The AI Infrastructure Crisis Nobody's Talking About

While everyone obsesses over GPU shortages and chip design, something far more critical is quietly breaking: the infrastructure connecting those GPUs together. For months, AI companies have been stacking thousands of graphics processors into massive clusters, treating them like they exist in a vacuum. But here's the truth nobody mentions at investor pitches: a single GPU cluster needs somewhere between four and five times as many optical transceivers as there are GPUs.

Think about that math for a moment. If Meta or OpenAI is bragging about deploying a million GPU cluster (which they do, constantly), that's really four to five million specialized devices you've never heard of handling the conversations happening between those processors. These aren't generic components. They're precision instruments that convert laser signals traveling through fiber optic cables into electrical signals computers can understand. They're the nervous system of artificial intelligence.

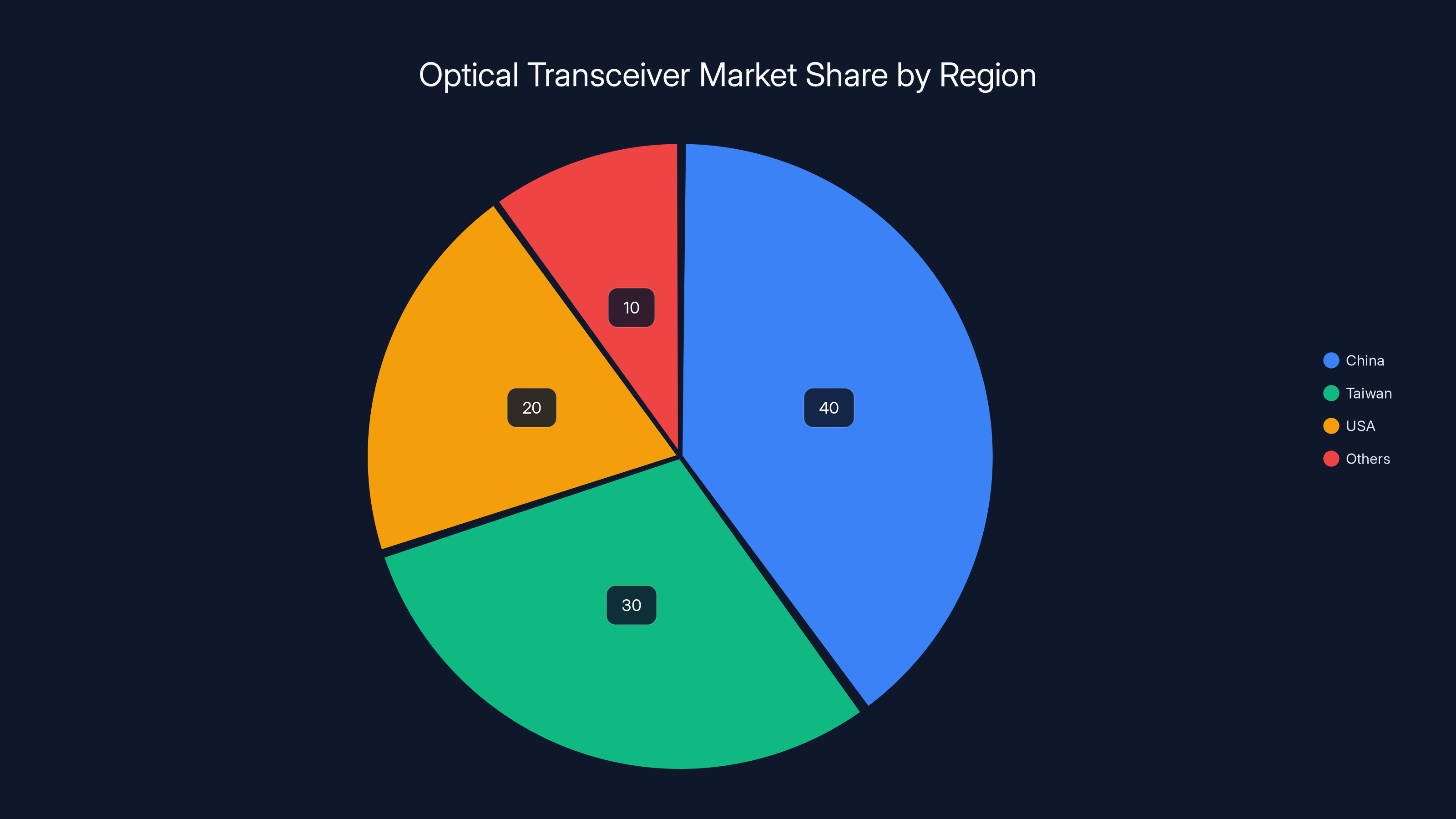

For years, this critical infrastructure bottleneck barely registered on anyone's radar. The market was dominated by established Chinese suppliers who'd been perfecting the manufacturing process for decades. American companies mostly shrugged and bought from overseas. It was cheaper, it was proven, and frankly, nobody at the board level cared about supply chain diversification until trade tensions made it impossible to ignore.

Then three engineers who'd spent years solving a similar problem at SpaceX looked at this market and saw something different. They saw inefficiency. They saw fragmentation. They saw an enormous opportunity hiding in plain sight because everyone was too focused on the flashier parts of AI infrastructure.

On Tuesday, February 17th, 2025, Mesh Optical Technologies announced a $50 million Series A funding round led by Thrive Capital. It's a moment that deserves far more attention than it's getting because it represents something fundamental shifting in how America approaches AI infrastructure.

TL; DR

- The Problem: AI data centers require 4-5 optical transceivers per GPU, creating massive supply bottlenecks currently dominated by Chinese manufacturers

- The Solution: Mesh Optical, founded by three SpaceX veterans, is building U.S.-based manufacturing for optical transceivers with $50M in Series A funding

- The Impact: A 3-5% reduction in power consumption per GPU cluster, plus strategic control over critical AI infrastructure

- The Timeline: Plans to manufacture 1,000 units daily by year-end 2025, qualifying for bulk orders in 2027-2028

- The Stakes: National security concerns around AI infrastructure critical to economic competitiveness and military capability

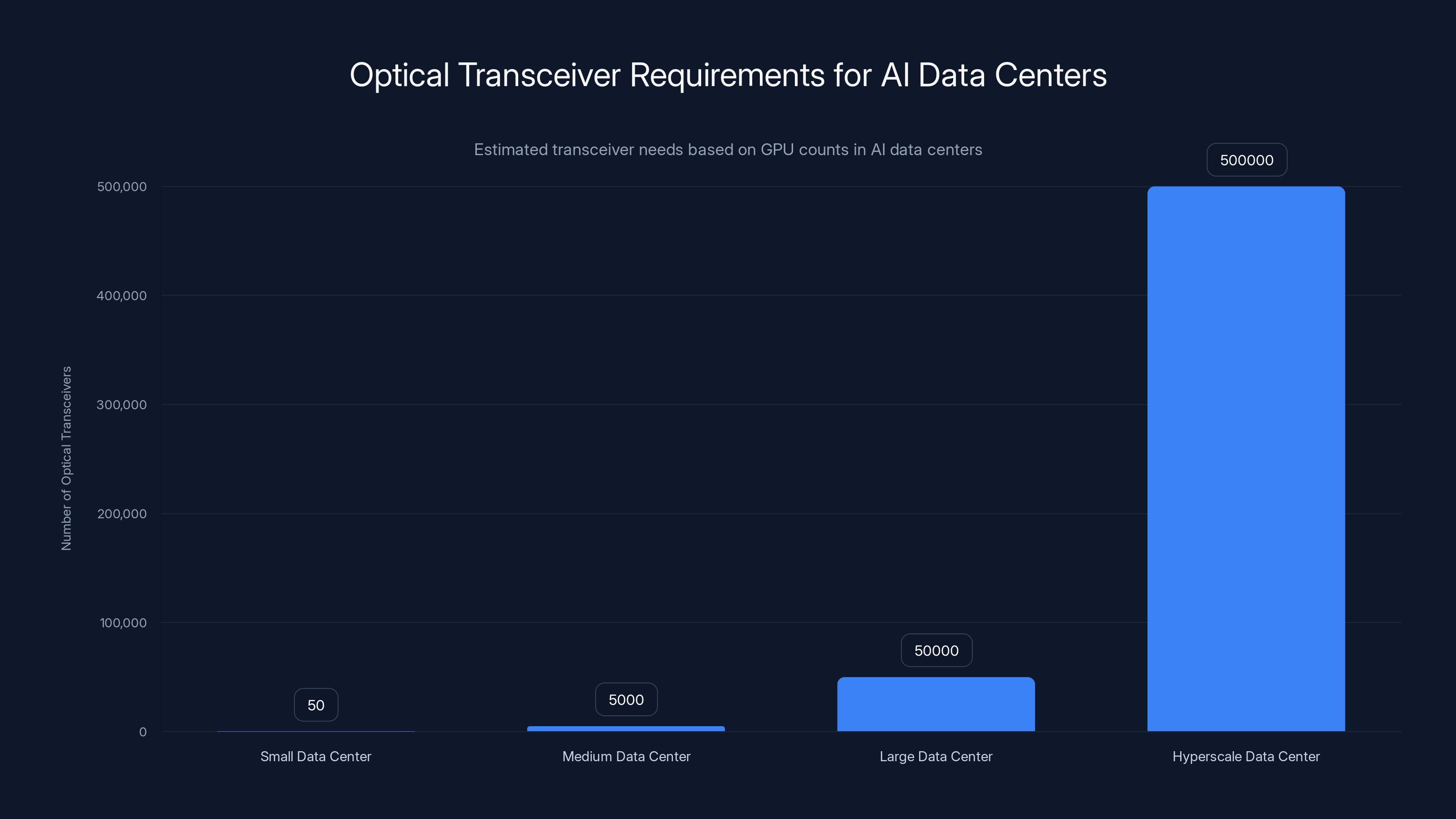

A hyperscale AI data center with 100,000 GPUs requires approximately 400,000 to 500,000 optical transceivers. Estimated data for smaller centers show significant scaling in transceiver needs.

Who These Founders Actually Are (And Why It Matters)

Travis Brashears, Cameron Ramos, and Serena Grown-Haeberli weren't random engineers who decided to start an optical components company. They were the people actually designing the communication systems keeping Starlink's constellation of thousands of satellites in constant contact with each other and the ground network below.

If you understand what SpaceX accomplished with Starlink, you understand why these three matter. Starlink didn't just need to build satellites. It needed to build an entirely novel communications architecture that could handle thousands of moving objects in orbit, all talking to each other at the speed of light, without the infrastructure that ground-based telecom companies take for granted.

The optical communications systems they developed had to solve problems nobody had solved at scale before. How do you maintain laser lock between satellites moving at 17,500 miles per hour? How do you design optical transceivers that work in the radiation environment of space? How do you manufacture and qualify components to that level of reliability when you're dealing with thousands of units?

Those aren't theoretical problems. Brashears, Ramos, and Grown-Haeberli lived them every day for years. When they sat down to design a new generation of compute-heavy SpaceX satellites, they had to assess what optical transceivers actually existed in the market. What they found shocked them: the market was fragmented, dominated by suppliers treating optical interconnect as a commodity, and riddled with inefficiencies that would never have been acceptable in aerospace.

When SpaceX says it needs something, it doesn't ask for price quotes and on-time delivery estimates. It says "here's what we need to accomplish" and engineers figure out how to build it. That mindset, applied to a market full of engineers running optimization algorithms in spreadsheets, created Mesh Optical.

Thrive Capital's interest in funding them speaks volumes. Thrive isn't a typical venture fund that spreads money across 50 companies hoping one becomes a unicorn. It's an investor focused on infrastructure-layer technology that power entire categories of computing. Thrive backed Anthropic when everyone was sleeping on the Claude opportunity. It backed companies that understood infrastructure before it became fashionable.

Philip Clark, a partner at Thrive, distilled the investment thesis in a single sentence: "If AI is the most important technology in several generations, to have critical parts of AI data center capex run through misaligned/competitive countries is a problem."

The Optical Transceiver Market: Massive, Hidden, Broken

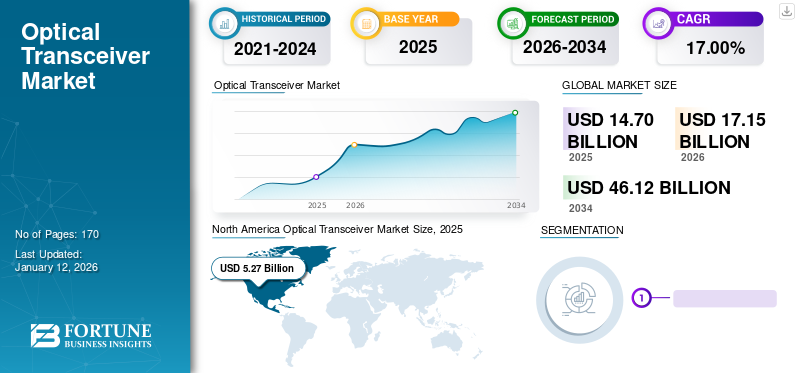

Most people have no idea that a $30 billion market exists for devices you've never heard of that connect computers together. Optical transceivers are that market. They're everywhere in hyperscale data centers, and they're absolutely critical to how AI works today.

Here's why they're so important: GPUs are incredibly powerful, but they're also incredibly picky about how they talk to each other. Two GPUs sitting next to each other need to exchange data constantly as they work through training steps on massive language models. Scale that up to thousands of GPUs, and you need a networking infrastructure that's fast enough, reliable enough, and power-efficient enough to not become the bottleneck.

Fiber optic cables can move data at the speed of light. They're faster than any copper-based electrical connection. But lasers creating light pulses down optical fiber don't automatically talk to computers that think in voltages and currents. That's where optical transceivers come in. They sit at the boundary between the optical and electrical domains, converting signals back and forth.

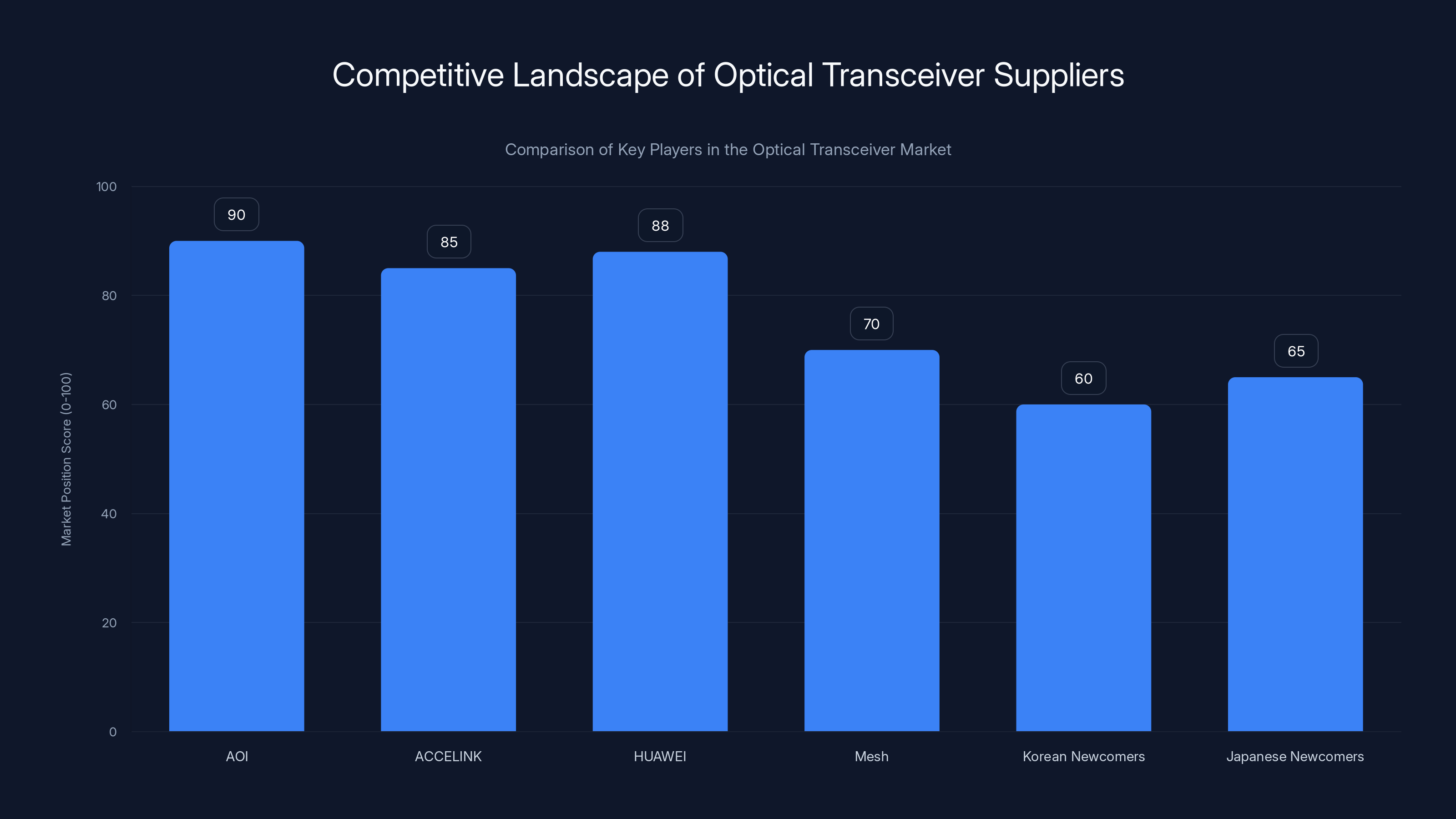

The market has been dominated for years by a small number of Chinese and Taiwanese manufacturers who perfected the production processes decades ago. Companies like ACCELINK, HUAWEI, and others built massive manufacturing facilities optimized for volume production. They got really good at cost reduction. They got really good at squeezing margins down to make components cheaper and cheaper.

But cheaper isn't always better when you're powering artificial intelligence. Consider AOI, a U.S. company that won a

Yet even with contracts like that flowing in America, the market structure hasn't fundamentally shifted. Chinese suppliers still dominate the volume market. American companies occupy niche segments where they can charge premium prices for specialized features. It's a bifurcated market that doesn't efficiently serve the needs of companies trying to build the next generation of AI infrastructure.

Mesh's insight was that the market had been optimized for the wrong thing. It had been optimized for component cost. It hadn't been optimized for integration, efficiency, or the specific needs of AI computing.

Established players like AOI, ACCELINK, and HUAWEI lead the market with high scores due to their scale and relationships. Mesh focuses on niche AI data center needs, while newcomers from Korea and Japan are emerging. (Estimated data)

Why the Starlink-to-AI-Datacenter Connection Matters

You could look at Mesh Optical and think "why would SpaceX engineers care about data center components?" The connection actually makes perfect sense once you understand the physics and engineering challenges involved.

Starlink requires optical communications systems that operate under extreme constraints. Satellites are power-limited. They're thermally limited. Every watt you save matters because you don't have an infinite power budget to draw from. Every gram of weight matters because it costs money to launch. Every component has to survive radiation exposure that would destroy commercial electronics in hours.

When you're engineering under those constraints, you get really good at optimization. You can't afford to ignore 3% efficiency gains because you can't afford to ignore anything. You learn to think about system-level performance instead of component-level specifications. You learn that manufacturing efficiency directly impacts component quality and reliability.

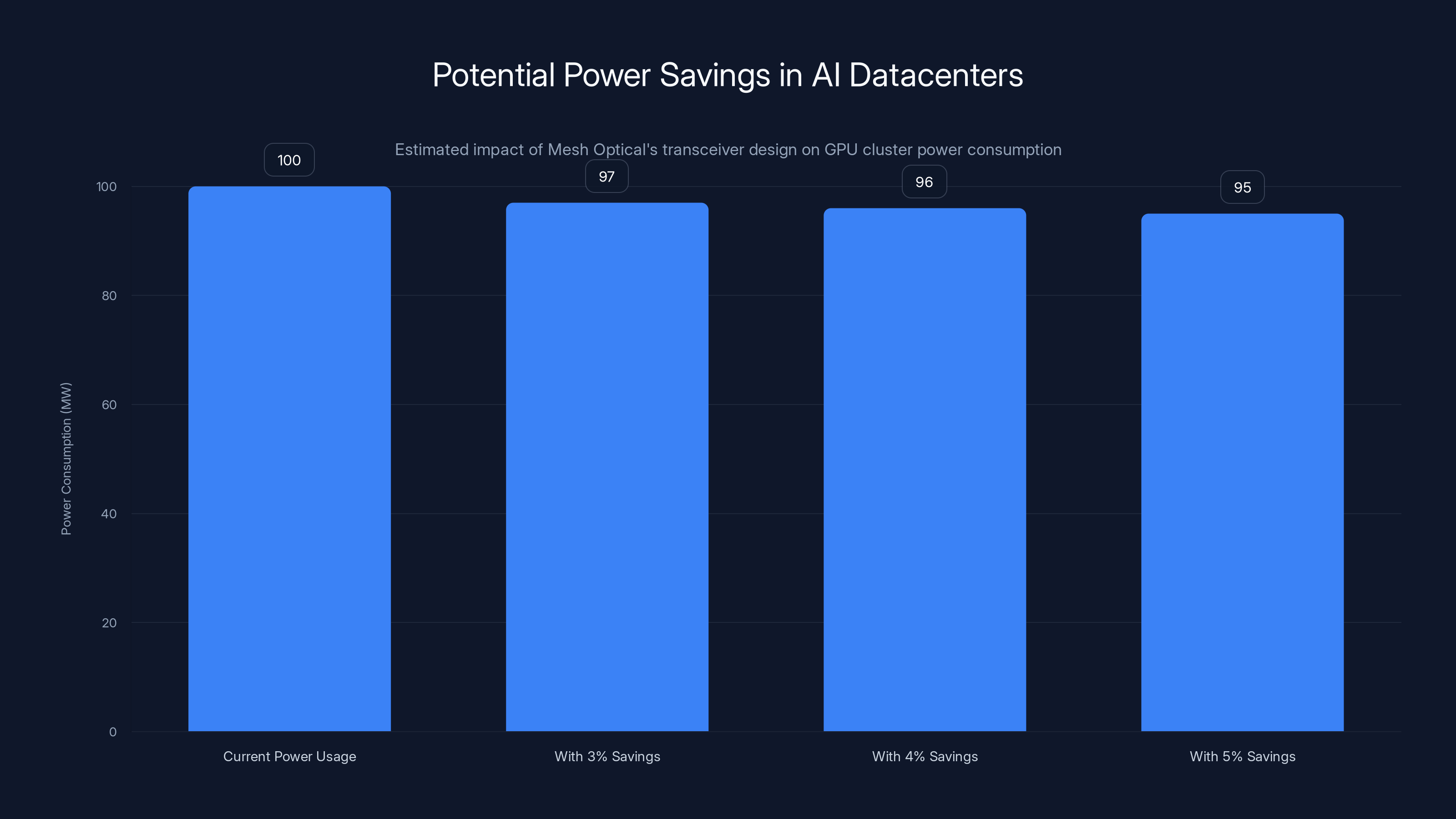

Those skills translate directly to data center optimization. A $10 million facility containing tens of thousands of GPUs burns enormous amounts of electricity. The cooling costs alone can run into millions of dollars monthly. If Mesh can design optical transceivers that reduce GPU cluster power consumption by 3-5%, that's not a marginal improvement. That's a game-changer for hyperscale operators running on thin efficiency margins.

Ramos explained that their current design removes a commonly used but power-hungry component from the standard transceiver architecture. That sounds simple. But it required actually understanding what that component was doing, why it was there, and whether that function could be achieved more efficiently. Those are exactly the kinds of questions engineers become expert at asking when they've spent years optimizing satellites.

The space industry also taught these three founders something else valuable: how to manufacture at scale with uncompromising quality standards. In aerospace, you can't have a 99% success rate. You need 99.99% or better because failures can be catastrophic and expensive to diagnose. That's bred into SpaceX's manufacturing culture.

Applied to optical transceivers, that mindset creates a different kind of company. Most transceiver manufacturers optimize for cost. Mesh is optimizing for reliability and efficiency first, then worrying about cost. That's a fundamentally different business model.

The Supply Chain Politics Nobody Discusses (But Everyone Should)

Trade tensions between the United States and China have been simmering for years, occasionally boiling over into actual restrictions and counter-restrictions. Semiconductors. Rare earth elements. Industrial equipment. Each became a flashpoint in a larger strategic competition.

Optical transceivers haven't yet become a direct flashpoint, but everyone in this market sees it coming. The logic is straightforward: if optical transceivers are critical to AI infrastructure, and AI is critical to national security and economic competitiveness, then control over the supply of optical transceivers is a strategic asset.

Currently, that control is concentrated in China and Taiwan. No American company dominates the commodity transceiver market. European manufacturers exist, but they largely serve European customers. There's a structural vulnerability here that becomes more obvious the longer you think about it.

Here's the political reality: trade restrictions haven't yet impacted the optical transceiver market directly. But hyperscalers and investors are looking at the history of semiconductor export controls and asking themselves whether it's worth the risk to depend on overseas suppliers for components this critical.

Thrive Capital's Philip Clark articulated this calculus perfectly: it's not about restrictions that exist today, it's about the asymmetric risk of restrictions that could exist tomorrow. If you're building AI infrastructure that you expect to be generating value for decades, do you want that infrastructure to depend on supply chains you don't control in geopolitical environments you can't influence?

Mesh is essentially taking a bet that the answer is "no." More than that, Mesh is betting that hyperscalers will eventually reach the same conclusion and be willing to pay a premium to reduce that risk.

The founders understand this risk landscape intimately. One detail Brashears mentioned during conversations with TechCrunch really crystallizes how concentrated this market has become: European equipment suppliers that make the manufacturing machinery for optical transceivers expect Chinese customers. Their standard intake forms ask for a Chinese company registration number. That's not an accident. That's an indication that the entire supply chain for the equipment to make these components has become China-centric.

If you're an American company trying to build optical transceivers in the United States, you're not just trying to outcompete existing manufacturers. You're trying to rebuild entire supply chains that have consolidated in Asia over decades. That's extraordinarily difficult. It's also extraordinarily valuable if you can pull it off.

Mesh's approach is to integrate design and manufacturing in the same facility. That's not how most semiconductor-adjacent companies operate. Most separate design from manufacturing for cost reasons. But integration creates benefits that pure cost accounting misses: you can optimize designs for your specific manufacturing processes, you can respond to customer needs faster, and you can maintain quality standards that don't get lost in translation between design teams and contract manufacturers halfway around the world.

The Manufacturing Challenge: Lights-Out Automation in America

Mesh's founders are under no illusions about what they're trying to accomplish. Building optical transceivers in the United States isn't harder than building them in China because American engineers are less talented. It's harder because American manufacturing has, over decades, optimized away the specific expertise needed for high-volume optical component production.

Most of the world's expertise in lights-out, automated manufacturing for optical components is concentrated in Asia. When German equipment suppliers expect Chinese customers, that's because Chinese factories represent the cutting edge of automated manufacturing. The people who know how to set up production lines, optimize yield, eliminate defects, and run factories with minimal human intervention work primarily in Asia.

For Mesh, that's a problem they have to solve by hiring or developing expertise. It's doable, but it's not easy. The company's target is audacious: manufacture 1,000 units per day within the next year. That's meaningful volume, but it's also a realistic target for a startup moving fast.

Here's where the math gets interesting. If Mesh hits 1,000 units per day production, that's roughly 300,000 units annually. At scale, their current thinking is to qualify for bulk orders in 2027 and 2028. Those are the years when hyperscalers are planning the next generation of massive AI infrastructure buildouts. If Mesh can demonstrate they can reliably produce hundreds of thousands of units annually, at quality levels that meet hyperscaler requirements, they become a genuine alternative to overseas suppliers.

But manufacturing 1,000 units per day with lights-out automation (meaning minimal human involvement, mostly robots) requires solving engineering problems that don't have off-the-shelf solutions in America. You can't just hire someone from Taiwan who worked in a factory and transplant their experience directly. You need to understand the manufacturing process deeply enough to solve novel problems that come up when you're implementing it in a different context.

Some of this is solvable through partnerships. Some of it comes from hiring specialists. Some of it requires just grinding through problems that don't have elegant solutions. It's unglamorous work that rarely gets mentioned in venture funding announcements, but it's the work that determines whether Mesh becomes a real supplier to hyperscalers or remains a niche player.

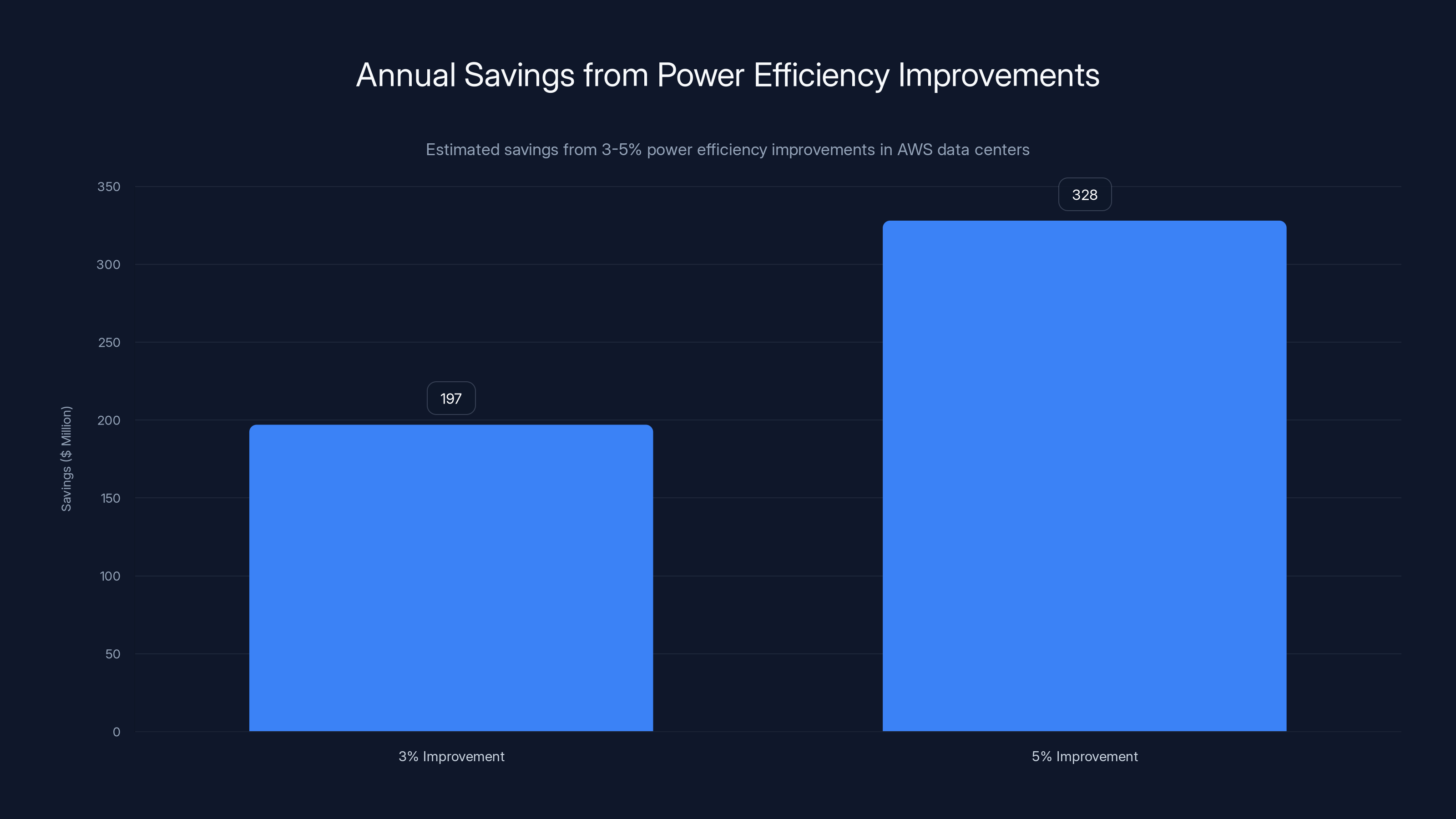

A 3% power efficiency improvement in AWS data centers could save

The Power Efficiency Angle: 3-5% Doesn't Sound Like Much Until You Do the Math

Let's actually quantify what Mesh is claiming about power efficiency improvements. A 3-5% reduction in power consumption per GPU cluster doesn't sound dramatic until you think about what it actually means in dollars and cents.

Amazon Web Services alone operates data centers consuming roughly 15 gigawatts of power globally. That's roughly the power consumption of a small country. When your data centers are consuming that much electricity, a 3% efficiency improvement isn't trivial. It's millions of dollars in annual operational costs.

Let's do the math. Electricity costs vary by region, but let's use a reasonable estimate of $50 per megawatt-hour, which is roughly the blended cost hyperscalers negotiate when they're buying power at scale.

15 gigawatts equals 15,000 megawatts. Running continuously, that's 15,000 MW × 24 hours × 365 days = 131.4 million megawatt-hours annually. At

A 3% reduction would save

Those are enormous numbers, and they're just for AWS. Add in Microsoft's Azure, Google Cloud, Meta, and other hyperscalers, and you're talking about billions of dollars in collective annual savings if they adopt more efficient optical transceivers.

But here's the thing: hyperscalers don't necessarily pocket those savings. They use efficiency improvements to either reduce customer pricing (making AI services cheaper and more accessible) or to improve margins slightly while investing the savings in the next generation of infrastructure. Either way, it's economically significant.

From Mesh's perspective, this efficiency improvement becomes a selling point that justifies premium pricing relative to commodity suppliers. If you can demonstrably save hyperscalers tens of millions of dollars annually, they'll happily pay 10-20% more for your components to capture those savings.

This is where understanding your customers' economics becomes crucial. Mesh could have designed transceivers that were slightly cheaper to manufacture but slightly less efficient. Instead, they optimized for the economics that matter to hyperscalers. That's good business strategy.

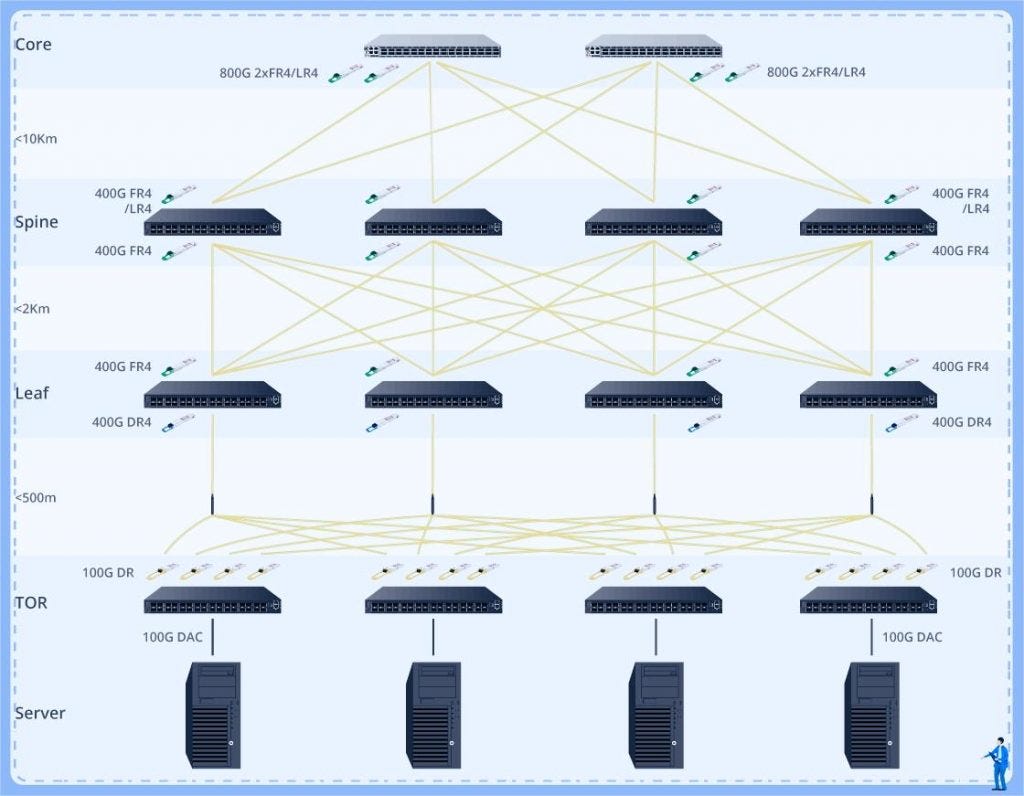

AI Data Center Architecture: Where Transceivers Actually Live

To understand why Mesh's technology matters, you need to understand how modern AI data centers are actually structured at the infrastructure level.

A hyperscale AI data center is organized in a hierarchical structure. GPUs are organized into pods, pods are organized into clusters, clusters are organized into zones. At each level, there are interconnection requirements. GPUs within a pod need to communicate with extremely low latency. Pods need to communicate with somewhat higher latency tolerance. Zones need to communicate with even more latency tolerance.

The interconnection infrastructure for data at the GPU level is where optical transceivers really matter. Nvidia's NVLink interconnect, which connects GPUs in high-performance clusters, can achieve incredibly high bandwidth, but getting that data to move at line-rate requires optical connections with specific characteristics.

Different hierarchical levels of the data center use different types of optical transceivers optimized for those specific use cases. Some are optimized for ultra-low latency GPU-to-GPU communication. Others are optimized for higher bandwidth at slightly higher latency for rack-to-rack or zone-to-zone communication. Still others are optimized for long-distance interconnection between geographically distributed data center sites.

Mesh's initial focus is on the lower-latency, higher-performance end of the spectrum, where hyperscalers are willing to pay premium prices for components that are optimized specifically for AI workloads.

This is actually a smart market entry strategy. Rather than trying to compete with established manufacturers on commodity components where price is the primary differentiator, Mesh is entering at the high end of the market where performance and efficiency matter more than absolute cost. Hyperscalers care about total cost of ownership, not component cost. If you can improve the efficiency of data center operations, they'll adopt your technology.

Competitive Landscape: Who Mesh Is Actually Going Up Against

Optical transceiver suppliers can be categorized into several tiers. At the top tier, you have established suppliers like AOI (the company that won the $4 billion AWS contract), ACCELINK, HUAWEI, and others who have been in the business for decades and have massive manufacturing capacity.

These companies have several advantages: established relationships with major customers, proven manufacturing processes, economies of scale, and supply chains that reach deep into the electronics industry. Competing directly against them on price is futile. They'll always be able to undercut you because they've optimized manufacturing to the point where prices are reflected in pure efficiency gains that take years to replicate.

But they also have disadvantages. Incumbent companies are often slow to innovate because innovation requires disrupting existing manufacturing processes that are already optimized for current products. They're also often not closely aligned with the specific needs of hyperscalers building AI infrastructure because many of their customers are telecommunications companies with different priorities.

Mesh's competitive strategy is essentially: don't compete on their terms. Instead, build products specifically optimized for AI data center use cases, manufacture in a location that appeals to customers concerned about supply chain concentration, and offer performance and efficiency benefits that justify premium pricing.

It's a playbook that's worked before in hardware. When Intel dominated x86 processors, AMD won market share not by building cheaper chips, but by building better chips for specific use cases and earning customer loyalty through superior engineering. That's a more sustainable competitive strategy than pure price competition.

Other competitors Mesh will eventually face include newcomers from Korea and Japan who are also trying to establish optical transceiver manufacturing outside China. There's enough market growth that multiple companies can win. The question is whether Mesh can establish itself as the preferred U.S.-based supplier before other well-funded competitors do.

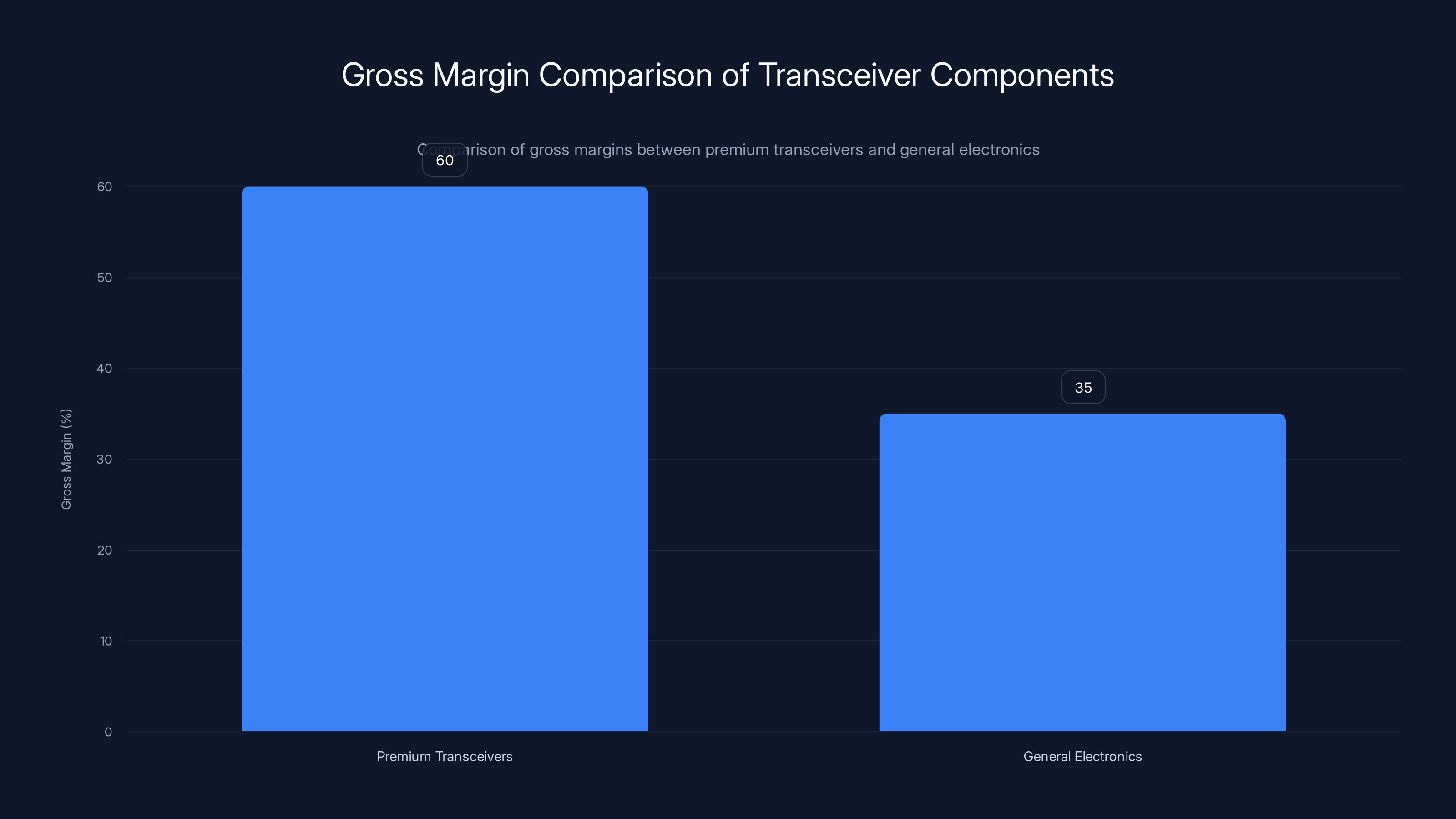

Premium transceiver components have significantly higher gross margins (60%) compared to general electronics (35%), highlighting their value and limited competition. Estimated data based on industry norms.

The Broader Vision: Photonics, Not Just Transceivers

Mesh's founders have ambitions that extend well beyond manufacturing optical transceivers for data centers. Brashears laid out their broader vision in conversations with TechCrunch: they want to be at the precipice of a transition from radio frequency (RF) communications to photonic communications across all computing domains.

What does that actually mean? Currently, most computing interconnect still uses radio frequencies. Wi-Fi, Bluetooth, 5G, and many other communication protocols operate in the RF spectrum. But RF communications have fundamental physical limitations. They generate heat, they consume power, and they have bandwidth constraints compared to optical communications.

Optical communications (using photons instead of radio waves) can achieve much higher bandwidth, much lower power consumption, and can transmit over longer distances without amplification. The tradeoff is that optical communications require direct line-of-sight paths and more precision alignment, which makes them more complex to implement.

For years, optical communications were limited to backhaul (long-distance data transport between data centers) and within very large data centers where you could justify the complexity. But as computing becomes more demanding and power consumption becomes more critical, there's a growing push to extend optical communications to every level of computing interconnect.

Mesh's broader vision is to help enable that transition. First by dominating data center optical transceivers. Then by expanding into optical interconnect for other computing domains as technology and manufacturing capabilities allow. Eventually, being positioned to capture value as photonics become the dominant paradigm for all computing communications.

That's ambitious. It's also not crazy. The physics supports it. The economics support it. The only question is execution, and that's where founders with SpaceX experience have an advantage.

National Security Implications: Why Governments Care

On the surface, optical transceiver manufacturing is a pretty niche topic. Not exactly front-page news. But beneath the surface, there's a national security calculus that explains why Thrive Capital was eager to fund Mesh and why the founders believe this business matters.

Artificial intelligence is becoming central to military capability, economic competitiveness, and technological leadership. Any country that falls behind in AI capability risks falling behind in broader competition with other major powers. That's not hyperbole, that's the explicit strategic thinking of defense planners and economic policymakers.

Now, if your entire AI infrastructure depends on optical components sourced from overseas suppliers in countries with which you have geopolitical tensions, that creates vulnerability. Your competitors could face similar constraints, but that's not reassuring. You need redundancy and resilience in supply chains critical to national capability.

There's also a secondary dynamic: American technological leadership increasingly depends on infrastructure that's designed and manufactured in America. Not for protectionist reasons, but because control over design and manufacturing enables rapid iteration and optimization. If you can't iterate quickly on critical infrastructure, you fall behind competitors who can.

Mesh is essentially positioned at the intersection of commercial competitiveness and national security. That's not something the founders are explicitly marketing, but it's what's attracting the interest of investors like Thrive Capital who think carefully about these dynamics.

Historically, when something becomes a national security priority, the venture dollars that could have been scarce become abundant. The government starts caring about domestic supply chains. Suddenly, premium pricing for domestic production becomes acceptable because the alternative (supply chain vulnerability) is worse.

Mesh's founders are smart enough to understand they need to win on commercial merits first. They need to build optical transceivers that hyperscalers genuinely prefer because they're better and more efficient, not because of policy directives. But once they've won commercially, they're positioned to benefit enormously from any policy momentum toward reshoring critical electronics manufacturing.

Manufacturing Timeline and Milestones: The Proof Is in Execution

Mesh has set specific manufacturing targets that serve as public commitments to investors and customers. They're aiming to manufacture 1,000 units per day within a year. That's a meaningful milestone because it's large enough to be taken seriously but small enough to be achievable without requiring massive capital expenditure.

For context, 1,000 units per day translates to roughly 300,000 units annually. That's enough to support a few large hyperscalers' optical transceiver needs for specific use cases, but not enough to be a market leader by volume. It's a beachhead position.

The timeline for actually winning business is equally important. They're planning to qualify for bulk orders in 2027 and 2028. That's a 2-3 year window to establish manufacturing, pass customer qualification processes, and prove reliability at scale. Those qualifications are not trivial. When hyperscalers certify suppliers, they're not just checking that components meet specifications. They're running extended validation testing to ensure components will perform reliably over years of operation.

This timeline actually aligns well with hyperscaler buildout plans. Most hyperscalers are planning major AI infrastructure expansions in 2027-2028 as they move beyond initial deployments toward production-scale AI systems. Mesh's ability to supply components at scale right when demand peaks could be genuinely valuable.

But timelines can slip. Manufacturing challenges can emerge. Yield issues can persist longer than expected. The real test of Mesh's viability will be whether they actually hit these milestones. The venture capital commitment is a vote of confidence, but it's not a guarantee of success.

Mesh Optical's design could reduce GPU cluster power consumption by 3-5%, leading to significant cost savings for hyperscale operators. Estimated data.

The Economics of the Business: Unit Economics and Margins

Let's think through the financial structure of Mesh's business model, because understanding that helps explain why investors are excited.

Optical transceivers have healthy gross margins if you can achieve manufacturing efficiency. Premium transceiver components typically have gross margins in the 50-70% range, well above the 30-40% margins common in many other electronics businesses. That's because they're precision components with limited competition and genuine value to customers.

Mesh's claim is that they can design and manufacture transceivers more efficiently than incumbents, which means they can achieve higher gross margins while still charging customers less than they pay to current suppliers. That's the magic formula that wins in hardware: deliver more value at lower cost.

The path to profitability depends on reaching sufficient manufacturing scale. At 1,000 units per day, with current cost structures and pricing, Mesh is probably not yet profitable. But the 3-4 year path to 2027-2028, with manufacturing optimization and modest scale-up, could reach profitability or near-profitability.

The venture funding they've raised ($50 million Series A) is enough to build a manufacturing facility, hire key manufacturing engineering talent, and run operations for 18-24 months while they scale up. Typical venture rounds for hardware companies in this space are 18-24 months of runway, so they're well-positioned.

The real question is whether they can move fast enough to capture market share before larger competitors respond. Incumbent manufacturers won't ignore Mesh's entry. They'll respond with their own efficiency improvements and may even invest in U.S. manufacturing if they sense the market shifting. The window to establish market leadership is probably 3-5 years. After that, the market likely consolidates and opportunities for new entrants diminish.

Customer Adoption and Qualification Processes

Hyperscalers don't casually switch suppliers for components critical to infrastructure. When a company like AWS or Google uses a specific supplier, there's usually a long qualification process, extensive testing, and often contractual commitments spanning multiple years.

For Mesh to land significant customers, they need to navigate these qualification processes successfully. That means:

-

Validation Testing: Demonstrating that transceivers meet specified performance characteristics under various operating conditions. This typically takes 3-6 months and involves extensive lab testing.

-

Reliability Testing: Showing that components will maintain performance over years of continuous operation. This often involves accelerated life testing and monitoring performance degradation over time. This phase can take 6-12 months.

-

Production Validation: Proving that manufacturing processes are stable and will produce consistent quality across batches. This requires running multiple production runs and demonstrating that quality metrics are maintained. This phase typically takes 3-6 months.

-

Deployment Trials: Installing components in test environments and monitoring performance under real workloads. This allows customers to identify issues in their actual infrastructure before committing to full deployment. This phase can take 3-12 months.

In total, the qualification process from first contact to volume orders can easily take 18-24 months. Mesh's 2027-2028 timeline for bulk orders makes sense given these constraints.

One advantage Mesh has is that at least some hyperscalers are actively interested in diversifying suppliers for components as critical as optical transceivers. That support can accelerate qualification processes. A motivated customer can push internal testing and qualification faster if they believe it's strategically important.

Potential Challenges and Risk Factors

Mesh is attacking a real market opportunity, but there are genuine risks that could prevent them from succeeding.

Manufacturing Complexity: Optical components are notoriously difficult to manufacture at scale with consistent quality. The mechanical tolerances are tight. The materials are sometimes exotic. Yield rates can be lower than with conventional semiconductors. If Mesh underestimates the manufacturing challenges, they could burn through capital without reaching their production targets.

Incumbent Response: Established suppliers won't sit idle while a startup takes market share. They can respond by investing in efficiency improvements, opening U.S. manufacturing facilities, or using their existing customer relationships to lock in contracts before Mesh can qualify. The speed at which incumbents respond will largely determine whether Mesh has a real opportunity.

Geopolitical Shifts: Ironically, if trade tensions ease and U.S.-China relations normalize, some of the strategic motivation behind Mesh evaporates. Their business case shifts from "strategic necessity" to "nice to have alternative." That's not necessarily fatal, but it removes a powerful customer motivator.

Technology Disruption: What if a completely different approach to optical interconnect emerges? What if optical wireless becomes viable, making fiber-based transceivers less critical? Mesh is betting on a specific technological trajectory. If that trajectory changes, the business changes with it.

Capital Requirements: If manufacturing proves more capital-intensive than expected, Mesh might need multiple funding rounds just to reach profitability. Each funding round dilutes founder ownership and introduces new investor pressures. Raising capital in the current environment is more difficult than during the 2021-2023 AI boom.

These are real risks, not theoretical concerns. But they're the same kinds of risks every infrastructure startup faces. The question is whether Mesh's advantages (experienced founding team, real market demand, customer interest, capital efficiency) outweigh these risks. Based on Thrive's decision to fund them, at least one major investor believes they do.

China and Taiwan dominate the Optical Transceiver market, collectively holding 70% of the market share. The USA, with companies like AOI, is emerging as a significant player with an estimated 20% share. (Estimated data)

The Broader Trend: Reshoring Electronics Manufacturing

Mesh's emergence is part of a much larger trend that's been building for years. American policymakers have become increasingly concerned about dependence on overseas manufacturing for components critical to national competitiveness and security.

This concern isn't new, but it's been amplified by recent geopolitical tensions and supply chain disruptions. When semiconductor shortages hit in 2021-2022, suddenly the vulnerability of depending on overseas manufacturing became visceral to executives who'd taken global supply chains for granted.

The CHIPS and Science Act, passed in 2022, represented a fundamental policy shift toward incentivizing domestic semiconductor manufacturing. While optical transceivers aren't semiconductors per se, they exist in the same policy environment. If the government is willing to subsidize semiconductor manufacturing in America, it's willing to create an environment where optical transceiver manufacturing is economically viable.

Mesh is positioned to benefit from this policy momentum. Not as a recipient of direct subsidies (at least not yet), but as a company solving a problem (supply chain concentration) that policymakers have decided matters.

Other startups are pursuing similar strategies in adjacent markets. Graphene manufacturing, advanced packaging, specialized semiconductor processes. There's a theme: taking manufacturing back to America for components that matter to future competitiveness.

Mesh's founders understand this context. That's part of why they're confident they can build a sustainable business. It's not just about being a better manufacturer. It's about being positioned at the intersection of commercial excellence and policy momentum.

Long-Term Vision: Data Center Interconnect as a Category

Mesh Optical is starting with optical transceivers, but the founding team has longer-term ambitions about reshaping how data centers are connected.

Currently, most data center interconnection is designed by hyperscalers working closely with established suppliers. Hyperscalers define requirements, suppliers build to those requirements. It's a customer-driven market.

Mesh's vision is different. They want to be designers of data center interconnect architecture, not just suppliers of components. That's a fundamental shift in the value chain. Instead of taking specifications from customers, Mesh wants to define new specifications that solve problems customers haven't even articulated yet.

That's more ambitious. It also requires not just manufacturing excellence, but also deep system-level thinking about how data centers should be architected. It requires the ability to take ideas from one domain (satellite communications, space systems) and apply them to another domain (terrestrial data centers).

But it's where the real value lies. Component suppliers are fungible. Architectural innovation creates durable competitive advantages.

If Mesh can establish itself as a thought leader in data center interconnect architecture, influencing how hyperscalers design their next-generation infrastructure, the business becomes much more defensible. You move from supplying components to competitors to actually shaping the direction of an entire industry.

That's the opportunity Mesh's founders see. It's why they're not content to just be another optical transceiver supplier. They want to be the company that fundamentally reimagines how computing infrastructure connects internally.

Investment Thesis: Why Thrive Capital Believed In This

Thrive Capital specializing in infrastructure bets gives us insight into their thinking. They don't invest in every startup with a good story. They invest in companies solving problems at the infrastructure layer that have the potential to reshape entire categories of computing.

With Mesh, several elements aligned perfectly with Thrive's investment criteria:

First-Mover Advantage in U.S. Manufacturing: There's no established American leader in optical transceivers for AI data centers. Thrive is investing at a moment when the market is still fragmented enough that a new entrant with the right capabilities can establish leadership.

Experienced Founding Team: Brashears, Ramos, and Grown-Haeberli aren't serial entrepreneurs with multiple exits. They're domain experts with deep experience in the specific problem space (optical communications systems). That matters more than business experience in this context.

Large Total Addressable Market: The optical transceiver market is already multibillion dollars annually. Growth driven by AI infrastructure expansion makes it larger and faster-growing. There's plenty of room for Mesh to capture meaningful market share without requiring the market to change radically.

Strategic Resonance: Supply chain diversification for critical infrastructure is becoming a policy priority. Mesh benefits from this tailwind without depending on it. That's the ideal position for an infrastructure startup: your business works on commercial merits, but policy momentum provides upside.

Defensibility: Once Mesh establishes manufacturing in the United States with proven quality, it becomes defensibly hard to displace them. Customers don't like switching suppliers. If Mesh delivers reliable components, the switching costs for customers are high.

Thrive's investment isn't based on Mesh being the only company that could succeed in this space. Other companies might also succeed. But Thrive is making a strategic bet that Mesh's specific advantages position them well to establish leadership early and defend that leadership over time.

Implications for the AI Infrastructure Industry

Mesh's success or failure has implications that extend well beyond Mesh itself. The company serves as a test case for whether American manufacturing can compete in components critical to AI infrastructure.

If Mesh succeeds, we'll likely see other startups attempting similar strategies in adjacent components. If Mesh struggles, it sends a signal that American manufacturing can't compete in these domains, which would reinforce dependence on overseas suppliers.

Hyperscalers are watching this carefully. They have incentives to see Mesh succeed because it gives them options. If Mesh can deliver comparable performance at competitive pricing, hyperscalers benefit from being able to diversify suppliers and reduce concentration risk.

But hyperscalers also have institutional inertia around supplier relationships. Switching suppliers isn't free. Even if Mesh's components are marginally better, that only matters if the improvement is large enough to justify the switching costs and risks of working with a new supplier.

For Mesh's success to be sustainable, they need to deliver not just components that meet specs, but components that demonstrably improve the economics of data center operations. That might mean lower power consumption, higher reliability, better integration with customer systems, or some combination. Parity isn't enough. Excellence is required.

The optical transceiver market itself is at an inflection point. AI data center demand is driving adoption of higher-speed, more power-efficient transceivers. Traditional telecom suppliers are optimizing for different use cases. The market is fragmented enough that a new entrant with AI-specific products could capture significant share, but only if they execute better than incumbents.

FAQ

What is an optical transceiver and why is it critical for AI data centers?

An optical transceiver is a device that converts optical signals from fiber optic cables into electrical signals that computers can process, and vice versa. They're critical for AI data centers because large clusters of GPUs need to communicate with extreme speed and efficiency. For every GPU in a large cluster, typically four to five optical transceivers are required to handle data movement between processors, making them fundamental to data center infrastructure.

How many optical transceivers does a typical AI data center require?

A hyperscale AI data center with 100,000 GPUs requires approximately 400,000 to 500,000 optical transceivers. For companies like Meta or Amazon operating million-GPU clusters, that translates to 4-5 million transceivers. This massive volume requirement is why the transceiver market has become so critical to AI infrastructure.

What makes Mesh Optical's approach different from existing suppliers?

Mesh differentiates through several advantages: a design process optimized specifically for AI data center use cases rather than generic optical communications, plans to manufacture in the United States reducing geopolitical supply chain risk, integration of design and manufacturing enabling faster iteration and quality control, and efficiency improvements (3-5% power reduction) that translate directly to meaningful cost savings for hyperscalers operating at scale.

Why do hyperscalers care about supply chain diversification for optical transceivers?

Hyperscalers care about supply chain diversification because optical transceivers are critical to AI infrastructure, and the market is currently dominated by Chinese and Taiwanese suppliers. Geopolitical tensions and the strategic importance of AI create vulnerability if supply is concentrated in one region. Having domestic alternatives reduces risk and provides negotiating leverage with suppliers.

What is Mesh's timeline for becoming a significant supplier?

Mesh is targeting 1,000 units per day manufacturing capacity by the end of 2025, approximately 300,000 units annually. The company aims to qualify for bulk orders from hyperscalers in 2027-2028, aligning with major data center expansion plans. This 2-3 year timeline allows for manufacturing optimization, customer qualification processes, and reliability validation before ramping volume production.

How does a 3-5% power efficiency improvement translate to business value?

For a hyperscaler like Amazon operating 15 gigawatts of data center power globally, a 3% efficiency improvement saves approximately

What are the main challenges Mesh faces in manufacturing optical transceivers in America?

Mesh's primary challenges include the concentration of automated manufacturing expertise in Asia, the need to build or hire manufacturing engineering talent experienced with lights-out automation, the complexity of maintaining quality and yield rates comparable to established suppliers, and managing scaling operations while maintaining profitability. These are solvable problems but require significant operational excellence and focused execution.

How does Mesh's connection to SpaceX inform their approach to optical transceivers?

The SpaceX background provides Mesh's founders with deep expertise in optical communications systems designed for extreme constraints (power limitations, thermal constraints, radiation exposure, reliability requirements). Those capabilities directly transfer to data center optimization, where power efficiency and reliability are equally critical. Additionally, SpaceX's manufacturing culture emphasizes quality and systems-level optimization, contrasting with suppliers optimizing purely for cost.

What is the broader vision for Mesh beyond optical transceivers for data centers?

The founders envision Mesh positioned at the precipice of a transition from radio frequency communications to photonic communications across all computing domains. The immediate focus is data center optical interconnect, but the longer-term vision includes extending optical communications to additional computing applications as technology and manufacturing capabilities evolve, potentially reshaping how all computing systems interconnect.

Could policy changes impact Mesh's business model and competitive advantage?

Policy momentum toward reshoring electronics manufacturing (like the CHIPS and Science Act) supports Mesh's business model by making domestic manufacturing more economically viable. However, the company's long-term viability depends primarily on commercial excellence. Favorable policy creates tailwind but isn't a substitute for building genuinely superior products and manufacturing processes that hyperscalers prefer on merit.

The Strategic Moment in AI Infrastructure

Mesh Optical's $50 million Series A represents a critical inflection point in how America approaches AI infrastructure. For years, we've obsessed over GPUs, processors, and software frameworks while treating interconnect as an afterthought. But interconnect is where the actual intelligence happens. It's where billions of parameters flow between processors, where latency measured in microseconds translates to hours of compute time lost, where efficiency improvements of a few percentage points translate to hundreds of millions in operational cost.

The founding team at Mesh understood something many founders miss: the most valuable companies often operate at layers so critical that customers must use them, yet so infrastructure-focused that outsiders barely notice they exist. AOI won a $4 billion contract worth barely a headline. Mesh is pursuing a similar strategy: become indispensable to AI infrastructure without needing massive consumer visibility.

Thrive Capital's investment suggests sophisticated investors believe this moment is real. The market is consolidating. Demand is accelerating. The supply chain is vulnerable. And the window for new entrants to establish leadership is open but closing. In 2-3 years, if Mesh executes, they'll be deeply integrated into hyperscaler operations. If they don't, the window closes and new entrants will find it much harder to displace incumbents.

For anyone building AI infrastructure, watching Mesh's progress over the next 18-24 months is worthwhile. Not because they're the only company that matters in this space, but because they're the visible test case for whether American manufacturing can compete at the infrastructure layer of AI computing. Their success or failure will shape which other startups emerge to compete in adjacent components and who invests in reshoring manufacturing for critical infrastructure.

The AI revolution is being built on top of infrastructure most people don't think about. Mesh is betting that infrastructure matters more than most people realize. Based on how hyperscalers are operating today, they might be exactly right.

Key Takeaways

- Mesh Optical's $50M Series A addresses a critical but invisible bottleneck in AI infrastructure: optical transceivers required in 4-5x quantity relative to GPUs

- Three SpaceX engineers leveraged satellite communications expertise to design AI data center-optimized transceivers achieving 3-5% power efficiency improvements

- The market is currently dominated by Chinese suppliers, creating supply chain vulnerability as AI becomes strategically critical to national competitiveness

- Mesh's timeline to 1,000 units daily production and 2027-2028 customer qualification aligns with hyperscaler infrastructure expansion plans

- Success of Mesh determines whether U.S. manufacturing can compete in infrastructure components critical to AI, with implications for other reshoring efforts

Related Articles

- PlayStation 6 Release Delayed, Switch 2 Pricing Hike: AI Memory Crisis [2025]

- Holographic Tape Storage Finally Meets Real-World Deployments in 2025 [2025]

- Cherryrock Capital's Contrarian VC Bet on Overlooked Founders [2025]

- Nvidia's Dynamic Memory Sparsification Cuts LLM Costs 8x [2025]

- DDR5 RAM Price Crisis: From 1000+ in 6 Months [2025]

- Inertia Fusion: $450M Funding Boom and the Race to Grid-Scale Power [2025]

![Mesh Optical Technologies $50M Series A: AI Data Center Interconnect Revolution [2025]](https://tryrunable.com/blog/mesh-optical-technologies-50m-series-a-ai-data-center-interc/image-1-1771349891718.png)