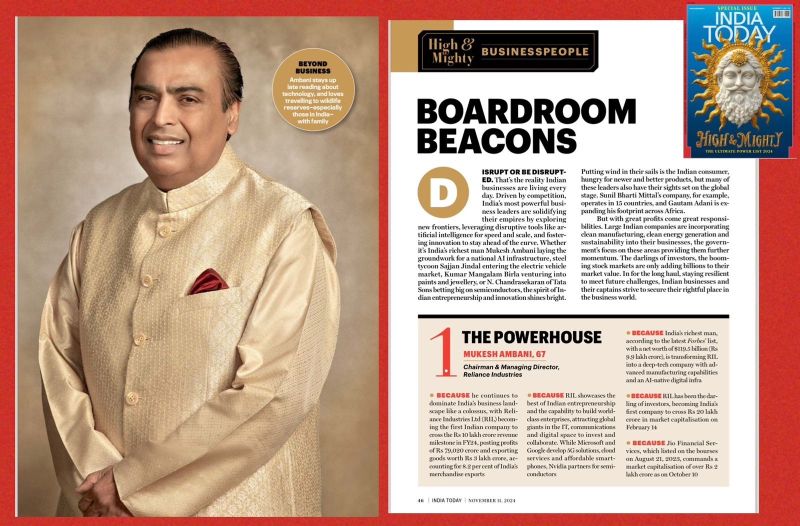

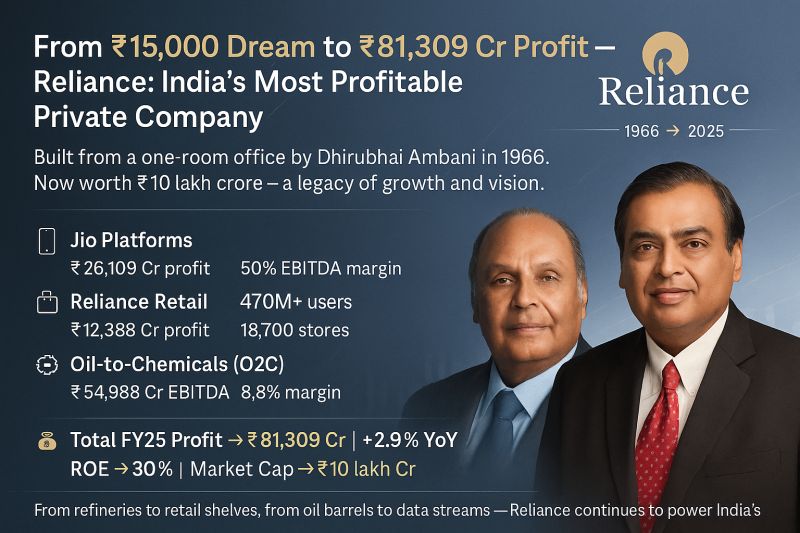

India's AI Moment: Why Reliance's $110B Bet Matters

Last week, something quiet but seismic happened in New Delhi. Mukesh Ambani, the billionaire chair of Reliance Industries, stood up and told India that the country couldn't keep "renting intelligence" from overseas tech giants. He announced a ₹10 trillion (roughly $110 billion) plan to build artificial intelligence infrastructure across India over the next seven years. Not a splashy app launch. Not a viral marketing campaign. Something far more fundamental: the physical foundation for an entire nation's AI ecosystem. According to Business Standard, this investment is a strategic move to position India as a leader in AI infrastructure.

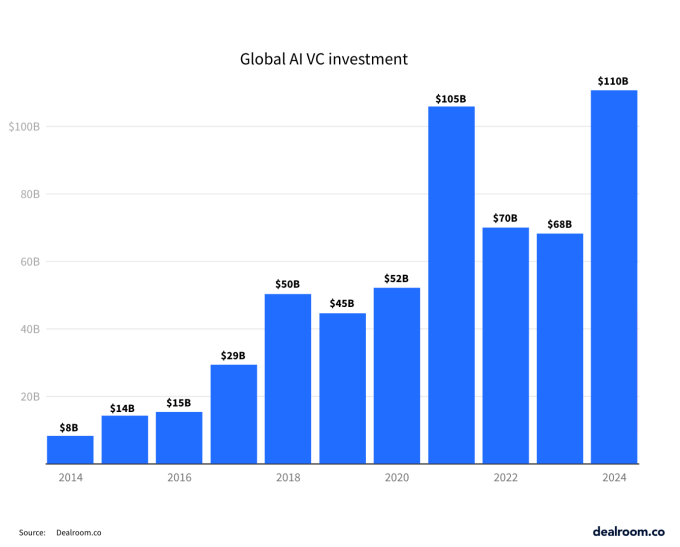

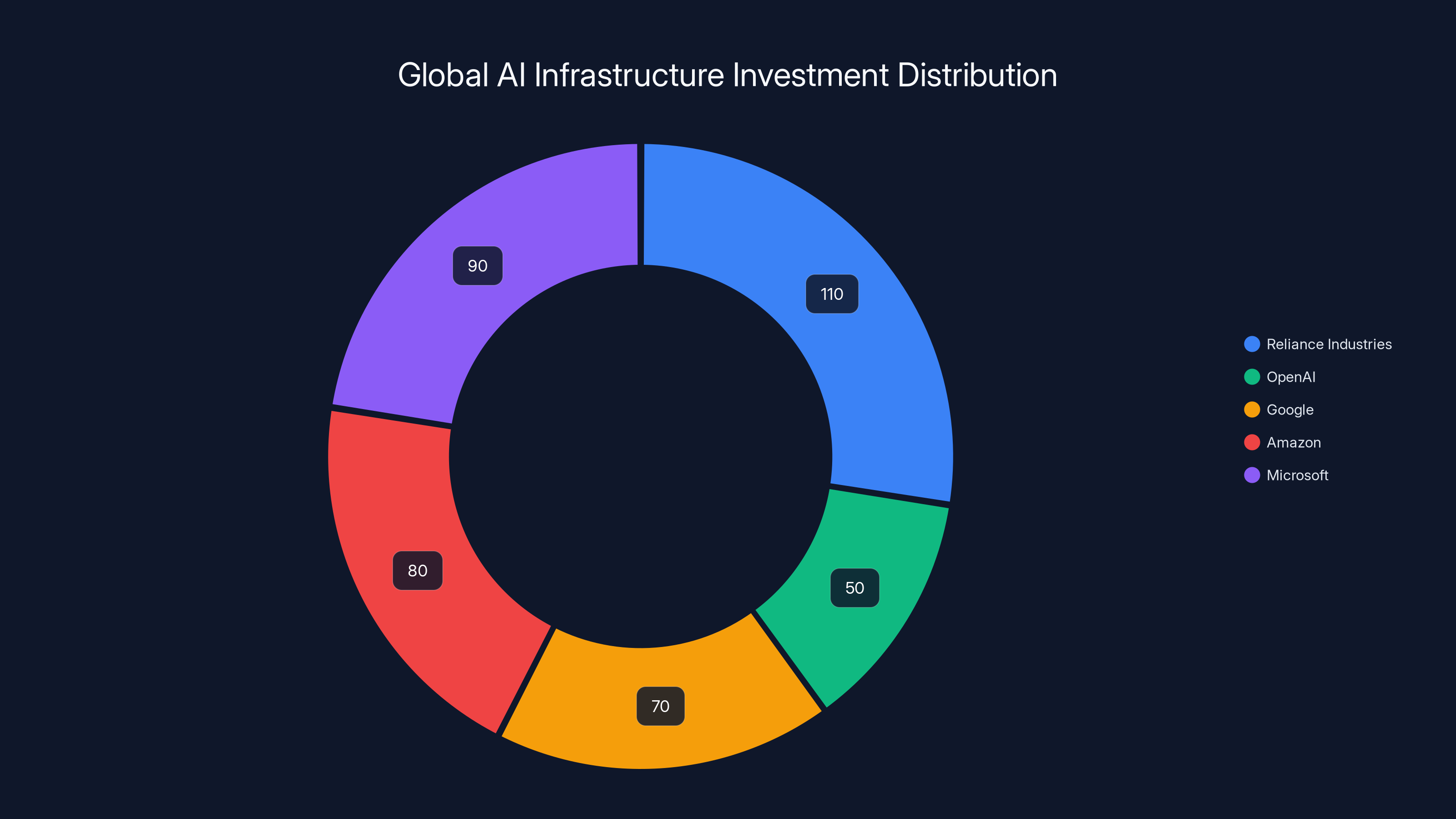

If that sounds granular, it's because it is. But here's why it matters: this isn't just one company's investment play. It's a signal that India's tech ambitions have shifted from software and services to the raw computational power that AI actually runs on. And it's happening in a context where global AI investment is consolidating dangerously. OpenAI, Google, Amazon, and Microsoft are all dumping billions into data center capacity. The question is whether India—home to 1.4 billion people and a massive tech talent pool—gets left behind as an AI customer or emerges as a competitive infrastructure player. As reported by Reuters, this investment could potentially reshape India's position in the global AI landscape.

Reliance's move is the opening volley in what might be the most consequential tech story of the next decade: the geographical decentralization of AI compute. Because here's the uncomfortable truth about AI right now: it's expensive, power-hungry, and concentrated in a handful of geographies. Building it in India changes multiple equations at once. It creates jobs. It drives down costs. It gives Indian companies a home advantage in building AI applications. And it threatens the existing power structure that treats the US and Europe as the default homes for cutting-edge technology. According to Bloomberg, this investment is a bold step towards decentralizing AI infrastructure globally.

But before we get too optimistic, let's understand what Reliance is actually building, why it's happening now, and what it means for the future of AI—both in India and globally.

The Anatomy of Reliance's AI Bet: What's Actually Being Built

When Ambani talks about a $110 billion investment, it's easy to think he's talking about buying server equipment and stacking it in warehouses. That's part of it, but only part. Reliance's plan is actually three interconnected pieces, and understanding each one reveals how serious they're being.

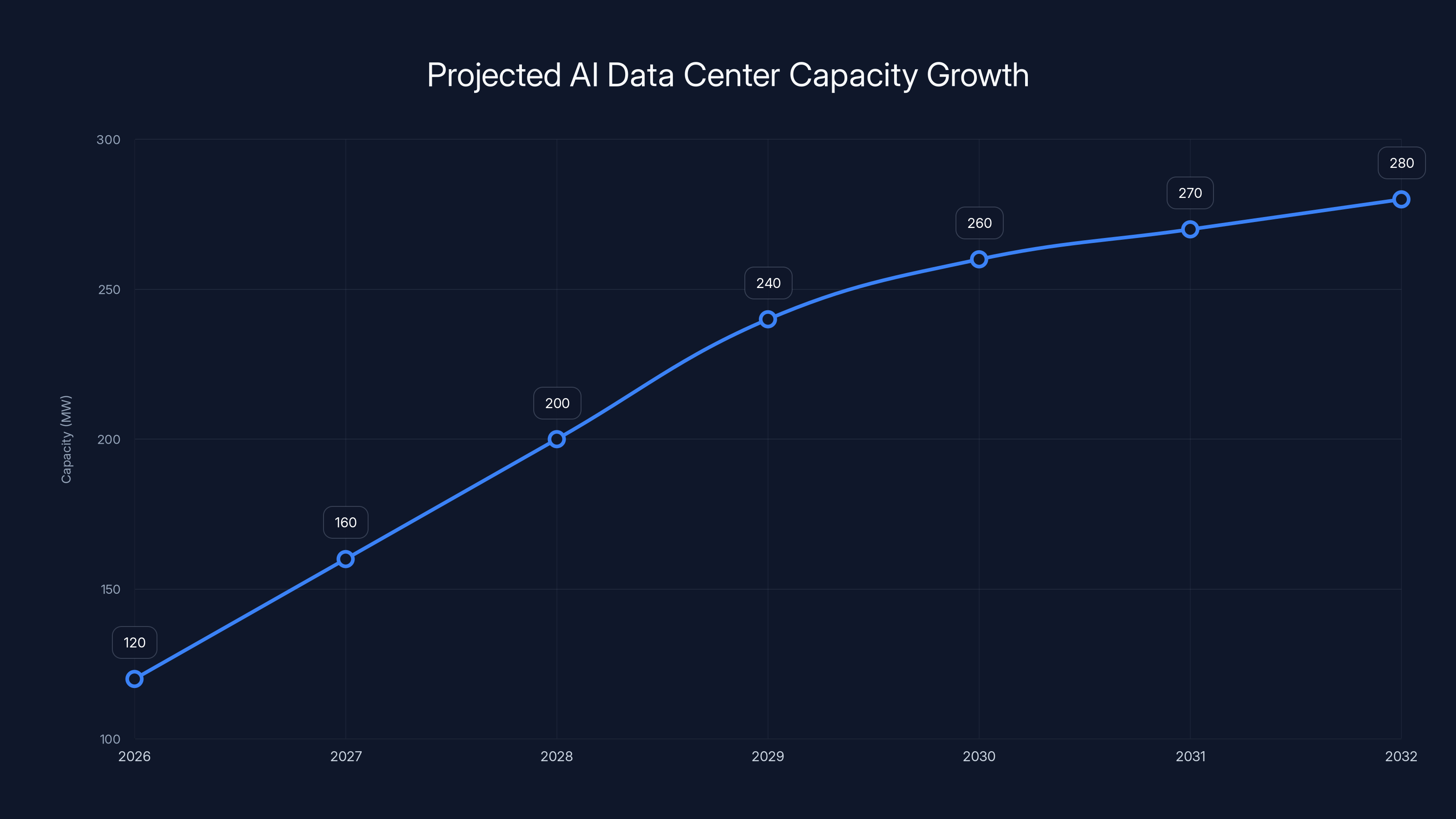

First, there's the data center buildout. Reliance is already constructing multi-gigawatt AI data centers in Jamnagar, Gujarat. By the second half of 2026, they expect to have more than 120 megawatts online. To put that in perspective, a megawatt of data center capacity costs roughly

But here's where Reliance has a massive structural advantage: they own Jio, India's largest telecom company, and they've already built 10 gigawatts of surplus solar power generation capacity in Gujarat and Andhra Pradesh. That's not borrowed power. That's owned power. That means they can run AI data centers at unit costs that competitors simply cannot match. In a world where electricity can represent 40-50% of data center operating costs, owning your own renewable generation is like printing money. As noted by EIA, renewable energy sources are becoming increasingly crucial for reducing operational costs.

Second, there's the edge computing network. This is less glamorous but equally important. Edge computing means distributing AI computation closer to end users rather than centralizing everything in massive data centers. Think of it like this: instead of every Indian person's request traveling to a data center in Jamnagar and back (which takes time and costs bandwidth), computation happens on local servers spread across cities and towns. Reliance plans to build a nationwide edge network that lets companies and developers run AI models locally while maintaining connection to central infrastructure when needed.

Why does this matter? Speed. A user in Mumbai doesn't want to wait 100+ milliseconds for a response to come from Jamnagar. Edge computing cuts that to single-digit milliseconds. It's especially critical for applications like autonomous systems, real-time translation, agricultural AI (for farmers needing instant crop analysis), and financial services. India's massive geographic spread and infrastructure challenges make this network potentially more valuable than anything in the West. According to Deloitte, edge computing is set to revolutionize how data is processed and utilized.

Third, and most important strategically, there's the integration with Jio's telecom platform and ecosystem. Reliance isn't building abstract compute. They're building compute that directly connects to a telecom platform that serves 400+ million users. They're talking about embedding AI services into Jio's existing infrastructure, so Indian consumers and businesses get AI-powered features as part of their normal data and voice subscriptions. This is vertical integration on a stunning scale.

Ambani specifically called out plans to develop AI capabilities in Indian languages. This is the detail everyone should pay attention to. English-language AI models are good because billions of dollars of training data comes in English. But India has 22 official languages, hundreds of dialects, and the vast majority of its population speaks English poorly or not at all. Building Hindi, Tamil, Telugu, Bengali, and Marathi language models requires different training data, different fine-tuning, and different infrastructure. It also requires actual investment from companies that believe India's market is valuable enough to justify that expense. Reliance is making that bet. As highlighted by Brookings, investing in local language capabilities can significantly enhance market penetration and user engagement.

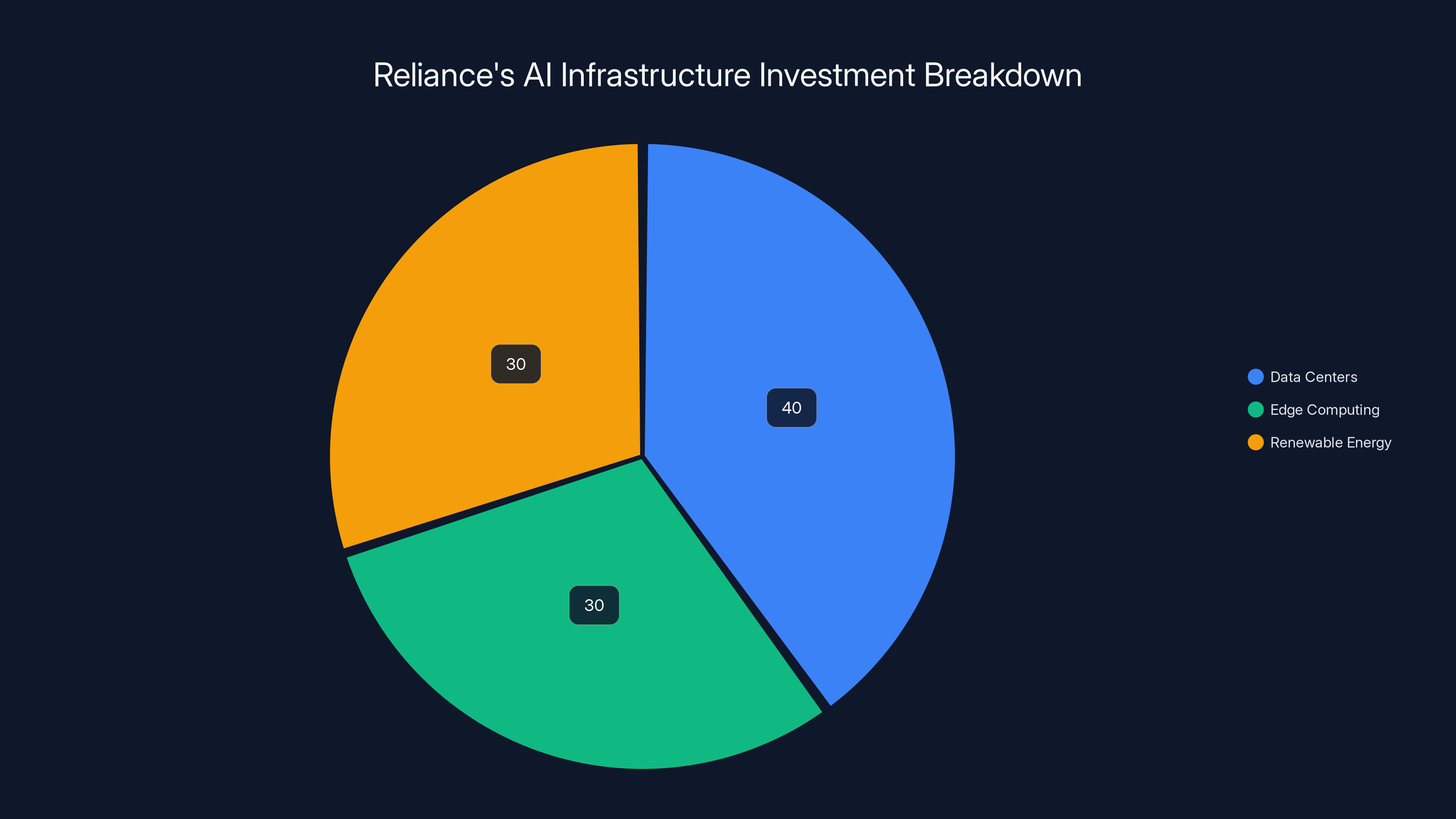

Reliance's AI investment is estimated to be distributed across data centers (40%), edge computing (30%), and renewable energy (30%). This strategic allocation supports both infrastructure and operational efficiency. Estimated data.

The Electricity Problem (And Why Reliance Solved It)

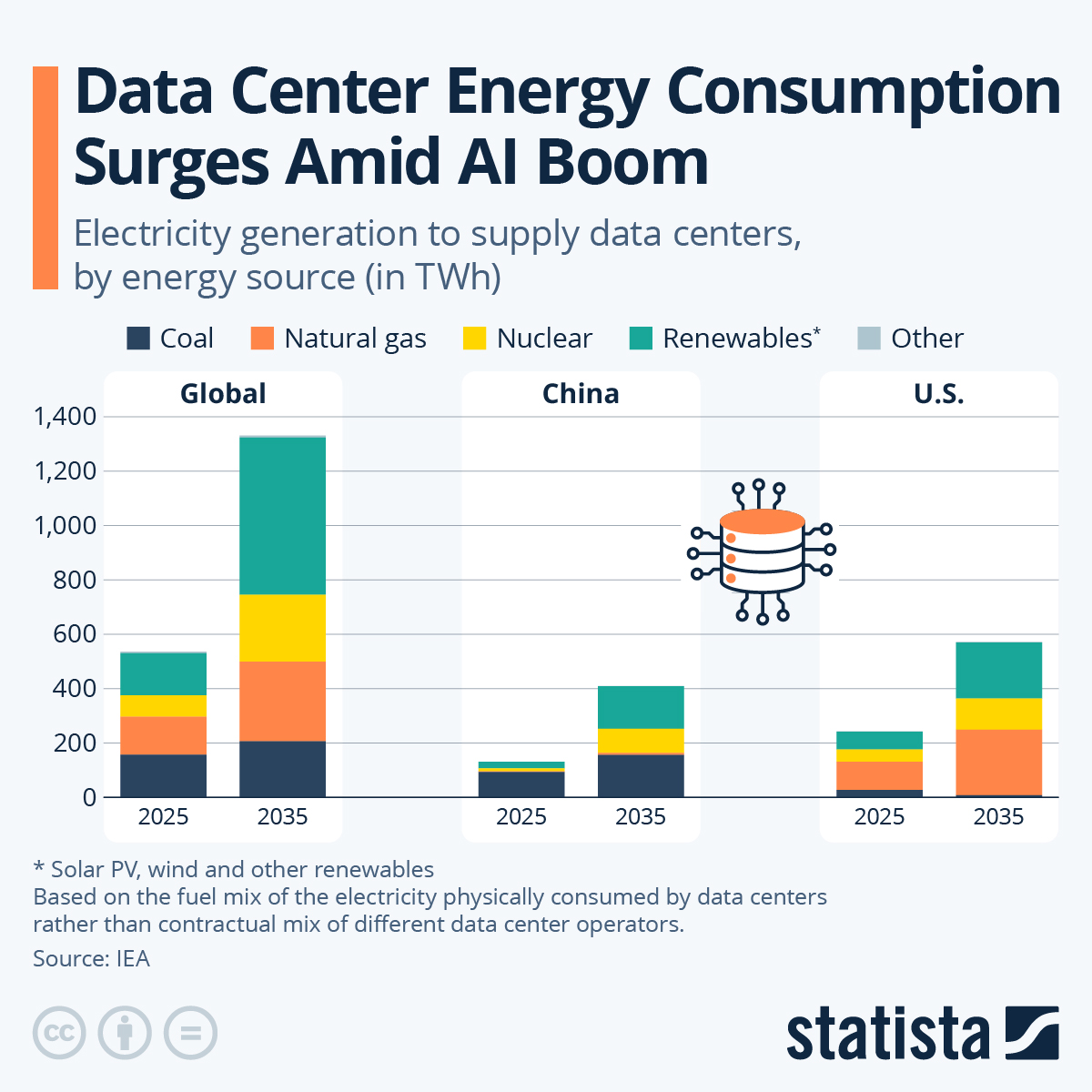

Here's something that almost nobody talks about when discussing the AI boom: data centers are electricity monsters. Large language models like GPT-4 consume between 50-100 kilowatt-hours per 1 million tokens generated. A single query to a powerful model might eat 1-2 kilowatts. Multiply that across millions of daily users and you're talking about massive, continuous power draw.

For most countries, this is an absolute constraint. India's electricity grid is already strained. Rolling blackouts in some states are routine. For a startup or even a mid-sized company to build AI data centers in India, they'd need to negotiate with state governments, build their own power infrastructure, or accept unreliable service. It's a moat that's hard to cross.

Reliance just leapfrogged that entire problem. They own 10 gigawatts of solar generation. Think about that number. A gigawatt is enough to power a city of 750,000 people. They have enough power to run 100+ data center operations simultaneously. And it's renewable, which means: (1) lower long-term costs as solar prices keep dropping, (2) massive PR advantage in a climate-conscious world, and (3) zero dependence on government-managed grid infrastructure. According to Evrimagaci, renewable energy is becoming a critical component of sustainable AI infrastructure.

But here's the nuance: 10 GW of surplus solar is surplus. Reliance generates that for their telecom operations, refineries, and petrochemical plants. Using "surplus" power for data centers is different from building dedicated generation. Still, even if they allocate 2-3 GW of that 10 GW to AI data centers, they have an advantage that no other Indian competitor can match.

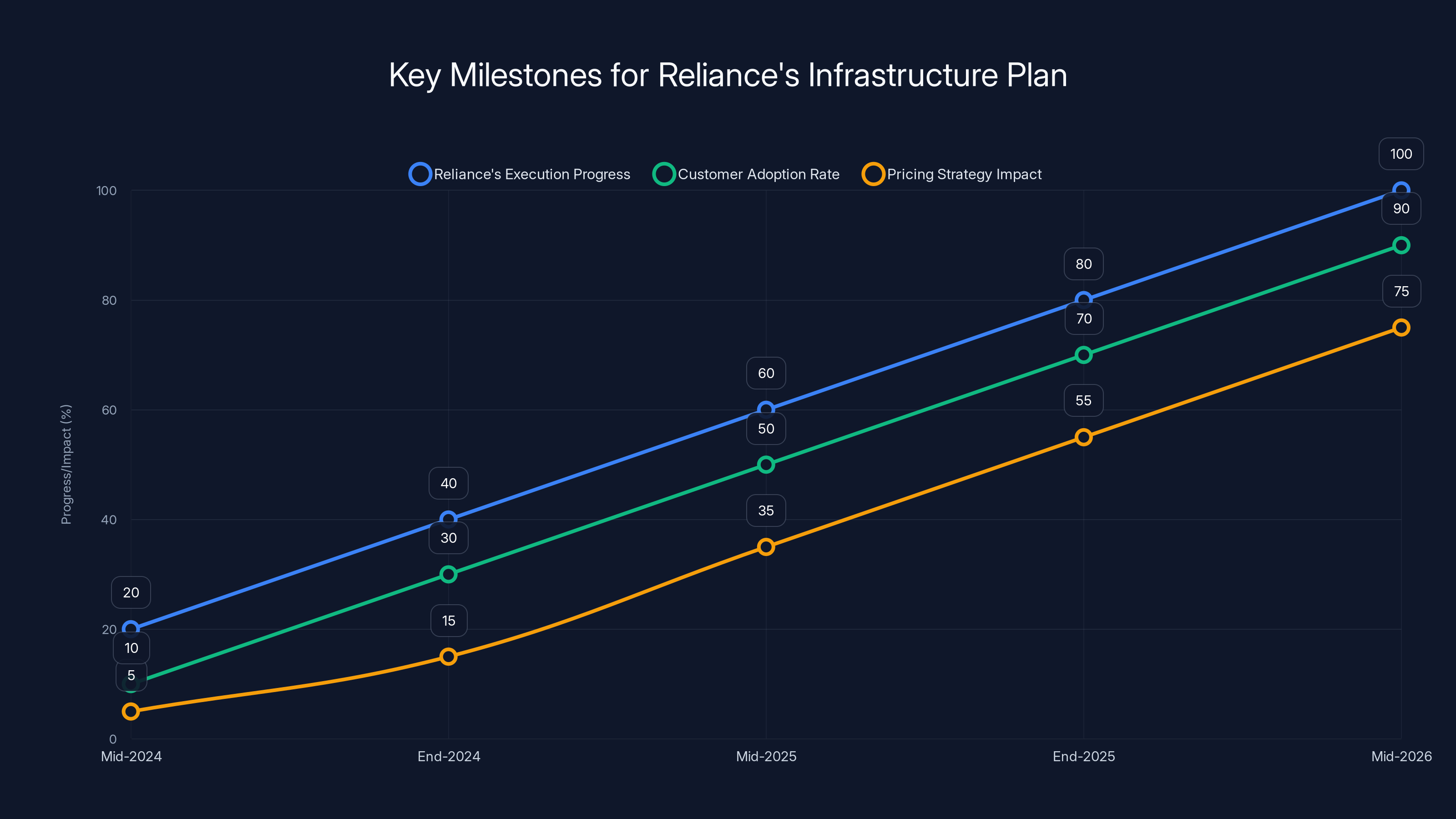

The chart illustrates the projected progress of Reliance's infrastructure plan, customer adoption, and pricing strategy impact over the next 18 months. Estimated data suggests significant milestones by mid-2026.

Why Now? The Competitive Pressure

Ambani's announcement didn't happen in a vacuum. Three things converged in the last 60 days that forced India's largest conglomerates to make urgent moves.

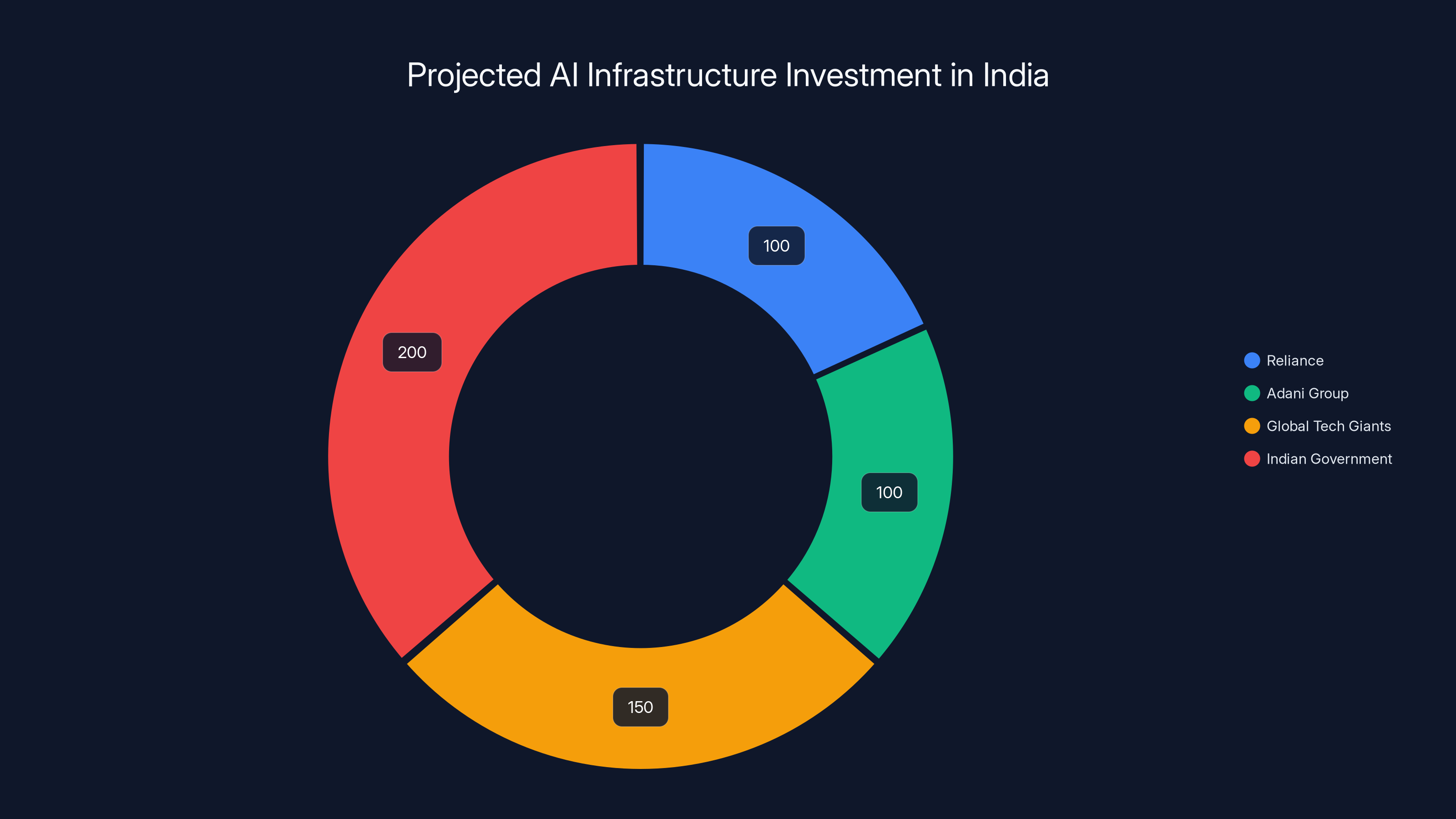

First, the Adani Group announced almost simultaneously that they're investing about

Second, global tech giants are moving fast. OpenAI partnered with the Tata Group to develop 100 megawatts of AI capacity in India, with plans to scale to 1 gigawatt eventually. Google, Amazon, and Microsoft all have India expansion plans. For Reliance and Adani, watching foreign companies partner with competitors to build India's AI infrastructure is existential. If OpenAI and Google own the compute layer in India, Indian companies will always be customers, never peers. According to Reuters Breakingviews, India's AI infrastructure race is a critical endurance test for tech giants.

Third, the Indian government has signaled this is a national priority. The government expects more than $200 billion in AI infrastructure spending over the next two years. That's massive government attention and likely means subsidies, tax breaks, and regulatory support for companies making these bets. It also means whoever gets in first and scales fastest gets the most government backing. As highlighted by TechCrunch, the government's support is pivotal in driving AI infrastructure development.

Ambani's quote captures the logic perfectly: "The biggest constraint in AI today is not talent or imagination. It is scarcity and high cost of compute." In other words, if you can solve the compute problem, you own the supply side of AI in your region. Everything else (apps, services, integration) becomes cheaper and easier by orders of magnitude.

The Software Layer: AI Services and Integration

Data centers and electricity are the foundation, but what Reliance actually makes money from is the software layer built on top. This is where things get strategically smart.

Reliance already has precedent here. When they launched Jio in 2016, they didn't just build a telecom network. They bundled free calls, free SMS, and cheap data to force the entire market to upgrade. They crushed competitors like Vodafone and Idea by undercutting on price while leveraging internal revenue from Reliance's other divisions. They turned India's telecom market from expensive and stagnant to cheap and explosive.

They're planning the exact same playbook for AI. Ambani said Reliance aims to "cut the cost of AI services as dramatically as it once reduced mobile data prices." That's the real threat to global AI competitors. If they can make AI services available to millions of Indians at a fraction of the cost of OpenAI or Google Cloud, they don't need to own 100% of the market. They just need to own India's market and use that as a beachhead to expand globally. As reported by Forbes, this strategy could significantly disrupt the global AI services market.

Jio has already struck AI partnerships. They signed a deal with Google to offer free Gemini AI Pro access to millions of users in India. Think about what that means: millions of Indians are already accessing premium AI features through Jio. The infrastructure exists to distribute AI services at massive scale. Now add Reliance's own compute infrastructure and they control both the supply and distribution of AI in their market.

Reliance also plans to partner with Indian enterprises, startups, and academic institutions to embed AI in specific industries: manufacturing, logistics, agriculture, healthcare, and financial services. This is vertical integration again. They're not building abstract AI infrastructure. They're building solutions tailored to industries where they already have relationships and leverage.

Think about manufacturing in India. Most Indian manufacturers are small or mid-sized. They can't afford custom AI solutions. But if Reliance offers AI-powered quality control, supply chain optimization, or predictive maintenance at low cost through their infrastructure, they capture entire verticals. Same with agriculture: India is still massively dependent on traditional farming. AI-powered crop analysis, weather prediction, and pest management could transform productivity, and Reliance would own that layer.

Reliance's

Ambani's Vision: Technological Self-Reliance

Here's where the story becomes geopolitical. Ambani's framing of this as "technological self-reliance" is significant. He's not saying India should be independent from the world. He's saying India shouldn't depend on renting compute and intelligence from foreign companies who can change terms, impose restrictions, or pull investment whenever priorities shift.

There's real historical logic here. India's IT services boom—companies like TCS, Infosys, and Wipro—happened because India built software talent but never controlled the infrastructure layer. They're always downstream. They execute work designed by companies in the US. They're competitive on cost, not control.

With AI infrastructure, India has a chance to reverse that. If Indian companies own the compute, they can build AI models trained on Indian data, optimized for Indian languages, and deployed on Indian infrastructure. That's not isolation. That's competition on the actual playing field.

Ambani's language also echoes something important in Indian politics and business: "Make in India" isn't just a slogan, it's a direction. The government has been pushing for years to reduce dependence on Chinese electronics, American software, and imported technology. Building AI infrastructure domestically aligns with that agenda perfectly. It means Reliance will likely get government support, land allocation, power subsidies, and regulatory flexibility that foreign competitors won't get.

But self-reliance doesn't mean isolation. Reliance is explicitly partnering with global companies (Google, eventually others). They're not trying to build everything from scratch. They're trying to own the infrastructure layer while remaining connected to global ecosystems.

The Timeline: 120 MW by 2026 and Beyond

Let's talk about what "real" means here. Ambani said more than 120 megawatts of capacity will come online in the second half of 2026. That's less than two years away. Is that credible?

Half the story is yes. Reliance has built massive infrastructure before. They built the entire Jio network in less than four years. They've constructed refineries, petrochemical plants, and manufacturing facilities across India. They have project management capabilities and execution excellence that most Indian companies can't match. And they're not starting from zero: they already own land in Jamnagar, they have electricity generation on-site, and they have relationships with equipment suppliers.

But the other half is caution. Data centers aren't just about building buildings and plugging in servers. You need:

Cooling infrastructure (because servers generate massive heat). Network connectivity (which requires laying fiber optic cables across the country). Redundancy and failover systems (because data center downtime costs millions per minute). Staffing and operations (which requires specialized expertise). Regulatory clearances (which move slowly in India, even with government backing).

120 MW by mid-2026 is achievable, but it'll be tight. And it's only the first wave. The ₹10 trillion plan implies scaling dramatically beyond that over seven years, potentially reaching gigawatts of capacity. That requires not just capital but talent, supply chain capacity, and sustained execution.

Reliance's investment is projected to increase AI data center capacity from 120 MW in 2026 to 280 MW by 2032, reflecting a strategic front-loading approach. Estimated data.

Jamnagar: Why This Location Matters

The choice of Jamnagar isn't random. It's in Gujarat, which is where Reliance is headquartered and where most of their infrastructure already sits. But there's deeper logic.

Jamnagar is on the Arabian Sea, which means fiber optic cables connecting India to the Middle East, Europe, and East Africa can terminate there. It's not as connected as Mumbai, but it's strategic. More important, Reliance already has ports, roads, electricity, and housing infrastructure in Jamnagar because of their refinery and petrochemical operations. Building data centers in the same place lets them leverage existing resources.

It also lets them build a technology cluster. If you're a software engineer interested in AI, you might not move to Jamnagar just for Reliance. But if there's already a data center ecosystem there, with infrastructure, housing, and opportunities, it becomes attractive. Reliance can poach talent from Bangalore and Hyderabad by offering competitive compensation and the chance to work on cutting-edge AI infrastructure.

Long-term, Jamnagar could become India's Silicon Valley for AI infrastructure. That's speculative, but it's the template Reliance is following.

The Competition: Adani and Other Players

Reliance isn't alone. The Adani Group's simultaneous $100 billion announcement shows this is becoming a competitive arms race. Adani is planning massive data centers as well, likely in different geographic regions to serve different markets.

There's also the OpenAI-Tata partnership, which brings global expertise into the mix. Tata can bring institutional knowledge, operational discipline, and India credibility, while OpenAI brings technology, training data relationships, and global market connections.

Beyond the giants, there are startups and mid-sized companies building smaller AI infrastructure plays. Companies are emerging in India focused on GPU optimization, model serving, and application-specific AI compute. They're not competing with Reliance on raw capacity, but they're competing on specialization and service quality.

What's remarkable is that rather than one company dominating, it looks like a healthy competitive market is emerging. That's actually good for India. Competition drives innovation, lowers prices, and prevents monopolies. Reliance's move might be designed to preempt competition, but in practice, it's legitimizing the market and attracting other players.

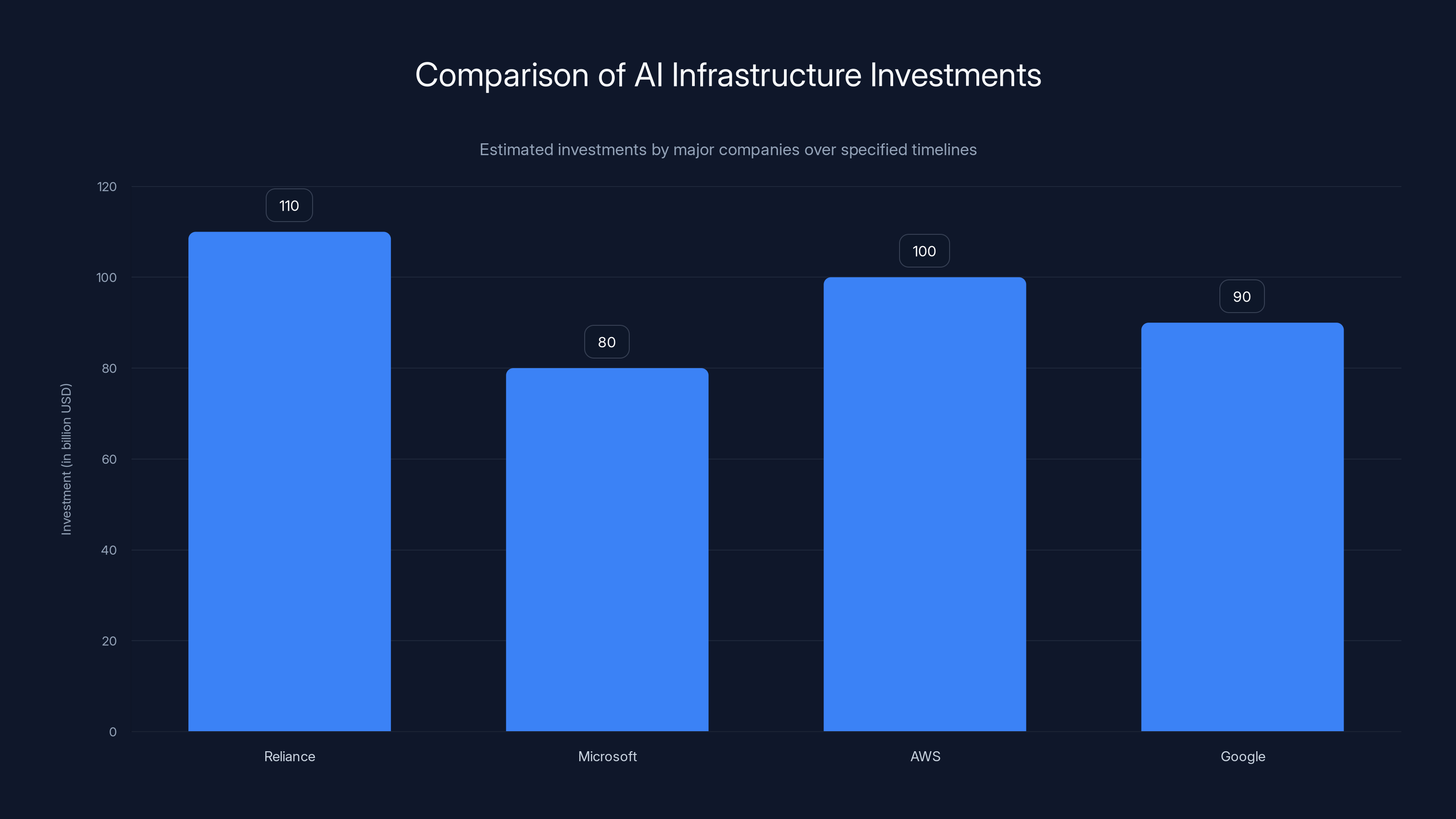

Reliance Industries' $110 billion investment marks a significant shift in AI infrastructure, positioning India as a potential leader alongside global giants. Estimated data.

The Power Consumption Math: What $110B Actually Buys

Let's ground this in real numbers. Building and operating AI data center capacity is expensive. Here's a rough breakdown:

Capital expenditure (building the facility): $3-5 million per megawatt

Equipment (servers, GPUs, networking): $1-2 million per megawatt

Annual operating costs (electricity, cooling, staffing): $500K-1 million per megawatt

Now, if Reliance's

At

But that's a rough average. They're starting with 120 MW in 2026, which implies heavy front-loading of investment. That makes sense: they want to secure market share, start generating revenue, and prove the model works before scaling further.

One thing this math reveals: $110 billion is ambitious but not unrealistic for what they're describing. It's a smaller allocation than capital-intensive oil and gas projects, but comparable in scale to telecom network buildouts, which Reliance has done before.

Language and Localization: The Underrated Advantage

When Ambani mentioned developing AI in Indian languages, it might sound like a feature. It's actually a moat. Here's why.

Large language models train on text data. English has billions of hours of text available: books, websites, academic papers, social media, everything. Models like GPT-4 have access to an absurd amount of English language data. That's why English-language AI is generally better than other languages.

But Indian languages are spoken by over 1 billion people who have far less representation in training data. A Hindi language model trained on internet-available data would be dramatically worse than an English model trained on the same amount of text. This creates an opportunity: if Reliance invests in curating and preparing training data for Hindi, Tamil, Telugu, Marathi, and other Indian languages, they can build models that are locally superior to global alternatives.

This isn't just about user experience. It's about market control. If you speak Hindi and want to use AI, you care more about a Hindi model that understands your language perfectly than an English model with a translation layer. Reliance can own that preference. They can make Hindi-language AI synonymous with their brand.

It also opens entire markets. A farmer in Madhya Pradesh who speaks Hindi and Marathi won't use English-language AI, no matter how good it is. But if Reliance offers agricultural AI in Marathi that predicts pest outbreaks based on local weather patterns, they have a customer for life.

Developing this capability requires investment in linguistics, data collection, and model fine-tuning that global AI companies won't prioritize because the English-speaking market is bigger. But for Reliance, it's a regional comparative advantage worth billions.

Estimated data shows major investments in AI infrastructure by Reliance, Adani, global tech giants, and the Indian government, totaling $550 billion over the next decade.

Global Context: The Decentralization of AI Compute

Reliance's move is part of a broader global pattern: the decentralization of AI compute. For a decade, cloud computing was dominated by AWS, Google Cloud, and Azure. A handful of regions (US, Europe) housed the vast majority of infrastructure. It was centralized, convenient for some, and limiting for others.

AI is changing that equation. Companies realize that keeping computation close to users, data, and regulations matters. China built its own AI infrastructure partly for sovereignty, partly for cost advantages. Europe is building regional capacity for sovereignty and GDPR compliance. India is doing the same for sovereignty, cost, and market opportunity.

What's different about India is scale and timing. Unlike China (which built in relative isolation) or Europe (which is trying to catch up), India is building while the global AI market is still forming. That means Indian infrastructure can compete on cost, reliability, and localization without playing catch-up on technology.

The bigger implication: in five years, the narrative around AI infrastructure won't be "how do I get access to US cloud compute?" It'll be "which regional provider is best for my use case?" Reliance is positioning to own the "best for India" answer.

Challenges and Realities

None of this is guaranteed. Reliance's plan faces real obstacles that are worth naming.

First, talent. AI infrastructure requires experts in machine learning, systems engineering, networking, and hardware optimization. India has tech talent, but not at the scale needed for multiple gigawatt-scale data centers. Reliance will need to recruit globally, offer premium salaries, and invest in education. That's expensive and slow.

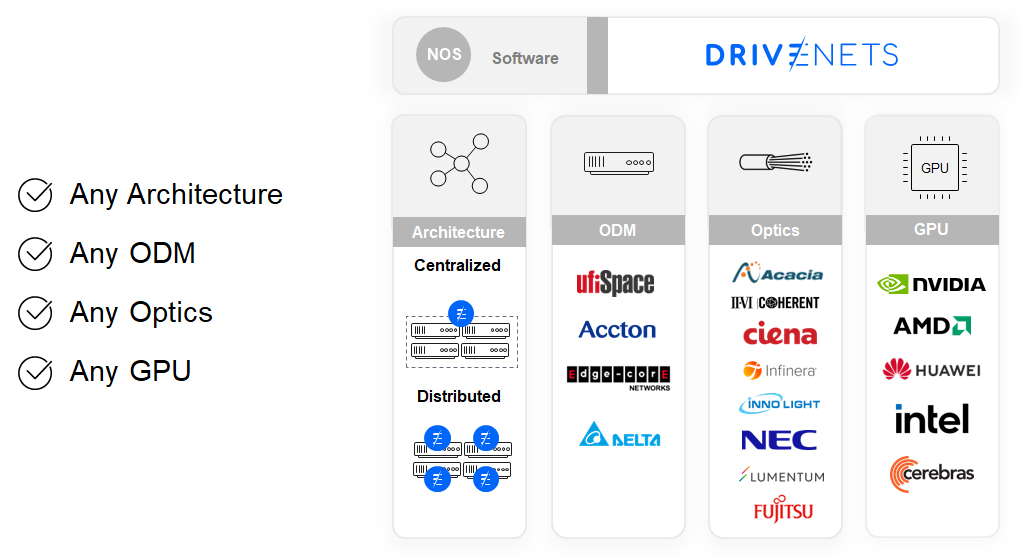

Second, technology lock-in. Most of the AI ecosystem today runs on American software (PyTorch, TensorFlow, CUDA) and American hardware (NVIDIA GPUs). Building alternative infrastructure that's competitive requires either adopting American tools (which means depending on American companies) or building alternatives (which takes years). Reliance will probably do a hybrid, but it's a constraint.

Third, regulatory risk. The Indian government's support is helpful, but it's also a double-edged sword. Government attention means government control. If regulations change, if political winds shift, or if geopolitical tensions rise, data center operations could face restrictions. That's not unique to India, but it's a real risk.

Fourth, competition from global giants. OpenAI, Google, Amazon, and Microsoft are also building in India. They have established brands, global infrastructure, and enormous capital. They can undercut on price if they choose. Reliance's main advantage is local integration (through Jio) and lower power costs, but that's not insurmountable.

Fifth, the assumption that Indian businesses will prioritize Indian infrastructure over proven global alternatives is optimistic. Cost matters, but so does reliability, features, and integration with global ecosystems. Reliance will need to prove their infrastructure is genuinely better, not just cheaper.

The Path Forward: From Announcement to Reality

Here's what we should watch for over the next 18 months:

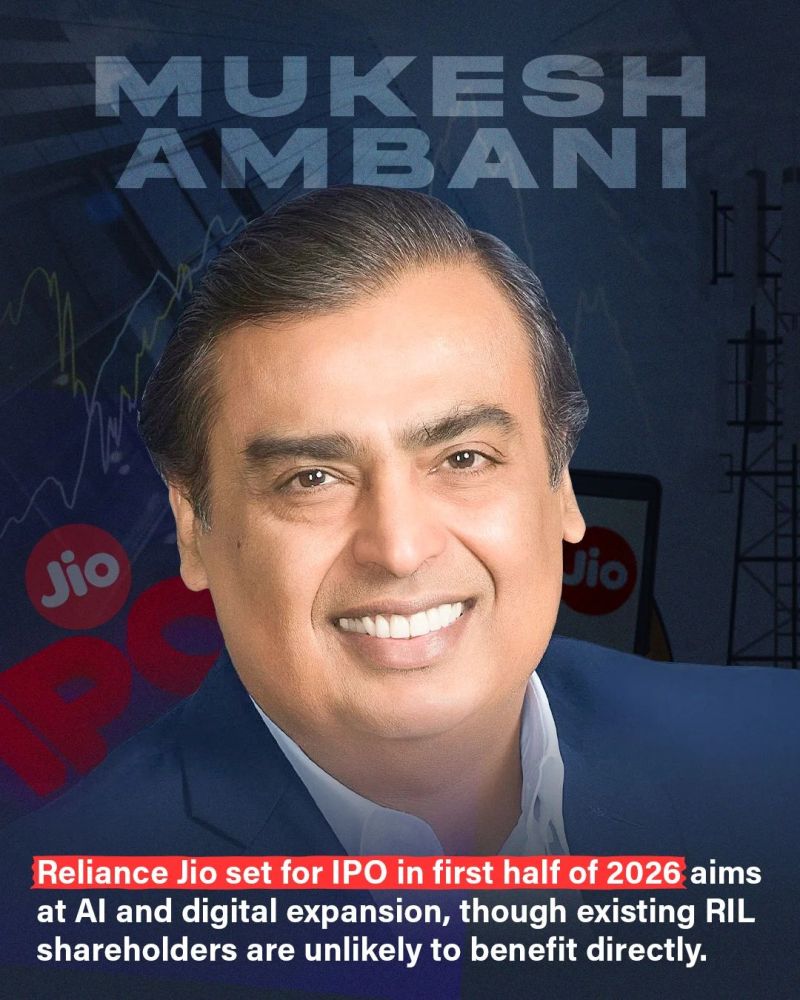

Mid-2026: Does Reliance actually bring 120 MW online as promised? This is the credibility test. If they hit the timeline, it signals serious execution capability. If they miss, it suggests the $110 billion plan is more aspiration than commitment.

Model performance: Do models trained on Reliance's infrastructure match global alternatives in quality and speed? Infrastructure without good models is just expensive electricity.

Customer adoption: Do Indian startups and enterprises actually use Reliance's infrastructure? Or do they stick with AWS, Google Cloud, and Azure? This determines whether the play is theoretical or real.

Pricing: How aggressively will Reliance price their services? If they drop prices 50% below global alternatives, they'll capture market share but might destroy margins. If they price similarly, they lose the cost advantage.

Adani's execution: Does Adani actually follow through with their $100 billion plan? A duopoly is better for Reliance than multiple competitors, but worse than monopoly control.

Government support: What subsidies and tax breaks do companies actually receive? How does government infrastructure investment complement private investment?

The next two years will reveal whether this is a genuine strategic pivot for Reliance or a reputational play designed to look forward-thinking while hedging bets with core businesses.

Implications for Developers and Startups

If you're a developer, data scientist, or startup founder in India, this matters directly. Reliance's infrastructure push could fundamentally change your options.

Right now, Indian startups building AI applications mostly rent compute from AWS, Google Cloud, or Azure. They pay in dollars or rupees to American companies. Their data flows across borders. They depend on global infrastructure that doesn't prioritize India's specific needs.

In two to three years, if Reliance executes, you'll have a local alternative. Potentially cheaper, definitely localized, and integrated with India's largest telecom network. That could be transformative for cost structures, latency, and competitive positioning.

But it also creates a choice. Do you bet on proven global infrastructure with established support and ecosystem, or on emerging Indian infrastructure with cost advantages and local optimization? For risk-averse enterprises, it's an easy choice: stick with what works. For startups trying to build a cost advantage or a new market, Indian infrastructure becomes suddenly attractive.

The Broader Geopolitical Story

Zoom out and this is about much more than Reliance's profit margin. It's about whether India becomes a technology-dependent nation or a technology-producing nation. The history of technology is the history of countries trying to escape dependency. The US built its own semiconductor industry instead of relying on the UK. Japan did the same instead of relying on the US. South Korea, Taiwan, China—all followed the same pattern.

India is trying to do the same with AI infrastructure. If they succeed, it reshapes the global AI landscape. If they fail, they remain dependent on whoever controls the hardware and infrastructure layers. And dependence in technology means dependence in politics, economics, and security.

Ambani's framing of this as "self-reliance" isn't nationalist rhetoric. It's pragmatic acknowledgment of how technology power translates to economic power.

What This Means for Global AI Competition

For OpenAI, Google, Amazon, and Microsoft, India's AI infrastructure boom is simultaneously a market opportunity and a structural threat. It's an opportunity because India has a massive potential customer base. It's a threat because India is building infrastructure that could make foreign services less necessary.

The smartest play for global companies is to partner (like OpenAI is doing with Tata) rather than compete head-to-head with local powerhouses. But that also means accepting margin compression. If they partner with Reliance to offer services, they're not capturing the infrastructure profit layer, only the application layer.

For China, India's move is particularly interesting. China has been dominant in manufacturing semiconductors and infrastructure at scale. If India becomes competitive in AI infrastructure, it dilutes China's manufacturing advantage and redistributes technology power.

The $110B Question: Is It Enough?

Last question: $110 billion over seven years—is it actually adequate?

It's a massive number, but put it in context:

- Microsoft is planning to spend 20B/year)

- Amazon and Google combined probably spend $50+ billion per year on data center and infrastructure

- NVIDIA, the GPU maker, is valued at $3+ trillion because AI data center buildout is so capital intensive

If you're trying to build globally competitive AI infrastructure, $110 billion over seven years is ambitious but not excessive. Adjusted for India's lower infrastructure costs (labor is cheaper, land is cheaper, electricity will be cheaper with solar), it might actually be more than adequate.

But if Reliance is trying to build infrastructure that serves India AND competes globally, it might not be enough. Building is one thing. Training models, creating applications, supporting developers, and competing with OpenAI and Google requires more than just hardware.

Most likely, the $110 billion is Phase 1. It establishes the infrastructure beachhead. Phase 2 would be building out applications, models, and services on top of that infrastructure. That's where the real profits and strategic value live.

TL; DR

- The announcement: Reliance Industries is investing ₹10 trillion ($110 billion) over seven years to build multi-gigawatt AI data centers, edge computing networks, and services integrated with their Jio telecom platform

- The advantage: Reliance owns 10 GW of surplus solar power in Gujarat, dramatically reducing operating costs compared to competitors

- The timeline: 120+ MW of capacity coming online in second half of 2026, with plans to scale significantly beyond that

- The strategy: Leverage vertical integration (power generation, telecom network, infrastructure) to own India's AI supply layer while other companies build applications

- The context: Simultaneous announcements from Adani (200B+ AI infrastructure spending signal India is treating AI infrastructure as a national priority

- The implication: If executed well, this could establish India as a competitive AI infrastructure provider, reduce costs for Indian developers and startups, and shift global AI economics away from pure US/Western dominance

FAQ

What exactly is Reliance building with the $110 billion investment?

Reliance is building three interconnected infrastructure components: multi-gigawatt AI data centers in Jamnagar (120+ MW by mid-2026), a nationwide edge computing network to distribute computation closer to end users, and AI services integrated directly into Jio's telecom platform. The investment also covers developing AI capabilities in Indian languages like Hindi, Tamil, and Telugu, which is critical for reaching India's non-English-speaking population.

Why does Reliance have an advantage over other companies building AI infrastructure in India?

Reliance's primary advantage is owning 10 gigawatts of surplus solar power generation in Gujarat and Andhra Pradesh. Since electricity often represents 40-50% of data center operating costs, having captive renewable power generation dramatically reduces their unit costs compared to competitors who must buy power from the grid. Additionally, they own Jio, India's largest telecom network with 400+ million users, giving them direct distribution for AI services. They also already have land, roads, ports, and infrastructure in place in Jamnagar, reducing buildout costs and timeline.

When will Reliance's AI infrastructure actually be operational?

Reliance plans to have more than 120 megawatts of data center capacity online by the second half of 2026, which is less than two years away. This is specifically credible because Reliance has demonstrated large-scale infrastructure execution with projects like Jio's nationwide telecom rollout. However, the full ₹10 trillion plan scaling to multiple gigawatts will take the full seven-year timeline.

How does this compare to global AI infrastructure investments?

Reliance's

Why is developing AI in Indian languages so important?

English-language AI models benefit from massive training datasets, but India's 1 billion+ people speak primarily Indian languages. Models trained primarily on English data perform poorly in Hindi, Tamil, Telugu, Bengali, and Marathi. By building locally-optimized language models, Reliance can offer AI services that work better for the vast majority of India's population, creating a competitive moat against global companies. This is especially valuable for applications like agricultural AI, healthcare, and financial services tailored to Indian contexts.

Will this make AI services cheaper in India?

Reliance's stated goal is to "cut the cost of AI services as dramatically as it once reduced mobile data prices." Their lower power costs and local infrastructure suggest they can offer services at significantly lower prices than global alternatives. However, actual pricing will depend on competitive dynamics, how quickly Adani and other competitors scale, and whether global players aggressively undercut to maintain market share.

Is $110 billion enough to compete with global AI companies?

$110 billion is substantial for infrastructure but needs context: it's primarily for building hardware and data centers, not for training models or building applications. If Reliance uses this infrastructure efficiently and leverages India's cost advantages (labor, land, electricity), the effective capacity might be comparable to much larger dollar investments by Western companies. However, competing globally would require additional investment in AI research, model training, and developer ecosystem building beyond the announced amount.

What's the risk that Reliance won't deliver on this plan?

Reliance has execution risk like any large infrastructure project. Challenges include talent acquisition (specialized AI infrastructure expertise is scarce), technology dependencies (most AI runs on American software and hardware), regulatory changes, and competition from well-funded global companies. Additionally, the assumption that Indian startups and enterprises will prioritize local infrastructure over proven global alternatives is optimistic and unproven. However, Reliance's track record with Jio suggests they have serious execution capabilities.

How does this affect Indian startups and developers?

If Reliance executes successfully, Indian startups could access locally-optimized AI infrastructure at lower costs with lower latency than current global alternatives. This could dramatically reduce barriers to building AI applications for Indian use cases. However, developers would face a choice between proven global infrastructure (AWS, Google Cloud) and emerging Indian infrastructure, with the local option becoming more attractive as it matures and proves reliability.

What's the geopolitical significance of this investment?

This represents India's effort to reduce technological dependence on the US and achieve "technological self-reliance." If successful, it shifts global AI economics away from pure Western dominance and establishes India as a competitive infrastructure provider rather than just a services provider. It also signals a broader pattern of regional AI infrastructure decentralization, with countries like China, Europe, and India building capacity rather than relying entirely on American cloud providers.

Conclusion: A Watershed Moment for India's Tech Future

Mukesh Ambani's $110 billion announcement isn't just another corporate investment. It's a watershed moment in India's relationship with technology. For decades, India built world-class software talent and services but remained fundamentally dependent on American and Western infrastructure, tools, and platforms. Companies like TCS, Infosys, and Wipro became global giants by executing work designed elsewhere. India's contribution was execution, not ownership.

This investment attempts to change that fundamental dynamic. By owning the infrastructure layer—the physical data centers, the compute, the power generation, the distribution network—Reliance is trying to capture not just the services layer but the fundamental source of technological power. That's much harder, much more capital-intensive, and much more consequential.

The audacious part isn't even the scale of the investment. It's the timing. Reliance is making this bet when AI is still early, when the market is still forming, when Indian companies can still compete on cost and local optimization rather than trying to catch up to entrenched incumbents. In five years, if they execute, Indian infrastructure might be as good as Western alternatives but cheaper and better-optimized for Indian use cases. That changes everything.

Will they execute? That's the real question. The capital is available, the talent can be recruited, the power is available, the regulatory environment is supportive. But large-scale infrastructure projects are littered with delays, cost overruns, and technology missteps. Reliance has executed before (Jio is proof), but this is more complex and more competitive than anything they've built.

What's certain is that India's AI future won't be defined by American companies and American infrastructure. It might be defined by Reliance, or by Adani, or by some company not yet on the radar. But that decision has already been made. India is moving from being a consumer of technology to a producer of it. The infrastructure layer is where that shift gets real.

Key Takeaways

- Reliance is investing ₹10 trillion ($110B) over 7 years to build multi-gigawatt AI data centers, edge computing networks, and AI services integrated with Jio's telecom platform

- Reliance's 10 GW of surplus solar power in Gujarat provides massive cost advantage—electricity represents 40-50% of data center operating costs

- 120+ megawatts of capacity will come online by second half of 2026, with plans to scale to multiple gigawatts across the full timeline

- Developing AI in Indian languages (Hindi, Tamil, Telugu, Bengali, Marathi) addresses 1 billion+ people and creates competitive moat against global alternatives

- Simultaneous 200B+ in AI infrastructure spending signal India treating AI infrastructure as national priority

- Vertical integration—combining power generation, distribution (Jio), and compute infrastructure—gives Reliance structural advantages unavailable to competitors

- This represents India's shift from being a technology consumer and services provider to establishing technological self-reliance and owning the infrastructure layer

Related Articles

- Saudi Arabia's The Line Transforms into AI Data Centers [2025]

- Edge AI Models on Feature Phones, Cars & Smart Glasses [2025]

- Sarvam AI's Open-Source Models Challenge US Dominance [2025]

- Meta, NVIDIA Confidential Computing & WhatsApp AI [2025]

- Blackstone's $1.2B Bet on Neysa: India's AI Infrastructure Revolution [2025]

- EU Data Centers & AI Readiness: The Infrastructure Crisis [2025]

![Reliance's $110B AI Investment: India's Tech Ambition Explained [2025]](https://tryrunable.com/blog/reliance-s-110b-ai-investment-india-s-tech-ambition-explaine/image-1-1771502787560.jpg)