China Approves NVIDIA H200 GPU Imports: What It Means [2025]

For months, the world watched as U.S. export restrictions tightened around advanced AI chips. China was cut off from NVIDIA's latest and greatest hardware. Then, quietly, something shifted.

China's government approved imports of NVIDIA's H200 AI processors. Not the cutting-edge Blackwell B200, mind you, but the H200 still represents a significant thaw in what's been an increasingly frozen relationship between Washington and Beijing over semiconductor access.

This isn't just a business story. It's a geopolitical moment that touches everything from AI development timelines to global tech competition. Understanding what happened, why it happened, and what comes next matters if you're tracking the AI industry, working in tech policy, or simply trying to make sense of how the world's superpowers are reshaping the technological landscape.

Let's dig into what this approval means, how we got here, and where things go from there.

TL; DR

- China approved H200 imports: After initial rejection, China's government authorized the first batch of several hundred thousand NVIDIA H200 chips for vetted companies

- Second-tier chip, not latest: The H200 is NVIDIA's second most powerful GPU behind the restricted B200, but still miles ahead of domestic Chinese alternatives

- Geopolitical compromise: The approval signals a potential shift from hard-line restrictions toward managed access for approved companies

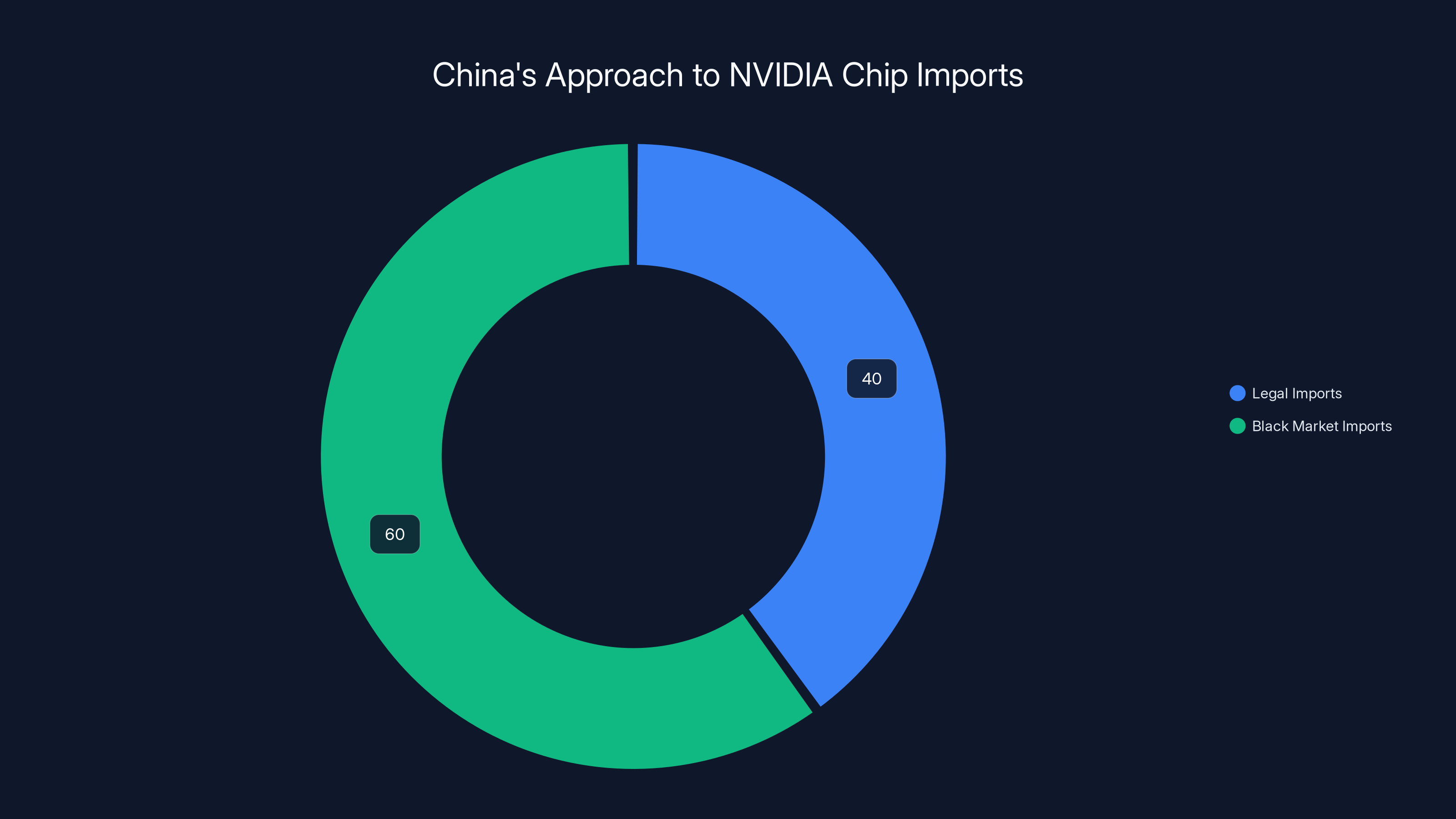

- Black market pressure: Over $1 billion in restricted NVIDIA chips already reached China illegally, creating incentives for legitimizing some trade

- Domestic alternatives lag: Huawei's processors remain China's best homegrown option, but experts agree they're still far behind NVIDIA's capabilities

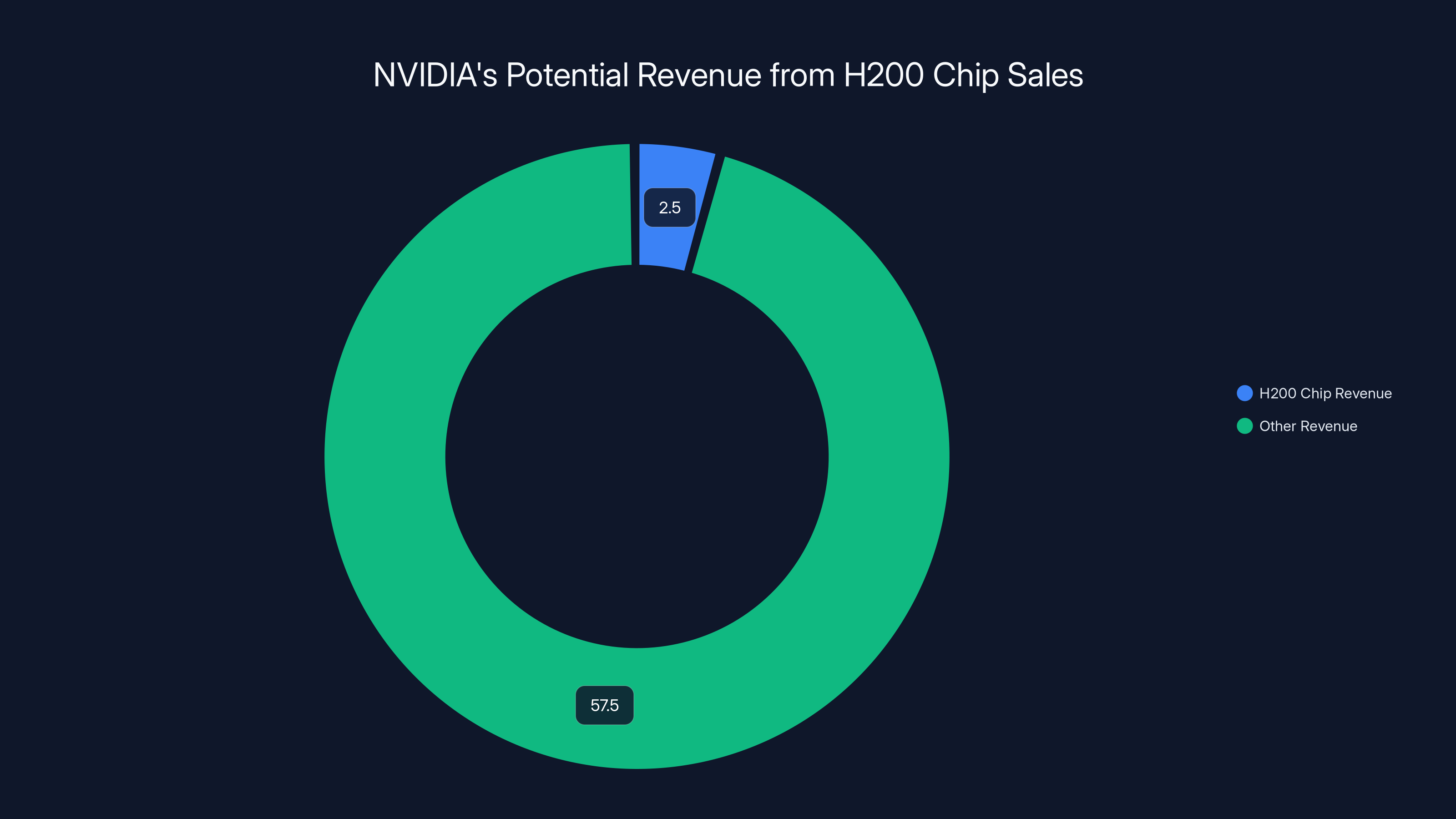

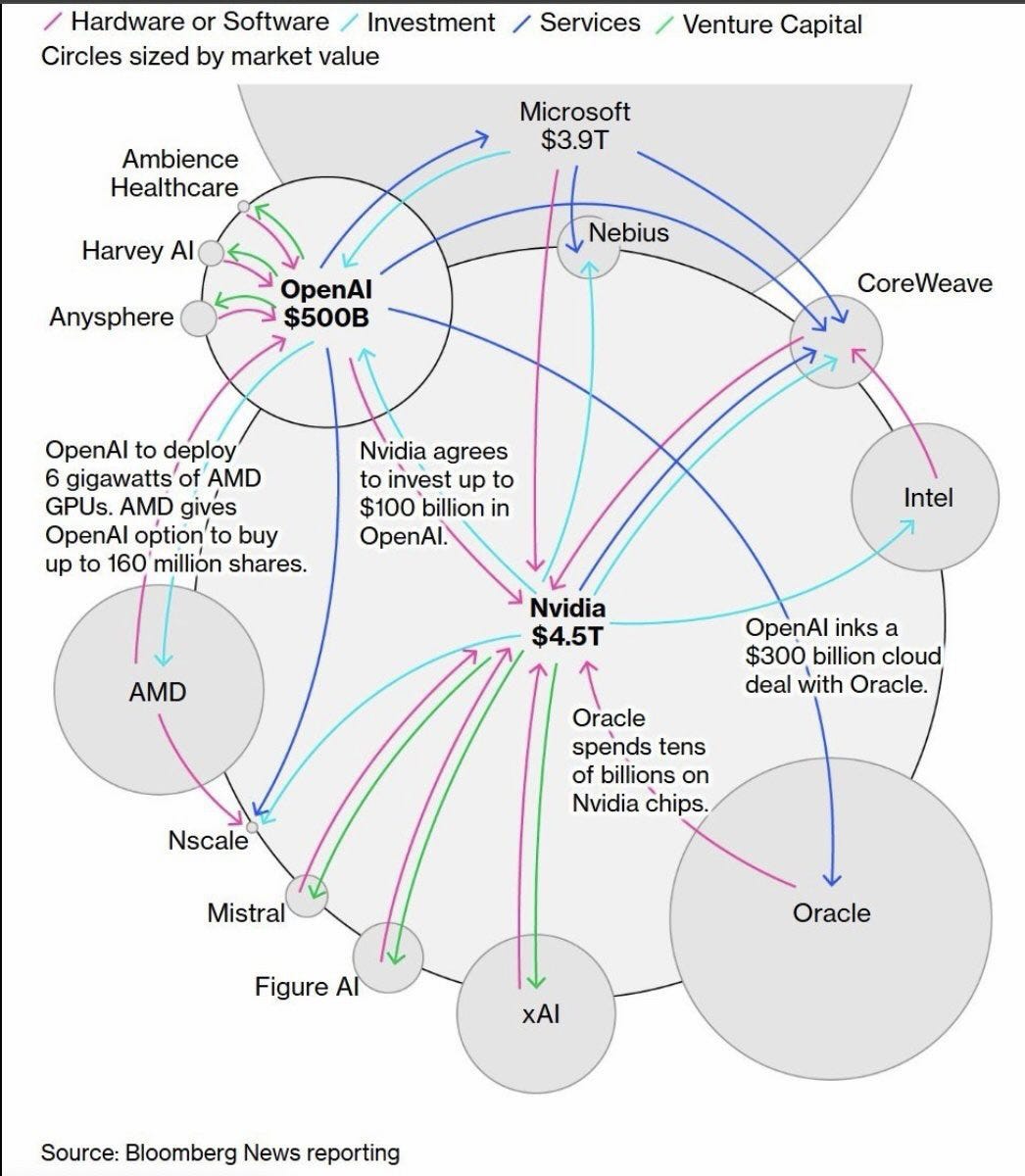

NVIDIA's potential revenue from H200 chip sales to China could represent about 2.5 billion USD, or approximately 4% of its total annual revenue, indicating a significant market opportunity. Estimated data.

The Context: How We Got Here

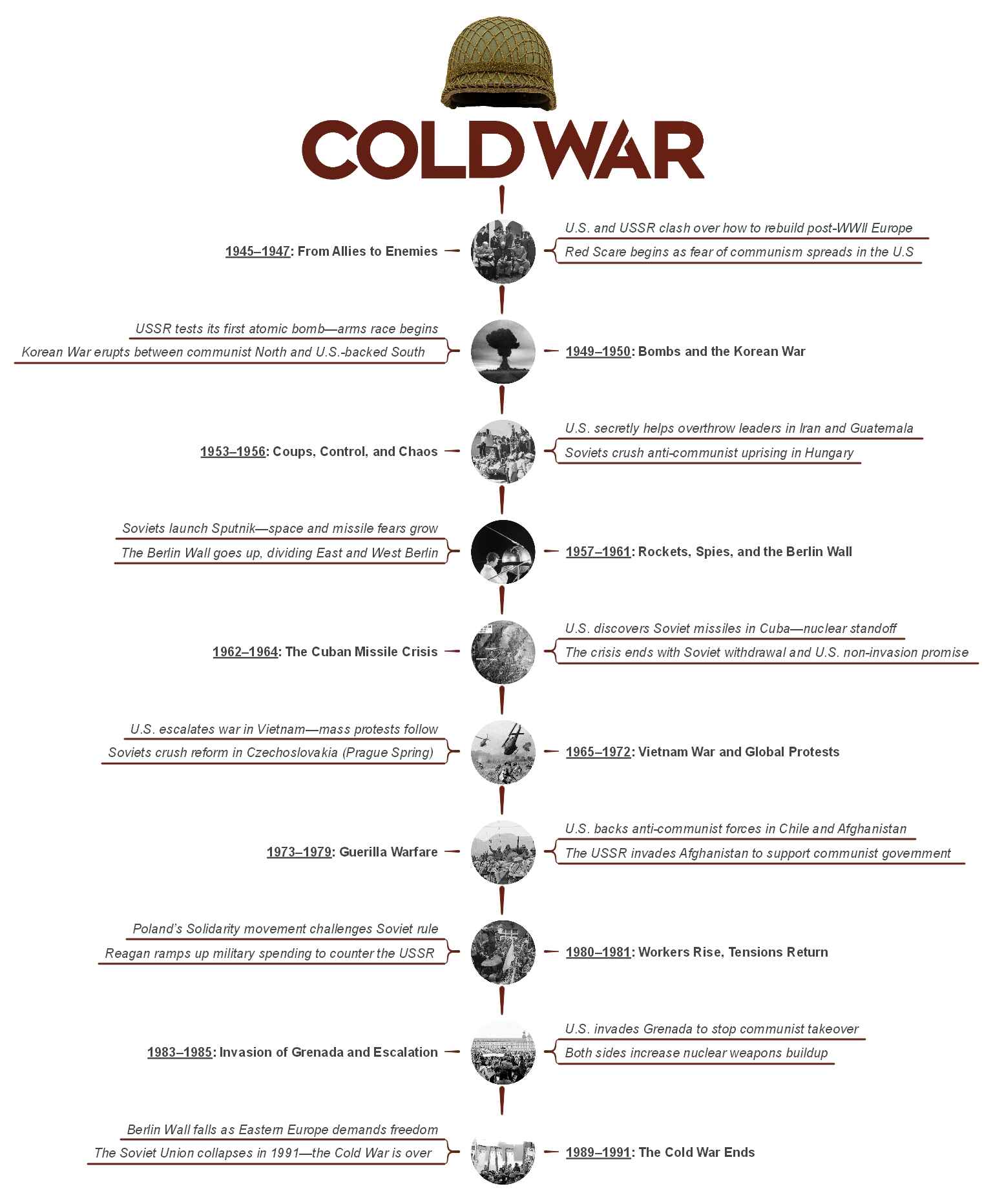

You need to understand the backdrop to appreciate why this approval matters. The last three years have seen an unprecedented tech cold war.

It started with the CHIPS Act and export controls. The Biden administration, concerned about China using advanced semiconductors for military AI and surveillance systems, implemented strict restrictions on selling cutting-edge chips to Chinese companies. The goal was clear: slow China's AI development while protecting American technological advantage.

NVIDIA felt the impact immediately. The company had built its empire on selling H100 and other advanced GPUs to global customers, including Chinese tech giants like Alibaba, Baidu, and Bytedance. Suddenly, those sales were off the table. NVIDIA's CEO Jensen Huang has said these restrictions cost the company billions in lost revenue.

In response, the U.S. created a carve-out: the H20 chip. It was essentially NVIDIA's way of trying to give China something while respecting export controls. The H20 was deliberately limited—less memory, lower bandwidth, weaker performance than the H100. It was designed to be useful enough for some workloads but not powerful enough to meaningfully accelerate military or surveillance applications.

China rejected it. Not overtly in the news, but through its actions. The country's government signaled that it wanted better chips, and domestically, Chinese companies started developing alternatives. Huawei launched its Ascend processors. SMIC ramped up production capacity. The message was clear: we'll build our own.

Then came December 2024. The Trump administration, in what seemed like a surprise move, approved the export of H200 chips to China under a licensing system. The H200 is significantly more capable than the H20, but still not as powerful as the unrestricted H100 or the completely off-limits B200.

China initially rejected this too. The government reportedly pushed back, preferring to prove its domestic chip capabilities rather than rely on American imports with political strings attached.

But now? Now China has approved the first batch. Several hundred thousand H200s for three unnamed Chinese internet companies. And the government says it's accepting applications for future approvals.

Something changed. Let's figure out what.

Estimated data suggests that 60% of NVIDIA chips entered China through the black market in 2024. Legalizing some imports aims to reduce this percentage.

Why China Changed Course

This reversal didn't happen in a vacuum. Multiple pressures converged.

The Black Market Reality Check

First, there's the elephant in the room: the black market is winning. According to reports from late 2024, over $1 billion worth of restricted NVIDIA chips have already made their way into China through gray market channels and illegal diversion schemes. These aren't small numbers.

When you realize that your export restrictions are being circumvented on a massive scale anyway, the political logic shifts. You can either:

- Pretend the black market doesn't exist and maintain the fiction of control

- Legitimize some trade, tax it, monitor it, and reduce the market for smugglers

China's approval suggests the government is choosing option two. By approving legal sales to specific, vetted companies, the Chinese government can track who has what, potentially collect licensing fees, and reduce the economic incentive for illegal smuggling operations.

It's pragmatism over ideology. The chips were going to reach China anyway. Better to control the flow than watch it happen in the shadows.

The AI Development Timeline Pressure

Second, there's the competitive timeline issue. China's AI companies are not sitting still. They're developing large language models, building recommendation systems, training computer vision models. All of this requires compute power.

Domestic alternatives are improving, sure. But they're not ready yet. Huawei's Ascend processors are capable, but not at the scale or speed China's leading companies want. Meanwhile, Chinese competitors like Baidu and Alibaba are racing to develop AI products that match American capabilities. If they're forced to wait another 12 months for domestic chips to mature, they lose ground in the global AI market.

The H200 approval isn't just about today's performance. It's about timeline compression. It gives Chinese AI companies breathing room to develop their products while the domestic supply chain matures.

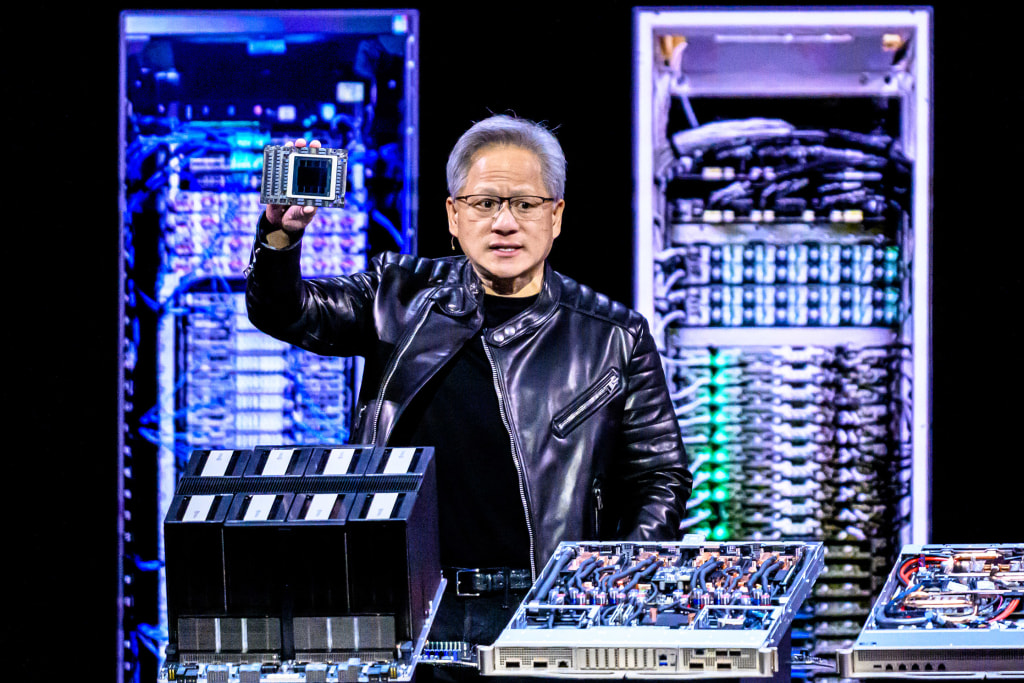

Jensen Huang's Visit

Don't underestimate the diplomatic side. NVIDIA's CEO visited China last week, before the H200 approval was announced. He met with government officials and industry leaders. This wasn't a casual trip.

Huang has spent years building relationships with Chinese partners and government officials. He understands the market. He understands the politics. And he clearly communicated something persuasive about why the H200 approval made sense for both sides.

Was it a softening position from Beijing? A recognition that total independence is unrealistic in the near term? Or simply a deal-making conversation that found mutual interest?

Most likely, it was all three. Huang probably framed the H200 as a middle ground: China gets capable hardware for legitimate commercial AI development, NVIDIA gets to operate in the world's largest AI market, and the U.S. government can point to restrictions still being in place (no B200 exports) while acknowledging that total embargo was economically unrealistic.

Understanding the H200: What China Actually Got

Let's talk specifics about what the H200 actually does and why it matters.

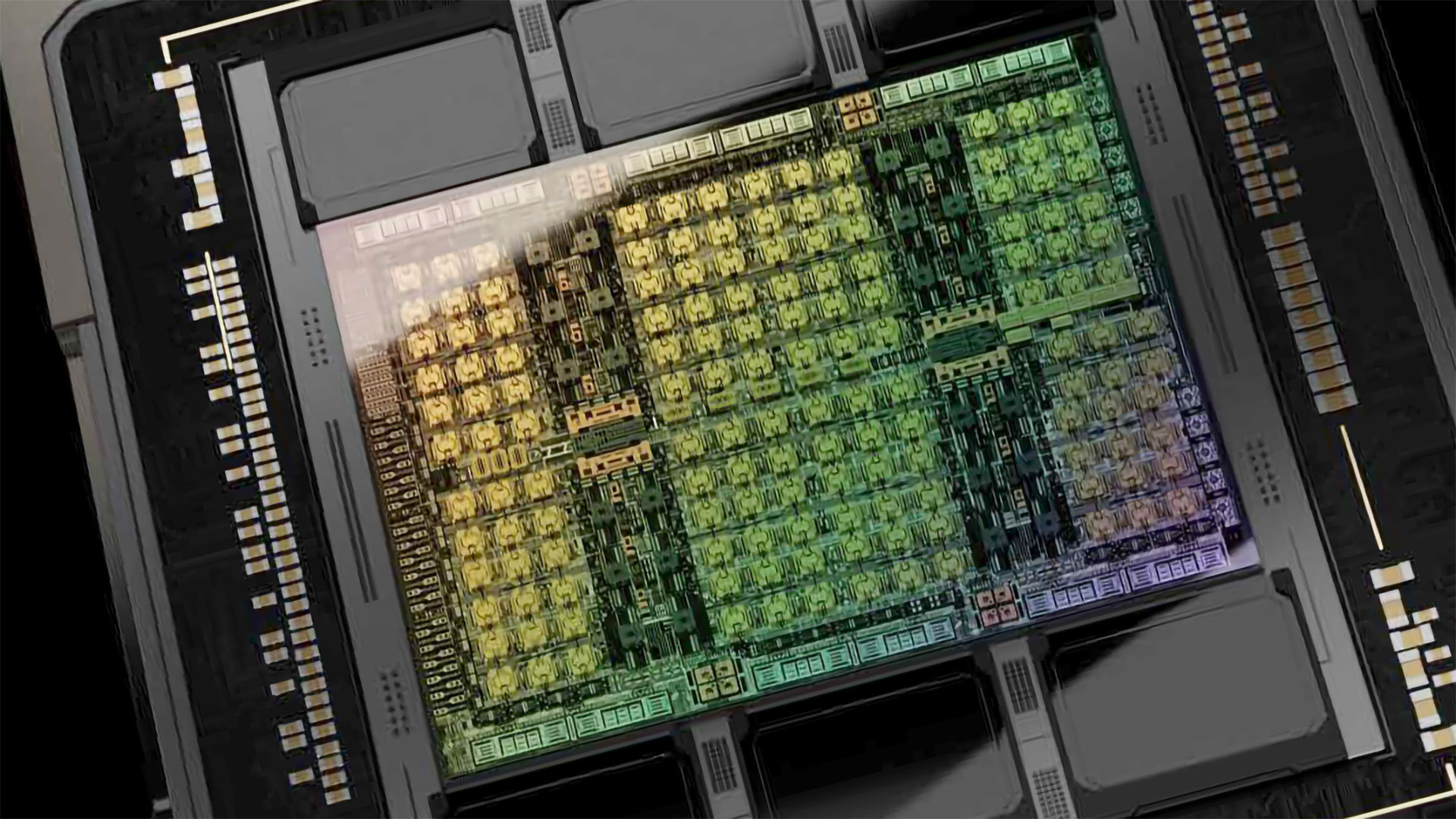

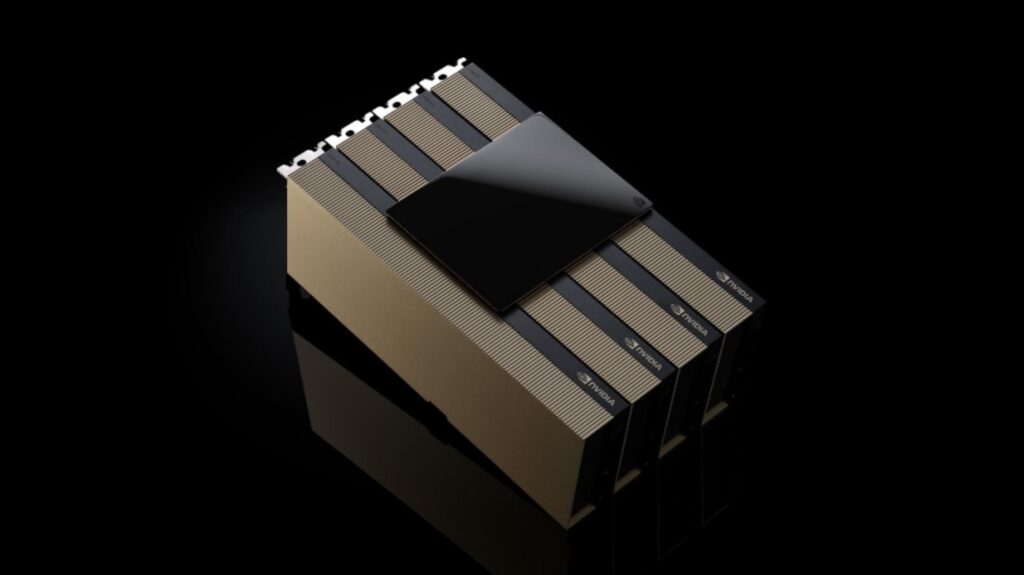

NVIDIA's current lineup has a clear hierarchy. At the top sits the Blackwell B200, which is NVIDIA's latest flagship AI GPU. It's absolutely bleeding-edge, with the highest memory bandwidth, the most CUDA cores, the fastest inference speeds. It's what you want if you're training the next generation of trillion-parameter language models.

The H200 sits one step below. It's based on the Hopper architecture, not Blackwell. It has 141GB of HBM3E memory (versus the B200's 192GB), lower bandwidth, and somewhat less raw compute power. According to NVIDIA's technical specs, the H200 is roughly 10 times slower than the B200 for certain workloads, though this varies depending on what you're doing.

But here's the thing: 10 times slower than revolutionary is still pretty revolutionary.

The H200 is absolutely capable of training large language models. It's absolutely capable of running inference on multi-billion-parameter models. It's fast enough for real-time applications in most scenarios. It's more than capable of handling the AI workloads that Chinese companies currently have in production.

Compare it to what came before. The H20, which was the only approved option, has just 96GB of memory and significantly lower bandwidth. The H20 is crippled relative to the H200. It's like comparing a sports car to a reliable sedan. Both work, but one is noticeably better.

And then compare the H200 to Huawei's best offering, the Ascend 910. The Ascend is competitive in some dimensions but generally doesn't match NVIDIA's specifications. Most AI chip experts agree that NVIDIA remains significantly ahead in raw performance, software ecosystem maturity, and optimization for real-world workloads.

So what China actually approved is this: access to hardware that's not the absolute latest, but is still substantially better than available alternatives, and substantially better than what they were previously allowed to have.

Why the H200 Specifically?

Why did the U.S. government and NVIDIA settle on the H200 as the compromise chip?

It comes down to the gap between performance and risk. The B200 is too advanced. Restricting it entirely makes strategic sense from a national security perspective. If China got unrestricted access to the latest generation of NVIDIA chips, the timeline for them to develop military AI capabilities accelerates dramatically.

But the H20 was too restrictive. It's a specialized chip that doesn't handle many workloads well, and it made little sense commercially. For Chinese companies, getting stuck with H20s wasn't a viable path forward. So they rejected it.

The H200 is the Goldilocks option. It's powerful enough to be actually useful for commercial AI applications. It's not so powerful that it dramatically changes the timeline for military capability development. It creates a sustainable middle ground that makes economic sense for all parties.

There's also a timeline element. The H200 is from the previous generation. It's older technology. By the time China masters the H200 and develops its own competitors, NVIDIA will have moved even further ahead with Blackwell and whatever comes next. The approval of the H200 doesn't lock the U.S. into a permanent disadvantage because the technology landscape is moving fast.

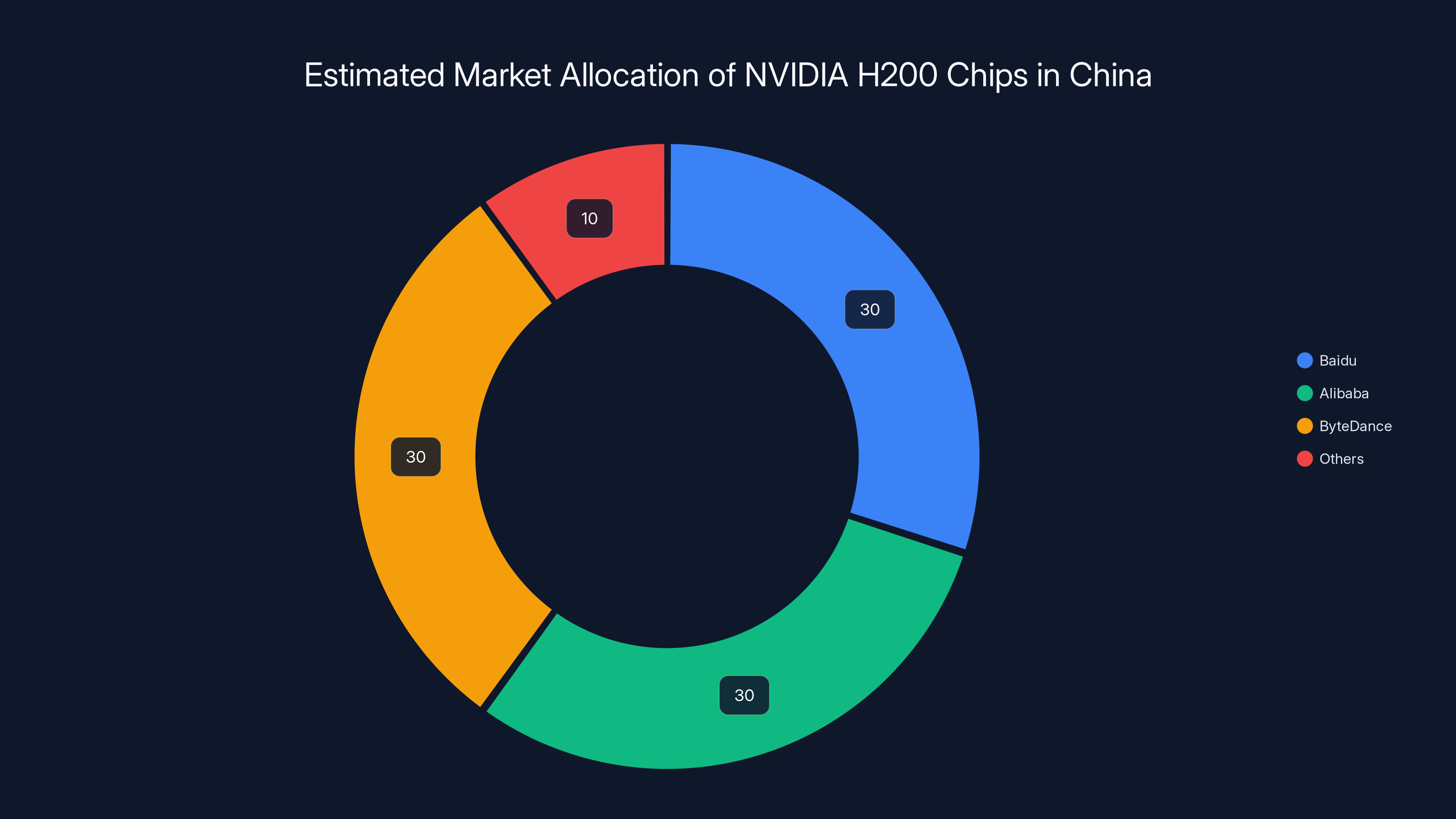

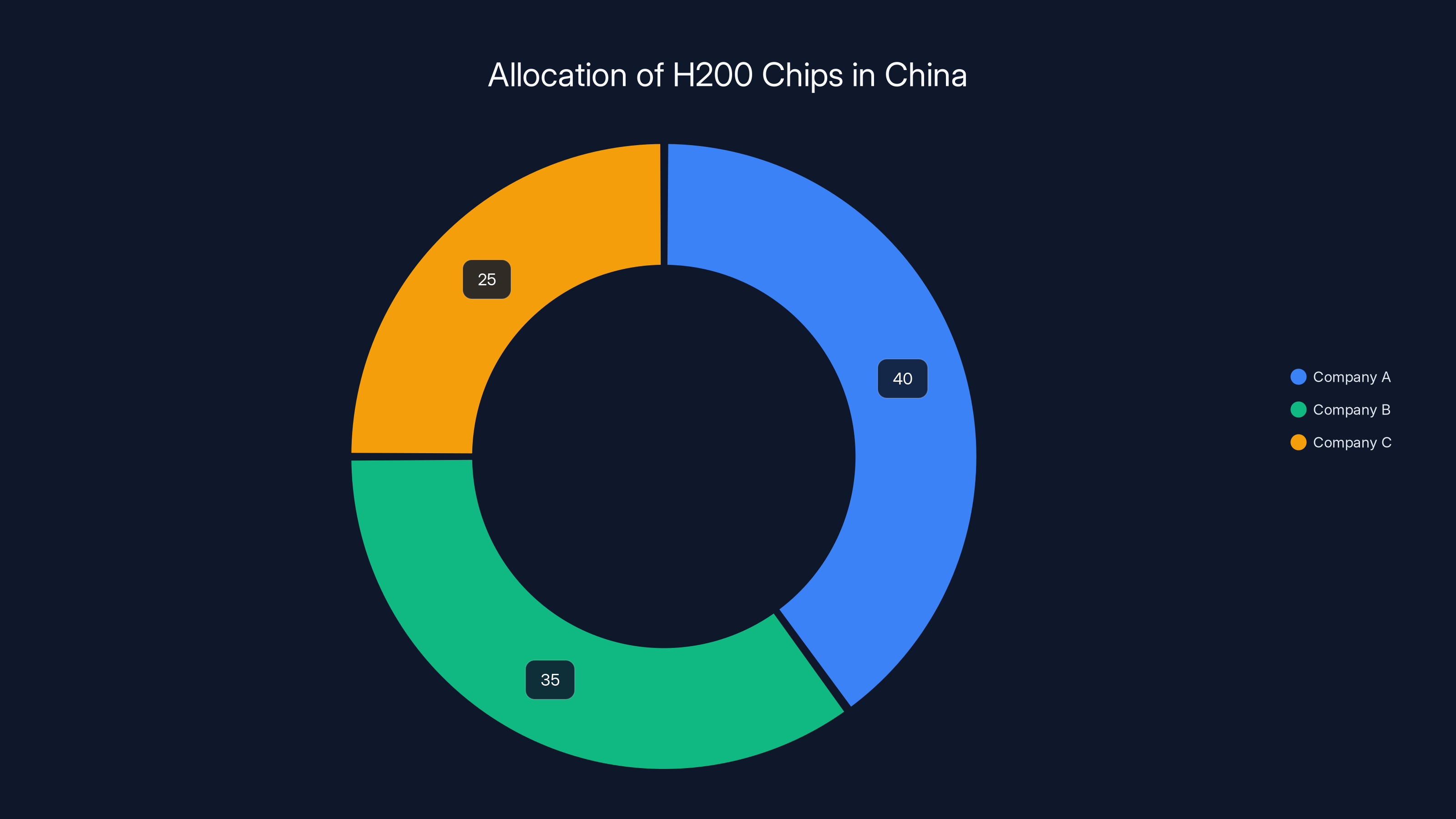

Estimated data suggests Baidu, Alibaba, and ByteDance each receive around 30% of the approved H200 chips, with 10% allocated to other firms. Estimated data.

The Scale of the Approval

Now let's talk about the actual numbers, because they're telling.

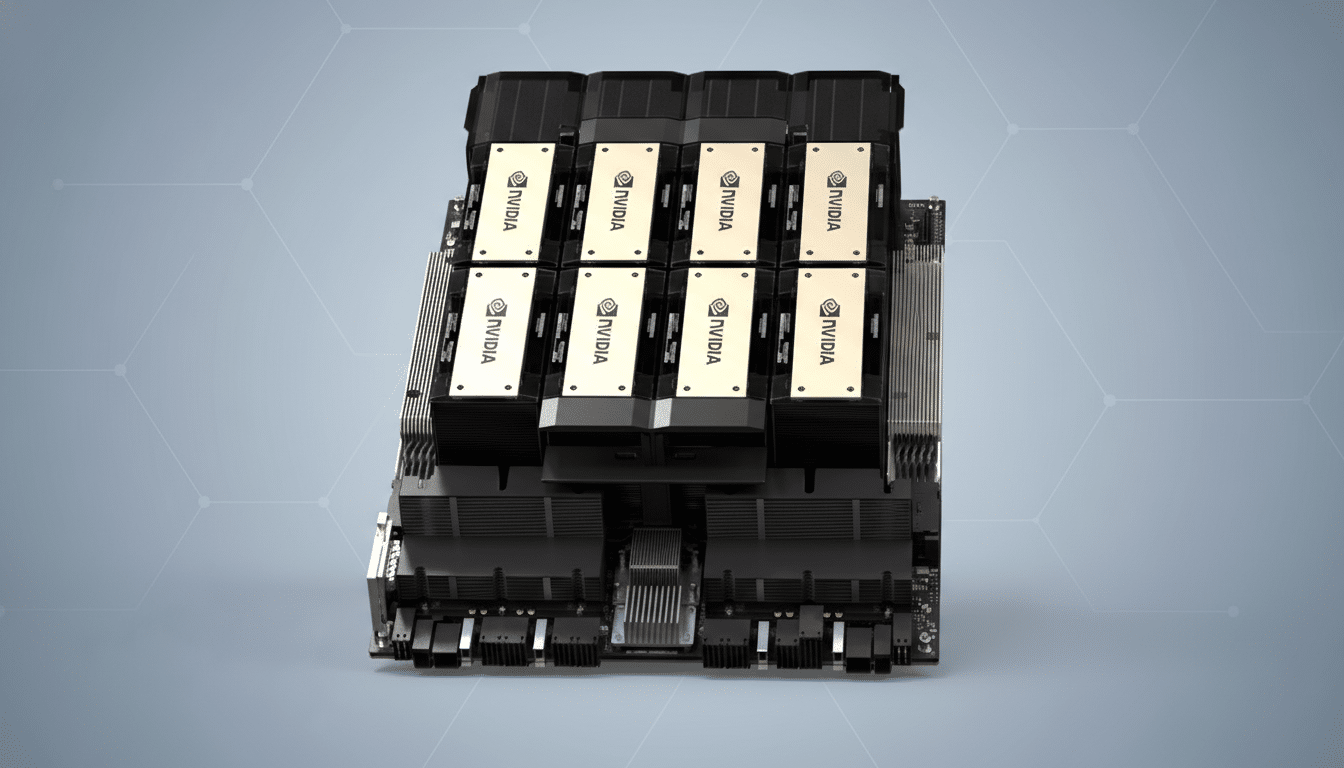

China approved "several hundred thousand" H200 chips for sale. That's a vague number, but let's put it in context.

Several hundred thousand chips, if we're talking 300,000-500,000 units, represents substantial capacity. Each H200 costs several thousand dollars. The total value could easily be in the $1-3 billion range, depending on the exact number and pricing.

That's real money. That's a meaningful portion of NVIDIA's business.

But it's also temporary. These chips were allocated "mainly to three unnamed Chinese internet companies." Three companies. In a country with thousands of AI development organizations. That's concentrated allocation, not democratized access.

The government is also "accepting applications for future approvals." This means the three companies didn't get unlimited access. This is a managed allocation system. More companies can apply, but there's a vetting process. The government maintains control.

This tells you something important about China's strategy: they're not opening the floodgates. They're carefully controlling who gets access to what. The largest companies—the ones with government connections and the ability to influence policy—get priority. Smaller companies and startups have to apply and wait.

It's a different model from the relatively open U.S. market, where anyone can buy NVIDIA chips (subject to export controls). In China, it's more like an allocation system, similar to how strategic resources like rare earth minerals are managed.

This approach makes sense from a government planning perspective. By controlling allocation, Beijing can:

- Ensure strategic priorities get compute resources first

- Prevent wasteful or speculative purchasing

- Monitor who's developing AI capabilities and for what purposes

- Leverage chip access as a policy tool for larger goals

It's not the most efficient system from a market perspective. But efficiency isn't the only goal here. Control and strategic advantage are equally important.

What the H200 Unlocks for Chinese AI Development

Let's get concrete about what this approval actually enables.

Large Language Model Training

The most obvious application is large language model development. Chinese companies like Baidu, Alibaba, and Byte Dance are all developing their own LLMs. Baidu has Ernie. Alibaba has Qwen. These models are competitive in the Chinese market and increasingly gaining traction in other Asian markets too.

With H200 access, these companies can accelerate their training pipelines. They can experiment with larger model sizes, longer training runs, and more ambitious architectures. They can iterate faster from prototype to production.

The H200 isn't sufficient for training a 100-trillion-parameter model, but it's plenty for the 7B-70B parameter range where most commercial LLMs operate today. It's enough for serious, production-grade model development.

Inference and Deployment at Scale

Just as important as training is inference. Once you have a trained model, you need to run it. You need to serve queries, handle user requests, power chatbots and search features and recommendation systems.

Inference is often more computationally demanding than training in production systems. You're running the model constantly, serving millions of requests. The H200's 141GB of memory is huge for this. You can keep the entire model in GPU memory, serving queries with minimal latency.

For a company like Byte Dance, which powers Tik Tok and has hundreds of millions of active users, this kind of inference capacity at scale is transformational. Better hardware means better recommendations, faster responses, more personalized experiences.

Multimodal and Vision AI

China is also deeply invested in vision AI. Computer vision for surveillance, traffic management, industrial automation, medical imaging, autonomous vehicles. All of these require serious compute.

Multimodal models (models that can process both text and images) are computationally expensive. The H200's memory and bandwidth are perfect for this kind of workload. Chinese companies developing these systems will benefit immediately.

Reinforcement Learning and Agent Development

There's also the emerging area of AI agents and reinforcement learning. Training models that can interact with environments, learn from feedback, and improve over time is even more compute-intensive than supervised learning.

Companies working on robotics, autonomous systems, and complex reasoning models will all benefit from additional H200 capacity. This is where some of the most interesting frontier AI work is happening, and it requires serious hardware.

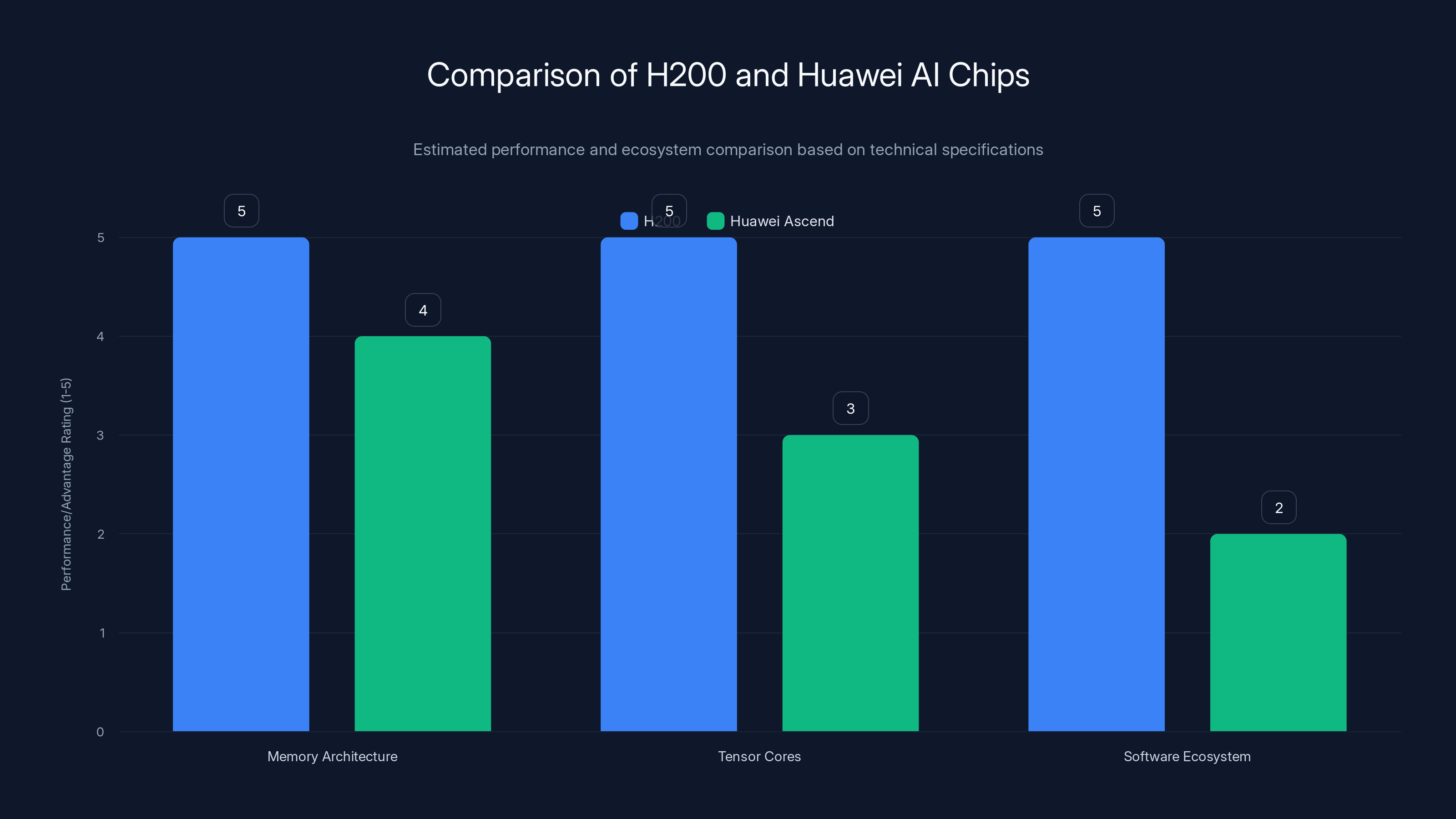

The H200 outperforms Huawei's Ascend chips in memory architecture, tensor core optimization, and software ecosystem support, making it a superior choice for AI development. Estimated data based on technical analysis.

The Huawei Factor: Domestic Alternatives

We need to talk about the elephant in the room: Huawei's Ascend processors.

Huawei has been investing heavily in semiconductor development, particularly in AI chips. The Ascend 910 and newer Ascend processors represent real engineering work and genuine capability.

Here's the thing though: Huawei is still playing catch-up.

The gap between NVIDIA's H200 and Huawei's current offerings is meaningful but narrowing. Huawei's chips are competitive in some benchmarks. They're improving rapidly. In five years, they might be genuinely competitive across the board.

But we're not at that point yet. Most chip experts and AI engineers will tell you privately that if they're building a mission-critical AI system and can get NVIDIA hardware, they'll prefer it. The software ecosystem is more mature. The optimization is better. The performance is more predictable.

China's approval of H200 imports essentially signals that the government agrees with this assessment. They could have doubled down on Huawei and banned all foreign chip imports as a nationalist move. Instead, they approved limited access to NVIDIA's H200.

What does this mean for Huawei? It's actually not necessarily bad news. The H200 approval gives Huawei time and market space to develop its processors. While Chinese companies are using H200s for production systems, Huawei can focus on research and development, building the next generation of technology. The goal is eventually independence from American suppliers, not immediate independence.

There's also a symbiotic relationship possible here. As H200s power more workloads, more engineers understand those systems. When Huawei releases competing products, those engineers can more easily evaluate and adopt them. The availability of imported hardware can actually accelerate domestic alternative development, counterintuitively.

When Will Domestic Alternatives Be Ready?

Most experts estimate that Huawei's processors will be genuinely competitive with NVIDIA's offerings in the 2026-2027 timeframe. That's one to two years away.

But "competitive in benchmarks" is different from "competitive in the real world." Software optimization takes time. Applications need to be rewritten or recompiled. Developers need to learn the platform. Switching costs are real.

Even if Huawei releases a processor that matches NVIDIA's specifications in 2026, the transition to actually using it at scale will take 2-3 more years. So we're probably looking at 2028-2029 before we see meaningful market share shift away from NVIDIA in China, even with active government support for domestic alternatives.

The H200 approval essentially fills that gap. It gives Chinese companies capable hardware while they wait for the domestic alternatives to mature.

The Geopolitical Implications

Let's step back and think about what this approval means for the broader U.S.-China technology competition.

Softening of the Hard Line?

One interpretation is that this represents a softening of the Trump administration's hard line on China technology restrictions. That could be true. The shift from blanket opposition to managed access is less restrictive.

But it's not a complete reversal either. The B200 remains completely off-limits. The H200 approval comes with strings attached (vetting, licensing, limited allocation). This isn't free trade resumption. It's managed, controlled, limited access.

It's more like a thaw than a full warming of relations. The freeze is easing slightly, but it's not spring yet.

Strategic Ambiguity

There's also an element of strategic ambiguity here. By approving some H200 sales, the U.S. government signals that it's not completely rigid. There's room for negotiation. There might be other things America wants from China (trade concessions, intellectual property protections, human rights improvements) that could be tied to technology access.

Similarly, by accepting the H200s but requesting better chips, China signals that it's pragmatic. It's not anti-American on principle. It's just looking for favorable terms and strategic advantage.

This kind of signaling is actually important for reducing misunderstandings and keeping competition from turning into conflict.

The Black Market Reprieve

From a policy perspective, the H200 approval also acknowledges a reality: the black market in restricted chips is huge and growing. By legitimizing some trade, the U.S. government reduces the incentive for smuggling.

Smuggling channels are expensive and risky. They add significant cost to chips. If you can buy legally, at market prices, the incentive to break the law disappears.

This is similar to how drug legalization or decriminalization can reduce black market activity, even if it increases total consumption slightly. Making some activity legal actually improves enforcement against truly illegal activity.

NVIDIA's Lobbying Power

We should also acknowledge NVIDIA's role here. The company has enormous influence with both American and Chinese policymakers. Huang's visit to China, followed immediately by the H200 approval, is probably not a coincidence.

NVIDIA has a financial incentive to sell chips to China. The company has made that case to the U.S. government. It's clearly found receptive ears. This is a reminder that major technology companies shape geopolitical policy as much as government dictates to them.

What This Means for Future Approvals

The H200 approval sets a precedent. It suggests that future exports might also be possible, depending on circumstances.

What circumstances? Probably a combination of factors:

- Further black market evidence showing the current restrictions don't work

- Chinese government purchases or commitments on other issues (tariffs, IP, etc.)

- Technology advancement creating new dividing lines (if the H200 is now approved, maybe something in between the H200 and B200 becomes approvable in a few years)

- Business pressure from other American companies (not just NVIDIA)

The approval isn't a one-time event. It's an opening to a new framework.

Estimated data shows a concentrated allocation of H200 chips among three major Chinese internet companies, highlighting strategic control over AI resources.

Economic Impact: For NVIDIA, China, and the Global Market

Let's talk money, because that's ultimately what this approval unlocks.

NVIDIA's Revenue Recovery

For NVIDIA, this is meaningful revenue recovery. Not full recovery (the B200 restrictions remain), but substantial. If we're talking 300,000-500,000 H200 chips at an average selling price of

NVIDIA's total annual revenue is around

More importantly, it signals that the Chinese market is reopening. If the H200 approvals lead to future approvals for newer chips, the revenue trajectory changes significantly. NVIDIA could return to the point where China represents 15-20% of total revenue, as it did before the restrictions.

That's not life-changing for NVIDIA (the company will grow regardless), but it's significant enough to move the needle on growth rates and shareholder expectations.

Chinese Tech Company Competitiveness

For Chinese AI companies, the H200 approval is a straightforward competitive advantage. They get better hardware than they had available. They can build better products faster.

For companies like Alibaba and Baidu that operate globally and compete with American firms, this directly impacts their ability to serve customers outside China. With better hardware, they can train more capable models, deploy them faster, iterate more quickly.

Byte Dance uses AI in Tik Tok's recommendation system, video editing tools, and content moderation. Better hardware means better recommendations, which means higher engagement, which means more advertising revenue. It compounds.

For smaller companies and startups, the allocation is unfortunately limited to three large firms initially. But as applications are approved, that access might spread. The first companies to get approvals have a 6-12 month head start on competitors. In AI, that can be significant.

Global Market Dynamics

At a global level, this approval might actually benefit AMD and other competitors to NVIDIA. Here's why: as China gets access to more NVIDIA chips domestically, the pressure to acquire them through black market channels or alternative suppliers decreases.

But the H200 approval is limited. China's allocation might never reach pre-restriction levels. So Chinese companies will still have incentives to develop or procure alternatives. AMD, Intel, and other chip makers might find more receptive customers in China now, since the Chinese market is looking for alternatives.

It's possible that the H200 approval actually increases competition in the Chinese AI chip market by demonstrating that NVIDIA access won't be unlimited, even with government approval.

Cloud Provider Competition

There's also an interesting dynamic in cloud services. Companies like Alibaba Cloud, Baidu Cloud, and Huawei Cloud provide GPU access as a service. With more H200s available, these providers can offer more compute capacity to customers.

This benefits startups and smaller organizations that can't buy H200s directly. They can rent access through cloud providers instead. The approval thus multiplies its impact beyond just the three companies that directly received the chips.

American cloud providers (AWS, Google Cloud, Microsoft Azure) also benefit from any improvement in the overall AI market. As more AI development happens globally, all cloud providers see increased demand.

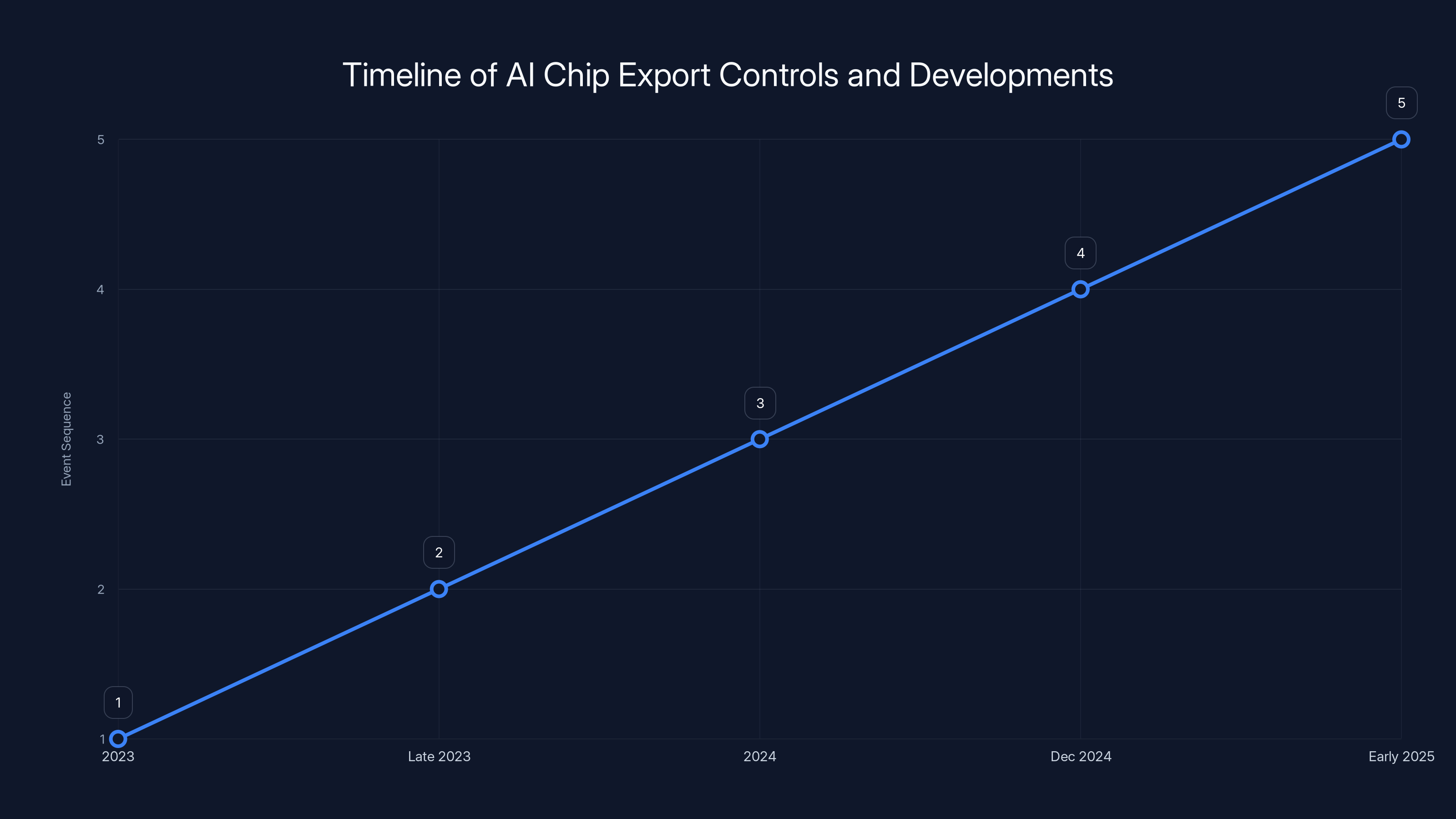

The Timeline: How We Got Here and What's Next

Let's map out the actual sequence of events to understand the momentum.

2023: The Initial Restrictions

The U.S. started implementing AI chip export controls in the fall of 2023. The H100 and other advanced NVIDIA chips were suddenly off-limits for sales to China. This was framed as a national security measure to prevent China from developing advanced military AI systems.

Late 2023: The H20 Compromise

Recognizing that a complete embargo wasn't sustainable, the Biden administration and NVIDIA developed the H20 as a compromise chip. It was intentionally crippled—less memory, lower bandwidth—but still useful for some workloads.

China rejected it. Unofficially, but clearly. The government and industry signaled that the H20 didn't meet their needs.

2024: Escalation and Circumvention

Throughout 2024, reports emerged of massive black market activity. Over $1 billion worth of restricted chips found their way to China through smuggling networks and gray market channels. This proved that the restrictions weren't actually preventing access, just making it more expensive and risky.

Meanwhile, Huawei accelerated its chip development efforts, and Chinese companies started investing more heavily in domestic alternatives.

December 2024: The Trump Administration Shift

In December, the Trump administration surprised many observers by approving limited H200 exports to China. This wasn't expected. The Trump administration is generally considered more hawkish on China than Biden's was.

The approval came with licensing requirements and was limited to vetted companies. But it was a meaningful shift from the blanket ban.

Early 2025: China's Acceptance and Jensen Huang's Visit

China initially didn't formally respond to the December approval. The government seemed to be holding out, preferring to develop domestic alternatives.

Then Jensen Huang, NVIDIA's CEO, visited China. The exact nature of his discussions isn't public, but they apparently moved the needle. Within days of his visit, reports emerged that China had approved the first batch of H200 chips for import.

The timing is too close to be coincidental. Something in those conversations convinced China's government that accepting H200 imports made sense.

What's Next?

Looking forward, we should expect:

- More H200 approvals: Additional companies will likely apply for and receive approvals in the coming months

- Potential policy shifts in Washington: The current administration might further adjust restrictions as they see how the H200 sales play out

- Accelerated domestic chip development: Chinese companies will use the breathing room provided by H200 availability to push Huawei's Ascend and other domestic alternatives forward

- Black market normalization: As legal imports increase, the smuggling market will gradually shrink

- New negotiating points: The H200 approval opens the door to discussions about other technology areas (cloud, AI software, etc.)

We're not at the end of this story. We're at a pivot point.

This timeline highlights significant events in AI chip export controls, showing initial restrictions in 2023, the H20 compromise, black market activities in 2024, a policy shift in December 2024, and developments in early 2025.

Technical Considerations: Why the H200 Matters for AI Development

Let's dig into the technical specifics of why the H200 is the right compromise chip for this moment.

Memory Architecture

The H200 has 141GB of HBM3E memory, which is absolutely crucial for AI workloads. Large language models are memory-hungry. A 70-billion-parameter model needs roughly 140GB of memory to store weights in full precision (32-bit floating point).

With 141GB, you can fit a full-sized model in a single GPU and run inference without having to distribute across multiple devices. That simplifies architecture, reduces latency, and improves efficiency.

Huawei's Ascend processors have comparable memory configurations, but the software ecosystem isn't as mature. The H200 comes with CUDA optimization, libraries, and decades of engineering know-how built in.

Tensor Cores and Compute Density

The H200 has thousands of tensor cores optimized for matrix multiplication, which is the fundamental operation in neural networks. The compute density is approximately 1.5x higher than the previous generation (H100).

For training, this translates to faster iterations. You spend less time waiting for gradient computations to finish, which means you can experiment more, train more models, iterate faster.

This is where Huawei's chips lag slightly. The tensor core equivalents are good but not quite at the same level of optimization as NVIDIA's offering. The gap is closing, but it's still meaningful.

Software Ecosystem

This is arguably the biggest advantage the H200 brings over domestic alternatives. NVIDIA has spent 20+ years building CUDA, cuDNN, cuBLAS, TensorRT, and hundreds of other libraries optimized for their hardware.

When you train a model with PyTorch on H200s, the code automatically gets optimized for the tensor cores, memory hierarchy, and communication patterns. Researchers don't have to think about it. The optimization is automatic.

With Huawei's chips, you need to rewrite code or at least recompile and re-optimize. Developers need to understand the specific hardware characteristics. It's more work.

This software ecosystem advantage is worth billions to NVIDIA. It's why they can maintain premium pricing even as competitors improve hardware specs.

Flexibility Across Workloads

The H200 is flexible. It handles training, inference, and deployment well. It works for computer vision, NLP, multimodal models, reinforcement learning. Different workloads need different optimizations, but the H200 can handle them all competently.

Domestic alternatives are often optimized for specific use cases. Good for training, maybe less good for inference. Good for certain architectures, maybe weaker on others.

The H200's versatility is valuable. It's a Swiss Army knife instead of a specialized tool.

Power Efficiency

The H200 uses significantly less power than the B200 (which is the unrestricted baseline) while delivering much better performance than the H20. This is important for data center economics.

In China, electricity costs vary but are generally lower than in the U.S. Still, power efficiency matters. Lower power consumption means lower operating costs, which means lower prices for customers, which means more adoption.

Huawei's chips are competitive here, but the H200 likely has a slight edge in terms of FLOPS per watt in most workloads.

The Role of Export Control Policy

Understanding how we got here requires understanding the policy framework.

The CHIPS Act and Foreign Direct Product Rule

Export controls don't just restrict direct sales. They restrict any product made with American technology, anywhere in the world. This is called the Foreign Direct Product Rule (FDP).

Because NVIDIA uses American software (CUDA), American design tools (from Synopsys, Cadence), and American manufacturing partners, technically all NVIDIA products fall under U.S. export control jurisdiction, even if they're made in Taiwan or South Korea.

China can't just say "we'll manufacture our own NVIDIA equivalent chips." If those chips use American tools or technology in the design process, they fall under export controls too.

This gives the U.S. government significant leverage. It's not just about restricting today's NVIDIA chips. It's about restricting China's ability to design better chips.

However, this leverage is not unlimited. Tools companies (Synopsys, Cadence, EDA vendors) want to sell to Chinese customers. NVIDIA wants to sell chips. There's constant pressure from industry to relax restrictions.

The Licensing System

The H200 approval uses a licensing system, not an outright ban. This means:

- China must approve each export

- The U.S. must approve each sale

- Both governments maintain oversight

- The system can be tightened or loosened as needed

This is more flexible than a blanket ban. It allows for adjustment as circumstances change. If China uses H200s to develop military AI systems, the licenses can be revoked. If it works out well, they can be expanded.

For policymakers, this is attractive. It's not permanent. It's adaptable.

The Precedent Question

One important question: does approving the H200 set a precedent for approving other chips?

Legally and formally, each export decision is separate. But practically, yes, approving H200s now makes it harder to justify rejecting H300s or H400s in the future if China requests them.

Once you accept the argument that H200s are okay for commercial AI development, that argument applies to other chips too. The government would need new reasoning to explain why H300s are different.

This is probably why industry observers are watching the H200 approval so closely. It's not just about this chip. It's about the framework being established.

Congressional Pressure

There's also Congress to consider. Some lawmakers are skeptical of any technology exports to China. They worry that "commercial AI development" can be quickly repurposed for military applications.

They're not entirely wrong. Dual-use technology is real. The same algorithms used for civilian AI can power military systems.

But completely banning exports is economically costly and practically impossible (due to black market activity). So policymakers are trying to find a middle ground.

The H200 approval probably represents the maximum approval Congress would accept right now. Going further would face strong opposition.

Competitive Impact: Winners and Losers

Let's think about who benefits and who loses from this approval.

Clear Winners

NVIDIA: More revenue, larger addressable market, reduced smuggling pressure

Chinese Internet Companies: Better hardware, faster development, improved products

Cloud Providers: Increased compute demand, more services sold

Huawei: More time to develop alternatives, less pressure for immediate perfection

Clear Losers

Smuggling Operations: The black market loses if legal channels open up

AMD and Intel: Limited opportunity to sell to China; the H200 approval crowds them out

American AI Startups in Competitive Fields: Any competition with well-funded Chinese companies just got worse

Unclear/Mixed Impact

American Consumers: Better hardware available to competitors, possibly better products from Chinese companies, but harder for American companies to maintain global AI leadership

The U.S. Government: Maintains some control through licensing, but loses the moral high ground of a "no sales to China" policy

Long-term Implications for American Chip Leadership

The H200 approval is a small concession in a much larger competition. NVIDIA and American chip makers maintain a significant lead. But that lead is eroding.

Every year that Chinese companies get access to good hardware, they improve. Every year that Huawei develops its processors, the gap narrows. By 2028-2030, Huawei's chips might be genuinely competitive.

When that happens, the export control advantages will matter less. A Chinese company with access to Huawei's latest chips won't care if the H200 is restricted.

So the H200 approval might actually be good for American long-term competitiveness. It maintains a revenue stream for NVIDIA. It signals that there's room for negotiation. It prevents a complete decoupling of tech supply chains.

Complete decoupling would accelerate China's independent development. Limited access and continued competition might actually be better for American interests.

What This Means for AI Development Globally

Zooming out from the immediate implications, what does the H200 approval mean for AI development globally?

Acceleration of Chinese AI

With better hardware available, Chinese AI companies will accelerate their development. They'll train larger models, deploy more capable systems, and compete more effectively in global markets.

This doesn't mean they immediately catch up with American capabilities. But the gap narrows faster. Instead of Chinese AI being 2-3 years behind American AI, it becomes 1-2 years behind. Then it becomes competitive in specific domains.

Decoupling Without Complete Separation

The approval signals that the world isn't moving toward complete technological separation between the U.S. and China. Instead, it's moving toward managed, controlled, limited interaction.

This is probably healthier than either extreme (complete decoupling or unrestricted access). It allows continued trade while maintaining strategic advantage.

The New Normal: Tiered Access

Looking forward, we'll probably see more of this: tiered access to technology. The newest, most advanced chips stay restricted. Previous-generation technology gets approved under licensing. Older technology gets fully opened.

This creates a natural technology cycle: technology gets exported 2-3 years after it's first released, giving America a head start before global competition catches up.

Increased Investment in Alternatives

The H200 approval reduces the urgency for China to develop alternatives, slightly. But it doesn't eliminate it. Chinese companies and the government will continue investing heavily in Huawei, SMIC, and other domestic initiatives.

Over the next 5 years, expect significant progress in Chinese chip design. Not parity with NVIDIA necessarily, but competitive alternatives.

AI Democratization Effects

Here's an interesting secondary effect: as more countries and companies get access to capable hardware (through legal or gray market channels), AI development becomes more distributed.

Right now, AI development is concentrated in the U.S., China, and a few other countries with deep pockets. As hardware becomes more accessible, more countries and companies can participate.

This is probably good for AI development overall. More diverse teams, more perspectives, more competing approaches leads to better innovation.

The Inference vs. Training Gap

One thing worth watching: as export controls limit access to training hardware, more focus might shift to inference and deployment.

You can do incredible things with inference even if you don't have the latest training hardware. You can fine-tune models, use transfer learning, build applications on top of existing models. The H200 supports inference very well.

So the approval might indirectly accelerate innovation in inference, deployment, and applications while slowing down innovation in frontier model training.

The Regulatory Framework Going Forward

The H200 approval doesn't exist in isolation. It's part of a larger regulatory framework that's constantly evolving.

Current U.S. Policy Direction

Under the Trump administration, the policy appears to be: maintain restrictions on the latest generation, allow limited sales of previous generations under licensing, and use technology sales as a negotiating tool.

This is different from the Biden approach (slightly less permissive) and likely different from a Clinton or Obama approach would have been (more permissive).

But notice the pattern: Republican and Democratic administrations both use export controls. This isn't a partisan issue. It's a strategic issue that transcends politics.

What matters more is the specific technology. As technology advances, the dividing line between "too advanced to export" and "safe to export" shifts. The H200 is at the current boundary. In 2027, a different chip will be at the boundary.

International Pressure

There's also international pressure to normalize technology trade. Countries like Japan, South Korea, and Taiwan have economies dependent on semiconductor exports. A complete ban on sales to China hurts their interests.

These countries have political leverage in Washington. They lobby for more open trade. Over time, their voices add up.

EU Perspective

Europe is developing its own export control frameworks. They're watching the U.S. approach but not automatically following it. European chip makers want to sell to China. The EU wants to maintain its technology base but not start a new Cold War.

The result is likely less restrictive European policy than American policy. This could create arbitrage opportunities where equipment and chips flow through Europe to China.

China's Regulatory Response

China is also building its own regulatory framework. They're restricting exports of rare earth minerals, for example, as a counter-measure to semiconductor restrictions.

They're also using government procurement to favor domestic chips, subsidizing companies like Huawei, and offering incentives for AI development on domestic platforms.

It's a tit-for-tat approach. The U.S. restricts chips, China restricts minerals. Eventually, both sides might realize total restriction doesn't serve either side's interests.

The Role of Multilateral Agreements

One possibility going forward is that export controls become more formalized in multilateral agreements. Rather than ad-hoc American restrictions, we might see a wider coalition of countries agreeing on joint export control policies.

This would be more stable and harder to circumvent. But it would also require consensus among allied nations, which is difficult.

Long-term Trend: Toward Managed Trade

My prediction is that we're moving toward managed trade rather than restricted trade. Instead of bans, we'll see licensing, quotas, and approval systems.

This is more flexible, more sustainable, and less economically destructive than outright bans. It also gives governments the control they want without completely shutting down commerce.

The H200 approval is a step in that direction.

Case Study: How Companies Will Use the H200

Let's think concretely about how the three approved Chinese companies (whoever they are) will likely use their H200 allocations.

Scenario 1: The Large Language Model Company

Let's imagine one of the three is a company like Baidu that's deeply invested in LLM development (which Baidu is with its Ernie models).

They'll use the H200s for:

- Model Training: Scaling up their models from 70B to 200B+ parameters

- Rapid Iteration: Running multiple training experiments in parallel to explore different architectures

- Fine-tuning: Creating domain-specific variants of base models for different applications

- Inference Optimization: Testing different quantization and optimization strategies

With several hundred H200s, they could train a large model to convergence in weeks instead of months. They could maintain 3-5 different models in active training simultaneously. This dramatically accelerates product development.

Scenario 2: The Recommendation System Company

Let's imagine another is something like Alibaba, heavily focused on e-commerce and content recommendation.

They'll use the H200s for:

- Ranking Model Training: Training multi-billion-parameter ranking models for search, recommendations, and ads

- Real-time Personalization: Running inference at massive scale to serve personalized results to millions of concurrent users

- A/B Testing: Running dozens of experiments in parallel to optimize conversion rates

- Data Pipeline: Processing and analyzing enormous amounts of user behavior data

Better ranking models mean higher conversion rates, which means more revenue. The H200s translate directly to money.

Scenario 3: The Emerging Capabilities Company

Let's imagine the third is a company exploring newer areas like multimodal AI, video understanding, or complex reasoning.

They might use the H200s for:

- Multimodal Model Development: Training models that understand text, images, and video simultaneously

- Foundation Model Research: Exploring new architectures and training paradigms

- Agent and Reasoning Development: Building models that can think, plan, and reason over multiple steps

- Long-context Processing: Training models to understand very long documents or conversations

This kind of frontier research requires expensive experimentation. The H200 allocation enables them to explore areas they couldn't afford to before.

Multiplier Effects

Here's the thing: these three companies don't keep the H200s entirely to themselves. They're parts of bigger ecosystems.

Alibaba runs Alibaba Cloud, which serves thousands of customers. Some of those customers get access to H200-powered services.

Baidu is connected with Baidu Research, universities, and startups. They share knowledge and collaborate.

The direct impact is three companies getting H200 access. The indirect impact is much broader through cloud services, partnerships, and knowledge sharing.

This is how the allocation multiplies beyond the nominal numbers.

The Long Game: What's the Endgame?

Taking the longest possible view, what's the actual endgame of this technology competition?

Scenario A: Complete Decoupling

One possibility is that the U.S. and China eventually build completely separate technology stacks. American companies use American chips, software, and services. Chinese companies use Chinese equivalents.

This would be economically inefficient for everyone but might happen anyway due to geopolitical pressure. We saw something similar during the Cold War.

If this happens, the H200 approval is just a temporary blip. Eventually, even these limited exports stop.

Scenario B: Managed Coexistence

Another possibility is that we settle into a stable state where:

- The U.S. restricts the absolute latest generation chips

- Previous generation chips are available under licensing

- Both sides maintain strategic advantages but allow significant trade

- Technology diverges somewhat but both sides keep talking

This seems more likely than complete decoupling. It's sustainable for longer and economically viable for all parties.

Scenario C: Negotiated Resolution

A third possibility is that larger geopolitical negotiations eventually resolve some of the chip tension. Maybe trade deals, IP protections, or human rights improvements lead to broader technology access.

This seems less likely in the near term but possible over a 5-10 year horizon.

My Prediction

I think we're in Scenario B territory. Managed coexistence with regular negotiations and shifting boundaries.

The H200 approval represents the current equilibrium. This equilibrium will shift as:

- New chips are invented (shifting the "frontier" of restricted tech)

- Chinese domestic alternatives mature (reducing the advantage of restrictions)

- Geopolitical circumstances change (wars, trade tensions, alliances)

- Economic pressures mount (companies losing money to restrictions)

What won't happen: complete freedom of trade or complete restriction. The middle ground is too appealing to all parties.

The Role of NVIDIA

Interestingly, NVIDIA is almost uniquely positioned to influence this endgame. The company has relationships with and influence in both Washington and Beijing.

NVIDIA's interest is clear: maximize sales globally. The company will lobby for more open trade while assuring governments that restrictions are important.

Other chip makers will do similarly. This industry pressure will gradually push policy toward more access over time.

Conclusion: A Moment of Pragmatism in the Tech Cold War

The H200 approval is a small thing on the surface: China approves some GPU imports.

But it's a significant symbolic moment. It represents a recognition that complete restriction doesn't work. It opens a door to negotiation. It suggests that even in an era of geopolitical competition, pragmatism and economic interest still matter.

For NVIDIA, it's a meaningful revenue recovery and a sign that the Chinese market isn't permanently closed.

For Chinese companies, it's breathing room to develop capabilities while domestic alternatives mature.

For the U.S. government, it's a way to maintain some strategic advantage while acknowledging economic reality.

What we're watching is the tech industry version of détente. Not a full thaw, but a meaningful easing of the absolute freeze that existed just a few months ago.

This probably won't be the last adjustment. As technology advances and circumstances change, expect regular negotiations and shifting boundaries. The H200 is approved. The B200 remains restricted. In 2027, maybe an H300 or whatever comes next gets approved under licensing.

It's a dynamic equilibrium, not a final settlement.

The implications are significant. Chinese AI development will accelerate. American companies' growth in China will be constrained but not eliminated. Global AI development becomes more distributed. The technology competition stays fierce but doesn't descend into complete Cold War-style separation.

For anyone tracking AI development, geopolitical trends, or semiconductor policy, this is an important moment to understand. The H200 approval is small, but it sets a direction that will shape technology competition for the next five to ten years.

Watch what happens next. Watch whether additional companies get H200 approvals. Watch whether Huawei's domestic chips improve fast enough to matter. Watch whether the U.S. government further adjusts its restrictions or doubles down.

The game is just getting interesting.

FAQ

What is the NVIDIA H200 GPU?

The NVIDIA H200 is a data center AI accelerator GPU based on the Hopper architecture. It features 141GB of HBM3E memory and is designed for large-scale AI model training and inference workloads. The H200 is NVIDIA's second most powerful GPU behind the restricted B200 Blackwell chip and represents a significant capability improvement over the H20 variant previously approved for export to China.

Why did China initially reject the H200 and then change its decision?

China initially rejected the H200 in favor of developing domestic semiconductors like Huawei's Ascend processors to reduce dependence on American technology. However, the government changed course after recognizing that black market chip smuggling was already circumventing restrictions ($1+ billion in restricted chips already reached China illegally) and that domestic alternatives weren't ready for immediate deployment at scale. The approval represents a pragmatic middle ground while companies wait for competitive domestic options to mature.

How many H200 chips did China approve and who gets them?

China approved several hundred thousand H200 chips (estimates suggest 300,000-500,000 units) for initial sale to three unnamed major Chinese internet companies, likely including firms like Baidu, Alibaba, and Byte Dance. The government is accepting applications for future approvals, creating a managed allocation system rather than open market access. This allocation totals approximately $1.5-3.5 billion in potential chip sales.

What does the H200 approval mean for American AI companies?

The H200 approval potentially intensifies competition for American AI companies. Chinese competitors now have access to significantly better hardware than before, enabling them to develop more capable AI models and products more quickly. However, the restriction on the more advanced B200 chip and the limited allocation help preserve some American technological advantage in frontier model development.

Is the H200 approval a one-time exception or the start of a new policy trend?

The H200 approval likely represents the start of a managed export control framework rather than a permanent policy. Future generations of chips will face similar questions about whether they should be restricted or allowed under licensing. The approval sets a precedent that suggests previous-generation technology may become available under licensing while the absolute latest generation remains restricted, creating a rolling window of access that shifts as new technology emerges.

When will Chinese domestic AI chip alternatives like Huawei's Ascend be competitive with NVIDIA's H200?

Most chip industry experts estimate that Huawei's next-generation Ascend processors will achieve competitive performance specifications with the H200 by 2026-2027, but real-world competitiveness in software ecosystem, optimization, and reliability may take until 2028-2030 to fully develop. The maturation timeline gives Chinese companies 2-3 additional years to explore options and plan transitions beyond initial reliance on imported NVIDIA hardware.

Could the H200 approval be reversed if geopolitical tensions escalate?

Yes, the approval can be reversed or modified through the licensing system. Export licenses are not permanent and can be revoked if geopolitical circumstances change, security concerns emerge, or the approved companies engage in prohibited activities. However, reversals would likely face strong opposition from NVIDIA and industry partners, making sudden changes politically difficult unless major provocations occur.

How does the H200 approval affect other chip makers like AMD and Intel?

The approval potentially benefits AMD and Intel by demonstrating that the Chinese market remains interested in foreign chips and that export restrictions create business opportunities. However, NVIDIA's dominant position in data center GPUs means most AI applications will still prefer H200s over alternatives. AMD and Intel might find niche opportunities in areas where NVIDIA isn't approved or where price competition becomes fierce as Chinese domestic alternatives improve.

What is the relationship between the H200 approval and broader U.S.-China technology competition?

The H200 approval signals a shift from absolute restriction toward managed trade in semiconductor technology. It reflects recognition that complete embargoes are economically costly, technically difficult to enforce (due to black market smuggling), and less effective than controlled licensing for maintaining strategic advantage. The approval sets a template for how the U.S. government might approach future technology sales to China under licensing systems that maintain oversight while allowing economic activity.

This article explores the geopolitical, technical, and economic dimensions of China's approval of NVIDIA H200 GPU imports, examining the factors that led to this decision and its implications for the global AI industry.

Key Takeaways

- China approved H200 imports after initial rejection, signaling pragmatic shift from hard-line restrictions to managed trade

- The H200 is significantly more capable than the H20 but still below the unrestricted B200, creating a middle ground for both governments

- Over $1 billion in black market chip smuggling created political incentive for legitimizing some trade under licensing systems

- Three unnamed Chinese companies received initial approvals, with the government accepting applications for future allocations

- The approval accelerates Chinese AI development while domestic alternatives like Huawei's Ascend continue maturing toward competitiveness

Related Articles

- GPU Memory Crisis: Why Graphics Card Makers Face Potential Collapse [2025]

- AI Chip Startups Hit $4B Valuations: Inside the Hardware Revolution [2025]

- Photonic Packet Switching: How Light Controls Light in Next-Gen Networks [2025]

- Microsoft Maia 200: The AI Inference Chip Reshaping Enterprise AI [2025]

- Why Agentic AI Projects Stall: Moving Past Proof-of-Concept [2025]

- Modernizing Apps for AI: Why Legacy Infrastructure Is Killing Your ROI [2025]

![China Approves NVIDIA H200 GPU Imports: What It Means [2025]](https://tryrunable.com/blog/china-approves-nvidia-h200-gpu-imports-what-it-means-2025/image-1-1769607719589.jpg)