Introduction: Why This Is the Right Time to Get Your Finances Under Control

Every January, millions of people make the same resolution: get their finances in order. And every January, most of them abandon spreadsheets after three weeks because tracking money manually is tedious, error-prone, and honestly kind of soul-crushing.

Here's the problem. Your bank statements are a disaster. You have subscriptions you forgot about. You're not sure where half your money actually goes. And the thought of categorizing thousands of transactions by hand makes you want to pull your hair out.

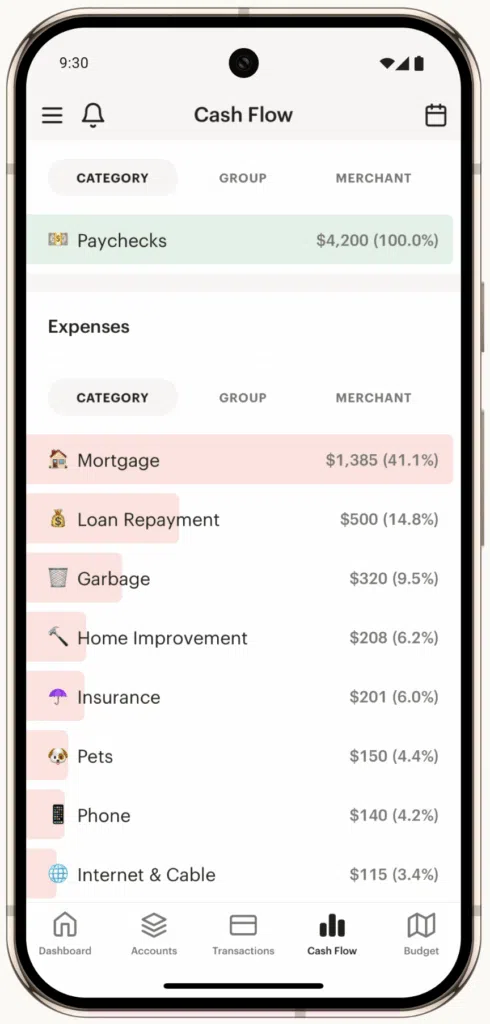

That's where budgeting apps come in. Instead of manually tracking every purchase, these tools connect directly to your bank accounts, credit cards, and investment accounts. They automatically categorize your spending, show you visual breakdowns of where your money goes, and help you plan for the future without the spreadsheet headache.

Monarch Money is one of the best budgeting apps available right now, and new users are getting 50% off one year of service (bringing the annual cost down to just $50). That's an incredibly aggressive discount for what's legitimately one of the more capable personal finance platforms out there.

But before you jump on the deal, let's dig into what Monarch Money actually is, how it works, whether it's worth your time, and how it stacks up against competitors like YNAB, Rocket Money, and others. Because the cheapest option isn't always the best option, and you need to know what you're actually getting.

TL; DR

- Monarch Money offers 50% off annually for new users with code NEWYEAR2026, bringing the cost to $50/year

- Multi-platform support: iOS, Android, iPadOS, web, and Chrome extension with automatic transaction sync

- Two budgeting approaches: Flexible budgeting and category budgeting so you can choose what works for your lifestyle

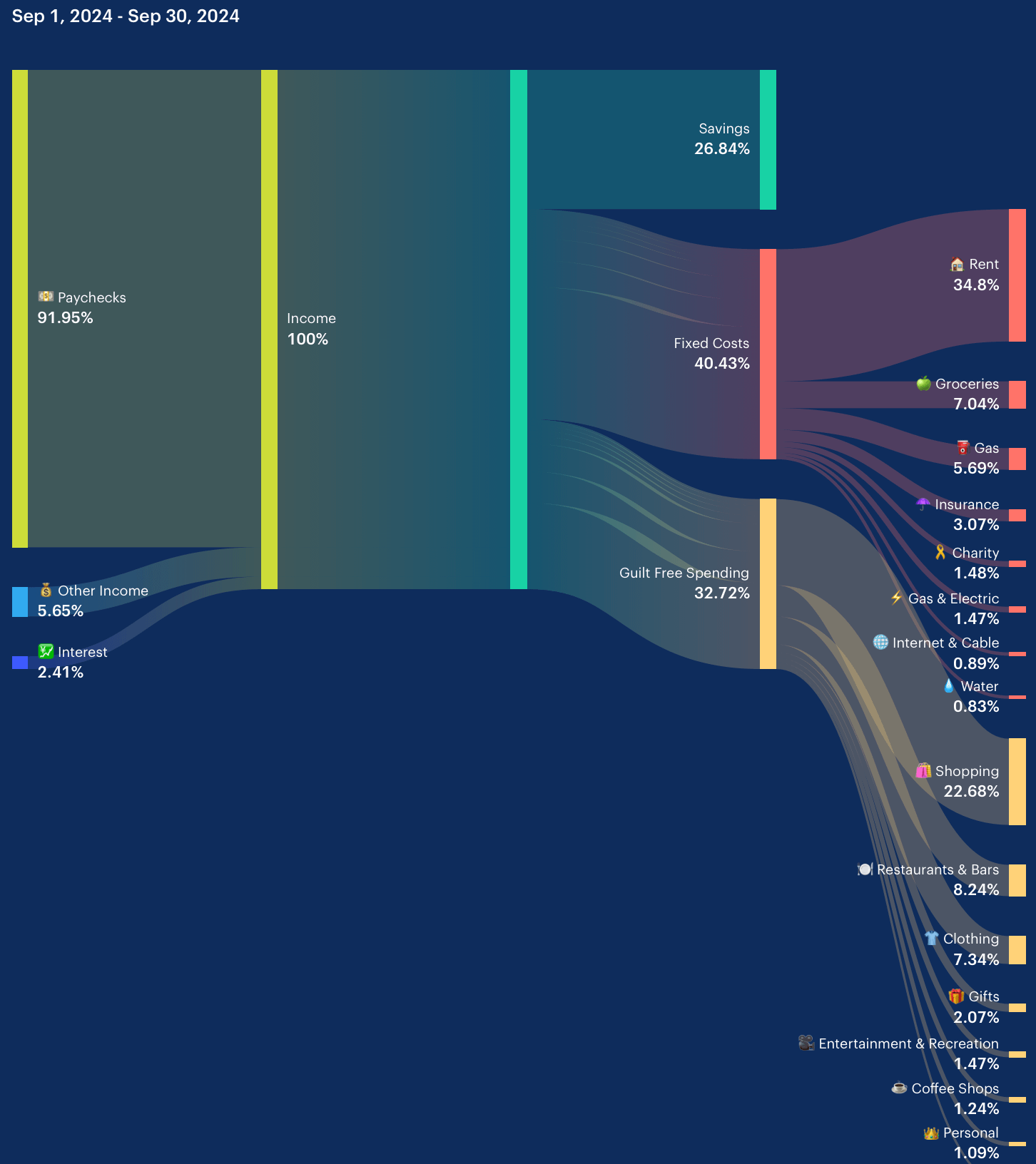

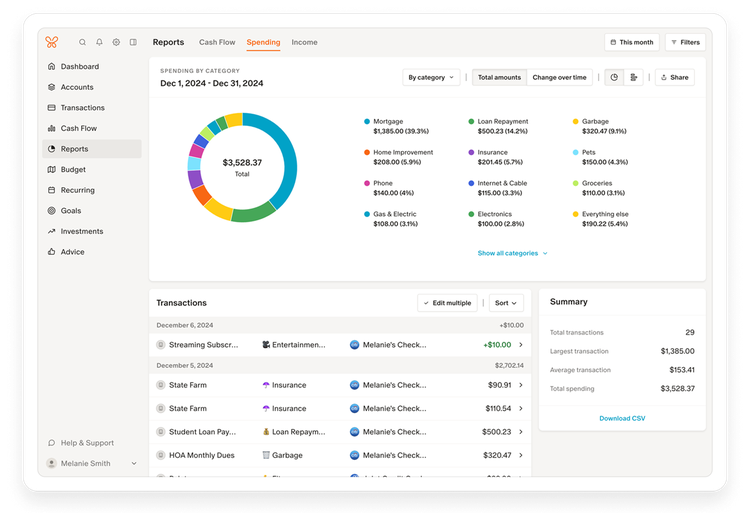

- Strong visualization tools: Multiple graphs and charts for spending analysis, investments, and custom categories

- Partner collaboration: Track both partners' spending in one place for joint financial planning

- Main drawbacks: Learning curve and feature inconsistencies between web and mobile versions

- Best for: People who want detailed expense tracking and collaborative budgeting without the complexity of YNAB

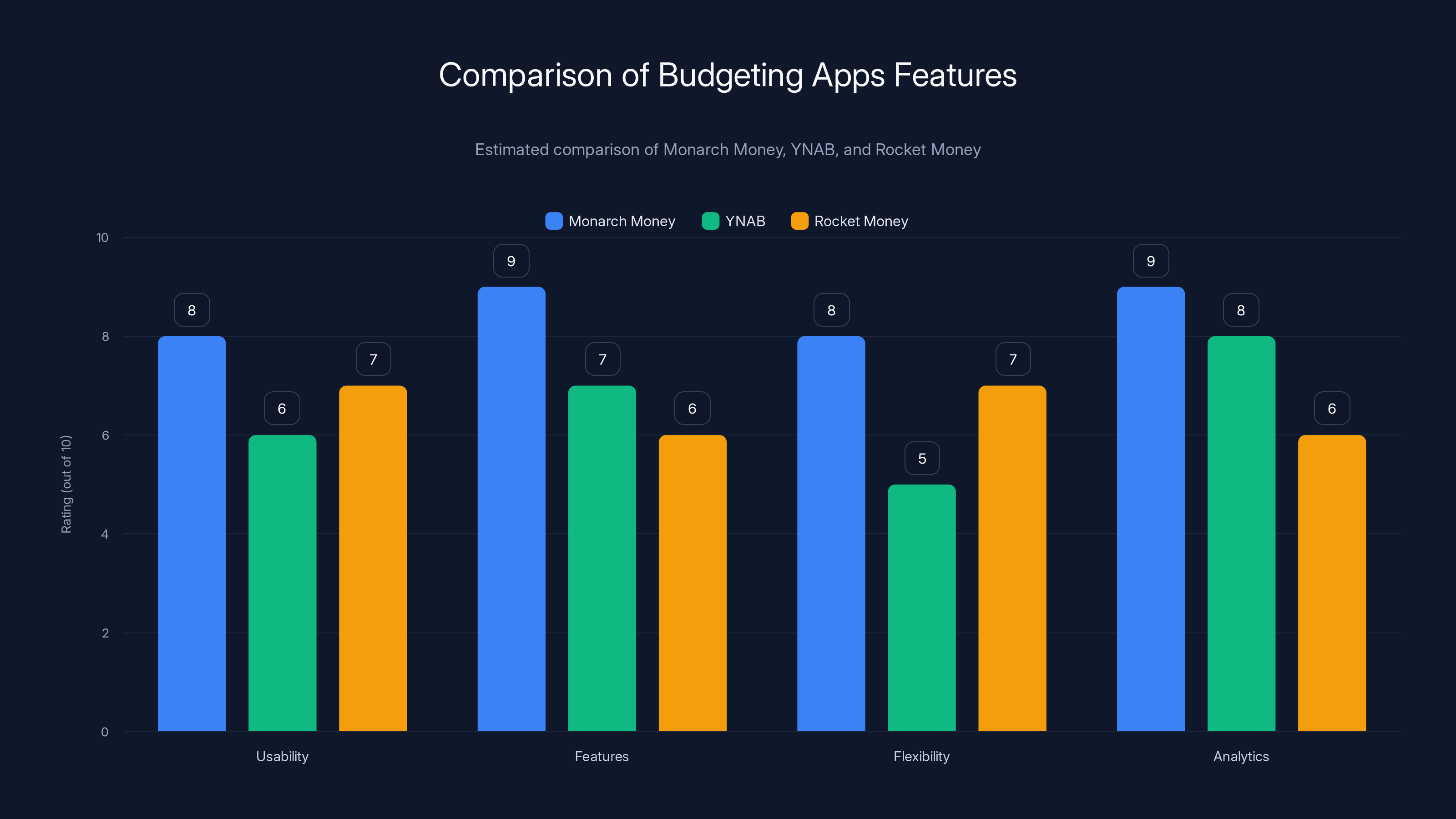

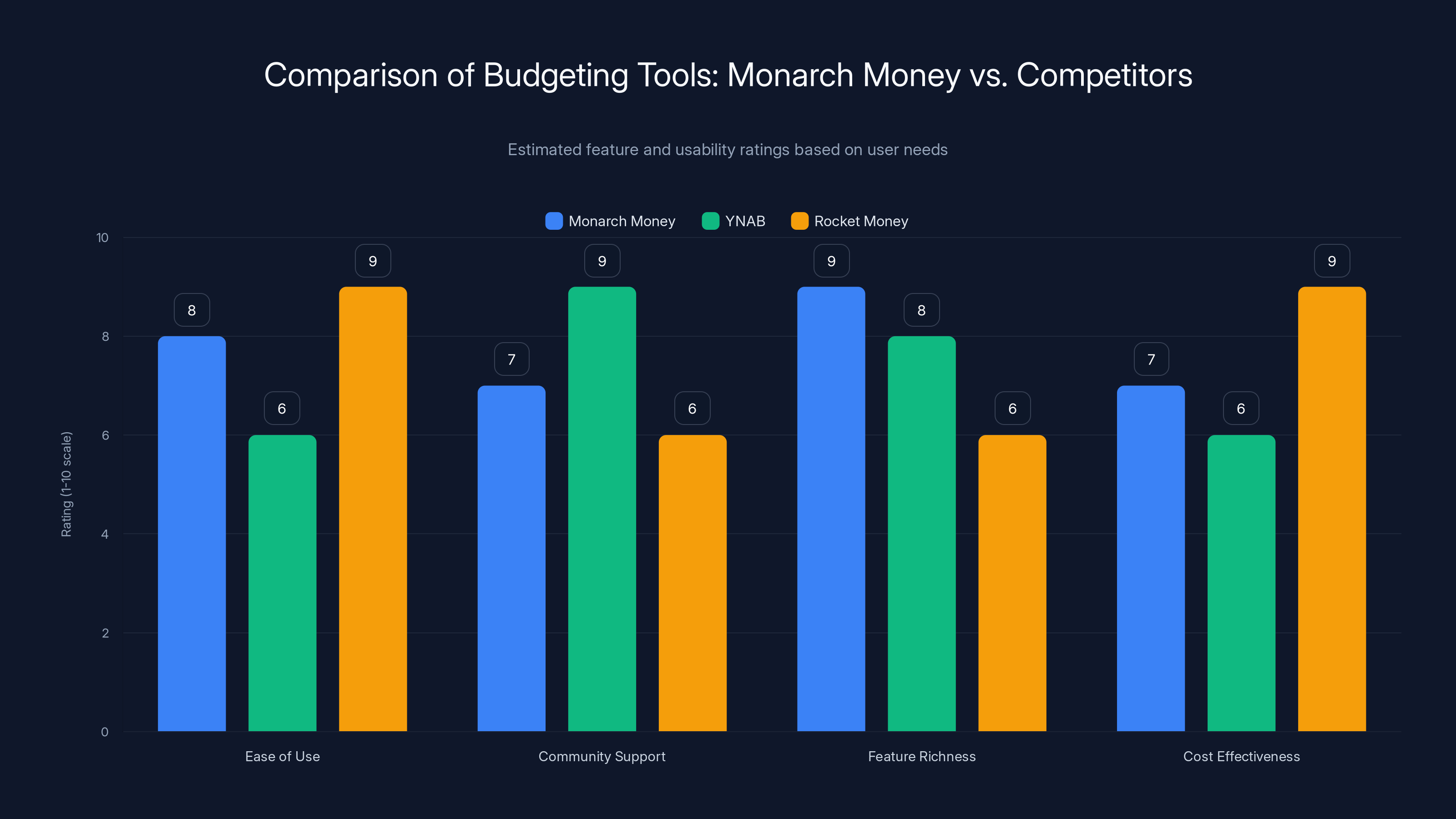

Monarch Money offers a balanced mix of usability, features, and analytics, surpassing YNAB in flexibility and Rocket Money in features. (Estimated data)

What Exactly Is Monarch Money and Why Should You Care?

Monarch Money is a personal finance management platform that sits between two categories: it's not as simple as banking apps, but it's not as rigid as traditional budgeting apps either. Think of it as a Swiss Army knife for personal finances.

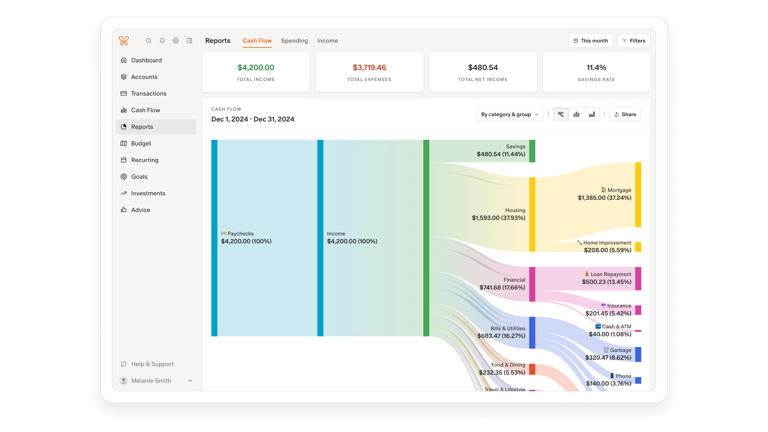

The core value proposition is straightforward. You connect your financial accounts (checking, savings, credit cards, investment accounts, cryptocurrency wallets, real estate assets, etc.), and Monarch pulls in your transactions automatically. Instead of living in a spreadsheet or banking app, you get a unified dashboard that shows you everything in one place.

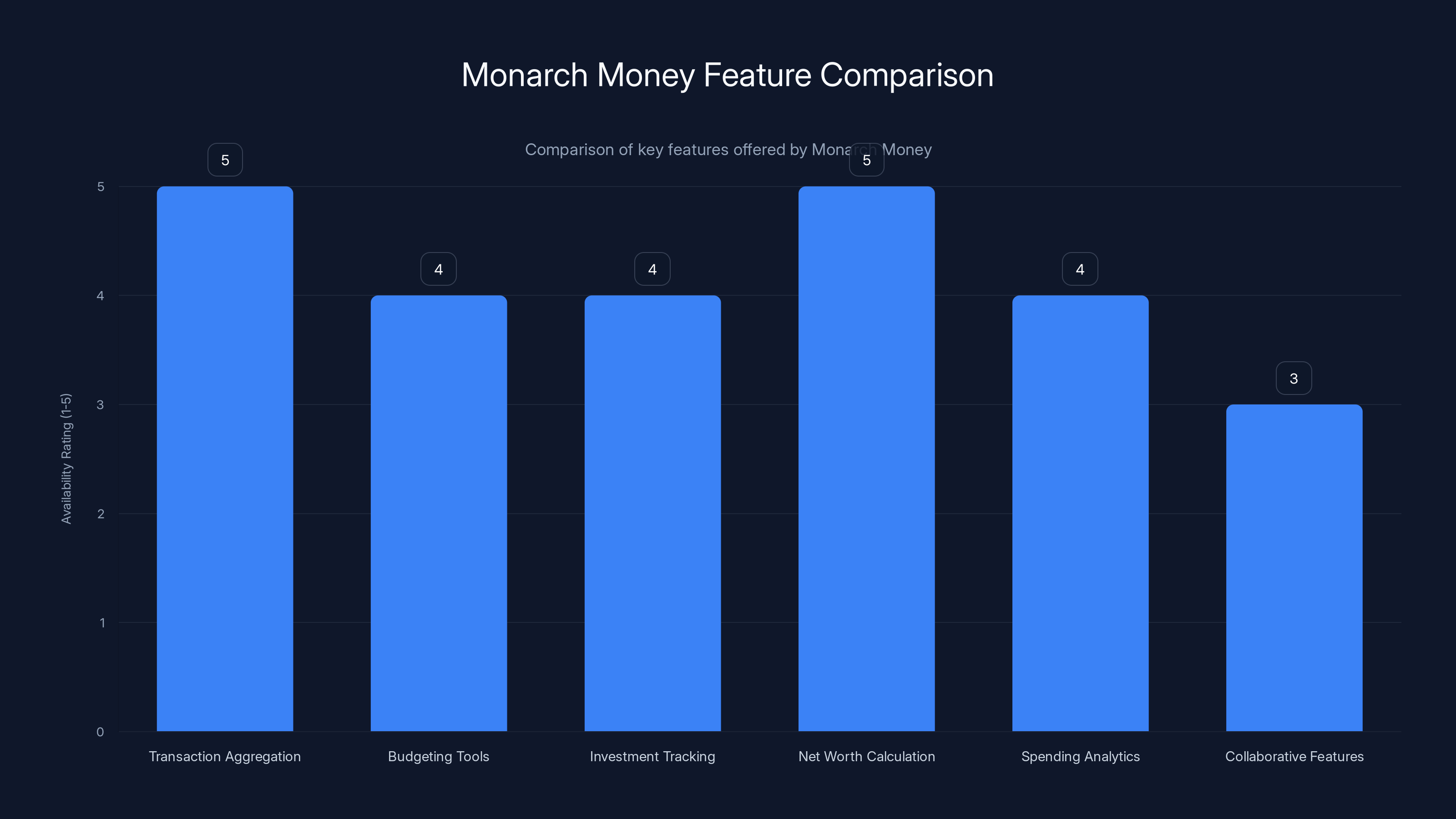

But here's what separates Monarch Money from just being a transaction aggregator. The app includes built-in budgeting tools, investment tracking, net worth calculations, spending analytics, and collaborative features if you're managing finances with a partner. It's designed for people who want to understand their financial picture without needing an accounting degree.

The company was founded by a former Intuit employee (the company behind Quicken and Mint) and has been building this product since 2022. That matters because they learned from Mint's mistakes (Intuit discontinued Mint in 2023, which left millions of users stranded) and designed Monarch Money with sustainability in mind.

What makes this relevant right now is the 50% off promotion for the entire first year. At regular pricing, Monarch Money costs

The catch? This promotion is time-limited, and new users only qualify. If you already have a Monarch Money account, you can't apply the discount retroactively.

Monarch Money offers a comprehensive set of features with high ratings in transaction aggregation and net worth calculation, making it a robust choice for personal finance management.

How Monarch Money Works: The Step-by-Step Process

Getting started with Monarch Money is surprisingly frictionless, but understanding how it actually functions will help you decide if it's right for you.

Step 1: Sign Up and Connect Your Accounts

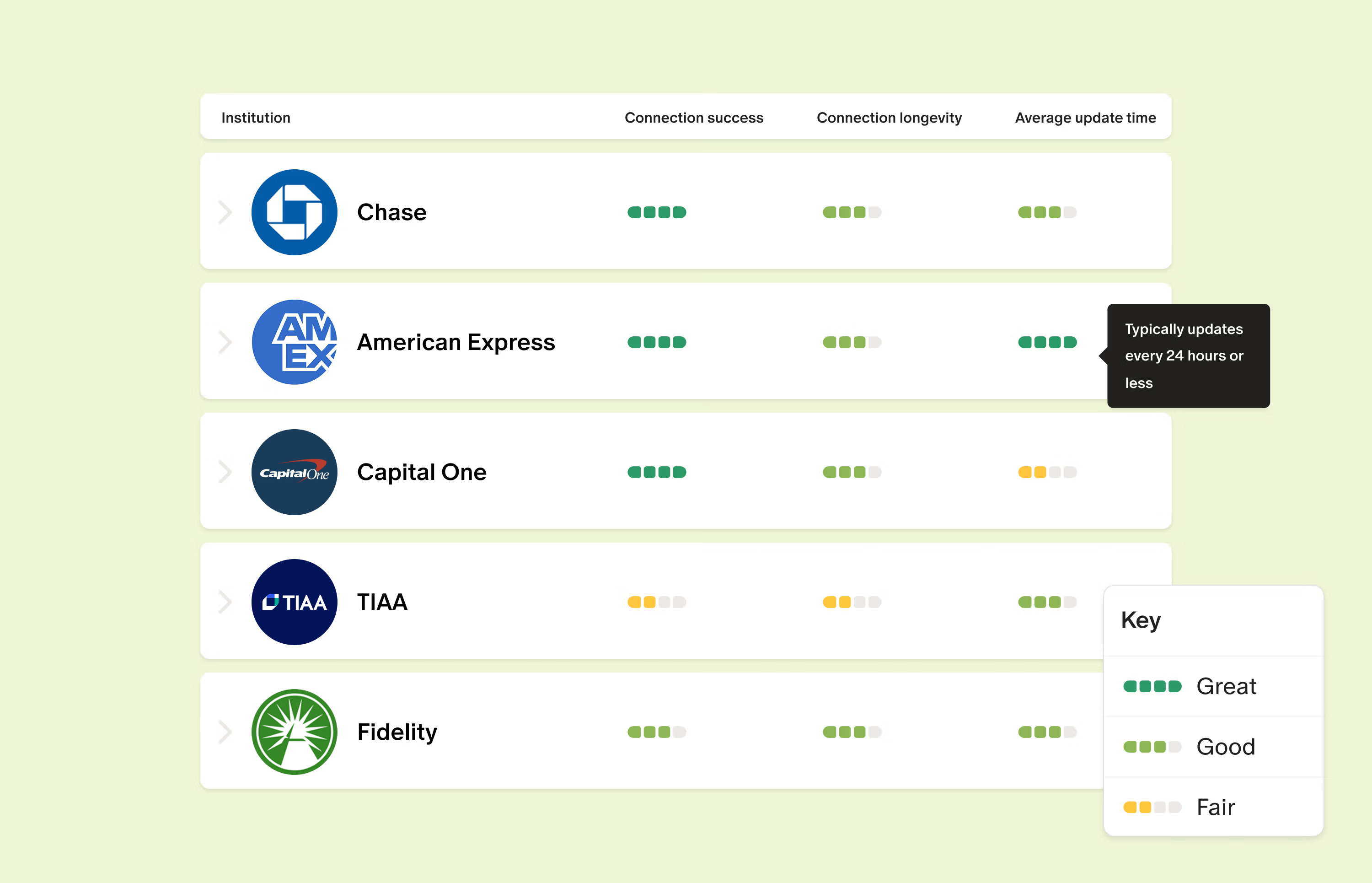

You download the app (or use the web version) and create an account with your email. Monarch Money uses a third-party aggregator called Plaid to securely connect to your financial institutions. This is the same technology that Venmo, Stripe, and most fintech apps use, so it's proven and secure.

When you connect an account, Monarch doesn't store your credentials. Instead, it gets a secure token that allows it to pull transaction data from your bank. This is industry standard and significantly more secure than giving an app your actual banking username and password.

You can connect essentially any financial institution: checking accounts, savings accounts, credit cards (all major issuers), investment accounts (Fidelity, Vanguard, Charles Schwab, etc.), cryptocurrency exchanges, real estate (for net worth tracking), and even business accounts if you're self-employed.

Step 2: The Automatic Transaction Import

Once accounts are connected, Monarch pulls in your transaction history (usually the past 3-6 months) and continues pulling in new transactions automatically. This happens in real-time or near-real-time depending on your bank's systems.

Here's where the Chrome extension becomes useful. If you're shopping on Amazon or Target, the extension automatically categorizes those transactions and syncs them to Monarch. Instead of seeing a generic charge from "Amazon.com," Monarch might recognize it as an Electronics purchase or Household Items based on what you actually bought. This saves you from manually recategorizing thousands of transactions.

Step 3: Set Up Your Budget

Monarch Money offers two distinct budgeting approaches, and this is where it gets interesting.

Flexible Budgeting works more like Dave Ramsey's envelope system. You set spending limits for different categories, and Monarch tracks you against those limits in real-time. If your grocery budget is

Category Budgeting is more nuanced. Instead of hard limits, you set target amounts and Monarch shows you how you're tracking throughout the month. This approach is better if your spending varies month-to-month. Say your utilities are usually $150 but spike in winter or summer. Category budgeting lets you understand spending patterns without rigid limits that would make you feel restricted every January.

Which approach you choose depends on your personality. Control-focused people typically prefer flexible budgeting. People who track spending for visibility prefer category budgeting. You can actually switch between them, so you're not locked into one approach.

Step 4: Customize and Analyze

Once your budget is set, Monarch gives you multiple ways to visualize your spending. You get pie charts showing where every dollar goes, line graphs showing spending trends over time, and detailed category breakdowns. You can drill down into specific categories to see exactly which subscriptions, restaurants, or shopping trips are eating your budget.

One feature that's genuinely useful is the ability to create custom categories and tags. Maybe you're saving for a specific goal (a vacation, a down payment, etc.), and you want to track spending toward that goal separately. Monarch lets you create that custom category and see your progress against it.

Step 5: Partner Integration (If Applicable)

If you share finances with a partner or spouse, this is where Monarch Money really shines. You can invite a partner to your account, and both of you can see all spending in a unified dashboard. You can set joint budgets ("we'll spend $400 on groceries this month") and see how you're tracking together.

This eliminates arguments about money because there's no secret spending. Both partners can see the full picture, and you're working toward shared financial goals with real data.

Monarch Money's Key Features That Actually Matter

There's a difference between features that sound impressive and features that actually save you time and money. Let's focus on the ones that move the needle.

Real-Time Spending Alerts

Monarch sends notifications when you're approaching your budget limits in specific categories. This prevents the end-of-month surprise where you discover you've overspent and can't do anything about it. Getting alerted mid-month means you can still adjust your behavior.

You can customize alert thresholds. Want to know when you've spent 50% of your budget? 75%? Both? You choose. This prevents alert fatigue while keeping you informed enough to make decisions.

Investment Tracking

Unlike basic budgeting apps, Monarch Money includes full investment account integration. You can see your stock portfolio, mutual funds, ETFs, cryptocurrency holdings, and real estate values all in one place. This matters because your net worth isn't just your bank account—it's everything you own minus everything you owe.

Monarch calculates your overall net worth and shows you how it's changing over time. If you're saving and investing, this gives you a complete picture of your financial progress instead of just watching your checking account.

Automatic Categorization with Learning

The first time you go to a coffee shop and spend $5, Monarch categories it as Food and Drink. The next time you go to the same coffee shop, Monarch remembers and automatically categorizes it the same way. This learning system means less manual recategorization over time.

You can create rules too. "Every transaction at Starbucks should be labeled as Coffee," or "Every Amazon purchase over $50 is an emergency fund withdrawal," etc. Rules save time when you have recurring transactions.

Budget Forecasting

Based on your historical spending patterns, Monarch can project what your full-month spending will be if current trends continue. This is useful for "Okay, I've spent

Subscription Tracking

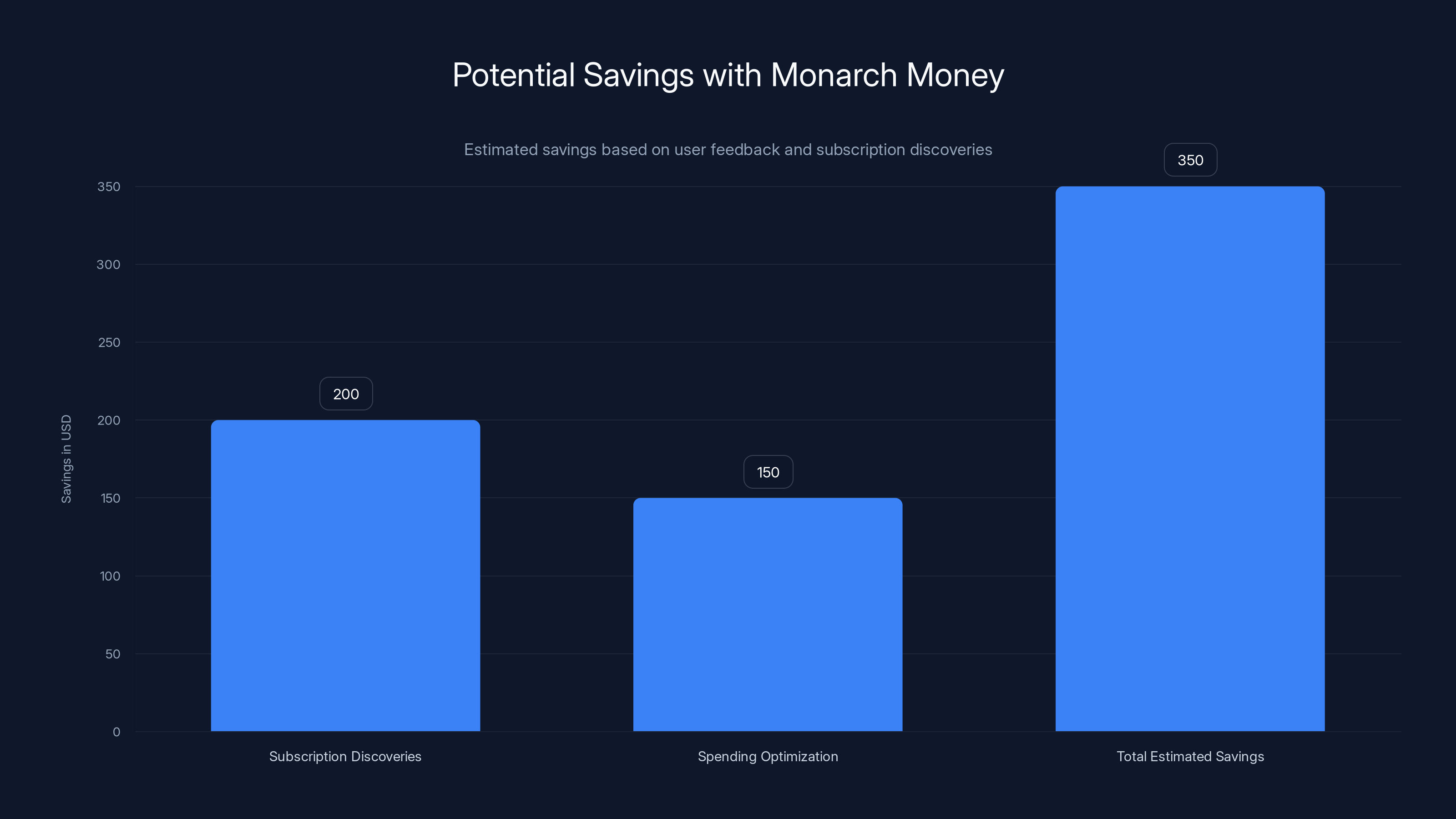

Monarch automatically identifies recurring subscriptions and shows them in a dedicated view. You see all your monthly subscriptions listed out with their costs. This single feature alone helps most people find $20-50/month in forgotten subscriptions they can cancel. Netflix you're not using? Gym membership you forgot about? Monarch highlights these instantly.

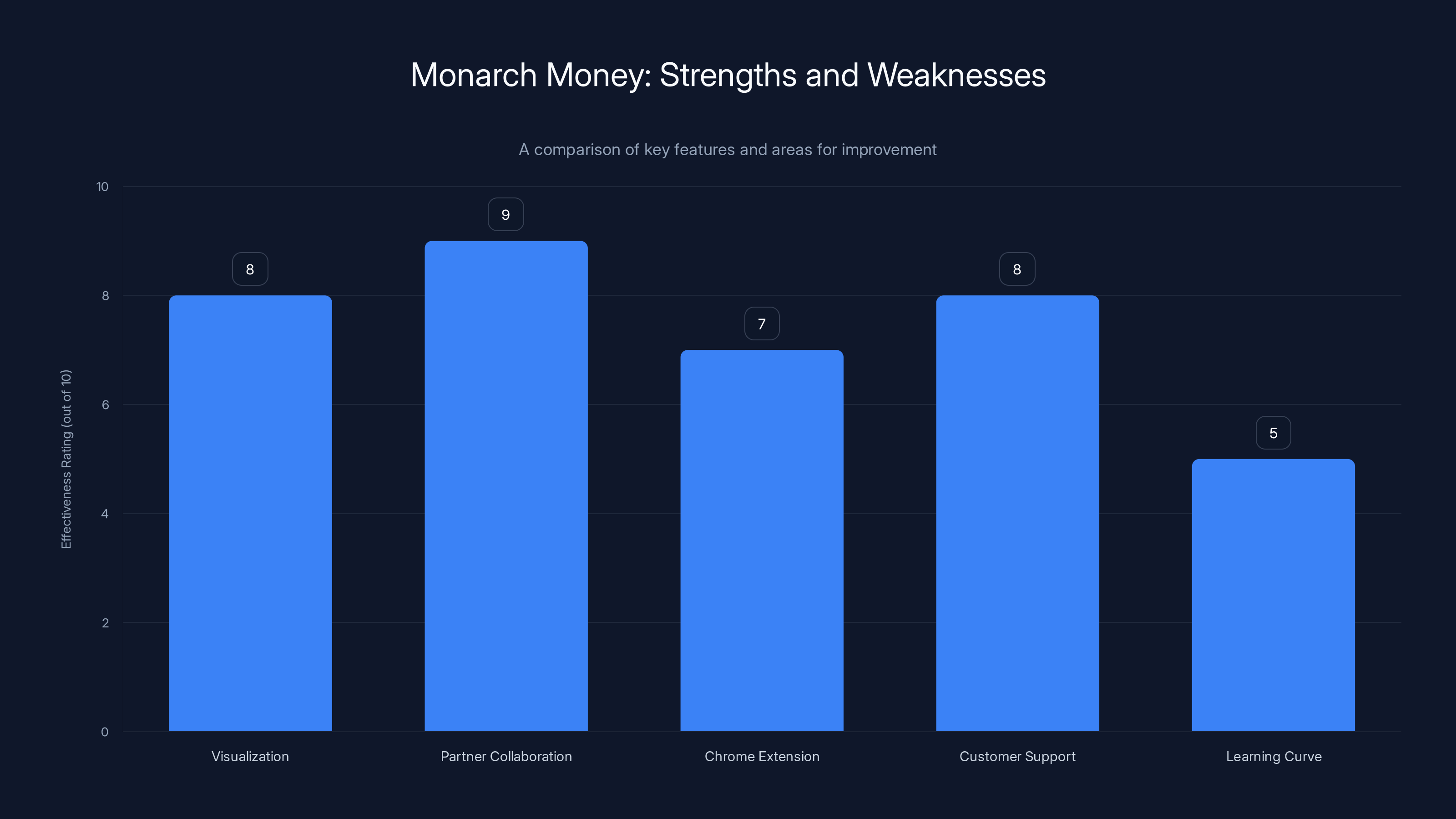

Monarch Money excels in partner collaboration and visualization, but has a steeper learning curve compared to competitors. (Estimated data)

The Honest Assessment: What Works and What Doesn't

No app is perfect, and pretending Monarch Money is flawless would be doing you a disservice. Let's talk about the real strengths and legitimate weaknesses.

What Monarch Money Does Really Well

The visualization approach is genuinely good. Most budgeting apps show you lists of categories and numbers. Monarch Money uses graphs and charts to help you understand patterns visually. If you're a visual learner, this is significantly better than text-based interfaces.

Partner collaboration actually works. Many budgeting apps claim to support couples managing money together, but in practice, the feature feels bolted-on. Monarch Money was built with couples in mind. Both partners can see spending, set shared budgets, and work toward goals together. This reduces financial arguments because you're not debating what something cost—you can see it clearly.

The Chrome extension is surprisingly useful. When you're actively shopping on Amazon or Target, automatically syncing transactions to Monarch saves you from having to manually categorize later. This might sound minor, but it's the difference between maintaining your budget and abandoning it because the data entry is tedious.

Customer support is responsive. The team actively monitors forums and responds to questions within hours. If you get stuck, you're not waiting days for a response.

Where Monarch Money Falls Short

The learning curve is real. Mint was designed to be immediately intuitive. You could open it and understand what was happening within 30 seconds. Monarch Money requires a bit more exploration. The interface isn't confusing, but there are enough options and customization points that new users benefit from spending 20-30 minutes actually learning how everything works.

This isn't necessarily a flaw—more powerful tools often have steeper learning curves—but it's worth acknowledging. If you want something you can open and use immediately with zero setup, you might find Monarch Money frustrating for the first few days.

Web and mobile versions have inconsistencies. Some features work better on mobile, others on web. For example, creating complex custom categories is more intuitive on the web, but checking your budget status is faster on mobile. You end up using both platforms, which creates a slightly fragmented experience.

The mobile app has also had occasional bugs that the web version doesn't have. These get patched, but if you're expecting a perfectly polished experience, you might notice some rough edges.

Reporting features are basic. If you need detailed tax reports or sophisticated financial analysis for business purposes, Monarch Money handles basic personal use cases well but doesn't go as deep as dedicated accounting software. For personal budgeting, this is fine. For self-employed people who need tax categorization for deductions, you might outgrow Monarch Money.

Historical data can be inconsistent. When you first connect accounts, Monarch pulls in available history (usually 3-6 months). Some banks provide longer history, others don't. This means your earliest budget comparisons might be based on incomplete data.

Comparing Monarch Money to the Competition

Let's be clear about what other budgeting options are out there and how Monarch Money stacks up.

Monarch Money vs. YNAB (You Need A Budget)

YNAB is the gold standard for intentional budgeting. It forces you to assign every dollar you have to a specific purpose before you spend it. This philosophy is powerful if you're trying to break bad spending habits or get out of debt.

YNAB costs $99/year (same as Monarch Money regular pricing) and has a steeper learning curve because you need to understand their methodology. The community is extremely supportive, which helps.

Monarch Money advantage: Lower barrier to entry, doesn't require you to adopt a specific budgeting philosophy, better for people who want analysis without ideology.

YNAB advantage: More proven framework for behavior change, stronger community, slightly more polished mobile app.

Best for whom? Choose YNAB if you're recovering from bad spending habits and need a system to force better behavior. Choose Monarch Money if you want detailed tracking and analysis without being lectured about budgeting philosophy.

Monarch Money vs. Rocket Money

Rocket Money (formerly Truebill) is a free or freemium app that also tracks spending and identifies subscriptions. The freemium model is attractive because there's no upfront cost.

Monarch Money advantage: More detailed analysis, better partner collaboration features, more customization options. You're paying for more sophisticated features.

Rocket Money advantage: Free tier is genuinely useful for basic tracking, lower barrier to entry, works fine if you just want to see where your money goes without detailed budgeting.

Best for whom? Choose Rocket Money if you want to dip your toes into spending tracking without committing to paid software. Choose Monarch Money if you're serious about budgeting and want more features and fewer ads.

Monarch Money vs. Mint (Historic Comparison)

Mint was discontinued in December 2023, but it was the dominant personal finance app for over a decade. Monarch Money is basically what you'd get if you updated Mint with modern features.

Many Mint users migrated to Monarch Money specifically because the interface felt familiar and the features were more advanced.

Monarch Money excels in feature richness and ease of use, while YNAB offers strong community support. Rocket Money is highly cost-effective with its free tier. Estimated data based on typical user feedback.

The Math: Is the 50% Discount Actually Worth It?

Let's be pragmatic about the money.

Regular annual price:

Savings:

This doesn't sound like much, but here's the value proposition. If Monarch Money helps you eliminate even one forgotten subscription (let's say a

Alternatively, if Monarch Money helps you reduce your discretionary spending by just 5% through better visibility and budget tracking, that could mean **

At

How to Get the Deal and What Comes Next

Here's the practical stuff.

Getting the Discount

- Visit Monarch Money's website or download the app

- Sign up for a new account (existing users don't qualify for this promotion)

- At checkout, enter code NEWYEAR2026

- Annual price drops from 50

The promotion is available for new users only, and there's no explicit end date mentioned. That said, these New Year promotions typically run through January and early February. Waiting until March probably means missing the deal.

What to Expect After Signup

You'll get access to Monarch Money's full feature set for the discounted year. After that year expires, the regular $99/year pricing applies. You're not locked into a recurring subscription though—you can cancel anytime.

Take 20-30 minutes in your first week to set up budgets and customize categories properly. The app is only as useful as the data you input. If you spend 15 minutes connecting accounts and then abandon it, you'll get no value. If you invest time upfront to create meaningful budgets and categories, you'll get real insights.

Investment Tracking is the most effective feature, scoring 90 out of 100, due to its comprehensive integration and net worth tracking. Estimated data.

Who Should Actually Buy This and Who Shouldn't

Let's be honest about whether this is right for you specifically.

Buy Monarch Money If You:

- Have multiple accounts (checking, savings, credit cards, investments) that you want in one place

- Want visual analysis of your spending instead of just numbers

- Manage finances with a partner and want a collaborative tool

- Want automatic transaction categorization so you don't have to manually track everything

- Forgot about subscriptions and want help finding them

- Are willing to spend 20-30 minutes setting up the app properly

- Want a middle-ground tool that's more powerful than Mint but less rigid than YNAB

Skip Monarch Money If You:

- Only have one or two accounts and don't really track spending at all

- Need tax-specific categorization for business deductions

- Want something you can use without any setup or customization

- Already have a budgeting system you love (don't fix what isn't broken)

- Prefer free-only tools and refuse to pay for apps

- Want the most advanced investment analysis (dedicated investment apps do this better)

Getting the Most Out of Monarch Money: Pro Tips

If you decide to go for it, here's how to actually get value from the platform.

Set Up Custom Categories Before You Need Them

The default categories Monarch Money provides are reasonable, but they're generic. Before you really start using the app, spend 15 minutes creating custom categories that match your actual spending. If you care about coffee spending specifically, create a Coffee category. If you're saving for something, create a category for that goal.

This front-load effort pays dividends because you'll have better data and the app will feel more tailored to your life.

Use the Budget Forecasting Feature Strategically

Mid-month, check the forecasting feature. If you're on pace to overspend in a category, you still have time to adjust. This is how you actually prevent overspending instead of just discovering it at month-end when you can't change anything.

Export Your Data Regularly

One lesson from Mint's shutdown is that you should always have backups of your financial data. Monarch Money lets you export transaction history and categorization data. Do this monthly. If anything ever happens to your account, you'll have a backup.

Turn On Alerts for Critical Categories

Don't set alerts for everything or you'll get alert fatigue and ignore them all. Instead, set alerts for categories where overspending would actually hurt (groceries, utilities, rent, debt payments). Ignore minor categories where small overages don't matter.

Review Your Subscriptions Monthly

Monarch Money's subscription tracker is powerful, but only if you actually use it. Once a month, look at your recurring charges and ask yourself, "Am I still using this?" Delete the ones you don't need.

Users typically find

The Security Question: Is It Safe to Connect Your Bank?

Legitimately, this is the biggest concern people have, and it deserves a straight answer.

How Monarch Money Protects Your Data

Monarch Money uses Plaid, which is the same third-party aggregator used by major fintech companies like Venmo, Stripe, Robinhood, and dozens of others. When you connect a bank account through Plaid, you're not giving Monarch Money your banking credentials.

Instead, Plaid provides a secure token that allows Monarch Money to pull transaction data from your bank. Your actual password and username are never exposed to Monarch Money or stored on their servers.

All data transmission between Plaid and banks uses industry-standard encryption (TLS 1.2+). All data stored by Monarch Money is encrypted at rest and protected by firewalls.

Is It Actually Safe?

Yes, this is legitimately safer than using your bank's own budgeting tools in many cases because Plaid's security standards are actually more strict than some smaller banks.

The only scenario where it's not safe is if your bank specifically warns you not to connect third-party apps. Some banks (particularly community banks and credit unions) have deprecated third-party aggregation. Check your bank's policy first.

Monarch Money's parent company has been fully transparent about their security practices and has gone through independent security audits. They're not hiding anything.

What Happens After Your First Year?

This matters for long-term planning.

After the discounted first year expires, your subscription goes to regular pricing: $99/year. You're not automatically charged—you'll get a notification that your free trial or discounted period is ending and you can choose to renew or cancel.

If the regular

Monarch Money also occasionally runs other promotions throughout the year. If you use it for the discounted year and then cancel, you could theoretically catch another promotion later. Or you could just pay $99/year and keep using it. That's a personal choice based on the value you get.

Alternative Tools If Monarch Money Doesn't Feel Right

Just to be comprehensive, here are other solid options depending on what you actually need.

For Couples: Couples Expense Apps

If your primary need is shared expense tracking with a partner, standalone couples apps like Splitwise or 1 Money might be more focused and simpler than Monarch Money. These are great if you split shared bills but want separate personal budgets too.

For Investments: Dedicated Investment Apps

If your primary concern is investment performance and portfolio analysis, apps like Personal Capital or Empower do investment tracking way better than Monarch Money. These are better if you're an active investor.

For Extreme Budgeting: YNAB

If you're recovering from serious debt or want a life-changing budgeting methodology, YNAB is still the gold standard. It's more expensive (

For Free and Simple: Rocket Money

If you want to start tracking spending with zero cost, Rocket Money's free tier genuinely works. You get subscription tracking, basic spending analysis, and budget tools without paying anything. Upgrade to premium ($99/year) if you need more.

The Bottom Line: Should You Actually Do This?

Let me cut through everything and give you the straight opinion.

If you currently have zero visibility into where your money goes, if you have multiple accounts spread across different banks, if you have subscriptions you've forgotten about, or if you share finances with a partner and want a unified view, then yes, try Monarch Money at 50% off. The deal is good, the tool is legitimate, and the risk is minimal.

The

The promotion is time-limited. This is January 2025, and these New Year deals typically expire by mid-February. If you're on the fence, the downside of waiting is that the discount goes away. The downside of trying is $50 for a year, which you'll make back immediately through subscription discoveries or spending optimization.

Is Monarch Money perfect? No. Are there features missing? Sure. But is it a legitimate, well-built tool from a company that's been transparent and customer-focused? Absolutely.

Use code NEWYEAR2026 at checkout, spend 20 minutes setting it up, and then let the app do the work of tracking for you. This is one of those rare cases where a discount makes an already good deal into a no-brainer proposition.

FAQ

What is Monarch Money and how does it differ from other budgeting apps?

Monarch Money is a personal finance management platform that aggregates all your financial accounts (checking, savings, credit cards, investments, crypto, real estate) into a single dashboard. Unlike simple banking apps, it includes sophisticated budgeting tools, spending analysis, investment tracking, and partner collaboration features. The main difference from competitors is that it balances depth with usability better than YNAB (which is more rigid) while offering more features than Rocket Money's free tier. Monarch Money sits in the middle, offering powerful analytics without forcing you to adopt a specific budgeting philosophy.

How do I actually connect my bank accounts to Monarch Money securely?

Monarch Money uses Plaid, a third-party service that securely aggregates financial data. You don't give Monarch Money your banking credentials. Instead, Plaid provides a secure token that allows Monarch Money to pull transaction data from your bank. Your actual password and username never leave your bank or get stored on Monarch Money's servers. All data transmission uses industry-standard encryption (TLS 1.2+), and stored data is encrypted at rest. This security approach is more advanced than some banks' internal systems, so it's legitimately safer than you might initially think.

What's the difference between flexible budgeting and category budgeting in Monarch Money?

Flexible budgeting works like an envelope system where you set hard spending limits for categories. If your grocery budget is

Will I really save money with Monarch Money, or is this just another app to pay for?

Most people save significantly more than the

Can I use Monarch Money with a partner if we share finances?

Yes, partner collaboration is actually one of Monarch Money's strongest features. You can invite a partner to your account, and both of you can see all connected accounts, transactions, and spending. You can set joint budgets for shared expenses (groceries, utilities, etc.) and see how you're tracking together in real-time. This eliminates arguments about money because both partners have complete transparency. The app shows which partner made which purchase and allows both to update budgets and make decisions collaboratively, making it one of the best tools for couples managing finances together.

What happens to my account and costs after the first discounted year?

After your first year with the NEWYEAR2026 promotional code, your subscription automatically moves to regular pricing at

Is there a free version of Monarch Money or a trial period?

Monarch Money offers a 30-day free trial for new users, which gives you access to the full feature set without requiring a credit card initially. After the trial, you can subscribe at the discounted promotional rate (

How does Monarch Money's Chrome extension work and what does it do?

The Monarch Money Chrome extension runs in your browser and automatically detects when you're shopping on sites like Amazon and Target. When you make purchases, the extension syncs those transactions directly to Monarch Money and often automatically categorizes them based on what you actually bought (Electronics, Household Items, Clothing, etc.). This saves you from manually recategorizing transactions later. The extension is optional but incredibly useful if you do most of your shopping online, as it essentially eliminates manual data entry for e-commerce purchases.

What are the main drawbacks or limitations of Monarch Money that I should know about?

The primary limitations are: a learning curve that's steeper than Mint but shallower than YNAB (expect to spend 20-30 minutes learning the interface), inconsistencies between web and mobile versions where some features work better in one platform than the other, occasional bugs in the mobile app that the web version doesn't have, and basic reporting features that aren't sufficient for business tax purposes or professional accounting needs. Historical data when you first connect can be inconsistent (usually 3-6 months depending on your bank), and some community banks or credit unions don't support third-party aggregation at all. These limitations are relatively minor and shouldn't affect most personal users.

How does Monarch Money's subscription tracker work and how accurate is it?

Monarch Money's subscription tracker automatically identifies recurring charges in your transaction history and flags them as subscriptions. It works by looking for patterns (same amount every month) and recognizing merchants known for subscriptions (Netflix, Spotify, Adobe, etc.). The tracker is quite accurate for standard subscriptions but might occasionally flag irregular recurring charges as subscriptions. You can manually confirm or dismiss flagged items, and you can also manually add subscriptions. Once identified, you can see a dedicated view of all your subscriptions with costs and renewal dates, making it easy to spot services you're paying for but no longer using. This feature alone is worth the annual cost for most people.

Conclusion: Taking Action in 2025

We've covered a lot of ground here, from how Monarch Money actually works to whether it's worth the investment to how it compares with alternatives. Let's bring it all together.

The situation is simple: you have access to a genuinely good personal finance tool at 50% off its normal price. The discount is time-limited to the New Year promotional period. The tool has real value—subscription discovery, spending analysis, partner collaboration, investment tracking—and the company behind it has proven they're building for the long term.

The decision you need to make is binary: either try it or don't. Here's how to think about it.

If you try it and hate it after 30 days, you've spent

The real opportunity cost is inaction. If you don't try Monarch Money now, you're accepting another year of not understanding where your money actually goes. You're accepting that you might be paying for services you forgot about. You're accepting that any financial planning you do will be based on guesses instead of actual data.

Those costs—invisible and spread across the year—probably exceed $50 by a significant margin.

So here's what I'd recommend: In the next 30 minutes, download Monarch Money or visit their website. Sign up with a new account. Enter code NEWYEAR2026 at checkout and pay $50 for the year. Spend your next 20 minutes connecting your accounts and setting up basic budgets that match your actual life.

Then let the app do its job for 30 days. Track your subscriptions. See where your money goes. Check the budget forecasts mid-month and adjust if needed. If you have a partner, invite them and see how unified financial planning changes your conversations about money.

By day 30, you'll have genuine data about whether this tool is valuable for your situation. And if it is—which it probably will be—you'll have spent the least amount of money possible because you caught the promotional rate.

Financial planning isn't sexy. Spreadsheets are tedious. But understanding where your money goes and making intentional decisions about your spending? That's genuinely powerful. Monarch Money makes that accessible and relatively painless.

Don't spend another year wondering where your money went. Get the 50% discount, try the tool, and find out what you've been missing.

Key Takeaways

- Monarch Money offers 50% off annual subscription (99) with code NEWYEAR2026, breaking even through subscription discovery within first month

- Multi-platform support across iOS, Android, iPadOS, web, and Chrome extension enables seamless spending tracking across devices

- Partner collaboration features allow couples to track shared and individual expenses transparently, reducing financial arguments through data visibility

- Subscription tracker automatically identifies recurring charges, helping users discover and cancel forgotten services worth $200+ annually on average

- Two budgeting approaches (flexible and category-based) accommodate different money management styles without forcing rigid methodology like YNAB

Related Articles

- Monarch Money Budgeting App: $50/Year Deal + Complete Review [2025]

- Monarch Money Deal: $50 for One Year (50% Off) [2025]

- Monarch Money Budgeting App Review: Complete Guide [2025]

- Monarch Money Annual Deal: Save 50% on Premium Budgeting [2025]

- Best Budgeting Apps: Monarch Money 50% Off Deal [2025]

- Monarch Money 50% Off Deal: Complete Guide to Annual Budgeting [2025]

![Monarch Money Budgeting App: Complete Guide to 50% Off Deal [2025]](https://tryrunable.com/blog/monarch-money-budgeting-app-complete-guide-to-50-off-deal-20/image-1-1769445654015.jpg)