Obvious Ventures Fund Five: The $360M Bet on Planetary Impact

There's a moment in every venture capital firm's lifecycle when the numbers stop being arbitrary. Obvious Ventures just had that moment.

The firm announced its fifth fund last month with a fundraise of exactly

The 360-degree circle. A complete view. Full coverage.

For a firm co-founded by Twitter's Evan Williams and led by managing director James Joaquin, this fundraise marks something deeper than another successful close. It signals a maturing conviction about what venture capital should actually do: invest in the frontiers of science and technology in ways that solve real problems for real people, then make money doing it. Not the other way around.

But before we get into why this matters, let's talk about why most people are getting this story wrong. They're fixating on the clever number. They're missing the actual thesis underneath.

The Rise of Impact-Driven Venture Capital

Venture capital has a credibility problem. For decades, the industry has talked a big game about disruption and innovation while largely funding companies that either (a) sell ads better, (b) take money from venture-backed companies to help them sell ads better, or (c) do something so abstract that nobody really understands whether it's solving a problem or creating one.

Then something shifted. It wasn't gradual. It was sudden.

The realization that climate change, energy scarcity, antibiotic resistance, and economic inequality weren't going to solve themselves hit venture firms like a reckoning. These weren't problems you could software-engineer away with better data structures and marginally faster load times. These were problems that required physics, chemistry, biology, and engineering to work in concert with capital and entrepreneurship.

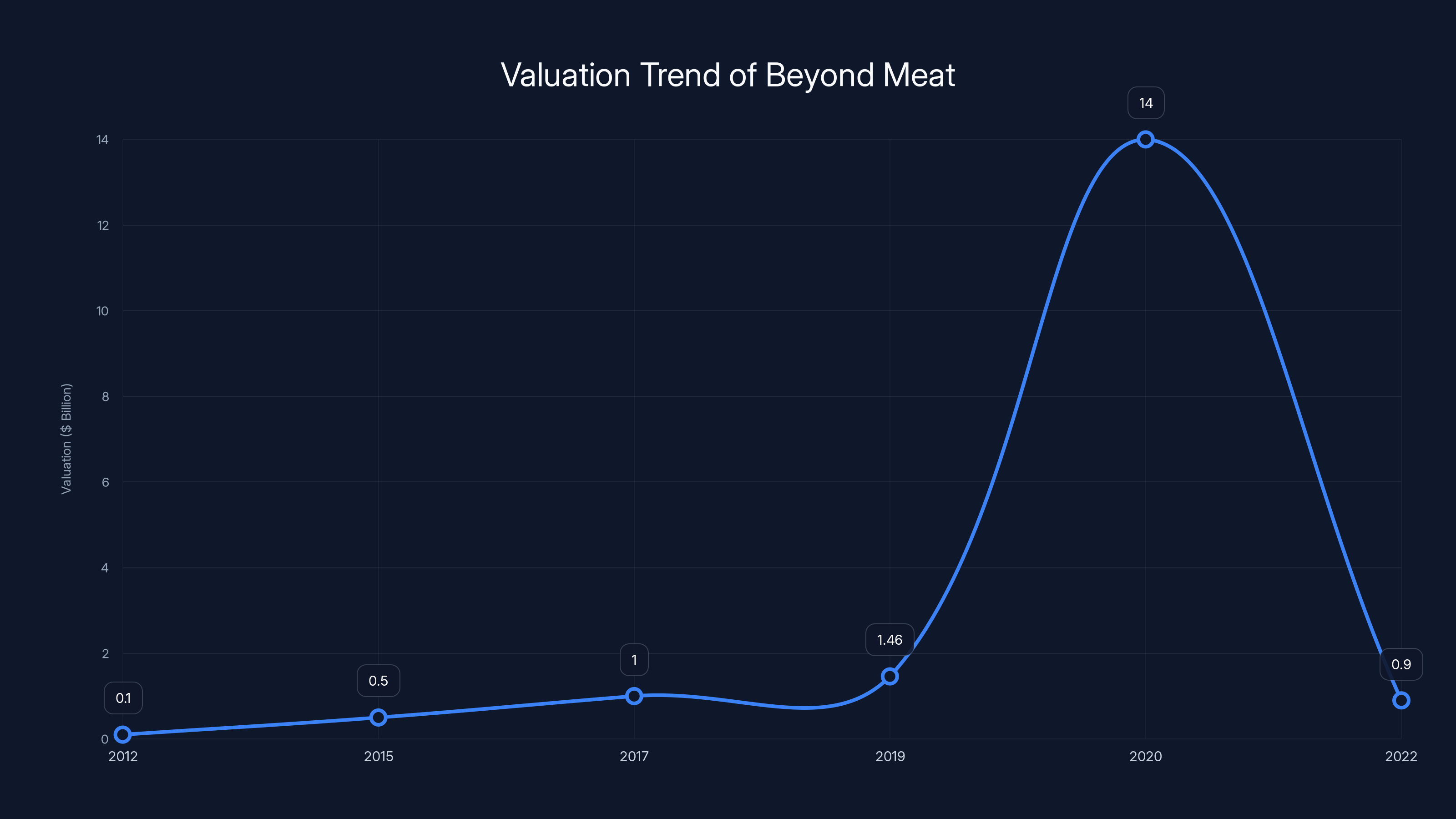

Obvious Ventures saw this coming earlier than most. The firm was founded in 2012, back when saying you wanted to invest in "impact" was considered slightly naive by the venture establishment. The firm's first major bet was Beyond Meat, which launched in 2012 and went public in 2019 at a

But here's the thing about Beyond Meat: it proved the thesis. It showed that you could build a massive, venture-scale business by solving a real problem (sustainable protein) and making a profit doing it. The fact that it subsequently became a meme stock and got massacred didn't invalidate the underlying insight.

Obvious Ventures stuck with the thesis anyway. And the results have been undeniable. The firm invested in Planet Labs, the satellite imagery company, which went public via SPAC in 2021 and is currently valued at approximately

These aren't lifestyle businesses. These are venture-scale outcomes. And they all share something in common: they're solving real problems using cutting-edge technology and science.

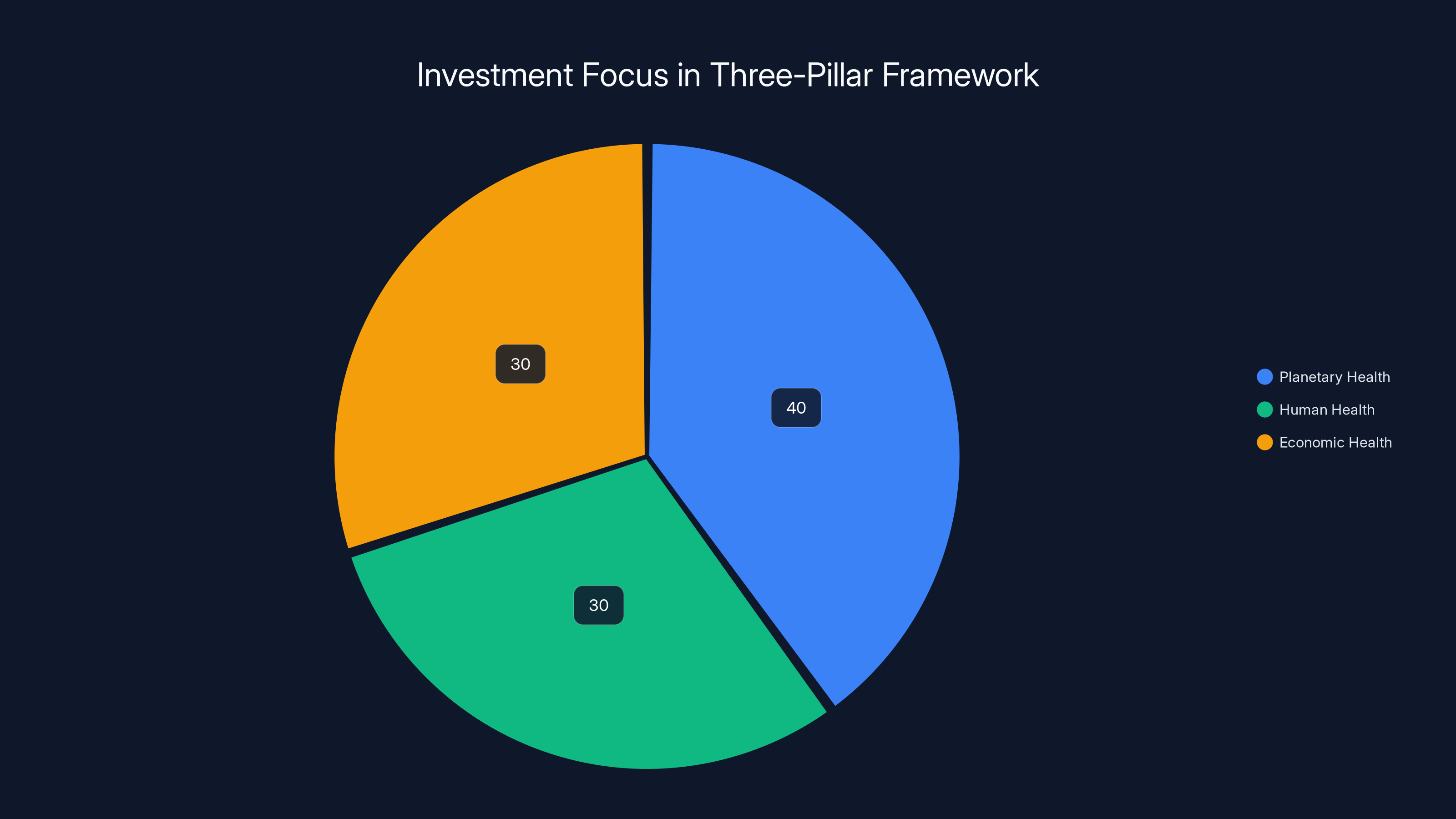

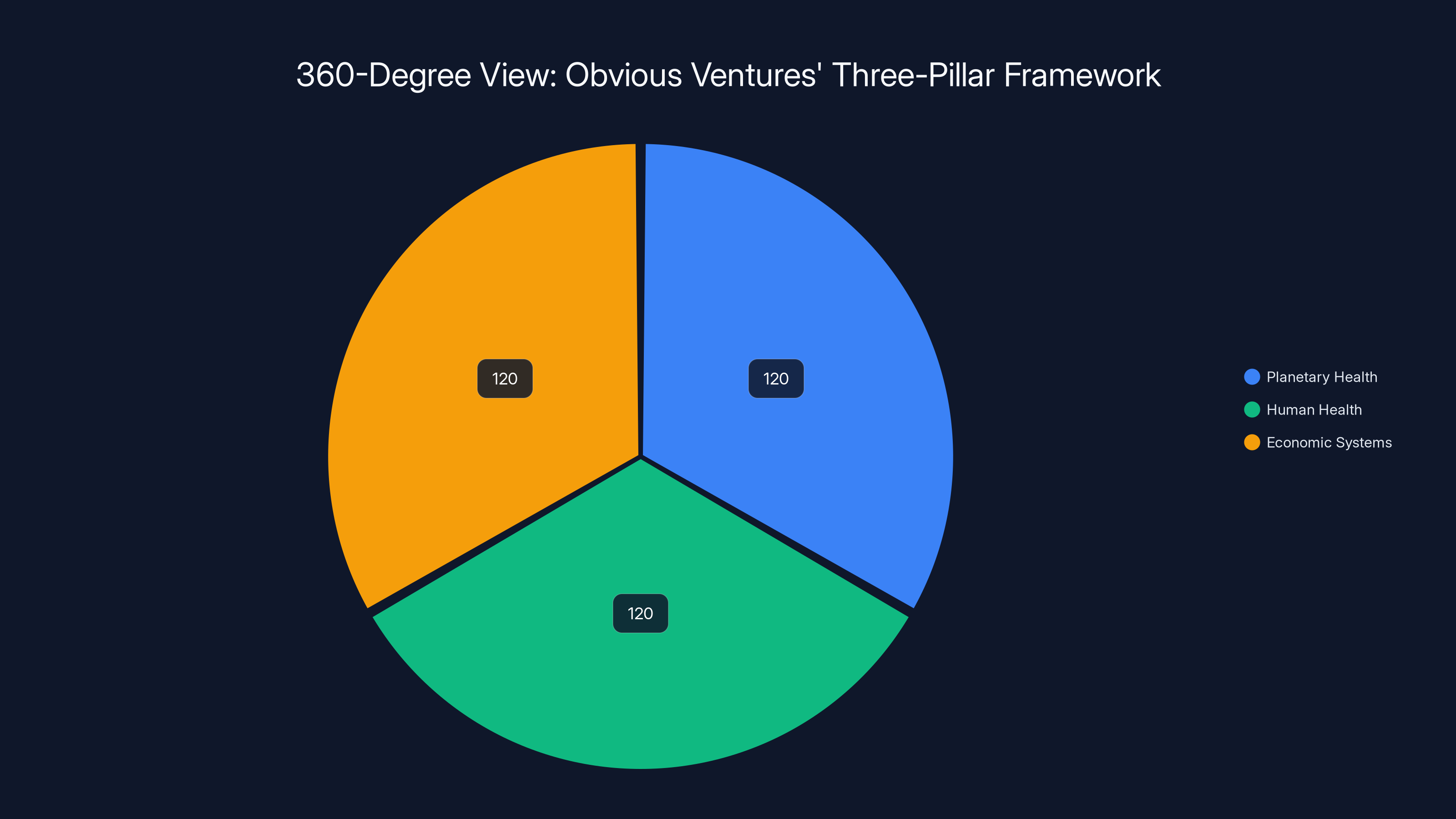

Estimated data showing that Obvious Ventures may focus more on Planetary Health due to its significant potential for venture capital wins, as exemplified by investments like Zanskar.

The Three-Pillar Framework: Planetary, Human, and Economic Health

Obvious Ventures doesn't organize its thesis around industries or technologies. It organizes around outcomes.

The firm's three pillars—planetary health, human health, and economic health—might seem broad enough to encompass literally everything. In practice, they're disciplined. They represent a forcing function. If a startup doesn't clearly address at least one of these three areas, it's not going into the portfolio.

Planetary Health: Energy and Resources

Let's start with planetary health, because it's where the most obvious venture capital wins have already been made.

Planetary health means climate stability. It means clean energy. It means using the finite resources we have more efficiently. For Obvious Ventures, this isn't abstract environmentalism—it's hard physics meeting entrepreneurship.

The firm's investment in Zanskar is a perfect case study. Zanskar uses proprietary data and AI to identify and harness geothermal energy. Geothermal has one of the lowest levelized costs of electricity (LCOE) of any power source, which means it's cheap and reliable. The problem is that finding good geothermal resources has historically required expensive drilling and exploration. Zanskar is solving that problem using machine learning and geological data.

Last week, Zanskar announced a $115 million Series C, and Obvious Ventures led the previous round. Why are they excited? Because geothermal power can fuel energy-hungry AI data centers, which are consuming increasingly massive amounts of electricity. This is the kind of bet that works at multiple levels: it solves climate, it solves energy scarcity, and it enables the next generation of AI infrastructure.

That's not accident. That's thesis alignment.

Other planetary health bets follow similar logic. The firm wants to invest in the physics and engineering that makes the world's resources go further. It's not about carbon offsets or tokenized nature. It's about actual, measurable impact on how energy and resources flow through the global economy.

Human Health: Molecule Design and Therapeutics

Human health is a different beast entirely. It's about extending lifespan, reducing suffering, and making sure new medicines actually work.

Obvious Ventures' investment in Inceptive is telling. Inceptive is an AI platform for molecule design and development. The company was founded by Jakob Uszkoreit, one of the primary authors of the "Attention is All You Need" paper published in 2017. That paper introduced the transformer architecture, which became the foundation for GPT, Claude, and basically every large language model that followed.

Why is that relevant? Because transformers are fundamentally about understanding sequences and learning patterns in high-dimensional data. Proteins are sequences. Molecules are structures made of sequences. The same mathematical machinery that helped us build better language models can help us design better drugs.

Inceptive is using this insight to accelerate drug discovery. Instead of waiting years for molecules to be synthesized and tested, AI can predict which molecules will work based on their structure and intended function. This doesn't just save money—it could save lives by getting effective medicines to market years faster.

That's the human health thesis. It's not about wellness retreats or meditation apps. It's about using the world's best AI and scientific talent to solve problems that have confounded humanity for decades.

Economic Health: Automation and Labor Markets

Economic health is the trickiest pillar to define. It doesn't mean "making money." It means distributing resources in ways that improve quality of life and opportunity.

Obvious Ventures' investment in Dexterity Robotics illustrates the point. Dexterity builds humanoid robots designed to handle "dull, dirty, and dangerous" tasks currently performed by humans in warehouses and factories. The company was valued at $1.65 billion last year.

On the surface, this looks like a story about automation replacing jobs. And sure, some jobs might be replaced. But the actual thesis is more nuanced. There are real jobs in warehouses and factories that are genuinely unpleasant—they're dangerous, they're repetitive, they cause injuries, and they don't pay well. If robots can take those jobs, humans can move up the value chain into better-paying, more interesting work.

That's economic health. It's not about making labor cheaper for corporations. It's about matching people with work that uses their highest skills and keeps them safe.

The bet is that this transition creates better economic opportunities, not fewer. Whether that actually plays out depends on policy, education, and how the gains get distributed. But the underlying thesis—that we should use technology to eliminate dull, dirty, and dangerous work—is solid.

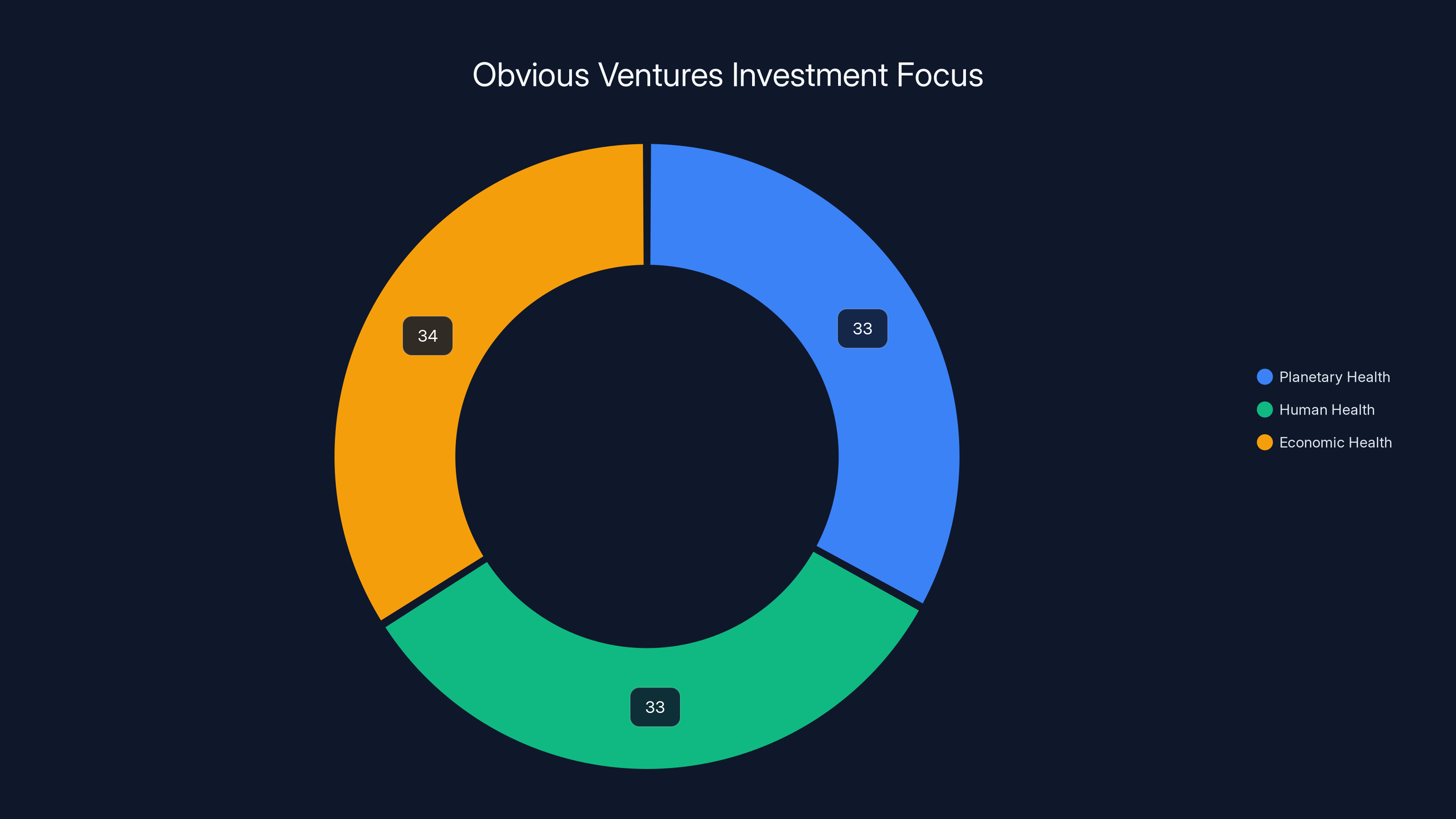

Obvious Ventures equally distributes its investment focus across planetary, human, and economic health, reflecting a balanced approach to tackling global challenges. Estimated data.

The Fund Size Strategy: Keeping Skin in the Game

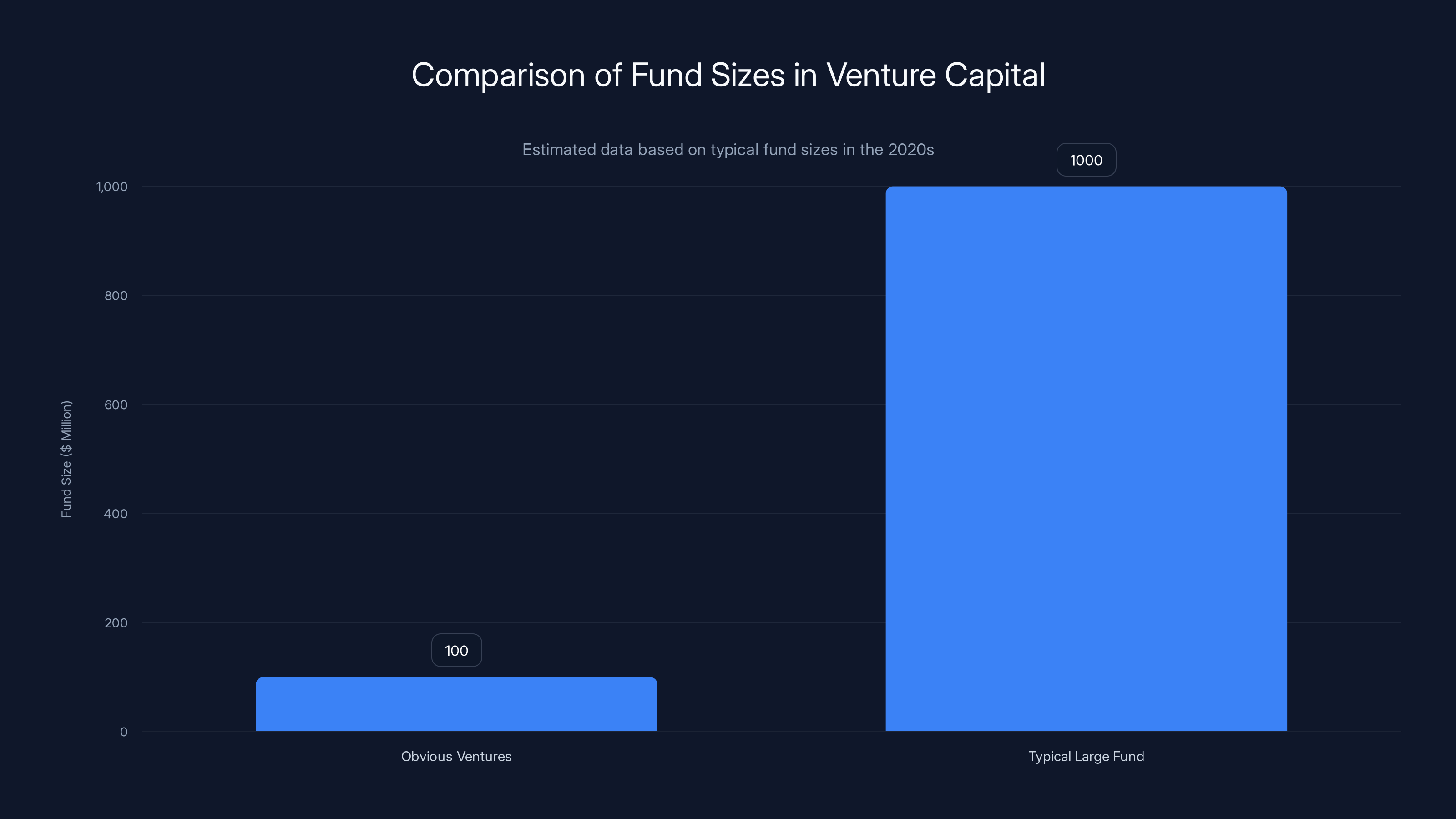

One of the reasons Obvious Ventures' thesis is worth taking seriously is the fund size discipline. The firm keeps its funds small enough that a single successful exit can return the entire fund.

This is not the venture capital orthodoxy. Most large venture funds raised in the 2020s were massive,

What actually happened is that large fund sizes created incentive misalignment. GPs had to find bigger and bigger check sizes just to deploy capital. This led to later-stage investments, which are less risky but also less exciting. It also led to pressure to chase returns through follow-on rounds in portfolio companies, rather than generating returns from new investments.

Obvious Ventures' approach is different. The firm makes roughly 10 investments per year, with check sizes ranging from

This creates better alignment between GPs and LPs. It also creates better alignment between VCs and founders. When a GP has one check size and uses it for everything, founders feel the pressure to "fit" the fund's thesis. When a VC is disciplined about check size and fund returns, founders can run their own race.

The Math Behind the Number: Why 360

Now let's address the elephant in the room: the $360,360,360 number.

On one level, it's exactly what Joaquin said it was—a playful celebration of math and science. The first four funds had clever numbers baked into them. Euler's number (e = 2.71828...), palindromes, sequences. These aren't accidents. They're signals that the firm founders think about the world mathematically and playfully.

But the 360 specifically? That's different. A 360-degree view. A full circle. Complete coverage.

In the context of Obvious Ventures' three-pillar framework, it's elegant. You can't take a 360-degree view of planetary health without understanding the economics of energy and resources. You can't understand human health without looking at how diseases arise from poverty and environmental degradation. You can't build sustainable economic systems without considering planetary limits.

The number is a forcing function. It's telling the team: we're serious about looking at all three dimensions. Not one, not two. All three.

Is this a coincidence? No. Is it also a bit cute? Yes. But the cuteness is actually strategically useful. It's memorable. It signals that the firm thinks differently. And it gives founders and LPs something to talk about besides the fund size.

Obvious Ventures maintains a smaller fund size (~

The Historical Context: Why Now?

Obvious Ventures didn't invent impact investing. That term has been around for over a decade. But the firm did something harder: it proved that impact investing could generate venture-scale returns.

There was a time, maybe five years ago, when venture capitalists would split into two camps: (a) people who wanted to make money, and (b) people who wanted to make impact. You picked one. If you picked impact, you worked at a nonprofit or a government agency. If you wanted to make money, you worked at a venture firm.

The best venture capitalists knew this was a false binary. Real innovation—the kind that changes markets and creates value—comes from solving real problems. The firms that figured this out early have significant structural advantages.

Obvious Ventures was one of those firms. So were firms like Breakthrough Energy Ventures (focused on climate tech), Lowercarbon Capital (focused on carbon removal), and others. But Obvious was earlier and broader. It wasn't betting on one mega-trend. It was betting on the idea that the future economy would be built on solving three interconnected problems simultaneously.

Now, five years later, that bet is looking increasingly prescient. Energy costs have become central to every venture discussion because AI data centers are eating the world's electricity. Climate regulation is becoming a feature of corporate strategy, not a bug. Human health has become intensely interesting because of advances in AI-driven drug discovery.

Obvious Ventures didn't predict all of this. But it positioned itself to benefit from all of it.

The Portfolio: Proof in the Numbers

Talk is cheap. Results matter. And Obvious Ventures' results have been genuinely impressive.

Beyond Meat showed that alternative protein could scale. Yes, the stock crashed. But the underlying thesis—that you could build a multi-billion-dollar company by solving the sustainability problem in protein—was correct. The market got ahead of itself on valuation, but the company still generated meaningful returns for early investors.

Planet Labs has generated real returns. The company went public at a

Recursion Pharmaceuticals was a Series A investment. The company is now public with a market cap over $2 billion. For a Series A investor, that's an enormous return.

Gusto is private and valued at over $9 billion. It's widely expected to IPO. Obvious Ventures got in at an early stage, so when it goes public, the returns could be massive.

These aren't home runs. They're not Google or Facebook or WhatsApp. But they're the kind of returns that actually matter to venture capital returns. They're exits in the $1-10 billion range, which is where most venture returns actually come from.

Beyond Meat's valuation soared to

The Investor Base: Who's Betting on Obvious?

Raising $360 million in the current environment is not trivial. The venture capital fundraising market has been challenging since 2022. LPs have become more skeptical, more focused on returns, and less interested in narratives.

The fact that Obvious Ventures closed this round tells us something important: LPs believe in the thesis. They believe that investing in planetary health, human health, and economic health creates venture-scale returns.

Who are these LPs? Joaquin didn't name them, but the typical Obvious Ventures LP base includes foundations (particularly those focused on climate and global health), endowments, family offices, and large institutional investors looking to make an impact alongside returns.

What's notable is that impact investing has become so mainstream that large institutional investors now have dedicated impact arms. Black Rock has an impact team. Goldman Sachs has an impact team. Universities have impact-focused investment mandates.

The old narrative that you had to choose between returns and impact is completely dead. Modern LPs expect both. Obvious Ventures is positioned right in the sweet spot of that shift.

The Competitive Landscape: Who Else Is Playing This Game?

Obvious Ventures isn't the only firm playing this game. It's just one of the best and most articulate about it.

Breakthrough Energy Ventures, backed by Bill Gates and other major philanthropists, has been raising massive funds ($1+ billion) to invest in climate and clean energy. They're playing in similar territory to Obvious on the planetary health side.

Manhattan Beach Ventures focuses on synthetic biology and biotech. They're playing similar games on the human health side.

There are also mega-funds like Andreessen Horowitz's bio fund and climate fund that are deploying capital in these spaces. But they're fund-sized at Sequoia scale, which means they're looking for bigger companies and later-stage deals.

Obvious Ventures' advantage is discipline. It's not trying to be everything to everyone. It's not raising $10 billion and trying to deploy it everywhere. It's raising focused funds, making focused bets, and actually thinking about whether investments align with the three pillars.

The 360-degree view represents equal focus on planetary health, human health, and economic systems, emphasizing a holistic approach. Estimated data.

The Challenges: Is the Thesis Too Broad?

Here's the honest critique of Obvious Ventures' approach: the three-pillar framework is broad enough to justify almost any tech investment.

Say you're funding a fintech startup. Does it contribute to economic health? Probably. Say you're funding a biotech platform. Does it contribute to human health? Obviously. Say you're funding an energy company. Does it contribute to planetary health? Yes.

The framework is powerful, but it's not limiting. And venture capital actually works best when frameworks are limiting.

Joaquin would probably push back on this. He'd say the limiting factor isn't the thesis, it's the execution. The firm makes roughly 10 investments per year. That's disciplined. The check sizes are relatively consistent. That's disciplined. The managing team is small. That's disciplined.

So the thesis might be broad, but the firm's actual deployment of capital is narrow. They can't invest in everything. They have to pick. And what they pick tends to be companies working on genuinely hard problems using frontier science and technology.

That's a legitimate response. But it's worth keeping in mind.

The Future: What's Next for Obvious?

Fund five is closed. Capital is deployed. Now the question is execution.

The firm plans to make approximately 10 investments annually from this fund. That's 50 companies over five years, assuming a typical fund lifetime. Some of those will fail. Some will take a decade to exit. Some might return the entire fund themselves.

The real test will be whether the firm's thesis actually generates better returns than traditional venture capital. Not because impact is good—everyone believes that now. But because impact is where the real technical problems are, and real technical problems generate venture-scale returns.

If Obvious Ventures can prove that over the next seven to ten years, with Fund Five exits, the firm will have established itself as one of the most important venture firms working in the space. If not, it'll be another well-meaning impact fund that didn't quite move the needle on returns.

Joaquin and the team clearly believe they'll prove it. The 360 number suggests they're thinking about full-circle victory—complete returns, complete impact, complete alignment between doing good and doing well.

Whether they get there is the only story that actually matters.

Key Takeaways for Founders and Investors

What should founders and other investors actually take from the Obvious Ventures Fund Five announcement?

First, impact investing is now mainstream. It's not a side bet or a feel-good initiative. It's central to how the best capital allocators think about the future.

Second, the best founders are solving real problems using cutting-edge science and technology. Obvious Ventures' portfolio is a masterclass in what this looks like across three different domains.

Third, disciplined fund size matters. Obvious Ventures keeps funds sized so that a single major exit can return multiples of the entire fund. This aligns incentives and keeps the firm focused.

Fourth, the future economy will be built on solving interconnected problems. It's not just climate. It's not just health. It's not just inequality. It's all three, simultaneously, with technology as the tool to solve them.

Fifth, even playful fund numbers have philosophical depth. The $360,360,360 number signals that this firm thinks holistically about the world. It's a small thing, but it's the kind of thing that permeates culture.

If you're founding a company, building a venture fund, or allocating capital, the Obvious Ventures playbook is worth studying. It's not perfect, but it's probably the clearest example of how to align profit motive with impact motive in the venture capital space.

FAQ

What is Obvious Ventures and what makes it different from other VC firms?

Obvious Ventures is a venture capital firm co-founded by Twitter's Evan Williams and currently led by managing director James Joaquin. What distinguishes Obvious is its explicit three-pillar investment thesis focused on planetary health, human health, and economic health. Rather than organizing around industries or market size, the firm invests exclusively in startups addressing one or more of these three interconnected challenges using frontier science and technology. The firm has demonstrated this approach works by generating venture-scale returns through companies like Planet Labs, Recursion Pharmaceuticals, and Gusto.

How does Obvious Ventures' fund size strategy work and why does it matter?

Obvious Ventures maintains disciplined fund sizes (

What does the $360,360,360 fund size number actually represent?

The amount represents Obvious Ventures' three-pillar thesis of taking a 360-degree view of planetary, human, and economic health. While the firm has always used clever mathematical numbers for its funds (the first was

How has Obvious Ventures actually performed on its investment thesis?

Obvious Ventures has generated genuine venture-scale returns across its portfolio. Key exits include Planet Labs, which went public via SPAC in 2021 and is currently valued at approximately

What specific companies or sectors does Obvious Ventures invest in under each pillar?

Under planetary health, the firm invests in companies like Zanskar, which uses AI and data to identify geothermal energy sources for clean power generation. Under human health, it backed Inceptive, an AI platform for molecular design founded by Jakob Uszkoreit (co-author of the transformer architecture). Under economic health, the firm invested in Dexterity Robotics, which builds humanoid robots to handle dangerous warehouse and factory work. These examples show how the firm applies its thesis across completely different technical domains.

Is Obvious Ventures' three-pillar framework too broad to be actually limiting?

The criticism is fair—the framework is broad enough to theoretically justify almost any tech investment's contribution to planetary, human, or economic health. However, the limiting factors aren't the thesis itself but the firm's actual deployment discipline: roughly 10 investments per year, consistent check sizes, and a small management team. This means the firm can't invest in everything, forcing difficult prioritization. The real test will be whether this disciplined deployment of capital generates returns superior to traditional venture firms over the next seven to ten years.

How does impact investing align with venture capital returns?

This is the central insight of Obvious Ventures' thesis: the false dichotomy between impact and returns is being eliminated. Real innovation that changes markets and creates value comes from solving real, hard problems. Companies addressing genuine challenges in climate, energy, drug discovery, and labor automation operate in markets where frontier technology creates defensible competitive advantages. LPs increasingly expect venture funds to demonstrate both financial returns and measurable impact, making the two objectives complementary rather than contradictory.

What's the broader venture capital context for Obvious Ventures' success?

Obvious Ventures raised Fund Five during a challenging fundraising environment (2022-2025) when venture capital fundraising contracted significantly. That institutional LPs committed $360 million signals genuine belief in the thesis. The firm also operates in an era where impact investing has become mainstream—major institutions like Black Rock, Goldman Sachs, and university endowments now have dedicated impact arms. This shift makes Obvious Ventures' decade-long emphasis on this approach look increasingly prescient.

Related Articles

- General Fusion's $1B SPAC Merger: Fusion Power's Survival Strategy [2025]

- TechCrunch Disrupt 2026: Your Complete Guide to Early Bird Deals & Networking [2025]

- TechCrunch Disrupt 2026: Complete Guide to Tickets, Speakers & Networking [2025]

- Why Bad Laptops Actually Improve Your Life: The Case for Trash Hardware [2025]

- Harvey Acquires Hexus: Legal AI Race Escalates [2025]

- TechCrunch Disrupt 2026: Save $680 + 50% Off +1 Tickets [2026]

![Obvious Ventures Fund Five: The $360M Bet on Planetary Impact [2026]](https://tryrunable.com/blog/obvious-ventures-fund-five-the-360m-bet-on-planetary-impact-/image-1-1769450795732.png)