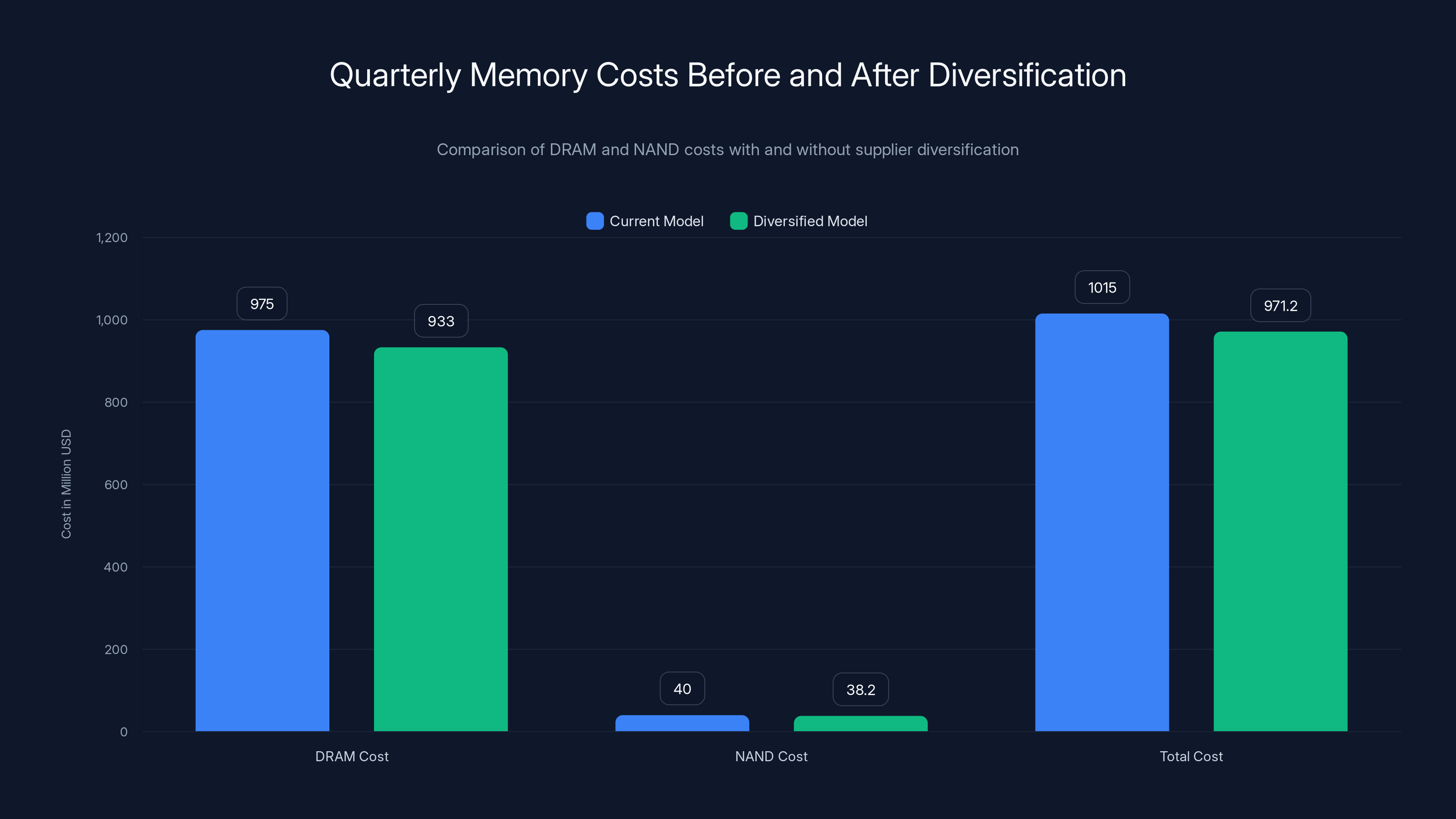

Apple could achieve up to 15% cost savings by sourcing memory from Chinese suppliers like YMTC and CXMT, compared to traditional suppliers like Samsung and SK Hynix. Estimated data.

The Problem: Why Apple's Current Memory Suppliers Are Becoming a Liability

Let's start with the uncomfortable truth: Apple's current memory supply arrangement is unsustainable in its current form.

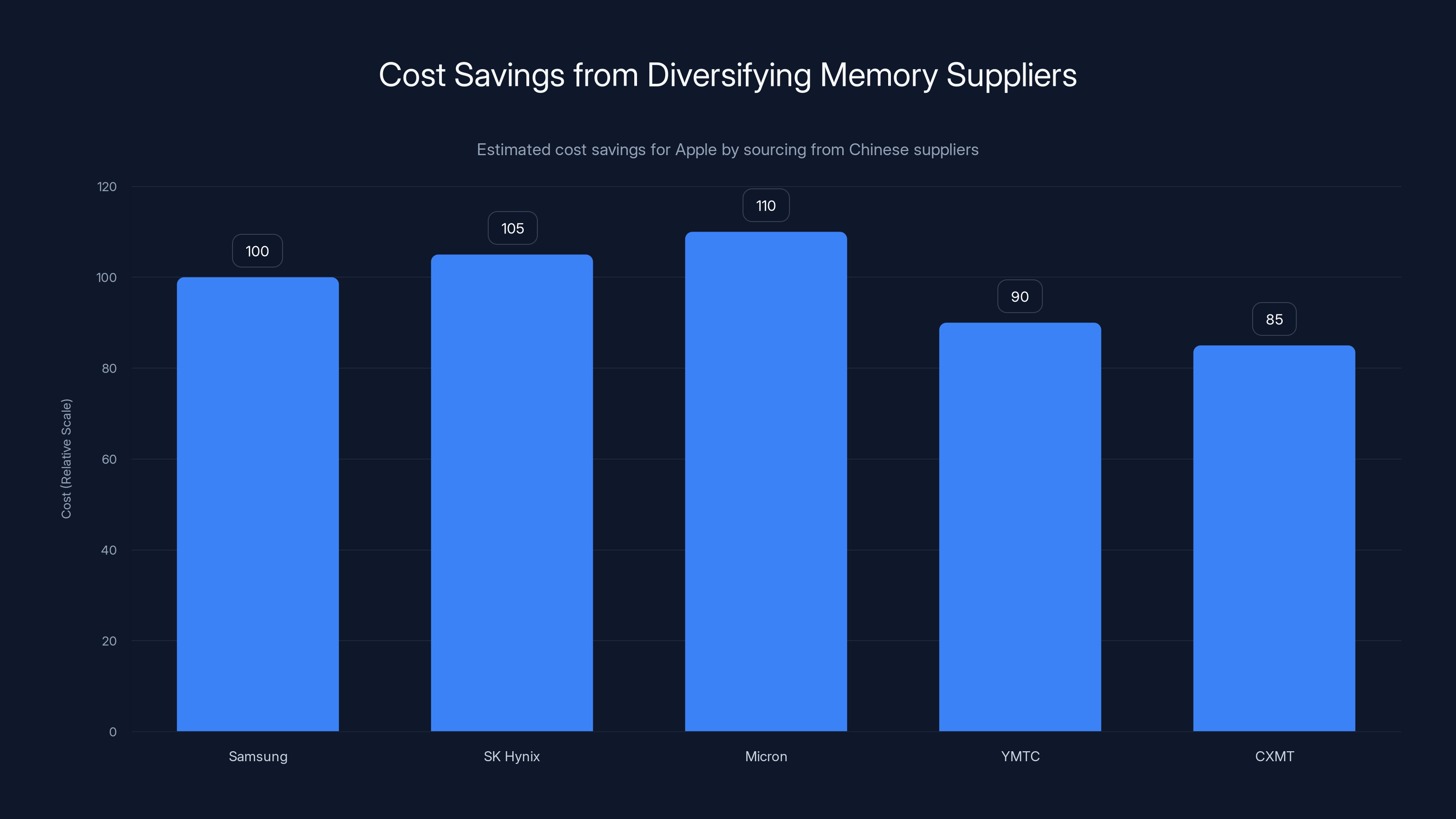

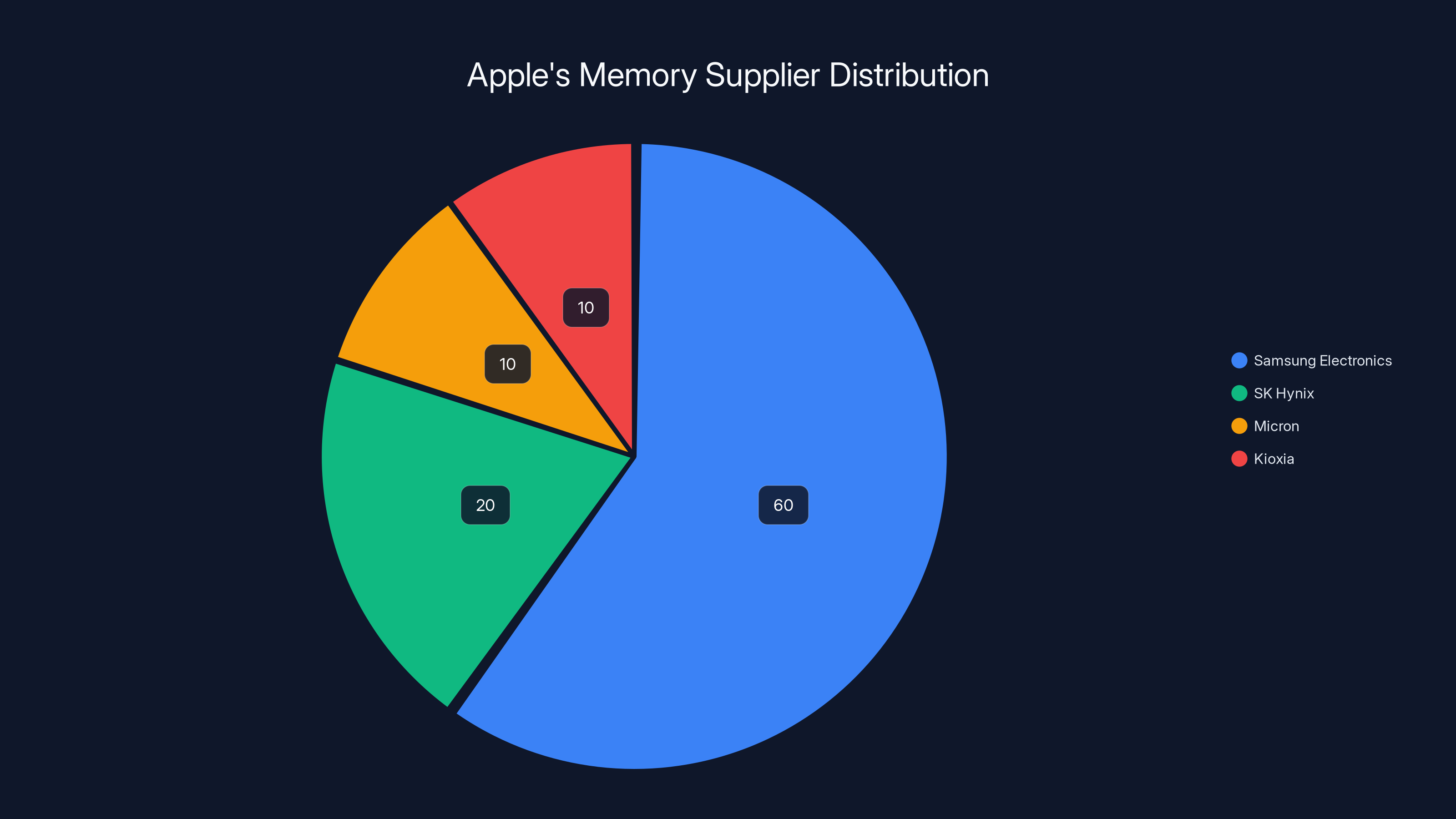

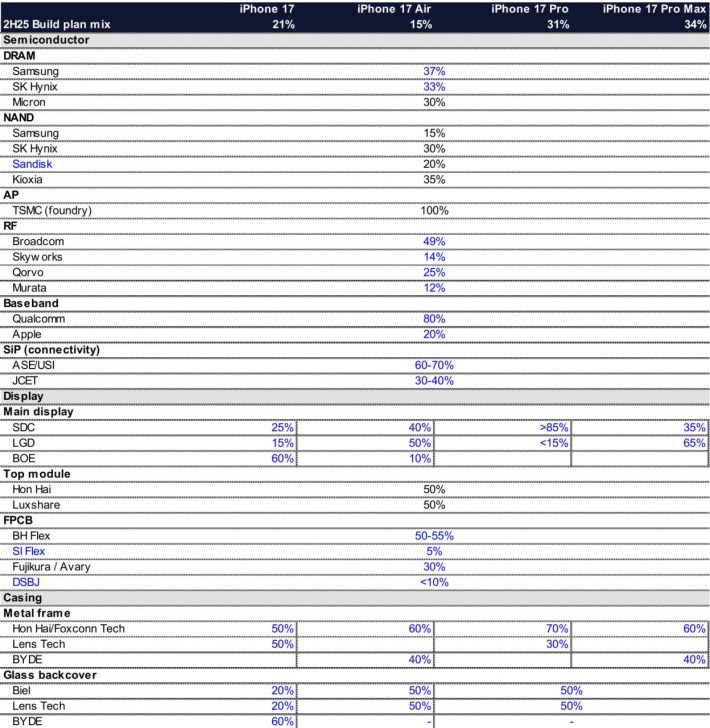

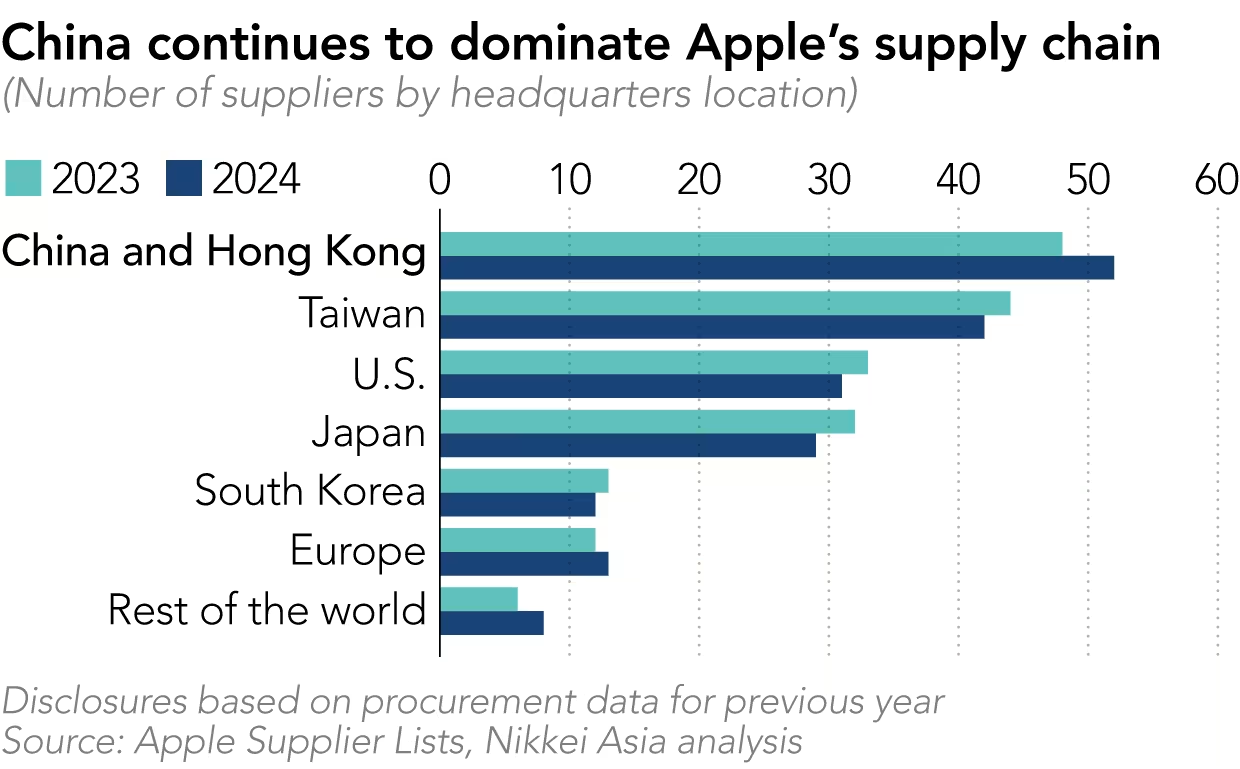

Right now, Apple sources approximately 60% of its DRAM from Samsung Electronics alone. SK Hynix and Micron split the remainder. For NAND flash storage, Samsung, SK Hynix, and Kioxia dominate the supply. This concentration creates a massive negotiating headache for Apple.

Here's the core problem: these suppliers control the pricing mechanism. Every single quarter, Apple sits down with Samsung, SK Hynix, and Micron, and they discuss what DRAM and NAND will cost for the next three months. These aren't friendly chats. These are high-stakes negotiations where small percentage moves translate to millions of dollars.

In the first half of 2026, memory prices became volatile. Some quarters saw DRAM and NAND costs double compared to prior periods. That's not a gradual increase—that's a shock to Apple's manufacturing budget. When you're building tens of millions of devices per quarter, a 50% swing in memory costs is a crisis.

Micron, Samsung, and SK Hynix know they have Apple over a barrel. Apple can't suddenly source memory elsewhere without massive engineering work and qualification cycles. So they use that leverage. The quarterly pricing discussions turn into negotiations where suppliers have the upper hand, knowing Apple has limited options.

On top of that, RAM availability has been constrained overall. Multiple product lines are facing forecasted output limitations because suppliers can't guarantee consistent volumes. HDD-based storage modules in certain devices require careful supply monitoring—meaning Apple's logistics team is literally checking inventory every single week, planning contingencies for shortfalls.

This is exactly the kind of dependency that keeps supply chain executives up at night. One geopolitical event, one supplier production mishap, one natural disaster affecting a fab facility, and Apple's entire quarterly forecast crumbles.

Apple doesn't like being dependent on anyone. So it's exploring alternatives. That's where Chinese memory makers enter the picture.

By sourcing 20-30% of DRAM from CXMT at a lower cost, Apple could save $50-75 million per quarter. Estimated data.

Understanding YMTC and CXMT: The Chinese Alternative

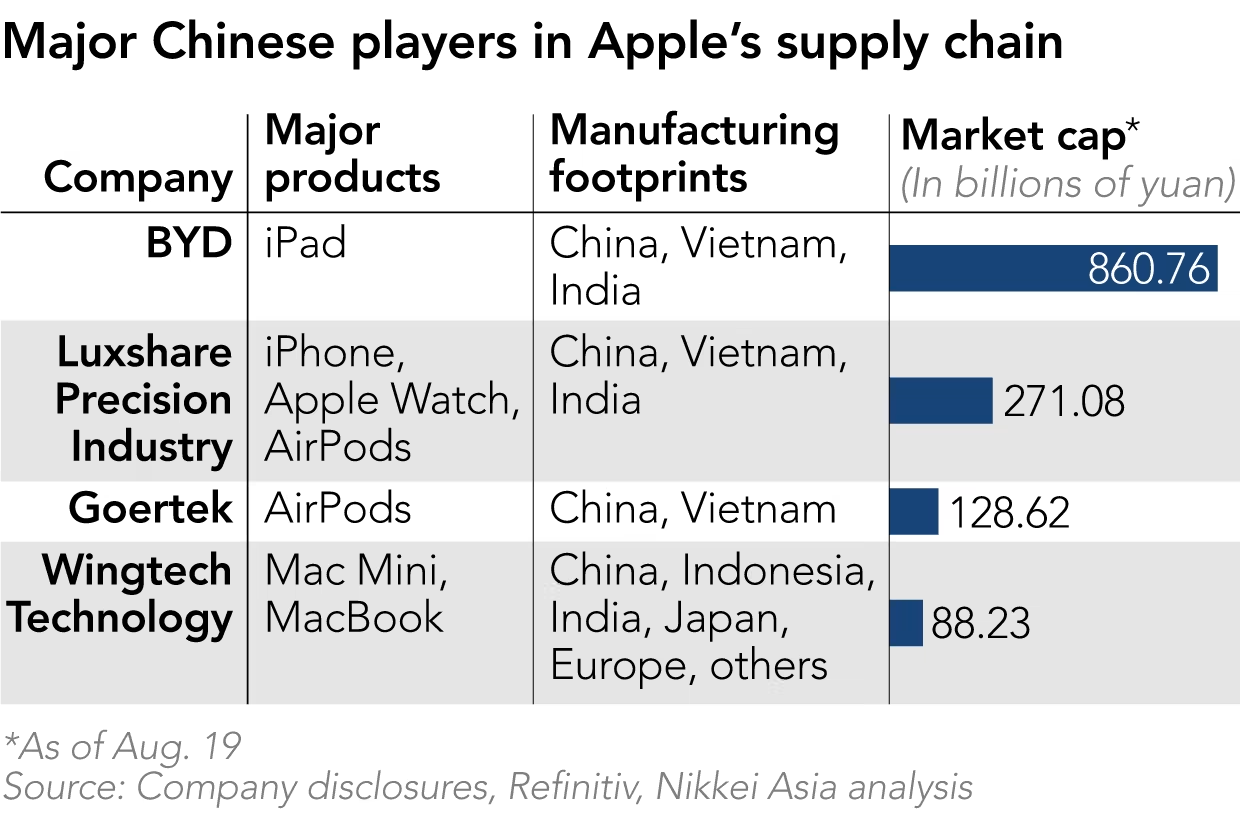

Yangtze Memory Technologies (YMTC) and Changxin Storage (CXMT) aren't new players. They've been building capacity for years, quietly expanding their production footprint while the world focused on the "Big Three" of Samsung, SK Hynix, and Micron.

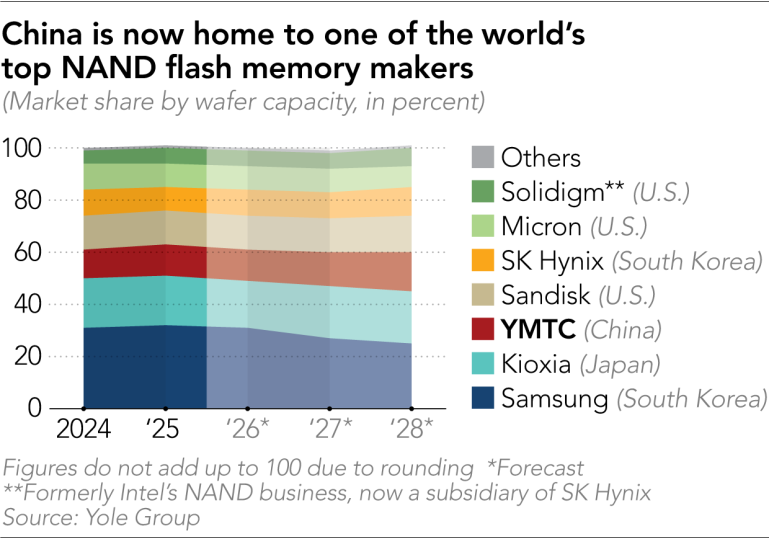

YMTC specializes in NAND flash memory. The company has invested heavily in 3D NAND technology and has ramped production significantly. Its manufacturing facilities in China have grown to substantial scale, making YMTC one of the world's largest NAND producers by capacity.

CXMT focuses on DRAM, a more technically challenging memory type. The company has been preparing for mass production of advanced memory architectures, including HBM3 (high-bandwidth memory). HBM3 is particularly important because it's used in AI accelerators, data center processors, and other high-performance computing equipment.

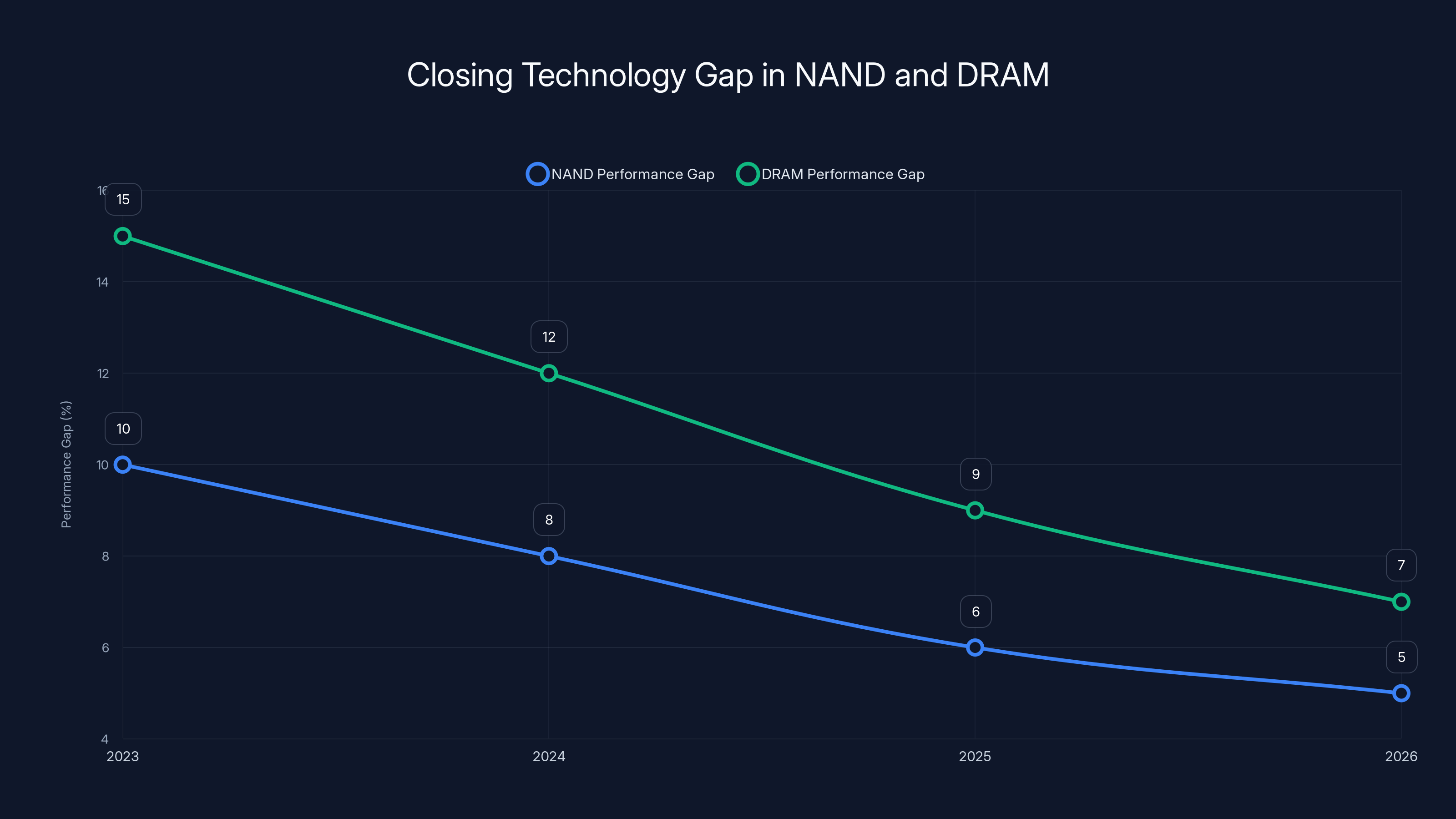

Neither company matches the performance levels of Samsung or SK Hynix in cutting-edge memory—yet. Their NAND technology is closer to parity than their DRAM. But they're improving at a pace that's genuinely concerning to the established players.

For Apple, this matters because NAND is what fills iPhones and MacBooks. If CXMT can supply DRAM at decent quality and YMTC can supply NAND at acceptable performance levels, Apple doesn't need the absolute bleeding-edge. It needs reliable, cost-effective supply.

The expansion of Chinese memory makers also gives Apple leverage in its negotiations with Samsung, SK Hynix, and Micron. If suppliers know Apple is seriously evaluating alternatives—even if those alternatives are second-tier—they become more flexible on pricing and terms. The mere threat of diversification is negotiating currency.

The Supply Chain Economics: Why Diversification Makes Financial Sense

Let's do the math on why Apple is exploring this.

Assume Apple uses approximately 100 million DRAM chips per quarter across all product lines (iPhones, Macs, iPads, etc.). If DRAM price is

For NAND, the math scales even larger. A single iPhone has somewhere between 128GB to 1TB of storage depending on model. That's billions of NAND chips annually. A 20% price increase across the board adds billions to annual manufacturing costs.

Now, here's what Apple likely calculated: if CXMT can supply 20-30% of DRAM needs at 10-15% lower cost than Samsung's quarterly price, Apple saves roughly

Those aren't negligible numbers. They're material to Apple's gross margins, which are already under pressure from increased competition and slowing iPhone growth in certain markets.

Beyond pure cost, there's also the issue of supply certainty. If Apple can source DRAM and NAND from three or four different suppliers instead of two, the likelihood of a supply disruption affecting all sources simultaneously drops dramatically. During the 2021-2022 chip shortage, companies that relied on single suppliers were devastated. Companies with diversified sources managed better.

Apple learned that lesson hard. The company had supply chain issues that impacted iPhone 13 production and contributed to slower sales growth. Since then, Apple has been quietly working to reduce single-supplier dependency across its supply base.

By bringing YMTC and CXMT into the fold, Apple achieves three things:

- Reduced dependency risk: If Samsung has a fab issue, YMTC and CXMT can fill part of the gap

- Pricing leverage: Samsung can't raise prices 50% when Apple has alternatives

- Cost reduction: Chinese suppliers typically operate at lower margins, which translates to lower prices

The financial math alone justifies the exploration, even if partnership negotiations are tricky.

Diversifying suppliers reduces Apple's quarterly memory costs from

The Regulatory Minefield: Why This Is Complicated

Here's where things get messy. Both YMTC and CXMT have had brushes with U.S. government restrictions.

Both companies were briefly added to the Pentagon's restricted companies list—essentially a blacklist of entities that present national security concerns. Being on that list means U.S. companies face severe restrictions on what they can sell to these companies and how they can work with them.

For Apple, partnering with companies on restricted lists creates serious compliance problems. The company would need to navigate complex export control regulations, ensure that any technology transfer complies with U.S. law, and potentially face scrutiny from government agencies.

Apple isn't a small startup that can ignore regulatory risk. The company has massive operations throughout the United States, critical relationships with U.S. government agencies, and substantial intellectual property that U.S. law protects. Getting on the wrong side of export controls could trigger investigations, fines, or worse.

That said, being on a restricted companies list doesn't mean permanent exclusion. Companies can petition to be removed, provide compliance assurances, and establish processes that satisfy regulators. YMTC and CXMT would need to do this. Apple would need to document that any partnership doesn't involve restricted technology transfer.

It's doable, but it requires careful legal and political management.

Another regulatory concern: intellectual property. If Apple works closely with YMTC or CXMT to optimize memory designs or compatibility, Apple needs assurance that its design knowledge stays confidential. Chinese companies have faced accusations of IP theft in the past. Apple would demand ironclad contracts and likely maintain strict compartmentalization of sensitive information.

Beyond U.S. regulation, Apple also faces European and Asian export control frameworks. The company operates globally and must comply with multiple regulatory regimes simultaneously. Adding Chinese suppliers to the mix adds complexity to every one of those frameworks.

This is why Apple is "exploring" partnerships rather than announcing them. The company is working through the regulatory landscape, understanding what's legally permissible, and building relationships with government agencies to ensure any partnership can proceed without legal jeopardy.

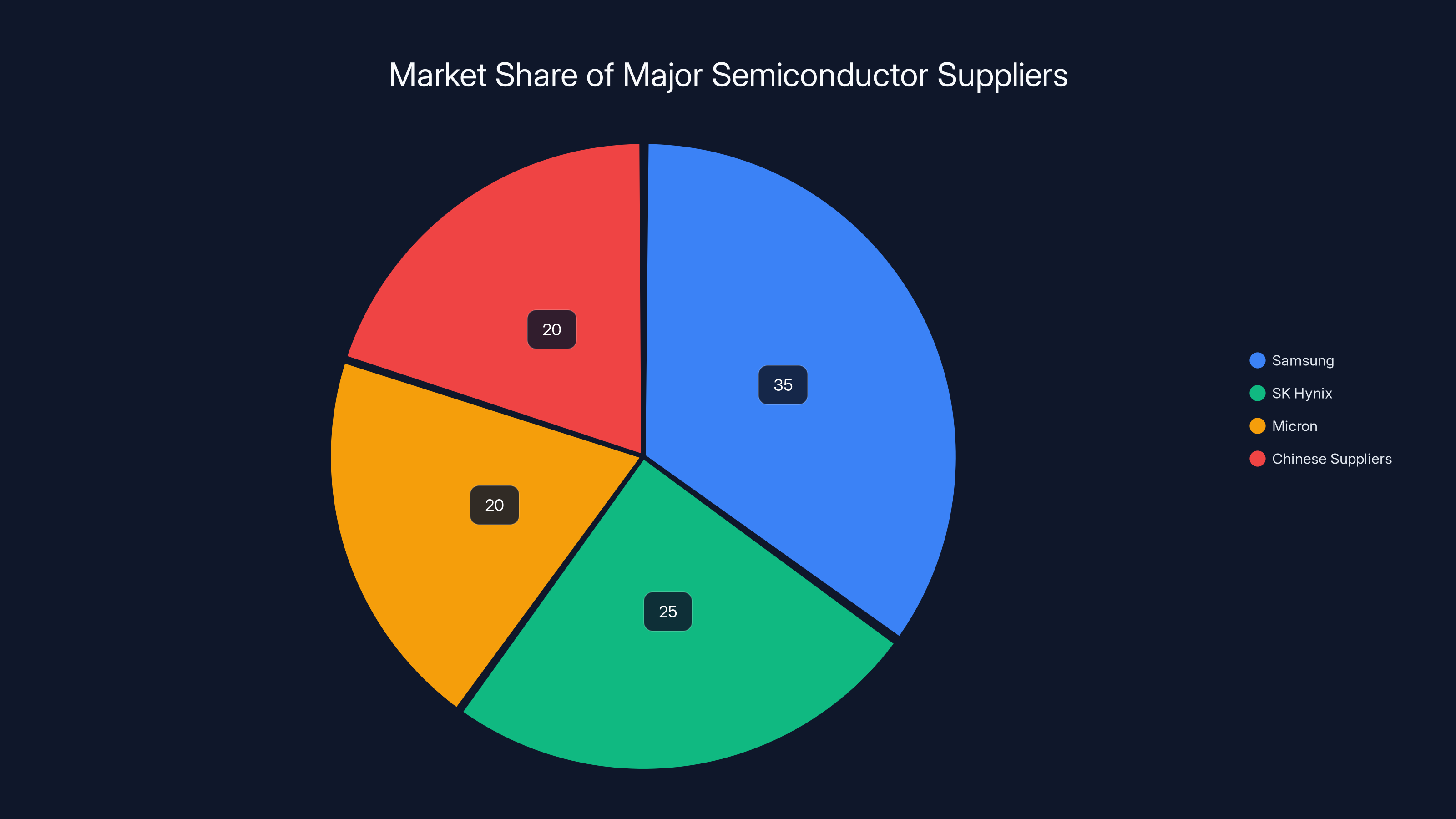

Market Dynamics: Why Samsung, SK Hynix, and Micron Are Vulnerable

Think about it from the suppliers' perspective. They've had Apple as a captive customer for years. Apple has limited options, so suppliers could push price increases through quarterly negotiations.

But now the math has changed. If Apple credibly threatens to diversify to Chinese suppliers, the suppliers' leverage disappears. Suddenly, Samsung, SK Hynix, and Micron are competing for Apple's business against lower-cost alternatives.

This creates intense pressure on the established players to rationalize their pricing. They can't maintain 30-50% price premiums if Apple has viable alternatives at 20% discount.

Micron is probably the most vulnerable. The company lacks Samsung's brand prestige and SK Hynix's manufacturing advantages. Micron's primary leverage is that it's an American company, which appeals to U.S. government and defense contractors worried about Chinese supply chain dependency. But for Apple, nationality is less important than cost and availability.

Samsung can lean on scale and quality. SK Hynix can emphasize advanced technology. But both will face pricing pressure from diversification.

Interestingly, this competition might actually improve the semiconductor industry overall. Suppliers competing on price incentivizes efficiency improvements and better production yields. Lower memory costs benefit all tech companies, not just Apple.

Apple relies heavily on Samsung for 60% of its DRAM supply, with SK Hynix and Micron sharing the remainder. This concentration poses a risk due to potential price volatility and negotiation challenges. (Estimated data)

Technology Parity: The Closing Gap

One key factor that makes Chinese suppliers viable is that the technology gap is narrowing, particularly in NAND.

NAND flash memory is somewhat commoditized. The fundamental technology has matured. The main differences between manufacturers are production yield, defect rates, and manufacturing efficiency. A 5-10% performance difference between Samsung NAND and YMTC NAND is often irrelevant for consumer devices.

DRAM is more performance-critical. DRAM needs to be fast and reliable. But even here, CXMT's technology is approaching adequacy for many Apple use cases. Not everything in an iPhone or MacBook requires cutting-edge DRAM—much of it is just standard-speed memory doing standard work.

Apple is brilliant at optimizing around component limitations. If Apple can source 70% of its NAND from YMTC and 30% from Samsung, it can engineer the system to use YMTC for less performance-sensitive storage and Samsung for critical high-speed caches. The customer wouldn't notice any difference.

This engineering flexibility is what makes diversification viable. Apple doesn't need suppliers to be identical—it needs them to be good enough for specific use cases.

Over the next two to three years, expect Chinese suppliers to close the technology gap further. They're investing billions in R&D, hiring world-class engineers, and learning from every iteration. The competitive advantage of the "Big Three" isn't permanent—it's eroding.

Quarterly Negotiation Complexity: The Real Catalyst

Here's something that doesn't get enough attention in supply chain discussions: the operational burden of quarterly price negotiations.

Every three months, Apple's procurement team has to sit down with Samsung, SK Hynix, and Micron and negotiate what DRAM and NAND will cost for the next quarter. These aren't one-hour meetings. They're complex, multi-week negotiations involving senior executives, legal teams, and production planners.

During these negotiations, uncertainty is paralyzing. Apple's financial forecasting team can't finalize product cost estimates. Manufacturing planning can't lock in production schedules. Supply chain optimization can't make forward commitments.

This quarterly uncertainty costs money. It creates suboptimal inventory levels, forces holding of safety stock that wouldn't be necessary with predictable pricing, and prevents dynamic optimization of supply chains.

Now imagine if Apple could split its supply across four suppliers with fixed contracts. The company would lock in pricing six months out, reducing quarterly negotiation burden to a minor administrative task. That stability has real value.

This is a major driver of diversification that often gets overlooked. It's not just cost—it's operational complexity and the cost of managing that complexity.

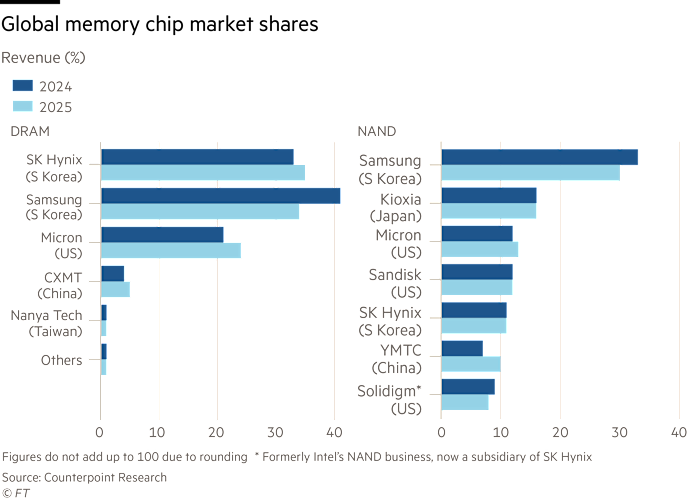

Samsung holds the largest market share, but increasing competition from Chinese suppliers threatens their pricing power. Estimated data.

Strategic Implications: What This Means for the Semiconductor Industry

If Apple successfully establishes supply relationships with YMTC and CXMT, it will trigger a fundamental shift in semiconductor power dynamics.

First, other major tech companies will follow Apple's lead. If Apple can buy quality NAND and DRAM from Chinese suppliers at 15-20% discount, Microsoft, Google, Meta, and Amazon will quickly do the same. The collective buying power of these companies dwarfs Samsung and SK Hynix's negotiating position.

Second, it establishes Chinese suppliers as tier-one vendors rather than commodity suppliers. This legitimizes their technology and opens doors with other customers who previously avoided them due to uncertainty about IP protection or quality.

Third, it forces the "Big Three" to fundamentally restructure their business models. They can't survive on the old model of high margins backed by limited customer options. They'll need to compete on efficiency, innovation velocity, and service quality—genuinely compete, not just extract rents from captive customers.

Fourth, it reshapes geopolitical dynamics. The U.S. and Europe have been concerned about over-dependence on Chinese semiconductors. But if Chinese suppliers become essential to American tech companies' supply chains, that dependency becomes mutual. China can't afford to cut off companies like Apple without destroying its own technology sector.

This mutual dependency might actually improve geopolitical stability. When both sides have something to lose, conflict becomes less likely.

Production Planning Challenges: The Hidden Complexity

Let's talk about what nobody sees: the production complexity of managing multiple supplier relationships for the same component.

When you source DRAM from Samsung and CXMT simultaneously, you need to qualify both suppliers' memory for the same hardware designs. That means extensive testing, validation of performance characteristics, and documentation of compatibility across different manufacturing batches.

Apple's engineering teams would need to establish separate supplier bins for production runs, track which devices used Samsung memory versus CXMT memory, and potentially maintain different quality assurance protocols. The operational overhead isn't trivial.

Then there's the inventory management question. If you're sourcing from multiple suppliers, you need safety stock from each supplier to buffer against supply disruptions. That ties up more capital in inventory than a single-supplier model would require.

Apple would also need to establish redundant supplier relationships for other components to avoid creating new single-points-of-failure elsewhere in the supply chain. Diversifying memory but consolidating around a single source for, say, image sensors would just move the problem.

All of this is solvable, but it requires Apple to invest in supply chain complexity that the company would prefer to avoid. Apple's ideal is having one supplier per component, integrated perfectly into its supply planning system.

But the cost and risk of that ideal aren't justifiable anymore. Diversification is a necessary evolution.

Estimated data shows a narrowing performance gap between Chinese and leading NAND/DRAM manufacturers, highlighting increased competitiveness over the next few years.

Cost Modeling: The Financial Case for Diversification

Let's build a financial model showing why this makes sense for Apple.

Assume the following baseline:

- Quarterly DRAM volume: 150 million units

- Current average DRAM cost: $6.50 per unit (Samsung pricing)

- Quarterly NAND volume: 50 exabytes (500 million GB equivalents)

- Current average NAND cost: $0.08 per GB

Quarterly memory costs under current model:

Now assume Apple diversifies:

- 60% from Samsung/SK Hynix at $6.50 per unit

- 40% from CXMT at $5.80 per unit (10% discount)

- NAND: 70% from Samsung/Kioxia at 0.068 (15% discount)

Quarterly savings: $43.8 million

Annual savings: $175.2 million

That's before accounting for reduced negotiation costs, improved supply certainty, and better inventory optimization. The pure cost savings alone justify the complexity of managing multiple suppliers.

For context, Apple's quarterly gross profit is roughly

Risk Assessment: What Could Go Wrong

Let's be realistic about downside scenarios.

Technology Risk: CXMT's DRAM or YMTC's NAND might not perform reliably at scale. What if 2-3% of CXMT DRAM fails within 18 months of use? That would be a product quality crisis. Apple's reputation depends on reliability. One failing DRAM chip in a million units is acceptable. One in fifty thousand isn't.

Intellectual Property Risk: What if YMTC or CXMT reverse-engineers Apple's proprietary memory optimization techniques and sells them to competitors? Or what if they leak designs to other Chinese manufacturers? Apple's competitive advantage sometimes depends on custom memory architectures. IP theft could negate Apple's cost advantages.

Regulatory Risk: What if the U.S. government changes policy and makes it illegal for Apple to source from Chinese suppliers? Export controls can shift suddenly. Apple would be caught mid-production with no backup suppliers. It happened during the Huawei sanctions—companies had to scramble.

Geopolitical Risk: What if U.S.-China relations deteriorate and China retaliates by restricting memory exports? Or what if conflict over Taiwan escalates and disrupts global semiconductor supply? Apple's diversification to Chinese suppliers actually increases Apple's exposure to Taiwan risk, since YMTC and CXMT use Taiwan-sourced equipment.

Operational Risk: Complex supply chains are fragile. Adding new suppliers adds new points of failure. What if YMTC has a catastrophic fab accident that takes out capacity for months? Apple's safety stock would be depleted quickly.

These are real risks. They're why Apple is "exploring" partnerships rather than signing contracts. The company needs to assess and mitigate these risks before committing significant volume.

The Bigger Picture: Semiconductor Supply Chain Evolution

Apple's pivot to Chinese suppliers is part of a broader evolution in semiconductor supply chains.

For decades, the semiconductor industry was organized around geographic hubs: the U.S. for design and equipment, South Korea and Taiwan for manufacturing, Japan for materials. This hub-and-spoke model worked because geography provided specialization and expertise concentration.

But the hub-and-spoke model created single-points-of-failure. When Taiwan faced geopolitical pressure or faced extreme weather, global semiconductor supply was at risk. When Japan's Fukushima disaster happened, it exposed how dependent the world was on single-country supply of critical materials.

The new model emerging is multi-polar. Design hubs are distributing (America, Israel, Europe, China). Manufacturing is distributing (Taiwan, South Korea, China, Japan, U.S., Europe). Materials sourcing is distributing. The idea is to reduce any single source of disruption from becoming industry-wide catastrophe.

Apple's move toward Chinese suppliers is one manifestation of this distribution trend. We'll see similar moves from Microsoft, Google, and others. The semiconductor industry is slowly becoming more resilient through diversification.

The transition period will be messy. There will be quality issues, IP concerns, regulatory stumbles. But the direction is clear: the age of single-supplier dominance is ending.

Timeline Expectations: When Will This Happen

Based on how Apple typically manages supply chain changes, here's the likely timeline:

Now to Q2 2025: Apple negotiates frameworks with YMTC and CXMT, establishes legal and compliance structures, begins IP protection protocols. Heavy focus on building trust and establishing governance structures.

Q2 to Q4 2025: Small-scale trials with non-critical products or low-volume device lines. Apple sources maybe 5% of quarterly DRAM or NAND from Chinese suppliers for testing. Intensive quality monitoring and performance validation.

Q4 2025 to Q2 2026: If trials succeed, ramp to 15-25% of supply. Apple announces nothing publicly but internal supply teams are aware of the new suppliers. Some new product launches include Chinese-sourced memory, disclosed only in regulatory filings if at all.

Q2 2026 onward: Stabilization at planned volumes (likely 25-40% of total DRAM and NAND). Chinese suppliers become normalized part of Apple's supply base. Public disclosure comes only if required by regulations or if competitors force the issue.

Apple rarely announces supply chain partnerships publicly. The company will manage this transition quietly, letting the tech press speculate while internally executing the plan.

Negotiating Leverage: How This Changes Apple's Bargaining Position

Here's where it gets interesting from a negotiation strategy perspective.

Apple's negotiating position with Samsung, SK Hynix, and Micron was previously: "You're our only option for this quality/volume. We'll pay what you ask."

With Chinese suppliers in the mix, it becomes: "We have options. Here's what we'll pay."

This is transformative leverage. Samsung and SK Hynix will immediately understand the threat. They'll become more flexible on:

- Pricing: Lock-in longer-term contracts at fixed prices instead of quarterly adjustments

- Volume commitments: Be more willing to commit to stable volumes and less demanding on minimum orders

- Technology access: Provide earlier access to next-generation memory for Apple's advanced devices

- Service: Faster response times on quality issues, dedicated support teams for Apple

- Terms: More favorable payment terms, inventory financing, warranty coverage

Apple doesn't need Chinese suppliers to be better—it just needs them to be credible alternatives. Once credibility is established, Samsung and SK Hynix become much more accommodating.

Interestingly, this might actually improve the semiconductor industry's health. Right now, suppliers extract monopoly rents from customers. With real competition, they'll be forced to innovate and improve efficiency. That benefits all of us.

The Competitive Implications for Other Tech Companies

Other major tech companies are watching Apple intently.

Microsoft faces the same memory supply challenges. Google faces the same challenges. Amazon and Meta face the same challenges. Once Apple proves the model works—that sourcing from Chinese suppliers is legally, operationally, and financially viable—these companies will replicate it.

Microsoft might be first to follow. The company has China experience through its partnerships with Chinese cloud providers. Google will follow eventually, though the company faces more regulatory scrutiny around China. Amazon has AWS-specific needs that might make diversification less appealing, but the company will still shift some volumes.

This collective move will accelerate the transformation of the semiconductor industry. Suddenly, YMTC and CXMT won't be "that Chinese company"—they'll be legitimate tier-one suppliers competing with Samsung and SK Hynix for the world's largest tech companies' business.

Smaller tech companies lack Apple's leverage and negotiating power. They might continue paying premium prices to Samsung and SK Hynix because they lack the scale to qualify alternative suppliers. Ironically, Apple's diversification might widen the competitive moat between large and small tech companies.

Conclusion: The Beginning of a New Era

Apple's exploration of Chinese memory suppliers represents a fundamental shift in how the technology industry sources critical components.

For decades, the semiconductor supply chain was stable, structured, and dominated by a small number of players who leveraged that dominance for profit. That era is ending. The causes are multiple: Chinese suppliers have improved dramatically, geopolitical pressures force supply chain resilience, and economic pressure drives cost reduction.

Apple is leading this transition, but it won't be the only company. Within two to three years, Chinese suppliers will be normalized as tier-one vendors. Within five years, the competitive advantage of Samsung and SK Hynix will be substantially eroded. Within ten years, we might not even talk about "Big Three" memory suppliers—just "major memory suppliers," with players distributed globally.

This transition is good for the industry overall. Competition drives innovation, efficiency improvements, and price reductions. It's good for Apple's margins. It might be slightly bad for Samsung, SK Hynix, and Micron in the short term, but even they will ultimately benefit from being forced to compete instead of extracting rents.

The regulatory and geopolitical challenges are real. Apple will need to navigate export controls, IP protection concerns, and potential U.S. government pushback. But these are solvable problems if Apple manages them carefully.

What's clear is that Apple didn't make this move lightly. The company has always preferred vertical integration and single-supplier relationships for critical components. Diversifying to Chinese suppliers only happens when the cost of the status quo becomes unbearable.

We're witnessing a supply chain inflection point. In five years, when people look back, this will be identified as the moment when Chinese suppliers transitioned from secondary options to essential partners in global tech manufacturing.

The era of memory supply chain consolidation is ending. The era of competition and diversification is beginning. Apple's move to explore YMTC and CXMT partnership is the opening chapter of that new story.

FAQ

Why is Apple exploring Chinese memory suppliers instead of sticking with Samsung and SK Hynix?

Apple is diversifying to Chinese suppliers like YMTC and CXMT because quarterly price negotiations with Samsung, SK Hynix, and Micron have become increasingly costly and complex. Memory costs have doubled in certain quarters, creating margin pressure. Additionally, supply constraints are affecting product output forecasting. Chinese suppliers offer 10-15% cost advantages and the potential for longer-term price stability through fixed contracts rather than quarterly renegotiations.

What are YMTC and CXMT, and how capable are they compared to Samsung?

Yangtze Memory Technologies (YMTC) specializes in NAND flash memory and has become one of the world's largest NAND producers by capacity. Changxin Storage (CXMT) focuses on DRAM and is preparing for mass production of advanced HBM3 chips. While neither company matches Samsung's or SK Hynix's cutting-edge performance levels, the technology gap is narrowing, particularly in NAND. For many consumer device applications, Chinese suppliers' performance is adequate, and Apple's engineering teams can optimize designs to work with slightly lower-performance memory.

What regulatory risks does Apple face by partnering with Chinese memory suppliers?

Both YMTC and CXMT have faced U.S. government restrictions, including brief inclusion on the Pentagon's restricted companies list. Apple would need to navigate complex export control regulations, ensure no restricted technology transfer occurs, and maintain intellectual property protection. The company would likely need to compartmentalize sensitive design information and work with U.S. government agencies to ensure compliance. These are solvable challenges, but they add operational complexity to any partnership.

How much money could Apple save by diversifying to Chinese suppliers?

Based on supply chain modeling, if Apple sources 40% of its DRAM from CXMT at a 10% discount and 30% of its NAND from YMTC at a 15% discount, the company could save approximately

Will this change affect Apple product prices or availability for consumers?

This diversification is unlikely to directly affect consumer pricing or availability. The change is being made at the supply chain level to improve Apple's manufacturing margins and supply chain resilience. Consumers won't typically know which supplier provided their device's memory. The benefits accrue to Apple as improved profitability and reduced supply chain risk, not as lower prices to consumers (though margins improvements could theoretically fund lower device prices if competitive pressure demands it).

What happens to Samsung and SK Hynix if Apple successfully partners with Chinese suppliers?

Samsung and SK Hynix face intense pricing pressure. Once Apple establishes YMTC and CXMT as credible alternatives, Samsung and SK Hynix lose their negotiating advantage. They'll need to become more flexible on pricing, offer longer-term fixed-price contracts, improve service quality, and invest more aggressively in R&D to maintain competitive advantage. The "Big Three" will transition from monopoly suppliers to competitive vendors. This is ultimately healthy for the industry but creates short-term challenges for these companies.

Could Apple's diversification to Chinese suppliers trigger U.S. government concerns?

Potentially. The U.S. government is sensitive about American tech companies becoming dependent on Chinese supply chains. However, Apple's move also creates mutual economic dependence between the U.S. and China—Apple depends on Chinese suppliers, and Chinese suppliers depend on Apple's business. This mutual dependence can actually reduce geopolitical conflict risk. Apple will likely manage government relationships carefully, emphasizing compliance, IP protection, and the strategic benefits of competition in semiconductor markets.

How quickly will Apple likely implement this supply chain change?

Based on typical Apple supply chain practices, expect a gradual rollout. Small-scale trials will likely begin in 2025 with non-critical products or low-volume device lines. If trials succeed, ramp to 15-25% of supply by mid-2026. Full stabilization at planned volumes (likely 25-40% of total DRAM and NAND) could occur by late 2026 or 2027. Apple rarely announces supply chain partnerships publicly, so most of this transition will happen quietly without consumer awareness.

Will other tech companies follow Apple's lead and diversify to Chinese suppliers?

Yes. Microsoft, Google, Amazon, and Meta all face similar memory supply challenges and pricing pressures. Once Apple demonstrates that Chinese supplier diversification is viable, these companies will replicate the model. This will accelerate the transformation of Chinese suppliers from secondary vendors to tier-one suppliers. Smaller tech companies may struggle to replicate Apple's success due to lower negotiating leverage and smaller volume commitments that make supplier qualification less attractive.

What intellectual property risks does Apple face by working closely with Chinese suppliers?

Apple faces risks that Chinese suppliers could reverse-engineer proprietary memory optimization techniques or leak designs to competitors. To mitigate this, Apple would implement strict compartmentalization of sensitive information, use third-party auditing, and maintain contractual penalties for IP theft. Apple likely won't share cutting-edge optimization techniques with Chinese suppliers—the company will work with commodity-grade memory designs and engineer optimization at Apple's level. This limits IP exposure while maintaining cost advantages.

Key Takeaways

- Apple is strategically diversifying memory suppliers to reduce dependency on Samsung, SK Hynix, and Micron while leveraging quarterly pricing volatility that has doubled costs in some periods

- YMTC and CXMT have expanded capacity significantly and achieved technology levels adequate for many Apple applications, particularly in NAND where the gap is narrowest

- Diversification could save Apple approximately $175 million annually while improving supply chain stability through longer-term fixed-price contracts instead of quarterly renegotiations

- Regulatory and geopolitical risks are real but manageable through careful compliance frameworks and IP protection protocols

- This move signals a fundamental shift in semiconductor industry power dynamics, ending the era of supplier consolidation and initiating competitive pressure that will benefit the entire tech industry long-term

Related Articles

- Mesh Optical Technologies $50M Series A: AI Data Center Interconnect Revolution [2025]

- Trump's 'Buy American' EV Charging Rule: A De Facto NEVI Moratorium [2025]

- Why America's $12B Mineral Stockpile Proves the Future Is Electric [2025]

- iPhone 18 Pricing Strategy: How Apple Navigates the RAM Shortage [2025]

- Intel Core Ultra Series 3 Launch Delayed by Supply Crunch [2025]

- Nvidia's $1.8T AI Revolution: Why 2025 is the Once-in-a-Lifetime Infrastructure Boom [2025]

![Apple's Chinese Memory Gambit: Why DRAM and NAND Diversification Matters [2025]](https://tryrunable.com/blog/apple-s-chinese-memory-gambit-why-dram-and-nand-diversificat/image-1-1771542427901.jpg)