The Tech Event You Can't Afford to Miss: Inside TechCrunch Disrupt 2026

There's something electric about a room filled with 10,000 founders, investors, and tech visionaries all in one place. The energy isn't manufactured. It's real. People are actually making deals. They're actually finding their next hire, their next investment, their next breakthrough.

That's TechCrunch Disrupt.

For the uninitiated, TechCrunch Disrupt isn't your typical tech conference. It's not a trade show where you shuffle between booths pretending to be interested in enterprise software you've never heard of. It's curated. Intentional. Built for people actually doing the work in tech—whether you're bootstrapping a seed-stage startup from a coworking space or managing a portfolio of 50 companies.

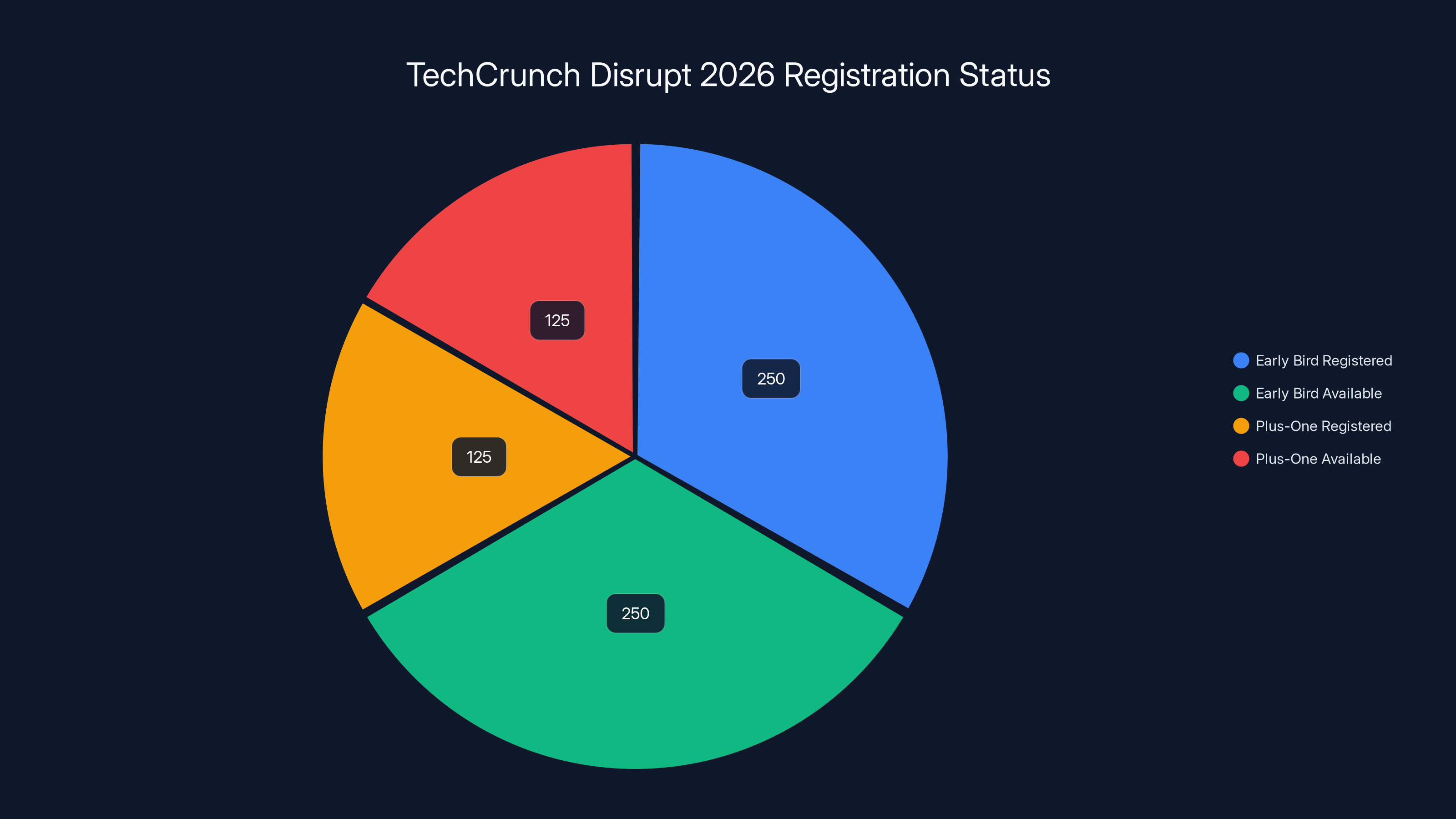

In just 5 days, the early bird pricing disappears. The 50% discount on plus-one passes runs out. The moment the first 500 registrations close, you lose both deals simultaneously. And here's the kicker: more than half are already gone, as reported by TechCrunch.

But here's what most articles don't tell you—why Disrupt matters, what actually happens there, and whether it's worth your time and money. Let's dig in.

Why Disrupt Stands Out in a Crowded Conference Calendar

Every week, there's another tech conference. Another summit. Another virtual event promising "unparalleled networking opportunities." Most of them blur together after 48 hours. You collect business cards from people you'll never call. You sit through keynotes from executives who read slides verbatim. You grab mediocre coffee and question your life choices.

Disrupt is different because it was built from the ground up to solve a specific problem: how do you create signal in an environment drowning in noise?

TechCrunch has been running this event for over a decade. They've learned what works and what doesn't. They've evolved it. The format prioritizes substance over spectacle. There are 200+ expert-led sessions across three days, which means you're not sitting through corporate keynotes for half the day. You're getting access to actual practitioners sharing real lessons.

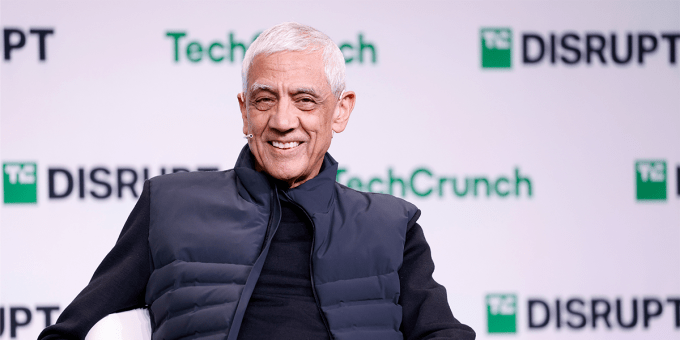

The speakers aren't B-list celebrities hired for name recognition. They're the founders and leaders actively shaping the industry. Past speakers have included people like Ashton Kutcher (Sound Ventures), Mary Barra (General Motors), Colin Kaepernick (Lumi), and Vinod Khosla (Khosla Ventures). These are people with skin in the game.

The Economics of Early Bird Pricing: Why $680 in Savings Matters

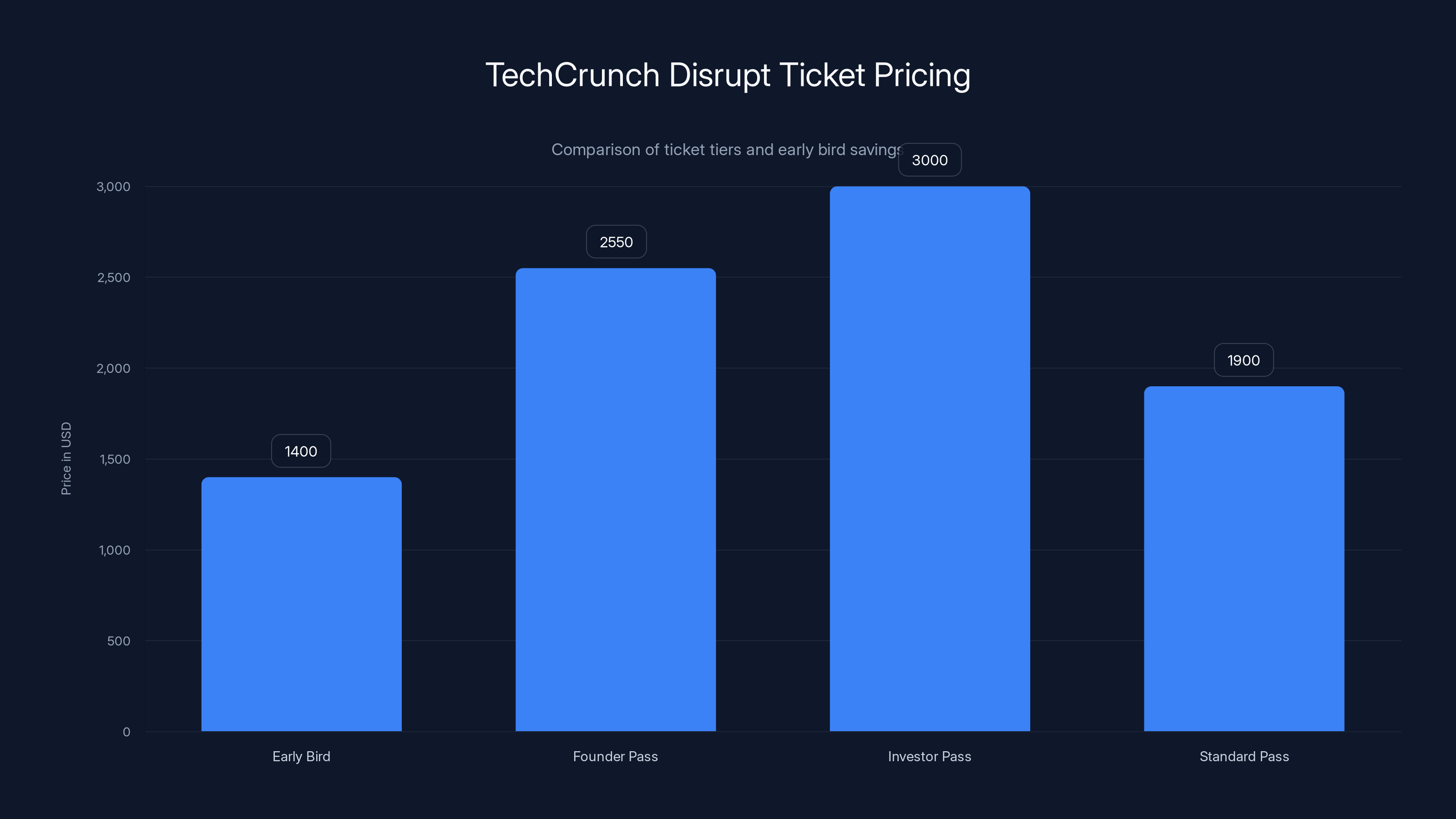

Let's do the math. Early bird pricing offers savings of up to

The plus-one deal is even more interesting. Getting a 50% discount on a companion ticket means bringing a co-founder, a key team member, or an investor costs half price. If regular plus-one pricing is

Here's why this matters psychologically: scarcity is real when it's actually enforced. TechCrunch isn't artificially inflating urgency. They're not running some fake countdown timer. The first 500 registrations get this deal. Once that's full, it ends. Once January 30 hits, it ends. Both conditions need to expire. Whichever comes first.

At the time this offer went live, more than half the 500 slots were already claimed within days. That's not a marketing tactic. That's people responding to actual value.

What You're Actually Paying For: Breaking Down the Disrupt Experience

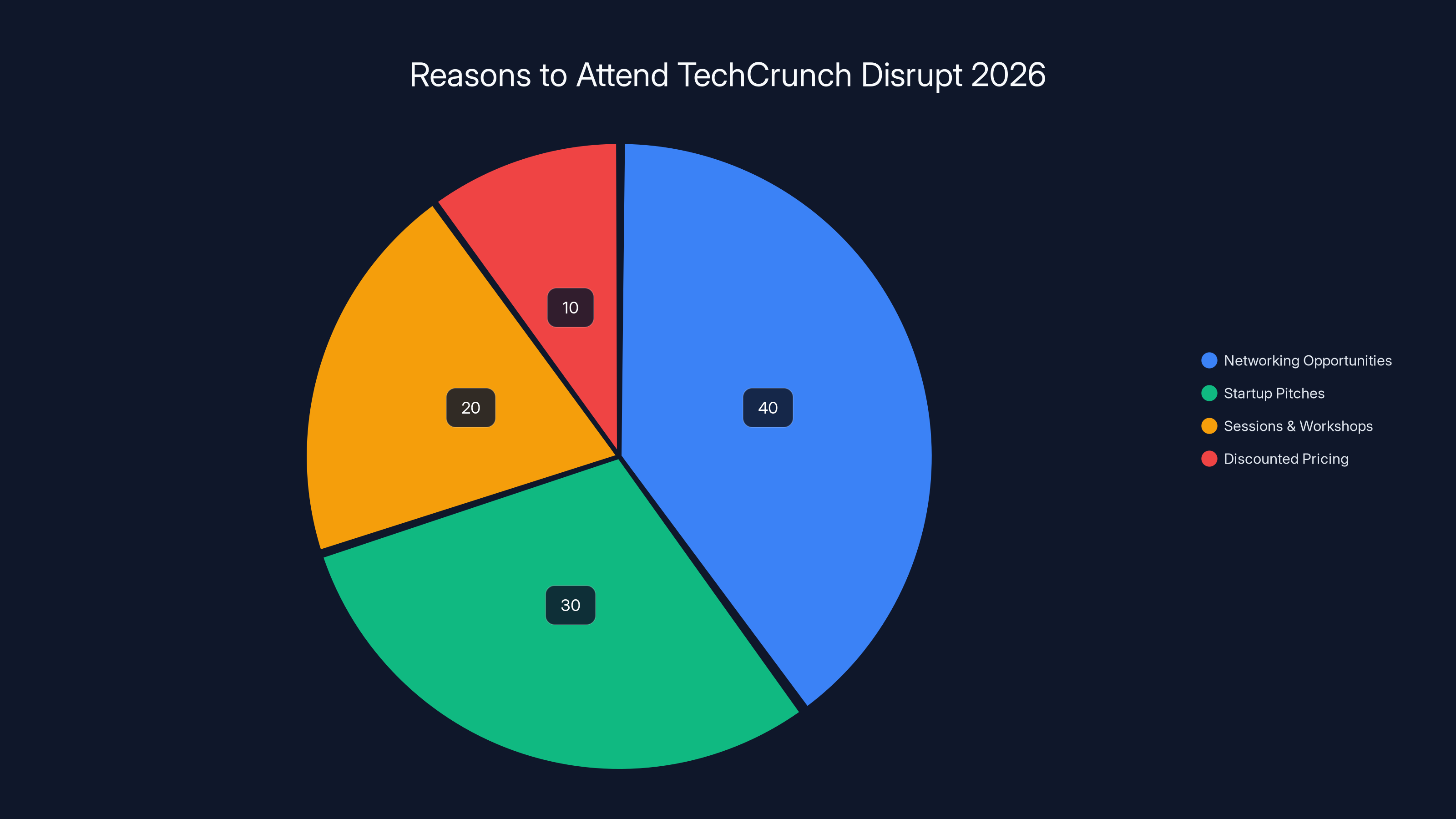

When you register for Disrupt, you're not just buying conference access. You're buying three things: structured learning, startup discovery, and high-quality networking.

Structured Learning. The 200+ sessions are organized by theme and expertise level. You're not wandering the expo hall hoping something interesting happens. Each session has a stated topic, usually led by someone with credible expertise. You know what you're walking into. You can plan your day. You can skip the stuff that doesn't apply to you and double down on the sessions that do.

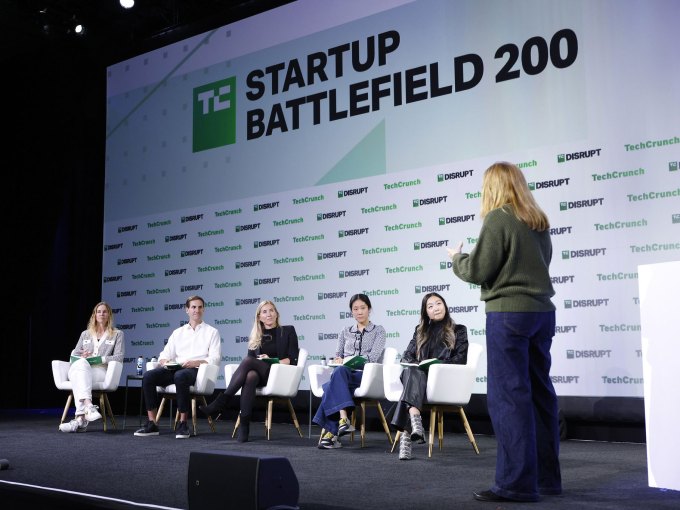

Startup Discovery. This is where Startup Battlefield comes in. Over 200 early-stage startups pitch live. Many of them are pre-launch or pre-funding. You're seeing the next wave before the hype cycle. For VCs, this is sourcing. For founders, this is inspiration and competitive analysis. For operators, this is "where are the talent and innovation heading?"

Networking. And not the awkward cocktail hour kind where you force conversations with people in a loud room. Disrupt includes curated networking, which means the event actually facilitates introductions. If you're a founder looking for specific investor expertise, there are structured opportunities. If you're a VC with a specific thesis, there are curated pitch sessions where relevant startups are identified for you.

The value isn't theoretical. Deals happen at Disrupt. Companies get funded. Teams get hired. Partnerships form. Journalists get stories. Not everyone achieves all three, but the probability is dramatically higher than at a typical conference.

Understanding the Three-Day Structure: How to Maximize Your Time

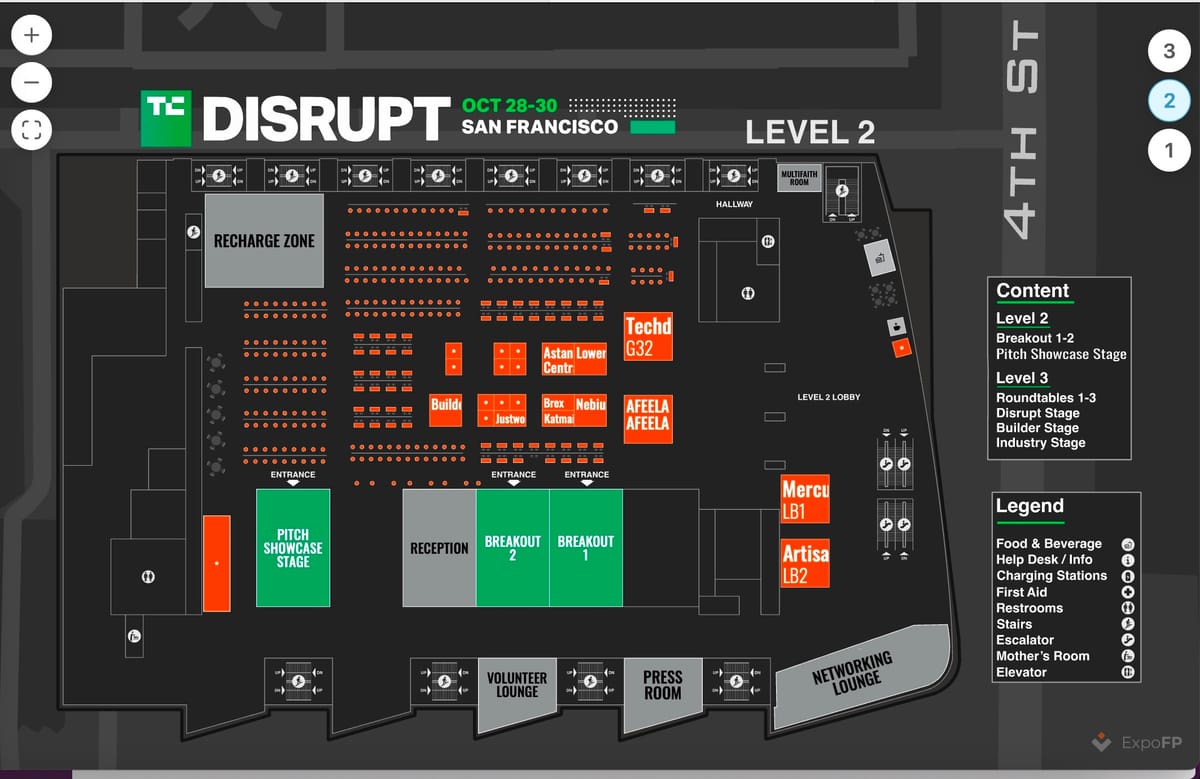

Disrupt runs October 13-15 at Moscone West in San Francisco. That's a specific venue, a specific time, a specific format. Understanding the structure helps you plan which sessions matter most to you.

Day One: Setting the Stage and Initial Connections

Day one typically kicks off with keynotes and opening ceremonies. This is when you'll see some of the headline speakers. This is also when you're making your initial physical connections—finding the registration desk, figuring out where the sessions are, getting oriented.

Most people waste day one by trying to catch every keynote. Don't do that. Skim the headliners, then immediately get into the sessions that directly apply to your work. If you're a founder in B2B SaaS, the sessions on customer acquisition and retention are more valuable than general "the state of AI" talks.

Use day one evening for preliminary networking. You'll be tired, but so is everyone else. The bar is lower for conversations. People are open. Make connections, exchange information, set up specific meetings for days two and three.

Day Two: The Deep Dive and Startup Battlefield

Day two is where the intensity peaks. Startup Battlefield typically happens on day two, which means 200 early-stage companies pitching in rapid-fire succession. If you're remotely interested in what's next in tech, this is essential viewing. You'll see companies that might be raising in 6 months. You'll see moonshot ideas that'll change your perspective. You'll see team dynamics that reveal a lot about founder quality.

Day two is also when you should be attending 3-4 sessions relevant to your specific niche. This is not a day to be casual. You're extracting value. You're taking notes. You're following up with speakers afterward.

Day two evening? More focused networking. By now, you've identified people worth meeting. Set up specific conversations. Don't just work the room. Have specific agendas for each conversation.

Day Three: Refinement and Final Connections

Day three is when people start thinking about leaving. Some do. Sessions are less crowded. The energy is lower. This is actually when the best conversations happen because there's less competition for attention.

Use day three for one-on-one meetings with people you've connected with on days one and two. The structured parts of the conference matter less. The unstructured connections matter more.

Estimated data shows that over half of the early bird and plus-one passes for TechCrunch Disrupt 2026 are already sold out, indicating high demand and interest.

Speaker Lineups: Who You're Actually Learning From

Let's talk about the speakers because this is where Disrupt separates from generic tech conferences.

The lineup includes founders, executives, and investors who've actually accomplished things. It's not theoretical. It's not motivational speaking. It's practitioners sharing what actually worked.

Ashton Kutcher brings investor perspective combined with entertainment industry insight. That's unique. Mary Barra, as CEO of General Motors, represents a traditional automotive company navigating AI and electrification. That's not a tech echo chamber. Vinod Khosla brings deep venture capital experience and climate tech focus. Matt Mullenweg, as co-founder of WordPress and CEO of Automattic, brings perspective on building distributed companies at massive scale.

Peter Beck from Rocket Lab talks about space. Tekedra Mawakana from Waymo talks about autonomous vehicles. Assaf Rappaport from Wiz discusses cybersecurity scaling. These aren't abstract speakers. These are people running actual businesses facing actual challenges.

When you attend sessions with speakers like this, you're not paying for their presence. You're paying for the opportunity to ask them questions. To follow up afterward. To potentially build a relationship. That's worth the admission price alone for the right conversation.

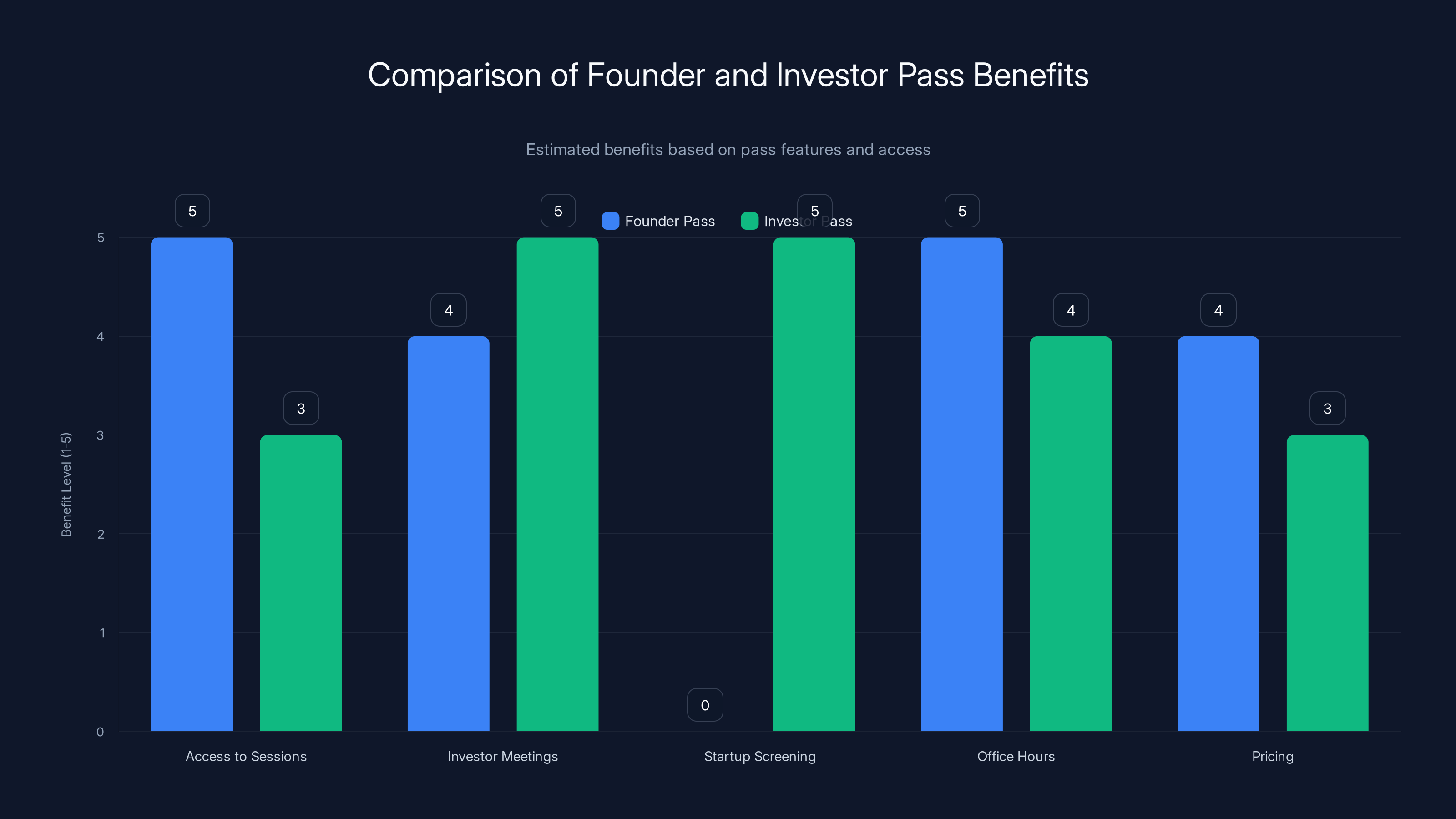

The Founder and Investor Pass Advantage: Different Tracks for Different Folks

Disrupt recognizes that founders, investors, and operators have fundamentally different needs. That's why there are specialized passes.

The Founder Pass: Built for Growth

If you're building a startup, the Founder Pass gets you access to specific sessions on growth, fundraising, hiring, and product-market fit. You also get access to investor office hours and pitch preparation support.

For early-stage founders, this is where you learn from people who've been in your exact situation. Not in theory. In practice. Founders who've scaled from zero to product-market fit share the patterns they've seen. What works. What doesn't. What they'd do differently.

The Founder Pass also gets you priority access to the Startup Battlefield judges and investor meetings. If you're pre-launch or pre-funding, these connections matter. The goal is to leave with commitments or at least strong leads.

Pricing for Founder passes reflects the value: they're positioned as premium compared to general passes because the curated access is more valuable. If you're genuinely building, it's worth the premium.

The Investor Pass: Unlocking Deal Flow

Investor passes get you curated access to the 200+ startups pitching. But more than that, you get screening access. You know which startups fit your thesis before you meet them. You can focus on specific sectors—AI infrastructure, climate tech, healthcare, fintech, whatever your focus is.

You also get priority access to founder office hours. If you're looking for specific expertise—a repeatable SaaS founder, or someone who's already exited once—you can find them and have actual conversations.

For VCs managing fund capacity constraints, this is massive. You're not wasting time on pitches that don't fit. You're seeing pre-vetted opportunities. You're meeting founders before the hype cycle.

The Investor Pass is where you build deal flow. It's not networking theater. It's business development.

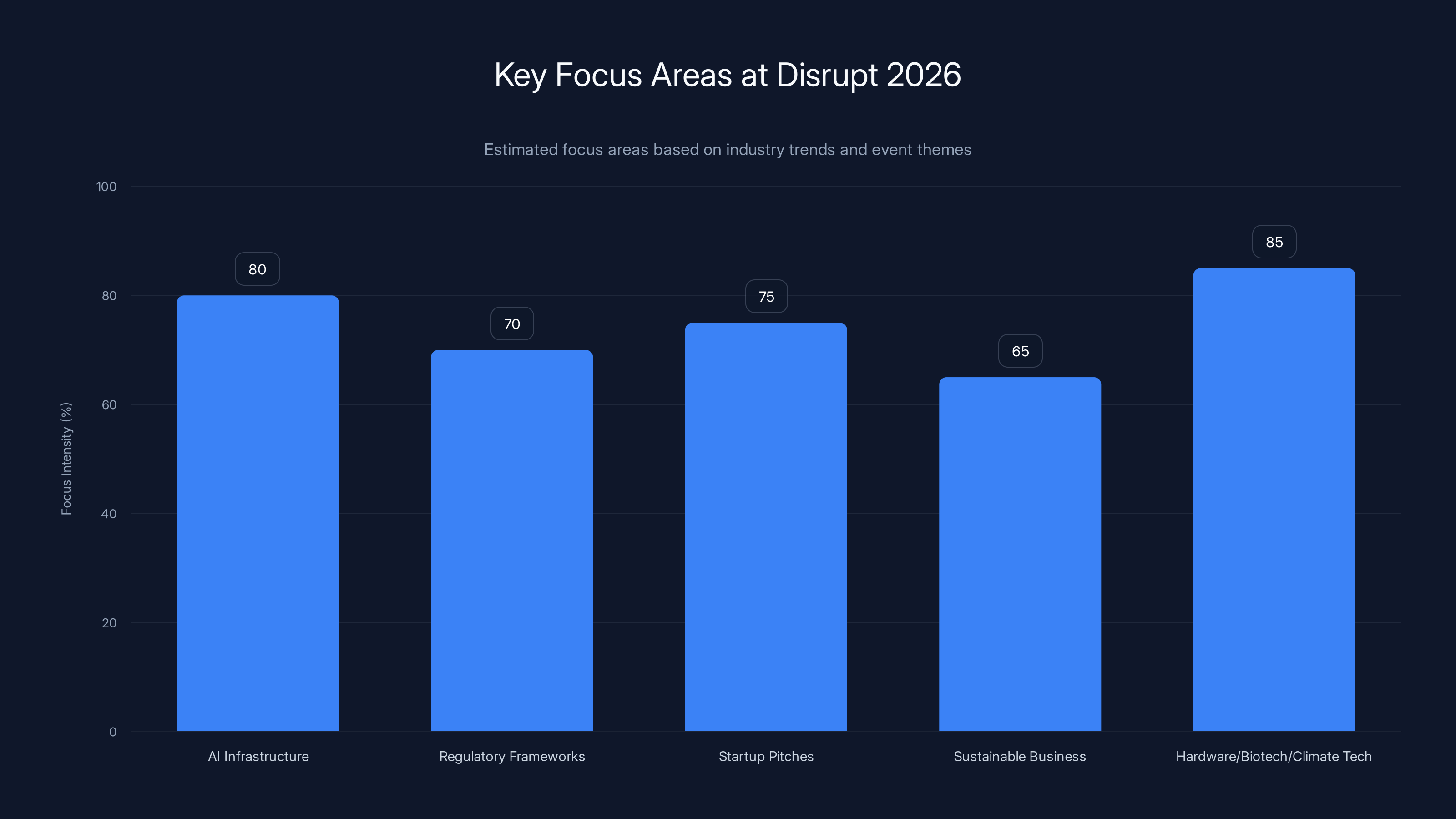

Disrupt 2026 is expected to focus heavily on AI infrastructure and emerging tech sectors like hardware, biotech, and climate tech, reflecting current industry trends. (Estimated data)

The Startup Battlefield: Where the Real Discovery Happens

Startup Battlefield is the centerpiece of Disrupt. 200 early-stage startups get 60 seconds to pitch in front of 10,000 people and a panel of judges. Some get funding announcements. Some get press coverage. Most get exposure to potential customers, employees, and investors.

Here's what makes Battlefield different from other pitch competitions: the diversity. You'll see companies in AI infrastructure, climate tech, hardware, software, biotech, fintech, and verticals you've probably never heard of. You'll see teams from 12 different countries. You'll see solo founders and teams. You'll see pre-product and post-product startups.

The pace is brutal. Sixty seconds per pitch. No exceptions. Companies are judged on clarity, novelty, team, and potential. It's a format that doesn't reward fluff. It rewards substance. That's why Battlefield pitches are frequently better than typical pitch events.

If you're interested in what's next in tech—actually next, not hype cycle next—Battlefield is essential. You'll see companies that'll be acquired in 18 months. You'll see moonshots that might fail spectacularly. You'll see the full spectrum.

For founders, watching Battlefield teaches you how to pitch. For investors, it teaches you to develop pattern recognition. For operators, it shows you where the industry is heading.

Networking Strategy: Making the Most of 10,000 People in a Room

Most people approach conference networking wrong. They work the room. They try to meet as many people as possible. They collect business cards. Then they go home and realize 90% of the connections are worthless.

Disrupt is too big for that approach. 10,000 people is too large a number to have meaningful conversations with everyone. Instead, you need a strategy.

Pre-Conference Planning. Before you go, identify 10-15 specific people you want to meet. Not "someone interested in AI." Specific people. Specific founders you admire. Specific investors who fund your space. Specific operators you want to learn from. Then, leverage Disrupt's networking features to request meetings or identify where they'll be.

Structured Sessions as Meeting Drivers. Attend sessions specifically because the speaker is someone you want to meet. After the session, you have legitimate context for conversation. You're not a random person pitching them. You're someone who attended their session and has specific questions.

The Hallway Conversations. The best connections often happen between sessions, during breaks, at meals. This is where serendipity lives. Have your elevator pitch ready, but make it genuine. Don't pitch. Connect.

Following Up. The conference is the beginning, not the end. The value is captured in the weeks after through follow-up. Take detailed notes on every meaningful conversation. Send personalized follow-ups within 48 hours. Reference specific discussion points. Most people don't do this. It makes you stand out.

Depth Over Breadth. Three deep conversations with the right people are worth more than 30 surface interactions. Focus on quality. Ask genuine questions. Listen more than you talk. This is how real relationships form.

Why San Francisco Matters: Venue and Ecosystem Context

Disrupt is held at Moscone West in San Francisco, and that's not accidental. San Francisco is still the epicenter of venture capital, startup density, and tech talent. There's no other city in the US with the same concentration.

When you're at Disrupt, you're in the actual headquarters of tech. Investors, founders, and operators are there because they're already in the ecosystem. That density matters. The quality of conversations is higher because everyone's already thinking in tech native mode.

Moscone West is specifically designed for conferences. Three days of programming, breakout sessions, exhibition space—it's built for exactly this format. The logistics matter more than people realize. When networking infrastructure is smooth, you can actually focus on conversations instead of wandering lost looking for the right ballroom.

Early bird pricing offers significant savings, with prices ranging from

The Timing Question: Early Bird Pricing and Real Scarcity

Okay, let's address the elephant in the room. Is the early bird pricing real, or is it manufactured scarcity?

It's real. Here's why: TechCrunch runs this event annually, and they've established patterns. The Founder and Investor passes are intentionally capped because the curated experience requires intimate access. You can't have 1,000 founders in a room designed for 500. The math breaks. The experience degrades.

The plus-one deal specifically for the first 500 is a way to drive early registration. Early registration helps TechCrunch with planning. It helps vendors with setup. It helps speakers prepare. It's not arbitrary.

Will there still be tickets available after January 30? Probably. Will they be at early bird prices? No. The pricing tiers typically escalate. Standard pricing is higher. Super-premium pricing is much higher. This is standard for conferences, not unique to Disrupt.

So here's the real calculation: Is the $680 savings worth moving up your timeline by 5 days? For some people, absolutely. For others, waiting for standard pricing is fine. Only you can make that call.

The ROI Angle: Should You Actually Go?

Let's be pragmatic. Is Disrupt worth the time and money?

If you're a founder raising capital, yes. The investor density and access is unmatched. You could pitch 50 investors in a week. You could also connect with other founders who've raised recently and learn their pitch deck mistakes.

If you're an investor managing deal sourcing, yes. You'll see 200 pre-vetted startups in concentrated format. The sourcing efficiency is high.

If you're an operator or employee at a tech company, maybe. If your company is sending you and it's career development, take it seriously. If you're going on your own dime, the ROI depends on what you're looking to accomplish. Are you changing jobs? Are you building a side project? Are you exploring a new industry? Clarity on your goal changes whether Disrupt is worth it.

If you're tangentially interested in tech but not actively working in it, probably not. The value capture is lower when you're not actively building, hiring, or investing.

Here's a simple ROI framework: If you make one meaningful connection that leads to an outcome—a hire, a customer, an investment, a partnership—the ticket pays for itself. If you have no actionable outcomes, it was expensive networking theater.

The key variable is how seriously you approach it. Half-assed attendance yields half-assed results. Intentional attendance with a clear agenda yields much better outcomes.

Logistics: What You Actually Need to Know About October in San Francisco

Disrupt is October 13-15, which is peak fall in San Francisco. Weather is typically 65-75°F, clear skies, low chance of rain. Pack layers. The conference venue will be cold, the outdoors will be mild.

San Francisco can be expensive. Hotel rooms near Moscone West run

Food is available everywhere. Moscone West has vendor options, though pricey. The surrounding neighborhoods have everything. You won't go hungry.

Internet is critical. The conference Wi-Fi can get congested. Consider a mobile hotspot or tethering as backup for important communications.

The Founder Pass excels in access to growth sessions and office hours, while the Investor Pass offers superior startup screening and investor meetings. Estimated data based on described features.

Unique Opportunities During Disrupt: Beyond the Sessions

While sessions and Startup Battlefield are the headline attractions, there are other opportunities that matter.

Media Access. TechCrunch has significant press presence. If you're announcing something, Disrupt is a stage for it. If you're a founder with news, journalists are everywhere. The media density creates opportunity.

Partner Booths. Companies like Google Cloud, Netflix, Microsoft, a16z, and Hugging Face have booth presence. These aren't vendor exhibits. They're networking hubs run by actual practitioners. You can have meaningful conversations with people in these organizations.

Evening Events. Official and unofficial events happen every evening. Some are curated. Some are open. The evening events are where the off-the-record conversations happen. Where founders get drunk and accidentally become best friends. Where partnerships form. Where the "real" networking occurs.

Private Meetings. Both Founder and Investor passes give you the ability to schedule private meetings with specific people. Use this. Schedule meetings. Be specific about what you want to discuss.

The Plus-One Advantage: Who Should You Bring?

The 50% off plus-one deal is specific and strategic. It's designed to encourage people to bring collaborators. So who should it be?

If you're a founder, bring a co-founder or your lead investor. Bring someone who'll engage seriously with the content. Don't bring a friend who's vaguely interested in startups. The 50% discount isn't free enough to justify dead weight.

If you're an investor, bring a teammate. Your partner. Your analyst. Bring someone who'll source deals independently and bring you insights you might miss.

If you're an operator, bring someone from your company who should be exposed to this ecosystem. A product leader. An engineer. Someone who'll return with ideas.

The plus-one works best when it's someone who'll engage independently, not just tag along. If your plus-one is just going to stand in the corner, you've wasted it.

Common Mistakes People Make at Disrupt (and How to Avoid Them)

After years of conference attendance, patterns emerge. Here are the mistakes most people make:

Mistake 1: Over-scheduling. Trying to attend every session sounds good. In practice, you burn out. Sessions run 45 minutes with 15 minutes between. You're moving constantly. You're not absorbing anything. Pick 5-6 sessions max per day. Leave room for spontaneous conversations.

Mistake 2: Not following up. You meet someone interesting. You exchange contact info. Then what? Most people do nothing. Your competitor follows up within 48 hours with a personalized message referencing your conversation. Guess who stays top of mind?

Mistake 3: Pitching instead of connecting. You see someone you want to meet. You pitch them for 60 seconds. You're another person in a long line of people pitching. Instead, ask them genuine questions. Demonstrate actual interest. Let the conversation emerge naturally.

Mistake 4: Skipping the startup pitches. Battlefield is where you see the next wave. If you skip it, you miss something. Even if you don't invest in startups, the companies pitching reveal industry direction.

Mistake 5: Not setting a clear goal. You show up to "network" and gain "insights." That's vague. What specific outcome do you want? A hire? An investment? A partnership? Customer feedback? Clarity drives behavior. Vague goals drive wandering.

Networking opportunities are the primary draw for attendees, followed by interest in startup pitches and sessions. Estimated data.

After the Conference: How to Capture Value Long-Term

The conference ends October 15. That's when the value capture really begins.

Day 1 After (October 16). Write down every meaningful conversation while it's fresh. Who did you meet? What did you discuss? What was the next step? What did you promise to send them? Get detailed notes out of your head.

Days 2-3 After (October 17-18). Follow up with everyone. Personalized emails, not generic templates. Reference specific discussion points. Send the information you promised. This is when you separate from 80% of the people there.

Week 2 After (October 20-24). If someone's idea was interesting, dive deeper. If you met an investor aligned with your thesis, schedule a follow-up call. If you met a potential hire, move the conversation forward. Momentum matters.

Month After (November). Check in with the most promising connections. Share relevant articles or opportunities that came up. Keep the relationship alive. This is when the real value emerges.

Most people do none of this. Most conference value evaporates. The people who systematically follow up build lasting relationships and actual business outcomes.

The Deal Deadline: Your Last Window for Savings

This is important, so let's be explicit: the early bird pricing expires January 30 or when the first 500 plus-one passes sell out, whichever comes first.

At the time this offer went live, more than 250 of the 500 plus-one passes were already claimed. That means roughly 250 remain. At the pace they were selling, that's a matter of days.

January 30 gives you a hard cutoff, but realistically, the plus-one discount disappears first.

After this deal ends, what happens? Standard pricing goes into effect. You're looking at roughly $680 more on your ticket. The plus-one becomes either unavailable or priced at full rate.

So the clock is real. It's not manufactured urgency. It's actual scarcity meeting actual deadline.

Who Actually Benefits from Disrupt (and Who Shouldn't Go)

Let's be honest about who this is for.

You should go if: You're a founder raising capital or preparing to raise. You're an investor sourcing deals. You're an operator navigating industry transitions. You're building your professional network in tech. You're launching a startup or a major initiative. You're exploring a new sector and want concentrated exposure.

You probably shouldn't go if: You're casually interested in tech but not actively involved. You're a software engineer looking for conference talks (there are cheaper options). You can't commit to serious preparation and follow-up. Your budget is extremely constrained and the $680+ doesn't fit. You're skeptical of networking and prefer remote learning.

There's no judgment either way. Disrupt is specifically designed for a purpose. If that purpose aligns with your situation, it's valuable. If it doesn't, there are cheaper ways to learn about tech.

Looking Ahead: What to Expect in the October 13-15 Timeframe

Disrupt 2026 is going to be shaped by the current moment in tech. AI adoption is accelerating. Regulatory scrutiny is increasing. The startup funding environment is stabilizing after years of excess. Infrastructure challenges are emerging.

Expect sessions on AI infrastructure, regulatory frameworks, founding in constrained markets, and building sustainable businesses. Expect startup pitches that are more focused on efficiency than growth-at-all-costs. Expect investors to be sharper about unit economics and path to profitability.

Expect the Startup Battlefield to include more hardware, biotech, and climate tech. AI is saturated with startups. The interesting opportunities are elsewhere.

Expect the speaker lineup to lean toward practitioners who've actually navigated recent turbulence, not celebrities or thought leaders who are disconnected from actual building.

This isn't just speculation. It's pattern recognition based on where the industry is actually heading.

Final Takeaway: Making Your Decision

So here's the core question: Is TechCrunch Disrupt 2026 worth your time and money?

If you're seriously involved in tech—either building, investing, or operating—the answer is yes. The early bird pricing makes it more accessible. The plus-one discount makes it easier to bring a collaborator. Both expire in 5 days.

If you're on the fence, ask yourself this: What specific outcome would make this trip worthwhile? If you can articulate a clear answer, get the ticket. If you're going because you should be at the place where tech people are, maybe reconsider.

The registration window is limited. Not infinitely limited, but genuinely limited on the discounted rates. If you're going to go, decide soon. You have 5 days.

Moscone West in San Francisco on October 13-15. 10,000 founders, investors, and tech leaders. 200+ sessions. 200 startups pitching live. Real opportunities. Real connections. Real value if you approach it right.

The deal expires January 30. The plus-one slots are running out. That's not pressure. That's just timing.

Make your choice.

FAQ

What exactly is TechCrunch Disrupt and who should attend?

TechCrunch Disrupt is a three-day annual conference held in San Francisco featuring 10,000 founders, investors, operators, and tech leaders. It includes 200+ expert-led sessions, 200+ startup pitches, investor access, and structured networking. You should attend if you're raising capital, sourcing investments, building a startup, hiring for tech roles, or exploring the latest industry trends.

How much does TechCrunch Disrupt cost and what's included in each ticket tier?

Early bird pricing (available through January 30) ranges from approximately

What is the 50% off plus-one deal and when does it expire?

The plus-one promotion offers a 50% discount on a second conference ticket for the first 500 registrations. More than half of these 500 slots were already claimed shortly after the offer launched. The deal expires on January 30, 2026, or when all 500 plus-one discounts are claimed, whichever comes first. After this expires, standard pricing applies and plus-one availability becomes limited.

What is Startup Battlefield and why is it important?

Startup Battlefield is the flagship pitch competition where 200 early-stage startups pitch in 60-second intervals live on stage before 10,000 people and a panel of judges. It's important because you see pre-hype cycle innovation across diverse sectors and geographies. For founders, it's inspiration and competitive analysis. For investors, it's deal sourcing. For operators, it reveals industry direction.

How should I prepare before attending Disrupt and what's the best strategy for maximizing value?

Prepare by identifying 10-15 specific people you want to meet, selecting 5-6 sessions relevant to your goals, and scheduling private meetings if you have an investor or Founder pass. During the conference, prioritize depth over breadth in conversations, take detailed notes on connections, and attend Startup Battlefield. After the conference, follow up within 48 hours with personalized messages referencing specific discussion points to capture lasting value.

Are there specific networking opportunities beyond the main sessions and pitches?

Yes. Beyond sessions and Startup Battlefield, there are partner booths from companies like Google Cloud, Netflix, Microsoft, and a16z; curated investor office hours for founders; pitch preparation support for Founder pass holders; evening events (official and unofficial) where off-the-record conversations happen; and opportunities to schedule private one-on-one meetings with specific speakers or investors.

What are the common mistakes people make at Disrupt and how can I avoid them?

Common mistakes include: over-scheduling sessions (attend only 5-6 per day), not following up after the conference, pitching instead of having genuine conversations, skipping Startup Battlefield, and not setting clear goals. Avoid these by being intentional about your agenda, committing to personalized follow-ups within 48 hours, asking questions instead of pitching, watching the full Battlefield lineup, and defining specific outcomes you want from the event.

Is the early bird pricing worth the urgency and should I register immediately?

The early bird pricing is genuinely valuable if you're committed to attending. The $680 savings is real, and the 50% off plus-one discount is limited to 500 registrations. However, you should only register if Disrupt aligns with your actual needs and you'll prepare seriously. If you're on the fence, clarify what specific outcome would make the trip worthwhile. If you can articulate a clear goal, the early bird deal justifies the urgency.

Looking to Streamline Your Pre-Conference Preparation?

Preparing for a major conference involves managing multiple tasks: scheduling meetings, organizing notes from research on speaker backgrounds, coordinating with your plus-one, and structuring your agenda. Platforms that automate workflow management and documentation can help you stay organized and maximize your preparation time before October 13.

Use Case: Create an automated conference prep document that pulls speaker bios, maintains your meeting schedule, and tracks follow-up actions—all updated in real-time.

Try Runable For Free

Key Takeaways

- TechCrunch Disrupt 2026 (October 13-15, San Francisco) brings 10,000 founders, investors, and operators with 200+ sessions and 200 startup pitches—early bird pricing saves up to $680 and expires January 30

- The 50% off plus-one deal is limited to first 500 registrations with more than half already claimed—real scarcity, not manufactured urgency

- Startup Battlefield is the centerpiece where 200 pre-hype-cycle startups pitch live—essential for competitive analysis, sourcing, and understanding industry direction

- Specialized Founder and Investor passes provide curated access aligned to your role—Founder passes include investor office hours and pitch preparation; Investor passes include deal flow and startup sourcing

- Conference ROI depends entirely on intentional preparation, clear goals, and systematic follow-up within 48 hours—this separates meaningful outcomes from wasted networking theater

Related Articles

- TechCrunch Disrupt 2026: Complete Guide to Tickets, Speakers & Networking [2025]

- TechCrunch Disrupt 2026: Save $680 + 50% Off +1 Tickets [2026]

- Startup Battlefield 2025: Glīd Founder Kevin Damoa's Winning Strategy [2025]

- Harvey Acquires Hexus: Legal AI Race Escalates [2025]

- How Davos Became Silicon Valley's Mountain Summit [2025]

- Inferact's 800M Startup [2026]

![TechCrunch Disrupt 2026: Your Complete Guide to Early Bird Deals & Networking [2025]](https://tryrunable.com/blog/techcrunch-disrupt-2026-your-complete-guide-to-early-bird-de/image-1-1769449301397.png)