Peak XV's $1.3B AI Bet: How India's VC War is Reshaping Global Tech

Introduction: The Moment India Became the VC Battleground

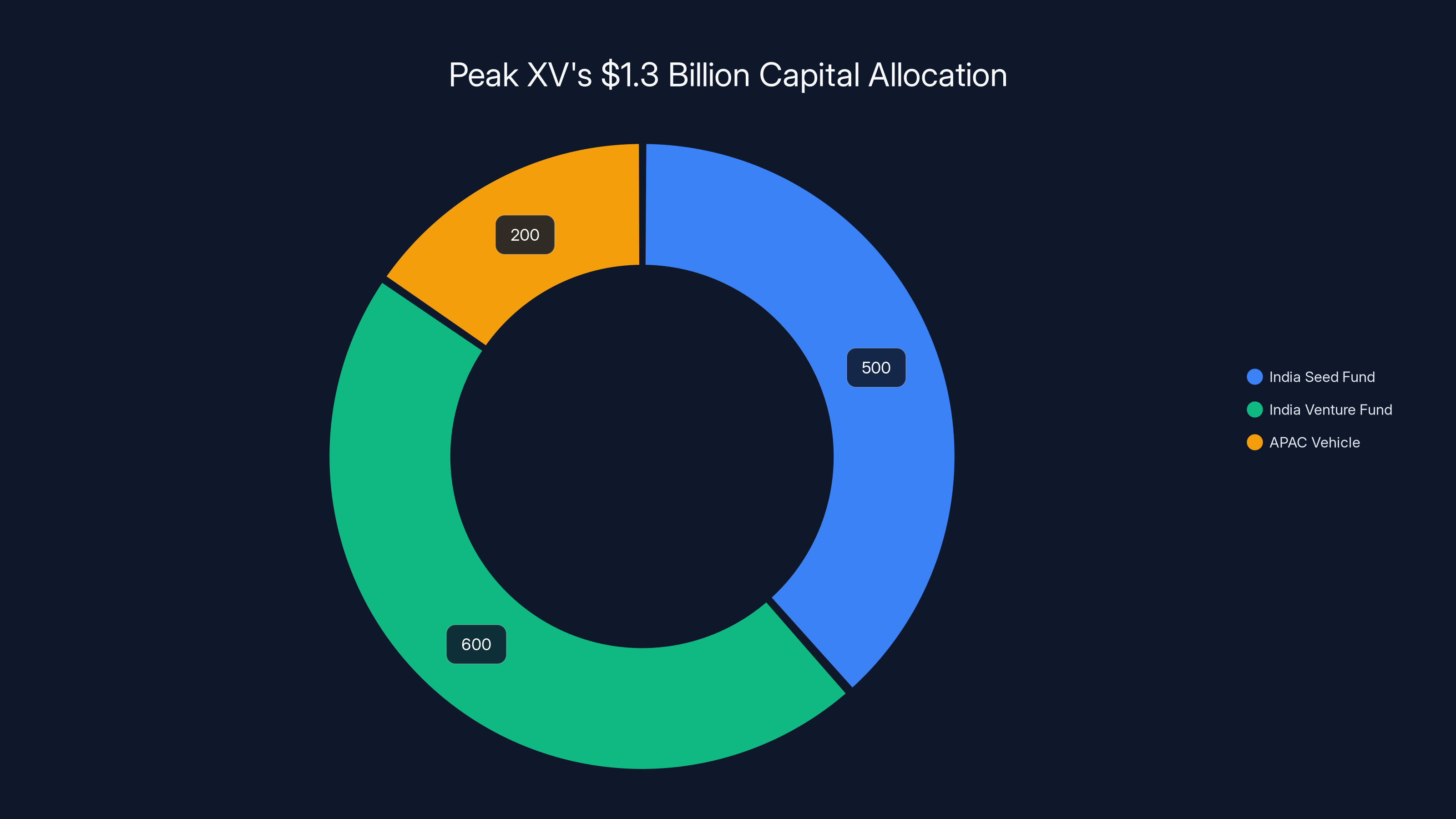

Something shifted in venture capital in early 2025. It wasn't just another fundraise announcement. When Peak XV closed $1.3 billion across its India and Asia-focused funds, it sent a signal that reverberated across Silicon Valley, Singapore, and beyond: India wasn't just an emerging market anymore—it was the prize. According to TechCrunch, this move is a strategic bet on India's burgeoning tech scene.

Peak XV now manages over

This isn't happening in isolation. General Catalyst announced plans to invest $5 billion in India over five years. Sequoia Capital, the firm Peak XV split from in 2023, continues aggressive expansion. Tiger Global has been quietly building. Every major global VC now has a dedicated India strategy. The competition for deals in the region has gone from hot to scorching.

What makes Peak XV's move significant is the why. The firm isn't chasing assets under management for the sake of it. Managing director Shailendra Singh was explicit about this: Peak XV is not trying to match rivals dollar-for-dollar. Instead, the firm is sizing funds based on where it sees genuine opportunity to deliver high-performing returns. In an era of capital abundance, that's a refreshing admission.

But here's what's actually happening beneath the surface. India is generating world-class founders at scale. The software talent is exceptional. The fintech opportunity is still in early innings—digital payments adoption, credit infrastructure, wealth management. AI applications are being built for Indian consumers and global markets simultaneously. For a VC firm, India represents the sweet spot: massive addressable market, founder quality, government support for tech, and geopolitical tailwinds.

The question isn't whether Peak XV's bet will pay off. The real question is what this arms race means for founders, the Indian tech ecosystem, and the future of venture capital itself. This article breaks down Peak XV's strategy, the competitive landscape, and what's actually happening beneath the headlines.

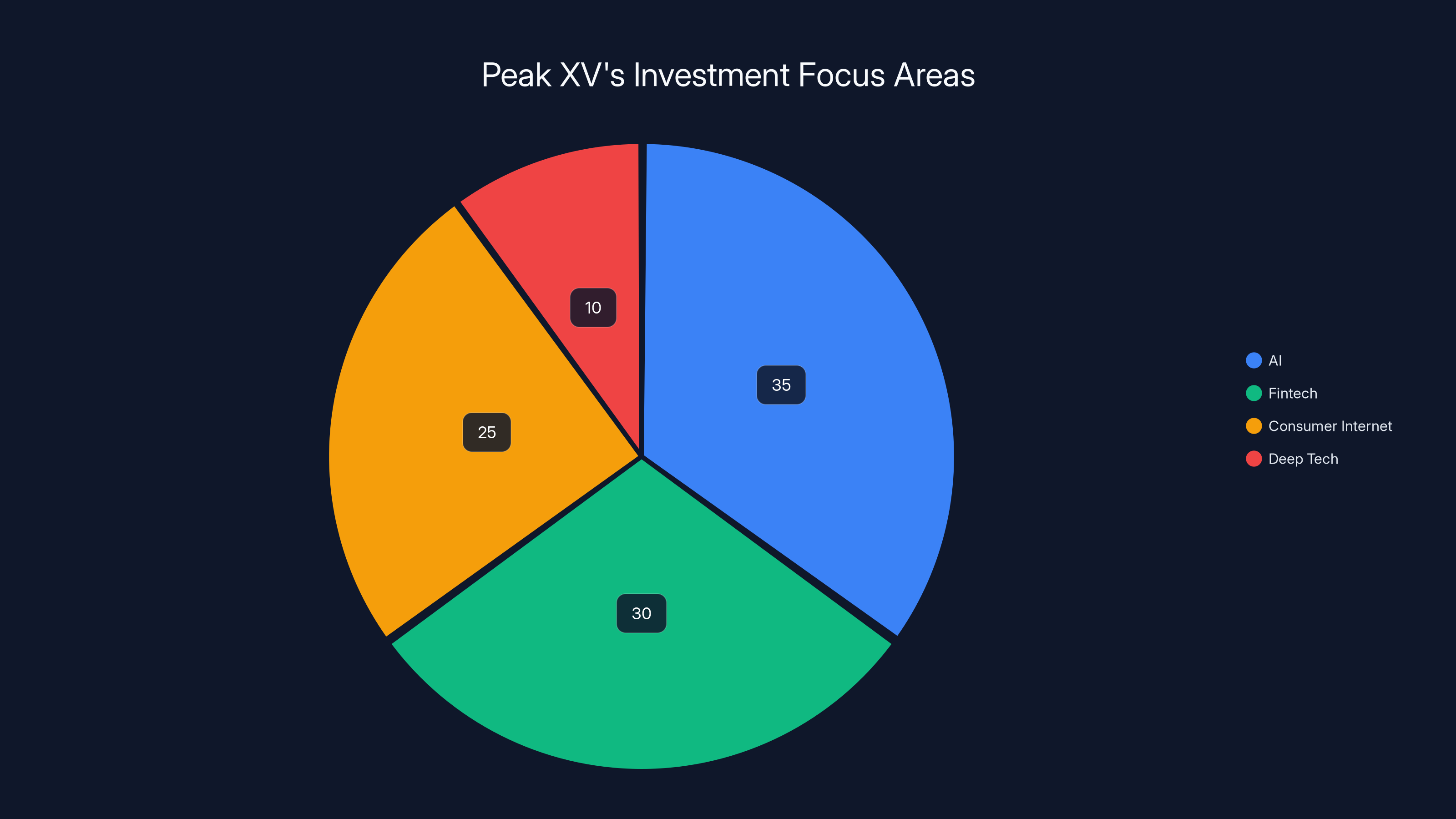

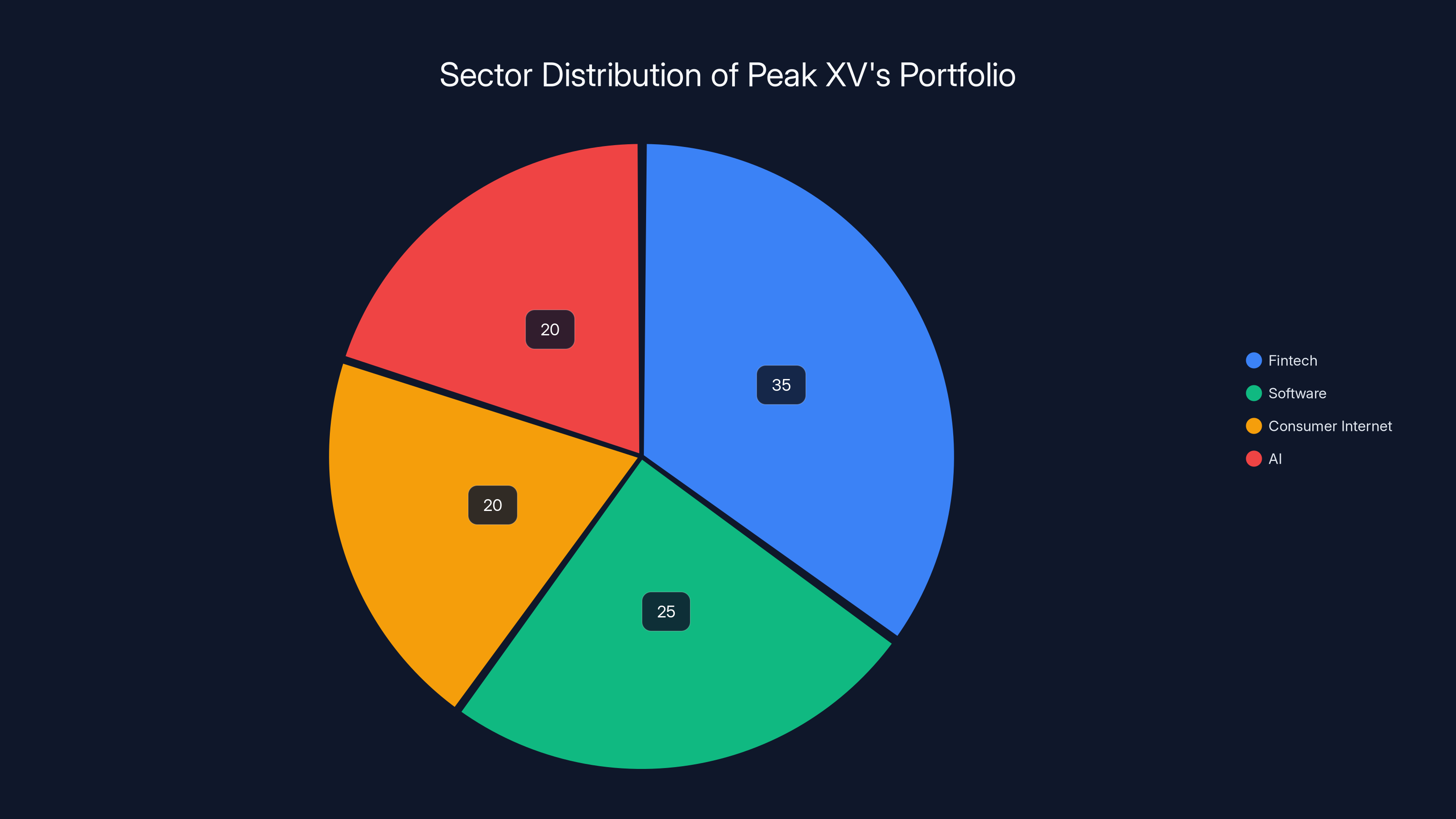

Peak XV is focusing its $1.3 billion raise primarily on AI (35%), fintech (30%), and consumer internet (25%), with a smaller portion (10%) on deep tech. Estimated data based on sector emphasis.

TL; DR

- Peak XV raised 10 billion

- Majority of capital targets India with deployment over the next 2-3 years, prioritizing AI, fintech, and consumer startups

- General Catalyst committed $5 billion to India over five years, signaling intensifying VC competition in the region

- Peak XV has 450+ portfolio companies spanning seed to growth stages, with 35 prior exits and $7 billion returned since inception

- The firm remains selective about U.S. expansion, positioning itself as an underdog focused on software, developer tools, and fintech where it has an edge

The $1.3 Billion Announcement: What Peak XV Actually Said

Let's start with the announcement itself, because the numbers tell a story, but the nuances matter more.

Peak XV raised $1.3 billion across multiple vehicles. The capital flows into three main buckets: its India seed fund, its India venture fund, and its broader APAC vehicle. The split is important. Peak XV isn't treating India as a single bet. The firm is building infrastructure across the investment funnel, from early-stage seed companies to later-stage growth investments. This strategic allocation was highlighted in Yahoo Finance.

The majority of this new capital is for India. That's the key detail. In global venture terms, India represents somewhere between 8-12% of worldwide VC activity by deal count, but that percentage is expanding rapidly. For Peak XV, India is becoming an outsized percentage of focus and capital deployment.

Shailendra Singh, managing director, provided the deployment timeline: two to three years. That's meaningful. It means the firm isn't trying to deploy $1.3 billion tomorrow. It's pacing capital based on deal flow, quality, and valuation discipline. In an overheated market, that constraint is actually a feature, not a bug.

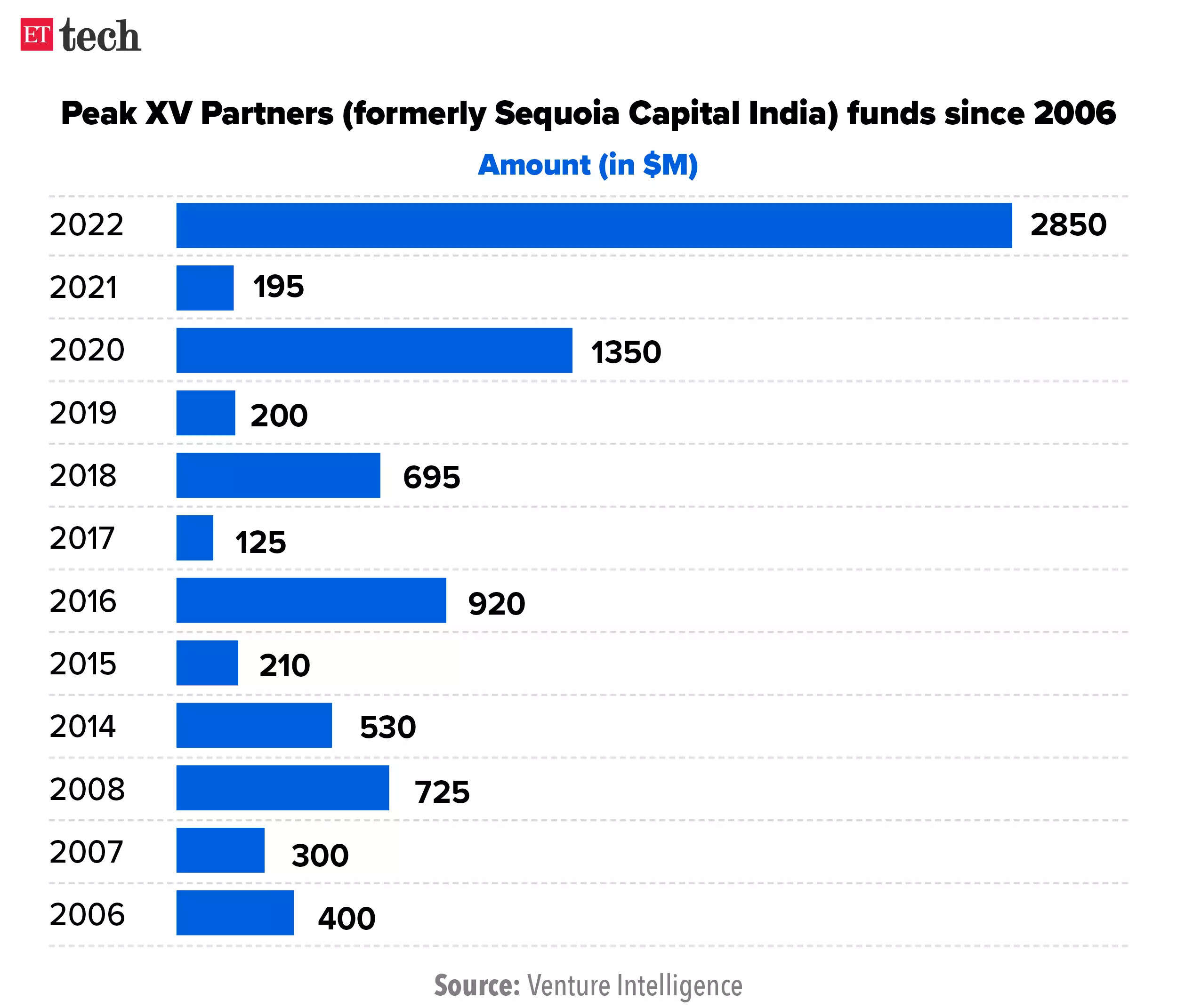

The fund sizing history also reveals discipline. Peak XV's prior fund closed at

Peak XV currently has no plans to raise a growth fund. The firm still has dry powder from the previous $2.4 billion fund that needs deployment. This is the opposite of how venture used to work—raise, deploy, raise again on the back of marked-up returns. Peak XV is saying: we'll raise when we need to, and only after we've proven the last fund worked.

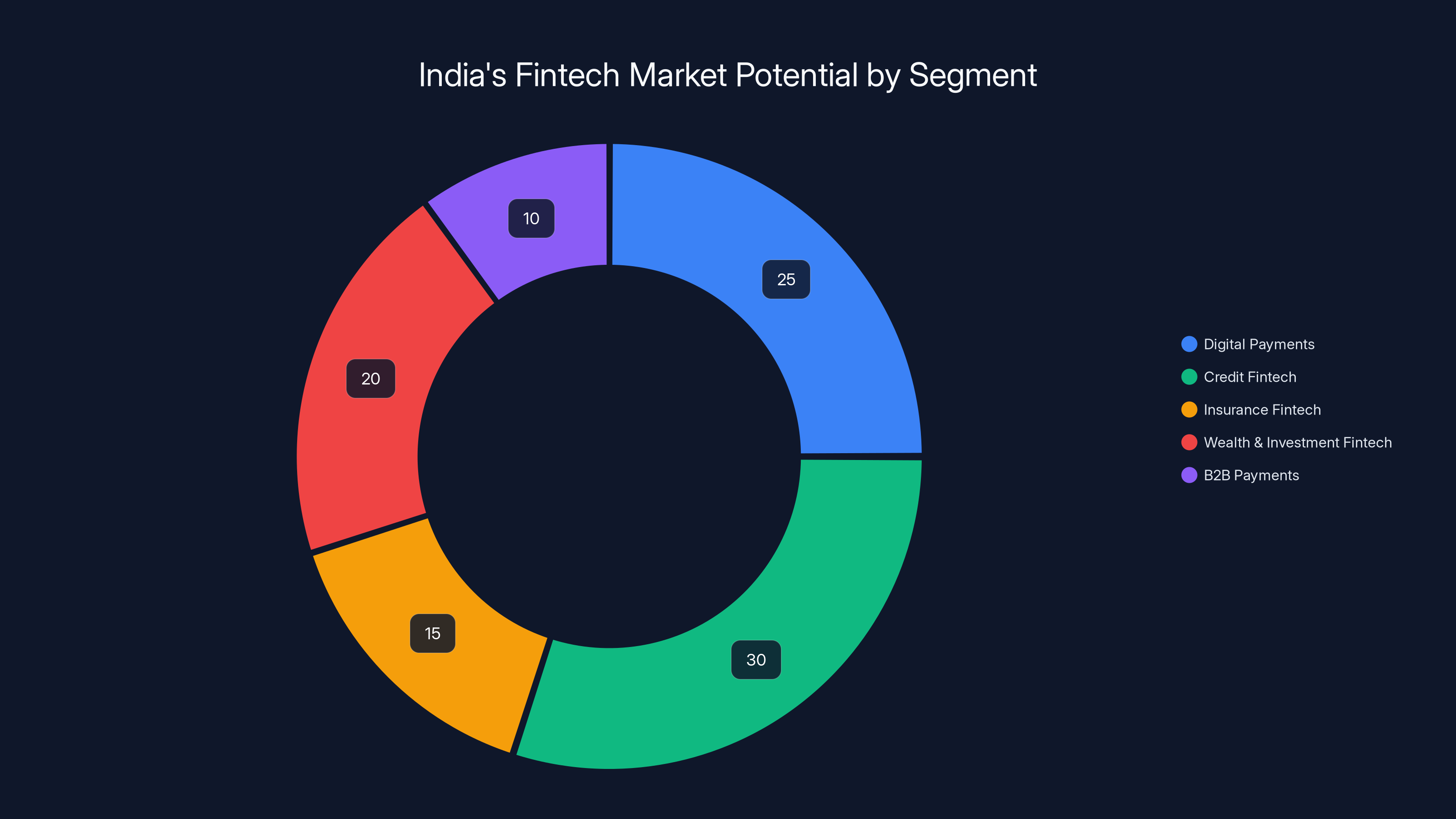

Digital payments lead the fintech market in India, but credit fintech holds the highest potential for growth, estimated at 30% of the market opportunity.

Context: How Peak XV Became Independent

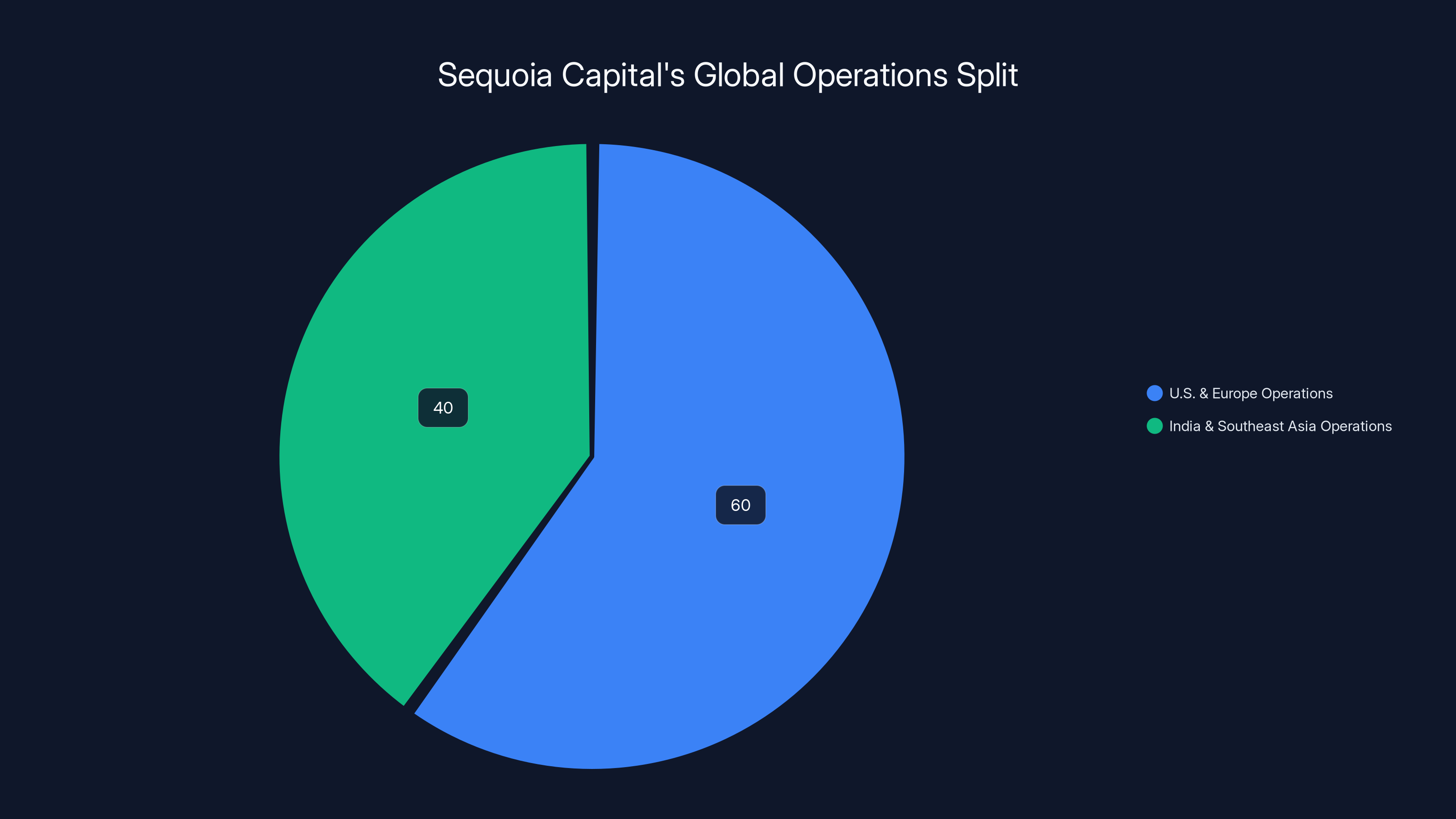

To understand Peak XV in 2025, you need to understand the 2023 split from Sequoia Capital. It wasn't a dramatic breakup. It was strategic separation.

Sequoia Capital has been one of the most successful venture firms in history. It backed Apple, Google, Airbnb, Instagram. But by the 2010s, it became clear that the firm had two fundamentally different business models colliding under one roof.

Sequoia's U.S. and Europe operations were primarily early-stage and growth-stage venture capital. The firm invested in companies raising Series A through Series D rounds, helping them scale to billion-dollar valuations. Sequoia also ran a late-stage fund for pre-IPO companies.

Sequoia's India operations, by contrast, were investing earlier. The firm was backing founders with minimal track records in a market that was still developing institutional infrastructure. The capital needs were different. The risk-return profile was different. The geopolitical considerations were different.

In 2023, Sequoia decided to spin out its India and Southeast Asia operations as an independent firm: Peak XV. This wasn't unique—other VCs have done similar splits. But the execution was significant. Peak XV would carry Sequoia's brand credibility while operating independently. This strategic move was detailed in The Arc Web.

The split gave Peak XV several advantages. First, it could raise funds specifically designed for India's opportunity, without competing for capital with Sequoia's U.S. flagship fund. Second, it could build a dedicated team that understood Indian markets, regulations, and founder dynamics. Third, it could move faster on decisions without coordination with a larger organization.

But it also created challenges. Peak XV had to build brand awareness independent of Sequoia. It had to attract LPs who wanted exposure to India specifically. It had to retain talent through transition. And it had to prove it could generate returns without Sequoia's operational support.

Five years later, this bet appears to be paying off. Peak XV is now independently fundraising, managing over $10 billion in AUM, and building a track record that stands on its own merit.

Peak XV's Portfolio: 450 Companies Across Three Continents

Numbers without context are meaningless. Let's look at what Peak XV actually owns and invests in.

The firm counts more than 450 portfolio companies across fintech, software, and consumer internet. These range from seed stage to growth stage. That's a wide net, and it's intentional. Peak XV isn't trying to specialize so narrowly that it misses opportunities.

The 35 public company exits are the headline. When a VC firm can point to 35 companies that went public, it's proof the model works. These aren't hypothetical returns. They're actual exits that returned capital to LPs.

The $7 billion in returned cash is the real proof point. That's not valuation on paper. That's actual cash that LPs received back. In venture, distributions are everything. A VC fund that generates massive returns on paper but can't distribute cash is failing its job.

But here's the nuance Singh provided: he declined to specify distributions since the firm's split from Sequoia Capital. That's actually smart. It allows Peak XV to build independent performance history without conflating pre-split and post-split returns.

The 80+ AI investments the firm has made to date are revealing. That's a meaningful portfolio concentration in AI without being reckless. The firm invested before the recent AI hype, which means some of those 80 were at reasonable valuations. Some likely have exceptional returns. Some are probably struggling.

What sectors drive the portfolio?

Fintech is the obvious one. India's financial inclusion story is still early. Digital payments have penetrated, but credit, insurance, wealth management, and B2B payments all have massive underpenetrated markets. Peak XV backed Razorpay (payments infrastructure), Slice (credit for young professionals), Navi (financial products). These solve real problems.

Software and developer tools are Peak XV's bread and butter. Indian developers are world-class but often underutilized by local companies. Global SaaS companies often lack local product expertise. This gap creates opportunities for India-based software teams to build for global markets. Peak XV has invested in this space heavily.

Consumer internet includes e-commerce, social, productivity, and lifestyle apps. India's smartphone penetration created a boom in consumer apps. Peak XV invested in some that succeeded (unlikely to disclose the failures) and some that failed. The portfolio is mature enough to have both.

Deep tech is emerging. This is long-dated, high-risk investing. Climate tech, biotech, advanced materials—areas where India has scientific talent and opportunity but limited VC infrastructure. Peak XV is positioning itself early.

The AI Focus: Why Peak XV is All-In

Singh explicitly said Peak XV expects to deploy the new capital primarily into AI, fintech, and consumer startups. The AI mention first isn't accidental.

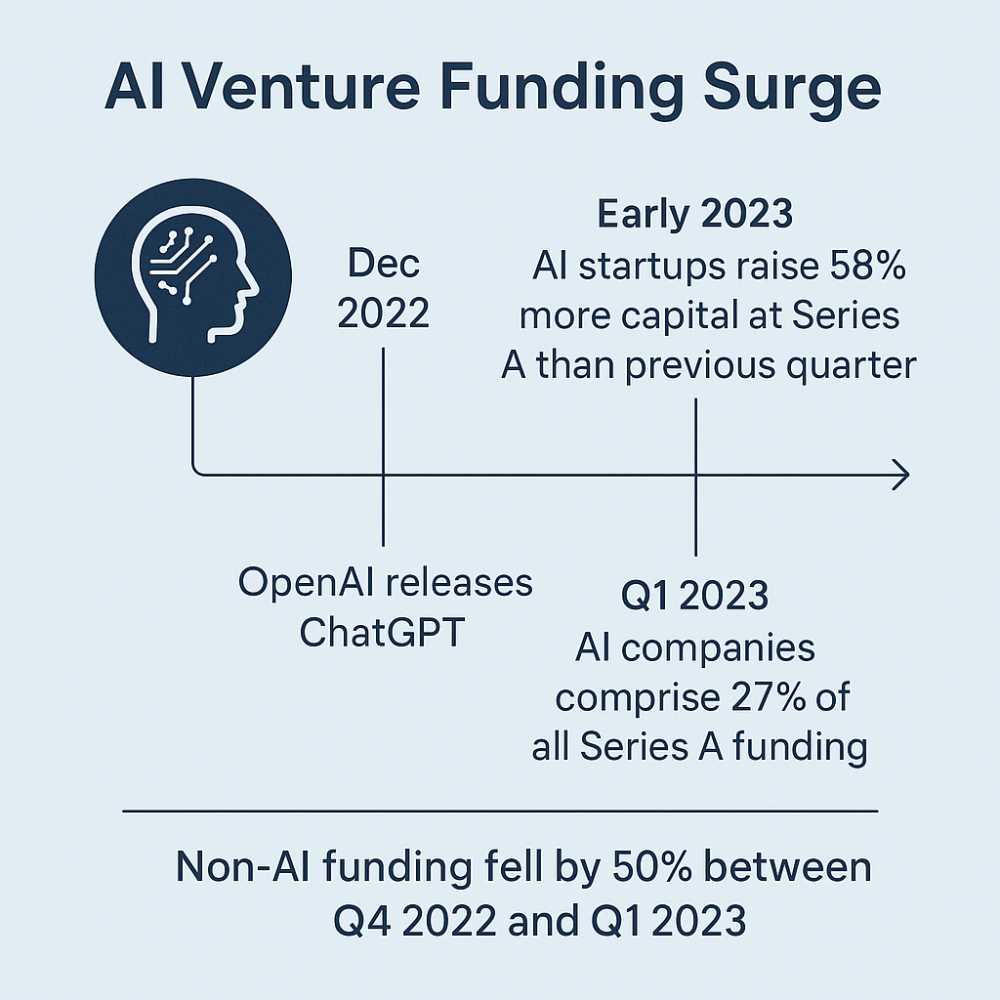

Artificial intelligence in 2025 isn't a speculative bet anymore. It's a reshaping force across every industry. For a VC firm, not having an explicit AI strategy is essentially saying "we don't understand where value is being created."

But Peak XV's AI focus is sophisticated. It's not just throwing money at "AI companies." The firm has made 80+ investments in AI startups. These likely span multiple categories:

AI for fintech might include companies building fraud detection, credit scoring, loan underwriting, or investment advisory. These are high-value problems in a high-value market.

AI for enterprise software could include SaaS companies adding AI features—analytics, automation, content generation. Every software company is asking "how do we add AI?" Peak XV is betting on the best implementers.

AI infrastructure and tools for developers might include model training platforms, inference optimization, or developer-friendly APIs. As AI gets mainstream, the infrastructure players often capture disproportionate value.

AI for consumer apps could include recommendation engines, personalization, or generative content. Consumer willingness to pay for AI is still uncertain, but the experimentation is happening.

Frontier AI models and research is unlikely for Peak XV given the capital requirements, but the firm might have small bets on promising researchers building toward next-generation models.

The distribution across these categories matters. A venture firm with 80 AI investments concentrated in one narrow vertical is exposed. A firm with 80 spread across multiple categories has more optionality.

India's advantage in AI is underestimated globally. The country has exceptional AI researchers and engineers. Labor costs are lower, making experimentation cheaper. The consumer base is large enough to test applications quickly. Regulatory environment is developing but not as restrictive as some alternatives. For building AI applications at scale and velocity, India is competitive.

Peak XV's $1.3 billion is primarily allocated to India-focused funds, with significant portions for seed and venture stages, reflecting strategic emphasis on India's growing market. (Estimated data)

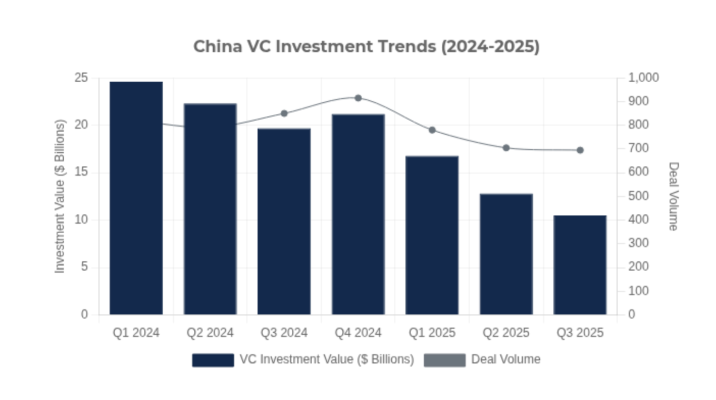

The Competition: Why Every Major VC Is Racing to India

Peak XV's $1.3 billion raise didn't happen in a vacuum. It happened at the exact moment global VCs were making India bets.

General Catalyst's $5 billion commitment is the highest-profile recent announcement. That's not just money. That's a signal that one of Silicon Valley's most respected growth stage VCs is going all-in on India for the next five years. General Catalyst has deep expertise in enterprise software and marketplace scaling. Applying that expertise to India's startups is a strategic move.

Sequoia Capital, Peak XV's former parent, continues aggressive expansion in India despite the spinout. The firm is competing against Peak XV for deals, which is awkward but also normal in VC—relationships matter more than formal ownership.

Tiger Global has been building India presence quietly. Tiger is known for moving fast on follow-on funding and for having deep pockets. In a frothy market, that's a significant advantage.

Accel, Insight Partners, Andreessen Horowitz—every major global VC has some India exposure. The FOMO is real. Every fund board is asking "what's our India strategy?" Missing an exceptional Indian startup that becomes a unicorn is expensive reputation-wise.

Why is India suddenly the VC battleground?

Market size: India has 450+ million internet users and growing. The TAM for consumer and fintech products is enormous. This is not a niche market.

Founder quality: Indian entrepreneurs are increasingly returning from the U.S. with experience, networks, and capital. First-time founders are also emerging from strong engineering backgrounds. The talent pipeline is exceptional.

Geopolitical winds: The U.S.-India technology relationship is strengthening. India is positioning itself as a tech power independent of China. Western countries see India as a geopolitical ally. Tech investment is part of that alliance-building.

Exit landscape: India's IPO market is maturing. Domestic M&A is happening at scale. Companies that would have needed to exit to the U.S. a decade ago can now exit domestically. This creates better returns for investors.

Regulatory clarity: India's startup regulations have improved. Regulations around startups, foreign investment, and data localization are becoming clearer. This reduces uncertainty relative to a decade ago.

The competition is fierce, though. If every major VC is in India, valuations rise. Returns fall. Deals get harder to source before competitors learn about them. The advantage goes to firms that have existing relationships, deep local knowledge, and the ability to move fast.

Peak XV has all three. The firm has 30+ full-time investors, with about a dozen leading investments. That's the muscle needed to source deals, diligence, and support portfolio companies in a competitive market.

Singh's Leadership and the Recent Departures

Venture capital is personal. Funds succeed or fail based on the quality of the people making decisions. Peak XV's recent personnel changes matter.

The firm saw departures of senior partners including Ashish Agrawal and investors Ishaan Mittal and Tejeshwi Sharma. These weren't mid-level employees. These were decision-makers on investment committees, deal sourcing leads, and potentially investors who had strong networks in specific sectors.

When key people leave a VC firm, it raises questions. Are they going to start a competing fund? Are they joining another firm? Did disagreements about strategy force them out? Are they just moving on to different chapters?

Singh addressed this directly, noting that five of Peak XV's seven managing partners have been with the firm for more than a decade. That's significant. It means the core leadership is stable and has been through market cycles together. They've seen unicorns emerge and failed bets. They have perspective.

Singh himself has been with Peak XV (and Sequoia India before that) for years. He's not a newcomer being installed to manage a turnaround. He's the institutional continuity.

The broader team of 30+ full-time investors, with a dozen leading investments, is more important than the handful of departures. A 12-person departure team at a 42-person investor shop would be a crisis. A handful of departures from a larger organization is churn, which happens in every firm.

The real test will be whether Peak XV continues to generate exceptional returns with these departures. If the firm's performance accelerates, the departures become irrelevant anecdotes. If performance slips, they become explanatory signals.

Strategy in the U.S.: Playing Underdog in a Crowded Market

Singh said something revealing about Peak XV's approach to the U.S. market: "In the U.S. market, we are an underdog—and that's great."

This is honest. Peak XV doesn't have the brand recognition of Sequoia, Andreessen Horowitz, or Lightspeed in the U.S. market. It doesn't have the existing LPs that would naturally funnel deal flow. It's building from a position of relative disadvantage.

But Singh reframed this as an advantage. Being an underdog means the firm can specialize, focus, and win where competitors aren't looking. Peak XV is focusing on areas where its experience gives it an edge: software, developer tools, and fintech.

This is smart strategy. If Peak XV tried to compete head-to-head with Andreessen Horowitz across all verticals, it would lose. Every founder in the world would rather have Andreessen's $5.5 billion fund committed than Peak XV's capital, all else equal. So Peak XV doesn't compete on that basis.

Instead, Peak XV can say: "We know fintech infrastructure better than most. We've invested in Razorpay, Wise, and other fintech companies at scale. We can add strategic value specific to fintech." Or: "We understand developer tools because we've built the ecosystem in India. We can help U.S. developer tool companies penetrate emerging markets."

This is specialty investing, not generalist investing. It's more defensible.

But Singh also said Peak XV is selective about where it competes in the U.S. It's not trying to be everywhere. It's choosing specific verticals and geographies where the firm has structural advantage.

This disciplined approach should drive better returns than a strategy of trying to compete everywhere and ending up nowhere.

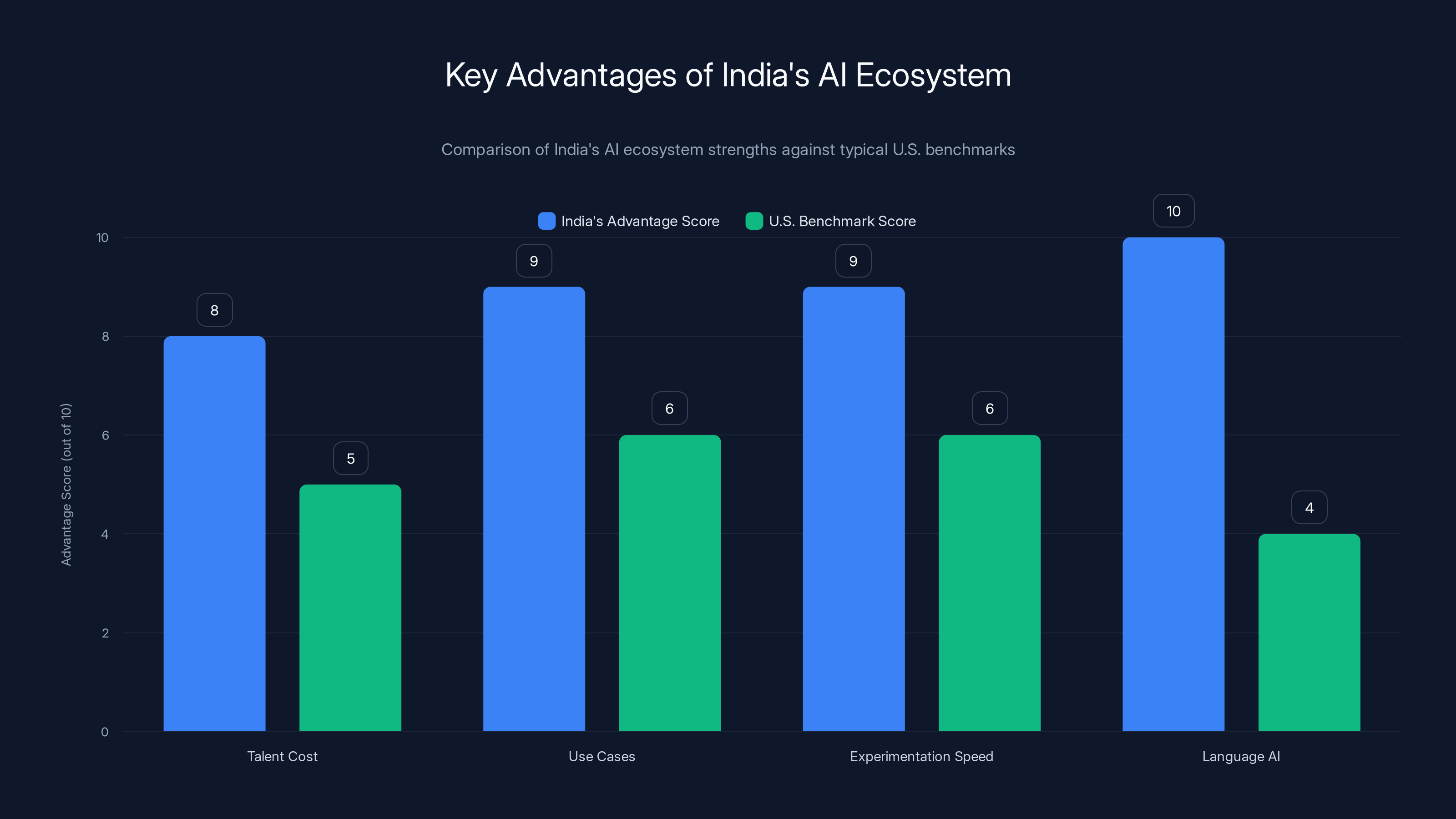

India's AI ecosystem excels in talent cost, diverse use cases, rapid experimentation, and multilingual AI capabilities compared to typical U.S. benchmarks. Estimated data.

The Fintech Opportunity: Still Early Innings

Fintech is one of Peak XV's three deployment focus areas. For India specifically, this deserves deeper analysis because the opportunity is genuinely exceptional.

India's fintech market is in an early phase relative to its potential. Yes, digital payments have penetrated significantly. Apps like Google Pay and PhonePe have made digital payments nearly ubiquitous for urban consumers. But that's just the foundation.

Credit fintech is still nascent. In the U.S., credit has been institutionalized and digitized for decades. FICO scores, credit bureaus, and automated lending infrastructure exist. In India, much of the population is still underbanked. There's no national credit bureau covering informal workers. Lending is manual, expensive, and inaccessible for millions.

A company that can build credit infrastructure for India—using mobile signals, transaction history, and AI credit scoring—addresses a market worth hundreds of billions of dollars. Peak XV has invested in companies doing this.

Insurance fintech is similarly underpenetrated. In developed markets, insurance is bundled and automated. In India, insurance distribution is still dominated by agents and brokers. Digital insurance for health, life, and property is growing but is a fraction of potential TAM.

Wealth and investment fintech is accelerating as India's middle class grows. Wealthfront-style automated investing, robo-advisors, and systematic investment plans are growing rapidly. But the market is still dominated by traditional wealth advisors.

B2B payments and working capital fintech is emerging. Indian SMEs struggle with cash flow. A company that can provide automated payables, receivables, and supply chain financing solves genuine cash flow problems.

Each of these verticals represents a multi-billion dollar opportunity in a single market. Peak XV's fintech exposure gives it optionality across multiple segments.

Cross-Border Tech: The Global-Local Hybrid

Singh mentioned that "U.S.-India ties are becoming increasingly important as more founders in the region build for global markets."

This is profound and often misunderstood. The narrative about India is usually "India is a big domestic market." That's true, but incomplete.

The real opportunity is companies building in India for the global market, specifically leveraging India-based talent and cost structures.

This happened in the 2000s with outsourcing and IT services. Wipro, TCS, Infosys—Indian companies dominated global outsourcing because they could deliver expertise at scale, cost-effectively. The model created hundreds of billions in value.

But today's cross-border opportunity is different. It's not outsourcing. It's product innovation. A founder in India can build a SaaS product, a developer tool, or a mobile app with exceptional engineers and at low burn rate. Then that company can be sold globally, competing against U.S.-based competitors.

The examples exist. Freshworks (now public) started in India, built a world-class CRM, and competes globally. Razorpay started in India, built payment infrastructure, and now serves companies across Asia. Postman (API development platform) was partially built in India.

This model has several advantages:

Cost arbitrage: Building a company in India with full-time engineers costs 40-50% of what it costs in San Francisco or New York. This extends runway, reduces dilution, and creates more time to find product-market fit.

Talent access: India has more software engineers than any country except the U.S. Quality engineers are abundant. Finding 100 exceptional engineers in Bangalore is easier than in San Francisco.

Global perspective: Indian founders increasingly have global networks. Many have worked at U.S. tech companies. They understand global markets, not just Indian markets. They build products with global scale in mind from day one.

No local market excuse: A company building in India can't succeed by relying on local market network effects. They're forced to build products that work globally because the network effects don't exist locally for many software categories.

Peak XV is positioned well to fund these cross-border companies. The firm has India relationships and capital. It's building U.S. presence. This is perfect for a company that starts in India but wants to scale globally.

The Deployment Timeline: Two to Three Years

Peak XV said it expects to deploy the new $1.3 billion over the next two to three years. Let's think about what that means.

In a frothy market, a VC firm might deploy capital over 18 months. The fund is raised, capital is deployed quickly, and the fund moves to follow-on rounds to support winners.

Peak XV's two to three year timeline is longer. This reflects several things. First, the firm is being disciplined about pace. It's not forcing capital out into mediocre deals just to hit deployment targets. Second, the firm expects to have enough deal flow that it can be selective and spread deployment over time. Third, the firm might be managing down-market sentiment expectations—acknowledging that frothy valuations might settle, and there's no rush to deploy at peaks.

For a

The deployment timeline also affects returns. Money deployed in 2025 at current valuations will be marked differently than money deployed in 2027 if valuations compress. The firm's willingness to be patient suggests confidence that valuations will be reasonable throughout the deployment period.

In 2023, Sequoia Capital strategically separated its operations, with 40% focusing on India and Southeast Asia under the new entity, Peak XV, to better align with regional market dynamics. Estimated data.

How Peak XV Compares to Sequoia and Other Rivals

Peak XV exists because Sequoia recognized India needed its own focused strategy. But Sequoia didn't exit India. It still invests there, which creates interesting dynamics.

In terms of pure scale, Sequoia's main fund is larger than Peak XV's entire AUM. Sequoia has

But in terms of India focus, Peak XV is more focused. Sequoia capital can flow to India, but it can also flow to the U.S., Europe, or anywhere else. Peak XV's capital is primarily for India and Asia. This focus advantage matters.

Compare to other competitors:

General Catalyst announced

Tiger Global has India exposure but is primarily a follow-on funding machine. The firm makes large bets on winners and scales them. Peak XV plays more in early-stage sourcing and development.

Accel and other established VCs have India programs, but these are often one of many regional strategies. There's less focus intensity.

Peak XV's advantage is focus and infrastructure. The firm has built operational expertise specific to India. It has the network, the investors, and the portfolio density to move quickly and effectively.

The test will be returns. On the metrics that matter—multiple on invested capital, internal rates of return, and distributions—Peak XV's performance will speak louder than announcements.

The Return Profile: $7 Billion Distributed

Singh shared that Peak XV has returned $7 billion in cash to investors since inception. That's a significant number. Let's understand what it means.

If Peak XV has returned

But $7 billion in distributions suggests multiple large exits. With 35 public companies, the firm has had IPOs that returned meaningful value. The firm likely also exited some companies to strategic acquirers.

Singh declined to break out distributions since the spinoff from Sequoia Capital. This is smart. It allows Peak XV to have its own return narrative separate from Sequoia's pre-spinoff performance.

What matters going forward is whether Peak XV can generate comparable returns on its standalone funds. If the firm can return 3-5x capital deployed, it will be considered successful. If it returns 1-2x, it will be considered below peer benchmarks.

The $2.4 billion fund from 2021 will be the first real test case for Peak XV's standalone performance.

Why India's AI Ecosystem Matters More Than You Think

When Singh said Peak XV expects to deploy primarily into AI, he's betting on something specific: India's ability to build AI products at global scale.

India isn't the U.S., which leads in frontier AI models. OpenAI, Anthropic, Google DeepMind—the frontier labs are overwhelmingly U.S.-based. This is partly due to capital concentration, partly due to historical AI research dominance, partly due to geopolitics.

But India's advantage is application-layer AI. This is where the venture opportunity actually lives.

Frontier models (GPT-5, Claude 4, etc.) require hundreds of billions in capital and will be built by the richest companies and research labs. But applications built on those models—products that solve specific problems for Indian or global customers—can be built by well-funded startups.

India has exceptional advantages for application-layer AI:

Talent: AI engineers in India are world-class and abundant. The cost is 40-50% of U.S. costs. A startup can hire 50 exceptional AI engineers for the same cost as hiring 25 in San Francisco.

Use cases: India's massive population generates endless use cases. Building customer service AI, content moderation AI, recommendation systems, predictive analytics—you can test products on 1.4 billion people.

Speed: Because labor is cheaper, startups can experiment faster. Try 10 different AI features in a month. Measure what works. Scale it. The velocity is higher than in more expensive markets.

Language AI: India is multilingual at scale. Building AI that works in Hindi, Tamil, Telugu, Bengali, and English solves problems for billions of people. U.S.-based companies often lack this focus.

Peak XV's $1.3 billion with explicit AI focus is betting that application-layer AI built in India will capture exceptional value over the next 5-10 years.

Fintech leads Peak XV's portfolio with an estimated 35% share, followed by Software and Consumer Internet. AI investments account for about 20%, reflecting strategic focus.

Geopolitics: The Elephant in the Room

No discussion of India's tech opportunity is complete without acknowledging geopolitics. It's not the main driver, but it's a tailwind.

The U.S. and India's technology relationship has deepened significantly. India is increasingly seen as a geopolitical counterweight to China. Western countries benefit from India developing world-class tech expertise and companies.

This creates indirect benefits for venture capital in India. Government support for tech entrepreneurship. Tax incentives for startups. Regulatory clarity around data and AI. These aren't accidental. They're strategic.

Singh mentioned "U.S.-India ties are becoming increasingly important." This is partly business-to-business ties (founders building for both markets, VCs funding cross-border companies). But it's also nation-state level alignment.

For entrepreneurs and VCs, this geopolitical alignment is favorable. It reduces regulatory uncertainty and creates government support.

What This Means for Founders and Startups

All this VC capital racing into India has direct consequences for founders. More money available is good and bad.

Good: Founders have more options. A company that couldn't get funded because one VC was full can pitch to multiple other VCs now. Series A terms improve when capital is abundant.

Bad: Valuations inflate. Founders demanding higher prices for equivalent equity is normal when capital is abundant. Burn rate expectations increase. Standards for what constitutes "traction" change.

For a founder building in India in 2025:

- More capital available means easier fundraising if you have traction

- Higher competition for capital means better terms if you're exceptional, tougher terms if you're mediocre

- More investors in India means more choice but also more noise

- Fintech and AI focus means advantages if you're building in those spaces, less attention to other verticals

The specific advantage of Peak XV's focus is that the firm has committed capital specifically for Indian startups. Founders building in India know Peak XV has dry powder and is actively deploying it. That's valuable information.

The Fund Sizing Discipline: Why Less Is Sometimes More

Peak XV reduced its prior fund from

In venture capital, there's a correlation between fund size and returns. Larger funds invest in larger rounds and later-stage companies, which have lower return potential but more certainty. Smaller funds invest in smaller rounds and earlier-stage companies, which have higher return potential but more risk.

But beyond a certain size, larger funds underperform due to capital concentration issues. A general partner has limited time. A $5 billion fund needs to find enough good investments to justify its size. Sometimes that means making mediocre investments just to deploy capital.

Peak XV's willingness to right-size its prior fund to match deployment pace suggests the firm prioritizes returns over AUM growth. This is admirable but uncommon in venture capital, where AUM size drives management fees and prestige.

Singh's explicit statement that Peak XV is not trying to maximize AUM reinforces this. The firm will raise when it has deployed the prior fund and has more opportunity than capital can cover.

The Competitive Dynamics: Whose Going to Win?

With every major VC fighting for India deals, the question becomes: who will generate the best returns?

Historically, venture returns are driven by a few factors:

Sourcing quality (finding the best founders before competitors) Due diligence quality (understanding founder quality and market opportunity) Support quality (helping portfolio companies succeed) Discipline (not overpaying, managing down-rounds)

Peak XV has advantages in sourcing and support. The firm has deep networks in India and operator expertise in the sectors it focuses on (fintech, software, AI).

General Catalyst has advantages in support. The firm has exceptional network and experience helping growth-stage companies scale.

Sequoia has advantages in brand. Every founder wants Sequoia involved, which is a self-fulfilling prophecy.

Tiger Global has advantages in speed. The firm can move fast and deploy capital quickly.

No single firm has all advantages. The winner will likely be the firm that gets the highest hit rate on its portfolio (the percentage of investments that return >3x). That's determined by execution, not capital size.

What Happens Next: Timeline and Expectations

Over the next two to three years, watch these signals:

Portfolio company announcements: Peak XV will announce new investments regularly. The quality and stage of these announcements will signal whether the firm is finding great deals or settling for mediocre ones.

Follow-on financing: When Peak XV portfolio companies raise Series B, Series C, and later rounds, watch whether they're raising at higher or lower valuations. This signals whether Peak XV made good picks.

Exits and IPOs: Track public offerings and acquisitions of Peak XV portfolio companies. Each exit provides data about returns.

Fund performance disclosures: In 2-3 years, LP updates will come out. These will show fund multiples and distributions. They're the real scorecard.

Competitive response: Watch how Sequoia, General Catalyst, Tiger, and others respond to Peak XV's successes or failures.

The next 36 months will determine whether Peak XV's $1.3 billion raise was prescient or just raising capital at the peak of India's startup hype.

FAQ

What exactly is Peak XV and how did it start?

Peak XV is an independent venture capital firm managing over

Why is India becoming the VC battleground in 2025?

India represents an exceptional venture opportunity due to several converging factors: a massive addressable market of 1.4+ billion people, world-class founder quality and engineering talent, regulatory clarity around startup policy, strong U.S.-India geopolitical alignment, and exceptional growth potential in underpenetrated verticals like fintech, software, and AI. Global VCs including General Catalyst, Sequoia, and Tiger Global are all significantly increasing India commitments, signaling that the market has matured from emerging opportunity to essential inclusion in every major fund's strategy.

What sectors is Peak XV focusing on with its $1.3 billion raise?

Peak XV is deploying the new capital primarily into three areas: AI across fintech, enterprise software, developer tools, and consumer applications; fintech including lending, insurance, payments, and working capital solutions; and consumer internet startups. The firm also sees emerging opportunities in deep tech sectors like climate technology and biotech. The majority of the capital will be deployed to Indian startups over the next two to three years, reflecting a disciplined approach to capital deployment.

How does Peak XV compare to competitors like Sequoia and General Catalyst?

Peak XV's key advantages are specialized India focus, deep local networks, and operator expertise in fintech and software sectors. Sequoia has larger total AUM (

What does Peak XV's fund sizing discipline tell us about their strategy?

Peak XV reduced its prior fund from

What are the recent leadership changes at Peak XV and what do they mean?

Peak XV experienced departures of senior partner Ashish Agrawal and investors Ishaan Mittal and Tejeshwi Sharma. However, Singh noted that five of the firm's seven managing partners have been with Peak XV for more than a decade, indicating stable core leadership. The broader team of 30+ investors with a dozen leading investments provides sufficient capacity to manage the new $1.3 billion fund. The departures appear to be normal VC churn rather than institutional instability signals.

How is India positioned for AI innovation and why does Peak XV believe AI will drive returns?

India has exceptional advantages for application-layer AI: abundant world-class AI engineers at 40-50% of Silicon Valley costs, a massive population generating diverse use cases for testing AI products, natural multilinguality enabling AI solutions for billions of non-English speakers, and government support for tech innovation. Peak XV has made 80+ AI investments to date and expects AI companies built in India will capture significant value over the next 5-10 years, particularly as founders leverage India-based talent and cost structures to build products for global markets.

What does deployment over "two to three years" actually mean for investors and founders?

Deploying over 24-36 months rather than 12-18 months indicates Peak XV is being disciplined about pace and valuation timing. It allows the firm to deploy capital selectively without forcing investments into mediocre opportunities just to hit deployment targets. For founders, this means consistent funding availability throughout the period as Peak XV maintains regular deployment pace, but also means the firm will be highly selective about which companies receive capital—quality matters more than filling deployment targets.

What is the fintech opportunity Peak XV sees in India?

India's fintech market is still early-stage relative to developed markets. Major underpenetrated opportunities include credit fintech for underbanked populations, insurance digitization, wealth and investment fintech for growing middle class, and B2B payments and working capital solutions for SMEs. The total addressable market across these segments is worth hundreds of billions of dollars, with growth rates of 30-40% annually in categories like digital lending. Peak XV's portfolio includes players across these segments positioned to capture significant value.

How is India's cross-border tech opportunity creating venture value?

The cross-border opportunity involves startups building in India with exceptional local talent at lower burn rates, then scaling globally by leveraging India's engineering advantage. Companies like Freshworks and Razorpay demonstrate this model's viability. Advantages include 40-50% cost arbitrage versus San Francisco, access to abundant high-quality engineering talent, global founder networks, and forced product discipline by needing to compete globally from inception rather than relying on local market network effects. Peak XV is well-positioned to fund these cross-border companies given both India base and developing U.S. presence.

Conclusion: The Biggest Bet on India's Tech Future

Peak XV's $1.3 billion raise and commitment to deploy it over two to three years is more than a fundraising announcement. It's a declaration that India's tech opportunity has matured and that the global venture capital community is recognizing it.

Shailendra Singh's statement that Peak XV isn't trying to match rivals dollar-for-dollar while maintaining focus on generating high returns is the most important part of the story. In an era when venture capital often prioritizes capital raising over capital discipline, Peak XV is taking the opposite approach. The firm is sizing funds based on real opportunity, deploying capital selectively, and measuring success by returns rather than AUM growth.

The competitive landscape is intense. General Catalyst's $5 billion commitment, Sequoia's continued aggressiveness, and Tiger Global's scale all create pressure. But Peak XV's advantages—deep India networks, investor bench strength, focused sector expertise, and startup ecosystem infrastructure—are genuine.

For founders, the $1.3 billion is meaningful because it's dry powder specifically allocated for Indian startups. The competition for deals is fierce, which benefits exceptional founders with traction. Founders building in fintech, AI, or software have particular tailwinds.

For the Indian tech ecosystem, this capital signals something beyond money. It signals that India has arrived as a major tech power, that the foundation for decades of value creation is being built, and that the next generation of global technology companies will be shaped by Indian entrepreneurs and engineers.

The next two to three years will determine whether Peak XV's bet was prescient or just capital raised at the market peak. But the fact that one of the world's most respected venture firms is committing $1.3 billion, with the expectation to deploy it carefully, suggests Peak XV sees something real.

That something is India's ability to generate world-class technology companies that solve problems for billions of people globally. Peak XV isn't betting on India because capital is abundant. It's betting on India because the fundamentals—talent, market size, opportunity, and founder quality—support exceptional returns.

That's a bet worth watching.

Key Takeaways

- Peak XV's $1.3B raise prioritizes returns over AUM growth, deploying capital selectively over 2-3 years rather than rushing to maximize assets

- India's venture landscape has intensified with General Catalyst's $5B commitment, Sequoia's continued presence, and Tiger Global's involvement—creating fierce competition for deals

- Peak XV's 450+ portfolio companies and $7B in distributions demonstrate the firm can generate exceptional returns despite being younger and smaller than legacy competitors

- Fintech remains massively underpenetrated in India across lending, insurance, wealth, and B2B payments—representing hundreds of billions in TAM for venture-backed companies

- Cross-border tech built in India for global markets represents a genuine arbitrage opportunity combining cost advantages, talent access, and global founder networks

Related Articles

- The OpenAI Mafia: 18 Startups Founded by Alumni [2025]

- General Catalyst's $5B India Bet: What It Means for AI & Startups [2025]

- Mirai's On-Device AI Inference Engine: The Future of Edge Computing [2025]

- Gay Tech Mafia: Silicon Valley's Networks, Power, and Influence [2025]

- Sarvam AI's Open-Source Models Challenge US Dominance [2025]

- India's $200B AI Infrastructure Push: What's Really Happening [2025]

![Peak XV's $1.3B AI Bet: How India's VC War is Reshaping Global Tech [2025]](https://tryrunable.com/blog/peak-xv-s-1-3b-ai-bet-how-india-s-vc-war-is-reshaping-global/image-1-1771601952183.jpg)