The Quiet Revolution: Why On-Device AI Is Reshaping Enterprise Legal

Back in 2023, most people thought generative AI was going to be a cloud-only story. Send your data to the internet, get an answer back. Simple, right? Except that doesn't work for lawyers.

Legal documents contain some of the most sensitive information a company has. Contracts hold pricing terms, intellectual property strategies, acquisition plans, deal structures that absolutely cannot live in some external cloud. A pharmaceutical company's licensing agreement might expose R&D roadmaps. A defense contractor's supply chain contract could trigger national security reviews. Financial institutions can't route their loan documentation through third-party servers without violating compliance frameworks they've spent millions building.

This is where Spot Draft enters the picture. The contract intelligence platform just raised

Spot Draft is betting everything on a different approach: what if the AI lived on your device instead? What if sensitive contract analysis happened locally, on the machine where the document already exists, rather than traveling through the internet to cloud infrastructure?

This shift represents something fundamental about how enterprise AI is actually going to work in regulated industries. Not the flashy consumer-facing chatbot model everyone's focused on. The unglamorous, compliance-critical infrastructure that keeps contracts moving through organizations without exposing them to external systems.

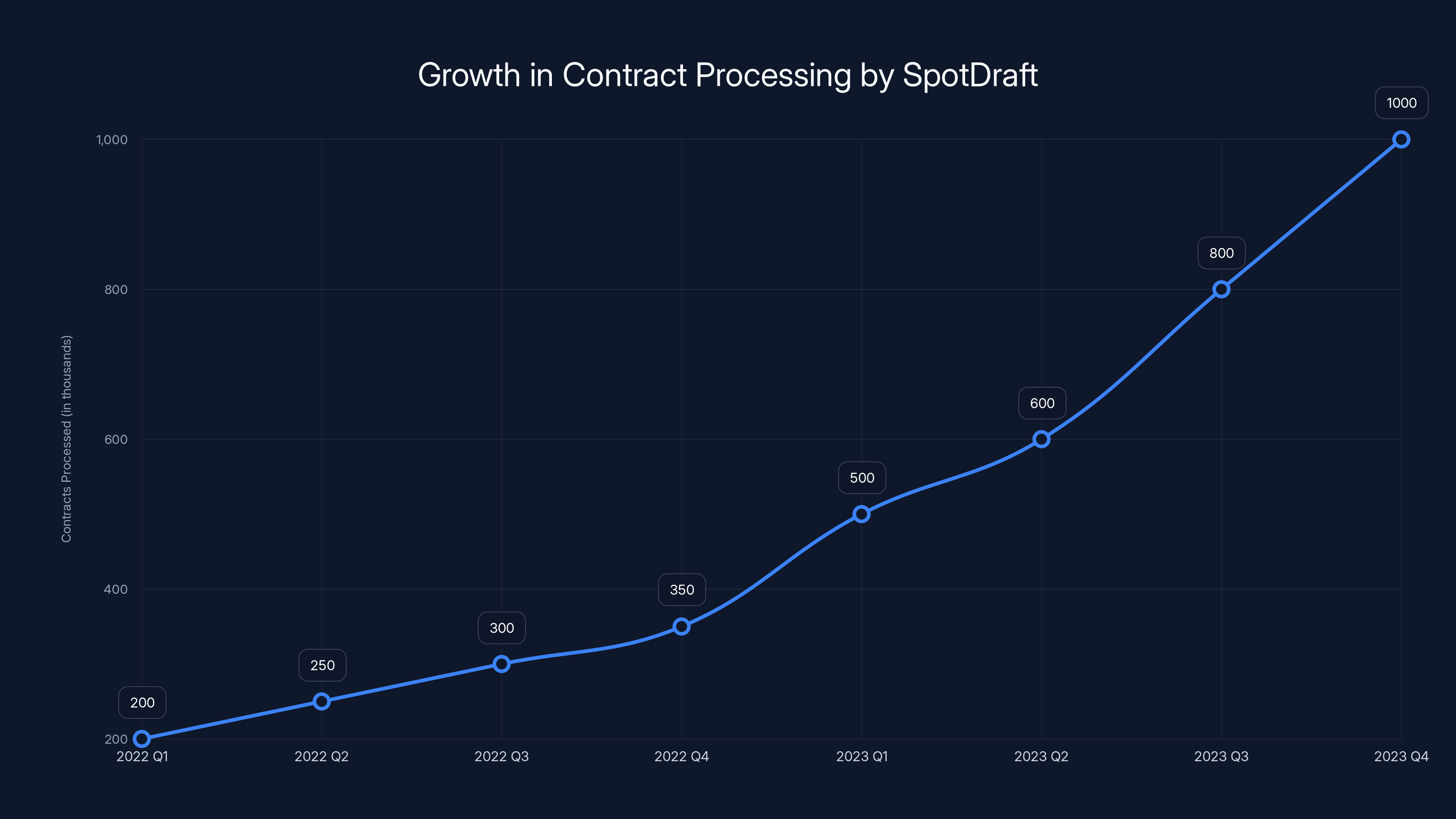

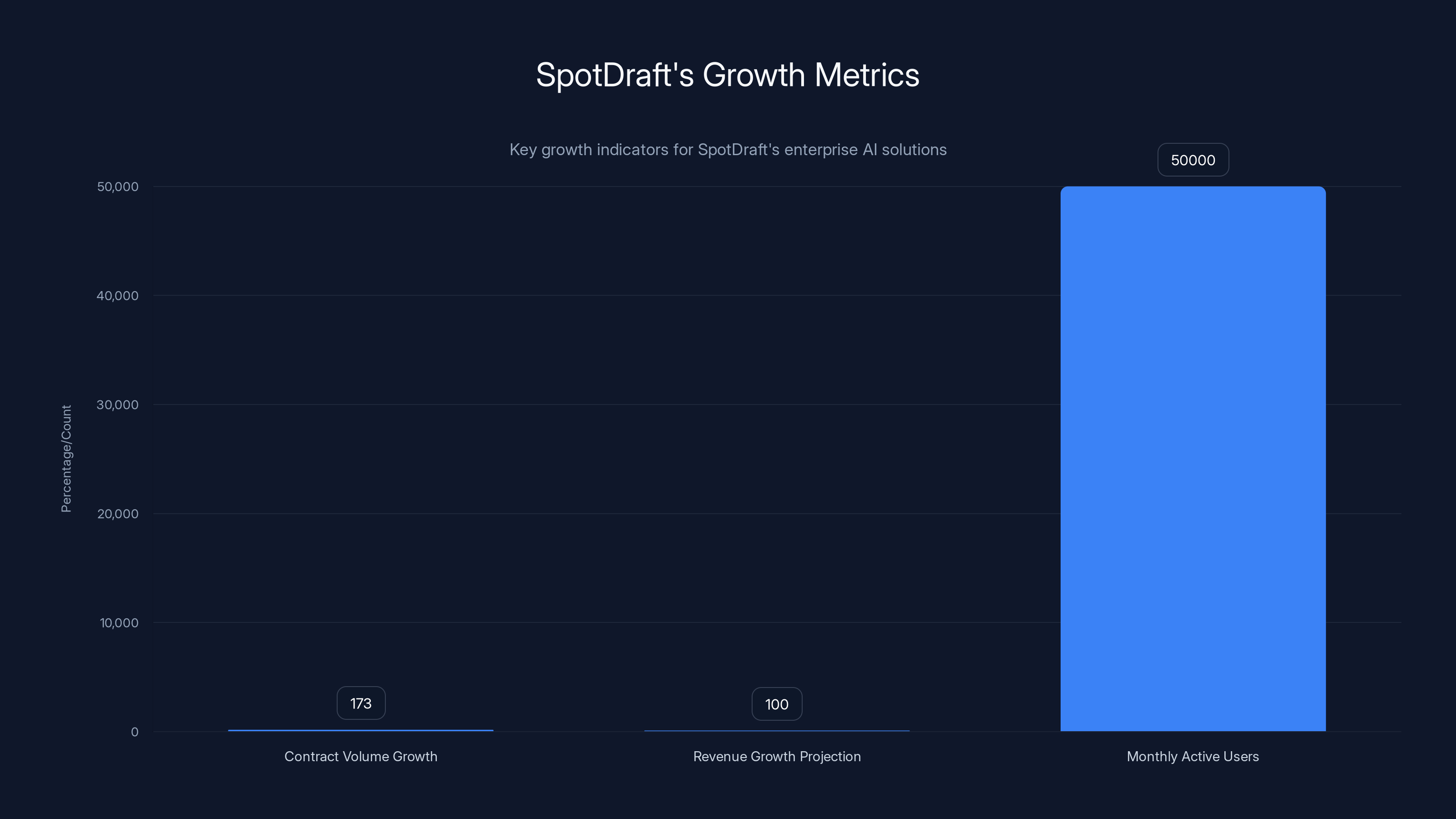

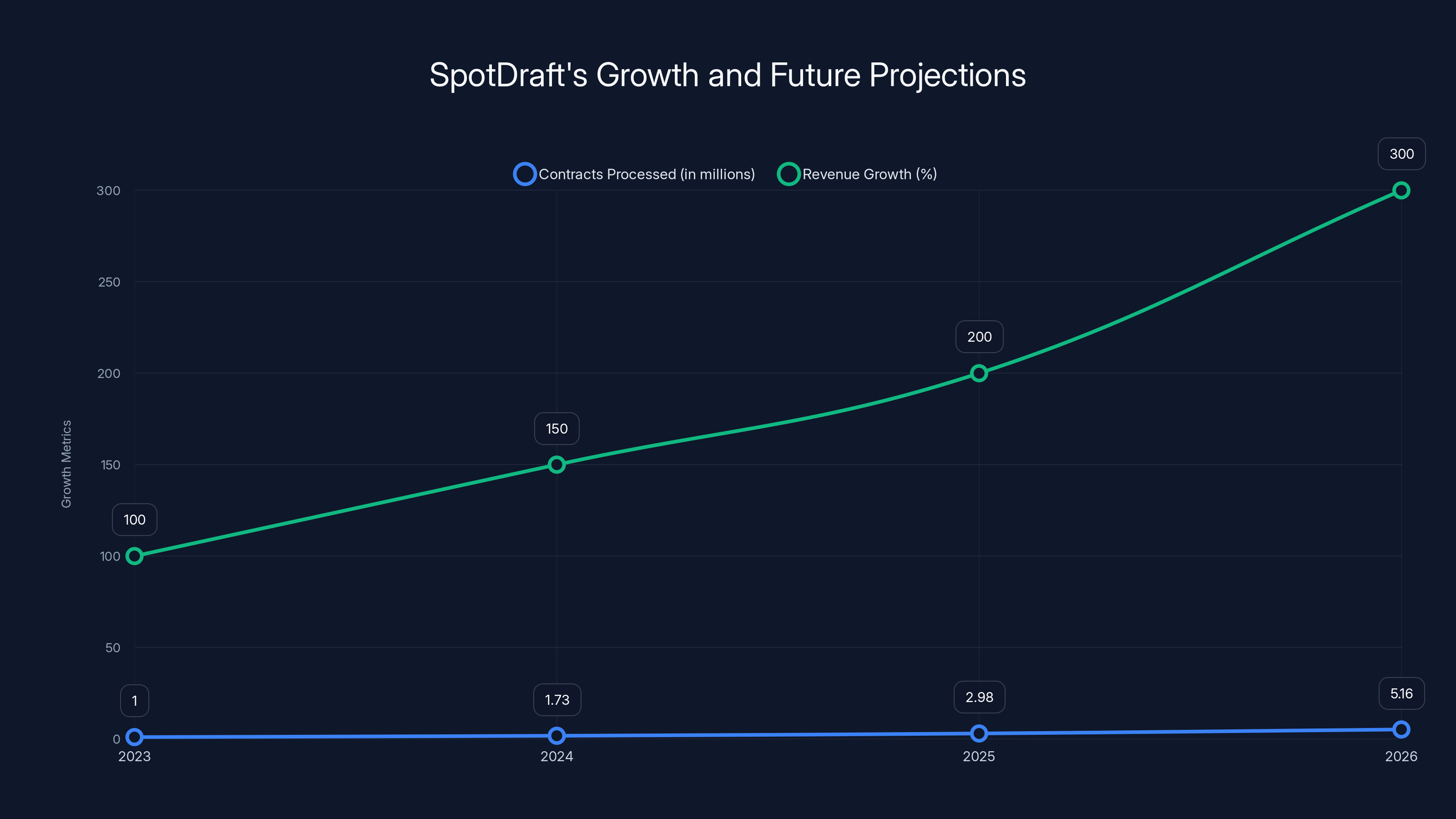

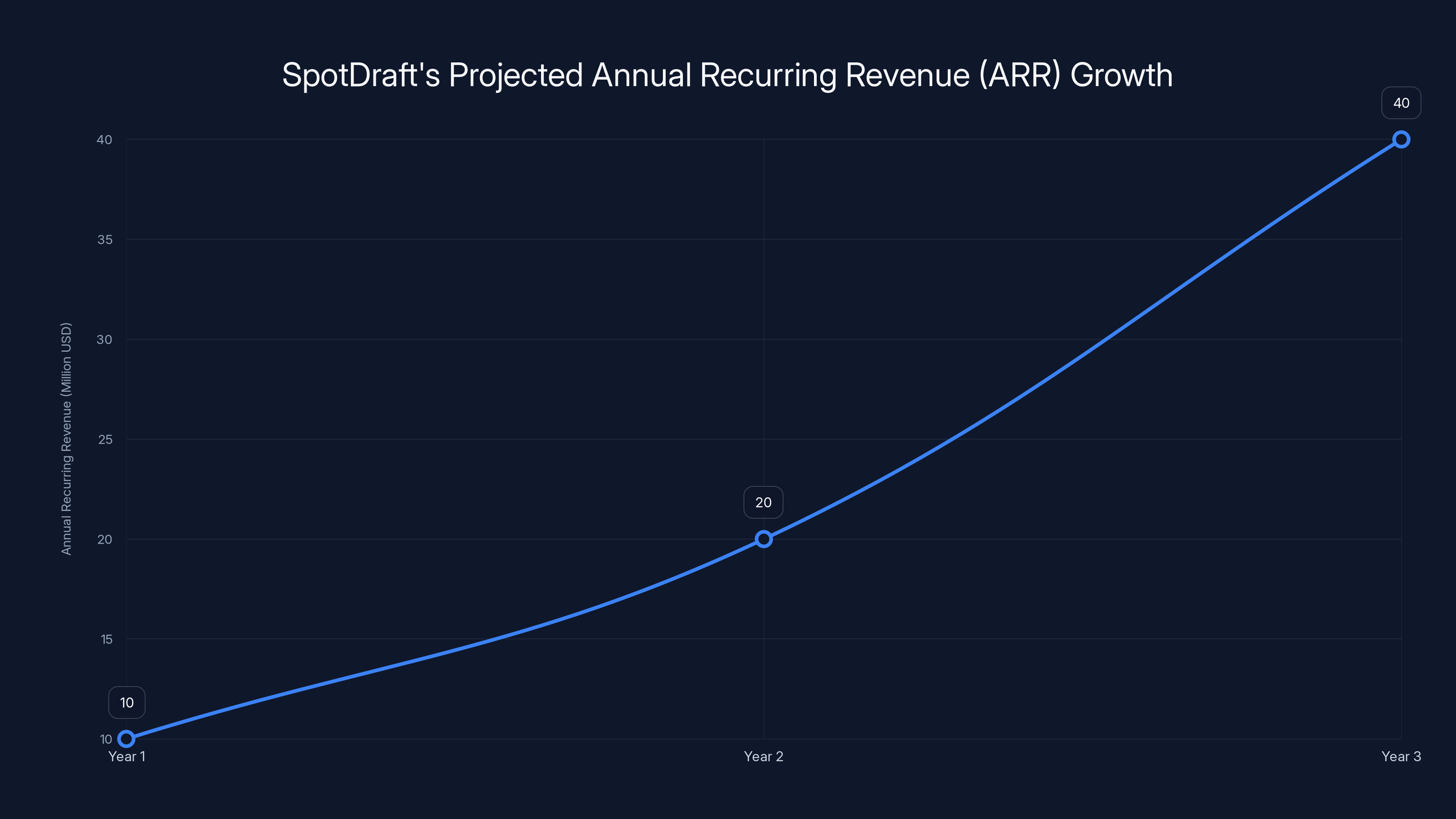

The company processes over 1 million contracts annually now, up from processing dramatically fewer just 18 months ago. Contract volumes have grown 173% year-over-year. They're expecting 100% year-over-year revenue growth in 2026, maintaining the same explosive trajectory from 2024 and 2025. This isn't a theoretical product anymore. This is a business hitting real scale with real enterprise customers.

The question becomes: what does on-device contract AI actually mean, why does it matter so much right now, and what does Spot Draft's growth tell us about where enterprise AI is actually heading?

Understanding On-Device AI: What Actually Changed

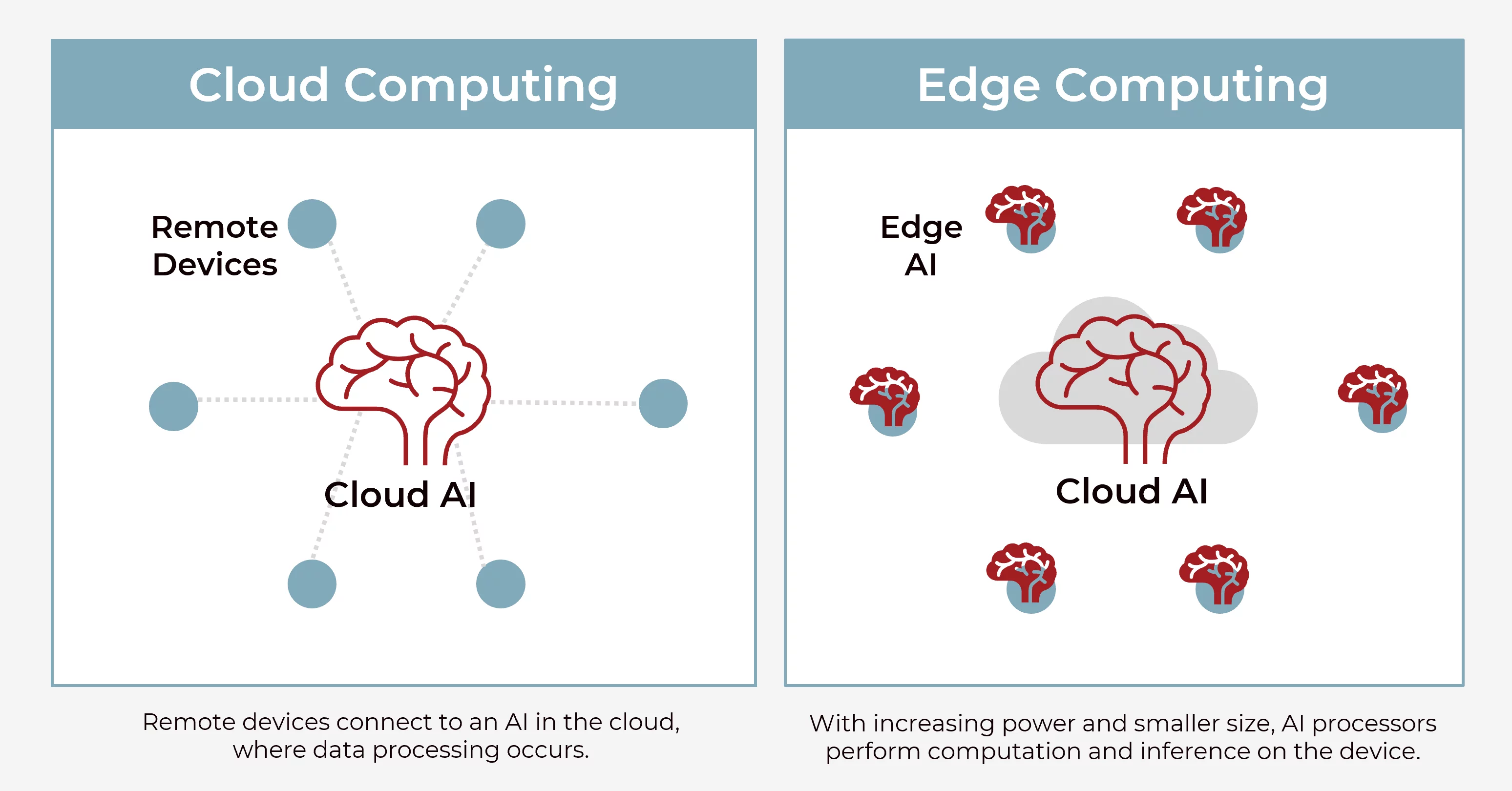

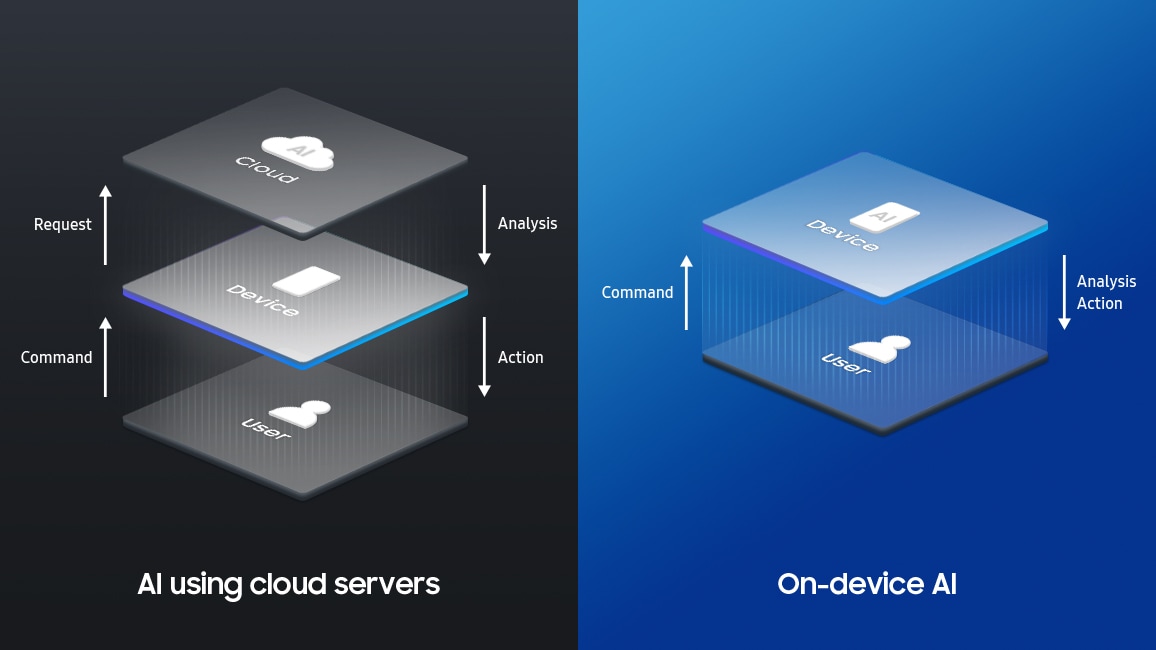

For years, "AI model" and "cloud service" were basically synonymous in people's minds. You had your document. You uploaded it somewhere. A model processed it and sent back results. Google Docs has suggestions. Microsoft Word has editor features. They all work through cloud infrastructure.

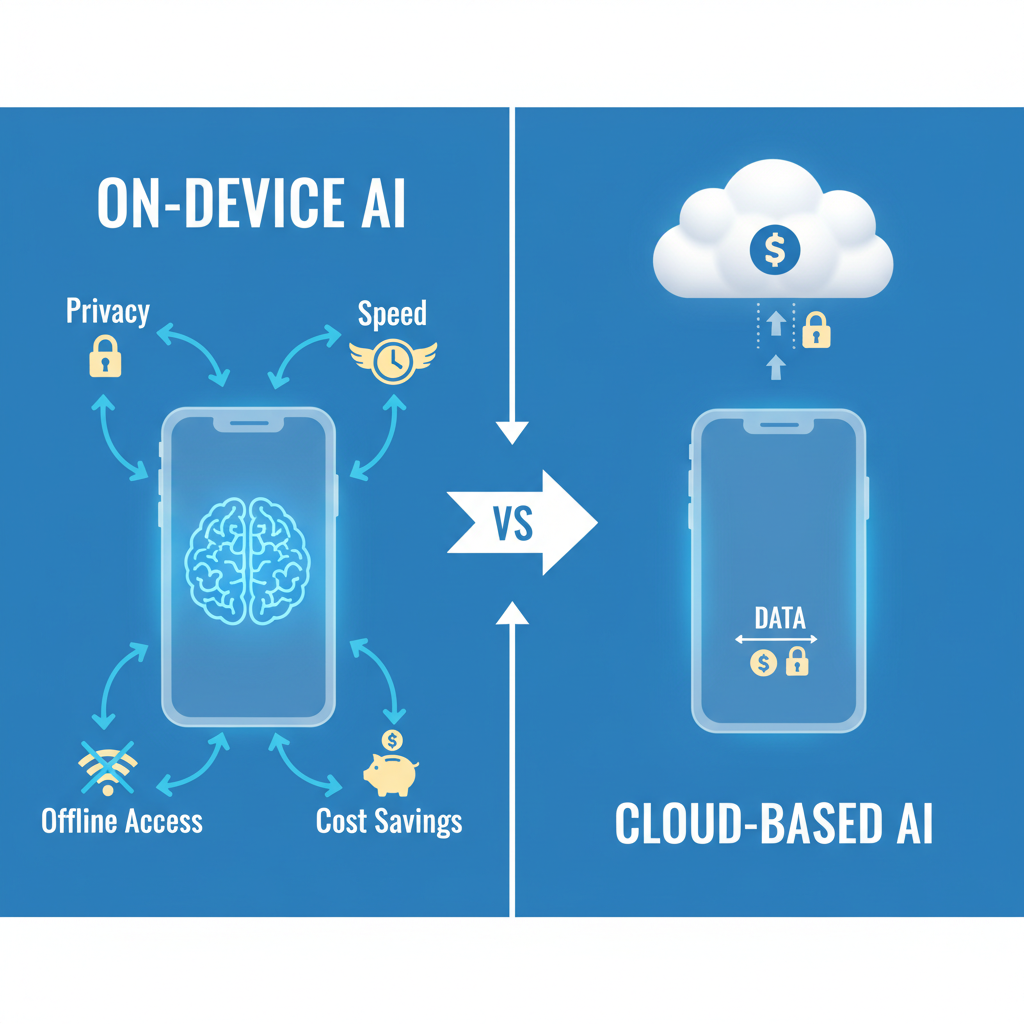

On-device AI reverses the flow. The model lives on the same hardware as your data. Your laptop, your corporate workstation, your secure server environment. The model never sees the internet (unless you specifically configure it to). Your data never leaves.

This sounds simple until you understand what it actually requires. Modern large language models are gigabytes in size. They were designed for cloud deployment where you have unlimited compute resources. Running them on a laptop or a typical workstation used to mean degraded performance, slower responses, reduced capability.

That's changed dramatically in the last 18 months.

Qualcomm's involvement here is critical. Qualcomm doesn't just invest in companies. They develop the chips that power devices. When Qualcomm backs Spot Draft with strategic investment, they're not just providing capital. They're providing a partnership on hardware acceleration. Qualcomm's latest processors—especially their AI-optimized variants—can now run sophisticated language models at speeds competitive with cloud-based inference.

Shashank Bijapur, Spot Draft's co-founder and CEO, explained the evolution clearly: "Right now, there's got to be AI that is close to the document, which is privacy critical, latency sensitive, [and] legally sensitive."

That phrase captures the entire thesis. Privacy critical. Latency sensitive. Legally sensitive.

Privacy critical means your data stays yours. No third-party cloud processor ever touches it. No data residency issues. No "is this GDPR compliant, is this HIPAA compliant, is this SOX compliant" nightmares. The data lives and dies on the device where the work happens.

Latency sensitive means you need fast responses. A lawyer reviewing a contract at 4 PM on a Friday doesn't want to wait 15 seconds for cloud processing. They want results in milliseconds. On-device processing eliminates network roundtrips entirely.

Legally sensitive means the legal system itself has requirements around data handling. Some contracts shouldn't be processed by external systems. Some law firms have policies around what they'll use cloud services for. Some jurisdictions have explicit requirements about where certain types of analysis can happen.

Co-founder and CTO Madhav Bhagat pointed to something unexpected: "Now we've come to a place where, in terms of eval, we are seeing as little as 5% difference between the frontier models, and some of these fine-tuned on device models."

This matters. The cutting-edge cloud models from Open AI, Anthropic, Google are marginally better than fine-tuned models running locally. Marginally. When you're talking about contract analysis—a task where you care about accuracy but you're also working from domain-specific training data—that 5% difference might be irrelevant. The document still gets analyzed correctly. The playbooks still apply. The recommendations still appear.

And speeds? "Speeds on newer chips are now one-third of what we get in the cloud," Bhagat said. One-third the latency. You process the document three times faster locally than sending it to the cloud and waiting for the response.

This is the inflection point. On-device models aren't a compromise anymore. They're not "good enough." They're actually better in meaningful ways for specific use cases. Faster. More private. More compliant. Just slightly less cutting-edge on raw model quality, which doesn't matter when you're specialized in contract analysis anyway.

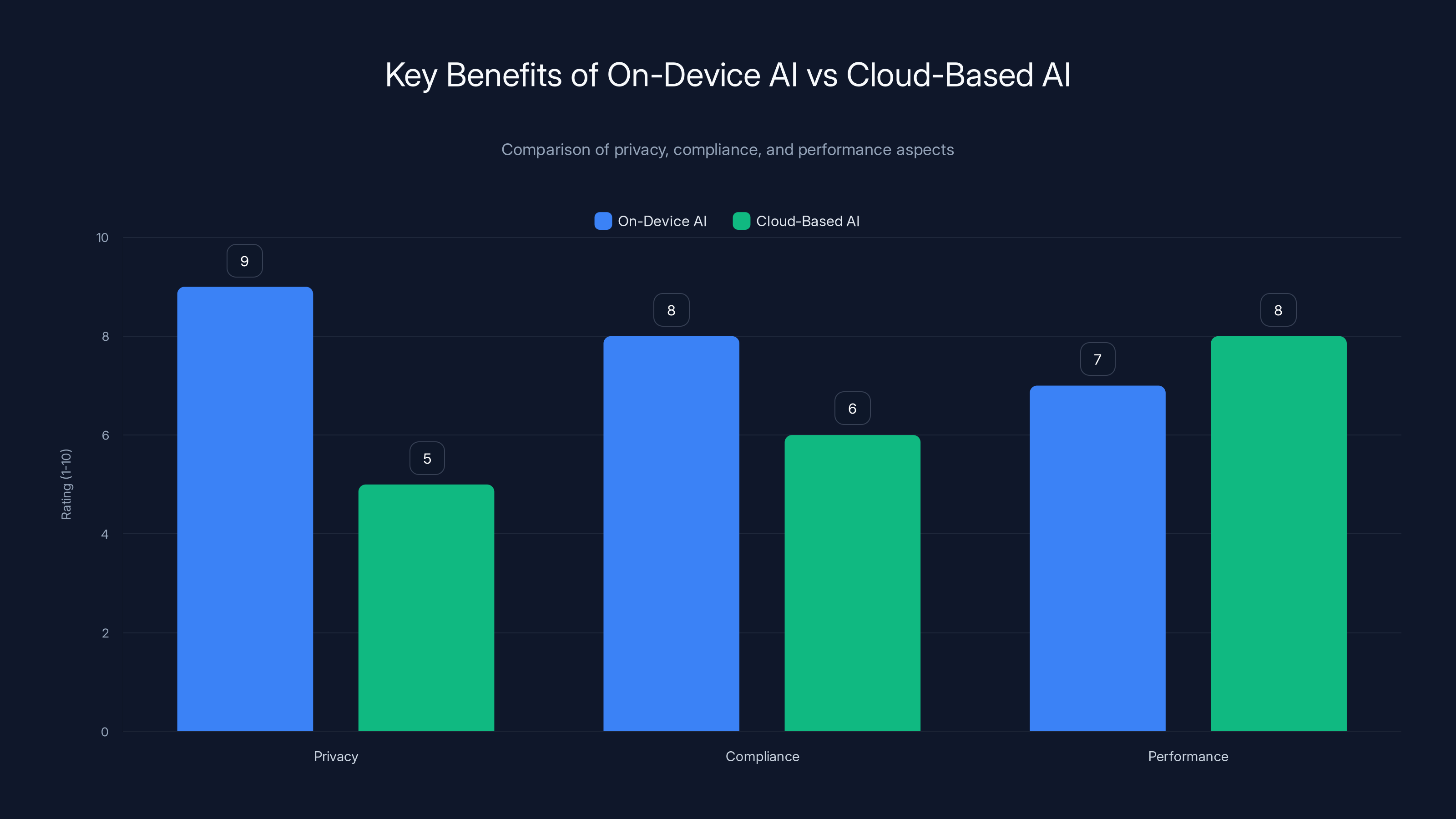

On-device AI scores higher in privacy and compliance due to data staying within the user's infrastructure, while cloud-based AI offers comparable performance. Estimated data.

The Enterprise Legal Market Is the Perfect Testing Ground

Why is Spot Draft focusing on legal contracts specifically? It's not random. Legal workflows have characteristics that make them ideal for on-device AI adoption.

First, the data sensitivity is real and non-negotiable. Contracts contain information companies genuinely cannot expose to external parties. Acquisition targets. Pricing strategies. Supply chain relationships. Technology partnerships. A single leak could cost millions. Legal teams have been conservative about cloud-based tools specifically because of this.

Second, legal work is highly regulated and heavily audited. A law firm can explain to its partners and clients exactly where analysis happens, who touches the data, what systems are involved. On-device processing makes these conversations much easier. "The analysis happens on your workstation. The model never leaves your environment. No external party processes the document." That's a simple, bulletproof explanation.

Third, legal has existing workflows and tools. Lawyers work in Microsoft Word. They use document review platforms. They have established processes for contract management. Spot Draft's Verif AI doesn't try to replace these tools. It integrates into them. The analysis appears right in Word, the same way you'd get spelling suggestions or grammar feedback.

Fourth, the problem is massive. Companies process thousands of contracts per year. Most legal teams spend enormous amounts of time on contract review—identifying key terms, flagging risks, comparing against company policies, ensuring compliance. There's no shortage of demand for tools that accelerate this work.

The company now has over 700 customers, up from around 400 roughly one year ago. Customers include Apollo.io, Panasonic, Zeplin, and Whatfix—companies across different industries that all have significant contract volumes. These aren't small implementations. Processing 1 million contracts annually requires significant usage from each customer.

What's notable is that legal isn't the only regulated industry eyeing on-device AI. Defense contractors need to process contracts without touching cloud infrastructure. Pharmaceutical companies have similar concerns. Financial institutions are extremely sensitive about routing sensitive data. Healthcare systems can't expose patient-adjacent data to external processors.

But legal is the wedge. It's the first sector where on-device AI is becoming standard because the regulatory and contractual requirements are so clear-cut.

SpotDraft's contract volume grew from 360,000 to 1 million in 2024, with projections reaching over 7 million by 2026. Estimated data based on 173% YoY growth.

How Spot Draft's Verif AI Actually Works in Practice

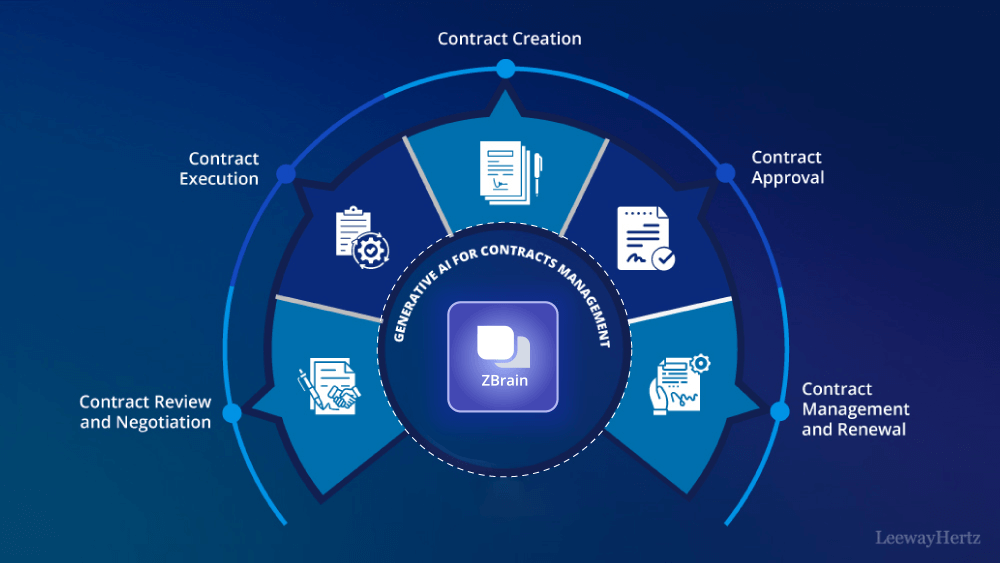

The product itself is called Verif AI, and it's worth understanding how it actually integrates into real workflows.

A lawyer gets a contract. Instead of manually reviewing it line by line (which takes hours), they open the document in Microsoft Word. Verif AI appears as a sidebar or integrated interface. The lawyer describes what they're looking for—does this match our standard terms, are there red flags, does it comply with our policies.

Verif AI compares the contract against the company's guidelines, playbooks, and prior policies. The model runs locally on the device. It identifies clauses that deviate from standard terms. It flags unusual indemnification language. It spots missing insurance requirements. It highlights passages that conflict with company policies.

The results appear right in the document. Highlighted sections. Inline notes. Recommendations for revision. The lawyer can approve, modify, or ignore each suggestion.

This is fundamentally different from traditional contract analysis tools, which usually require uploading documents to a cloud platform, waiting for results, then downloading a PDF report. It's clunky. It breaks workflow. Lawyers don't want to stop working to upload something and wait for analysis.

Verif AI eliminates that friction. The analysis happens seamlessly, in the tool they already use, without any data leaving their environment.

The playbook concept is important. Companies have internal standards for contracts. They have mandatory insurance clauses. They have standard indemnification language. They have rate cards that cannot be exceeded. They have vendor categories with associated terms.

Verif AI learns these playbooks. It understands what the company cares about. It doesn't just do generic contract analysis. It does company-specific contract analysis. That's much more valuable.

This requires fine-tuning. Spot Draft's engineering team takes domain-specific data—previous contracts, internal policies, approval decisions—and uses it to train models specifically for that customer. That's why having the model run locally is actually important. Different companies have different playbooks. Running locally means the customer's fine-tuned model lives in their environment, not in some multi-tenant cloud database.

The Growth Story: 1 Million Contracts and 173% Yo Y Expansion

Let's talk about what the numbers actually mean.

Processing 1 million contracts annually sounds impressive in isolation. But context matters. If Spot Draft has 700 customers, that's roughly 1,428 contracts per customer per year. That's about 3-4 contracts per business day per customer. For companies that sign dozens or hundreds of contracts per month, that's not high utilization.

But wait—the 173% year-over-year growth in contract volumes is where the story gets real. If contract volumes grew 173% year-over-year, that means the annual contract volume roughly tripled in a single year. They went from about 360,000 contracts annually (rough math based on the growth rate) to 1 million.

That's not gradual adoption. That's inflection.

The company is also reporting nearly 50,000 monthly active users. With 700 customers, that's about 71 active users per customer on average. Some customers might have hundreds of users. Some might have a handful. The fact that 50,000 people are actively using the platform monthly shows that this isn't a niche tool. People are integrating it into their daily workflows.

The revenue growth projections reinforce this. The company expects 100% year-over-year revenue growth in 2026. They grew 169% in 2024 and posted a similar rate in 2025. If they maintain even 80-90% growth through 2026 and beyond, they're looking at a company that could hit $100+ million ARR within 2-3 years.

For comparison, Lexis Nexis—the dominant player in legal technology—has been growing in the high single digits to low double digits the last few years. Docu Sign, which pivoted toward legal workflows, has been growing in the mid-teens. Spot Draft is growing nearly 10 times faster.

Why? The answer is partially product (better experience, on-device architecture, integration with existing tools). It's partially market timing (enterprises are finally comfortable with generative AI for sensitive workflows). It's partially demand (companies desperately want to reduce contract review time).

But it's also because they're solving a problem the traditional legal tech incumbents haven't solved. Lexis Nexis came up in a different era, with different constraints, optimized for different workflows. They've tried to bolt AI onto existing products. Spot Draft was built from the ground up as an AI-powered platform.

Built-from-scratch products designed for a specific use case often beat older players trying to modernize. That's what's happening here.

SpotDraft has significantly increased its contract processing capacity, with a 173% year-over-year growth, indicating a strong adoption of on-device AI solutions in the legal industry. Estimated data reflects typical growth patterns.

The Qualcomm Partnership: Why Hardware Matters

The Qualcomm investment isn't just capital. Qualcomm designs and manufactures the chips that power most mobile devices and an increasing number of laptops and workstations. They're invested in making on-device AI viable at scale.

When Bijapur mentioned that newer chips can run models at one-third the latency of cloud processing, he's largely talking about Qualcomm-optimized processors. Qualcomm's Snapdragon platforms include dedicated AI processing units. Their latest desktop and laptop processors have AI accelerators built in.

The partnership extends beyond financing into joint development and go-to-market efforts. This means Qualcomm is likely helping Spot Draft optimize their models to run efficiently on Qualcomm hardware. It also means Spot Draft gets featured in Qualcomm's developer programs and partnerships. When Qualcomm is showing enterprise customers the possibilities of their new AI-enabled chips, Spot Draft is probably in the demo.

This is a valuable position. Spot Draft becomes the reference implementation for "what you can do with on-device AI" in the enterprise. They're not just a customer of Qualcomm chips. They're partners in proving out the entire category.

The timing also matters. AI PC adoption is ramping up rapidly through 2025 and 2026. Intel, AMD, and Qualcomm are all releasing new chips with on-device AI capabilities. Microsoft is integrating AI directly into Windows. Apple has been shipping on-device AI features for months.

As hardware becomes more capable, software needs to be ready to use those capabilities. Spot Draft is positioned to be that software. When companies buy new AI-enabled laptops, they'll have tools ready to use on day one.

Expansion Strategy: Americas, EMEA, India

Spot Draft is a Bengaluru and New York-based company. They're headquartered in India with significant presence in the US. The Series B extension funding is being deployed toward expansion in three key regions: the Americas, EMEA (Europe, Middle East, Africa), and India.

This is a deliberate geographic strategy. The Americas is the world's largest legal services market and the most willing to adopt new technology. EMEA includes some of the world's most strict data protection and privacy regulations (GDPR, UK Data Protection Act). India is both home base and a growing market for legal services and contract management.

The EMEA expansion is particularly interesting given Spot Draft's on-device focus. European enterprises are extremely sensitive about data privacy. GDPR gives them explicit rights around data handling. On-device processing is much easier to make GDPR-compliant than cloud-based alternatives. "We process your contracts locally. No data leaves your infrastructure. You maintain full compliance." That's a compelling pitch in a GDPR-heavy market.

The company has 300+ employees total, with about 15-20 in the US, 4-5 in the UK, and the remainder in Bengaluru. This ratio suggests they're investing heavily in engineering and product development (concentrated in India) while building sales and partnerships teams in the US and Europe.

This hiring structure makes sense. Product development and engineering can be done efficiently from India. Sales, partnerships, and regulatory navigation benefit from local presence in target markets.

SpotDraft has experienced significant growth with a 173% increase in contract volume, a 100% revenue growth projection, and 50,000 monthly active users, highlighting its strong product-market fit.

The Broader Trend: Enterprise AI Adoption in Regulated Industries

Spot Draft's growth is part of a larger shift in how enterprises think about generative AI. The initial enthusiasm for using cloud-based large language models for everything has tempered considerably. Enterprises realized that "send your data to the cloud, get AI-powered results back" doesn't work for sensitive information.

Instead, a new architectural pattern is emerging: hybrid approaches where some tasks use cloud APIs, but sensitive work happens on-device. A company might use a cloud-based model for customer service chatbots, but on-device models for internal contract analysis. They use cloud APIs for summarizing customer feedback, but on-device models for analyzing their own internal documents.

This creates opportunities for companies like Spot Draft that specialize in on-device AI for specific domains. Legal is first, but the pattern will extend to healthcare (patient records), finance (proprietary analysis), defense (classified contracts), and pharma (research data).

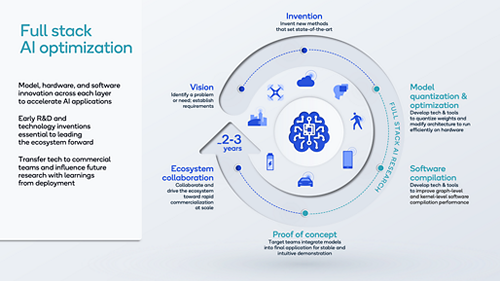

The infrastructure to support this is getting better. Model compression techniques (quantization, pruning, knowledge distillation) make large models small enough to run locally without degradation in quality. Hardware vendors are building specialized AI accelerators into consumer and enterprise chips. Development frameworks like Ollama, LM Studio, and commercial tools from cloud providers make it easier to deploy and manage on-device models.

Enterprise IT departments are more comfortable with this approach. They understand how to secure on-device systems. They know how to prevent data exfiltration. They can manage security updates and model updates locally.

What was impossible just two years ago—running sophisticated AI models locally without meaningful performance degradation—is now routine. This shifts the competitive landscape entirely.

Technical Architecture: How On-Device Models Scale

Running models locally seems simple in theory. In practice, it's complicated. Here's what's actually involved.

First, model size. A cutting-edge language model might be 70 billion parameters or more. That's 140+ gigabytes of raw parameter data (at FP16 precision). You can't store that on a laptop. You need compression.

Quantization reduces precision. Instead of storing each parameter as a full floating-point number, you store smaller bit representations. 8-bit quantization reduces the model to 1/2 the size with minimal quality loss. 4-bit quantization reduces it further. A 70B parameter model can be squeezed down to 10-20 gigabytes through aggressive quantization, making it storable on enterprise workstations.

But there's a trade-off. Smaller models or more compressed models run faster but are less capable. Spot Draft's trick is that they don't need the most capable model. They need a model that's good at contract analysis. Fine-tuning a smaller model specifically for contract work makes it competitive with much larger general-purpose models.

Second, inference optimization. Once the model is small enough to store, you need to run it efficiently. Modern AI accelerators in consumer chips (Qualcomm Snapdragon, Apple Neural Engine, Intel AI Boost) can handle this, but only if the model is optimized for the specific hardware.

This is where Spot Draft's partnership with Qualcomm becomes concrete. They're optimizing their models to use Qualcomm's AI accelerators efficiently. The same model might run slowly on a generic CPU but significantly faster on Qualcomm's specialized hardware.

Third, security and isolation. If the model lives on the device, you need to ensure it doesn't exfiltrate data, doesn't get compromised, doesn't run malicious code. Enterprise IT departments need visibility and control.

This usually means containerization, secure enclaves, or sandboxed execution environments. The model runs in an isolated space where it can access the document being analyzed but can't make arbitrary network calls or access other files.

Fourth, updates and management. A deployment that works today needs to work six months from now. That means updating the model, updating the underlying inference engine, patching security vulnerabilities. IT departments need to manage these updates centrally, potentially across thousands of workstations.

This is more complex than cloud deployment (where updates happen server-side) but more secure and more compliant than traditional enterprise software.

SpotDraft is experiencing explosive growth with a projected 100% revenue increase by 2026 and a significant rise in contracts processed. Estimated data based on current trends.

Privacy Architecture: The Real Differentiator

Spot Draft's privacy story is simple but powerful: your data never leaves your infrastructure.

Compare this to a cloud-based alternative: you upload your contract to a service provider's servers, a model processes it in a shared cloud environment, results come back. From a privacy perspective, this means:

- The service provider can see your contracts

- Your data is commingled with other customers' data in shared infrastructure

- The service provider's security practices determine whether your data is safe

- You're dependent on the provider's privacy policy and data handling practices

- You have limited visibility into what happens to your data

With on-device processing:

- Your data stays on your infrastructure

- The model runs in an isolated environment on your machine

- No external party sees your contracts

- You maintain full control over data security

- You can audit exactly what happens to your data

- Compliance is your responsibility and your choice

For regulated industries, this difference is enormous. A pharmaceutical company can't send drug patents to an external AI service. A defense contractor can't route classified contracts through cloud infrastructure. A financial institution can't expose proprietary trading analysis to third parties.

With on-device processing, these constraints disappear. The company controls the entire pipeline. The data never leaves secure infrastructure.

This isn't theoretical. Spot Draft's growth came from enterprises that couldn't use cloud-based alternatives due to compliance requirements. As more regulated industries adopt AI, the demand for on-device solutions will only increase.

Market Competition and Incumbent Response

Spot Draft isn't the only player in this space, but they're winning. Other contract intelligence platforms exist, but most are cloud-based. Lexis Nexis, the legal tech incumbent, is trying to add AI features but is hamstrung by legacy architecture. Thomson Reuters is doing similar work. Docu Sign is pivoting toward AI-powered contract management.

None of these incumbents built for on-device AI from the ground up. They're layering it on top of existing products. That's a disadvantage when your competitive advantage is specifically on-device processing.

Smaller startups are also appearing—tools that use LLMs for specific legal tasks. But most are also cloud-based. Few have the focus, the specialized fine-tuning, the integration with existing legal workflows, or the hardware partnerships that Spot Draft has.

The competitive moat Spot Draft is building is architectural. As they accumulate customer data and legal playbooks, their fine-tuned models get better. As they integrate deeper with enterprise IT infrastructure and legal workflows, switching costs increase. As they expand partnerships with hardware vendors, the advantages compound.

Inefficient competitors (those still pushing cloud-based architectures) will gradually lose deals to Spot Draft as enterprises increasingly demand on-device processing. The incumbent cloud players will eventually be forced to either build on-device alternatives or cede market share.

SpotDraft's ARR is projected to grow from

Revenue Model and Unit Economics

Spot Draft's revenue model is Saa S subscription, sold per user or per contract volume. Different tiers probably exist for different customer sizes and usage patterns.

The company isn't disclosing specific revenue figures, but we can estimate based on what they've said. They're growing 100% year-over-year. They're processing 1 million contracts annually. Assuming an average contract generates

That might seem low for a

The unit economics are probably healthy. Contract analysis is a high-leverage problem. Once the model is built and fine-tuned for a customer, adding more contracts has minimal marginal cost. Adding more users in the same organization has minimal marginal cost. The software scales beautifully.

This is different from services-based legal work, where each contract requires human attorney time. Software scales. Services don't. Spot Draft benefits from this fundamental leverage.

Future Roadmap and Investor Expectations

With Qualcomm's strategic backing, Spot Draft has clear runway and clear direction. The immediate focus is making Verif AI available to more customers and expanding to new geographies.

The longer-term roadmap probably includes vertical expansion. If on-device contract intelligence works for legal, it should work for healthcare (medical records analysis), finance (proprietary document analysis), and defense (classified document handling). Spot Draft might stay focused on legal, or they might use their architecture as a foundation to expand into adjacent verticals.

Another likely direction is horizontal expansion within legal. Beyond contract review, legal teams do many other tasks: due diligence, legal research, compliance monitoring, risk assessment. An on-device AI platform could potentially address all of these.

Investor expectations at a

For Qualcomm specifically, the expectation is that Spot Draft's success validates the broader market for on-device AI. As Spot Draft wins more deals, it proves the value of on-device processing. That makes Qualcomm's chips more valuable. That justifies Qualcomm's investments in AI-optimized processors. It's a virtuous cycle.

Implications for Enterprise AI Adoption

Spot Draft's trajectory tells us something important about how enterprise AI adoption is actually unfolding. It's not the democratic, anyone-can-use-an-AI story that gets media attention.

It's specific, focused, architecturally different, and heavily centered on solving real business problems while maintaining compliance and security.

Enterprise AI adoption will follow this pattern: specialized tools for specific workflows in regulated industries, using on-device or hybrid architecture to maintain privacy and compliance.

Cloud-based general-purpose AI has a role, but it's shrinking for sensitive workflows. Companies will use cloud models for external-facing work (customer service) and non-sensitive internal work (marketing copy, routine analysis). For contract work, medical records, financial analysis, proprietary data—on-device processing will become standard.

This creates a massive market for companies like Spot Draft. Millions of enterprises need to process millions of sensitive documents. They need tools that are better than manual work but don't require sending data to the cloud. That's a problem that can be solved, and Spot Draft is proving it at scale.

Key Takeaways and What's Next

Spot Draft's $8 million funding and doubling valuation represent more than just capital raising. They represent validation that on-device AI is the right architecture for enterprise legal workflows.

The company has built something genuinely differentiated. It's not another cloud-based AI wrapper. It's not leveraging open-source models to do generic AI tasks. It's domain-specific infrastructure designed from the ground up for the constraints of regulated enterprise work.

The growth numbers are real—173% contract volume growth, 100% revenue growth projection, 50,000 monthly active users. These aren't vanity metrics. They're evidence of product-market fit.

The geographic expansion into Americas, EMEA, and India means Spot Draft is moving from early adopters to broader market. The company is past the "will this work" phase and into the "how do we scale this" phase.

For the broader enterprise AI market, Spot Draft shows the future. It's not chatbots. It's not general-purpose models. It's specialized, on-device, privacy-preserving intelligence for specific high-value workflows. As other enterprises face similar challenges around sensitive data and compliance, this pattern will repeat across healthcare, finance, defense, and pharma.

The next inflection point is probably when on-device AI becomes the default for sensitive enterprise work. When the question shifts from "should we use on-device processing" to "why wouldn't we." Spot Draft is driving that shift.

FAQ

What is on-device AI and how does it differ from cloud-based AI?

On-device AI runs machine learning models locally on your hardware rather than sending data to cloud servers for processing. The key difference is privacy and control. With cloud-based AI, your sensitive documents travel to external servers, processed by third-party systems you don't fully control. With on-device AI, the model lives on your machine, your data never leaves your infrastructure, and you maintain complete visibility over what's happening. For contract analysis, this means your company's proprietary terms, pricing, and deal structures stay entirely within your own systems. Modern hardware accelerators make on-device models nearly as fast as cloud alternatives, often with better latency since there's no network roundtrip required.

How does Spot Draft's Verif AI integrate into existing legal workflows?

Verif AI appears as an integrated tool within Microsoft Word, the software lawyers already use daily. When a lawyer opens a contract, Verif AI analyzes it against company-specific playbooks, policies, and prior agreements without requiring any document upload or separate process. The platform identifies deviations from standard terms, flags compliance risks, and highlights unusual language—all with suggestions appearing directly in the document. This integration eliminates the friction of traditional contract analysis tools, which require uploading documents to external platforms and waiting for batch-processed results. The analysis happens seamlessly in real-time within the lawyer's existing workflow.

What are the main benefits of on-device contract AI for enterprises?

The benefits center on three dimensions: privacy, compliance, and performance. Privacy-wise, sensitive contract data never leaves your infrastructure, eliminating exposure to external parties or cloud-based security risks. Compliance becomes easier because you maintain full control over data handling, making GDPR, HIPAA, and industry-specific regulations straightforward to maintain. Performance improves because on-device processing eliminates network latency, delivering results in milliseconds rather than seconds. For regulated industries like defense, pharma, and financial services, on-device processing isn't optional—it's often a requirement. For other enterprises, it's increasingly a preference because the security and performance advantages are substantial.

Why is Qualcomm's involvement strategically important for Spot Draft?

Qualcomm designs the chips powering most mobile and an increasing number of desktop devices. Their involvement extends beyond capital into hardware optimization and go-to-market partnership. Qualcomm's AI accelerators (like those in Snapdragon processors) are optimized specifically for running AI models efficiently locally. By partnering with Qualcomm, Spot Draft ensures their models run optimally on Qualcomm hardware while gaining access to Qualcomm's developer partnerships and enterprise relationships. This is particularly valuable as AI-capable PCs become standard. When enterprises buy new devices with Qualcomm's AI chips, Spot Draft's tools will be ready to use on day one. The partnership essentially validates on-device AI as a strategic direction while giving both companies complementary competitive advantages.

What do the growth metrics—1 million contracts annually and 173% Yo Y expansion—actually indicate about market adoption?

These numbers reveal genuine product-market fit in a large market. Processing 1 million contracts annually with 700 customers indicates substantial enterprise adoption, not niche usage. The 173% year-over-year contract volume growth suggests that existing customers are using the platform dramatically more each year, while new customer acquisition is also accelerating. Combined with 50,000 monthly active users, these metrics show lawyers are integrating the tool into daily workflows. For comparison, traditional legal tech platforms grow in high single digits to low double digits annually. Spot Draft's growth rate is an order of magnitude higher, indicating that enterprises are rapidly adopting on-device AI for contract work because it solves a real problem better than existing alternatives.

How does fine-tuning improve model quality for contract analysis?

Fine-tuning is the process of training an already-capable language model on domain-specific data to specialize it for particular tasks. With contracts, this means training the model on thousands of customer contracts, company playbooks, internal policies, and previous approval decisions. This specialization makes the model excellent at understanding contract language, identifying relevant clauses, and assessing compliance with company standards. The result is that a smaller, fine-tuned model on-device can outperform larger general-purpose cloud models because it's specifically trained for contract analysis. Spot Draft's engineers reported only a 5% quality difference between frontier cloud models and specialized fine-tuned on-device models, but the fine-tuned version runs three times faster and maintains privacy. For enterprises, this means they get better results, faster, with no privacy compromise.

Which industries beyond legal are likely to adopt on-device AI next?

The pattern will spread to any industry handling sensitive data with regulatory requirements. Healthcare is the obvious next frontier—medical records, patient data, research information cannot be processed through cloud services without HIPAA complications. Financial services face similar challenges with proprietary trading analysis, customer financial data, and internal research. Defense and aerospace contractors need on-device processing for classified and controlled unclassified information. Pharmaceutical companies require on-device analysis of R&D data and clinical trial information. Each of these industries has the same characteristics that make on-device AI ideal for legal: sensitive data, regulatory constraints, compliance requirements, and substantial document volumes requiring analysis. Spot Draft's success in legal essentially proves the architecture works for these adjacent markets.

What percentage of a company's legal work can realistically be automated with on-device contract AI?

For contract analysis and review, the automation percentage is high but not complete. Tasks like identifying missing clauses, spotting deviations from standard terms, flagging compliance issues, and highlighting unusual language can be 80-90% automated. These are structured, rule-based tasks where AI excels. Tasks requiring judgment—should we accept this higher payment term, is this clause business-acceptable, how does this compare to our strategic goals—still require human decision-making. The realistic model is that on-device AI handles 60-70% of contract review work (the mechanical, pattern-matching portion), while lawyers focus on the 30-40% requiring judgment and negotiation. This is still transformative because it frees expensive legal talent from tedious work and lets them focus on high-value decision-making.

How does model quantization work and what are the trade-offs?

Quantization reduces model file size by storing parameters with lower numerical precision. A language model normally stores parameters as 32-bit floating-point numbers. Quantization might reduce this to 8-bit or 4-bit representations, using roughly 1/4 to 1/8 the storage space. The trade-off is minimal quality loss. An 8-bit quantized model might be 1-2% less accurate than the original, which is often imperceptible for specific tasks like contract analysis. A 4-bit quantization might reduce accuracy 3-5%, but still be highly usable. This matters for on-device deployment because a 70-billion-parameter model normally requires 140+ gigabytes of storage. Aggressive quantization can squeeze it down to 10-20 gigabytes, making it practical to store and run on enterprise workstations. The key insight is that losing a few percentage points of general capability matters little when you've fine-tuned the model for a specific domain like contracts.

TL; DR

-

On-Device Privacy Advantage: Spot Draft's architecture keeps contract data on company infrastructure rather than cloud servers, making it compliant for regulated industries including defense, pharma, and finance where sensitive documents cannot leave secure systems.

-

Explosive Growth: The company processes 1 million contracts annually with 173% year-over-year volume growth, 50,000 monthly active users, and projects 100% revenue growth for 2026, indicating genuine product-market fit.

-

Hardware Partnership Validation: Qualcomm's strategic investment signals that on-device AI is becoming viable not just theoretically but practically, with modern chips running sophisticated models at speeds competitive with cloud processing.

-

Legal as Wedge Market: Legal workflows are the ideal testing ground for on-device enterprise AI because contracts are sensitive, regulation is strict, existing workflows are established, and the problem is massive at scale.

-

Future Pattern: On-device AI for sensitive documents will become standard across healthcare, finance, defense, and other regulated industries, following the same trajectory Spot Draft is establishing in legal.

-

Bottom Line: Spot Draft's $380M valuation reflects validated demand for privacy-preserving, on-device contract intelligence in enterprise workflows, establishing a blueprint for how generative AI actually works in regulated industries.

Related Articles

- From AI Hype to Real ROI: Enterprise Implementation Guide [2025]

- Qwen3-Max Thinking vs GPT-5.2 & Gemini 3 Pro: AI Reasoning Showdown 2025

- AI Failover Systems: Enterprise Reliability in 2025 [Guide]

- Parloa's $3B Valuation: AI Customer Service Revolution 2025

- Google Gemini vs OpenAI: Who's Winning the AI Race in 2025?

- Nvidia's $2B CoreWeave Investment: AI Infrastructure Strategy Explained

![On-Device Contract AI: How SpotDraft's $380M Valuation Changes Enterprise Legal Tech [2025]](https://tryrunable.com/blog/on-device-contract-ai-how-spotdraft-s-380m-valuation-changes/image-1-1769479586872.jpg)