Introduction: When Celebrity Founders Meet Public Markets

Jennifer Garner isn't just an actor anymore. She's a co-founder of a rapidly scaling organic food company that's about to trade on public exchanges, and that's a genuinely big deal in the world of startup funding. Once Upon a Farm, the organic kids' snack and baby food company she co-founded, has officially resumed its IPO plans after a pause during the government shutdown, signaling something important about market conditions and investor appetite in 2025.

But here's what makes this story worth paying attention to beyond the celebrity angle: it tells us a lot about how the consumer goods startup ecosystem has evolved, how celebrity equity can actually create real business value, and what kind of metrics matter when a food company tries to compete in public markets dominated by established giants like Nestlé and Mondelēz.

The company filed its updated S-1 with the SEC on Tuesday, offering a price range of

Let's break down what's really happening here, because there are multiple layers to this story. There's the macro story about the thawing IPO market and whether investors are getting comfortable with growth companies again. There's the specific story about Once Upon a Farm as a business, its unit economics, and whether its growth trajectory justifies the valuation. And then there's the broader trend about celebrity founders and whether having a recognizable name on the cap table actually matters when it comes to revenue and profitability.

What surprised me most when researching this was how unsexy the kids' food market actually is from a business perspective. It's not software. It's not even particularly high-margin. You're manufacturing physical products, dealing with supply chain complexity, managing retail relationships, and competing against companies that have been doing this for decades. That makes Once Upon a Farm's path to $764.4 million in valuation even more interesting.

The Rise of Once Upon a Farm: From Startup to IPO Candidate

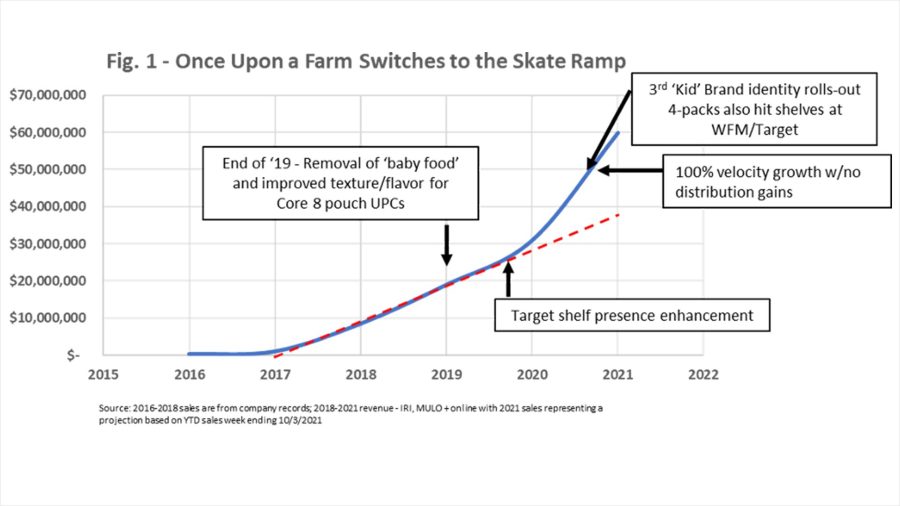

Once Upon a Farm launched in 2015, which means this company has been building for a full decade before going public. That's actually longer than most people realize. A lot of startups that IPO in 2024-2025 were founded in 2015-2016, so the timeline here isn't unusual, but it's worth noting because it shows this wasn't an overnight success story.

The company was founded by Cassandra Curtis and Ari Raz, who were serial founders coming into this space with actual operating experience. Jennifer Garner joined later as a co-founder, which is different from being a celebrity investor. When someone joins as a co-founder rather than just buying equity, it signals deeper involvement and alignment. In Garner's case, this wasn't a passive celebrity endorsement—she's been involved in strategic decisions and brand positioning.

The market they entered was already crowded. Organic baby food and kids' snacks were becoming increasingly mainstream by 2015. Companies like Plum Organics had already scaled, and the market showed that consumers would pay premium prices for organic, clean-label products aimed at children. What Once Upon a Farm had to do was differentiate, which meant focusing on specific product categories and nailing the distribution strategy.

The company's focus has been on organic fruit and vegetable pouches, smoothie blends, and snack products that parents can feel good about feeding their kids. This is the kind of product category that actually benefits from celebrity involvement, because parenting is deeply emotional and personal. If Jennifer Garner is feeding her kids this product, the logic goes, then other parents should trust it too. Whether that's rational or not, it's how consumer psychology works.

By the time we get to 2024 and 2025, Once Upon a Farm had raised almost $100 million in venture capital, according to public records. The investors backing them included S2G Ventures, which focuses specifically on food and agriculture, and CAVU Consumer Partners, which specializes in consumer goods and retail. These aren't random venture funds—they're specialists who understand the specific challenges and opportunities in food distribution and scaling.

The original IPO plan was for 2024, but they paused it during the government shutdown. This is actually a smart move that a lot of companies make. When there's uncertainty in the markets and the government isn't operating normally, the conditions for a successful IPO become less predictable. Better to wait a few months than to launch into choppy waters.

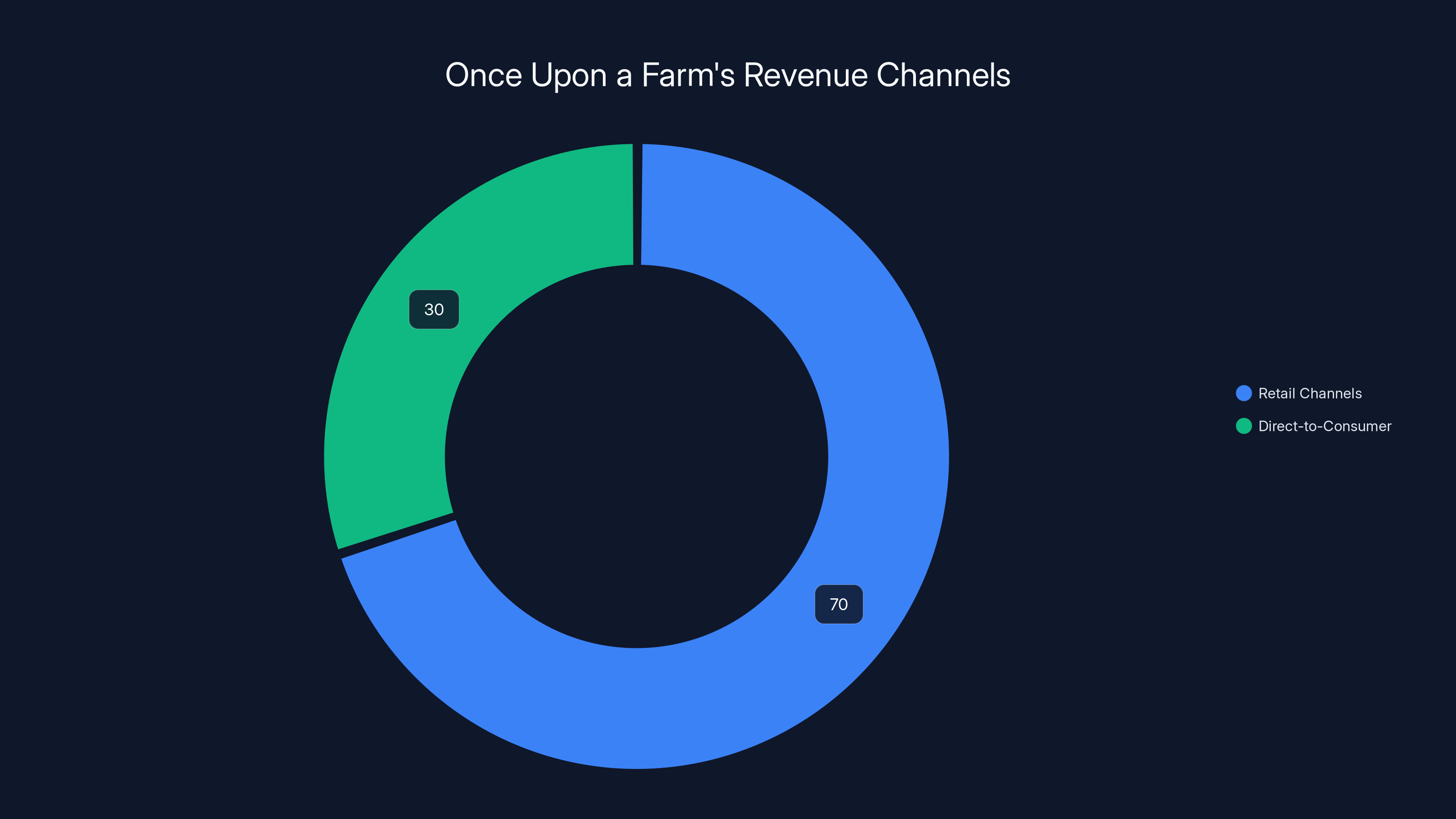

Estimated data suggests that Once Upon a Farm generates 70% of its revenue from retail channels and 30% from direct-to-consumer sales. Retail provides higher volume, while direct-to-consumer offers higher margins.

Understanding the IPO Timeline and Market Conditions

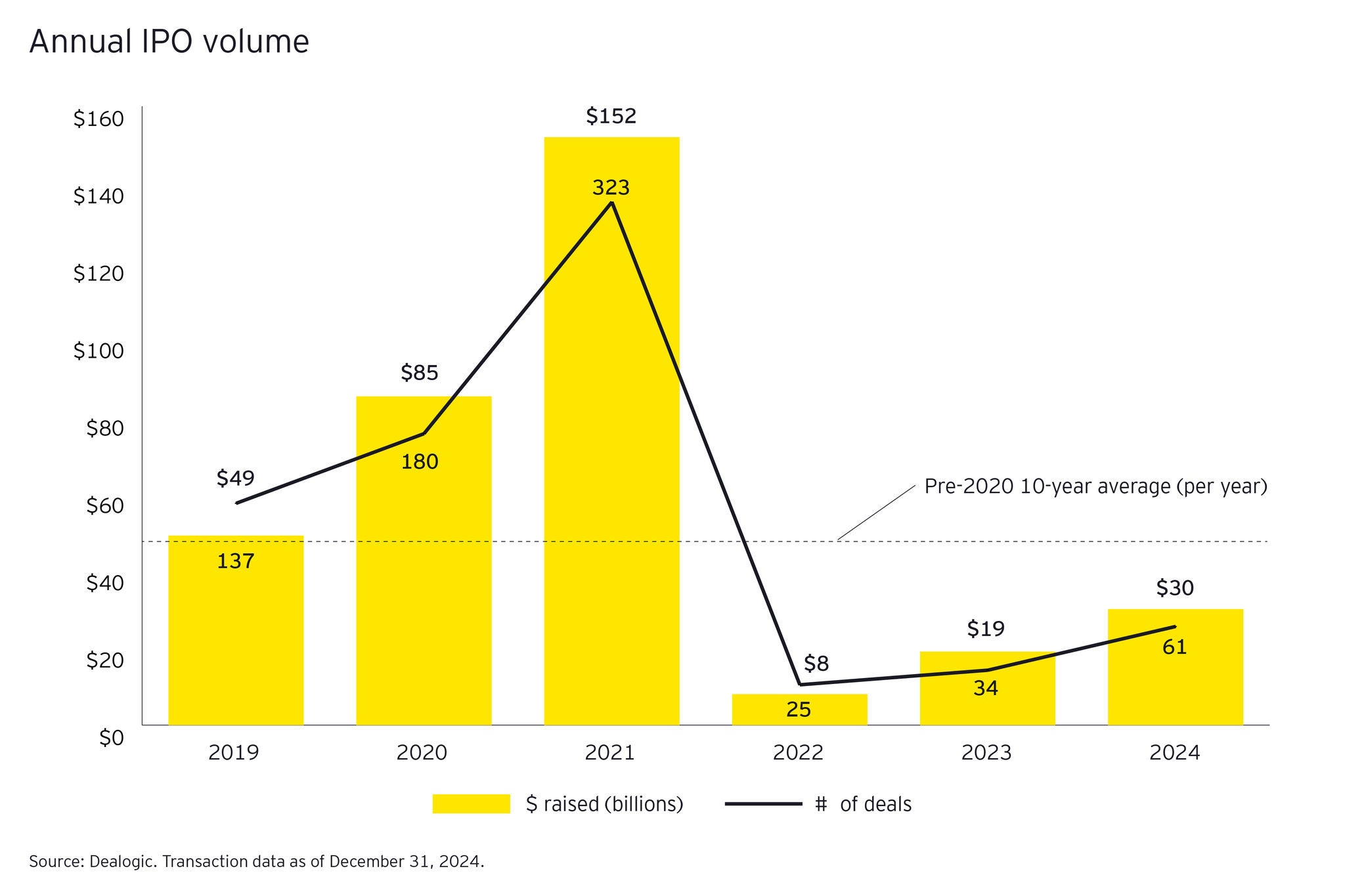

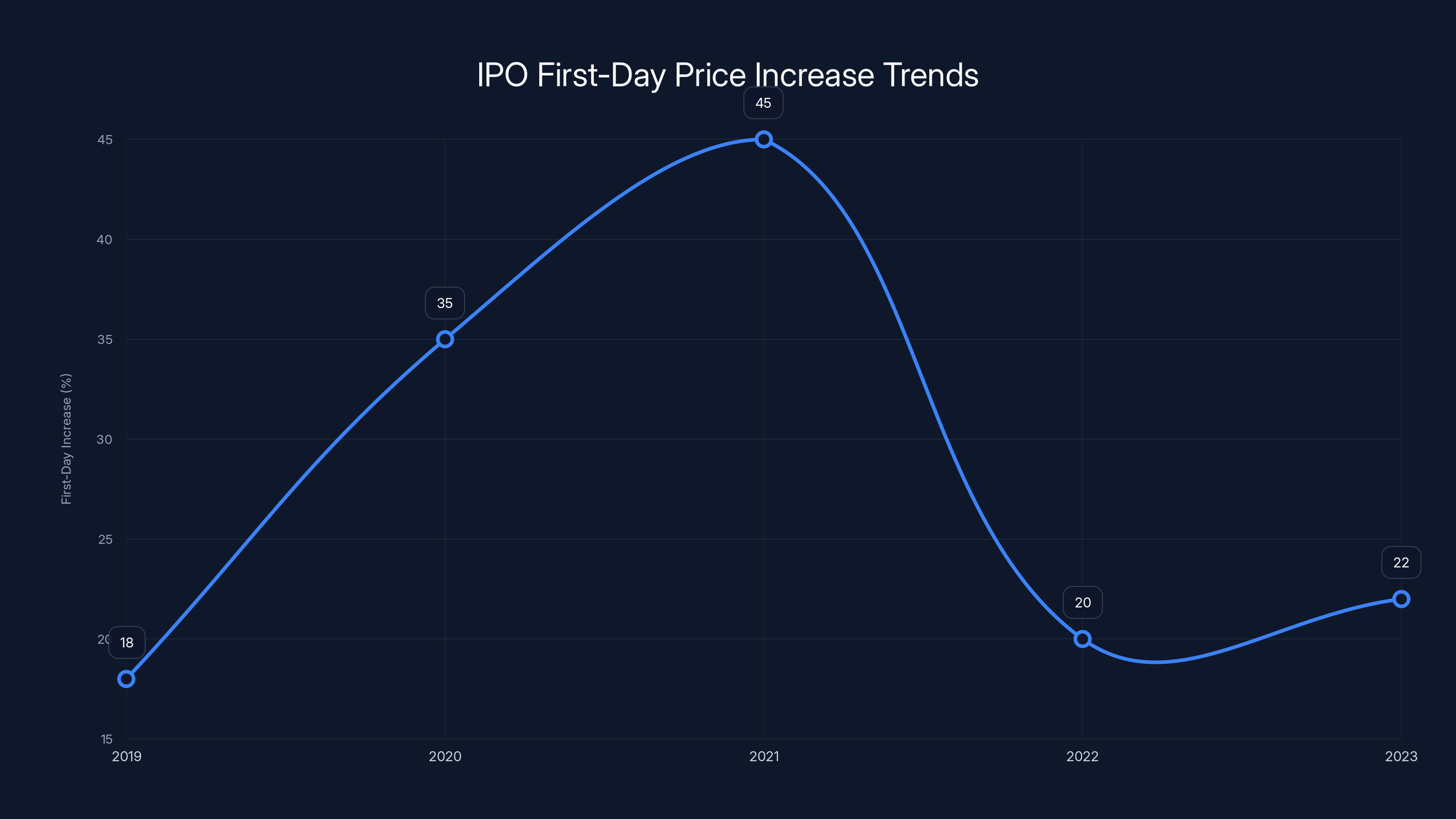

The fact that Once Upon a Farm is resuming its IPO now, in early 2025, tells us something meaningful about the broader IPO market. The past few years have been brutal for IPOs. The super-hot market of 2020-2021, when basically any company with a pulse could go public, ended abruptly. Money got tight, interest rates climbed, and investors got pickier.

2024 was slightly better. We saw companies like TPG and other large players return to public markets. But for mid-cap, consumer-focused companies, the market remained selective. Investors wanted profitable companies with clear paths to continued growth. They were skeptical of companies betting on explosive growth without profitability.

Now we're in early 2025, and the narrative is slowly shifting. There's optimism about artificial intelligence and tech innovation, but there's also a return to basics—companies that actually generate revenue and have reasonable unit economics are getting attention again. Once Upon a Farm fits that profile. It's a revenue-generating business with actual profitability, not a speculative bet.

The timing also matters because of seasonality in the food business. January and February aren't the strongest months for food companies from a sales perspective. Spring is when parents are thinking about stocking up on snacks for outdoor season. But from an IPO perspective, early in the year is actually strategic because it gives institutional investors time to add the stock to their portfolios ahead of spring conferences and institutional buying seasons.

The choice of Goldman Sachs and J.P. Morgan as lead bankers is significant. These are tier-one investment banks with deep relationships in the food and consumer goods space. They bring serious credibility and execution capability. Having banks of this caliber managing your IPO means they believe they can successfully place the shares and create a viable public market for the stock.

The company is targeting at least $208.9 million in gross proceeds from the IPO. That's a serious amount of capital that will fund expansion, pay down debt if there is any, and give the company a war chest to compete more aggressively in distribution and marketing.

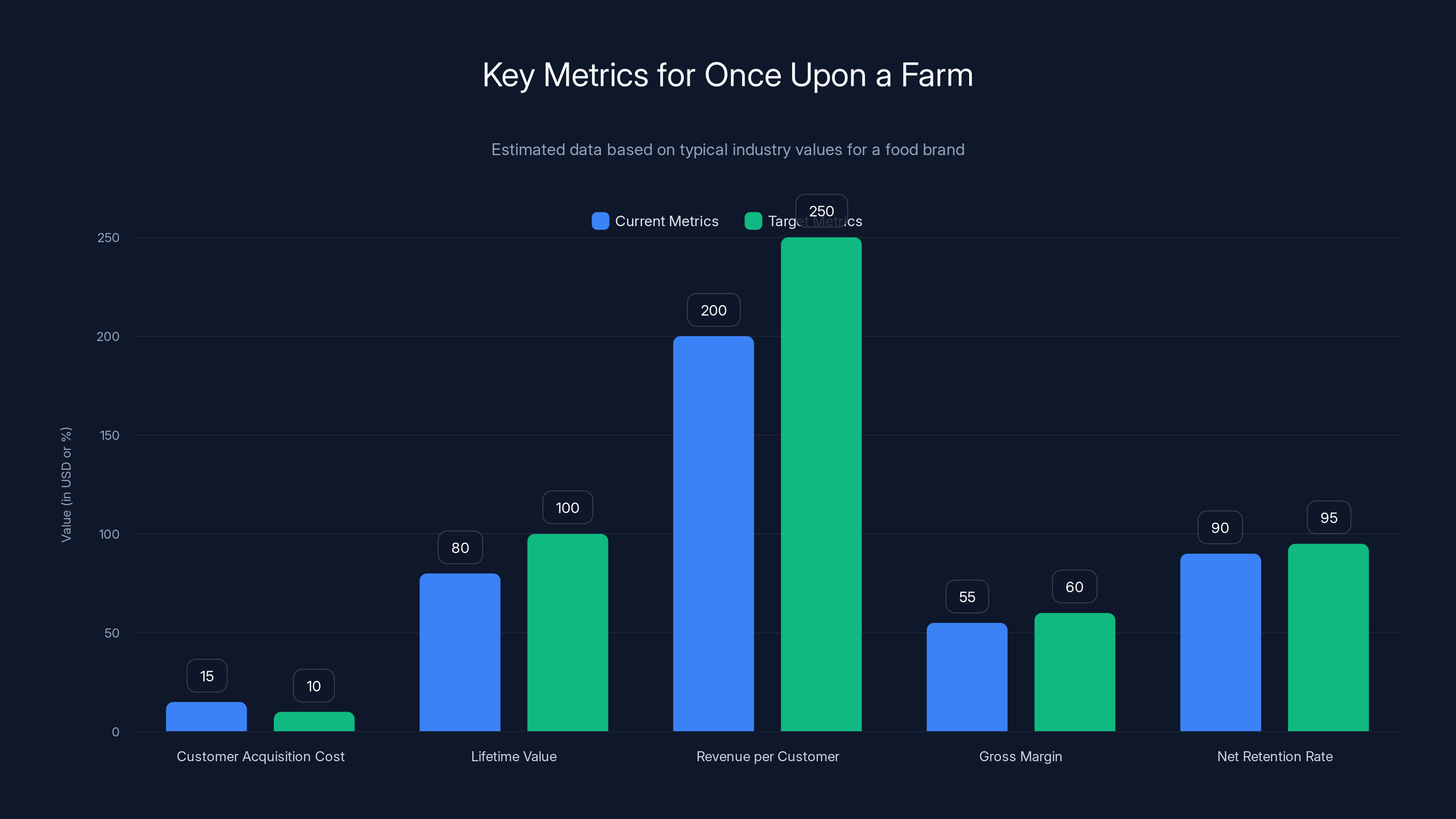

Estimated data shows that improving CAC, LTV, and gross margin while maintaining high net retention rate can significantly enhance Once Upon a Farm's financial health. Estimated data.

The Business Model: How Once Upon a Farm Makes Money

Let's talk about what the business actually does, because this is where things get real. Once Upon a Farm manufactures and sells organic, allergen-conscious snacks and baby food products. Sounds simple, but the execution is complex.

The company sells through two main channels: traditional retail (grocery stores, Target, Whole Foods) and direct-to-consumer (primarily through their website). Each channel has different economics. Retail requires dealing with large distributors and retailers who take significant margins. Direct-to-consumer has higher margins but requires more marketing investment to acquire customers.

The products themselves are manufactured, not just assembled. The company sources organic fruits and vegetables, processes them, packages them in signature pouches, and manages the cold chain for products that need refrigeration. This is capital-intensive in ways that pure software companies aren't.

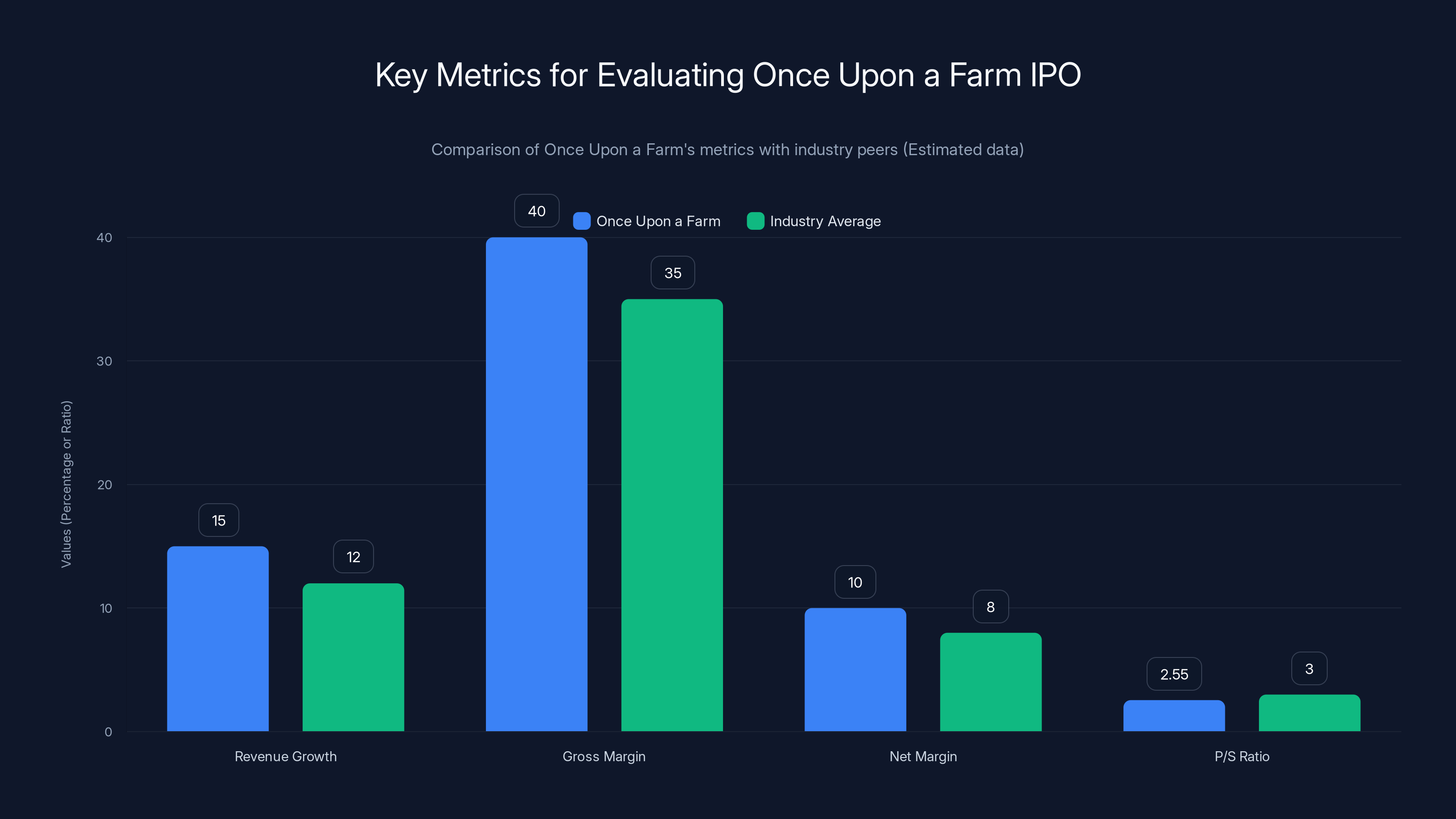

Their gross margins are probably in the 50-60% range, which is typical for premium food brands. But once you layer in distribution costs, marketing, corporate overhead, and supply chain management, net margins are likely in the 5-15% range. Compare that to software companies with 70%+ net margins, and you see why food companies are valued more conservatively.

The real value in Once Upon a Farm isn't in any single product or innovation. It's in the brand, the distribution relationships, the operational efficiency of the supply chain, and the customer loyalty they've built. Parents who trust this brand for their kids are likely to keep buying it, which creates recurring revenue patterns. That's what investors are actually paying for.

Valuation Analysis: Is $764.4 Million Reasonable?

Here's the core financial question: Is Once Upon a Farm worth $764.4 million? To answer this, we need to think about comparable companies and what metrics matter in food business valuations.

Public food companies typically trade at 1.5x to 3x revenues, depending on growth rates and margins. If Once Upon a Farm is doing roughly

The key is proving that revenue is growing at least 15-20% year-over-year and that margins are improving or at least stable. If the company shows a 20% growth rate with 12% net margins, investors might justify a 3x revenue multiple. If growth is slowing to single digits or margins are compressing, the multiple should be lower.

Here's the valuation formula that matters for food companies: Enterprise Value = (Revenue × Growth Multiple) + (Margin Improvement Premium)

Where Growth Multiple ranges from 1.5x (for mature companies) to 3x (for high-growth companies), and the Margin Improvement Premium reflects how much margin expansion is expected.

The company has raised

One risk factor in the valuation is concentration. If a significant percentage of revenue comes from a few large retail customers like Target or Whole Foods, then the company is vulnerable to those customers delisting the product or negotiating harder on margins. Public filings will reveal this, and it could impact stock performance after the IPO.

Once Upon a Farm's valuation at 2.5x revenue is on the higher end, reflecting its strong growth and brand recognition. Estimated data based on typical market multiples.

The Celebrity Founder Question: Does Jennifer Garner's Involvement Matter?

This is the question everyone wants answered: How much of Once Upon a Farm's value comes from Jennifer Garner's celebrity, and would the company be worth less without her name on it?

Honest answer: It's probably worth something, but probably not as much as people think. Here's why.

Celebrity equity can create real business value in consumer-facing brands, particularly in categories where trust and lifestyle aspirations matter. When Jennifer Garner, a well-known mother and reasonably relatable celebrity, endorses an organic kids' snack, it does move purchasing decisions. Parents see this and think, "If Jennifer Garner feeds her kids this, it's probably good."

But that effect is strongest at launch and in marketing. It's a brand accelerator, not the core business. The real value comes from product quality, distribution, customer retention, and operational excellence. Jennifer Garner can't fix supply chain problems or negotiate better retailer margins.

What's interesting is that Garner didn't just buy equity. She joined as co-founder and has been operationally involved. That's different from celebrity investors who show up for photo ops and board meetings. The fact that she's been in the trenches with Cassandra Curtis and Ari Raz means her celebrity advantage came with actual work and decision-making responsibility.

Would Once Upon a Farm be worth

From an IPO perspective, having a recognizable co-founder actually helps. It creates media interest, which drives retail foot traffic, which increases volume. The stock will likely get more attention from retail investors because of her involvement, which could support a strong IPO opening. But long-term stock performance depends on the actual business metrics, not the founder's fame.

Competitive Landscape: Who Else Is Playing in This Space?

Once Upon a Farm doesn't compete in a vacuum. Let's map the actual competitive set.

First, there are established organic baby food brands like Plum Organics, which is owned by Campbell Soup Company. Campbell paid several hundred million for Plum years ago, which shows that investors have valued these brands seriously. Plum has scale, distribution, and brand recognition that matches or exceeds Once Upon a Farm in many markets.

Then there are the massive incumbent players like Gerber (Nestlé) and Beech-Nut. These companies have dominated baby food for decades. They're not organic-focused, but they have massive distribution, strong retail relationships, and enormous brand awareness with older parents. They're also starting to offer organic lines to compete with startups like Once Upon a Farm.

Then there are younger direct-to-consumer startups that are more recent entries. Companies like Little Spoon and other DTC baby food services compete specifically in the premium, organic segment. These companies have focused on subscription models and direct shipping, which is a different business model from Once Upon a Farm's hybrid retail plus DTC approach.

What Once Upon a Farm has that some competitors don't is a strong retail presence combined with celebrity brand recognition. Plum might have better distribution in some regions, but Once Upon a Farm has Jennifer Garner and a clear lifestyle positioning. That's defensible.

The threat from incumbents is real though. If Nestlé or General Mills decides they want to own the "premium organic kids snacks" market, they can throw enormous resources at it. They have supply chains, manufacturing capacity, and retail relationships that no startup can match. That's actually the biggest risk for Once Upon a Farm as a public company. It's not that they'll run out of money or that demand will disappear. It's that they'll face intense competitive pressure from companies with 100x their resources.

IPO first-day pops have varied over the years, with a peak in 2020-2021 due to market conditions. Estimated data for 2023 suggests stabilization.

Distribution Strategy: Retail vs. Direct-to-Consumer

How Once Upon a Farm gets products to customers is fundamental to its business model and profitability.

Retail distribution through grocery stores, Target, and specialty retailers like Whole Foods accounts for the majority of revenue. This channel requires dealing with distributors and retail buyers, managing shelf space, running promotional campaigns, and handling returns. The margins are lower because retailers take their cut, but the volume is massive. Walking into a Target and seeing your product on the shelf next to Gerber is the ultimate validation and scale.

The challenge with retail is that you're constantly negotiating. Retailers want lower prices, better promotional support, and faster response times. They can delist your product if sales underperform, and they can leverage their size to demand exclusivity or special terms. This is why food companies often end up selling at compressed margins even though retail volume looks good.

Direct-to-consumer through their website and possibly through Amazon Prime is the other channel. DTC margins are much higher because there's no middleman, but customer acquisition costs are real. You need to run marketing campaigns, spend money on ads, and build email lists. But once you get a customer, you can have higher lifetime value and you control the customer relationship directly.

The optimal strategy is probably a 70-30 split (retail at 70%, DTC at 30%), which gives you scale and efficiency from retail while maintaining higher-margin DTC revenue. The actual mix for Once Upon a Farm isn't public yet, but it's something to track when the IPO filing becomes available.

The company also probably sells through Amazon, which is its own channel with specific requirements and costs. Amazon's role in food distribution has grown enormously and is now a serious competitor to traditional retail for many categories.

Growth Metrics and Unit Economics

When Once Upon a Farm goes public, investors will obsess over specific metrics. Let's talk about what actually matters.

Customer Acquisition Cost (CAC) is what the company spends to acquire a new customer. For a food brand doing

Revenue per customer tells you how much average customers spend annually. For repeat purchases of kids' snacks, this could be $100-300 per year depending on brand loyalty and frequency.

Net retention rate matters for subscription or recurring products. If existing customers are increasing their spending year-over-year, retention is improving. If spending is flat or declining, it's a warning sign.

Gross margin is revenue minus cost of goods sold. For premium organic food, this is probably 50-60%. The trend matters more than the absolute number. If margins are expanding, the company is getting more efficient. If margins are compressing, it could signal pricing pressure or rising costs.

Inventory turnover is critical for food companies because inventory can spoil or become obsolete. Fast-turning inventory (inventory sold and replenished quickly) is healthier than slow-turning inventory that ties up cash.

Once Upon a Farm's ability to sustain 20%+ annual growth while maintaining or improving margins is what will determine if the IPO price is justified. If growth slows to 10% and margins compress to 8%, the stock will underperform. If growth stays at 20% and margins expand to 15%, the stock will outperform.

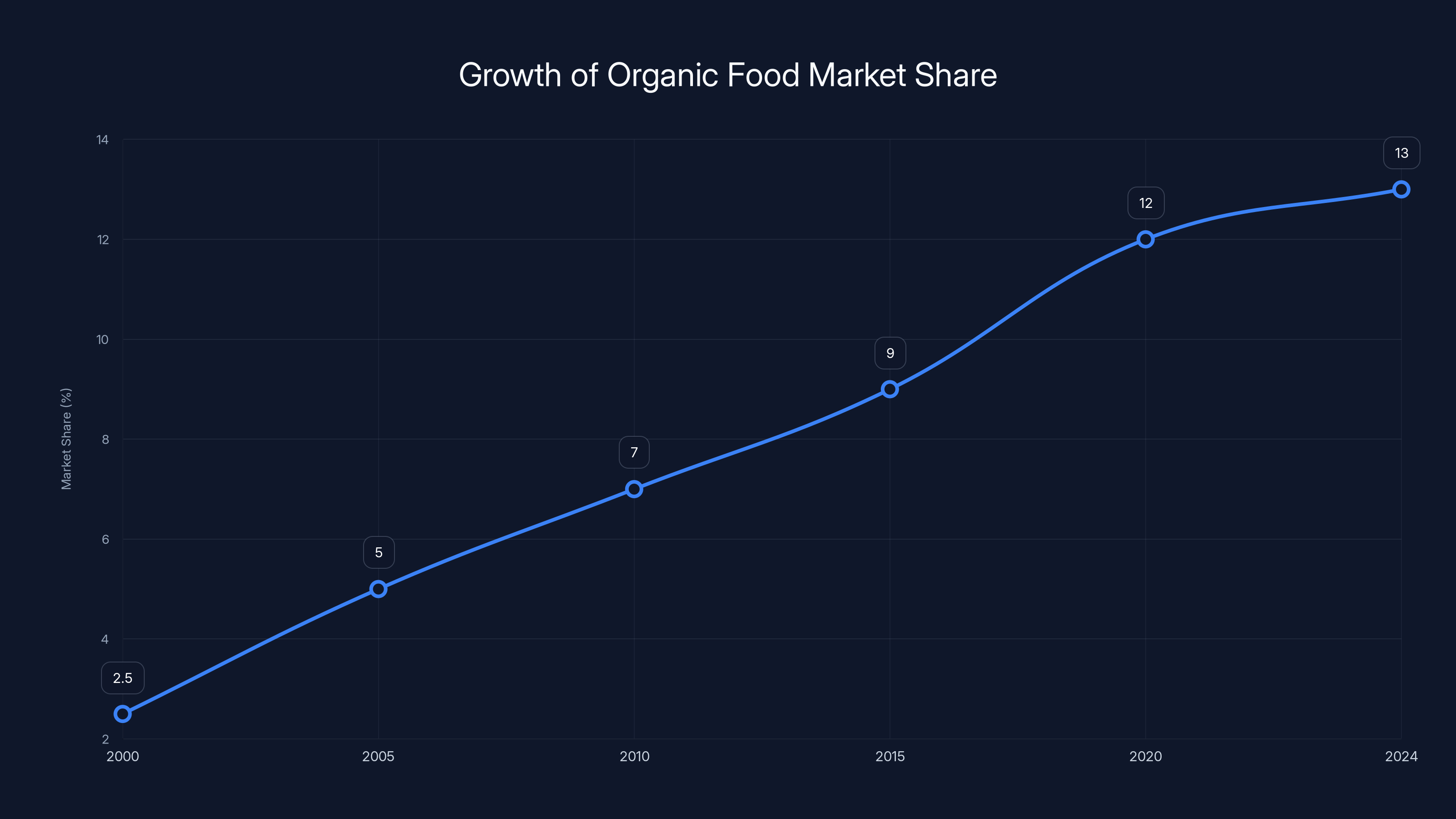

The organic food market has grown from 2-3% in 2000 to an estimated 10-15% in 2024, indicating a shift from niche to mainstream. Estimated data.

IPO Mechanics: What Happens at Launch

The IPO process has several phases, and understanding them helps predict what happens after the stock starts trading.

First, there's the S-1 filing, which is the company's detailed disclosure to the SEC. This includes everything: business model, risk factors, financial statements, competitive position, executive biographies. The S-1 is public once filed, and you can read it yourself on the SEC website. The updated S-1 with the price range (

Next comes the roadshow, where the company's executives travel to meet institutional investors (pension funds, mutual funds, hedge funds) and pitch the company. These meetings typically happen over 1-2 weeks and are focused on large investors who might buy millions of shares.

Then comes the pricing meeting, where the company, underwriters, and SEC discuss the final offering price within the range. If demand is strong, they price at the high end (

Finally comes the trading debut. On the first day of trading, the stock typically trades significantly higher than the IPO price if demand was strong. This is normal and expected. But it doesn't necessarily mean the investment is good. High first-day pops can indicate the IPO was priced too low, which benefits existing investors but not new buyers on day one.

The real valuation question emerges over weeks and months of trading. If the company continues to report good metrics and execute well, the stock will appreciate. If expectations aren't met, the stock will fall. This is where the rubber meets the road.

Risk Factors: What Could Go Wrong

Every business has risks. For Once Upon a Farm, the specific risks are worth understanding.

Retailer Concentration: If more than 30% of revenue comes from Target, Whole Foods, or other large retailers, the company is vulnerable to margin pressure or delistings. The S-1 will disclose this, and it's worth checking.

Supply Chain Disruption: Food manufacturing depends on supply chains. Organic ingredients can be scarce, and disruptions in logistics can hurt margins. Climate change is making organic agriculture less predictable, which could impact costs.

Intense Competition from Large Incumbents: Nestlé, General Mills, or other food giants could decide to compete aggressively in premium kids' snacks. They have resources that Once Upon a Farm can never match.

Organic Market Saturation: The organic market is growing, but it's also becoming crowded. If growth slows, profitability will suffer.

Economic Downturn: Premium food products are sometimes the first thing families cut in a recession. If the economy weakens significantly, demand could drop.

Scaling Challenges: Moving from

Private Label Competition: Retailers are increasingly offering their own organic snack brands under private labels. These undercut premium brands on price.

None of these risks is necessarily disqualifying, but they're all factors that matter for long-term investment decisions.

Once Upon a Farm shows higher revenue growth and margins compared to industry averages, but trades at a lower P/S ratio, indicating potential undervaluation. Estimated data.

The Broader Context: Celebrity Founders and Startup Scaling

Once Upon a Farm is interesting not just as a company but as a case study in how celebrity and entrepreneurship intersect.

We've seen this pattern before. Jessica Alba co-founded The Honest Company (which eventually went public), Gwyneth Paltrow was involved early with Goop (though it remained private), and many other celebrities have started or invested in consumer brands. The results are mixed.

The Honest Company went public and has had a rocky stock market experience, with stock trading below IPO prices at various points despite strong revenue. This suggests that celebrity doesn't guarantee long-term stock success. What matters is actual business metrics.

Once Upon a Farm's advantage is that it has real co-founders (Curtis and Raz) with operational experience beyond celebrity. Garner is involved as co-founder, not just as the name. That matters. She's not showing up to sign marketing materials while someone else runs the business.

The trend going forward is probably toward more founder-celebrities and less celebrity investors. When celebrities are deeply involved in the business and not just the branding, companies tend to do better. It's the difference between a shortcut and actual leverage.

For potential investors, the lesson is: celebrity creates a marketing advantage, but the business model and metrics are what matter. Don't get dazzled by the name on the cap table. Read the S-1, understand the unit economics, and evaluate whether the valuation makes sense based on growth and margin potential.

Financial Projections and Market Expectations

What are investors expecting from Once Upon a Farm after the IPO?

Based on the $764.4 million valuation and the typical expectations for IPO companies, here's what needs to happen for the stock to do well:

Year 1 Post-IPO (2025): Revenue of $350-400 million with 15-20% growth. Net margins of 8-12%. The company is investing heavily in distribution and marketing but also proving that it can scale efficiently.

Year 2 Post-IPO (2026): Revenue of $450-500 million with 20-25% growth. Net margins improving to 10-14%. The company has expanded distribution and increased brand awareness, and margin expansion shows operational leverage.

Year 3 Post-IPO (2027): Revenue approaching $600 million with 20%+ growth. Net margins at 12-16%. The company is competing effectively against incumbents and has proven it can scale profitably.

If the company hits these targets, the stock could reasonably trade at 2.5-3x revenue, which would imply valuations of $1.1-1.8 billion by 2027. That's a 50-135% return from the IPO price.

But if growth slows to 10% and margins compress to 6%, the stock could trade at only 1.5x revenue, implying $675-900 million valuation. That's a minimal return or even a loss.

The actual results will depend on execution, market conditions, and competitive dynamics. The IPO is really the beginning of the test, not the end.

The Organic Food Market: Is It Sustainable or Fading?

A critical question for Once Upon a Farm's long-term prospects is whether the organic food market continues to grow or if it's a trend that's moderating.

The data suggests the organic market is real but maturing. Organic foods have gone from a niche category (2-3% of the market in 2000) to mainstream (10-15% of the market in 2024). Growth has slowed from 15-20% annually to more like 8-12% annually.

For kids' snacks specifically, organic is even more mainstream. Parents have been conditioned to believe organic is safer and healthier for their children, and that belief is sticky. Even if parents become skeptical about organic's benefits, they're unlikely to switch to non-organic for their kids.

The real risk isn't that organic becomes uncool. The risk is that organic premiums compress as organic becomes more commoditized. When everyone offers organic, the price premium shrinks. That's why margins matter so much for companies like Once Upon a Farm.

The company's ability to maintain premium pricing depends on maintaining brand differentiation. Jennifer Garner's involvement helps with that. So does product innovation, sustainability credentials, and customer service. But the core driver is product quality and trust.

Once Upon a Farm needs to stay ahead of private label competition and keep improving its margins through operational efficiency. If they can do that, the organic market's maturation isn't a threat. If they can't, they'll be squeezed between premium brands above and cheap private label below.

Post-IPO Expectations: What Happens Next

Assuming the IPO successfully prices and trades begin on February 6 as expected, what should investors and observers expect in the following weeks and months?

First Week Trading: Likely to see a pop on day one (10-20%) as buyers pile in. This is normal and doesn't necessarily mean the investment is good. Many IPOs spike then settle back down.

First Earnings Report (Probably Late April/Early May): The company will report Q1 2025 results and provide guidance for the year. This is when serious investors will start evaluating actual business metrics against the IPO price. If results are better than expected, stock pops. If worse, it falls.

Analyst Coverage: Investment banks that weren't underwriters will initiate coverage, publishing research reports with price targets and recommendations. Some of these will be cheerleading ("strong buy"), others will be more critical. Watch for any analysts who question the valuation or margins.

Insider Lock-Up Expiration: Typically 6 months after the IPO, executives and early investors can sell their shares. This often creates selling pressure when the lock-up expires, so watch for that in August 2025.

Competitive Moves: Expect larger food companies to respond. They might launch aggressive promotions, enter distribution channels the company was planning, or acquire competing brands. This is the competitive intensity test.

Strategic Options: By year two post-IPO, there's often acquisition interest from larger players. General Mills, Mondelēz, or Nestlé might express interest in buying the company. If the stock has underperformed, these offers might be attractive to shareholders. If the stock has done well, the board might reject them.

The next 2 years will be critical for determining whether this IPO was a success for investors and founders.

How to Evaluate the IPO as an Investment

If you're considering buying Once Upon a Farm shares, here's a framework for thinking about it.

First, understand that IPO day is not the time to buy. The price discovery for IPOs happens over weeks and months of trading, not on day one. Be patient.

Second, read the actual S-1 filing before investing. Not the summary, the actual document. Focus on:

- Revenue sources by customer (concentrated or diversified?)

- Gross and net margins (are they improving or compressing?)

- Customer concentration (percentage from top 5 customers)

- Competitive positioning (how do they differentiate?)

- Growth investments (where are they spending to drive growth?)

Third, compare the company's metrics to peers. If you can find comparable companies (even if they're private), compare revenue growth, margins, and valuation multiples. Is Once Upon a Farm trading at a premium or discount to similar businesses?

Fourth, understand your time horizon. If you're looking for a quick flip for a 20% gain in month one, IPOs are not the right vehicle. If you're looking for a 3-5 year investment in a quality consumer brand that can scale, then this might be worth considering.

Fifth, consider the risks specific to the food business. Supply chain, competitive intensity, margin compression, and retailer concentration are real risks. Make sure you're comfortable with them.

Finally, remember that Jennifer Garner's involvement is a feature, not a substitute for fundamentals. The business metrics matter more than the celebrity factor.

Broader IPO Market Implications

Once Upon a Farm's IPO is more significant than just the company itself because it signals something about the broader IPO market in 2025.

For the past 3-4 years, the IPO market has been slow and selective. Only companies with proven business models, strong profitability, and clear growth paths could go public. Venture-backed losses-per-dollar-of-revenue and hype-driven IPOs became toxic.

Now, in 2025, we're seeing a thaw. Companies that were in the IPO pipeline but shelved their plans are dusting off S-1s and filing again. This suggests investors are more comfortable with growth companies and IPO conditions are improving.

If Once Upon a Farm has a successful IPO, expect to see more consumer companies try to go public in 2025. If it flops, we'll see another pause. So this IPO is a bellwether for the broader market.

The macro conditions matter too. Interest rates, economic growth expectations, and overall investor sentiment all affect IPO success. In early 2025, conditions seem modestly positive, which helps Once Upon a Farm's timing.

For venture investors who backed this company, a successful IPO is a significant win. The $100 million they raised at various valuations can now be marked at IPO valuations, and they can start selling shares after the lock-up expires. That's how VC funds return capital to their LPs.

The Future of Celebrity-Backed Startups

Once Upon a Farm is part of a larger trend of celebrities starting real companies, not just endorsing products.

The difference between celebrity endorsement and celebrity founding is crucial. An endorsement is a marketing fee. A founding role is equity and operational involvement. Increasingly, we're seeing celebrities take the latter approach because the financial upside is much larger.

But this trend faces headwinds. Not every celebrity can successfully run a business. Many celebrity founders have naive assumptions about how businesses actually work. They underestimate supply chain complexity, competitive intensity, and the unglamorous work of operations.

The ones who succeed, like Jennifer Garner, tend to do so because they partner with experienced operators (Curtis and Raz in this case) and they stay involved in actual decision-making, not just branding.

Expect to see more celebrity founders in the coming years, but also more failures. The market will eventually reward actual competence over celebrity. Companies that have celebrity plus operational excellence will do well. Companies that have celebrity minus competence will stumble.

Once Upon a Farm's long-term success will depend on whether Garner, Curtis, and Raz can continue executing well as the company scales. Celebrity doesn't insulate you from competitive pressure or operational challenges. It just gives you a head start.

FAQ

What is Once Upon a Farm?

Once Upon a Farm is an organic kids' snack and baby food company co-founded by Jennifer Garner, Cassandra Curtis, and Ari Raz in 2015. The company manufactures and sells organic fruit and vegetable pouches, smoothies, and snack products primarily through retail channels like Target and Whole Foods, as well as through direct-to-consumer sales. It's preparing to debut on public markets with a targeted IPO date of February 6, 2025, at a $764.4 million valuation.

How does Once Upon a Farm's business model work?

The company generates revenue through two main channels: traditional retail distribution (grocery stores, specialty retailers) and direct-to-consumer sales through their website. Retail channels provide higher volume but lower margins due to retailer and distributor markups. Direct-to-consumer generates higher margins but requires more marketing investment to acquire customers. The company manufactures its own products, managing the entire supply chain from sourcing organic ingredients to packaging and distribution.

What are the financial details of the IPO?

Once Upon a Farm is planning to offer shares at

Why did Once Upon a Farm pause its IPO and then resume it?

The company originally planned to go public in 2024 but paused the process during the government shutdown when market conditions became uncertain. The company waited for more favorable conditions before resuming, which signals prudent timing. Resuming in early 2025 indicates that management and underwriters believe market conditions have improved sufficiently to support a successful IPO. This strategy is common and reduces the risk of launching into choppy market conditions.

How does Jennifer Garner's involvement add value to Once Upon a Farm?

Jennifer Garner's role as co-founder (not just investor) provides several benefits to Once Upon a Farm. Her celebrity and recognized status as a mother create marketing advantages and consumer trust in the brand, particularly in the parenting demographic. Her involvement also brings attention to the company and likely influences retail placement and marketing effectiveness. However, the actual long-term value depends on the company's business metrics, operational efficiency, and ability to compete against larger incumbents. Garner's involvement is a brand accelerator, not the core business driver.

What is Once Upon a Farm's competitive position?

Once Upon a Farm competes in the premium organic kids' snack market against established brands like Plum Organics (owned by Campbell Soup), direct-to-consumer competitors like Little Spoon, and large incumbent players like Gerber (Nestlé) and Beech-Nut. The company's competitive advantages include Jennifer Garner's brand recognition, hybrid retail plus DTC distribution strategy, and focus on organic, allergen-conscious products. The major threat comes from larger food companies (Nestlé, General Mills, Mondelēz) that could aggressively enter the market if they choose to prioritize this segment.

What are the key risks for Once Upon a Farm investors?

Major risks include retailer concentration (if a few large customers represent significant revenue), supply chain disruption in organic agriculture, intense competition from larger food companies with vastly more resources, slowdown in organic market growth, economic downturn reducing premium food purchasing, scaling challenges, and private label competition from retailers offering cheaper alternatives. Additionally, food manufacturers face margin compression pressure and inventory management challenges. Potential investors should carefully review the S-1 filing for specific disclosures about these risks.

What should investors focus on after the IPO launches?

Investors should monitor quarterly earnings reports, particularly focusing on revenue growth rates, gross and net margin trends, customer concentration metrics, and management's guidance on future growth. Watch for competitive moves from larger incumbents, track insider selling after the six-month lock-up period expires, and pay attention to analyst coverage and price targets from research firms. Also monitor market share trends in the organic kids' snacks category and any major retailer changes in shelf space allocation. These metrics will determine whether the IPO valuation is justified by actual business performance.

Is the $764.4 million valuation reasonable?

The valuation appears reasonable based on typical food company multiples and growth expectations. At an estimated $300-350 million in annual revenue, the company is trading at 2.2-2.5x revenue, which is typical for premium food brands with 20%+ growth rates. The valuation justifies itself if the company maintains 15-20% annual growth while keeping net margins at 10-12%. However, if growth slows significantly or margins compress, the stock could underperform. The actual reasonableness will become clear once the company begins reporting as a public company and investors can compare actual results to projections.

What does Once Upon a Farm's IPO mean for the broader IPO market?

The successful resumption of Once Upon a Farm's IPO signals that the IPO market is slowly recovering from the difficult 2022-2023 period. It suggests institutional investors are becoming more comfortable with growth companies going public, particularly those with actual profitability and proven business models. If the IPO performs well, expect to see more consumer goods companies attempting IPOs in 2025. If it underperforms, it could trigger another pause in the IPO pipeline. The company's performance will serve as a bellwether for market conditions and investor appetite for consumer-focused public companies.

How will Once Upon a Farm compete against much larger food companies?

Once Upon a Farm must compete through differentiation and agility. The company has advantages in brand recognition (Jennifer Garner), targeted focus on premium organic kids' snacks, and faster innovation cycles compared to large incumbents. However, larger companies (Nestlé, General Mills) have advantages in scale, capital, distribution, and pricing power. Long-term success requires Once Upon a Farm to maintain pricing power through brand strength, continuously improve operational margins, expand distribution faster than competitors can respond, and potentially merge with or be acquired by a larger player. The company must prove it can scale profitably without losing the brand attributes that differentiate it.

What has Once Upon a Farm raised in venture funding and who are the investors?

Once Upon a Farm has raised approximately $100 million in venture capital prior to the IPO. Key investors include S2G Ventures, which specializes in food and agriculture investing, and CAVU Consumer Partners, which focuses on consumer goods and retail companies. These are sophisticated investors with expertise in the food business, suggesting they believed in the company's business model and market opportunity. The fact that experienced food investors have backed the company multiple times provides some validation of the business model, though it doesn't guarantee IPO success or long-term stock performance.

The Bottom Line

Once Upon a Farm's IPO is a significant moment for celebrity-backed startups, the organic food market, and the broader IPO landscape in 2025. Jennifer Garner's involvement brings attention and brand value, but the company's ultimate success depends on its business metrics, operational excellence, and ability to compete against companies with vastly more resources.

The $764.4 million valuation is reasonable if the company maintains strong growth and margins. It's expensive if growth slows or margins compress. Like any IPO, the real price discovery happens over months and years of actual business performance, not on day one.

For investors, the advice is simple: be patient, read the S-1, understand the metrics, and remember that celebrity is a marketing advantage, not a substitute for fundamentals. Once Upon a Farm has a real business with proven revenue and real co-founders with operational experience. That puts it ahead of many IPOs. But the organic kids' snacks market is competitive, and scale is hard. The next 2-3 years will determine whether this IPO was a success or a disappointment.

For the broader market, Once Upon a Farm's performance will signal something important about investor sentiment and market appetite for consumer goods IPOs. If it succeeds, expect more food and consumer companies to pursue public listings. If it struggles, we'll see another pause in the IPO pipeline. The company is a bellwether for what's next in venture and public markets.

Key Takeaways

- Once Upon a Farm is resuming its IPO with a price range of 764.4 million valuation

- Jennifer Garner's role as co-founder provides real brand value and marketing advantage, but the company's long-term success depends on operational metrics and profitability

- The company has raised 208.9 million through the IPO with Goldman Sachs and J.P. Morgan as lead underwriters

- Key risks include retailer concentration, supply chain complexity, intense competition from large incumbents like Nestlé and General Mills, and margin compression from private label competitors

- The IPO success will serve as a bellwether for the broader 2025 IPO market and investor appetite for consumer goods companies with proven revenue and profitability

Related Articles

- AI Chip Startups Hit $4B Valuations: Inside the Hardware Revolution [2025]

- Why Allbirds Closing Stores Signals Tech Culture's Biggest Shift [2025]

- TechCrunch Founder Summit 2026: The Ultimate Guide to Scaling Your Startup [2026]

- Snap's AR Glasses Spinoff: What Specs Inc Means for the Future [2025]

- Redwood Materials $425M Series E: Google's Bet on AI Energy Storage [2025]

- Northwood Space Lands 50M Space Force Contract [2026]

![Once Upon a Farm IPO 2025: What Investors Need to Know [2025]](https://tryrunable.com/blog/once-upon-a-farm-ipo-2025-what-investors-need-to-know-2025/image-1-1769629032293.png)