Monarch Money Annual Deal: Save 50% on Premium Budgeting [2025]

TL; DR

- 50% discount available: New users can grab a year of Monarch Money for 100) with code NEWYEAR2026

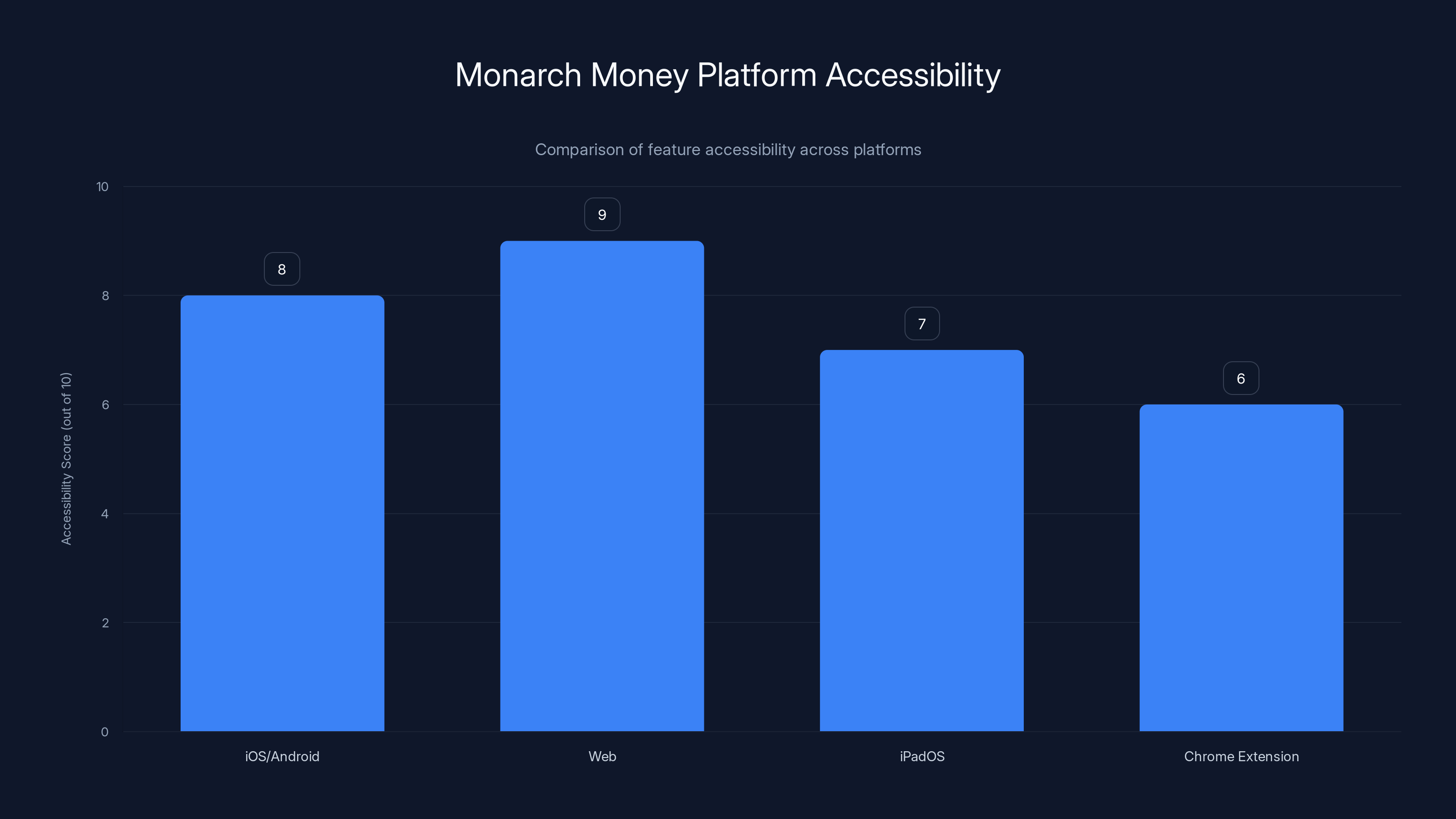

- Multi-platform access: Available on iOS, Android, iPadOS, web, and Chrome extension for seamless money tracking

- Collaborative features: Track spending alongside partners in real-time for joint financial planning

- Flexible budgeting: Choose between flexible or category-based budgeting approaches that match your lifestyle

- Learning curve trade-off: Powerful features come with some initial complexity in the interface and setup process

The NEWYEAR2026 discount code reduces the annual subscription cost of Monarch Money from

Introduction: Why This Budget App Discount Matters Right Now

The new year hits different when you're actually prepared for it. Most people make vague resolutions about "saving more money," then abandon them by February because they never set up a real system. The difference between people who build wealth and people who don't? Usually comes down to this single habit: tracking where your money actually goes.

Here's the uncomfortable truth: you probably have no idea how much you're spending on subscriptions, dining out, or "miscellaneous" categories each month. The average American underestimates their spending by about 25 percent. That's not a character flaw—it's just what happens when you're swiping cards and tapping phones instead of writing checks.

This is where budgeting apps change the game. Instead of maintaining a spreadsheet (which 98% of people abandon after three weeks), you get a system that connects to your bank accounts, categorizes transactions automatically, visualizes your spending patterns, and tells you whether you're on track. It's passive, accurate, and surprisingly motivating when you see the numbers.

Monarch Money sits near the top of the budgeting app landscape, and right now you can get a full year of access for

But before you jump in, you need to understand what you're getting. What makes Monarch Money stand out? Where does it excel, and where does it stumble? How does it compare to alternatives? And most importantly, is this the right tool for your specific situation?

This guide walks you through everything.

What Is Monarch Money and How Does It Actually Work

Monarch Money is a personal finance management platform that connects to your financial institutions and gives you a comprehensive view of your money. Think of it as the control panel for your finances that your bank won't give you.

You start by connecting your checking account, savings accounts, credit cards, investment accounts, and sometimes loan accounts. The app uses bank-level encryption and industry-standard connections (through Plaid, the same infrastructure that dozens of fintech apps use) to pull transaction data. You're not handing over your passwords—you're granting the app permission to read and categorize your transactions.

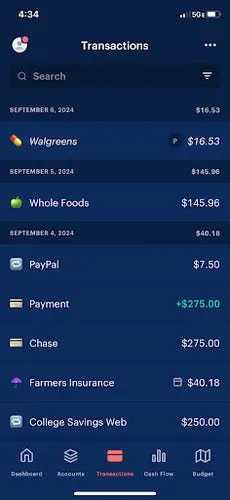

Once connected, Monarch Money's algorithms do something interesting: they automatically categorize every transaction. That $47.83 Whole Foods charge? It sees "groceries." Your Amazon purchase? It might tag it as "shopping" or "household," depending on what you bought. Your Spotify charge? "Subscriptions." This automation saves you from the tedious job of manually sorting thousands of transactions.

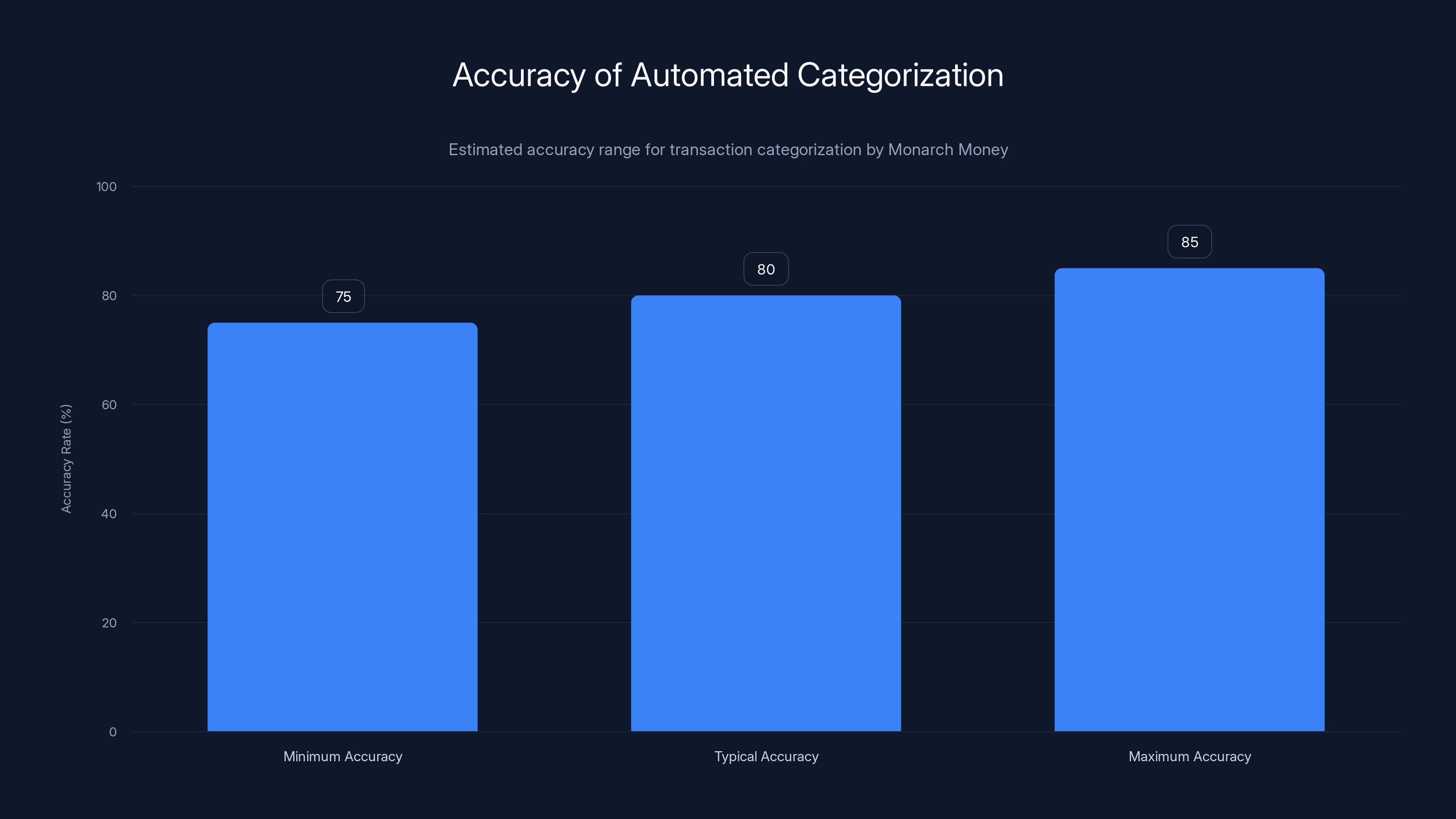

The categorization isn't perfect—you'll spend time recategorizing things—but it gets you about 80% of the way there on day one. That's the baseline work already done.

From there, Monarch Money offers two distinct budgeting philosophies, and this choice matters for how you'll actually use the tool.

The Two Budgeting Approaches: Flexible vs. Category-Based

Flexible budgeting is less rigid. You set monthly spending targets by category, but you're not penalized for going over. The app shows you visually where you stand—you've spent 65% of your entertainment budget, 102% of your food budget—and lets you decide whether to adjust spending or accept the overage. It's psychological, not restrictive. It works well for people who find hard limits stressful or unrealistic.

Category budgeting is traditional envelope budgeting reimagined for the digital age. You allocate fixed amounts to each category monthly. Once you hit the limit, the app alerts you. You can't overspend without explicitly choosing to do so. It works better for people who need firm guardrails and want to know exactly where every dollar is allocated.

Neither is objectively better. One works for your brain, the other might work for your partner's. The fact that Monarch offers both means you can actually choose what fits your real behavior, not what some productivity guru thinks you should do.

The mobile and web apps function as your interface to this system. The Chrome extension adds another layer: when you're shopping on Amazon or Target, it can auto-sync your purchases and categorize them in real-time. That's one less thing to manually import later.

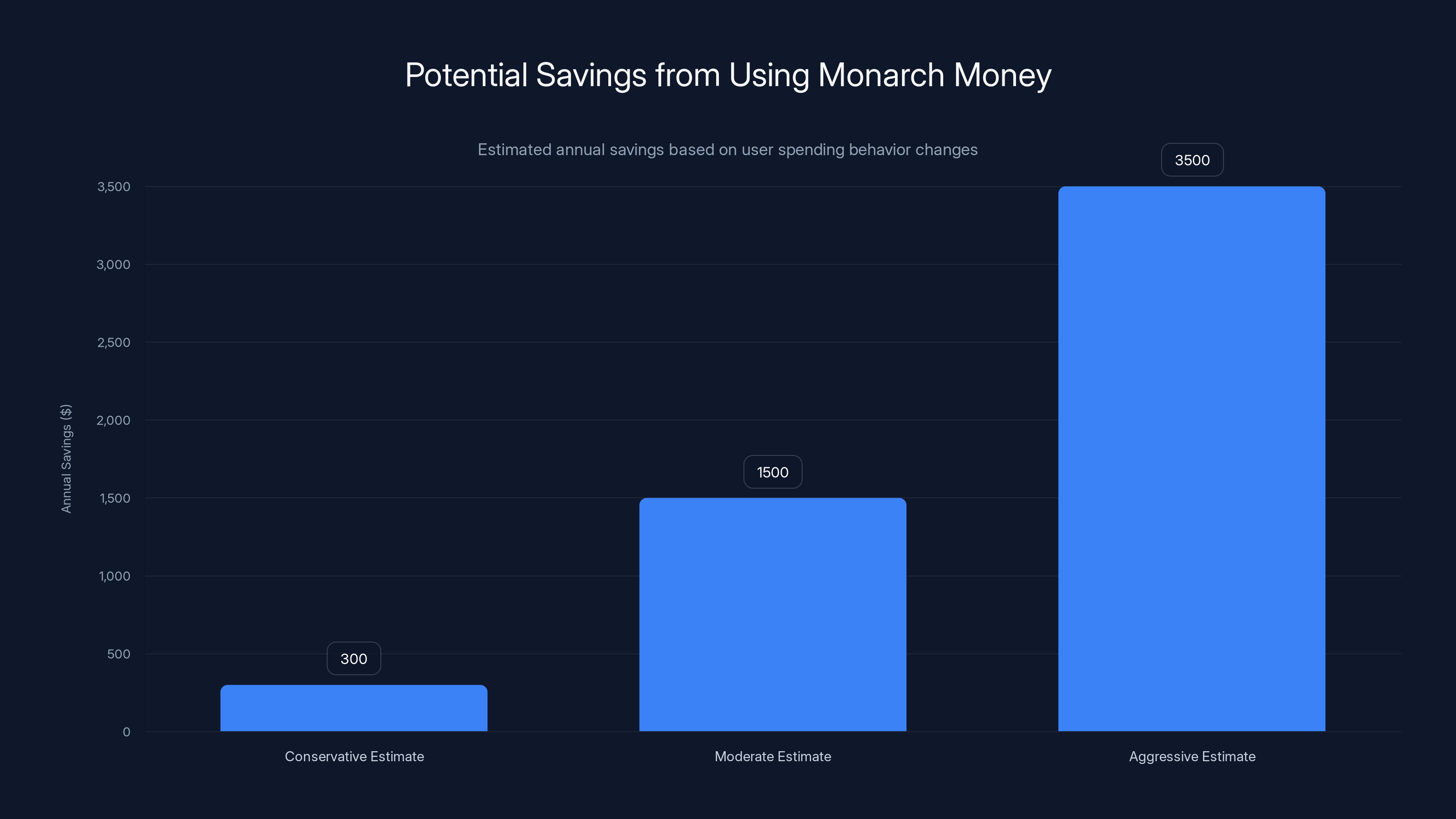

Even with a conservative estimate, users can save

The $50 Deal: What You're Actually Paying For

Let's break down the economics here. Monarch Money normally costs

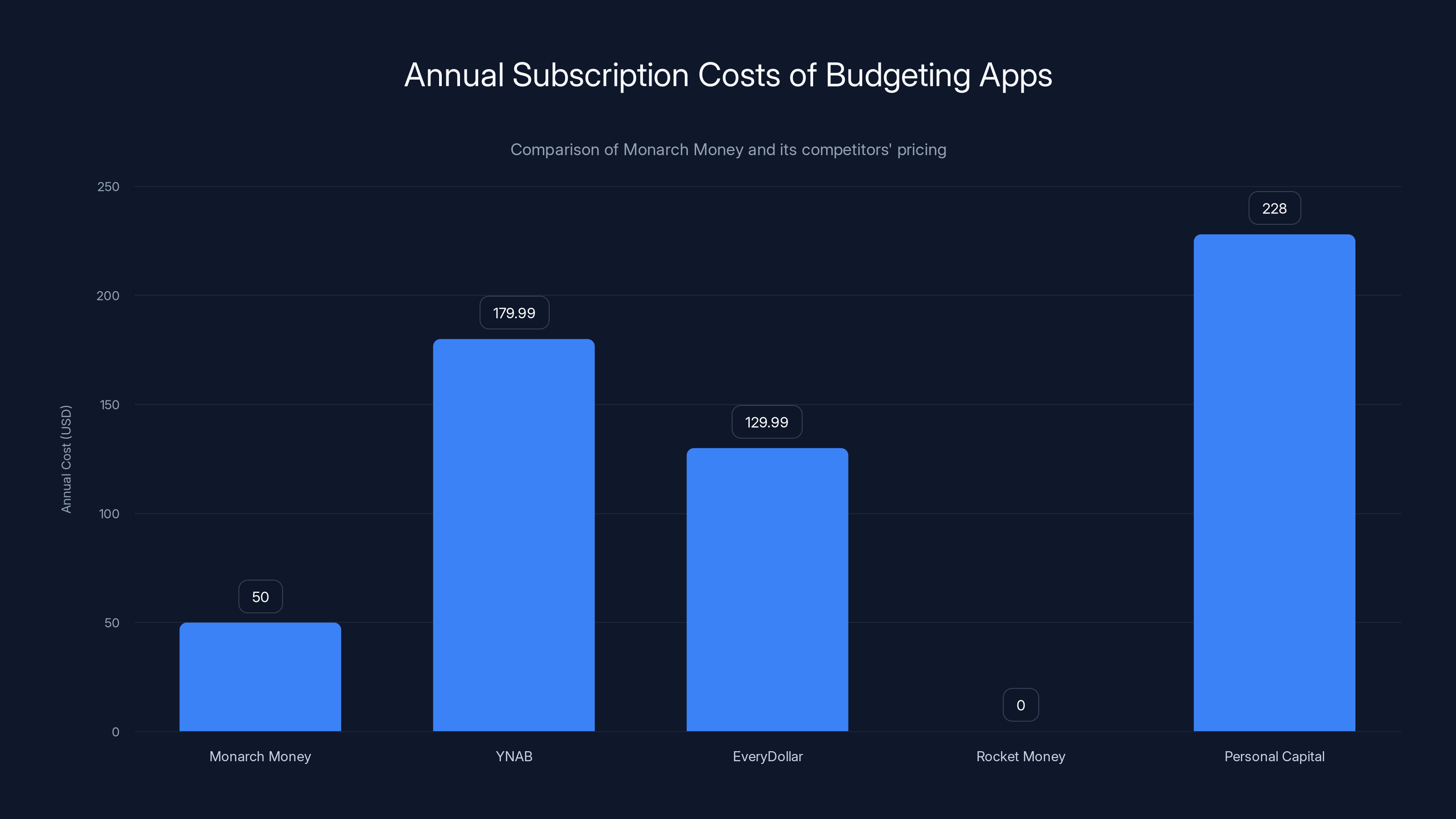

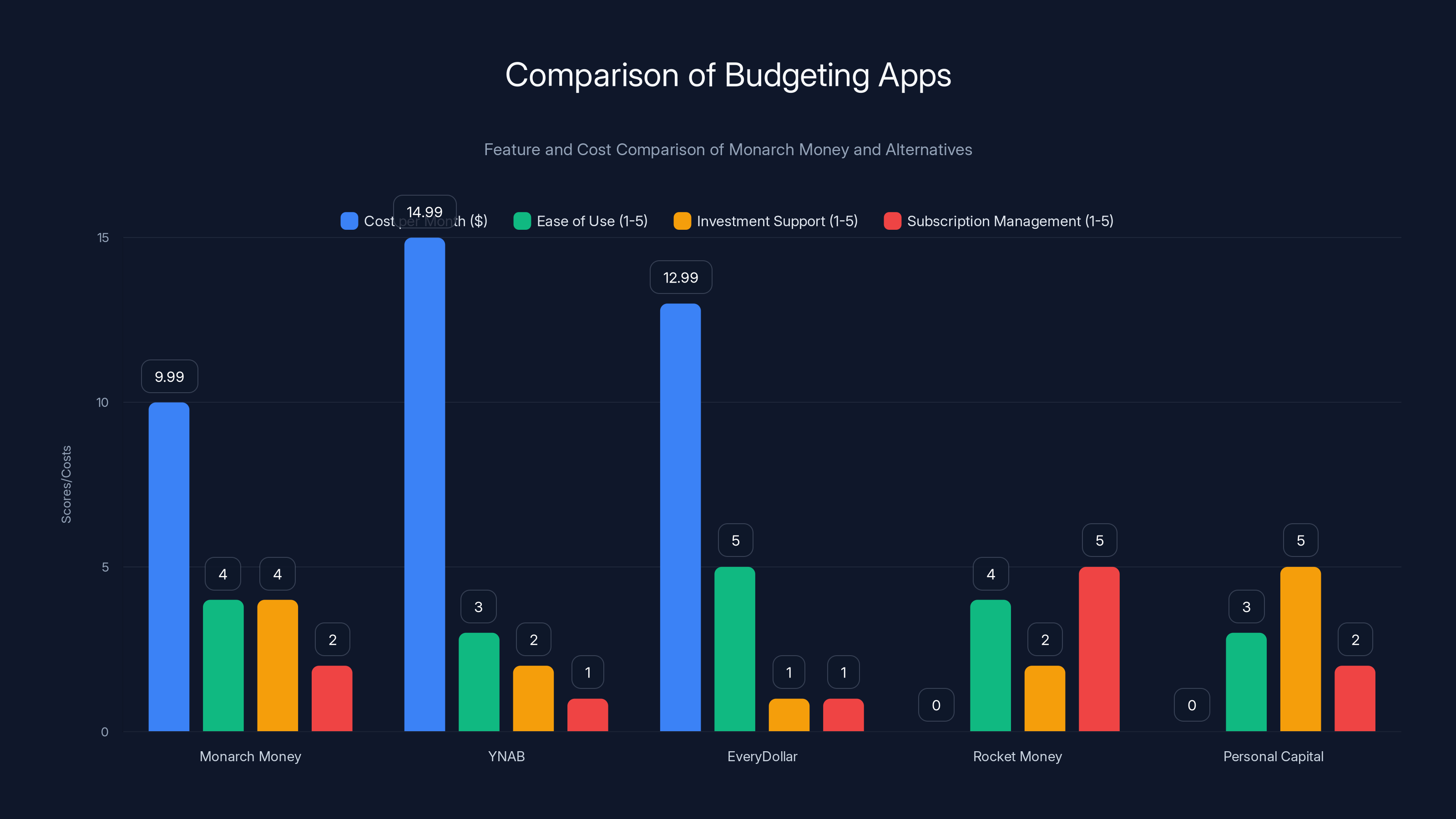

For context, this makes Monarch Money one of the cheaper premium budgeting apps when you look at annual subscriptions. Most competitors charge

The deal applies to new subscribers only. If you've ever had a Monarch Money account, you don't qualify. This is designed to bring fresh users into the platform. The discounted tier gives you the full suite of features—no feature gatekeeping based on price tier.

Comparison to other major budgeting apps:

- YNAB (You Need A Budget): 179.99/year. Focuses heavily on behavioral change and zero-based budgeting.

- Every Dollar: 129.99/year. Simplistic interface, strong for beginners.

- Rocket Money (formerly Truebill): Free tier available; premium adds credit monitoring and bill negotiation features.

- Personal Capital: Free tier; premium wealth management starting at $19/month.

- Mint (defunct as of January 2024, replaced by Credit Karma's product): Used to be free; now the ecosystem has fragmented.

At $50 for a year, Monarch Money undercuts most competitors significantly. The question isn't price—it's whether the features justify the investment for you.

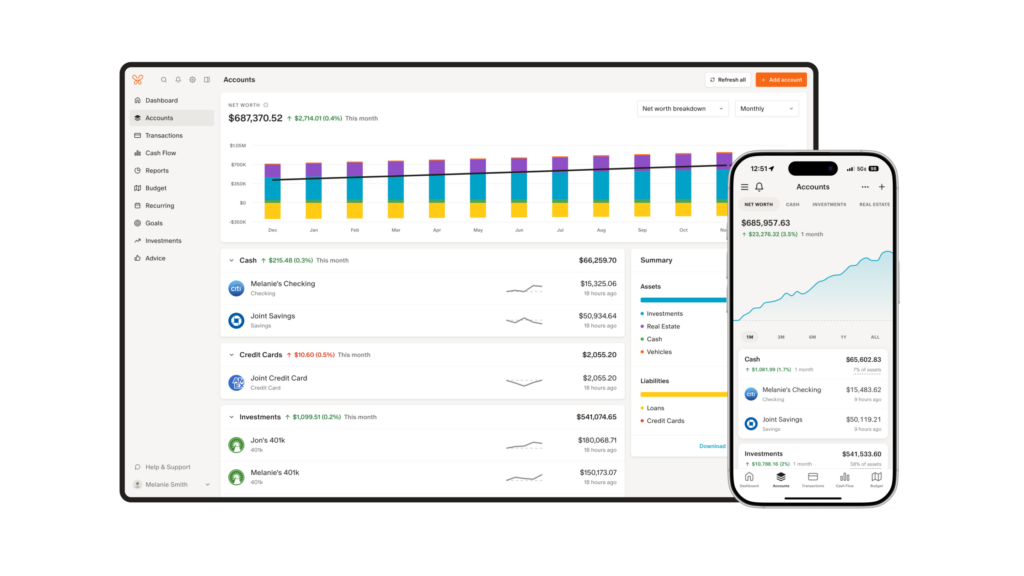

Multi-Platform Access: Why It Matters That Monarch Works Everywhere

Monarch Money isn't just a web app you visit when you remember to budget. It's available on iOS, Android, iPadOS, web browsers, and as a Chrome extension. This multi-platform approach sounds like a commodity feature, but it's actually one of the bigger differentiators.

Here's why: you need the tool where you are when you need it. If you only have web access, you'll forget to check your budget at the grocery store. If you only have mobile, you'll struggle with detailed analysis on a small screen. Monarch solves this by meeting you wherever makes sense.

iOS and Android apps give you quick access. You can check your budget before making a purchase, log a transaction manually if something didn't sync, or quickly glance at month-to-date spending. The mobile interface is cleaned up compared to the web version—less information, more actionable quick views.

The web version is where power users live. Full-screen charts, detailed filtering, complex reports, account management, settings—all the stuff that's cramped on phones. If you need to do serious analysis or setup, you're going to the web.

iPadOS gets its own native app, not just a stretched mobile version. On a tablet, Monarch Money becomes more usable for couples sitting down together to plan finances. The larger screen lets both people see charts clearly.

The Chrome extension might seem minor until you actually use it. You're shopping on Amazon. You add something to your cart. The Monarch extension shows you instantly: "You have $247 left in your shopping budget this month. You're 71% of the way there." It's a real-time reality check that prevents impulse overspending. It works for Target too.

The synchronization between these platforms matters. You log an expense on mobile, it appears on web immediately. Your partner's spending on their phone shows up on your web dashboard. The system doesn't get confused or out of sync.

That said, there's a caveat here. The web and mobile versions don't have feature parity—they're genuinely different products. This is the most common complaint from users. Some charts exist on web but not mobile. Some settings only work on certain platforms. New features sometimes roll out to web first, leaving mobile users waiting weeks or months.

It's not broken, but it's inconsistent. If you're going to use Monarch Money effectively, plan to use both web and mobile depending on the task.

The Chrome Extension: Passive Spending Awareness

The Chrome extension deserves its own section because it's genuinely useful in a way that most browser extensions aren't.

When you install it and visit Amazon or Target, a small panel appears showing you your spending budget status in that category. No popups. No interruption. Just information available if you need it.

More importantly, the extension can auto-sync your Amazon and Target purchases in real-time. You buy something, the charge hasn't even hit your account yet, but Monarch Money already knows about it and categorized it. By the time your bank confirms the transaction, Monarch's already been tracking it for days.

This solves a real problem: transaction lag. If you have a

Not all retailers are supported. The extension works with Amazon and Target specifically. If you primarily shop at Costco, Whole Foods, or specialty retailers, it's less useful for you. If you're an Amazon and Target regular, it's transformative.

Monarch Money offers a competitive annual subscription price of $50, significantly lower than YNAB and EveryDollar, and more comprehensive than free tiers like Rocket Money.

Connected Accounts: How Many Financial Institutions Can You Actually Link

The core promise of any budget app is that it connects to your financial institutions. Monarch Money handles this through Plaid, which connects to over 12,000 financial institutions in the US, Canada, and the UK.

In practical terms, this means:

Banks: Every major bank (Chase, Bank of America, Wells Fargo, Citi, etc.) connects. Most regional and community banks connect too.

Credit cards: Every credit card issuer connects.

Investment accounts: Fidelity, Vanguard, Charles Schwab, E*TRADE, and most brokerages work.

Cryptocurrency wallets: Limited support. Some exchanges (Coinbase) connect; others require manual entry.

Loans: Student loans, mortgages, auto loans sometimes connect, depending on the servicer.

Retirement accounts: 401(k)s and IRAs can be connected for net worth tracking, though sometimes with limited data.

The more accounts you connect, the better picture you get of your total finances. Someone with five checking accounts, three credit cards, a brokerage account, and a 401(k) can see everything in one place. That holistic view is powerful.

But there's a practical limit. Most people maintain 3-7 active accounts. Connecting all of them gives you 90% of the benefit. Going beyond that adds complexity without proportional value.

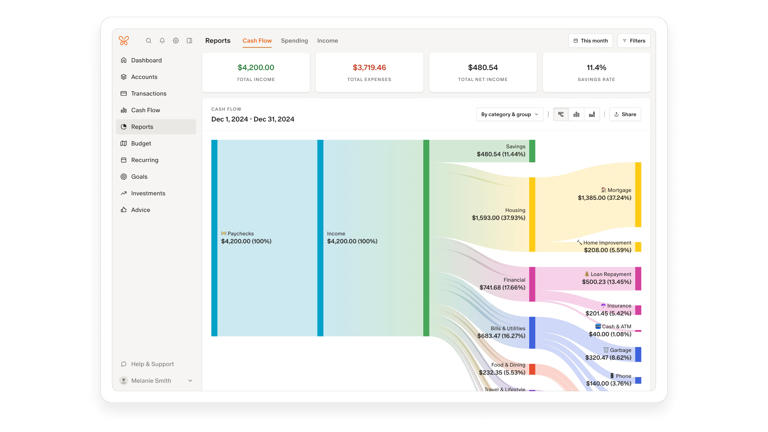

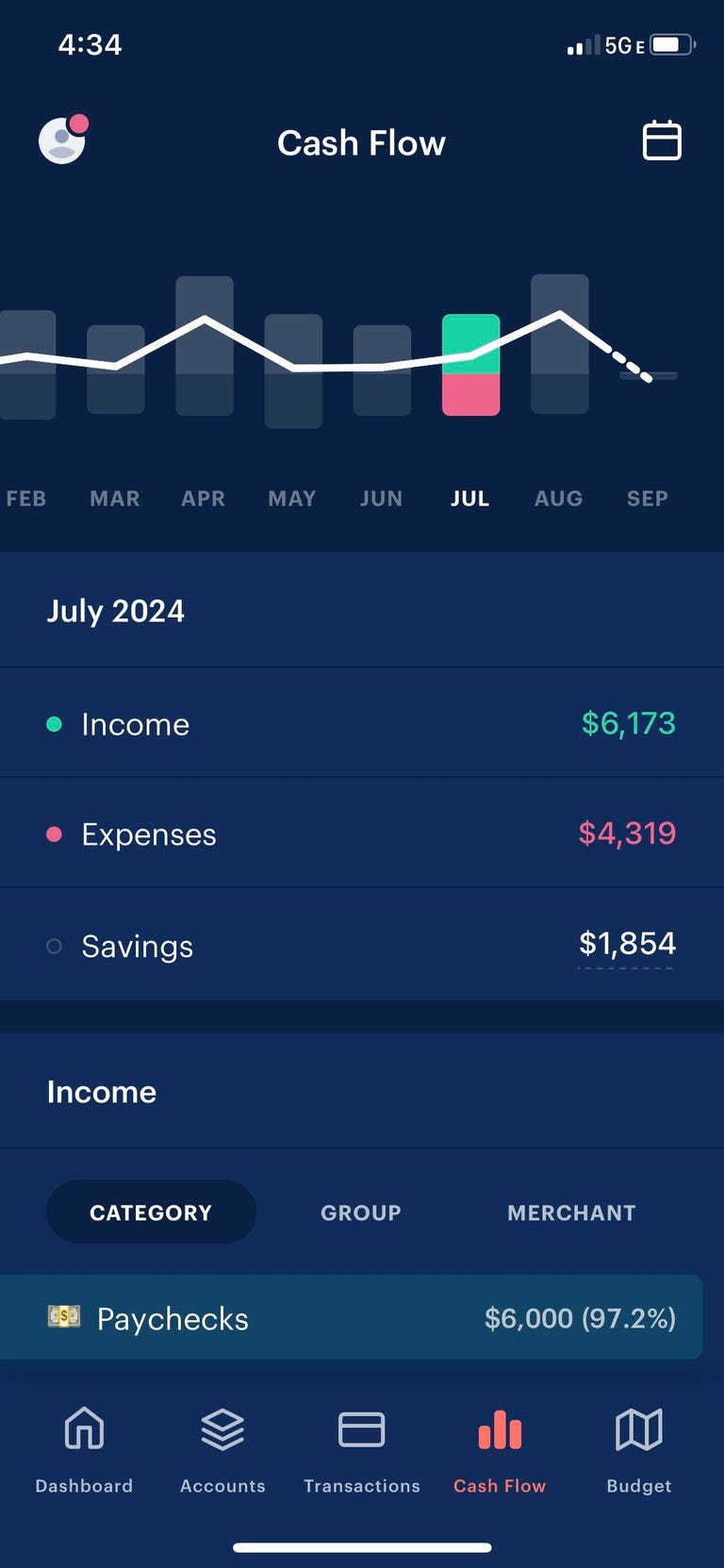

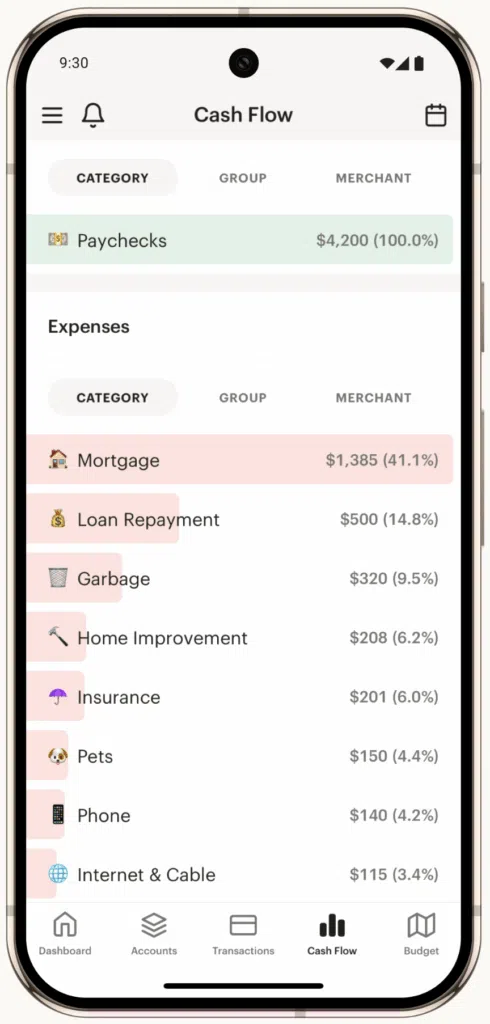

Data Visualization: How Monarch Money Turns Raw Transactions into Insights

Every budgeting app can connect to your accounts and show you transactions. The real differentiator is visualization—turning raw data into patterns you can understand instantly.

Monarch Money offers multiple views:

Spending overview: A graph showing your total spending by month. Is January higher than December? You can see it immediately. This catches seasonal patterns. Holiday spending spikes. Summer vacation costs. January gym membership purchases that never get used.

Category breakdown: Pie charts and bar graphs showing how much you spent in each category. One glance shows whether groceries are eating your budget or whether subscriptions are the real culprit.

Investment tracking: If you connected investment accounts, Monarch shows your portfolio value over time, asset allocation, and returns. This is useful context when planning how much you can safely allocate to discretionary spending.

Custom reports: You can build reports comparing specific date ranges, categories, or spending with a partner. "We spent $X last January, how does that compare to this January?" It answers questions like this automatically.

Cash flow visualization: See money flowing in (income, transfers, investment gains) and flowing out (expenses, transfers, investment purchases). Understanding your cash flow beats analyzing individual transactions.

The strength here is flexibility. You're not locked into one view. If a pie chart doesn't help you understand your spending, try a bar graph. If neither works, create a custom report.

The weakness is that some visualizations are web-only. The mobile app has simplified charts that sometimes don't match web versions. If you prefer mobile, you're limited in the insights you can access.

Collaborative Budgeting: Managing Finances With a Partner

Monarch Money's collaborative features deserve attention because most budget apps treat joint finances as an afterthought.

You can add a partner to your Monarch Money account. Both of you get full visibility into spending. You both see the shared budget progress. You both get notifications when budgets are exceeded. You both can categorize transactions.

This solves a huge problem in relationships: financial surprise. One partner doesn't realize the other spent $200 on restaurant meals this month. Without visibility, this becomes a fight. With Monarch Money, you both see it happening in real-time.

The system tracks spending by person. You can see not just the total restaurant spending, but how much each partner contributed. This isn't about blame—it's about understanding patterns. Maybe one person eats out much more frequently. Maybe you need different budgets for food vs. restaurants.

You can also set up shared budgets (money you both contribute to, like household expenses) and individual budgets (money each person controls separately, like entertainment). Most couples use a combination: shared budget for housing, utilities, groceries; individual budgets for discretionary spending.

The limitation: you can only add one partner. If you're in a complex household with multiple earners and decision-makers, Monarch Money gets awkward. It's designed for couples, not extended families or roommate situations.

Also, once someone's an account holder, they have full access—they can change budgets, modify categories, adjust goals. There's no permission system for "view only" access. If you need that level of control, Monarch doesn't offer it.

Monarch Money's multi-platform approach ensures accessibility across devices, with the web version providing the most comprehensive features. Estimated data.

Budget Widgets: Checking Progress Without Opening the App

Monarch Money offers home screen widgets for iOS and Android that show your budget progress without opening the full app.

Think of widgets as the "at a glance" version. You unlock your phone and see: "Shopping: 68% of

Small feature, but it works psychologically. You see it dozens of times per day without trying. It becomes a subliminal reminder: "I have a budget. I'm tracking it. These are my limits." That awareness alone changes behavior.

Widgets work best when sized appropriately. A large widget showing all categories is overwhelming. A small widget showing just your most problematic category is useful. Most people end up with 1-2 budget widgets on their home screen.

The limitation: widgets update periodically, not in real-time. If you made a purchase 20 seconds ago, the widget might not reflect it for a few minutes. It's close enough for practical purposes but not second-by-second accurate.

The Learning Curve: Where New Users Get Stuck

Here's the honest part: Monarch Money has a noticeable learning curve. This was Engadget's primary criticism in testing, and it's accurate.

The first time you open the app, you're overwhelmed by choices. Do you want flexible or category budgeting? What categories should you even create? Should you connect all your accounts at once or gradually? How do you handle irregular expenses like car insurance or annual subscriptions?

These aren't bugs—they're actually good problems to have. The flexibility that makes Monarch Money powerful is the same flexibility that makes it complex for beginners.

Compare this to Every Dollar, which has a radically simpler interface. You pick a template, adjust some numbers, and you're done in 15 minutes. Monarch Money takes 45 minutes minimum if you're doing it right.

The secondary learning curve comes from understanding the difference between the web and mobile interfaces. Features you expect on mobile don't exist there. Settings you change on mobile don't appear in the interface the same way on web. It's not inconsistent—it's different by design—but it confuses people.

The third issue: category management. Most people don't think about spending in the default categories Monarch offers. You might need to create custom categories, merge others, and reorganize the whole structure. This is powerful but requires intentional setup work.

That said, the learning curve is temporary. After two weeks of regular use, new users usually figure out the rhythm. After a month, they wonder how they ever managed finances without it.

Feature Parity Problems: Web vs. Mobile Inconsistencies

Enter any online forum where Monarch Money users gather, and you'll find complaints about feature parity. The web version has capabilities that mobile doesn't, and vice versa. Sometimes the same feature works differently on each platform.

Example: the insights feature. On web, Monarch Money shows detailed spending insights with comparisons to previous months, trend analysis, and pattern detection. On mobile, you get a simplified version that sometimes feels like it's missing information entirely.

Another example: custom reports. You can build detailed custom spending reports on web with precise date ranges, multiple filters, and export options. On mobile, the custom report feature is either hidden or works with significant limitations.

New features sometimes roll out to web first. Mobile users might wait 2-4 weeks for feature parity. During that time, you get a divided experience where your partner's phone has features yours doesn't.

This isn't unusual for apps—web and mobile development are different—but it's worth knowing upfront. If you primarily use mobile, you're getting a different product than someone who primarily uses web.

Monarch Money offers a balanced approach with moderate cost and strong investment support, while Rocket Money excels in subscription management. Estimated data used for feature ratings.

Automated Categorization Accuracy: Getting It Right 80% of the Time

Monarch Money's machine learning categorizes most transactions automatically. Groceries get tagged as "groceries," restaurants as "dining out," subscriptions as "subscriptions."

What's the accuracy rate? Somewhere between 75-85% for most users, depending on how clearly they label transactions. A charge that literally says "WHOLE FOODS MARKET" gets categorized correctly almost always. A generic charge from "AMAZON*" could be groceries, household items, clothing, anything.

This means you'll spend time fixing misclassified transactions. It's not hours per week—probably 5-15 minutes per month for most people—but it's ongoing. The good news: you only need to correct a transaction once. The next time a similar transaction appears, Monarch learns from your correction.

You can also set up rules. "Anything from STARBUCKS is "Coffee," not "Dining Out."" "Amazon charges under

Power users eventually build rule sets that work for their spending patterns, and then the automation actually works efficiently.

Security and Data Privacy: How Monarch Money Protects Your Information

Monarch Money connects to your actual bank accounts. This raises a legitimate security question: how safe is your data?

The short answer: as safe as any modern fintech app. Monarch Money uses industry-standard security practices:

- Encryption in transit: All data traveling between your device and Monarch's servers uses 256-bit encryption (bank-grade).

- Encryption at rest: Data stored on Monarch's servers is encrypted.

- No password storage: Monarch never sees your bank password. You authenticate with your bank directly through Plaid (the connection infrastructure), and Plaid provides Monarch with access. Your actual passwords never leave your device.

- Regular security audits: Monarch Money undergoes third-party security audits regularly.

- SOC 2 compliance: They meet the security standards that banks and financial institutions require.

The real risk isn't Monarch Money getting hacked—it's your email getting compromised. If someone gains access to your Monarch Money email account, they can reset your password and access all your financial data. Use a strong, unique password for Monarch Money. Ideally, use a password manager so you don't have to remember it.

Enable two-factor authentication on your Monarch Money account. Most users don't, but it's free and eliminates a huge attack vector.

Pricing Breakdown: Why $50/Year Actually Becomes Worth It

Let's do the math on whether this deal makes sense for you.

At

- One coffee: $5-7

- One restaurant meal: $15-25

- One subscription service: $10-20

- One month of Monarch Money: $4.17

The question isn't whether

Conservative estimate: Most people find

Moderate estimate: You become intentional with discretionary spending. You see your restaurant spending is 30% of food budget and adjust. You realize your entertainment category is double what you planned and cut back. This behavioral change typically saves $1,000-2,000 annually.

Aggressive estimate: You optimize across every category. You renegotiate bills. You eliminate duplicated services. You shift spending from high-cost to low-cost options. This saves $2,000-5,000+ annually, though it requires significant intentionality.

Even at conservative estimate, the $50 investment saves you 6-12x that amount within the year. The ROI is obvious.

The offer details:

- Code: NEWYEAR2026

- Valid for: New subscribers only

- Price: 100)

- Access: Full feature set, no limitations

- Cancel anytime: You can cancel after first year if unsatisfied

Monarch Money's automated categorization accuracy ranges from 75% to 85%, depending on transaction clarity. Estimated data.

How Monarch Money Compares to Other Budgeting Apps

Monarch Money isn't the only budgeting app. How does it stack up against alternatives?

Monarch Money vs. YNAB (You Need A Budget)

YNAB costs

YNAB's strength is behavioral change. It uses "zero-based budgeting," meaning you assign every dollar a job before spending it. It's philosophically different from Monarch Money's flexible approach. For people who thrive on constraint, YNAB is better. For people who find it suffocating, Monarch Money is better.

YNAB's weaknesses: smaller financial institution network, less investment account support, steeper learning curve.

Monarch Money vs. Every Dollar

Every Dollar costs

Every Dollar wins on simplicity. The interface is radically straightforward. You create a budget, you track spending, done. If you want simple, Every Dollar is faster.

Every Dollar loses on depth. Power users hit limitations quickly. The visualization options are limited. The investment account integration is poor. If you want detailed analysis, Monarch Money is better.

Monarch Money vs. Rocket Money

Rocket Money offers a free tier with bill negotiation and credit monitoring built in. Paid tier adds more features.

Rocket Money is strongest for subscription management and bill negotiation. If your primary goal is eliminating wasted subscriptions, Rocket Money's automated detection is excellent.

Monarch Money is stronger for overall budget planning and investment tracking.

Monarch Money vs. Personal Capital

Personal Capital focuses on wealth management and investment optimization. It's aimed at people with investment portfolios.

If you have significant investments, Personal Capital is better. If you're primarily focused on income/spending budgeting, Monarch Money is better.

Monarch Money vs. Mint (RIP)

Mint shut down in January 2024. Its replacement is Credit Karma's budgeting product, which is still rolling out.

If you were a Mint user, Monarch Money is the closest modern equivalent with similar features and pricing.

Honest Drawbacks: Where Monarch Money Falls Short

Monarch Money is genuinely good, but it's not perfect. Here are the real limitations:

Learning curve: We've mentioned this, but it's the biggest barrier to new users. Budget apps should be simple, but Monarch Money's flexibility requires upfront complexity.

Feature inconsistency between platforms: You get different products on mobile vs. web. This is frustrating and confusing.

Categorization requires maintenance: Even with automation, you'll spend time fixing misclassifications, especially in the first month.

Limited cryptocurrency support: If you have significant crypto holdings, Monarch Money's integration is limited. You'll need manual tracking or third-party tools.

No scheduling for irregular expenses: If you have quarterly or annual expenses, Monarch Money doesn't have a feature to predict or allocate for them. You'll need to manually project.

Customer support limitations: For a paid product, Monarch Money's customer support is basic. Email-only support with 24-48 hour response times.

Partner-only collaborative features: The "partner" feature is designed for couples, not families or roommate situations with more than two budgeters.

Real-World Usage: What the First Month Looks Like

Imagine you're a new user. You've grabbed the NEWYEAR2026 discount. Here's what happens:

Week 1: Setup and overwhelming choice You download the app. You create an account. You choose between flexible and category budgeting (this choice alone takes 15 minutes of deliberation). You connect your bank account. The first transaction sync takes a few minutes. Then suddenly, you're seeing transactions from the past 90 days already categorized.

You think: "Okay, this is useful already." Then you realize half the categories are wrong. That Uber charge is tagged as "shopping," not "transportation." That Target run is mixed between "groceries" and "household."

You spend 30 minutes recategorizing. You're frustrated but making progress.

Week 2: Building rules and understanding categories You've created custom categories that match how you actually think about spending. You've set up rules for common merchants. You're starting to see spending patterns.

You notice you've spent more on dining out than you budgeted. You also realize you forgot to budget for something annual, and Monarch Money is showing zero allocated to it.

You feel mildly stressed about clarity, which is actually good—you weren't aware before.

Week 3-4: The "aha" moment You're using the app several times weekly without thinking. You check before buying things. You see a category's getting near limit and consciously spend less that week. The partner feature becomes useful—you're no longer surprised when your partner spends money because you're seeing it together.

You've caught one or two subscriptions you forgot about. That

Monarch Money has already paid for itself.

Who Should Actually Use Monarch Money

Monarch Money is exceptional for:

- Couples managing joint finances: The partner tracking feature is excellent for transparent money management.

- People who want flexibility over rigidity: If you hate the strictness of zero-based budgeting, Monarch Money's flexible approach works better.

- People who invest: The investment account tracking and net worth visualization is solid.

- Detailed data people: If you like analyzing spending patterns and running custom reports, Monarch Money has the features.

- Multi-platform users: If you use both mobile and web, the synchronization works smoothly.

Monarch Money is poor for:

- Beginners who want simplicity: Start with Every Dollar instead.

- Behavioral change through rigid budgeting: Use YNAB instead.

- People who need subscription management as primary focus: Rocket Money is better.

- People with significant cryptocurrency: Limited integration makes it awkward.

- Families with more than two financial decision-makers: The two-person limit is limiting.

Why New Year Is The Right Time For This

You know why budgeting apps sell heavily in January? Because that's when people actually change behavior.

The motivation is high. You have 364 days ahead of you. The budget isn't already broken with December overspending. You're genuinely thinking about money differently because new years symbolize fresh starts.

Harness this. Use that psychological momentum. Getting the tool set up in January means you're tracking for the entire year, not signing up in June and only tracking half the year.

The NEWYEAR2026 code expires. Check when—it might be January 31st or February 14th, but it won't last forever. If you're even 60% sure this is worth trying, grab it now. The discount makes the risk minimal.

You're spending $50 to potentially save hundreds. That's not a financial decision—that's an obvious move.

Use Case: Need to build a financial dashboard or automated reports from your spending data? Runable can help you create presentations, documents, and reports instantly.

Try Runable For FreeThe Real Question: Will You Actually Use It

The final question isn't whether Monarch Money is good. It is. The question is whether you'll actually use it consistently.

Budgeting apps are tools. The best tool in the world is useless if you don't use it. Some people check their budget daily. Others check weekly. Some abandon the app after three weeks because they don't feel the motivation.

If you're the type who:

- Gets genuinely interested in financial data

- Likes seeing visual progress

- Wants to understand where money goes

- Finds accountability motivating

- Values making intentional spending decisions

Then Monarch Money is excellent.

If you're the type who:

- Gets overwhelmed by financial details

- Prefers to avoid thinking about money

- Trusts your ability to estimate spending without tracking

- Finds constraint stressful

- Just wants to set it and forget it

Then Monarch Money might frustrate you. A simpler app might be better.

Be honest with yourself. Don't buy the $50 plan because it's a good deal. Buy it because you'll actually use it.

If you will? This is one of the best $50 investments you can make in 2025.

FAQ

What exactly is Monarch Money and who makes it?

Monarch Money is a personal finance management platform developed by Monarch Money Inc. It's a subscription-based budgeting and financial tracking service that connects to your bank accounts, credit cards, investment accounts, and other financial institutions to provide a comprehensive view of your money. The company was founded by financial software entrepreneurs focused on creating a more intuitive alternative to older budgeting tools.

How does the NEWYEAR2026 discount code work and when does it expire?

The code NEWYEAR2026 provides a 50% discount on Monarch Money's annual subscription, reducing the normal

Is Monarch Money safe to use with my real bank accounts?

Yes, Monarch Money uses bank-level security. Your actual bank credentials are never stored or seen by Monarch Money. Instead, you authenticate directly with your financial institution through Plaid (a third-party connection service that connects to over 12,000 financial institutions). All data transmission uses 256-bit encryption (the same encryption banks use), and data stored on Monarch's servers is also encrypted. Monarch Money maintains SOC 2 compliance and undergoes regular third-party security audits. For maximum security, enable two-factor authentication on your Monarch Money account, which most users don't do but absolutely should.

Can I use Monarch Money with my partner, and how does shared budgeting work?

Yes, Monarch Money has explicit partner collaboration features. You can add one partner to your account, and both of you get full visibility into all spending, budgets, and financial accounts. The system tracks spending by person so you can see not just total household spending but individual contributions to each category. You can set up shared budgets for joint expenses (like housing and utilities) and individual budgets for personal discretionary spending. However, once someone is added as a partner, they have full account access and can modify budgets, settings, and categories—there's no read-only permission level. The feature is designed for couples specifically; it doesn't accommodate larger households or roommate situations with more than two people.

What's the difference between flexible budgeting and category budgeting in Monarch Money?

Flexible budgeting lets you set monthly spending targets by category but doesn't penalize you for exceeding them. The app shows you visually where you stand (like "You've spent 68% of your $300 dining budget"), and you decide whether to adjust spending or accept the overage. It's psychologically motivating without being restrictive. Category budgeting (traditional envelope budgeting) assigns fixed amounts to categories, and the app alerts you when you approach or hit the limit, preventing overspending without your explicit override. Flexible budgeting works better for people who find hard limits stressful; category budgeting works better for people who want firm guardrails and absolute control.

How accurate is Monarch Money's automatic transaction categorization?

Monarch Money's machine learning categorizes most transactions automatically with 75-85% accuracy for most users, depending on how clearly merchants label their charges. A charge explicitly labeled "WHOLE FOODS MARKET" gets categorized correctly almost always, while a generic "AMAZON*" charge could be anything from groceries to clothing. You'll spend 5-15 minutes monthly fixing misclassifications, especially in the first month. The good news: Monarch learns from your corrections—if you recategorize a similar transaction once, it remembers for future ones. You can also set up rules like "all STARBUCKS charges are Coffee, not Dining" to reduce manual corrections significantly.

What are the main differences between using Monarch Money on mobile vs. web?

Monarch Money functions as different products on mobile versus web. The web version is where power users live—full-screen charts, detailed filtering, complex reports, and complete settings management. Mobile apps (iOS, Android, and iPadOS) are simplified for quick access—budget checks, transaction logging, and simplified charts. Some features exist only on web, not mobile. Some settings changed on mobile don't appear identically on web. New features sometimes roll out to web first, leaving mobile users waiting weeks or months for parity. This isn't a bug—it's intentional design—but it's worth knowing. If you'll primarily use mobile, you're getting a different product than someone using web regularly.

How does the Chrome extension work and what does it actually do?

The Monarch Money Chrome extension provides real-time budget visibility when shopping on Amazon and Target. When you visit these sites, a small panel appears showing your current spending budget and progress (like "Shopping: 68% of

Is the 50% new year discount worth it compared to other budgeting apps?

At

What happens after the first year—how much will Monarch Money cost then?

After your discounted first year at

Conclusion: Making 2025 The Year You Actually Understood Your Money

Most people have vague financial anxiety. They make decent money but somehow don't know where it goes. They intend to save but end each month surprised by their balance. They know they're spending too much on something but can't identify what.

Monarch Money doesn't fix your income problem. If you don't make enough money, no budget app solves that. But if you make enough and still feel broke, Monarch Money reveals where the gap lives. Knowledge isn't everything, but it's the foundation everything else builds on.

The math here is straightforward. You pay $50. You gain visibility. You catch wasted spending. You save hundreds. You've tripled your money.

The decision isn't whether Monarch Money is good—it's genuinely solid software. The decision is whether you'll actually use it. Be honest with that question. If you answer yes, use code NEWYEAR2026 right now. The offer won't last forever, and the motivation you have at the beginning of a new year is exactly when budgeting sticks.

If you answer no—if you know you'll abandon it in three weeks—skip it. No shame in that. Not everyone thrives with detailed financial tracking. Some people genuinely don't care about the data.

But if you're reading a 6,000-word guide about a budgeting app, you probably care. You probably want to actually know where your money goes. You probably want to feel more in control of your finances. Monarch Money delivers exactly that.

The $50 is the easy part. The hard part is committing to actually using it. Do that, and 2025 becomes the year you finally got your finances right.

Key Takeaways

- 50% discount available: Use code NEWYEAR2026 to get a full year of Monarch Money for 100) for new subscribers only, with no additional charges or feature limitations

- Multi-platform access: Monarch Money works across iOS, Android, iPadOS, web, and Chrome extension, though web and mobile have different feature sets requiring both for full functionality

- Automated categorization: The app automatically categorizes 75-85% of transactions correctly, saving hours monthly while learning from your corrections and custom rules

- Collaborative budgeting: Partners get full visibility of shared and individual spending, enabling transparent financial management without surprise purchases affecting budgets

- Learning curve trade-off: Initial setup takes 60-90 minutes due to category customization and budgeting philosophy choices, but ROI is high at roughly 6-12x the $50 investment through identifying forgotten subscriptions and intentional spending changes

- Security and privacy: Bank-level encryption protects your financial data; your actual passwords never reach Monarch Money's servers, and two-factor authentication is available

Related Articles

- Monarch Money Deal: $50 for One Year (50% Off) [2025]

- Monarch Money Budgeting App: $50/Year Deal + Complete Review [2025]

- Monarch Money 50% Off Deal: Complete Guide to Annual Budgeting [2025]

- Best Budgeting Apps 2025: Complete Guide After Mint Shutdown

- Best Mint Alternatives in 2025: Complete Guide to Top Budgeting Apps

- TurboTax Discount Codes & Coupons: Save Up to 54% [2026]

![Monarch Money Annual Deal: Save 50% on Premium Budgeting [2025]](https://tryrunable.com/blog/monarch-money-annual-deal-save-50-on-premium-budgeting-2025/image-1-1768757916636.jpg)