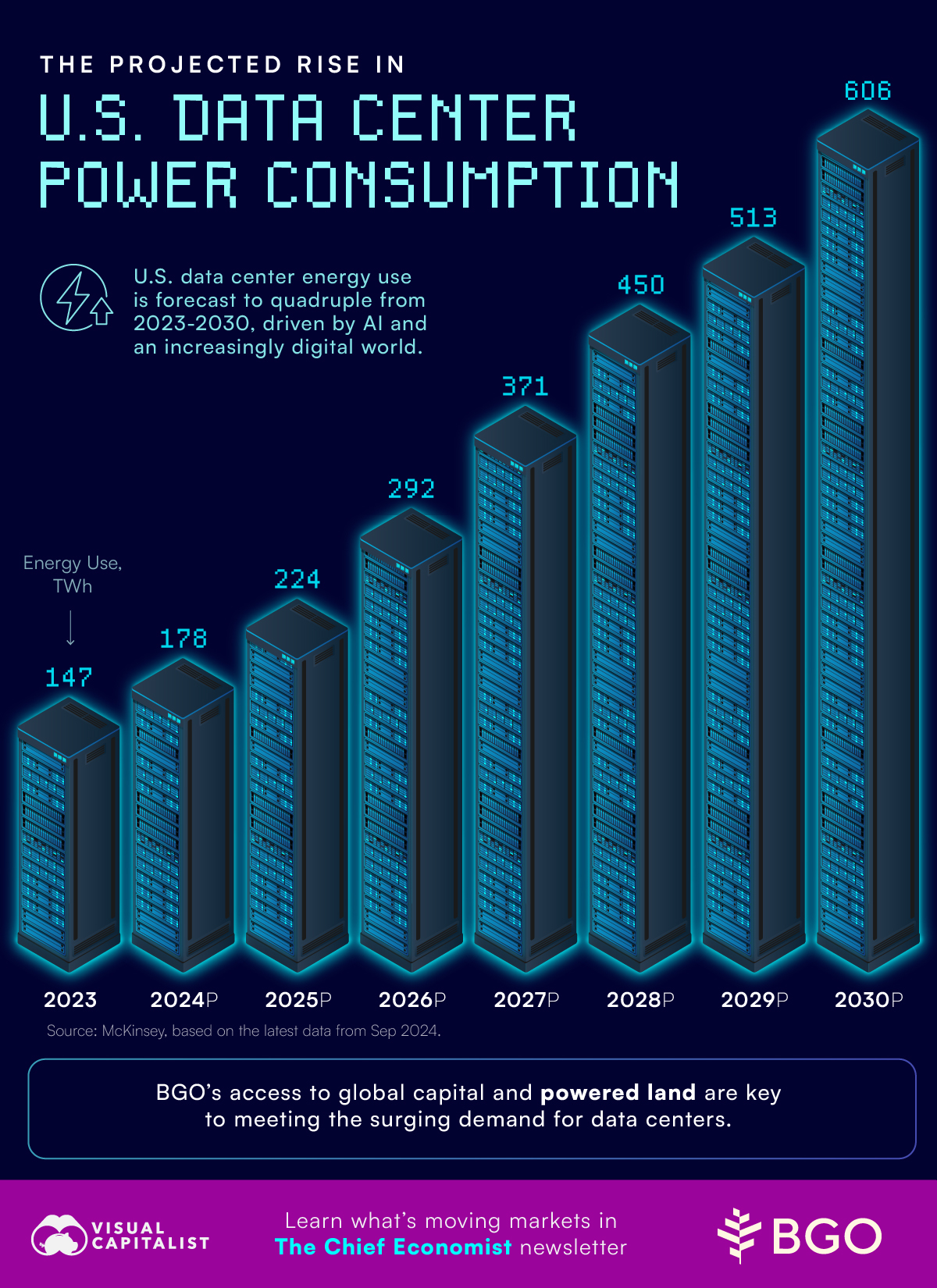

Introduction: The Power Problem Data Centers Can't Ignore

Data centers are hungry beasts. A single hyperscale facility can consume as much electricity as a small city, and that appetite keeps growing. But here's the problem nobody talks about enough: getting that power to the servers is inefficient, outdated, and increasingly wasteful.

Traditional transformers and power distribution systems were designed in an era when data centers looked completely different. They relied on century-old transformer technology, bulky equipment, and rigid power architectures that couldn't adapt to modern demands. Today's data centers are densifying, adding more servers per rack, experimenting with liquid cooling, and increasingly partnering with renewable energy sources like solar and wind. The old infrastructure simply doesn't fit.

Enter DG Matrix, a startup that just raised $60 million in Series A funding to solve this exact problem. The company builds solid-state transformers that act as intelligent power routers, capable of aggregating electricity from multiple sources and intelligently distributing it to data center racks. It's not just an engineering improvement. It's a fundamental rethinking of how power flows through the facilities that power the internet.

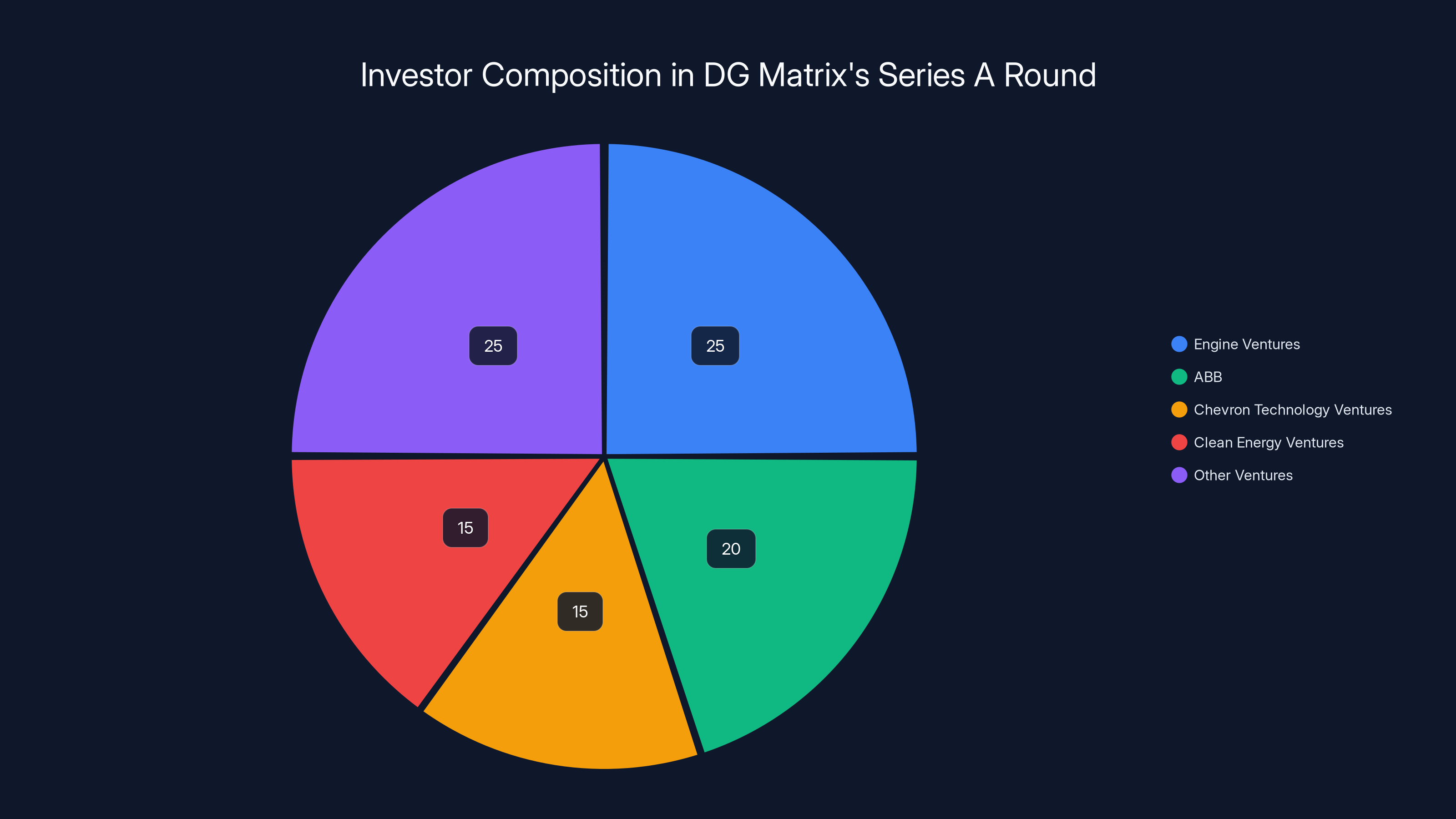

What makes this funding round significant isn't just the $60 million figure. It's the quality of the investors. Engine Ventures led the round, but the syndicate includes ABB (a century-old power technology company), Chevron Technology Ventures, Clean Energy Ventures, and Helios Climate Ventures. This investor mix signals something important: the problem DG Matrix is solving matters at the intersection of energy infrastructure, sustainability, and data center economics.

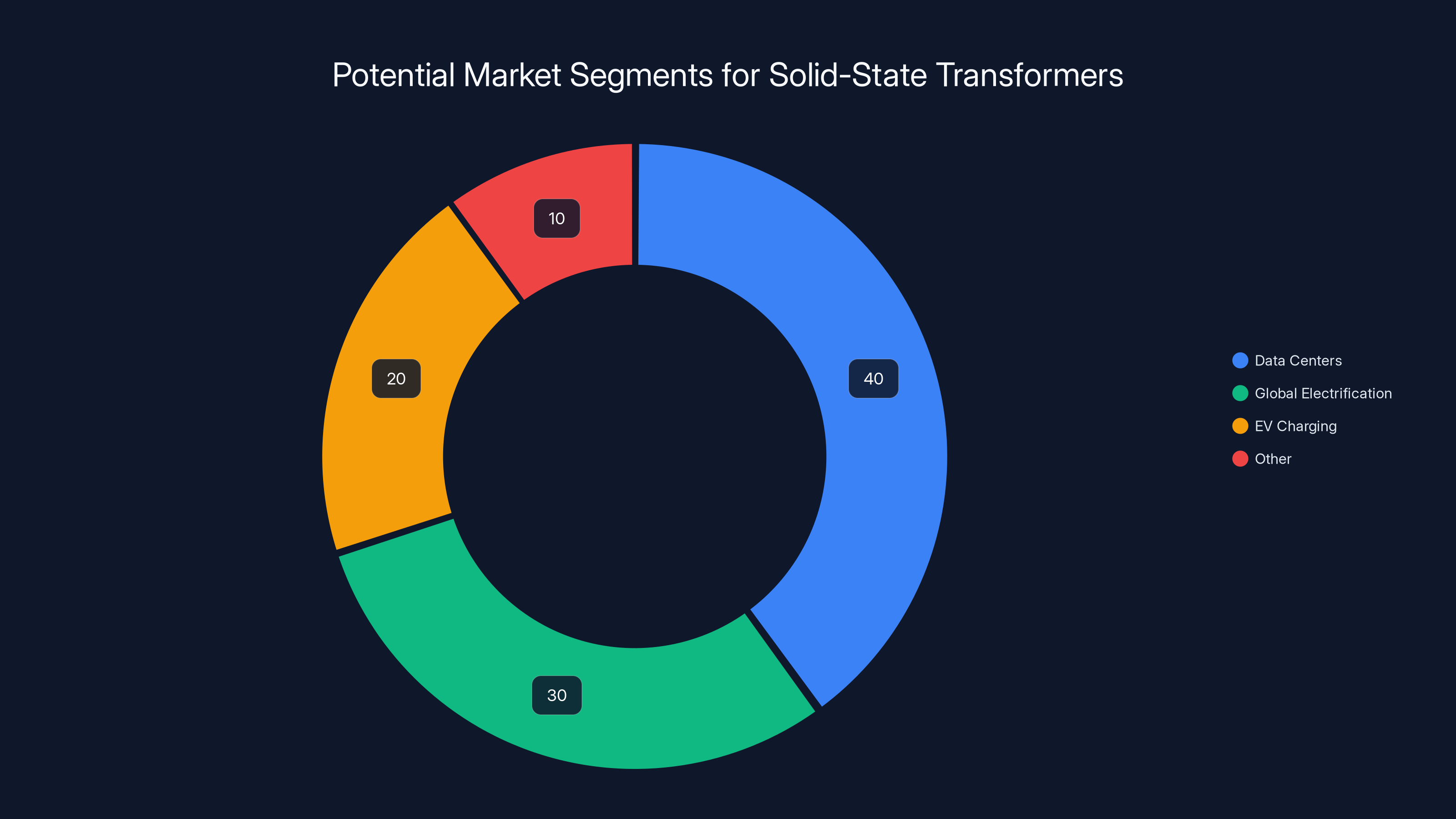

The implications extend far beyond data centers. DG Matrix's technology could eventually power remote communities, support EV charging networks, and enable distributed energy systems in places where building traditional power infrastructure is prohibitively expensive. But first, they're focused on the $1 trillion data center industry.

This article dives deep into what DG Matrix is building, why it matters, how solid-state transformers work, and what it means for the future of data center infrastructure. We'll explore the technical architecture, the competitive landscape, the financial implications, and the broader energy transition story happening right now.

TL; DR

- DG Matrix raised $60 million Series A to scale solid-state transformer technology for data centers

- Efficiency gains are massive: 95-98% efficiency versus 82-90% from legacy systems, translating to millions in annual power savings

- Space reduction is dramatic: One 4x 4 foot Interport replaces two 4x 30 foot skids of traditional power conversion equipment

- Renewable energy integration: The technology seamlessly combines power from solar, batteries, and the grid to eliminate uninterruptible power supplies

- First customers shipping June 2026: DG Matrix is moving from development to revenue within months

Estimated data suggests that data centers represent 40% of the solid-state transformer market, with significant opportunities in global electrification and EV charging. Estimated data.

The Data Center Power Crisis: Why This Matters Now

Data centers consume roughly 1 to 2 percent of global electricity, and that number is accelerating. Every AI model trained, every video streamed, every cloud computation requires power. But the infrastructure delivering that power is a mess of inefficiency, redundancy, and aging technology.

Traditional data center power distribution works like this: grid power comes in, gets transformed multiple times, flows through uninterruptible power supplies (UPS), gets converted again, and finally reaches the servers. Each conversion step loses energy. A typical chain of legacy devices achieves 82 to 90 percent efficiency, meaning 10 to 18 percent of the electricity gets wasted as heat.

For a hyperscale data center consuming 50 megawatts, that inefficiency translates to millions of dollars annually. A 50 megawatt facility operating at 85 percent efficiency wastes 7.5 megawatts of power. At an average industrial electricity rate of

But the problem goes beyond cost. It's also space and reliability. Traditional power systems require massive amounts of physical real estate devoted to conversion equipment, cooling systems, and redundancy infrastructure. This equipment fails sometimes. Each device in the chain represents a potential failure point.

And then there's the renewable energy complication. More data centers want to pair with solar and wind farms. But intermittent renewable sources create challenges. When solar production doesn't match server demand, data centers need batteries. When demand spikes above renewable generation, they need grid power. Managing this mix with legacy equipment is clunky and inefficient.

DG Matrix's core insight is elegant: what if, instead of all this conversion and reconversion, you had a single device that could intelligently route power from multiple sources directly to the servers? That's what a solid-state transformer does.

Understanding Solid-State Transformers: Engineering Fundamentals

Traditional transformers are marvels of 19th-century engineering. They work through electromagnetic induction: alternating current flows through a coil, creating a magnetic field that induces current in a second coil. By changing the number of turns in each coil, you can step voltage up or down. It's elegant, proven, and hasn't fundamentally changed in over a hundred years.

Solid-state transformers (SSTs) throw out the magnetic induction playbook and use power electronics instead. They use semiconductor devices like silicon carbide (Si C) or gallium nitride (Ga N) to convert power directly. Instead of relying on magnetic fields, SSTs use fast-switching semiconductors to convert AC to DC and back again, or to step voltages up and down electronically.

This shift brings several immediate advantages. First, semiconductors don't generate heat like traditional transformers do. You need far less cooling infrastructure. Second, they're smaller and lighter. DG Matrix's Interport device is 4 feet by 4 feet. Traditional equivalent power conversion equipment occupies two 4-by-30 foot skids. That's roughly 75 percent less physical space.

Third, and this is crucial, solid-state transformers can be intelligent. Because they're controlled by software, they can dynamically adjust to changing power sources and loads. A traditional transformer is passive. It converts voltage. A solid-state transformer can actively manage power flow.

The Interport device can handle up to 2.4 megawatts of simultaneous connections. Imagine a scenario: 600 kilowatts flowing in from a solar array, 600 kilowatts from a grid-scale battery system, and 1.2 megawatts from the grid. The Interport aggregates all three and intelligently distributes them to 12 racks, each drawing 100 kilowatts. The device makes real-time decisions about which source feeds which rack, optimizing for cost, efficiency, and reliability.

Subhashish Bhattacharya, DG Matrix's CTO, emphasized this intelligence aspect. The Interport isn't just a passive converter. It's an active power router that understands the characteristics of each source and each load.

The efficiency gains are substantial. DG Matrix claims 95 to 98 percent efficiency for the Interport, compared to 82 to 90 percent for legacy systems. But the real story isn't just the device itself. It's the entire system simplification. By eliminating UPS systems, step-down transformers, and distribution equipment, you remove multiple failure points. DG Matrix estimates that using only 10 to 15 percent of the components that legacy systems require means dramatically improved reliability.

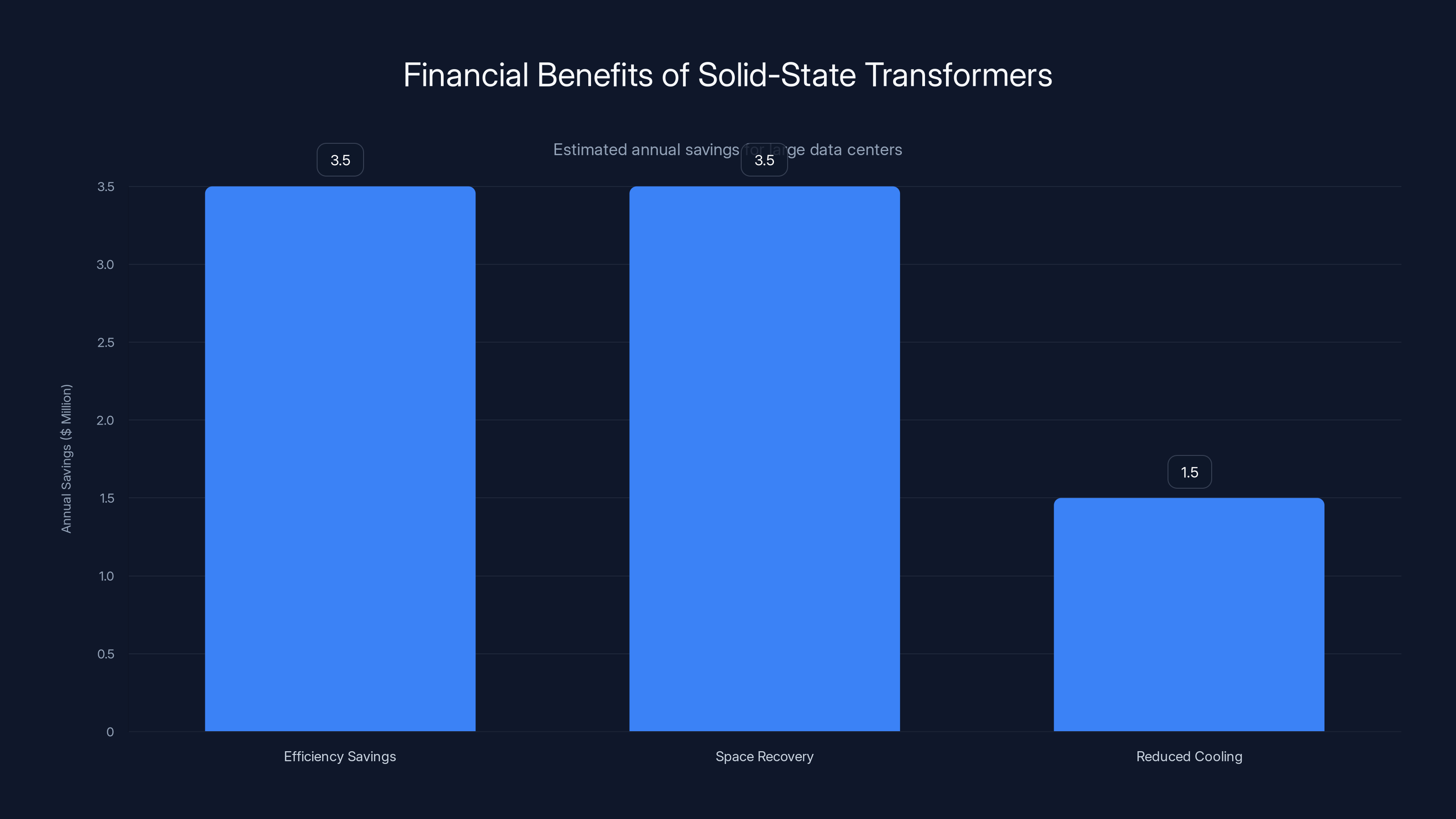

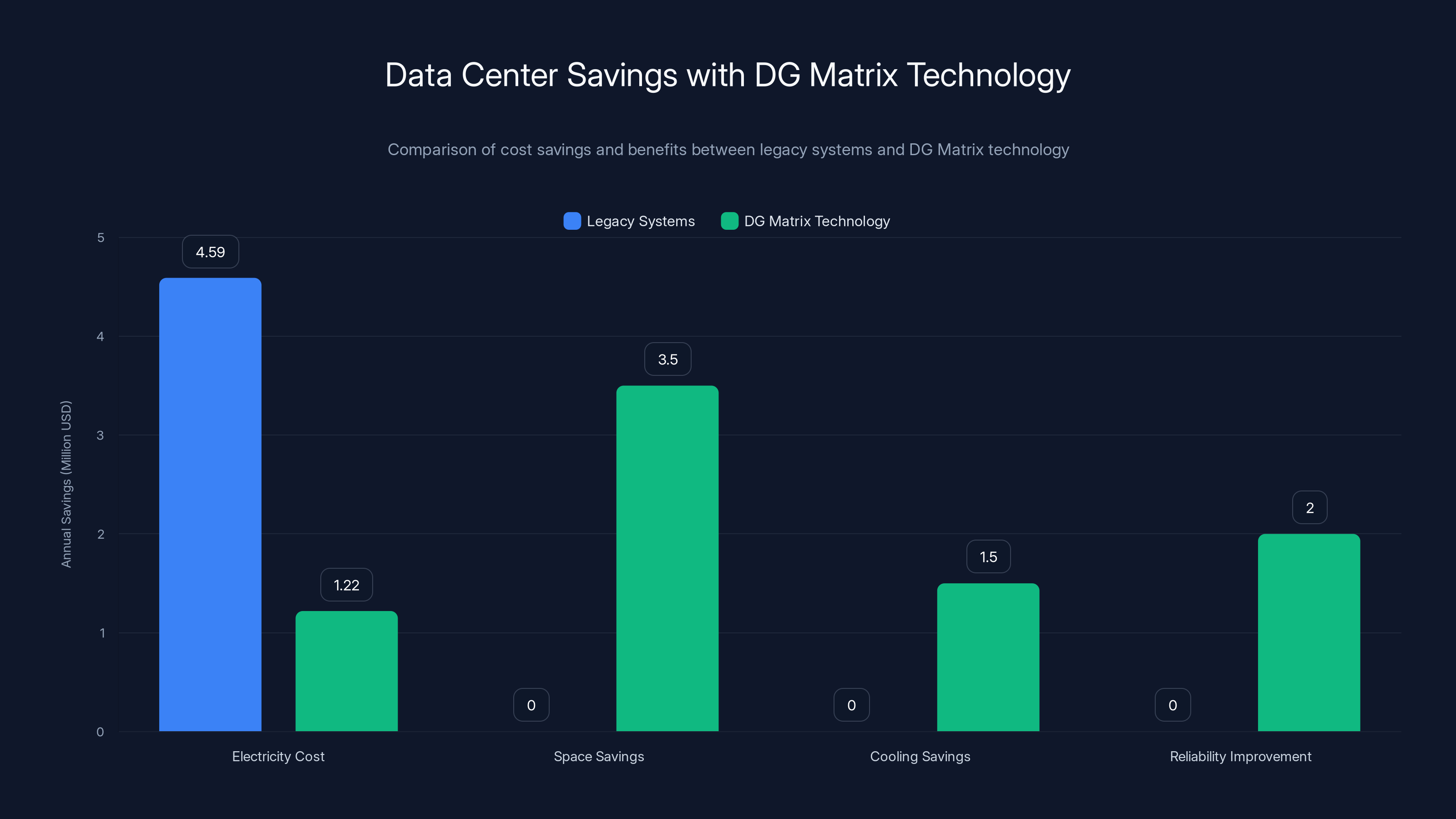

Switching to solid-state transformers can save large data centers approximately $8.5 million annually through efficiency, space, and cooling improvements. (Estimated data)

How DG Matrix's Interport Actually Works: Real-World Architecture

Let's walk through how the Interport actually functions in a real data center scenario. Understanding the mechanics helps explain why this technology matters.

Imagine a hyperscale data center in Northern California partnering with a solar farm and a battery system. Here's the power flow:

Solar Generation Phase: During sunny afternoon hours, the solar farm generates 600 kilowatts. This power comes in as DC (direct current) from the solar inverter. The Interport accepts this input.

Battery Management Phase: The data center also has a 10 megawatt-hour lithium-ion battery system. During periods when solar generation exceeds server demand, excess power charges the batteries. When solar output drops, the batteries discharge. The Interport manages this charge/discharge flow automatically, optimizing the battery's lifespan and availability.

Grid Integration Phase: When both solar and batteries can't meet demand, the Interport pulls additional power from the grid. During expensive peak hours, the Interport might prioritize battery discharge to avoid high-rate grid power. During off-peak hours when grid rates are cheap, it might prefer grid power to preserve battery capacity for peak periods.

Server Distribution Phase: All this aggregated power flows to the Interport's output, where it distributes power to data center racks. The device maintains the correct voltage and frequency, and monitors each output for faults. If a rack's circuit experiences a problem, the Interport isolates that output while continuing to serve other racks.

This entire process happens in milliseconds. The Interport's control systems constantly sample voltage, current, and power factor on every input and output, making adjustments thousands of times per second.

Comparison to legacy systems illustrates the complexity reduction:

Legacy System Flow: Grid power → Step-down transformer → UPS rectifier (AC to DC) → UPS battery charger → UPS inverter (DC back to AC) → Distribution transformer → PDU (Power Distribution Unit) → Rack-level conversion → Server power supplies

Interport System Flow: Grid power + Solar + Batteries → Interport → Server power supplies

You're eliminating five to seven conversion stages and multiple physical devices. Each stage typically costs money, consumes space, generates heat, and represents a failure point.

The Financial Impact: Calculating Data Center Savings

Let's do the math on what DG Matrix's technology means financially for data center operators.

Assume a large data center with a 50-megawatt annual average power draw. Using typical industrial electricity pricing of $0.07 per kilowatt-hour:

Annual electricity cost: 50 MW × 8,760 hours ×

Now compare efficiency scenarios:

With legacy systems at 85% efficiency:

- Useful power to servers: 50 MW × 0.85 = 42.5 MW

- Wasted power: 7.5 MW

- Cost of waste: 7.5 MW × 8,760 hours × 4.59 million annually**

With Interport at 96% efficiency:

- Useful power to servers: 50 MW × 0.96 = 48 MW

- Wasted power: 2 MW

- Cost of waste: 2 MW × 8,760 hours × 1.22 million annually**

Annual efficiency savings: $3.37 million

But the financial benefits extend beyond efficiency:

Space Savings: Eliminating traditional power conversion equipment means recovering real estate worth thousands per square foot in prime data center locations. A 50 megawatt facility might recover 2,000 to 4,000 square feet of space, worth

Reduced Cooling Requirements: Legacy power conversion generates heat. A 7.5 megawatt power loss requires significant cooling capacity. Reducing this to 2 megawatts means reduced HVAC and liquid cooling requirements, saving on equipment, space, and energy.

Improved Reliability: Fewer components mean fewer failures. Data center downtime costs $9,000 per minute for large enterprises according to industry research. Reducing unplanned outages from redundancy issues directly improves revenue.

Renewable Energy Optimization: The ability to seamlessly integrate variable renewable sources means data centers can sign more attractive renewable energy contracts. Instead of requiring 24/7 stable power (forcing backup grid contracts), they can use more solar and wind at lower rates, with Interport managing the variability.

Compound Effect Over Time: These savings compound. A data center operator upgrading to Interport technology across 10 megawatts of capacity might save

For DG Matrix customers, this economic case provides strong justification for technology adoption.

The Series A Round: Who's Investing and Why

The $60 million Series A tells a story about market confidence and investor conviction. Let's break down what each investor brings to the table.

Engine Ventures led the round. Engine focuses on deep tech and climate technology. They understand the 7 to 10 year timelines for hardware startups and the capital intensity of scaling manufacturing. Engine's leadership suggests they see DG Matrix not as a quick flip, but as a foundational technology company.

ABB is a century-old power technology conglomerate. They manufacture transformers, switchgear, and industrial automation equipment. Their investment is strategic. They're either hedging against solid-state transformer disruption, positioning for eventual acquisition, or both. ABB's presence also provides DG Matrix with manufacturing expertise and distribution channels.

Chevron Technology Ventures and Clean Energy Ventures signal that energy companies see DG Matrix as part of the distributed energy transition. Chevron, despite being an oil and gas company, invests in technologies that manage variable renewable integration. Their backing suggests they see solid-state transformers as inevitable infrastructure.

Cerberus Ventures, Fine Structure Ventures, Helios Climate Ventures, MCJ, and Piedmont Capital represent a mix of infrastructure-focused investors and climate tech specialists. This syndicate composition suggests broad confidence in the market opportunity.

The timing is notable too. DG Matrix announced the funding in early 2026, just as data center power challenges are becoming impossible to ignore. AI's explosive growth is driving data center construction at record rates. Every new facility needs power infrastructure. First-mover advantage matters in infrastructure markets.

Haroon Inam, DG Matrix's CEO, has been public about deployment timelines. The company is shipping initial units to customers in June 2026. That's not vaporware. That's a company with manufacturing capability ready to scale.

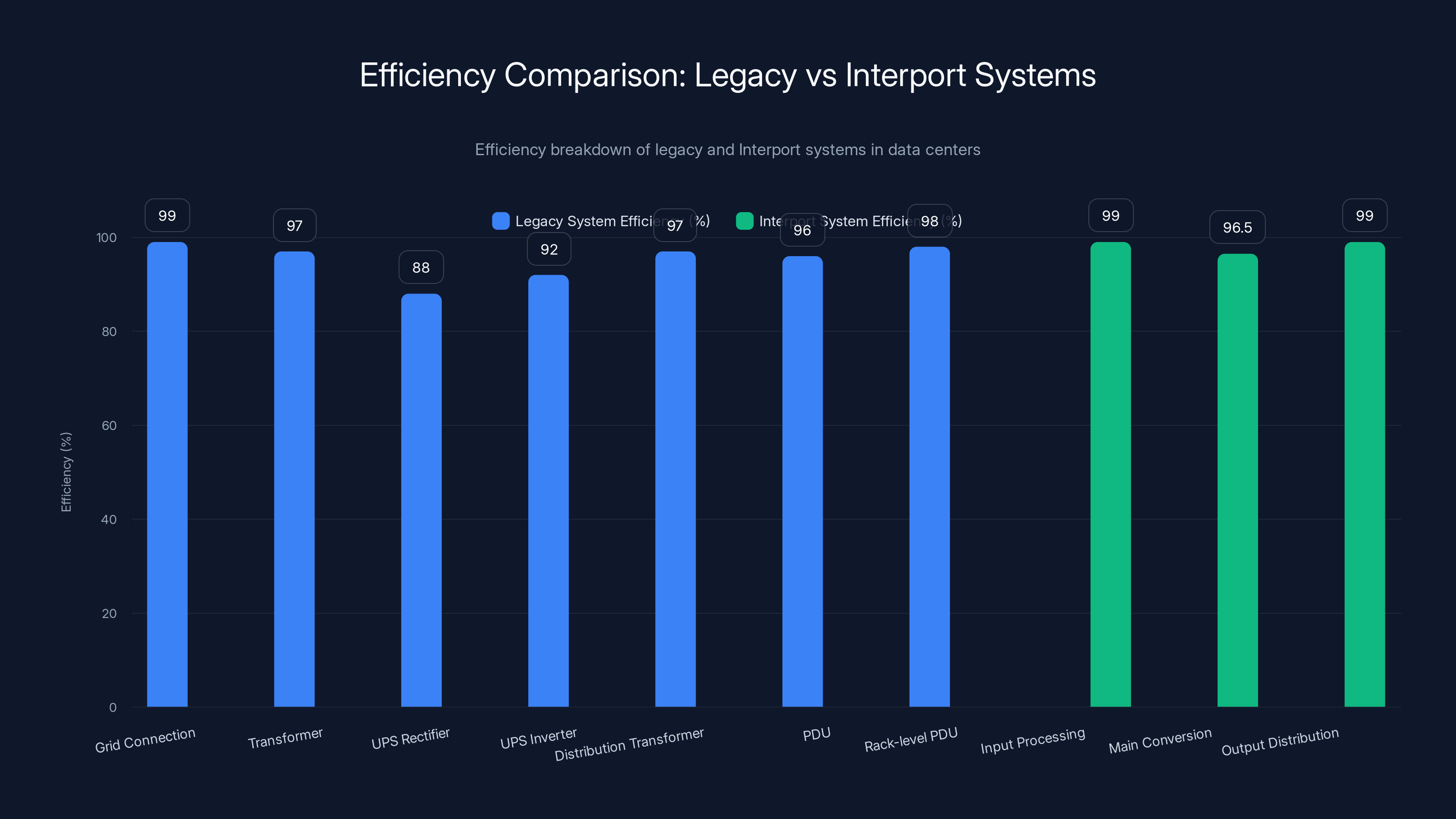

The Interport system shows a significant improvement in efficiency over legacy systems, with an overall efficiency increase from 75.9% to 94.5%. This translates to substantial cost savings in power consumption.

Strategic Partnership with Exowatt: Renewable Integration at Scale

DG Matrix's partnership with Exowatt reveals how the technology actually deploys in the real world. Exowatt builds solar-plus-storage containers that provide 24/7 electricity to data centers. The containers pack lithium-ion batteries alongside solar panels, creating standalone power systems that don't require grid connection.

The problem Exowatt previously faced: how do you feed power from these containers into a data center when that data center has traditional power distribution? The containers generate power at one voltage, the data center infrastructure expects another. Conversion losses mount.

With Interport, Exowatt simply plugs into the Interport's input. The device handles all voltage conversion and power routing. Exowatt can focus on their core competency (generating renewable power efficiently) while Interport handles distribution.

This partnership matters because it shows how modular infrastructure can accelerate renewable energy adoption. Instead of building large solar farms and transmitting power long distances with accompanying losses, data centers can pair with distributed renewable capacity using Interport to manage the integration.

Exowatt's containers can generate 100 kilowatts to multiple megawatts depending on size. An Interport handling up to 2.4 megawatts can aggregate multiple containers plus batteries plus grid power. This flexibility is precisely what renewable energy transition requires.

The economics work too. If Exowatt can reduce integration costs through Interport partnership, they can offer data centers renewable power at competitive rates. Lower integration costs mean lower power prices, making renewable contracts more attractive.

Current Customer Pipeline and June 2026 Rollout

DG Matrix has revealed limited information about specific customers, which is typical for enterprise infrastructure startups. But CEO Inam disclosed that data centers represent about 90 percent of the company's pipeline, with the remaining 10 percent devoted to EV charging for commercial fleets.

The June 2026 deployment timeline is significant. This isn't a future product. This is something shipping within months of the Series A funding announcement. DG Matrix has clearly already completed engineering, conducted field trials, and validated the technology with customers.

The EV charging application is worth noting. Commercial fleet operators face similar challenges to data centers: managing power from multiple sources (grid, renewable generation, charging station recovery systems) and routing it efficiently. Interport could manage charging station loads similarly to data center racks.

This EV charging direction suggests DG Matrix sees itself as a general-purpose power routing platform, not just a data center company. If the company can establish itself in both markets, they're building a diversified revenue base resilient to any single industry's cyclicality.

Deployment at scale also means supply chain maturation. Manufacturing 2.4 megawatt power devices is capital intensive. DG Matrix is probably already investing heavily in manufacturing capacity to support the June shipments.

Future Roadmap: From Data Centers to Microgrids

DG Matrix's ambitions extend far beyond data centers, though that's clearly the near-term focus. CEO Inam outlined the company's vision in several directions.

Building Power Applications: The next product will be a sidecar device supplying data center racks with power directly, building on existing Interport technology. This move suggests the company is thinking about the entire data center power ecosystem vertically.

Micro and Mini-Grid Infrastructure: Inam specifically mentioned expanding into building power and creating micro-grids to support electrification in remote communities. This is where solid-state transformers solve a completely different problem.

In remote areas without grid connection, traditional power infrastructure is prohibitively expensive. Running a transmission line to a village can cost $100 million. But with DG Matrix's technology, you could deploy solar panels, wind turbines, and batteries orchestrated through an Interport. The device would intelligently route whatever power is generated to whatever loads are present, providing 24/7 reliability from intermittent sources.

This application addresses energy poverty affecting roughly 770 million people globally who lack reliable electricity access. It's also a massive market opportunity. Development organizations, governments, and mining companies operating in remote regions face constant power infrastructure challenges.

The scalability potential is enormous. Once DG Matrix proves the technology in data centers, adapting it to microgrids is engineering execution. The fundamental physics is identical. DG Matrix would be moving from a billion-dollar data center market opportunity to a potentially ten-billion-dollar global electrification market.

Haroon Inam's comment about transmission lines is revealing: "Nobody's going to build a $100 million transmission line to a village. Now you can spend a fraction of that money and help eliminate energy poverty." This suggests the company is thinking about impact beyond pure profit, which is consistent with the climate-focused investors backing them.

Engine Ventures led the Series A round, indicating strong belief in DG Matrix's long-term potential. ABB's involvement highlights strategic alignment with manufacturing and distribution, while Chevron and Clean Energy Ventures underscore the importance of DG Matrix in the energy transition. Estimated data.

Competitive Landscape: Who Else Is Building Solid-State Transformers?

DG Matrix isn't the only company pursuing solid-state transformer technology. Understanding the competition provides context for the company's funding and market position.

Cree Wolfspeed (formerly Cree, Inc.) manufactures silicon carbide semiconductors used in power electronics. They're not building complete transformers, but they're enabling companies like DG Matrix through component supply.

Power Conversion Control and Cree/Wolfspeed partnerships are providing key technologies, but these are component manufacturers, not systems integrators.

Traditional equipment manufacturers like ABB, Schneider Electric, and Siemens are all researching solid-state transformers but moving cautiously. These companies have entrenched interests in traditional transformer business and move slower than startups.

Startups in adjacent spaces like Stem and Fluence provide energy storage and software, but not solid-state transformers specifically.

DG Matrix's competitive advantage appears to be twofold: first, they've developed a working product shipping in June 2026, while competitors are still in R&D phase. Second, they have strategic investor backing from both climate tech specialists (Clean Energy Ventures, Helios) and legacy equipment manufacturers (ABB), giving them credibility and potential distribution.

The 2.4 megawatt capacity also matters. Competing solutions often handle lower power ratings. DG Matrix's capacity puts them in data center range rather than smaller applications.

The Technical Challenges DG Matrix Had to Solve

Building a 2.4 megawatt solid-state transformer requires solving several non-trivial engineering problems. Understanding these challenges explains why the company needed $60 million and why the technology hasn't been deployed broadly until now.

Semiconductor Performance at Scale: Silicon carbide and gallium nitride semiconductors can switch fast and handle high voltages, but doing this reliably at 2.4 megawatts involves thousands of individual semiconductor devices working in parallel. Each one must switch at slightly different times to balance load. This requires sophisticated control algorithms and thermal management.

Thermal Management: 2.4 megawatts flowing through semiconductors generates heat, even at 95-98% efficiency. The 2 percent loss is still roughly 50 kilowatts continuously. Managing this requires advanced cooling systems. DG Matrix likely uses liquid cooling for the high-density semiconductor boards.

Control Complexity: The software controlling the Interport must sample inputs and outputs thousands of times per second, calculate optimal power routing, and adjust switching patterns accordingly. This is real-time embedded systems work, not standard enterprise software. The algorithms must be deterministic and fail-safe.

Electromagnetic Compatibility: Power systems generate electromagnetic noise. The Interport must operate near data center IT equipment without interfering with network performance. This requires careful filtering, shielding, and compliance with electromagnetic emissions standards.

Regulatory Certification: Power equipment requires extensive testing and certification. UL, IEC, and IEEE standards must be met. This certification process alone can take 18 months and cost millions.

Manufacturing Scalability: Building one prototype is hard. Building thousands of units that perform identically is harder. DG Matrix had to solve manufacturing processes, quality control, and supply chain management for complex electronics at scale.

Each of these challenges required specialized expertise. The $60 million funding undoubtedly covers engineering team salaries, manufacturing setup, and regulatory certification costs.

Efficiency Comparison: The Numbers That Matter

Let's drill deeper into the efficiency numbers that define DG Matrix's value proposition, because efficiency in infrastructure is where small percentages translate to massive financial impact.

Legacy System Efficiency Breakdown:

- Grid connection equipment: 99% efficiency

- Step-down transformer: 97% efficiency

- UPS rectifier (AC to DC): 88% efficiency

- UPS inverter (DC to AC): 92% efficiency

- Distribution transformer: 97% efficiency

- Power Distribution Unit (PDU): 96% efficiency

- Rack-level PDU: 98% efficiency

Multiplying these together: 0.99 × 0.97 × 0.88 × 0.92 × 0.97 × 0.96 × 0.98 = 0.759 or 75.9% overall efficiency

This assumes nothing fails and everything operates at optimal load. Real-world systems often run worse because legacy equipment isn't sized optimally. Heavy equipment running at partial load loses more efficiency.

Interport Efficiency Breakdown:

- Input processing: 99% efficiency

- Main conversion stage: 96.5% efficiency (semiconductor switching losses)

- Output distribution: 99% efficiency

Multiplying these together: 0.99 × 0.965 × 0.99 = 0.945 or 94.5% overall efficiency

DG Matrix claims 95-98% range depending on operating conditions. The estimate above is conservative.

Efficiency gain from 76% to 95%: That's 19 percentage points or a 25% relative improvement in efficiency. For a 50 megawatt data center, this means reducing power loss from 12 megawatts to 2.5 megawatts.

Over 24 hours with electricity cost of $0.07/k Wh:

- Legacy waste: 12 MW × 24 hours × 20,160 daily**

- Interport waste: 2.5 MW × 24 hours × 4,200 daily**

- Daily savings: $15,960

- Annual savings: $5.83 million

For a data center operator, this isn't theoretical. This is money on the balance sheet. Equipment costing millions becomes profitable within 2-3 years.

DG Matrix technology significantly reduces electricity costs by

Reliability and Redundancy: The Secondary Value Proposition

While efficiency dominates the discussion, reliability is equally important for data center operators. Power disruptions are catastrophic. Google, Amazon, and Facebook all have experienced multi-hour data center outages costing millions.

Traditional data center power systems use redundancy to improve reliability. They might have dual power feeds from different substations, dual UPS systems, and dual distribution paths. This redundancy is expensive and space-consuming but necessary because traditional equipment fails.

DG Matrix's approach is different. By using only 10-15% of the components that legacy systems require, you reduce failure points dramatically. Fewer components means lower probability of failure.

Additionally, solid-state transformers can inherently provide some redundancy. If one semiconducting device fails, others can compensate briefly while the system notifies operators. Traditional transformers fail catastrophically.

The Interport's software also provides visibility. It monitors every input and output in real time, logging events, tracking power flows, and identifying anomalies before they become outages. This predictive capability means data center operators can schedule maintenance proactively rather than reacting to failures.

For customers, this means either improving reliability at the same cost, or maintaining current reliability with significantly reduced capital and operational complexity.

Supply Chain and Manufacturing Implications

DG Matrix's transition from Series A funding to June 2026 shipping reveals several things about their manufacturing readiness.

First, they've already solved semiconductor supply. Building 2.4 megawatt solid-state transformers requires thousands of high-performance silicon carbide or gallium nitride devices. These components are in demand and sometimes supply-constrained. DG Matrix either has supply contracts in place or has secured capacity with manufacturers.

Second, they've established manufacturing partners or internal facilities. Companies manufacturing enterprise power equipment typically work with established contract manufacturers or build their own lines. The capital and expertise required suggests DG Matrix has already invested in manufacturing infrastructure.

Third, they've completed regulatory certification or have a clear path. UL, IEEE, and IEC certifications for power equipment take time. The June timeline suggests certification is complete or imminent.

This manufacturing-ready posture is why the $60 million funding is credible. The money isn't going toward speculative R&D. It's going toward manufacturing scale-up, customer deployments, and expanding product lines (the data center rack sidecar mentioned).

For supply chain observers, DG Matrix's success would validate silicon carbide semiconductor demand in a completely new application category. Si C is increasingly used in EV powertrains and industrial applications. Power infrastructure is another massive market.

Market Size and Opportunity Assessment

Quantifying the total addressable market (TAM) for solid-state transformers in data centers requires understanding several factors.

Global Data Center Power Market: There are roughly 8.6 million data centers globally, but only about 1,000 are hyperscale facilities (Amazon, Google, Microsoft, Meta, etc.). The hyperscale tier consumes roughly 20-30% of all data center electricity despite representing a tiny fraction of facilities. This tier is DG Matrix's primary target.

New Construction Rate: The data center industry is constructing roughly 5,000 to 8,000 MW of new capacity annually. This growth rate is accelerating due to AI demand. Each megawatt of new capacity requires power infrastructure. Even if solid-state transformers capture 10% of new construction, that's 500-800 MW annually, worth hundreds of millions in equipment sales.

Installed Base Retrofit: Existing data centers face increasing power constraints as they try to increase density. Retrofitting legacy power systems with Interport technology could address this installed base gradually over 10-15 years.

Global Electrification Market: DG Matrix's longer-term vision targets remote microgrids. The global electrification market addressing energy poverty is potentially larger than data centers. Governments and development organizations spend tens of billions annually on electrification projects.

EV Charging Infrastructure: Commercial charging stations face similar power routing challenges to data centers. The EV charging market is growing 40%+ annually, providing another potential application.

Conservative estimates suggest a $2-3 billion annual market for solid-state transformer devices in data centers alone by 2035, with potential for multiples of that in adjacent markets.

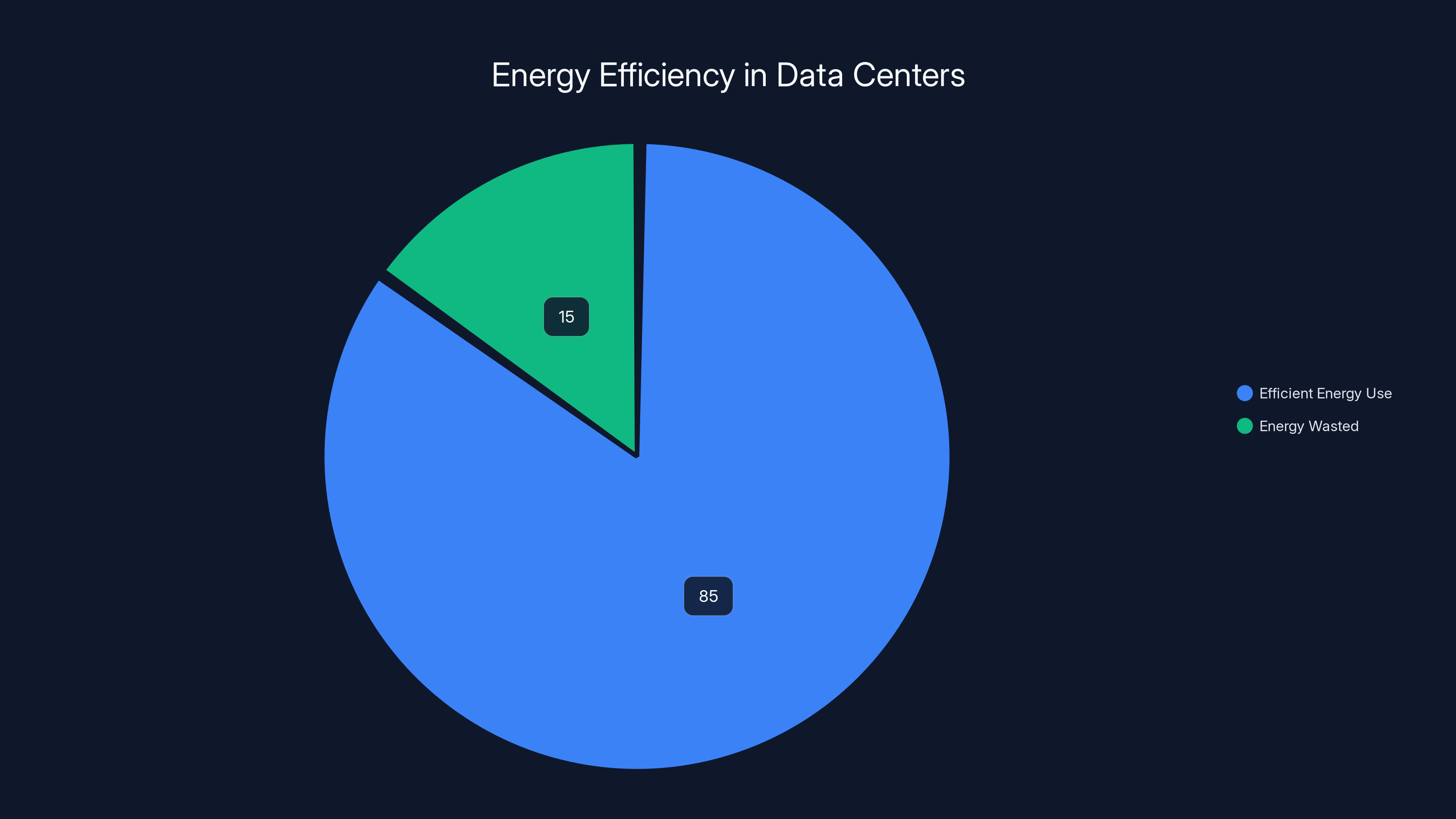

Traditional data centers operate at around 85% efficiency, wasting approximately 15% of electricity as heat. This inefficiency translates to significant financial and environmental costs.

Challenges and Risks: What Could Go Wrong?

Despite the compelling narrative, DG Matrix faces real challenges and risks worth considering.

Technology Adoption Risk: Enterprise infrastructure changes slowly. Even if Interport is technically superior, data center operators might resist adopting unproven technology from a startup. They prefer proven, established vendors. DG Matrix needs early customer successes that generate testimonials and case studies.

Manufacturing Scaling Risk: Going from dozens of units to hundreds or thousands requires manufacturing discipline. Quality issues or delivery delays would damage credibility. This risk is real; it's why the June 2026 timeline matters. Hitting that date proves manufacturing capability.

Competitive Response: Legacy power equipment manufacturers like ABB and Siemens have vastly more resources. If they prioritize solid-state transformers, they could outcompete DG Matrix through distribution advantages and established relationships. However, ABB's investment in DG Matrix suggests they're not viewing this as a competitive threat, at least not immediately.

Regulatory and Standards Challenges: Power equipment regulations exist for safety reasons. Meeting UL, IEEE, and IEC standards isn't optional. Any certification delays push back deployments and revenue. International standards vary by country, adding complexity for global expansion.

Semiconductor Dependency: DG Matrix depends on silicon carbide and gallium nitride semiconductor availability. If global demand for these devices increases sharply (which it will, given EV adoption), DG Matrix might face supply constraints and rising component costs.

Customer Financing: Buying a $2-3 million Interport device requires capital. If data center customers face financing constraints, deployment timelines could extend. This risk is lower given data center industry profitability, but it's not zero.

Long Sales Cycles: Enterprise infrastructure sales take 6-12 months from initial contact to purchase decision. DG Matrix's June 2026 shipping date suggests they have customers already committed, but scaling beyond these initial deployments will take time.

The Broader Energy Transition Story

DG Matrix's technology matters beyond just data center economics. The company is part of a larger shift in how we manage electricity in a renewable-heavy future.

Traditional power systems were designed for centralized generation (large power plants), long-distance transmission, and centralized control. This architecture worked fine when demand was predictable and generation was stable.

But renewable energy is distributed, variable, and increasingly local. Wind farms and solar installations pop up everywhere. Battery systems store energy locally. Electric vehicles act as mobile batteries. Data center demands fluctuate with computing loads.

Managing this complexity requires technology that can intelligently route power from diverse sources to diverse loads in real time. Solid-state transformers are a foundational piece of this puzzle.

Other companies are working on parallel pieces: Stem, Fluence, and others provide software for energy management. Tesla, Eos, and others provide battery systems. Companies like Ener Tech develop advanced refrigeration for cold storage. But the physical infrastructure connecting all these pieces (the transformers, switches, and distribution equipment) needs updating too. That's where DG Matrix comes in.

If DG Matrix succeeds, they're not just building a profitable company. They're enabling the entire renewable energy transition by making distributed power management practical and economical.

Investor Rationale and Strategic Implications

Looking at the investor syndicate reveals why DG Matrix attracted such strong backing.

Engine Ventures sees a generational opportunity in deep tech that solves infrastructure problems. They've invested in companies like Commonwealth Fusion Systems (fusion energy) and others tackling foundational challenges. DG Matrix fits this pattern.

ABB's investment is particularly interesting. ABB manufactures traditional transformers and power equipment. Their $60M fund participation signals they see solid-state transformers as inevitable. Better to invest and learn than to be disrupted. This is strategic investment disguised as VC.

Clean energy investors (Clean Energy Ventures, Helios) see DG Matrix as infrastructure enabling renewable energy integration. They've likely analyzed that solid-state transformers accelerate renewable adoption by removing a bottleneck. The faster renewable energy becomes practical, the better for their portfolio.

Chevron Technology Ventures is subtler. Chevron invests in technologies that could eventually displace their core business. But they're also pragmatic. They see energy transition as inevitable and want insight into how technology is changing. DG Matrix investment gives them exposure to power infrastructure evolution.

The syndicate composition suggests DG Matrix's success directly aligns with multiple investor theses: infrastructure innovation, renewable energy transition, climate tech, and energy security. When a startup's mission aligns with this many investor priorities, funding typically follows.

Lessons for Infrastructure Innovation

DG Matrix's story offers lessons for anyone thinking about infrastructure innovation.

First: Infrastructure problems provide durable competitive advantages. Once you solve a foundational problem (power distribution), you're embedded in customer operations. Switching costs are high. DG Matrix won't face simple commoditization if they execute well.

Second: Strategic investor backing matters in infrastructure. ABB's participation is as valuable as the capital. It signals credibility to enterprise customers and provides potential pathways to distribution and manufacturing.

Third: Clear timelines and shipping dates matter. DG Matrix isn't promising future breakthroughs. They're shipping in June 2026. This specificity builds credibility and differentiates them from companies still pursuing theoretical advantages.

Fourth: Adjacent markets provide growth beyond initial TAM. DG Matrix's pivot from data centers to EV charging to microgrids shows how infrastructure technology can address multiple problems. This versatility justifies larger funding and positions the company for longer-term growth.

Preparing Data Centers for Solid-State Transformer Adoption

If you're a data center operator considering DG Matrix or similar technologies, what should you evaluate?

Power Audit First: Baseline your current power efficiency. Install monitoring on your legacy power systems to understand losses at each conversion stage. You can't optimize what you don't measure. Tools like power quality analyzers from Fluke, Hioki, or others provide detailed insights.

Renewable Energy Alignment: If you have renewable energy commitments or want to reduce grid dependence, solid-state transformers enable this. Calculate your renewable integration costs with legacy equipment. Compare this to estimated costs with Interport.

Space Constraints: If you're power-limited by space (you can't fit more power distribution equipment in your facility), Interport's 75% space reduction becomes compelling. Calculate your space recovery value at your data center's cost per square foot.

Reliability Requirements: If your service levels demand extremely high power reliability, evaluate whether Interport's reduced component count and predictive monitoring improves your position.

Financial Payback: Calculate the efficiency savings using your actual electricity costs and power consumption. For most data centers, payback under 4-5 years is acceptable. Beyond that, the decision becomes more nuanced.

Long-term Vision: Where is your data center headed? If you're planning major expansions or density increases, new power infrastructure is unavoidable. Getting solid-state transformers as part of that expansion makes sense. If you're consolidating, it's less critical.

Conclusion: The Future of Data Center Power Is Here

DG Matrix's $60 million Series A funding represents more than just a startup victory. It signals a fundamental shift in how the world manages electricity in a renewable-heavy, data-hungry future.

Solid-state transformers eliminate a century of power infrastructure baggage. They're smaller, more efficient, more intelligent, and more reliable than traditional equipment. They enable seamless renewable energy integration. They recover vast amounts of data center floor space. They reduce power waste by one-third or more.

The numbers are compelling. A typical hyperscale data center can save millions annually on electricity costs alone, not counting reliability improvements and space recovery. When you stack these benefits, the economic case for solid-state transformers becomes overwhelming.

DG Matrix isn't the only company pursuing this technology, but they're clearly the furthest along. Shipping in June 2026 while competitors are still in R&D phase represents significant progress. The investor syndicate—combining climate tech specialists, legacy equipment manufacturers, and infrastructure-focused VC—signals broad confidence in the market opportunity.

What makes this particularly important is the timing. Data center power demands are accelerating. AI training and inference are driving new facility construction at record rates. Renewable energy commitments are becoming mandatory, not optional. Every new data center built in the next five years will need to solve the power distribution problem. Why not solve it with 21st-century technology instead of 1920s equipment?

For data center operators, the question isn't whether solid-state transformers will become standard. It's when. For investors, the question is which companies in this space will win long-term. For energy infrastructure enthusiasts, the question is how quickly this technology scales beyond data centers into the microgrids and electrification projects that will define the energy transition.

DG Matrix's journey from engineering breakthrough to $60 million Series A to first customer deployments in June 2026 is a case study in how deep tech infrastructure innovation happens in the modern era. It's not fast. It's not cheap. But when it works, it transforms industries.

The data center industry is one step closer to smarter power management. If DG Matrix executes on their roadmap, the broader global energy system might eventually follow.

FAQ

What exactly is a solid-state transformer?

A solid-state transformer is an electrical device that uses semiconductor power electronics (silicon carbide or gallium nitride chips) instead of magnetic coils to convert voltage levels and manage power flow. Unlike traditional transformers that work through electromagnetic induction and are relatively passive, solid-state transformers are actively controlled by software, allowing them to intelligently route power from multiple sources in real time. They offer 95-98% efficiency compared to 82-90% for legacy systems, consume 75% less space, and generate significantly less heat.

How does DG Matrix's Interport device work in real-world data center operations?

The Interport aggregates power from multiple sources (solar panels, batteries, grid connection) on its input side and intelligently distributes it to data center racks on the output side. The device samples voltages and currents thousands of times per second, using software algorithms to optimize which power source feeds which load at any given moment. For example, during daytime when solar generation exceeds demand, excess power might charge batteries. During peak evening hours when grid rates are expensive, the Interport prioritizes battery discharge to reduce grid power consumption. All this happens automatically without manual intervention, and the device provides 2.4 megawatts of connection capacity in a device just 4 feet by 4 feet.

What are the main financial benefits of switching to solid-state transformer technology?

The primary financial benefits include efficiency savings (reducing power waste by roughly 10-12 percentage points, worth

Why did legacy data center power systems become outdated despite working for decades?

Traditional power infrastructure was designed for centralized power generation, long-distance transmission, and predictable demand patterns. But modern data centers face different challenges: extremely dense server racks requiring massive instantaneous power; increasing requirements to integrate variable renewable energy sources like solar and wind; space constraints in expensive urban locations; and rapidly changing workloads. Legacy equipment handles these requirements inefficiently because it wasn't designed with these constraints in mind. Additionally, equipment like uninterruptible power supplies (UPS) were designed for equipment failure mitigation through redundancy, introducing significant inefficiency. Solid-state transformers eliminate this redundancy by simply being far more reliable through simplification.

What makes the June 2026 deployment timeline significant?

June 2026 deployment is significant because it indicates DG Matrix has moved beyond the R&D phase and actually solved manufacturing, regulatory certification, and operational challenges. Most startups claiming to disrupt infrastructure technology never ship production units. DG Matrix's specific deployment timeline demonstrates they have manufacturing partners in place, regulatory certifications likely complete or imminent, and customers already committed to purchase. This distinguishes them from competitors still in theoretical or prototype phases. For investors, it proves the company has executable strategy, not just good ideas. For customers, it means they can plan actual deployment timelines rather than waiting indefinitely.

How does DG Matrix's partnership with Exowatt demonstrate the technology's practical application?

Exowatt builds solar-plus-storage containers that generate renewable power for data centers without grid connection. Traditionally, integrating this power into a data center required complex voltage conversion because the containers generate power at one voltage while data center infrastructure expects another. With DG Matrix's Interport, Exowatt simply plugs its containers into the device. The Interport handles all voltage conversion, power routing, and load balancing automatically. This partnership demonstrates several key points: first, that solid-state transformers simplify complex power integration problems; second, that the technology enables renewable energy adoption by reducing integration costs; and third, that the market is actively seeking solutions like DG Matrix's, as evidenced by Exowatt's willingness to integrate with them.

What are the biggest technical challenges DG Matrix had to overcome in building the Interport?

Key technical challenges included managing 2.4 megawatts through semiconductor devices requiring sophisticated switching coordination, developing control software that samples inputs and outputs thousands of times per second to optimize power routing in real time, managing thermal dissipation from 50+ kilowatts of continuous losses through liquid cooling systems, ensuring electromagnetic compatibility so the device doesn't interfere with sensitive data center IT equipment, meeting complex regulatory standards (UL, IEEE, IEC certifications), and solving manufacturing processes to build thousands of identical units with high quality consistency. Each of these areas represents 6-12 months of specialized engineering work, explaining why the technology took a decade or more to develop and why the $60 million Series A funding is credible.

How could DG Matrix's technology eventually expand beyond data centers?

DG Matrix's longer-term roadmap includes power distribution for EV charging stations (which face similar source routing challenges as data centers) and micro-grid infrastructure for remote communities without grid connection. In these applications, the Interport would intelligently route power from solar panels, wind turbines, and batteries to provide reliable 24/7 electricity to remote villages, medical clinics, or industrial facilities. This addresses energy poverty affecting hundreds of millions globally. The underlying physics and technology is identical to data center applications, but the market opportunity is arguably larger. Companies and development organizations spend tens of billions annually on rural electrification projects. If DG Matrix can cost-effectively deploy Interport technology in this space, the total addressable market could reach $20+ billion globally, dwarfing the data center application.

What should data center operators consider when evaluating solid-state transformer adoption?

Data center operators should first conduct a power audit to establish baseline efficiency and identify specific losses. Second, calculate your actual electricity costs multiplied by your usage patterns to quantify efficiency savings in your specific location (electricity costs vary dramatically by region). Third, assess your space constraints—if you're power-limited by physical space, the Interport's 75% space reduction becomes compelling. Fourth, evaluate your renewable energy integration goals and costs. Fifth, calculate financial payback period (most infrastructure investments targeting 4-5 year payback). Finally, assess your long-term data center trajectory—are you expanding significantly, consolidating, or staying flat? This determines urgency for power infrastructure upgrades. Most large data center operators should model the DG Matrix scenario against their current plans to quantify the financial opportunity.

Final Thoughts on Data Center Infrastructure Innovation

DG Matrix's funding and June 2026 deployment timeline mark a turning point in data center infrastructure innovation. For over a century, power distribution in data centers has relied on equipment fundamentally unchanged from early 20th-century designs. Solid-state transformers represent a genuine shift, not an incremental improvement.

What's particularly noteworthy is that this innovation is happening in a mature, established industry. Data centers are not new. Power infrastructure is not new. Yet here we are, watching an infrastructure company raise $60 million to deploy technology that's more efficient, more compact, more intelligent, and more reliable than what came before. That's how transformative innovation works in mature industries—not through entirely new ideas, but through applying modern semiconductor technology and software control to very old problems.

For companies building infrastructure, for investors backing technical innovation, and for the energy transition more broadly, DG Matrix's success or failure will provide important signals about whether established infrastructure industries can be successfully disrupted from the startup model or if they'll resist change until legacy manufacturers eventually innovate.

The next few years will be telling.

Key Takeaways

- DG Matrix's 3-4 million annual savings for large data centers

- Solid-state transformers reduce power conversion equipment footprint by 75% (one 4x4 device replaces two 4x30 skids), recovering valuable data center real estate

- Technology enables seamless renewable energy integration by intelligently aggregating power from solar, batteries, and grid, eliminating complex legacy equipment

- June 2026 customer deployment timeline demonstrates manufacturing readiness and validates business model with actual revenue-generating customers

- Strategic investor syndicate (Engine Ventures, ABB, Chevron Ventures, Clean Energy Ventures) signals broad confidence in $2-3 billion+ addressable market in data centers alone

- Long-term roadmap extends beyond data centers to EV charging infrastructure and remote microgrids, potentially addressing global energy poverty with distributed renewable systems

Related Articles

- Mesh Optical Technologies $50M Series A: AI Data Center Interconnect Revolution [2025]

- AI Data Centers Hit Power Limits: How C2i is Solving the Energy Crisis [2025]

- Microsoft's High-Temperature Superconductors for Data Centers [2025]

- Microsoft's Superconducting Data Centers: The Future of AI Infrastructure [2025]

- Meta, NVIDIA Confidential Computing & WhatsApp AI [2025]

- Holographic Tape Storage Finally Meets Real-World Deployments in 2025 [2025]

![DG Matrix Raises $60M: Solid-State Transformers Transform Data Center Power [2025]](https://tryrunable.com/blog/dg-matrix-raises-60m-solid-state-transformers-transform-data/image-1-1771418323099.jpg)