Harvey's Explosive Rise: From 11B in One Year

There's something magnetic about Harvey's trajectory that makes even seasoned venture capitalists lose their cool. In just twelve months, the legal AI startup went from a

When founder and CEO Winston Weinberg announced in December 2025 that Harvey had hit

The legal industry is notoriously analog. Spreadsheets, email threads, and manual document reviews still dominate how law firms operate. Partners bill thousands per hour for work that could be automated. Associates spend nights reviewing contracts that AI can process in minutes. The friction points are everywhere, and Harvey is attacking them with precision.

But here's what makes this story worth paying attention to: Harvey isn't just raising capital on hype. The valuations are doubling because the company is actually printing revenue. This is the opposite of the 2022-2023 AI bubble where every startup claimed they'd change everything. Harvey is changing things, and law firms are writing checks to prove it.

Sequoia, Andreessen Horowitz, Kleiner Perkins, and GIC aren't throwing billion-dollar valuations at Harvey because they believe in AI abstractions. They're doing it because the unit economics work. Because the sales cycles are predictable. Because the problem is real, the solution is measurable, and customers can't live without it once they start using it.

This article digs into what makes Harvey tick, how it climbed so fast, and what its trajectory tells us about the future of enterprise AI.

TL; DR

- **Harvey hit 100M just six months earlier, proving massive market demand

- Valuation jumped from 11B in one year, with the latest round led by Sequoia and Singapore's GIC

- Legal AI is a $17 billion addressable market, with Harvey capturing a meaningful slice through its LLM tailored for law firms

- Revenue growth vastly outpaces valuation growth, suggesting the company is sustainable and profitable-on-trajectory

- Multiple VC rounds (Series D through potential new raise) prove conviction, with top-tier investors competing for allocation

- Enterprise adoption is the real story, not the valuation number itself

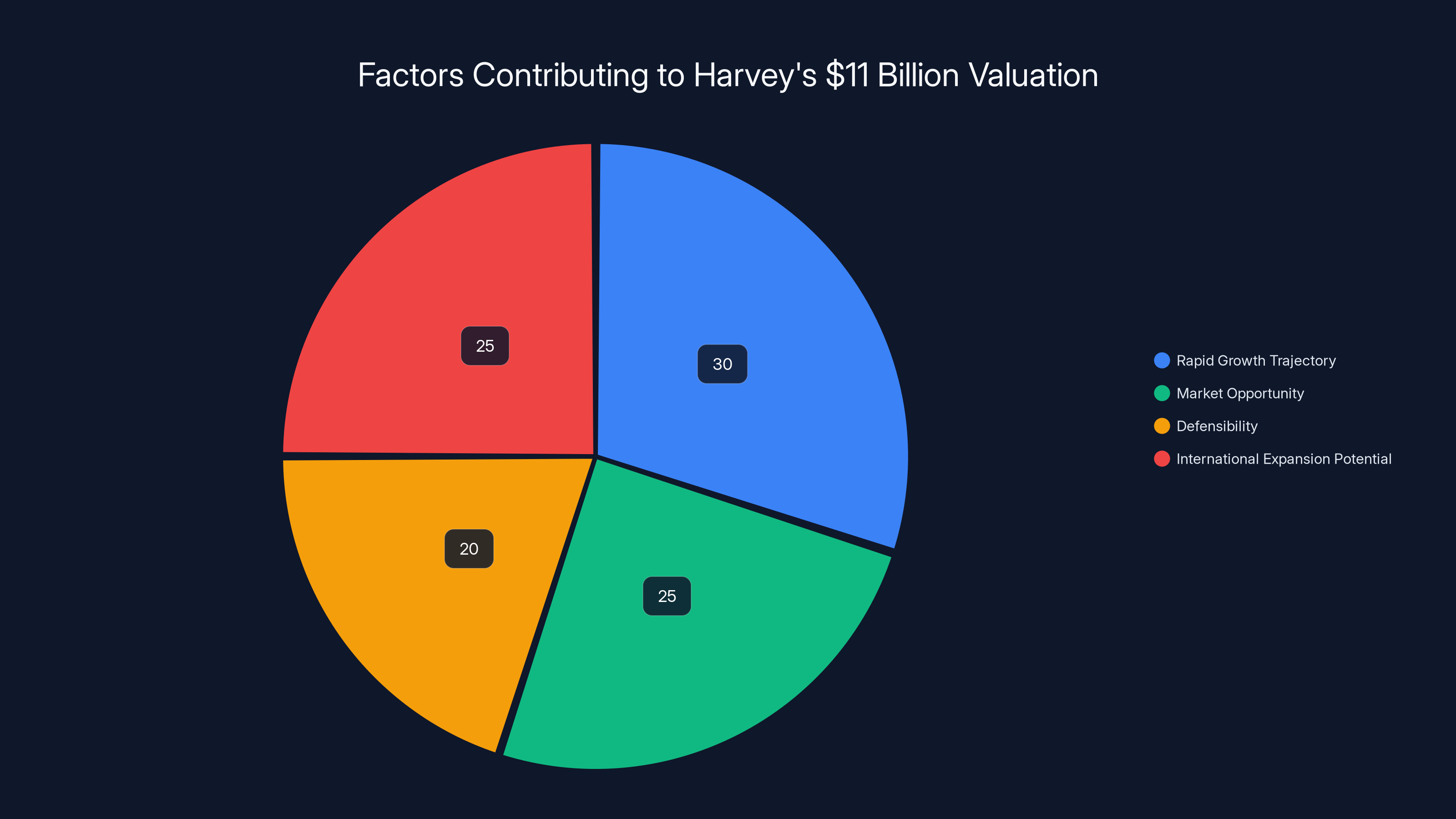

Harvey's $11 billion valuation is driven by rapid growth, market opportunity, defensibility, and international expansion potential. Estimated data.

The Legal Industry's AI Moment

Legal services are one of the last bastions of analog workflows in a digital-first world. A corporate law firm in Manhattan operates similarly to how it did in 1995. Partners still delegate massive document review tasks to junior associates who bill at $400 per hour to read contracts. Those same contracts could be analyzed by an AI in seconds, extracting risk factors, missing clauses, and inconsistencies automatically.

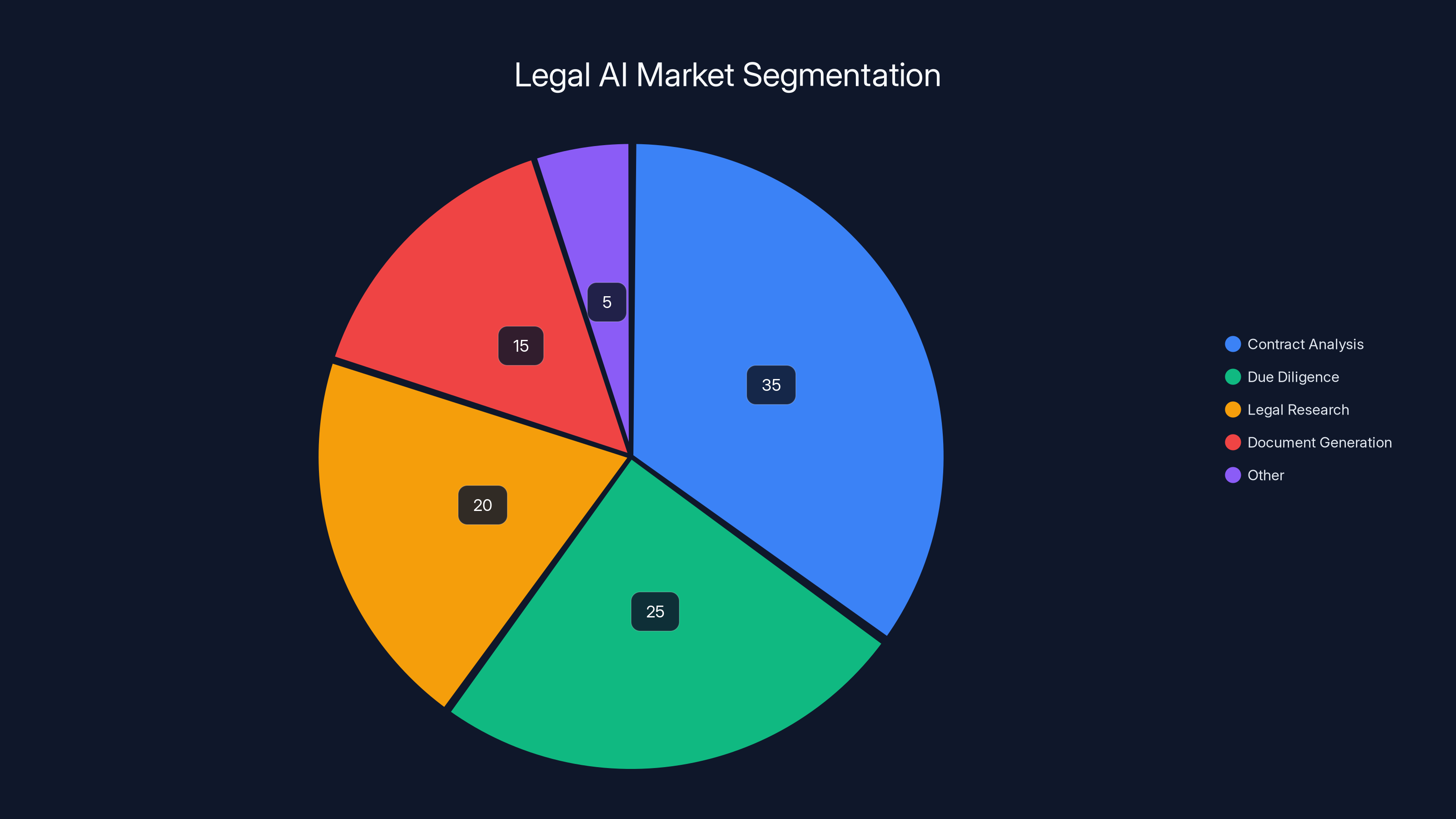

The addressable market for legal AI is estimated at $17 billion globally. That includes everything from contract analysis to due diligence, legal research, and document generation. Every major law firm spends hundreds of thousands annually on repetitive work that doesn't require human judgment. They're leaving money on the table, and more importantly, they're wasting talent on busywork.

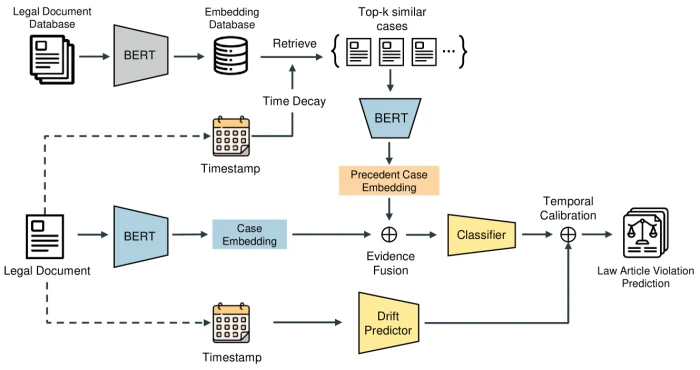

Harvey's specific angle is building an LLM (large language model) that understands legal language with precision. Generic AI tools like Chat GPT can answer legal questions, but they can't reliably parse nuanced contract language or flag jurisdiction-specific issues. A general-purpose model might miss a critical liability clause because it was trained on internet text where legal precision matters less. Harvey's model is trained on legal documents, case law, and regulatory frameworks. It speaks the language natively.

The timing is perfect. Law firms have been experimenting with AI for years, but the tools were clunky and required extensive customization. GPT-4 changed that. It became smart enough that law firms could actually use it without constant verification. Harvey took that foundation and built a product specifically designed for legal workflows.

Partners at major firms care about one thing: billable hours and client satisfaction. If an AI tool can reduce the time required for document review by 70%, the math is obvious. A firm billing

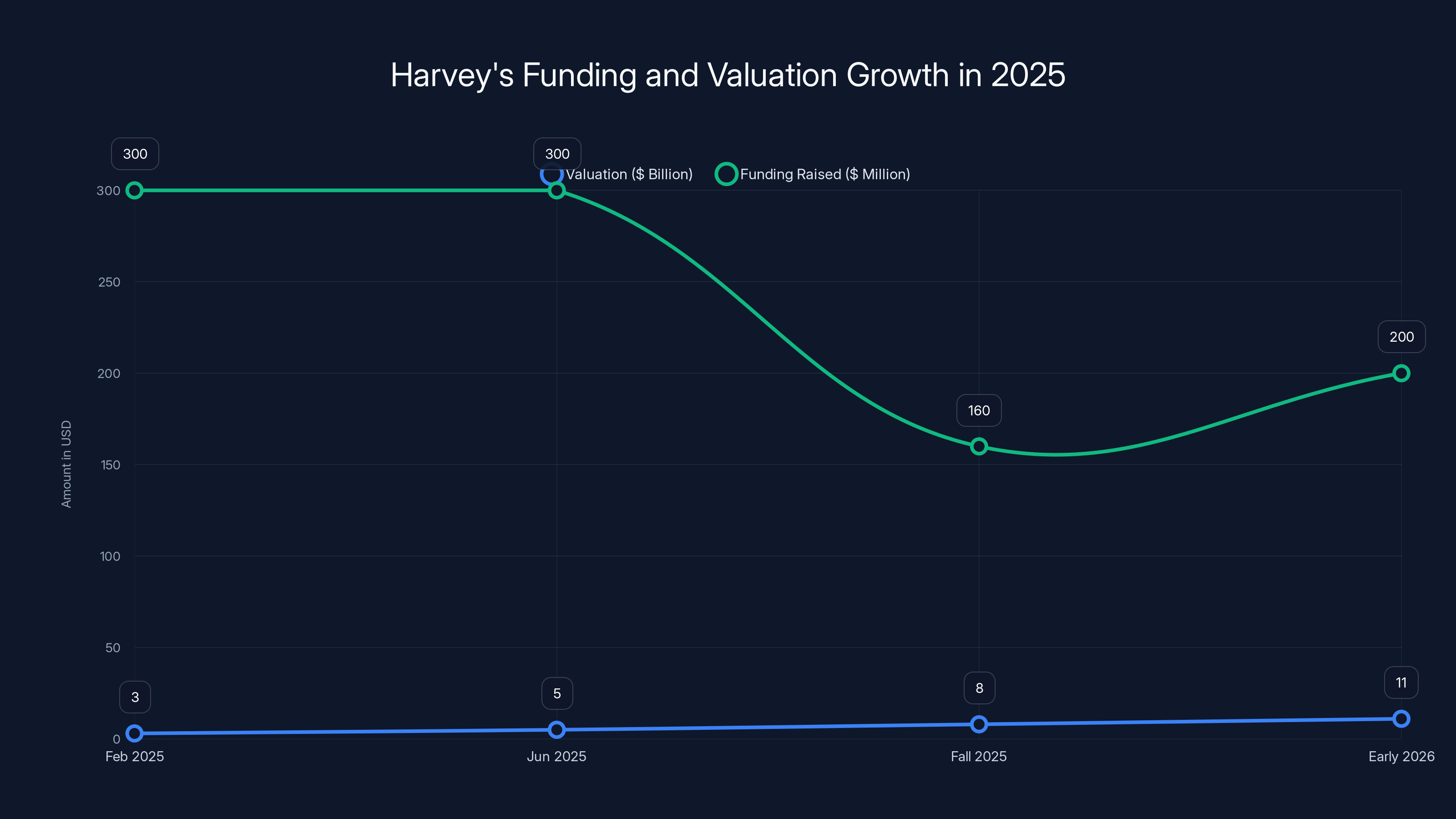

Harvey's valuation grew from

The Funding Timeline: How Harvey Went from Unknown to Unicorn

The sequence of funding rounds tells a story of accelerating conviction from top-tier VCs. In February 2025, Harvey raised

Six months later in June 2025, Harvey raised another

Then came the big one. In fall 2025, Harvey raised

Now, just months later, Harvey is reportedly raising at

What's remarkable isn't the dollar amount. It's the velocity. Mega-rounds used to happen once a year for breakout companies. Harvey is raising at a major valuation every six months because the company keeps hitting growth targets that exceed investor expectations.

The $190 Million ARR Achievement: What It Actually Means

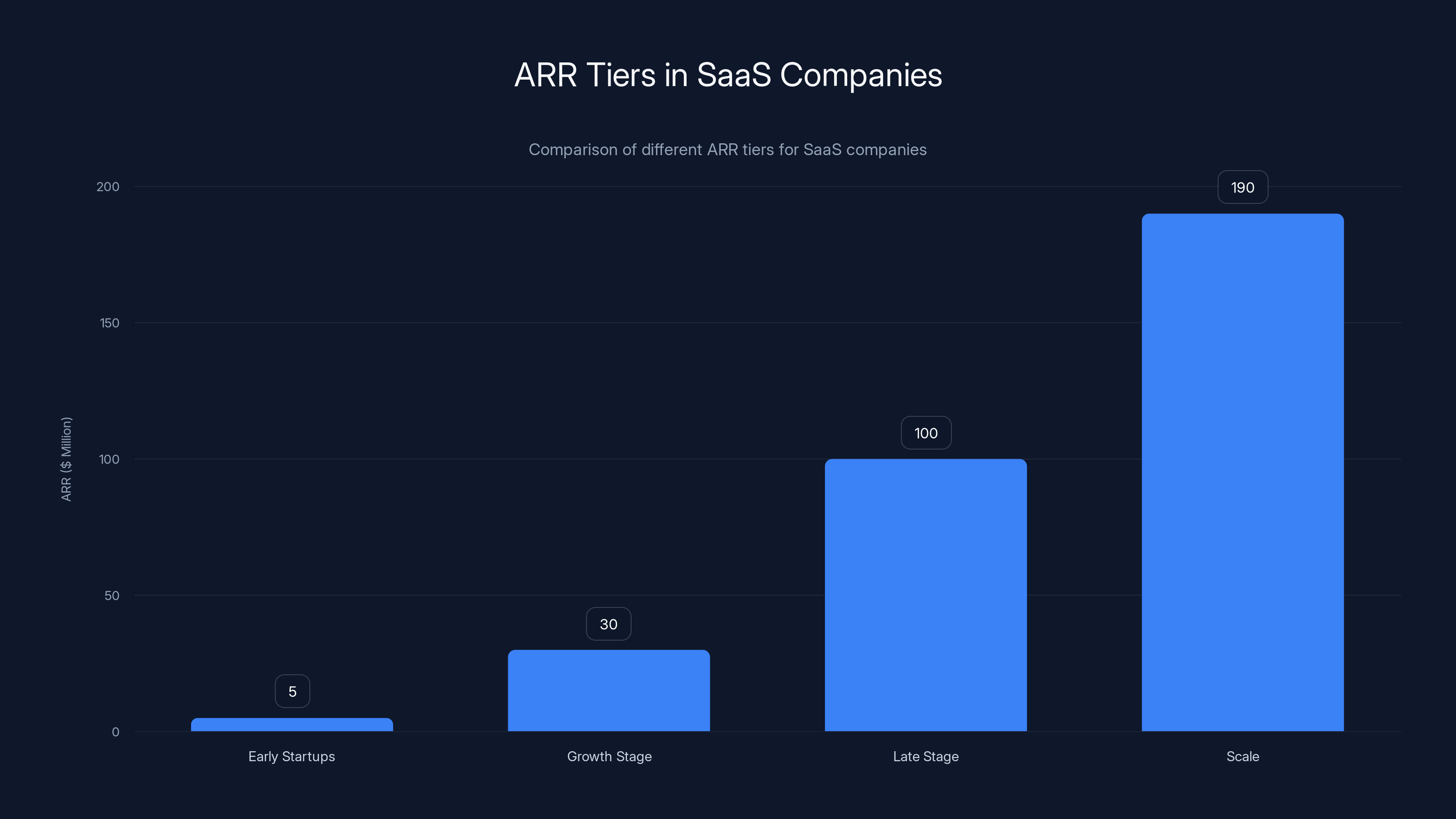

ARR—annual recurring revenue—is the metric that matters most for venture-backed Saa S companies. It's contracted annual revenue, not theoretical future revenue or once-off deals. Harvey announcing

In the Saa S world, there are tiers of companies:

- Early startups: $1-10M ARR

- Growth stage: $10-50M ARR

- Late stage: $50-150M ARR

- Scale: $150M+ ARR

At

What makes the number even more impressive is the customer concentration question. Is Harvey's revenue spread across hundreds of firms, or is it dominated by a few whale customers? If it's the latter, growth could slow dramatically if a major customer leaves. Law firms, like most enterprises, have long sales cycles and procurement processes. They don't sign $10 million deals lightly.

Industry rumors suggest Harvey's customer base includes multiple major law firms—Am Law 100 firms that have tens of thousands of lawyers and billions in revenue. A single large firm might contribute $5-10 million ARR once fully deployed across multiple practice areas. That would suggest Harvey has 20-30 significant customers, not a handful of whales. That's a healthy distribution.

The revenue growth from

But here's the question nobody's asking publicly: is Harvey profitable? ARR of

Estimated data shows that the

Why Sequoia, Andreessen Horowitz, and Kleiner Perkins Are Competing for Harvey

Top-tier venture firms don't just write checks because a startup is popular. They invest when they see three things: a massive market opportunity, a defensible product, and a team that can execute. Harvey hits all three.

The massive market opportunity is obvious. Legal services are a

Defensibility is where it gets interesting. Harvey's product isn't just a generic chatbot. It's a legal-specific LLM that understands nuances most AI models miss. Building that required deep domain expertise, proprietary datasets, and sustained investment in model improvement. A competitor can't just release a general-purpose AI and claim it works for legal. The training, fine-tuning, and customer feedback loop matter.

But the real defensibility is customer lock-in. Once a law firm embeds Harvey into their workflows—training associates on it, building custom document templates around it, relying on it for due diligence—switching costs become enormous. The firm would have to retrain staff, rebuild workflows, and risk productivity dips during the transition. Sticky products with high switching costs are venture's holy grail.

The team is equally important. Winston Weinberg and Harvey's founding team included people from Open AI, Anthropic, and top law firms. That combination of AI expertise and legal domain knowledge is rare. You can't just hire it; you need founders who inherently understand both worlds.

When multiple top VCs compete for a round, valuations rise. It's supply and demand. If Sequoia wants Harvey but Kleiner Perkins is also bidding, the round price goes up. Andreessen Horowitz's participation signals validation. A16z's checks carry weight in the market. New investors see that and want in.

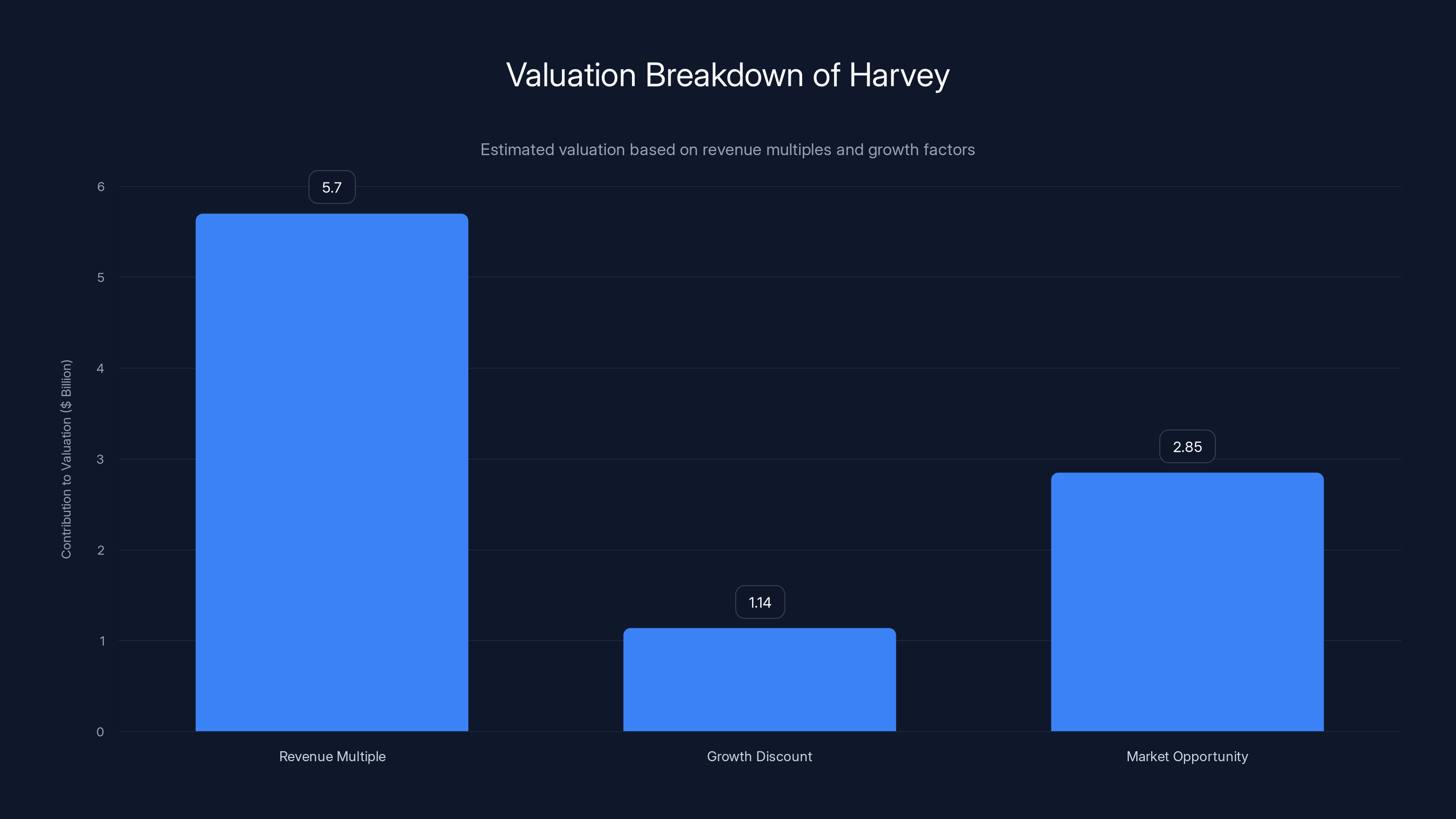

The Valuation Math: Is $11B Reasonable?

Venture valuations are notoriously disconnected from traditional company metrics. A public company trading at 10x revenue seems expensive. A private startup valued at 50x revenue seems insane. But venture logic is different.

Using the traditional Saa S multiple of revenue, Harvey at

Here's the venture valuation formula:

Let's break it down:

- Current Revenue: $190M ARR = 1.0x

- Revenue Multiple: 30x (high growth Saa S, not mature software)

- Growth Discount: 1.2x (company growing 90% year-over-year, so investors discount it up, not down)

- Market Opportunity: 1.5x (legal industry is huge and mostly untouched by AI)

That gives us:

But here's the real factor: path to IPO. Venture investors aren't buying shares in perpetuity. They're buying into a company that will either be acquired or go public. A

The risk, of course, is that AI commoditizes. If every legal software vendor—Thomson Reuters, Lexis Nexis, Westlaw—incorporates AI into their products, Harvey loses differentiation. If open-source legal AI models emerge, the moat shrinks. These are real risks that investors are pricing in, but they're betting the probability is low enough to justify the valuation.

Another factor: international expansion. Harvey has traction in the US, but the legal market is global. If the company can replicate its success in UK, European, and Asian markets, the addressable market multiplies. A truly global legal AI could be a $50+ billion company by 2030.

Harvey's $190 million ARR places it in the 'Scale' tier, indicating significant growth and positioning among top SaaS companies. Estimated data for visualization.

How Harvey's Product Works in Practice

Understanding the product is key to understanding why law firms are paying so much. Harvey isn't just a chatbot. It's an AI-powered platform that integrates into existing legal workflows.

At the core, Harvey's LLM can:

- Analyze contracts at scale, flagging risky clauses, identifying missing terms, and comparing against templates

- Generate legal documents from templates and specifications, reducing hours of drafting work

- Conduct legal research faster than human lawyers, pulling relevant case law and regulatory guidance

- Summarize documents for due diligence, M&A, and litigation discovery

- Spot issues across large document sets that humans would miss or take weeks to find

For a mid-sized law firm with 200 lawyers, having an AI that can instantly summarize a 500-page acquisition target's legal exposure isn't just convenient—it's transformative. It changes what's possible in a given timeframe.

Harvey also learns. When lawyers correct the AI's analysis, the system improves. Over time, a law firm's instance of Harvey becomes customized to that firm's specific practice areas, clients, and risk tolerance. This creates the lock-in effect mentioned earlier.

Integration is handled through APIs and direct connections to the law firm's document management systems, email, and case management software. The AI doesn't sit in isolation; it's embedded in the day-to-day work.

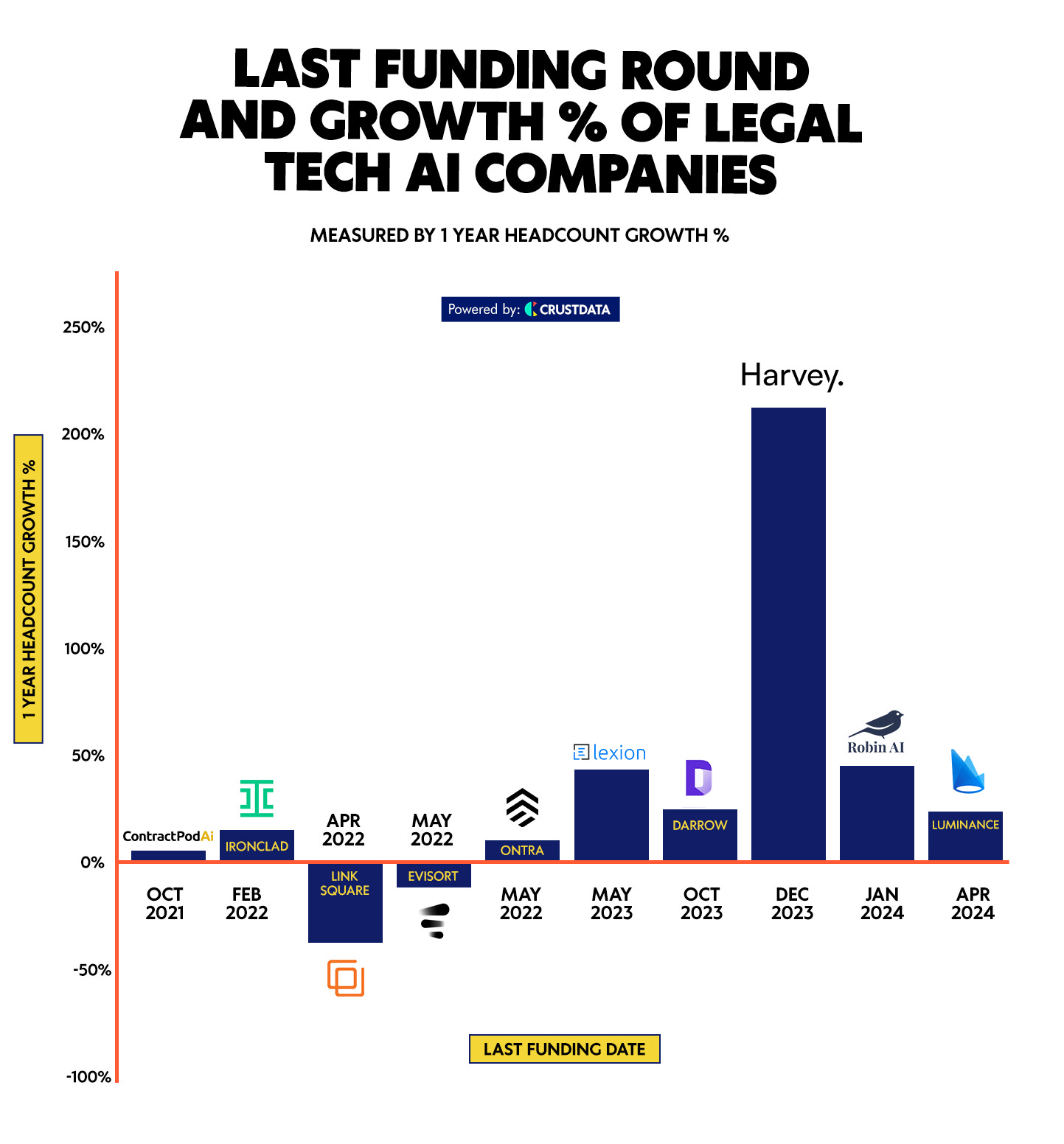

The Competition: Who Else Is Building Legal AI?

Harvey isn't alone, but it's ahead. Several players are competing in the space:

Lexis Nexis and Thomson Reuters have massive existing businesses in legal research and document management. They're adding AI capabilities to their platforms. But they're legacy software companies, and legacy companies move slowly. Their customers might have AI features, but they don't have a ground-up AI-native product.

Casetext, which is owned by Westlaw parent company Thomson Reuters, is building AI for legal research and brief writing. It's good, but it's an add-on to existing products, not the core.

Spellbook (from the Atlas Grant team) focuses on contract review and generation. It's specific in its focus, which is both a strength (deep domain expertise) and a weakness (limited addressable market within legal AI).

General-purpose LLMs like Claude and Chat GPT are technically capable of legal analysis, but they require careful prompting and verification. Law firms need trust. An AI that gets it right 90% of the time isn't good enough when stakes are billions of dollars.

Harvey's advantage is that it was built from the ground up for legal, with a founding team that understands both AI and law. That's harder to replicate than code. It's cultural and institutional.

The market is big enough for multiple winners, but Harvey's position as the AI-native, well-funded, well-executed legal tool gives it first-mover advantage in the enterprise segment.

Regulatory risk poses the highest potential impact on Harvey's operations, followed by challenges in international expansion and commoditization. (Estimated data)

Customer Adoption: Who's Actually Using Harvey?

Based on public information and industry rumors, Harvey's customer base includes significant law firms across multiple segments:

Am Law 100 Firms like Linklaters, Allen & Company, and others have publicly mentioned or are rumored to have Harvey implementations. These are firms with billions in revenue where efficiency gains translate to massive margin improvements.

In-house legal teams at major corporations are also adopters. General Counsel at Fortune 500 companies have similar document review and research challenges as law firms, and Harvey serves both markets.

Mid-market firms are the growth frontier. There are thousands of 50-200 lawyer firms in the US and globally. If Harvey can move downmarket without losing premium positioning, the TAM expands dramatically.

The sales motion is straightforward: Harvey sells directly to law firms, usually at the Practice Area Partner level or to the General Counsel for in-house teams. The initial implementation is specific to one practice area (e.g., M&A, Corporate, Litigation) with an expansion roadmap to other areas once ROI is proven.

Typical deployment might be a 2-year contract at

The Network Effects Play: Why the Valuation Could Be Even Higher

One angle that often gets overlooked in Harvey discussions is the potential for network effects. If Harvey becomes the standard legal AI, the value compounds.

Here's how it could work:

Marketplace of AI Agents: Harvey could evolve into a platform where other AI tools (specialized contract analysis, IP research, litigation prediction models) plug in. Imagine lawyers accessing an ecosystem of specialized AI tools through Harvey's interface. Each tool makes Harvey more valuable.

Legal Knowledge Commons: As thousands of lawyers use Harvey, the system learns from aggregate patterns. A risky clause that one firm missed gets flagged in another firm's documents. Precedent that's useful for one practice area gets suggested to others. The collective knowledge compounds.

Industry Standards: If Harvey becomes the de facto standard for AI in legal (even if it doesn't have 100% market share), other legal software will be forced to integrate with it or become less useful. That's platform power.

Training and Talent: Law schools could start training lawyers on Harvey as early as their first year. A generation of lawyers who've always used Harvey would create massive stickiness. They'd expect Harvey at their firm. New firms would need Harvey to compete for talent.

These network effects are speculative, but they're what venture investors see when they value Harvey at $11 billion. They're not just buying current revenue; they're buying optionality on becoming infrastructure for the entire legal industry.

Contract analysis leads the legal AI market, capturing an estimated 35% of the $17 billion market, followed by due diligence and legal research. Estimated data.

The Broader Implications for Enterprise AI

Harvey's trajectory matters beyond legal. It's a data point about where enterprise AI is heading.

For years, AI venture investors bet on horizontal platforms (everyone using the same AI for everything). Harvey proves the vertical thesis: AI tailored for specific industries and use cases wins. A legal-specific AI beats a general-purpose AI in law because it understands the domain, the customers, and the workflows.

This matters for other industries too. Healthcare has massive opportunities for domain-specific AI. Manufacturing, finance, insurance, real estate—all have specialized needs that general models can't serve optimally.

Harvey also proves that AI companies can achieve venture-scale returns without consumer scale. They don't need 100 million users. A few hundred paying customers, each worth millions per year, is enough. That changes the playbook for AI founders. You don't need to become the next Tik Tok. You need to become the standard tool for a valuable professional segment.

Finally, Harvey shows that investor demand for proven AI companies exceeds supply. There aren't many well-executed, well-funded, high-growth AI startups. The ones that exist face immense competition for capital. Harvey's ability to raise rounds at rising valuations every six months reflects genuine scarcity in the venture market.

Challenges and Risks: What Could Go Wrong?

Even with $190M ARR and top-tier backers, Harvey faces real challenges.

Regulatory risk is the biggest. If regulators decide that AI-generated legal analysis requires human sign-off or creates liability questions, Harvey's value proposition changes. A law firm can't deploy AI if using it creates malpractice liability. The legal profession is heavily regulated, and no AI startup wants to be the catalyst for new restrictions.

Commoditization is another real threat. As GPT-4, Claude 3, and other base models improve, specialized legal fine-tuning becomes less necessary. If a general-purpose model reaches 95% accuracy on legal tasks, law firms might opt for the cheaper, broader tool instead.

Customer concentration is a silent risk. If Harvey's revenue is weighted toward a few whale customers, and one decides to build internally or switch tools, growth stalls. The company has been cautious about this, but it's still a structural risk.

Expansion international is harder than US market penetration. Legal systems differ significantly between countries. A tool built for US law might need substantial refactoring for UK, European, or Asian markets. That extends timelines and increases costs.

Talent retention matters as the company scales. Early employees at AI startups often leave when valuations hit billions because their stock feels priced in. Retaining great engineers becomes harder, not easier, at unicorn scale.

The Path to an IPO or Acquisition

Harvey is on a clear trajectory toward one of two endpoints: IPO or acquisition.

IPO scenario: If Harvey maintains 60%+ annual growth and reaches

Acquisition scenario: A larger software company like Salesforce, Microsoft, or a legal-specific player could acquire Harvey for $20-40 billion. Microsoft, in particular, has been aggressively acquiring AI companies to integrate into its Office and legal solutions.

Whatever happens, the investors who funded Harvey early at

What This Means for the Broader AI Startup Ecosystem

Harvey's success isn't just a legal AI story. It's a template for how to build venture-scale AI companies in 2025 and beyond.

Vertical over Horizontal: Build for a specific industry, not everyone. Domain expertise beats general capability.

Enterprise over Consumer: Focus on customers with serious budgets, not free users. Make

Revenue Matters: Growth metrics are great, but demonstrated revenue (ARR) is what drives valuations. Harvey's growth wouldn't matter without $190M ARR to back it up.

Sales Motion is Critical: Harvey's ability to close million-dollar deals with law firms is as important as its AI technology. Great products fail without great sales.

Founder Credibility: Harvey's founding team combined AI expertise with legal domain knowledge. That combination is harder to replicate than code and attracts capital differently.

The next wave of AI unicorns will likely follow Harvey's playbook: vertical focus, enterprise customers, real revenue, experienced founders. Copycats will emerge in healthcare, finance, real estate, and other industries. Some will succeed. Most will struggle because domain expertise is harder to hire than it looks.

How Runable Fits Into the Enterprise AI Landscape

While Harvey is focused specifically on legal, platforms like Runable are building broader AI automation infrastructure that complements specialized tools. Runable offers AI-powered automation for creating presentations, documents, reports, images, videos, and slides, starting at $9/month.

For enterprise teams deploying AI across multiple workflows—whether it's generating client reports alongside Harvey's contract analysis or automating document creation—platforms that handle cross-functional AI tasks provide a complementary layer. Specialized tools like Harvey handle domain-specific problems with precision, while broader platforms like Runable manage general automation and content generation across teams.

This two-tier approach is increasingly how enterprises deploy AI: specialized tools for high-value, domain-specific work and broader platforms for general productivity. Harvey won't generate a firm's client slides; Runable might. But together, they create a more complete AI-powered workflow.

Use Case: Automating legal document generation and client report creation while specializing in domain-specific contract analysis with Harvey.

Try Runable For Free

The Timeline: When Will We See the Next Big Milestone?

Based on Harvey's current trajectory, here's what to expect:

Q1 2026: The reported

Q2-Q3 2026: Harvey launches international expansion, likely starting with UK and European markets. Legal structures in those regions are different, but the AI application is similar.

Q4 2026: Harvey likely announces $250M+ ARR, maintaining momentum from 2025. This would position the company for potential IPO-readiness discussions.

2027: Either Harvey announces an IPO filing or becomes acquisition target discussions accelerate. At this scale, staying private becomes harder. Public market capital and the credibility of a ticker symbol become valuable.

2027-2028: If IPO happens, initial valuation likely

These projections assume Harvey maintains execution and the legal AI market doesn't face major regulatory headwinds. Both are reasonable assumptions based on current trajectory.

Key Takeaways for Investors, Founders, and Industry Observers

Harvey's rise is instructive across multiple dimensions.

For VCs: Vertical AI companies with enterprise customers and proven revenue are the new golden ticket. If you're evaluating AI startups, ignore the hype and ask: What industry are you optimizing for? Do customers have budget? Is ARR growing faster than valuation?

For Founders: Domain expertise matters more than AI expertise. You can hire AI engineers. You can't easily hire deep industry knowledge. If you're building an AI startup, pick an industry where you have genuine insight or founder expertise.

For Law Firms and Enterprises: Harvey is a proof point that AI adoption isn't optional. It's competitive necessity. Firms not deploying AI for document review, research, and generation within the next 2 years will lose efficiency war to firms that do. The best time to adopt was 2024. The second-best time is now.

For the Broader Tech Industry: Harvey's success on a $1B+ capital raise proves that not every AI startup needs billion-user consumer scale. Focused, profitable businesses with enterprise customers are just as (or more) valuable than consumer moonshots.

FAQ

What exactly is Harvey and what does it do?

Harvey is an AI platform built specifically for legal professionals that uses a specialized large language model to automate tasks like contract review, legal research, document generation, and due diligence. Rather than being a general-purpose AI, Harvey is trained on legal documents, case law, and regulatory frameworks to understand legal nuances with precision that generic AI tools often miss. Law firms use Harvey to compress weeks of work into days while improving accuracy and consistency.

How did Harvey achieve $190 million ARR so quickly?

Harvey's rapid ARR growth resulted from three factors working together: a massive addressable market (law firms spend billions on repetitive document review and research), a product that solves a real, expensive problem (lawyers cost

Why is Harvey valued at 190 million in ARR?

The valuation reflects multiple factors beyond current revenue: rapid growth trajectory (ARR doubled in six months), enormous market opportunity (legal services are a

How does Harvey's AI actually avoid legal mistakes that could create liability?

Harvey combines specialized legal training with human-in-the-loop workflows. While the AI can flag issues and draft analysis, law firms retain human lawyers in the loop for final decisions on high-stakes matters. The AI is positioned as a productivity tool that speeds up work and reduces human error (catching missed clauses, spotting inconsistencies), not as a replacement for lawyer judgment. Harvey also learns from lawyer corrections, improving its accuracy over time on each firm's specific practice areas and risk tolerance.

Could open-source AI models or competitors like Chat GPT make Harvey obsolete?

It's a real risk, but unlikely in the medium term. While general-purpose models are improving, specialized legal AI trains on different datasets and gets feedback from legal experts in ways general models don't. A law firm might use Chat GPT for basic legal questions, but for mission-critical work, most firms would still prefer an AI built by lawyers, for lawyers. Competitors could emerge, but Harvey's first-mover advantage, customer lock-in, and $1 billion in capital give it significant lead time to cement market position.

Is Harvey actually profitable, or is it growing into losses?

Based on available information, Harvey appears to be on trajectory toward profitability or already profitable at the EBITDA level. At

What happens to Harvey if legal education and law firms start training lawyers in-house on basic AI tools?

It could reduce Harvey's advantage, but unlikely significantly. Law schools training lawyers on Chat GPT or basic AI isn't the same as having an integrated, purpose-built legal AI system embedded in firm workflows. Harvey's strength is workflow integration, specialized training, and customization to firm-specific practices. A lawyer who learned Chat GPT in school wouldn't eliminate the need for a dedicated legal AI platform anymore than learning general Excel would eliminate the need for specialized finance software. Harvey has moat protection through specialization.

When might Harvey go public or get acquired?

Based on trajectory, Harvey is likely 2-3 years from either an IPO or acquisition event. If the company reaches

How does Harvey compare to existing legal tech players like Lexis Nexis or Westlaw?

Harvey is fundamentally different because it was built from the ground up as an AI-native product, while Lexis Nexis and Westlaw are legacy software companies adding AI capabilities to existing platforms. Harvey is faster to iterate, purpose-built for AI workflows, and not constrained by legacy code or business models. That said, Lexis Nexis and Westlaw have massive installed bases and customer relationships, which is their defensive advantage. Most likely outcome is coexistence: Harvey wins with innovation-forward firms and new customers, while legacy players retain existing relationships but lose mindshare among growth-oriented firms.

What's the biggest risk to Harvey's continued success?

Regulatory risk tops the list. If bar associations or regulators decide that AI-generated legal analysis requires specific oversight, disclaimers, or human sign-off, Harvey's value proposition changes. The legal profession is heavily regulated, and AI vendors have less leverage than in other industries. A regulatory backlash could slow adoption significantly. Secondarily, customer concentration risk (if revenue is heavily weighted to a few whale customers) and commoditization (general models improving faster than expected) are structural threats worth monitoring.

Conclusion: Harvey as a Harbinger of Enterprise AI's Future

Harvey's journey from

The company's success rests on three pillars that most startups can't replicate simultaneously: a massive, expensive problem that enterprises will pay to solve, a product specifically designed for that problem rather than adapted from a general platform, and a founding team with credibility in both AI and the domain they're disrupting.

The $190 million ARR proves this isn't hype. Law firms aren't paying millions annually for vaporware. They're writing large checks because Harvey saves them real money while improving work quality. That unit economics conversation—where a tool pays for itself within months of deployment—is what venture capitalists live for.

What makes Harvey interesting beyond legal is the template it establishes. The next decade of AI won't be defined by one universal AI tool everyone uses. It'll be defined by specialized, vertical tools that dominate specific industries, paired with broader platforms that handle cross-functional needs. Specialized tools solve hard problems with precision. Broad platforms solve common problems with simplicity.

For builders and VCs, the lesson is clear: vertical AI with enterprise customers and proven revenue is venture's new north star. For enterprises, the lesson is equally clear: AI adoption isn't optional. It's competitive necessity. The firms deploying domain-specific AI today will have unfair advantages over those waiting for the technology to mature.

Harvey will either become a $100 billion company or acquire/be acquired by 2028. Whichever path it takes, the company has already proven its thesis: AI can transform entire industries when it's built by people who understand those industries deeply.

That's not just good investing. That's how progress actually happens.

Related Articles

- ElevenLabs 11B Valuation [2025]

- From AI Pilots to Real Business Value: A Practical Roadmap [2025]

- Benchmark's $225M Cerebras Bet: Inside the AI Chip Revolution [2025]

- The ARR Myth: Why Founders Need to Stop Chasing Unrealistic Growth Numbers [2025]

- Claude Opus 4.6: Anthropic's Bid to Dominate Enterprise AI Beyond Code [2025]

- Google Hits $400B Revenue Milestone in 2025 [Full Analysis]