Introduction: When Chat GPT Meets Customs Paperwork

Sam Basu was comfortable. Senior software engineer at Google. Stock options. The whole Silicon Valley dream. Then OpenAI released Chat GPT in late 2022, and like thousands of other engineers, Basu started asking himself the dangerous question: "What if I built something with this?"

He tried a few ideas. Nothing stuck. But in early 2023, a friend called with an unusual problem. He needed help filling out customs paperwork. That's it. That simple phone call became the eye-opening moment that would eventually launch Amari AI.

Here's what makes this story interesting: Basu started cold-calling customs brokers in Los Angeles. What he discovered shocked him. An entire industry—one that literally moves everything from your smartwatch to your car parts across borders—runs on paper, faxes, and manila folders stuffed in filing cabinets. One customer gave him a FaceTime tour of her office. "There's just papers and papers," he told me later. He flew to her office the next day.

That impulse to look deeper, to actually see the problem instead of imagining it, changed everything.

Today, Amari AI (co-founded with Arushi Vashist, a former senior software engineer at LinkedIn) has already signed over 30 customers and helped move more than

This isn't a story about AI hype. It's a story about AI actually solving real problems for real businesses that have been ignored by the tech industry for decades. And it's a masterclass in how the best startup ideas often come from asking questions, not from chasing trends.

TL; DR

- AI is modernizing a paper-based industry: Customs brokerage still relies on faxes and manual data entry, even though it moves trillions in goods annually and is critical to global commerce.

- Trade chaos creates urgency: Trump's shifting tariff policies have made customs brokers essential consultants, but also burned them out with constant policy changes.

- The labor problem is acute: Customs brokers must be US-based, licensed professionals with a 10-20% exam pass rate, making the talent shortage critical.

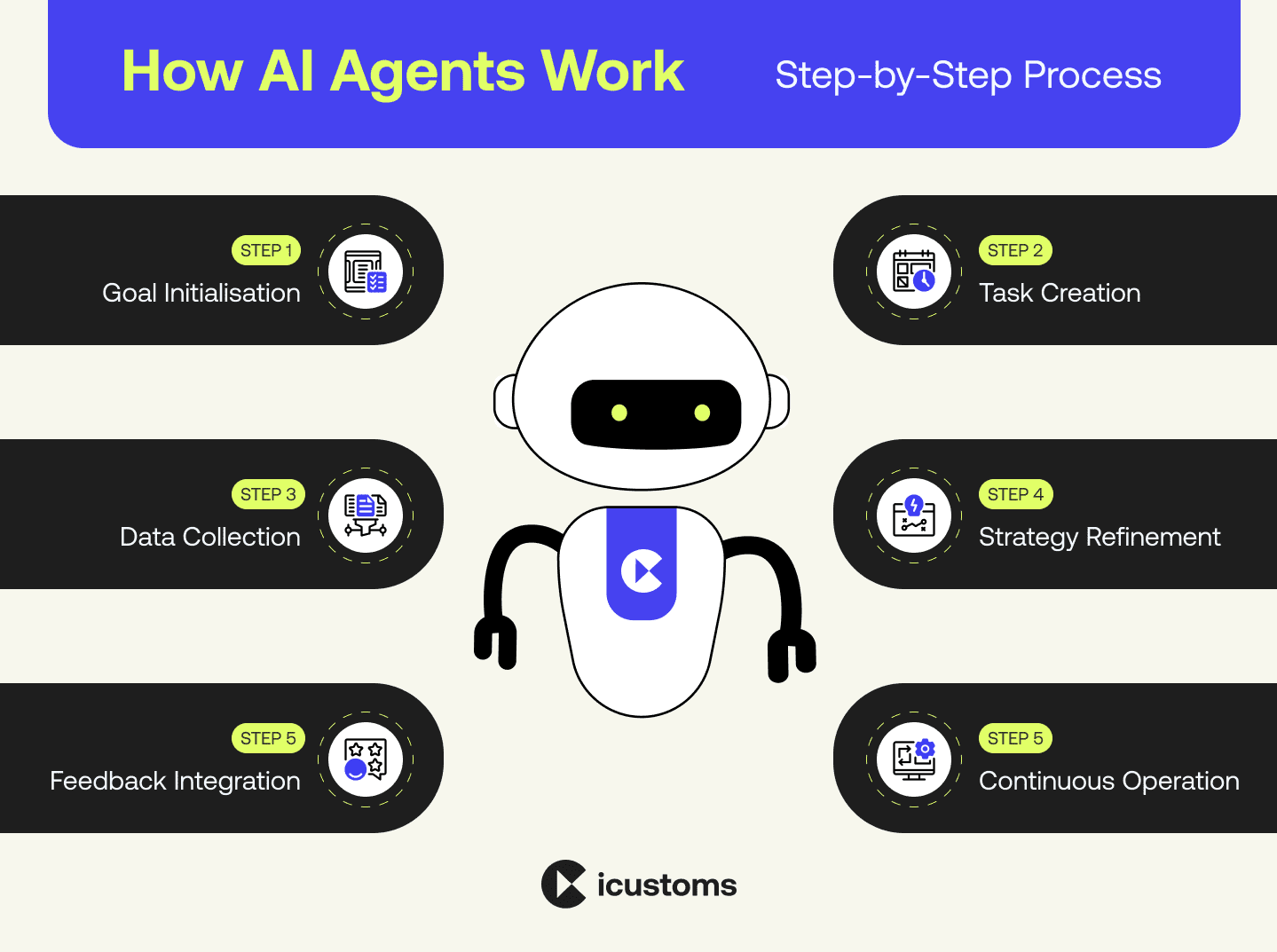

- AI agents solve real workflow gaps: Startups like Amari are building AI systems that monitor policy changes, automate paperwork entry, and help brokers stay compliant in real time.

- The opportunity is massive: The customs brokerage industry is fragmented, underinvested, and ready for consolidation around modern technology.

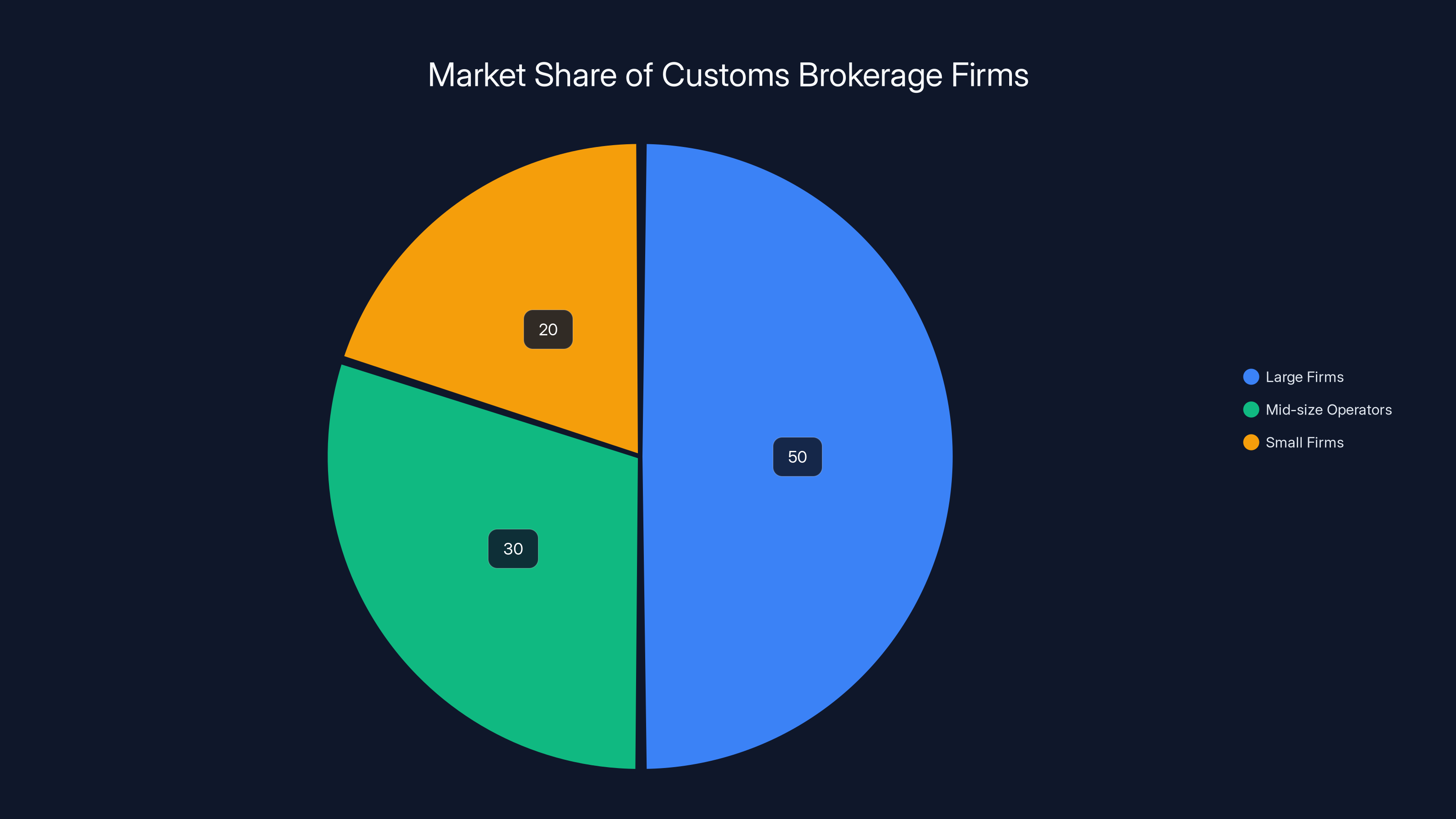

Large firms dominate the customs brokerage market with an estimated 50% share, while mid-size operators and small firms hold 30% and 20% respectively. (Estimated data)

The Industry Nobody Talks About (But Everyone Depends On)

Let's start with the obvious question: what even is a customs broker?

When something crosses the US border, it doesn't just magically clear customs on its own. It requires paperwork. Lots of paperwork. Import forms. Tariff classifications. Compliance documentation. Duty calculations. Declarations about the contents, origin, value, and intended use.

For most companies, especially mid-market manufacturers and retailers, handling this complexity internally doesn't make sense. You'd need to hire specialists, maintain expensive compliance infrastructure, and stay obsessively current on policy changes. Instead, businesses hire customs brokers. The broker handles the paperwork, manages the compliance risk, and shepherds goods through customs clearance.

This sounds straightforward. In practice, it's chaos.

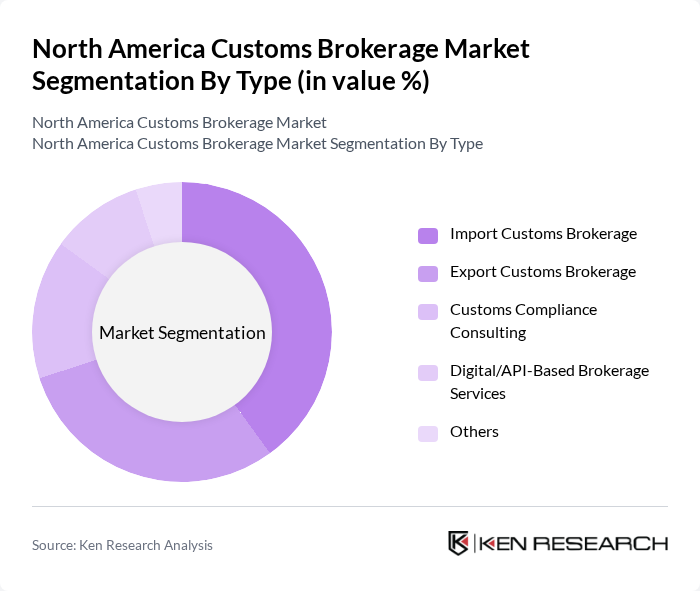

The customs brokerage industry is fragmented. You've got massive firms like FedEx that handle volume domestically, you've got mid-size operators like GHY International (125 years old, serving major accounts), and you've got mom-and-pop shops in every port city that handle niche clients. Most of these firms operate like they did in 1995.

I'm not exaggerating. Many brokers still:

- Receive shipment documents via fax

- Enter data manually into spreadsheets or legacy systems

- Track compliance updates by reading trade publications

- Store physical copies of every shipment's documentation

- Manage client relationships via email and phone

- Use basic OCR software that breaks frequently

Why does this matter? Because when tariffs change, when trade policy shifts overnight, when a new executive order suddenly impacts your supply chain, these brokers are often the only people who can help you understand what it means for the goods you have in transit.

Chris Bachinski, CEO of GHY International, told me his customers often don't have compliance staff at all. They rely entirely on his brokers to interpret policy and minimize duty exposure. "Last year," he said, "was the first time in history our families knew what we do for a living. Because all of a sudden, customs brokers became very, very important."

The problem is compounded by labor scarcity. To become a licensed customs broker, you need to pass the US Customs Broker License Exam. The pass rate hovers between 10-20%. Brokers must be US-based (you can't offshore the work). And they must maintain constant CE credits in a field that's constantly changing.

This creates a perfect storm. Burnout is rampant. Experienced brokers are leaving for early retirement. Younger professionals see the pay and stress and choose different careers. The talent pool is shrinking while demand keeps growing.

This is the industry Sam Basu walked into with fresh eyes and a blank slate. He didn't know the history. He didn't know the constraints. He just saw a problem: sophisticated companies moving trillions in goods, relying on brokers who operate like it's 1999, unable to scale because they're bottlenecked by manual processes and labor constraints.

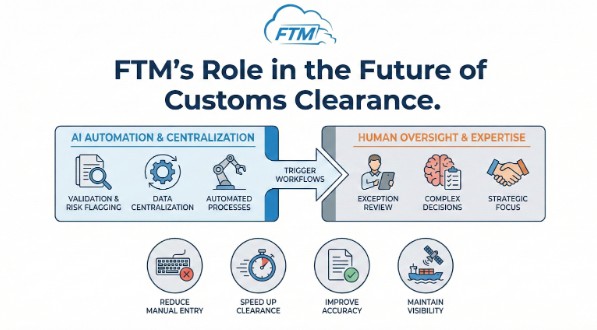

He saw an obvious solution: AI agents that could automate the repetitive work, monitor policy changes in real time, and give brokers back the time to focus on relationship management and strategic compliance work.

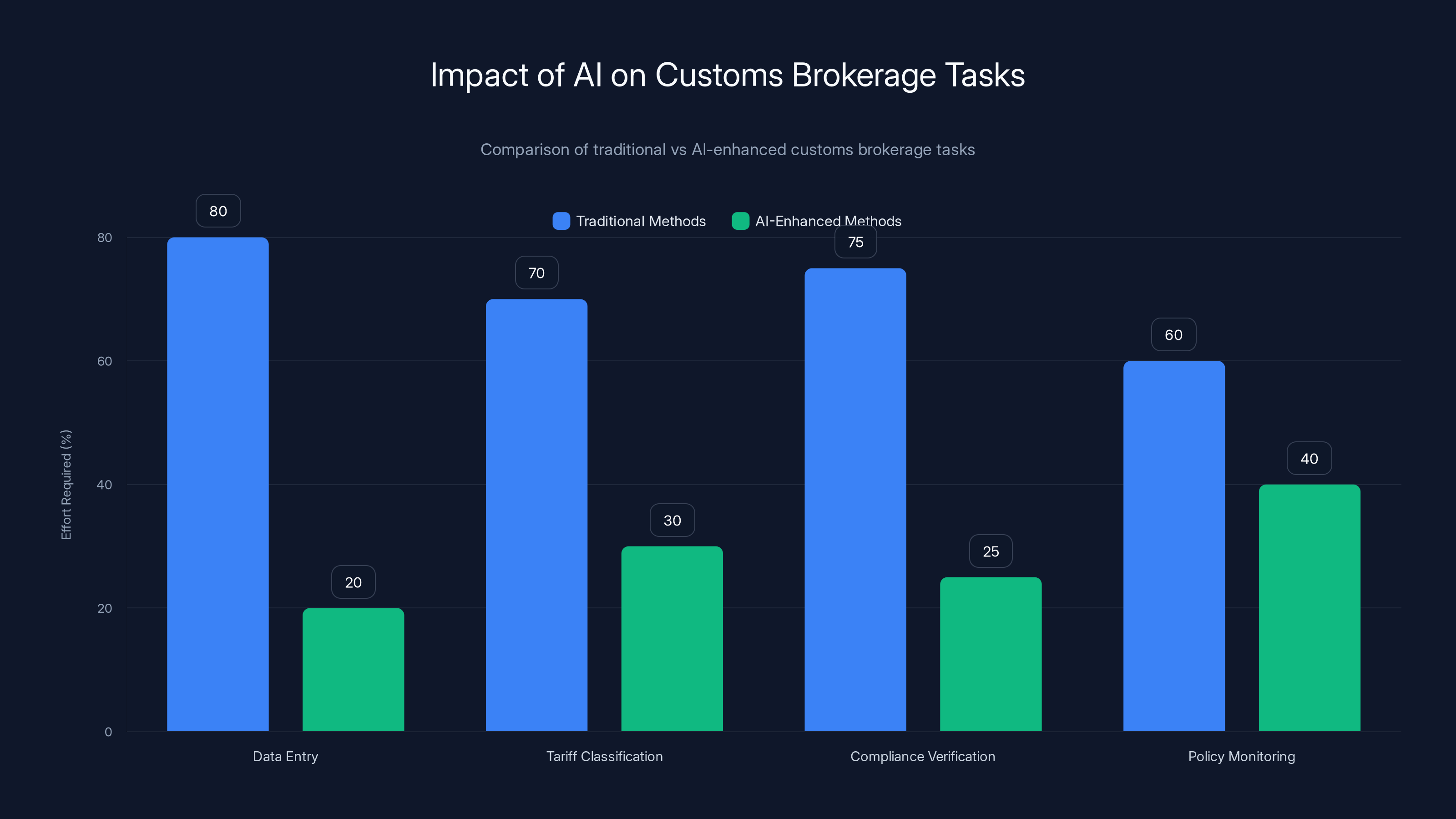

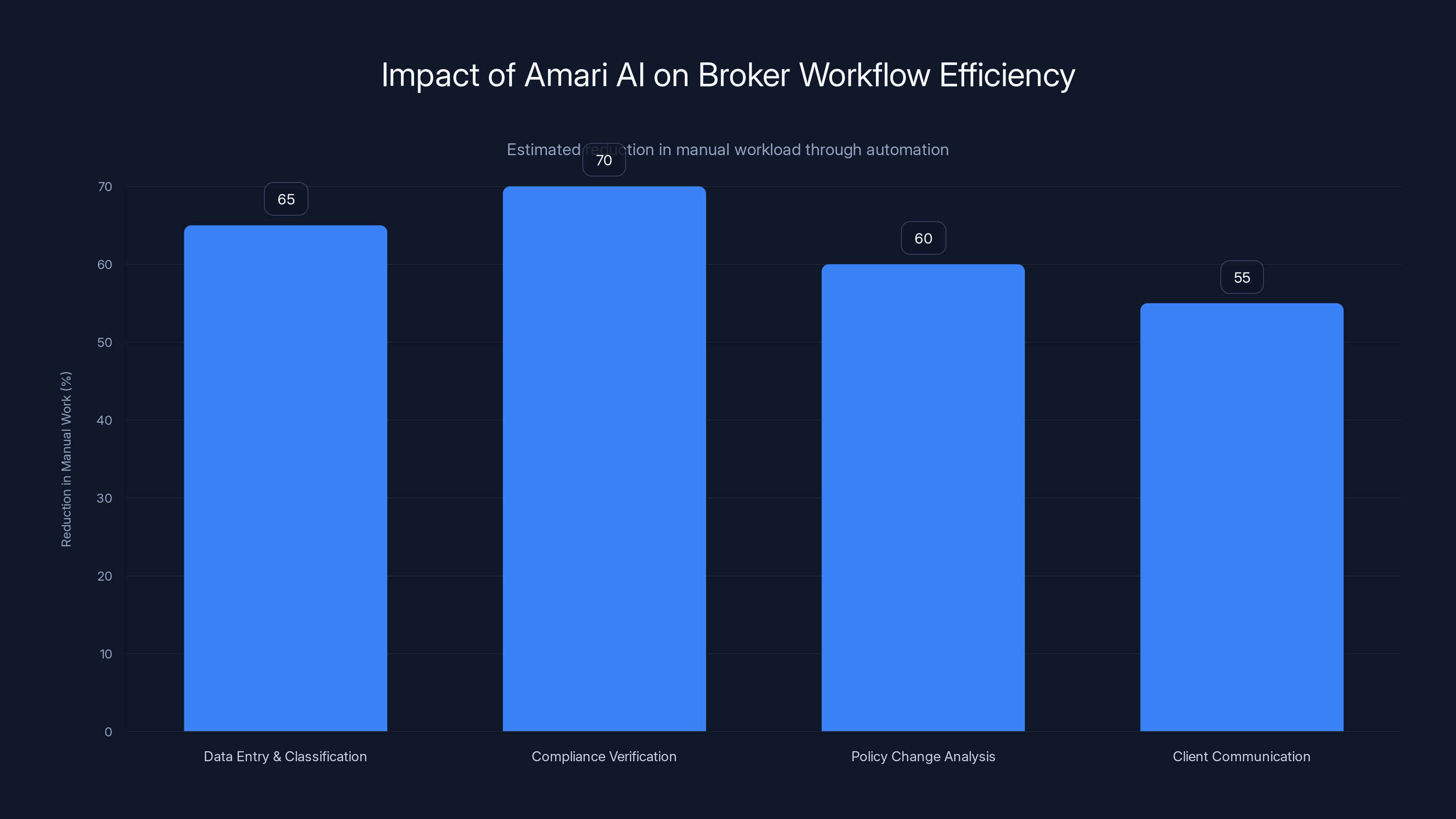

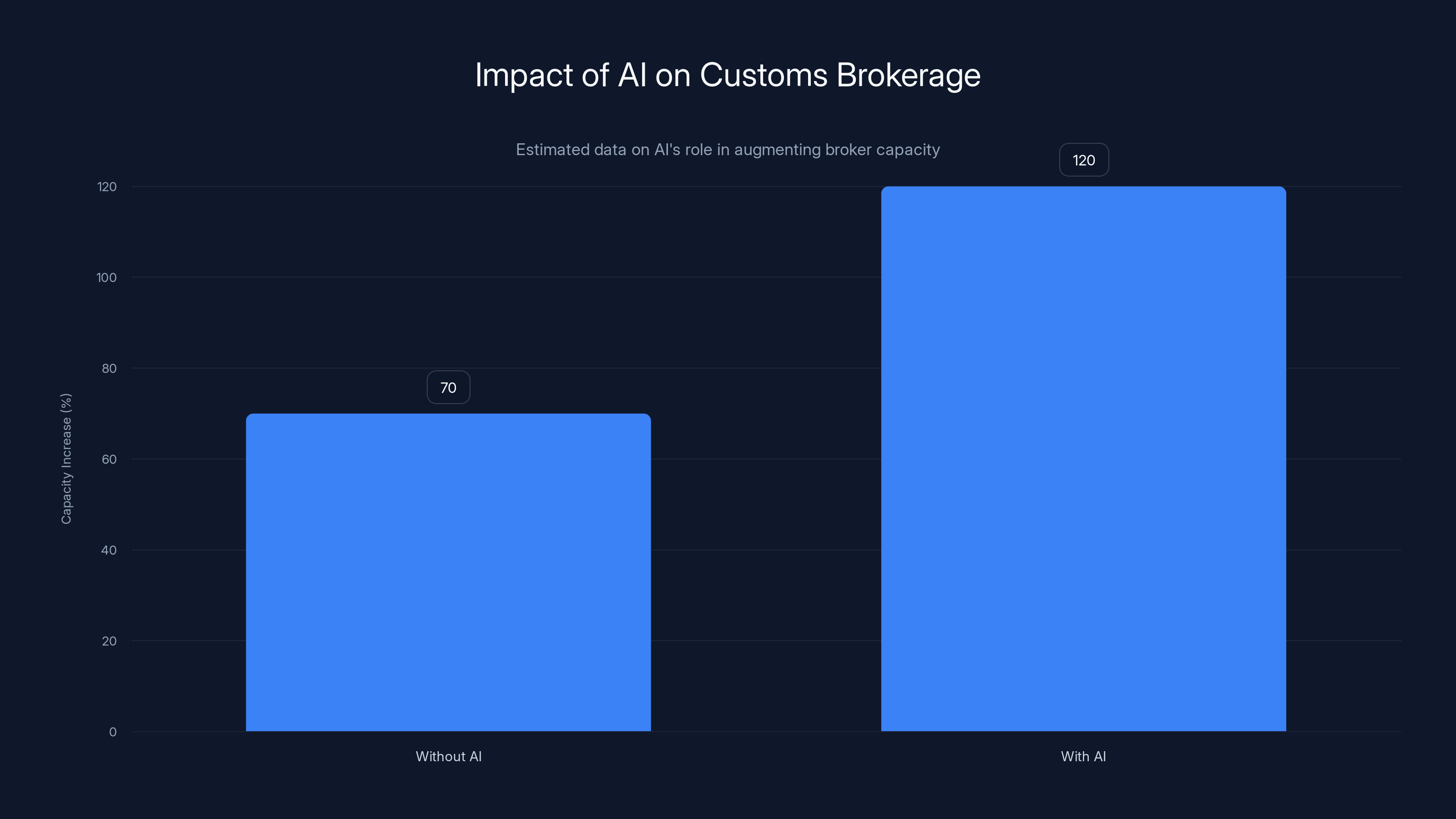

AI significantly reduces the effort required for routine customs brokerage tasks, allowing brokers to focus on strategic activities. Estimated data based on typical task automation impact.

The Trade Policy Problem: Why This Moment Exists

Customs brokers have always been important. But they've never been as important as they are right now.

Trade policy, historically, moved slowly. Tariffs changed infrequently. Policy was predictable enough that brokers could maintain playbooks of how to handle common scenarios. Compliance was complicated, but stable.

Then 2025 happened.

Without getting into the political weeds, the current administration has made trade policy volatile. Tariffs change on short notice. Executive orders redefine tariff classifications. Trade wars escalate. Countries retaliate. Exemptions are granted, then revoked.

From a customs broker's perspective, this is a nightmare. Every policy change requires immediate reinterpretation. Goods that were compliant yesterday might have duty implications today. Shipments already in transit face sudden reclassification. Brokers have to respond fast to minimize their clients' exposure.

Previously, this required manual research. A broker would read the announcement, consult their experience, maybe call a colleague, and then advise their client. This took time. In a low-change environment, that's fine. In a high-change environment, it's a massive liability.

Bachinski of GHY International put it plainly: "The industry needs to be agile. Tariffs change, and we need to respond within hours, not days. If we're slow, our customers suffer."

This urgency is where AI becomes genuinely useful.

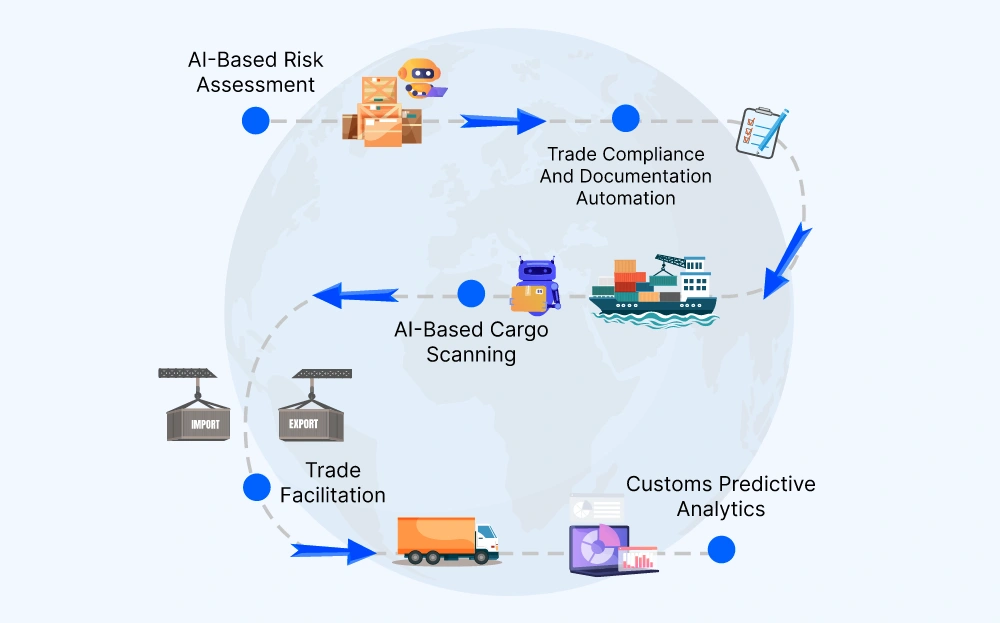

Amari's approach is to build AI agents that constantly monitor trade announcements, tariff updates, and compliance changes. When something changes, the agents parse the new information, update their understanding of how policies apply to different goods, and flag relevant updates for specific brokers and clients.

Instead of brokers manually researching each change, the AI does the initial analysis. Instead of hoping nothing falls through the cracks, the AI systematically ensures every relevant policy change is evaluated for impact.

Basu told me Amari's AI agents are trained on over one million historical shipping documents. The AI has learned how different types of goods are classified, what compliance requirements apply, and how policy changes typically cascade through different product categories. When new policy is announced, the AI can immediately model the impact on existing shipments in the pipeline.

The accuracy matters because the cost of mistakes is high. Misclassifying tariff codes can result in underpayment of duties (creating liability for brokers and importers) or overpayment of duties (creating cost exposure for importers). Getting it right, fast, is critical.

"It's a perfect fit for AI," Basu said. "Brokers need speed and accuracy. AI doesn't get tired. It doesn't have emotion. It systematically evaluates every policy change and every shipment."

Inside Amari AI: How Modern Tech Solves an Old Problem

Amari AI isn't a consulting firm. It's not a SaaS platform where brokers log in and click buttons. It's a technology partner that works inside brokers' workflows, automating the repetitive work and flagging the important decisions.

Here's how it works in practice:

A customs broker is managing shipments for 50 different clients. A new tariff announcement drops. Instead of the broker manually reviewing the announcement and assessing which clients are affected, Amari's AI agents do the first pass.

The agents read the new policy. They cross-reference it against the broker's existing shipments. They identify which clients are likely affected. They draft an analysis of the impact. They flag items that need human review.

The broker, freed from the initial grunt work, can now focus on the strategic analysis. Do we appeal? Do we reroute? Do we accelerate shipment timelines to avoid the new tariff? Should we recommend the client source from a different country?

This is the template for how Amari is approaching automation across the broker workflow:

Data Entry and Classification: Brokers spend significant time entering shipping information, classifying goods under the Harmonized Tariff Schedule (HS codes), and matching shipments to existing customer data. Amari's AI handles this, reducing manual data entry by an estimated 60-70%.

Compliance Verification: Before shipments are cleared, brokers verify compliance against a matrix of requirements: country of origin rules, anti-dumping duties, export controls, licensing requirements. Amari automates this verification, checking shipments against thousands of regulatory combinations.

Policy Change Analysis: When new announcements drop, Amari's agents analyze impact systematically. Instead of brokers manually researching, the AI does the legwork.

Client Communication: Amari helps draft clear, timely communications to clients about policy changes and their implications. This is template-based but personalized.

Documentation Management: Instead of paper and folders, Amari maintains a structured digital record of every shipment, every policy it's evaluated against, and every compliance determination.

Basu emphasized that Amari is training its own AI models on the shipment documents its customers provide. These aren't off-the-shelf models. They're customized to understand customs brokerage specifically.

"We've trained on over one million documents," Basu said. "The models understand the nuances of tariff codes, the way compliance requirements interact, the patterns in how goods are classified across different product categories."

He was also quick to note that customers can opt out of this training. Amari doesn't sell data. Data belongs to the customer. But for customers who opt in, Amari's models get smarter, which means the AI becomes more accurate and more valuable for everyone.

Todd Jackson, a partner at First Round Capital (an investor in Amari), told me the reason Amari resonated was Basu's commitment to understanding the customer. "He's going to conferences. He's going to trade shows. He's learning what these brokers actually need, not what he thinks they need."

This customer-centric approach is often missing from AI startups. Many founders assume technology is the answer and try to force fit solutions. Basu did the opposite. He listened first, built second.

Amari AI significantly reduces manual workload in broker workflows, with an estimated 60-70% reduction in tasks like data entry and compliance verification. Estimated data.

The Customer Reality: GHY International's Transformation

GHY International isn't a mom-and-pop operation. It's a 125-year-old company with significant scale and reputation. But even GHY was struggling with the same challenge smaller brokers face: how to scale without overloading your team.

Chris Bachinski, CEO of GHY, discovered Amari at a trade show. He was looking for ways to compete on speed and accuracy while also growing revenue. The concern from his team was predictable: job loss.

"The biggest concern when we first implemented Amari was that people would lose their jobs," Bachinski said. "But what we're seeing is the opposite. The technology is freeing people to do higher-value work."

Here's what happened in practice:

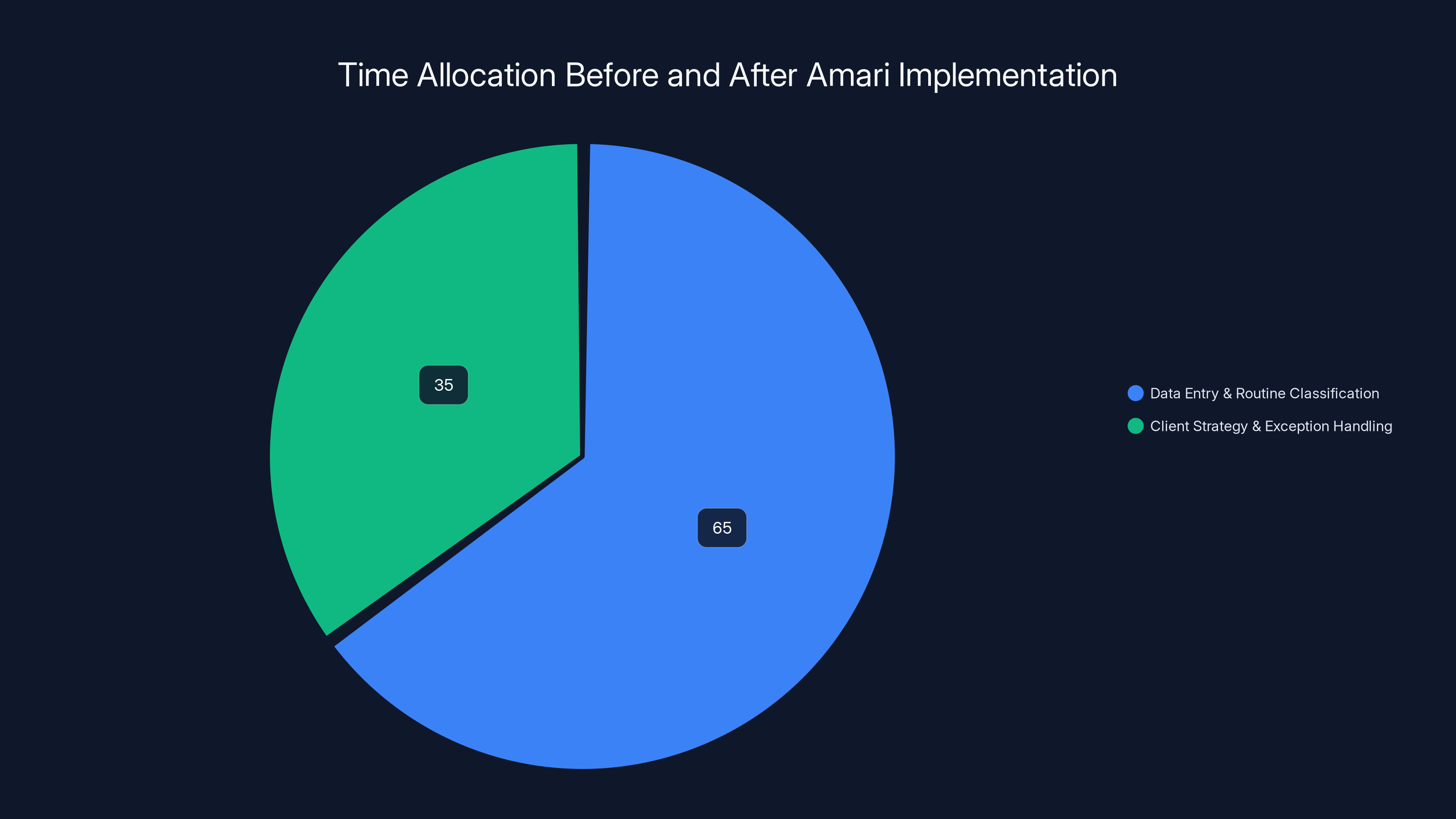

GHY's compliance team, which previously spent 60-70% of their time on data entry and routine classification, now spends 70% of their time on client strategy and exception handling. Brokers are less stressed. They're not staying late processing backlog. They're focused on relationships and complex decision-making.

Meanwhile, GHY is processing more shipments with the same headcount. They're hitting compliance SLAs faster. They're providing more proactive analysis to clients.

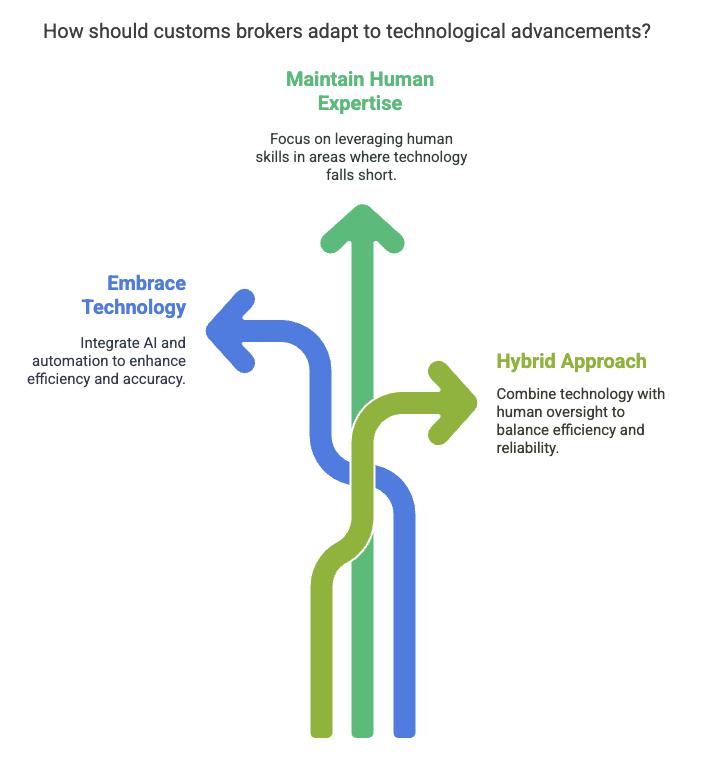

Bachinski was candid about the fact that this is how technology should work in mature industries: not destroying jobs, but reallocating human effort to where humans add the most value.

"Technology is going to shift our industry faster than most customs brokers understand," Bachinski said. "The ones who adapt will thrive. The ones who don't will become obsolete."

The irony is sharp. Customs brokers are critical to understanding trade policy. Yet most of them are forced to spend their time on mindless data entry instead of strategic analysis. Automation doesn't eliminate the job. It elevates it.

The Broader Implications: Why This Matters for Supply Chain

Amari is solving a specific problem (customs brokerage modernization), but the broader implications are massive.

Supply chain is, fundamentally, about information. Who has what? Where is it going? What's the cost? What are the risks? What are the regulations?

For decades, supply chain information moved slowly. Brokers knew things. Freight forwarders knew things. Customs cleared things. But the data was fragmented, the communication was slow, and the visibility was limited.

AI is creating transparency.

Instead of a broker learning about a new tariff from email, the AI detects it automatically. Instead of a shipper discovering a compliance issue when goods are flagged at the border, the AI flags it before shipment. Instead of manual research taking hours, AI analysis takes minutes.

This has ripple effects:

Importers benefit: Faster clearance times mean lower carrying costs. Better policy analysis means fewer surprise duty bills. Real-time compliance flagging means less shipment rejection.

Brokers benefit: Higher throughput. More time for strategic work. Better client service. Lower burnout.

The economy benefits: Goods clear borders faster. Supply chains move faster. Trade happens more efficiently.

This is the kind of AI application that works: solving a real problem, freeing humans to do higher-value work, and creating economic value.

Basu emphasized that Amari is building defensible technology. As the AI trains on more documents, it gets smarter. Competitors starting from scratch face a significant disadvantage. This is a genuine moat, not a temporary advantage.

Estimated data shows a significant shift in GHY's compliance team time allocation from routine tasks to strategic activities after implementing Amari.

The Labor Problem: Why AI Isn't Replacing Brokers (Yet)

One of the persistent concerns in this space is whether AI will eliminate jobs. In customs brokerage, the answer is probably not. At least not yet.

Here's why: licensing and regulatory requirements.

A customs broker's license isn't something an AI can get. Brokers are personally liable for the accuracy of their work. They must maintain malpractice insurance. They must pass continuing education requirements. They must be available to testify about their decisions if challenged.

This is intentional regulation. Customs compliance has legal consequences. The government wants to know there's a human being, with credentials and liability, standing behind every compliance determination.

Amari's AI can assist with the technical work. It can't replace the licensed broker.

But there's a second part to this story: the talent pipeline is already broken. There aren't enough brokers. The profession isn't attracting young people. The pass rate on the licensing exam is 10-20%.

Without AI, the problem gets worse. More experienced brokers retire. Fewer new brokers enter the field. The bottleneck tightens.

With AI, brokers can handle more volume without overload. Newer brokers can learn faster, assisted by AI that handles routine work. The profession becomes more sustainable.

Basu's framing of this is important: "We're positioning ourselves as extra hands that brokers can hire or keep alongside their expertise. We're not replacing people. We're augmenting them."

This distinction matters. In industries with regulatory requirements, compliance liability, and professional licensing, AI augmentation is often more realistic than full automation.

Technology Stack: What Amari Is Actually Building

Basu mentioned that Amari has been leveraging off-the-shelf models to date, but the company is building its own trained models. This is an important distinction.

Off-the-shelf models (like GPT-4) are general-purpose. They're trained on broad internet data. They're good at many things but not specialized in any one thing.

Amari's custom models are trained specifically on customs documentation, tariff codes, compliance requirements, and historical policy analysis. This makes them far more accurate in the specific domain of customs brokerage.

Here's what that training process looks like:

-

Data Collection: Gather historical shipment documents, tariff classifications, compliance determinations, and policy analyses.

-

Annotation: Classify each document, mark up relevant details, and create training labels.

-

Model Training: Train language models to understand patterns in customs documentation.

-

Validation: Test accuracy against held-out data.

-

Continuous Learning: As new shipments are processed, the models improve.

One million training documents is a massive dataset. For context, most enterprise AI projects have far fewer examples. Amari's scale is a significant competitive advantage.

Basu was careful to note that customers can opt out of contributing their data to model training. This is both ethically important and practically important (since some customers may have competitive concerns about their import patterns).

The business model implications are interesting. Amari could theoretically become a data business, selling insights gleaned from pattern analysis across customers. Basu seems to be avoiding this (at least for now). Instead, Amari is focused on providing value to individual customers.

AI can potentially increase brokers' capacity by 50% or more by handling routine tasks, making the profession more sustainable. Estimated data.

The Funding Story: Why VCs Suddenly Care About Customs

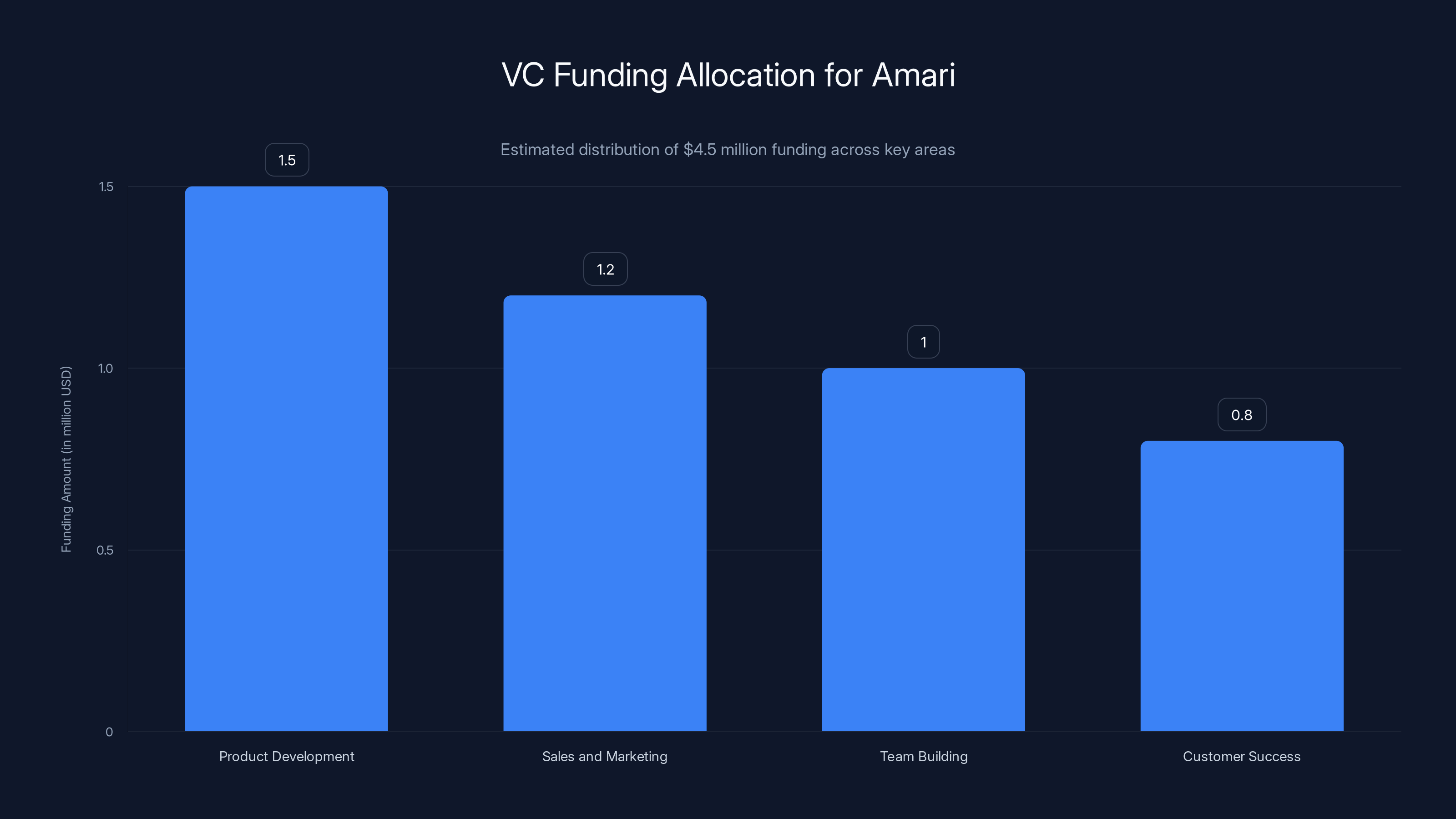

Amari raised $4.5 million from First Round Capital and Pear VC. That's not massive in venture terms, but it's significant for a domain that historically hasn't attracted venture interest.

Why?

Because Todd Jackson and other investors are seeing what Basu saw: a large, fragmented industry with a real problem, a credible founding team with relevant expertise, and a clear path to meaningful revenue.

First Round Capital is known for backing founders who understand their customers deeply. Jackson specifically mentioned Basu's approach: "He's going to conferences. He's going to trade shows. He's in the trenches learning."

This is the opposite of hype-driven investing. Jackson is backing a founder who's doing the unglamorous work of understanding a boring industry deeply.

Pear VC, similarly, focuses on infrastructure and commerce. Customs brokerage is commerce infrastructure. It's exactly the kind of domain Pear focuses on.

The funding is meaningful for several reasons:

Product Development: Building custom AI models requires compute resources, data annotation, and validation. Money accelerates this.

Sales and Marketing: Getting brand recognition in a fragmented industry requires trade show presence, content, and relationship building.

Team Building: Attracting talent to work on customs brokerage (not exactly a sexy domain) requires competitive salaries and resources.

Customer Success: Early customers need support, customization, and integration work.

Basu is clear that the business model is straightforward: charge brokers for usage. The more shipments they process with Amari's help, the more they pay. This aligns incentives (Amari makes more money when brokers process more shipments) and keeps pricing tied to value.

Competitive Landscape: Why This Space Is Ripe for Disruption

Amari isn't the only company approaching customs brokerage modernization. But the competitive landscape is interesting.

There are a few large software vendors that serve the freight forwarding and brokerage space (think Hudson, Magaya, others). These are mature, established players. They have customer relationships and revenue. But they're also legacy. They tend to be slow-moving, cautious about new technology, and focused on maintaining existing customer relationships rather than transforming the industry.

There are also newer logistics platforms (like Flexport, Everstream, others) that have raised significant capital and built modern interfaces for supply chain visibility. These companies are more technologically sophisticated than traditional freight software. But customs brokerage is often not their core focus.

Amari is positioned in a gap: focused specifically on customs brokerage, built with modern AI technology, and designed from scratch for the problem.

The competitive threat isn't other AI startups (yet). It's the large software vendors potentially building AI capabilities, or the larger logistics platforms potentially expanding into customs brokerage automation.

But Amari has first-mover advantages. They have customer relationships. They have real data (over 30 customers, over $15 billion in goods processed). They're building defensible models.

The bigger risk to Amari is if customs brokerage becomes interesting to larger technology companies. Imagine if AWS built a customs brokerage AI service. Or if Google decided to tackle this. Those companies could out-resource Amari quickly.

For now, though, Amari has breathing room. The market isn't crowded. The customer need is clear. The technology works.

Estimated distribution of Amari's $4.5 million funding shows a balanced investment in product development, sales, team building, and customer success, reflecting strategic priorities.

Policy Risk: When Government Changes Affect Your Business

Amari's business is, fundamentally, dependent on policy being important. If trade policy became stable and predictable, the urgency would decrease. If tariffs were eliminated, brokers would matter less.

This is a real risk that investors should understand.

Basu is betting that trade policy will remain chaotic. And historically, that's been a reasonable bet. Trade policy shifts with administrations. New geopolitical tensions emerge. Domestic industries lobby for protection.

But there's a scenario where Amari's primary value proposition (rapid policy change analysis) becomes less relevant if policy stabilizes.

That said, there's a counter-argument: even stable policy requires compliance. Even low-tariff regimes require classifications and documentation. The underlying problem (customs brokerage runs on paper and faxes) exists independent of policy volatility.

So Amari's long-term value is modernizing the industry, not just helping brokers respond to policy chaos. The policy chaos is what's creating the moment, but the underlying modernization need is durable.

Implementation Reality: How Brokers Actually Use Amari

I've described how Amari works in theory. But what's the actual implementation like?

According to Bachinski at GHY, it's been relatively straightforward. Amari's team works with GHY to understand their workflows, integrate with their systems, and set up the AI agents.

For GHY specifically:

- Week 1-2: Discovery and workflow mapping. Understanding how GHY currently processes shipments.

- Week 3-4: Integration setup. Connecting Amari's API to GHY's systems.

- Week 5-6: Pilot with limited shipments. Testing accuracy and identifying edge cases.

- Week 7+: Gradual rollout across the organization.

The challenge isn't usually the technology. It's change management. Brokers have been doing things a certain way for years. Even if the new way is objectively better, adoption takes effort.

Amari addresses this by automating things in the background (data entry, policy analysis) rather than requiring brokers to change their behavior dramatically. The interface to brokers is the analysis and flags, not a completely new system.

This is smart product design. Don't require people to change how they work; just give them better tools within their existing workflows.

The Data Advantage: Why Training Data Matters

One of the most underrated aspects of AI companies is data moat. Amari has processed over $15 billion in goods and trained on over one million documents. That's a significant dataset.

Why does this matter?

Because customs brokerage has patterns. Certain types of goods have common tariff codes. Certain countries have predictable origin rules. Certain policies interact in specific ways.

The more data Amari's models see, the better they become at pattern recognition. A competitor starting from scratch faces a significant disadvantage because they don't have access to this historical dataset.

This is true for most machine learning businesses. The data moat is often more valuable than the algorithm moat. Two companies could use the same ML algorithms, but the company with more training data will have better models.

Basu's willingness to discuss this openly is interesting. He's not claiming Amari's AI is proprietary (it's not; they use off-the-shelf models plus custom training). He's claiming the dataset and domain expertise are defensible.

That's a more honest and probably more accurate assessment.

There's a secondary benefit to the data: Amari can offer analytical insights to customers. Which tariff codes are increasing in cost? Which countries are seeing tariff changes? What compliance trends are visible across the customer base?

These insights, properly anonymized and aggregated, could become a valuable product in themselves.

Scaling Challenges: From 30 Customers to 3,000

Amari has 30 customers. That's validation. That's proof the model works. But it's not scale.

There are several thousand customs brokers in the US. Most are small operations. Some have just a handful of people. The market is highly fragmented.

Getting from 30 to 3,000 customers requires:

Brand Awareness: Most brokers don't know Amari exists. Marketing to a fragmented industry is expensive and slow.

Sales Organization: Someone needs to build relationships, understand needs, and close deals. Amari's founding team can only do so much.

Product Flexibility: Every broker has different systems, different processes, different needs. The product needs to be flexible enough to handle variation without becoming too complex.

Customer Success: As the customer base grows, ensuring each customer gets value becomes harder. Amari needs systems and processes to support that.

Trust: Customs compliance is serious. Brokers need to trust Amari's AI. Trust is built through track record, transparency, and reliability. That takes time.

Basu is clearly aware of these challenges. His approach to sales (going to conferences, building relationships) is not scalable in the long term. As Amari grows, they'll need a more systematic approach to customer acquisition.

This is a common challenge for AI startups entering new domains. You start with bottom-up sales (founder-driven). You need to transition to top-down sales (sales organization) without losing the customer empathy that made you successful in the first place.

Industry Transformation: What Customs Brokerage Looks Like in 2030

If Amari succeeds, and if similar AI solutions are adopted across the industry, what does customs brokerage look like in five years?

Probably something like this:

Automated Data Entry: Paper and faxes are gone. Documents are received digitally and processed automatically.

Real-Time Compliance: AI agents continuously monitor shipments against changing regulations. Violations are flagged immediately, not discovered at the border.

Predictive Analysis: Rather than waiting for policy changes, brokers can model potential changes and prepare clients proactively.

Integrated Intelligence: Customs brokers have visibility into the broader supply chain (where goods are coming from, where they're going, what they'll be used for) and can provide more holistic advice.

Smaller, More Specialized Teams: Brokers need fewer data entry people and more strategic consultants. The profession becomes more knowledge-worker focused.

Better Client Relationships: Freed from administrative work, brokers can focus on understanding their clients' business and providing proactive guidance.

This transformation is good for brokers, importers, and the economy. It's the kind of AI application that actually creates value rather than just extracting efficiency.

That's what makes Amari interesting.

Lessons for Other Industries

Amari's approach—start with deep customer understanding, solve a real problem, build defensible technology—is a template that applies far beyond customs brokerage.

There are dozens of industries like customs brokerage: mature, fragmented, still heavily manual, running on outdated technology, with real problems that AI could solve.

Freight forwarding is an obvious example. So is international legal work. So is tax compliance and tax preparation. So is healthcare administrative work.

The entrepreneurs who win in these spaces will be the ones who do what Basu did: ask questions, listen to customers, understand the domain deeply, and build technology that solves real problems rather than theoretical problems.

This is harder than chasing hype. It requires patience, humility, and willingness to work in boring domains. But the payoff, when it comes, is often more sustainable and more valuable.

The Founder Perspective: Why Sam Basu's Background Matters

It's worth noting what Basu brought to this problem: senior-level software engineering experience at Google.

This background is relevant in several ways:

Technical credibility: Building AI systems at scale requires serious engineering. Basu knows how to do this.

Product thinking: Google's approach to product is data-driven and user-centric. Basu applied this to a new domain.

Confidence in ambition: Having succeeded at a massive company, Basu had the confidence to enter a completely unfamiliar industry and trust his ability to figure things out.

Network: Google alumni are well-connected. Basu likely has relationships that helped with fundraising and recruiting.

But there's a flip side: his background could have been limiting. Big Tech engineers often have preconceived ideas about what technology should look like. They sometimes discount customer needs in favor of elegant technical solutions.

Basu avoided this trap by actually listening to customers. He spent time in their offices. He went to trade shows. He cold-called brokers. He didn't let his expertise become an obstacle to learning.

This is a lesson for all founders: your background gives you superpowers and blind spots. Use the superpowers. Work hard to identify and overcome the blind spots.

FAQ

What is customs brokerage and why does it matter?

Customs brokers are licensed professionals who handle the paperwork and compliance requirements for goods crossing international borders. They classify products under tariff codes, verify compliance with import regulations, calculate duties, and manage the documentation required for customs clearance. This is essential because every imported good must pass through this process, making customs brokers critical to global supply chains. Without them, imports would face significant delays and compliance risks.

How is AI being applied to customs brokerage specifically?

AI is automating routine tasks like data entry, tariff code classification, and compliance verification. Machine learning models trained on historical shipping documents can analyze new shipments, flag compliance issues, and predict tariff impacts. AI agents also monitor trade policy announcements in real time, analyzing how new policies affect existing shipments. This frees brokers from manual research and paperwork processing, allowing them to focus on strategic decision-making and client relationships.

What makes Amari AI different from traditional customs brokerage software?

Traditional software in this space is mature and often legacy-based, designed for data management rather than intelligent automation. Amari is built with AI at its core, trained on over one million customs documents, and designed specifically to automate the analytical work that brokers currently do manually. Instead of just storing data, Amari's AI actively analyzes shipments, monitors policy changes, and provides real-time compliance insights. It's fundamentally a different approach to solving the problem.

Why are customs brokers dealing with burnout and labor shortages?

Customs brokers face significant labor challenges because the profession requires specific licensing (with a 10-20% exam pass rate), must be performed by US-based professionals (can't be offshored), and involves constant policy study. Additionally, much of the work is repetitive manual data entry and administrative tasks, not intellectually stimulating. The combination of high barrier to entry, regulatory constraints, and administrative drudgery makes it hard to attract and retain talent. As experienced brokers retire, the industry faces a shrinking talent pool.

How does trade policy volatility affect customs brokers?

When trade policies change frequently, customs brokers must rapidly assess how new tariffs, exemptions, or regulations affect their clients' existing and in-transit shipments. This requires manual research and analysis that traditionally took days. In a volatile policy environment, brokers who respond slowly put their clients at financial risk. This creates urgency and stress. AI solutions that analyze policy changes and model their impact automatically can dramatically reduce this burden.

What is the actual market size for customs brokerage modernization?

There are roughly 6,000-8,000 licensed customs brokers in the US, ranging from solo practitioners to large firms. The industry handles over

Can AI completely replace customs brokers?

No. Customs brokers are personally liable for the accuracy of their work and must maintain professional licenses and insurance. Regulatory frameworks require human accountability for compliance decisions. AI can assist brokers tremendously by automating routine work and providing analysis, but the licensed broker must still make final determinations and sign off on compliance. The value proposition is augmentation, not replacement.

How does Amari protect customer data when training AI models?

Amari trains its models on over one million shipment documents provided by customers, but customers can opt out of this training. The company anonymizes data before feeding it to models and maintains data privacy. Importantly, Amari doesn't sell customer data to third parties. This approach allows the company to build increasingly accurate models while respecting customer concerns about competitive sensitivity and data privacy.

What does successful implementation of Amari look like for a broker?

At GHY International, implementation involved discovery and workflow mapping (weeks 1-2), integration setup (weeks 3-4), pilot testing (weeks 5-6), and gradual rollout (ongoing). The key is that Amari integrates into existing workflows rather than requiring complete process redesign. Brokers spend less time on data entry and routine classification and more time on client strategy and complex decisions. Throughput increases while stress and overtime decrease.

What are the regulatory risks to an AI-powered customs brokerage solution?

The primary risk is regulatory changes that might require human-in-the-loop for compliance decisions. However, given that brokers' professional liability already requires human sign-off, and given that AI is assisting rather than replacing brokers, regulatory risk is moderate. The bigger risk is if policy becomes highly unstable or if tariffs are eliminated, reducing demand for broker services generally. This would affect Amari along with the entire industry.

Conclusion: The Real AI Story

When people talk about AI transforming industries, they often focus on dramatic examples: driverless cars, medical imaging, creative content generation. These are real possibilities. But the AI stories that are actually creating value right now are often the quiet ones.

Sam Basu didn't set out to disrupt customs brokerage. He set out to solve a friend's problem. He visited an office. He saw paper and folders. He asked why. The answer—legacy processes in a regulated industry, labor constraints, policy chaos—turned out to be solvable with AI.

Amari AI is solving a real problem for real customers. Thirty brokers have signed up. They're processing $15 billion in goods. They're getting value. They're paying for it.

That's the story. Not hype. Not speculation. Not theoretical benefits. Real customers, real problems, real results.

This is what sustainable AI businesses look like: deep domain understanding, customer obsession, realistic assessment of what the technology can do, and focus on genuine value creation.

There are thousands of industries and problems like customs brokerage. The entrepreneurs who will build the next major AI companies will be the ones who have the patience and humility to find these problems, understand them deeply, and build technology solutions thoughtfully.

Basu is showing that playbook. The question now is whether Amari can scale it. Can they grow from 30 customers to 3,000 while maintaining the customer obsession that got them here? Can they navigate policy risk, regulatory complexity, and competition? Can they build a durable business that benefits brokers, importers, and the broader economy?

Based on the early signals—strong investors, real customers, real traction, serious founders—I'd bet on yes. But only time will tell.

One thing is clear: the customs brokerage industry will be transformed by AI over the next five years. The question is which company, or companies, will lead that transformation. Right now, Amari is the most credible candidate.

If you're involved in international trade, import logistics, or customs compliance, it's worth paying attention. The paper era in customs brokerage is ending. The AI era is beginning.

Key Takeaways

- Customs brokerage is a $2 trillion annual industry still reliant on paper, faxes, and manual data entry, creating massive inefficiency and opportunity

- Trade policy volatility has made brokers more essential but also more stressed, as they must rapidly analyze policy changes and advise clients in real time

- AI companies like Amari are solving genuine problems by automating routine work and enabling brokers to focus on strategic client relationships

- The talent shortage in customs brokerage (10-20% licensing exam pass rate, burnout, early retirements) makes AI augmentation critical to industry sustainability

- Successful AI startups in mature industries succeed through deep customer understanding, not through technology alone—founders must spend time in customers' worlds

Related Articles

- Amazon's Blue Jay Robotics Project Failure: What Went Wrong [2025]

- Aurora's Driverless Trucks: The Superhuman Era of Autonomous Freight [2025]

- Aurora Triples Driverless Truck Network: The Future of Autonomous Logistics [2025]

- SME AI Adoption: US-UK Gap & Global Trends 2025

- The AI Deployment Gap: Why Surface-Level Integration Is Costing You [2025]

- Enterprise AI Agents & RAG Systems: From Prototype to Production [2025]

![How AI Is Transforming Customs Brokerage in the Age of Trade Chaos [2025]](https://tryrunable.com/blog/how-ai-is-transforming-customs-brokerage-in-the-age-of-trade/image-1-1771511912751.jpg)