Introduction: A Strategic Pivot in Commercial Spaceflight

Jeff Bezos' Blue Origin just made one of the most consequential decisions in commercial spaceflight since SpaceX landed a booster on a drone ship for the first time. The company announced it's pausing its New Shepard space tourism program for at least two years, redirecting all resources toward lunar missions. This isn't a temporary setback or a pivot driven by market conditions. It's a calculated, high-stakes gamble that reflects the rapidly shifting landscape of commercial spaceflight in 2025.

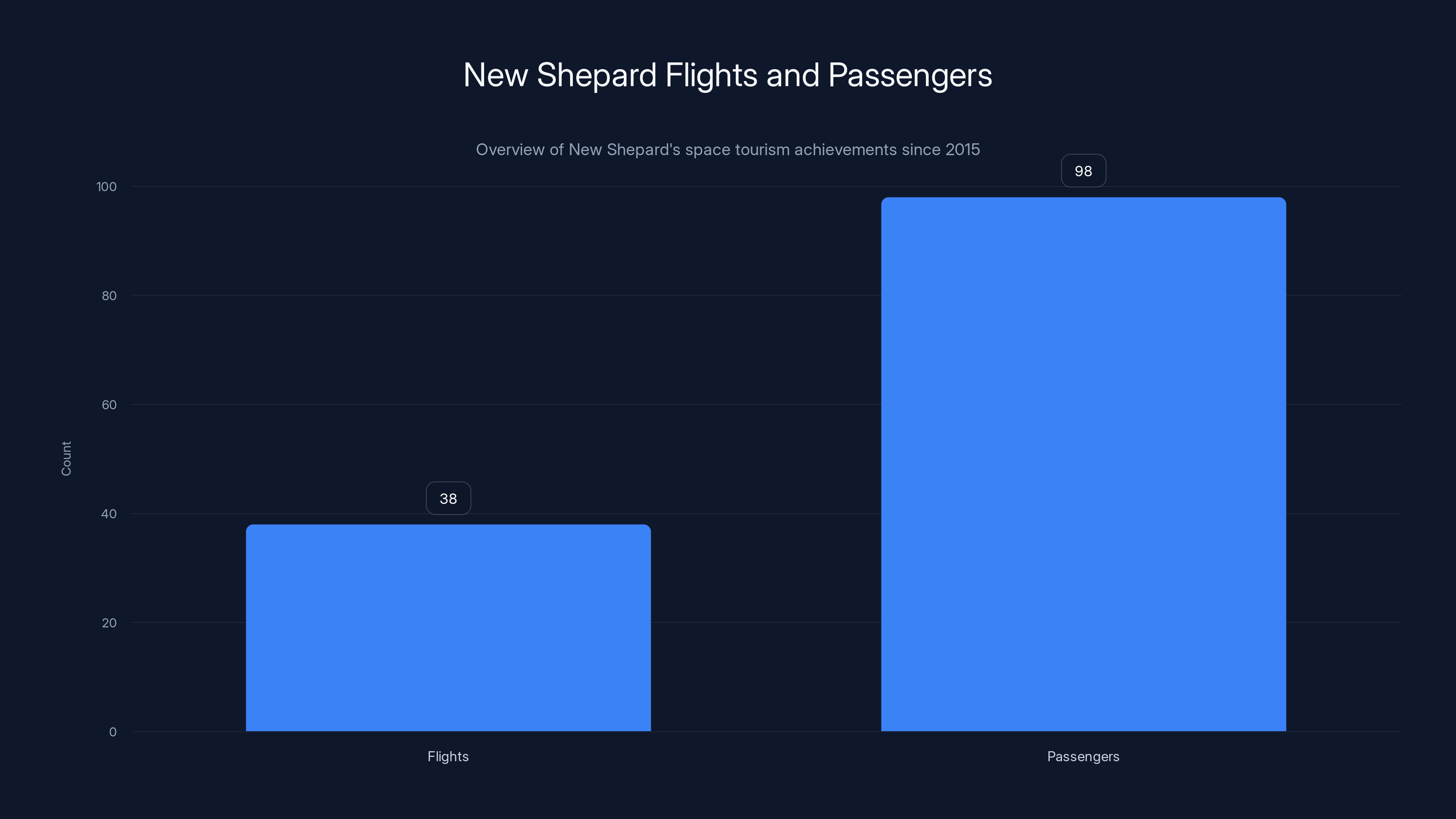

Let's be clear: this is enormous. For five years, Blue Origin has been flying paying customers on brief, exhilarating journeys to the edge of space. They've carried 98 humans above the Kármán line at 100 kilometers altitude, providing roughly four minutes of weightlessness before returning safely to Earth. That program generated revenue, built brand recognition, and proved the New Shepard vehicle was reliable. It was working.

But Blue Origin made the call to stop it. Completely. For a minimum of 730 days.

Why? Because the window of opportunity for capturing lucrative government contracts—particularly NASA-backed lunar missions—requires unprecedented focus. President Donald Trump's second term has reinvigorated the push to return humans to the Moon before 2025 ends, creating a competitive environment where companies like Blue Origin, SpaceX, and others are jostling for position. The stakes are existential. This article breaks down what Blue Origin's decision means for the future of commercial spaceflight, the lunar economy, and the broader implications for companies betting everything on government contracts.

Understanding Blue Origin's Space Tourism Program

Before diving into why this pause matters, you need to understand what Blue Origin is actually pausing. New Shepard isn't a spacecraft designed to reach orbit. It's a suborbital vehicle, which means it goes up, crosses the Kármán line boundary, and comes back down. The entire flight lasts roughly eleven minutes from launch to landing.

The vehicle consists of two components: a reusable booster that lands itself vertically (similar to SpaceX's Falcon 9), and a capsule that carries up to six passengers. That capsule is where the magic happens. Passengers experience weightlessness as they float for about four minutes at the apex of the flight, with windows providing views of Earth's curvature and the blackness of space beyond.

Blue Origin first flew New Shepard in 2015, making it one of the earliest commercial vehicles to reach space. The company then spent years refining the vehicle, improving safety systems, and eventually opening it to paying customers. The first crewed flight with passengers occurred in July 2021, carrying Bezos himself, his brother Mark, aviation pioneer Wally Funk, and teenager Oliver Daemon. That flight marked a watershed moment for commercial spaceflight, proving that private companies could safely fly civilians to space.

Since then, Blue Origin has flown New Shepard 38 times, carrying not just tourists but also scientific payloads and research experiments. The program generated significant revenue—tickets weren't cheap, with costs reportedly ranging from

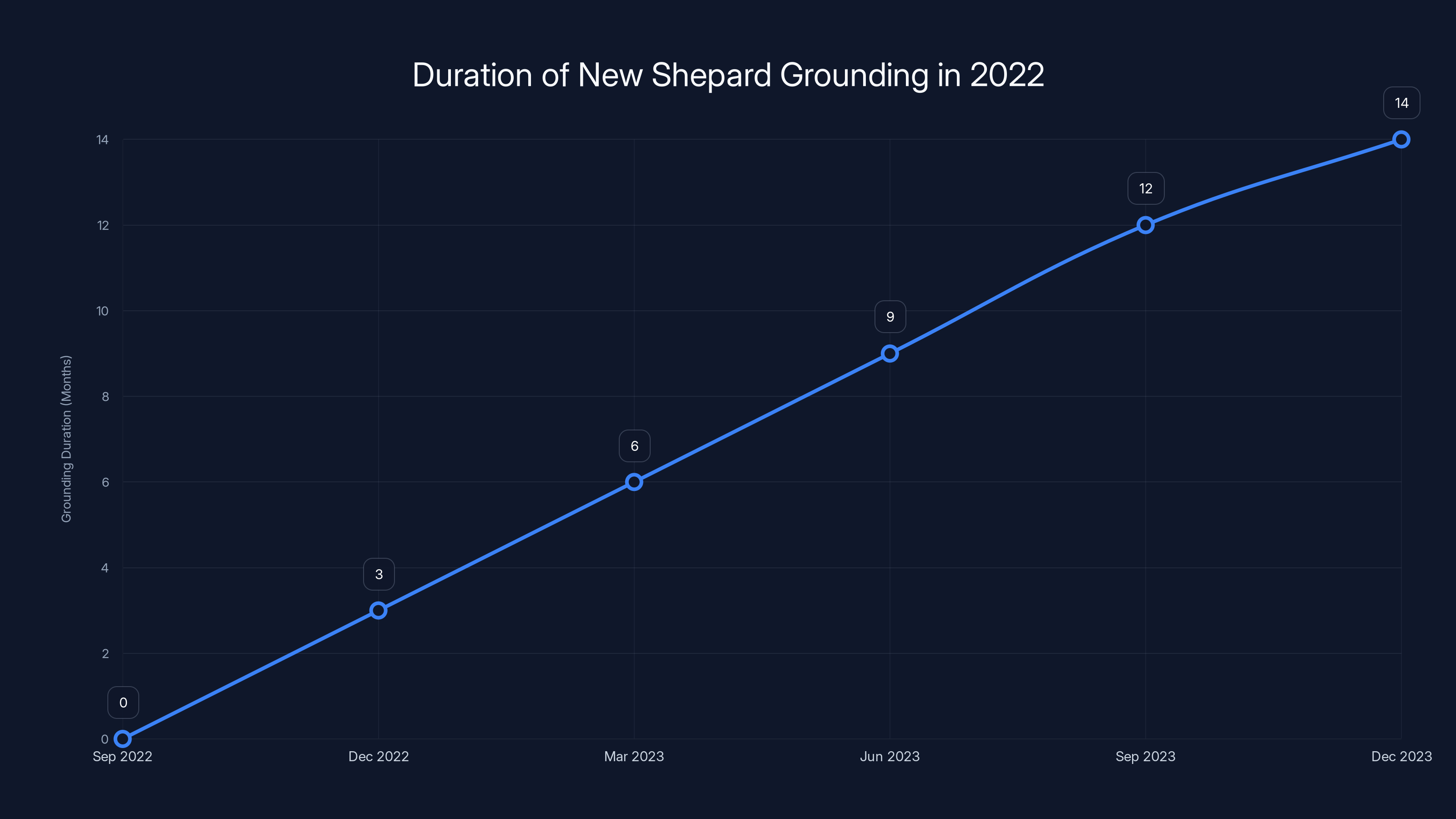

The program also experienced setbacks. In 2022, a booster failure during flight operations grounded New Shepard while the company investigated root causes. The mishap didn't involve passengers—the capsule ejected safely—but it exposed vulnerabilities in Blue Origin's development process and raised questions about vehicle reliability. It took over a year for New Shepard to return to flight, a delay that cost the company momentum and revenue.

By 2025, New Shepard had proven itself reliable enough to resume regular operations. Blue Origin was discussing increased flight rates and expanded passenger capacity. The program was becoming profitable and sustainable. Yet despite this success, Blue Origin chose to pause it. That decision reveals something fundamental about where the real money is in spaceflight: government contracts, not tourists.

Blue Origin's New Shepard has conducted 38 flights, each lasting about 11 minutes, with a passenger capacity of 6 and ticket prices ranging between

The Lunar Economy and Government Competition

Here's the uncomfortable truth about commercial spaceflight: most of the money doesn't come from tourists. It comes from governments. Specifically, it comes from space agencies that pay enormous sums for launch services, satellite deployment, cargo transport, and increasingly, human spaceflight missions.

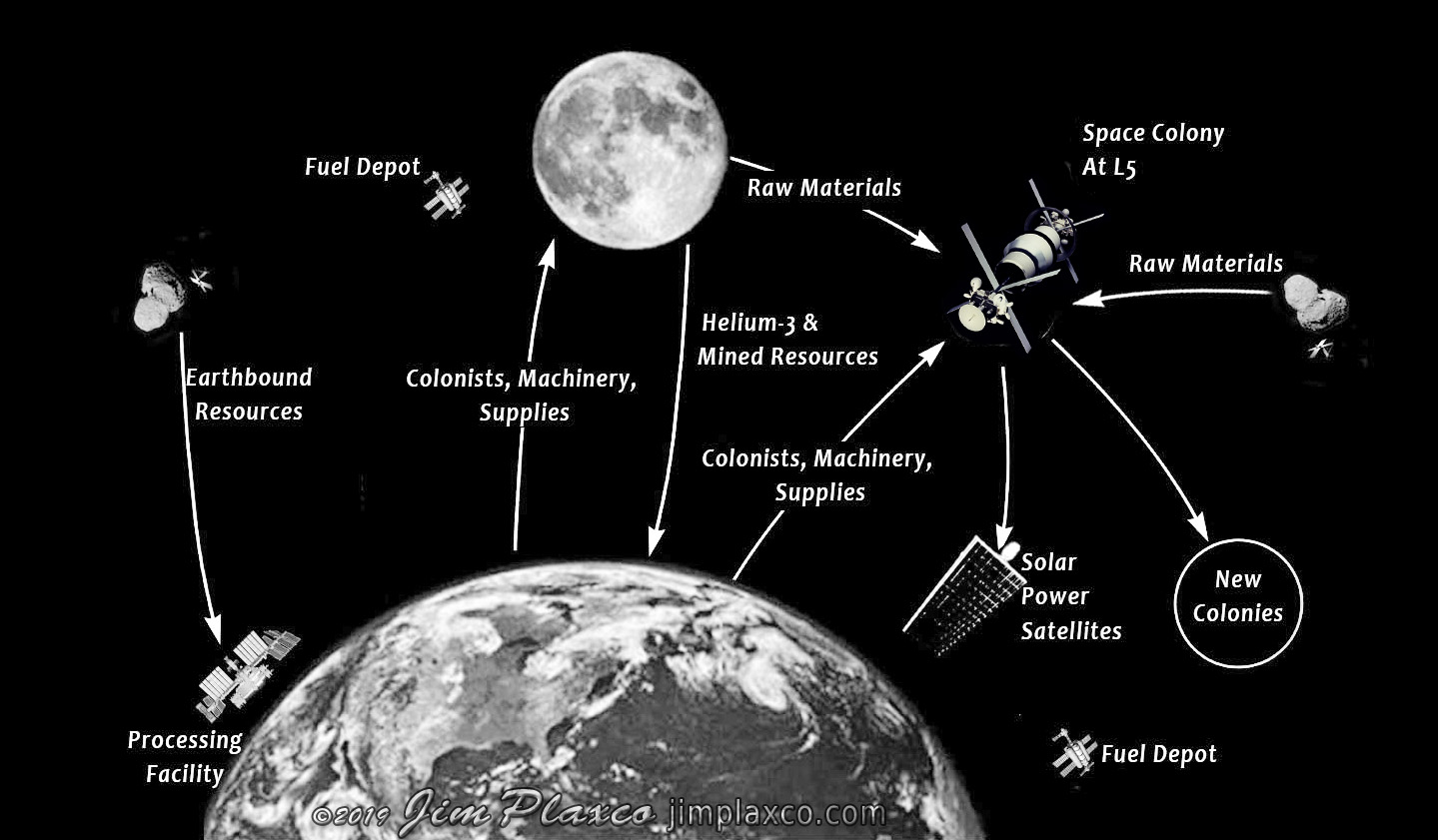

The lunar economy represents an entirely new frontier. NASA's Artemis program aims to return humans to the Moon for the first time since 1972. The agency is simultaneously pursuing lunar landers, habitats, transportation systems, and supporting infrastructure. That's not just one contract—it's dozens of contracts worth billions of dollars combined.

Blue Origin has been positioning itself to capture a meaningful piece of this lunar market. The company developed the Blue Moon lunar lander, a large robotic spacecraft designed to deliver cargo and eventually humans to the lunar surface. This isn't a tech demo or a proof-of-concept. It's a sophisticated, capable vehicle that Blue Origin plans to use for both government missions and commercial lunar activities.

Competition in this space is intense. SpaceX, which has already captured enormous government contracts through its Dragon spacecraft and Falcon 9 launch vehicle, is now developing Starship—a massive, reusable vehicle that could eventually land humans on the Moon. Other companies like Axiom Space are building commercial space stations. Axiom is also planning lunar missions. The competitive landscape has shifted dramatically.

For Blue Origin, the calculus is straightforward: pausing New Shepard frees up engineering resources, manufacturing capacity, launch availability, and management focus. Instead of scheduling tourism flights, coordinating passenger logistics, and managing the operational overhead of carrying civilians, those resources can concentrate on perfecting the Blue Moon lander, preparing for crewed missions, and competing for NASA contracts.

It's also a signal. By pausing tourism, Blue Origin is sending a message to NASA, to Congress, and to competitors: we're serious about this. We're willing to make short-term sacrifices for long-term positioning. That message has value in government contracting environments where consistency and commitment matter as much as technical capability.

The Trump Administration Effect and Lunar Timeline Pressure

The timing of Blue Origin's announcement is not coincidental. It comes just weeks before the expected third launch of New Glenn, Blue Origin's next-generation heavy-lift rocket. More importantly, it comes in the context of President Donald Trump's renewed push to accelerate the lunar timeline.

Trump has stated his goal of returning humans to the Moon before the end of his second term, which ends in January 2029. That's only four years—an incredibly compressed timeline for a project of this magnitude. NASA has been under pressure to demonstrate progress, accelerate timelines, and prove that American space capabilities remain unmatched.

This administration's approach differs significantly from the previous one. Where the earlier framework focused on a sustained, methodical return to the Moon with emphasis on establishing permanent infrastructure, the current approach emphasizes speed, American capability demonstration, and competitive advantage over China and other space-faring nations.

That pressure creates opportunity for companies like Blue Origin. Government agencies desperate to meet an accelerated timeline can't wait for perfect solutions. They need working solutions now. Companies that can demonstrate rapid development, reliable execution, and complete systems attract premium contracts.

Blue Origin's decision to pause tourism makes more sense in this context. The company is essentially saying: we're going all-in on meeting your timeline. We're pulling people off other projects, accelerating development, and focusing entirely on delivering lunar capabilities faster than anyone else can. That's a powerful positioning statement.

But there's also risk embedded in this decision. If the lunar timeline slips, if contracts don't materialize, or if competing programs deliver capabilities faster, Blue Origin's pause becomes a liability. The company has sacrificed reliable, profitable revenue for a bet on government spending that may not materialize on schedule.

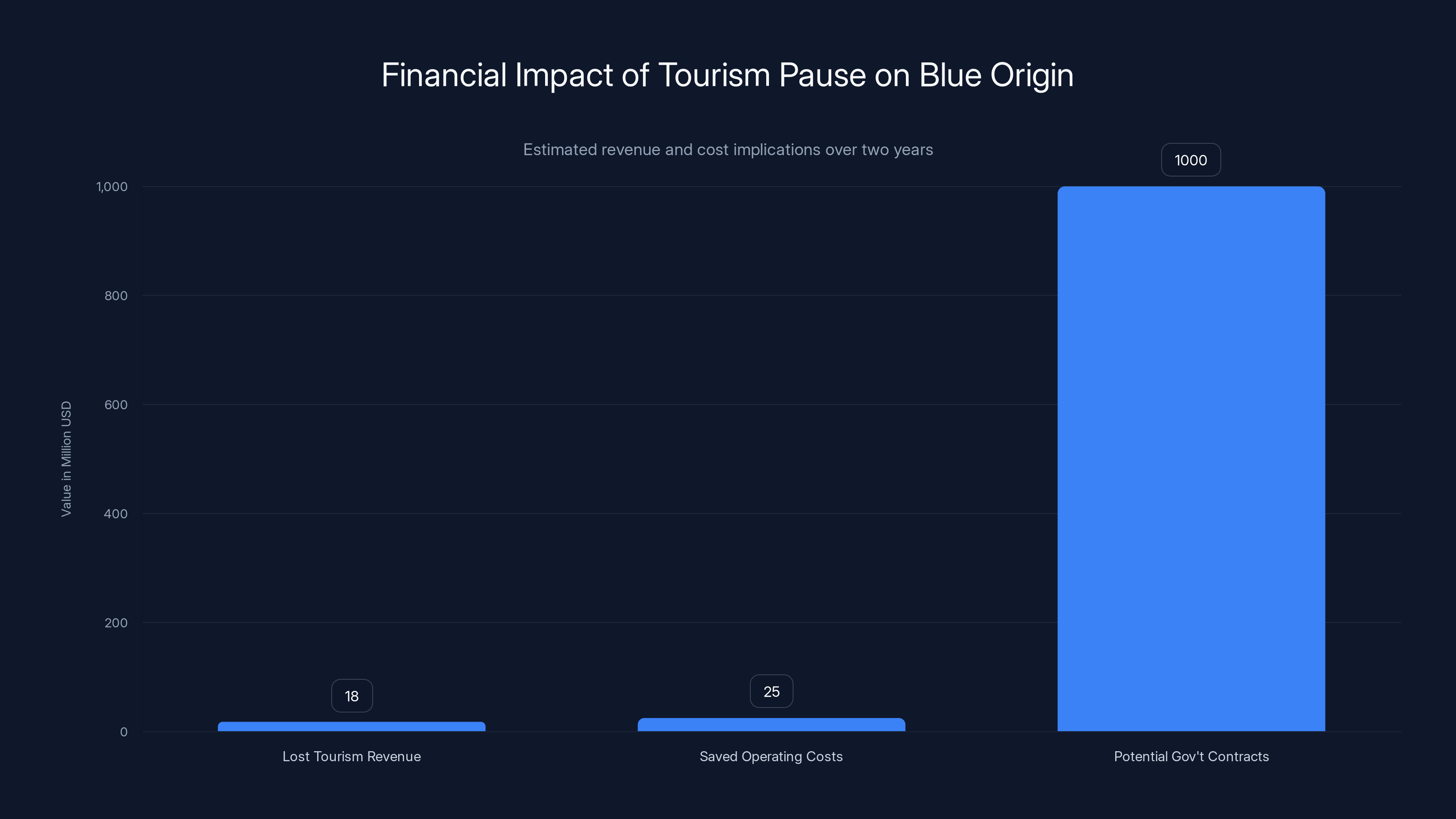

Estimated data shows that while Blue Origin loses

New Glenn's Role in Blue Origin's Lunar Strategy

New Glenn is critical to understanding Blue Origin's strategic pivot. The rocket represents the next evolutionary step for the company, a heavy-lift launch vehicle designed to carry massive payloads to orbit and beyond. Unlike New Shepard, which never reaches orbit, New Glenn is built to compete directly with SpaceX's Falcon Heavy and eventually Starship.

The first New Glenn test flight occurred in 2024. That vehicle is currently undergoing modifications. The second flight is scheduled for early 2025, with the third flight expected in late February 2025. These aren't commercial flights—they're test and development missions designed to perfect the vehicle's capabilities.

New Glenn's relevance to lunar missions is substantial. The rocket is powerful enough to carry Blue Moon landers, crew capsules, and supporting systems to lunar destinations. More importantly, New Glenn is expected to generate significant revenue from commercial customers launching satellites. That revenue could subsidize the company's lunar development programs.

By pausing New Shepard and focusing on New Glenn's development, Blue Origin is essentially rebalancing its portfolio. Instead of relying on small, incremental revenue from tourism flights, the company is betting on large government contracts and significant commercial launch revenue from New Glenn. It's a higher-risk, higher-reward strategy.

The rocket's development timeline is critical. Every delay in New Glenn's deployment pushes back Blue Moon's availability for missions. Every month of additional testing reduces the window for meeting aggressive lunar timelines. Blue Origin needs to get New Glenn flying reliably and frequently to support its lunar ambitions.

Blue Moon Lander: The Centerpiece of Blue Origin's Lunar Strategy

Blue Moon is Blue Origin's lunar lander program, and it's perhaps the most important asset the company possesses for capturing government contracts. The vehicle is a large, sophisticated spacecraft designed to land cargo and eventually humans on the lunar surface.

The lander comes in multiple variants. The Blue Moon cargo version is designed to deliver equipment and supplies to lunar sites. A crewed variant is in development for astronaut missions. The company has also been working on a specialized variant to support landing systems for other spacecraft, recognizing that lunar surface operations require diverse capabilities.

Blue Moon represents years of development and billions of dollars in investment. The vehicle incorporates advanced landing systems, autonomous navigation, communications, power, and life support capabilities. It's not a simple lander—it's the foundation of Blue Origin's vision for commercial lunar infrastructure.

NASA has expressed interest in Blue Moon for Artemis missions. The agency needs multiple landers capable of different missions—delivering cargo, landing humans at different sites, supporting long-duration surface operations. Blue Moon is positioned to compete for these contracts, but so are other companies.

By pausing New Shepard, Blue Origin frees up resources to accelerate Blue Moon development. The company can assign more engineers to the program, expedite testing cycles, and potentially meet aggressive delivery timelines. For a NASA program operating under congressional pressure to achieve results quickly, accelerated delivery timelines are valuable enough to justify contracts and partnerships.

The lander's design emphasizes reusability, which aligns with Blue Origin's broader philosophy inherited from Bezos. If Blue Moon can land multiple times, be refurbished, and return to lunar orbit for additional missions, the economics improve dramatically. Reusable lunar landers could reduce the cost of lunar logistics by an order of magnitude, transforming the economics of sustained lunar presence.

The Financial Implications of the Tourism Pause

Let's talk about what this pause actually costs Blue Origin in revenue terms. With ticket prices ranging from

Over two years, the pause sacrifices between

The indirect costs are more complex. Training for tourism flights, logistics operations, capsule maintenance, range operations, and customer service all contribute to operating costs that won't go away entirely but will decrease significantly. A scaled-back tourism program might cost

Moreover, pausing tourism frees up launch capacity. New Shepard was scheduled for multiple flights annually. Those flight slots—which require use of Blue Origin's launch facilities, ground crew, range time, and management attention—can now redirect to other priorities. In the space industry, launch capacity is often the most constrained resource. If Blue Origin can repurpose that capacity for New Glenn tests or military missions, the value multiplies.

The real financial opportunity lies in government contracts. A single NASA lunar lander contract could be worth $1 billion or more. Multiple such contracts could total several billion dollars. Even capturing a small percentage of the lunar economy dwarfs the ongoing tourism revenue. That's the math driving this decision.

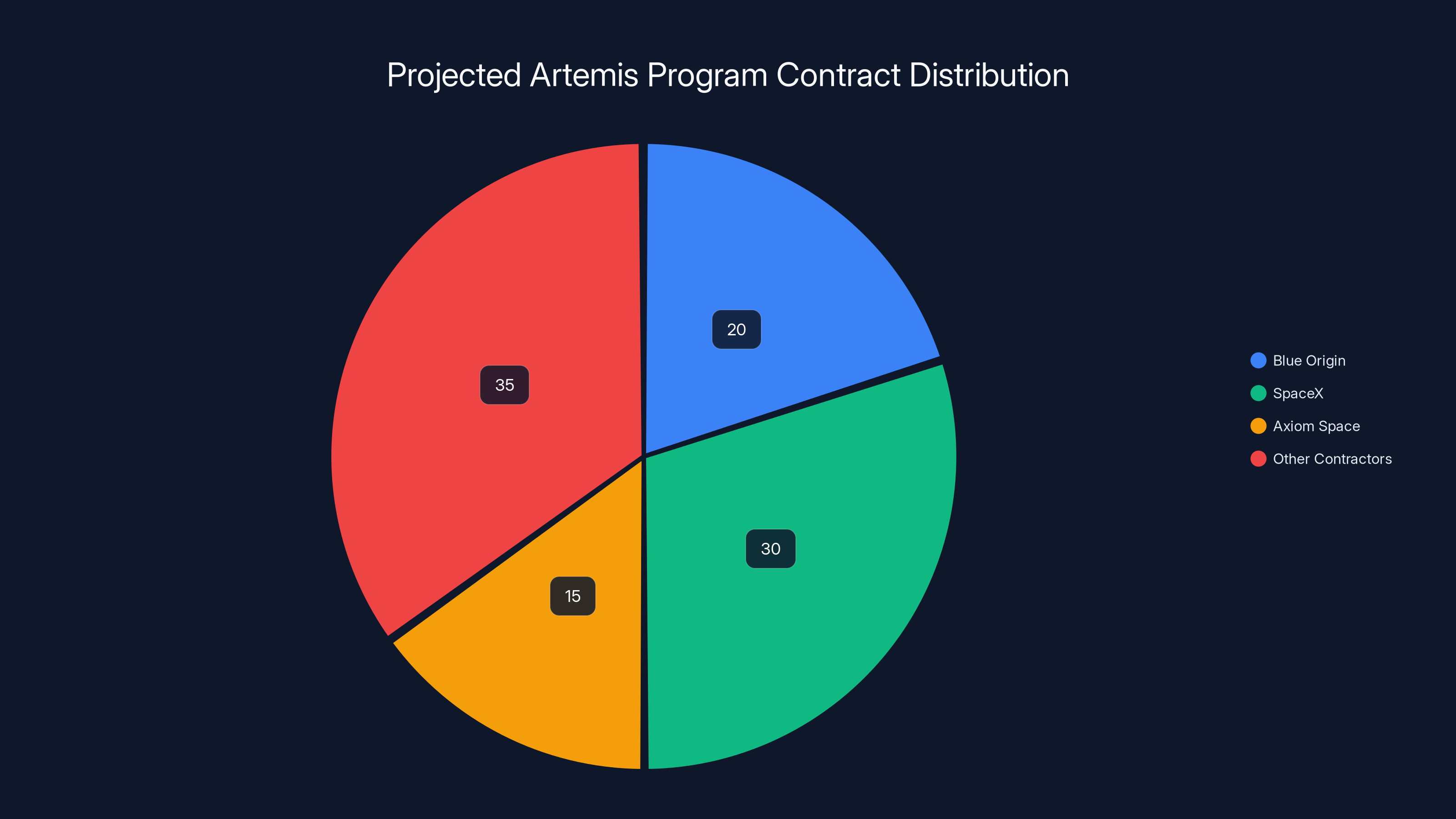

Estimated data suggests SpaceX and Blue Origin are likely to capture significant portions of Artemis funding, with SpaceX potentially leading due to its established track record. Estimated data.

Workforce and Resource Reallocation

Pausing New Shepard allows Blue Origin to reallocate human talent to higher-priority programs. The company likely employs hundreds of people supporting New Shepard operations—ground crew, flight directors, capsule technicians, engineers, logistics coordinators, and customer service specialists. While some of these roles might reduce in scope, many can transition to supporting Blue Moon development and New Glenn operations.

Engineering talent is particularly valuable in spaceflight. The people who've maintained New Shepard reliability and successfully managed recovery operations possess deep expertise in spacecraft operations. That expertise directly transfers to lunar programs. Mission planners, systems engineers, and test directors can shift focus from tourism flights to government missions.

The manufacturing and production side also benefits from this reallocation. Blue Origin's production facilities can reduce New Shepard capsule manufacturing and focus on Blue Moon production, New Glenn components, or military contracts. This flexibility matters enormously in an industry where capital investments in factories and facilities are massive.

Culturally and organizationally, this pivot signals that Blue Origin is a serious lunar company, not primarily a tourism company. That messaging affects recruitment, retention, and morale. Engineers and managers want to work on moonshots, not incremental programs. A strategic pivot toward lunar missions and government contracts attracts and retains the highest-caliber talent.

The Competitive Landscape and SpaceX's Influence

Understanding Blue Origin's pause requires understanding SpaceX's dominance in commercial spaceflight. SpaceX has captured the vast majority of commercial launch contracts, military contracts, and NASA partnerships. The company's Falcon 9 is the most-flown orbital rocket in the world. Starship is under development and positioned to become the most capable heavy-lift vehicle ever built.

SpaceX's success creates pressure on competitors like Blue Origin. The company can't out-compete SpaceX on cost or launch frequency—not yet. SpaceX has years of operational experience and established customer relationships. Instead, Blue Origin must compete by being strategically positioned in markets SpaceX hasn't fully dominated.

The lunar market represents such an opportunity. SpaceX is pursuing lunar missions through Starship, but the program is still in heavy development with frequent failures and delays. Starship hasn't reached lunar orbit yet, let alone landed humans or cargo on the Moon. That delay creates a window for alternative providers like Blue Origin.

If Blue Moon can deliver lunar cargo reliably before Starship reaches operational capability, Blue Origin captures market share. If the company can offer lunar services at competitive prices, win NASA contracts, and establish lunar operations before competitors fully mobilize, the competitive position changes dramatically.

This is the calculation driving the New Shepard pause. Blue Origin is essentially betting that lunar opportunity is more valuable than tourism revenue. That's a high-stakes wager, but in the context of SpaceX's rapid advancement and the government's lunar timeline pressure, it may be the right call.

Government Contracts and the Artemis Program

NASA's Artemis program represents the single most important opportunity in the space industry for the next decade. The program aims to return humans to the Moon, establish a lunar gateway station (a small orbiting outpost around the Moon), and eventually land humans near the lunar south pole.

Artemis requires multiple contractors. NASA can't accomplish this alone and doesn't want to. The agency is distributing contracts across multiple companies to foster competition, distribute risk, and accelerate development. Blue Origin, SpaceX, Axiom Space, and other contractors are all competing for slices of the Artemis funding.

Blue Origin has already received multiple Artemis contracts. The company was awarded funding to develop Blue Moon variants specifically tailored to NASA requirements. The company has competed successfully for other lunar-related contracts. But these preliminary awards are just the foundation—the real contracts, with the massive budgets, are still being negotiated and awarded.

By pausing New Shepard, Blue Origin signals to NASA that the company is completely committed to Artemis success. The company isn't hedging its bets by maintaining tourism revenue streams. It's going all-in. That commitment is valuable in government relationships where demonstrating serious intent matters.

Moreover, government contracting often rewards companies that show rapid progress and the ability to accelerate timelines. NASA is under pressure to move faster. If Blue Origin can demonstrate accelerated development, successful testing, and on-time delivery of lunar capabilities, contract awards will follow.

The financial stakes are enormous. Artemis program funding is expected to total $93 billion through 2025, with additional spending anticipated beyond that timeline. Even capturing 5-10% of that spending would exceed Blue Origin's historical revenue multiple times over.

New Shepard has successfully completed 38 flights, carrying 98 passengers to space since 2015, offering a unique experience of weightlessness and views of Earth.

The Historical Precedent: 2022 New Shepard Grounding

This isn't Blue Origin's first encounter with uncertainty in the New Shepard program. In 2022, the company experienced a significant setback when a New Shepard booster failed during flight operations. The unmanned vehicle experienced a structural failure and was lost, though the capsule safely separated and deployed parachutes for recovery.

That incident had two important consequences. First, it demonstrated that Blue Origin's safety systems worked—even when the booster failed catastrophically, the capsule's abort system performed flawlessly, proving the vehicle's essential redundancy. Second, it grounded the program for extended investigation and remediation.

The 2022 grounding lasted approximately 14 months—longer than most space industry observers expected. The extended downtime suggested that root cause analysis was complex and that fixes required significant engineering work. When New Shepard finally returned to flight in late 2023, it marked a hard-won confidence that the vehicle had been comprehensively fixed.

That history informs the current pause. Blue Origin has now experienced the operational challenges of grounding a human-rated vehicle and understands the cost of delays. The company knows that fixing problems takes time, that customers expect transparency, and that schedule pressure can't override safety requirements.

The 2022 grounding also demonstrated market vulnerability. Tourism companies, researchers, and government partners who had been anticipating New Shepard flights had to find alternatives or defer their plans. That disruption taught the company that relying on a single revenue stream for any one program creates risk.

Pausing New Shepard voluntarily now, on the company's own terms and timeline, is different from being forced to ground the program due to a failure. It demonstrates management control and strategic clarity rather than reactive problem-solving.

Manufacturing, Supply Chain, and Operational Logistics

Blue Origin's spaceflight operations depend on complex manufacturing, supply chain management, and logistics. New Shepard operations require maintaining facilities, training personnel, managing consumables, scheduling flights, and coordinating customer logistics.

By pausing New Shepard, the company can optimize its operational footprint. Facilities that supported tourism operations can be repurposed. Supply chain contracts for consumables can be renegotiated or paused. Personnel can be redirected to higher-priority programs.

Spaceflight manufacturing is capital-intensive. Blue Origin owns facilities across multiple locations, including their headquarters in Kent, Washington, manufacturing facilities in Huntsville, Alabama (formerly United Launch Alliance facilities), and rocket engine manufacturing in multiple locations. These assets are expensive to maintain.

Optimizing facility utilization is a key lever for improving profitability and reinvesting capital in development programs. By concentrating on New Glenn production and lunar programs, Blue Origin can run factories more efficiently, reduce overhead, and redeploy resources.

Supply chain considerations are particularly important in spaceflight. Critical components are often specialized and expensive. Sourcing, manufacturing, testing, and delivering components involves long lead times and committed budgets. By pausing New Shepard, Blue Origin can adjust supply chain spending, renegotiate supplier relationships, and focus procurement on lunar and heavy-lift priorities.

Logistics for tourism flights—coordinating passenger transport, training, accommodations, and customer experience—is surprisingly complex and expensive. Pausing these operations eliminates that overhead, freeing up management attention and capital for more strategic priorities.

The Broader Commercial Spaceflight Landscape

Blue Origin's pause reflects broader trends in commercial spaceflight. The industry is consolidating around a few key business models: launch services, space infrastructure, and government contracts. Pure tourism is a niche market with limited long-term revenue potential.

Companies like Virgin Galactic pioneered suborbital tourism with their spaceplane concept. Yet Virgin Galactic has struggled to scale tourism profitably and is pursuing government contracts and military applications. Even Richard Branson's ambitious vision of making spaceflight accessible and routine has had to adapt to market realities.

The commercial spaceflight industry is maturing. Companies that survive the current consolidation wave will be those capturing large government contracts, establishing profitable launch services, and building infrastructure that supports sustained operations. Tourism is an interesting proof-of-concept and a marketing tool, but it's not a primary revenue driver.

Blue Origin's pivot signals recognition of this market reality. The company is positioning itself as a serious infrastructure company, not a tourism company. That positioning is reinforced by pausing New Shepard and concentrating on lunar missions.

Other commercial spaceflight companies are pursuing similar strategies. Axiom Space initially focused on commercial space station modules but is now pursuing lunar missions. Relativity Space is building rocket manufacturing facilities and pursuing launch services. Sierra Space is developing spaceplane capabilities for crewed missions. The industry consensus is clear: government contracts and infrastructure are where sustainable revenue lives.

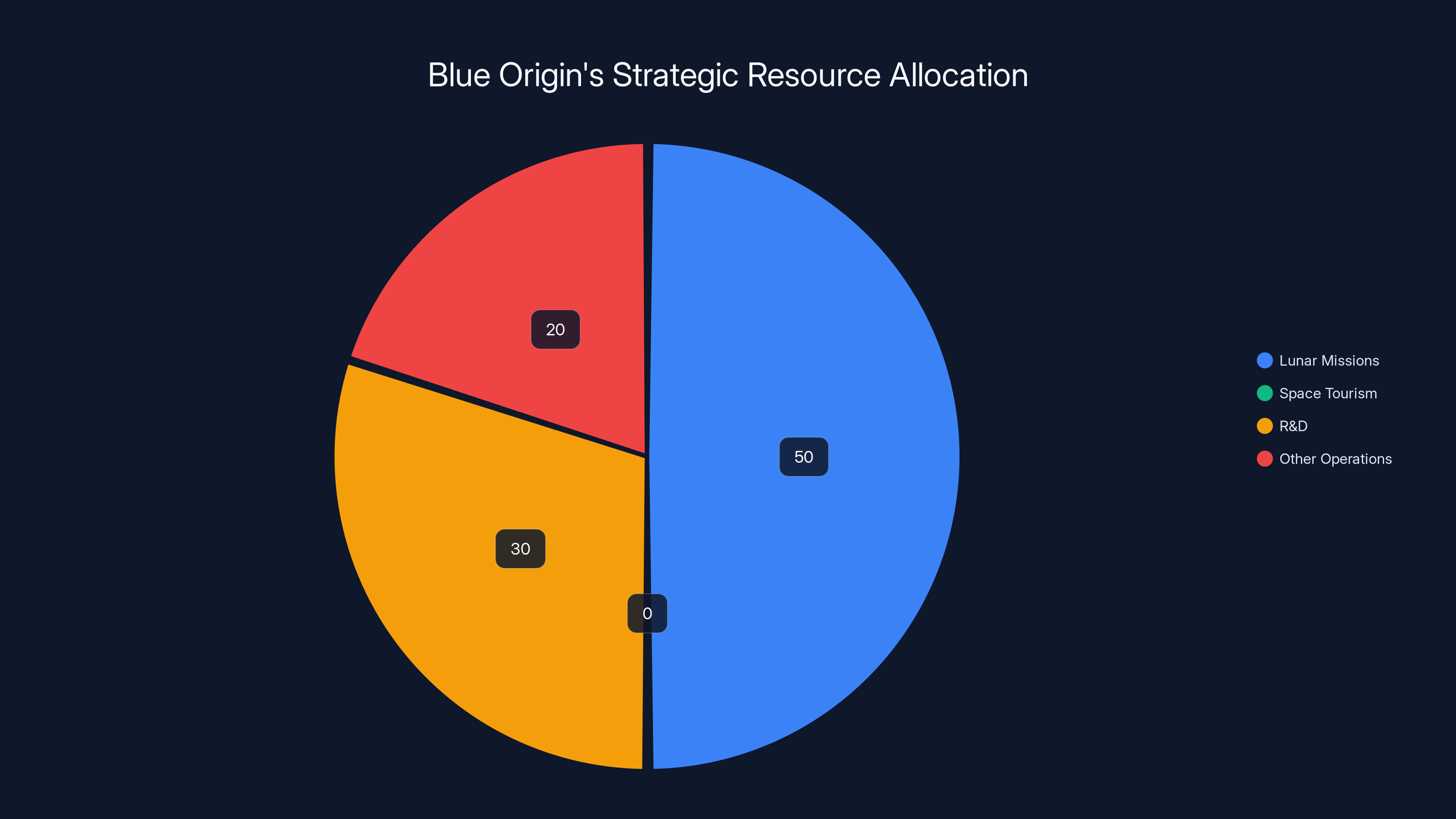

Following the strategic pivot, Blue Origin is estimated to allocate 50% of its resources to lunar missions, with space tourism paused entirely. Estimated data.

Timeline Analysis: Two Years and Beyond

Blue Origin specified a pause of "no less than two years." That's a carefully chosen timeframe with strategic significance. Two years aligns with several important development milestones: New Glenn operational maturity, Blue Moon testing completion, and potential completion of initial Artemis mission phases.

Two years is long enough to make meaningful progress on lunar programs without being so distant that it seems indefinite. It's a timeframe that signals serious commitment without making promises the company might struggle to keep.

What happens after two years? Multiple possibilities exist. If Blue Moon successfully demonstrates capability, wins major government contracts, and starts flying lunar missions, New Shepard might restart with a different business model—perhaps exclusively for scientific missions or government payloads rather than paying tourists.

Alternatively, if the lunar program faces delays or if tourism demand resurges, Blue Origin might extend the pause or restart at a reduced operational tempo. The two-year commitment provides optionality while signaling current strategic priority.

For companies and customers planning around New Shepard, this timeline matters enormously. Research organizations planning to fly experiments on New Shepard have other options for the next two years—suborbital platforms from other providers, parabolic flights from companies like ZERO-G, or delaying experiments until New Shepard returns to operations.

Implications for Commercial Spaceflight Investment

Blue Origin's pause has implications for investor sentiment about commercial spaceflight. The move signals that profitability and sustainability matter more than aggressive growth in consumer-facing programs. That's a mature business perspective, but it might disappoint investors betting on rapid commercialization of space tourism.

For venture capital and private equity investors funding other commercial spaceflight companies, the signal is clear: build sustainable business models based on government contracts and infrastructure, not consumer tourism. The most successful commercial spaceflight companies will be those capturing large, recurring government revenue streams.

This realization is already reflected in startup funding patterns. Most venture capital flowing into spaceflight companies targets launch services, satellite operations, in-space manufacturing, orbital refueling, and space infrastructure—not space tourism. The few tourism-focused companies attract funding, but at lower valuations and with greater skepticism about exit strategies.

Blue Origin's decision validates investor skepticism about pure-play tourism models. The company has a diversified business strategy, deep pockets from Bezos' wealth, and is still choosing to prioritize government contracts over tourism revenue. That's a powerful statement about where the real opportunity lies.

The Role of Military and National Security Interests

Beyond NASA and civil spaceflight, military and national security interests play an important role in Blue Origin's strategic calculations. The U.S. Space Force and Space Command have contracts for launch services, and national security space priorities influence government spending on commercial spaceflight.

Blue Origin has pursued military contracts aggressively. New Glenn is being positioned for national security payload deliveries. The company's capabilities in reliable launch services and spacecraft operations are valuable to military organizations requiring assured access to space.

By focusing on lunar capabilities and New Glenn development, Blue Origin strengthens its position in military and national security spaceflight contracting. That category of revenue is reliable, long-term, and well-funded. Military programs operate with less budget variability than NASA civil programs.

The Trump administration's space policies emphasize military space capability and rapid development of American spaceflight infrastructure. That emphasis creates favorable conditions for companies like Blue Origin positioned to deliver military-relevant capabilities.

Pausing New Shepard also reduces the company's exposure to regulation and liability associated with commercial human spaceflight. Tourism flights carry regulatory overhead and risk of incidents that could generate negative publicity. By pausing tourism, Blue Origin simplifies its regulatory environment and focuses on government mission profiles with established oversight frameworks.

The New Shepard grounding lasted approximately 14 months from September 2022 to December 2023, indicating a thorough investigation and remediation process. (Estimated data)

Competitive Response and Market Adaptation

Blue Origin's pause creates opportunities for other commercial spaceflight companies. Tourism demand isn't disappearing—it's just unmet by Blue Origin for the next two years. Companies like Virgin Galactic have the potential to capture some of this market.

Virgin Galactic's spaceplane offers a different experience than New Shepard's ballistic trajectory. The spaceplane provides extended weightlessness and a different view of the black sky. That differentiation might attract customers frustrated by New Shepard's unavailability.

Other suborbital providers might also see increased interest. Companies experimenting with suborbital vehicles and space tourism concepts could benefit from Blue Origin's market exit. The market might fragment into multiple providers serving different niches and geographies.

Long-term, Blue Origin's pause creates a market gap that could be filled by emerging commercial spaceflight startups. If companies can develop reliable suborbital vehicles and build profitable tourism businesses, they'll have access to a market that Blue Origin is temporarily abandoning.

This competitive dynamic reinforces an important reality: the future of commercial spaceflight involves multiple business models and multiple providers. Consolidation around government contracts is occurring, but consumer spaceflight markets aren't disappearing—they're fragmenting and evolving.

Technical Innovation and Development Acceleration

Pausing New Shepard creates space—figuratively and literally—for technical innovation. Blue Origin can experiment with new systems, test advanced components, and refine technologies without the constraints of maintaining a commercial flight schedule.

Spaceflight development requires extensive testing. Each innovation must be validated across multiple test campaigns before flying on operational vehicles. Compressed commercial schedules can constrain testing rigor and innovation potential.

By pausing New Shepard, Blue Origin gains testing flexibility. The company can run more rigorous validation campaigns for new avionics, materials, landing systems, and recovery technologies. These innovations can eventually benefit New Shepard if it returns to service, but they're also applicable to Blue Moon and New Glenn.

The aviation industry provides an interesting historical parallel. When aircraft manufacturers pause specific production lines, they often use that time to implement manufacturing improvements, test new materials and designs, and prepare for next-generation variants. The same dynamics apply to spaceflight.

Blue Origin has invested heavily in advanced manufacturing technologies, including 3D printing and robotic production. Pausing New Shepard allows the company to implement these technologies without disrupting operational flight schedules. Efficiency improvements gained during the pause can translate to cost reductions and increased capabilities when production resumes.

Reputational and Brand Implications

From a brand perspective, Blue Origin's decision is more nuanced than it might first appear. On one hand, the company is sacrificing a visible consumer-facing program that generates positive media coverage. Space tourism is aspirational and gets media attention.

On the other hand, pursuing lunar missions and government contracts is more prestigious. Working with NASA and supporting Artemis aligns the company with humanity's greatest space exploration ambitions. That positioning attracts talent, strengthens relationships with government partners, and builds long-term credibility.

Bezos has positioned Blue Origin with the long-term vision of making life better through space infrastructure. That vision is better served by supporting government lunar missions than by entertaining tourists, even if tourism is currently more profitable.

Brand positioning also affects access to capital and partnership opportunities. Investors and strategic partners prefer companies pursuing transformational missions rather than incremental ones. Blue Origin's focus on lunar infrastructure and heavy-lift launch capability positions the company as a serious infrastructure player, not just a tourism operator.

The decision also sends a message about Blue Origin's confidence in its technology. By pausing tourism and pursuing government contracts, the company is essentially saying: our vehicles and systems are so capable that we're comfortable redirecting them to the most demanding missions. That confidence is valuable in competitive bidding situations.

Supply Chain Vulnerabilities and Economic Considerations

Space industry supply chains are concentrated and sometimes fragile. Critical components are often produced by a small number of suppliers. Long lead times and specialized manufacturing create supply chain vulnerabilities.

By pausing New Shepard, Blue Origin can optimize supplier relationships and inventory management. The company can negotiate better terms with suppliers, reduce inventory carrying costs, and simplify supply chain complexity.

Economic conditions also influence spaceflight business decisions. Supply chain disruptions, inflation, and labor market tightness have affected space industry costs dramatically since 2020. By consolidating programs and reducing operational complexity, Blue Origin improves economic resilience.

Inflation particularly impacts spaceflight because so many materials, components, and services are specialized. General inflation is manageable, but cost increases for specialized aerospace materials and services significantly impact program budgets. Pausing New Shepard is partially a response to economic pressures requiring portfolio consolidation.

International Competition and the Space Race Context

Beyond American competition, international factors influence Blue Origin's strategy. China is pursuing aggressive lunar exploration programs. Russia has historical lunar expertise. Europe, India, and Japan have active lunar programs. The geopolitical context frames commercial spaceflight decisions.

The Trump administration's emphasis on lunar missions is partially driven by competitive concerns with China. If China establishes claimed sovereignty over lunar resources or establishes exclusive access to strategic lunar sites, American strategic interests suffer.

Blue Origin's focus on lunar capabilities positions American commercial spaceflight companies to support government objectives and maintain American leadership in space. That positioning has geopolitical significance beyond commercial considerations.

International partnerships also matter. Blue Origin might pursue partnerships with international space agencies or commercial entities for lunar missions. The pause on New Shepard doesn't preclude such partnerships—it simply focuses corporate resources on capabilities that matter most for government and international cooperation.

Long-Term Vision: Beyond the Two-Year Pause

What does Blue Origin's future look like beyond the two-year New Shepard pause? That's partially speculative, but strategic trends suggest several possible futures.

Scenario one: New Shepard returns to limited operations after two years, perhaps with a different business model focusing on scientific missions rather than paying tourists. The company maintains the vehicle for specialized missions while concentrating on lunar and heavy-lift capabilities.

Scenario two: New Shepard remains paused indefinitely if Blue Moon and New Glenn operations prove sufficiently profitable and demanding. The company might eventually retire the New Shepard program, focusing entirely on orbital and lunar capabilities.

Scenario three: Blue Origin develops multiple vehicle classes, with New Shepard eventually flying alongside new suborbital offerings. The company might create an internal tourism division separate from core spaceflight operations.

Scenario four: Blue Origin partners with or spins off New Shepard operations to another company, allowing the tourism program to continue under different management while Blue Origin focuses on government and commercial lunar missions.

Long-term, the trajectory suggests Blue Origin evolving into a vertically integrated space infrastructure company—launch provider, spacecraft manufacturer, lunar systems operator, and potentially space station operator. Tourism would be a secondary consideration if it exists at all.

This vision aligns with Bezos' stated objective of making life better through space infrastructure. It's ambitious, requires sustained investment, and depends on successfully capturing government contracts. The New Shepard pause is one step in executing that longer-term vision.

Challenges Ahead: Execution Risk

Blue Origin's strategy carries significant execution risk. The company is betting enormous resources on the assumption that Blue Moon will develop successfully, that New Glenn will become operational, and that government contracts will materialize as expected.

If Blue Moon experiences unexpected technical challenges, the entire strategy suffers. Lunar landing is extraordinarily difficult—only a handful of entities have successfully landed payloads on the Moon. Success is not guaranteed.

New Glenn's development has faced challenges and delays. The rocket's first flight occurred in 2024, later than originally planned. If additional delays occur or if the rocket requires more extensive modifications, Blue Origin's timeline suffers.

Government contracts are also uncertain. NASA's budget is subject to congressional appropriation, which can change based on political priorities. An unexpected budget cut, a change in NASA leadership, or a shift in space policy could alter contract availability.

Competition is intense. SpaceX continues advancing Starship. Other companies are developing lunar capabilities. Blue Origin needs to out-execute all competitors while managing technical and schedule risk. That's an extraordinarily demanding challenge.

The company also faces regulatory uncertainty. Commercial spaceflight is increasingly subject to environmental review, orbital debris mitigation requirements, and other regulatory frameworks that could affect operations and timelines.

Conclusion: Strategic Pivot or Necessary Adaptation?

Blue Origin's decision to pause New Shepard for at least two years represents either a bold strategic pivot or a pragmatic response to market realities, depending on perspective. What's undeniable is that it's a consequential decision with implications reaching far beyond the company itself.

The pause signals recognition that the true opportunity in commercial spaceflight lies with government contracts, space infrastructure, and sustained lunar operations—not with tourism flights. That recognition aligns Blue Origin with broader industry trends and investor sentiment.

The timing, context, and explicit focus on lunar missions reflect an understanding that the current window of opportunity is narrow. President Trump's lunar timeline, NASA's Artemis ambitions, and the competitive pressure from SpaceX create a specific moment in which lunar capability development offers exceptional value.

For passengers who had dreamed of experiencing weightlessness aboard New Shepard, the pause is disappointing. For Blue Origin employees whose work depends on tourism operations, it creates uncertainty. For competitors, it opens market opportunities.

But for Blue Origin shareholders, government partners, and observers interested in the long-term trajectory of commercial spaceflight, the decision makes strategic sense. The company is positioning itself to capture enormous value in the lunar economy while establishing itself as a serious infrastructure provider alongside or in competition with SpaceX.

The ultimate vindication of this strategy depends on execution. Blue Origin must deliver on its lunar promises, successfully operate New Glenn, and capture substantial government contracts. If the company succeeds, the New Shepard pause becomes a turning point in Blue Origin's evolution from a promising spaceflight company to a dominant player in the space infrastructure industry.

If execution falters, the pause becomes a cautionary tale about betting corporate resources on uncertain government timelines and competitive uncertainties. For now, the company is committed, and the next two years will determine whether that commitment pays off or becomes a costly miscalculation.

FAQ

What is Blue Origin pausing and why?

Blue Origin is pausing its New Shepard space tourism program for a minimum of two years to redirect all resources toward developing lunar capabilities and the Blue Moon lander. The company is making this move to compete more effectively for NASA contracts under President Trump's accelerated timeline for returning humans to the Moon before the end of his second term in 2029.

How many people has New Shepard flown and what's the experience like?

New Shepard has carried 98 humans to space across 38 flights since first launching in 2015. Passengers experience a roughly eleven-minute flight, with approximately four minutes of weightlessness at the apex when the capsule crosses the Kármán line (100 km altitude). The experience provides unobstructed views of Earth's curvature and the blackness of space beyond before the capsule descends back to Earth under parachutes.

What is Blue Moon and why does it matter for lunar missions?

Blue Moon is Blue Origin's large lunar lander designed to deliver cargo and eventually humans to the lunar surface. The vehicle incorporates advanced landing systems, autonomous navigation, and life support capabilities. It matters because NASA is distributing Artemis contracts across multiple companies, and Blue Moon is positioned to compete for substantial government funding to support sustained lunar operations and human missions.

How does this pause affect Blue Origin's other programs like New Glenn?

The New Shepard pause frees up resources, launch capacity, facility utilization, and management attention that can now focus on accelerating New Glenn development and operations. New Glenn is Blue Origin's heavy-lift rocket designed to compete with SpaceX's Falcon Heavy, and it's critical for delivering Blue Moon landers and payloads to lunar orbit. Redirected resources should enable faster New Glenn operational maturation.

Why would Blue Origin sacrifice profitable tourism revenue for uncertain government contracts?

While tourism generates revenue, government contracts offer scale and sustainability far exceeding tourism potential. A single major NASA lunar contract could exceed the entire lifetime revenue of New Shepard tourism operations. Under Trump's accelerated lunar timeline, the window for capturing this opportunity is narrow, and first-mover advantage in lunar capability has substantial value in competitive government contracting.

Could New Shepard return to operations after the two-year pause?

It's possible but uncertain. New Shepard could return with a modified business model focused on scientific missions rather than paying tourists, or the company could maintain the pause if Blue Moon and New Glenn operations prove sufficiently demanding and profitable. Alternatively, Blue Origin might partner with other companies to continue tourism operations while maintaining corporate focus on government and lunar missions.

How does Blue Origin's pause compare to SpaceX's approach to space tourism?

SpaceX hasn't pursued commercial space tourism with dedicated suborbital vehicles like New Shepard. Instead, SpaceX offers orbital spaceflight through its Dragon spacecraft with private crews traveling to orbit. While Blue Origin is pausing suborbital tourism to focus on lunar missions, SpaceX is developing Starship for both lunar missions and future Mars operations, never treating tourism as a core business. Both companies prioritize government contracts over consumer-facing spaceflight.

What does the 2022 New Shepard grounding tell us about this pause?

The 2022 booster failure and subsequent 14-month grounding demonstrated that unexplained spaceflight incidents cause extended operational disruptions. By pausing New Shepard voluntarily on the company's own terms, Blue Origin maintains control over its narrative and timeline rather than being forced into reactive problem-solving. It's a strategic choice rather than a crisis response, signaling management confidence and deliberate prioritization.

How might this pause affect other commercial spaceflight companies?

Blue Origin's exit from active space tourism operations creates market opportunities for companies like Virgin Galactic and emerging suborbital providers. Research organizations and tourism companies previously planning New Shepard flights have alternatives, though perhaps less capable. Competitors might capture some customers frustrated by the pause, potentially accelerating Virgin Galactic's recovery from its operational challenges or enabling smaller companies to enter the market.

What economic factors influenced this decision?

Supply chain disruptions, inflation in aerospace materials, and tight labor markets have increased spaceflight operating costs significantly since 2020. By consolidating programs and reducing operational complexity, Blue Origin improves economic resilience. The decision also reflects recognition that tourism revenue can't sustain a diversified spaceflight company—long-term sustainability requires profitable government contracts and infrastructure operations.

Key Takeaways

-

Blue Origin is pausing New Shepard space tourism for at least two years to concentrate on lunar missions and lunar lander development, redirecting corporate resources toward more valuable government contracts.

-

Government contracts dwarf tourism revenue: A single NASA lunar contract could exceed the lifetime revenue of New Shepard tourism operations, explaining why Blue Origin prioritizes lunar capability development.

-

Trump's lunar timeline creates competitive urgency: The administration's goal of returning humans to the Moon before 2029 creates a narrow window for companies to capture contracts, and Blue Origin is betting that accelerated focus improves competitive positioning.

-

New Shepard has proven reliable and successful across 38 flights carrying 98 humans and 200+ research payloads, but the program's limited revenue and operational constraints make it less strategically valuable than lunar infrastructure development.

-

Blue Moon lunar lander is now the centerpiece of Blue Origin's strategy, designed to deliver cargo and crews to the lunar surface and competing for substantial Artemis program funding.

-

New Glenn rocket development is critical to lunar mission capability, and freed resources from New Shepard can accelerate New Glenn's operational maturation and commercial deployment.

-

Execution risk remains substantial: Success depends on Blue Moon technical success, New Glenn operational reliability, and actual materialization of government contracts—outcomes that aren't guaranteed.

Related Articles

- Blue Origin's New Glenn Third Launch: What's Really Happening [2026]

- NASA's Mars Orbiter Decision: What's at Stake [2025]

- Satellite Ground Stations: The Bottleneck Reshaping Space Infrastructure [2025]

- Blue Origin's TeraWave: The Next Satellite Internet Game-Changer [2025]

- Blue Origin's TeraWave Megaconstellation: The 6Tbps Satellite Internet Game Changer [2025]

- Palantir's £240 Million UK MoD Contract: What It Means for Defense Tech [2025]

![Blue Origin Pauses Space Tourism to Focus on Moon Missions [2025]](https://tryrunable.com/blog/blue-origin-pauses-space-tourism-to-focus-on-moon-missions-2/image-1-1769809338171.jpg)