CVector's Industrial AI Nervous System: How $5M Funding Powers Factory Intelligence

Imagine a factory floor where every valve, every machine, every energy decision is tracked in real time by an AI that understands not just operations, but economics. That's the vision driving CVector, a New York-based startup that just closed a $5 million seed round to build what founders Richard Zhang and Tyler Ruggles call an "industrial nervous system."

Last year, if you'd walked into a manufacturing plant and mentioned AI, you'd have gotten a 50/50 reaction: excitement or skepticism. Today? Every plant manager is asking for AI-native solutions. CVector entered this market at exactly the right moment, but the real challenge isn't solving technical problems anymore. It's proving that small optimizations—turning a valve here, adjusting efficiency there—actually translate to measurable savings.

This article dives deep into CVector's approach, why industrial AI matters, how the startup is winning customers from Iowa to San Francisco, and what this $5M round means for the future of manufacturing intelligence. Whether you're running a plant, investing in industrial tech, or curious about how AI is quietly reshaping legacy industries, this story shows you exactly how it's happening.

What CVector Actually Does (And Why It Matters)

CVector isn't building robots. It's not replacing factory workers. What it's building is harder to describe because it sits in a space most people don't think about: the economics layer between plant operations and actual profitability.

Here's the core problem: A factory might run perfectly from an operational standpoint. Machines hum. Production targets get met. But is the plant making the maximum amount of money? Usually not. The issue is visibility. A plant manager can see if Machine A is running, but can they see if Machine A running right now—at this electricity price, with these commodity rates, given current demand—is the most profitable decision?

CVector's software sits between operations and economics. It watches everything: equipment performance, energy consumption, material costs, market prices. Then it tells you, in real terms, what each decision costs or saves. That nondescript valve Zhang mentioned? The one that seems like it shouldn't matter? Turning it at the right time might save

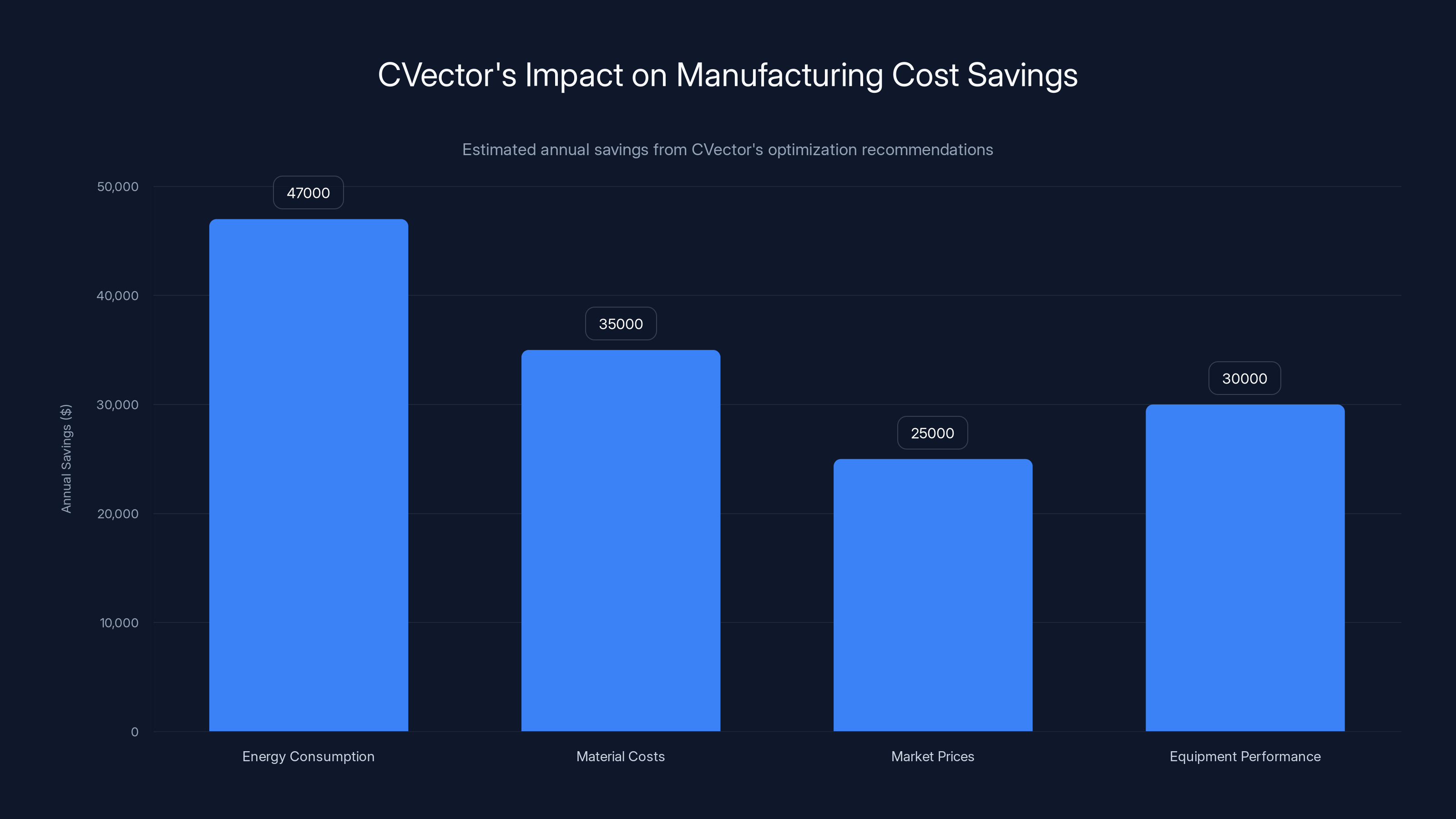

The startup's system learns from historical data, equipment telemetry, and external data sources like energy prices and material markets. Over time, it starts making recommendations. Not just "optimize this," but "optimizing this will save you $47,000 annually." That's the pitch that's resonating.

CVector's technology can potentially save manufacturing plants significant costs annually through optimized energy consumption, material costs, market price adjustments, and improved equipment performance. Estimated data.

The Market Opportunity: Legacy Industry's AI Awakening

Industrial manufacturing is massive, fragmented, and deeply traditional. The U.S. alone has over 290,000 manufacturing facilities. Most of them run on legacy systems, older equipment, and paper-based processes. They're also extremely profitable—the sector generates trillions in annual revenue—but they operate with enormous inefficiencies baked in.

For decades, these plants couldn't afford to modernize. A single minute of downtime costs tens of thousands of dollars. Ripping out systems and installing new ones? Unthinkable. But AI changes the equation. You don't need new equipment. You just need a software layer that makes existing equipment smarter.

The timing is perfect. Energy prices are volatile. Supply chains are fragile. Labor is expensive and hard to find. Companies are desperate for anything that shaves costs without major capital investment. CVector's approach—software-only, works with existing infrastructure, shows ROI in months—hits exactly what industrial customers need.

Then there's the secondary market: new energy companies and advanced manufacturing startups. These aren't replacing old plants. They're building new ones from scratch, and they want to optimize from day one. Ammobia, the materials science startup working to lower ammonia production costs, gets it immediately. For new operations, the ROI math is even clearer.

Inside CVector's First Customers: Iowa and San Francisco

CVector's customer roster tells an interesting story. The startup is winning in two very different markets simultaneously, which suggests the technology has broader applicability than narrow verticals.

ATEK Metal Technologies, based in Iowa, makes aluminum castings for Harley-Davidson and other manufacturers. It's a company with serious technical expertise—the engineers there know what they're doing—but like most mid-sized manufacturers, they operate with limited real-time economic visibility. CVector's software helps ATEK spot potential equipment failures before they happen, monitor the entire plant's energy efficiency, and track how commodity prices impact material costs.

For a company like ATEK, this is transformative. Equipment downtime is catastrophic. If a furnace fails mid-production, you're looking at thousands of dollars in losses per hour. A system that predicts failures even a few hours early is valuable. But the energy and commodity tracking is equally important. Material costs fluctuate constantly. If ATEK can time when it buys aluminum based on market data plus production forecasts, it saves money on every purchase.

Ammobia represents the opposite end of the spectrum. This startup is brand new, working on materials science innovation to reduce ammonia production costs. The materials science is novel, but the operational economics are the same as ATEK's. Ammobia needs to understand how each decision affects profitability. CVector's approach works for both because it's economics-agnostic. It doesn't care if you're running a 50-year-old casting plant or a brand new chemical facility. It measures what matters: money.

This breadth of customer success is huge. It proves CVector isn't solving a narrow problem. It's solving a universal manufacturing problem: "Are we making as much money as we could?"

CVector's software can significantly enhance profitability by optimizing various operational areas, potentially saving up to $50,000 annually. (Estimated data)

The Team and Hiring Strategy: Attracting Fintech Talent

CVector's growth is modest but strategic. The company is up to 12 people, with the first physical office in Manhattan's financial district. That location choice is telling. Zhang and Ruggles are deliberately recruiting from finance and fintech—people who already understand how to use data for competitive advantage.

This is smart hiring. A hedge fund analyst understands analyzing vast datasets to find an edge. A fintech engineer knows how to build systems that track money in real time. These skill sets transfer directly to industrial optimization. The team members aren't starting from zero on how to think about economics. They're already fluent in the language of ROI and arbitrage.

The strategy also signals confidence. CVector isn't struggling to find engineers willing to work on industrial problems. The startup is intentionally recruiting people with specific expertise and backgrounds, which means they're being selective. That's a sign of momentum.

Zhang has been upfront about the team composition. He's not hiring people who want to "modernize manufacturing" in an abstract sense. He's hiring people who understand how to translate operations into economics, and who get excited about that challenge.

The Funding Round: Who's Backing CVector

The $5 million seed round was led by Powerhouse Ventures, a firm focused on climate and energy infrastructure. That's the lead investor, but what's interesting is the breadth of the syndicate. The round includes Fusion Fund and Myriad Venture Partners, early-stage firms with track records in deep tech. And it includes Hitachi's corporate venture arm.

Hitachi's involvement is significant. Hitachi is a massive industrial conglomerate with deep manufacturing expertise and relationships. A corporate investor at this stage usually means two things: one, they see genuine commercial potential, and two, they're already thinking about how this technology could integrate with their existing business.

Powerhouse Ventures leading is also notable. Climate and energy are real focus areas for this firm, and industrial optimization directly impacts both. A more efficient plant uses less energy. A plant that can dynamically adjust based on energy prices and carbon intensity becomes part of the climate solution. That's not environmental BS marketing. That's a real value proposition that investors care about.

The round size—

How Industrial AI Is Different From Consumer AI

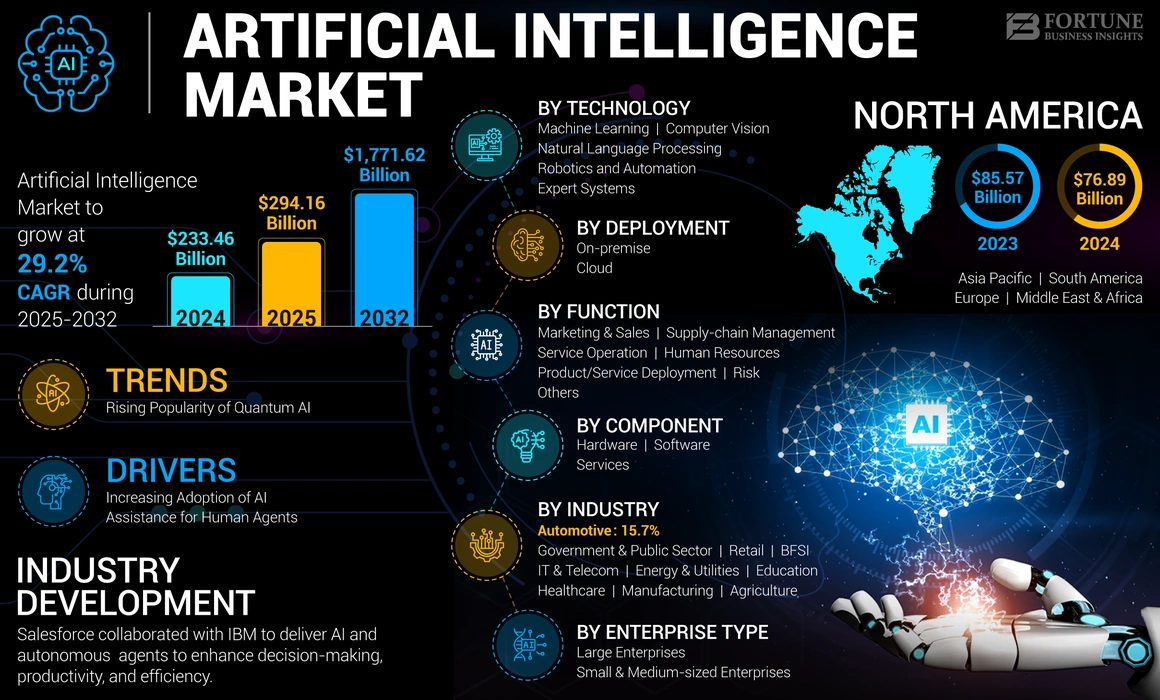

When people think about AI startups, they usually think about Chat GPT-style consumer applications or enterprise software like Salesforce's AI features. Industrial AI is a completely different animal, and it's actually where some of the most valuable AI applications will emerge.

First, industrial AI deals with specialized domain knowledge. A factory isn't a generic business problem. It's a complex system with equipment from different eras, custom processes, and domain expertise that took years to develop. The AI can't just copy Chat GPT's architecture. It has to learn factory-specific patterns.

Second, the stakes are higher and the feedback loops are faster. In consumer AI, getting something slightly wrong is annoying. In industrial AI, a bad recommendation could cost thousands of dollars or cause safety issues. That means the accuracy bar is much higher, and the testing process is much more rigorous.

Third, integration is complex. Consumer AI usually just runs in isolation—you chat with it, it responds. Industrial AI has to integrate with existing equipment, historians, ERP systems, and operational data. That requires deep technical work that doesn't make good marketing material but is absolutely essential.

Fourth, the adoption curve is slower but steeper. Getting a factory to adopt new software takes time because of the operational risk. But once they adopt it and see results, they become deeply embedded customers. There's not much customer churn in industrial software. Once a plant is running with CVector, it's going to keep using it.

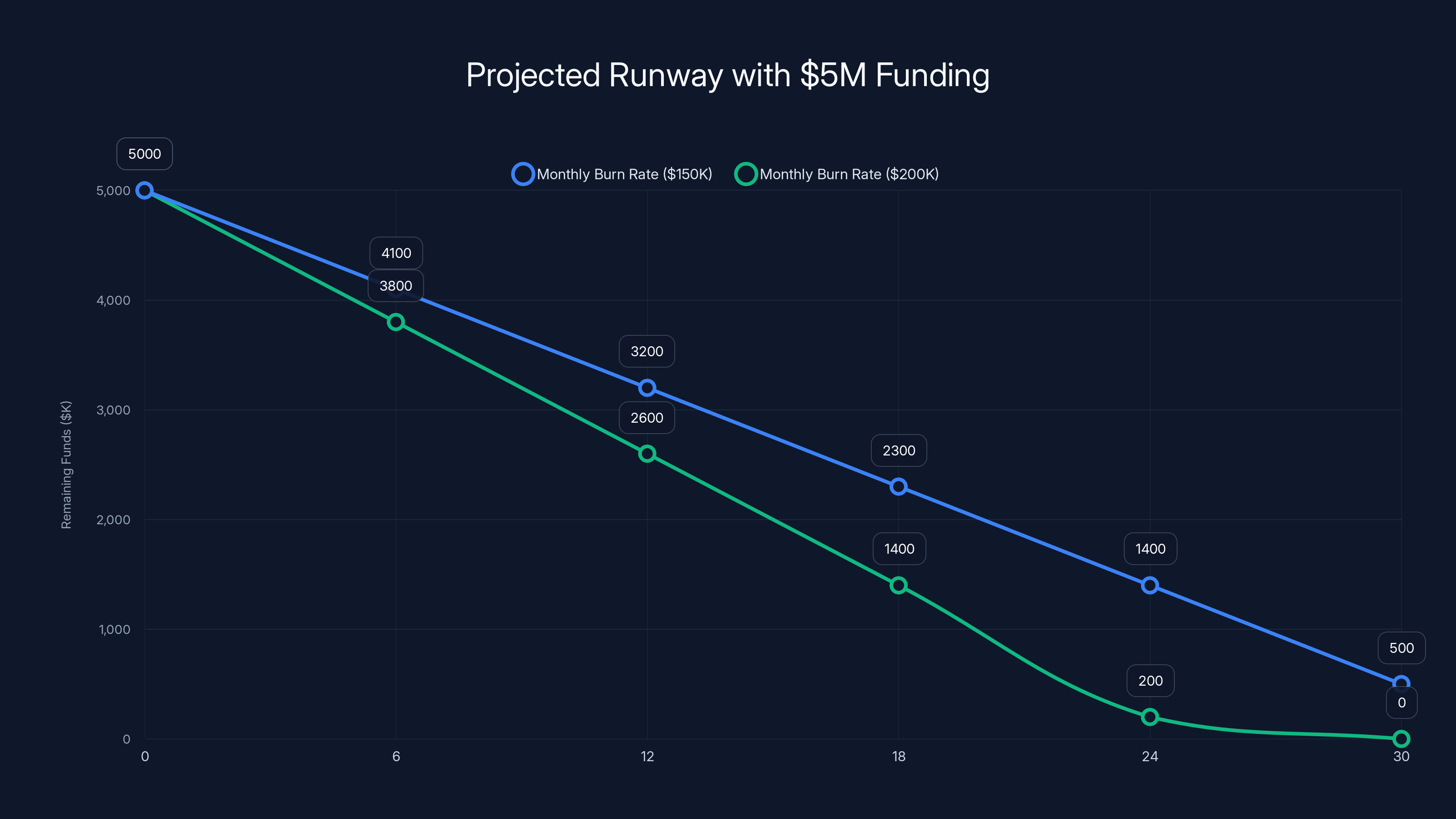

With a $5M funding, CVector can sustain operations for approximately 25-30 months depending on their monthly burn rate. Estimated data.

The ROI Pitch: From Vague to Specific

CVector's competitive advantage isn't just the technology. It's the ability to articulate ROI in concrete terms. That sounds simple, but it's actually the hardest part of selling to industrial customers.

Most enterprise software pitches are fuzzy: "Improve efficiency by 15%" or "Streamline operations." These phrases don't mean anything to a plant manager. CVector does the opposite. Instead of saying "improve efficiency," it says, "This optimization will reduce compressed air consumption by 8%, saving $47,000 annually based on your current energy rates and production profile."

The specificity matters because it's verifiable. Once CVector makes a recommendation, the plant can track it. Did compressed air consumption actually drop 8%? Did the plant actually save $47,000? If it did, the software paid for itself. If it didn't, the customer has evidence-based feedback for the CVector team.

This creates a virtuous cycle. Early customers get specific ROI. They renew. They expand to other plants or facilities. New customers ask for case studies and hear about concrete results. The pitch gets stronger over time as the track record grows.

Zhang emphasized this during the announcement. He calls it "operational economics," and it's the core of the pitch. Everything CVector does feeds into one question: Did that save us money?

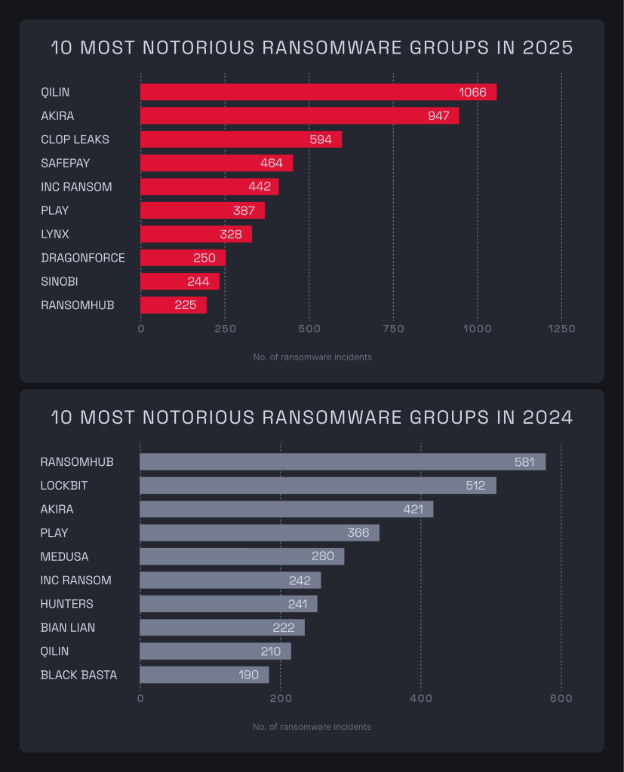

AI Adoption in Industrial Spaces: The Shift Toward Acceptance

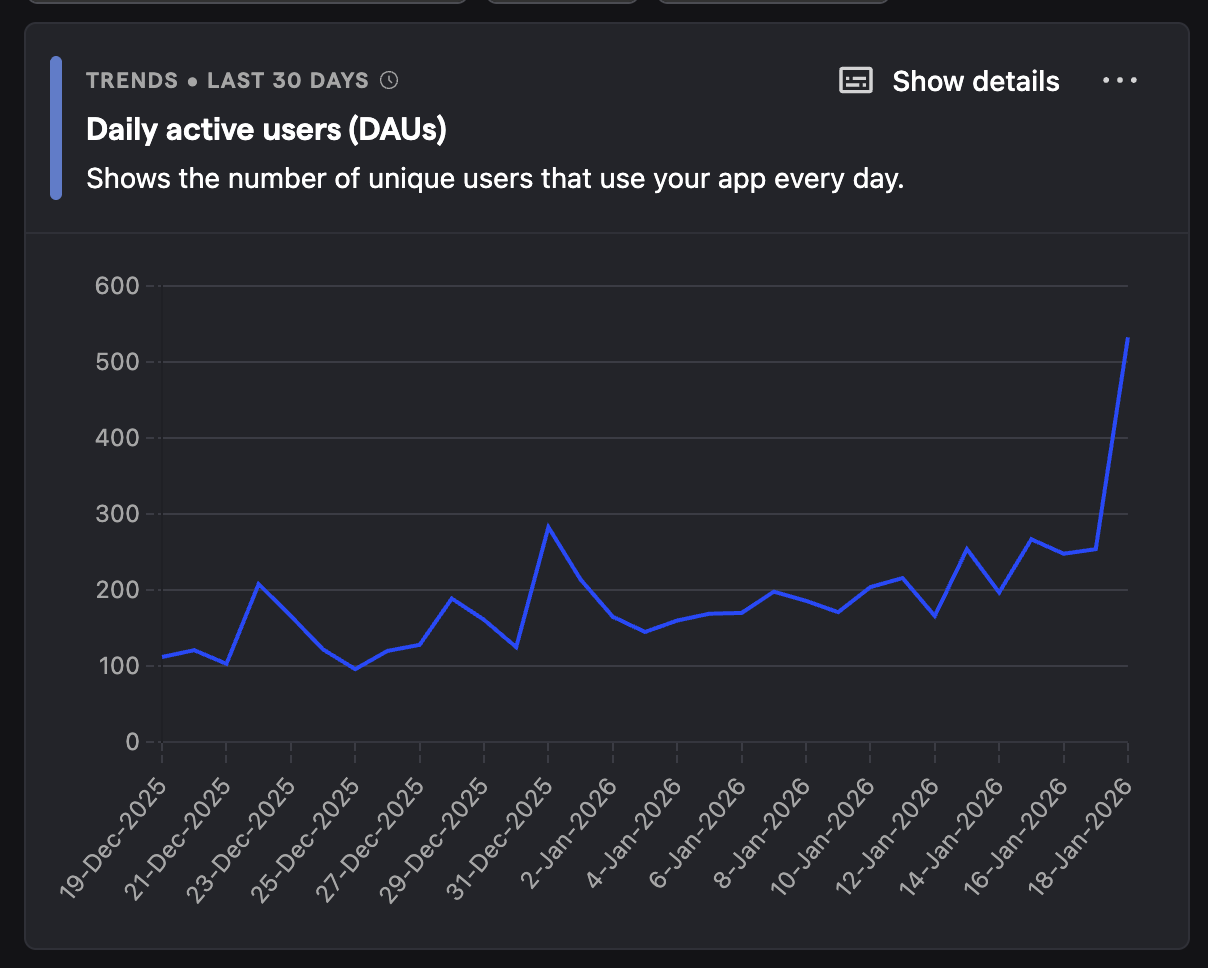

One year ago, mentioning AI to an industrial customer was risky. You had a 50/50 shot of enthusiasm or dismissal. Today, the mood has shifted dramatically. Every customer is asking for AI-native solutions. The taboo is gone.

This shift happened for a few reasons. First, Chat GPT and other consumer AI tools normalized the concept. Plant managers and executives use these tools in their personal lives. They're not scared of AI anymore. They want it.

Second, they see competitors adopting AI. Nobody wants to be left behind. If your competitor is using AI to optimize their plant, and you're not, that's a competitive disadvantage that compounds over time.

Third, the economics are clear now. AI isn't theoretical. It's producing measurable results. Plants that adopt optimization software are outperforming plants that don't. That's not philosophy. That's competitive reality.

This context is crucial for understanding why CVector's timing is so good. The founder duo isn't trying to convince skeptical customers that AI is real. They're meeting customers who are already sold on AI and just need to find the right solution for their specific problem.

Supply Chain Volatility: Why Industrial AI Matters Now

For the past five years, manufacturing supply chains have been in chaos. COVID disrupted everything. Shipping costs tripled. Materials became scarce. Prices became unpredictable. Companies that could adapt and optimize quickly survived. Companies that couldn't got crushed.

That environment created permanent anxiety. Even with supply chains stabilizing, manufacturers are terrified of being caught off guard again. Any technology that provides visibility into costs, supply constraints, or potential disruptions is attractive.

CVector fits this perfectly. By tracking commodity prices, energy costs, and production efficiency in real time, the software gives plant managers visibility into economic volatility. It's not predicting the future, but it's helping them respond to current conditions better and faster.

Ruggles made this point in the announcement. Companies are intimately worried about supply chain costs and variability. Being able to layer AI on top of the economic model of a facility resonates whether you're running legacy industrial operations or building new energy systems. The uncertainty is real, and CVector addresses it.

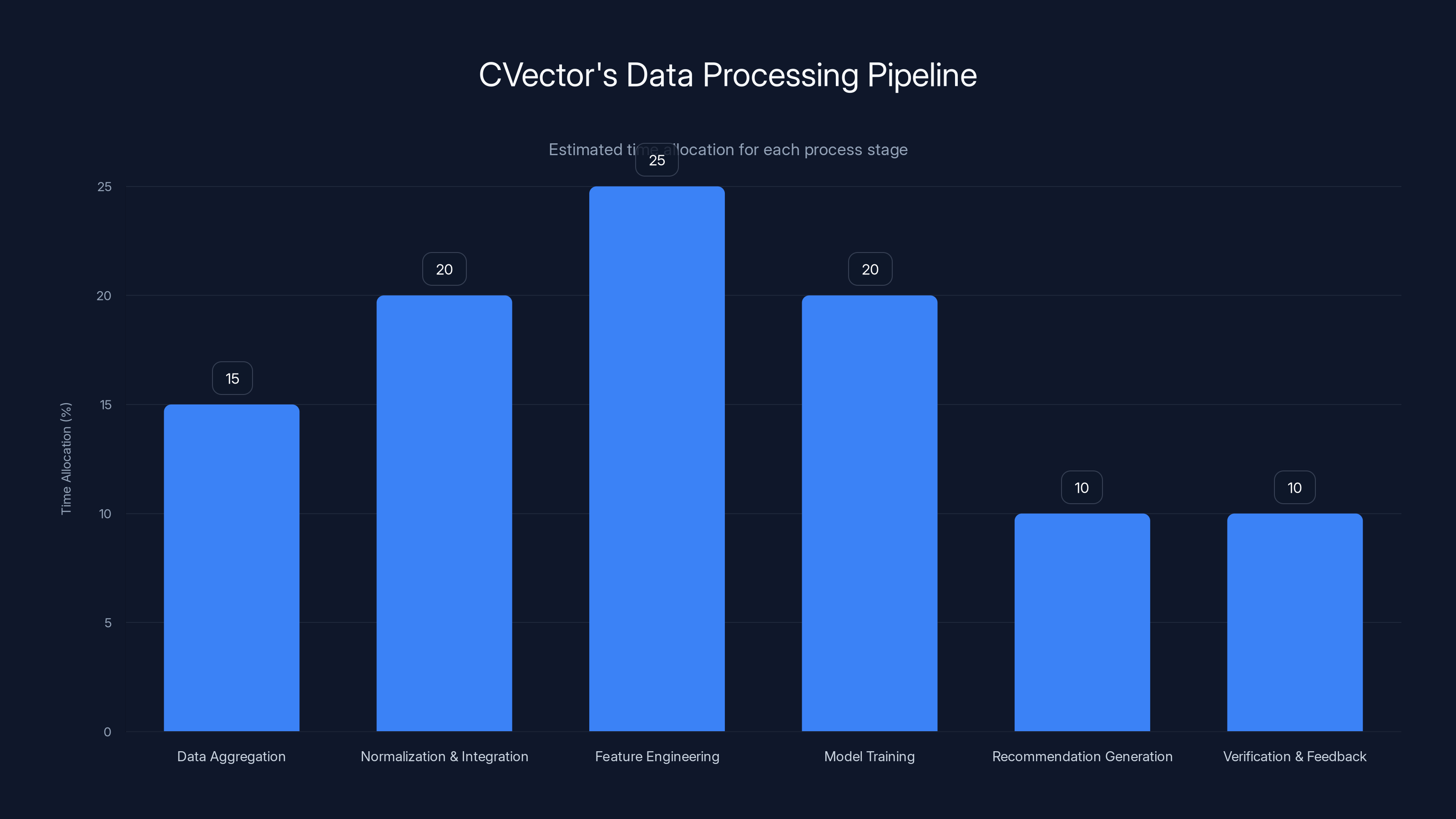

Feature engineering and model training are the most time-consuming stages in CVector's data processing pipeline, each taking approximately 20-25% of the total time. Estimated data.

The New Energy Connection: Why Ammobia and Future Startups Matter

Ammobia is working on a specific materials science problem: reducing the cost of producing ammonia. This matters because ammonia is critical to fertilizer, and fertilizer is critical to global food production. Making ammonia cheaper helps agriculture and food security.

But for CVector, Ammobia represents something more significant: a category of customer that barely existed five years ago. New energy and materials startups that are building manufacturing operations from scratch, and who want to optimize from day one.

Traditional manufacturing customers ask CVector for optimization because they're trying to fix problems in legacy operations. They're reactive. New energy customers like Ammobia ask for CVector because they want to bake optimization into their design from the start. They're proactive.

That difference is important because it affects the sales cycle and the product requirements. Ammobia knows exactly what they're building and what efficiency looks like. They just need help hitting those targets. Legacy manufacturers are still figuring out what's possible and where the biggest opportunity lies.

Both customer types are valuable, but the growth vector is probably through startups and new operations. As more deep tech and new energy companies start manufacturing operations, CVector becomes a prerequisite system, not an add-on.

Competitive Landscape: Who Else Is in This Space

CVector isn't the only company working on industrial optimization and AI. There are established players like GE Digital, Siemens MindSphere, and Baker Hughes offering AI-powered industrial solutions. There are also smaller startups with different angles: predictive maintenance specialists, energy optimization companies, and supply chain visibility platforms.

What separates CVector is the focus on economics rather than operations. Predictive maintenance companies tell you when equipment will fail. That's useful. Energy optimization companies tell you how to reduce consumption. Also useful. But CVector tells you what each decision is worth in dollars.

This economic focus is harder to compete with because it requires deeper integration with customer business models, financial systems, and decision-making processes. A company that adopts CVector has to trust the software with real business decisions. That's a much stickier relationship than a company that just uses predictive maintenance as a data input.

The competitive moat, then, isn't just the technology. It's the customer relationships, the domain expertise, the integration depth, and the track record of economic results. Those things are hard to replicate, which is why this funding round is validating the team's approach.

Implementation and Customer Journey: From Concept to Reality

Understanding how CVector actually works with customers is important. The startup doesn't just hand over software and disappear. Implementation is a process.

First comes the assessment phase. CVector's team works with the customer to understand the plant, the equipment, the processes, and the business model. They collect baseline data on operations, costs, and outcomes. This takes weeks and requires serious customer commitment.

Second comes integration. CVector's software needs to connect to equipment sensors, historians, ERP systems, and external data sources like energy and commodity prices. This is technical work that requires the customer's IT team to participate.

Third comes training and learning. The AI system starts learning from historical data. It's not smart on day one. It becomes smarter over weeks and months as it sees patterns in operations and sees which recommendations work out well.

Fourth comes optimization and recommendations. Once the system understands the plant, it starts making recommendations. Early recommendations are usually conservative to build trust. As the system gains confidence, recommendations become more aggressive.

Fifth comes measurement. CVector and the customer track whether recommendations actually produce the promised results. This is where ROI becomes concrete.

This implementation process takes months, not weeks. But that's actually an advantage because it builds deep customer relationships and makes switching costs high. Once a plant is fully integrated with CVector's system, the switching cost is significant.

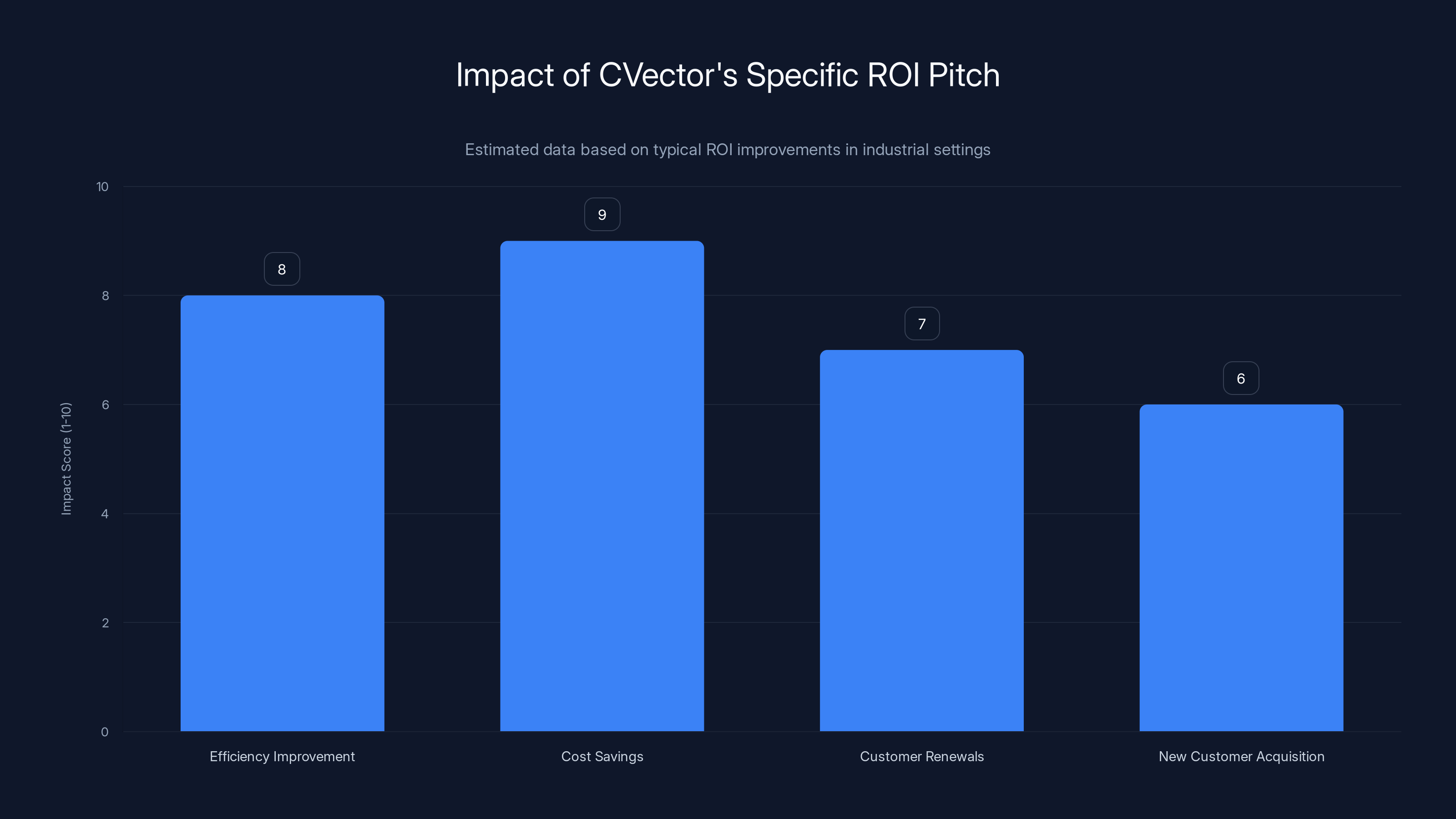

CVector's specific ROI pitch significantly impacts cost savings and efficiency improvements, leading to higher customer renewals and acquisitions. Estimated data.

The Path to Scale: From Early Customers to Thousands of Plants

Right now, CVector is in the early customer phase. The startup has proven it can land customers, deliver results, and expand. But getting from a dozen customers to hundreds or thousands of customers requires different strategies.

One path is vertical expansion. Dominate metals and manufacturing, then expand to chemicals, utilities, food processing, and other industrial verticals. Each vertical has different characteristics, but the core economic problem is the same.

Another path is geographic expansion. Start in the U.S., then expand to Europe, Asia, and other regions where manufacturing is significant. Every country has old plants trying to optimize costs.

A third path is deeper integration with OEMs and equipment providers. If Hitachi (the corporate investor) integrates CVector's technology into their systems and solutions, that's instant distribution to thousands of potential customers who already use Hitachi equipment.

A fourth path is partnerships with software providers that already serve industrial customers. If ERP companies, MES (Manufacturing Execution System) providers, or predictive maintenance platforms integrate CVector's economic layer, they instantly offer economic optimization to all their customers.

The $5M funding probably enables the first path (vertical expansion in the U.S.) and starts laying groundwork for paths two and three. The presence of Hitachi as a corporate investor suggests path three is already in motion.

The Technology Behind the Scenes: How It Actually Works

While CVector's pitch is about economics, the underlying technology is sophisticated. Here's what's happening under the hood:

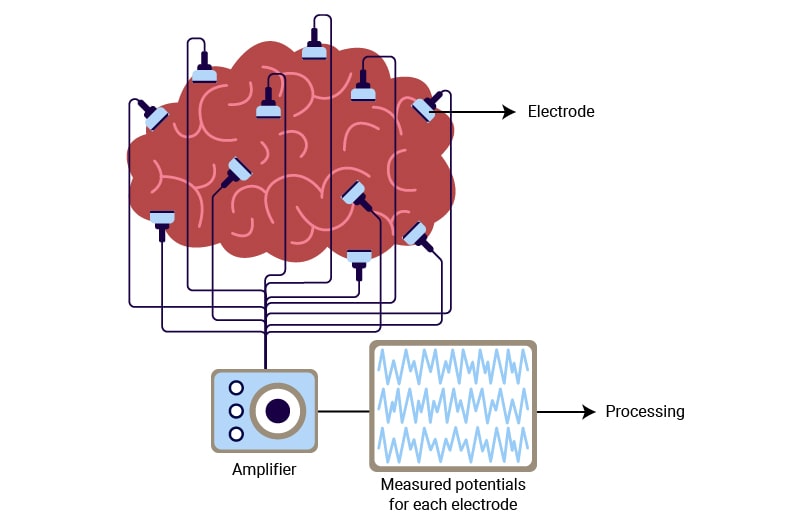

First, data aggregation. CVector's platform collects data from multiple sources: equipment sensors providing real-time performance data, historical databases showing past performance, external APIs providing energy prices and commodity markets, and customer business systems showing production schedules and orders.

Second, normalization and integration. All this data comes in different formats and frequencies. CVector has to normalize it into a consistent format that the AI system can understand and process.

Third, feature engineering. Raw sensor data isn't useful by itself. The system has to engineer features: rolling averages, anomaly detection flags, correlation with other variables, economic indicators like cost per unit of output.

Fourth, model training. Using historical data and these engineered features, CVector trains models that predict outcomes given certain operational decisions. These models learn patterns about what works well in this specific plant.

Fifth, recommendation generation. Given current conditions (equipment status, market prices, production schedule), the models generate recommendations ranked by expected economic impact.

Sixth, verification and feedback. The system tracks what actually happened when the recommendation was followed. Did it produce the expected result? This feedback loops back into the training process, improving future recommendations.

This whole pipeline is proprietary and tuned for industrial environments. It's not a generic "apply GPT to industrial data" solution. It's a purpose-built system that understands industrial operations and economics.

Funding Context: What $5M Means for Runway and Growth

To understand whether $5M is the right amount for this stage and market, it's useful to think through the burn rate and how that translates to runway.

A 12-person startup in Manhattan isn't cheap. Base salaries, benefits, and overhead probably run

If CVector is already generating some revenue from customers, the burn is lower. If they're still entirely pre-revenue, $5M gives them about 25-30 months of runway. That's enough to prove the product, land several customers, show real revenue growth, and get to Series A fundraising.

Series A for a company like this would probably be

The funding timeline is important too. CVector raised pre-seed funding last July. They're now raising seed $5M roughly six months later. That's a fast timeline, which suggests strong investor demand and good progress with early customers.

Lessons for Other Industrial AI Startups

CVector's approach offers a blueprint for industrial AI startups: focus on economic value, not just operational improvement. This is counterintuitive because traditional industrial software focuses on operations. But the CEO and CTO have figured out that plant managers don't actually care about operations. They care about profitability.

A second lesson: start with legacy industries, not greenfield. Greenfield operations are rare, but legacy operations are everywhere. Starting with ATEK Metal instead of just Ammobia was smart. The economics are easier to understand, and the potential market is much larger.

A third lesson: hiring matters. Bringing in people from finance and fintech rather than traditional manufacturing was unconventional, but it's paying off. Those people think about economics and optimization natively. They don't need to learn that mindset.

A fourth lesson: timing is everything. Six months ago, some customers were still skeptical about AI. Now they're asking for it. The team launched at the inflection point where industrial customers had accepted AI but hadn't yet found the right solutions. That's the best time to enter a market.

Future Opportunities: Beyond Optimization

As CVector grows and gets deeper into customer plants, new opportunities will emerge. Optimization is just the beginning.

Predictive maintenance is one obvious expansion. CVector already has visibility into equipment performance. The step from optimization to maintenance prediction is relatively small.

Supply chain management is another. Once CVector understands a plant's economics, extending that to suppliers and logistics is natural. Can you optimize your supply chain decisions the same way you optimize operations?

Carbon optimization is a third. As companies face pressure to reduce emissions, economic optimization and carbon optimization often overlap. Reduce energy consumption, and you reduce both costs and carbon. CVector could build carbon accounting directly into its recommendations.

Financial planning and forecasting is a fourth. With real-time understanding of plant economics, CVector could help plants predict cash flow, profitability, and capital requirements. That's valuable for plant-level financial planning.

None of these are core to the current product, but they're natural extensions of the platform. As the company scales, these adjacent opportunities will become increasingly relevant.

The Broader Context: AI's Impact on Manufacturing

CVector is one company, but it's part of a larger trend. AI is quietly revolutionizing manufacturing in ways that aren't always obvious to people outside the industry.

For decades, manufacturing productivity has grown slowly because automation hit a wall. You can automate the repetitive stuff, but you can't automate the complex decision-making that experienced operators do every day. AI changes that. It doesn't replace operators, but it augments them with better information and better recommendations.

This is happening across the industry. Companies are adopting AI for predictive maintenance, quality control, demand forecasting, and supply chain optimization. CVector is entering a market where the fundamental receptiveness to AI has shifted. That's why the funding round is significant. It's not just capital. It's validation that this is the right approach at the right time.

FAQ

What is CVector's industrial nervous system?

CVector's system is software that sits between a factory's operations and its economics. It monitors equipment performance, energy consumption, material costs, and market prices, then provides recommendations aimed at improving profitability. The "nervous system" metaphor describes how the software provides real-time visibility and responsiveness across the entire plant, similar to how a nervous system coordinates responses in the human body.

How does CVector's technology help manufacturing plants?

The software identifies optimization opportunities by analyzing operational data and economic data simultaneously. Rather than just saying "reduce energy consumption," it quantifies the actual financial impact: "This optimization will save you $47,000 annually." This specificity helps plant managers understand ROI and make better decisions about which improvements to prioritize.

What types of companies use CVector's technology?

CVector serves both legacy manufacturing operations like ATEK Metal Technologies (which makes aluminum castings for Harley-Davidson) and newer startups like Ammobia (a materials science company developing cheaper ammonia production). This breadth shows the technology addresses universal manufacturing problems rather than niche use cases.

Why did CVector raise $5 million now?

The funding round validates investor confidence in the team and market opportunity. The timing reflects a shift in industrial customer attitudes toward AI adoption. Twelve months ago, customers were skeptical about AI. Today, they're actively seeking AI-native solutions. CVector entered the market at this inflection point, proving the business model works before scaling further.

What makes CVector different from other industrial AI companies?

Most industrial software focuses on operational improvements (reduce downtime, improve efficiency). CVector focuses on economic improvements (increase profitability). This difference matters because it changes the value proposition from abstract operational goals to concrete financial outcomes that customers can measure and verify.

How long does it take to implement CVector in a manufacturing plant?

Implementation is a multi-phase process taking several months. It starts with assessment and data collection, moves through integration with existing systems, includes a learning phase where the AI understands the plant's patterns, and culminates in recommendations and continuous optimization. The timeline reflects the operational risk involved in industrial environments and the need to build customer trust through verified results.

What is the competitive landscape for industrial optimization software?

Established players like GE Digital and Siemens offer industrial AI solutions, while predictive maintenance startups focus on equipment failure prediction and energy optimization companies focus on consumption reduction. CVector differentiates by focusing specifically on economic impact, which requires deeper business integration than pure operational solutions.

How does CVector acquire customers?

The company uses a direct sales approach, traveling to industrial plants in the heartland to build relationships and demonstrate understanding of their problems. Customer acquisition relies heavily on specific ROI examples and case studies. Early success with customers like ATEK provides proof points for similar operations.

What happens after a plant implements CVector successfully?

Successful implementations typically lead to customer expansion (adding more facilities), account growth (expanding services), and strong retention. The implementation depth and integration with business processes create switching costs that make customers sticky. Satisfied customers also become reference accounts that help with new customer acquisition.

What are the growth opportunities for CVector beyond its current market?

Expansion opportunities include vertical expansion into adjacent industries (chemicals, utilities, food processing), geographic expansion into international markets, deeper integration with original equipment manufacturers (OEMs) and software platforms that serve industrial customers, and related services like predictive maintenance, supply chain optimization, and carbon footprint management.

Key Takeaways

CVector's $5M seed round marks a critical validation point for economic-focused industrial AI. The startup has moved beyond proving the concept to proving the business model works with real customers generating measurable results. The team's choice to hire finance-focused talent rather than traditional manufacturing veterans shows sophisticated thinking about the skills actually needed to solve this problem.

The market timing couldn't be better. Industrial customers have shifted from skepticism about AI to actively seeking AI-native solutions. Supply chain volatility continues to create urgency around optimization. The combination means CVector has a clear runway to establish itself as the go-to platform for plant-level economic optimization.

For anyone paying attention to AI's real-world impact, CVector represents something important: AI's most transformative applications might not be consumer-facing. They might be systems running quietly in factories across America, helping aging operations compete with modern manufacturing. That story doesn't get headlines the way Chat GPT does, but it's arguably more important to the economy.

The next 18 months will determine whether CVector can scale beyond early customers to become a category leader. But based on what's visible so far, the company has nailed the hardest part: finding a specific problem where AI creates measurable economic value, and getting customers to pay for that value. Everything else is execution.

If you're working on manufacturing optimization problems or considering how AI could improve industrial operations at your organization, CVector's approach offers a clear playbook: focus relentlessly on economic impact, make ROI specific and measurable, and build a team that understands business economics as deeply as they understand technology. That combination is winning in industrial AI right now.

Related Articles

- Boston Dynamics Atlas Robot: The Future of Factory Automation [2025]

- Why AI Projects Fail: The Alignment Gap Between Leadership [2025]

- Why Agentic AI Projects Stall: Moving Past Proof-of-Concept [2025]

- Modernizing Apps for AI: Why Legacy Infrastructure Is Killing Your ROI [2025]

- How HEN Technologies Built a Fire Nozzle Empire on AI Data [2025]

- The AI Adoption Gap: Why Some Countries Are Leaving Others Behind [2025]

![CVector's Industrial AI Nervous System: How $5M Funding Powers Factory Intelligence [2025]](https://tryrunable.com/blog/cvector-s-industrial-ai-nervous-system-how-5m-funding-powers/image-1-1769456218843.jpg)