Why B2B Software Isn't Dead: What AI Really Means for SaaS [2025]

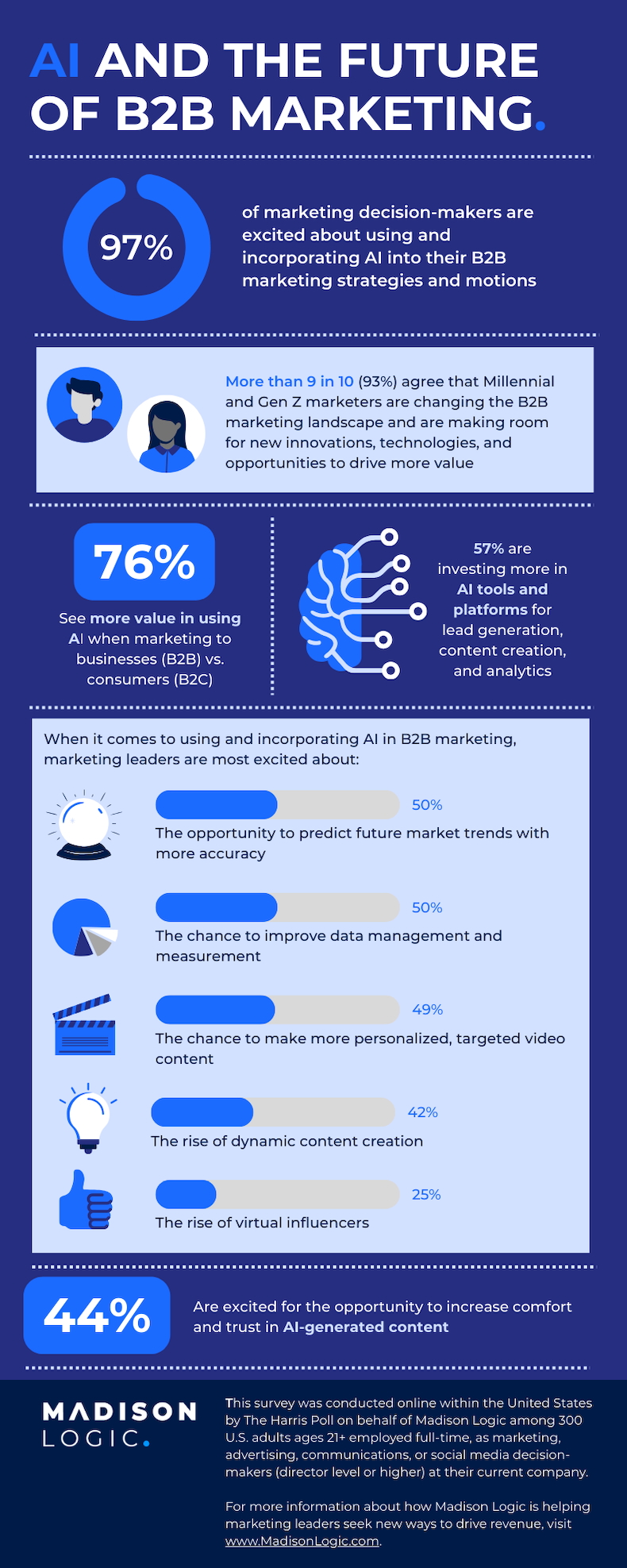

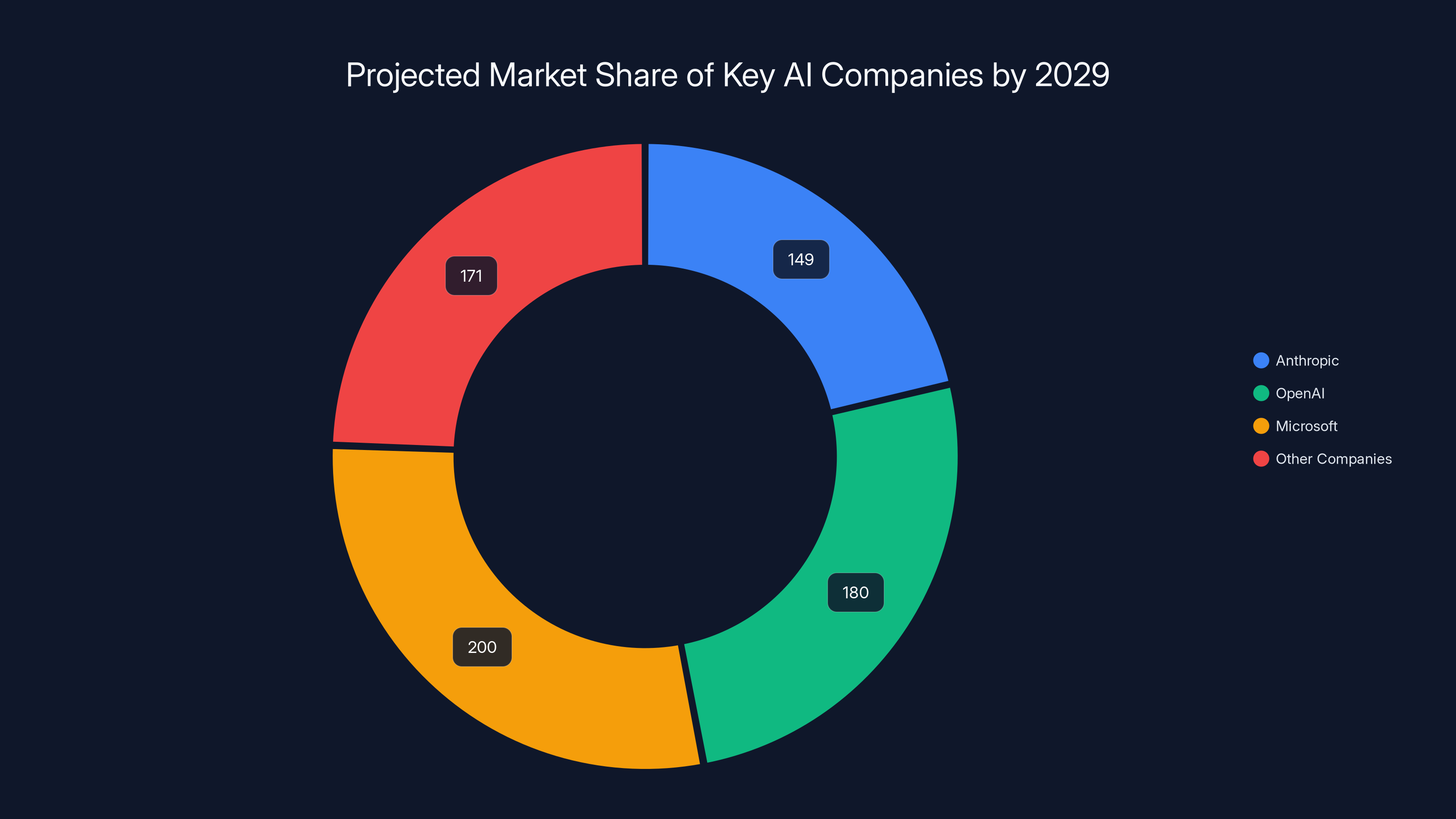

Last month, Anthropic made headlines projecting

Except that's not quite what's happening.

Mike Cannon-Brookes, CEO and co-founder of Atlassian, just sat down with Harry Stebbings, Jason Lemkin, and Rory O'Driscoll on 20VC x SaaStr to dismantle the doomsday narrative. And what he revealed isn't panic. It's nuance. It's the kind of nuance that separates founders who'll thrive in 2025 from those who'll spend the year waiting for the sky to stop falling.

Here's what nobody's talking about: the math is being misread. The conclusions being drawn are backward. And if you're running a B2B software company right now, understanding the actual game board matters more than ever.

TL; DR

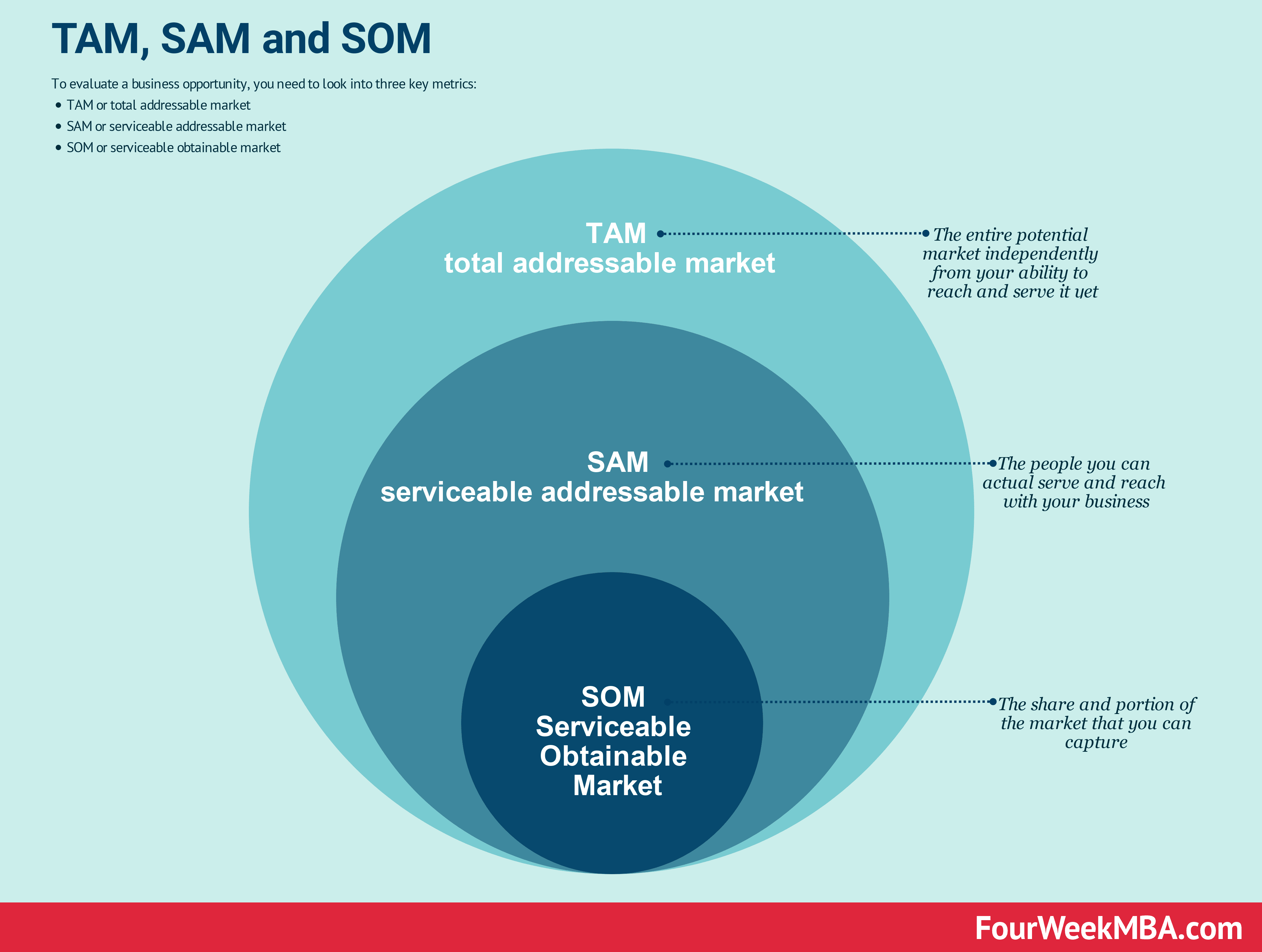

- Revenue stacking makes Anthropic's $149B projection misleading: When Atlassian pays AWS for Anthropic's API, that's the same revenue being counted multiple times through the stack. The real number is smaller, the market opportunity is still massive, and the key question isn't whether AI takes all the money—it's whether TAM expands enough to feed everyone.

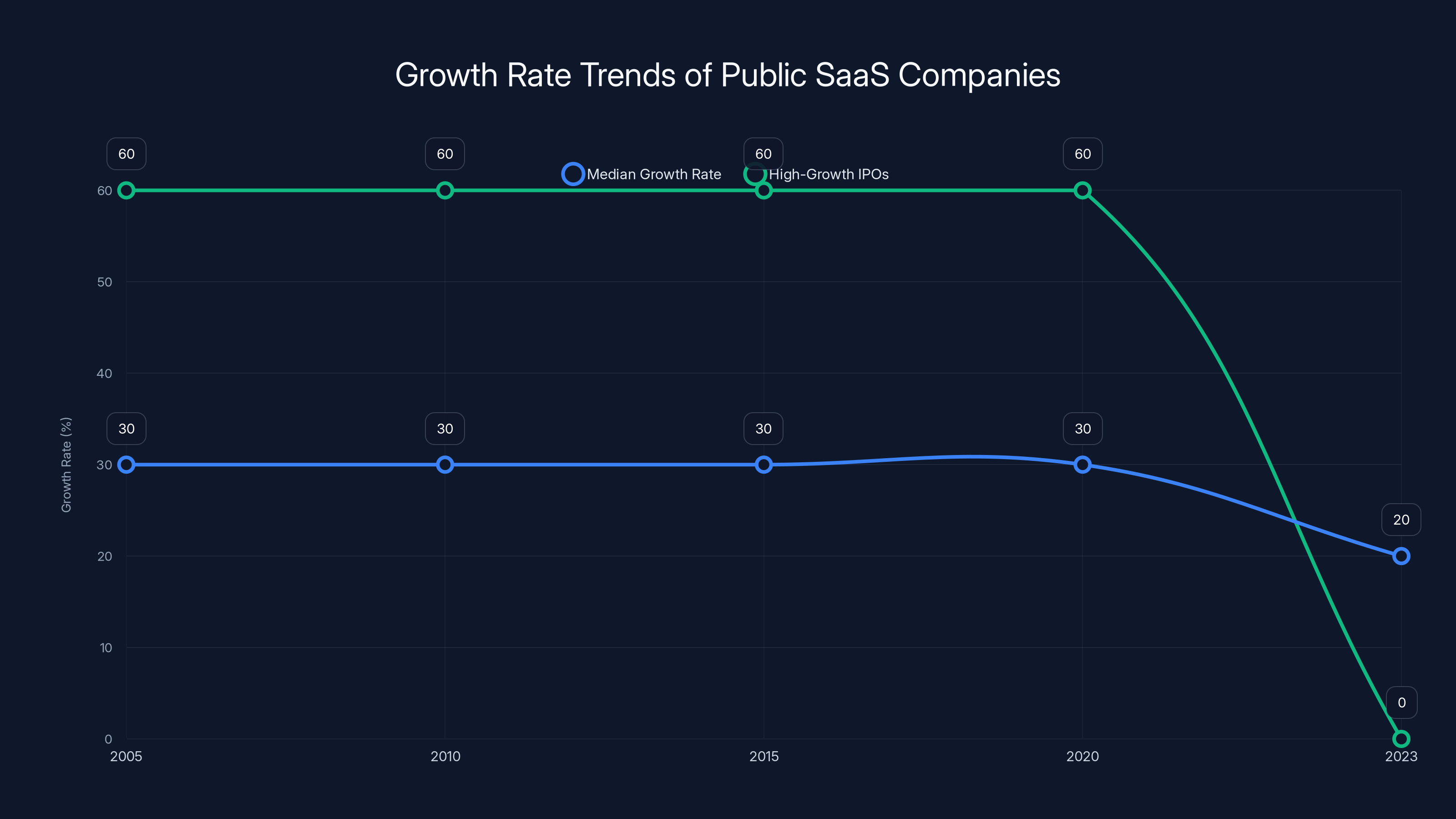

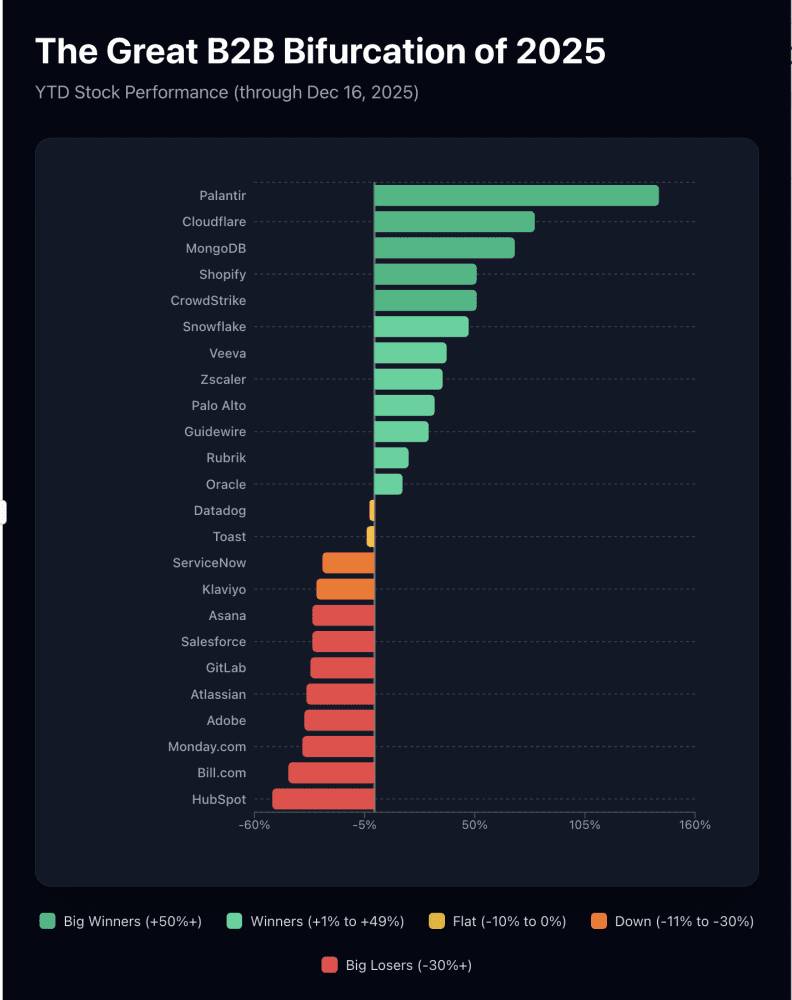

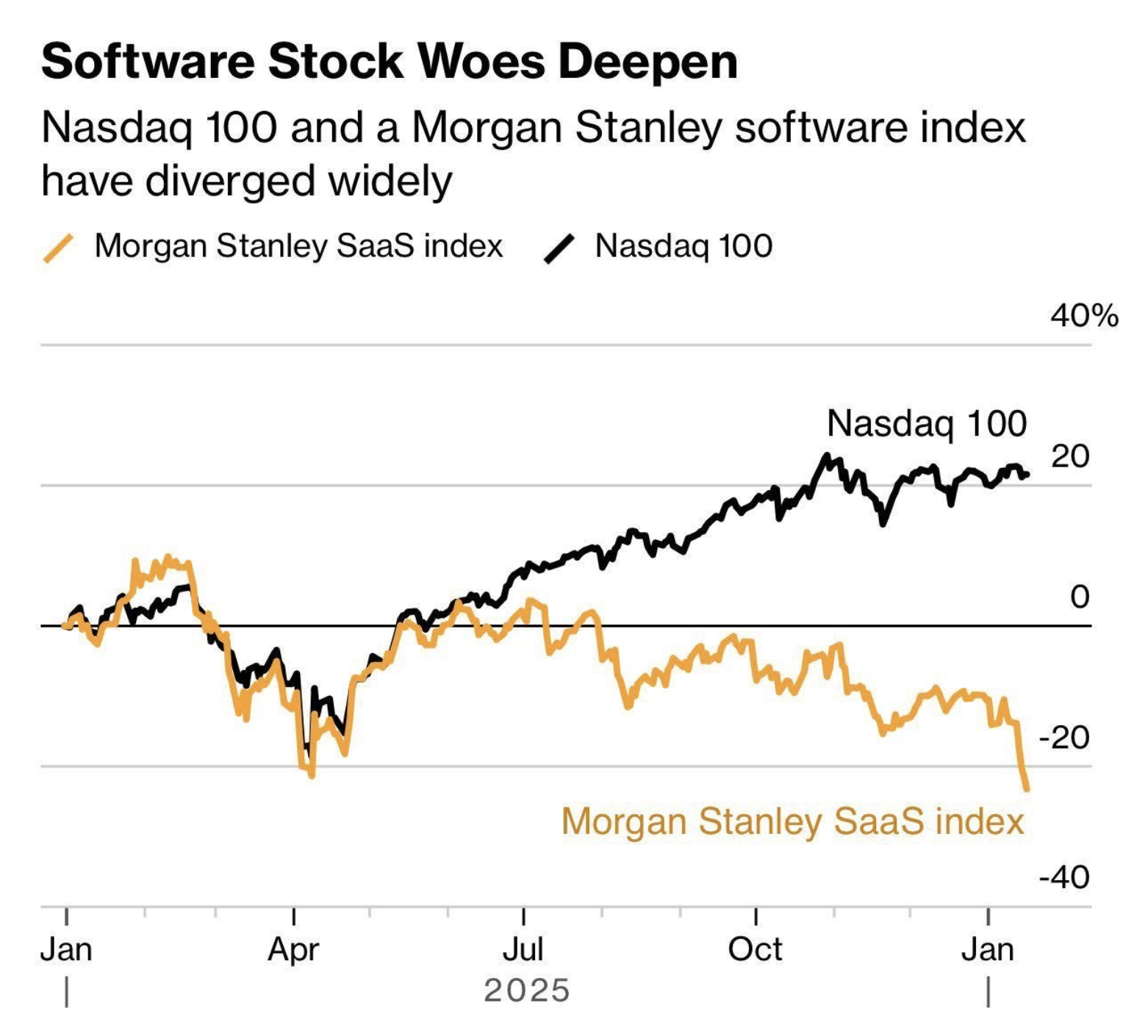

- Software isn't dead, composition is broken: The SaaS index looks terrible not because software is dying, but because 90% of public SaaS companies got acquired by PE or big tech. The new IPOs aren't coming. A composition crisis looks like a death spiral if you're not paying attention.

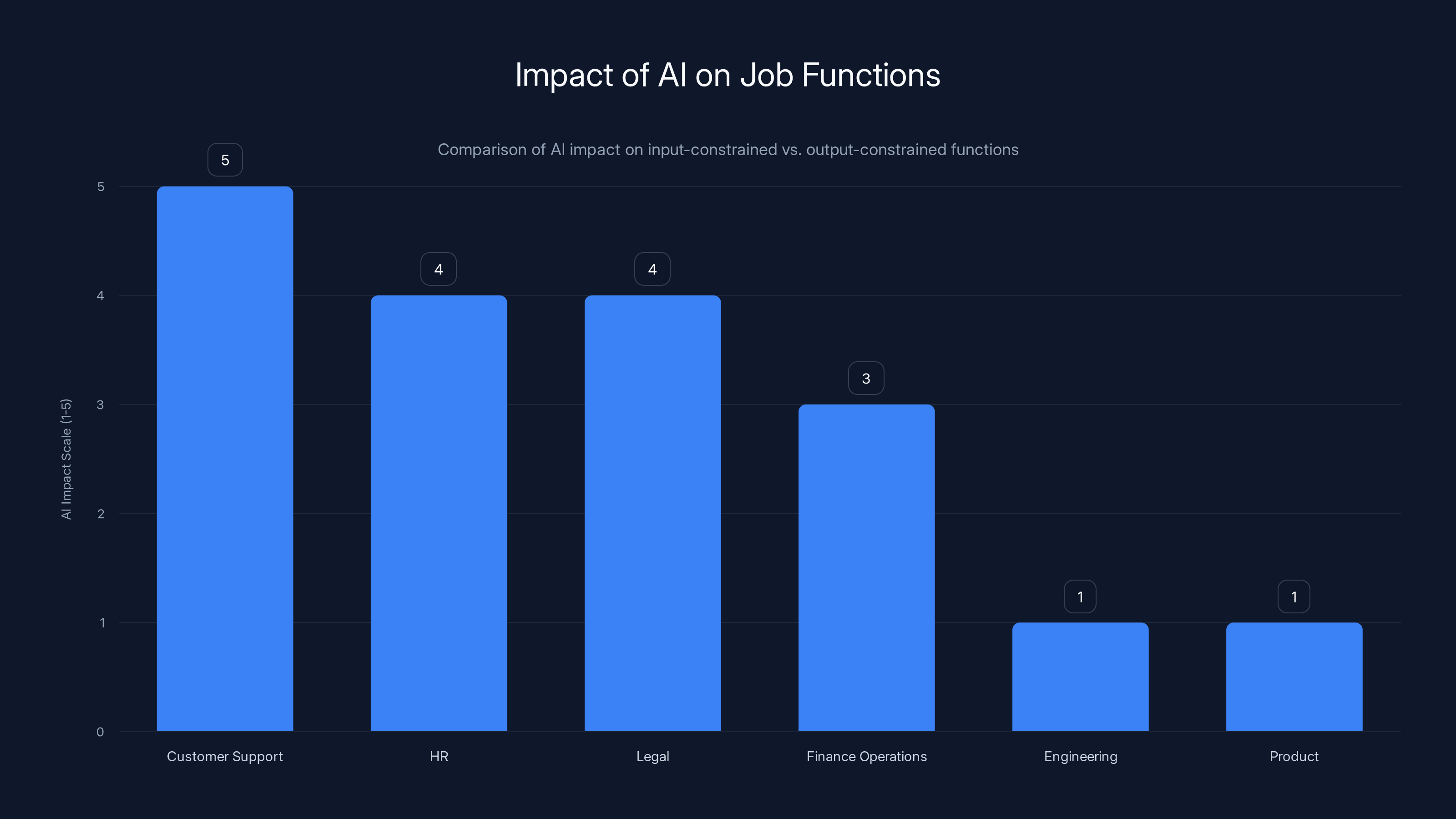

- Input-constrained functions are at existential risk: Customer support, HR, legal, and finance roles have bounded work tied to external demand. AI will systematically reduce headcount in these categories. Engineering and product teams will stay untouched because builders can't outsource thinking.

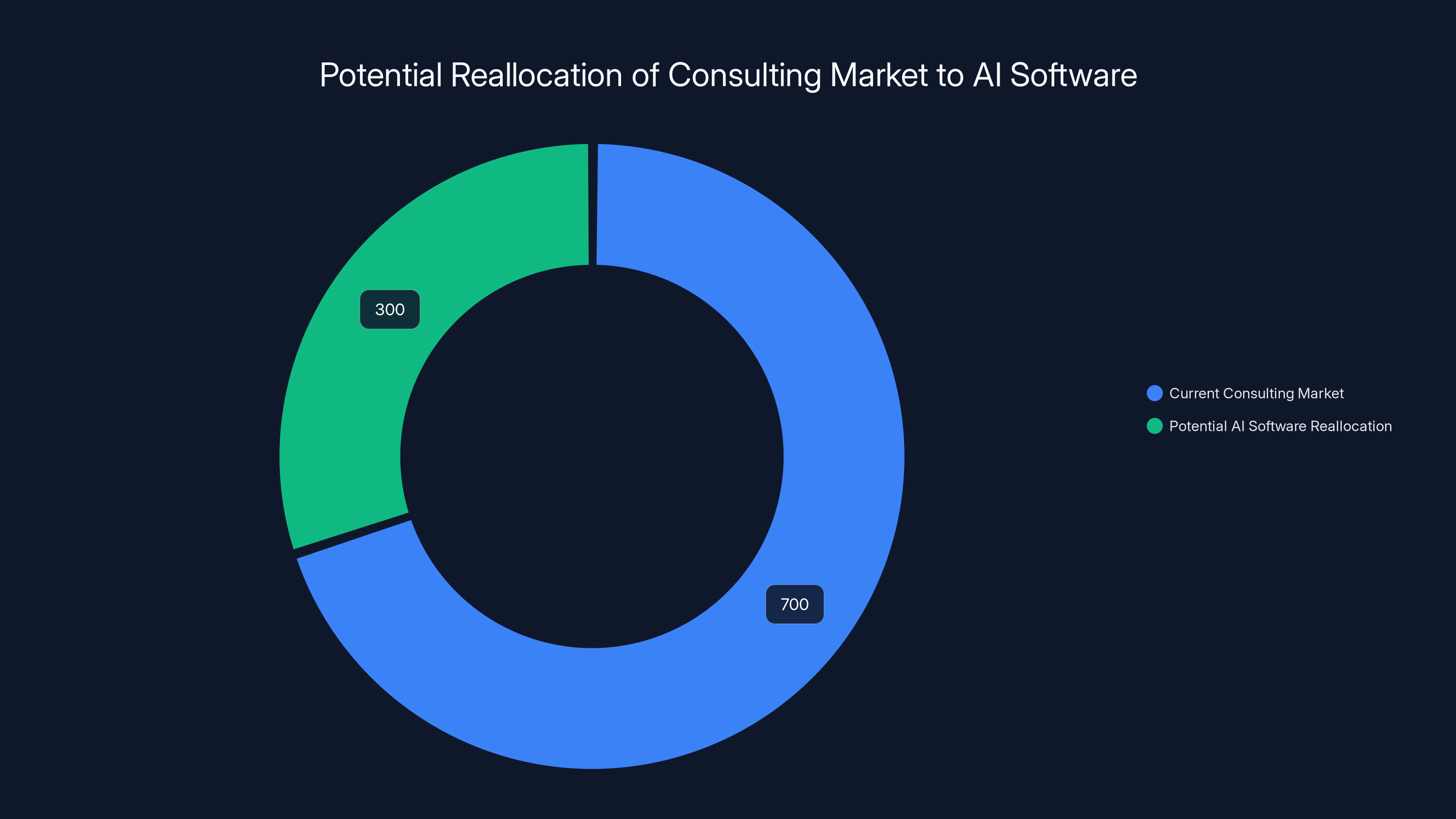

- The trillion-dollar consulting market is the relief valve: If AI eats into SAP/Oracle implementation work, that budget gets reallocated to more efficient software. That's a massive TAM shift that could save margin compression in the core SaaS market.

- The best founders are working harder, not easier: AI doesn't let you build slower. It lets you build faster, better, and more cheaply than ever before. If you're not using it that way, you're losing ground to someone who is.

AI efficiency could potentially reallocate $300 billion from the consulting market to AI software solutions. Estimated data.

Part 1: The Revenue Stacking Problem Nobody's Discussing

Why Anthropic's $149B Projection Doesn't Mean What You Think It Means

Let's start with the headline everyone's freaking out about: Anthropic projects

Now add in Microsoft's $200B. Do the math. You get a nightmare scenario where the money doesn't stretch far enough for anyone else.

Here's the catch: that math assumes every dollar of revenue gets counted once. It doesn't.

When Atlassian spends money on Anthropic's API through AWS, they pay AWS first. AWS takes a cut, then pays Anthropic. When a developer using Cursor (which runs on OpenAI or Anthropic) generates $1B in revenue, a massive chunk of that is the same billion dollars flowing through multiple hands. It's revenue stacking, and it's invisible in these top-line numbers.

"The individual revenue number is not necessarily counting the whole stack," Cannon-Brookes said. Even with the stacking effect accounted for, the numbers are staggering. But they're staggering in a different way than the headline suggests.

As Rory O'Driscoll from Scale framed it: "You're basically saying Anthropic becomes another Microsoft and OpenAI becomes another Microsoft—that's two new Microsofts that are pretty voracious mouths to feed out of the same pile of cash."

So here's the real question: either the market expands to feed all these mouths, or the math gets brutal for everybody. There's no middle ground.

The TAM Expansion Question

The only escape hatch is massive TAM expansion. The trillion-dollar consulting and services market might be that relief valve. AI could systematically eat into the systems integration spend around SAP, Oracle, and NetSuite deployments. That's money already budgeted. That's a massive slug of spend that could get reallocated to more efficient, AI-powered software.

But consulting isn't simple either. Implementation consulting for AI itself is booming—Accenture, Deloitte, and others are hiring like crazy to help enterprises adopt AI. Meanwhile, rote integration work gets automated away. Some consulting roles expand, others contract. Swings and roundabouts.

The real bet underneath all of this: does the expanding efficiency from AI create enough new use cases, new customer segments, and new workflows to justify the capital flowing to AI companies? The consensus answer is yes, but "consensus" in a bull market means nothing.

What This Means for Your Margins

If you're running a SaaS company right now, revenue stacking has a direct impact on your bottom line: your costs for AI infrastructure will increase, but the revenue you can extract from that AI feature set might plateau as competition commoditizes the offering.

You're not in a race to build AI features. You're in a race to build AI-powered efficiency that justifies its cost in the market you're selling to. That's a much harder problem than slapping a ChatGPT integration on your product.

When does paying for API costs make sense? When the feature drives measurable ROI for your customer. When it doesn't, you're just burning margin to stay competitive. The companies that figure out the math first win. Everyone else starts a slow bleed.

Part 2: The "Software Is Dead" Narrative Is Wrong, But the Composition Problem Is Real

Why Software Isn't Actually Dying

Mike Cannon-Brookes was unequivocal on this point: the idea that software as a category is dead is "ludicrous." Companies have always bought pre-built software solutions. They didn't write everything in assembly language before AI showed up. They won't build everything from scratch with LLMs now.

He pulled up Atlassian's competitive docs from 2005, 2010, and 2015. A huge chunk of those competitors are gone. Merged, acquired, dead. That's not because software died. That's how capitalism works. AI accelerates the consolidation cycle, but it doesn't change the fundamental pattern: winners eat market share, losers get acquired or disappear.

The confusion comes from conflating two different things: the death of software as a category versus the death of software as a business structure for mid-tier companies.

For 15 years, the median public SaaS company grew at around 30% year-over-year. But that number wasn't reflecting the reality of any single company. Here's what was actually happening: high-growth companies (60% growth) would IPO, then when they slowed to 30%, private equity would swoop in and take them private. Simultaneously, a new 60% grower would IPO to replace it at the top of the index.

That cycle broke around 2021. No new high-growth IPOs in years. Private equity hoovered up the mid-tier businesses. Big tech improved its M&A execution and started acquiring earlier-stage software companies. The result: the index got stuck with a weird survivor set. Companies too big for PE to acquire, too small for big tech, with no new entrants coming.

The average looks terrible. But it's a composition problem masquerading as a death spiral.

The Public Market Problem

The public SaaS market has become a zombie index. It's full of companies that:

- Are too mature to grow 30% (so they underperform investor expectations)

- Are too big for the typical PE buyer to acquire

- Are too small to be meaningful acquisitions for big tech

- Face constant pressure to either shrink their cost structure or get bought

This creates a doom loop for founders: if you're a SaaS company stuck in the middle, you either dramatically cut costs, get acquired, or face years of underperformance. None of those are the narrative the industry tells about tech companies.

But here's the thing: the capital markets are still funding SaaS. The growth has shifted. It's not coming from public company IPOs anymore. It's coming from:

- Private equity acquiring mature SaaS companies and improving operations

- Late-stage venture funding of companies that are high-growth but not ready for public markets

- Strategic acquisitions by large tech companies

- Bootstrapped SaaS businesses that never go for external capital

The category didn't die. The business model for how SaaS gets funded and scaled changed. That's not a death spiral. That's evolution.

Anthropic, OpenAI, and Microsoft are projected to capture a combined

Part 3: The Input-Constrained vs. Output-Constrained Framework

Understanding Which Jobs AI Will Eliminate

Here's the framework that explains everything about AI's impact on B2B software: the input-constrained versus output-constrained function distinction.

An input-constrained function has work bounded by external demand. Customer support is the clearest example. If you have 100 customers, you have a certain volume of support tickets. You can't generate more tickets by working harder or thinking more creatively. The input is fixed.

An output-constrained function has work bounded by thinking, creativity, and problem-solving. Engineering and product are the clearest examples. You can create infinite value by thinking better, solving harder problems, or inventing new features. The output is unbounded.

AI obliterates input-constrained functions. It doesn't eliminate the need for them, but it dramatically reduces headcount required to handle the volume.

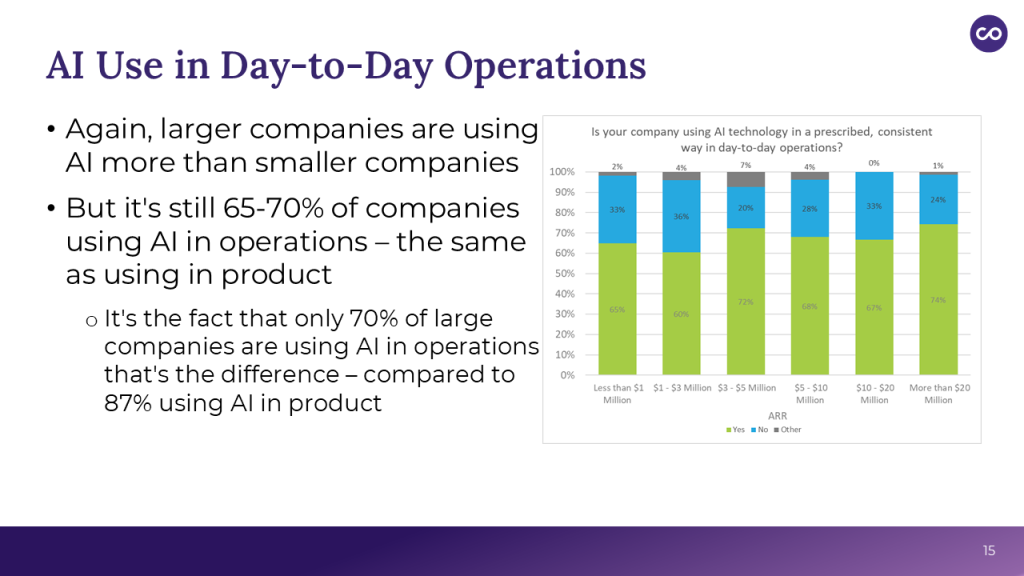

Customer support headcount is getting slashed at every company because AI can handle 70% of tickets automatically and escalate the hard ones. Workday said it publicly: they're seeing seat headwinds for HR software because Fortune 500 companies aren't hiring like they used to, and AI is automating more of the work that does exist.

Meanwhile, nobody is cutting engineering teams. The demand for engineers is still going up because every company needs engineers to build AI products, integrate AI into their workflows, and maintain the tech stack.

Which SaaS Categories Are at Existential Risk?

Every category outside of engineering and product is at existential risk of seat shrinkage. That doesn't mean they'll disappear. It means:

- Customer support software will see fewer users (because companies are hiring fewer support reps)

- HR software will see headcount reduction (automation is hitting payroll, benefits, recruiting)

- Legal tech will see pressure (contract review and legal research are AI's favorite tasks)

- Finance operations software will feel the squeeze (close processes, reconciliation, and routine accounting are being automated)

- Sales organizations will downsize (AI prospecting and lead qualification reduces the need for junior salespeople)

This is brutal honesty, and it's what the market isn't talking about when it discusses AI impact. The growth narrative around SaaS assumed that the number of seats in every function would stay constant or grow. That assumption is broken.

Jason Lemkin's data on hiring trends backs this up. Pave data shows customer support has been decimated in hiring. It's not coming back. The headcount across customer support functions is going down, and AI is the accelerant.

Why Engineering and Product Are Protected

Engineering and product aren't protected because they're special. They're protected because they're output-constrained. You can always think better, build better, ship better. There's no ceiling on the value you can create.

AI actually makes engineering more valuable, not less. An engineer with AI assistance can do the work of two or three engineers from five years ago. That means companies can either reduce headcount (they're not) or build more ambitious products (they are). The net effect: demand for engineers keeps going up.

Founders who understand this distinction will make different product bets. They'll stop building tools to reduce headcount in input-constrained functions and start building tools to increase output in output-constrained functions.

Part 4: The Consulting Market as the Relief Valve

Why the $1 Trillion Consulting Market Matters

The only way the math works for sustainable growth across AI companies, SaaS companies, and traditional software is if a massive pool of budget gets reallocated.

That pool is the consulting market. Global consulting spend is roughly $1 trillion per year. A huge chunk of that money goes to systems integration for ERP implementations. Enterprise software deployments on SAP, Oracle, NetSuite, and similar platforms generate hundreds of billions in consulting spend annually.

If AI makes those implementations faster, simpler, and cheaper, that budget doesn't disappear. It gets reallocated.

Here's the scenario: a Fortune 500 company budgets

Where does it go? Maybe into more ambitious technology initiatives. Maybe into additional software. Maybe into maintaining and optimizing the systems that now exist. The budget doesn't vanish.

But here's the catch: implementation consulting for AI itself is booming. Accenture, Deloitte, McKinsey—all of them are hiring aggressively to help enterprises adopt AI. New consulting jobs are being created while routine integration work is being automated.

It's not a zero-sum game, but it's closer to zero-sum than anyone wants to admit. Some consulting roles will expand, others will contract. The net effect on consulting headcount and billing is unclear.

The Hidden Opportunity in Consulting Automation

The real opportunity for SaaS companies isn't in trying to eat consulting spend directly. It's in building tools that make consulting more efficient and valuable.

Take Runable, for example. A platform that automates document generation, report creation, and workflow orchestration for consultants could dramatically increase the output per consultant, allowing them to take on more clients or more complex work. That's not eating consulting spend—that's multiplying the value consultants can create.

The SaaS companies that will thrive in the consulting automation space are the ones that understand this distinction: don't try to replace consultants. Build tools that make consultants more valuable.

Part 5: The Founder Productivity Shift

The Best Founders Are Working Harder, Not Easier

Mike Cannon-Brookes made a pointed observation: the best founders aren't taking AI as permission to slow down. They're using it to move faster, build better, and stay ahead of competition.

The worst founders are doing the opposite. They're hoping AI will do the work for them, waiting for the market to stabilize, and generally just... delaying decisions.

AI doesn't give you permission to work less. It gives you permission to work smarter. And "working smarter" in the context of modern product development means: using AI to eliminate the tedious parts of your job so you can focus on the creative, high-judgment parts.

Here's the brutal truth: if you're a founder spending time on repetitive tasks, AI has already displaced you. You're not losing to competition. You're losing to tools that are doing the work faster and better.

Rebuilding Atlassian in 2025

Cannon-Brookes made a specific point: "If we refounded Atlassian today, that would be a pretty darn starting point for an epic B2B business."

What does that mean? It means that the tools available today to build SaaS companies—AI-powered development, no-code platforms, cloud infrastructure, open-source libraries—are so powerful that a small founding team can build something that would have required 50 people in 2005.

This is the counter-narrative to "software is dead." It's not that software is dying. It's that the barrier to building software is collapsing. The cost of building is dropping exponentially. The speed of development is increasing. The quality of code generated with AI assistance is comparable to human-written code in many domains.

For founders, this is either terrifying or liberating. If you're a founder who can't adapt to building 10x faster with AI, you're finished. If you're a founder who embraces it, you can ship products that would have taken years in half the time.

What This Means for Your Product Roadmap

If you're building B2B software, AI should be in your product in two ways:

- As a feature set that customers can use to be more productive

- As an internal efficiency play that lets you ship faster and serve customers better

The companies that master both will dominate. The companies that ignore either one will lose ground.

For founders still on the fence about whether to invest in AI: you're making a mistake. This isn't a question of "should we add AI to our roadmap?" It's a question of "how do we rebuild our entire product and internal operations around AI?"

AI significantly reduces headcount in input-constrained functions like customer support, while demand for output-constrained roles like engineering remains high. Estimated data.

Part 6: The CEO Whining Problem

Stop Waiting and Start Building

Mike's frustration was palpable on the call: CEOs are spending way too much time worrying about AI and not enough time building products that take advantage of it.

The narrative in most boardrooms is some version of: "Let's wait and see what happens. Maybe AI is a bubble. Maybe regulations will stop it. Maybe we can wait six months and get more clarity."

Here's the thing: waiting for clarity is a strategy that only works if you're comfortable ceding market share to faster competitors. And in a market where the cost of building is collapsing and the speed of development is accelerating, waiting is the same as losing.

The companies that will define the next era of B2B software are the ones building right now. Not waiting. Building. Testing. Iterating. Shipping.

Every quarter a founder spends worrying instead of building is a quarter where a competitor is shipping and learning. The gap compounds.

The CEOs Who Will Win

The CEOs who will win in the next five years are the ones who:

- Make the hard calls on which jobs will be automated and which will expand

- Shift capital from hiring to product development

- Experiment relentlessly with AI integration, not as a feature, but as a fundamental rethinking of product design

- Accept that some lines of business will die and redirect energy to new opportunities

- Hire differently—fewer junior support roles, more experienced engineers and product leaders

- Compete on speed—launch features faster, iterate faster, respond to competition faster

The CEOs who will lose are the ones still in planning mode when execution starts.

Part 7: What Public SaaS Company CEOs Aren't Saying

The Hidden Pressure on the Public Cohort

There's a subtext to this entire conversation that Mike and Jason both hinted at but didn't fully articulate: the CEOs of public SaaS companies are in a vise.

On one side, their investors want them to show how AI creates new revenue opportunities. On the other side, their product teams are being cannibalized by AI tools that make their software cheaper or less necessary.

A customer support software CEO is watching their TAM contract because AI is replacing support tickets. A finance operations CEO is watching AI handle reconciliation, close processes, and routine accounting tasks. An HR software CEO is watching AI recruitment tools eat into their core use case.

They can't say this publicly. It would crater the stock. So instead, they give vague presentations about "AI-powered innovation" and "leveraging AI for customer success." Translation: "We're panicking."

The stock market is pricing in a narrative where AI creates value for SaaS companies. The reality might be different. For some companies, AI is a revenue threat. For others, it's a revenue opportunity. The bifurcation is happening now.

Which Public SaaS Companies Will Thrive

The ones that will thrive are the ones in output-constrained categories:

- Engineering and DevOps tools

- Product development and design platforms

- Creative software

- Complex analytics and data platforms

- Enterprise workflows that create new value, not just optimize existing work

The ones that will struggle:

- Input-constrained categories where automation is the obvious play

- Software that competes on cost (because AI will commoditize them)

- Companies with inflexible business models that can't adapt

- Mature SaaS that can't innovate fast enough

Part 8: The TAM Expansion Question That Keeps Everyone Up at Night

Is There Actually Enough TAM?

The elephant in the room: can the market support AI companies taking such massive revenue, plus OpenAI, plus all the existing SaaS companies, plus traditional enterprise software?

The answer depends entirely on TAM expansion. If the market expands—if new use cases, new customer segments, and new workflows emerge—then everyone can win. If the market is static, then it's a brutal zero-sum game.

Historically, TAM expansion happens when technology makes something that was previously impossible now possible, or something that was previously expensive now cheap.

AI is doing both. It's making workflows that required teams of people now possible with AI. It's making custom software that cost millions to build now buildable in weeks. It's making analytics that required data engineers now accessible to business users.

Those are TAM expansion opportunities. The question is: how much larger does the market get? 2x? 5x? 10x?

Most venture investors are betting on 5-10x TAM expansion. That's probably optimistic, but it's not crazy. If they're right, everyone wins. If they're wrong, we're headed for consolidation and pain.

The Most Likely Scenario

TAM probably expands, but not evenly. Some categories expand 10x (everything related to code generation and engineering automation). Other categories stay flat or contract (customer support, HR operations).

The smart play for entrepreneurs: bet on the categories that are expanding. Abandon the categories that are contracting. Let the consolidators mop up the mature software that can't adapt.

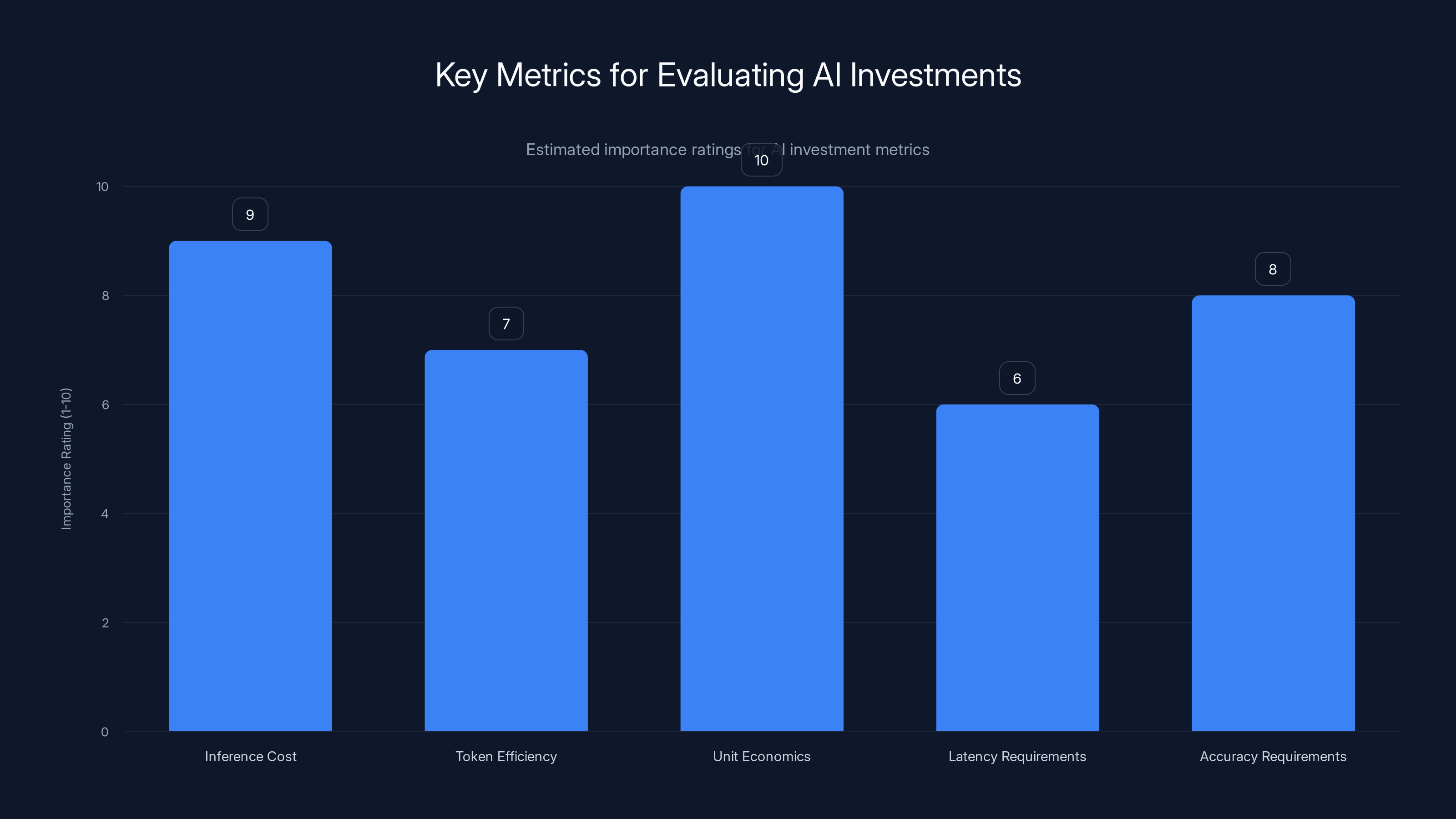

Unit economics and inference cost are critical metrics for evaluating AI investments, with unit economics being the most crucial. Estimated data.

Part 9: Why the Super Bowl Ad Wars Matter

Signals From the Top of the Cycle

There's a telling detail in the conversation that most people missed: the observation about Super Bowl ads from AI companies.

AI companies are buying Super Bowl advertising slots. That's the mark of a bubble top. Companies that haven't reached profitability are spending millions on brand advertising to the masses. That's not a signal of a sustainable business. That's a signal of capital being sloshed around like crazy.

It doesn't mean AI is a scam or that the technology is overvalued. It means we're definitely in a hype cycle, and the capital allocation is probably too bullish.

What does this mean for founders? It means that capital will be available for AI projects for the next 12-24 months, maybe longer. But it also means that the boring, sustainable path to profitability is back in fashion. You can't count on venture capital to subsidize your growth indefinitely.

What Happens After the Hype Cycle

Every tech hype cycle follows a pattern:

- Inflated expectations (we are here)

- Capital floods in (we are here)

- Most companies fail or get acquired (next 18-24 months)

- Survivors become the new normal (3-5 years out)

The survivors won't be the companies that raised the most money. They'll be the companies that:

- Built sustainable unit economics

- Found a real problem and solved it better than alternatives

- Could survive a capital drought

- Didn't bloat headcount on the assumption of infinite capital

The companies that will blow up: the ones that raised

Part 10: The Future of SaaS: Consolidation and Specialization

The Consolidation Playbook

If Mike Cannon-Brookes' prediction is right—that public SaaS companies are going to become a smaller and smaller cohort—then consolidation is the logical outcome.

Here's how it plays out: mature SaaS companies that can't grow fast enough to satisfy public market expectations get acquired by big tech or taken private by PE. Mid-market SaaS companies that have product-market fit but can't scale raise venture funding and stay private for longer. Early-stage companies that are AI-native and building new categories get funded and start new public companies.

The gap between the old cohort (mature, slow-growth SaaS) and the new cohort (AI-native, fast-growth software) keeps widening.

This is actually good news for founders and employees, even if it's bad news for public market investors. It means:

- More interesting companies get built

- More capital gets deployed to innovation

- More consolidation opportunities exist

- The S&P 500 gets some new SaaS names instead of just the same old ones

Specialization Over Generalization

The companies that will thrive are the ones that specialize deeply in a specific category or customer segment.

Trying to be a horizontal platform (we'll be Excel, but for AI, or we'll be Salesforce, but for AI) is a race against entrenched competitors with massive distribution. Trying to be a vertical solution (we'll be the AI-powered software for mortgage origination, or for radiology workflows) is a race for product-market fit in a smaller TAM.

The math favors specialization. Build deeply in a specific vertical, become indispensable, then expand horizontally. Don't try to be horizontal from day one.

Part 11: How to Think About AI Impact on Your Product

The Feature Versus Fundamental Question

Every founder is asking: should AI be a feature in my product, or should my product be fundamentally reimagined around AI?

The answer: probably fundamental.

If AI is just a feature (we added an AI chatbot to our support software), you're just keeping pace with competition. Every competitor adds the same feature. You don't gain defensibility.

If AI is fundamental (we redesigned the entire product around AI-powered automation of the core workflow), you get defensibility. At least for a few quarters, until someone else rearchitects their product the same way.

The best companies don't just add AI. They change the fundamental unit of work in their category. They make something that previously required a team now possible with AI and one person. That's a 10x improvement, not a 10% improvement.

The Automation Versus Augmentation Question

Should your AI feature automate work, or should it augment human capability?

Automation is higher risk, higher reward. If you can fully automate a workflow, you solve a problem completely. But you also cannibalize your own user base (fewer people needed to do the work).

Augmentation is safer, lower risk, lower reward. You make humans more productive, so they get more done with fewer hours. The user base stays large, but the value creation per user might be lower.

The right choice depends on your market. If you're selling to companies trying to reduce headcount (they'll be explicit about this), automation is the right choice. If you're selling to companies trying to increase output (they'll be implicit about this), augmentation is the right choice.

Almost every software company thinks they're selling augmentation when they're really selling automation. Be honest about what you're doing.

The median growth rate of public SaaS companies remained around 30% until 2021, when the cycle of high-growth IPOs broke, leading to a decline in new high-growth entrants. (Estimated data)

Part 12: The Hiring Reset

How Companies Should Be Recruiting Now

If the input-constrained versus output-constrained framework is right—and the evidence suggests it is—then hiring should follow a specific pattern.

Companies should be:

- Hiring fewer junior people in input-constrained roles (support, finance operations, HR operations)

- Hiring more senior people in output-constrained roles (engineering, product, design)

- Hiring fewer generalists in any role

- Hiring specialists who can work effectively with AI

- Reducing the hiring bar for routine tasks (because AI will do those tasks anyway)

- Raising the hiring bar for judgment calls (because AI can't do those)

The companies executing this today will have competitive advantages in 12 months. The companies that don't will be overstaffed in the wrong places.

The Skills Gap

There's an emerging skills gap in the market. Everyone's looking for:

- Prompt engineers (basically senior engineers who understand how to work with AI)

- Data specialists (people who can prepare data for AI pipelines)

- AI product managers (people who understand both AI and customer needs)

- Change management specialists (people who can help organizations adopt AI)

These roles pay a premium because they're scarce. Anyone who can develop these skills will be highly valuable over the next few years.

Part 13: The Regulatory Wildcard

Will Regulation Stop AI?

One concern many CEOs expressed: what if government regulation kills the AI opportunity?

Canon-Brookes' take: regulation will slow growth, but it won't stop the category. It will probably protect larger companies more than smaller companies (because compliance is expensive). It will probably accelerate consolidation (because smaller companies can't afford legal and compliance overhead).

So regulation, if it comes, is actually a bullish signal for consolidation and a bearish signal for early-stage companies that haven't achieved scale yet.

That's not a reason to avoid AI. It's a reason to move faster, get to scale, and build defensibility before regulation tightens.

The Geographic Question

The US, EU, and Asia are on different regulatory trajectories. The US is light on regulation, the EU is heavy, and Asia is somewhere in the middle.

That means US companies have a temporary advantage. But the advantage is temporary. As US regulation tightens, companies will have to adapt. The ones that can build compliant products globally will win. The ones that build for US-only regulatory environment will eventually be stuck.

Part 14: How to Evaluate AI Investments

The Right Metrics for AI Products

Traditional SaaS metrics don't always apply to AI products. You need to think about:

- Inference cost (how much does it cost to run the model?)

- Token efficiency (how many tokens does your product consume per unit of value created?)

- Unit economics (does the value created by AI exceed the cost of the inference?)

- Latency requirements (does the AI need to respond instantly, or can it batch process?)

- Accuracy requirements (how often can the AI be wrong before it becomes unusable?)

A traditional metric like "users per month" is less useful for AI products than a metric like "inference cost per customer per month."

If your inference costs are rising faster than your revenue, you have a problem that no amount of growth will fix. You need to fix unit economics first, then scale.

The True Cost of Inference

Many founders are building on top of OpenAI's API or Anthropic's API and not really thinking about the cost structure. They assume that as they scale, API costs will come down or they'll eventually move to open-source models.

Both might be true, but don't bet on it. The smart play is to build your economics assuming API costs stay constant or increase. If costs go down, that's a bonus.

Here's a concrete example: if you charge a customer

If inference costs go up 20%, you're underwater. This is the unit economics problem that will kill 80% of AI startups that raised funding at 2024 valuations.

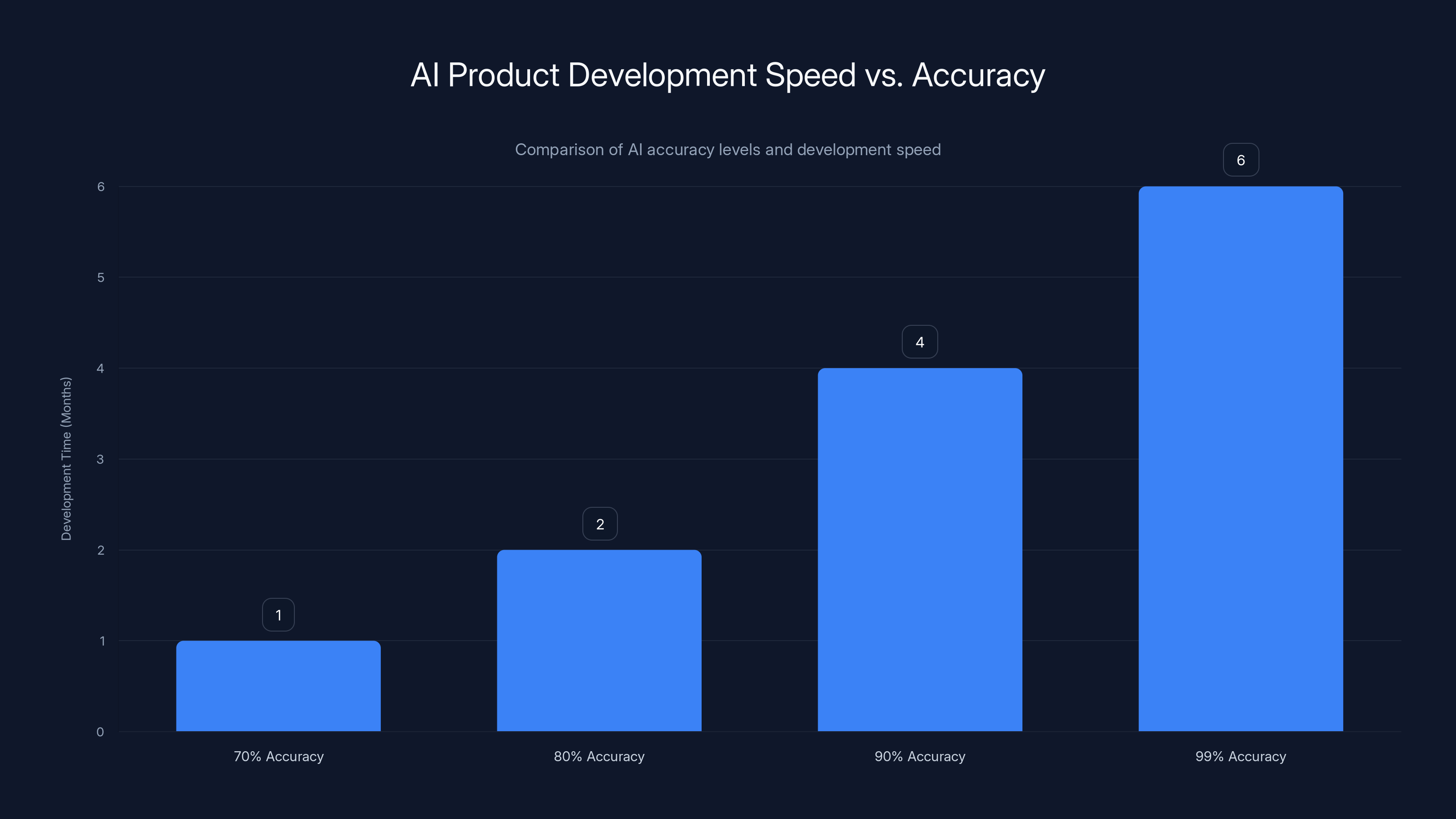

AI products with 70% accuracy can be developed in just 1 month, while striving for 99% accuracy can extend development to 6 months. Estimated data highlights the trade-off between speed and perfection.

Part 15: The Path to Product-Market Fit with AI

How to Find Product-Market Fit Faster

One advantage of building with AI: you can iterate faster and talk to more customers because you're not constrained by engineering capacity.

Here's the playbook:

- Identify a specific customer pain point (not a vague problem, a specific workflow that takes X hours per week)

- Build a prototype that uses AI to solve 80% of it (don't try to solve 100%, that's a trap)

- Ship to 10-20 customers (not publicly, just direct outreach)

- Measure if the AI solution is actually solving the problem (ask: would you pay for this, and how much?)

- Iterate based on feedback (most of your assumptions will be wrong)

- Once you find a cohort that values the solution, move to broader go-to-market

The companies that move fastest through this cycle will win. The ones that spend six months perfecting the AI model before talking to customers will lose.

The Customer Education Problem

Most B2B customers don't understand AI. They understand their problem. So don't sell them AI. Sell them the problem being solved.

Don't say: "Our product uses advanced generative AI with retrieval-augmented generation to solve X."

Say: "This reduces the time to complete X from 2 hours to 15 minutes, and it costs $99/month."

The customer doesn't care how you built it. They care what it does and what it costs.

This is a mental shift for founders who are obsessed with their AI architecture. But it's a necessary shift if you want to find product-market fit in the actual market (not the venture capital market).

Part 16: The Competitive Moat Question

Do AI Products Have Defensibility?

One concern that keeps founders up at night: if I build an AI product, won't a bigger company just copy me?

Yes. Absolutely. They will.

But here's the thing: defensibility in the AI era comes from:

- Data (proprietary datasets that make your model better)

- Distribution (customers, partnerships, market position)

- Unit economics (ability to operate cheaper than competitors)

- Speed (ability to iterate faster and ship features faster)

- Domain expertise (understanding a specific industry better than anyone else)

A big company can copy your product. But they probably can't copy all five of those at once. You can build defensibility by winning in three of them.

For example: a startup that understands radiology deeply, has built a customer base of 50 radiology practices, and can operate at lower cost than a big tech company has defensibility even if the big company copies the AI feature.

Part 17: The Founder Skills Reset

What Founders Need to Know Now

The skills that mattered five years ago matter less today. The skills that matter today:

- How to prompt LLMs effectively (it's not magic, it's a learnable skill)

- How to evaluate AI model capabilities and limitations (knowing when to use GPT-4 vs. Claude vs. Llama)

- How to think about inference costs (understanding the economics)

- How to manage AI projects (different from traditional software projects)

- How to talk to customers about AI (without overhyping or underselling)

These aren't deep technical skills. They're founder skills. Any founder can develop them if they spend two weeks focused on learning.

The founders who spend two weeks learning will be 3-6 months ahead of the founders who wait for someone to explain it to them.

The AI Learning Path

If you're a founder who's new to AI, here's the fastest path:

- Spend 2 hours using ChatGPT, Claude, Perplexity, and one open-source model. Get a feel for the differences.

- Spend 2 hours reading about how LLMs work (Andrej Karpathy's lecture, Chris Olah's work, or similar).

- Spend 2 hours exploring existing AI products and understanding what they're using under the hood.

- Spend 2 hours thinking about how AI could solve a specific problem your customers have.

- Spend 2 hours experimenting with an AI API (OpenAI, Anthropic, or Replicate).

- Spend 2 hours talking to customers about whether an AI solution would be valuable.

After 12 hours, you'll know more about AI than most founders. After 40 hours, you'll be dangerous. After 100 hours, you'll be an expert.

The time investment is tiny. The upside is enormous.

Part 18: The Macro Trends Tying It All Together

Why B2B Software Will Survive and Thrive

Bringing it all back together: why is B2B software not dead?

Because the fundamental unit of business value—efficiency, automation, insights, collaboration—still requires software. AI doesn't change that. It accelerates it.

The companies that provide that value will thrive. The companies that try to hide from AI, or wait for it to go away, will be acquired or disappear.

The narrative should be: B2B software is evolving, not dying. The evolution is fast, uncomfortable, and brutal for some. But it's evolution, not extinction.

What 2025-2026 Will Look Like

If we're right about all of this, here's what the next 18 months look like:

- More consolidation of mature SaaS companies into PE or big tech

- Continued capital flow into AI startups and AI-powered SaaS

- Margin compression for SaaS companies exposed to input-constrained functions

- Margin expansion for SaaS companies in output-constrained functions

- More public company exits for late-stage startups (they'll go to PE, not IPO)

- Faster product iteration across the board (AI makes it cheaper to ship)

- Higher standards for founders (no capital-subsidized mediocrity anymore)

The chaos you're feeling right now is real. But it's productive chaos. It's the market repricing what software is worth now that AI exists.

Part 19: The Honest Assessment

What We Don't Know

Before we close, let's be honest about what we don't know:

- Will TAM expand enough? We don't know. It might, it might not.

- Will AI stay this good? We don't know. The scaling laws might hit a wall.

- Will regulation kill growth? We don't know. The regulatory path is completely unclear.

- Will open-source models commoditize API providers? We don't know. But we should assume yes for planning purposes.

- Will the current capital flow continue? We don't know. It might reverse if growth slows.

- Will enterprise adoption accelerate or plateau? We don't know yet.

What we do know: the rate of change has accelerated. Waiting is a losing strategy. Building is the only winning strategy.

The Real Message

Mike Cannon-Brookes' real message—the one that matters—is simpler than all the TAM discussion and revenue stacking and input-constrained frameworks.

The message is: the best time to build is now, because you've never been able to build better products faster and cheaper than you can today.

That's it. That's the whole message. Everything else is just context.

Part 20: Your Move

What to Do Next Week

If you're a founder, here's what you should do next week:

- Pick one workflow in your product that could be 10x better with AI

- Spend 10 hours learning about AI and how it could solve that workflow

- Talk to 5 customers about whether they'd value an AI solution

- Build a prototype that's 70% of the way to solving the problem

- Ship it to 5 more customers and see if they use it

- Based on feedback, decide: is this a real opportunity, or am I chasing hype?

If it's a real opportunity, you now have a head start on every competitor waiting for "clarity."

If it's hype, you've lost one week and learned something valuable. That's not a bad trade.

The CEOs Who Will Thrive

If you're a CEO of an existing SaaS company, you're at an inflection point. The next 12 months will determine whether you're a leader or a laggard in the AI era.

Your choice is simple: rebuild your product around AI, or defend your legacy business while competitors eat your lunch.

There's no middle ground. There's no "wait and see." There's no hoarding capital and hoping things stabilize.

You either embrace the change and move faster, or you get left behind.

Mike's not wrong about this. The best founders and CEOs are working harder than ever. The ones who aren't should get out of the way.

FAQ

What does "revenue stacking" mean in the context of AI companies?

Revenue stacking occurs when the same dollar of customer spend gets counted multiple times as it flows through different layers of a technology stack. For example, when Atlassian pays AWS for Anthropic's API, that dollar appears in AWS's revenue, then in Anthropic's revenue. This makes headline revenue projections misleading because a single customer dollar supports multiple companies' reported growth, creating the illusion of larger total market opportunity than actually exists.

Is B2B software actually dying in the AI era?

No. B2B software as a category isn't dying—the composition of companies is changing. For 15 years, the public SaaS index remained strong because high-growth IPOs replaced slowing companies that got acquired by PE. That cycle broke around 2021. The index now contains the "survivor" companies: too big for PE, too small for big tech, with no new entrants. This composition problem creates the appearance of a death spiral, but the fundamental business of selling software solutions to enterprises remains viable and valuable.

What are input-constrained versus output-constrained functions, and why do they matter?

Input-constrained functions have work bounded by external demand. Customer support illustrates this well—100 customers generate a fixed volume of tickets. AI obliterates input-constrained functions by automating 70% of volume and escalating complex issues. Output-constrained functions have unbounded work based on thinking and problem-solving (engineering, product development). AI augments output-constrained work but doesn't replace it. For B2B software, this distinction determines which TAM categories will thrive (output-constrained) and which will contract (input-constrained).

How much of the consulting market could be reallocated to software due to AI efficiency?

The global consulting market is roughly $1 trillion annually, with hundreds of billions tied to ERP implementation and systems integration. If AI accelerates implementations, companies don't eliminate that budget—they reallocate it. However, implementation consulting for AI itself is booming while routine integration work gets automated. The net effect on consulting headcount and revenue is unclear, but the opportunity for software that multiplies consultant productivity (rather than replacing them) is substantial.

What's the realistic timeline for TAM expansion from AI?

The honest answer is that nobody knows. Most venture investors are betting on 5-10x TAM expansion, which is probably optimistic. TAM expansion happens when technology makes previously impossible workflows possible or reduces costs dramatically. AI is doing both, but the question—can the market expand fast enough to support $350B in AI company revenue plus existing SaaS plus traditional software—remains unanswered. Conservative planning assumes TAM expands 2-3x over the next 5-7 years.

How should SaaS founders think about unit economics for AI products?

Traditional SaaS metrics fail for AI products. Founders must obsess over inference costs, token efficiency, and the spread between customer value and infrastructure cost. If an AI product costs

What hiring patterns should companies adopt in the AI era?

Companies should reduce hiring in input-constrained roles (support, HR operations, finance operations) where AI handles 70% of work. Simultaneously, they should increase hiring of senior engineers and product leaders in output-constrained functions where AI augments human thinking. The bar for routine tasks should drop (since AI handles them), while the bar for judgment-call roles should rise significantly. Specialists who understand how to work effectively with AI command a premium.

Will regulation stop AI adoption in B2B software?

Regulation will slow growth but won't stop the category. If anything, heavy regulation will accelerate consolidation because compliance overhead favors large companies over early-stage startups. The US currently has light regulation, giving US companies a temporary advantage. The EU is stricter and Asia varies. Smart founders will build compliant products globally rather than optimizing for a single regulatory environment.

How can founders find product-market fit with AI products faster?

The fastest path is: pick a specific customer pain point, build AI that solves 70% (not 100%) of it, ship to 10-20 customers immediately, measure whether they'd pay and how much, and iterate. Most founders make the mistake of perfecting the AI model before talking to customers. Speed of iteration matters more than perfection. A flawed but useful tool beats a perfect tool that doesn't exist yet.

Conclusion: The Founders Who Will Define the Next Era

When Mike Cannon-Brookes said "the best founders are working harder than ever," he wasn't talking about hustle culture or 80-hour weeks. He was talking about the intellectual and strategic intensity required to navigate the most volatile moment in software since the internet went public.

B2B software isn't dead. But the game has changed fundamentally. The rules that applied for 15 years—steady growth, large sales teams, predictable unit economics—don't apply anymore.

What replaces them is a focus on:

- Speed of product iteration and shipping

- Unit economics that work at current prices and costs

- TAM selection toward output-constrained functions that expand

- Distribution and defensibility that prevent larger competitors from copying you

- Domain expertise in specific verticals, not horizontal platforms

- Building, not waiting or hedging

The founders and CEOs who internalize these principles will dominate the next five years. The ones who don't will be acquired, go out of business, or spend the decade wondering where it went wrong.

You don't have the luxury of waiting for clarity. Clarity comes from shipping, learning, iterating, and moving faster than competitors. The capital will flow to the companies that prove they can do this.

The question isn't whether B2B software will survive. It is. The question is whether you will.

Key Takeaways

- Revenue stacking makes AI company projections misleading—a single customer dollar gets counted multiple times through the stack, obscuring real market capacity.

- B2B software isn't dying; the composition of the market is changing. 90% of public SaaS companies got acquired, leaving a weird survivor set that makes averages look terrible.

- Input-constrained functions (support, HR, finance) face existential headcount risk from AI. Output-constrained functions (engineering, product) will expand because thinking work is unbounded.

- TAM must expand 2-5x for all projections to work. The trillion-dollar consulting market is the relief valve—AI that eats integration work reallocates that budget to more efficient software.

- The best founders are moving faster with AI, not slower. The ones who aren't should step aside. Speed of execution matters more than perfection of architecture.

Related Articles

- Anthropic's $14B ARR: The Fastest-Scaling SaaS Ever [2025]

- The 10x ARR Club: Which SaaS Companies Still Trade at Premium Valuations [2025]

- Why B2B Software Survives the AI Era: Atlassian's Growth Blueprint [2025]

- Cohere's $240M ARR Milestone: The IPO Race Heating Up [2025]

- How Rivian's Software Strategy Saved the Company in 2025

- How Spotify's Top Developers Stopped Coding: The AI Revolution [2025]

![Why B2B Software Isn't Dead: What AI Really Means for SaaS [2025]](https://tryrunable.com/blog/why-b2b-software-isn-t-dead-what-ai-really-means-for-saas-20/image-1-1771170116349.jpg)