The Autonomous Truck Revolution Just Entered Its Critical Phase

Last quarter, something quietly shifted in the world of autonomous vehicles. While everyone's been obsessing over self-driving cars that can park themselves or make you a cappuccino, a startup called Aurora has been busy solving a much harder problem: getting 18-wheelers to haul cargo across hundreds of miles without a single human at the wheel.

And they just announced they're about to do it at a scale that frankly surprised even industry veterans.

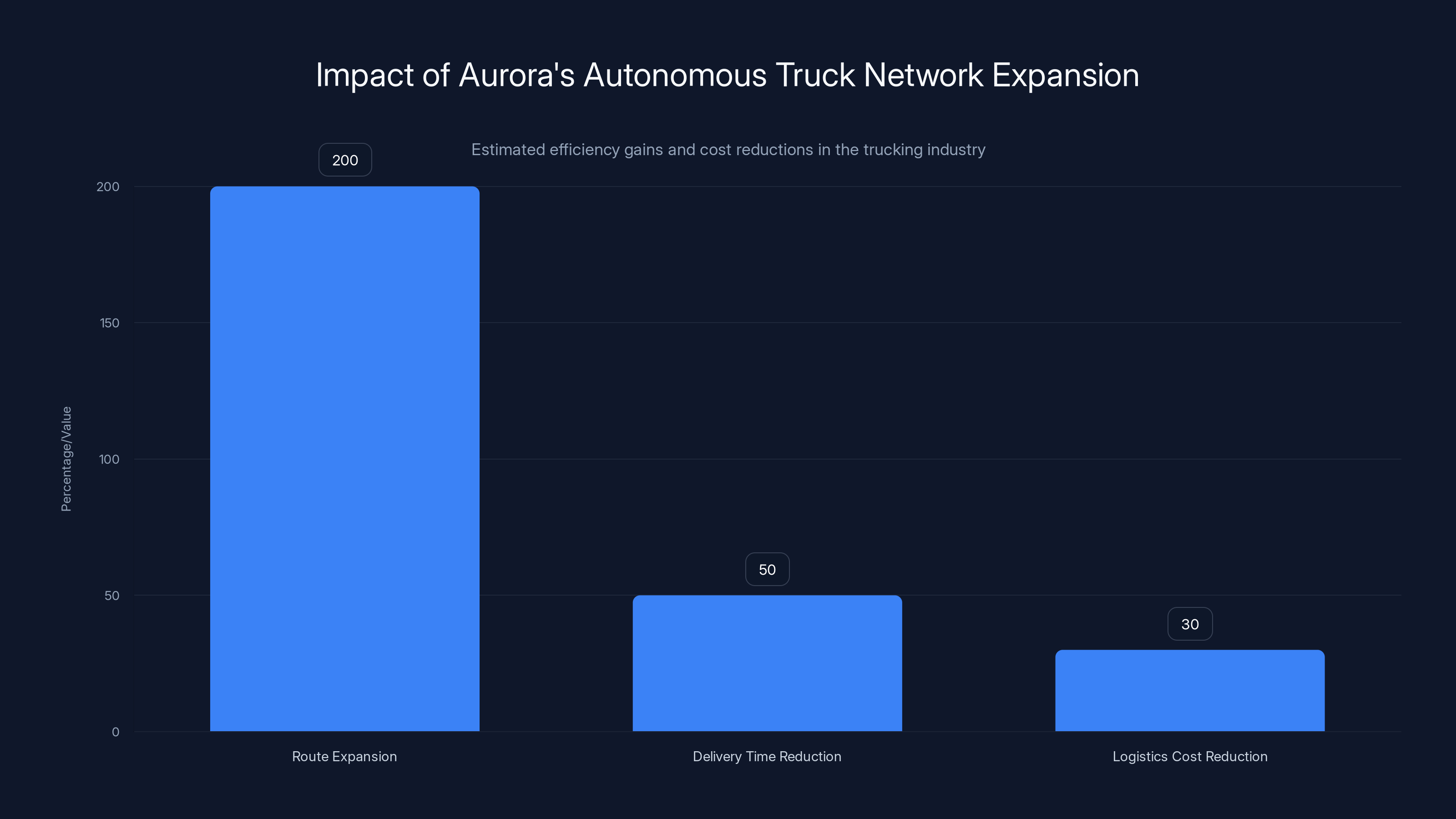

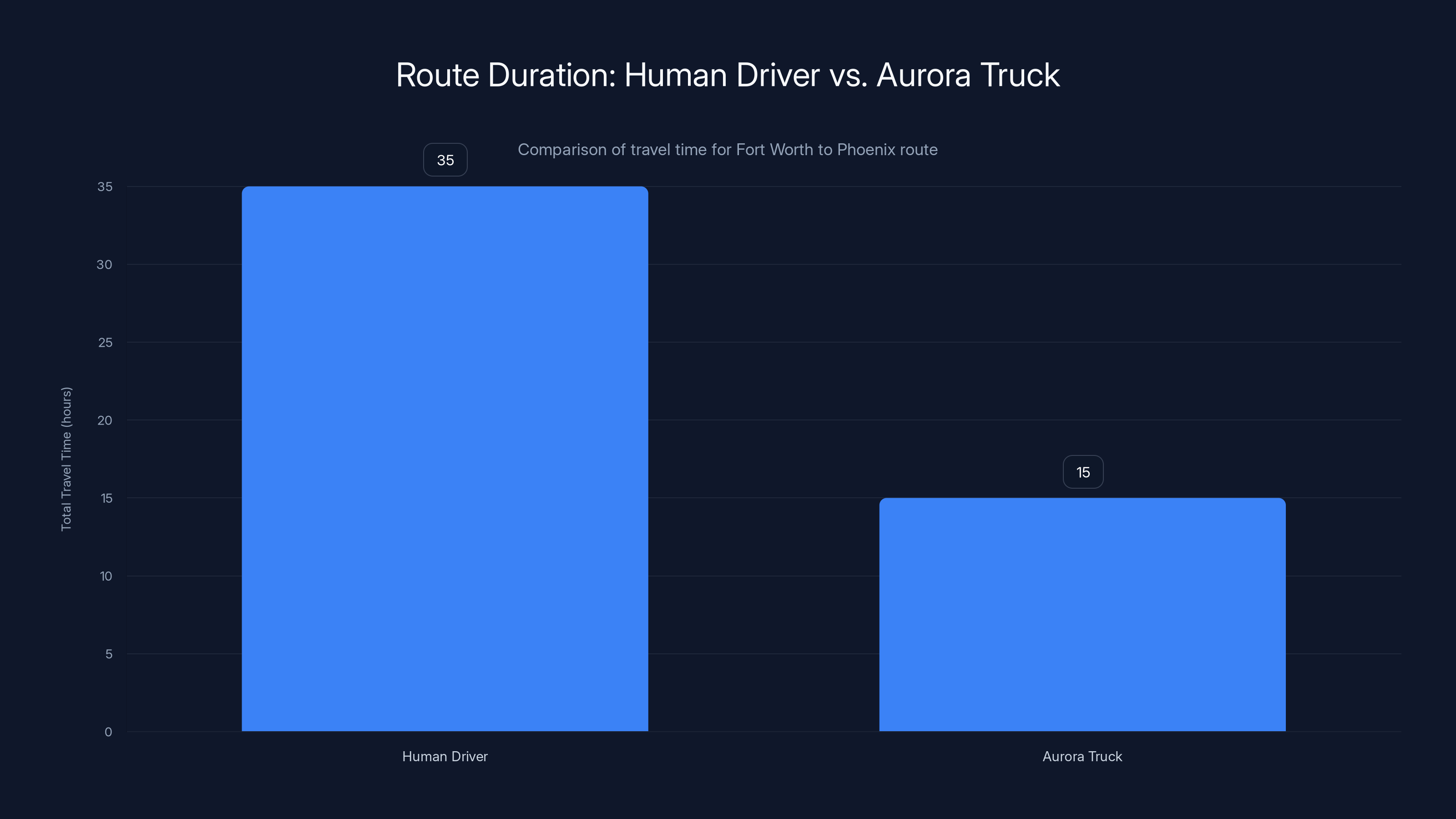

Aurora, the brainchild of former Google self-driving car researchers, just revealed they're tripling their driverless truck network from five routes to ten routes across the Southern US. But here's what makes this announcement genuinely important: these aren't short hops between nearby cities. We're talking about routes like Fort Worth to Phoenix, a haul that takes over 15 hours of continuous driving. A human driver can't legally do that without taking a mandated break.

An autonomous truck? It doesn't sleep. It doesn't get tired. It doesn't need rest breaks.

This expansion matters because it reveals something profound about where autonomous vehicle technology actually stands right now. It's not "almost there." It's here, operating, moving real cargo, making real money. And it's accelerating faster than anyone predicted just two years ago.

The question isn't whether autonomous trucks will eventually take over long-haul logistics. The question is how quickly, how thoroughly, and what gets disrupted in the process. We're about to explore all of it.

What Aurora Actually Does (And Why It's Different From Everything Else)

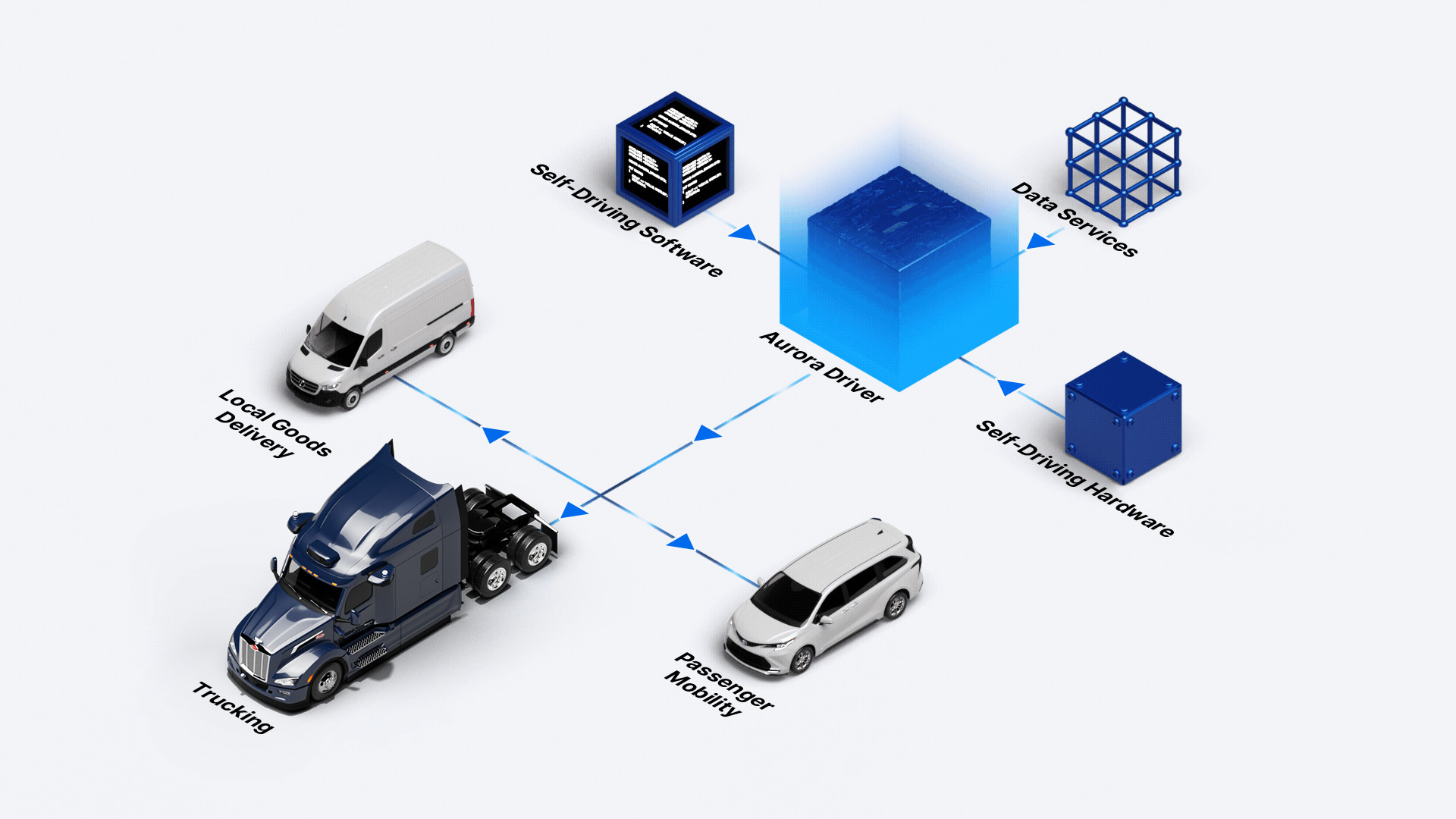

Let's start with the basics, because Aurora's approach is fundamentally different from how most people imagine self-driving vehicles working.

Aurora isn't trying to build a car with magical AI that can handle any situation on Earth. Instead, they're building a truck system optimized for one specific job: hauling cargo on highway routes in structured environments. That's not a limitation. That's genius.

Think about it. A highway is one of the most predictable, constrained driving environments that exists. You've got lane markings, clear rules, reduced complexity at intersections, minimal surprise obstacles. A truck on Interstate 10 between Dallas and Houston encounters far fewer variables than a robotaxi navigating downtown San Francisco.

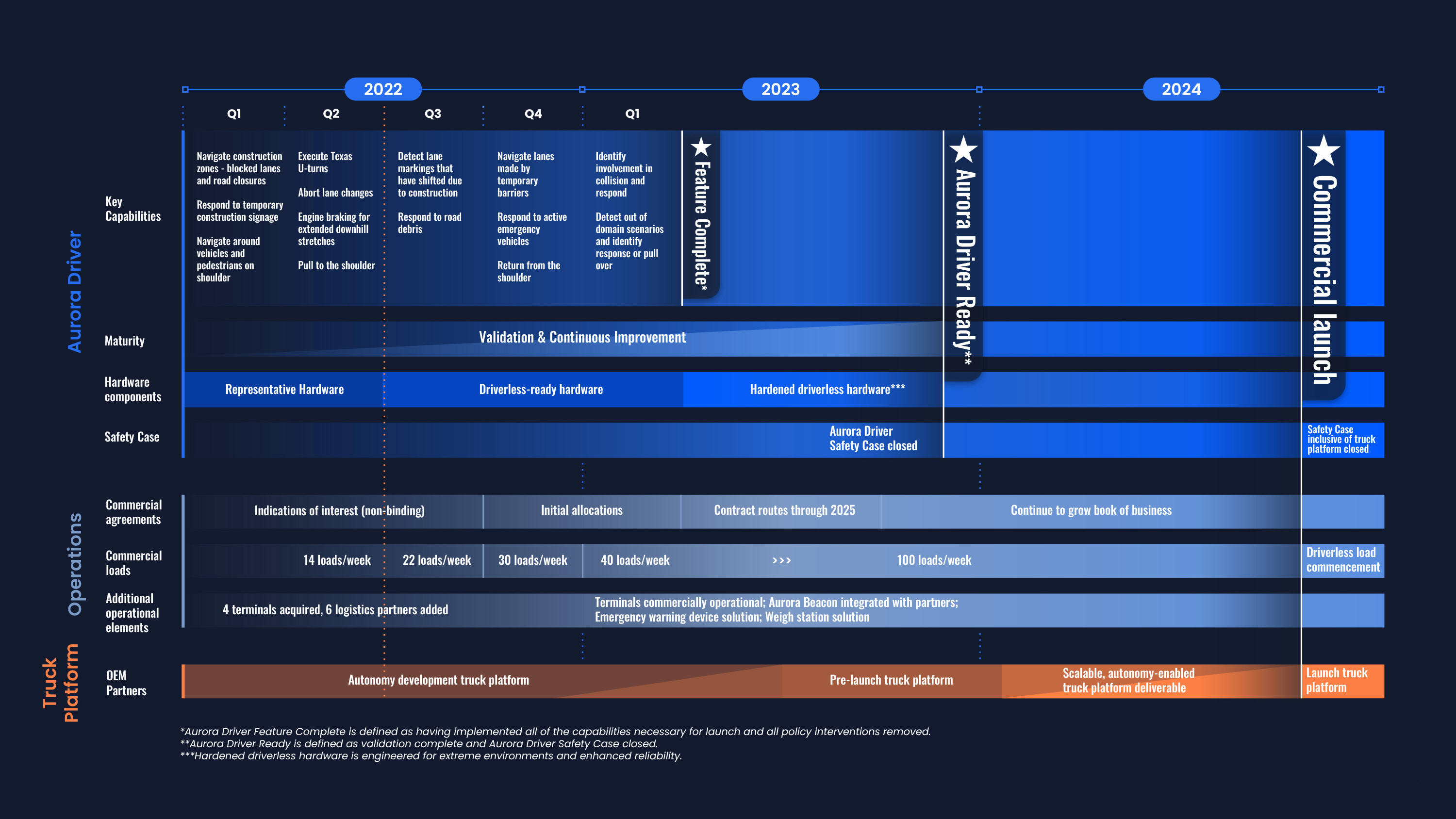

Aurora's fundamental technology stack consists of several key components. First, there's the Aurora Driver, their autonomous driving software. This isn't a single neural network trying to learn everything. It's a layered system combining classical computer vision, lidar processing, sensor fusion, and machine learning models trained specifically on highway driving patterns.

The lidar sensors are crucial. A truck equipped with Aurora's hardware suite can "see" 360 degrees around the vehicle, detecting obstacles up to 100 meters away. That's roughly three football fields of visibility in every direction. Even at highway speeds of 65 mph, that gives the system multiple seconds to react to obstacles.

Second, there's the massive mapping infrastructure. Aurora has built custom HD maps of every route they operate. These maps contain far more detail than regular GPS navigation. They know exactly where lane markers are, where elevation changes occur, where curves tighten. The system doesn't just know the route exists. It knows the route's precise geometry.

Third, there's the hardware integration. Aurora partnered with Volvo to equip the VNL semi trucks with their sensor suite and computing platform. The hardware costs matter because Aurora recently released a new, cheaper hardware stack that costs roughly half what the previous generation required. That's the economic scaling that matters for commercial viability.

What separates Aurora from competitors like Waymo, Cruise, or traditional autonomous truck startups is focus. Aurora isn't trying to solve autonomous driving. They're solving autonomous trucking on highways. That narrowed scope means they can optimize every single decision around that one problem.

Their CEO, Chris Urmson, was employee number one at Google's self-driving car project (now Waymo). He knows the landscape, knows the pitfalls, knows what actually works versus what's marketing vapor. When Aurora announces something, it's typically because they've actually done it, not because they're predicting what might happen if everything goes perfectly.

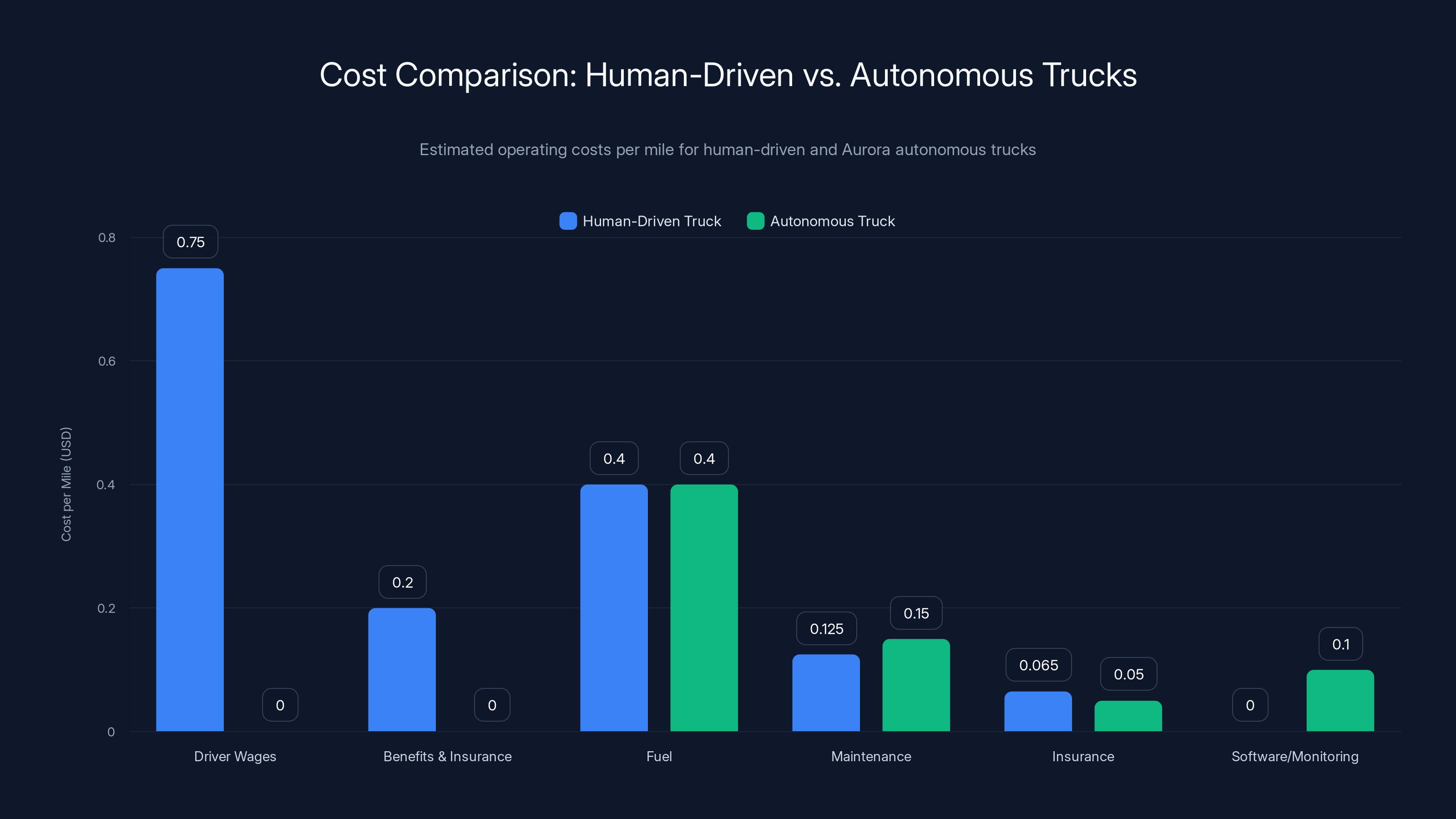

Autonomous trucks potentially reduce operating costs by 20-35% per mile, primarily by eliminating driver wages and reducing insurance costs. Estimated data.

The Network Expansion Explained: From 5 Routes to 10

Aurora's original network was modest. Five routes, all in Texas, all relatively short hauls:

Original Route Structure:

- Dallas to Houston (approximately 240 miles)

- Houston to Dallas (return route, different conditions)

- Houston to El Paso (approximately 625 miles)

- Fort Worth to El Paso (approximately 625 miles)

- Various shorter connector routes

These routes were methodically chosen. Dallas to Houston is high-volume freight with consistent conditions. It was a perfect training route. Each subsequent addition added complexity: night driving, longer distances, different road conditions, different weather patterns.

The new expansion pushes significantly further:

New Route Expansion:

- Fort Worth to Phoenix: 1,050+ miles, 15+ hours of continuous driving

- El Paso to Phoenix: 300+ miles through desert terrain

- Dallas to Laredo: 250+ miles south toward the Mexican border

- Dallas to Houston: Already operational, remains active

- Fort Worth to El Paso: Already operational, remains active

- Houston to El Paso: Already operational, remains active

Plus additional routes that Aurora has been somewhat coy about publicly, but which reportedly include smaller freight corridors in Louisiana and Oklahoma.

Now, here's what actually matters about that Fort Worth to Phoenix route. That drive typically takes a human driver 15+ hours. Federal law restricts truck drivers to a maximum of 11 hours of driving per 14-hour duty period. Then they're legally required to take a 10-hour break.

This means a Fort Worth to Phoenix shipment with a human driver requires:

- 15+ hours of driving

- 10-hour mandatory rest break

- Likely a second driver or overnight accommodation

- Total time: 35-40 hours minimum

An Aurora truck does that same route in 15 hours. No breaks. No second driver. No overnight stays. That's not just a marginal improvement. That's a fundamental economics shift.

The expansion also reveals Aurora's confidence in their technology maturity. They're not just extending slightly further. They're moving into desert routes, mountainous terrain, and longer distances. Phoenix routes pass through Arizona's monsoon season territory. Summer thunderstorms that catch human drivers off-guard. Can Aurora's system handle that?

Apparently, yes. Or at least, they believe they can, and they're willing to stake their commercial operations on it.

Aurora's expansion from 5 to 10 routes significantly reduces delivery times by up to 50% and logistics costs by 20-35%, enhancing efficiency in the trucking industry. (Estimated data)

The Safety Paradox: Why Driverless Trucks Are Actually Safer

This is where the conversation usually goes wrong. People think about autonomous vehicles and their minds immediately jump to liability, catastrophe, edge cases where an AI needs to make an impossible choice about who lives or dies.

That's not how truck safety actually works.

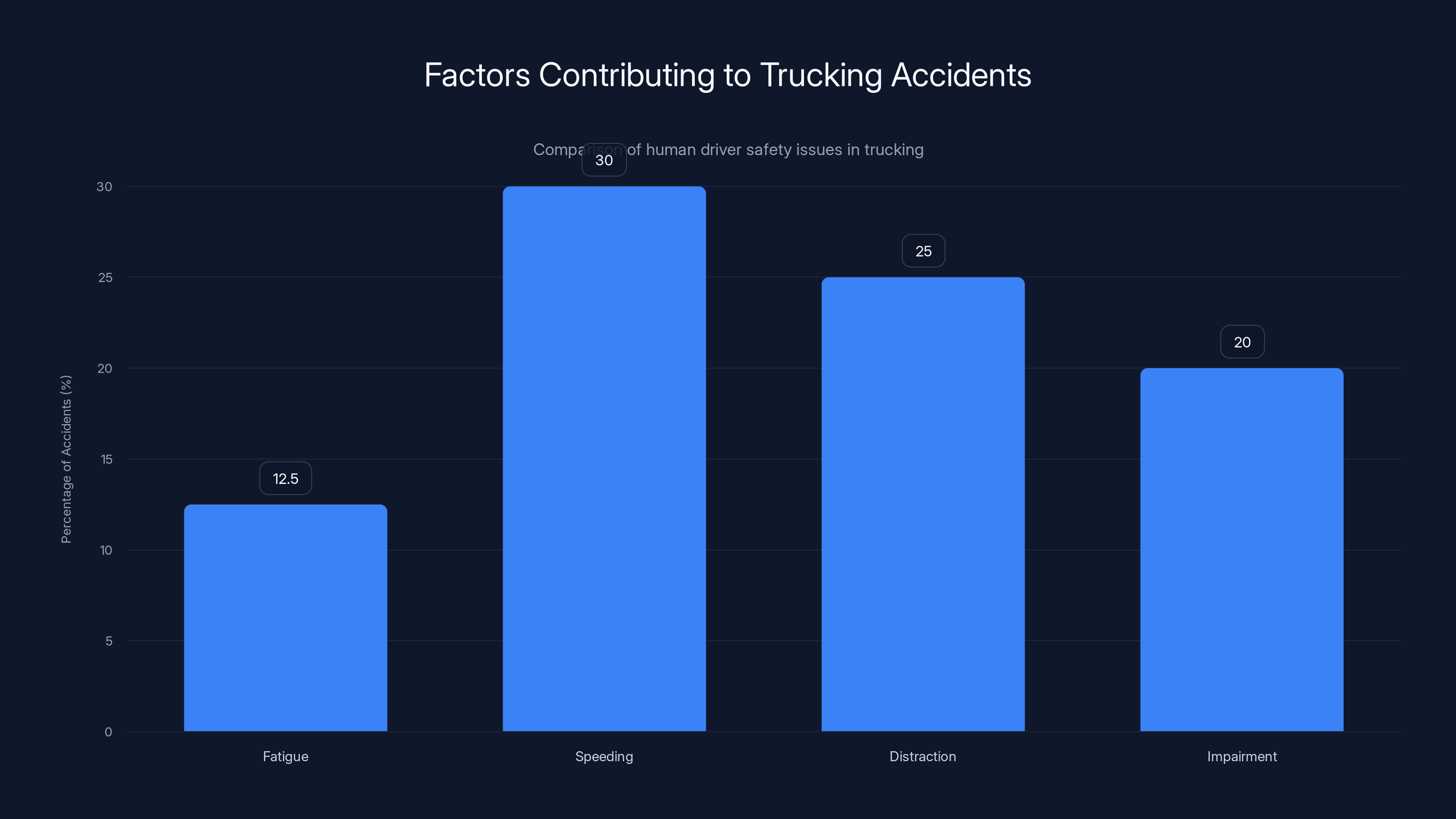

Long-haul trucking is dangerous primarily because of human limitations, not road complexity. Consider these facts:

Human Driver Safety Issues:

- Fatigue-related crashes account for roughly 10-15% of trucking accidents

- Speeding contributes to approximately 30% of fatal truck crashes

- Distraction (phones, food, boredom) is involved in 20-30% of crashes

- Impairment (alcohol, drugs, medication) remains a significant factor

- Age-related reaction time degradation affects older drivers significantly

An autonomous system doesn't get tired. It doesn't speed. It doesn't get distracted by a phone. It doesn't impair. It maintains consistent reaction times whether it's been operating for 2 hours or 12 hours.

Sure, autonomous systems have failure modes. They can misidentify objects. They can struggle with unusual weather conditions. They might occasionally make conservative decisions that seem wrong in hindsight.

But here's the crucial point: Aurora's routes are currently limited to structured highway environments where failure modes are rare and manageable. They're not attempting to solve urban driving, residential areas, or completely novel scenarios.

Let's look at actual safety data. Human truck drivers in the US are involved in approximately 5,000 fatal crashes per year. Per 100 million miles driven, that's roughly 1.5 fatal crashes. Severe injuries are roughly 10-15 times more common than fatalities.

Aurora hasn't publicly released comprehensive safety data for comparison, which is appropriate because they're still in the expansion phase. But they have mentioned that their driverless trucks have completed over 1 million miles of autonomous operation without a single fatality or severe injury caused by autonomous system failure.

Now, sample size matters. A million miles is statistically insufficient to prove safety is higher than human drivers (which would require roughly 300+ million miles of incident-free operation for statistical significance at typical confidence levels). But it's a meaningful baseline that shows the technology isn't obviously catastrophic.

The real safety advantage of autonomous trucks isn't that they're mathematically safer per mile driven (though they likely are). It's that they're immune to the primary failure modes that currently cause trucking accidents: human fatigue, impairment, and distraction.

And that advantage compounds as the system operates more consistently in its defined operational domain.

The Economic Case That Actually Moves the Industry

Safety matters. Environmental efficiency matters. But in trucking, economics is what truly matters.

Long-haul trucking is a low-margin business. A large trucking company might operate with 5-8% net profit margins. Shippers care about cost per ton-mile moved. Anything that improves cost economics gets adopted rapidly.

Let's run the actual numbers on what Aurora's autonomous trucks mean economically:

Cost Structure of a Human-Driven Truck (rough industry estimates):

- Driver wages: 80,000 annually

- Benefits, taxes, insurance: 25,000

- Total driver cost: 105,000 annually

- Per mile (assuming 120,000 miles/year): 0.88 per mile

- Fuel cost: 0.45 per mile

- Maintenance: 0.15 per mile

- Insurance: 0.08 per mile

- Total operating cost: 1.56 per mile

Cost Structure of an Aurora Autonomous Truck:

- Software licensing (estimated): 0.12 per mile

- Hardware amortization: 0.25 per mile (higher hardware costs offset by vehicle longevity)

- Fuel cost: 0.45 per mile (identical)

- Maintenance: 0.18 per mile (slightly higher due to sensor replacement)

- Insurance: 0.07 per mile (still uncertain, likely lower risk)

- Remote monitoring/support: 0.05 per mile

- Total estimated operating cost: 1.12 per mile

Even with significant uncertainty and potentially higher insurance costs for new technology, you're looking at a potential 20-35% cost reduction per mile. For a company running 10,000 trucks, that's roughly $300-400 million in annual savings.

That's the number that makes executives actually care. That's what gets Aurora customers.

But there's another economic multiplier that's equally important: velocity. Because autonomous trucks don't require rest breaks, they can complete more miles per calendar day.

A human driver completes, on average, 500-600 miles per day over long distances when you include rest requirements. An autonomous truck could theoretically complete 1,200-1,500 miles per day on the same routes.

That means fewer trucks needed to move the same volume of cargo. Or alternatively, far more cargo moved per truck.

Let's model the difference:

Cargo Movement: 10,000 Miles of Freight Weekly (100,000-ton shipment across 100 lanes)

Human Driver Solution:

- Assume average 550 miles/day per truck

- Each truck covers 3,850 miles weekly (7 days with breaks)

- Trucks needed: 26 trucks

- Weekly labor cost: 75,000/52 weeks) = $35,000

- Weekly operating cost: 38,500 miles × 51,975

- Total weekly cost: $86,975

Autonomous Solution:

- Assume average 1,200 miles/day per truck

- Each truck covers 8,400 miles weekly (7 days, no breaks)

- Trucks needed: 12 trucks

- Weekly labor cost: $0 (no drivers)

- Weekly operating cost: 100,800 miles × 95,760

- Total weekly cost: $95,760

Wait, that doesn't look right. Let me recalculate with realistic utilization:

The real advantage isn't just cost per mile. It's utilization improvement. A truck sitting idle overnight while a driver rests is dead capital. An autonomous truck is either operating or being maintained.

Real-World Comparison (more realistic):

Traditional Fleet:

- 20 trucks required

- 40 drivers needed (working rotation with backups)

- Annual driver cost: $3.2 million

- Annual vehicle utilization: 60% (downtime for maintenance, breaks, weather)

- Annual miles: 1.2 million per 20 trucks

Aurora Fleet:

- 12 trucks required

- 0 drivers needed

- Annual driver cost: $0

- Annual vehicle utilization: 75% (better utilization, still downtime for maintenance)

- Annual miles: 1.44 million per 12 trucks

The Multiplier Effect:

- Fleet size reduction: 40% fewer vehicles needed

- Utilization improvement: 25% better vehicle utilization

- Combined: 60% more cargo moved per dollar of fleet capital

That's the economic incentive that actually drives adoption. It's not about moving fewer trucks. It's about moving more cargo with fewer resources.

Aurora trucks complete the Fort Worth to Phoenix route in 15 hours without breaks, compared to 35-40 hours for human drivers, highlighting significant efficiency gains.

How Aurora Built Maps That Match Reality

One of the less-publicized but absolutely critical innovations Aurora announced is their automated map generation system. This deserves focus because it's the difference between scaling to 50 routes and scaling to 500.

Traditional HD mapping is brutally expensive. A human driver must manually navigate a route, with specialized equipment recording precise lane positions, curb locations, traffic signal positions, speed limit changes, every relevant detail. That's hours of manual labor per route.

Aurora's new system works differently. A single manual drive collects raw sensor data. Then cloud-based algorithms process that data automatically, identifying semantic components (lane markings, curbs, road signs, traffic signals) and building an HD map with minimal human intervention.

They claim this reduces mapping time from weeks to days. From expensive to reasonable.

This is crucial because it means Aurora's expansion isn't bottlenecked by mapping capacity. Previously, each new route required weeks of human effort. Now, a single drive generates a map that can be refined and validated quickly.

The technical process looks roughly like this:

- Data Collection: A truck equipped with lidar, cameras, and GPS drives the route once

- Raw Processing: Cloud systems process terabytes of sensor data

- Semantic Segmentation: ML models identify lane markings, curbs, signs, obstacles

- Map Generation: Algorithms build HD map from semantic components

- Validation: Engineers validate map accuracy and identify edge cases

- Integration: Map is integrated into Aurora's navigation system

This process takes roughly 1-2 weeks per route now, where it previously took 4-8 weeks.

Over time, as Aurora collects more data, they can improve the underlying ML models. Every new route teaches the system to recognize patterns better. This is classic machine learning scaling: early routes are expensive, later routes become cheaper as the system learns.

The economic impact is enormous. If Aurora can map a new route in 5 days instead of 30 days, they can scale far faster. If mapping cost drops from

This is actually more important than the truck hardware improvements, because it directly enables the network expansion announcement.

The New Hardware: Cheaper and Smarter

Aurora also announced a new hardware suite that costs approximately half of the previous generation. This is significant not because the new hardware is groundbreaking, but because cost matters for scaling.

The previous generation of Aurora hardware stack (primarily Volvo VNL integration) cost roughly

Now, $100,000 is still expensive for a truck upgrade. But spread across a truck's 5-year useful life and millions of miles, that's a marginal cost.

What did they cut without losing capability?

- Sensor redundancy: Fewer duplicate sensors while maintaining safety margins

- Computing power: More efficient processors and GPU utilization

- Integration complexity: Streamlined installation and maintenance procedures

- Power consumption: Lower electrical overhead for onboard systems

The International LT platform was specifically chosen because it allows for cleaner integration. Volvo's VNL is an excellent truck, but integrating autonomous systems into its architecture requires significant modification. The International LT's platform was designed with future autonomous integration in mind.

Here's what's important: cheaper hardware means faster expansion. If each autonomous truck cost

Human factors like speeding and distraction are significant contributors to trucking accidents, highlighting the potential safety benefits of autonomous trucks. Estimated data.

Customers and Market Demand: The Real Validation

Aurora isn't operating in a vacuum. They have actual customers. This isn't a demo. This is commercial operation.

Aurora's current partners include:

-

Hirschbach Motor Lines: One of the largest trucking companies in North America, headquartered in Iowa. They're operating Aurora trucks on specified routes and providing real-world logistics data.

-

Detmar Logistics: A regional carrier focused on high-value freight and time-sensitive deliveries. Detmar's participation suggests Aurora's trucks are handling real, revenue-generating cargo.

-

Phoenix-based Carrier: Aurora has alluded to "one of the leading carriers in the US" operating from their Phoenix facility, though they haven't disclosed the name publicly. This suggests they're already moving freight in the Southwest.

These aren't small operators. Hirschbach operates 5,000+ trucks. Detmar is a significant regional player. These companies wouldn't integrate Aurora trucks if the system wasn't performing reliably.

The fact that they're still operating with safety drivers in some cases isn't a limitation. It's a commercial choice. Some shippers, some routes, some customers prefer human oversight. That's optics and customer preference, not a technical requirement.

Aurora CEO Chris Urmson explicitly stated: "We comply with requests from partners to keep safety drivers in the cab as a matter of optics, not an indicator of technological regression. Operationally, it has no bearing on Aurora's progress."

That's the statement of a company that's already confident in their core technology.

What matters is that actual trucking companies, managing millions of revenue dollars per year, have chosen to integrate Aurora's driverless systems into their operations. That's not a beta test. That's market validation.

The Financial Trajectory: From Burn to Break-Even

Aurora's financial situation just improved meaningfully, and that's worth understanding because it affects their ability to execute on their expansion plans.

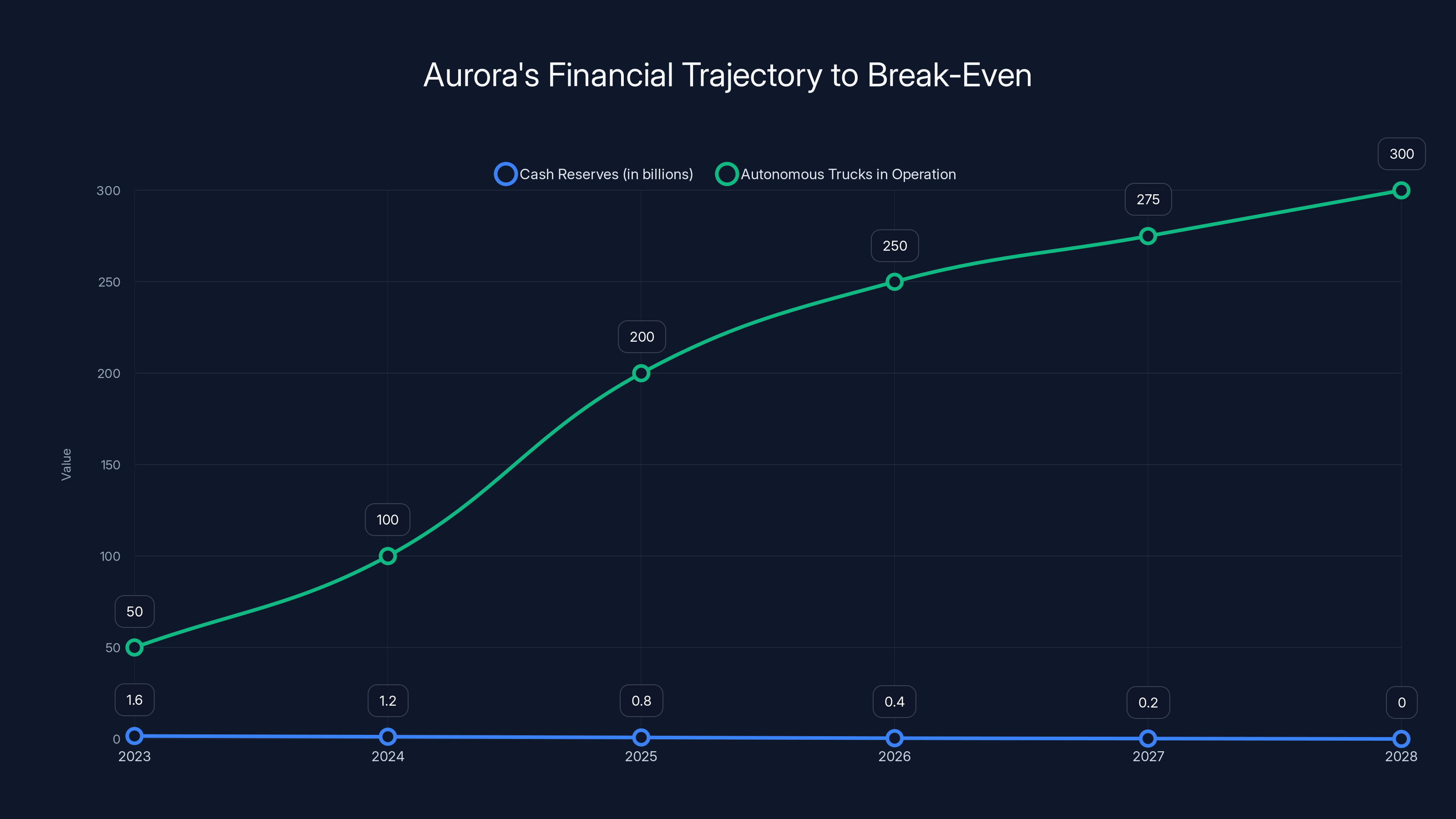

Previously, Aurora had approximately

That's not terrible for an early-stage transportation company, but it's not comfortable either. Every missed target, every unexpected setback, every quarterly miss eats into that runway.

Now, Aurora is projecting they'll achieve positive free cash flow by 2028. That's a crucial inflection point.

Free cash flow means money coming in from operations minus money going out. When a company turns FCF-positive, it can self-fund growth. It no longer needs external funding. That's the line between "well-funded startup" and "real business."

Getting to FCF-positive in 3 years from now requires several things to align:

- Revenue Growth: Freight moved per truck per day increasing

- Cost Reduction: Hardware costs continue declining

- Scale: More routes, more trucks, more customers

- Operational Efficiency: Better utilization, fewer maintenance issues, optimized logistics

Aurora is essentially projecting that by 2028:

- They'll have 300+ autonomous trucks in operation (they mentioned 200 by end of 2025, progression from there)

- They'll have 25-30+ routes across multiple states

- Their margins will have improved through scale efficiencies

- They'll be generating enough freight revenue to cover all operating costs plus capital reinvestment

That's an ambitious timeline. It requires almost everything to go right. But it's a concrete projection, not vague handwaving. And it's based on existing operations that are already profitable per-truck.

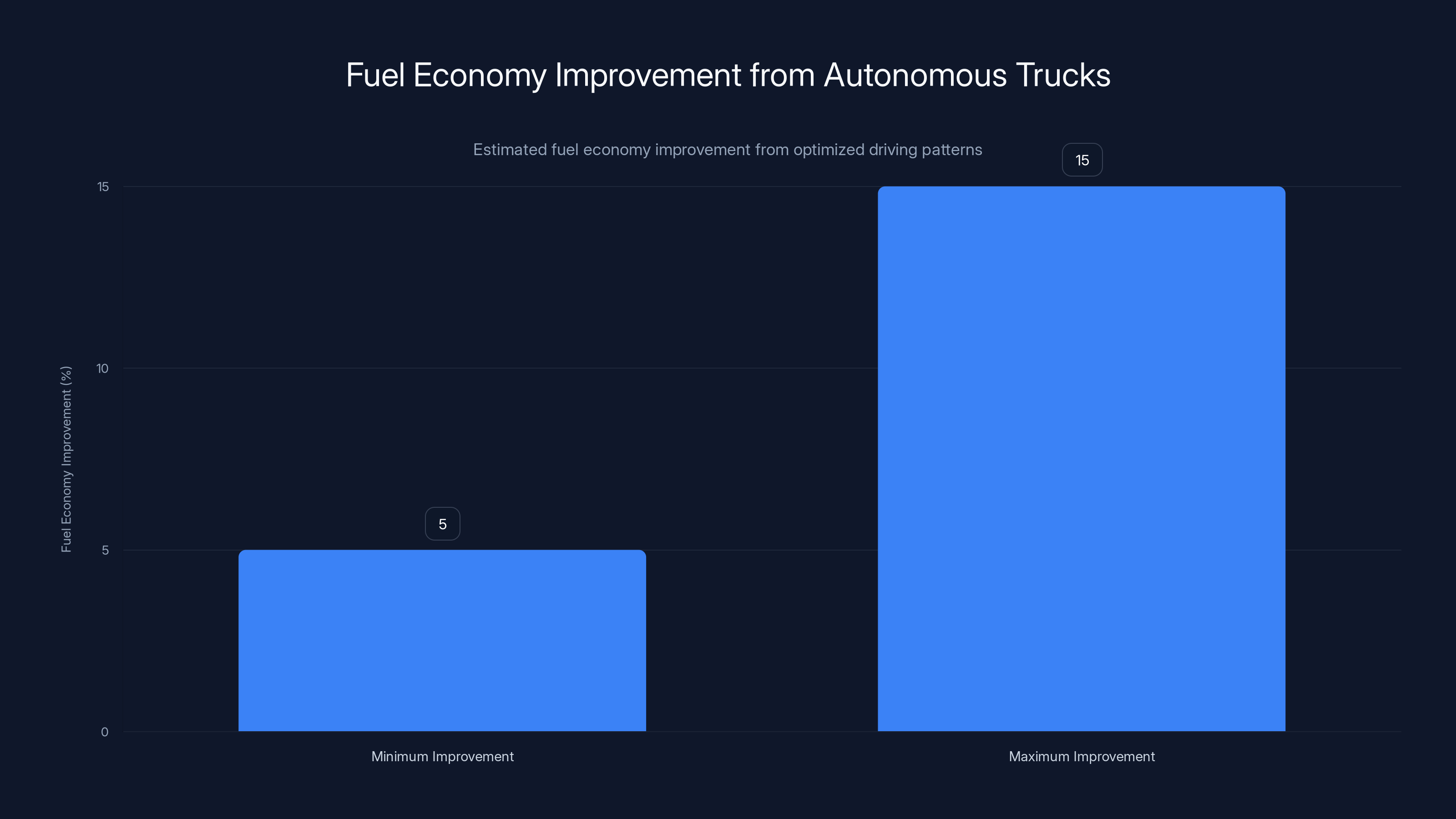

Autonomous trucks can improve fuel economy by 5-15% through optimized driving patterns, leading to significant savings and emissions reduction. Estimated data.

Regulatory Environment: The Hidden Advantage

One thing Aurora benefits from that many competitors don't is regulatory clarity. At least on highways in Texas and the Southwest, autonomous truck operation is explicitly permitted and regulated.

The Federal Motor Carrier Safety Administration (FMCSA) and individual states have created frameworks for autonomous vehicle operation. Texas, in particular, has been relatively permissive for autonomous truck testing and operation.

This regulatory clarity matters because:

- Certainty: Aurora knows what they're legally allowed to do

- Scale: They can expand without fighting regulatory battles on each new route

- Insurance: Insurance companies can price autonomous truck risk

- Customer confidence: Shippers know operations are legally sanctioned

Other autonomous vehicle companies (especially robotaxis in urban environments) face far more regulatory uncertainty. Cities change their minds. Politicians interfere. Regulatory frameworks shift.

Aurora's chosen domain (highway trucking in Texas and the Southwest) is far more stable. The regulatory environment won't suddenly forbid highways trucking. Economic pressure from shippers and logistics companies ensures autonomous operation will remain legal.

This is actually one of the smarter decisions Aurora made: focus on the domain where regulatory permission is most likely to be sustained.

Comparison to Traditional Truck Companies: The Disruption Angle

Let's be honest: if Aurora succeeds, traditional trucking companies' business models are genuinely threatened.

Companies like JB Hunt, Swift, and Werner have built business models around managing driver pools, managing driver turnover (notoriously high in trucking, 90-100% annually), and maximizing driver utilization.

Autonomous trucks disrupt that model completely.

Driver management becomes irrelevant. Recruitment becomes unnecessary. Turnover becomes moot. Instead, the game becomes:

- Truck acquisition and capital management

- Route optimization

- Maintenance and reliability

- Customer service and logistics innovation

Traditional trucking companies understand driver management. Do they understand autonomous vehicle fleet management and capital-intensive operations? Possibly not.

This is why we're seeing traditional trucking companies like Hirschbach partnering with Aurora rather than building their own autonomous systems. It's harder to build autonomous trucking capability in-house than it is to operate trucks someone else engineered.

However, larger companies like JB Hunt have invested in their own autonomous development. But those efforts have been slower, less public, and arguably less advanced than Aurora's.

The company that wins the autonomous trucking transition will likely be either:

- A company like Aurora that builds superior autonomous technology and sells it to trucking companies

- A massive traditional trucking company that successfully transitions its fleet and business model

- A new entrant that combines autonomous technology with logistics expertise

Right now, Aurora looks like the strongest player in category 1. That doesn't mean they automatically win long-term. But they have the most mature deployed system and the strongest operational track record.

Aurora aims to reach positive free cash flow by 2028, with a projected increase in autonomous trucks and depletion of cash reserves. Estimated data.

Long-Haul Economics: Why Trucks Before Cars

You might wonder: why are driverless trucks coming before driverless cars? The answer is economic, and it explains a lot about where autonomous vehicles are actually heading.

Truck driving is profitable. The economics work. A long-haul truck driver removes themselves from the equation and you save $75,000-100,000 annually, plus improved utilization. That math is urgent.

Rideshare (robotaxi) is different. The economics are harder. You need to replace a driver earning $40,000-50,000 annually, but you're competing with human drivers offering similar or better service in many cases. The profit margin improvement is incremental, not transformative.

Truck driving also happens in predictable, structured environments. Long-haul highways are known, mapped, relatively consistent. Cities are chaotic, unpredictable, endlessly variable.

So it makes perfect economic and technical sense that driverless operation succeeds first in trucking, specifically long-haul trucking, on major highways.

This is actually a meaningful insight about where autonomous vehicles are headed long-term: they'll dominate in structured, predictable environments (trucks, some logistics, potentially some mining or construction) before they dominate in urban environments.

Safety Monitoring and Intervention: How Bad Situations Get Handled

What happens when something unexpected occurs? A tree falls across the highway. A jackknifed truck blocks both lanes. An earthquake cracks the road surface.

Aurora's system has multiple layers of response:

-

Autonomous Detection and Response: The truck's lidar, cameras, and processing detect the hazard and attempt autonomous response (slow down, change lanes, stop)

-

Onboard Decision System: If autonomous response isn't sufficient, the onboard computing evaluates options and may request remote assistance

-

Remote Operator Intervention: A human operator monitoring the vehicle can take control remotely, though with higher latency than a safety driver in the cab

-

Safe Failure State: If all else fails, the truck can safely come to a controlled stop

We don't have detailed data on how often remote intervention is necessary. Aurora hasn't published comprehensive statistics. But the fact that they're willing to operate driverless (on approved routes) suggests intervention is rare enough that it's operationally feasible.

The interesting engineering challenge is latency. A remote operator controlling a truck over a network connection faces communication delay (typically 100-300 milliseconds depending on network quality). At 65 mph, that's 25-40 feet of drift while waiting for a control command to execute.

For routine situations, that's manageable. For emergency situations, it's potentially problematic. That's why the onboard autonomous system needs to be robust enough to handle most situations without human intervention.

Based on Aurora's willingness to deploy driverless trucks commercially, we can infer their system is robust enough for their operating domain. That doesn't mean it's perfect. It means it's acceptable.

The Real Timeline: When Do We See Massive Adoption?

Let's separate what's happening now from what might happen in the future.

Right Now (2025):

- Aurora has 10 approved routes

- Approximately 50-100 trucks operating (mostly with safety drivers)

- ~20 fully driverless trucks on approved routes

- Revenue is happening but modest

- Key customers: Hirschbach, Detmar, one unnamed major carrier

Near Term (2025-2027):

- Aurora targets 200+ trucks in operation

- 25-30+ routes across Texas, Southwest, potentially Oklahoma

- Increasing portions operating fully driverless

- Expansion to other regions begins

- Competitors (Waymo, Cruise, traditional OEMs) launch competing services

Medium Term (2027-2030):

- Assuming Aurora executes well: 1,000+ trucks operating

- National presence on major freight corridors

- Profitability achieved

- Industry-wide adoption begins (other companies integrate or build their own)

- Regulatory frameworks solidify

Long Term (2030+):

- Potentially 20-30% of long-haul trucking converted to autonomous

- Major efficiency gains in logistics

- Driver shortage eliminated as economic problem

- Human drivers shift to local delivery, complex logistics

This timeline assumes Aurora continues executing well. It assumes no major accidents or setbacks that spook the industry. It assumes regulatory environment remains favorable. Those are big assumptions.

But the trajectory seems clear. Autonomous long-haul trucking isn't theoretical anymore. It's operational. The question is how fast adoption accelerates.

Competitive Landscape: Who Else Is Doing This?

Aurora isn't the only company pursuing autonomous trucking. Let's be clear about that.

Waymo (Google's Autonomous Vehicle Company): Waymo has been testing autonomous trucks for years. They operate a commercial freight service called "Waymo Via" which handles short-haul freight around Arizona and California. However, their approach has been more cautious, typically operating on shorter routes with more controlled conditions. They're profitable on a per-truck basis but haven't announced network expansion at Aurora's scale.

Embark Robotics: Embark has been operating autonomous trucks on select California routes, primarily Los Angeles to San Diego freeway runs. They've raised significant funding and have partnerships with logistics companies. However, their operations haven't scaled as visibly as Aurora's.

Kodiak Robotics: Kodiak focuses on medium-haul trucking and has secured funding from major logistics investors. They're operating in Arizona and Texas but haven't announced triple-scale network expansions.

Tesla and Traditional OEMs: Tesla's autonomous truck efforts (the "Cybertruck" autonomous capability) remain mostly vaporware. Traditional truck manufacturers (Volvo, Daimler, Navistar) are investing in autonomous research but haven't deployed commercial operations at scale.

Chinese Companies (Tu Simple, We Ride): Companies like Tu Simple were pursuing autonomous trucking but have faced funding and regulatory challenges. Their progress has stalled relative to American companies.

Why is Aurora ahead? Likely a combination of factors:

- Founders: Chris Urmson's Google background and relationships matter

- Focus: Aurora narrowed their scope to highway trucking rather than trying to solve all autonomous driving

- Funding: Aurora raised substantial capital ($1.6 billion+) which provided runway for long development cycles

- Execution: They've actually deployed operationally, not just tested

- Partnerships: Real customers (Hirschbach) providing operational data and legitimacy

But the competitive landscape will intensify. Waymo likely will scale up. Traditional OEMs will eventually get serious. Chinese competitors might surprise everyone.

Aurora's announcement of network tripling is partly a market signal: "we're ahead, we're executing, we're the real deal." It's both a technical achievement and a competitive move.

The Environmental Angle: Are Autonomous Trucks Greener?

This rarely gets discussed, but autonomous trucks have meaningful environmental implications.

Direct Efficiency Gains: Autonomous trucks can optimize speed, acceleration, braking patterns in ways humans can't. Aggressive acceleration wastes fuel. Excessive braking kills efficiency. Erratic highway speed decreases fuel economy.

A human driver might maintain inconsistent speed, accelerate aggressively, brake harder than necessary. An autonomous truck optimizes every acceleration, deceleration, gear shift for maximum efficiency.

Estimates suggest 5-15% fuel economy improvement simply from optimized driving patterns. At $3-4 per gallon and consuming 6-7 gallons per 100 miles, that's meaningful savings and emissions reduction.

Utilization Gains: Because autonomous trucks don't require rest breaks, they move more efficiently. Full truck utilization (maximizing cargo carried) improves because there's more flexibility in scheduling.

If a company moves 30% more cargo per truck, that's 30% fewer trucks needed for the same logistics work. Fewer trucks means lower emissions per ton of cargo moved.

Highway Congestion Effects: Autonomous trucks traveling at consistent, optimal speeds can improve traffic flow (in theory). Reduced congestion means less brake-and-accelerate inefficiency for all vehicles. This is speculative but potentially significant.

Limitations: Autonomous trucking isn't inherently cleaner. They still burn diesel. If electricity is the true goal, autonomous trucks need to be electric trucks. Several companies are developing autonomous electric trucks (Volvo, Daimler), but the technology and infrastructure aren't mature yet.

Also, some environmental advocates worry autonomous trucks could increase total vehicle miles by making trucking cheaper, causing induced demand. That's possible but speculative.

On balance, autonomous trucking likely produces meaningful but modest environmental benefits: maybe 5-20% emissions reduction per ton-mile moved, not 50%+.

Workers and Disruption: The Elephant in the Room

Let's address this directly: if Aurora and competitors succeed, 3-4 million truck drivers in the US face economic disruption.

That's real. That matters. It's not irrelevant just because it's economically inevitable.

The question isn't whether autonomous trucking is good or bad (the economic case is clear: it's economically efficient). The question is how societies manage a transition that displaces millions of workers.

Some realistic points:

-

Timeline: Full transition will take 15-20 years, not 5. That's time to adjust, retrain, transition.

-

Partial Transition: Many trucking jobs won't disappear. Local delivery, complex logistics, unusual situations will still require humans. Maybe 50-60% of trucking jobs survive in different forms.

-

Wage Pressure: In the near term (5-10 years), competitive pressure from autonomous trucks will suppress driver wages. That's genuinely harmful to current drivers.

-

Opportunity: The logistics industry will need different skills. Remote operation of autonomous systems. Logistics optimization. Fleet management. Some displaced drivers might transition to these roles.

-

Government Role: Smart government policy (retraining programs, transition assistance, wage insurance) can meaningfully cushion disruption. Absence of such policy means unnecessary human suffering.

Aurora's announcement of network expansion should prompt serious conversation about economic transition management. From an economic perspective, autonomous trucking is clearly superior. From a human perspective, it requires thoughtful transition planning.

The trucking industry has too much political significance (it's scattered across rural areas that have political power) for the transition to happen without policy attention. Expect debates about autonomous truck regulation, driver support programs, and logistics industry transformation.

Technical Challenges Still Remaining

Aurora has solved a lot. They haven't solved everything.

Weather Challenges: Severe weather (heavy snow, flash flooding) can overwhelm autonomous systems. Aurora's routes avoid worst-case weather for most of the year, but winter in the North or monsoon season in Arizona present real challenges.

Edge Cases: Situations that are rare but possible still cause problems. Debris on the road. Unusual driving behavior from other vehicles. Construction zones with unclear markings. Aurora's system has improved handling of these, but not perfectly.

System Failures: Software bugs, hardware failures, unexpected sensor degradation. These aren't routine, but they happen. How Aurora responds to major system failures during operation will determine long-term viability.

Adversarial Scenarios: If someone intentionally tries to fool an autonomous system (bad actors, testing, etc.), can it respond safely? This is both a technical and security question.

Customer Edge Cases: Some shippers need specialized handling. Hazmat transport. High-value cargo requiring specific routing. Time-critical delivery requiring rerouting. Aurora's system handles standard freight well. Specialization takes time.

None of these are show-stoppers. None are insurmountable. But they're real remaining challenges that autonomous trucking companies face.

What Aurora's Announcement Actually Means for The Industry

Let's synthesize what's really happening here.

Aurora announcing they're tripling their network means:

-

Proof Point: Autonomous long-haul trucking works at commercial scale, not just in controlled tests

-

Viability Signal: The economics work well enough that expanding the network makes business sense

-

Competitive Challenge: Traditional trucking companies and competitors need to respond or risk disruption

-

Investor Signal: Autonomous vehicles are here. The future is sooner than expected. This matters for investment capital allocation across the transportation sector

-

Regulatory Validation: Government regulators are permitting and even facilitating autonomous truck operation, suggesting confidence in safety

-

Market Timeline Acceleration: This moves the autonomous trucking transition timeline forward. We see meaningful market adoption sooner than pessimistic estimates suggested

-

Technology Confidence: A company with serious funding, serious customers, and serious regulatory approval believes their technology is mature enough to expand aggressively

That's not a minor announcement. That's a signal that a major industrial transition is actually happening, not just being theoretically discussed.

The Path Forward: What to Watch

If you want to understand whether Aurora will actually succeed at transforming long-haul logistics, watch these metrics:

-

Fleet Size Growth: Do they actually deploy 200 trucks by end of 2025? 500 by 2027? Growing fleet size is the truest measure of execution.

-

Route Expansion Success: Do new routes maintain the safety and reliability of existing routes? Route proliferation into less-optimal environments is a real test.

-

Cost Trajectory: Do hardware costs continue declining? Do mapping costs per route continue decreasing? Cost curves matter more than absolute costs.

-

Customer Expansion: Do they move beyond their initial customers? Do Fortune 500 logistics companies adopt their service? Diversified customer base signals robustness.

-

Regulatory Expansion: Do they move beyond Texas and the Southwest? Do they gain operating authority in new states? Geography expansion signals regulatory confidence.

-

Profitability Timeline: Do they achieve positive free cash flow by 2028? Or does it slip to 2029, 2030? Profitability timeline is the ultimate test.

-

Competitive Response: How do Waymo, traditional OEMs, and new entrants respond? Does competition intensify or do established players ignore the threat?

These metrics will tell you whether Aurora has actually started an autonomous trucking revolution or whether this is impressive but ultimately niche operation.

FAQ

What is Aurora's autonomous truck technology?

Aurora's autonomous truck technology is a comprehensive system that combines specialized software (the Aurora Driver), advanced sensors (lidar, cameras, radar), and integrated hardware to enable trucks to operate safely without human drivers on highway routes. The system uses machine learning, classical computer vision, and sensor fusion to detect road conditions, obstacles, and hazards, making routing decisions based on real-time environmental data.

How does Aurora's driverless truck network expansion impact the trucking industry?

Aurora's tripling of their network from 5 to 10 routes represents a significant shift toward commercial viability of autonomous trucks. This expansion enables routes that normally require mandatory human driver rest breaks, meaning cargo delivery times drop substantially (from 35-40 hours to 15-20 hours on long routes). The efficiency gains drive down logistics costs by an estimated 20-35% and create competitive pressure across traditional trucking companies.

What are the safety advantages of autonomous trucks compared to human drivers?

Autonomous trucks eliminate primary causes of trucking accidents: human fatigue (responsible for 10-15% of truck crashes), distraction, impairment, and inconsistent reaction times. While autonomous systems have different failure modes, they operate consistently across millions of hours without degradation. Aurora's reported 1+ million miles of autonomous operation without fatal incidents suggests safety competitive with or superior to human drivers in their operating domain.

Which companies are already using Aurora's autonomous trucks?

Aurora's current operational customers include Hirschbach Motor Lines (one of North America's largest trucking companies with 5,000+ trucks), Detmar Logistics (a regional carrier focused on high-value freight), and one unnamed major US carrier operating from Phoenix. These partnerships represent real commercial operations moving actual revenue-generating freight, not just testing or demos.

When will autonomous trucks become widespread in the industry?

Based on Aurora's timeline and current progress, meaningful autonomous truck adoption likely accelerates in 2026-2028, with potentially 20-30% of long-haul trucking converted to autonomous operation by 2035. However, the exact timeline depends on continued execution, regulatory environment stability, competitive responses, and successful expansion beyond current routes. Near-term disruption focuses on major freight corridors and established routes before expanding into more complex logistics scenarios.

How does Aurora's automated map-building system work and why is it important?

Aurora's cloud-based map generation system processes sensor data from a single manual drive, using AI algorithms to automatically identify semantic components like lane markings, curbs, and traffic signals, then building HD maps with minimal human assistance. This reduces mapping time from 4-8 weeks to 1-2 weeks and costs per route by up to 80%, which is critical for rapid network scaling. The importance is that mapping was previously the bottleneck limiting expansion speed; automating it removes that constraint.

What makes autonomous trucking economically viable where other autonomous vehicles struggle?

Long-haul trucking has dramatic economics: removing a driver saves $75,000-100,000 annually (20-35% cost reduction) while improving utilization through elimination of rest-break requirements. The operating domain (highways) is far more constrained and predictable than urban driving, making technical solutions simpler. The combination of high driver costs, clear economic ROI, and simpler technical requirements makes autonomous trucking commercially viable where robotaxis remain uncertain.

How does Aurora handle exceptional situations like severe weather or system failures?

Aurora's system operates with multiple safety layers: autonomous detection and response systems, onboard decision systems that can request remote assistance, remote operator intervention capabilities, and safe failure modes that bring trucks to controlled stops. However, Aurora intentionally limits operation to routes where exceptional situations (severe weather, unusual road conditions) are manageable within their system's capabilities. Their willingness to operate driverless (on approved routes) indicates their system handles their operating domain reliably.

What is the timeline for positive cash flow and when might Aurora achieve profitability?

Aurora projects achieving positive free cash flow by 2028, which would represent a fundamental inflection point from funding-dependent startup to self-sustaining business. This requires successful scaling to 300+ trucks, 25-30+ routes, and improving margins through scale efficiencies. The timeline is ambitious and assumes successful execution across multiple fronts, but is concrete enough to indicate management confidence in their technology and business model viability.

How will autonomous truck expansion affect truck drivers and employment in logistics?

Full adoption would impact 3-4 million US truck drivers, though transition will occur over 15-20 years, not immediately. Jobs won't disappear entirely: local delivery, complex logistics, unusual situations will still require human operators. However, wage pressure will increase in near term (5-10 years) before full automation, requiring policy interventions like retraining programs and transition assistance. The disruption is real and significant, requiring thoughtful government and industry response to manage transition humanely.

Key Takeaways

- Aurora tripled its driverless network from 5 to 10 routes across the Southern US, with plans for 200+ autonomous trucks by end of 2025

- Autonomous trucks eliminate mandatory driver rest breaks, cutting delivery times nearly in half on long routes and reducing operating costs by 20-35%

- Aurora's automated map-building system uses cloud AI to reduce route preparation time from weeks to days, enabling rapid network scaling

- The company projects achieving positive free cash flow by 2028, a crucial inflection point indicating the business model is fundamentally viable

- Long-haul trucking adoption of autonomous vehicles is proceeding faster than urban robotaxi development due to simpler operating environments and stronger economic incentives

Related Articles

- Tesla Autopilot Death, Waymo Investigations, and the AV Reckoning [2025]

- Apptronik $935M Funding: Humanoid Robots Reshaping Automation

- Waymo's Fully Driverless Vehicles in Nashville: What It Means [2025]

- Waymo's Nashville Robotaxis: The Future of Autonomous Mobility [2025]

- Tesla Optimus Gen 3: The Humanoid Robot Reshaping Industry [2025]

- Tesla's Fully Driverless Robotaxis in Austin: What You Need to Know [2025]

![Aurora Triples Driverless Truck Network: The Future of Autonomous Logistics [2025]](https://tryrunable.com/blog/aurora-triples-driverless-truck-network-the-future-of-autono/image-1-1770845937352.jpg)