Compliance Culture Reset 2026: From Gatekeepers to Growth Enablers

There's a moment in every organization's life where compliance stops being the department everyone fears and starts becoming the team everyone respects. For most companies, that moment hasn't arrived yet. But 2026 could be the year it does.

For decades, compliance has carried a reputation problem that's almost impossible to shake. You know the one. Compliance is the "Department of No." The team that kills innovation with red tape. The function that responds to every business proposal with a ten-slide deck explaining why it can't be done. When advisors pitch a new client communication tool, their hearts sink knowing what compliance will say. When product teams suggest launching in a new market, they're already mentally preparing for the compliance pushback.

Here's the thing: that reputation isn't entirely unfair. Compliance teams have been saying no—for legitimate, well-intentioned reasons—for a very long time. But the conditions that made that reactive, restrictive approach necessary are changing. Technology has matured. Regulatory expectations have evolved. And business leaders are starting to see compliance differently.

TL; DR

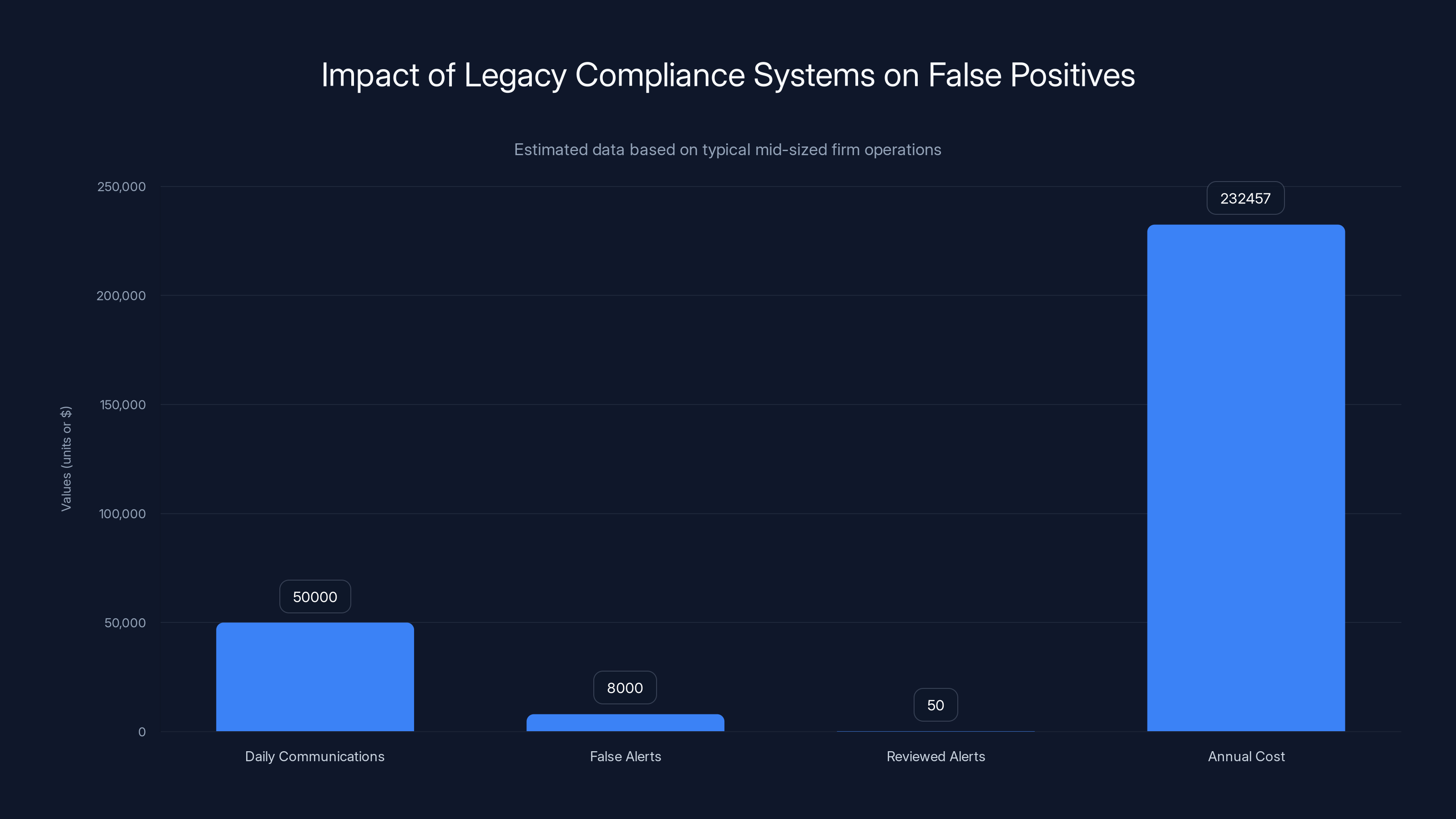

- Compliance teams waste $232K+ annually on false positives buried in legacy systems, forcing them into reactive rather than proactive risk management

- Modern explainable AI replaces opaque black-box systems, providing defensible decision-making frameworks that regulators actually accept

- Strategic enablement shifts the narrative from "you can't use that" to "here's how to use it compliantly," turning compliance into a competitive advantage

- Native channel capture eliminates false choices between innovation and oversight, letting organizations supervise all communication channels without blocking business tools

- Compliance leaders who embrace this shift will position their organizations as both secure and forward-thinking, attracting talent and business growth

Legacy compliance systems generate high false positive rates, with firms wasting an average of $232,457 annually on these inefficiencies. Estimated data highlights the need for modernization.

The Current State: Why Compliance Got Stuck in Reactive Mode

Let's start with why compliance earned its reputation in the first place. It wasn't incompetence or stubbornness. It was math.

Compliance teams operate under massive scale challenges. A mid-sized financial services firm might process 50,000+ client communications daily across email, messaging apps, phone calls, texts, and collaboration platforms. That's 50,000 potential risks that need monitoring. Multiply that across a year and you're looking at roughly 18 million communications requiring some form of oversight.

Now here's where it breaks: legacy compliance systems use basic keyword matching and crude pattern recognition. They're designed to catch obvious problems—explicit language, prohibited topics, clear violations. But they're terrible at nuance. A compliance system might flag 8,000 communications daily as potential violations. An actual compliance team gets maybe 50 of those flagged items reviewed per day. Do the math: it takes 160 days to review one day's worth of alerts.

Recent benchmark research across 200+ compliance leaders revealed firms waste an average of $232,457 annually chasing false positives across mobile communications alone. That's not a small cost—that's the salary of an additional compliance professional, or two, or three. Money that could go toward genuine risk management instead goes toward drowning in noise.

This creates a vicious cycle that's almost Kafkaesque in its inevitability. Your compliance team gets buried under false positives. They miss genuine risks until violations have already occurred. By the time problematic communications surface through all the noise, an advisor has already repeated the behavior across multiple client interactions. The pattern has metastasized. Then compliance shows up to the scene of the accident to document what went wrong.

The narrative solidifies: compliance is the team that shows up after the fact to tell you what you did wrong. Of course they're reactive. Of course they're saying no. They're too overwhelmed with yesterday's false alarms to help with today's business decisions.

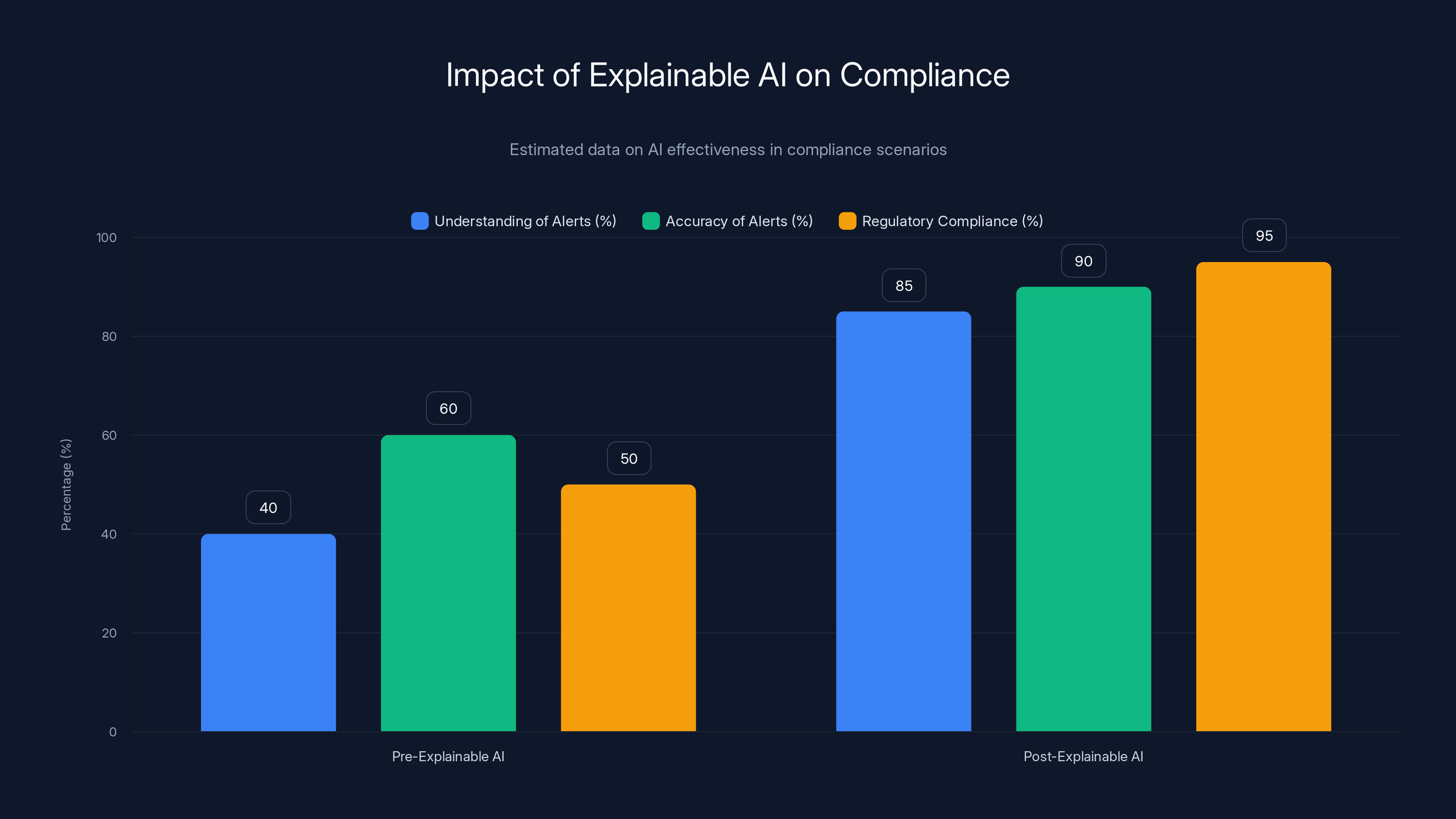

Explainable AI significantly improves understanding, accuracy, and regulatory compliance in AI systems, transforming compliance processes. Estimated data.

The Regulatory Environment Is Changing

Regulators aren't satisfied with this anymore. And that's actually the breakthrough moment.

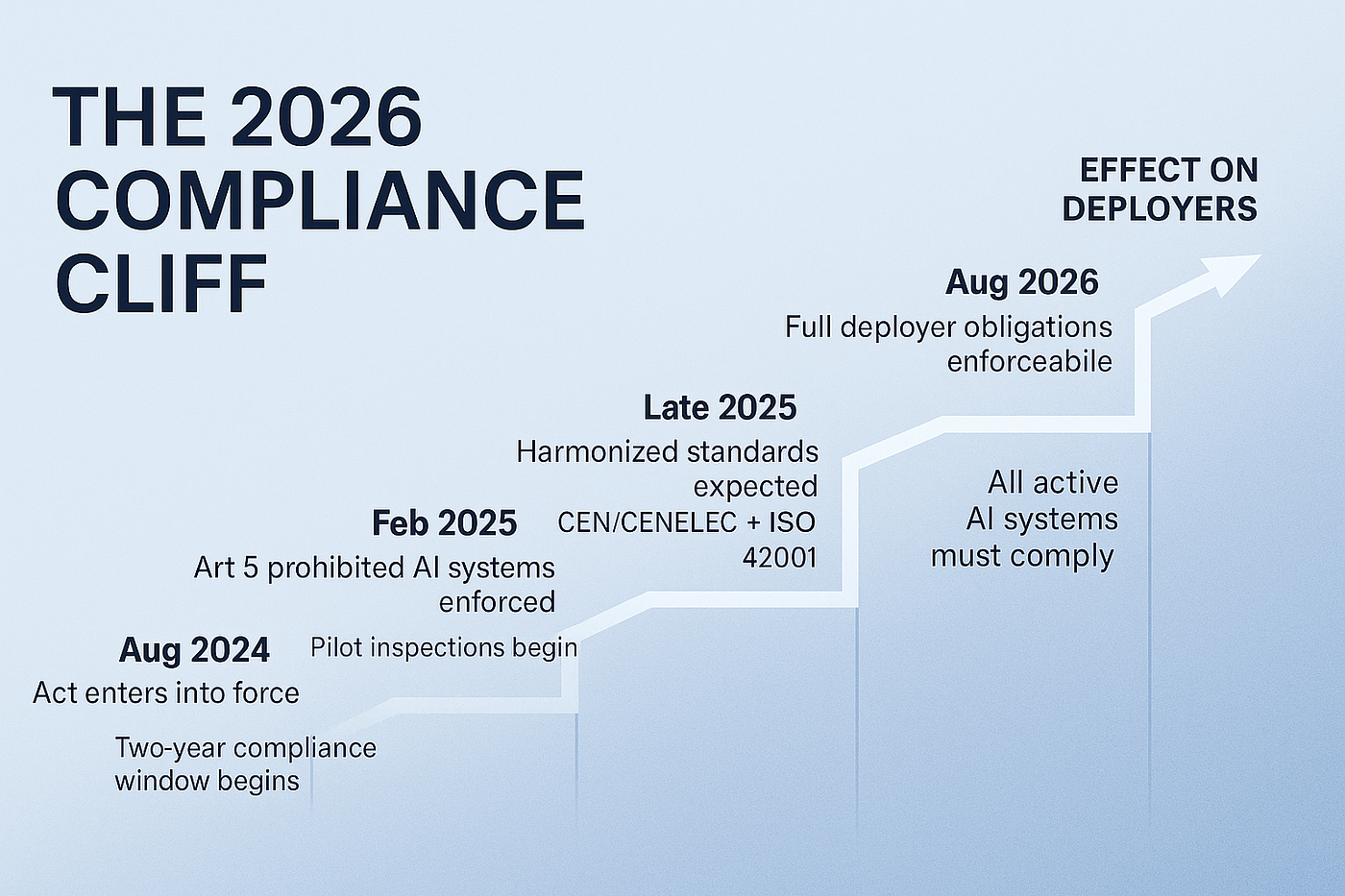

For years, regulators cared about documentation. Did you run your compliance checks? Check. Did you document the results? Check. Can you show us the logs? Check. Compliance was largely performative—a box-checking exercise where the goal was to have defensible documentation that you'd made an effort.

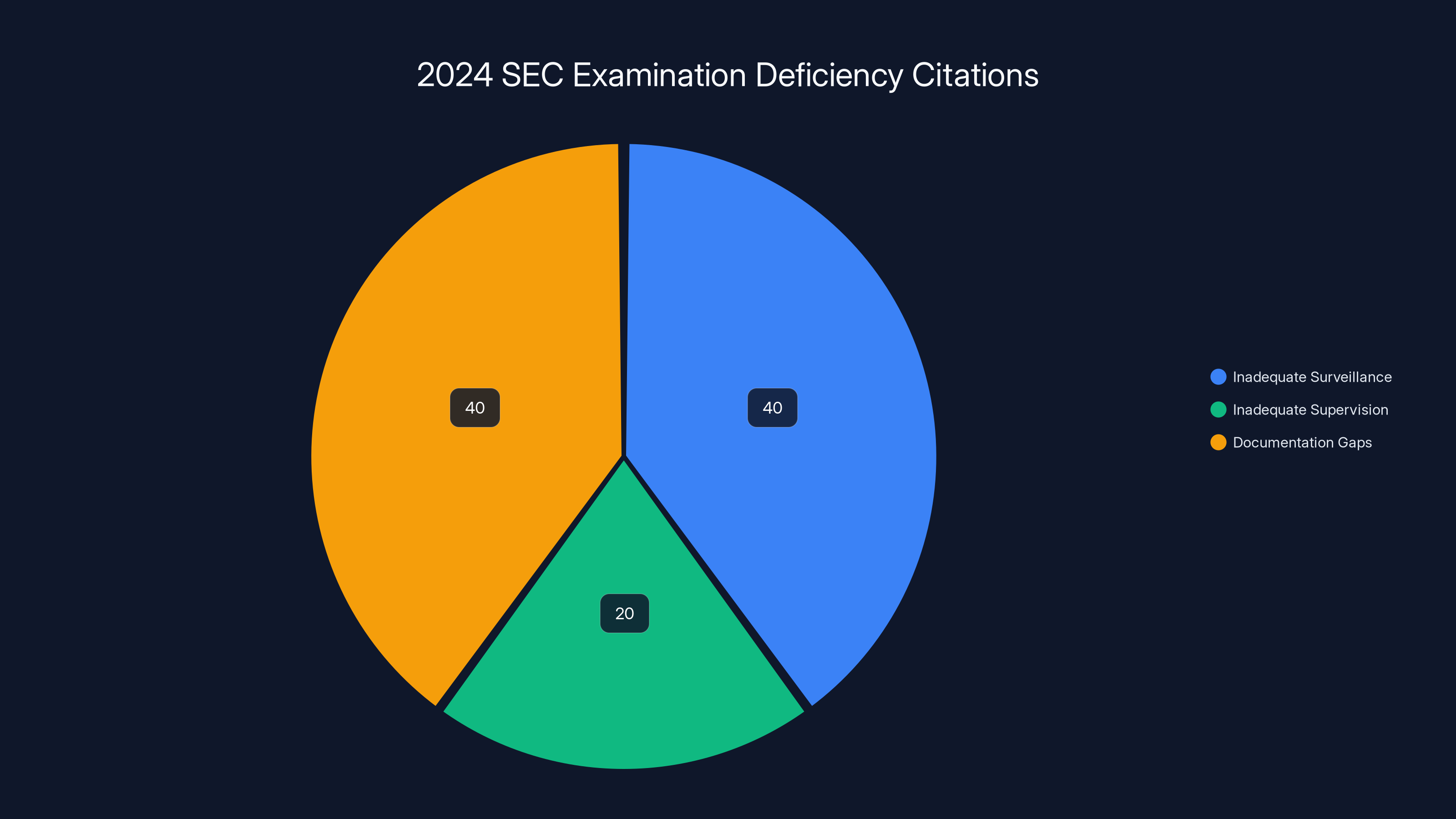

That standard is dying. Recent FINRA and SEC examination priorities make abundantly clear what regulators actually want: evidence of effective supervision programs that genuinely identify and address risks, not just documentation proving you ran the alerts. They want to see that your compliance program actually works.

When an examiner asks how your surveillance program reached a conclusion about a violation, "the AI flagged it" isn't an acceptable answer anymore. Neither is "the system was configured to catch keywords X, Y, and Z." Regulators want to understand the reasoning. They want explainability. They want confidence that your controls actually prevent harm rather than just creating a paper trail.

This shift seems subtle, but it's revolutionary. It means checking boxes without demonstrating genuine risk management sophistication won't pass inspection anymore. Firms that spend millions documenting their compliance processes but don't actually catch real problems will eventually face consequences. The ones that take genuine risk seriously—that distinguish signal from noise—will get rewarded.

For compliance leaders, this is the permission structure they needed. You can stop defending your "no" with documentation of false positives. Instead, you can build systems that actually work.

The Technology Breakthrough: Explainable AI Changes Everything

For years, AI in compliance meant black boxes. A machine learning model would ingest thousands of data points and spit out a risk score, but nobody could explain why. Was it the language used? The people involved? The topic? The context? The system couldn't articulate it. You just had to trust the algorithm.

Trust is great when the algorithm is right. When it's wrong—flagging a legitimate conversation as suspicious or missing actual violations—you've got a problem. You can't defend a decision you don't understand. And regulators won't accept "the AI said so" as a basis for supervision.

Explainable AI changes this fundamentally. Modern systems now articulate precisely why something triggered review. Maybe the system flagged a message because it contains language that appears in known trading violations, combined with timing that correlates with unusual market activity, combined with communication patterns that deviate from baseline behavior. That's a defensible decision-making framework. That's something you can explain to an examiner. That's something the compliance team can explain to the business.

This matters more than it might initially seem. When compliance can point to specific, articulated reasons why something needs review, the conversation with the business changes. Instead of "this is flagged, we don't know why," you can say "this triggered because of X, Y, and Z, which aligns with regulatory expectations." Instead of compliance appearing arbitrary and opaque, it appears thoughtful and grounded.

There's another dimension too: explainability helps compliance teams themselves understand what their systems are actually catching. You'd be surprised how many compliance professionals don't fully understand what their own surveillance system is doing. It's configured by a vendor, it runs in the background, and it produces alerts. If the alerts are mostly noise, nobody really digs in to understand why. With explainability, you get visibility into your own program. You can identify blind spots. You can tune configurations to actually work better.

The regulatory environment increasingly rewards this sophistication. Examiners distinguish between firms that merely check boxes—running surveillance, documenting results—and those demonstrating genuine risk management sophistication. The firms that say "here's what we found, here's why we found it, here's what we did about it" advance the conversation much further than firms that say "here's a report of 10,000 alerts we reviewed."

Compliance teams face a massive challenge with 8,000 daily alerts, of which only 50 are reviewed, leaving a significant portion as false positives. Estimated data.

Strategic Enablement: The New Compliance Operating Model

Let's talk about what strategic enablement actually looks like in practice. Because it's not compliance doing nothing. It's not opening the floodgates and hoping for the best. It's a fundamentally different operating philosophy.

Traditional compliance operates on restriction. A new communication tool becomes available—Microsoft Teams, Slack, iMessage, whatever—and compliance's default response is no. Why? Because the legacy archiving system can't capture it natively. Or it can, but only partially. Or it flattens the conversation in ways that lose context. So the answer is: you can't use it. Stick with email, which we can archive perfectly.

This creates genuine problems. Microsoft Teams conversations contain context that email strips away. There are reactions, threaded discussions, embedded files. When compliance forces everything into email, you're losing signal. You're making the business less efficient. You're frustrating advisors who want to communicate naturally.

Worse, it's not even that effective. An advisor who's forbidden from using Teams might text a client instead. Or call them without leaving a record. Or use a personal device on personal accounts. You haven't eliminated the communication. You've just eliminated your visibility into it. Compliance has actually increased risk by forcing communication underground.

Strategic enablement inverts this approach. Instead of starting with "no," you start with "how." How can we supervise this channel properly? What's the minimum viable control set? What trade-offs are acceptable?

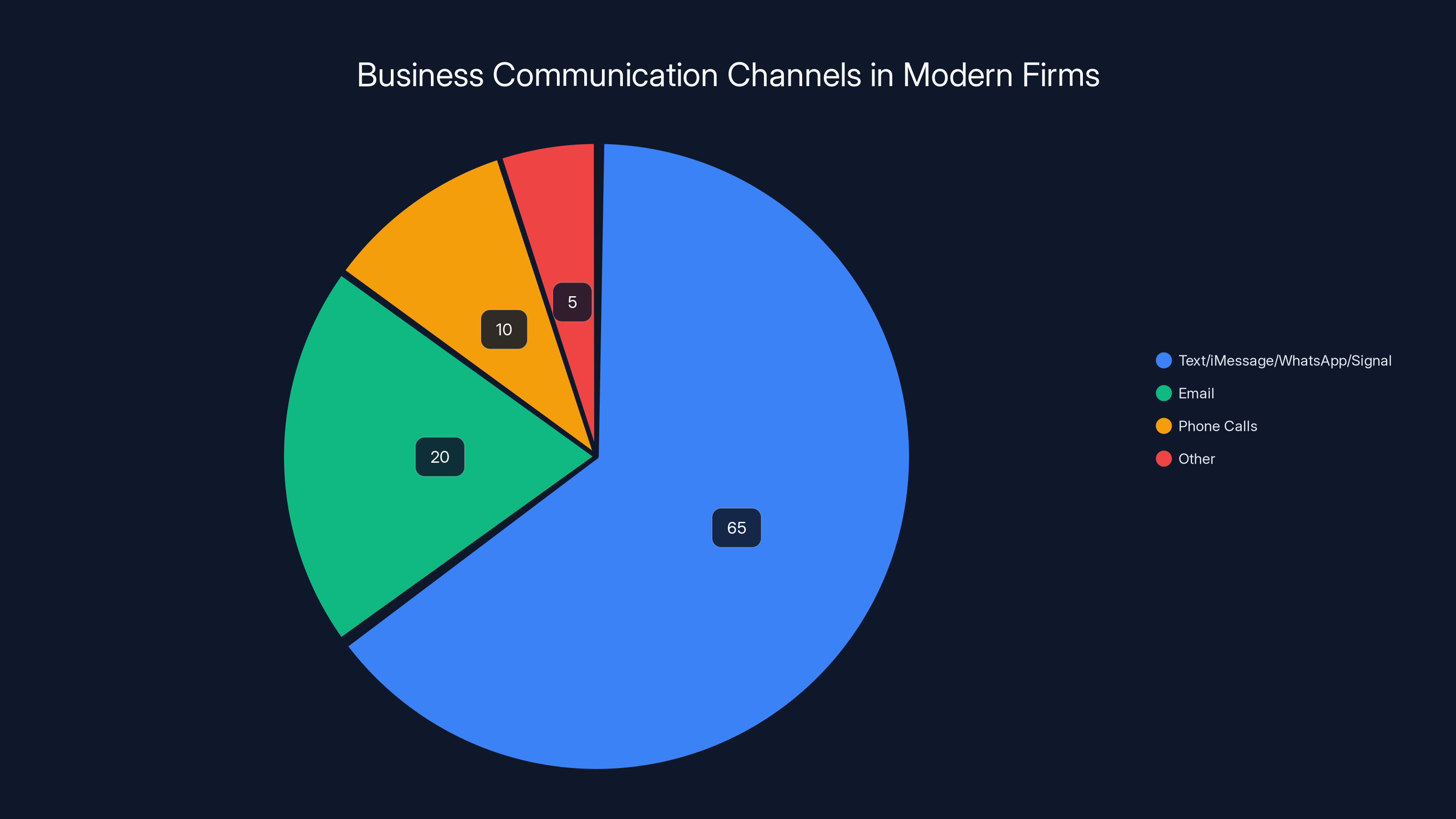

Sometimes the answer is genuinely "we can't supervise this yet." Mobile communications are a real challenge in many cases. If your compliance infrastructure can't capture text messages or iMessages, that's a real limitation. But increasingly, modern platforms can.

When you can actually supervise every channel properly, something magical happens. The conversation shifts from "you can't use that tool" to "here's how to use it compliantly." An advisor gets a text from a client about a major deal at 8pm. They're not stuck choosing between three bad options: ignore the client, reply on a different channel they know is unarchived, or create an unarchived gap in their communication record. Instead, they can reply confidently knowing the conversation is being captured.

For firms positioning themselves as modern and tech-savvy, telling clients "we're not allowed to text" is genuinely embarrassing. And it's not because you're being cautious. It's because your compliance technology hasn't kept pace with how people actually communicate.

Strategic enablement also means compliance can move at business speed instead of lumbering behind. When legacy systems need modifications, you call a vendor. Vendor tickets take weeks. Change management takes months. By the time you've added support for a new channel, the business has already moved on to the next one.

Modern cloud-based compliance platforms let compliance teams configure new channels themselves. You want to add monitoring for a new Slack workspace? Done in minutes. You want to adjust supervision parameters for a specific team? No vendor ticket required. This means compliance can operate at the pace the business demands.

There's a trust dimension too. When compliance is responsive, when they enable business objectives while managing risk, advisors start viewing them as partners rather than obstacles. That's not just cultural. That's operationally valuable. Partners share information. Partners ask for guidance before problems happen. Obstacles get worked around.

The Privacy-Compliance Balance: Supervision Without Surveillance

Here's where compliance leaders need to be thoughtful about something legitimate: not everything needs to be supervised.

Modern compliance technology can distinguish between business and personal communications. An employee texting their spouse about dinner plans doesn't need compliance oversight. An employee receiving a message from their doctor doesn't require archival. These aren't risks. They're just human life happening during business hours.

Legacy compliance systems are blunt instruments. They capture everything or nothing. A text-enabled compliance system either archives all texts or no texts. Cloud-based platforms can be more nuanced. They can distinguish based on patterns, relationships, and context. Communications with known clients get archived. Random personal texts don't.

This matters for employee trust. When people know their personal messages are being captured, it erodes morale. It creates a sense of surveillance that goes beyond legitimate oversight. But when compliance only focuses on business communications—when employees know personal stuff stays private—the culture changes. You're not under surveillance. You're under reasonable, proportionate oversight that focuses on genuine risks.

This also matters legally in some jurisdictions. GDPR, for instance, places strict requirements on employer surveillance. You can monitor work communications. Monitoring personal communications during work hours? That gets trickier. You need legitimate business reasons. You need proportionality tests. Blanket capture might fail the reasonableness standard.

Strategic compliance systems respect these boundaries. They establish clear rules about what gets captured and why. They minimize personal data collection. They build employee trust rather than eroding it.

There's a business case here too. Companies that position themselves as respecting employee privacy while maintaining robust compliance win in talent markets. Tech workers especially care about this. They don't want to work somewhere they're under constant surveillance. But they're comfortable working somewhere they're under proportionate oversight that doesn't intrude on personal life.

When compliance gets this balance right, it becomes a feature of company culture rather than a source of resentment.

In 2024, over 60% of SEC deficiency citations were related to inadequate surveillance and supervision controls, highlighting a shift from documentation to effective risk management.

Mobile Communications: The Last Frontier

Mobile communications remain the biggest headache for compliance teams, and there's good reason.

Probably 60-70% of business communications in modern firms happen over text, iMessage, WhatsApp, Signal, or similar channels. Clients have your advisor's cell phone number. They text. It's faster than email. It's more immediate. Clients expect responses.

But archiving text messages is complicated. The infrastructure is different. The authentication is different. People treat text communications differently—they're more casual, often less formal, sometimes more candid. Compliance systems designed for email don't translate neatly to SMS.

Add in privacy considerations and it gets messier. Employees understandably bristle at the idea that their personal phone is being monitored. But the business communications on that personal phone need oversight.

Legacy approaches handle this poorly. Either you ban personal phones—which nobody follows—or you accept visibility gaps—which creates risk. Some firms try workarounds, like requiring advisors to use company phones. But then clients have to learn two numbers, advisors maintain two devices, and the policy breaks the first time an advisor gets a 2am emergency message.

Modern compliance platforms handle this better. They can create managed channels on personal devices. They can sandbox capture to business communications only. They can distinguish based on established business relationships rather than requiring blanket device monitoring.

The compliance industry is still catching up on mobile, but it's catching up. By 2026, firms that properly supervise mobile communications will have a significant advantage. They'll catch risks earlier. They'll have more complete records. They'll demonstrate to regulators that they take oversight seriously.

Firms still relying on email-centric systems will face increasing regulatory pressure. Examiners will ask: where are your text messages? Where's your iMessage archive? If the answer is "we don't have one," that's a red flag.

Generative AI Integration: The Next Layer

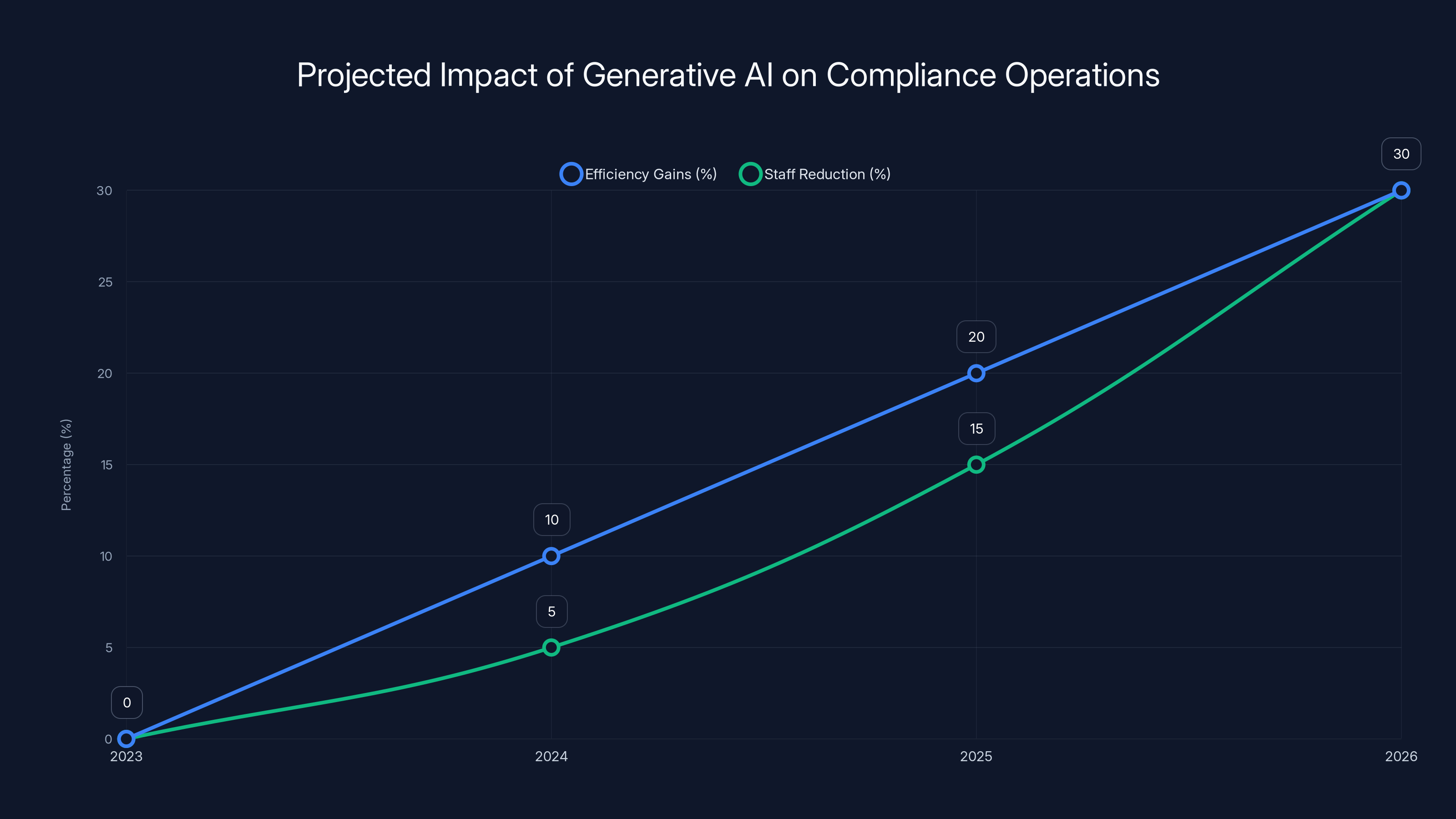

We're entering a phase where compliance will integrate generative AI not just for alert generation, but for resolution support.

Imagine this: Your compliance system flags a communication. Instead of a human analyst spending 15 minutes reading the message, researching context, and writing a summary, a generative AI system does the initial analysis. It identifies the relevant context. It highlights the risky elements. It suggests whether this is likely a genuine violation or a false positive. It even recommends next steps.

The analyst then focuses on the high-value work: making judgment calls on ambiguous situations, assessing intent, evaluating context that purely algorithmic systems miss.

This doesn't eliminate human oversight. It enhances it. Analysts spend less time on mechanical work and more time on actual risk assessment.

There are legitimate concerns here—hallucinations, bias, over-automation. But the potential efficiency gains are substantial. A compliance operation that processes 10,000 alerts daily could theoretically handle that workload with 30% fewer staff if those staff focus on high-value decisions rather than mechanical review.

More importantly, generative AI can surface patterns that purely keyword-based systems miss. Machine learning can identify when an advisor's communication style changes in ways that suggest problematic behavior. It can flag relationship development patterns that suggest conflicts of interest. It can identify when certain topics consistently appear together in ways that suggest coordination.

This is getting into predictive compliance. Not just catching violations after they happen, but identifying early warning signals that something might be developing.

By 2026, forward-thinking compliance organizations will be experimenting with these capabilities. The early adopters will discover operational efficiencies and risk insights that give them competitive advantages.

Estimated data shows that 60-70% of business communications occur via text or similar channels, highlighting the need for improved compliance systems.

The Cultural Shift: From Cost Center to Strategic Function

Here's what actually changes when compliance shifts from reactive gatekeeper to strategic enabler: how business leaders view the function.

Today, most executives see compliance as a cost center. Like legal. Like HR benefits administration. Like facilities. It's necessary, but it costs money and slows things down. You minimize it if you can.

Strategic compliance is different. It becomes a source of competitive advantage. A firm that can move faster because compliance enables risk-managed innovation outcompetes firms that move slowly because compliance blocks everything.

Consider a scenario: Two financial advisory firms both identify an opportunity to develop a new service line that involves real-time client communication. Firm A's compliance team says "we can't supervise that channel, so you can't offer it." The service line never launches.

Firm B's compliance team says "that's an interesting idea. We can supervise it using these channels with these controls. Here's what we need to implement." Six months later, Firm B is offering a service Firm A still can't. Firm B wins clients. Firm B grows faster.

This isn't theoretical. This is playing out in markets right now. Firms with modern compliance infrastructure are winning talent and client battles against firms still running on legacy systems.

Business leaders recognize this. The executives at forward-thinking firms are asking their compliance leaders: "How do we enable more, faster, with better risk management?" Those compliance leaders are getting budget, getting support, getting a seat at strategic tables.

Compliance leaders who are still primarily focused on blocking things are being sidelined. Not because they're failing, but because the business model has shifted away from that function.

This creates a virtuous cycle. Compliance gets resources, tools, talent. The team becomes more strategic. The organization moves faster. Growth accelerates. Compliance becomes obviously valuable.

Firms that haven't made this shift yet will face increasing pressure to do so. Talent will gravitate toward organizations where compliance is strategic rather than restrictive. Business will move toward vendors and partners who enable rather than block.

Building Your Compliance 2026 Roadmap

If you're a compliance leader reading this and thinking "okay, but where do I actually start?", here's a practical roadmap.

First, audit your current state. Document what channels you're actually supervising. List what gaps exist. Calculate the cost of your false positive problem. Get specific about how much analyst time goes toward noise. That number is usually shocking enough to justify action.

Second, talk to your business stakeholders. Ask them what they want to do that they're currently blocked from doing. Ask them what tools they wish they could use. Ask them where compliance feels like friction. You'll usually find there's a lot more demand for capability than you realized.

Third, evaluate your compliance technology strategically. Not just functionally—can it do what we need today—but architecturally. Can it evolve? Can you add channels without vendor involvement? Can you integrate new tools easily? Is it cloud-based or legacy on-premise infrastructure? The architecture matters more than the feature list.

Fourth, prioritize ruthlessly. You're probably not going to overhaul everything at once. Start with your biggest pain point. Is it mobile? Fix mobile. Is it false positives? Implement better AI. Is it slow processes? Move to cloud-based configuration. Pick one area, solve it, measure the improvement, then move to the next.

Fifth, communicate progress visibly. When you solve the mobile problem, tell the organization about it. When you reduce false positives by 40%, share the metrics. When you enable a new channel, highlight the business value. Compliance leaders tend to be invisible when things go right and very visible when things go wrong. Reverse that.

Sixth, build the case for continued investment. Compliance modernization isn't free. But the ROI is usually clear: fewer false positives means lower analyst costs. Faster process times mean more business can move forward. Better risk insight means fewer violations and better exam results. Quantify these returns and use them to justify ongoing investment.

By 2026, generative AI is projected to increase compliance efficiency by 30% and reduce staff needs by a similar percentage, allowing teams to focus on high-value tasks. Estimated data.

The Examiner Perspective: What Regulators Actually Care About

Let's talk about what's happening in examination rooms, because compliance leaders live or die based on this.

Regulators have gotten much more sophisticated. They're not just looking at documentation anymore. They're testing systems. They're asking examiners to run their own surveillance and see if it catches the same things the firm's system caught. They're looking at false positive rates. They're examining whether the firm is actually managing risk or just creating paper trails.

When an examiner asks your compliance team "show me an example of how your system identified an actual problem and what you did about it," the answer matters. If your answer is "well, we ran the system and these are the outputs," that's weak. If your answer is "our system identified elevated activity in this account based on these factors, we escalated it to senior compliance, they interviewed the advisor, and found this problematic behavior that we addressed through this remediation," that's strong.

Examiners are also more skeptical of black boxes. If your system is proprietary and you can't explain how it works, they're going to doubt whether it actually works. Modern compliance leaders are pushing back on this. They want systems they can understand, explain, and defend.

There's also a shift toward predictive oversight. Examiners care less about whether you caught something after it happened and more about whether you would have caught it if you'd been paying attention. Do you have early warning systems? Do you monitor for warning signs? Do you take proactive steps to prevent problems?

Firms that demonstrate genuine proactive compliance—not just reactive box-checking—do better in exams. They get fewer citations. They reduce follow-up risk. They establish reputations as compliance-serious organizations that examiners trust.

Organizational Change Management: Making the Shift Real

Here's where theory meets reality: changing how compliance operates requires managing significant organizational dynamics.

For years, advisors have learned to work around compliance. They know compliance is slow, compliance is restrictive, compliance is the enemy. That belief is now embedded in your culture. You can't change it with a memo. You change it by demonstrating different behavior consistently over time.

When compliance enables something quickly, that's notable. When compliance responds to business needs in hours instead of weeks, that's memorable. When compliance helps someone do something they want to do instead of blocking them, that shifts perception.

Build this in deliberately. When you implement a new capability, involve the business in the implementation. Let them help design the controls. Let them see that compliance isn't building restrictions from spite—they're building frameworks that work for both risk management and business efficiency.

Involve senior business leaders in the narrative shift. Have them talk about compliance as an enabler. Have them explain how compliance modernization helps the business move faster. Have them make it clear that they want compliance involved in strategic decisions, not relegated to reaction mode.

Train your compliance team on this shift too. If your analysts have spent years saying no, you need to help them understand the new posture. You need to give them tools and frameworks for thinking about risk management differently. You need to help them understand that enabling with controls is harder than simply blocking.

Measure cultural change explicitly. Survey the business on how they perceive compliance before and after. Track how many new initiatives come through compliance for pre-project discussion versus how many bypass it or come through as problems later. These metrics matter for understanding whether the cultural shift is actually happening.

Technology Investment Priorities for 2026

If you're making compliance technology investments in the next year, here's what's worth prioritizing.

First, explainability. Any AI or machine learning system needs to articulate why it's flagging something. If it can't explain its decision, it's not ready for compliance use. This applies to vendor systems you're evaluating and to custom models your team might be building.

Second, multi-channel native capture. Email-only compliance is over. You need platforms that natively capture Teams, Slack, email, SMS, and other key channels. Native capture is key—APIs are better than workarounds.

Third, configurability and speed. You need systems you can modify without vendor involvement. Cloud-based systems that let you adjust rules, add channels, and run custom reports in minutes rather than weeks.

Fourth, integration with business systems. Compliance data is more valuable when it connects to your CRM, your client onboarding systems, your trading systems. You want to know not just what communications happened, but the context—what trade was being discussed, what client was involved, what was the business rationale.

Fifth, analytics and insights. Beyond just flagging problems, you want systems that help you understand patterns. Which advisors have the highest flag rates? Which clients generate the most compliance questions? What communication patterns correlate with problems?

Sixth, employee privacy by design. Systems that minimize personal data collection, that let you exclude personal communications, that build employee trust rather than eroding it.

Investments in these areas will likely yield ROI faster than investments in traditional compliance infrastructure.

Common Mistakes Compliance Leaders Make During This Transition

I've seen compliance modernization efforts fail. Here's what usually goes wrong.

Mistake One: Moving too fast without carrying the organization. You implement a new platform, open up new channels, and suddenly advisors are confused about what's allowed. Invest heavily in change management and communication. Make the transition visible and gradual.

Mistake Two: Assuming technology solves the culture problem. You can't buy your way to strategic compliance with better software. You still need governance, you still need training, you still need processes. Technology enables the shift. It doesn't create it.

Mistake Three: Optimizing for false positives at the cost of missing real violations. You can reduce alerts to almost nothing by making your system less sensitive. That's not strategic. You need to optimize for finding actual risks while minimizing noise. The balance matters.

Mistake Four: Forgetting that compliance is partly about precedent. Some communications don't trigger modern algorithms because they're subtle. You still need people reviewing communications occasionally to maintain knowledge of what risky behavior looks like. Automate the obvious stuff, but maintain human judgment on ambiguous cases.

Mistake Five: Not building the business case for continued investment. Modernization is expensive. You need to prove it's working. Document the improvements. Show the ROI. Use it to justify ongoing investment rather than treating it as a one-time project.

Mistake Six: Centralizing all decisions in compliance. Strategic compliance means the business participates in designing controls. Talk to business stakeholders about risk tolerance. Involve them in decisions about channel enablement. You're not building rules from on high. You're building frameworks collaboratively.

The Competitive Advantage: Why This Matters Now

Let's zoom out for a second and talk about why this shift is happening now and why it matters for competitive positioning.

For a long time, compliance was a symmetric capability. All firms needed it. Most firms were equally bad at it. It was table stakes—you needed to have it, but it didn't differentiate you.

That's changing. Firms with modern, strategic compliance infrastructure are starting to differentiate. They can onboard advisors faster because compliance works faster. They can launch new business lines because compliance can supervise them. They can attract talent that values good governance without surveillance. They can trust their compliance programs more than their competitors trust theirs.

Meanwhile, firms with legacy compliance infrastructure are getting left behind. They're slower. They're missing business opportunities. They're struggling with examiners who want to see more sophisticated risk management than documentation.

By 2026, this gap will widen. The firms that have invested in compliance modernization will be operating with better risk insight, faster processes, and more strategic contributions. The firms that haven't will be defending increasingly dated infrastructure and struggling to explain to examiners why their compliance programs aren't more sophisticated.

This matters especially for competitive talent acquisition. Smart compliance professionals want to work somewhere they can be strategic. They want modern tools. They want to work on problems that matter, not just run old processes. Organizations that haven't modernized will struggle to attract and retain good compliance talent. Organizations that have will be attracting the best.

What The Shift Actually Requires

Let's be clear about something: this isn't about being soft on compliance. It's not about reducing standards or loosening oversight. If anything, strategic compliance is more rigorous than reactive compliance.

Reactive compliance catches things after they happen. Strategic compliance tries to prevent them. That requires better thinking, more sophisticated systems, and more rigorous governance.

The shift requires compliance leaders to be both thoughtful and bold. Thoughtful about understanding risks deeply, about designing controls that actually work, about building frameworks that prevent problems rather than document them. Bold about pushing back on legacy constraints, about imagining what's possible with modern infrastructure, about positioning compliance as strategic.

It requires business leaders to view compliance differently. Not as an obstacle to be minimized, but as a partner in managing risk while enabling growth. It requires them to actually listen to compliance perspectives in strategic decisions. It requires them to provide resources and support for compliance modernization.

It requires technological progress, which is thankfully happening. AI has matured enough to provide explainability. Cloud infrastructure is reliable enough to handle sensitive compliance data. Integration capabilities are sophisticated enough to connect compliance to business systems.

When all three pieces come together—thoughtful compliance leadership, supportive business leadership, and modern technology—magic happens. Compliance becomes strategic. The organization moves faster with better risk management. The culture shifts from "compliance blocks us" to "compliance enables us."

That's the 2026 opportunity.

The Path Forward: Your Compliance 2026 Strategy

Okay, so you're convinced. You want to move your organization from reactive gatekeeper compliance to strategic enablement. What's the actual path?

Year One: Foundation. Audit your current state. Evaluate your technology. Identify your biggest pain point. Start small. Solve one problem. Implement one new capability. Measure the results. Build confidence internally that change is possible and valuable.

Year Two: Expansion. With momentum from the first year, expand to other pain points. Add channels. Improve analytics. Invest in training and change management. Build the case for continued investment based on demonstrated results.

Year Three: Strategic Integration. By year three, compliance should be operating truly strategically. You should be sitting at business planning tables. You should be involved in decisions about new service lines, market expansion, and client acquisition. You should be advising on risks proactively, not just reacting to problems.

That's the timeline. It's not overnight. But it's achievable if you start now.

Looking at 2026 and Beyond

2026 won't be the end of this transition. But it could be the year the momentum becomes irreversible.

The technology is ready. Modern compliance platforms can do things that were impossible five years ago. They can explain decisions. They can distinguish signal from noise. They can move at business speed. They can integrate with the systems the business actually uses.

The regulatory environment is ready. Examiners are clearly moving away from documentation-based compliance toward demonstration-based compliance. They're clearly favoring firms that show genuine risk management sophistication over firms that show thorough documentation.

The business case is ready. Firms are realizing that compliance speed matters. Growth matters. Talent matters. Culture matters. The firms that figure out how to maintain rigorous compliance while enabling rapid business growth will win.

What's not guaranteed is that every compliance leader will make the shift. Some will stay stuck in reactive mode. Some will over-automate and lose the human judgment that actually prevents problems. Some will move too fast and lose control. Some will move too slow and miss the window.

The ones who get it right—who balance modern technology with thoughtful governance, who enable the business while maintaining rigor, who shift the culture from restriction to enablement—those are the ones who'll be leading strategic compliance organizations in 2026.

The "Department of No" reputation isn't inevitable. It's a choice. Compliance leaders can choose differently. Business leaders can choose differently. Organizations can choose differently.

2026 is the year that choice becomes really obvious. The question isn't whether compliance should be strategic. The question is whether your organization will be one that actually makes the shift or one that lags behind.

The opportunity is there. The technology is there. The regulatory permission is there. What's left is execution. For compliance leaders ready to lead that execution, 2026 is going to be a good year.

FAQ

What does it mean for compliance to shift from gatekeeper to growth enabler?

The shift means moving compliance from a purely defensive, risk-blocking function to one that actively enables business growth while managing risk. Instead of responding with "no" to new business initiatives, strategic compliance asks "how can we enable this safely?" This requires modernized technology, different processes, and cultural change across the organization. Growth enablement doesn't mean less rigor—it means more sophisticated risk management that prevents problems rather than just documenting them after they occur.

Why are legacy compliance systems creating such high false positive rates?

Legacy systems rely on keyword matching and crude pattern recognition that can't distinguish between genuine violations and innocent business communications. A mid-sized firm processing 50,000+ communications daily might generate 8,000 false alerts, but compliance teams can only review 50 per day. This 160-day lag means real violations get missed while analysts drown in noise. Benchmark research shows firms waste an average of $232,457 annually chasing these false positives, which is why modernization delivers measurable ROI.

How does explainable AI improve compliance decision-making?

Explainable AI systems articulate precisely why something triggered review, such as "this message contains language from known violations plus unusual timing plus behavioral deviation." This defensible decision-making helps compliance teams explain their conclusions to regulators, who increasingly reject black-box decisions. It also helps compliance leaders understand what their own systems are actually catching and tune configurations for better performance. Regulators specifically reward this sophistication in examinations.

What's the relationship between compliance modernization and employee privacy?

Modern compliance systems can distinguish between business and personal communications using pattern analysis, relationship mapping, and contextual understanding. This allows firms to supervise business communications rigorously while respecting personal privacy—an employee's text to their spouse doesn't get captured. This builds employee trust and supports compliance with GDPR and similar regulations that require proportionate, justified monitoring. Strategic compliance respects privacy boundaries while maintaining effective oversight.

How should compliance leaders prioritize their technology investments for 2026?

Investment priorities should focus on: (1) explainability in any AI system, (2) multi-channel native capture beyond email, (3) cloud-based configurability that doesn't require vendor involvement, (4) integration with business systems for contextual analysis, (5) analytics that surface patterns rather than just flag problems, and (6) privacy-by-design architecture. These investments typically deliver ROI faster than traditional compliance infrastructure and support the shift toward strategic compliance.

What does the regulatory environment actually expect from compliance programs now?

Regulators have moved beyond documentation-based compliance toward demonstration-based compliance. They want evidence that your program actually identifies and prevents risks, not just that you ran it and documented results. FINRA and SEC examiners test systems, verify actual problems were caught, and assess whether firms demonstrate genuine risk management sophistication. Firms that can articulate how their controls prevent violations outperform those that simply show alert documentation.

How long does it typically take to transition from reactive to strategic compliance?

Most organizations complete meaningful transition in 2-3 years when committed. Year one focuses on foundation—auditing current state, solving one pain point, building internal confidence. Year two expands to additional capabilities and improvements. Year three integrates compliance strategically into business decisions. Rushed transitions risk losing control. Overly slow transitions miss competitive advantage windows. The key is consistent progress with measured milestones.

Can compliance modernization actually reduce compliance costs while improving effectiveness?

Yes, though not uniformly. Eliminating false positives through better AI reduces analyst time on noise. Faster processes mean the same team handles more volume efficiently. Integration with business systems surfaces patterns earlier, preventing costly violations. However, initial modernization investment is real. The ROI typically becomes apparent within 12-18 months as efficiency gains and risk improvement offset implementation costs. Leadership needs to understand the investment timeline and build the business case accordingly.

What's the relationship between compliance culture and regulatory exam results?

Regulators increasingly distinguish between firms that demonstrate genuine compliance commitment and those going through motions. Firms with strategic, engaged compliance functions show better exam results than firms with siloed, defensive compliance. Examiners also assess whether compliance recommendations are actually implemented or just documented. Organizations where compliance is viewed strategically, where compliance leaders have business credibility, and where risk management is integrated into business decisions pass exams more confidently.

How does mobile communication supervision fit into strategic compliance?

Mobile communications (text, iMessage, WhatsApp) now represent 60-70% of business communication in many firms, but archiving has traditionally been difficult. Modern compliance platforms can capture mobile communications natively on both company and personal devices while respecting privacy boundaries. This eliminates the false choice between oversight and restriction. Strategic compliance doesn't ban mobile—it supervises it properly, enabling advisors to communicate naturally while maintaining required oversight.

The compliance culture reset is happening. Organizations that embrace this shift in 2026 will position themselves for competitive advantage, better regulatory relationships, and sustainable growth. The question isn't whether compliance should evolve—it's whether your organization will lead that evolution or lag behind it.

Key Takeaways

- Compliance teams waste an average of $232K annually on false positives from legacy systems, making modernization a financial imperative

- Regulators have shifted from documentation-based to demonstration-based compliance, rewarding firms that show genuine risk management sophistication

- Explainable AI systems provide defensible decision-making frameworks that compliance leaders can actually explain to regulators and business stakeholders

- Strategic compliance enables rapid business growth by supervising channels natively rather than blocking them, shifting conversations from 'you can't' to 'here's how'

- Organizations that position compliance as strategic rather than restrictive will win competitive advantages in talent acquisition, client relationships, and regulatory relationships by 2026

Related Articles

- Complyance Raises $20M Series A: How AI Is Reshaping Enterprise Compliance [2025]

- Grok's Deepfake Crisis: EU Data Privacy Probe Explained [2025]

- EU Parliament Bans AI on Government Devices: Security Concerns [2025]

- Discord's Age Verification Disaster: How a Privacy Policy Sparked Mass Exodus [2025]

- Discord Age Verification 2025: Complete Guide to New Requirements [2025]

- India's New Deepfake Rules: What Platforms Must Know [2026]

![Compliance Culture Reset 2026: From Gatekeepers to Growth Enablers [2025]](https://tryrunable.com/blog/compliance-culture-reset-2026-from-gatekeepers-to-growth-ena/image-1-1771342875808.jpg)