How Code Metal is Rewriting Defense Software With AI

When the Pentagon needs legacy code modernized, there's a brutal reality that sits underneath every decision: you can't afford to break it. Satellites stay in orbit because of code written in COBOL. Communications networks humming beneath cities run on Fortran written decades ago. The defense contractors maintaining this infrastructure face an impossible choice: keep running on outdated programming languages and hardware, or risk introducing catastrophic bugs during the translation process.

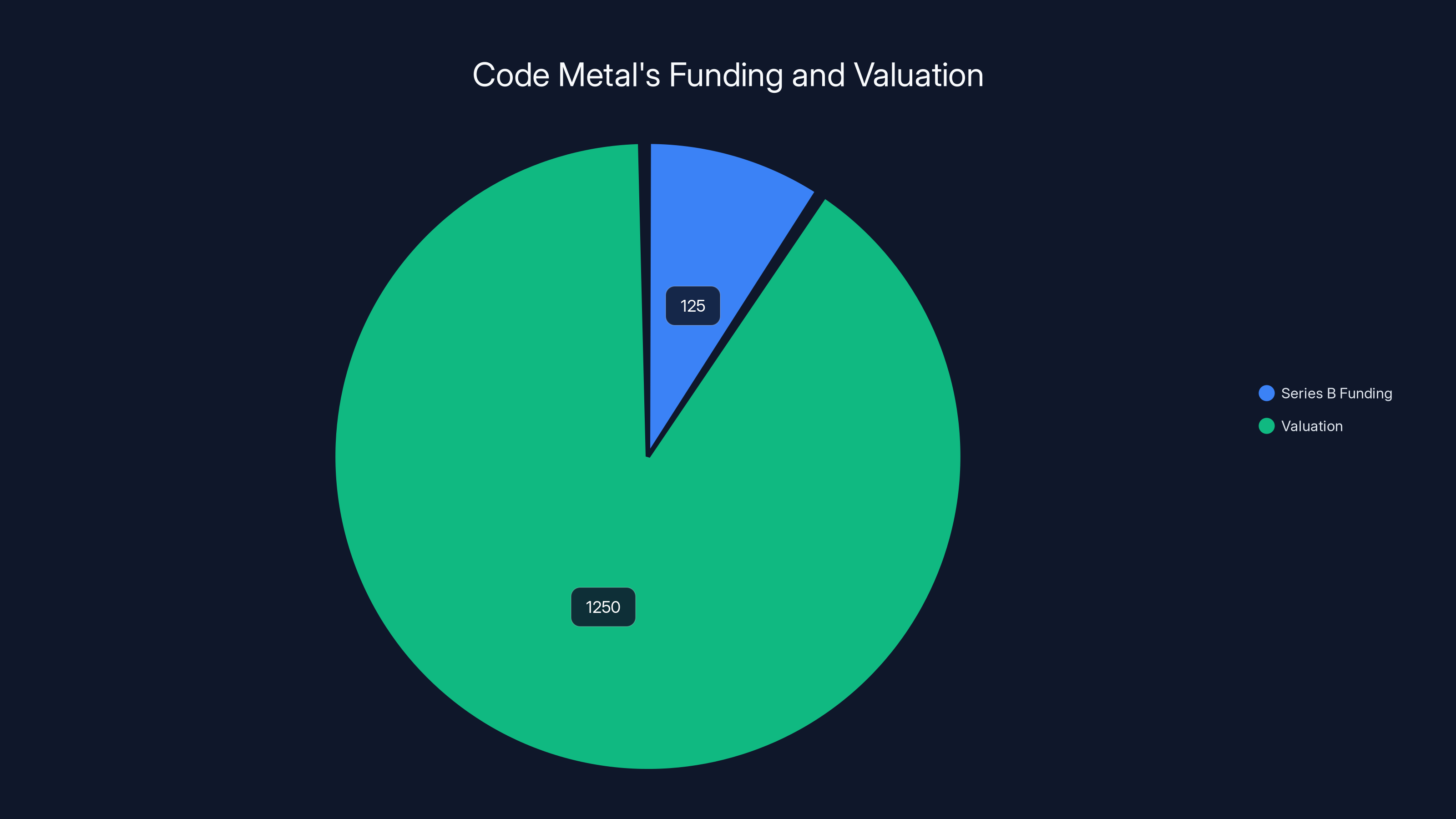

Enter Code Metal, a Boston-based startup that just closed a $125 million Series B funding round. The company is betting that artificial intelligence can solve what's become the defense industry's most stubborn technical problem: how to modernize decades-old code without breaking the systems that protect critical infrastructure.

The announcement lands months after the startup raised $36 million in Series A funding, and it signals something bigger than just another AI startup chasing venture money. Code Metal represents a new category of AI-powered enterprise tools that don't try to replace engineers—they augment them. The startup works with the US Air Force, RTX (formerly Raytheon), L3 Harris, and Toshiba. Its software translates code from high-level languages like Python, Julia, Matlab, and C++ into lower-level languages and hardware-specific implementations like Rust, VHDL, and Nvidia's CUDA.

But here's what separates Code Metal from the hype machine surrounding generative AI: it actually cares whether the output works. That obsession with correctness is why investors are willing to bet nearly $200 million on the company.

TL; DR

- Code Metal raised $125M Series B to modernize legacy defense software using AI translation and verification technology

- The startup targets a massive market pain point: translating decades-old code without introducing bugs, with customers including the US Air Force and RTX

- Verification is the differentiator: Code Metal generates test harnesses at each translation step to validate output, not just generate code

- Pricing innovation matters: The company charges based on value delivered (time saved, lines translated) rather than traditional per-seat licensing

- Unicorn status achieved: Code Metal reached $1.25 billion valuation while claiming profitability, making it profitable before exit

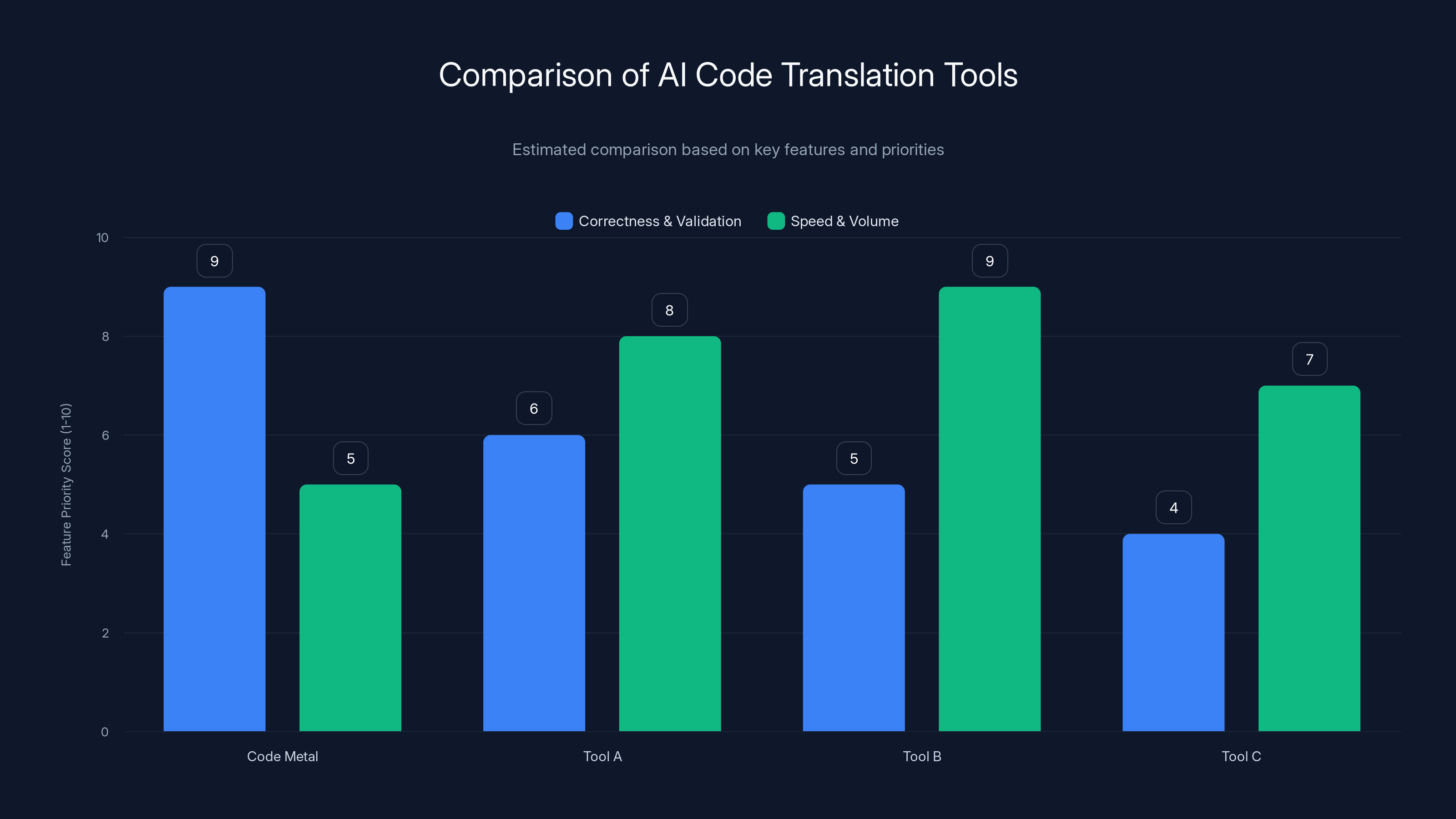

Code Metal scores highest in correctness and validation, reflecting its focus on error-free translation for defense applications. Estimated data.

The Defense Industry's Code Modernization Crisis

Defense contractors operate in a parallel universe from consumer software companies. When Spotify pushes a buggy update, users restart the app. When defense code breaks, people potentially die. This existential difference shapes everything about how the industry approaches technology decisions.

The problem began decades ago. Government agencies and contractors chose programming languages based on what was available at the time. COBOL, Fortran, Ada—these weren't arbitrary choices. They were optimized for the hardware of the 1970s and 1980s. They were standardized. They worked. And then the world moved on.

Today, finding engineers who specialize in legacy languages is like finding someone who still repairs VHS players. The talent pool is aging. Universities don't teach COBOL anymore. When a contractor needs to add features or fix vulnerabilities in legacy systems, they either hire expensive consultants who remember the old languages, or they embark on the nightmare scenario: rewriting entire systems from scratch.

This is where Peter Morales, Code Metal's CEO, saw an opportunity. Morales previously worked at Microsoft and MIT Lincoln Laboratory, so he understood both the software industry and government systems. He recognized that the problem wasn't just technical—it was economic. Rewriting millions of lines of code takes years and costs hundreds of millions of dollars. Porting it automatically, if done correctly, could cut that timeline and cost dramatically.

Andrej Karpathy, the renowned AI researcher who previously led Tesla's AI team, recently posted on X about the momentum behind converting C code to Rust. His observation: "It feels likely that we'll end up rewriting large fractions of all software ever written many times over." Code Metal's entire thesis exists in that single observation.

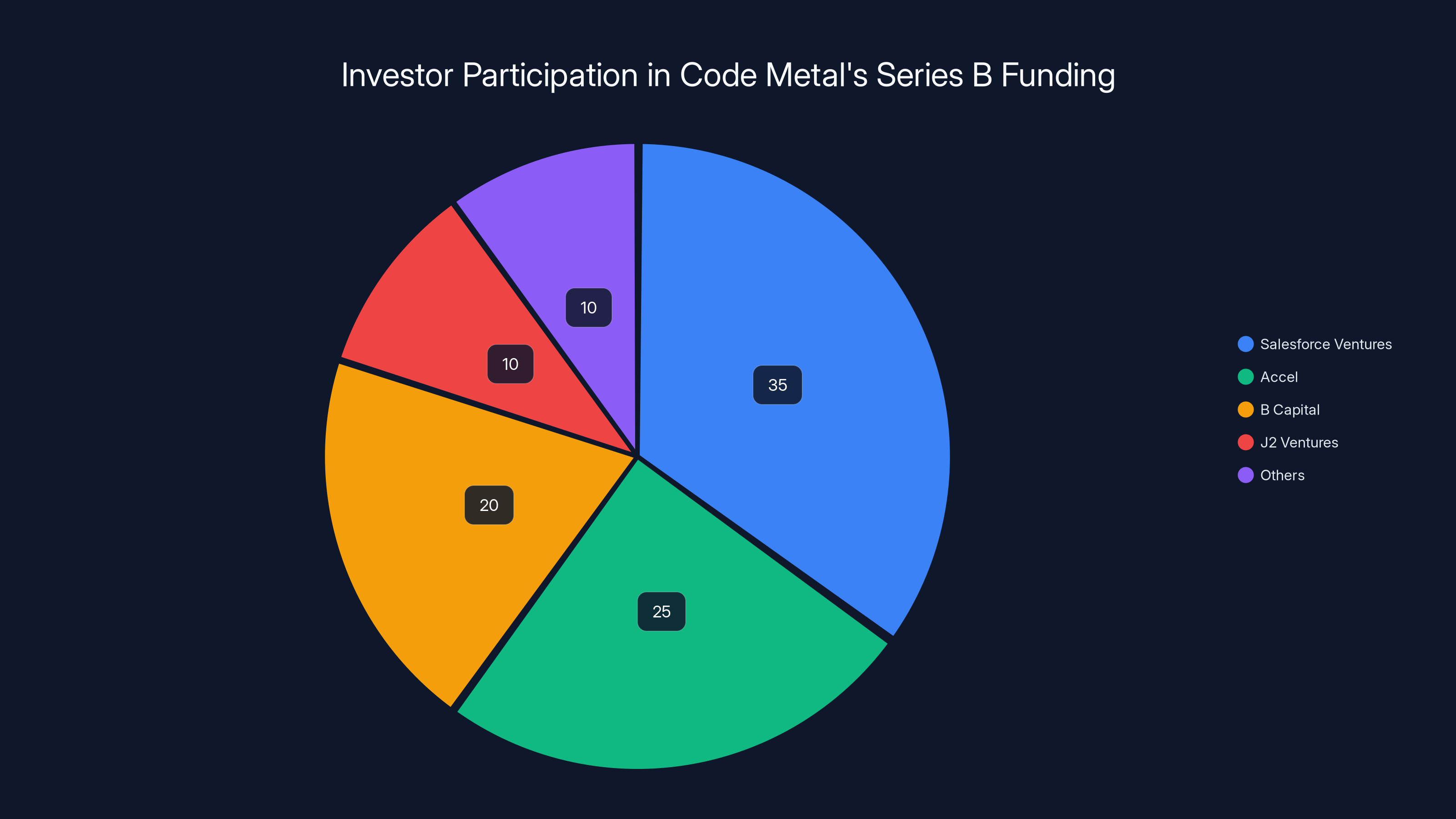

Salesforce Ventures led the Series B round, contributing an estimated 35% of the total investment, indicating strategic interest in Code Metal. Estimated data.

Why Translation Is Harder Than Writing Code From Scratch

Most people assume that translating code is just a mechanical process. Take Python, convert it to Rust, done. In reality, translation sits at the intersection of multiple impossibly hard problems.

First, every programming language has idiomatic patterns. Python code that's "correct" Python doesn't necessarily translate cleanly to Rust, which has different memory management, borrowing rules, and conventions. A literal translation might work but violate every Rust best practice. A good translation needs to understand not just syntax, but semantics and idiom.

Second, legacy code is often layered with technical debt and kludges. Someone wrote a function in 1987 to work around a hardware limitation that hasn't existed for twenty years. Should that workaround be preserved in the translation? Sometimes yes—it might hide complex business logic that took two decades to perfect. Sometimes no—it's pure cruft that slows everything down.

Third, testing becomes exponentially harder as codebase size increases. A small script can be manually verified. When you're translating millions of lines of defense code that controls satellite communications, verification becomes a mathematical and engineering nightmare.

Yan-David Erlich, a general partner at B Capital and an investor in Code Metal, articulated the core problem: "Some of the code that controls essential communications infrastructure, and even satellites, is old, it's crufty, it's written in programming languages that people might not use anymore. It needs to be modernized. But in the course of translation, you might be inserting bugs—which is catastrophically problematic."

This is why Code Metal's approach differs from most AI coding tools. The startup isn't primarily focused on generating code. It's focused on verification and validation.

How Code Metal's Verification Technology Actually Works

During each step of the translation process, Code Metal's software doesn't just generate code—it generates a series of test harnesses alongside it. A test harness is essentially a virtual container filled with data and tools that evaluate whether the translated code produces the same outputs as the original code.

Morales describes the approach with confidence: for the pipelines Code Metal currently handles, there's effectively no error rate in the translations. If the system can't complete a translation with confidence, it simply says so. It won't generate buggy code and hope the customer doesn't notice.

This approach represents a fundamentally different philosophy than most AI tools. Many generative AI platforms optimize for speed and volume. They generate code quickly and let humans sort through what's correct. Code Metal optimizes for correctness and then measures speed second.

The verification process works in multiple layers. At the syntax level, the system checks that the translated code is valid in the target language. At the semantic level, it verifies that the logic produces equivalent outputs. At the performance level, it checks that the translated code doesn't have dramatic performance regressions.

What's crucial is that this verification happens before the customer ever sees the code. The company doesn't charge for the process of generation and verification. It charges for successful translation. This inverts the risk model—the vendor assumes the risk of getting it right, not the customer.

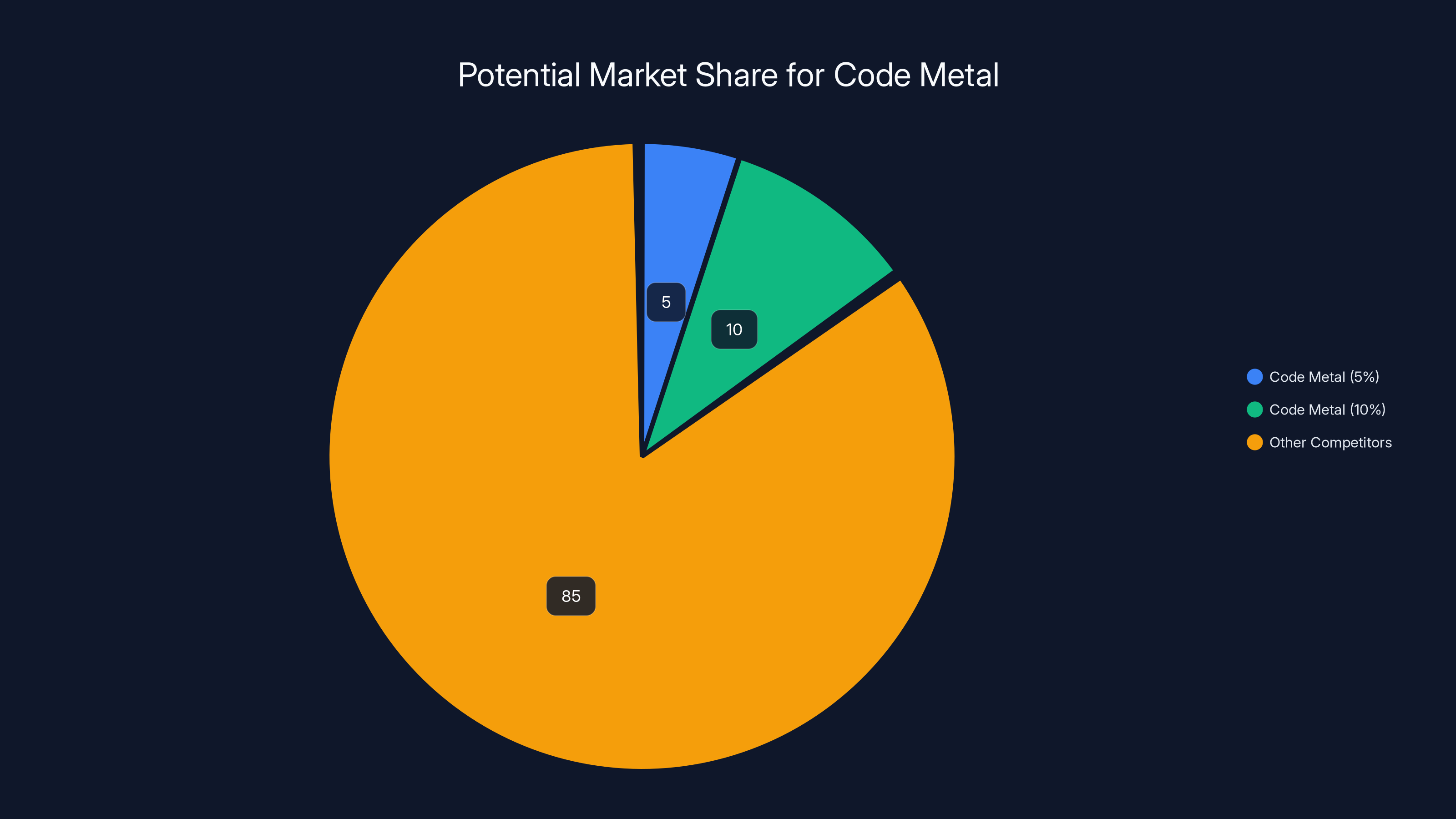

Code Metal could capture between 5% to 10% of the

The Venture Capital Gold Rush Around AI Code Tools

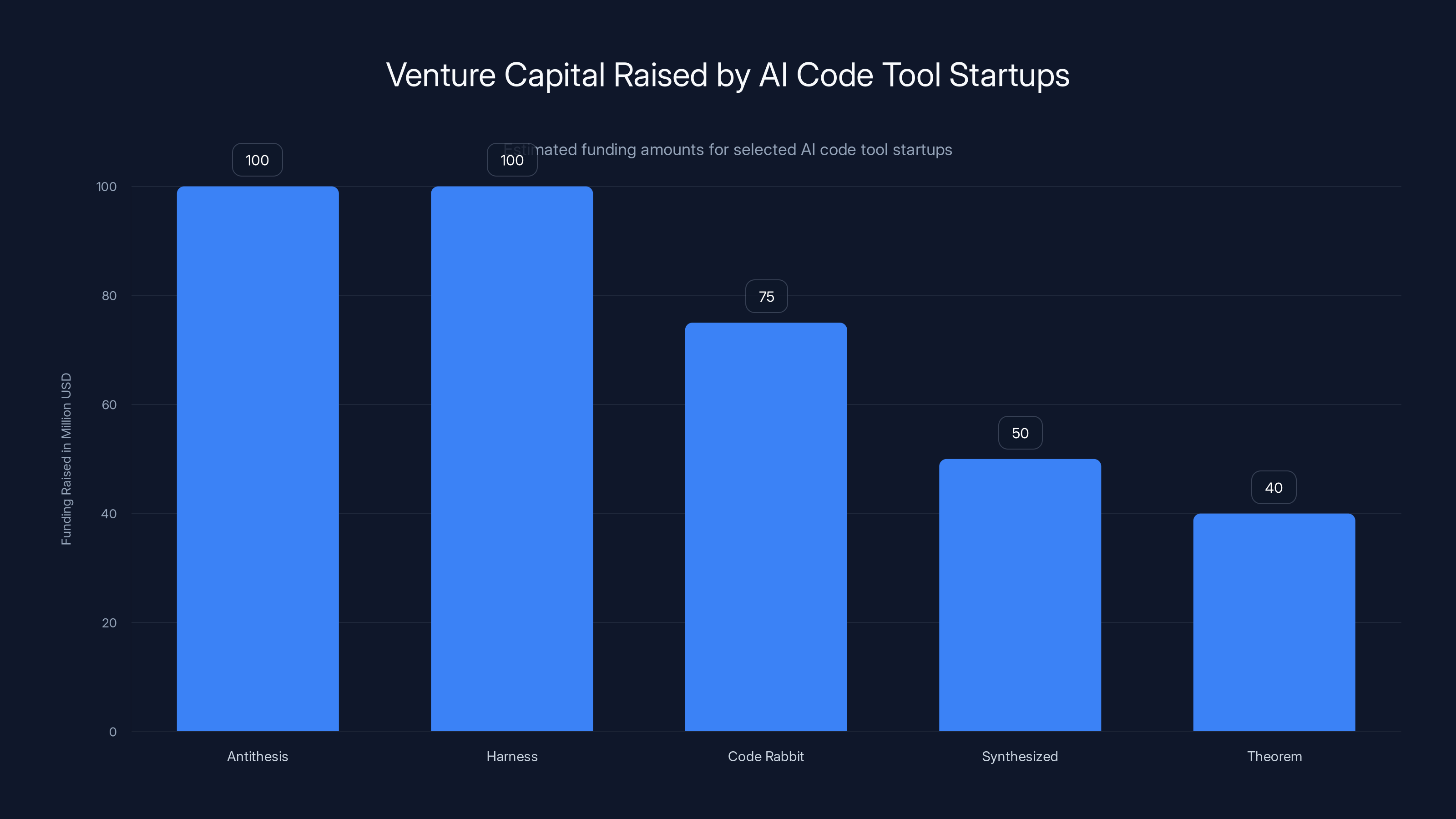

Code Metal isn't the only startup betting on AI-powered code transformation. Over the past two years, companies like Antithesis, Code Rabbit, Synthesized, Theorem, and Harness have all raised significant venture capital for different approaches to the same underlying problem: how do you ensure AI-generated code is safe, correct, and secure?

These startups function as what venture capitalists call the "picks and shovels" of the AI gold rush. During actual gold rushes, the people who got rich weren't always the miners—they were the people selling picks, shovels, and supplies to the miners. Similarly, these code-focused startups aren't trying to be the next Open AI. They're selling infrastructure and tools to the companies building AI applications.

The venture capital market has warmed substantially to this thesis. Antithesis, which focuses on automated testing for smart contracts and software systems, has raised over

What's interesting is that investors are willing to fund these companies despite the fact that many of the underlying methodologies remain unproven at scale. Companies like Code Metal make strong claims about correctness and reliability, but they're operating in specialized markets where direct verification takes time. A defense contractor can't just trust Code Metal's word that a translation is correct—they need to deploy it, test it, and validate it over months or years.

This gap between marketing claims and proven results creates obvious risk. Some of these startups will deliver massive value. Others will fade because their technology works in demos but struggles with real-world complexity. Investors are betting that enough will succeed to justify funding 10 or 20 at once.

Code Metal's track record suggests they might be among the successful ones. The company didn't just raise money from generalist venture firms. Salesforce Ventures led the Series B, which indicates that a major enterprise software company sees the opportunity. Salesforce doesn't typically lead rounds in companies that are clearly destined to fail—the risk to their reputation is too high.

Who's Investing in Code Metal (And Why That Matters)

The Series B funding round includes some notable names. Salesforce Ventures took the lead, with participation from Accel (who backed the Series A), B Capital, J2 Ventures, and others. This is a carefully curated investor list, not a random collection of opportunistic VCs.

Salesforce Ventures is the corporate venture arm of Salesforce, which operates at a different strategic level than traditional venture firms. They're not just looking for return on investment—they're looking for opportunities that could integrate with Salesforce's products or create strategic partnerships. The fact that they led Code Metal's round suggests they see the company as either a potential acquisition target or a long-term partner.

Accel's continued participation indicates that the Series A investors still believe in the thesis. Accel has a track record of backing infrastructure and platform companies—they're comfortable with companies that have long sales cycles and high implementation complexity.

B Capital, led by Yan-David Erlich, explicitly articulated why they believe in Code Metal. The investor recognized that defense infrastructure modernization is a structural market opportunity, not a cyclical trend. Even when the economy slows, governments still need to modernize their critical systems.

The investor lineup also tells you something about Code Metal's positioning. Traditional venture capital is usually concentrated in Silicon Valley, with secondary clusters in New York and Boston. This round included investors with specific expertise in defense, enterprise software, and specialized AI applications. It's the investor equivalent of asking, "Who would actually understand this company's market and technology?"

At a

This claim should be taken seriously. Profitability at scale indicates that the business model works, that customers see enough value to pay, and that the company has found repeatable processes. It's not a guarantee of success—plenty of profitable startups eventually fail—but it's a strong signal that the core value proposition resonates with customers.

Code Metal raised

Building the Team That Can Execute at This Scale

Code Metal's founding team is competent, but what's more impressive is the team they've brought in to execute on the Series B opportunity. This is where you see evidence that the company takes market execution seriously.

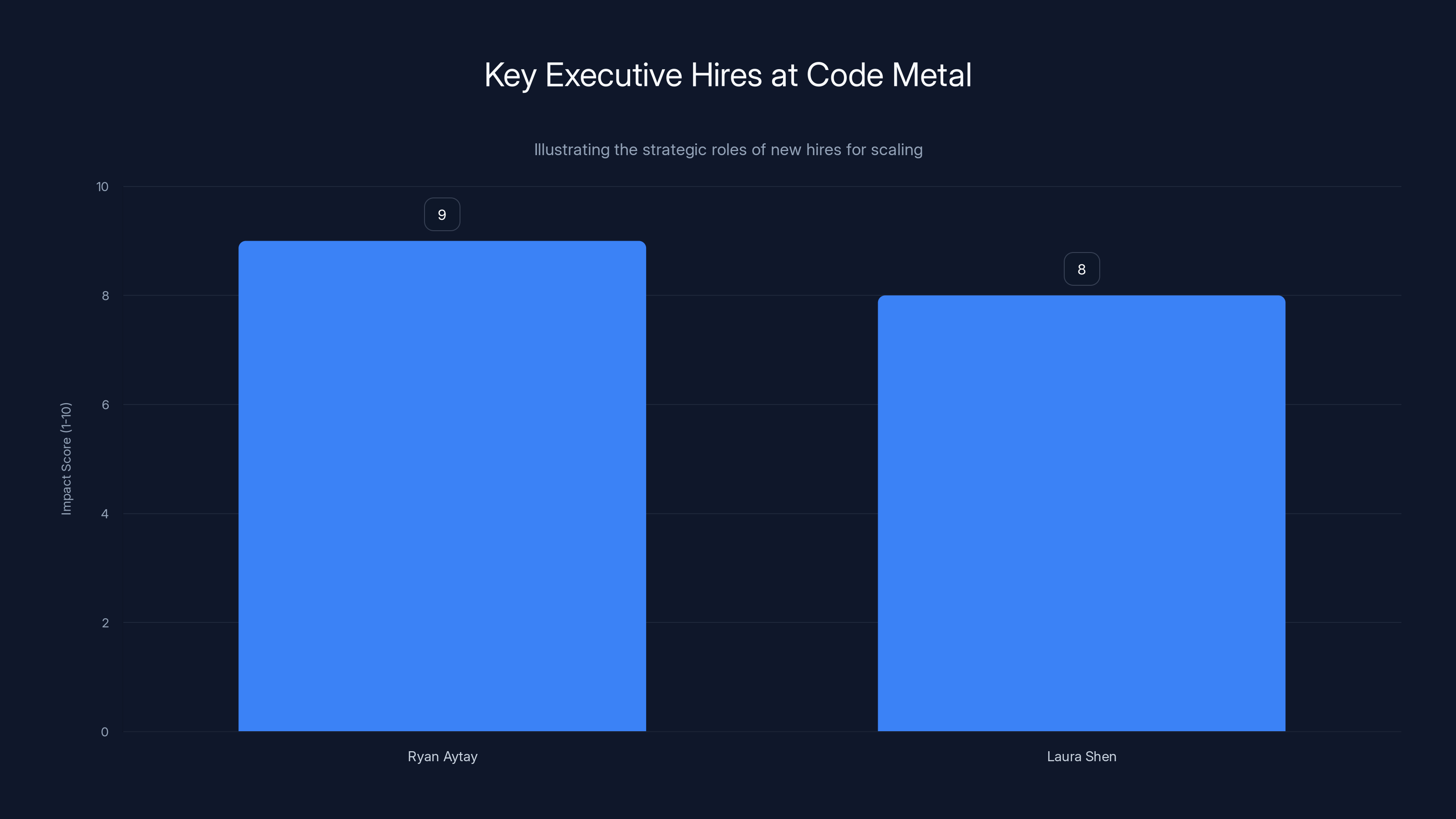

The startup hired Ryan Aytay as president and chief operating officer. Before joining Code Metal, Aytay was the chief executive of Tableau, which was acquired by Salesforce for $15.7 billion in 2019. Aytay knows how to scale enterprise software companies. He understands sales models, customer success, organizational structure, and how to manage hypergrowth. Bringing Aytay on signals that Code Metal is preparing for explosive scaling.

The company also brought in Laura Shen as executive vice president of growth. Shen previously served as director for China at the US National Security Council. This is a strategic hire that signals Code Metal is serious about government relationships and understanding the unique dynamics of selling to defense contractors and government agencies.

These hires tell you something important: Code Metal isn't just a technology company with a brilliant founding team. It's becoming an organization with deep expertise in enterprise sales, government relationships, and organizational scaling. The founding team can invent the technology. The new executives help the organization capture the market opportunity that the technology enables.

This is a pattern you see with the most successful enterprise startups. The founders typically come from technical backgrounds and drive innovation. As the company scales, they bring in executives with operational and commercial expertise. Both are necessary—you need the technology and the organization to capture the value the technology creates.

The Pricing Model Evolution: From Seats to Outcomes

Most enterprise software companies sell on a per-seat basis. You have 100 employees, so you buy 100 licenses. This model worked well for software companies in the 1990s and 2000s, but it's becoming increasingly outdated in the age of AI and automation.

Code Metal is experimenting with outcome-based pricing, which is fundamentally different. Instead of charging for seats or usage, the company negotiates custom pricing with each customer based on one of three factors: the time it takes to develop a kernel (the core translated component), the number of lines of code translated, or the total development time saved by using Code Metal's platform.

The elegance of this approach is that it aligns Code Metal's incentives with the customer's incentives. The customer wants to save time and money. Code Metal wants to be paid for the time and money the customer saves. If Code Metal's translation work saves a defense contractor three engineer-months of effort, that's worth millions to the contractor. Code Metal captures some percentage of that value.

Morales acknowledges that this model introduces complexity. Determining exactly how much time Code Metal's work saved can get "murky." There's legitimate room for disagreement. Did Code Metal save two weeks or two months? Different customers with different baselines might reach different conclusions.

But here's why this model is winning: every pilot deployment Code Metal has done has resulted in the customer moving to the next phase. This is a powerful signal. If customers are happy with the outcomes and willing to pay for them, the outcome-based pricing model works. If customers felt cheated or uncertain about value, they'd push back. They're not pushing back.

This pricing innovation matters because it signals maturity in how Code Metal thinks about its business. Many startups focus on generating revenue any way they can. Code Metal is structuring pricing to align incentives and demonstrate clear ROI. That's the behavior of a company that expects to survive for decades.

Ryan Aytay and Laura Shen are pivotal hires for Code Metal, with estimated impact scores of 9 and 8 respectively, indicating their critical roles in scaling and strategic growth. Estimated data.

Comparing Code Metal to Competing Approaches

Code Metal isn't the only company trying to solve the code modernization problem, but it's taking a distinctly different approach than most competitors.

Some companies focus on "lift and shift" approaches, where they take legacy systems and automatically move them to cloud infrastructure without fundamentally changing the code. This is faster but addresses a different problem than Code Metal. Lift and shift might take a system from on-premises servers to AWS, but it doesn't translate the underlying programming language.

Other companies focus on complete rewrite automation, where they analyze legacy code and use that analysis to guide engineers in rewriting systems from scratch. This approach is sometimes necessary when legacy code is so tangled that translation becomes infeasible. But it's also far more expensive and time-consuming than translation would be.

Code Metal's translation approach sits in between. It's more ambitious than lift and shift but more practical than complete rewrites. The company is betting that a significant portion of legacy code modernization happens through translation: taking code that works, converting it to modern languages and platforms, and maintaining the same functionality.

Where Code Metal differentiates is through verification. Most automated translation tools generate code quickly but leave validation to the customer. Code Metal embeds validation into the process itself. The company doesn't hand over translated code and say, "Hope this works." It hands over translated code and says, "We've verified this extensively—here's the testing we did."

This verification advantage becomes more valuable the more critical the system. For consumer software, a few bugs are annoying. For defense infrastructure, bugs can be catastrophic. Code Metal's obsession with correctness over speed makes sense in this context.

The Broader AI Software Development Trend

Code Metal's success reflects a broader trend in how companies are approaching AI and software development. The days of massive, monolithic rewrites are ending. The future involves incremental modernization, automated tooling, and verification at every step.

This shift is being driven by several factors. First, the cost of software development continues to rise. Labor is expensive. Manual code translation is phenomenally expensive. If AI can automate that work while human engineers focus on verification and validation, the economics improve dramatically.

Second, technical debt is becoming more obvious and urgent. Every major software company has legacy systems they wish they could modernize but can't afford to rewrite. The number of these systems keeps growing as software systems age and accumulate technical debt.

Third, security vulnerabilities are increasingly discovered in legacy code. Old programming languages don't have modern security features built in. Translating code to modern languages can be part of a security modernization strategy.

Code Metal is positioned at the intersection of these three forces. The company offers tools that reduce the cost of modernization, enable incremental migration rather than big-bang rewrites, and can be part of a broader security and capability upgrade.

If the company successfully executes on this vision, it could capture a massive market. Defense spending alone is hundreds of billions of dollars annually. The portion dedicated to software modernization is substantial and growing. Even if Code Metal captures a small fraction of this market, it's worth billions in revenue.

Antithesis and Harness lead the pack with $100 million each, indicating strong venture capital interest in AI code tools. Estimated data.

Challenges and Risks Ahead

For all the excitement around Code Metal's funding round, the company faces real challenges that could derail even this well-funded effort.

First, the company is in highly specialized, slow-moving markets. Defense contractors and government agencies move cautiously. A multi-year deployment timeline is normal. If Code Metal's technology works perfectly but takes years to fully deploy, the company's profitability could disappear under the weight of customer acquisition costs.

Second, there's significant regulatory and compliance complexity in defense markets. Code Metal isn't just selling software—it's selling software that will control critical defense infrastructure. This comes with extensive security reviews, compliance audits, and certification requirements. These processes are expensive and slow.

Third, competitive pressure is likely to increase. As the AI code generation market matures, other companies will focus on translation and verification. Some might be better funded. Some might have stronger relationships with defense contractors. Code Metal's first-mover advantage is real but not insurmountable.

Fourth, the core claim that AI-generated translations are correct at high rates remains unproven at massive scale. Code Metal can point to successful deployments, but these are still relatively recent and relatively limited in scope. What happens when the company tries to translate a particularly complex system with millions of lines of interdependent code? Real challenges might emerge.

Finally, there's the question of strategic partnerships and potential acquisition. Salesforce Ventures' involvement suggests that Salesforce might eventually acquire Code Metal as a strategic asset. If that happens, Code Metal's independent runway ends. The company becomes a product line within a larger enterprise. Some founders and investors view this as an ideal outcome. Others see it as the company never reaching its full potential.

The Market Opportunity: How Big Could This Get?

To understand Code Metal's potential, you need to understand the scope of the modernization opportunity.

The US Department of Defense maintains an estimated 2 billion lines of active legacy code. A significant portion of this code runs on outdated languages and platforms. Translating even a fraction of this code using Code Metal's approach could generate billions in value.

Defense contractors aren't the only market. Every major government agency has legacy systems. Financial institutions have modernized faster than most, but still maintain substantial legacy codebases. Telecommunications companies control infrastructure that depends on decades-old code. Manufacturing companies operate systems built in the 1990s and early 2000s.

If you estimate the total addressable market for code modernization services globally at

At a $1.25 billion valuation, Code Metal would need to grow revenue by 20-30x to justify that valuation. This is an aggressive but not impossible growth trajectory. Other enterprise software companies have achieved similar growth rates (Box, Slack, Datadog, Figma).

The path to that growth involves expanding beyond defense into other industries, building out product capabilities to handle increasingly complex translation scenarios, and establishing Code Metal as the de facto standard for code modernization.

What This Funding Round Means for the AI Industry

Code Metal's $125 million Series B isn't notable just because it's a large check. It's notable because it represents confidence in a specific thesis about how AI will be deployed in enterprise software development.

The thesis is this: AI's biggest impact won't be in replacing humans, but in automating specific, high-value tasks that are currently done manually by expensive experts. Code translation is one such task. There are dozens more: API documentation generation, security vulnerability analysis, test case generation, performance optimization.

Startups that win in this space will be those that combine AI's capability for automation with human expertise in validation and verification. Code Metal exemplifies this approach. The company doesn't claim to fully automate code modernization. It claims to automate 80-90% of the work, leaving humans to handle edge cases, validation, and integration.

This model differs from the visions of many AI enthusiasts who imagine AI fully replacing human workers. The reality of enterprise software is far messier. Companies care deeply about risk. They want their critical systems verified by experts. They're willing to use AI to make experts faster and more productive. They're not ready to trust AI alone with critical infrastructure.

Code Metal's funding success signals that venture capital is starting to understand this distinction. The companies that will generate the largest returns aren't necessarily the ones making the boldest claims about AI. They're the ones building boring, effective tools that solve real problems for paying customers.

The Future of Defense Tech Innovation

Code Metal's rise is part of a broader shift in how defense innovation happens. Twenty years ago, defense technology was dominated by large contractors like Lockheed Martin, Raytheon, and Boeing. These companies had deep government relationships and understood the procurement process.

Today, startups are increasingly winning defense contracts. The government has realized that it needs to move faster than traditional contractors allow. Startups like Palantir, Anduril, and Code Metal bring cutting-edge technology and agility that legacy defense contractors struggle to match.

Code Metal's customers—the US Air Force, RTX, L3 Harris—represent a willingness to try newer approaches to critical problems. The Air Force would not adopt Code Metal unless the technology genuinely addressed a pressing need. RTX and L3 Harris wouldn't deploy Code Metal unless it produced measurable ROI.

As more startups succeed in the defense space, you'll see increased startup competition, faster technology cycles, and greater innovation pressure on legacy contractors. This is largely positive for the government—it means better technology and faster deployment. It's challenging for legacy contractors, who need to either adopt startups' innovations or build competitive capabilities internally.

Code Metal benefits from this shift. The company is exactly the kind of startup the government wants to work with: focused on a specific, critical problem, moving fast, and bringing genuine innovation. As long as the company continues to deliver results, it should have a strong position as a government technology provider.

Lessons for Other Enterprise AI Startups

Code Metal's success offers valuable lessons for other AI startups targeting enterprise markets.

First, focus on verification and correctness, not just speed. Most AI startups optimize for volume and velocity. Code Metal optimizes for correctness. In enterprise markets, especially regulated industries, correctness is worth far more than speed.

Second, understand your customer's incentives deeply. Code Metal doesn't try to impose a single pricing model on all customers. It negotiates based on how the customer measures value. This flexibility is expensive operationally, but it generates customer goodwill and alignment.

Third, assemble teams with both technical depth and commercial experience. The founding team built the technology. The new executives bring sales, operations, and strategic expertise. Both are necessary.

Fourth, be patient with market development. Code Metal hasn't tried to serve every customer at once. It's focused on a specific market (defense) with specific customers (contractors with critical systems that need modernization). This narrow focus allows depth and builds credibility.

Fifth, demonstrate outcomes, not features. Code Metal talks about time saved and lines translated. It doesn't talk about lines of AI code written or transformer sizes. What customers care about is whether the solution solves their problem, not how the solution works internally.

Other enterprise AI startups that follow these lessons will likely enjoy similar success to Code Metal. Those that pursue the opposite strategy—moving fast, ignoring verification, one-size-fits-all pricing, broad market ambitions—will likely struggle.

The Unresolved Questions

Despite Code Metal's success, significant questions remain unanswered.

The most important: how does Code Metal's approach scale to truly massive codebases with millions of lines and complex interdependencies? The company has proven it works on substantial projects. Has it proven it works on the most difficult cases?

Second: what's the actual error rate in Code Metal's translations? The company claims "no way to generate an error," but this needs independent verification. Has the company submitted its methodology to external security researchers for validation?

Third: how does Code Metal maintain competitive advantage as other companies build similar tools? The company's current advantage seems to be first-mover status and deep customer relationships. As the market matures, can the company maintain this lead?

Fourth: what's Code Metal's path to eventual profitability at much larger scale? The company claims current profitability, but this might be at relatively low revenue levels. What happens as the company scales sales and marketing to hundreds of millions of dollars?

These questions don't invalidate Code Metal's progress. They're the natural questions any investor or observer should ask of any startup at this stage.

Conclusion: The Beginning of a Larger Trend

Code Metal's $125 million Series B funding round is significant, but not because of the dollars raised. It's significant because it validates a specific thesis about how AI will transform enterprise software development.

The thesis: AI won't replace software engineers. Instead, AI will automate the tedious, error-prone, expensive parts of the job, allowing engineers to focus on architecture, design, and validation. Code Metal has built a company around this idea in the specific context of code modernization. But the same principle applies to dozens of other enterprise software challenges.

If Code Metal successfully executes, it could become a multi-billion-dollar company. But more importantly, it will have proven that this model of human-AI collaboration works in critical systems. That proof will likely inspire dozens more startups building similar tools for other domains.

The defense industry benefits because it gets a tool that solves a critical problem. The venture capital market benefits because it validates a new category of enterprise AI startups. Customers benefit because they get tools that make their expensive experts more productive. And AI researchers benefit because they see their technology deployed in meaningful ways.

Code Metal's journey is just beginning. The company has product-market fit and customer validation. It has funding and experienced leadership. What it needs now is time to execute, expand into new markets, and prove that the approach works at truly massive scale.

If the company delivers on that promise, Code Metal won't just be a successful startup. It will be the template that defines how AI gets deployed in enterprise software for the next decade.

FAQ

What is Code Metal and what does it do?

Code Metal is a Boston-based startup that uses artificial intelligence to translate legacy code from older programming languages like COBOL, Fortran, and C++ into modern languages such as Rust, Python, and hardware-specific implementations like Nvidia's CUDA. The company focuses specifically on the defense industry, helping contractors and government agencies modernize critical systems without introducing bugs or vulnerabilities during the translation process.

How does Code Metal's code translation technology actually work?

Code Metal's approach differs from typical AI code generation tools by emphasizing verification at every step. As the software translates code from one language to another, it simultaneously generates test harnesses—virtual containers filled with data and tools—that validate the translated code produces the same outputs as the original. The system won't hand over translated code unless it has extensively verified the translation. If the system can't complete a translation confidently, it simply reports that no valid solution exists rather than generating potentially buggy code.

What makes Code Metal different from other AI code tools?

While most AI coding tools prioritize speed and volume of code generation, Code Metal prioritizes correctness and validation. The company embeds verification into the translation process itself rather than leaving validation to the customer. Code Metal also operates in highly specialized markets (defense contractors, government agencies) where verification is non-negotiable, whereas many competing tools target broader consumer and startup markets where speed matters more than perfection.

Why is code modernization such a critical problem for defense contractors?

Defense systems often run on code written decades ago in programming languages like COBOL and Fortran. Finding engineers who specialize in these outdated languages is nearly impossible. Modern alternatives exist, but simply rewriting millions of lines of code takes years and costs hundreds of millions of dollars. Code translation offers a middle path—maintaining the same functionality while converting to modern languages and platforms—potentially reducing timelines and costs dramatically.

How does Code Metal price its services?

Rather than using traditional per-seat licensing, Code Metal negotiates custom pricing with each customer based on measurable outcomes. The company typically charges based on one of three factors: the time it takes to develop a kernel (the core translated component), the total lines of code translated, or the development time saved by using Code Metal's platform. This aligns Code Metal's incentives with customers' incentives—both benefit when the translation is successful and saves time.

What does Code Metal's profitability claim mean for the startup ecosystem?

Code Metal claims to be profitable while valued at $1.25 billion, which is extraordinarily rare in the startup ecosystem. Most venture-backed unicorns are still in aggressive growth mode, burning cash to expand. Profitability at this valuation indicates that Code Metal's business model works, customers perceive clear value, and the company has found repeatable processes that generate more revenue than expenses. This signals maturity and sustainability unusual for startups at this stage.

Who are Code Metal's customers?

Code Metal works with the US Air Force, RTX (formerly Raytheon), L3 Harris, Toshiba, and several other government agencies and defense contractors. The company is in discussions with major chip manufacturers about code portability across hardware platforms. The focus on defense customers reflects both the criticality of verification in that market and the size of the modernization opportunity in government technology systems.

What is the broader market opportunity for code modernization?

The US Department of Defense alone maintains approximately 2 billion lines of legacy code across various systems. Beyond defense, financial institutions, telecommunications companies, manufacturing firms, and government agencies worldwide have substantial legacy codebases requiring modernization. Industry analysts estimate the total addressable market for code modernization services at

What are the main risks Code Metal faces?

Key challenges include the slow procurement timelines in defense markets, regulatory and compliance complexity in government systems, increasing competitive pressure as other startups build similar tools, the need to prove translation accuracy at massive scale, and questions about maintaining competitive advantage over time. Additionally, Salesforce Ventures' involvement suggests potential acquisition, which could limit the company's independent growth trajectory.

How does Code Metal's approach align with broader trends in enterprise AI?

Code Metal exemplifies a trend toward AI as an augmentation tool rather than a replacement tool. The company uses AI to automate 80-90% of code translation work, leaving human experts to handle validation, edge cases, and integration. This model differs from visions of AI fully replacing human workers and better reflects how enterprises actually deploy AI in critical systems where risk and correctness matter tremendously.

Related Resources for Enterprise AI Implementation

As enterprises explore AI-powered modernization strategies, several frameworks and methodologies provide additional context for decision-making. Teams implementing similar approaches should consider comprehensive testing protocols, establish clear verification standards before deployment, and align AI tooling with existing organizational processes rather than forcing organizational change around new tools.

The success of tools like Code Metal ultimately depends on the underlying principle that AI works best when it amplifies human expertise rather than replacing it entirely. Organizations evaluating AI investments should assess whether specific tools follow this augmentation model or make unrealistic claims about full automation. Code Metal's emphasis on verification before delivery, rather than verification after deployment, represents best practices for critical systems modernization.

Key Takeaways

- Code Metal raised 1.25B valuation while claiming profitability, signaling real business model validation beyond typical startup hype

- The company's verification-first approach differs from most AI code tools by embedding validation into translation rather than leaving it to customers

- Defense contractors face a critical modernization challenge: legacy systems running on outdated languages that almost no engineers know anymore need updating without introducing bugs

- Code Metal's outcome-based pricing aligns vendor incentives with customer incentives by charging based on time saved and lines translated rather than per-seat licensing

- The startup success demonstrates that AI's biggest enterprise impact is augmenting human expertise for high-value tasks rather than replacing human engineers entirely

Related Articles

- Palantir's $1 Billion DHS Deal: What It Means for Immigration Surveillance [2025]

- AI Governance & Data Privacy: Why Operational Discipline Matters [2025]

- Freeform's $67M AI-Powered Laser Manufacturing Revolution [2025]

- Enterprise Agentic AI's Last-Mile Data Problem: Golden Pipelines Explained [2025]

- OpenAI's 100MW India Data Center Deal: The Strategic Play for 1GW Dominance [2025]

- Alibaba's Qwen 3.5 397B-A17: How Smaller Models Beat Trillion-Parameter Giants [2025]

![Code Metal's $125M Bet on AI-Powered Defense Code Modernization [2025]](https://tryrunable.com/blog/code-metal-s-125m-bet-on-ai-powered-defense-code-modernizati/image-1-1771531806825.jpg)