Introduction: The Memory Market Collision Course

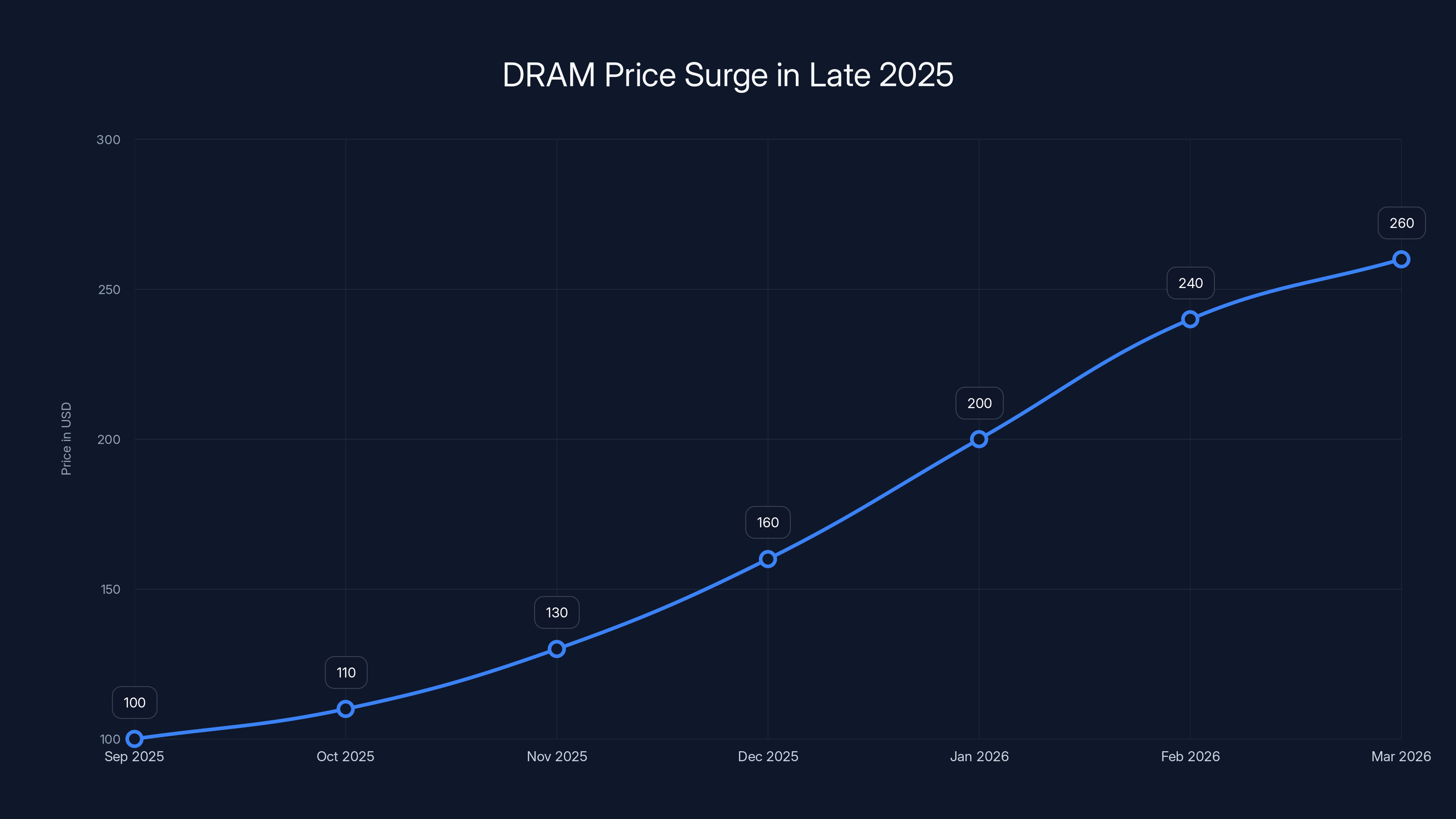

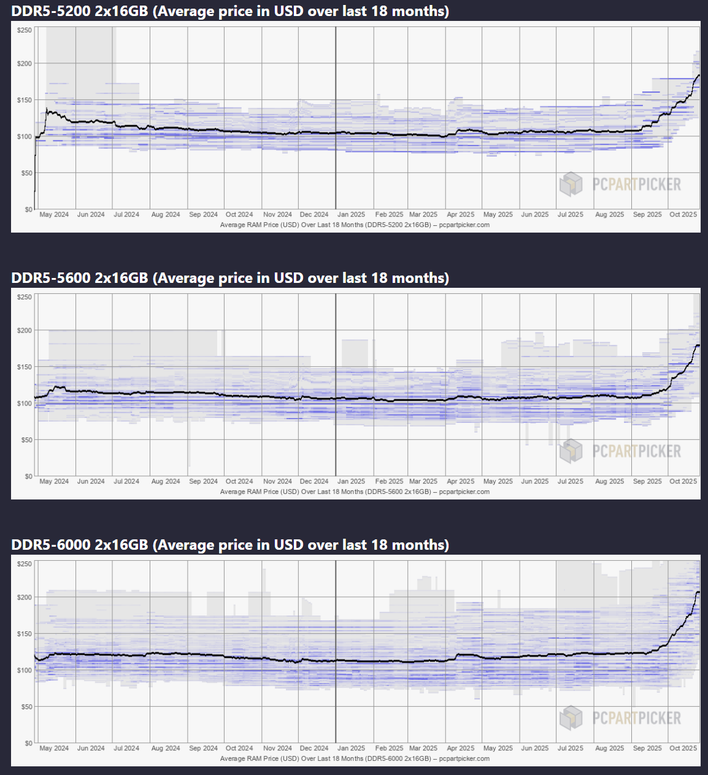

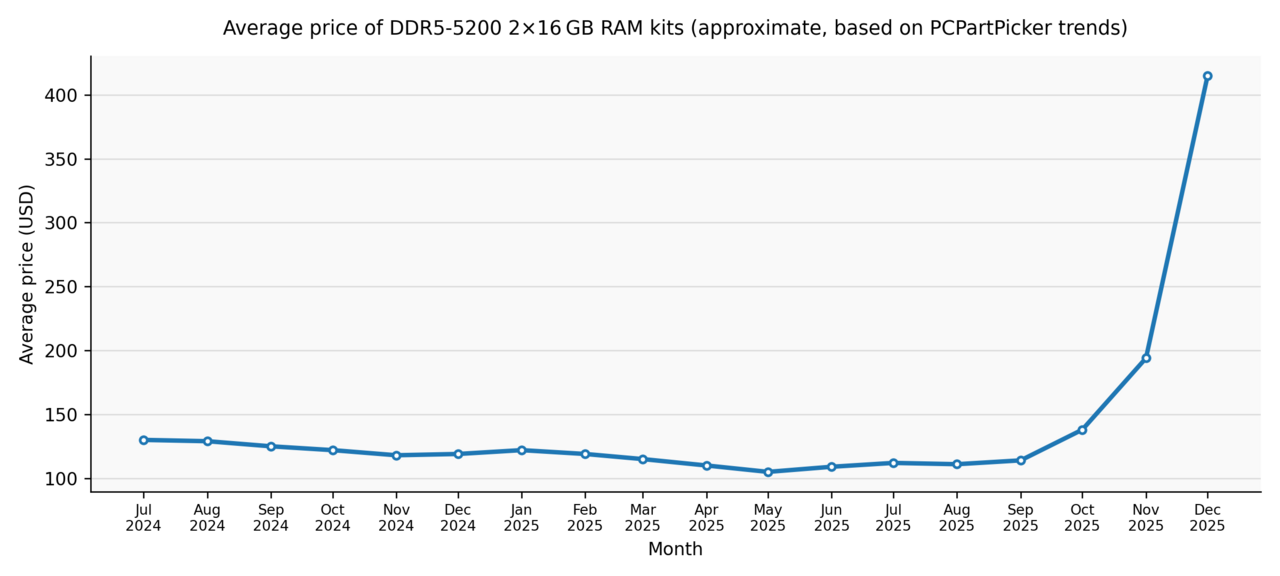

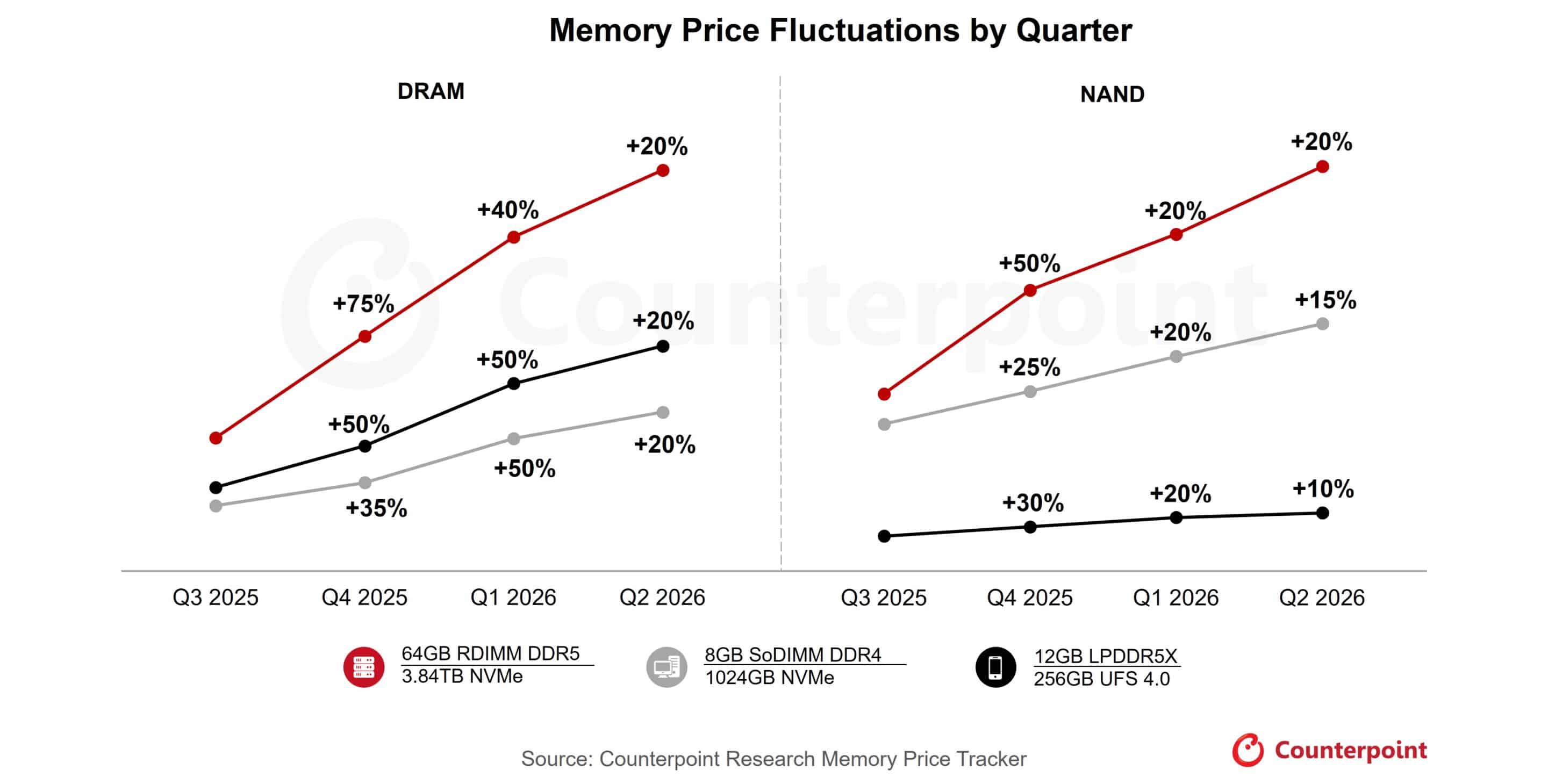

Something strange happened in the memory market during the final months of 2025. After spending most of the year in relative stability, DRAM prices suddenly shifted into overdrive. High-capacity DDR5 modules that cost a certain amount in September were dramatically more expensive by December. And according to industry forecasts, things are only getting worse.

The culprit? AI infrastructure is consuming memory at unprecedented rates.

When companies like OpenAI, Google, and Meta scaled their AI training clusters, they didn't just need more servers. They needed servers absolutely packed with memory. High-capacity DDR5 RDIMM modules, the kind that sit in data centers, became scarcer. Suppliers made a strategic choice: allocate wafer production capacity toward the servers generating the most revenue per unit rather than toward consumer PC memory.

This pivot created a ripple effect. Available supply for consumer-grade DDR5 modules tightened. Retailers couldn't stock what they couldn't source. Prices crept upward. Then they accelerated.

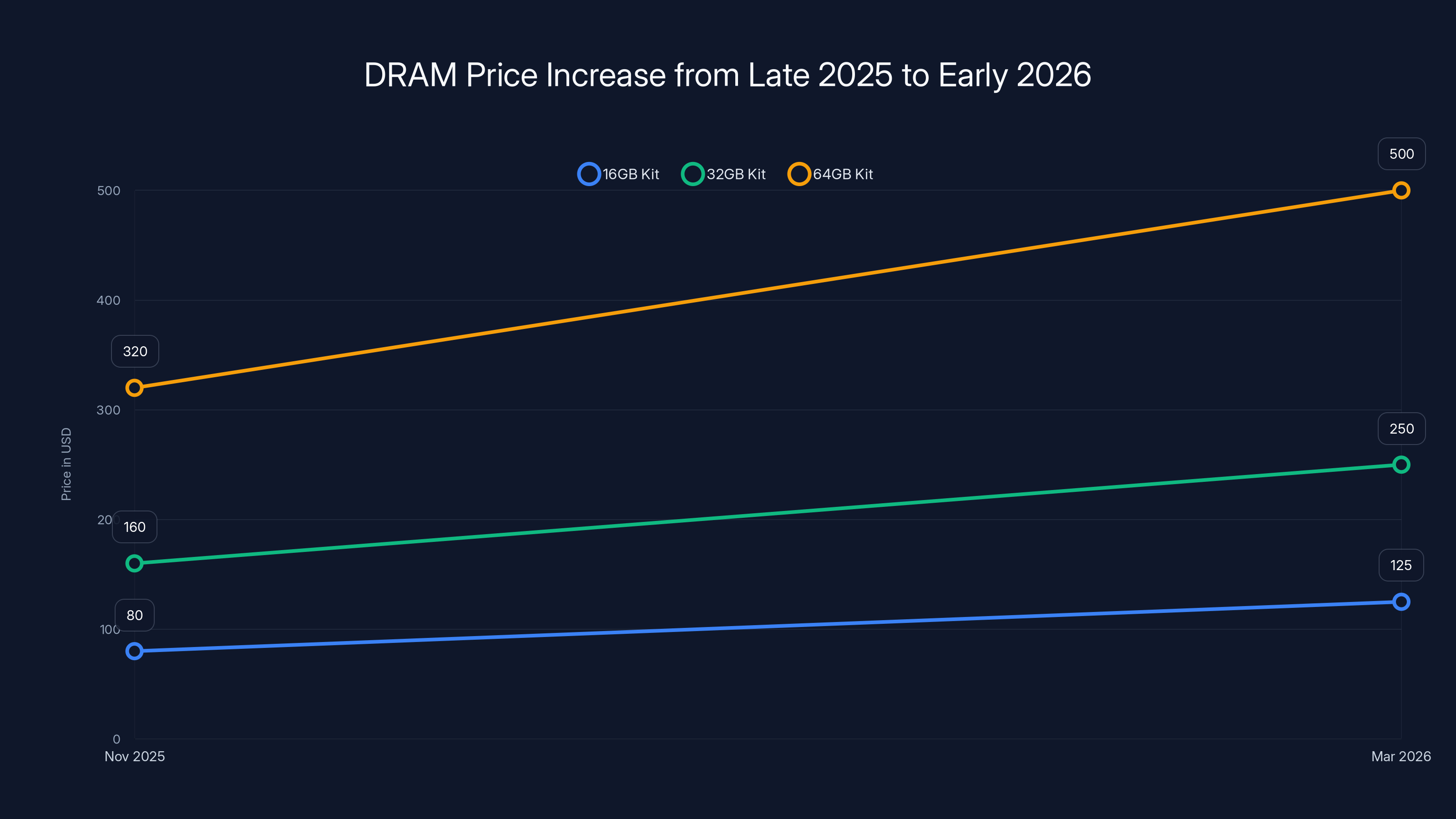

By early 2026, industry analysts were predicting something remarkable: a 60% price increase in Q1 alone. Some were even joking about $500 32GB DDR5 modules becoming reality. The jokes masked a genuine problem. PC builders faced a genuine constraint. Gamers, content creators, and everyday users contemplated whether now was the right time to upgrade. For many, the answer became a definitive no.

This isn't a temporary blip. The dynamics creating this price surge are structural, not cyclical. As long as AI infrastructure expansion continues at current velocity, as long as data centers keep ordering memory-dense servers, consumer DRAM availability will remain constrained. And constrained supply creates room for sustained price elevation.

Understanding what happened requires looking at three interconnected forces: how AI deployment changed memory consumption patterns, how suppliers responded to this shift, and what the data actually shows about where prices are headed. The story is more complex than simple supply scarcity. It's about how the entire semiconductor supply chain is being reorganized around AI infrastructure priorities.

TL; DR

- AI server demand absorbed 60%+ of DRAM wafer capacity in late 2025, leaving consumer DDR5 modules in tight supply

- Q1 2026 contract prices are forecast to jump 60%, with sustained elevation expected through the rest of the year

- Server-class RDIMM prices increased more sharply than consumer SODIMM prices, confirming the supply shift was intentional

- PC memory may experience $500+ pricing for 32GB modules if forecasts hold, pricing out typical upgraders

- The price surge reflects demand constraint, not healthier supply conditions recovering after the increase

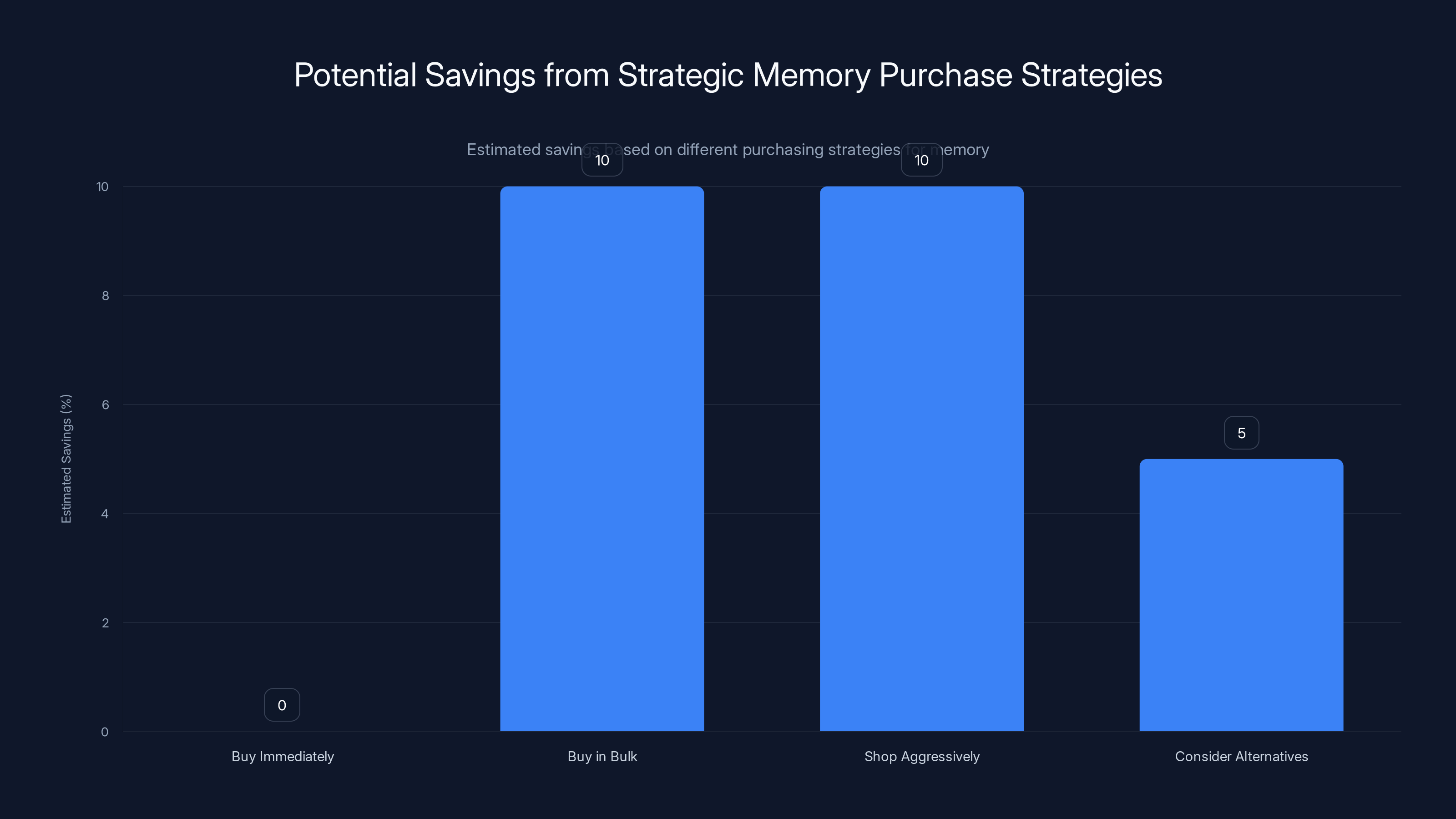

Estimated savings from different strategies show bulk buying and aggressive shopping can save up to 10%. Immediate purchase avoids future price increases. Estimated data.

How AI Reshaped DRAM Supply Chains

The AI Training Infrastructure Explosion

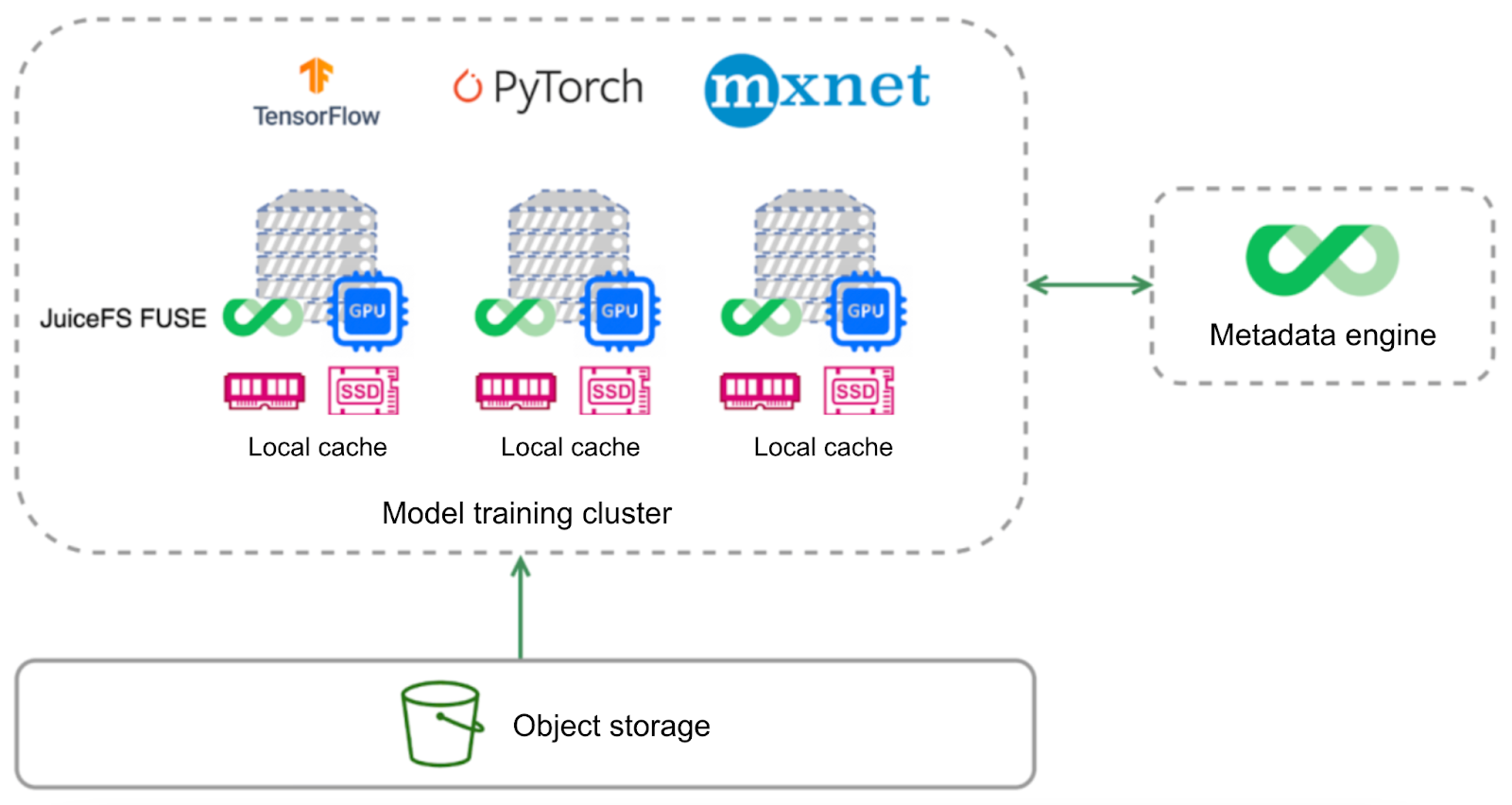

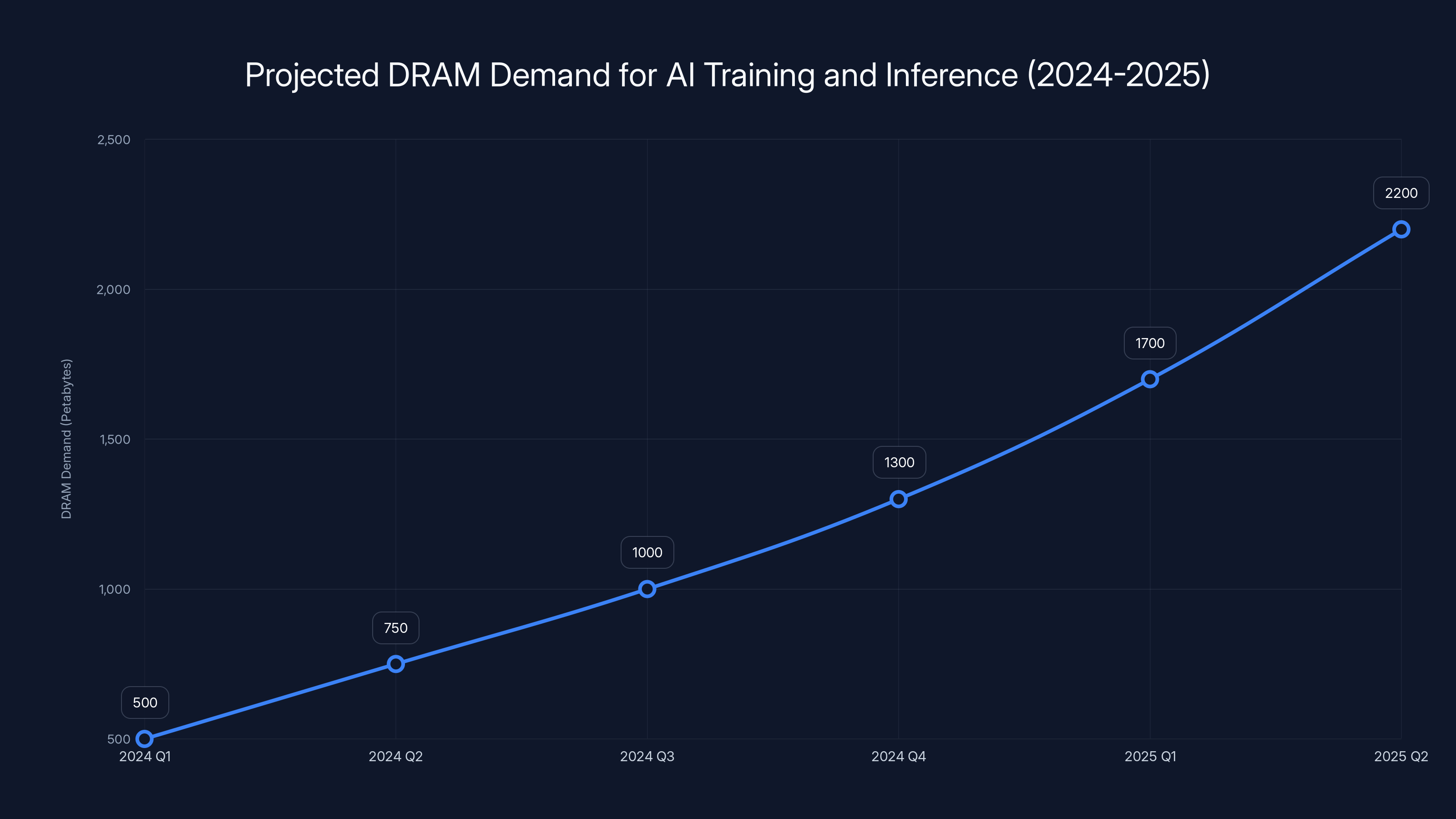

Understanding the memory shortage requires zooming out first. In 2024 and early 2025, generative AI moved from research demo to production infrastructure. Companies weren't just experimenting anymore. They were building massive training clusters and deploying inference engines at scale.

An NVIDIA H100 GPU with 80GB of HBM memory can process training batches efficiently. But you need multiple GPUs, coordinated across multiple nodes. Each node needs bandwidth, interconnect, and system memory. A single GPU server might hold 512GB to 2TB of DDR5 memory just to support efficient training workflows. When you're building training clusters with hundreds or thousands of nodes, memory consumption becomes astronomical.

Inference deployments compound the problem. A large language model running inference requires enough memory to hold the entire model weights, activations, and key-value cache. Llama 3 variants with 70B parameters demand enormous amounts of memory to achieve reasonable throughput. Multiply that across regional inference centers, and memory consumption scales into the exabyte territory.

The math is straightforward. More AI deployments equals more data center servers. More servers means higher memory demand. And memory, unlike processors that can be manufactured at multiple foundries, comes from a concentrated supplier base with fixed wafer capacity.

Supplier Allocation Strategies

Memory manufacturers like SK Hynix, Samsung, and Micron face a straightforward economic decision. They have limited wafer capacity. They can allocate that capacity toward PC memory modules sold at

But suppliers didn't just passively let this happen. They made active allocation decisions. Production equipment was configured for server-grade modules. Wafer starts were directed toward RDIMM and LRDIMM production. Consumer-grade SODIMM production, which requires different testing parameters and quality assurance procedures, received lower priority.

These allocation decisions weren't made in isolation. Suppliers coordinated with large OEM customers like Dell, Hewlett Packard, and Super Micro Computer to ensure server configurations would be well-stocked. This wasn't malice toward PC builders. It was business logic. One customer ordering 50,000 server nodes with 2TB of memory each commands more attention than millions of individual consumers.

Samsung and SK Hynix both reported in earnings calls during this period that server memory demand was unprecedented. Micron executives noted that high-capacity DDR5 modules were sold out faster than they could manufacture. The shortage was real, and it was intentional—suppliers were choosing to serve the highest-revenue segments first.

Contract vs. Spot Price Divergence

One of the strangest aspects of the 2025-2026 memory situation was that retail prices seemed somewhat stable even as deeper market signals screamed about impending shortages. Why?

The answer lies in the difference between contract prices and spot prices. Large manufacturers negotiate long-term pricing with memory suppliers. These contracts lock in pricing for quarters or years. They're the real signal of what's happening in the supply chain. Retail prices, meanwhile, are what consumers see at Amazon or Newegg. They lag the true market dynamics by weeks or months.

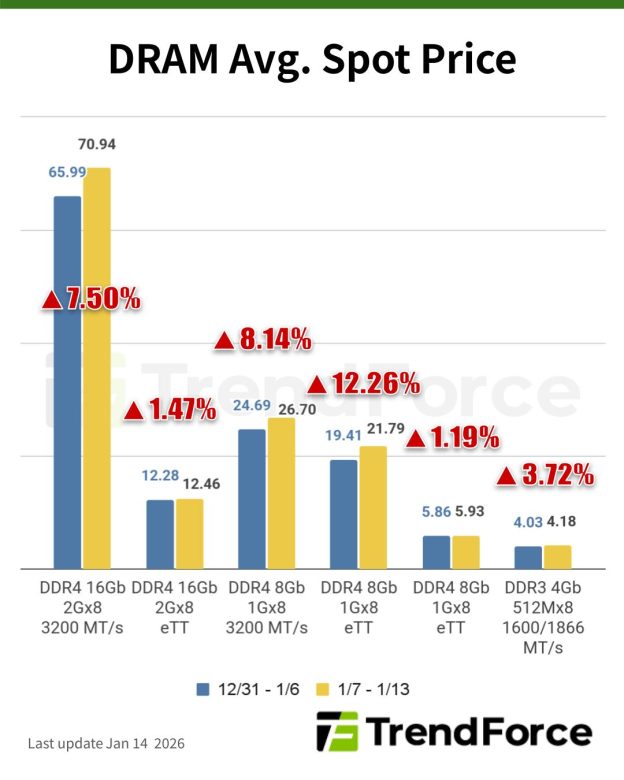

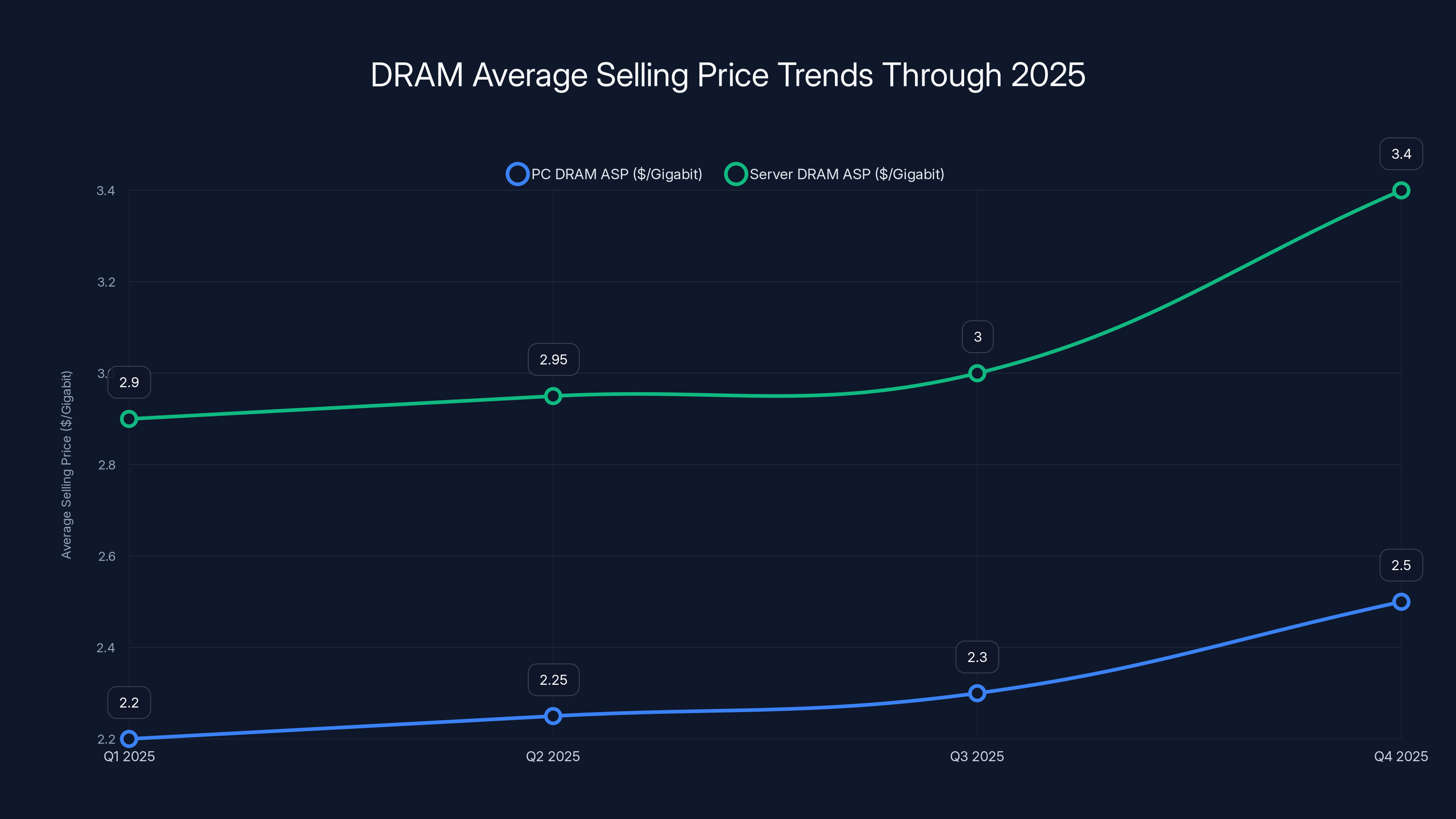

Trend Force data showed that through Q3 2025, both PC and server DRAM average selling prices per gigabit barely moved. The market looked stable. Then Q4 arrived, and contract prices for both PC and server memory began rising simultaneously. But server prices climbed more steeply.

This divergence between contract and retail pricing created confusion. Casual observers looking at retail memory prices in early December 2025 thought things were fine. Deeper analysis of contract pricing revealed the true story: suppliers were tightening terms, increasing prices, and preparing the market for significant cost elevation.

By January 2026, retail prices finally caught up to reality. 32GB kits that sold for

DRAM prices increased significantly from late 2025 to early 2026, with 16GB kits rising from

The Q1 2026 Price Jump: What the Data Actually Shows

Forecast Models and Their Implications

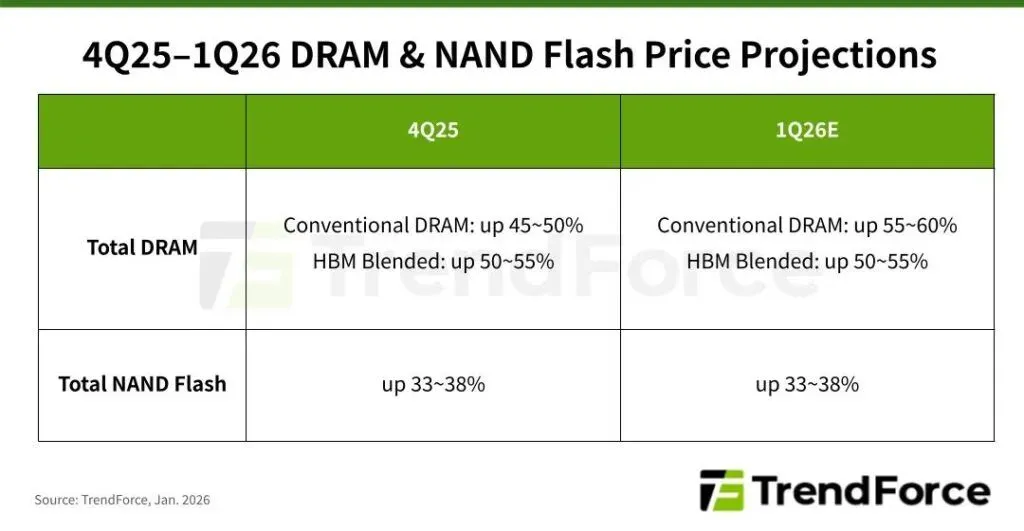

Trend Force, which tracks average selling prices through manufacturers, is projecting that PC DRAM will increase by approximately 60% in Q1 2026. Let's break down what this number actually means, because it's the kind of statistic that sounds catastrophic without context.

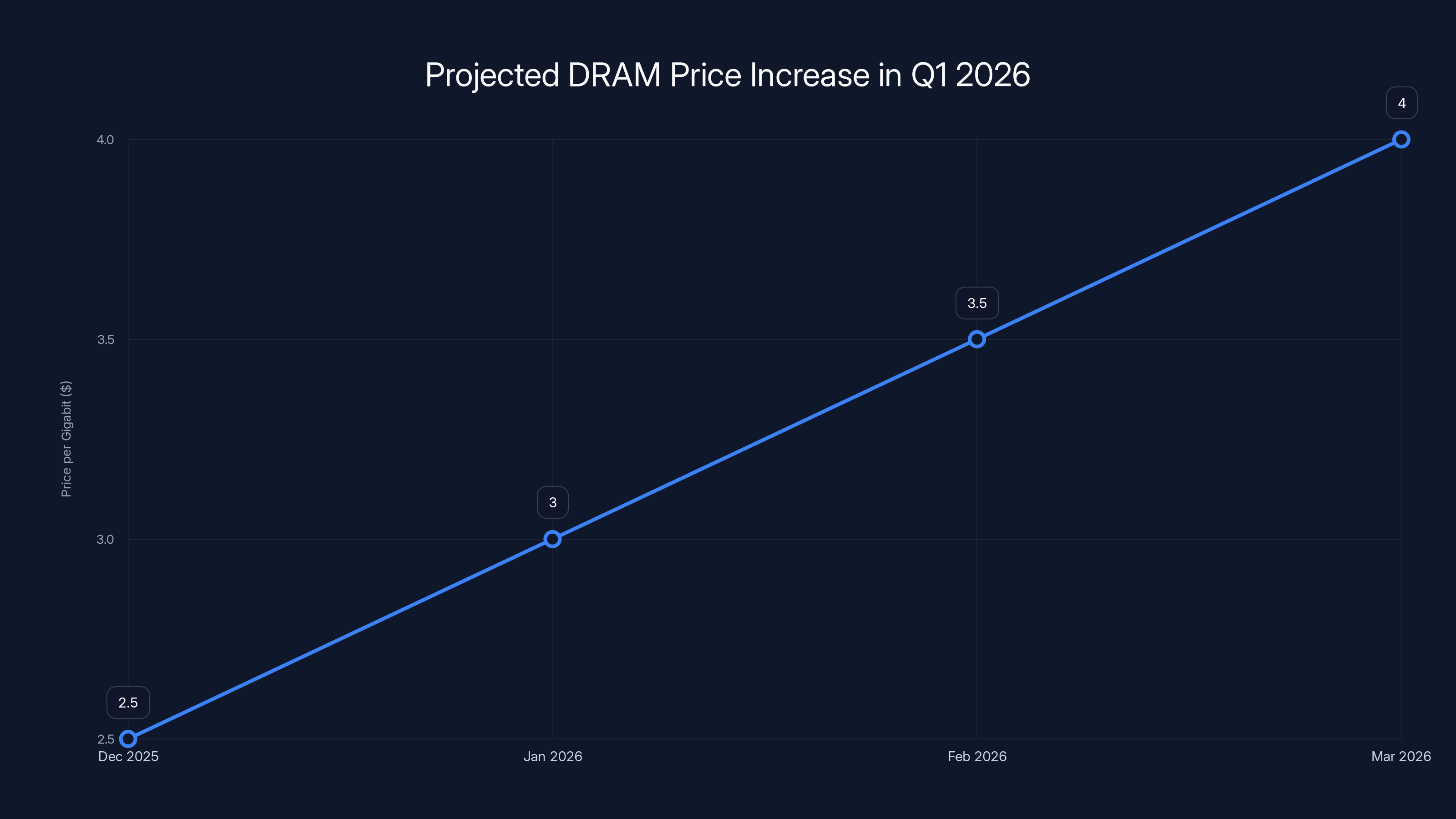

If average selling price per gigabit in December 2025 was around

These numbers aren't hypothetical. Retailers were already seeing precursors to this shift by mid-January 2026. Memory prices were creeping upward daily. The 60% figure wasn't some wild worst-case scenario. It was the baseline expectation from the industry's primary data aggregator.

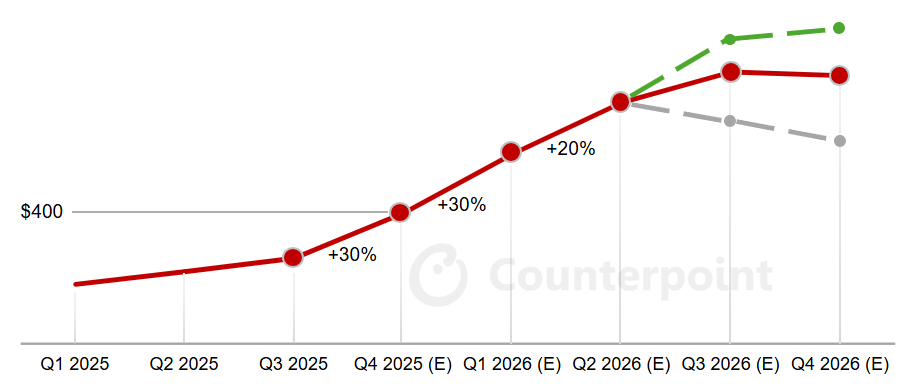

What makes this particularly painful is that 60% is just Q1. Trendforce forecasts continued increases through the remainder of 2026, albeit at a slower pace. The projection shows no reversal point where prices correct. Instead, pricing stabilizes at this higher level. Both PC and server DRAM settle into a sustained higher range, with server modules maintaining a persistent premium.

The critical insight here is that the forecast doesn't show prices coming down. It shows elevated prices persisting. This matters because it changes the consumer decision calculus. If you're thinking "I'll wait for prices to normalize," you're potentially waiting through all of 2026.

Why the Forecasts Probably Aren't Wrong

Industry forecasts often miss. Sometimes dramatically. Predicting semiconductor markets is notoriously difficult. There are inventory cycles, demand shocks, geopolitical surprises. Why should anyone believe Trendforce's 60% prediction?

The answer is that the prediction is grounded in observable facts. Wafer capacity is allocated. That reallocation doesn't happen quickly or easily. Memory manufacturing requires dedicated production lines configured for specific modules. Changing that configuration takes months and substantial capex investment. Suppliers aren't going to rapidly reconfigure lines to produce more consumer DRAM if they're making record margins on server DRAM.

Second, AI infrastructure spending isn't slowing down. The major cloud providers and AI companies are accelerating data center expansion, not pulling back. Every quarterly earnings call from Meta, Google, and others discusses increased capex for AI infrastructure. That spending flows directly into server orders, which flows directly into memory demand.

Third, the price increase creates a natural constraint on demand that allows prices to stay elevated. If DRAM were doubling in price but everyone kept buying it at the same volume, suppliers would have reason to increase production. But elevated prices suppress demand. Consumers delay upgrades. Small and medium businesses postpone infrastructure refreshes. This reduced demand lets suppliers maintain pricing without creating backlog risk.

The forecasts assume these dynamics persist through 2026. Based on the underlying supply constraints and demand patterns, that assumption seems reasonable.

Supply Chain Mechanics: Why Servers Win Over PCs

Profitability Per Wafer Output

Underneath all the surface-level supply shortage talk is a simple economic truth: memory suppliers make more money allocating capacity toward server modules than consumer modules.

Consider the math. A 16GB consumer DDR5 SODIMM kit contains 128 gigabits of memory and sells at retail for roughly

Both require similar wafer capacity. The server module returns 20x more revenue to the supplier. Once you understand that basic ratio, the allocation decision becomes straightforward. If you're a memory manufacturer and you have constrained capacity, you allocate to the product generating the most margin per unit of production.

This profit-per-unit dynamic creates a structural pressure toward server modules that doesn't disappear when consumer demand increases. You'd need consumer memory pricing to increase dramatically to make it as profitable as server memory. And that's exactly what happened in late 2025—prices increased until the margin per unit began to approach server memory levels.

OEM Preference and Contractual Lock-In

The largest server manufacturers—Dell, Hewlett Packard, Lenovo (in China)—have enormous purchasing power. They also have long-term supply agreements with memory manufacturers. These agreements often include minimum purchase commitments, preferred pricing, and allocation guarantees.

When AI demand surged, these OEMs simply increased their orders. Their existing contracts gave them confidence that they could get supply. Smaller system integrators and independent module makers? They got whatever was left.

This created a cascade effect. Large OEMs secured supply. They built servers, sold them to cloud companies and enterprises deploying AI. Cloud companies expanded capacity. They ordered more servers. Demand created a virtuous cycle for the entire server ecosystem, while consumer DRAM got whatever capacity didn't get consumed upstream.

Memory suppliers aren't stupid about this. They understand the dynamics. Large OEMs have negotiating leverage that individual consumers don't possess. Keeping major customers happy is worth far more than the revenue from consumer sales. If Dell says "we need 10 million DIMMs for our next quarter's production," that's a guarantee. If consumer demand for memory is high, that's a probability.

Production Line Configuration Requirements

One aspect of memory manufacturing that's often overlooked is that different module types require different production configurations. A consumer SODIMM and a server RDIMM aren't just different products off the same assembly line. They require different testing parameters, different reliability standards, different burn-in procedures.

Reconfiguring a production line from SODIMM to RDIMM production takes time and involves downtime. During that reconfiguration, you're not producing anything. The opportunity cost is significant. So suppliers, facing constraint, have strong incentive to keep lines configured for the product type with highest demand and margin.

If you spend three weeks reconfiguring a line to produce consumer DRAM, you need to be confident that consumer demand is strong enough to justify that downtime and the reduced efficiency while the line comes back up to speed. Elevated consumer DRAM pricing in early 2026 was sufficient proof of demand, but suppliers had already made their allocation decisions for the quarter. Reconfiguration wouldn't happen until Q2 at the earliest, creating a lag between rising consumer demand and increased supply.

The line chart illustrates the stability of DRAM ASPs for PC and Server through Q1-Q3 of 2025, followed by a sharp increase in Q4, particularly for Server DRAM, indicating strategic supplier allocation.

The Data: What Trend Force Numbers Actually Reveal

Average Selling Price Patterns Through 2025

Trend Force's average selling price data, measured in dollars per gigabit, tells a specific story when you examine it carefully. Through most of 2025, from Q1 through Q3, both PC and server DRAM ASPs (average selling prices) remained relatively flat. PC memory ASPs hovered around

That stability masked underlying tightness. Prices weren't moving because supply and demand were in equilibrium. They were moving because suppliers were maintaining pricing discipline while supply constraints tightened. It was the calm before rapid acceleration.

Then Q4 arrived. Both PC and server ASPs began rising almost simultaneously, but at different rates. Server DRAM ASPs climbed more steeply, confirming that suppliers were directing capacity toward server modules. PC DRAM prices rose more gradually, but they rose nonetheless.

The divergence between the two curves is the crucial insight. If this was a broad-based supply shortage affecting both segments equally, you'd see parallel price increases. Instead, you see server prices accelerating more sharply, indicating intentional allocation rather than general scarcity.

What Flat Q1-Q3 Pricing Means

The fact that memory prices stayed relatively flat through most of 2025 is sometimes interpreted as evidence that everything was fine. That's a misreading. Flat pricing with tightening supply suggests supplier discipline and pricing power.

Memory manufacturers weren't cutting prices to move inventory. They were holding pricing steady while their inventory position tightened. This is exactly what happens when supply is constrained. You don't see prices collapse. You see prices hold at high levels while availability deteriorates.

If you were shopping for memory in June 2025, it was available. It seemed like normal times. But underneath, supply chains were tightening. Wafer allocation was shifting. Inventories were declining. The stability was illusory—a snapshot of a moment before the shift became visible in consumer pricing.

This matters because it challenges the common interpretation that "prices were stable, so there was no real shortage." Real shortages often don't show up in average prices first. They show up in availability, allocation, and then later in pricing.

The Q4 Inflection Point

The real story emerges in Q4 2025. Both PC and server ASPs begin rising in October-November. The movement accelerates into December. The inflection point represents the moment when supplier allocation decisions translated into visible pricing signals.

Trend Force projected that this movement would continue into Q1 2026 with the 60% increase mentioned earlier. That projection was based on contract pricing signals—what suppliers were telling large customers about January-March 2026 costs.

By January 2026, when those contracts began flowing through to actual manufacturing and retail, the predictions held up. Prices did increase substantially. Not every product hit 60% increases simultaneously, but the trajectory was clear.

The important nuance is that this pricing increase doesn't represent a supply shock. It represents suppliers tightening terms and exercising pricing power in a supply-constrained environment. Shock implies unexpectedness. This was foreseeable from supply allocation metrics.

Server vs. Consumer Memory: Why the Gap Widens

RDIMM vs. SODIMM Economics

Registered DRAM (RDIMM) modules, used in servers, and Small Outline DRAM (SODIMM) modules, used in laptops and high-end desktops, serve different markets with different economics.

RDIMMs are bulkier, more complex, more expensive to manufacture. A 256GB RDIMM might cost

SODIMMs are smaller, simpler, cheaper. A 32GB laptop SODIMM might cost

With constrained supply, suppliers naturally allocate toward the product with less price sensitivity. RDIMMs had inelastic demand—cloud companies would pay whatever was necessary to get capacity. SODIMMs had elastic demand—too high a price, and consumers simply wouldn't buy. Allocate accordingly.

Capacity Density and Data Center Requirements

Server deployments increasingly demand high-capacity memory modules. You don't want thousands of 16GB modules in a single server if you can have dozens of 256GB modules. Dense memory modules reduce board complexity, power consumption per gigabit, and physical footprint.

All the major memory manufacturers recognized this trend. They prioritized producing the highest-capacity, highest-margin modules. 256GB RDIMMs in 12800MT/s configurations were the focus. 16GB SODIMMs? Much lower priority.

This created a strange inversion. The parts of the market with highest demand (capacity-dense server modules for AI clusters) got priority in allocation. The parts with lower demand but higher consumer interest (mid-range consumer modules) got deprioritized. It's the opposite of what typical supply shortage intuition would suggest.

Premium Maintenance in Constrained Conditions

Server memory has historically maintained a 20-30% price premium over consumer memory when both are readily available. In constrained conditions, that premium widened. By Q1 2026, server DRAM ASPs were 60-70% higher than consumer DRAM for equivalent capacity.

This premium expansion is structural. As long as supply remains tight, suppliers will maintain higher margins on the segments with lower price sensitivity. It's a rational economic response to constraint.

The implication is that even as consumer memory prices eventually normalize, server memory might maintain elevated pricing longer. The supply situation that created this premium might persist through multiple years of data center expansion.

The projected 60% increase in DRAM prices from

Consumer Impact: What Rising DRAM Prices Mean for Your Upgrade Plans

The $500 32GB Module Scenario

Early 2026 forecasts joking about

Actually,

The economic consequence is that typical consumer upgrades become unaffordable. A reasonable upgrade path in 2024—spending

This creates demand destruction. When prices hit certain psychological thresholds, people stop buying. That's why, paradoxically, the price increases eventually stabilized the market. Fewer people upgraded. Supply and demand approached equilibrium at the elevated price point.

Laptop and Ultrabook Impacts

Laptops with soldered memory were somewhat protected from price volatility. Once manufactured, the cost was sunk. But new laptop designs during 2025-2026 faced increased memory costs. This directly impacted retail prices for new laptops.

A 16GB Mac Book Air that cost

Consumers considering new laptop purchases faced the exact timing problem. Buy now at elevated system prices because memory costs were high? Wait and hope memory prices fell? The uncertainty suppressed demand.

Gaming PC and Enthusiast Impacts

Gaming PC builds in 2025-2026 faced genuine constraints. High-end gaming builds often use 32GB or 64GB of DDR5, because games increasingly leverage fast memory for frame rate. DDR5 memory costs directly impacted build budgets.

A typical high-end gaming build budget might be

For enthusiasts, the calculus became particularly frustrating. DDR5 platforms were still relatively new. Jumping to newer memory was the primary upgrade path that would show tangible benefit. But the cost of that upgrade had become prohibitive.

Workstation and Content Creation Impacts

Video editors, 3D artists, and other content creators often benefit from large amounts of system memory. 64GB or 128GB configurations allow working with large projects without swapping to disk. Those configurations became genuinely expensive in early 2026.

A 128GB memory upgrade that cost

This depressed memory demand in the professional segment as well. It wasn't just consumer budgets feeling the impact. Professional buyers with greater purchasing power were making deliberate decisions to delay upgrades.

Market Dynamics: Stabilization vs. Healthy Conditions

The Price Resistance Phenomenon

One of the more nuanced observations about the 2025-2026 memory market is that observed prices "stabilized" at certain points. Observers pointed to this as evidence that the shortage was resolving. The underlying reality was quite different.

Prices stabilized because they reached levels where buyer demand became suppressed. Fewer people bought memory at

This is a crucial distinction. Healthy price stabilization happens when supply increases, demand remains stable, and prices adjust downward to clear inventory. Shortage-driven stabilization happens when prices increase so far that fewer people can afford to buy. Both create equilibrium, but with vastly different implications.

In 2026, you were looking at shortage-driven stabilization. Prices stabilized high. They stayed high. Buyers adapted by not upgrading. Suppliers maintained elevated margins. This equilibrium could persist for years.

Inventory Cycles and Seasonal Variation

Memory markets typically have seasonal demand cycles. Back-to-school, holiday buying, and enterprise refresh cycles all drive predictable demand patterns. These seasonal effects usually matter more than underlying supply changes.

In 2025-2026, seasonal patterns were less visible because the underlying supply shift dominated. A typical back-to-school season might see memory prices dip as retailers clear inventory. In 2025, there was no inventory to clear. Prices had no room to dip.

Looking forward, seasonal effects might re-establish themselves if supply constraints eased. But the forecast suggested they wouldn't ease through 2026. That meant pricing would remain elevated even in periods that typically saw softness.

Spot vs. Contract Pricing Divergence Continuing

The gap between contract prices and spot retail prices became significant during this period. Manufacturers were agreeing to contracts for 2026 at elevated prices. But retail prices sometimes stayed lower for a few weeks or months before catching up.

This divergence created brief arbitrage windows for informed buyers who understood the supply chain signals. By the time most consumers noticed prices rising, the worst of the increases had already priced in at the contract level.

Looking forward, this lag between contract and retail pricing was expected to narrow. Retailers would adjust pricing to contract levels within weeks rather than months. That meant less opportunity for consumers to catch deals before prices rose.

The line chart illustrates an estimated 160% increase in DDR5 module prices from September 2025 to March 2026, driven by AI infrastructure demands. Estimated data.

Forecasting Reliability: Can You Trust the 60% Number?

Historical Accuracy of Trend Force Predictions

Trend Force has a decent track record predicting DRAM price movements, but nothing is 100% accurate. Their forecasts in 2024-2025 captured the general direction of price movements accurately. They correctly predicted the shift from declining prices to stabilization. They correctly identified the server memory surge.

Their error rates are typically in the 10-20% range for near-term forecasts (1-2 quarters out). Their forecasts for later periods can diverge more from actual outcomes. The 60% Q1 2026 increase falls within their near-term forecast window, so it's worth taking seriously.

That said, forecasts exist in probability distributions, not certainties. There are scenarios where the actual increase is smaller (maybe 40-50%) or larger (maybe 70-80%). The underlying directional forecast—significant price increases in early 2026—is robust across scenarios.

Factors That Could Change the Trajectory

Several scenarios could alter the projected price path:

AI spending pullback: If major cloud providers decreased data center spending, demand for server memory would decline. Suppliers would pivot allocation toward consumer memory. Prices would stabilize at lower levels. Probability of this happening by Q2 2026: low. Companies are committed to their AI infrastructure plans through 2026.

Competitor wafer capacity: If Intel or another company brought significant additional DRAM wafer capacity online, supply could increase faster than expected. Intel, Samsung, and others have announced new capacity additions. These would begin contributing in 2026-2027. Probability of material supply relief in Q1 2026: very low.

Chinese market reopening: China's domestic DRAM manufacturers exist but lack high-capacity production capabilities. If Chinese manufacturers dramatically ramped capacity or if Chinese demand for imports collapsed, it could change pricing. Probability of material impact by Q1 2026: low.

Geopolitical shock: Trade restrictions, sanctions, or manufacturing incidents could further constrain supply. The semiconductor industry has concentration risk. A single facility issue could tighten supplies further. Probability of negative shock: non-zero but unpredictable.

Demand destruction deeper than expected: If prices rose so far that demand collapsed faster than anticipated, price increases might stabilize sooner. This already seems to be happening to some degree. Probability: moderate to high.

The consensus forecast is relatively robust to these variations. Significant price increases are expected. The exact magnitude might vary, but the direction is confident.

Looking Beyond 2026: Long-Term Outlook

Data Center Expansion Plans Through 2027

Major cloud providers have publicly committed to extraordinary data center spending through 2026 and beyond. Meta's CEO announced plans to double AI infrastructure capacity. Microsoft is expanding data center footprint across Europe, Asia, and North America. Google continues massive GPU purchases. Amazon is building out custom silicon and inference infrastructure.

These expansion plans were made based on demand forecasts that assume AI services continue growing rapidly. Memory is essential infrastructure for all of these. You're not going to see demand reduction unless the fundamental AI services business case changes.

The memory supply chain will likely remain tight through at least mid-2026. Recovery depends on whether new wafer capacity can come online faster than growth in AI infrastructure demand. Current forecasts suggest that won't happen until late 2026 or early 2027.

Consumer Market Recovery Timeline

When do consumer memory prices normalize? Based on current supply plans and demand forecasts, probably not until H2 2026 at the earliest, more likely 2027. That's two years from now, which is a long time to wait for an upgrade.

PC memory will only become widely available again when either (a) AI infrastructure demand slows, or (b) memory supply capacity exceeds AI infrastructure demand by a significant margin. Neither condition seems likely to arrive before summer 2026.

Inter, Samsung, and SK Hynix have announced new memory manufacturing capacity coming online in 2026 and beyond. But these additions are measured in wafers per month, and demand is measured in millions of modules. The gap needs to narrow significantly.

Technology Transitions and DDR6

DDR6 memory is on the horizon, probably arriving in 2026-2027. DDR6 will offer significantly higher bandwidth and power efficiency than DDR5. But the transition from DDR5 to DDR6 will take years, especially for servers with longer platform lifecycles.

This transition might eventually provide some relief to DDR5 pricing pressure. As newer technology arrives, older generations become less desirable. But the transition period—where DDR5 systems are still primary and DDR6 is emerging—could see continued elevated pricing as manufacturers manage inventory and production mix.

For consumers planning 2026 upgrades, DDR5 will remain the primary option. DDR6 adoption will be limited to high-end systems and new platforms.

The demand for DRAM in AI training and inference is projected to grow significantly from 2024 to mid-2025, driven by the expansion of AI infrastructure. Estimated data.

Strategic Responses: What Buyers Can Actually Do

Timing Strategies for Individual Purchases

If you need memory soon:

Buy immediately: Don't wait for prices to drop. The forecast is for continued increases or stable elevation through Q1 2026. Waiting is unlikely to save money. Buying now might be cheaper than buying in March.

Buy in bulk: If you anticipate needing upgrades for multiple systems over the next year, buying for all of them simultaneously might provide bulk discounts with retailers. It's harder to negotiate discounts on individual purchases.

Shop aggressively: Memory is fungible. Differences between brands are minimal. Price comparison across retailers can save 5-15%. That's money in your pocket.

Consider alternatives: SODIMM memory for laptops is sometimes less affected than desktop DIMM pricing because laptop manufacturers often lock in prices earlier. If you need laptop memory, the market might be slightly better than the desktop market.

Enterprise and Institutional Strategies

Large organizations taking different approaches:

Forward contracting: Enterprise buyers can lock in pricing by signing supply agreements for 2026 deliveries. This removes uncertainty but commits to elevated pricing. The question is whether that certainty is worth the cost.

Vendor consolidation: Negotiating volume discounts by concentrating purchases with one or two suppliers can provide better pricing than spread buys. But it increases dependence on specific suppliers.

Capacity efficiency: Some organizations are optimizing algorithms and workload distribution to achieve required performance with less memory. This isn't always possible, but where it is, it's the ultimate defense against price increases.

System design changes: Heterogeneous computing approaches using specialized accelerators alongside general-purpose CPUs can sometimes reduce memory requirements per system. It's a longer-term approach but worth exploring.

When to Just Accept the Elevated Pricing

For many use cases, waiting for prices to normalize isn't practical. Businesses need systems functioning now. Consumers need working computers now. At some point, you have to accept that memory costs what it costs and budget accordingly.

The question becomes: can the system justify the cost? A

For professional systems used to generate revenue, the ROI calculation might easily justify elevated memory costs if memory improves productivity. For consumer enthusiasts, the cost-benefit is harder to justify.

Conclusion: Understanding the Memory Market Inflection

The DRAM price surge of late 2025 and early 2026 represents a fundamental reallocation of the memory supply chain around AI infrastructure priorities. This isn't a temporary shortage that will resolve quickly. It's a structural shift in how semiconductor capacity is allocated across market segments.

Here's what actually happened: AI companies needed enormous amounts of memory for training and inference. They had the budget to pay for it. Memory manufacturers, facing constrained wafer capacity, made the economic decision to prioritize these high-margin, high-volume customers. This left consumer DRAM supply tight and prices elevated.

The 60% price increase forecast for Q1 2026 isn't arbitrary. It's grounded in contract pricing signals, supply allocation patterns, and demonstrated supplier behavior. While forecasts can be wrong, the directional prediction—significant price increases continuing through 2026—is robust across different scenarios.

What should you do with this information? If you need memory, buy it soon rather than waiting. Prices aren't going down in the next few months. If you can delay purchases to H2 2026 or beyond, you're more likely to see relief. If you're planning new system builds, factor in elevated memory costs and adjust budgets accordingly.

The most important insight is understanding why this is happening. This isn't random supply shock. It's rational response to AI infrastructure demand overwhelming general consumer demand. As long as AI deployments continue expanding (which they are), as long as data center spending remains elevated (which it is), memory supply will remain tight and prices elevated.

The good news, eventually, is that this situation does resolve. New wafer capacity comes online. AI infrastructure growth eventually matches capacity. DDR6 starts transitioning demand away from DDR5. But that resolution is probably 18+ months away. Until then, expect elevated memory costs to be a fact of life for PC builders, upgraders, and anyone else purchasing new systems.

Understand the dynamics, accept the near-term reality, and plan your upgrades accordingly. The memory market isn't broken. It's just reorganized around different priorities than it was a year ago.

FAQ

What is DRAM and why does it matter for AI?

DRAM (Dynamic Random Access Memory) is the fast, temporary memory that computers use while running applications. For AI infrastructure, DRAM matters enormously because large language models and training workloads require enormous amounts of fast memory to hold model weights, activations, and intermediate calculations. A single AI training cluster might contain hundreds of petabytes of total DRAM capacity across thousands of servers. Without sufficient DRAM, AI systems either run slowly or can't run certain workloads at all.

How much has DRAM pricing actually increased?

Average selling prices per gigabit increased roughly 40-60% from late 2025 to early 2026. In practical consumer terms, this means a 16GB DDR5 kit that cost

When will DRAM prices come back down?

Based on current supply forecasts and data center expansion plans, meaningful price relief probably won't arrive before mid-2026 at the earliest, more likely late 2026 or early 2027. New wafer capacity from Samsung, SK Hynix, and Micron will begin coming online in 2026, but it takes time for that capacity to translate into consumer-facing supply. Additionally, DDR6 transition might keep DDR5 prices elevated longer than expected. If you need memory urgently, don't wait. If you can delay 18+ months, prices should improve.

Should I buy high-capacity DRAM modules now, or wait?

If you need DRAM for a system you're building or upgrading within the next three months, buy now rather than waiting. Prices are forecast to stay elevated or increase further through Q1 2026. If you can delay purchases to mid-2026 or later, waiting probably makes economic sense. The worst strategy is buying in late Q1 2026 when prices are at their peak relative to eventual recovery points. The best strategy is buying either immediately (capturing lower prices than March) or waiting until supply constraints ease.

Why are server memory prices higher than consumer memory prices?

Server memory (RDIMM) commands a price premium compared to consumer memory (SODIMM) because servers generate revenue for buyers that justifies higher costs. A data center paying

What does this mean for laptop and gaming PC prices?

Memory cost increases flow through to retail laptop and gaming PC prices. A laptop manufacturer that paid

Could geopolitical issues make memory prices even worse?

Yes, there are several geopolitical risk factors that could tighten memory supply further. Memory manufacturing is concentrated in South Korea (Samsung, SK Hynix), Taiwan (TSMC partnerships), Japan (Micron operations), and the United States (Intel). Trade restrictions, sanctions, or manufacturing disruptions at any major facility could dramatically worsen supply constraints. For example, if sanctions targeted specific memory manufacturers, supply would tighten overnight and prices would spike further. The semiconductor industry has significant concentration risk, meaning single-point failures could have massive market impacts. However, these are low-probability scenarios. The base case assumes stable geopolitical conditions and continued normal manufacturing operations.

Is this price increase permanent, or will prices return to 2024 levels?

Prices will eventually return to lower levels, but "return to 2024 levels" probably shouldn't be your expectation. Memory pricing is driven by manufacturing costs, supply-demand balance, and competitive dynamics. Once new capacity comes online and AI infrastructure growth matches available supply, prices should decline from peak 2026 levels. But they might stabilize at levels modestly higher than 2024 due to increased manufacturing costs, higher industry profitability expectations, and the general inflationary environment. Expect prices to normalize, not to collapse. The period of

What's the relationship between AI demand and consumer DRAM shortages?

AI infrastructure demand is the direct cause of consumer DRAM shortages and price increases. When cloud providers and AI companies order billions of dollars worth of servers for AI training and inference, those servers consume enormous amounts of high-capacity DRAM modules. Memory manufacturers, facing constrained wafer capacity, rationally allocate capacity toward the highest-margin customers—the cloud providers buying server-class memory. This allocation reduces the supply available for consumer and laptop memory, tightening that market. It's not that DRAM manufacturing capacity declined. It's that available capacity is fully consumed by AI infrastructure demand, leaving nothing for the consumer market. As long as AI infrastructure expansion continues, this pressure persists.

The Memory Market Takes Its Shape

The 2025-2026 DRAM market represents an inflection point where infrastructure priorities—specifically AI infrastructure—fundamentally reorganized how semiconductor capacity is distributed. It's a reminder that downstream consumer markets are affected by upstream infrastructure decisions in ways that take months or years to become visible.

Understanding these supply chain dynamics helps explain why memory prices are where they are and why waiting for relief is probably a long bet. The situation will resolve, but not on the timeline most consumers would prefer. Until then, memory costs are elevated, and system builders need to plan accordingly.

Key Takeaways

- AI infrastructure demand absorbed 60%+ of DRAM wafer capacity in late 2025, directly causing consumer memory shortages and price increases

- TrendForce forecasts 60% Q1 2026 price increases for consumer DRAM with sustained elevation expected through remainder of year

- Server memory maintained 60-70% price premium over consumer memory as suppliers prioritized high-margin data center modules

- Memory costs as percentage of total system budgets doubled from ~8% in 2024 to 15-18% in 2026, compressing PC builder budgets

- Price stabilization at elevated levels reflects demand destruction, not supply relief—fewer people can afford to buy at $4+ per gigabit

- Meaningful consumer price relief probably won't arrive before H2 2026 or early 2027 when new wafer capacity comes online

- The reallocation reflects rational supplier economics: server memory generates 20x more revenue per wafer output than consumer modules

Related Articles

- Samsung TV Price Hikes: AI Chip Shortage Impact [2025]

- Why Premium SSDs Cost More Than Gold: Storage Price Crisis [2025]

- Micron's AI Memory Pivot: What It Means for Consumers and PC Builders [2025]

- Trump's 25% Advanced Chip Tariff: Impact on Tech Giants and AI [2025]

- RAM Price Hikes & Global Memory Shortage [2025]

- China's Technological Dominance: The Chinese Century Explained [2025]

![DRAM Prices Surge 60% as AI Demand Reshapes Memory Market [2026]](https://tryrunable.com/blog/dram-prices-surge-60-as-ai-demand-reshapes-memory-market-202/image-1-1768682215089.jpg)