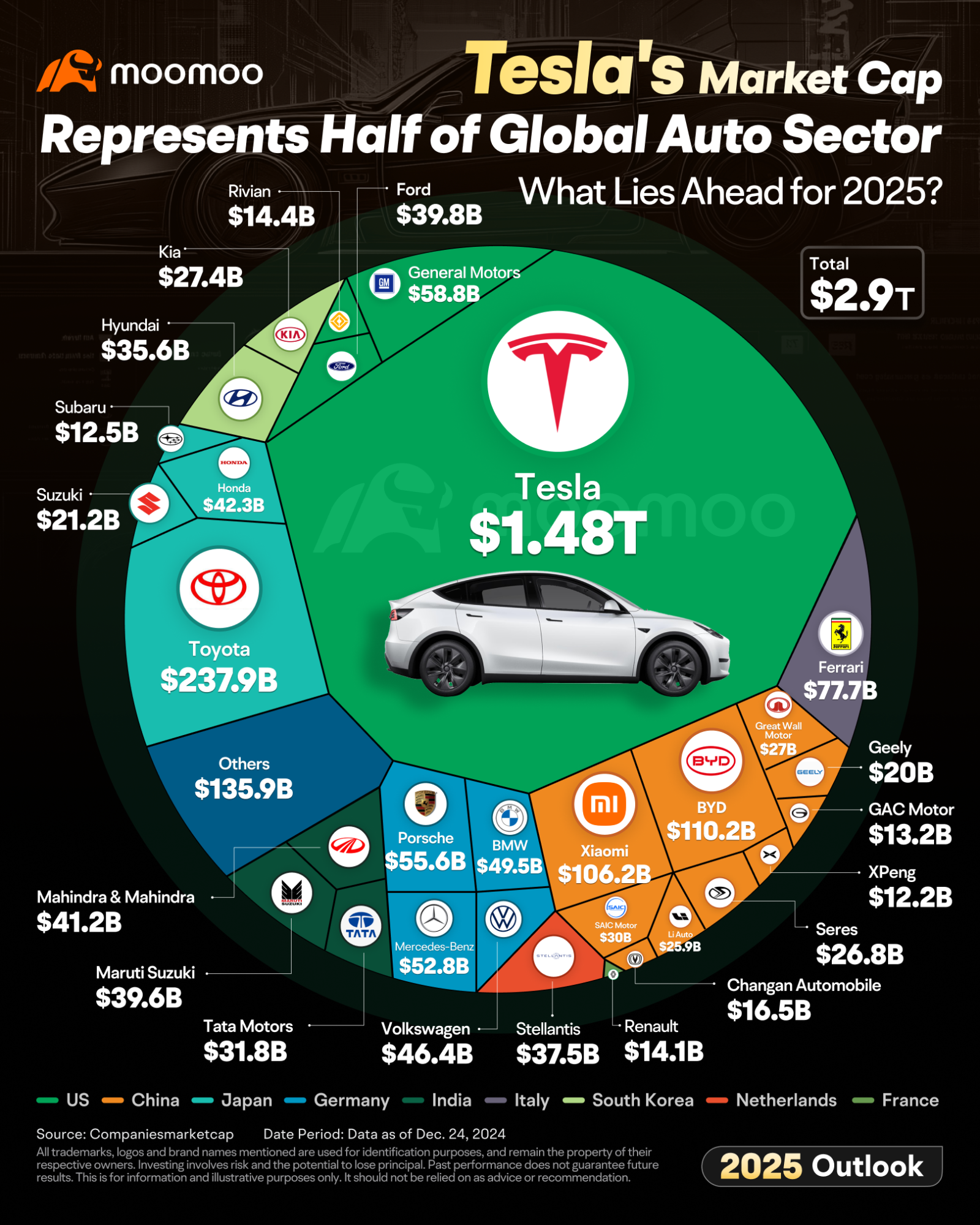

The Autonomous Vehicle Industry Is At a Critical Inflection Point

There's a moment in every emerging industry when the hype crashes into reality. Sometimes spectacularly. The autonomous vehicle space just hit that moment, and frankly, it's messy.

Tesla made two massive announcements that rippled through the industry this week, and they're not what they seem on the surface. The company killed Autopilot, the advanced driver-assistance system that's been around since 2014. At the same time, it began rolling out truly driverless robotaxi rides in Austin without a safety driver in the front seat. These moves look contradictory, but they're actually part of the same strategy: Tesla is rebranding, consolidating, and pivoting hard toward subscriptions while sidestepping regulatory heat, as noted by TechBuzz.

Meanwhile, the National Transportation Safety Board opened investigations into Waymo incidents. These aren't theoretical concerns anymore. Real vehicles are on real roads with real people inside them, and regulators are paying attention.

Here's the thing: the autonomous vehicle industry built itself on promises of imminent fully-driverless cars. The timeline kept slipping. Ten years ago, industry leaders said Level 5 autonomy was five years away. Then it was five more years. Now we're in 2025, and the reality is far more complex. Some companies are pivoting to partial autonomy and long-haul trucking, as discussed by Automotive News. Others are betting everything on a single city's robotaxi service. A few are failing publicly.

This article breaks down what's actually happening in autonomous vehicles right now, why Tesla's moves matter more than they appear to, and what the regulatory investigations mean for the industry's future.

TL; DR

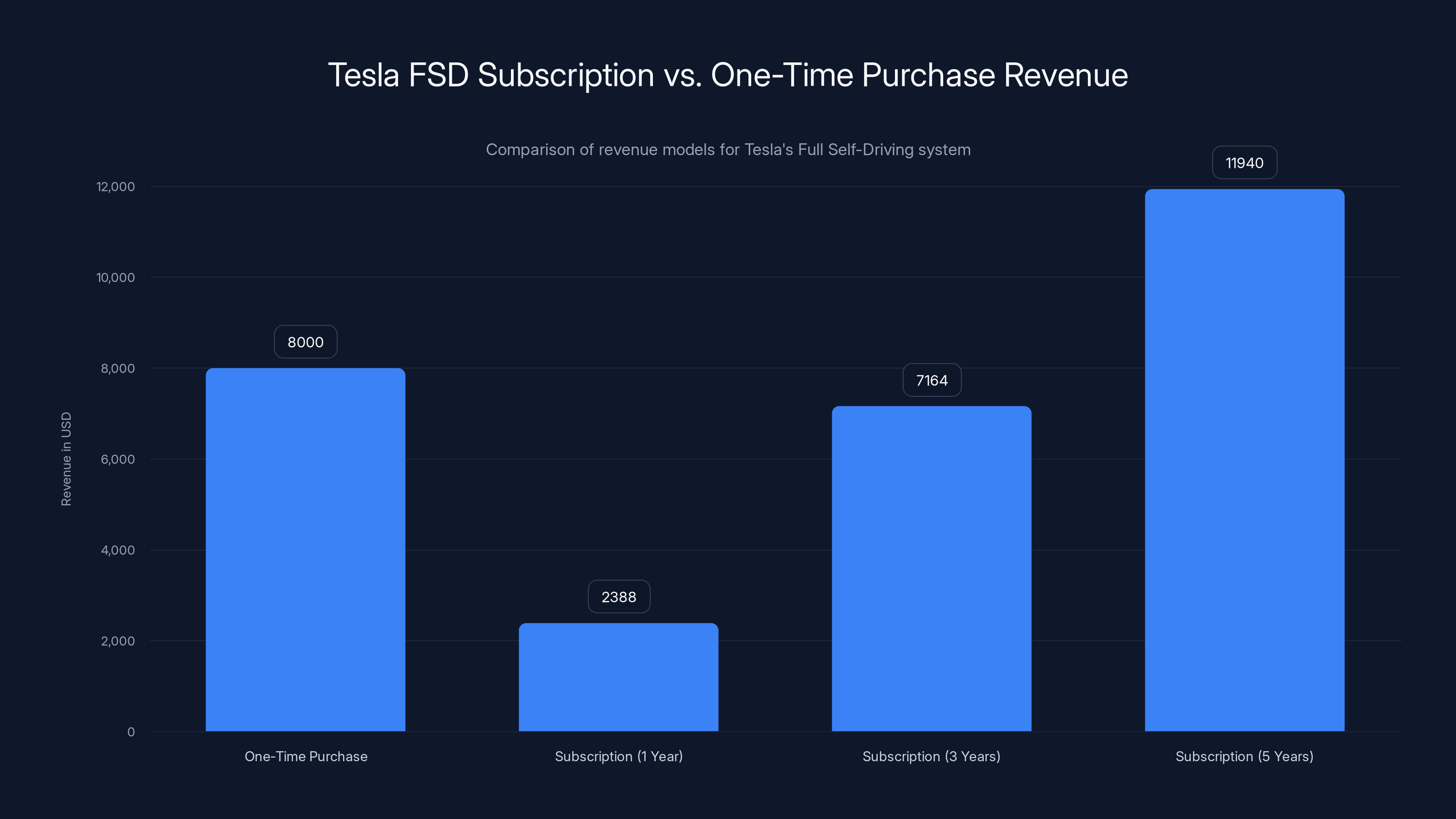

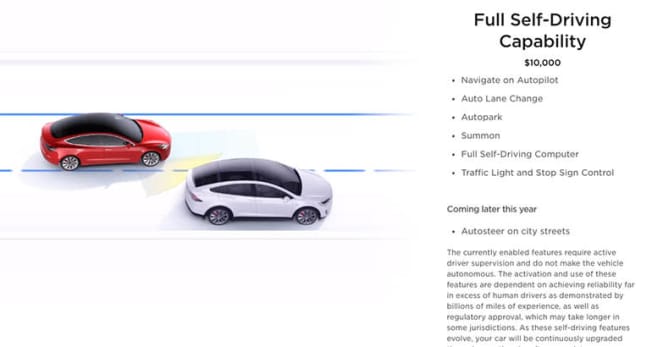

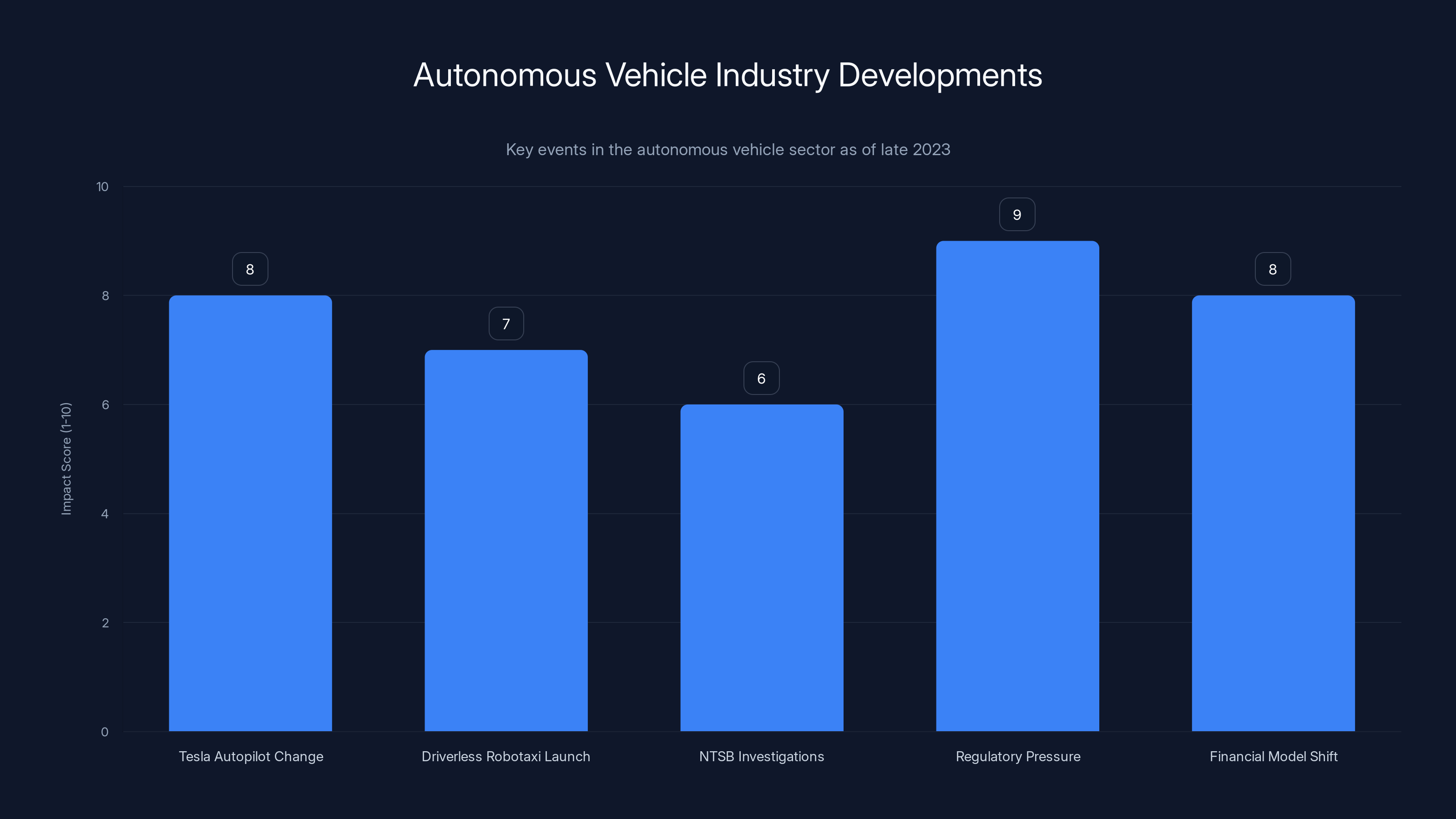

- Tesla killed Autopilot (the basic driver-assistance system) and is consolidating everything into Full Self-Driving (Supervised), which now uses a monthly subscription model instead of a one-time $8,000 purchase, as reported by CNBC.

- Tesla launched truly driverless robotaxi rides in Austin without safety drivers, marking the first major U.S. rollout of this kind, though it's still limited in scope and has chase vehicles following some cars, according to CNBC.

- The NTSB opened multiple investigations into Waymo incidents, signaling serious regulatory scrutiny of the autonomous vehicle industry at a critical moment, as covered by CBS News.

- Regulatory pressure is mounting: Tesla faces a potential 30-day suspension of manufacturing and dealer licenses in California due to deceptive marketing claims about Autopilot and FSD capabilities, as noted by KOMO News.

- The financial model is shifting: Rather than selling autonomy as a one-time premium feature, companies are moving to recurring revenue streams, subscription models, and service-based deployments, as analyzed by McKinsey.

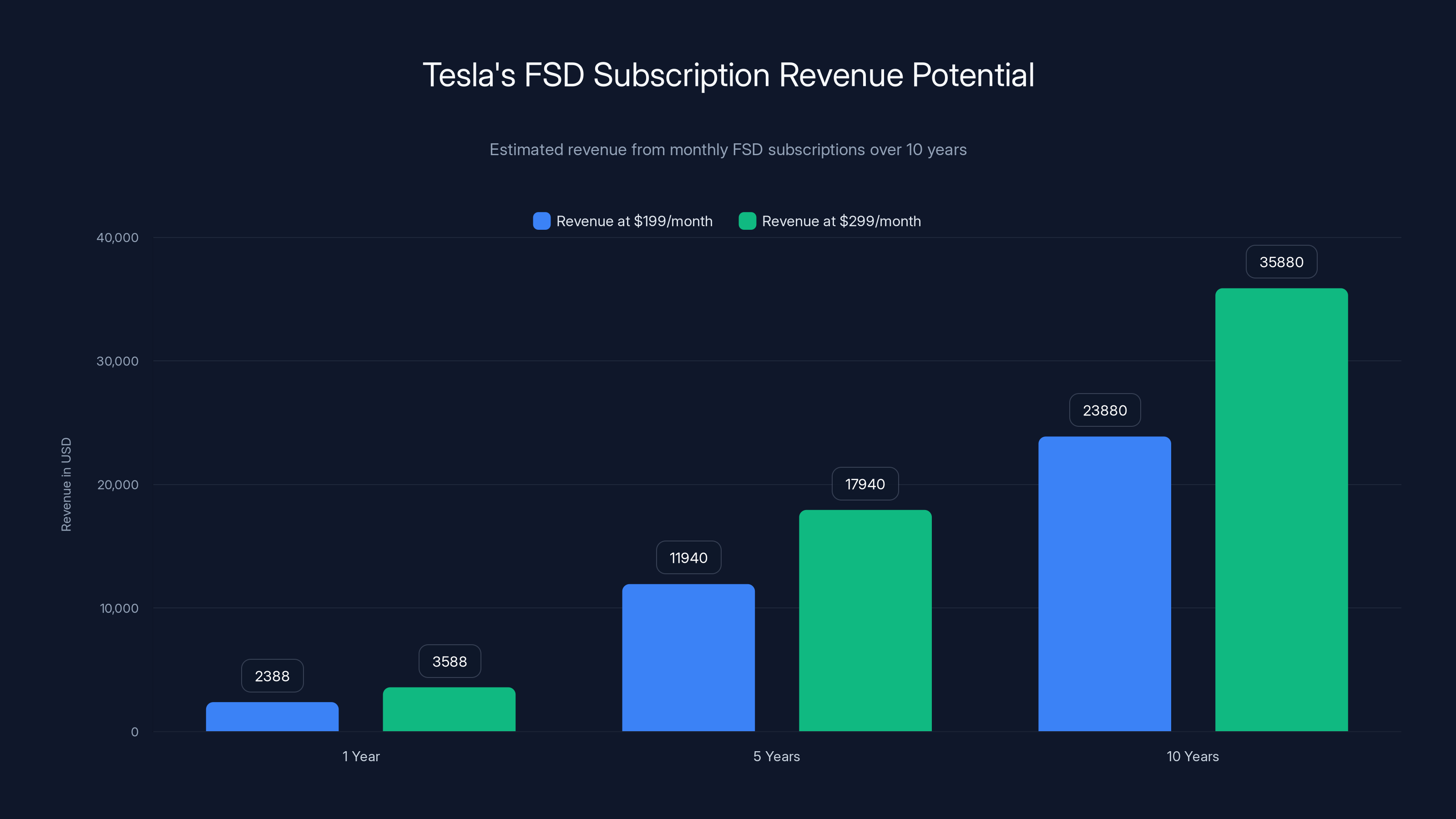

Tesla's shift to a subscription model for FSD could generate significant recurring revenue, with potential earnings of up to $35,880 per customer over 10 years at the highest subscription rate. Estimated data based on monthly fees.

Why Tesla Killed Autopilot: The Name Problem Nobody Talks About

Autopilot was a genius marketing name and a regulatory nightmare wrapped in one.

When Tesla introduced Autopilot in 2014, the name immediately suggested the car could drive itself. It couldn't. Autopilot was always an advanced driver-assistance system (ADAS), technically no different in capability from lane-keeping assist and adaptive cruise control you'd find on a $35,000 Toyota. The system would maintain a safe following distance behind other cars, steer to keep the vehicle centered in its lane, and some versions would change lanes on highways. Revolutionary? Not really. But "Autopilot" sounded revolutionary.

That marketing advantage became a liability. Federal regulators, state regulators, and especially California's DMV all noticed that drivers were treating Autopilot like the car could actually drive itself. Some drivers took their hands off the wheel entirely. Some fell asleep. A few died in crashes where Autopilot was engaged, as reported by KOMO News.

Tesla's response was always the same: the name is just marketing, drivers are supposed to keep their hands on the wheel, and anybody who drives a Tesla knows this from the onboarding screens and manual. Technically true. Practically? The name created liability.

In December 2024, a California judge ruled that Tesla engaged in deceptive marketing by overstating Autopilot's capabilities. The court ordered a 30-day suspension of Tesla's manufacturing and dealer licenses, though a 60-day stay was granted to allow Tesla to comply with the ruling, as noted by TechBuzz.

Then Tesla did something audacious: it killed Autopilot entirely. Not the technology, but the name. Everything gets folded into Full Self-Driving (Supervised), which is a more honest name because it explicitly states the car isn't fully autonomous. The system still does the same things Autopilot did, but now it's called something different.

This is brilliant and cynical simultaneously. By renaming the system, Tesla can argue it addressed the marketing deception. At the same time, Autopilot's death removes one of the regulatory hooks that was used to argue the company was misleading drivers.

Tesla's subscription model for FSD generates more revenue over time compared to a one-time purchase, with a 5-year subscription yielding nearly 50% more revenue than the one-time fee. Estimated data.

The Subscription Pivot: How Tesla Plans to Monetize What It Already Offers

Alongside killing Autopilot, Tesla made another strategic shift: Full Self-Driving is no longer a $8,000 one-time purchase.

As of January 2025, customers can only subscribe to FSD on a monthly basis. The pricing model is roughly

This is pure business strategy disguised as product evolution. Tesla's margins on vehicles have compressed. Elon Musk has repeatedly stated that the company's future lies in autonomy and AI, not selling hardware. But autonomy is taking longer than promised, and investors are impatient for proof that the AI story is real.

Subscription revenue is recurring revenue. A customer who pays

For Tesla, this shift accomplishes several things simultaneously:

- It eliminates the large upfront cost barrier that was preventing some customers from purchasing autonomy features, potentially increasing adoption rates.

- It creates recurring revenue that looks better on balance sheets and makes the company appear more stable to investors.

- It increases lifetime customer value by extracting more money from engaged users over time.

- It creates a financial justification for continuous software improvements, since Tesla now has a direct revenue incentive to make FSD better every month.

But here's the cynical read: it also means customers who bought FSD as a one-time

The market hasn't decided yet whether this is reasonable or exploitative. Early feedback has been mixed, with some customers canceling the subscription and others accepting it as the cost of being on the cutting edge.

The Austin Robotaxi Service: Tesla's Driverless Gamble

Now for the exciting part. Tesla launched robotaxi rides in Austin this week where there's literally no human driver in the front seat, as highlighted by CNBC.

This is not a test program with engineers carefully monitoring each ride from a control center. This is an actual service where real customers can hail a robotaxi, sit in the back seat, and the car drives them to their destination with only the AI in control. No safety driver. No teleoperation. Just the vehicle's autonomous system making all the decisions.

Tesla has been promising full autonomy for years. This is the first significant step toward proving it can actually deliver.

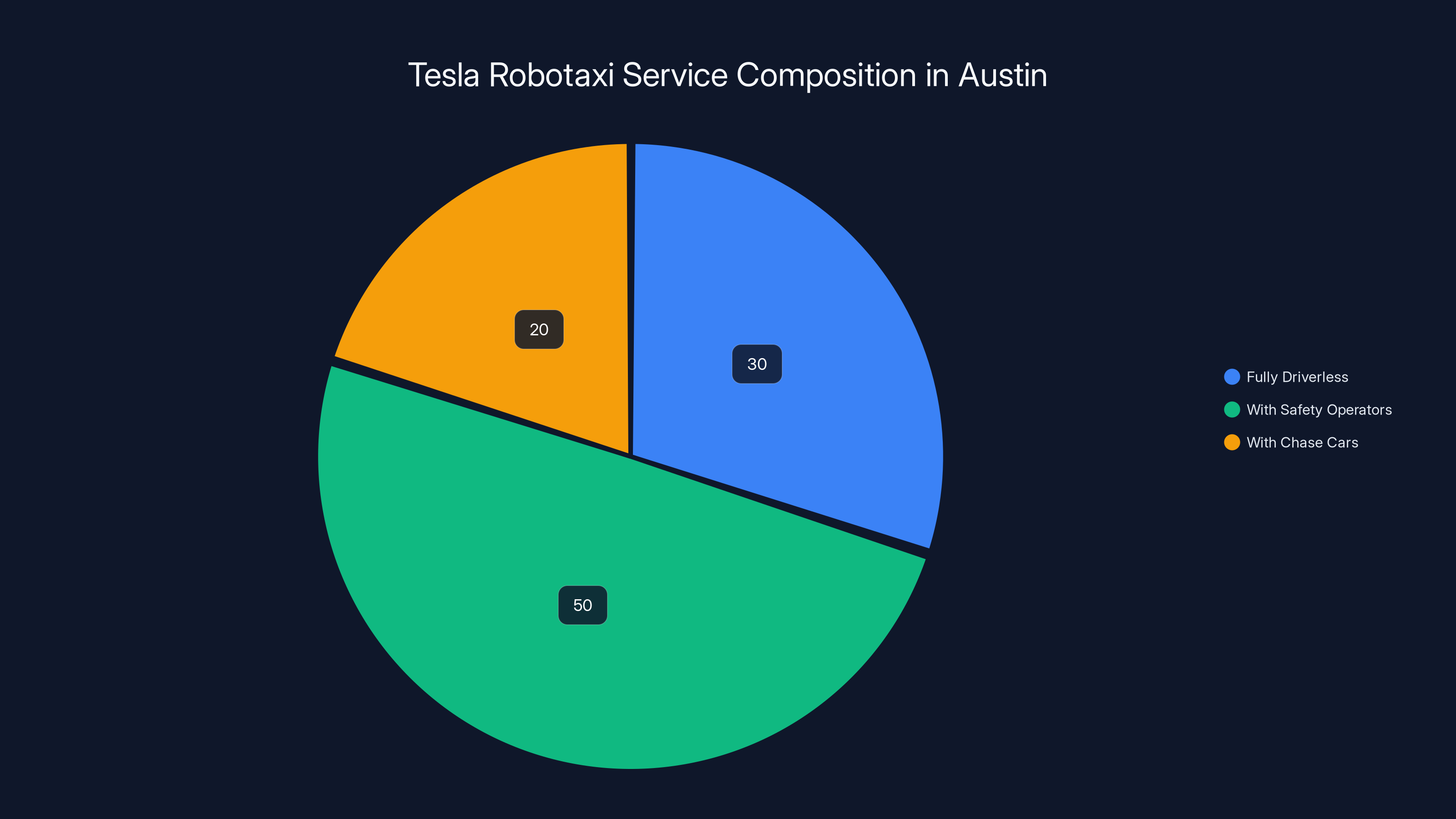

The scope is limited. Not all of Tesla's Austin fleet is fully driverless yet. Some still have human safety operators in the passenger seat. The company is gradually expanding the driverless percentage as confidence in the system increases. Additionally, some of the fully driverless vehicles have chase cars following behind them, which suggests Tesla isn't entirely confident in the failure modes yet.

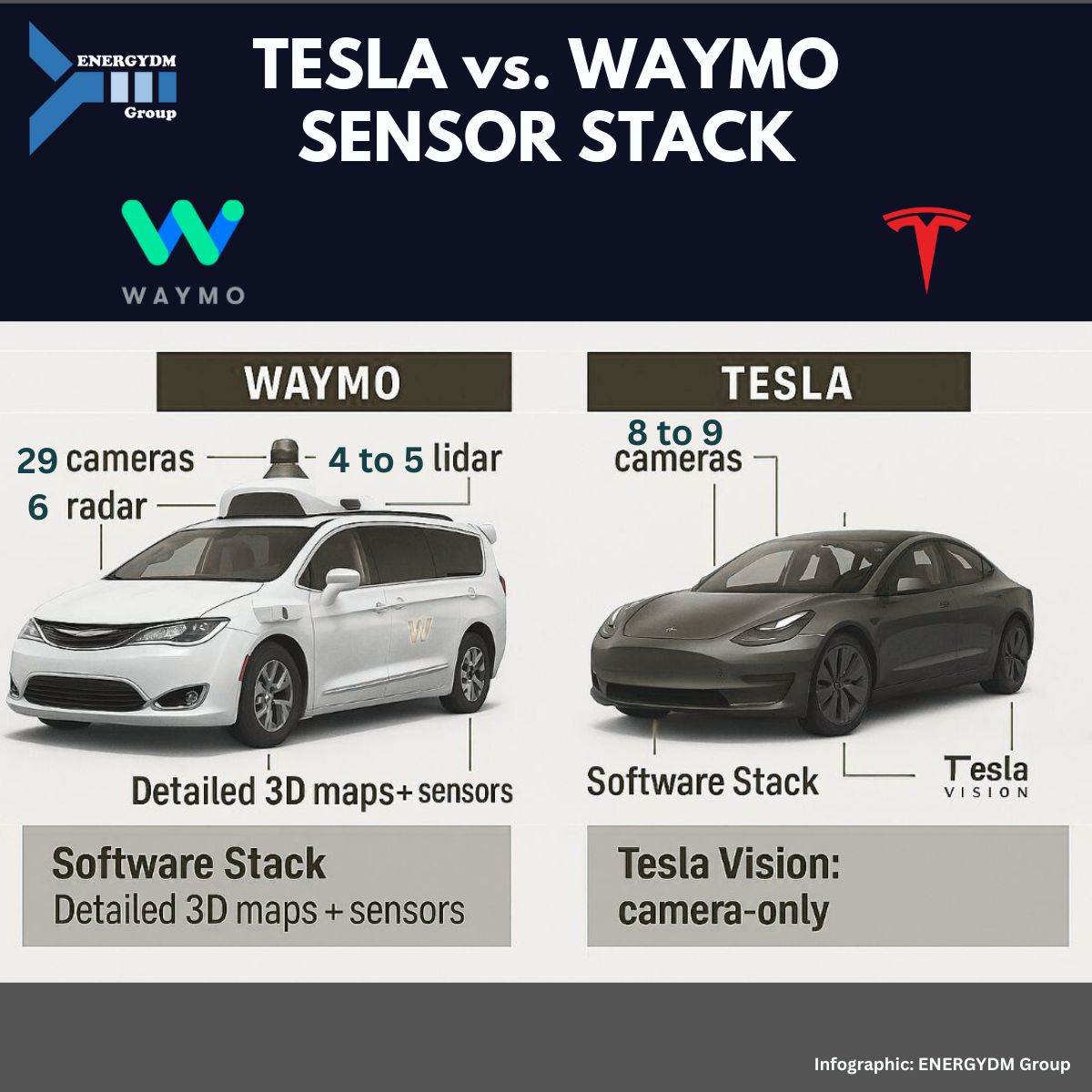

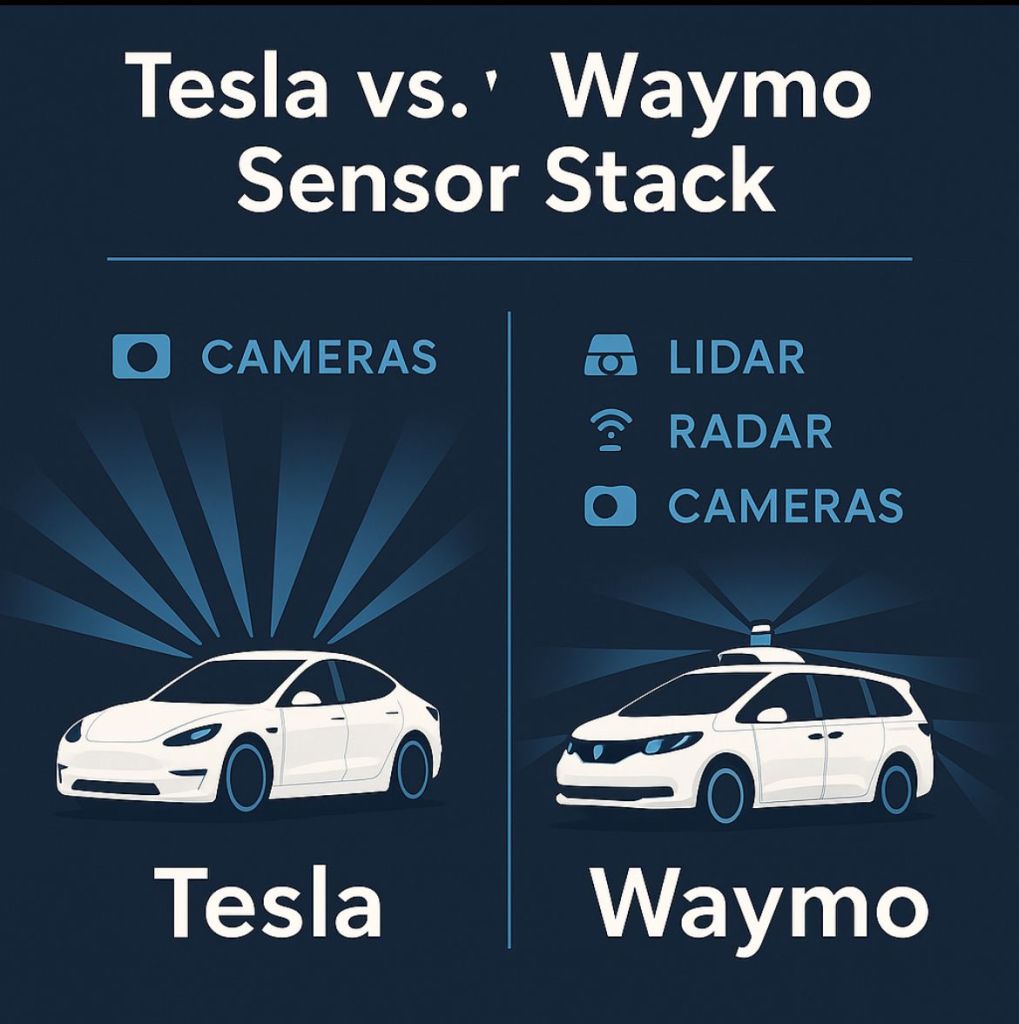

Still, this is a watershed moment. Waymo has been running driverless robotaxi services in San Francisco and other cities, but Waymo uses specialized hardware, lidar sensors, and decades of robotics research. Tesla's system is built on cameras alone, using computer vision and neural networks trained on driving data. If Tesla can prove that camera-only autonomy works at scale, it fundamentally changes the economics of autonomous vehicles because cameras are cheap and can be added to any vehicle with a software update, as discussed by Global X ETFs.

The business model here is also interesting. Tesla isn't positioning robotaxi as a ride-hailing service that competes with Uber. Instead, it's positioning it as a way for Tesla owners to earn money from their vehicles when they're not driving them. Owners can enable their cars to work as robotaxis and keep a percentage of the fare. This transforms the car from a depreciating asset into a potential income generator.

The math is compelling on paper. If a Tesla owner can earn

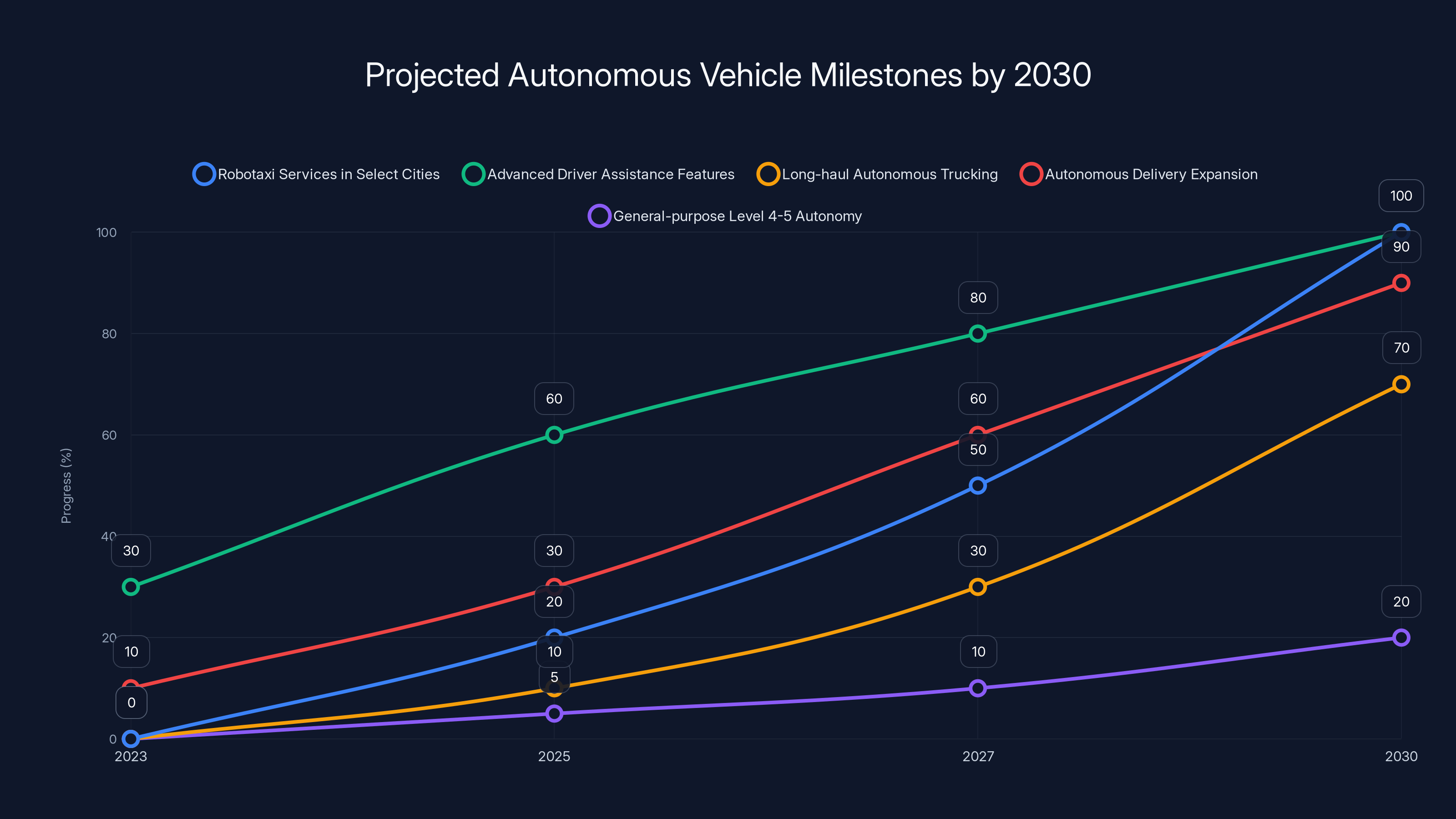

By 2030, significant progress is expected in robotaxi services and advanced driver assistance features, while general-purpose Level 4-5 autonomy remains a distant goal. Estimated data.

The NTSB Investigation: Regulatory Reality Arrives for Waymo

While Tesla was celebrating Austin, the National Transportation Safety Board opened investigations into multiple Waymo incidents.

The NTSB doesn't investigate every accident. It investigates accidents that involve fatalities, significant injuries, or novel circumstances. The fact that it's opening Waymo investigations suggests there's something unusual about the crashes that caught regulators' attention.

Waymo operates some of the most technically advanced autonomous vehicles on the road. The company uses lidar, radar, and multiple camera systems to build a detailed three-dimensional map of the world around it. The software is built on decades of robotics research from Google. Waymo's vehicles have driven millions of miles autonomously with a safety record that appears superior to human drivers in the routes and conditions where they operate.

But even the best system will eventually have failures. The question is how Waymo responds when it does.

NTSB investigations serve multiple purposes. Officially, they're fact-finding missions designed to identify the root causes of accidents and recommend safety improvements. Practically, they're also a regulatory signal. When the NTSB investigates a company, it tells the industry that this is serious, and standards are being evaluated.

For Waymo specifically, NTSB investigations could result in recommendations that effectively set the standard for how autonomous vehicles should be tested, validated, and deployed. If the NTSB concludes that Waymo's approach was insufficient and recommends additional safeguards, those recommendations often become de facto requirements for the industry.

This matters because Waymo is the most advanced autonomous vehicle company in the U.S. market right now. Tesla's system is more impressive in terms of scale, but Waymo's system is more technically sophisticated. If the NTSB determines Waymo's approach is inadequate, the entire industry has to rethink what adequate autonomy looks like.

The Regulatory Pressure Building Across Multiple Fronts

Tesla's Autopilot suspension threat is just one example of escalating regulatory scrutiny.

At the federal level, the National Highway Traffic Safety Administration (NHTSA) has opened investigations into Tesla's Full Self-Driving system, examining whether it meets the safety standards required for operation on public roads. California's Department of Motor Vehicles is actively pursuing the deceptive marketing case. Multiple states are developing autonomous vehicle regulations, and some are requiring manufacturers to post bonds or insurance to cover potential liability, as reported by FindArticles.

The fundamental regulatory challenge is that autonomous vehicle safety is genuinely difficult to measure. How many miles is enough to prove a system is safe? 10 million? 100 million? 1 billion? Different regulators have different answers. Some have proposed testing requirements that are mathematically nearly impossible to satisfy. Others have taken a more permissive approach, allowing manufacturers to operate under research exemptions.

There's also the liability question. If a fully autonomous vehicle causes a crash and someone dies, who's responsible? The manufacturer? The owner? The software? The law hasn't caught up with the technology, and that legal uncertainty is creating risk for companies deploying these systems.

Tesla's aggressive approach and large user base have made it the focal point of regulatory attention. The company operates the most Autopilot/FSD systems in the U.S., which means any widespread safety issues would affect the most people. This has forced regulators to treat Tesla's autonomy claims with extreme scrutiny, which in turn has created pressure on the company to either prove the system is safe or stop claiming it's autonomous.

Killing the Autopilot brand partially addresses this by removing the explicit "auto" prefix that implies the vehicle drives itself. Full Self-Driving (Supervised) is more technically honest about the system's capabilities.

Estimated data: Tesla's Austin robotaxi fleet is composed of 30% fully driverless vehicles, 50% with safety operators, and 20% with chase cars. This distribution highlights Tesla's cautious approach to scaling its autonomous service.

The Broader Industry Implications: Who's Winning, Who's Struggling

The autonomous vehicle industry is fracturing along different strategic lines.

The robotaxi play: Waymo is focused on driverless robotaxi services in limited geographic areas. The company has raised significant capital and is profitable in its core operations in San Francisco. Tesla is entering this market with a different approach, using its existing customer base and vehicle scale. Both are betting that the profitable future is in providing rides, not selling cars.

The long-haul trucking play: Companies like Waymo (which acquired Waymo Via, formerly Alphabet's autonomous trucking division) and others are targeting autonomous trucking. The value proposition here is different: trucking is primarily a highway operation with fewer variables than city driving. Automation could save money on driver salaries and fuel through optimized routing and less aggressive acceleration. Some companies claim autonomous trucks could be on highways within two to three years, as noted by McKinsey.

The advanced driver assistance play: Some manufacturers are taking the pragmatic approach of incremental automation. Rather than pursuing full autonomy immediately, they're focusing on features like adaptive cruise control, lane-keeping assist, and automatic parking. These features are safer and more realistic given current technology. They don't generate the venture capital or attention that autonomous driving does, but they're deployable today.

The failed bets: Companies like Uber, which invested billions in autonomous driving research, eventually shut down their programs. Others like Aurora, which raised over $900 million, faced delays and challenges that prompted significant workforce reductions. The gap between what's technically possible and what's commercially viable remains enormous.

The Data Problem: Why Tesla's Camera-Only Approach Is Controversial

Tesla's strategy of using cameras and neural networks to achieve autonomy is fundamentally different from Waymo's approach of using lidar, radar, and multiple sensor types.

Lidar works by bouncing lasers off objects and measuring the reflection time to create a precise 3D map. It's excellent at detecting obstacles and understanding the environment, but the sensors are expensive (tens of thousands of dollars per unit) and bulky. Waymo has built its entire system around lidar being reliable.

Tesla's approach is to process camera images through deep neural networks that have been trained on millions of miles of driving data. The theory is that if you train the network on enough data, it learns to recognize patterns and make decisions that are statistically similar to how human drivers would behave.

The controversial part is whether this approach is actually safer. Tesla has driven billions of miles with Autopilot/FSD engaged, which provides enormous amounts of training data. Neural networks are very good at fitting to data they've been trained on, but they can fail catastrophically in situations they haven't seen before. A heavy snowfall that obscures road markings, for example, or an unusual construction scenario, or a vehicle-blocking situation that the training data didn't adequately represent.

Regulators worry that Tesla's system might work well in the environments where it's been tested and deployed, but fail unpredictably in novel situations. Waymo's approach is more conservative: if the sensors can't see something clearly, the system errs on the side of caution.

There's a legitimate technical debate here, not a clear winner. Tesla's approach could turn out to be superior if the neural network generalizes well to novel situations. Waymo's approach could turn out to be necessary for safety reasons if cameras alone prove insufficient in certain scenarios.

What we don't have yet is enough real-world data from large-scale deployments of either approach in diverse conditions to definitively answer the question. That's precisely what makes regulatory scrutiny so important right now.

The shift to subscription models and regulatory scrutiny are major impacts in the autonomous vehicle industry. Estimated data based on recent developments.

The Insurance and Liability Landscape Is Still Broken

One of the biggest unsolved problems in autonomous vehicle deployment is insurance and liability.

When a traditional car crashes, liability is determined relatively straightforwardly: usually the driver at fault bears responsibility. Their insurance covers it. If there's a defect in the vehicle, the manufacturer might be liable. But when a fully autonomous vehicle crashes and there's no human driver to blame, the liability framework breaks down.

Is the owner liable? They didn't choose to make the maneuver that caused the crash. Is the manufacturer liable? The software might have made the decision, but did the software fail, or did the owner use it in a context where it wasn't intended to be used? Is the city liable for bad road infrastructure? Is the insurance company liable?

Different states and countries are approaching this problem differently. Some are requiring manufacturers to post bonds to cover potential damages. Others are requiring autonomous vehicles to carry specialized insurance that covers situations that traditional auto insurance doesn't. Some regulators are suggesting that full autonomy should require manufacturer liability for crashes, which could dramatically increase deployment costs.

Tesla's model is partially addressing this by keeping humans "in the loop." Full Self-Driving (Supervised) explicitly requires a driver to be ready to take over if the system fails. This puts liability back on the driver/owner for not maintaining sufficient attention, rather than solely on Tesla. It's less risky legally than deploying fully autonomous vehicles.

Waymo's approach in San Francisco involves insurance coverage that's been negotiated between the company, the city, and insurance carriers. It's not a model that scales easily because every jurisdiction might have different requirements.

The insurance and liability questions are genuinely hard, and they're holding back deployment more than the technology itself.

What This Means for Consumers: Should You Care About This Week's News?

If you're a Tesla owner, the practical impact is modest. Full Self-Driving (Supervised) still does what Autopilot did. The name changed, but the functionality remains the same. If you weren't using Autopilot, you won't be affected. If you were using it, you'll now find it under the FSD menu instead of the Autopilot menu.

If you're considering buying a Tesla specifically for the autonomous driving capabilities, you should be aware of several facts:

First, Full Self-Driving is not ready for general deployment. Tesla has been promising it for years, and it's improved significantly, but it's not yet at a level where most people would be comfortable taking their hands off the wheel in most driving scenarios. Recent demos look impressive, but they're curated demonstrations in familiar routes. Real-world testing with diverse drivers and environments shows more limitations.

Second, the subscription model means you'll be paying an ongoing fee. If you buy FSD as a subscription but never use it, you're paying money for unused capability. If you buy it and then change your mind after a few months, you've spent hundreds of dollars on something you didn't ultimately want.

Third, the regulatory environment is uncertain. It's possible that future regulations will require substantial changes to how Full Self-Driving works, which could obsolete the system you're paying for or limit its usage.

If you're interested in autonomous vehicles as a technology, this week's news suggests we're reaching the stage where these systems are going from laboratory to real-world deployment, and regulators are making sure companies justify their claims. That's actually healthy for the industry.

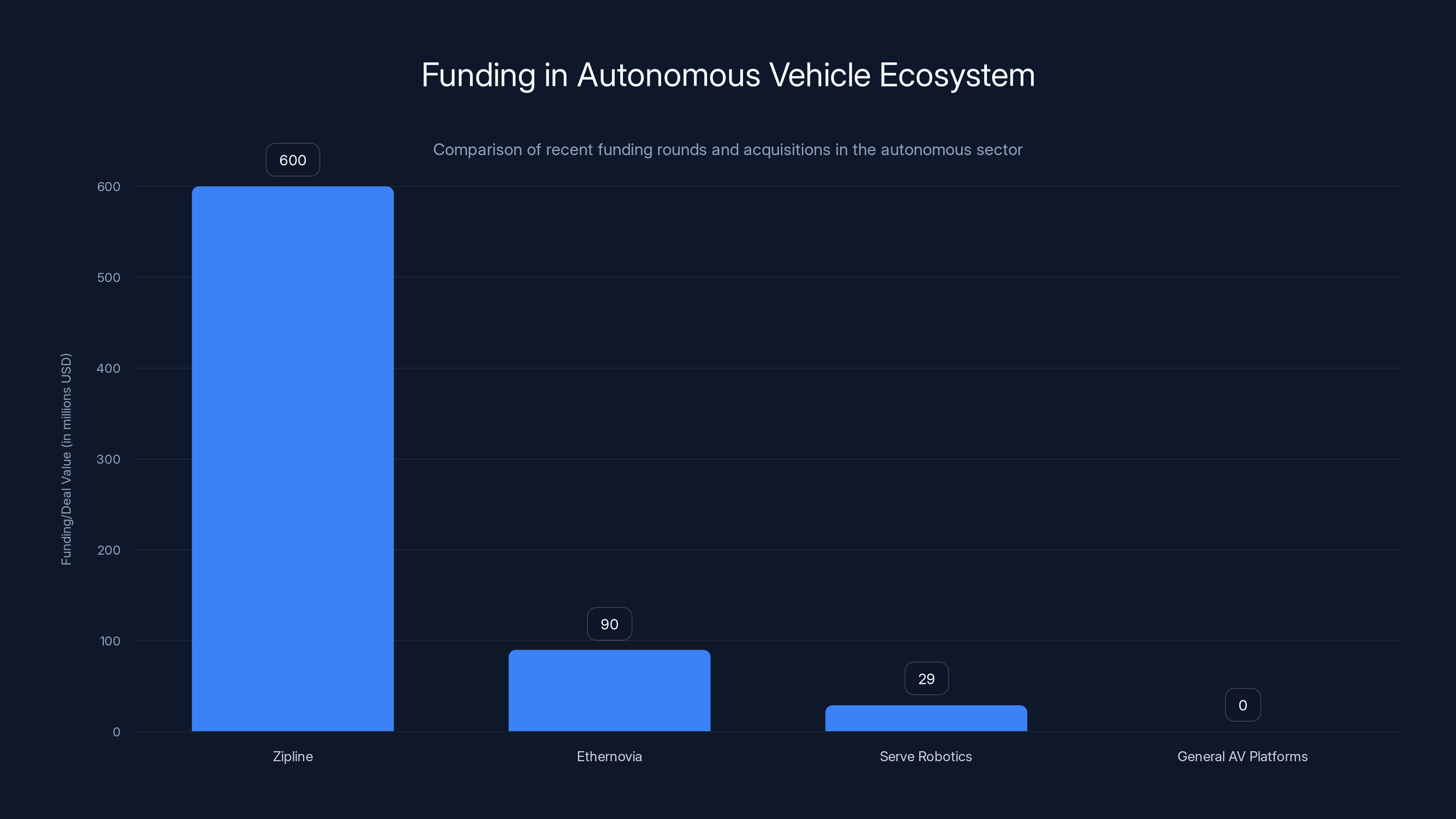

Zipline leads with $600 million in funding, highlighting investor confidence in niche autonomous applications, while general AV platforms face skepticism. Estimated data for general AV platforms.

The Funding Landscape: Who's Getting Money and Who's Not

The broader autonomous vehicle ecosystem is also reshaping around which companies are actually funding and which are retreating.

Zipline, the autonomous drone delivery company, just raised

Ethernovia, which makes Ethernet systems for autonomous vehicles, raised $90 million in Series B funding, suggesting that investors believe in the infrastructure layer for autonomous vehicles even if consumer autonomous vehicles remain years away.

Serve Robotics acquired Diligent Robotics in a deal valued at $29 million, showing consolidation in the robotics space as investors look for synergies between different autonomous systems.

On the flip side, several autonomous vehicle companies have shut down or substantially reduced operations. The funding has slowed. The venture capital that was funding every autonomous vehicle startup in 2018-2019 has become much more selective.

What this tells us is that the market has bifurcated. Infrastructure, robotics, and niche applications like drone delivery are still attracting capital. General autonomous vehicle platforms that promised to replace all human driving remain skeptical.

The Timeline Resets Again: What's Actually Feasible by 2030

Let's talk about timelines, because the autonomous vehicle industry has a terrible track record with them.

In 2015, Elon Musk claimed that Tesla would have "summon" functionality (where the car drives itself to you) within two years. In 2020, he promised "self-driving capability" was imminent. In 2024, he claimed robotaxis would be operating in Austin within months. Some of these promises materialized in limited forms. Many didn't within the promised timeframe, as noted by StockTwits.

Given this history, treat the current timeline claims with skepticism.

What seems realistic by 2030:

- Robotaxi services in specific cities like San Francisco, Austin, and perhaps a dozen other major urban areas where infrastructure is well-mapped and routes are relatively consistent. These will operate in limited zones with careful monitoring.

- Advanced driver assistance features will become standard on most vehicles, including lane-keeping, adaptive cruise, lane-changing assist, and automatic parking. These are proven technology.

- Long-haul autonomous trucking will likely begin limited operations on highways, initially with safety drivers or teleoperation as backup, gradually increasing autonomy as the systems prove reliable.

- Autonomous delivery via drones and ground robots will expand substantially into last-mile delivery in urban areas.

- General-purpose Level 4-5 autonomy on regular roads in diverse weather conditions and unexpected scenarios remains unlikely. The technical challenges are larger than most people appreciate.

What seems unlikely by 2030:

- Mass-market autonomous vehicles where anyone can buy an autonomous car and use it to drive themselves anywhere. The liability, insurance, and regulatory frameworks aren't in place, and the technical challenges remain significant.

- Complete elimination of rideshare drivers. Even if robotaxis launch successfully, they'll coexist with human drivers for at least a decade. The transition will be gradual.

- Significantly lower transportation costs from autonomous vehicles. If robotaxis launch, they might offer modest cost savings, but they'll need to cover capital costs, insurance, and maintenance, so they won't dramatically undercut current ride-hailing prices.

What the Industry's Technical Challenges Actually Are

When engineers and researchers talk privately about autonomous vehicle challenges, certain problems keep coming up.

The edge case problem: A system might work perfectly in 99% of scenarios and fail in rare cases. But rare cases happen regularly when you multiply them across millions of vehicles. Autonomous vehicles need to handle the weird stuff: the traffic cop in the intersection directing traffic, the vehicle with a broken light that's illegally parked, the pedestrian in a wheelchair on the highway, the driver having a medical emergency. These situations are rare in any individual city but common in aggregate.

The adversarial problem: Once autonomous vehicles are widespread, bad actors will figure out how to fool them. A sophisticated spoofing attack on GPS could disorient them. Adversarial inputs to computer vision systems can cause neural networks to misidentify objects. These attacks are theoretical now but they'll become practical concerns.

The liability problem: We covered this earlier, but it's huge. No company is comfortable deploying fully autonomous vehicles if it means taking on unlimited liability for any crashes, regardless of cause.

The weather problem: Autonomous vehicles trained primarily in sunny California or Arizona often struggle in snow, heavy rain, or fog. These conditions are common in much of the U.S., but most testing has been done in favorable weather.

The 99% problem: Getting from 95% autonomous to 99% autonomous might take as long as getting from 50% to 95%. The last marginal improvements are exponentially harder.

These aren't marketing problems or regulatory problems. They're genuine technical challenges that the industry is still working through.

The Path Forward: Where This Industry Actually Goes

Based on what we know about the technical challenges, the regulatory environment, and the business models being pursued, the autonomous vehicle industry is likely to evolve like this:

Phase 1 (2025-2027): Limited robotaxi services in major cities. Tesla, Waymo, and perhaps one or two other companies will launch robotaxi services in controlled urban environments. These will be profitable in specific geographies but won't be widely available. The services will be heavily monitored and will operate in pre-mapped areas with fallback options.

Phase 2 (2027-2030): Expansion and consolidation. The successful robotaxi services will expand to more cities. Failed experiments will shut down. The autonomous vehicle industry will consolidate around a few winners. Meanwhile, trucking companies will begin deploying autonomous trucks on highways, initially with safety drivers.

Phase 3 (2030-2035): Coexistence and adaptation. Autonomous vehicles will exist alongside human-driven vehicles, creating complex traffic patterns. Insurance and liability frameworks will mature. Regulation will standardize. The market share of autonomous vehicles will grow but remain limited to specific use cases and geographies where the technology is proven.

Phase 4 (2035+): Uncertain transformation. If fully autonomous vehicles eventually become viable at scale, they could reshape transportation and urban planning. But this is speculative. The outcome depends on technical breakthroughs that aren't guaranteed.

What's almost certain is that the timeline will continue to slip, some companies will fail, and regulatory scrutiny will increase. What's uncertain is whether the underlying technology will ultimately prove viable enough to justify the hype.

The Week's News Illustrates a Crucial Transition Point

Tesla killing Autopilot and the NTSB investigating Waymo aren't isolated events. They're both symptoms of the same reality: autonomous vehicle companies are transitioning from research phase to deployment phase, and regulators are awake to the implications.

Tesla's moves are pragmatic and strategic. The company is simplifying its messaging, converting revenue to a recurring subscription model, and addressing regulatory concerns about marketing deception. These are the actions of a company that's no longer chasing moonshots but rather working to build a defensible business in a regulated environment.

Waymo's NTSB investigations are the price of being a leader. When you're operating the most advanced autonomous vehicles, you become the measuring stick for what the industry should be capable of. Regulatory scrutiny follows.

For consumers and investors, the key insight is that the autonomous vehicle industry has fundamentally changed. The narrative has shifted from "cars will drive themselves soon" to "some cars will do some driving in some places, and we're figuring out how to make that work." It's less exciting, but it's more realistic.

The autonomous vehicle industry will eventually transform transportation. But that transformation is further away and more complicated than the industry has been claiming. That's not a failure of technology. It's the reality of deploying complex systems in the real world under regulatory oversight.

The news this week is the sound of that reality arriving.

FAQ

What exactly did Tesla do with Autopilot?

Tesla killed the Autopilot brand name and consolidated all driver-assistance features into its Full Self-Driving (Supervised) system. The underlying technology remains the same, but customers will now find these features under the FSD menu instead of Autopilot. This move was partially in response to regulatory pressure from California's DMV, which ruled that Tesla engaged in deceptive marketing by implying Autopilot could drive the vehicle autonomously when it actually requires constant driver attention, as reported by TechBuzz.

Is Full Self-Driving actually full self-driving?

No, despite the name. Full Self-Driving (Supervised) is more accurately described as advanced driver assistance. It can control steering, acceleration, and braking on highways and in some city environments, but it still requires a human driver to be ready to take over at any moment. Tesla claims the system is approaching Level 4 autonomy, but regulators generally classify it as Level 2. The "supervised" part of the name is important because it's an explicit acknowledgment that human supervision is required.

Why did Tesla move to a subscription model for FSD?

Subscription revenue is more predictable and recurring than one-time purchases, which improves Tesla's financial metrics and investor perception. A customer paying

What's happening with Waymo and the NTSB investigations?

The National Transportation Safety Board opened investigations into multiple incidents involving Waymo's autonomous vehicles. The NTSB doesn't investigate every accident, so these investigations indicate regulators believe the incidents involve unusual circumstances or safety concerns worth examining. The investigations could result in recommendations that effectively set industry standards for autonomous vehicle safety, testing, and deployment. This is part of broader regulatory scrutiny of the autonomous vehicle industry as real-world deployments increase.

What's the difference between Tesla's approach and Waymo's approach to autonomy?

Tesla relies primarily on cameras and neural networks trained on driving data to make autonomous driving decisions. Waymo uses lidar, radar, and multiple camera systems to build a detailed three-dimensional map of the environment. Tesla's approach is cheaper to scale because cameras are inexpensive, but it relies on neural networks which can fail unpredictably in novel scenarios. Waymo's approach is more conservative and uses proven robotics technology, but the equipment is more expensive. There's a legitimate technical debate about which approach is ultimately safer and more practical.

When will autonomous vehicles be widely available?

Robotaxi services in specific major cities will likely become available in limited form within 2-3 years. General-purpose autonomous vehicles that work in diverse conditions and weather, and are available for purchase by consumers, are probably at least 5-10 years away, and potentially much longer. The regulatory and liability frameworks haven't been established, and the technical challenges for handling edge cases and adverse weather remain significant. Be skeptical of companies claiming otherwise, as the autonomous vehicle industry has a track record of overstating timelines.

Why does this week's news matter if I'm not buying an autonomous vehicle?

The decisions Tesla and other companies make about autonomy affect the future of transportation, urban development, and labor. Additionally, if you're a Tesla owner, your vehicle's capabilities and the company's legal status are being directly shaped by these regulatory and business developments. The regulatory scrutiny means that companies will eventually need to be more honest about what their systems can and cannot do, which is beneficial for consumer safety.

What's the insurance situation with autonomous vehicles?

Insurance and liability frameworks for autonomous vehicles are still being worked out and vary significantly by jurisdiction. For partially autonomous vehicles like Tesla's FSD, the driver remains liable in most cases. For fully autonomous vehicles, liability could fall on the manufacturer, but this hasn't been fully tested in courts. Insurance companies are developing specialized coverage for autonomous vehicle use, and some jurisdictions require manufacturers to post bonds. The lack of clarity here is one of the factors slowing autonomous vehicle deployment.

Conclusion: The Autonomy Reckoning Is Here

We've spent the last decade hearing about the autonomous vehicle revolution. Hundreds of billions of dollars have been invested. Countless companies have launched. Regulators have been working to establish frameworks. And this week, we got a clear signal that the industry has reached an inflection point.

Tesla's moves signal pragmatism. The company is working within regulatory constraints, simplifying its messaging, and building a defensible business model based on recurring revenue rather than speculative moonshots. The robotaxi service launch shows real progress, but it also shows scale limitations and the need for careful deployment.

Waymo's NTSB investigations signal regulatory maturity. Authorities are no longer content with companies making claims about autonomy. Real-world deployments are being scrutinized with the same rigor that regulators apply to commercial aviation and pharmaceuticals. This is actually healthy for the industry because it will eventually establish clear safety standards.

The broader industry shift signals consolidation around viable models. Robotaxi services in specific cities, autonomous trucking on highways, and delivery robots in urban areas seem plausible. Mass-market autonomous vehicles for general consumption remain speculative.

What this means for you depends on who you are. If you're a Tesla owner, your vehicle hasn't changed, but the company is navigating regulatory and business strategy challenges that will shape what capability you have access to in the future. If you're considering buying an autonomous vehicle, be realistic about what the current technology can actually do and skeptical of claims about timelines. If you're an investor in autonomous vehicle companies, recognize that this is a long-term bet requiring patience and capital, and the winners will be different from what people expected five years ago.

The autonomous vehicle industry promised to transform transportation. It still might. But the reckoning has arrived: the promises are meeting reality, and the reality is messier and slower than the promises suggested. That's not a failure. It's the sound of an industry growing up.

For those interested in staying current on these developments, monitoring regulatory announcements from NHTSA and state DMVs will provide clearer signals of where this industry is actually heading. Follow companies being investigated and see how they respond. Watch which funding rounds succeed and which fail. The future of autonomous vehicles will be written in these mundane regulatory and financial details, not in the press releases and demos.

Key Takeaways

- Tesla killed Autopilot to address regulatory deception claims, consolidating all driver-assistance into FSD (Supervised) with a subscription-based pricing model

- Tesla launched truly driverless robotaxi rides in Austin, marking the first major U.S. rollout of fully autonomous vehicles without safety drivers

- The NTSB opened multiple investigations into Waymo incidents, signaling serious regulatory scrutiny and suggesting safety standards for the industry will tighten

- Regulatory pressure on Tesla includes a potential 30-day suspension of manufacturing licenses in California due to deceptive marketing of Autopilot capabilities

- The autonomous vehicle industry is fragmenting: robotaxi services in limited cities, trucking applications on highways, and niche delivery robots—but general consumer autonomy remains years away

- Technical challenges like edge cases, adversarial attacks, weather dependency, and the 99% improvement problem remain the industry's biggest bottlenecks

- The insurance and liability framework for autonomous vehicles is still unsolved, creating legal uncertainty that's slowing deployment

Related Articles

- Waymo Launches Miami Robotaxi Service: What You Need to Know [2026]

- Waymo's School Bus Problem: What the NTSB Investigation Reveals [2025]

- Waymo in Miami: The Future of Autonomous Robotaxis [2025]

- NTSB Investigates Waymo Robotaxis Illegally Passing School Buses [2025]

- Tesla's Fully Driverless Robotaxis in Austin: What You Need to Know [2025]

- Waymo's Miami Robotaxi Launch: What It Means for Autonomous Vehicles [2025]

![Tesla Autopilot Death, Waymo Investigations, and the AV Reckoning [2025]](https://tryrunable.com/blog/tesla-autopilot-death-waymo-investigations-and-the-av-reckon/image-1-1769362573175.jpg)