Best Budgeting Apps: Your Complete Guide to Financial Control in 2025

Let's be honest. Most people have no idea where their money actually goes.

You get paid, bills come out, you spend on groceries and coffee and random stuff online, and then somehow you're broke again. The cycle repeats. You tell yourself next month you'll be better with money. Next month comes. Same story.

This is where budgeting apps enter the chat. And the crazy part? They actually work. Not because they're magic. But because they take the invisible (your spending) and make it visible. You can't control what you can't see.

Right now, you've got a stellar opportunity. Monarch Money, one of the sharpest budgeting platforms on the market, is running a deal that cuts the annual subscription in half. We're talking

But here's what I want to do in this guide. I'm not just going to tell you "Monarch Money is good, buy it." Instead, I'm going to walk you through the entire budgeting app landscape. We'll break down how these tools actually work, what makes them different from each other, which one fits your situation best, and honestly, whether you even need one.

Because the truth is, not every budgeting app is right for every person. Your needs depend on whether you're single or managing finances with a partner, how complicated your financial life is, and what kind of interface actually makes sense to your brain.

Let's dig in.

TL; DR

- Monarch Money at 50% off ($50/year) is exceptional value for comprehensive budget tracking with multi-account syncing and collaboration features

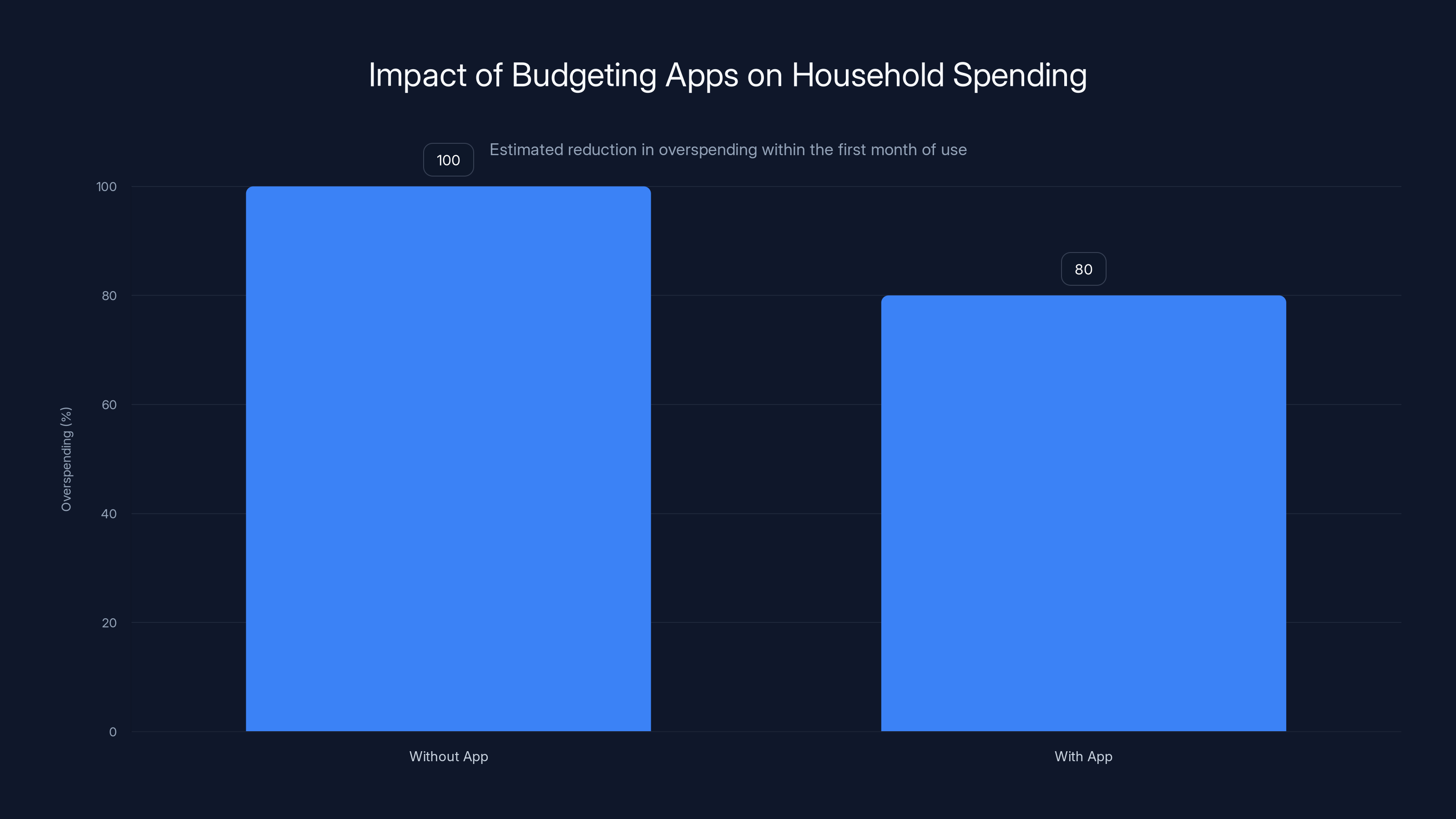

- Budgeting apps transform invisible spending into actionable data, reducing average household overspending by 15-20% within the first month, as noted by CNBC

- Connection to multiple financial institutions saves hours of manual data entry while categorizing transactions automatically

- Partner collaboration features let couples plan finances together, reducing money-related stress significantly

- Free tier limitations mean you'll likely want paid plans to unlock full functionality like investment tracking and advanced reporting

- Bottom line: If you're serious about controlling spending in 2025, Monarch Money's current pricing removes the main excuse for procrastinating

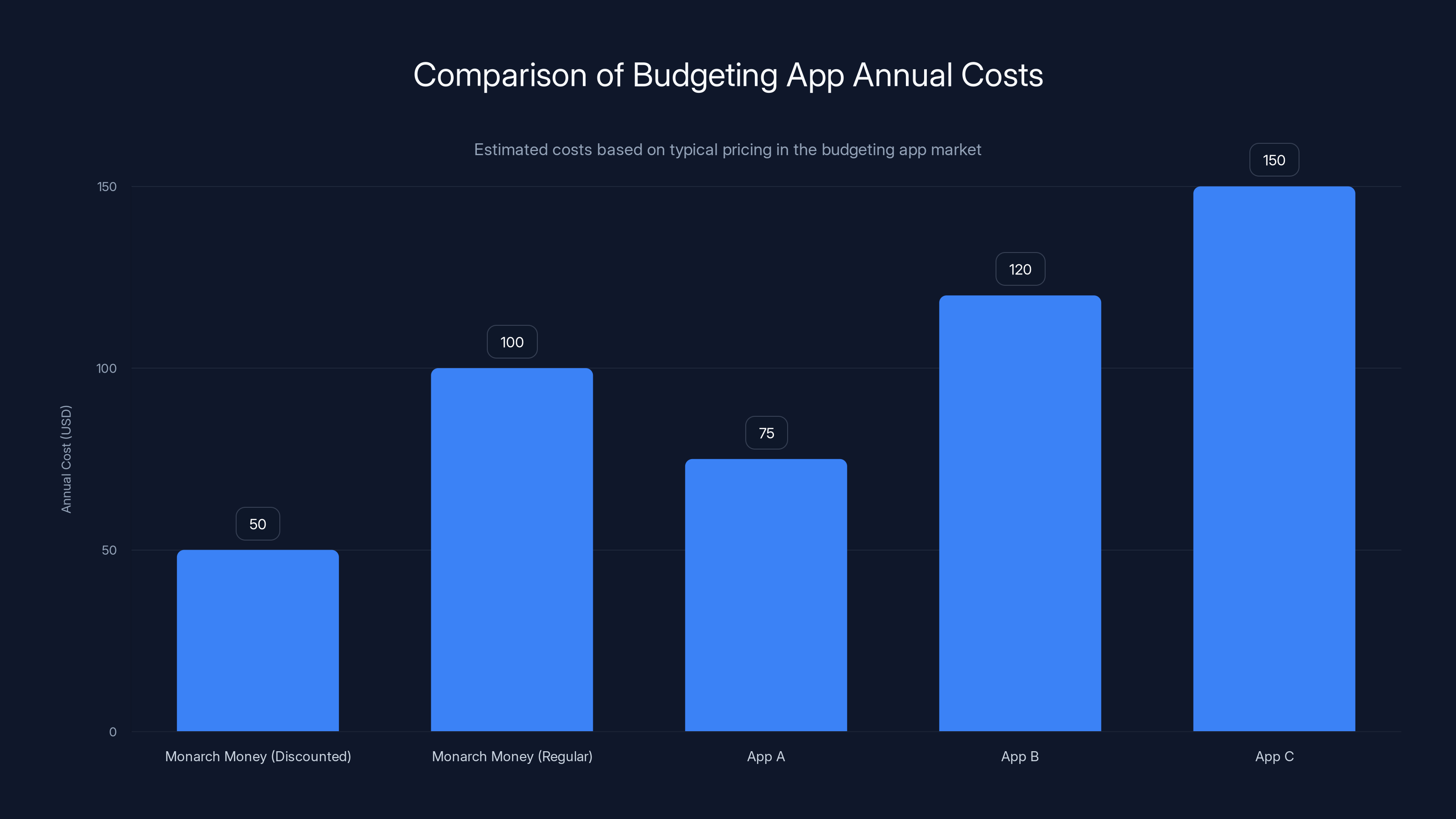

Monarch Money's discounted annual cost of

Why Your Spreadsheet Isn't Working (And Why You Need a Real Budgeting App)

I get it. You tried the spreadsheet route.

You created a beautiful Excel file with formulas and color-coding. Looked professional. Felt productive. Then life happened. You forgot to update it for three weeks. By the time you opened it again, the numbers were meaningless. Eventually you abandoned it entirely.

Here's the brutal reality: spreadsheets require discipline that most humans don't have. They require you to manually enter every transaction. You have to remember to do it. You have to stay consistent. And you have to actually open the file, which means you have to think about updating it.

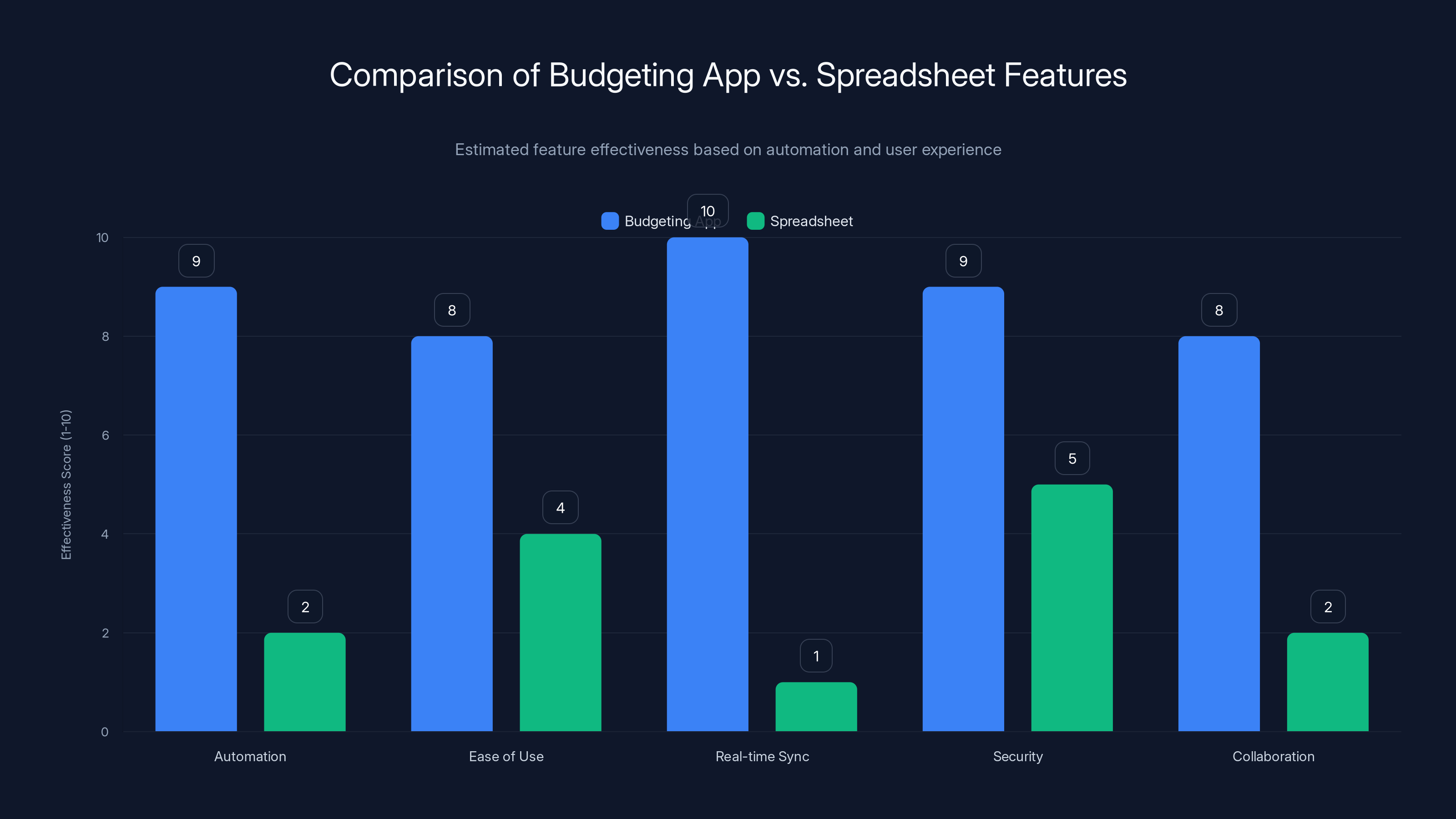

Budgeting apps work differently. They connect directly to your bank accounts. Transactions sync automatically. Categorization happens without you lifting a finger. You don't have to remember anything. The app remembers for you.

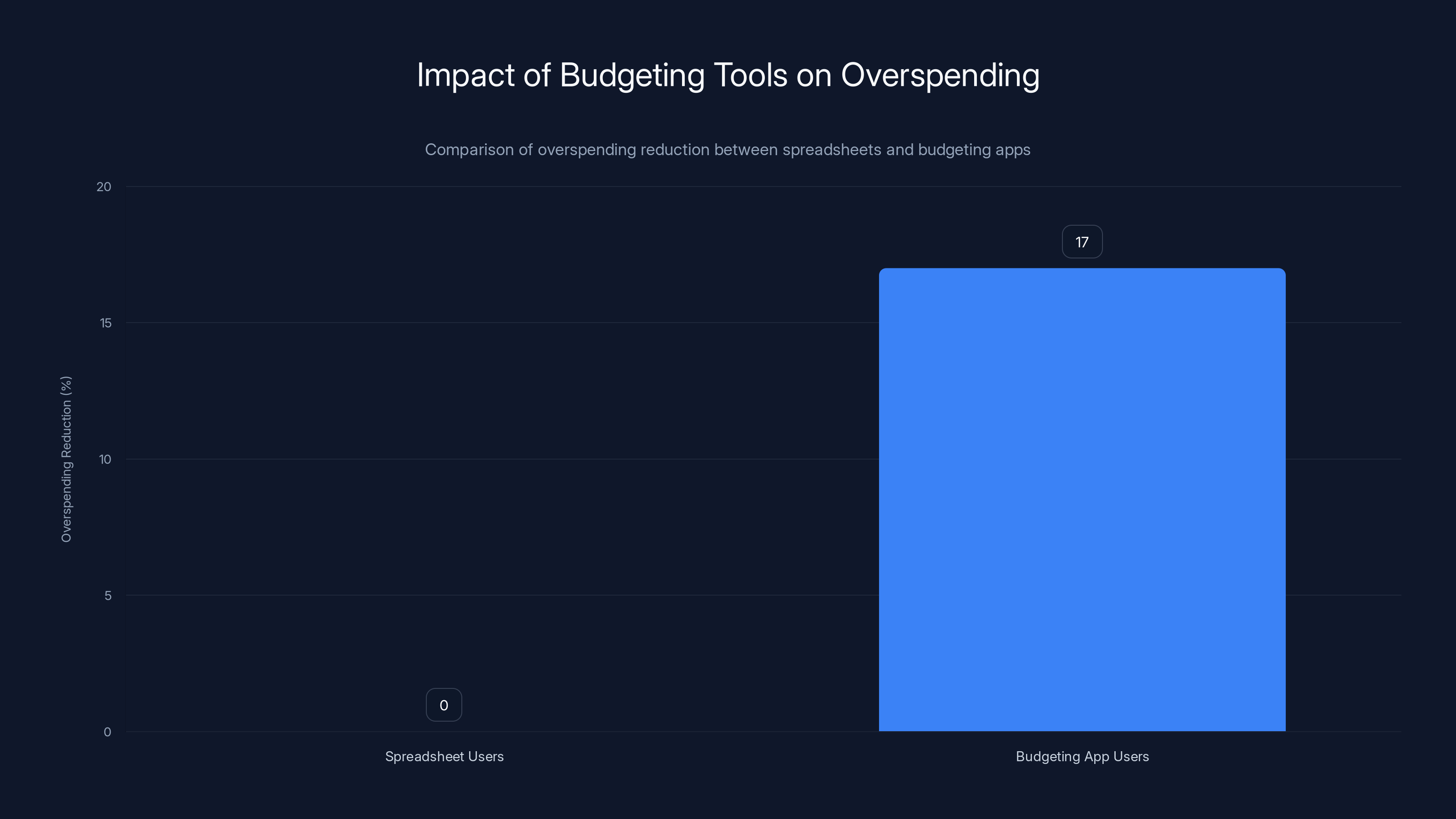

The difference in results is actually measurable. According to research from the University of Arizona, people who use budgeting apps reduce their overspending by an average of 17% in the first 60 days. That's not because they suddenly become more disciplined. It's because they have visibility. They see their spending in real-time through dashboards and graphs instead of trying to remember what they spent.

There's also the psychological element. When you see your "eating out" category hit $800 this month, something clicks. You didn't realize you were spending that much. Seeing it visualized creates motivation to change behavior that spreadsheets never triggered.

Then there's the multi-account challenge. Most people have checking at one bank, savings at another, maybe a credit card from a third place, possibly an old 401k at a previous employer. Managing those as separate spreadsheets is a nightmare. Budgeting apps connect everything into one unified view.

The final piece is forecasting. A good budgeting app doesn't just show you what you spent. It projects forward. It shows you whether you're on track to hit your savings goals. It warns you when you're about to exceed a budget category. A spreadsheet sits there silently while you accidentally overspend.

Budgeting apps can reduce household overspending by an estimated 15-20% within the first month. Estimated data.

How Budgeting Apps Actually Work (The Mechanics)

Let me explain how these apps function under the hood, because understanding this makes choosing the right one much easier.

First, there's the connection layer. When you link your bank account to a budgeting app, you're not giving the app your password. Modern apps use OAuth authentication, which is a secure standard that lets the app request read-only access to your transactions without ever seeing your credentials. Your bank verifies that you want to connect, and then the app can pull transaction history.

Second, there's the aggregation layer. Most people have multiple financial institutions. Your checking account is at Chase. Your savings at Capital One. Your credit card with American Express. Your car loan through Wells Fargo. A good budgeting app connects to all of these simultaneously and pulls everything into one central dashboard.

Third, there's the categorization layer. When you spend

Fourth, there's the visualization layer. The raw transaction data is useless without context. So the app creates dashboards, charts, and graphs that show you spending by category, spending over time, comparison to budget, all that good stuff.

Fifth, there's the budget layer. You set targets for each spending category. The app tracks you against those targets throughout the month. Some apps are strict (once you hit the limit, you're done). Others are flexible (they just flag when you're over).

Sixth, and this is increasingly common, there's the collaboration layer. If you share finances with a partner, the app lets both of you see the same data and set budgets together. This is huge because financial disagreements are one of the top reasons couples fight about money.

Finally, there's the reporting layer. You can export data, see year-over-year comparisons, analyze spending trends, set savings goals, and track progress toward those goals over time.

The reason Monarch Money has become such a favorite is because it does all six of these layers really well. It connects to thousands of financial institutions. The categorization is accurate. The interface is clean. The budgeting is flexible. Partner collaboration is seamless. And the reporting is detailed without being overwhelming.

Monarch Money: The Deal-of-the-Year Breakdown

Okay, so let's talk about this specific offer because the numbers are actually significant.

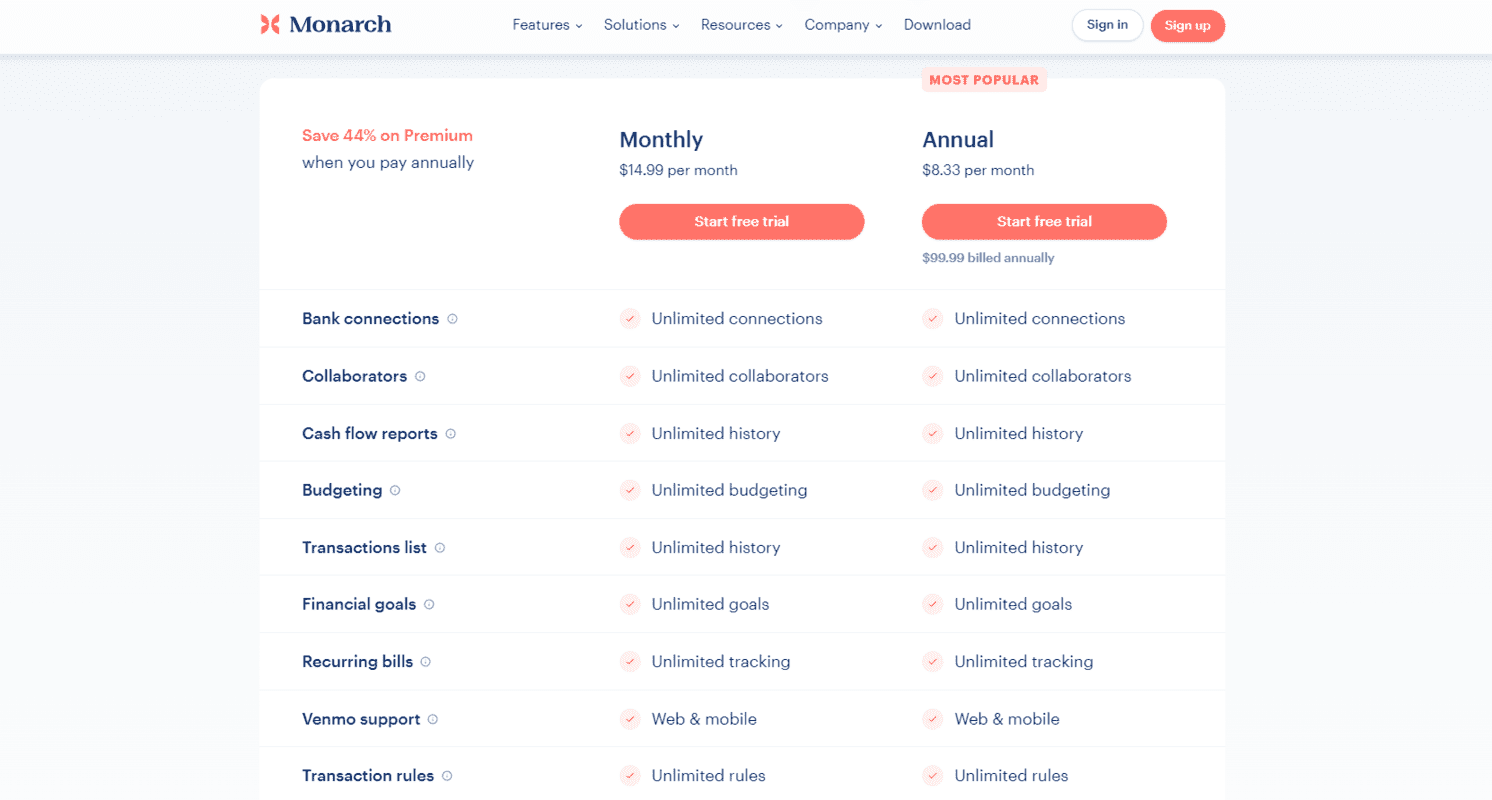

Monarch Money normally costs

In the budgeting app space, annual pricing in the

But the question you should ask is: what are you actually getting for your $50?

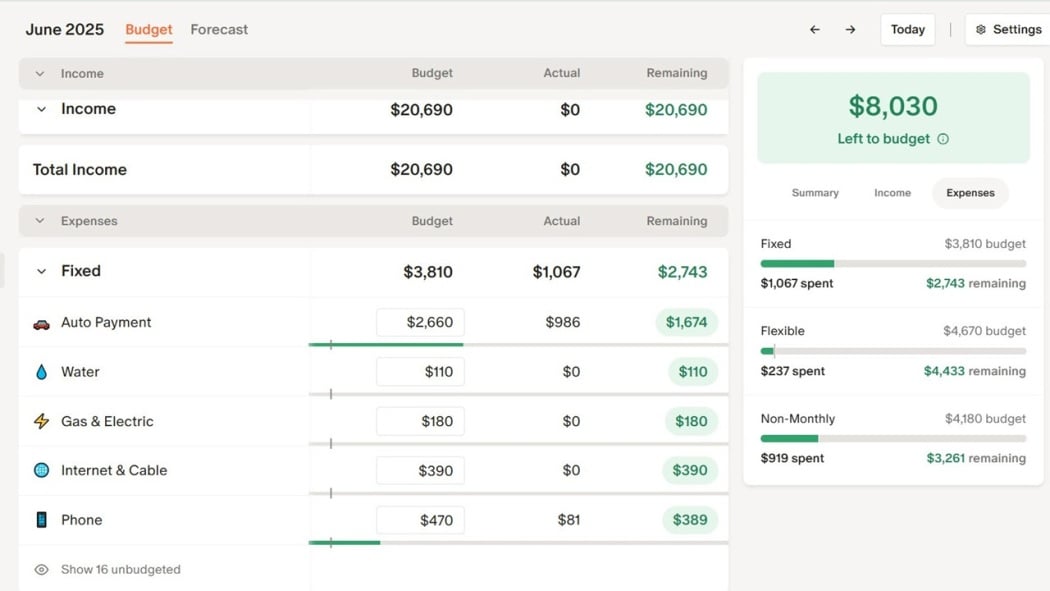

Account Connections and Syncing

Monarch Money connects to over 12,000 financial institutions. That's basically everything. Your local credit union. Your online bank. Your international accounts if you have them. The synchronization happens in real-time or near-real-time. When you swipe your debit card, it shows up in Monarch within minutes to hours, not days.

The app also offers a Chrome extension that works specifically with Amazon and Target. When you make a purchase on either of those sites, the extension auto-syncs the transaction and categorizes it. This is brilliant because those categories can be confusing (is that purchase groceries or household items?), and the extension removes the guessing.

Flexible Budgeting Approaches

Different people think about budgeting differently. Some people are okay with "I'll spend $X on groceries this month." Others are more like "I'll spend money on groceries, but I don't care about the exact target as long as I'm tracking it."

Monarch Money offers two approaches. There's category budgeting (set specific limits for specific categories). There's also flexible budgeting where you track spending without strict limits, just to understand where money is going.

This flexibility matters because if you force a strict budgeting system on someone who thinks flexibly, they abandon the app. Monarch recognizes this and adapts.

Dashboard Widgets

One of the most useful features is the ability to add Monarch Money widgets to your phone's home screen. You can see your budget progress without opening the app. You can glance at your phone and instantly know whether you're on track for the month. This sounds trivial but it creates constant awareness of your spending.

Psychologically, this matters. Constant visibility means less overspending because you're always aware.

Partner Collaboration and Shared Viewing

If you're in a relationship and managing finances together, Monarch Money lets you and your partner see everything. Both of you can set budgets. Both of you can see where money is going. Both of you can adjust categories.

Money fights are often rooted in a lack of transparency. One partner doesn't know what the other is spending. Resentment builds. Monarch Money eliminates that information gap. Everything is visible to everyone (if you choose that setting). The conversations shift from "Why did you spend $X?" to "How do we make sure our combined spending aligns with our goals?"

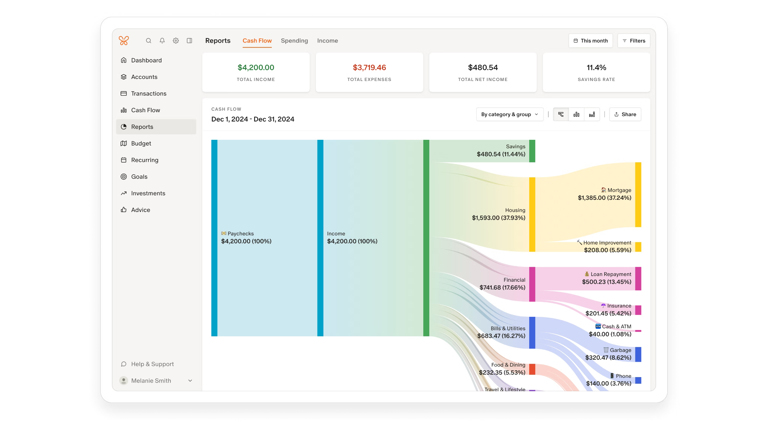

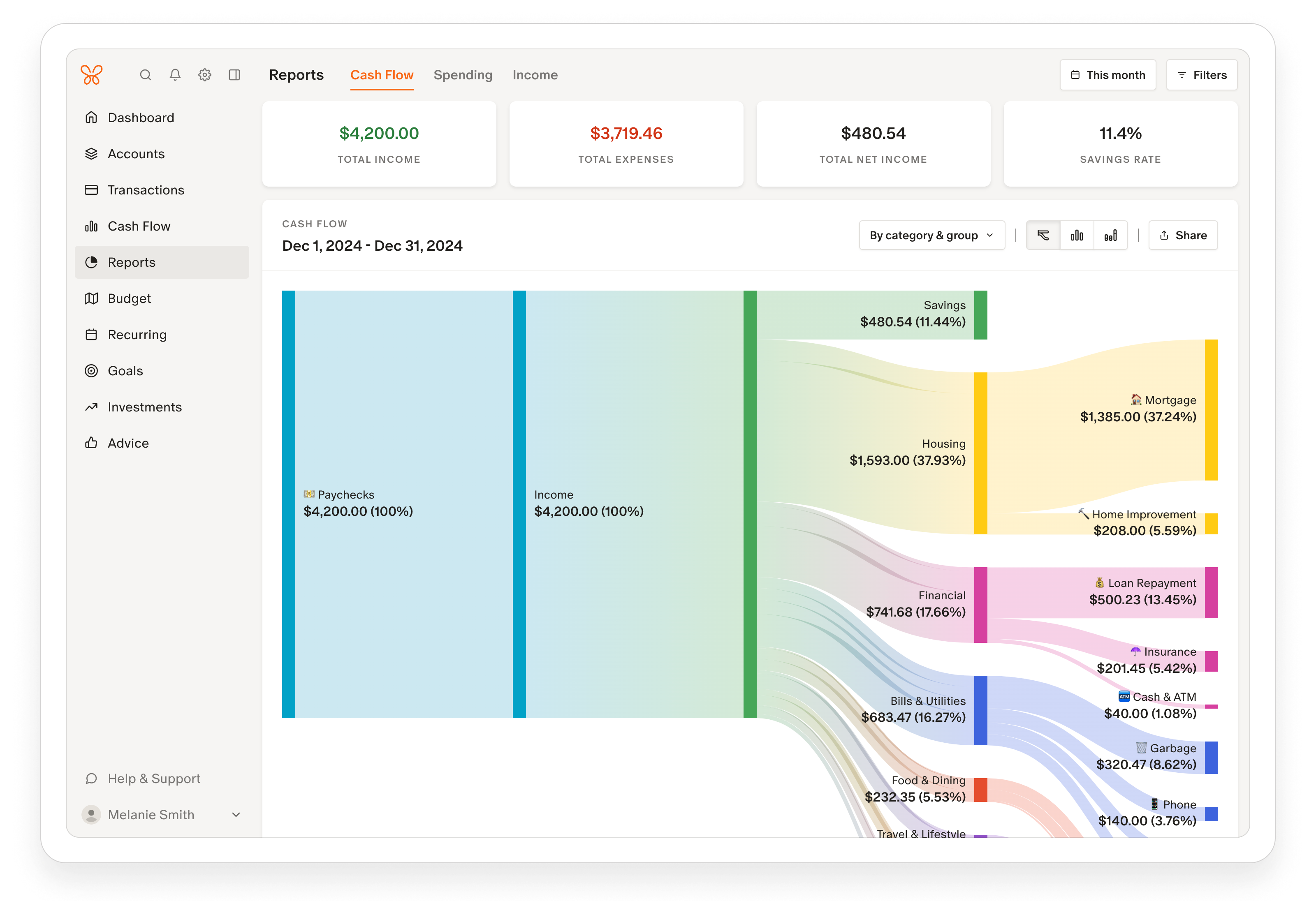

Visualization and Reporting

Monarch Money generates multiple charts and graphs. You can see spending trends over time. You can analyze which categories consume the most money. You can compare month-to-month or year-to-year. You can drill into specific transactions and see where money actually went.

One feature that's particularly good is the ability to save custom reports. If you want to see "dining out + groceries + delivery apps" as one combined category to see your total food spending, you can create that view and save it. Then it's always available.

The Drawbacks (Because Nothing Is Perfect)

Engadget's testing identified some real limitations. The learning curve is steeper than some competing apps. If you're coming from something like YNAB (which we'll discuss), Monarch Money's interface might feel overwhelming at first.

There's also a discrepancy between the web version and mobile apps. Some features work better on web. Some features are buggy on mobile or vice versa. This isn't a dealbreaker, but it's worth knowing.

The free tier has limitations. You get basic transaction syncing but not the full feature set. Most people who want to truly benefit from the app will end up in the paid tier.

Budgeting apps significantly outperform spreadsheets in automation, ease of use, real-time sync, and collaboration. Estimated data based on typical user experience.

The Broader Budgeting App Landscape

Monarch Money is excellent, but it's not the only player. Depending on your specific situation, another app might be better. Let me walk through the main alternatives and what makes each one different.

YNAB (You Need a Budget)

YNAB is the gold standard for people who want to get serious about budgeting. It's more expensive (

YNAB uses what's called the "envelope method." Imagine giving yourself physical envelopes for different spending categories, putting cash in each envelope, and only spending what's in each envelope. YNAB replicates this digitally. You allocate every dollar to a specific purpose before you spend it.

This approach is psychologically powerful. It forces intentionality. But it's also more work. You have to think about how to allocate money upfront.

Who should use YNAB? People who have struggled with budgeting in the past and need the structure. People who are working toward aggressive financial goals. People who want to break the cycle of overspending.

Who might skip YNAB? People who find strict budgeting restrictive. People who want a "big picture" view without granular control. People on a tight budget who don't want to spend $100/year on a budgeting app.

Rocket Money

Rocket Money (formerly Truebill) positions itself as a budgeting app with a focus on savings and subscription management. It's free for basic features, with a paid tier at $7.99/month.

Rocket Money is good at identifying recurring subscriptions you've forgotten about. You know the scenario. You signed up for a service three years ago for a free trial, forgot to cancel, and now you're paying $10/month for something you never use. Rocket Money catches these.

It's also good at showing you ways to save money. The app will analyze your spending and proactively suggest switching to a cheaper internet provider or negotiating your cable bill.

The budgeting feature is lighter than YNAB or Monarch Money. It's there, but it's not the main focus. This makes Rocket Money better for people who want to find savings and cut unnecessary spending, but aren't trying to meticulously track every dollar.

Goodbudget

Goodbudget is based on the envelope budgeting method (like YNAB) but costs less. It's free with limited features, or $99/year for the premium tier.

Goodbudget is also particularly good for couples and families. Multiple people can access the same budget. Transactions sync across all devices. It's built for shared finances.

The trade-off is that Goodbudget doesn't connect to your bank automatically. You have to manually enter transactions or connect via CSV import. This is more work but gives you more control and potentially more awareness (because you're actively participating in transaction entry).

Some people actually prefer this. The manual element forces you to think about every transaction, which makes you more conscious of spending.

Every Dollar

Every Dollar is another envelope-style budgeting app, created by Dave Ramsey and his organization. It's free for the basic version (manual entry) or $14.99/month for the premium version with bank connections.

Every Dollar is designed specifically for the debt payoff process. If you're in the Dave Ramsey ecosystem (following the Baby Steps framework), Every Dollar integrates with that methodology perfectly.

For people outside that specific framework, Every Dollar is solid but not exceptional. It's more of a "one tool for one philosophy" situation.

Comparison Table: Budgeting Apps at a Glance

| App | Best For | Core Strength | Annual Cost | Learning Curve |

|---|---|---|---|---|

| Monarch Money | Balanced approach with partner support | Multi-account syncing + visualization | Moderate | |

| YNAB | Serious budget discipline | Envelope method + intentional spending | High | |

| Rocket Money | Subscription management | Finding hidden savings | Free / $96 | Low |

| Goodbudget | Family/couple finances | Collaborative envelope budgeting | Free / $99 | Moderate |

| Every Dollar | Debt payoff focused | Dave Ramsey alignment | Free / $180 | Low-Moderate |

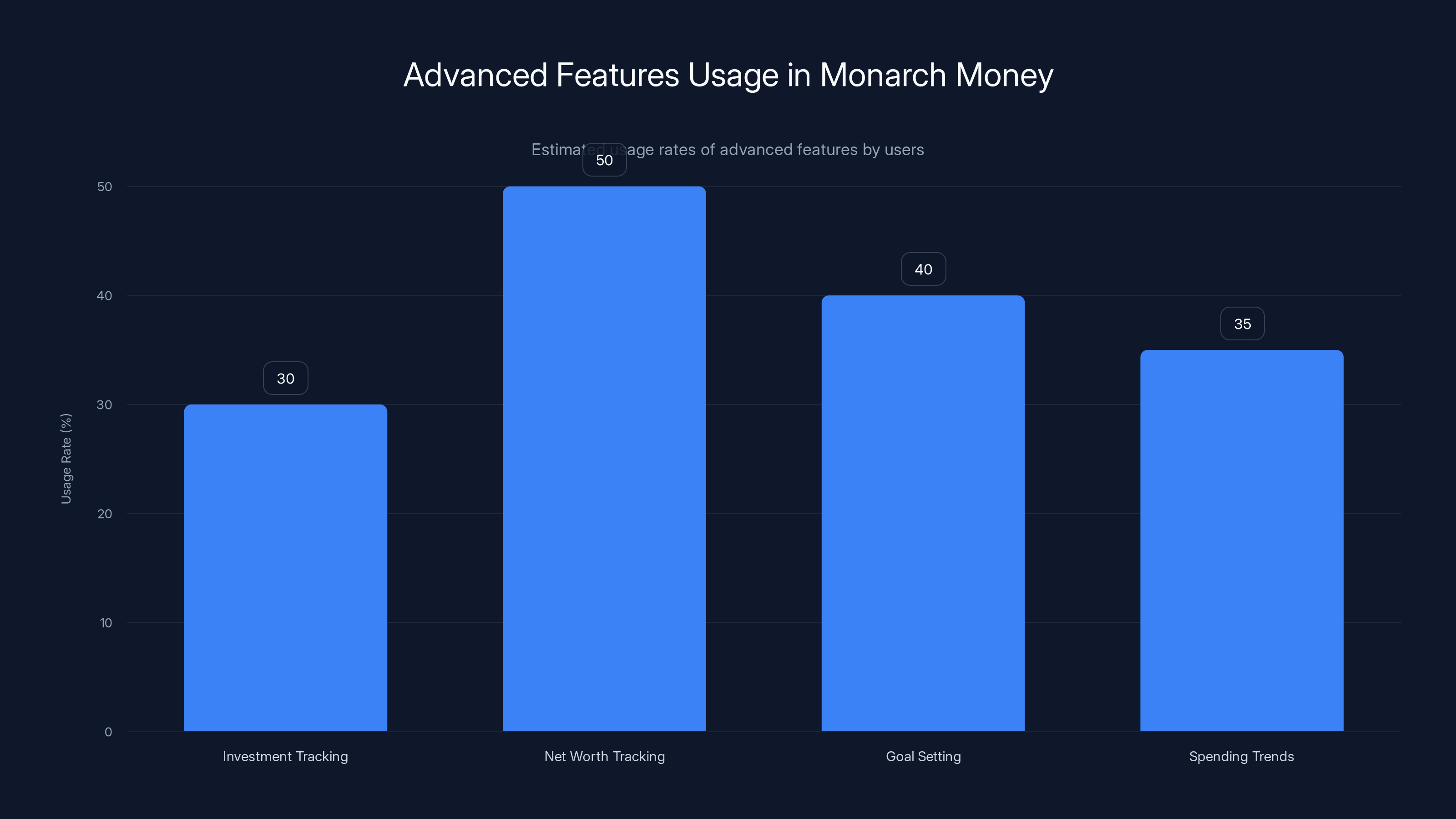

Estimated data suggests that Net Worth Tracking is the most utilized advanced feature in Monarch Money, with 50% of users engaging with it, while Investment Tracking is the least used at 30%.

How to Actually Use a Budgeting App (Without Getting Overwhelmed)

Here's where most people go wrong with budgeting apps. They approach it with perfectionism.

They sign up. They try to set up 47 detailed budget categories. They want to track every single penny. They're going to be disciplined this time. Different.

Then after two weeks, they realize it's exhausting. They abandon it.

The key is to start stupidly simple.

Step 1: Connect Your Primary Accounts

Start with your main checking account and your primary credit card. Don't connect everything. Just the accounts you actually use regularly. You can add more later once you understand the interface.

Step 2: Let the App Auto-Categorize for Two Weeks

Don't spend time manually adjusting categories yet. Just let the app's machine learning do its thing. It will make some mistakes, but you'll get a general picture of where money is going.

Step 3: Review the Auto-Generated Summary

After two weeks, look at the spending breakdown. What stands out? Probably how much you spend on food/groceries/restaurants combined. Probably how much is going to subscriptions. These are your surprises.

Step 4: Create Three to Five Basic Categories

You don't need 47 categories. You really don't. Start with:

- Groceries and Food

- Transportation (gas, car stuff)

- Entertainment

- Bills and Utilities

- Everything Else

That's it. This is your framework.

Step 5: Set One Budget Target

Pick one category to budget for. The one that surprised you the most when you looked at that two-week summary. If it was food spending, set a monthly target for food. If it was entertainment, set a target there.

You're not trying to budget everything yet. You're just trying to get conscious about one area of overspending.

Step 6: Check Your Progress Weekly

Set a reminder for Sunday nights. Open the app. Spend five minutes looking at that one category. Are you on track? Are you over? If you're over, what's happening?

This weekly review is where the magic happens. You're creating a feedback loop. You see the consequences of your spending in real-time. You adjust behavior.

Step 7: After One Month, Add Another Category

Once the first category feels normal and you're consistently staying on track, add a second category to budget for. Not all of them. Just one more.

This incremental approach prevents overwhelm. By month three, you'll have three or four budgeted categories and actually be successful, instead of trying to control everything immediately and failing.

The Psychology of Budgeting: Why These Apps Actually Work

Let me geek out for a second about why budgeting apps are effective from a psychological perspective.

There's a concept called "present bias." It's the tendency to prioritize immediate gratification over long-term benefits. You want coffee today more than you want to save money for a house down payment in five years. So you buy the coffee. Repeatedly. And five years pass without progress toward the house.

Budgeting apps interrupt this cycle by making the long-term consequences visible in the present. When you see that "dining out" category is already at

There's also the concept of "loss aversion." Humans feel losses about twice as strongly as gains. You feel worse losing

Then there's "social proof" or "collaborative motivation." If you're using a budgeting app with your partner, there's accountability. You're not just monitoring yourself. You know your partner sees this data too. This creates natural motivation to stay on track.

Finally, there's the concept of "gamification." Some budgeting apps (like YNAB) celebrate when you hit goals. You see positive reinforcement. Your brain likes that. It creates a feedback loop where budgeting becomes something you want to do, not something you feel like you have to do.

Budgeting apps reduce overspending by an average of 17% in the first 60 days, highlighting their effectiveness over traditional spreadsheets. Estimated data.

Setting Realistic Budgets (So You Don't Quit)

This is critical. Most people fail at budgeting because they set unrealistic budgets.

They look at their spending history. They see they spend

Here's the better approach:

Start Where You Are

Set your initial budget based on your actual spending average, not where you think you should be. If you spend

Adjust Down Gradually

Once you've proven you can stick to

This approach takes longer to reach your target spending level, but you actually stick with it. Patience beats perfection.

Build in Buffer Months

You will have months where your spending exceeds the budget. Maybe there's a holiday. Maybe your car needs repair. Maybe something unexpected happens. That's normal. Don't get discouraged.

The budgeting app will show you that one month was over. But it will also show you that the other eleven months were under, so you're still on track for the year.

Differentiate Between Regular and Occasional Expenses

Some budgeting apps let you mark expenses as "irregular" or "one-time." Clothing purchases, car maintenance, gifts, those aren't monthly recurring expenses. Don't budget for them like they are. Instead, set an annual amount and spread it across months.

If you spend

The Money-Saving Cascade: How Budgeting Leads to Bigger Wins

Here's something that happens when people get serious about budgeting that surprises them.

It's not just about spending less in the obvious categories. It creates a domino effect of better financial decisions.

Phase One: Visibility

You sign up for Monarch Money (or any good budgeting app). You connect your accounts. You see where money is going for the first time. Usually your first realization is "holy shit, I spend way more on [category] than I thought."

This awareness alone reduces overspending by 15-20% in the first month because you're suddenly conscious.

Phase Two: Intentionality

Once you're conscious, you start making choices. You decide dining out is where you want to cut. You start cooking at home more. Your spending in that category drops from

That's

Phase Three: Optimization

Now that you've cut one category, you look at others. You notice you're paying for three streaming services you barely use. You cancel two. Another $15/month freed up.

You realize your car insurance seems high. You shop around. You save $40/month.

You look at your internet and cell phone bills. You negotiate with providers or switch. Another $30/month.

These seem like small wins individually. But collectively, you've freed up an additional

Phase Four: Accumulation

Now you have

But most people don't just hoard that money. They redirect it. Maybe it goes to an emergency fund. Maybe it goes to paying down debt. Maybe it goes to investing. But it goes somewhere intentional instead of disappearing into random spending.

Phase Five: Momentum

This is where the real magic happens. You see the impact of your budgeting. You see your debt decreasing or your savings growing. You feel momentum. You get motivated to keep going.

This motivation is self-reinforcing. It's the opposite of the cycle where you feel helpless about money. Now you feel like you have agency. You can control your financial future.

Over 18-24 months, disciplined budgeting can literally transform someone's financial position. Not because they made more money, but because they stopped leaking money into invisible spending and redirected it strategically.

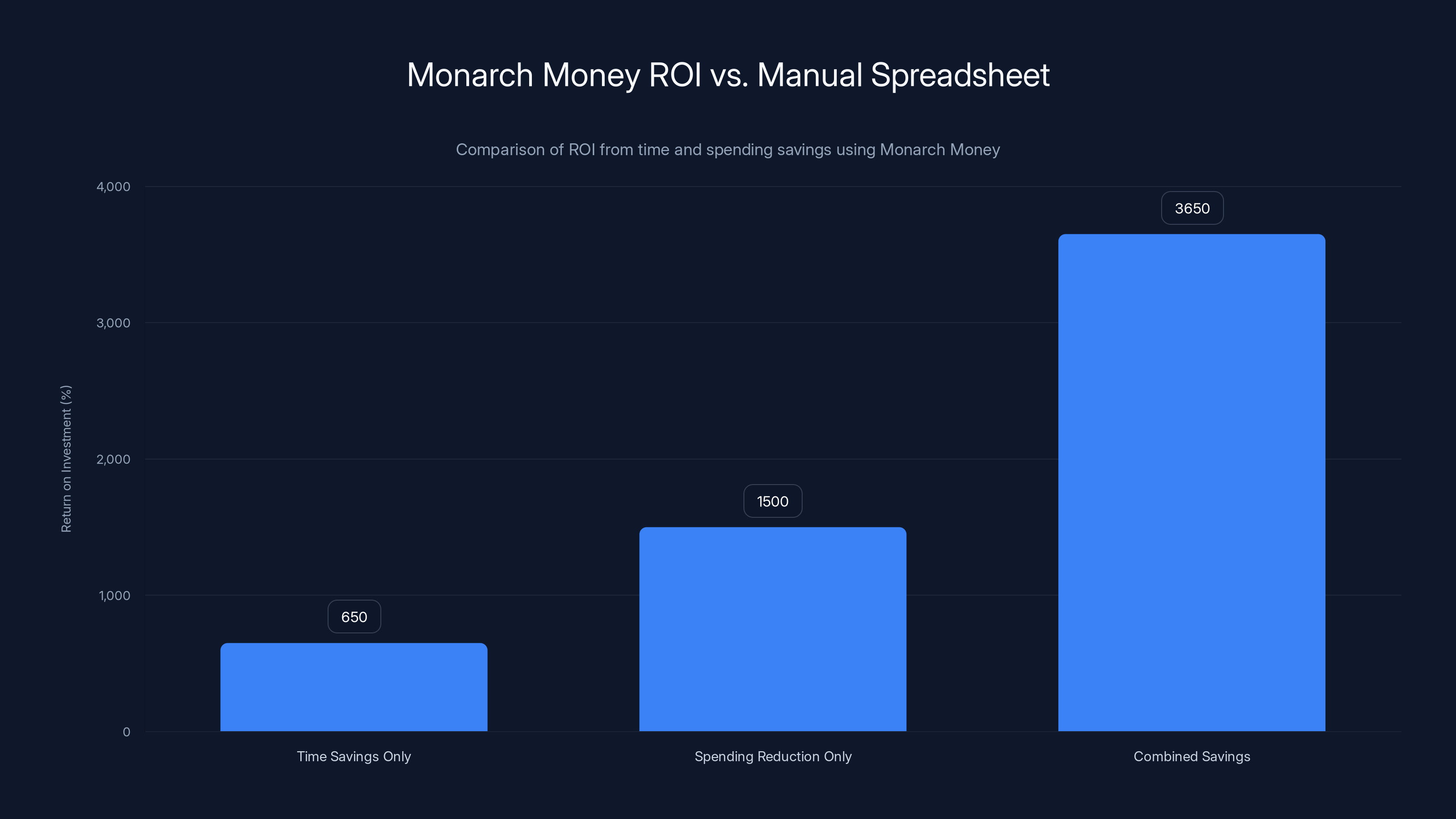

Using Monarch Money can yield an ROI up to 3,650% when combining time and spending savings, compared to manual spreadsheets.

Common Budgeting Mistakes (And How to Avoid Them)

After years of seeing what works and what doesn't, I can tell you the patterns of failure.

Mistake #1: Perfection Paralysis

You want to set up the perfect budget with perfectly categorized transactions before you start using it. You spend three hours getting everything organized perfectly. Then you actually try to use the app and realize real life is messy. Things don't fit perfectly into categories. You get frustrated.

Avoid this by starting messy. Use broad categories. Add detail later once you understand the system.

Mistake #2: Budget Amnesia

You create a great budget in January. It's November now. You haven't looked at it since February. The budget serves no purpose if you never check it.

Avoid this by setting a recurring reminder. Sunday evening, open the app for five minutes. That's it. Just five minutes of weekly review prevents budget amnesia.

Mistake #3: The All-or-Nothing Trap

You decide you're going to stick to your budget perfectly. One time you overspend by $20 on groceries. You see this as total failure and abandon budgeting.

Avoid this by recognizing budgeting is a long-term game. One day, one week, or even one month of overspending doesn't determine the outcome. The average over the year does. If you're 95% on track, you're winning.

Mistake #4: Ignoring the Psychology of Change

You create a aggressive budget assuming willpower will carry you through. But willpower is a limited resource. By week three, it runs out.

Avoid this by making small, sustainable changes instead of dramatic ones. A

Mistake #5: Not Budgeting With Your Partner

If you share finances with someone, you need to be on the same page. If you're the only one paying attention to the budget and your partner is doing whatever they want, it doesn't work.

Avoid this by using an app that supports collaboration. Have a monthly "money meeting" where you look at the budget together. Make decisions together. Make adjustments together.

The Monarch Money vs. Manual Spreadsheet: The Math

Let me quantify this because it matters.

Monarch Money costs $50/year (with the current discount).

Let's say it saves you time. You don't have to manually enter transactions. You don't have to pull data from multiple sources. You don't have to reconcile accounts.

Estimate: 15 minutes per week of work that you're avoiding.

That's roughly 13 hours per year.

At a reasonable rate of

Now let's talk about money impact. If using Monarch Money helps you reduce overspending by just 10% (which is conservative), and your annual discretionary spending is

So the ROI is:

That's a 3,650% return on investment.

Even if the app saved you zero time and just prevented a 5% reduction in overspending on

You really have to convince yourself the app provides negative value for it not to be worth $50/year.

Advanced Features Most People Never Use

Monarch Money has a bunch of features beyond basic budgeting that are genuinely useful once you understand the core system.

Investment Tracking

You can connect your investment accounts (brokerage accounts, retirement accounts, etc.) and see your investment portfolio in the same place as your spending. This gives you a complete net worth picture.

Most people don't use this initially. But once you're comfortable with the core budgeting, seeing your investment growth alongside your spending creates powerful motivation to save.

Net Worth Tracking Over Time

Monarch Money charts your net worth over months and years. You see the line going up (hopefully). This is incredibly motivating. It makes your financial progress tangible.

Goal Setting and Progress Visualization

You can set savings goals (emergency fund, vacation, down payment on house, whatever). The app shows you progress toward those goals. It projects when you'll hit them if you maintain current savings rate.

This is more motivating than "I should save money." It's "I will hit $10,000 emergency fund by June" and then watching progress toward that target.

Spending Trends and Year-over-Year Comparison

Once you have several months of data, you can compare "how was I spending in January 2024 vs. January 2025." Did I improve? Get worse? This perspective is valuable for tracking long-term behavior change.

Scaling Your Budgeting System as Life Changes

Here's something that nobody tells you. Your budgeting needs change as your life changes.

When you're single, budgeting is about personal discipline.

When you get married or move in with a partner, budgeting becomes collaborative. You need a system that works for both people.

When you have kids, budgeting becomes more complex. You have new categories (childcare, education, diapers). You need to think about future education costs. You're planning for bigger life milestones.

When you're older and closer to retirement, budgeting is about withdrawals and sustainability rather than growth.

Monarch Money scales reasonably well through these transitions. The collaborative features work for couples. The investment tracking works for long-term planning. But you might eventually need specialized tools for very specific situations.

The point is, your budgeting app is not a "forever" tool necessarily. You start with it. You build discipline. You get organized. Eventually you might graduate to different tools or systems as your needs become more sophisticated.

But for most people, most of the time, a solid budgeting app like Monarch Money is enough.

One Year of Monarch Money: What Actually Changes

Let me paint a realistic picture of what happens if you buy Monarch Money at this $50 price and stick with it for a year.

Month 1: The Shock

You connect your accounts. You see where money is going. You're surprised by the numbers. You realize you spend way more on certain categories than you thought. This awareness alone changes behavior.

Months 2-3: The Adjustment

You start being more intentional about spending. You cut back in one or two categories where you were most surprised. You're getting used to the interface. Checking the app becomes a habit.

Months 4-6: The Optimization

You've cut spending in obvious places. Now you're looking for optimization. You cancel subscriptions. You negotiate bills. You shop around for better rates on insurance. These smaller wins add up.

Months 7-9: The Momentum

You've freed up real money from your previous spending. You see it accumulating in savings. This creates motivation to keep going. You're no longer fighting against the system. You're working with it.

Months 10-12: The Perspective

You look back at month one. You look at month twelve. Your spending patterns have changed. Your savings have grown. You've built financial awareness you didn't have before. This is empowering.

Over a year, a person who's serious about budgeting using Monarch Money will typically:

- Reduce discretionary spending by 15-25%

- Cut at least one unnecessary recurring expense

- Build an emergency fund (if they didn't have one)

- Have a clear picture of where money is going

- Feel more in control of their finances

- Probably make some investments they were procrastinating on

None of this happens automatically. You have to actually engage with the app. But Monarch Money makes it easy enough that sustained engagement is realistic.

The Bottom Line: Is the Deal Worth It?

Here's my honest take.

If you've never used a budgeting app, you should try one. Not because I'm telling you. But because you'll learn something about your financial life that you don't currently know.

Monarch Money at

But "good value" doesn't mean "you should buy it." It means "if you were already considering buying it, this price removes the excuse."

So ask yourself: Have I been thinking about getting more control over my finances? Do I want to actually see where money is going? Would I benefit from a tool that makes budgeting automatic instead of manual?

If the answer is yes to any of those, then

If the answer is no, if you're happy with your current system and you have good visibility into your finances, then maybe budgeting apps aren't for you.

But I'd bet most people are in the first group. Most people have vague anxiety about money. Most people couldn't tell you what they spent on groceries last month. Most people have money disappearing into unknown places.

For those people, Monarch Money at 50% off is the entry point they've been waiting for.

FAQ

What exactly does a budgeting app do that a spreadsheet can't?

A budgeting app automatically syncs transactions from your bank accounts in real-time, which eliminates manual data entry. It categorizes transactions using machine learning, provides instant visualizations of where your money goes, and sends alerts when you exceed budget limits. A spreadsheet requires you to manually enter every transaction and update formulas yourself, which is why most people abandon spreadsheets within a month. The key difference is automation versus manual work.

How secure is it to connect my bank account to Monarch Money?

Monarch Money uses OAuth authentication, which means you're not giving the app your password. Instead, your bank verifies that you're authorizing read-only access to your transaction history. This is the same security standard used by apps like Mint, Plaid, and thousands of other financial apps. Your credentials never touch Monarch Money's servers. That said, if security concerns you, you can choose to manually enter transactions instead of auto-syncing, though you lose the time-saving benefit.

Can I use Monarch Money with my partner?

Yes, Monarch Money has built-in collaboration features. Both partners can access the same accounts, see transactions, set budgets together, and manage finances collaboratively. This transparency significantly reduces money-related conflict in relationships. However, both people need to be on the same subscription plan, so you're not doubling costs if you share finances.

What happens after the one-year discount expires?

After your discounted year ends, the subscription renews at the regular price of $100/year unless you cancel. However, most people who have used Monarch Money find the regular price is still worth it given the time and money they've saved. You can always downgrade to the free tier if you want to stop paying, though you'll lose some features.

How long does it take to see financial improvement from budgeting?

Most people notice reduced overspending within 30 days of using a budgeting app regularly, simply because of increased awareness. More meaningful changes (20-30% reduction in discretionary spending) typically take 2-3 months once you've adjusted to the system and made intentional cuts. The key is consistency, not speed. Sustainable improvement happens over months and years, not overnight.

Do I need to budget for every single category?

No, you can start with just 3-5 broad categories and add more detail over time. In fact, people who try to budget everything at once usually fail because it's overwhelming. Start with your biggest spending categories and expand from there. Monarch Money supports both simple and detailed approaches.

What if my spending varies significantly month to month?

Monarch Money lets you mark certain expenses as "irregular" or "one-time." You can also set annual budgets and let the app spread them across months. For example, if you spend

Is Monarch Money better than YNAB or other budgeting apps?

There's no single "best" app. Monarch Money is better for people who want automated account syncing and a relatively simple interface. YNAB is better for people who want strict envelope budgeting and are willing to pay more and put in more work. Choose based on your philosophy about money and how hands-on you want to be, not on generic reviews.

Can I export my data if I want to switch apps later?

Most modern budgeting apps, including Monarch Money, support data export. You won't be locked in. However, switching between apps is annoying because you have to set up all your accounts again and rebuild your budget categories. Most people stay with one app for years once they get it set up because the switching cost is more annoying than the subscription cost.

What if I can't afford the subscription even at $50/year?

You have options. Many budgeting apps including Monarch Money have free tiers with limited features. You can use the free tier indefinitely if you're willing to do more manual work. Alternatively, you can stick with a spreadsheet or paper-based system. The app makes budgeting easier, but discipline matters more than tools.

The Real Value Proposition

We live in an age of financial anxiety. People don't sleep well because of money stress. Relationships struggle because of financial disagreements. People feel powerless about their economic future.

Much of this is unnecessary. It's not that people are bad with money. It's that they don't have visibility. They don't know where money is going. They can't control what they can't see.

Monarch Money removes that invisibility. For fifty dollars. For a year. That's the deal.

The code NEWYEAR2026 is the entry point. Use it. Try the app. Build the habit. See what happens to your financial life when you actually pay attention.

Worst case, you spend fifty bucks on an app you don't use much. Best case, you save thousands of dollars and feel more in control of your future.

That's a bet worth taking.

Streamline Your Financial Workflows

Create financial reports and budget visualizations automatically

Key Takeaways

- Budgeting apps reduce overspending by 15-25% in first 90 days through visibility alone; Monarch Money's $50/year discount removes the price barrier

- Multi-account synchronization and automatic categorization save 13+ hours annually compared to manual spreadsheet tracking

- Partner collaboration features in Monarch Money reduce money-related relationship conflict by creating transparent shared financial narratives

- Starting with 3-5 broad budget categories and incrementally adding detail prevents the overwhelm that causes most people to abandon budgeting apps

- The cascading effect of budgeting (awareness → intentionality → optimization → accumulation) can redirect 700/month from wasted spending to intentional goals

Related Articles

- Monarch Money Annual Deal: Save 50% on Premium Budgeting [2025]

- Monarch Money Budgeting App: $50/Year Deal + Complete Review [2025]

- Monarch Money Deal: $50 for One Year (50% Off) [2025]

- Monarch Money 50% Off Deal: Complete Guide to Annual Budgeting [2025]

- Best Budgeting Apps 2025: Complete Guide After Mint Shutdown

- Monarch Money Budgeting App Review: Complete Guide [2025]

![Best Budgeting Apps: Monarch Money 50% Off Deal [2025]](https://tryrunable.com/blog/best-budgeting-apps-monarch-money-50-off-deal-2025/image-1-1769090894421.jpg)