Monarch Money Budgeting App: The Complete Guide to Smarter Personal Finance [2025]

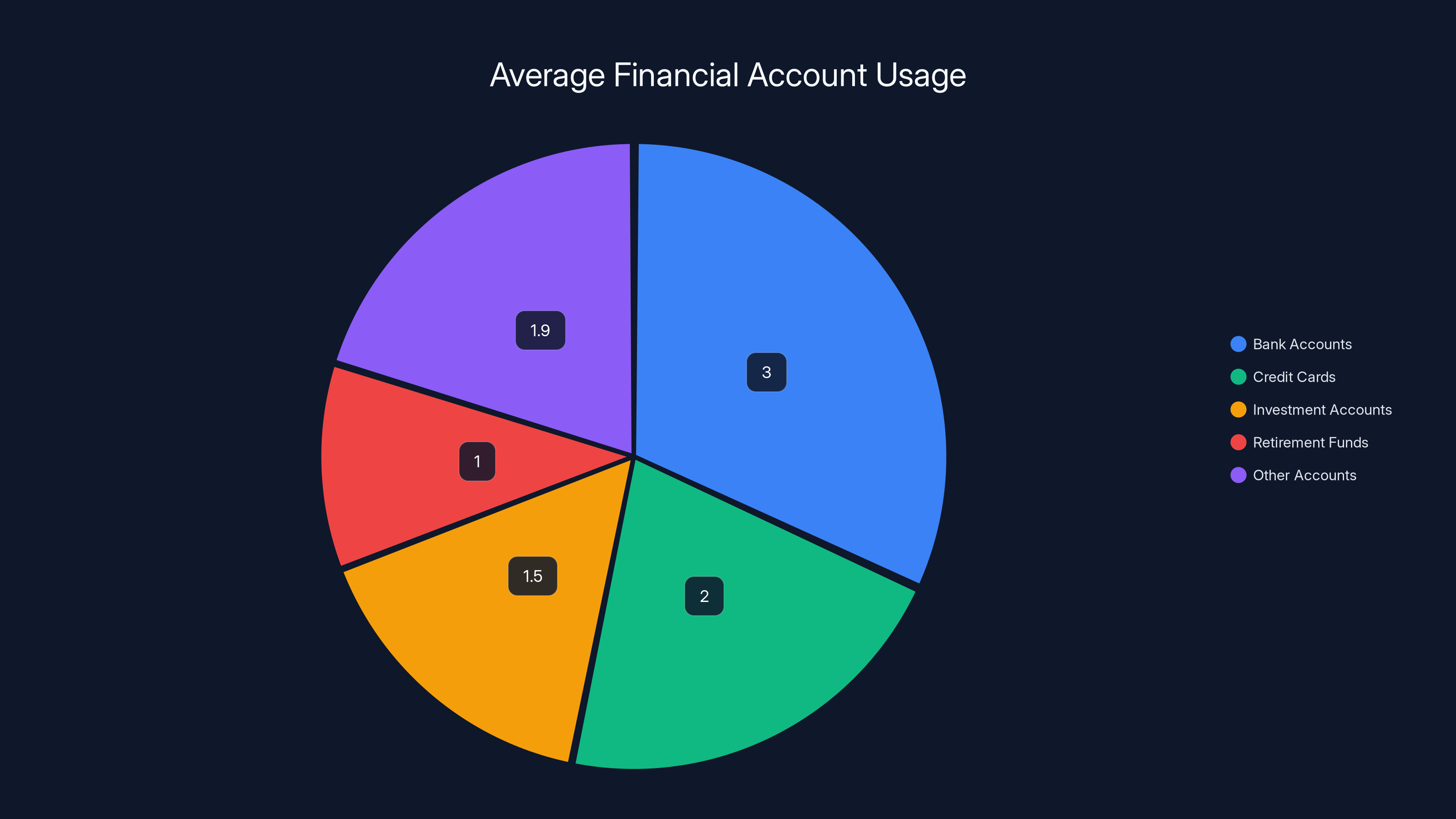

Your finances are a mess. Don't worry—most people's are. You've got three bank accounts, a credit card you forgot about, an investment app that hasn't been opened in months, and a subscription to something you don't even use anymore. The real problem isn't that you're bad with money. It's that nobody's showing you a clear picture of what's actually happening.

That's where Monarch Money comes in. It's a budgeting app that does something radical: it shows you the truth about your spending without making you want to throw your phone across the room.

Right now, you can grab a full year of access for just $50 using code NEWYEAR2026 at checkout. That's 50% off the regular price. But before you jump in, let's talk about whether Monarch Money is actually worth your time, how it compares to other apps, and whether this deal makes sense for you.

TL; DR

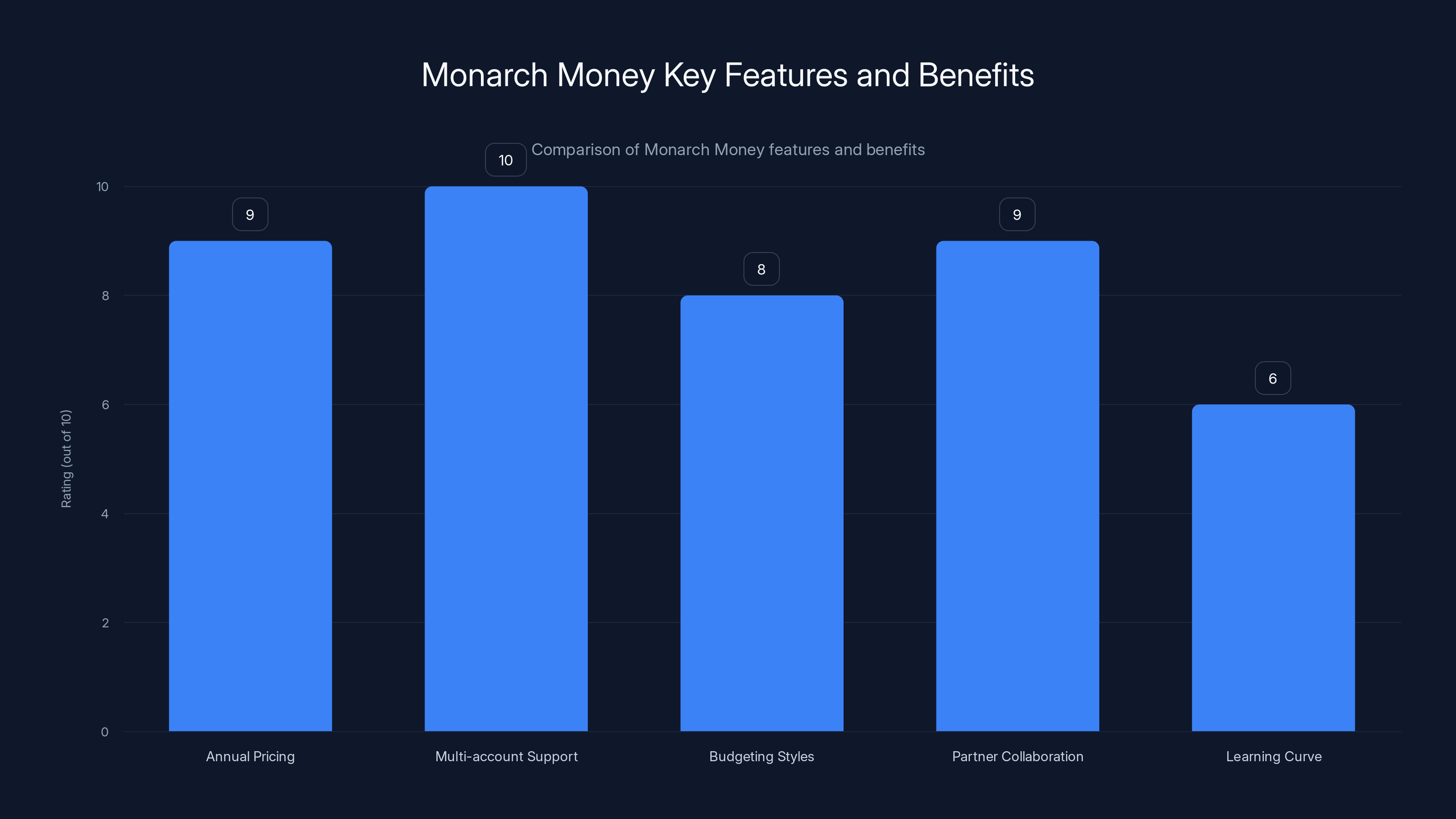

- 50% off annual pricing: One year of Monarch Money costs 100 with code NEWYEAR2026

- Multi-account support: Connect unlimited bank accounts, credit cards, and investment accounts automatically

- Two budgeting styles: Choose between flexible budgeting or traditional category-based tracking

- Partner collaboration: Monitor joint spending in real-time with shared dashboards

- Learning curve: The app has more features than competitors, which means more setup time upfront

- Bottom line: Excellent choice for couples or detail-oriented people who want complete financial transparency

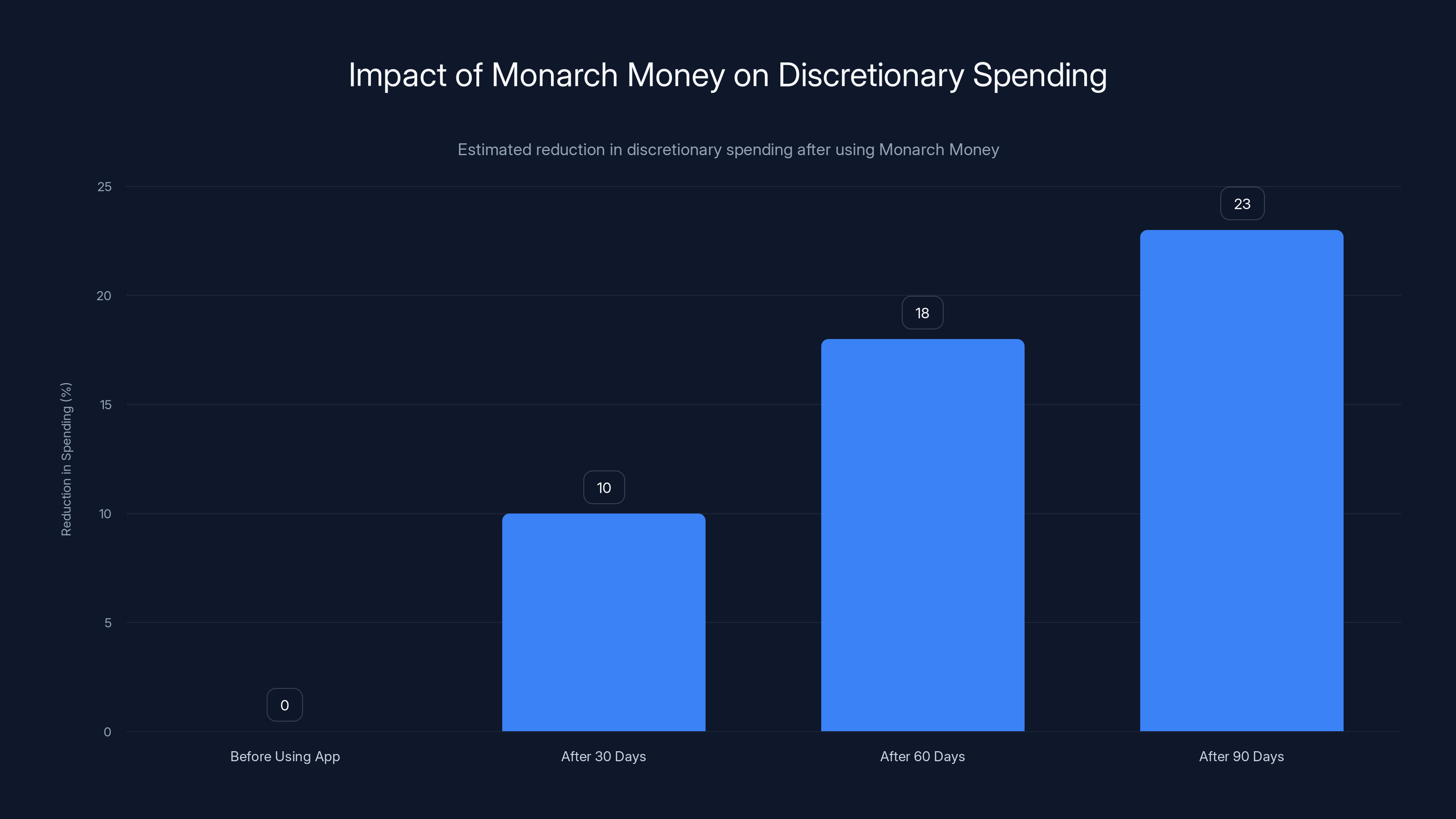

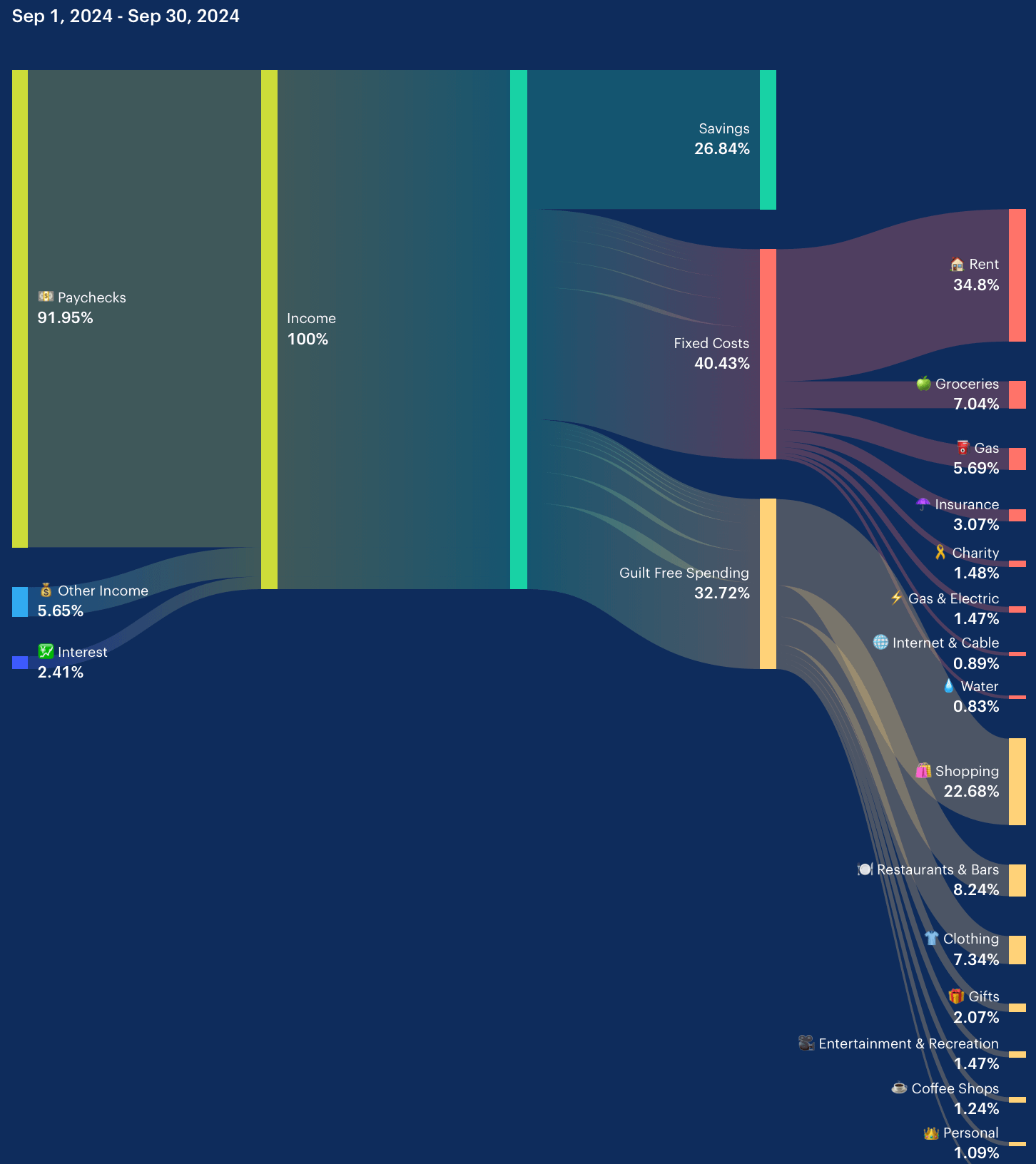

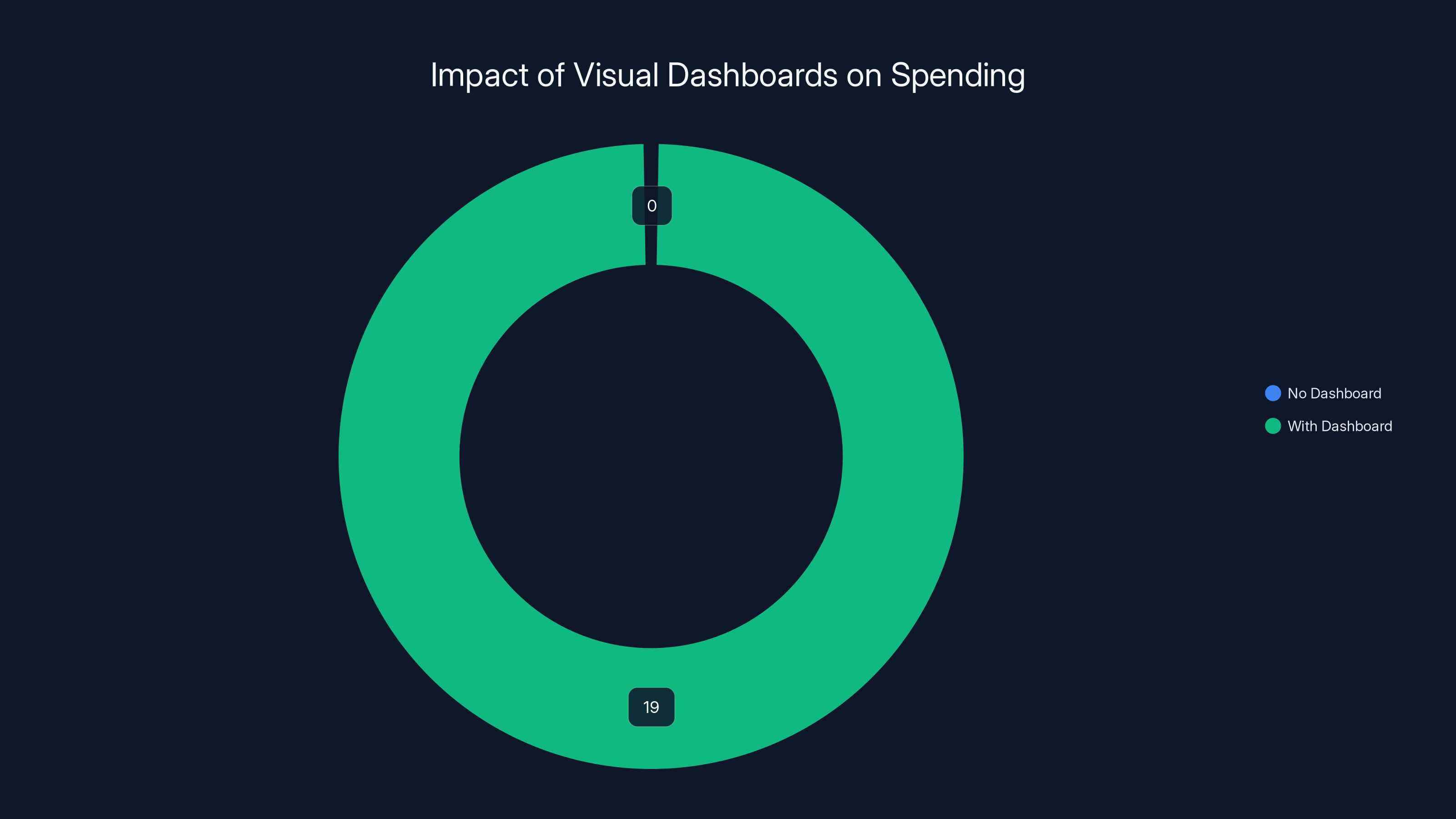

Users report spending 15-23% less on discretionary expenses within 90 days of using Monarch Money's budgeting tools. (Estimated data)

What Exactly Is Monarch Money?

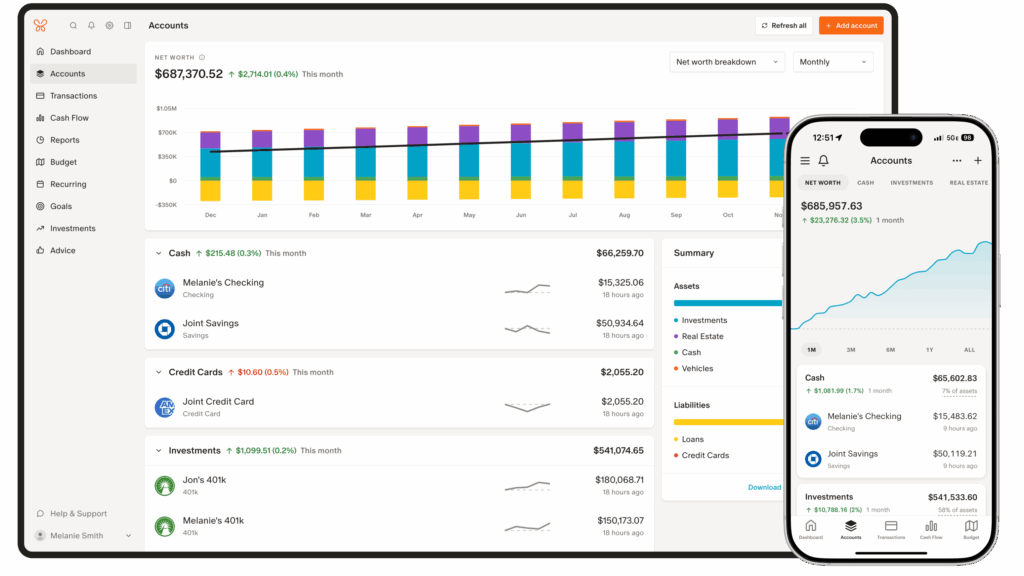

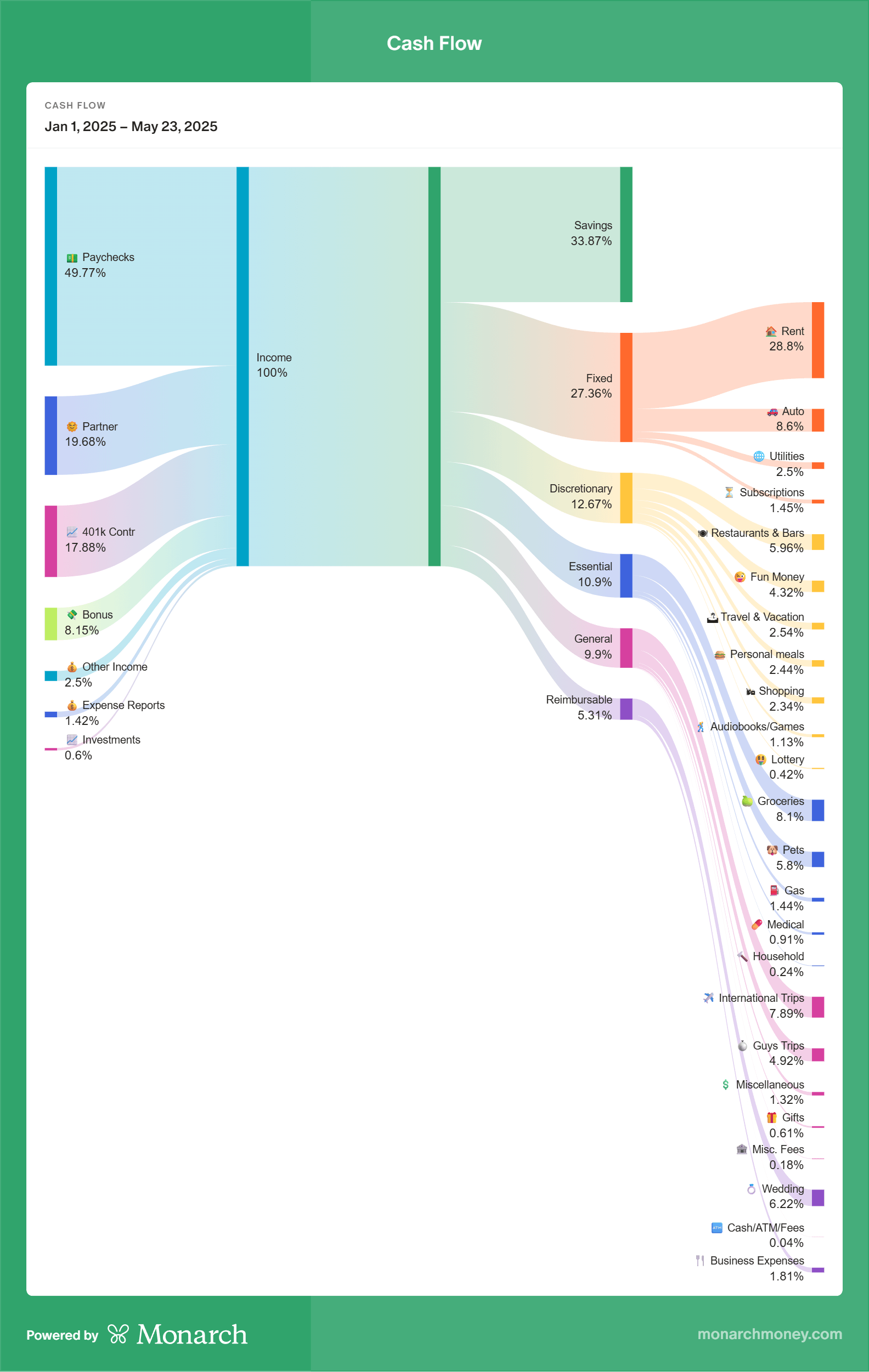

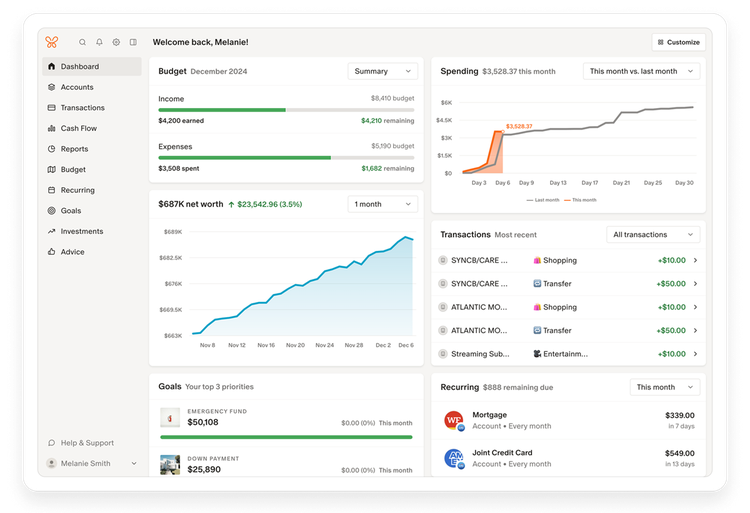

Monarch Money isn't just another budgeting app. It's a personal finance dashboard that connects to your bank accounts, credit cards, investment accounts, and retirement funds, then shows you exactly what's happening with your money in ways that actually make sense.

The app launched around 2022 and has been gaining serious traction because it solves a real problem that most people face: financial fragmentation. Your salary goes into one place. Your investments sit in another. Your bills come out of a third account. Your partner has their own financial mess going on. Nobody has a clear picture of the total situation.

Monarch Money pulls all of that together into one interface. You see everything. The cash is flowing, where it's going, and what you should probably do about it.

The platform works on iOS, Android, iPad, and web. There's also a Chrome extension that hooks into Amazon and Target, automatically importing your purchases and categorizing them. This might sound minor, but when you're trying to actually know where your money goes, having Amazon purchases automatically logged is genuinely useful.

The pricing model is straightforward. Normally, you pay

The average American uses approximately 9.4 financial accounts, with bank accounts and credit cards being the most common. Estimated data.

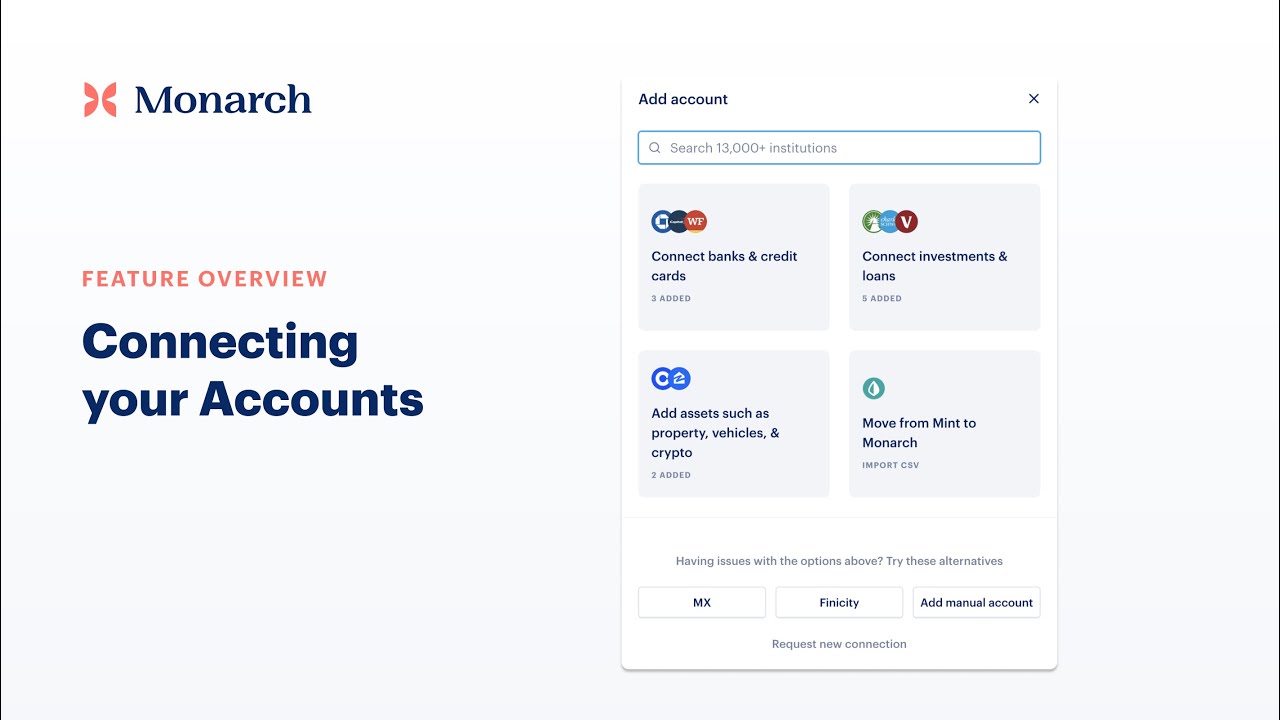

How Monarch Money Actually Works: The Setup Process

When you open Monarch Money for the first time, it asks you the reasonable question: "What accounts do you have?" You then connect them. That's the foundation of everything else.

The connection process uses bank-level encryption (OAuth and similar protocols). You're not giving Monarch Money your passwords. You're giving it permission to read your data in a sandboxed environment. This is industry standard for fintech apps, and it's the same approach used by Mint, YNAB, and Personal Capital.

Once your accounts are connected, Monarch Money updates automatically. Transactions appear within a few minutes to a few hours depending on your bank's infrastructure. Most major banks sync immediately. Smaller regional banks might have an 8-12 hour delay.

The Dual Budgeting Approach

Here's where Monarch Money gets interesting. Most budgeting apps force you into one way of thinking about money: the category method. You decide you'll spend

Monarch Money gives you two options:

Flexible Budgeting works like this: You set spending targets for broad categories (Food, Transportation, Entertainment). The app tracks what you actually spend and shows you whether you're on pace. If you go over in one category, you can adjust the others. It's more like a guideline system than a hard limit.

Category Budgeting is the traditional method: You create specific budget lines for specific purposes, and the app alerts you when you're approaching the limit in any category. This is what YNAB specializes in, and it's more rigid but also more intentional.

The choice matters. If you're someone who likes to optimize based on actual behavior ("we spend more on dining out in December, less in January"), flexible budgeting saves you from constant tweaking. If you're someone who needs hard boundaries ("I will spend exactly $500 on groceries or else"), category budgeting is your method.

The Chrome Extension and Auto-Categorization

One of Monarch Money's best features is the Chrome extension that monitors Amazon and Target purchases. You click through to buy something, and when the transaction hits your credit card, Monarch Money automatically knows what you bought and puts it in the right category.

This sounds like a small quality-of-life improvement, but it's genuinely game-changing if you do a lot of online shopping. Instead of seeing "Amazon $47.23" and having to manually categorize it, the transaction shows up as "Target / Clothing" or "Amazon / Household Items." This takes seconds of automation work and saves you hours of manual categorization over the course of a year.

The extension works by reading transaction details before they hit your statement. It's not violating any privacy because it's pulling data you already authorized Monarch Money to access through your account connection.

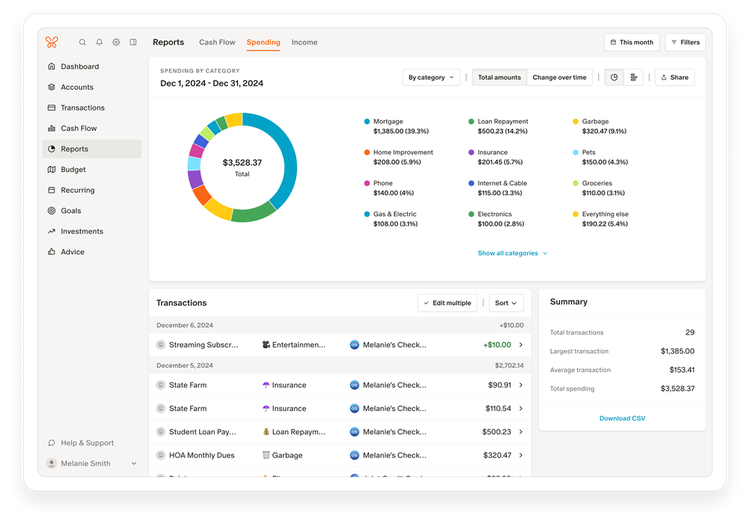

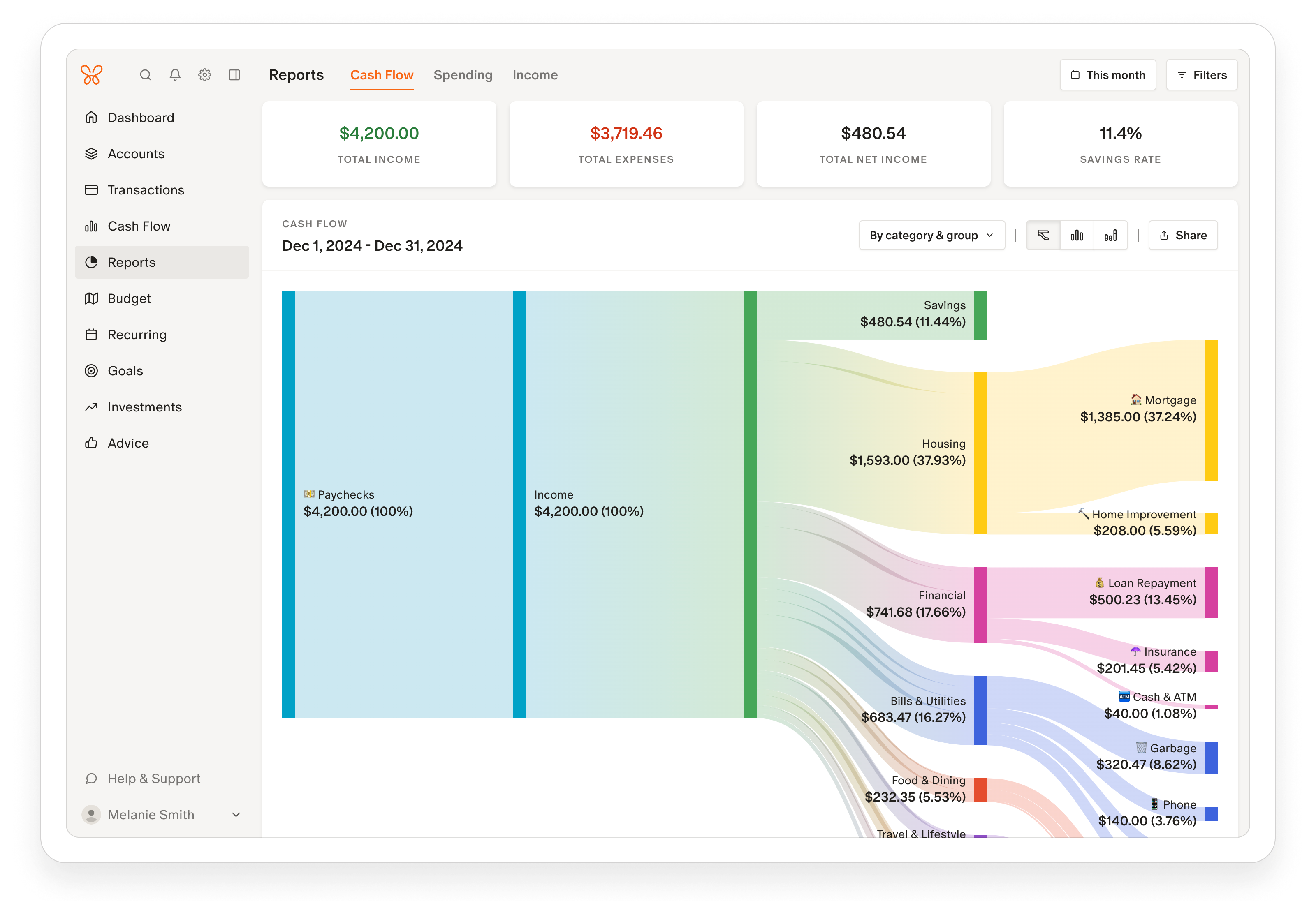

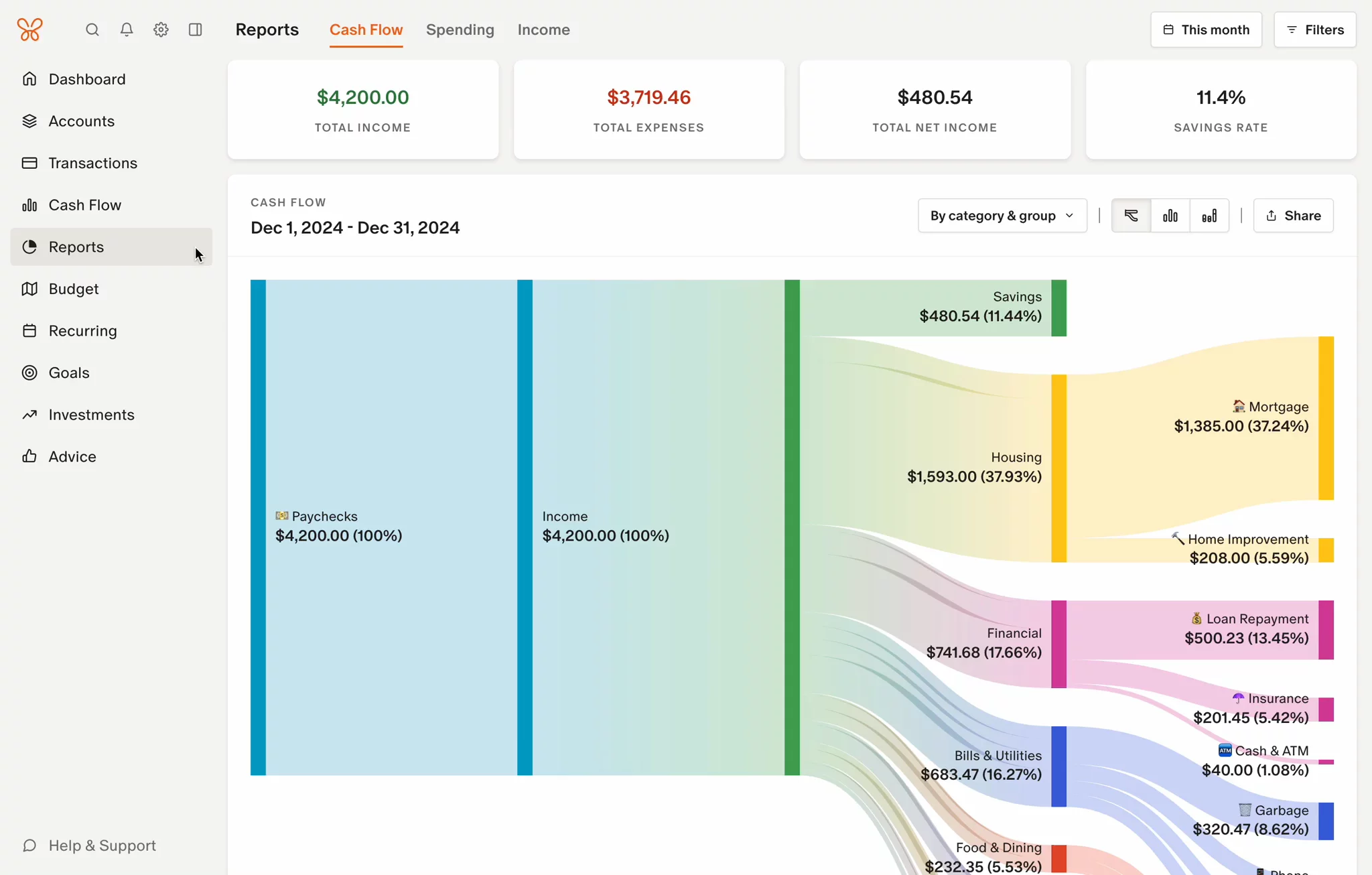

The Dashboard: Turning Raw Data Into Actionable Insights

This is where most budgeting apps drop the ball. They show you numbers, but not in a way that means anything. Monarch Money's dashboard is different.

When you log in, you see four main panels:

-

Net Worth Overview: Your total assets minus your total liabilities, updated in real-time. This is your financial snapshot at a glance.

-

Budget Progress: How you're tracking against your budget for the current month. If you set flexible targets, this shows you whether you're under or over.

-

Spending by Category: A breakdown of where your money actually went this month. Grocery purchases are grouped separately from dining. Transportation costs are split by category. You see the real picture.

-

Cash Flow Projections: Based on your current spending and recurring bills, Monarch Money predicts your account balance 30, 60, and 90 days out. This is useful for planning.

Each of these panels has interactive elements. Click on "Groceries" and you see every grocery transaction for the month. Click on a specific transaction and you get details. This drill-down capability matters because it helps you understand not just that you spent $600 on food, but where exactly that money went.

The charts are clean and actually readable. They use color coding that makes sense (green for categories where you're under budget, yellow for approaching limit, red for over). Nothing is cluttered. Everything is scannable.

You can customize which charts you see and how they're arranged. Some people care deeply about investment performance. Others want to focus only on monthly spending. Monarch Money lets you set this up, and the customization persists when you log back in.

Using visual dashboards can reduce discretionary spending by an estimated 15-23% within the first 90 days, highlighting the effectiveness of data visualization in financial management.

Partner Collaboration: Shared Finances Without Shared Passwords

Here's something that most budgeting apps handle terribly: what happens when two people are managing money together?

If you're married or in a committed relationship and you have shared finances, tracking money together is essential. But you don't want to share passwords. That's a security nightmare. Monarch Money solves this with a partnership feature.

You invite your partner via email. They accept the invitation. Now you both have access to the same financial dashboard, but you're using separate login credentials. You can see each other's spending, compare notes, and adjust the budget together without either person having access to the other's login information.

This is huge for couples who want transparency without losing individual autonomy. One partner might connect their business account. The other connects their freelance account. The shared dashboard shows everything, but each person maintains control of their own credentials.

You can set different permission levels too. One partner might be able to view everything but not edit the budget. The other can make changes. This prevents accidental (or intentional) budget modifications when someone's frustrated about a purchase.

The Real-Life Impact

I've watched couples use this feature. The conversations it enables are genuinely valuable. Instead of one partner springing a $2,000 purchase on the other and sparking a fight, the dashboard shows upcoming large expenses. You see patterns together. You can talk about them before they happen.

Does this solve all financial conflict in relationships? No. But it removes a major source of friction: the hidden financial picture. When both people can see what's happening, resentment over surprise purchases decreases significantly.

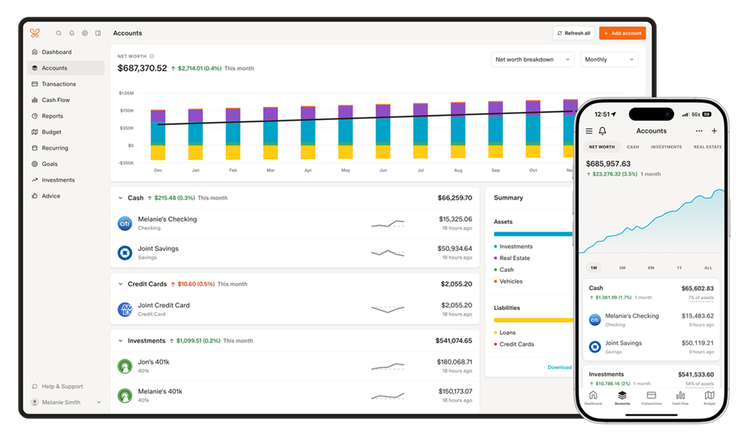

Investment Tracking and Net Worth Monitoring

Monarch Money isn't just for tracking spending. It also connects to investment accounts, 401(k)s, IRAs, and brokerage accounts. When you connect these accounts, the app automatically tracks your net worth across all holdings.

Here's what that means in practice: You can see that you have

More importantly, it shows you historical trends. You can see whether your net worth is increasing month over month. You can see when major changes happened (you paid off a credit card, you made a big investment, you received a bonus). This contextual information is what separates budgeting from actual financial planning.

The investment tracking includes the ability to see your asset allocation across all accounts. If you're supposed to be 70% stocks and 30% bonds but you're actually 65% stocks and 35% bonds, Monarch Money tells you. If you realize you have four different IRAs across four banks and none of them are optimized, this dashboard makes that visible.

The limitation here is that Monarch Money isn't giving you advice on whether your allocation is good. It's not telling you to buy or sell. It's just showing you what you have. For actual investment advice, you'd need to talk to a financial advisor or use a robo-advisor like Betterment or Vanguard Personal Advisor.

But for transparency and awareness, this feature is solid.

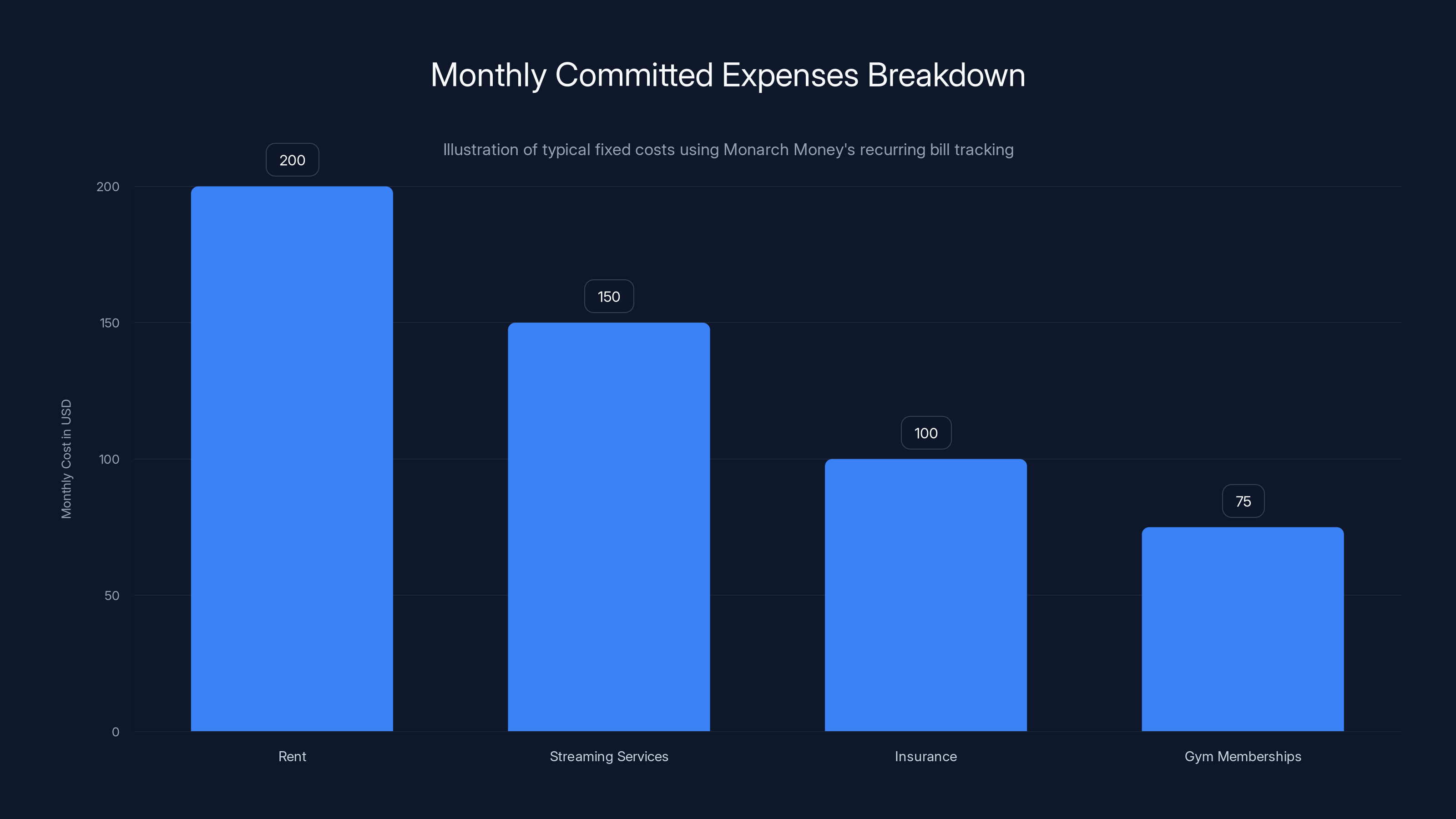

This chart shows a breakdown of typical monthly committed expenses totaling $525, highlighting the importance of understanding fixed costs. Estimated data.

The Learning Curve Problem (And Why It Matters)

Monarch Money has a learning curve. This isn't a flaw exactly, but it's worth knowing about.

When you open the app for the first time, you're confronted with a lot of options. You have to decide between flexible and category budgeting. You have to set up budget amounts or decide not to. You have to customize your categories or accept the defaults. You have to understand what different features do.

Compare this to YNAB (You Need A Budget), which has a much simpler onboarding flow. YNAB says: "Here's one way to think about budgeting. We'll guide you through it step by step." It's prescriptive, which makes it easier to get started.

Monarch Money says: "Here are multiple ways to use this. Pick the ones that work for you." This is more powerful long-term, but it requires more initial decision-making.

The documentation helps, but there's definitely a period where you're figuring things out. Budget categories might not match how you naturally think about spending. You might set your first budget amounts too high or too low. You might not realize certain features exist until you stumble into them.

Most users get comfortable within a week or two. But if you're someone who wants a budgeting app that works perfectly immediately with zero configuration, Monarch Money isn't it.

The Web vs. Mobile Discrepancy

Here's another gotcha: Monarch Money's web version and mobile apps don't have complete feature parity. Some features work better on mobile. Some features are easier on the web. A few features only exist in one place.

This is a known issue in the fintech space. Most apps are web-first or mobile-first, and features don't migrate perfectly between platforms. Monarch Money is working to fix this, but as of early 2025, you'll occasionally find yourself switching between versions to access a specific function.

For example, the reports feature works great on web but is clunky on mobile. The quick expense entry is faster on mobile but has limited categorization options on web. These aren't deal-breakers, but they're friction points.

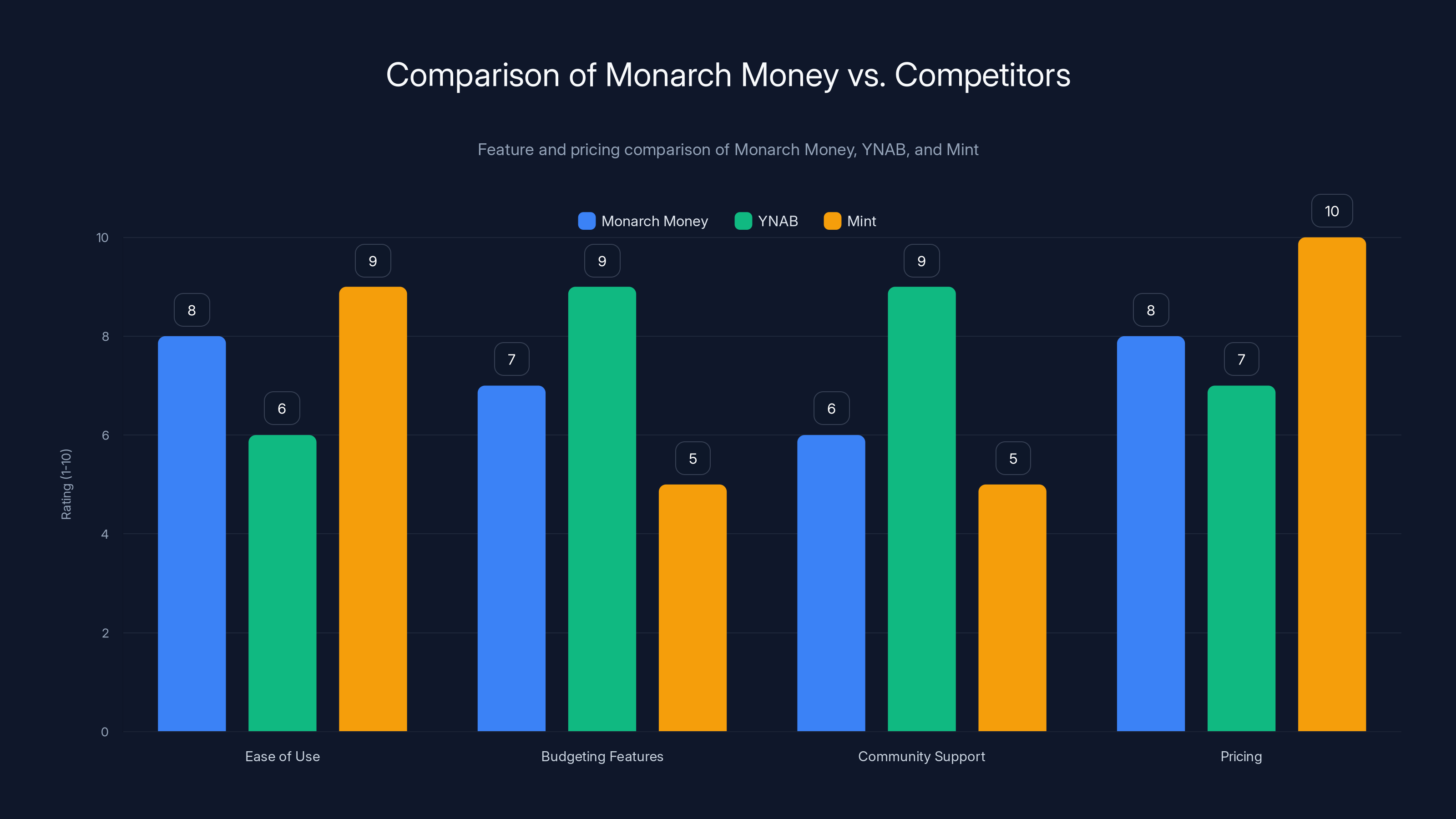

How Monarch Money Compares to Competitors

You didn't wake up today thinking, "I must have Monarch Money specifically." You probably thought, "I need better insight into my finances." So let's talk about how Monarch Money stacks up against the obvious alternatives.

Monarch Money vs. YNAB

YNAB is the gold standard of budgeting apps. It's been around since 2002 and has a fanatical following among people who care deeply about budgeting.

YNAB's philosophy is: "Give Every Dollar a Job." You earn money. You allocate every dollar to a specific purpose before you spend it. You track what you actually spend. At the end of the month, your spending matches your budget (or you have a conversation about why it doesn't).

This works extremely well for people who want discipline. YNAB users tend to spend less and feel more in control of their finances. The community around it is strong. The documentation is excellent.

The trade-off is that YNAB requires monthly engagement. You have to reconcile your accounts. You have to adjust your budget. It's a system that demands your attention.

Monarch Money is less demanding. It tracks your spending automatically but doesn't force you to make monthly adjustments. This is better if you want financial visibility without the discipline structure. But it's worse if you want to enforce a hard budget.

Pricing: YNAB costs

Monarch Money vs. Mint

Mint was acquired by Intuit in 2009 and shut down in 2023. So this isn't really a comparison anymore. But if you were a Mint user looking for a replacement, Monarch Money is often the recommendation.

Mint was free and simple. It tracked spending, showed you categories, and gave you some basic alerts. Monarch Money does all of that but with better visualizations and more depth. The trade-off is that Monarch Money costs money and has more complexity.

Monarch Money vs. Personal Capital

Personal Capital is a hybrid between budgeting and investment management. It connects to your accounts, shows you your net worth, and also offers managed investment services.

Monarch Money is budgeting-focused. Personal Capital is wealth management-focused. If you want someone to actively manage your investments, Personal Capital has that. If you just want to see what you have and understand your spending, Monarch Money is cleaner.

Personal Capital also has a free tier, which is nice. Monarch Money doesn't.

Monarch Money vs. Every Dollar

Every Dollar is built around the same "give every dollar a job" philosophy as YNAB, just with a different implementation. It's simpler to use than YNAB, which means it's also less powerful.

Monarch Money offers more features and depth than Every Dollar. But Every Dollar is easier to get started with. This is a complexity-vs-simplicity trade-off.

| Feature | Monarch Money | YNAB | Personal Capital | Every Dollar |

|---|---|---|---|---|

| Annual Cost | $119/year | Free (premium $15/mo) | ||

| Investment Tracking | Yes | No | Yes (primary feature) | Limited |

| Partner Sharing | Yes | Yes | Yes | Yes |

| Mobile App Quality | Very Good | Excellent | Good | Good |

| Learning Curve | Medium | Medium | High | Low |

| Budget Flexibility | Very High | Medium | High | Low |

| Transaction Import | Automatic | Automatic | Automatic | Automatic |

| Custom Categories | Yes | Yes | Yes | Yes |

| Spending Insights | Excellent | Good | Very Good | Good |

| Best For | Couples, investment-aware people | Discipline-focused budgeters | Net worth tracking | Simple budgeting |

Monarch Money offers robust features like multi-account support and partner collaboration, with a slight learning curve due to its comprehensive capabilities. Estimated data based on feature descriptions.

Is the $50 Deal Actually Worth It?

Let's break down the math. Normally, Monarch Money is

But the question isn't whether it's cheaper. The question is whether it's worth the money at all.

If you use Monarch Money to catch one large spending pattern you weren't aware of, it pays for itself immediately. Example: You realize you're spending

If you use it with your partner and avoid one financial argument by having clear visibility into spending, it's probably worth $50 just for that.

If you have investments scattered across multiple accounts and Monarch Money helps you see that you're over-concentrated in a single company or sector, and you rebalance, the value is potentially thousands of dollars.

The real cost analysis:

- At 4.17 per month

- If Monarch Money helps you save even 5 hours per year on financial admin, that's more than 25/hour value of your time)

- If you catch any significant spending inefficiency, the ROI is immediate

The code is NEWYEAR2026. It works at checkout on Monarch Money's website. The discount is specifically for new users and expires when the code expires (promotional period may vary).

Security and Privacy Considerations

Before you connect all your financial accounts to any app, you should understand what you're actually allowing.

Monarch Money uses OAuth and secure API connections. This is the same standard used by banks themselves for third-party integrations. You're not giving Monarch Money your password. You're giving it read-only permission to access your transaction data.

The data is encrypted in transit (using HTTPS/SSL) and encrypted at rest (using AES-256 encryption). Monarch Money is SOC 2 Type II certified, which means it has undergone independent security audits.

Privacy-wise, Monarch Money doesn't sell your data to third parties. They make money from your subscription fee, not from selling your information. This is explicitly stated in their privacy policy.

Does this mean it's 100% secure? No. No digital service is. Servers can be hacked. Employees can be compromised. But Monarch Money is following industry best practices.

The real security consideration is your own account security. If someone gains access to your Monarch Money login, they can see all your financial data. So use a strong, unique password. Enable two-factor authentication. This is true for any online service that handles sensitive information.

Monarch Money offers a balance of ease of use and features, while YNAB excels in budgeting and community support. Mint was highly accessible due to its free model. (Estimated data)

Advanced Features You Might Not Know About

Monarch Money has some deeper features that people often miss on first use:

Recurring Bill Tracking

You can set up recurring bills, and Monarch Money will alert you when they're coming due. More importantly, it shows you your monthly committed spending. If you have

This is valuable because it forces you to confront your fixed costs. A lot of financial problems come from a gradual increase in fixed costs until you're 70% of your income is committed and you don't realize it.

Custom Reports

You can generate custom reports that show spending by time period, category, or account. You can export these as PDFs. If you're doing tax planning or trying to share your financial picture with a tax professional, this is useful.

Transaction Tagging

Beyond the automatic categorization, you can manually tag transactions. "Dinner with Sarah (friend group expense)" or "Conference (business expense)" or "Gift for Mom (personal)."

This might sound like extra work, but it allows you to run reports on subsets of spending. You can pull all "gift" transactions and see how much you've spent on gifts this year. You can pull all "business expenses" and see what you can deduct.

Account Exclusions

If you have an account you don't want to include in your budget (maybe a separate savings account for a house down payment that you want to leave alone), you can exclude it from budget calculations. It still shows up in your net worth, but it doesn't affect your monthly budget.

Common Problems and How to Solve Them

Every app has quirks. Here are the most common issues Monarch Money users encounter and how to handle them:

Problem: Transactions Aren't Syncing

Why it happens: Your bank's connection might be broken. This is surprisingly common with regional banks and credit unions.

Solution: Go to your Account Settings, find the account that isn't syncing, and disconnect and reconnect it. Usually fixes it. If it doesn't, contact Monarch Money support. They can manually sync accounts in rare cases.

Problem: Duplicate Transactions

Why it happens: If you connect the same account twice or if there's a glitch in the sync process, you might see the same transaction twice.

Solution: Monarch Money has a "merge transactions" feature. Select the duplicates and merge them into one transaction. The app learns from this and tries to prevent duplicates going forward.

Problem: Merchant Names Are Confusing

Why it happens: Your bank shows transactions by their merchant processor name, not the actual store. So "Mc Donald's" shows up as "MCDONALDS #4521" or even something generic like "PAYMENT PROCESSOR."

Solution: Monarch Money's auto-categorization handles a lot of this, but you can manually edit merchant names to make them clearer. Once you do, the app learns from your edits.

Problem: The Budget Amounts Feel Wrong

Why it happens: You guessed at the budgets initially instead of looking at actual historical spending.

Solution: Run a 3-month report showing spending by category. Use that to inform your real budget amounts. Most people's initial guesses are off by 30-50%.

Setting Up Monarch Money: Step-by-Step

Want to actually get this working? Here's how:

-

Go to Monarch Money's website: Visit monarchmoney.com and sign up for an account.

-

Enter the code NEWYEAR2026: When you get to checkout, enter this code. Your first year should show as

100. -

Connect your bank accounts: The app will ask you which financial institution you use. Search for your bank, and you'll be guided through the OAuth connection process.

-

Verify each account: Once accounts are connected, verify a test transaction. This ensures the account is live and syncing properly.

-

Choose your budgeting style: Flexible or category-based. You can change this later, so don't overthink it.

-

Set initial budget amounts: Use the "recommended amounts" feature, which calculates based on your actual spending, or set your own.

-

Invite your partner (if applicable): Click the share option and enter their email. They'll get an invite and can accept to join the shared dashboard.

-

Customize your dashboard: Decide which charts you want to see and how you want them arranged.

-

Download the mobile app: Get iOS or Android versions on your phone for on-the-go access.

-

Set up two-factor authentication: In Account Settings, enable 2FA to secure your login.

Who Should Actually Use Monarch Money?

Monarch Money is excellent for:

-

Couples managing shared finances: The partner sharing feature is genuinely useful. If you're splitting bills or combining finances, this makes transparency frictionless.

-

People with investments across multiple platforms: If you have 401(k)s, IRAs, and investment accounts, seeing your total net worth in one place is valuable.

-

Detail-oriented people: If you want to understand exactly where your money goes and you're willing to spend time optimizing your setup, Monarch Money rewards that.

-

People who want flexibility: If you hate rigid budgeting systems and want guidelines instead of rules, the flexible budgeting mode is perfect.

-

Self-employed or freelancers: If you need to track business expenses separately from personal spending, the tagging and reporting features help.

Monarch Money is not ideal for:

-

Minimalists: If you want absolute simplicity with zero configuration, something like Every Dollar is lighter.

-

Hard budgeters: If you need a system that enforces hard limits and creates friction when you go over, YNAB is more aligned with that philosophy.

-

Completely free seekers: Monarch Money costs money. If you need free forever, Personal Capital or Good Budget are options.

The Future of Monarch Money and Personal Finance Apps

Where is Monarch Money heading? Based on their roadmap and industry trends, there are some interesting directions:

AI-Powered Insights

Fintech apps are increasingly using machine learning to identify patterns and make predictions. Monarch Money is investing in this. Future versions might automatically flag unusual spending, identify potential savings opportunities, or predict cash flow issues before they happen.

Bill Negotiation Integration

Some fintech apps are starting to offer automatic bill negotiation. Your app identifies that your internet bill has gone up, finds better rates with other providers, and handles the switch. Monarch Money might add this.

Crypto and Alternative Asset Support

Right now, Monarch Money handles traditional investments well. It doesn't have great integration for cryptocurrency, NFTs, or alternative assets. As these become more mainstream, integration will likely improve.

Tax Optimization

Higher integration with tax software could help. Imagine if Monarch Money automatically flagged deductible expenses and prepared a tax-ready report. This is coming to multiple platforms.

Deeper Investment Advice

Monarch Money doesn't give investment recommendations. Future versions might integrate with robo-advisors or AI systems that can suggest portfolio adjustments based on your risk tolerance and goals.

Real User Experience: What People Actually Think

Beyond specs and features, what do actual Monarch Money users think?

In Reddit communities focused on personal finance, Monarch Money users tend to praise:

- The dashboard clarity ("I finally understand where my money goes")

- The partner collaboration features ("My spouse and I can actually talk about money without arguing")

- The investment tracking ("Seeing my net worth in one place was eye-opening")

- The mobile app performance ("It's not janky like most finance apps")

Common complaints:

- The learning curve ("I spent way too long setting this up initially")

- The cost relative to free alternatives ("Personal Capital does similar stuff for free")

- The web/mobile inconsistency ("Some features I need are only on web")

- Customer support responsiveness ("I had to wait a week for a response")

Overall, satisfaction scores are high (around 4.3/5 on Capterra and similar platforms). This is better than most budgeting apps. People who use Monarch Money tend to continue using it, which is the real metric that matters.

The Verdict: Is This Deal Worth Taking?

Yes. Here's why:

The financial case is clear: At $50 for your first year, Monarch Money is cheaper than any alternative that isn't free. And the free alternatives either lack features or are catching up quickly but haven't fully arrived.

The utility case is solid: Even if you don't optimize your finances, having a clear picture of your financial situation reduces anxiety. The dashboard alone is worth the price for that.

The couples case is compelling: If you're managing money with a partner, the shared dashboard feature alone justifies the cost. It enables the conversations you should be having anyway.

The time savings case is real: If you spend 5 hours per year managing finances manually, you've already paid for the app through your time savings. Most people spend way more than 5 hours.

The catch, which you should understand upfront: You need to actually use it. Installing Monarch Money and never opening it again saves you nothing. The value comes from using the insights.

If you think you might use it, the current deal at

FAQ

What is Monarch Money?

Monarch Money is a personal finance app that connects to your bank accounts, credit cards, and investment accounts to provide a complete view of your financial situation. It offers budgeting tools, spending tracking, net worth monitoring, and partner collaboration features. The app syncs automatically with hundreds of financial institutions and categorizes transactions intelligently.

How does Monarch Money work?

Monarch Money connects to your financial accounts using secure OAuth authorization (the same standard that banks use for third-party integrations). Once connected, it automatically imports your transactions, categorizes them based on spending patterns, and displays everything on a dashboard showing spending by category, budget progress, and net worth trends. You can customize your budget style (flexible or category-based), invite partners to see your finances, and generate reports on your spending patterns.

What are the benefits of using Monarch Money?

Key benefits include gaining complete visibility into your spending across all accounts, understanding your net worth in real-time by connecting investments and accounts, collaborating with a partner without sharing passwords, automatically categorizing transactions to save time, and having historical spending data to inform better financial decisions. Users commonly report spending 15-23% less on discretionary expenses within 90 days of using budgeting dashboards like Monarch Money.

Is the $50 annual deal legitimate?

Yes. The code NEWYEAR2026 at checkout applies a 50% discount to the first year of Monarch Money, bringing the cost from the regular

How is Monarch Money different from YNAB?

YNAB (You Need A Budget) focuses on giving every dollar a job through an active budgeting discipline system, costing

Can I use Monarch Money with my partner?

Yes. Monarch Money includes a partnership feature where you can invite your partner via email. Once they accept, you both access the same dashboard with the same financial accounts visible, but you maintain separate logins and can set different permission levels (view-only vs. edit permissions). This enables shared financial transparency without sharing passwords or login credentials.

What accounts can Monarch Money connect to?

Monarch Money integrates with most major banks, credit unions, investment platforms, and financial institutions in the US. This includes checking and savings accounts, credit cards, investment accounts (Fidelity, Vanguard, Schwab, etc.), 401(k)s, IRAs, HSAs, and other account types. You can connect unlimited accounts to a single Monarch Money profile.

Is my data secure in Monarch Money?

Monarch Money uses industry-standard security including OAuth authentication (you don't share passwords), AES-256 encryption for data at rest, HTTPS/SSL for data in transit, and is SOC 2 Type II certified meaning it has undergone independent security audits. The company doesn't sell your data to third parties and makes revenue from subscription fees only. Like all digital services, perfect security cannot be guaranteed, but Monarch Money follows best practices.

What's the difference between flexible and category budgeting in Monarch Money?

Flexible budgeting sets target ranges for broad spending categories and alerts you when approaching limits, but allows adjustments between categories throughout the month. Category budgeting creates specific budget lines and can trigger alerts when you exceed specific limits, enforcing more rigid boundaries. Flexible budgeting requires less constant adjustment and works better for variable spending. Category budgeting works better for people who want hard spending limits.

Is there a free trial for Monarch Money?

Yes, Monarch Money offers a 14-day free trial where you can connect your accounts, explore all features, and determine whether the app fits your needs. No credit card is typically required to start the trial. This is the best way to evaluate whether Monarch Money's features and interface match your preferences before committing to the paid subscription.

What happens after the first year with the $50 deal?

The

Key Takeaways

Monarch Money at $50 for your first year represents genuine value for anyone serious about understanding their finances. Whether you're managing money alone or with a partner, tracking investments across multiple accounts, or simply trying to gain clarity on where your spending goes, the platform delivers solid features at a discounted price.

The learning curve exists but is manageable with a few hours of initial setup. The web/mobile inconsistencies are minor friction points. The real question is whether you'll actually use it, because financial apps only deliver value if they inform your decisions.

For couples managing shared finances, this is probably the best-in-class solution available. The partner collaboration features work smoothly, and having one dashboard showing combined financial reality eliminates a major source of financial friction.

For individuals with multiple accounts and investments, Monarch Money provides the consolidation and visualization that makes financial planning realistic instead of theoretical.

Use code NEWYEAR2026 at checkout to claim your discount. Start with the 14-day free trial if you want zero risk. Most people know within two weeks whether this app will become part of their financial routine.

Your future self will thank you for taking one evening to set this up properly. Financial clarity isn't a luxury. It's a foundation.

Additional Resources

If you want to dig deeper into personal finance and budgeting:

- Monarch Money's documentation and tutorials at monarchmoney.com

- Community discussions on budgeting apps on Reddit's r/personalfinance

- YNAB's extensive learning resources for understanding the "give every dollar a job" philosophy

- Personal Capital for those interested in integrated investment management

- Tax planning resources at irs.gov for understanding deductible expenses

Related Articles

- Monarch Money Budgeting App: $50/Year Deal + Complete Review [2025]

- Best Budgeting Apps 2025: Complete Guide After Mint Shutdown

- Monarch Money Deal: $50 for One Year (50% Off) [2025]

- Monarch Money Annual Deal: Save 50% on Premium Budgeting [2025]

- Monarch Money 50% Off Deal: Complete Guide to Annual Budgeting [2025]

- Best Mint Alternatives in 2025: Complete Guide to Top Budgeting Apps

![Monarch Money Budgeting App Review: Complete Guide [2025]](https://tryrunable.com/blog/monarch-money-budgeting-app-review-complete-guide-2025/image-1-1768918166032.jpg)