Palantir: The Enterprise Software Giant Redefining Growth [2025]

Something unusual just happened in enterprise software. A company with a $600+ billion valuation reported numbers that shouldn't be possible at that scale.

Palantir dropped Q4 2025 earnings that are breaking every conventional rule of how large software companies should perform. Yes, the stock is expensive. Michael Burry is short. The traditional valuation metrics look insane. But before dismissing it, you need to see the actual numbers.

We're talking about 70% revenue growth in Q4 at a

This isn't gradual growth with margin expansion. This is something different entirely.

TL; DR

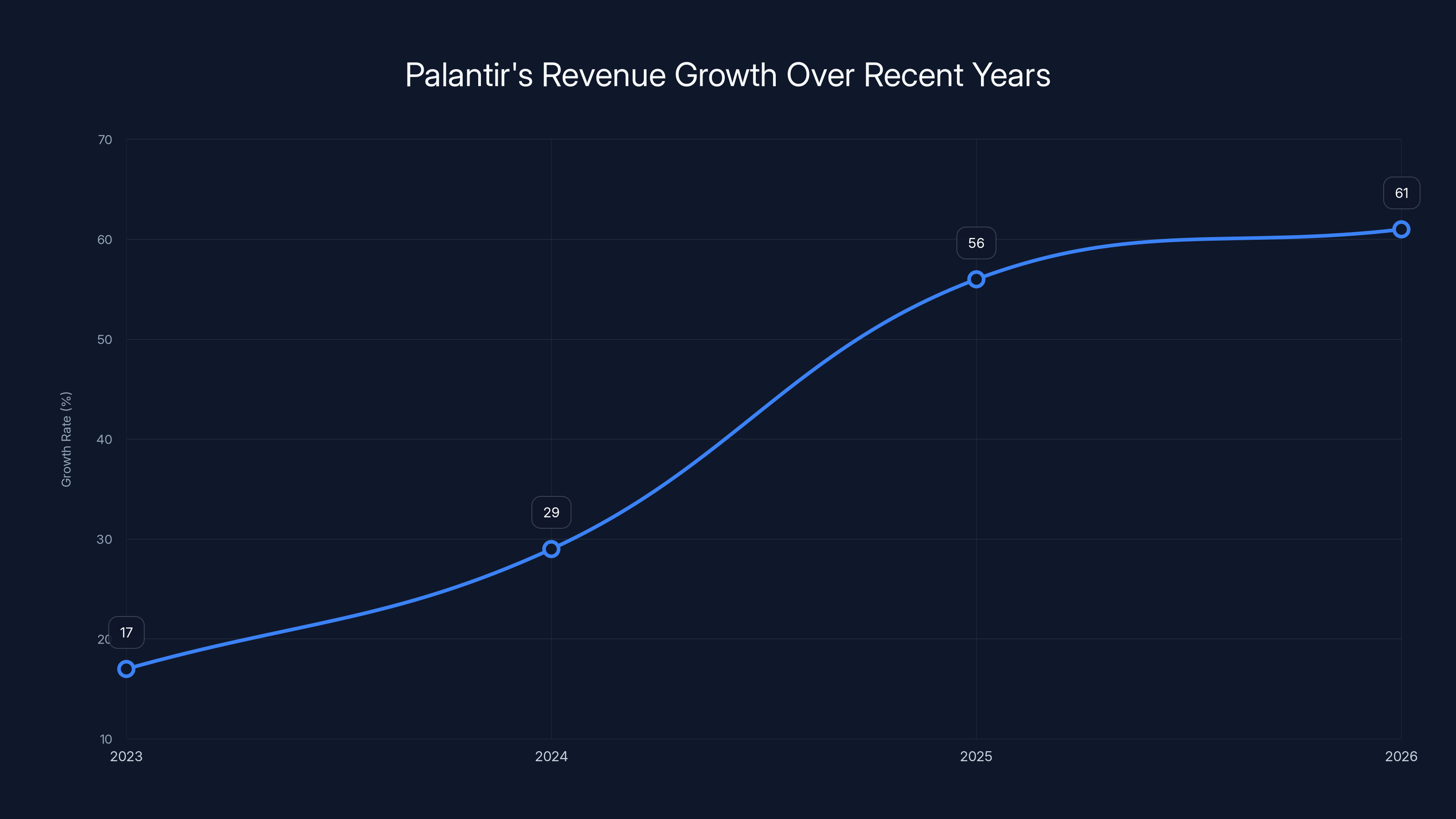

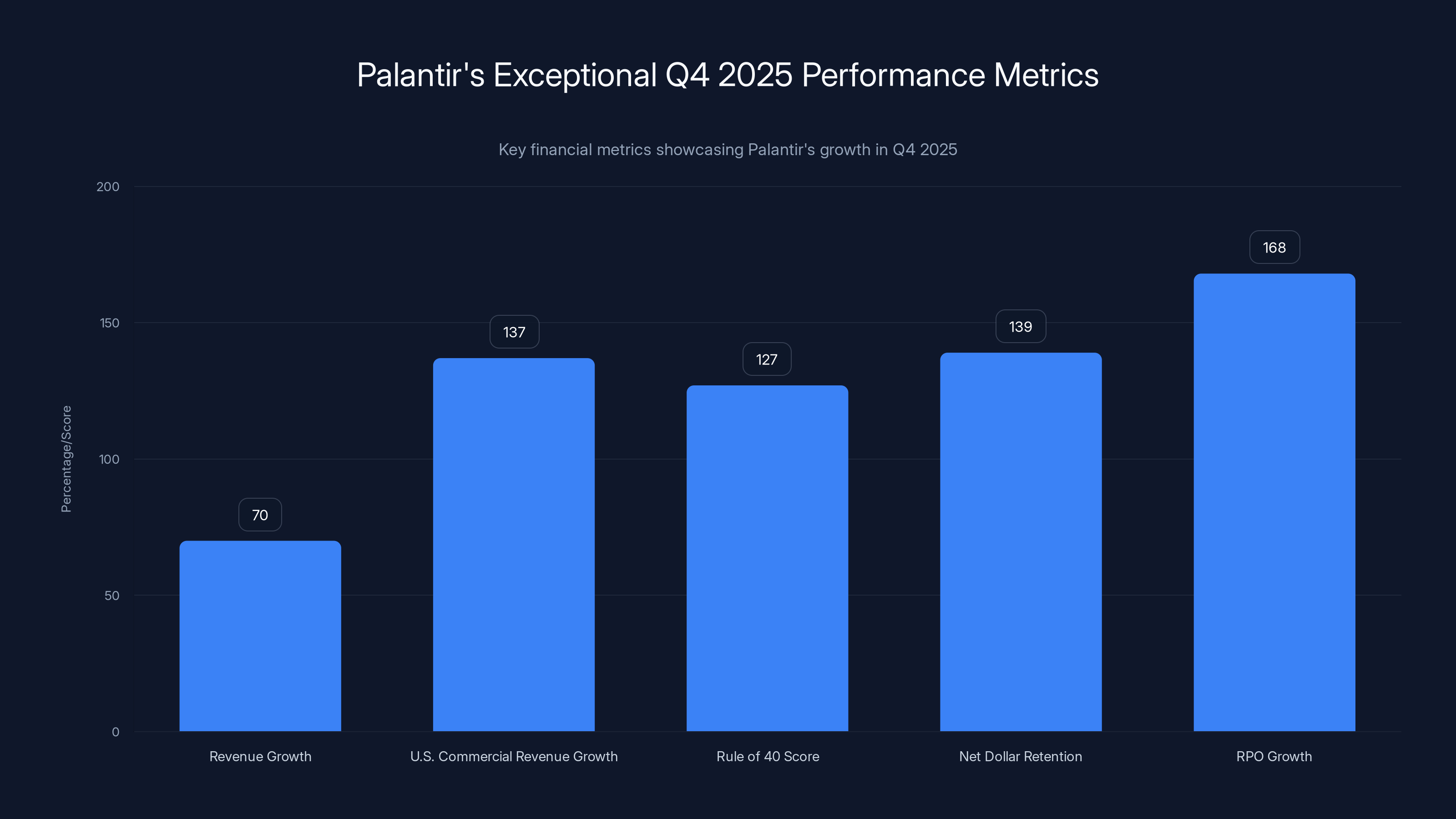

- Unprecedented growth at scale: 70% revenue growth at $5.6B run rate, accelerating from 56% in 2025 and 29% in 2024

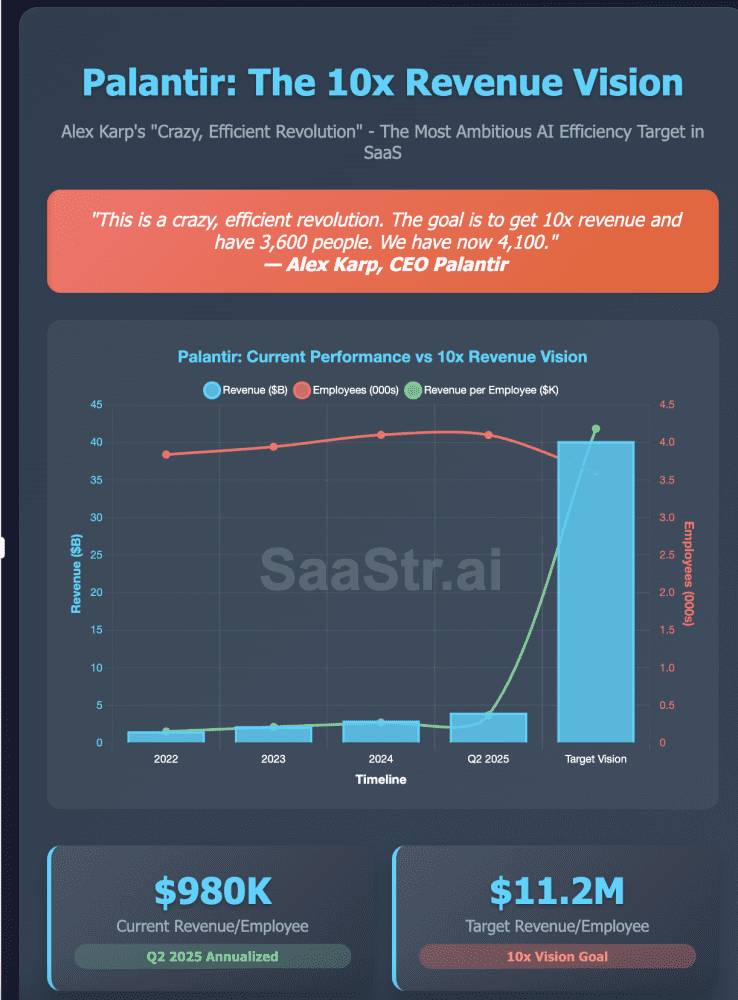

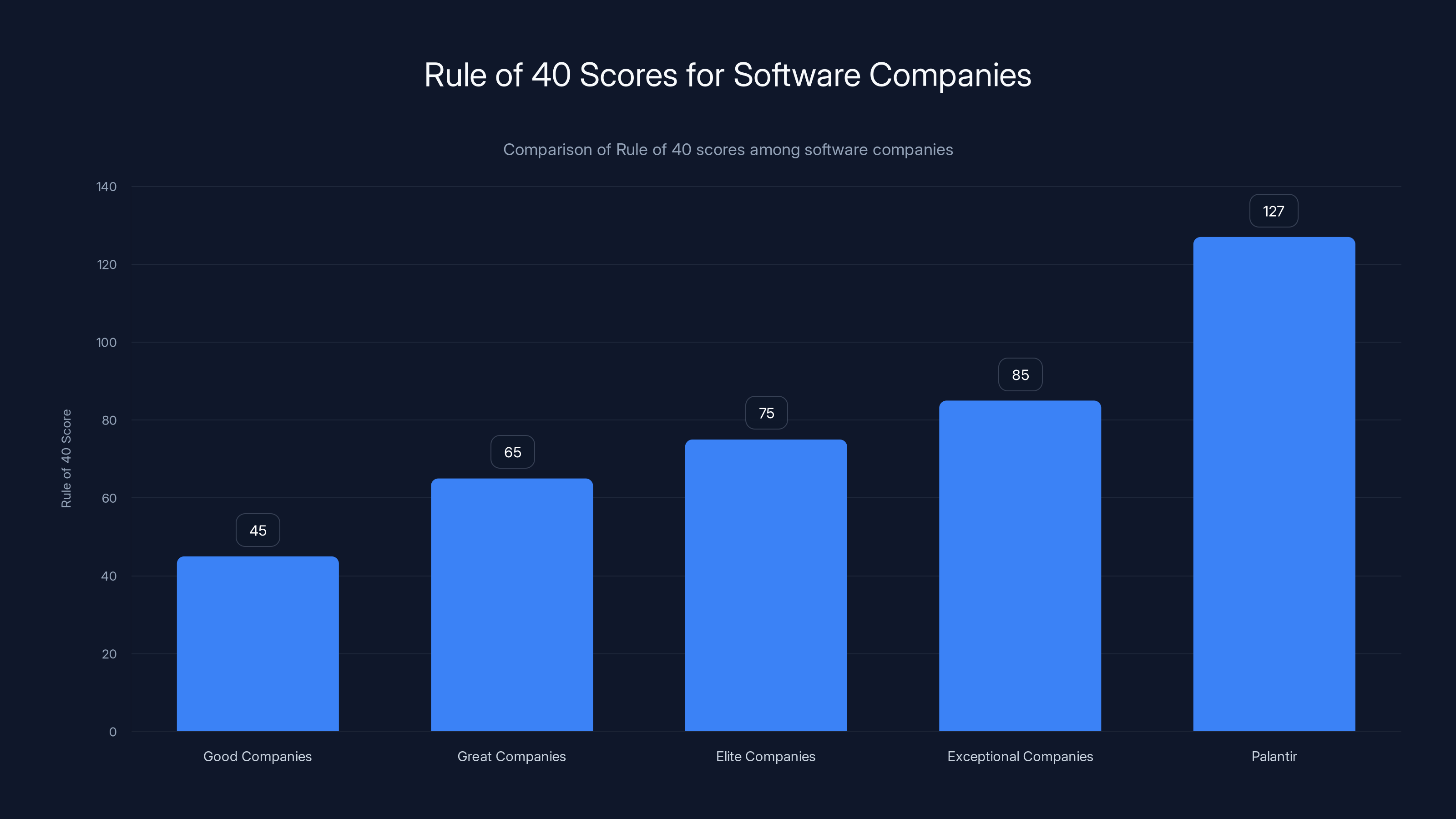

- Rule of 40 dominance: Posted 127 (70% growth plus 57% adjusted operating margin) versus typical 40-50% for good companies

- U.S. commercial explosion: 137% YoY growth with customers expanding from 31M ACV in nine months

- Massive backlog building: RPO grew 168% in five quarters to 11.2B in total remaining deal value

- Operational leverage: 139% net dollar retention shows customers spending 39% more YoY before counting new logos

Palantir's Rule of 40 score of 127 is significantly higher than the typical scores for good, great, and elite companies, highlighting its exceptional balance of growth and profitability.

The Numbers That Changed Everything: Q4 2025 Earnings Deep Dive

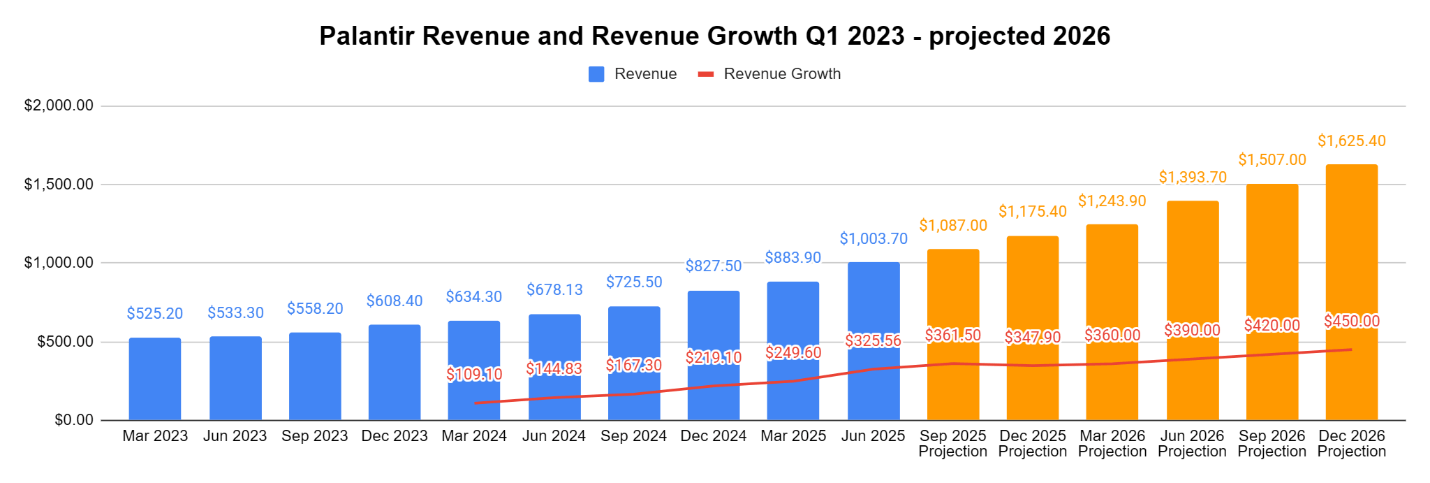

Palantir reported $1.4 billion in Q4 2025 revenue, up 70% year-over-year. This was their highest growth rate as a public company. Not their highest when they were a small startup burning cash. Their highest ever, at multi-billion dollar scale.

Here's what makes this remarkable: the growth isn't slowing. It's accelerating. In 2023, growth was 17%. In 2024, it jumped to 29%. In 2025, it hit 56%. Now they're guiding for 61% in 2026. The law of large numbers should make this impossible. Revenue growth should decelerate as companies get bigger. Software companies are supposed to slow down once they hit unicorn status.

Palantir is doing the opposite.

The 2026 guidance is particularly stunning. Consensus estimate was

Let's break down the revenue streams:

U.S. Government Revenue: $570 million in Q4, up 66% year-over-year. This is the traditional business that funded the company for two decades. It's still growing solidly, though it's being overshadowed by the commercial segment.

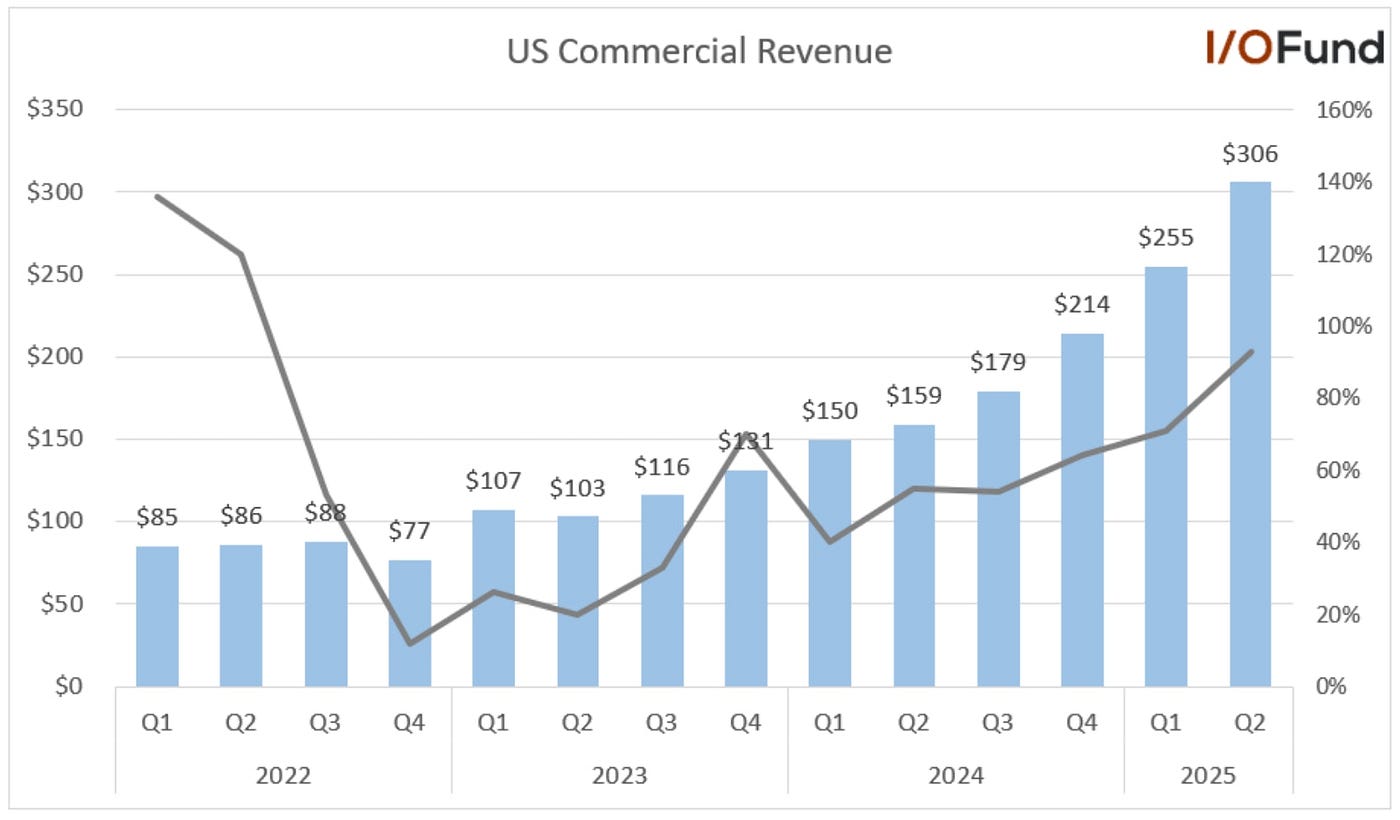

U.S. Commercial Revenue: $507 million in Q4, up 137% year-over-year. This is the new story. This is what's breaking the valuation model. This segment is now growing so fast it's making government work look like a mature, stable business.

The implications are significant. U.S. commercial revenue is now annualizing at over

This velocity is unlike anything I've seen at this scale before. A utility company went from

Palantir's revenue growth has accelerated significantly from 17% in 2023 to a projected 61% in 2026, defying typical trends for large software companies. Estimated data for 2026.

The Rule of 40: Redefining What's Possible

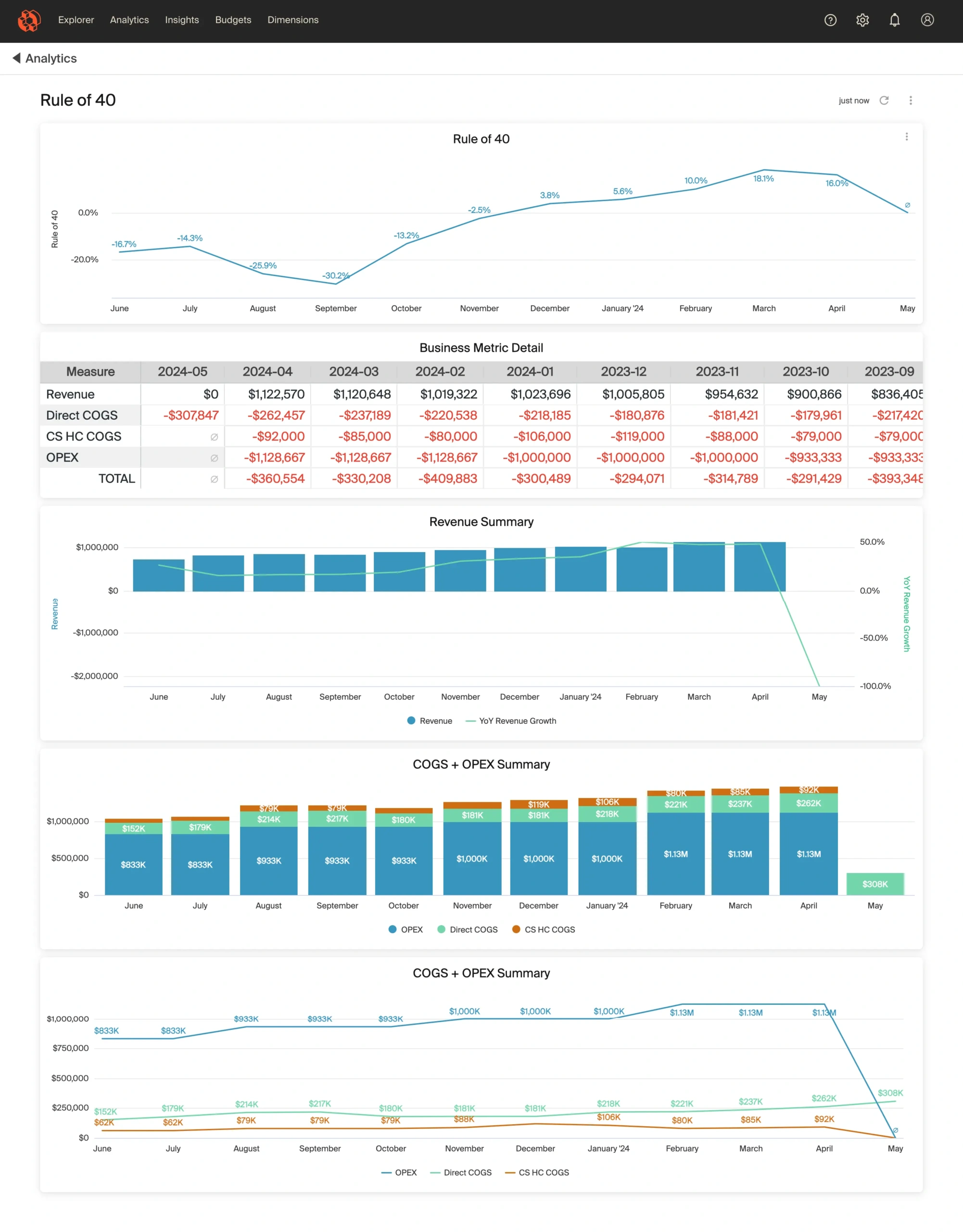

The "Rule of 40" is a framework that's been around for years. Revenue growth rate plus profit margin should equal at least 40%. It's the standard metric for evaluating company health across software.

Here's how it typically breaks down:

Good companies: 40-50 Rule of 40 score Great companies: 60-70 Rule of 40 score Elite companies: 70-80 Rule of 40 score (rare) Exceptional: Anything above 80

Palantir posted 127.

That's 70% revenue growth plus 57% adjusted operating margin. One year ago, this number was 81. Two years ago, it was in the 50s. The company is accelerating on both axes simultaneously. Growing faster and becoming more profitable at the same time.

Look at their investor presentation competitive chart. Every enterprise software company with $1B+ in revenue is clustered together. Salesforce, Service Now, Snowflake, Adobe, Workday. They're all in the same quadrant. Palantir is in a different one. Alone.

What makes this possible? Let's look at the mechanics.

Revenue per employee is one key metric. Palantir has been investing heavily in headcount, but productivity per employee is accelerating. This suggests the business model is becoming more efficient as it scales. You're getting more revenue per unit of labor.

Sales efficiency is another factor. The sales team is closing larger deals and doing it faster. That $96 million healthcare deal took months from first demo to signature, not years. This suggests product-market fit is so strong that customers don't need extensive evaluations.

Operating leverage is kicking in on the cost side. Customer support, infrastructure, and overhead aren't scaling linearly with revenue. As the installed base of customers grows, these costs grow slower than revenue.

The traditional venture capital narrative says you can't have both. Growth or profitability. Pick one. Build revenue, sacrifice margins. Or slow growth to print profits. Palantir is proving that narrative wrong at scale.

The U.S. Commercial Explosion: The Real Story

Government revenue is stable and important. But the commercial business is where the growth story lives. This is the segment that's forcing analysts to rewrite their models.

What's driving this acceleration?

Market expansion: Palantir spent years building infrastructure for government agencies. Now they're taking that infrastructure and selling it to commercial enterprises. But not as a generic product. They're customizing it for specific verticals: financial services, energy, utilities, healthcare, manufacturing.

Each vertical has different data challenges. A utility company needs to analyze grid data differently than a financial services firm needs to analyze trading data. Palantir's platform is flexible enough to handle both.

Product maturity: The platform has moved from a specialized tool for government contractors to something that regular enterprises can actually use. The user experience has improved. The documentation is better. The onboarding is cleaner. These aren't exciting things to investors, but they matter for commercial adoption.

AI acceleration: Palantir's CEO Alex Karp mentioned they're "exclusively focused on scaling the operational leverage made possible by the rapid advancements of AI models." This is code for: they're embedding AI capabilities directly into the platform.

Think about what that means. Instead of analysts spending hours writing queries to understand data, the AI does it. Instead of trying to figure out which data points matter, the AI highlights them. This is multiplying the effective capacity of the sales team and reducing the effort required from customers.

Sales team maturity: The company has been hiring experienced enterprise sales leaders. They're not just hiring heads. They're bringing in people from Salesforce, Oracle, and other large software companies who understand how to sell into enterprises. These aren't people trying to figure out enterprise sales. They've done it before.

Customer expansion velocity: This is the metric that's most important. New customer acquisition is one thing. Existing customers spending more is another.

U.S. commercial customer count grew 49% year-over-year to 571 customers. That's solid logo growth. But the expansion story is wilder.

Net dollar retention hit 139%, up 500 basis points sequentially. This means existing customers are spending 39% more year-over-year before counting any new logos. And management noted that this NDR figure excludes customers acquired in the last twelve months, which is exactly where the most explosive growth has been.

So 139% NDR actually understates the real expansion happening inside the company.

Here's why this matters: if you have

Palantir's Rule of 40 score of 127 significantly surpasses typical benchmarks, indicating exceptional growth and profitability.

The Backlog Story: $4.21 Billion in RPO

One number captures the magnitude of what's happening: Remaining Performance Obligations (RPO) went from

That's a 1,478% increase in six years. A 58.3% compound annual growth rate.

But the recent acceleration is what matters most. RPO went from

Total remaining deal value hit $11.2 billion, up 105% year-over-year. This is the pipeline that's been committed to, not the pipeline that's still in discussion. Customers have signed contracts. The revenue is coming.

Total contract value booked in Q4 was

Let's put this in perspective. If Palantir stopped selling today and just fulfilled existing contracts, they'd have $11.2 billion in revenue to recognize over the next several years. That's already more than their total 2025 revenue.

This is what separates a growth story from a hype story. The money is already committed. The deals are already signed. You're not trying to forecast whether customers will buy. They already have.

The mechanics of how they got here matter. In Q4, they booked

This is typical for enterprise software sales. The downside is it looks inflated if you don't understand what TCV means. The upside is it provides visibility into future revenue.

Customer Expansion Economics: The Secret Sauce

Palantir isn't winning on new customer logos alone. They're winning on expansion. Existing customers are spending dramatically more.

Let's walk through some real examples:

Utility Company: Started at

Energy Company: Started at

Healthcare Company: Did two bootcamps in summer 2025. Signed an $80 million deal within months of first engagement. Then did additional bootcamps in fall and signed another major deal. These are customers who spent minimal time in evaluation and went straight from proof-of-concept to large-scale deployment.

Engineering Services Firm: Saw a demo in fall, signed an $80 million deal. This is enterprise sales at extreme velocity.

These aren't typical land-and-expand motions. In traditional SaaS, you might expand from

Why is this possible?

First, the product is genuinely valuable. When a utility company realizes they can optimize grid operations and save millions in operational costs, they want to expand immediately. They're not evaluating whether the product works. They're scaling it because it works.

Second, the contracts are structured for expansion. Palantir typically starts with a proof-of-concept or limited deployment. As soon as the customer sees results, they want to expand to other departments, regions, or use cases. The contract framework allows this.

Third, there's organizational demand. Once one department deploys Palantir, adjacent departments want it. IT wants it. Operations wants it. Finance wants it. Suddenly you have multiple internal stakeholders pushing for expansion.

Fourth, the AI capabilities are new. Customers haven't had tools like this before. The competitive position inside their organization is weak. There's no established vendor to displace. Palantir is creating a new category.

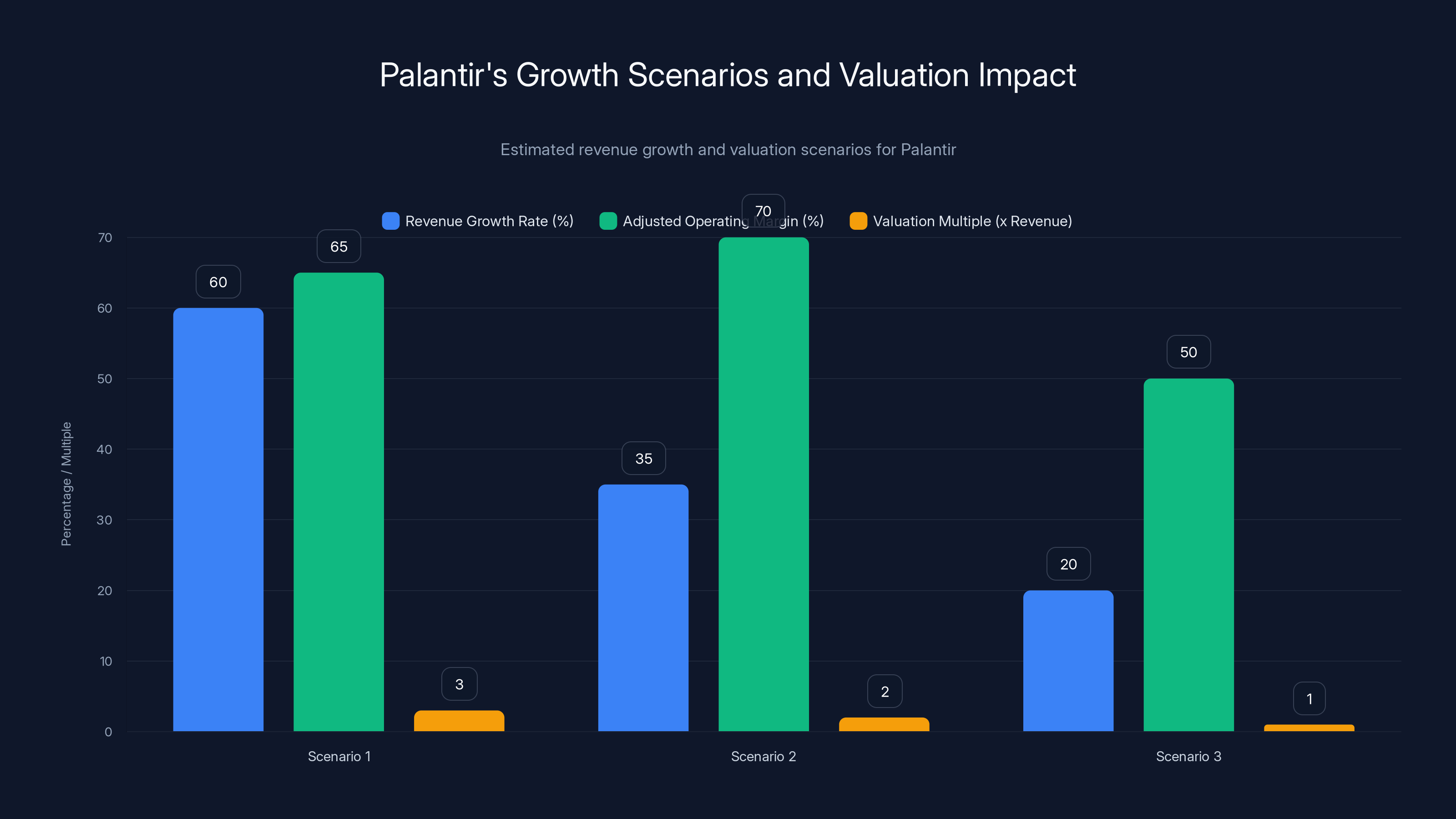

Estimated data shows varying growth rates and valuation impacts for Palantir. Scenario 1 suggests high growth and reasonable valuation, while Scenario 3 indicates significant valuation compression.

The Valuation Question: Is This Justified?

Palantir trades at 142x earnings. 86x revenue. These are extreme multiples.

For context, Salesforce trades at around 30x revenue in normal times. Service Now trades at 10-12x revenue. Even hyper-growth Snowflake came down to single-digit revenue multiples.

So is Palantir's valuation insane? The traditional answer is yes. The company would need to grow faster than almost any software company in history to justify those multiples.

Except it's already doing that.

Let's think about what happens if Palantir grows 61% in 2026 as guided, and the market assigns a more reasonable 3x revenue multiple to the business:

If they hit

But here's the thing: if the economics continue like this, the valuation comes down naturally. Not because the stock crashes, but because revenue grows faster than the stock price needs to rise.

The real question isn't whether the valuation is justified today. It's whether the execution can continue at this pace.

Three scenarios:

Scenario 1: Growth continues at 60%+ for the next 2-3 years. Margins expand to 65%+ adjusted operating margin. The Rule of 40 stays above 100. In this case, the valuation becomes reasonable over time as revenue grows.

Scenario 2: Growth moderates to 30-40% over the next 2-3 years, but margins expand to 70%+. The business becomes wildly profitable. Valuation contracts, but shareholders are fine with it because profits are real.

Scenario 3: Growth moderates faster than expected, to 20% range, without corresponding margin expansion. Valuation multiple compresses significantly. Stock sells off.

The market is pricing in something between scenarios 1 and 2. The short case (Michael Burry and others) is betting on scenario 3.

Historically, companies with this kind of execution win out. When a management team can grow revenue 70% at multi-billion scale while expanding margins, they tend to keep doing it for longer than people expect.

The AI Advantage: What Competitors Are Missing

Palantir's CEO Alex Karp said something important in the earnings call: "We are an n of 1. Palantir is alone in choosing to exclusively focus on scaling the operational leverage made possible by the rapid advancements of AI models."

Translate that: while everyone else is trying to figure out how to add AI features to existing products, Palantir is rebuilding the core platform around AI.

This is a meaningful distinction. There are two approaches to AI:

Approach 1: Bolt-on AI: Add Chat GPT integration to your product. Let users chat with a bot. Call it AI-powered. Most software companies are doing this.

Approach 2: AI-native architecture: Rebuild the entire platform with AI at the core. Make the AI part of the data pipeline, not an afterthought. Palantir is doing this.

Why does this matter? When AI is truly native, it compounds. The AI gets better as more customers use the platform. Better models emerge. Better training data accumulates. Better workflows get built. Suddenly you're not just adding a feature. You're creating a moat.

In Palantir's case, they have 20 years of government data work. They have proprietary data sets. They have domain expertise in how organizations actually use data. They're combining all of that with modern AI models.

Competitors have to either:

- Build their own infrastructure (takes years and billions in investment)

- License Palantir's (gives Palantir distribution advantage)

- Try to compete on pure software capability (Palantir's execution is better)

This doesn't mean Palantir wins forever. But it means they have a genuine head start that most competitors haven't recognized yet.

Palantir's Q4 2025 performance metrics are extraordinary, with a 70% revenue growth, 137% U.S. commercial revenue growth, and a Rule of 40 score of 127, indicating robust financial health and growth potential. Estimated data.

Government Business: The Stable Foundation

While U.S. commercial gets all the attention, the government business is still important. It's the foundation that funded the company through the unprofitable years.

U.S. government revenue was $570 million in Q4, up 66% year-over-year. That's solid growth for a mature segment. The fact that it's still accelerating is significant.

Historically, government software businesses are viewed as boring. They're slow-growing. Margins are fixed by contract. You're dependent on government budgets. It's a low-risk, low-return business.

Palantir is proving that narrative wrong. Government revenue is growing faster than most commercial software companies and still profitable.

Why? The customer is mission-critical. When a government agency deploys Palantir, they're often using it for intelligence, defense, or law enforcement. Failure isn't an option. Funding is protected. Multi-year contracts are standard.

In 2026, even with the U.S. commercial acceleration, government will still likely represent 25-30% of revenue. That's a stable, growing, highly profitable base business.

Most software companies would be thrilled with this. Palantir has it as a secondary business while the main business is doing 137% growth.

The Path to $100 Billion in Revenue

Let's do some math on where this company could be in 5-10 years.

Current run rate:

If growth moderates to 50% in 2027:

If growth moderates to 40% in 2028:

If growth moderates to 30% in 2029:

If growth moderates to 20% in 2030:

That's not

If growth stays elevated longer:

If growth stays at 50% through 2028:

Now we're approaching $30B+ revenue in five years. With 55%+ adjusted operating margins, that's real profitability at scale.

$100 billion in revenue requires staying at elevated growth rates longer than traditional software companies. But given the AI tailwinds and the backlog, it's not impossible.

Here's the key insight: Palantir doesn't need to be growing 70% forever. If it can maintain 40%+ growth for the next 5-7 years while expanding margins, it becomes one of the largest software companies in the world just through organic growth and leverage.

Most software companies can't do that. They hit a ceiling. Growth decelerates. Margins plateau. The business matures.

Palantir's thesis is that AI capabilities let companies escape that traditional ceiling.

RPO grew from

Risk Factors: Why This Could All Fall Apart

We should address the short case seriously. Michael Burry isn't stupid. He doesn't short companies for entertainment.

Here are the real risks:

Valuation mean reversion: If growth moderates faster than expected and the market reprices the stock to match traditional software multiples, you could see significant downside. A drop from 86x to 10x revenue would represent an 85% decline.

Execution slippage: Sales organizations at this scale are hard to maintain. If they can't hire fast enough or if new sales leaders don't assimilate the culture, growth could stall quickly.

Customer concentration: We don't have full disclosure on customer concentration, but with huge deals going to single customers, there's risk if a major customer reduces spend or deploys internally.

Competitive response: If tech giants like Microsoft, Google, or Amazon notice the market opportunity and respond with integrated offerings, they could pressure margins or growth.

Economic recession: Enterprise software typically holds up in downturns, but a severe recession could delay customer deployments and reduce expansion velocity.

AI hype waning: If AI becomes less exciting to the market or if the actual value delivered underperforms expectations, growth narratives collapse fast.

Geopolitical risks: Palantir's government business is sensitive to political changes and geopolitical tensions. Sudden shifts could impact that segment.

Talent retention: High growth companies often burn out employees. If key technical and sales leaders leave, execution suffers.

These aren't trivial risks. Any one of them could materialize and significantly impact the company. The valuation leaves no room for error.

The Comparison: How Palantir Stacks Against Historical Precedent

Let's compare Palantir's current execution to other "greatest software companies of all time" candidates:

Salesforce (2003-2008)

- Growth rate: 40-60% annually

- Margins: Negative to low single digits

- Rule of 40 equivalent: Around 40-50

- Valuation multiple: 20-40x revenue (peak)

Workday (2010-2015)

- Growth rate: 40-60% annually

- Margins: -30% to -10% (investing heavily)

- Rule of 40 equivalent: Not yet positive

- Valuation multiple: 10-20x revenue

Snowflake (2020-2023)

- Growth rate: 60-100% annually

- Margins: -20% to -30% (investing in growth)

- Rule of 40 equivalent: 40-50

- Valuation multiple: 50-100x revenue (peak), now 5-8x

Palantir (2025)

- Growth rate: 70% with guidance to 61%

- Margins: 57% adjusted operating

- Rule of 40: 127

- Valuation multiple: 86x revenue

Palantir is unique because it's growing faster than Salesforce and Workday historically while being massively more profitable. That's not a common combination.

The closest comparison is Snowflake at peak growth, but Snowflake wasn't profitable. Palantir is.

Historically, software companies that achieve this combination have become multi-hundred-billion-dollar businesses. Not because of hype, but because the underlying economics work.

The AI Software Narrative: Why Now?

Why is Palantir able to achieve this level of execution now when they couldn't five years ago?

The answer is AI acceleration. Not just the existence of large language models, but the integration of AI into enterprise data infrastructure.

Five years ago, AI was exciting but optional. You could run an organization without it. Today, it's becoming a core competency. Every organization needs to be data-driven and AI-aware.

Palantir's platform sits at exactly the intersection where this matters most: turning raw data into insights and automating decisions based on those insights.

When you combine:

- Modern AI models (GPT-4, Claude, specialized domain models)

- Enterprise data infrastructure (what Palantir built)

- Operational leverage (doing more with the same resources)

- Customer demand (everyone wants AI)

You get what Palantir is experiencing: accelerating growth, expanding margins, and multiple expansion.

The timing is right. The product is ready. The market is hungry. The execution is sharp.

Five years ago, this would have been impossible. The AI models didn't exist. The organizational appetite wasn't there. The competitive landscape was different.

Now, it's all aligned.

What Happens Next: The Critical Milestones

Palantir needs to hit specific milestones to validate this narrative:

2026 (Most Critical)

- Hit the $7.19B revenue guidance

- Maintain Rule of 40 above 80+

- U.S. commercial revenue exceeds $3.14B as guided

- Commercial customer count hits 750+

- RPO approaches $6-7B

2027 (Consolidation)

- Revenue hits $10B+ annualized by end of year

- Growth moderates to 40-50% (still exceptional at this scale)

- Adjusted operating margins stay above 50%

- International commercial business starts showing real momentum

2028-2030 (Scaling)

- Revenue approaches $20-25B

- Becomes one of the top 10 largest software companies globally

- International operations match or exceed domestic

- Becomes profitable on GAAP basis with real free cash flow

Miss any of these, and the narrative breaks. Hit all of them, and we're talking about a genuinely historic software company.

The good news is management has been predictive with guidance. They've beaten or guided higher in recent quarters. That suggests they're not sandbagging.

The bad news is expectations are now extraordinarily high. Any stumble will be heavily punished.

The Contrarian View: Why Skeptics Have a Point

It's worth seriously considering the bear case because it highlights real risks.

Growth at this velocity doesn't persist: True. Most companies that grow 70% for one year see deceleration the next year. If Palantir decelerates faster than expected, valuation reverts quickly.

The backlog is a double-edged sword: Large RPO is great until customers cancel or reduce orders. If Fortune 500 companies book huge deals and then delay or reduce implementation, RPO becomes less predictive of actual revenue.

Government is still concentration risk: While U.S. commercial is exciting, government still represents significant revenue. Political changes could affect funding or strategy.

The talent market is increasingly competitive: Hiring the specialized talent needed to execute at this scale is hard. Burnout at scaling companies is real. Retention could become an issue.

Macro headwinds are underestimated: If the economy softens, enterprise IT budgets get cut. Expansion gets delayed. Growth moderates.

The competitive response is coming: Salesforce, Microsoft, AWS, and others are all building AI capabilities. If they execute, Palantir's advantage erodes.

The valuation leaves no room for execution mistakes: At 142x earnings, there's zero margin for error. Any missed quarter and the stock sells off 30%.

These aren't fringe concerns. They're legitimate. The short thesis has merit. It's just betting that execution fails or growth moderates faster than the market currently prices in.

Comparable Company Analysis: Putting the Numbers in Context

Let's look at how Palantir compares on specific metrics to other enterprise software leaders:

Net Dollar Retention (NDR)

- Palantir: 139%

- Salesforce: 120-130%

- Snowflake: 150%+ at peak

- Microsoft (Cloud): 130%+

Palantir is in the top tier globally. 139% means each existing customer dollar expands 39% annually. This is exceptional for a company at multi-billion scale.

Rule of 40

- Palantir: 127

- Salesforce at IPO: Around 20

- Salesforce today: Around 45-55

- Service Now: Around 60

- Snowflake: Around 40-50

Palantir is off the charts compared to any comparable company at any point in their history.

Gross Margins

- Palantir: 75-80% (estimated)

- Salesforce: 70-75%

- Service Now: 75-80%

- Snowflake: 60-65%

Palantir's gross margins are in line with the best software companies. No advantage here, but no deficit either.

Operating Margins (Adjusted)

- Palantir: 57%

- Salesforce: 10-20%

- Service Now: 15-20%

- Snowflake: -10% to 5%

Palantir is far ahead on profitability. This is the real differentiator. They're not sacrificing profitability for growth. They're doing both.

The AI Software Company Inflection: A Thesis

Here's the overarching thesis: we're at the beginning of an inflection in enterprise software where AI becomes the core of the product, not an add-on.

Companies that built their platforms around traditional architectures (databases, data warehouses, BI tools) are trying to retrofit AI. It's awkward. It doesn't integrate cleanly. Customers have to use multiple tools.

Companies like Palantir that are rebuilding from the ground up with AI at the core will have a lasting advantage.

This inflection typically lasts 5-10 years. It's the period where new architectures prove they're better and incumbent vendors struggle to transition. During this period, growth companies can grow much faster than the market expects because they're capturing not just new customers but also replacing entrenched solutions.

Palantir is positioned perfectly for this. They have:

- The technical capabilities

- The sales organization

- The product-market fit

- The capital to execute

- The backlog to fund growth

The window for this kind of acceleration is finite. Eventually, growth moderates. Margins compress as competition increases. But the company that captures the most market share during the inflection becomes an industry giant.

Palantir could be that company.

What the Numbers Tell Us About the Future

Strip away the valuation debate and focus on what the actual business fundamentals suggest:

-

Customer demand is accelerating: The fact that TCV booked is accelerating (up 138% YoY) and RPO is growing 62% sequentially suggests customers want more, not less.

-

Expansion is generating most of the growth: New logo growth (49% in commercial customers) is solid but smaller than the expansion growth (139% NDR). The business model is increasingly about deepening customer relationships, not just acquiring new ones.

-

Margins are expanding even as they invest: Management is hiring aggressively and growing the business, yet adjusted operating margins are expanding. This suggests the unit economics are getting better, not worse.

-

The backlog is real: $11.2B in total remaining deal value isn't theoretical. These are signed contracts. The revenue will be recognized.

-

Execution is strong: Beating guidance by 15% doesn't happen by accident. The team is executing and delivering results.

These fundamentals suggest the company is genuinely in a strong position, regardless of how you feel about the valuation.

The realistic scenarios:

Bull case: Growth stays 50%+ for another 3-4 years, margins expand to 60%+, the company becomes one of the largest software companies in the world. Stock eventually trades at lower multiples (20-30x) but at a much higher absolute price because the business is bigger.

Base case: Growth moderates to 30-40% by 2028, margins stabilize at 55-60%, company becomes a top-20 software company globally. Valuation compresses but shareholders do fine due to revenue growth and profitability.

Bear case: Growth falls to 20% within two years, execution issues emerge, valuation compresses to 15-20x revenue, stock sells off 60%+.

Most of the risk is priced in for the bear case. Most of the upside is still available for the bull and base cases.

Conclusion: The Greatest Enterprise Software Company?

Is Palantir the greatest enterprise software company of all time? Not yet. Salesforce, SAP, and Microsoft have done far more to transform enterprise operations.

Could it become one? Actually, yes.

The earnings numbers from Q4 2025 are genuinely exceptional. Not inflated, not accounting tricks, not one-time benefits. The company is growing faster, becoming more profitable, and building a bigger backlog than any software company at this scale in recent history.

The valuation is admittedly expensive. 86x revenue, 142x earnings. The traditional metrics scream "sell." But those metrics were built for companies growing 20% and earning thin margins. Palantir is growing 70% and earning 57% adjusted operating margins.

The short thesis has merit. Growth could moderate faster than expected. Execution could slip. Valuation could compress. That's real risk.

But the bull thesis also has merit. If management executes on the guidance (61% growth in 2026, expanding margins), they've built something genuinely special. A company that combines venture-scale growth with enterprise-scale profitability is rare. Historically, companies that achieve this become industry giants.

The most likely outcome is somewhere in the middle: the company continues growing at elevated rates for several more years, margins stay strong, and valuation moderates but shareholders do well because they own a piece of something that genuinely matters.

Palantir probably isn't the greatest enterprise software company of all time. But if execution continues, it could be one of the top five within a decade. That's not hype. That's just math.

FAQ

What does Palantir actually do?

Palantir develops data integration and visualization platforms that help organizations consolidate, analyze, and understand complex datasets. Originally built for U.S. government intelligence agencies, the company now provides two main products: Gotham for government and defense customers, and Foundry for commercial enterprises. The platform uses AI and machine learning to uncover patterns in data and help organizations make better operational decisions across industries like energy, healthcare, finance, and manufacturing.

Why are Palantir's growth numbers so unusual for a company this size?

Most software companies experience growth deceleration as they scale, following what's called the law of large numbers. Palantir is growing 70% at a $5.6 billion revenue run rate, which is exceptional. This is possible because of three factors: rapid AI adoption accelerating market demand, expanding customer expansion velocity as existing customers deploy the platform more broadly within their organizations, and strong execution from a sales organization led by experienced enterprise software veterans. Additionally, the company is investing heavily in growth while simultaneously expanding profitability margins, which is unusual.

What is the Rule of 40 and why does it matter?

The Rule of 40 is a metric where revenue growth rate plus profit margin should equal at least 40%. It's used to evaluate whether a company is balancing growth with profitability. Good companies score 40-50, great companies hit 60-70, and elite companies occasionally reach 80. Palantir posted 127 (70% revenue growth plus 57% adjusted operating margin), which is the highest I've ever seen from an enterprise software company. It suggests the company is achieving what was previously thought to be impossible: explosive growth and strong profitability simultaneously.

What is Remaining Performance Obligations (RPO) and why is the growth significant?

RPO represents revenue from customer contracts that hasn't been recognized yet. It provides visibility into future revenue. Palantir's RPO grew from

How is Palantir's U.S. commercial business different from its government business?

The government business (

What is Net Dollar Retention (NDR) and what does Palantir's 139% mean?

NDR measures how much revenue you generate from existing customers, including expansion, minus churn. An NDR of 139% means that if you had

Is the valuation of 86x revenue and 142x earnings justified?

Traditional valuation metrics suggest Palantir is expensive. Salesforce trades at 30x revenue, Service Now at 10-12x. However, these comparisons ignore execution differences. Palantir is growing 70% with 57% margins. Salesforce grows 10-15% with 15-20% margins. When you account for growth rate and profitability (the Rule of 40), Palantir's valuation is less extreme than it appears. The company would need to maintain 40%+ growth for 5+ years while expanding margins to justify current levels. That's a high bar, but not impossible if execution continues.

What are the main risks to Palantir's business?

Key risks include valuation mean reversion if growth moderates faster than expected, execution slippage as the company scales, customer concentration in large deals, competitive response from Microsoft, Salesforce, or AWS, macroeconomic headwinds affecting enterprise IT budgets, and geopolitical risks affecting the government business. At current valuation multiples, there's minimal margin for error. Any significant miss on guidance could trigger substantial stock declines. Additionally, maintaining growth at this velocity requires continued successful hiring and execution, which becomes harder as the organization scales.

How does Palantir's AI strategy differ from competitors?

Palantir is building AI into the core architecture of its platform rather than bolting it on as a feature. This "AI-native" approach means AI is fundamental to how data flows through the system and how insights are generated. Competitors like Salesforce and Microsoft are adding AI features to existing products built on traditional architectures. This distinction matters because it affects how seamlessly AI works and how much competitive advantage it provides. Palantir's approach should create lasting advantages if executed successfully, but it also requires continuous innovation to maintain the lead.

What would cause Palantir's growth to decelerate significantly?

Potential causes include macroeconomic recession reducing enterprise IT spending, faster competitive response from tech giants, failure to maintain sales team hiring and retention at current pace, slower-than-expected adoption of AI in enterprise, customer implementation challenges slowing expansion deals, geopolitical tensions reducing government budget, or products not delivering promised value once scaled. While Palantir has execution advantages, none of these risks are trivial. Deceleration from 70% to 40% would be normal and healthy, but further deceleration to 20% range would signal structural problems.

The enterprise software industry has seen remarkable companies emerge, but few have achieved what Palantir is demonstrating right now. Whether this becomes one of the greatest software companies of all time depends on whether management can sustain execution at an exceptional level for years to come. The Q4 2025 numbers suggest they can.

Key Takeaways

- Palantir achieved 70% YoY revenue growth at $5.6B scale in Q4 2025, accelerating from 56% in 2025 and defying typical enterprise software deceleration patterns

- The company posted a Rule of 40 score of 127 (70% growth plus 57% adjusted operating margin), the highest ever recorded from an enterprise software company

- U.S. commercial revenue grew 137% YoY to $507M with customers expanding 4-5x in ACV within nine months, showing unprecedented expansion velocity

- Remaining Performance Obligations reached 11.2B in total deal value

- Net dollar retention hit 139%, meaning existing customers spend 39% more YoY, though this excludes the most explosive growth from recent customer acquisitions

Related Articles

- Tech Leaders Respond to ICE Actions in Minnesota [2025]

- Vercel v0: Solving the 90% Problem with AI-Generated Code in Production [2025]

- How Government AI Tools Are Screening Grants for DEI and Gender Ideology [2025]

- Enterprise AI Race: Multi-Model Strategy Reshapes Competition [2025]

- OpenAI vs Anthropic: Enterprise AI Model Adoption Trends [2025]

- Why The Trade Desk Stock Collapsed: SaaS Growth Lessons [2025]

![Palantir: The Enterprise Software Giant Redefining Growth [2025]](https://tryrunable.com/blog/palantir-the-enterprise-software-giant-redefining-growth-202/image-1-1770219570182.jpg)