Blue Origin's Tera Wave: The Next Satellite Internet Game-Changer [2025]

Jeff Bezos just made a quiet announcement that might reshape how enterprises and governments access the internet. Blue Origin, his aerospace company, unveiled Tera Wave—a satellite internet network that's not trying to compete with Starlink in the consumer market. Instead, it's going after something bigger: enterprises, data centers, and governments that need guaranteed performance without the compromises.

Here's what caught my attention: while everyone's focused on Starlink's consumer dominance (over 9,000 satellites in orbit), Blue Origin is building something entirely different. Tera Wave isn't racing for the most satellites or the biggest subscriber base. It's targeting speed, symmetry, and reliability at enterprise scale.

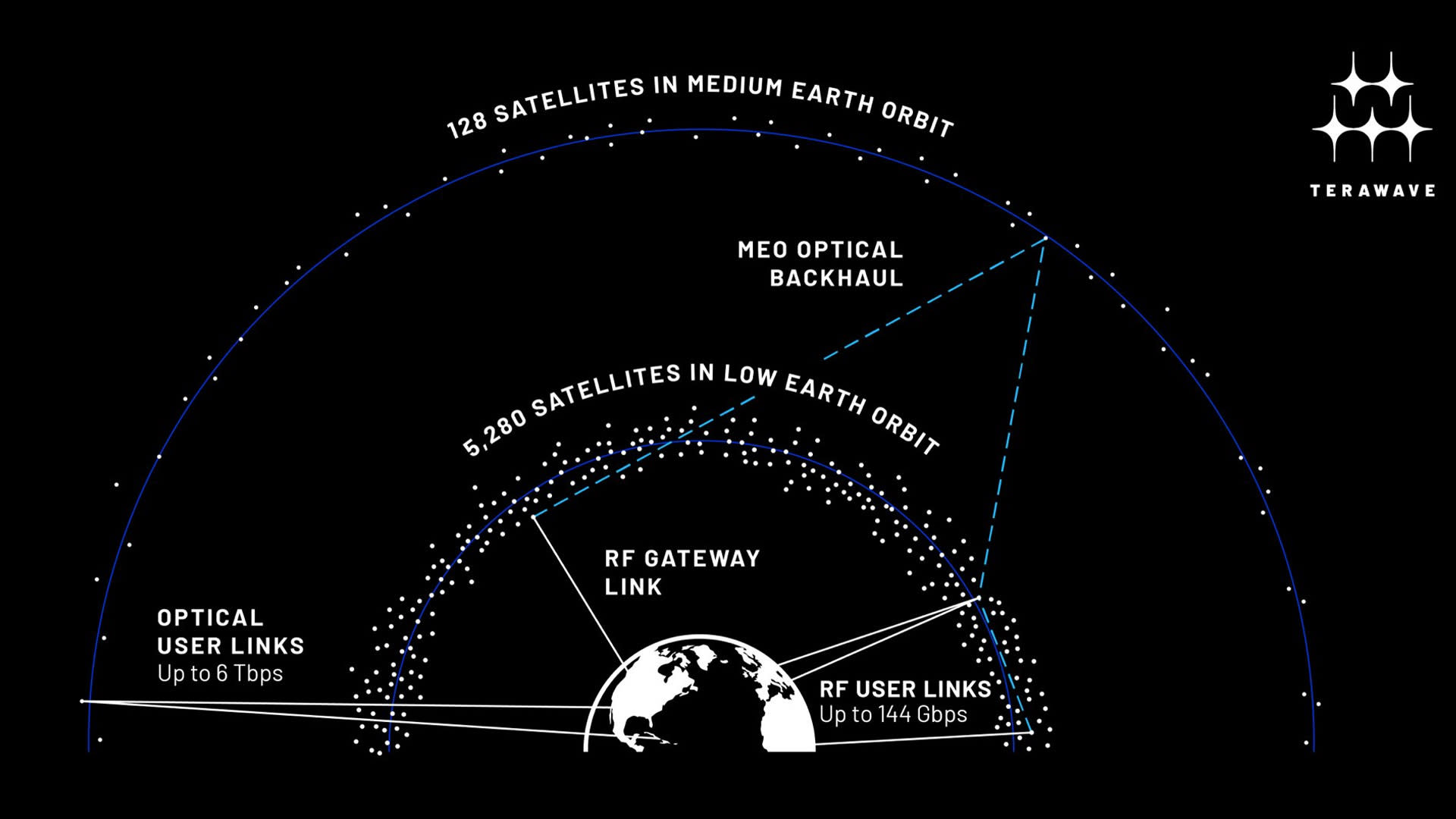

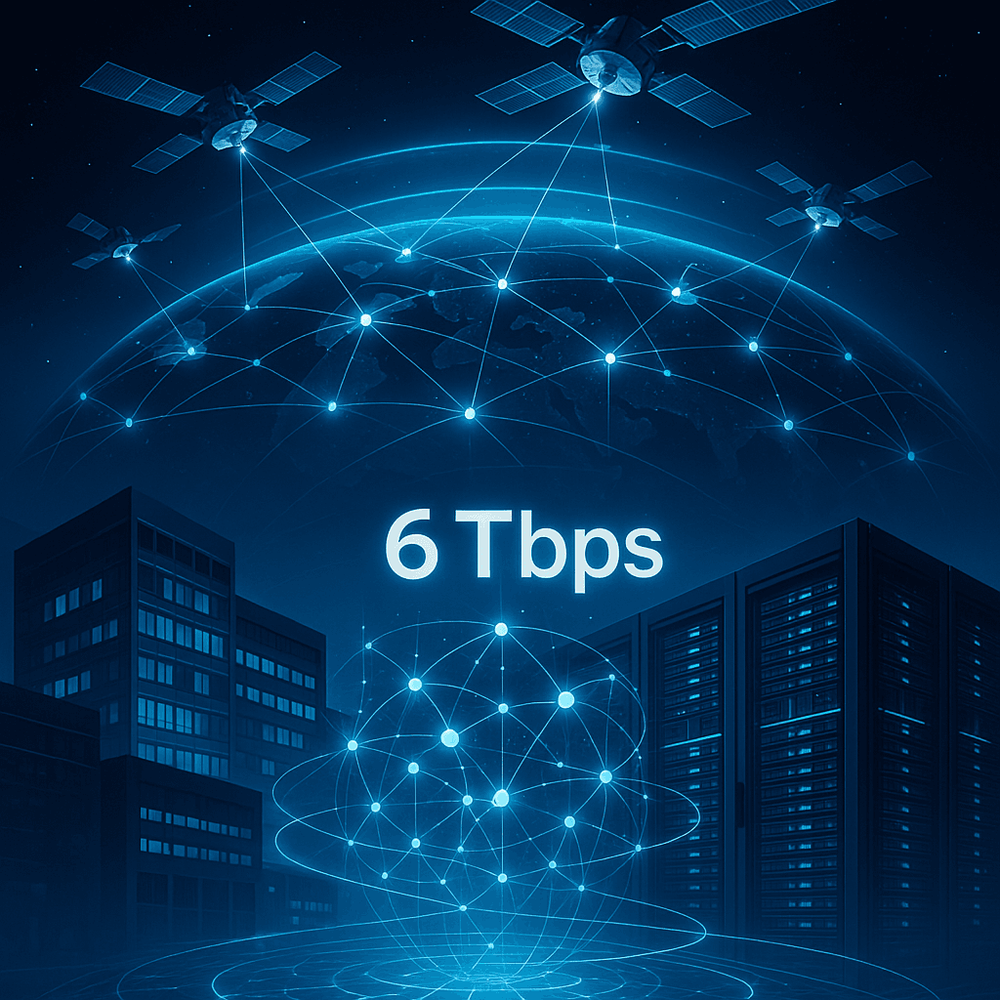

The numbers alone are striking. Tera Wave promises up to 6 terabits per second (6 Tbps) of total capacity through optical links and 144 gigabits per second (144 Gbps) per customer using radio frequency. Compare that to current low-earth orbit networks offering around 1 gigabit per second download and 400 megabits per second upload. That's a quantum leap.

But here's the thing: launching in late 2027 means we're still years away from seeing this network operational. In the meantime, Amazon Leo (formerly Project Kuiper) is already moving faster with 180 satellites in orbit and plans for 3,200+ total. Starlink's running laps around everyone with its 9,000-satellite network already providing service.

So what makes Tera Wave worth the wait? Let's dig into the architecture, the competitive landscape, and what this means for the future of global connectivity.

TL; DR

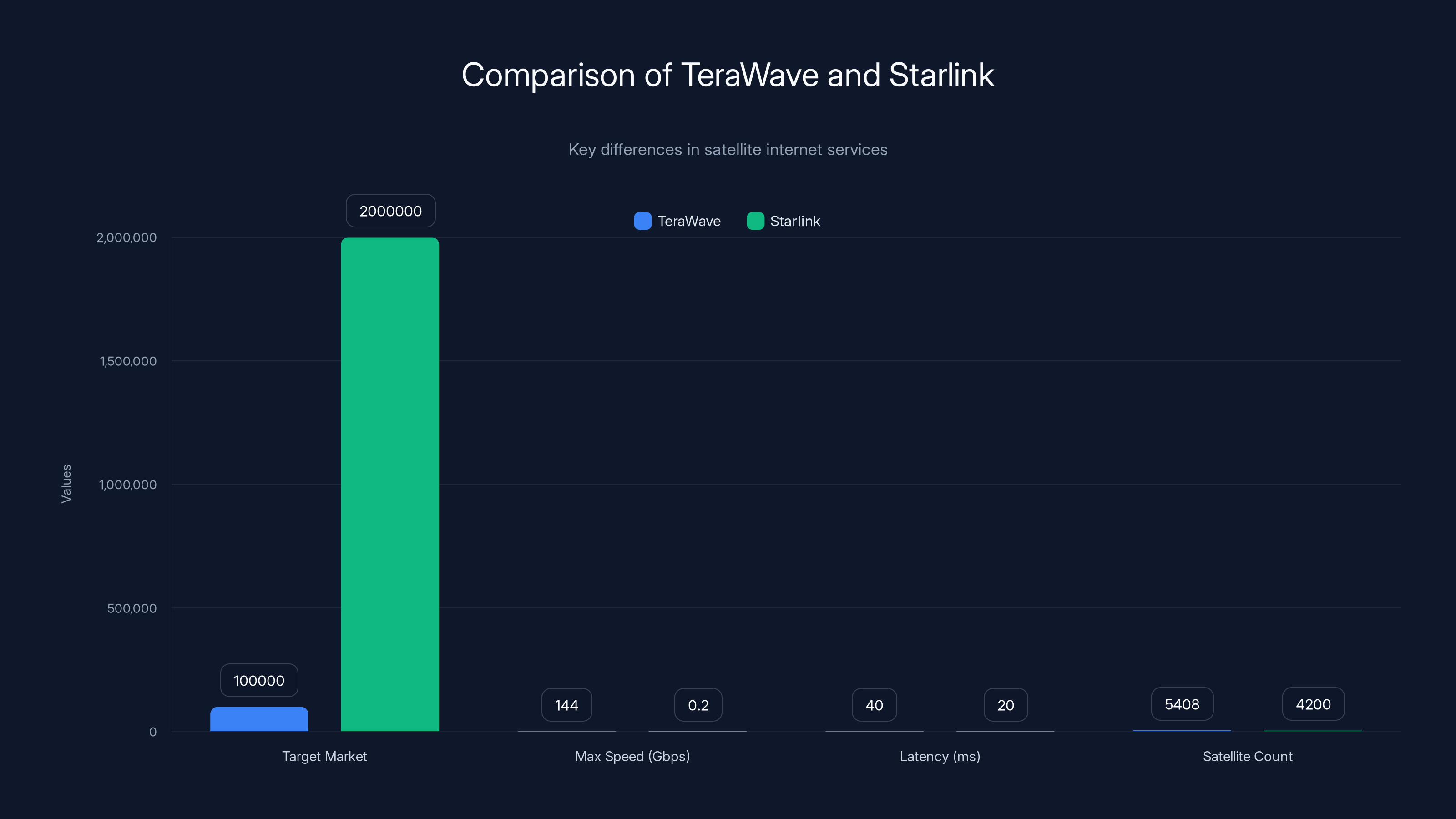

- Tera Wave targets enterprises, not consumers: 5,408 satellites designed for 100,000 high-value customers with guaranteed performance

- Speed advantage is real: Promises 6 Tbps optical capacity and 144 Gbps per customer—far exceeding current LEO networks

- Optical architecture differentiates it: Unlike radio-only competitors, Tera Wave uses 128 medium-earth orbit satellites for ultra-high-capacity optical links

- Launch timeline: late 2027: Years behind competitors, but Amazon continues using Blue Origin as launch partner, signaling confidence

- Strategic positioning matters: This isn't about competing with Starlink's consumer market; it's about controlling enterprise satellite internet

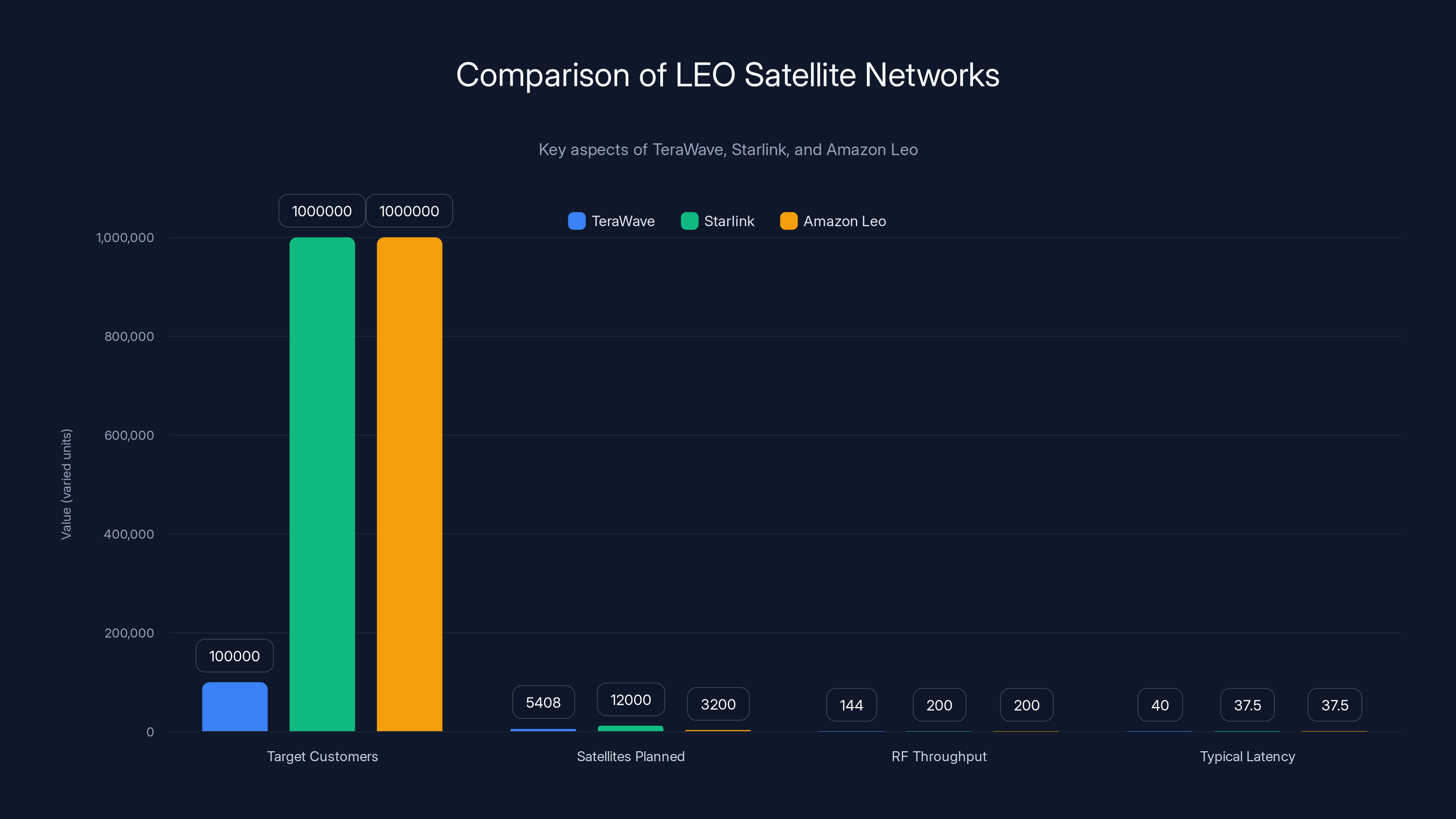

TeraWave targets enterprise customers with higher speeds and lower latency, while Starlink focuses on a larger consumer base with lower speeds. Estimated data for Starlink's target market and latency.

Understanding Low-Earth Orbit (LEO) Satellite Networks

Before diving into Tera Wave specifically, you need to understand why LEO satellites matter so much right now. Traditional internet infrastructure relies on fiber optic cables buried underground and submarine cables crossing oceans. These work great if you live in developed regions with existing infrastructure. But for remote areas, maritime vessels, military operations, and developing nations? Fiber just isn't economically viable.

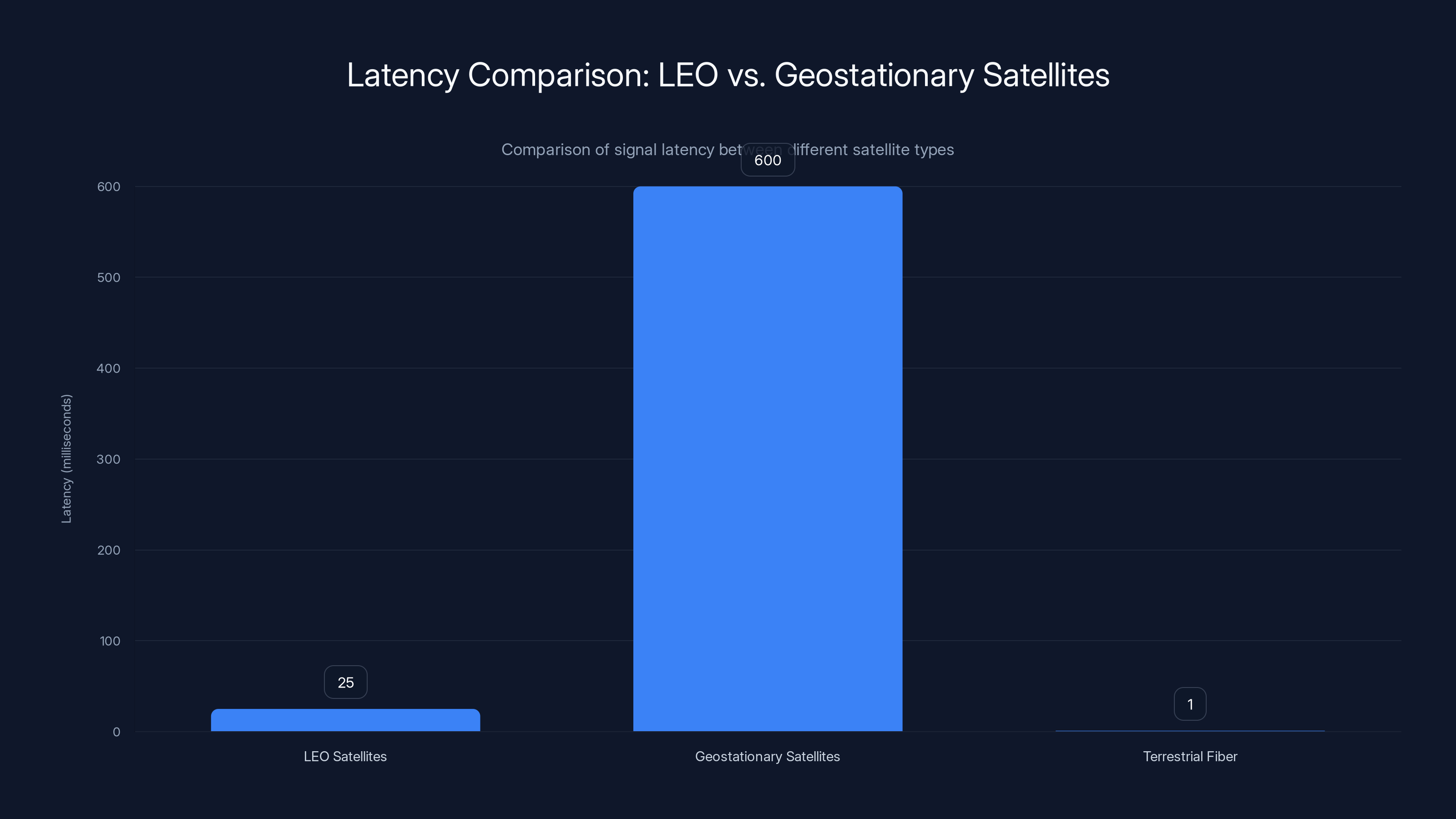

LEO satellites orbit between 160 and 2,000 kilometers above Earth. Unlike geostationary satellites (which sit 36,000 kilometers up and have massive latency), LEO satellites move fast and stay closer, dramatically reducing the time it takes for signals to travel. This means lower latency—crucial for real-time applications like video conferencing, online gaming, and financial transactions.

The tradeoff? You need a lot more LEO satellites to cover the planet. That's why Starlink has 9,000+. More satellites mean more complexity, more launches, and more orbital congestion.

Latency matters more than you think. Current LEO networks like Starlink deliver roughly 25-50 milliseconds of latency. That sounds fast, but data centers and financial networks operate on sub-millisecond timescales. A 50ms delay can cost traders millions. For enterprises, latency directly impacts productivity and real-time collaboration.

Tera Wave's architecture addresses this through a hybrid approach combining radio frequency and optical links. The optical links operate at the speed of light through fiber—essentially the same speed as terrestrial fiber optic cables. This is a crucial distinction that most satellite networks don't offer.

The LEO Advantage Over Geostationary Satellites

Geostationary satellites seem simpler: you launch fewer satellites and they stay in fixed positions relative to Earth's surface. But the distance creates problems. Latency hits 500+ milliseconds—too slow for interactive applications. Video calls become awkward. Online games become unplayable. Cloud computing connections lag.

LEO solves this through sheer orbital mechanics. Satellites at lower altitudes move faster, so signals don't have as far to travel. The tradeoff is you need global coverage through constellation management—coordinating hundreds or thousands of satellites passing overhead continuously.

For enterprise use cases, LEO's lower latency is non-negotiable. Tera Wave's positioning as an enterprise network specifically leverages LEO's speed advantage.

Current LEO Network Performance Benchmarks

Existing LEO networks demonstrate what's possible today. Starlink's network provides download speeds of 50-250 Mbps with 25-50ms latency. That's genuinely useful for most applications. But it's asymmetrical—upload speeds lag significantly.

For enterprises, this asymmetry is limiting. Video conferences with multiple participants require good upload speeds. Cloud backup operations need symmetrical speeds. Autonomous vehicles sending continuous sensor data to edge servers need reliable uploads. Starlink's architecture wasn't built for these use cases.

Amazon Leo is still ramping up, but similar limitations apply. It's designed more for broadband coverage than enterprise performance. Tera Wave explicitly targets the gap in the market where current networks fall short.

The Tera Wave Architecture: What Makes It Different

Here's where Tera Wave gets interesting. Most satellite internet networks use radio frequency (RF) communication across the board. Signals bounce between ground stations and satellites, then between satellites. It works, but RF has inherent limitations in throughput and distance.

Tera Wave splits the architecture. The constellation includes 5,280 satellites in low-earth orbit handling radio frequency communication for global coverage. But it also includes 128 satellites in medium-earth orbit (MEO) dedicated to optical links. This is the differentiator.

Optical links use lasers to transmit data between satellites and ground stations. Lasers move at light speed (obviously) and can carry far more data per second than radio signals. A single optical link can carry terabits per second. That's the key to Tera Wave's promised 6 Tbps total capacity.

But optical links require line-of-sight and can be blocked by weather. That's why Tera Wave uses RF as the primary access layer for customers, then uses optical for backbone connectivity. Customers connect via radio frequency to the nearest LEO satellite. That satellite then routes traffic to an MEO satellite via optical link for maximum capacity, then down to ground infrastructure.

It's elegant because it combines the best of both worlds: RF's weather tolerance and coverage with optical's throughput.

The 5,280 LEO Satellites

These are the workhorses of the Tera Wave network. They provide radio frequency access globally. The constellation's density ensures that multiple satellites are always visible from any point on Earth, enabling handoff as satellites pass overhead.

5,280 satellites is substantial but less than Starlink's current fleet. This suggests Blue Origin's engineering focused on efficiency rather than raw numbers. Strategic placement and orbital mechanics might allow fewer satellites to achieve similar coverage if the underlying technology is more advanced.

Each LEO satellite likely carries multiple RF antennae and ground station equipment. The technical specs remain proprietary, but typical modern LEO satellite designs include phased array antennae that electronically steer beams to different locations without mechanical movement.

The 128 MEO Satellites for Optical Backbone

Medium-earth orbit sits between LEO and geostationary orbit. At roughly 8,000-20,000 kilometers altitude, MEO satellites move more slowly than LEO but faster than geostationary. For optical backbone purposes, this matters less than capacity.

128 MEO satellites strategically placed can create an optical mesh network covering Earth's entire surface. Each satellite can link to multiple neighbors via laser links, creating redundant paths for data. If one optical link fails, traffic reroutes automatically.

The optical link capacity is the game-changer. Blue Origin hasn't published exact specs, but industry estimates suggest each optical link might handle 100 Gbps to 1 Tbps. With 128 satellites and multiple links per satellite, the network's total capacity becomes enormous.

For context, current submarine fiber optic cables carry 200-400 Tbps collectively. Tera Wave's 6 Tbps optical capacity is roughly equivalent to a modern transatlantic cable. That's significant capacity in the sky.

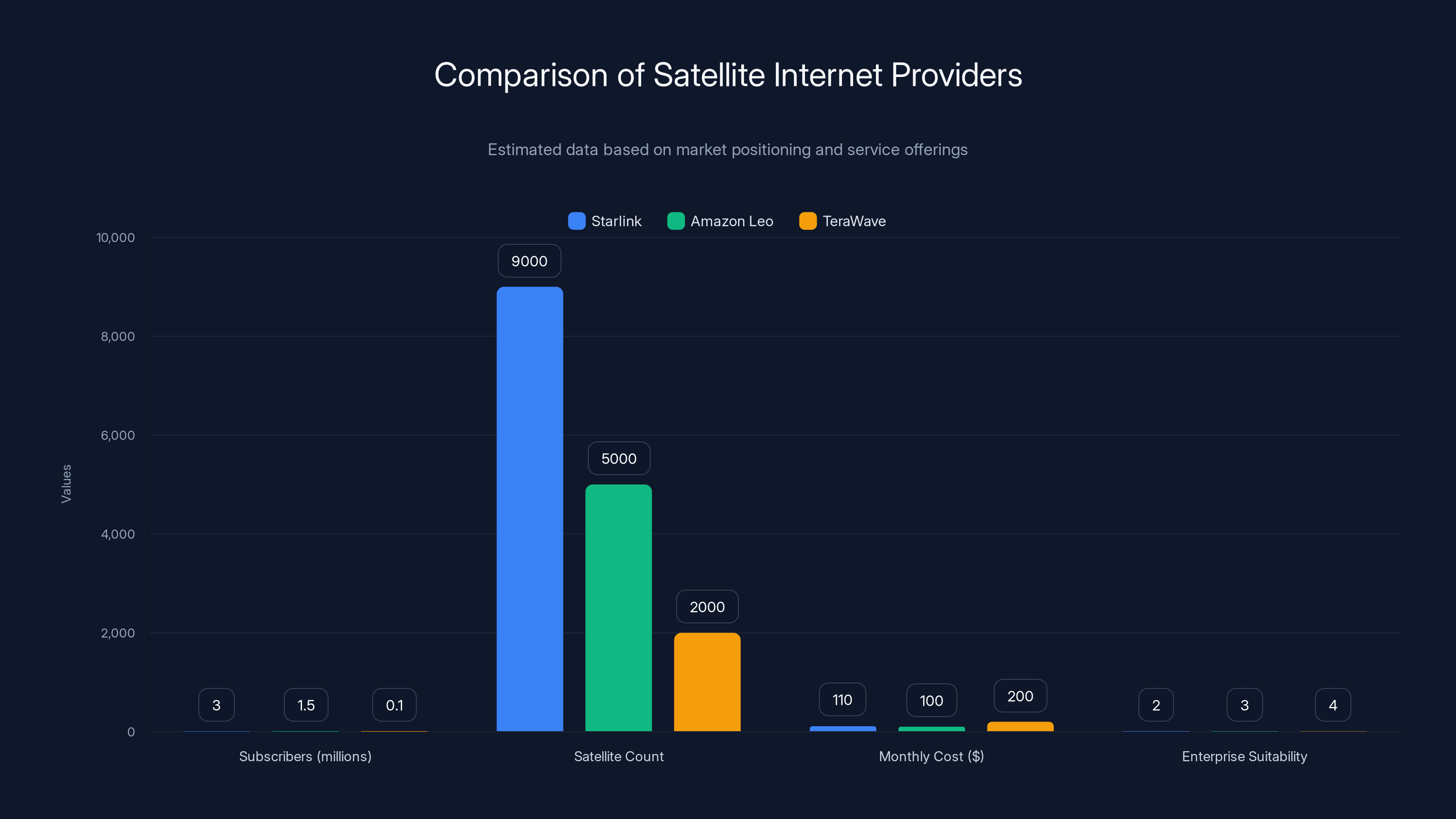

Starlink leads in subscribers and satellite count but faces challenges in enterprise suitability. TeraWave targets fewer customers with potentially higher revenue per user. (Estimated data)

Performance Specifications: The Numbers That Matter

Tera Wave's promised performance metrics are aggressive. Let's break down what they actually mean in practice.

6 Terabits per second total capacity sounds like an enormous number. For context, that's equivalent to simultaneously streaming 100,000 4K Netflix videos at maximum bitrate. But total network capacity and per-customer speeds are different things. The 6 Tbps is aggregate—shared across all connected customers.

With 100,000 target customers, that math works out to 60 Gbps average per customer if everyone's using the network simultaneously. In reality, not everyone uses max capacity simultaneously (called oversubscription). But even at 8:1 oversubscription, that's 7.5 Gbps per customer—still massive.

144 Gbps per customer via RF is the per-connection specification. This is an individual user's maximum throughput when connected via radio frequency. This is where most actual customer connections happen.

For comparison, current Starlink plans max out around 150-200 Mbps. That's 720x slower. Even fiber-to-the-home gigabit internet is 144x slower than Tera Wave's per-customer spec.

Of course, you won't find individual customers subscribing to 144 Gbps of satellite capacity anytime soon. But data centers, large enterprises, and government facilities absolutely would. A financial trading firm might lease 50-100 Gbps of capacity. A cloud service provider expanding to a remote region might lease similar amounts. These customers justify the investment.

Symmetrical upload and download speeds is another key claim. Current LEO networks like Starlink are asymmetrical because they optimize for download-heavy consumer use cases. Tera Wave explicitly designing for symmetry indicates enterprise focus where uploads matter.

Symmetrical speed changes the equation for cloud backup, video conferencing, autonomous vehicle telemetry, sensor networks, and any two-way real-time application. It's a feature, not a bug.

Latency Expectations

Blue Origin hasn't published specific latency numbers for Tera Wave yet. But physics provides guidance. LEO satellites at typical orbits (400-500 km altitude) create roughly 30-40ms one-way latency just from signal travel time. Ground infrastructure adds another 10-20ms. Total LEO latency typically ranges 25-50ms round-trip.

Tera Wave's hybrid RF/optical architecture shouldn't significantly improve these numbers. The RF access layer has the same basic physics. However, routing through optical backbone links might reduce some ground infrastructure latency by creating more direct paths.

Expect Tera Wave latency in the 30-50ms range for most connections. That's competitive with current LEO networks but not groundbreaking. The real advantage is throughput and consistency, not latency improvement.

For enterprise applications, latency consistency matters more than absolute latency. If latency varies wildly (jitter), applications fail. Dedicated satellite circuits with SLAs (Service Level Agreements) can guarantee latency stability even if absolute latency is 50ms. That's what enterprises pay premium prices for.

The Competitive Landscape: Starlink vs. Amazon Leo vs. Tera Wave

The satellite internet market is getting crowded. Understanding how Tera Wave fits requires examining existing players.

Starlink's Dominance and Limitations

Starlink, operated by Space X, has become synonymous with satellite internet. Over 9,000 satellites in orbit, millions of subscribers globally, and an extraordinarily ambitious expansion roadmap.

Starlink's consumer service is undeniably impressive. It provides reasonable broadband speeds to rural areas where terrestrial fiber is economically unviable. For consumers, that's genuinely transformative. Farmers in Montana can now run modern operations. Remote cabin owners get connectivity. That's real value.

But Starlink's architecture makes it ill-suited for enterprise networks. The service is designed for consumer loads: bursty downloads, asymmetrical traffic, tolerance for variable performance. The company doesn't offer SLA guarantees to consumers. Latency varies. Throughput depends on congestion. That's fine for consumer Netflix streaming. It's unacceptable for enterprise data center interconnection.

Starlink does offer commercial services through a separate tier, but that's relatively new and still building out. The network's fundamental architecture wasn't engineered for enterprise reliability.

Cost is another factor. Space X needs to launch satellites continuously to maintain and expand the Starlink constellation. This generates revenue pressure—they need massive subscriber numbers or high subscription prices to justify launch costs. Consumer pricing is aggressive ($110-500/month depending on tier), but even at those rates, the economics are tight.

Tera Wave explicitly targeting 100,000 customers (vs. Starlink's millions) changes everything economically. Smaller customer base but much higher revenue per customer makes the financial model work without the launch frequency Starlink requires.

Amazon Leo's Challenge

Amazon's Project Kuiper (rebranded as Amazon Leo) is similar to Starlink in positioning—consumer and enterprise broadband. Currently with 180 satellites in orbit and targeting 3,200+ eventually, Amazon Leo is scaling but still years behind Starlink in deployment.

The advantage Amazon has is scale. As the world's largest cloud provider, Amazon Web Services (AWS) can integrate satellite internet into broader cloud offerings. An enterprise buying cloud services from AWS might simultaneously purchase satellite backup connectivity from Amazon Leo. That bundling creates switching costs and natural competitive advantages.

However, Amazon Leo faces the same fundamental architecture challenge as Starlink: it's designed as a broadband network, not an enterprise dedicated-circuit network. The service model treats all customers similarly, offering tiers of throughput but not guaranteed symmetrical performance or dedicated capacity.

Amazon does have advantage in capital. AWS's profits fund Leo's expansion at a pace Space X alone can't match. Eventually, Amazon Leo could dominate the satellite internet market through sheer financial power and AWS integration.

But that's a future scenario. Today, Amazon Leo is still launching satellites and building out ground infrastructure.

Tera Wave's Strategic Positioning

Tera Wave enters a market already dominated by Starlink with Amazon Leo ramping up. So why does Blue Origin think it can succeed?

The answer is market segmentation. Starlink and Amazon Leo are chasing consumer and SMB broadband. Tera Wave is chasing a different segment: enterprises needing dedicated satellite capacity with guaranteed performance.

This segment has historically been served by satellite providers like Viasat and Intelsat using geostationary satellites. Those networks offer reliable, guaranteed service but with terrible latency (500ms+). Enterprises tolerate the latency for specific use cases: remote site backup, government operations, maritime communications.

If Tera Wave delivers guaranteed 40ms latency at 144 Gbps per customer with symmetrical speeds, it becomes the first truly viable replacement for geostationary satellite infrastructure. That's a transformative shift.

The market for dedicated enterprise satellite capacity is smaller than the mass-market broadband market. But it's much more lucrative. A single enterprise customer on a 100 Gbps dedicated circuit might pay

Blue Origin's strategy is to be the premium provider in a premium segment, not to compete on price and volume with Starlink. That's a fundamentally different business model.

Amazon's Continued Partnership with Blue Origin

Here's something worth analyzing carefully: Amazon continues using Blue Origin as a launch partner for Amazon Leo expansion despite competition from Tera Wave.

On the surface, this seems contradictory. Amazon's competing with Blue Origin in satellite internet, yet buying launches from Blue Origin. Why not just use Space X's Falcon 9 rockets?

The answer reveals strategic complexity in the satellite internet market. Blue Origin's New Glenn rocket, currently in development, is designed to be extremely heavy-lift capable. It can carry larger payloads more efficiently than current Falcon 9 configurations.

For Amazon Leo's expansion, efficiency matters. Launching 3,200+ satellites requires hundreds of launches. If Blue Origin's New Glenn can launch more satellites per mission at lower cost, Amazon benefits financially. That benefit can offset competitive concerns.

There's also technology sharing. Amazon's involvement with Blue Origin gives Amazon insight into optical satellite technology development. Even if Amazon Leo doesn't directly use optical links initially, insights into that technology could inform future iterations.

Finally, there's strategic redundancy. Amazon has no interest in depending on Space X exclusively for satellite launches. By maintaining relationships with multiple launch providers, Amazon reduces dependency risk. If Space X faces launch delays or capacity constraints, Amazon can flex to Blue Origin.

This dynamic—competitors cooperating on specific infrastructure while competing on services—is increasingly common in space infrastructure. It's a sign of market maturation.

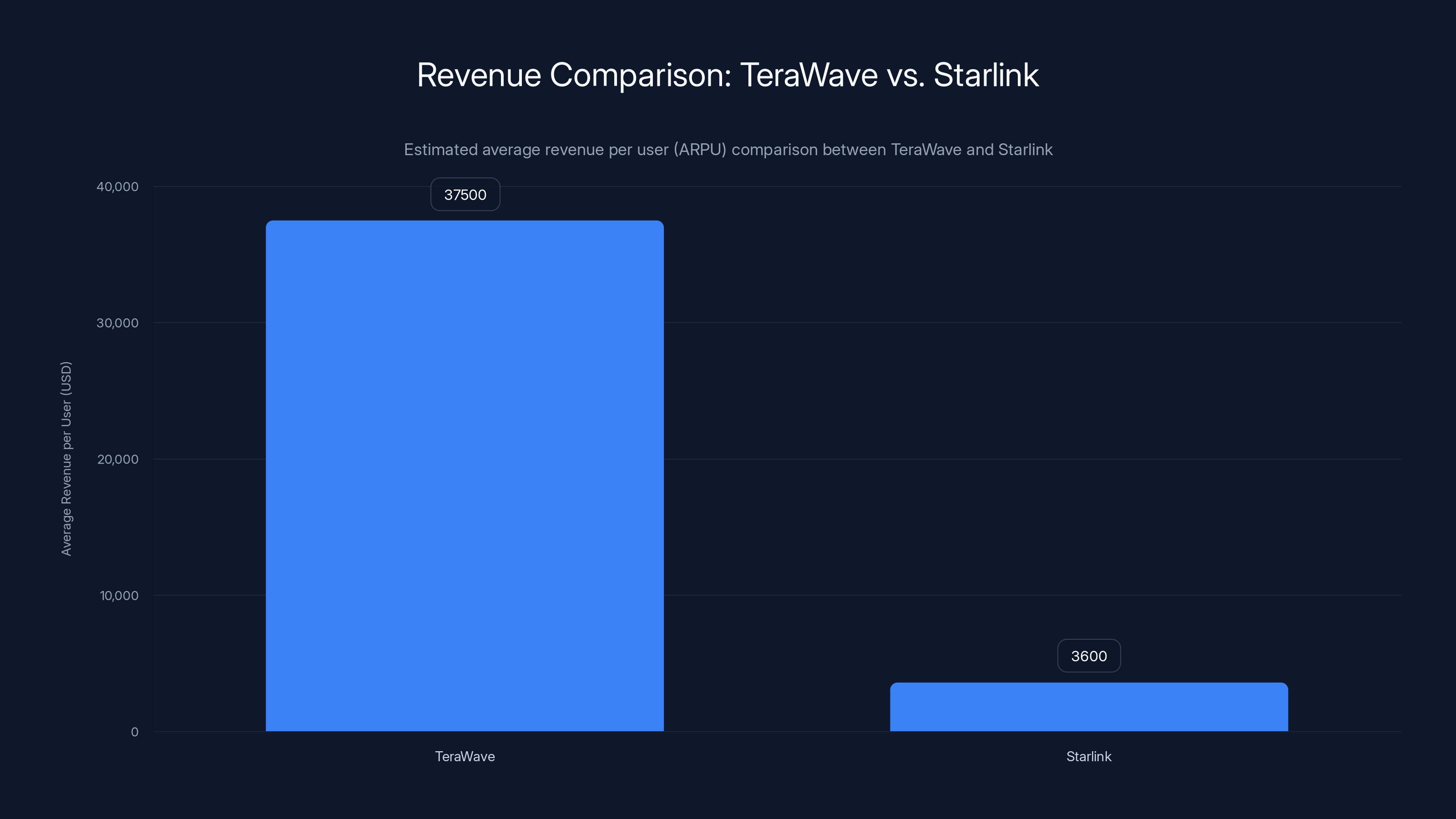

TeraWave's estimated ARPU is significantly higher than Starlink's, ranging from

Timeline and Deployment Strategy

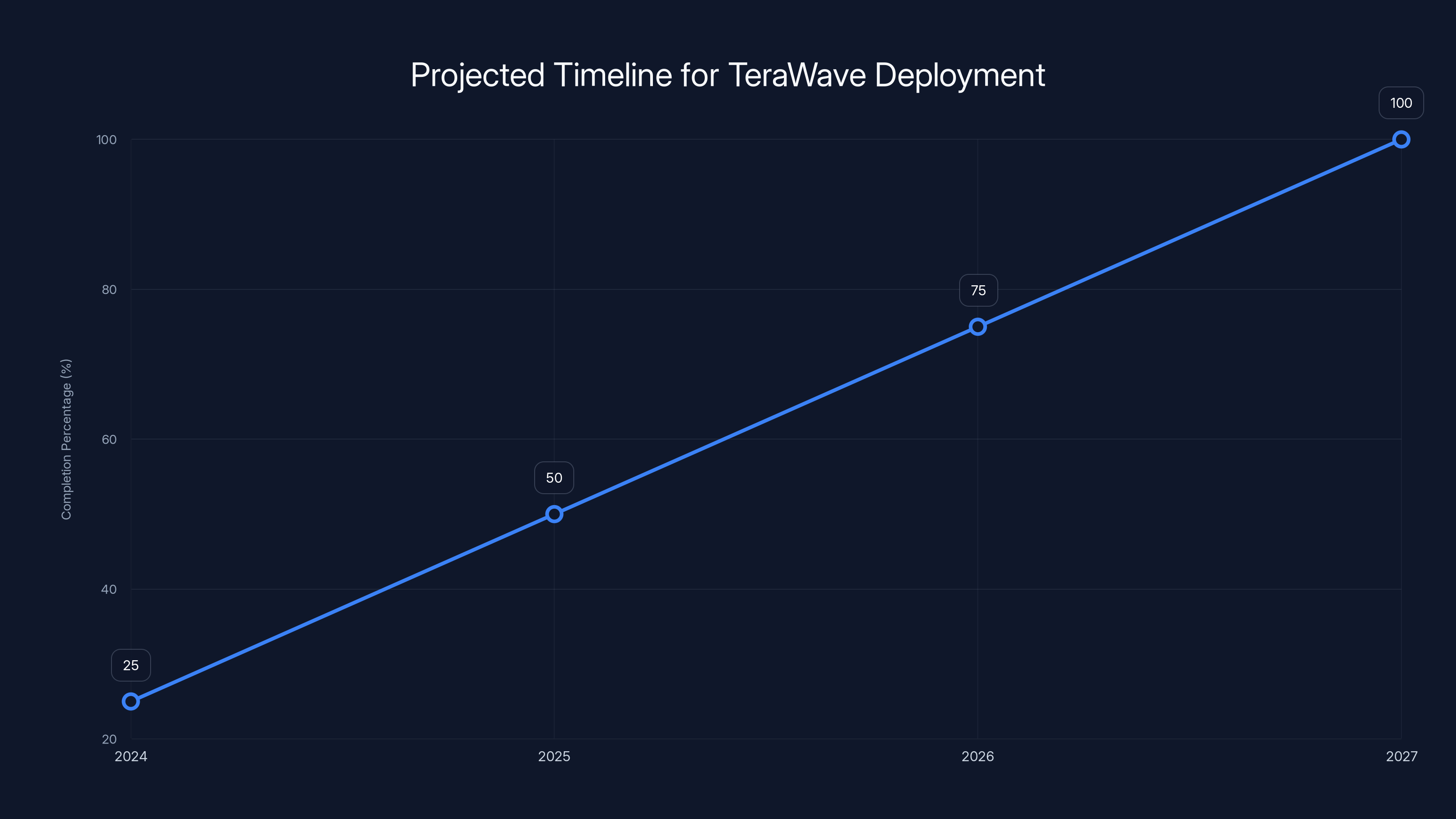

Tera Wave's planned launch in late 2027 is ambitious but realistic for a 5,408-satellite constellation. Let's put that in context.

Starlink's deployment timeline is instructive. Space X began Starlink launches in 2019. By 2024—five years later—they had deployed over 9,000 satellites. That's roughly 1,800 satellites per year, or 150 per month.

Blue Origin would need similar deployment rates. 5,408 satellites deployed by end of 2027 means roughly 1,350 satellites annually from 2025-2027, or about 110 per month. That's aggressive but achievable if Blue Origin executes launch schedules successfully.

The constraint is launch capacity. Blue Origin's New Glenn is designed to launch regularly, but the rocket is still under development. Early missions will likely have lower cadence while the company optimizes operations. As experience builds, launch frequency should increase.

There's also regulatory complexity. Every satellite launch requires licensing from national authorities. Frequencies must be coordinated to prevent interference. Orbital slots must be registered internationally. These administrative processes can delay deployment.

Historically, telecommunications satellite launches face 6-12 month delays beyond engineering timelines. Tera Wave's late 2027 target likely builds in some buffer, but delays are common.

Phased Deployment Strategy

None of the satellite internet providers deploy entire constellations simultaneously. Instead, they follow phased deployment: launch enough satellites for coverage of high-priority regions first, then expand.

Tera Wave will likely follow this pattern. Initial deployment (perhaps 1,000-2,000 satellites) would provide coverage over North America and Europe—the highest-revenue regions. Subsequent phases would expand globally.

This approach spreads technical risk and generates revenue faster. Early customers get service years before the constellation is complete. That revenue funds ongoing launches.

For enterprises, this phasing is actually advantageous. It allows early adopters to commit to Tera Wave for critical links before the entire network is operational. By the time full global deployment completes, the service will have operational history and proven reliability.

Ground Infrastructure Requirements

Satellites alone don't provide service. Tera Wave needs ground stations worldwide to connect satellites to terrestrial internet infrastructure. Each ground station is a substantial capital investment: land, buildings, equipment, redundant power, fiber connections.

Estimates suggest a global LEO satellite network needs 50-100 ground stations for adequate coverage. Tera Wave will likely follow this pattern, focusing initially on major markets.

The good news: Blue Origin likely leverages Amazon's existing infrastructure. AWS data centers globally can host ground stations. Amazon's existing fiber connections to internet backbones can integrate Tera Wave traffic. This gives Blue Origin enormous deployment advantage over startups without major IT infrastructure.

In fact, Amazon's partnership with Blue Origin might be partially motivated by this—AWS can rapidly deploy Tera Wave ground infrastructure, accelerating service availability.

Optical Satellite Technology: The Technical Frontier

Tera Wave's optical architecture deserves deeper analysis because it represents the frontier of satellite technology.

Optical communication between satellites isn't new. NASA's lunar laser communication demonstration in 2013 proved concept viability. But implementing optical links across an entire commercial constellation at scale is genuinely cutting-edge engineering.

How Optical Satellite Links Work

Instead of radio frequency antennae sending electromagnetic waves to distant ground stations, optical systems use lasers to transmit data through space. The advantage is enormous throughput density: a single optical fiber or free-space optical link can carry terabits per second.

The mechanics: a laser module on one satellite aims a narrow beam at another satellite kilometers away. The beam carries data encoded in light pulses. A receiver on the target satellite captures the photons and decodes the data.

This requires extraordinary precision. Satellites moving at 7 kilometers per second in different orbits must maintain laser locks on each other within microradians of error. The engineering is brutal.

But that precision unlocks performance. A single optical link can replace dozens of radio frequency channels. The network becomes radically more efficient.

Challenges and Constraints

Optical links have real limitations. Clouds and bad weather can block laser signals entirely (RF links penetrate clouds, optical doesn't). This is why Tera Wave uses RF as primary access and optical only for backbone links between satellites.

Another challenge: thermal management. Lasers generate heat. Satellites in vacuum can't use normal cooling methods. Radiative cooling works but requires sophisticated thermal design. Early optical satellite systems experienced reliability issues from thermal stress.

Pointing accuracy is genuinely difficult. Satellites jitter from thermal expansion, solar pressure, and gravity gradients. Tracking systems must compensate constantly. A single degree of error and the laser beam misses its target entirely.

Despite these challenges, the industry is advancing. ESA (European Space Agency) successfully demonstrated optical inter-satellite links on Sentinel-1 satellites. NASA's TDRSS system uses optical links. The technology works—it just requires careful engineering.

Blue Origin has significant aerospace expertise from developing Blue Origin's New Shepard suborbital vehicle and New Glenn heavy-lift rocket. Applying that expertise to optical satellite systems is a natural evolution.

Competitive Advantage Through Optical

If Tera Wave successfully deploys optical satellite links at scale, it gains structural advantage over RF-only competitors. Optical links are more reliable, higher-capacity, and lower-latency than RF ground uplinks.

The per-satellite cost is higher (lasers and pointing systems are expensive). But amortized across massive throughput and small customer numbers, the cost per gigabit becomes very attractive.

This is why optical satellite technology specifically appeals to the enterprise segment. Enterprises accept higher costs for better performance. Consumers don't.

Use Cases: Where Tera Wave Makes Sense

Understanding Tera Wave requires understanding which applications it actually solves for.

Data Center Interconnection

Cloud providers like AWS, Azure, and Google Cloud operate data centers globally. Connecting them requires fast, high-capacity links. Typically, this uses submarine fiber cables. But submarine cable is expensive ($100M+) and takes years to deploy.

Tera Wave could provide temporary or permanent backup links between data centers. A cloud provider could establish dedicated Tera Wave circuits between major data centers, providing redundancy and capacity buffering.

Latency of 40ms is acceptable for many cloud-to-cloud connections. Throughput of 100+ Gbps enables substantial traffic volumes. Cost is high, but cheaper than deploying submarine cable.

For geographic expansion into regions without existing cable infrastructure, Tera Wave could be transformative. A cloud provider expanding to Africa or Southeast Asia might use Tera Wave as temporary backbone while planning permanent cable investment.

Maritime and Aviation Connectivity

Ships at sea and aircraft in flight have traditionally relied on expensive satellite communications with horrible service. Starlink improved aircraft service through special antennas, but maritime service remains limited.

Tera Wave's enterprise service level makes it viable for shipping companies to operate remote fleets with live monitoring and control. Container vessels could maintain full real-time visibility into operations. Autonomous vessel research becomes feasible with reliable, high-capacity communications.

For aviation, Tera Wave isn't immediately applicable (aircraft need different antenna designs), but the technology roadmap could eventually support aviation applications.

Government and Military Operations

This is likely a primary target. Defense departments globally need secure, reliable communications in remote locations and over oceans. Tera Wave's dedicated capacity model suits government needs better than consumer Starlink.

The U. S. Department of Defense already uses satellite communications extensively. A purpose-built network designed for government requirements could capture market share from traditional geostationary satellite providers.

Government contracts also provide stable, long-term revenue. A single multi-year government contract could be worth $1B+. That's the kind of revenue that makes the business model work.

Remote Site Backup and Redundancy

Mining operations, oil and gas facilities, and other remote enterprises need reliable backup connectivity. Current solutions are expensive and unreliable. Tera Wave's guaranteed performance model suits this perfectly.

A remote mining site would pay premium prices for guaranteed 100 Mbps backup connectivity. That's far more than it would pay for consumer broadband. Volume might be limited (perhaps thousands of remote sites globally), but revenue per site is high.

Scientific Research

Scientific facilities in remote locations (Antarctica, high mountains, ocean platforms) need connectivity for research data transmission. Climate research, astronomy, oceanography, and seismic monitoring all benefit from reliable, high-capacity connections.

Tera Wave wouldn't be the primary funding source, but long-term research contracts could provide steady revenue while supporting scientific advancement.

Estimated data suggests a progressive timeline for TeraWave, with key milestones in satellite manufacturing, testing, and regulatory approvals leading to a late 2027 deployment. Estimated data.

Market Size and Revenue Potential

Estimating Tera Wave's potential requires understanding market dynamics.

The global satellite communications market is roughly

If Tera Wave captures just 5% of that market, that's $2.5-5B annual revenue at maturity. That justifies the infrastructure investment and operational costs.

For 100,000 target customers, that implies average revenue per user (ARPU) of $25k-50k annually. That's achievable if customers are data centers, government agencies, and large enterprises committing to dedicated circuits.

Compare to Starlink's consumer business: millions of customers at

Tera Wave's revenue per customer is 5-25x higher than Starlink's. That's the core business logic. Smaller customer base, much higher value per customer.

But scaling to 100,000 customers requires global sales infrastructure, integration engineering, and ongoing support. This isn't a self-serve business like Starlink. Each customer requires custom integration, dedicated circuits, and SLA management.

Operating costs are likely significantly higher than Starlink's per customer. But margins on enterprise contracts are also higher.

Technical Risks and Challenges

Despite ambitious specifications, Tera Wave faces significant technical and operational risks.

Optical Link Reliability at Scale

Optical satellite links have never been deployed at constellation scale commercially. Tera Wave will be the first (or among the first) to attempt this. That creates execution risk.

What happens when one optical link fails mid-mission? The network must rapidly reroute traffic to alternative paths. Software-defined networking handles this, but validating reliability across thousands of satellites is extraordinarily complex.

Failed experiments are expensive in space. You can't service a satellite 400 km up. Whatever happens on launch day is what you're stuck with for its 5-7 year lifespan. Redundancy helps, but redundancy means more satellites and higher cost.

Launch Schedule Risk

New Glenn is still in development. First flight is expected in 2025, but inaugural heavy-lift rockets historically experience delays. If New Glenn slips, Tera Wave's entire deployment schedule slips.

Starlink had the advantage of working with Falcon 9, which was already operational. Space X iterated from there. Blue Origin will be introducing a new rocket and new satellite operations simultaneously. That compounds risk.

Space Debris and Collision Risk

With 5,400+ satellites in LEO, Tera Wave joins an increasingly crowded orbital environment. Starlink's 9,000+ satellites are already concerning to astronomers and orbital debris researchers.

Tera Wave satellites will eventually reach end-of-life (typically 5-7 years). Each dead satellite becomes debris. Debris collides with other satellites, creating more debris (Kessler syndrome). Eventually, LEO becomes too congested to use safely.

Regulatory bodies are implementing end-of-life requirements—satellites must de-orbit within 5 years. This is good for orbital sustainability but increases satellite design complexity and cost.

Regulatory Approval Across Jurisdictions

Tera Wave requires spectrum approval in multiple countries, orbital slot registration with ITU (International Telecommunication Union), and specific licensing in each nation where ground stations operate.

Not all countries allow commercial satellite services. Some reserve spectrum for domestic providers. Others require extensive environmental review. The approval process is slow and uncertain.

Starting in developed Western countries makes sense, but truly global deployment requires navigating dozens of regulatory regimes. That's complex and time-consuming.

Financial Model and Capital Requirements

Launching and operating 5,400+ satellites requires enormous capital investment.

Upfront Capital Costs

Satellite manufacturing: roughly

Launch costs: depends on cadence and rocket efficiency. Modern launch costs are roughly

With efficient launch manifesting (multiple satellites per launch), launch costs might total $1-2B. But this is highly variable.

Ground infrastructure: 50-100 global stations at

Total first-phase capital: roughly

Operating Costs

Once operational, satellite internet networks have relatively steady operating costs:

- Launch costs for replacements: Each satellite lasts 5-7 years. To maintain constellation, need roughly 20% of satellites launched annually. That's 1,000 satellites/year = $2-4B/year in launch costs.

- Ground operations: Staff, power, connectivity = $100-200M annually

- Spectrum licenses and regulatory: $50-100M annually

- R&D and technology advancement: $200-500M annually

Total annual operating costs: roughly

With 100,000 customers at

LEO satellites offer significantly lower latency (25-50ms) compared to geostationary satellites (600ms), making them more suitable for real-time applications. Terrestrial fiber remains the fastest with sub-millisecond latency.

The Broader Implications for Global Connectivity

Tera Wave's emergence signals important shifts in how the world thinks about connectivity.

Decentralization of Backbone Infrastructure

Historically, global internet backbone was dominated by submarine fiber cables controlled by major carriers. This created central points of control and failure. Political actors could pressure carriers to block traffic.

Satellite networks create alternative infrastructure. Even if terrestrial cables are disrupted (cut by ships anchors, affected by international disputes), satellite remains operational. This redundancy is strategically valuable to nations and enterprises.

Tera Wave won't replace submarine cables—they're more efficient for most routes. But Tera Wave provides meaningful redundancy and alternative pathways. That changes geopolitics of internet infrastructure.

Enterprise Independence from Terrestrial Carriers

Currently, enterprises depend on local carriers for connectivity. In countries with poor terrestrial infrastructure or monopolistic carriers, this creates problems—high costs, poor service, political risk.

Tera Wave offers escape. An enterprise can establish direct satellite connectivity, bypassing local carriers entirely. This shifts power dynamics.

For developing nations, this is double-edged. Satellite connectivity could accelerate development by eliminating connectivity bottlenecks. But it also allows enterprises to bypass local infrastructure investment, reducing incentive for governments to build terrestrial networks.

Military and Defense Implications

Satellite networks are inherently dual-use: civilian and military applications. Tera Wave's dedicated enterprise model makes it attractive to defense departments.

Many nations view satellite internet networks as critical infrastructure. U. S. government is deeply concerned about relying on Starlink (controlled by Space X/Elon Musk) for military and government communications. Tera Wave (controlled by Blue Origin/Jeff Bezos) might be marginally less controversial, though questions about corporate ownership of critical infrastructure remain.

Expect government involvement in Tera Wave through direct procurement, subsidized contracts, and potential security oversight.

Comparison: Tera Wave vs. Starlink vs. Amazon Leo

Let's directly compare the three major LEO satellite networks:

| Aspect | Tera Wave | Starlink | Amazon Leo |

|---|---|---|---|

| Target Market | Enterprise/Government | Consumer/SMB | Consumer/SMB |

| Target Customers | ~100,000 | Millions | Millions |

| Satellites Planned | 5,408 | 12,000+ | 3,200+ |

| RF Throughput Per Customer | 144 Gbps | 150-250 Mbps | Similar to Starlink |

| Optical Backbone | 128 MEO satellites | No | No |

| Total Capacity (6 Tbps claim) | 6 Tbps | Not specified | Not specified |

| Expected Launch Date | Late 2027 | Already operational | 2025-2026 |

| Service Model | Dedicated circuits, SLAs | Shared bandwidth | Shared bandwidth |

| Symmetrical Speeds | Yes (claimed) | No | No |

| Typical Latency | ~40ms | 25-50ms | Similar to Starlink |

| Pricing Model | Premium enterprise | Consumer-tier | Consumer-tier |

| Parent Company | Blue Origin | Space X | Amazon |

| Integrated Services | Potential AWS integration | Starlink standalone | AWS integration |

This table reveals strategic positioning clearly. Tera Wave isn't trying to beat Starlink at its own game. It's playing a different game entirely.

Regulatory Considerations and Frequency Coordination

Satellite networks operate in shared spectrum. Coordinating so thousands of satellites can coexist without interfering requires complex regulatory processes.

ITU Coordination Process

The International Telecommunication Union (ITU), a UN agency, manages global spectrum allocation and orbital slot registration. Before operating a satellite, you must:

- File frequency and orbital slot requests

- Coordinate with other operators who might experience interference

- Resolve conflicts through negotiation or ITU arbitration

- Receive formal approval and registration

This process can take years. Tera Wave's 2027 launch target assumes regulatory approvals proceed roughly on schedule. Delays are common—Space X spent years on Starlink ITU coordination before launch.

National Spectrum Licensing

Each nation controls spectrum within its borders. To operate in a country, Tera Wave needs licensing from that nation's regulator (FCC in U. S., OFCOM in UK, etc.).

This creates opportunities for political leverage. Nations can grant or deny licenses based on strategic considerations, not just technical merit. Some nations might require local partnerships or technology sharing as licensing conditions.

For Blue Origin, U. S. government support is likely. The U. S. has strategic interest in alternatives to Starlink and wants satellite internet diversity. Government might push FCC to expedite Tera Wave licensing.

TeraWave targets fewer, high-value enterprise customers with higher throughput and lower latency, while Starlink and Amazon Leo focus on broader consumer markets with more satellites and similar throughput. Estimated data for throughput and latency based on typical values.

Future Technology Roadmap

Tera Wave's initial constellation is ambitious, but technology will evolve. What's the roadmap beyond 2027?

Generation 2 Satellites

First-generation satellites balance cost, performance, and development timeline. Second-generation (likely 2030s) could incorporate improvements:

- More efficient optical links (currently experimental, soon mature)

- Higher power allocation per satellite (larger solar panels, radioisotope thermal generators)

- Phased array antennae with superior beam steering

- Built-in AI for traffic routing optimization

- Enhanced thermal tolerance for equatorial orbits

Each improvement increases throughput, reduces latency variability, or reduces power consumption. Incremental improvements compound over years into generational advantages.

Hybrid Terrestrial-Satellite Networks

The future likely involves seamless integration of satellite and terrestrial networks. Customers experiencing terrestrial congestion automatically overflow to satellite. Costs and performance optimize dynamically.

This requires open standards for network integration. IETF (Internet Engineering Task Force) and 3GPP (cellular standards body) are working on these standards. Tera Wave will need to support them.

Quantum Key Distribution via Satellite

As quantum computing threatens current encryption, quantum-safe alternatives emerge. Quantum key distribution (QKD) could be distributed via satellite. Optical satellite links are actually superior for QKD compared to fiber (no tap-ability).

This is speculative but demonstrates how Tera Wave's optical architecture might evolve beyond just throughput.

Investment and Business Model Sustainability

For Tera Wave to succeed long-term, the business model must prove sustainable.

Capital Intensity vs. Operating Leverage

Satellite networks are extremely capital-intensive but eventually show operating leverage. After initial constellation deployment, primary costs are:

- Replacements for dead satellites (~20% annually)

- Ground operations and support

- Regulatory compliance

- Technology upgrades

Once this curve is understood and predictable, the business becomes investable. Investors know exactly what returns to expect. That's when growth accelerates.

Blue Origin has patient capital from Amazon and Bezos himself. This patience is crucial. Space X benefited from similar patience from Elon Musk's wealth.

Revenue Growth Trajectory

Tera Wave won't achieve 100,000 customers in 2028. More realistic: 10,000 customers by 2030, scaling to 50,000 by 2035. This matches typical B2B satellite service adoption curves.

Each year, revenue compounds. By 2030, if tera Wave has 10,000 customers at average

That 5-7 year path to profitability requires patient capital willing to absorb losses while growing. Blue Origin has exactly that.

Acquisition and Exit Scenarios

Blue Origin could eventually sell Tera Wave to a larger player: AT&T, Verizon, international telco, or infrastructure fund. Tera Wave's infrastructure assets would be valuable as strategic acquisition.

More likely: Blue Origin holds Tera Wave long-term as core business. The revenue and strategic value (government contracts, integrated AWS services) justify retention.

Challenges to Success

Tera Wave faces significant obstacles beyond pure technology:

Execution Risk

Building, launching, and operating 5,400+ satellites while developing cutting-edge optical technology is extraordinarily difficult. Slip-ups accumulate.

One major launch failure delays the entire program. One optical satellite design flaw cascades across hundreds of launches. Integration with AWS infrastructure takes longer than planned. Sales move slower than projected.

Executing complex aerospace programs on schedule is historically difficult. Space X is an exception, not the norm. Blue Origin could find itself facing 1-2 year delays, consuming more capital and falling behind schedule.

Competitive Obsolescence

Other companies could develop superior satellite technology before Tera Wave launches. ESA is developing its own satellite networks. China is ramping up satellite deployments. Private startups are innovating on optical, laser, and other technologies.

If a competitor launches superior technology in 2025-2026, Tera Wave launching in late 2027 becomes obsolete before operational.

This is a real risk in fast-moving space technology. The window for first-mover advantage is shrinking.

Market Development Uncertainty

Tera Wave assumes 100,000 customers will pay premium prices for dedicated satellite capacity. What if that market is smaller? What if Starlink rapidly improves and offers competitive enterprise service at lower cost?

Market development uncertainty haunts all new satellite networks. Demand could be far lower than projected, making the business unviable even with successful technical execution.

Geopolitical Risk

Satellite networks operate globally, touching multiple political jurisdictions. Geopolitical tensions could force countries to ban or restrict Tera Wave operations. Trade tensions might limit access to certain markets.

For an enterprise, relying on satellite internet from a U. S. company could become politically unacceptable in some nations. This limits addressable market.

What This Means for You: Practical Implications

If you're working in any of these sectors, Tera Wave's emergence matters:

For IT Leaders

Watch Tera Wave's deployment timeline. If your enterprise needs backup connectivity or international site connectivity, Tera Wave could become a viable option by 2030. Start planning integration now so you're ready to adopt early when service launches.

Early adopters typically get favorable pricing and dedicated support. But also accept higher risk—first-generation service has growing pains. Evaluate your risk tolerance.

For Government

If you're in defense, intelligence, or civilian government, Tera Wave should be on your radar. U. S. government particularly benefits from alternatives to Starlink. Expect government to strategically promote Tera Wave deployment.

For nations globally, satellite internet creates independence from terrestrial infrastructure. This is strategic value worth planning for.

For Investors

Blue Origin is private and not directly investable. But AWS (Amazon's satellite division partner) is public through Amazon stock. Amazon's involvement in Tera Wave increases cloud business stickiness. That's value creation.

Public satellite-related stocks (Viasat, Intelsat) face disruption from Tera Wave. Monitor how these companies adapt.

For Tech Entrepreneurs

Satellite internet creates opportunities for application-level innovation. Startups can build services assuming reliable satellite connectivity. Autonomous vehicles, remote AI applications, edge computing—all become viable with Tera Wave infrastructure.

Tera Wave is enabler technology. The real value creation happens in applications built on top of it.

The Bigger Picture: Satellite Networks as Infrastructure

Tera Wave is one piece of a larger trend: satellite networks becoming critical global infrastructure.

Shift from Terrestrial Dominance

Historically, telecommunications was terrestrial: fiber, copper, microwave. Satellites were niche. That's shifting. As terrestrial networks saturate in developed regions, growth moves to satellite.

In developing regions, terrestrial infrastructure is expensive and slow. Satellite can leapfrog terrestrial—wireless home internet replaced wired home internet in many developing nations. Satellite internet could do the same globally.

Convergence with Cloud Computing

Satellite networks + cloud computing = transformed possibilities. AWS, Azure, Google Cloud operating edge data centers served by satellite networks could democratize compute access globally.

This convergence is fundamental to how future computing infrastructure evolves. Tera Wave is part of this infrastructure revolution.

Power Dynamics Shift

Traditionally, terrestrial network providers (telecom carriers) controlled global connectivity. They extracted rents from traffic. Satellite networks change this.

Enterprises can now bypass carriers entirely, building direct satellite connectivity. This shifts negotiating power to enterprises and reduces carrier leverage. Geopolitically, it reduces certain nations' ability to control information flow.

These dynamics create winners and losers. Existing carriers lose leverage. Enterprises gain autonomy. Satellite operators gain strategic importance.

When Will Tera Wave Actually Be Available?

Let's be realistic about timeline:

2025: New Glenn development complete, first test flights. Tera Wave satellite manufacturing begins. Regulatory coordination in progress.

2026: New Glenn operational launches beginning. Tera Wave satellites launching. First 500-1000 satellites deployed. Limited testing of optical links. Ground stations under construction.

2027 (Q4): Constellation reaching critical mass (2000+ satellites). First customer trials underway. Full service launch possibly delayed to Q1 2028. Initial service available to pilot customers in North America and Europe.

2028-2029: Expansion to other regions. Customer base growing to thousands. Service stabilizing, proving reliability.

2030: Full global coverage achieved (eventually). 10,000+ customers. Service becoming reliable enough for critical enterprise operations.

2032-2035: Mature operations. 50,000+ customers. Competing effectively against Starlink for enterprise market.

The key insight: don't expect consumer-grade Tera Wave service in 2027. Expect enterprise pilot service in limited regions. Full global deployment takes 5+ years.

FAQ

What is Tera Wave and how is it different from Starlink?

Tera Wave is Blue Origin's enterprise-focused satellite internet network comprising 5,408 satellites designed to provide up to 144 Gbps per customer with symmetrical speeds and guaranteed performance. Unlike Starlink, which targets millions of consumer subscribers with asymmetrical speeds and shared bandwidth, Tera Wave targets approximately 100,000 enterprise and government customers willing to pay premium prices for dedicated, guaranteed service. Tera Wave's differentiation lies in its hybrid radio frequency and optical backbone architecture, enabling extremely high throughput and reliability unsuitable for mass-market broadband but essential for data center interconnection and government operations.

How does Tera Wave's optical technology work?

Tera Wave uses 128 medium-earth orbit satellites equipped with laser communication systems to create an optical backbone network, complementing the radio frequency access layer provided by 5,280 LEO satellites. Optical links between satellites operate at light speed and can transmit terabits per second, dramatically exceeding radio frequency capacity. Customers connect via radio frequency to the nearest LEO satellite, which routes traffic through the optical backbone (which handles up to 6 Tbps aggregate capacity) to ground infrastructure, then onward to the terrestrial internet. Optical links require line-of-sight and can be affected by weather, but the RF access layer ensures reliable customer connectivity even during optical link outages.

What are the main benefits of Tera Wave for enterprises?

Tera Wave offers several compelling advantages for enterprise users including guaranteed symmetrical upload and download speeds (critical for cloud backup and real-time applications), dedicated capacity with Service Level Agreements ensuring predictable performance, lower latency than geostationary satellites (40ms vs. 500ms+), and freedom from dependence on terrestrial carrier infrastructure. For data centers, Tera Wave enables cost-effective international site connectivity without submarine cable investment. For government and remote operations, it provides reliable backup connectivity independent of terrestrial infrastructure. The enterprise-focused business model prioritizes reliability and performance over volume, creating incentives for continuous service quality improvement.

When will Tera Wave service actually be available?

Blue Origin plans to begin constellation deployment in late 2027, with initial service availability likely in 2028 for pilot customers in North America and Europe. Full global coverage and mature operations are projected for 2030-2032. It's important to note that this timeline is ambitious—launch delays are common in satellite programs, and actual service availability could slip 1-2 years. Early service will likely be limited to thousands of customers rather than the eventual 100,000-customer target. Enterprises interested in Tera Wave should plan integration now but not depend on 2027 availability.

How much will Tera Wave service cost?

Blue Origin hasn't published consumer pricing for Tera Wave because it's not targeting consumers. Enterprise pricing for satellite capacity typically ranges from

How many satellites does Tera Wave have compared to Starlink and Amazon Leo?

Tera Wave's constellation comprises 5,408 total satellites: 5,280 in low-earth orbit for radio frequency access and 128 in medium-earth orbit for optical backbone. This is substantially smaller than Starlink's 9,000+ satellites but larger than Amazon Leo's planned 3,200. The smaller number reflects Tera Wave's targeting of enterprise customers (100,000 projected) versus mass-market consumers (millions). Fewer satellites enable focused deployment in high-value regions and reduce operational complexity, though it means less global redundancy than Starlink's network.

Will Tera Wave work for consumer broadband like Starlink?

No. Tera Wave is explicitly designed as an enterprise and government network. Blue Origin has not announced consumer-focused plans. The architecture, service model, and pricing all assume business or government customers. For consumer broadband, Starlink remains the primary option. This doesn't mean Tera Wave is consumer-inaccessible forever—business models could evolve—but current plans show zero consumer focus.

How does Amazon's continued partnership with Blue Origin affect competition?

Amazon continues purchasing launch services from Blue Origin (particularly for New Glenn heavy-lift capacity) while simultaneously operating Amazon Leo, a competing satellite network. This isn't contradictory because launch services and orbital services are distinct markets. Amazon benefits from using Blue Origin's efficient launch capability to accelerate Leo deployment while maintaining relationship diversity (not depending exclusively on Space X). Additionally, Amazon likely gains technical insight into optical satellite technology, potentially informing future Leo iterations. This cooperation-while-competing pattern reflects industry maturation where companies cooperate on infrastructure while competing on services.

What happens if Tera Wave fails or delays significantly?

If Tera Wave experiences major delays (2+ years), it could miss the market window as Starlink improves enterprise offerings and Amazon Leo scales. If technical failures occur (optical links fail at scale, constellation deployment proves unreliable), the entire business model collapses. However, Blue Origin's substantial capital resources and parent company support (Amazon) provide financial cushion that many space companies lack. Worst case: Tera Wave is shelved and Blue Origin redirects resources. Most likely: Tera Wave launches successfully but with delayed timeline and adjusted specifications. Complete failure is possible but not probable given organizational capabilities.

How does Tera Wave's latency compare to terrestrial fiber?

Tera Wave's projected latency is 30-50 milliseconds (round-trip), compared to fiber optic latency of roughly 5-10ms over similar geographic distances. For most applications, the difference is imperceptible. However, for ultra-low-latency applications (high-frequency trading, real-time vehicle control), terrestrial fiber remains superior. Tera Wave's advantage over geostationary satellites (500ms+) is transformative. For practical purposes, Tera Wave latency is acceptable for all standard enterprise applications including cloud compute, video conferencing, and data backup.

Will Tera Wave eventually become consumer broadband?

Possibly, but not in near term. Business model economics suggest enterprise focus makes sense. However, if Tera Wave successfully deploys and capacity exceeds demand, consumer offerings could emerge around 2035+. At that point, legacy enterprise contracts could represent smaller percentage of revenue. But this is speculative—current planning explicitly excludes consumer market.

Conclusion: The Future of Satellite Enterprise Connectivity

Tera Wave represents a pivotal moment in satellite internet evolution. While Starlink grabbed headlines with consumer broadband, Blue Origin is targeting a different, potentially more lucrative market: enterprise connectivity.

The business logic is sound. Enterprises will pay premium prices (

The technical ambition is genuine but challenging. Optical satellite links at constellation scale have never been commercially deployed. Coordinating thousands of satellites in increasingly crowded orbit is complex. Integration with AWS infrastructure and government operations introduces operational complexity.

The timeline is aggressive. Late 2027 deployment means Blue Origin must execute flawlessly for three years: complete New Glenn development, manufacture thousands of satellites, successfully execute optical link testing, and coordinate global regulatory approvals. Any major slip creates cascading delays.

But if Blue Origin executes, Tera Wave could genuinely transform how enterprises and governments access connectivity. Breaking dependence on terrestrial carriers and geostationary satellite providers creates genuine optionality. For governments, satellite network diversity improves resilience. For enterprises, it reduces costs and increases reliability.

The stakes are high. Success validates satellite networks as critical infrastructure and establishes Blue Origin as essential infrastructure operator. Failure represents billions in capital losses and strategic setback for both Blue Origin and Amazon's satellite ambitions.

For now, the smartest posture is cautious optimism. Technical fundamentals are sound. Financial backing is substantial. Market opportunity is real. Execution risks are significant but manageable given organizational capabilities.

Watch Tera Wave closely. When 2027 arrives, watch for initial deployment results. If optical links perform and customer acquisition proceeds on schedule, Tera Wave could reshape enterprise connectivity for decades. If problems emerge, you'll see them first in early technical reports and customer feedback.

The satellite internet future isn't just Starlink. It's a constellation of competitors, each optimizing for different markets. Tera Wave is the enterprise player in this evolving landscape.

Key Takeaways

- TeraWave targets enterprise and government customers (100,000 planned) with dedicated capacity, not mass-market broadband like Starlink's millions of consumers

- Optical satellite links enable unprecedented 6Tbps total capacity and 144Gbps per customer, dramatically exceeding current LEO network performance

- Hybrid architecture (5,280 RF LEO + 128 optical MEO satellites) combines reliability of radio frequency with throughput of laser optical links

- Late 2027 launch timeline provides 3-year execution window but faces significant risks including New Glenn development delays and optical link reliability at scale

- Enterprise market opportunity is smaller in volume (100k customers) but far higher in revenue per customer ($35k-50k annually) than consumer broadband

Related Articles

- Blue Origin's TeraWave Megaconstellation: The 6Tbps Satellite Internet Game Changer [2025]

- Blue Origin's New Glenn Third Launch: What's Really Happening [2026]

- SpaceX's 7,500 New Starlink Satellites: What It Means [2025]

- SpaceX's 7,500 New Starlink Satellites: What the FCC Approval Means [2025]

- SpaceX's 15,000 Starlink Gen2 Satellites: What It Means [2025]

- Starlink's Free Internet Push in Venezuela: What It Means [2025]

![Blue Origin's TeraWave: The Next Satellite Internet Game-Changer [2025]](https://tryrunable.com/blog/blue-origin-s-terawave-the-next-satellite-internet-game-chan/image-1-1769109171675.jpg)