The End of an Era: Robert Playter's Departure from Boston Dynamics

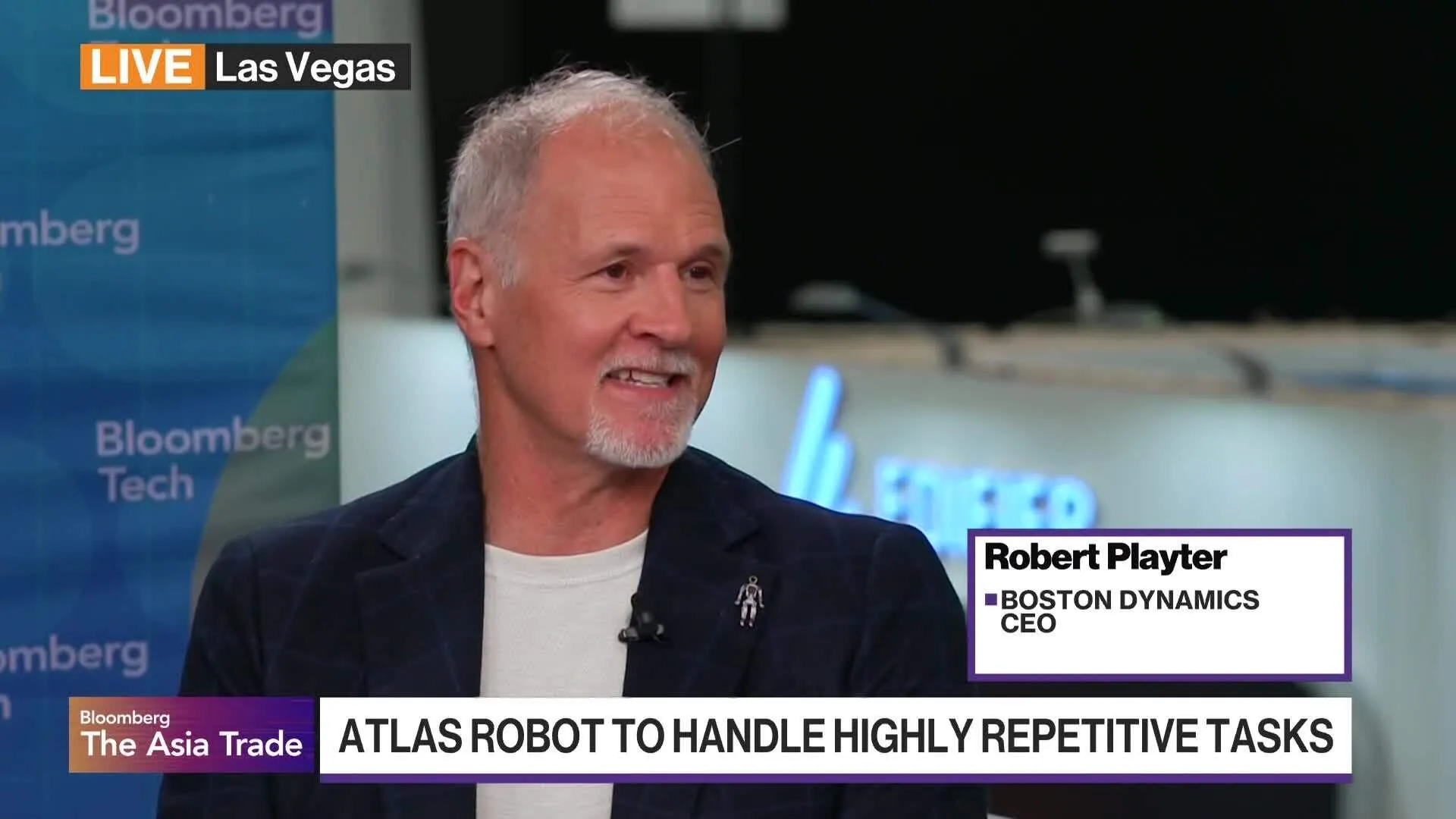

On a Tuesday morning in February 2026, Boston Dynamics announced a shift that few saw coming. Robert Playter, the company's chief executive officer and the architect of its transformation into a commercial robotics powerhouse, would be stepping down after three decades of service. The announcement rippled through the robotics industry, raising questions about the company's future direction, the state of commercializing advanced robots, and what happens when a visionary leader passes the torch, as detailed in The Robot Report.

Playter's departure isn't a sudden departure. It's the culmination of a 30-year journey that began in the mid-1990s at a small MIT spinoff and evolved into one of the world's most recognizable robotics companies. His tenure as CEO lasted six years, a period marked by the commercial launch of Spot, the development of Atlas, and navigating ownership changes from Google to SoftBank to Hyundai. What makes this transition particularly significant is the timing: Boston Dynamics stands at an inflection point where its advanced robots are finally transitioning from research curiosities to practical commercial solutions, as noted by Business Insider.

The robotics industry moves slowly. Development cycles stretch across years. Trust builds gradually. Playter understood this better than most. He didn't just lead a company through technological advances, he shepherded an entire industry toward practical automation. His departure forces Boston Dynamics and the broader robotics community to confront uncomfortable questions about commercialization, market adoption, and whether humanoid robots will ever justify their massive development costs, as discussed in Beritaja.

For anyone paying attention to robotics, AI, or the future of manufacturing and logistics, this moment matters. It's not just about one executive leaving. It's about what his departure reveals about the state of the industry he helped define.

Who Is Robert Playter? The 30-Year Roboticist

Playter isn't a household name like Elon Musk or Sam Altman. He operates in the realm of technical excellence rather than flashy headlines. Yet his career trajectory tells the story of modern robotics in miniature.

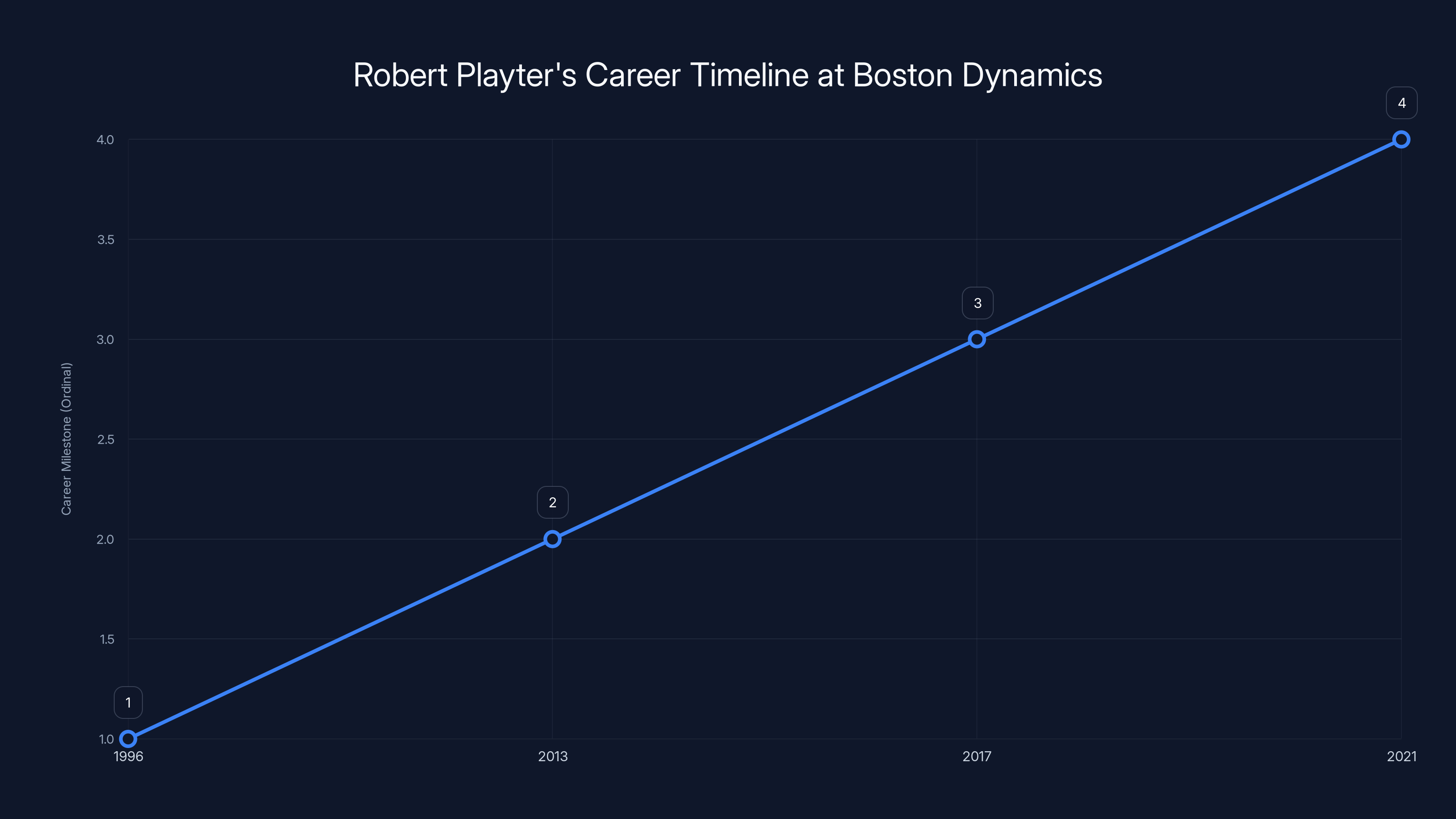

He joined Boston Dynamics in 1996, just four years after the company's founding. At that time, robotics was almost entirely academic. Marc Raibert, Boston Dynamics' founder, had spent decades at MIT studying bipedal locomotion and dynamic movement. The company existed in that nebulous space between research lab and commercial venture, closer to the former than the latter.

Playter's early work at Boston Dynamics focused on engineering challenges that most people outside the field don't think about. How do you make a robot balance on four legs? How do you implement algorithms that keep it from tipping? These aren't sexy problems. They're hard problems. They require deep understanding of control systems, mechanical engineering, and software architecture. Playter worked on all of it.

Over the following two decades, he moved through several roles. Vice president of engineering. Chief operating officer. Each position gave him broader exposure to the company's challenges. He learned that building robots wasn't just a technical problem. It was an operational problem, a financial problem, and eventually, a market problem.

When Google's parent company Alphabet acquired Boston Dynamics in 2013, the company was still firmly in the research phase. No commercial products. No revenue. Just brilliant engineering and ambitious research. Google's ownership changed the dynamics. The company had resources to pursue moonshot ideas, but also pressure to eventually show commercial viability. Playter navigated that tension for seven years.

Then came the SoftBank ownership period from 2017 to 2021. SoftBank's Masayoshi Son has a different vision for robotics than Google does. He's more focused on near-term commercialization, less interested in pure research. Spot was commercialized during this period. Playter became CEO in 2020 under SoftBank's ownership.

Hyundai's acquisition in 2021 marked another ownership transition. The Korean conglomerate sees robotics as strategically important for manufacturing and logistics. Under Hyundai, Boston Dynamics has more industrial focus. The humanoid robot Atlas shifted from a research platform to a potential commercial product, as highlighted in The Korea Times.

Playter has lived through all of these transitions. Each one required different skills, different perspectives, different compromises. That's the arc of his career: not revolutionary innovations (though Boston Dynamics has plenty of those), but rather the unglamorous work of turning advanced research into products people might actually use.

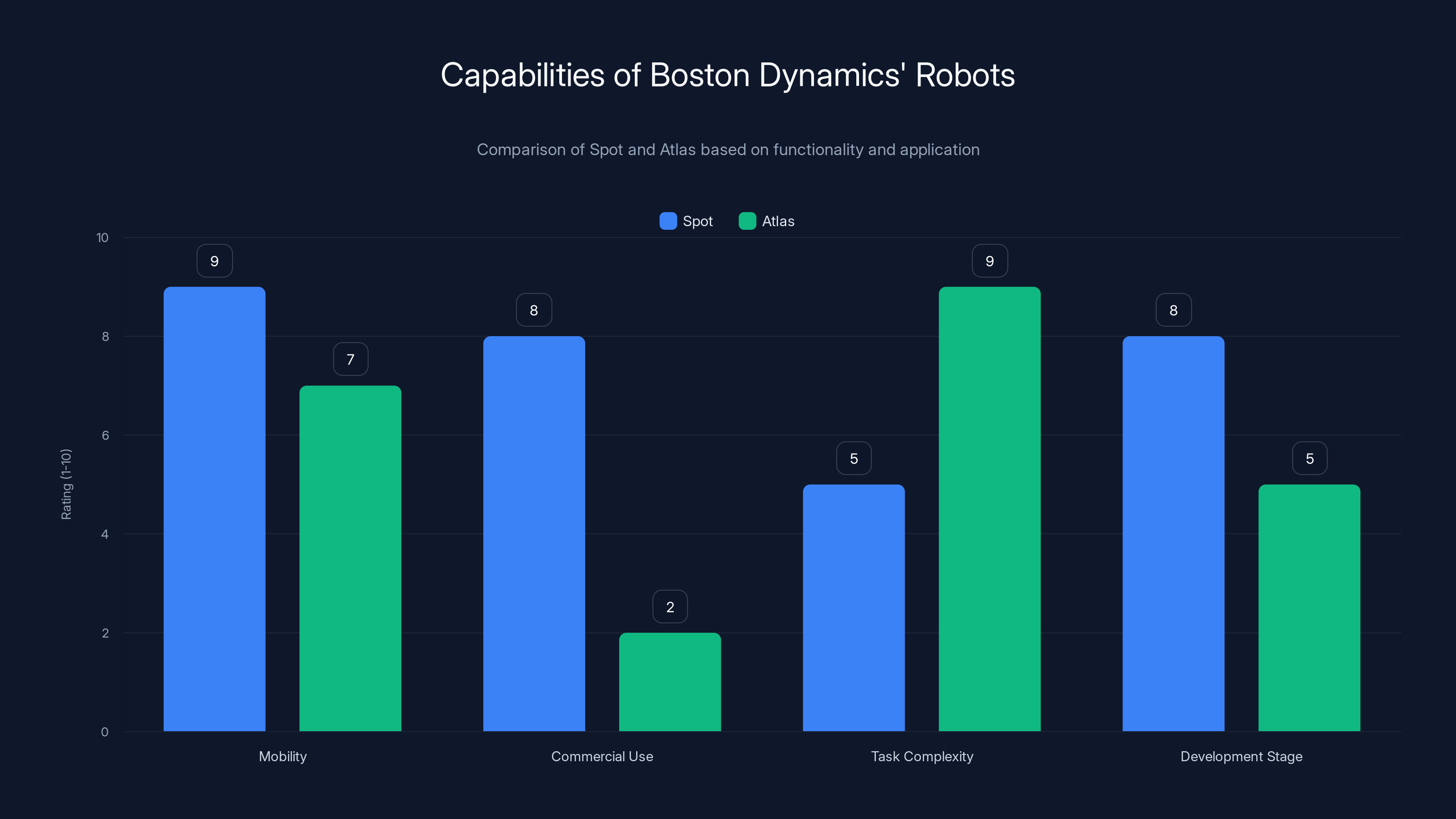

Spot excels in mobility and commercial use, while Atlas is superior in task complexity but remains in development. Estimated data based on known features.

The Spot Era: Commercializing the Four-Legged Robot

Playter's most significant contribution to Boston Dynamics might be overseen, not created. Spot is the company's flagship product, and it exists because Playter championed its commercialization.

Spot started as a research platform. The robot could walk, climb stairs, and navigate rough terrain. But for years, it was a demonstration tool. Impressive to watch, but what was it actually useful for? That question haunted Boston Dynamics. Brilliant engineering means nothing without market demand.

Playter took the helm as CEO in 2020 with a mandate to change that. He pushed for commercialization. Not someday. Now. Spot went from prototype to product. The company released a developer edition, then began focusing on specific use cases.

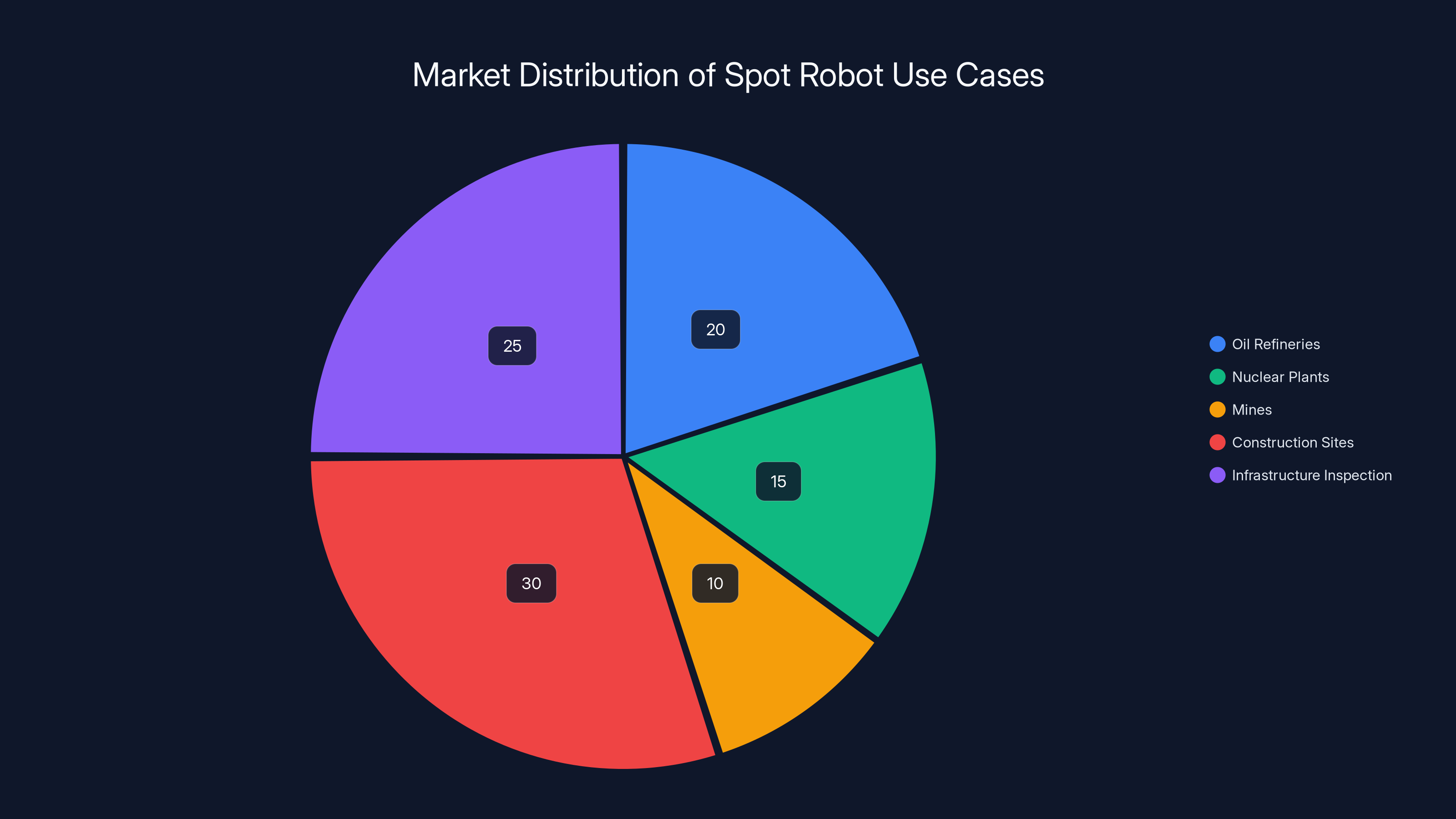

What use cases? Inspection. A four-legged robot can walk into dangerous environments humans shouldn't enter. Oil refineries. Nuclear plants. Mines. Construction sites. Infrastructure inspection. These became the initial markets. Not sexy, but profitable enough to justify continued development, as noted by The Globe and Mail.

Spot's commercialization wasn't smooth. Early adopters faced challenges. The robot required technical expertise to operate. Integration with existing workflows proved difficult. Costs remained high. Customer acquisition was slow. But gradually, the market expanded. Construction companies bought units. Facility managers purchased robots for inspection work. Police departments experimented with Spot for search and rescue.

The key insight Playter pushed was this: don't try to sell robots to everyone. Find a specific problem where a robot is clearly better than human alternatives. Solve that problem perfectly. Then expand.

This is fundamentally different from how many robotics companies approach the market. The temptation is always to build a general-purpose robot that can do anything. Playter's approach was more disciplined. He understood that four-legged robots are best at inspection and exploration. So that's where Boston Dynamics focused.

By the time Playter announced his departure, Spot was generating meaningful revenue. Not world-changing revenue. Not a billion-dollar business. But enough to validate the commercial robotics model. Enough to prove that advanced robots could have near-term applications beyond research, as discussed in Beritaja.

Robert Playter's career at Boston Dynamics highlights key transitions from engineering to executive roles, navigating ownership changes from Alphabet to SoftBank.

Atlas and the Humanoid Moment

While Spot found its commercial niche, Boston Dynamics was also developing Atlas. The humanoid robot represents a different bet. Spot is optimized for specific tasks. Atlas is designed to be more generally useful.

Humanoid robots have been the white whale of robotics for decades. If you could build a robot that looks and acts like a human, it could theoretically do anything a human can do. A humanoid robot in a factory could switch between tasks without requiring a completely different physical platform. A humanoid robot could work in spaces designed for humans. The theoretical appeal is enormous.

The practical challenges are equally enormous. Humanoid robots need to balance on two legs. They need dexterous hands. They need to understand context. They need to be strong enough to be useful but safe enough not to hurt humans nearby. These are spectacularly hard problems.

Atlas has been in development for years. The robot has evolved dramatically. Early versions were impressive but clunky. Recent versions are faster, more fluid, more capable. Boston Dynamics released videos of Atlas performing increasingly complex tasks. Unpacking boxes. Moving objects. Operating machinery designed for human operators.

Under Playter's leadership, Atlas transitioned from pure research to a platform with commercial potential. The vision is clear: factories with a mix of traditional machinery and humanoid robots working alongside human workers, as highlighted in ETF Trends.

But here's the tension that likely influenced Playter's decision to step down. Spot had found a market. Atlas hasn't. It's still in that liminal space between research project and product. The investments are massive. The timeline is uncertain. The market size is theoretical.

Humanoid robots might represent the future of automation. Or they might be the robotics industry's equivalent of jetpacks, perpetually five years away. Playter made the bets he thought were right. Whether those bets pay off will be someone else's responsibility, as noted in IFR.

Leadership Transitions in Robotics: A Broader Context

Playter's departure raises interesting questions about leadership in hardware companies, particularly robotics firms.

Building robots is different from building software. Software companies can iterate quickly, release updates frequently, and respond to market changes at remarkable speed. Hardware companies move slower. A robot design requires physical manufacturing. Supply chains are complex. Costs are high. Pivoting is expensive.

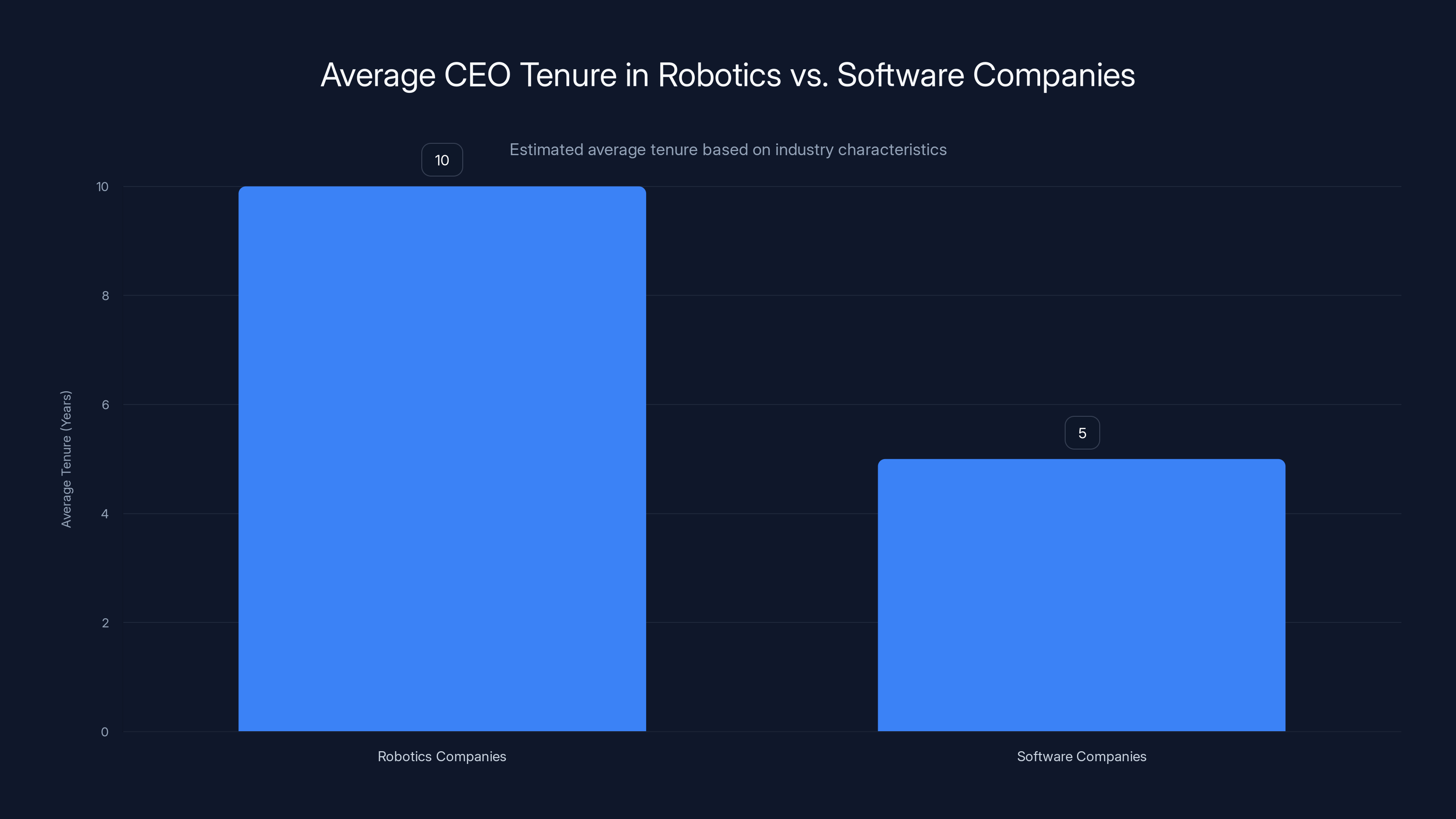

This slower pace means CEO tenures at robotics companies tend to be longer than in software. A hardware CEO needs time to see their strategy through from conception to commercialization. That can take a decade or more.

Playter's six-year tenure as CEO is actually moderate by hardware standards. He had enough time to guide Spot toward commercialization and Atlas toward practical demonstration. But he didn't have time to see either robot achieve massive market penetration.

The question for Boston Dynamics now is what kind of leader they need next. Do they need someone who can accelerate commercialization? Do they need someone who can navigate relationships with Hyundai? Do they need someone with different ideas about which products to prioritize?

Amanda Mc Master, the CFO who's stepping in temporarily, brings financial expertise. She's managed Boston Dynamics' economics. She understands the constraints of profitability and the realities of hardware costs. Her temporary role suggests the board is taking time to find the right permanent replacement rather than rushing to fill the position.

This is actually a smart move. Robotics companies have made mistakes by hiring CEOs with the wrong expertise or the wrong vision. You need someone who understands both the technical complexity and the commercial realities. Someone who can advocate for engineering excellence while respecting business constraints. That's a rare combination.

Spot's initial commercialization focused on specific markets with construction sites and infrastructure inspection leading the way. (Estimated data)

The Hyundai Question: What's Changed?

Boston Dynamics operates under Hyundai's ownership. That matters more than people realize.

Hyundai is primarily a manufacturing company. They understand factories, supply chains, quality control, and scale. When Hyundai acquired Boston Dynamics in 2021, it signaled a shift in the robotics company's strategic direction.

Under Google and even SoftBank, Boston Dynamics had some freedom to pursue moonshot ideas. Google was explicitly interested in moonshots. SoftBank had vision but looser operational control. Hyundai is different. Hyundai wants robotics to solve specific problems in manufacturing and logistics.

This isn't necessarily bad for Boston Dynamics. It provides focus. It ensures funding. It connects the company to actual manufacturing problems that robots might solve. But it also constrains the vision somewhat. You can't just follow interesting technical directions. They have to connect to Hyundai's business.

Playter navigated this transition for five years. He helped Boston Dynamics become more focused on commercial applications. Spot moved from "cool inspection robot" to "practical tool for facility managers." Atlas moved from "pure research platform" to "prototype for factory automation."

Whether Playter's successor will maintain this direction or take Boston Dynamics in a different direction remains unclear. But Hyundai's ownership does suggest that whoever replaces him will need to balance innovation with commercial realism.

The Robotics Industry at an Inflection Point

Playter's departure occurs at a fascinating moment for robotics broadly.

For decades, robotics has been the industry that's always "about to break through." We've been promised humanoid robots and fully automated warehouses for years. The breakthroughs keep getting delayed. Costs remain prohibitive. Technical challenges prove deeper than expected.

But something has shifted recently. AI improvements have accelerated robot capabilities. Computer vision works better. Language models help robots understand context. Mechanical design has improved. Battery technology is better. The components necessary for practical robotics are finally converging.

Spot hasn't revolutionized inspection work, but it has shown that commercial robotics can be viable. Other companies like Tesla, Boston Dynamics competitors, and startups are all pursuing humanoid robots. The market is finally starting to take shape.

Playter led Boston Dynamics through the awkward middle period. Not pure research. Not yet mass-market. Just this uncomfortable zone where the company had to fund expensive development while generating enough revenue to justify its existence. That's exhausting. It requires patience, technical credibility, and business discipline.

His departure suggests he's passed that baton to someone else. Whether that someone can push Boston Dynamics into the next phase remains the industry's most important open question.

Estimated data suggests that CEO tenures in robotics companies are typically longer than in software companies due to the slower pace of hardware development.

The Competitive Landscape: Who Else Is Building Robots?

Boston Dynamics exists in a crowded field now, though they arrived first.

Tesla is developing Optimus, a humanoid robot with the company's typical approach: ambitious, fast-moving, focused on manufacturing integration. Elon Musk has claimed Optimus will eventually be more valuable than Tesla's automotive business. That might be hyperbole, but it shows how seriously Tesla takes the opportunity.

Figure AI, a newer entrant, is focused specifically on humanoid robots for warehouse work. They're moving faster than Boston Dynamics in some ways, bringing a startup mentality to robot development. Their funding suggests investors believe they can accelerate timelines.

Brand new companies are emerging regularly. Some have interesting ideas. Others are clearly going to fail. The sheer number of humanoid robot projects suggests the industry believes the inflection point is near.

Boston Dynamics' advantage is deep technical expertise, a proven product in Spot, and backing from Hyundai. Their disadvantage is that they've been developing robots longer than anyone else, which means they've had to fund longer, which means they have higher costs baked into their processes.

Playter's departure doesn't change these competitive dynamics, but it does represent uncertainty at a critical moment. New leadership might accelerate development, might shift focus, or might make changes that surprise the market. Competitors will be watching closely.

What's Next for Boston Dynamics?

The search for a new CEO will be closely watched by the robotics industry.

The ideal candidate probably has some combination of these characteristics: deep experience in hardware or robotics, understanding of manufacturing or logistics, proven ability to commercialize complex products, and comfort working within Hyundai's structure.

They probably won't be a celebrity CEO. They probably won't make big promises about timeline. They'll probably focus on execution and commercialization. Spot needs to expand its market. Atlas needs to prove it can do meaningful work in real factories. Both require disciplined, unglamorous execution.

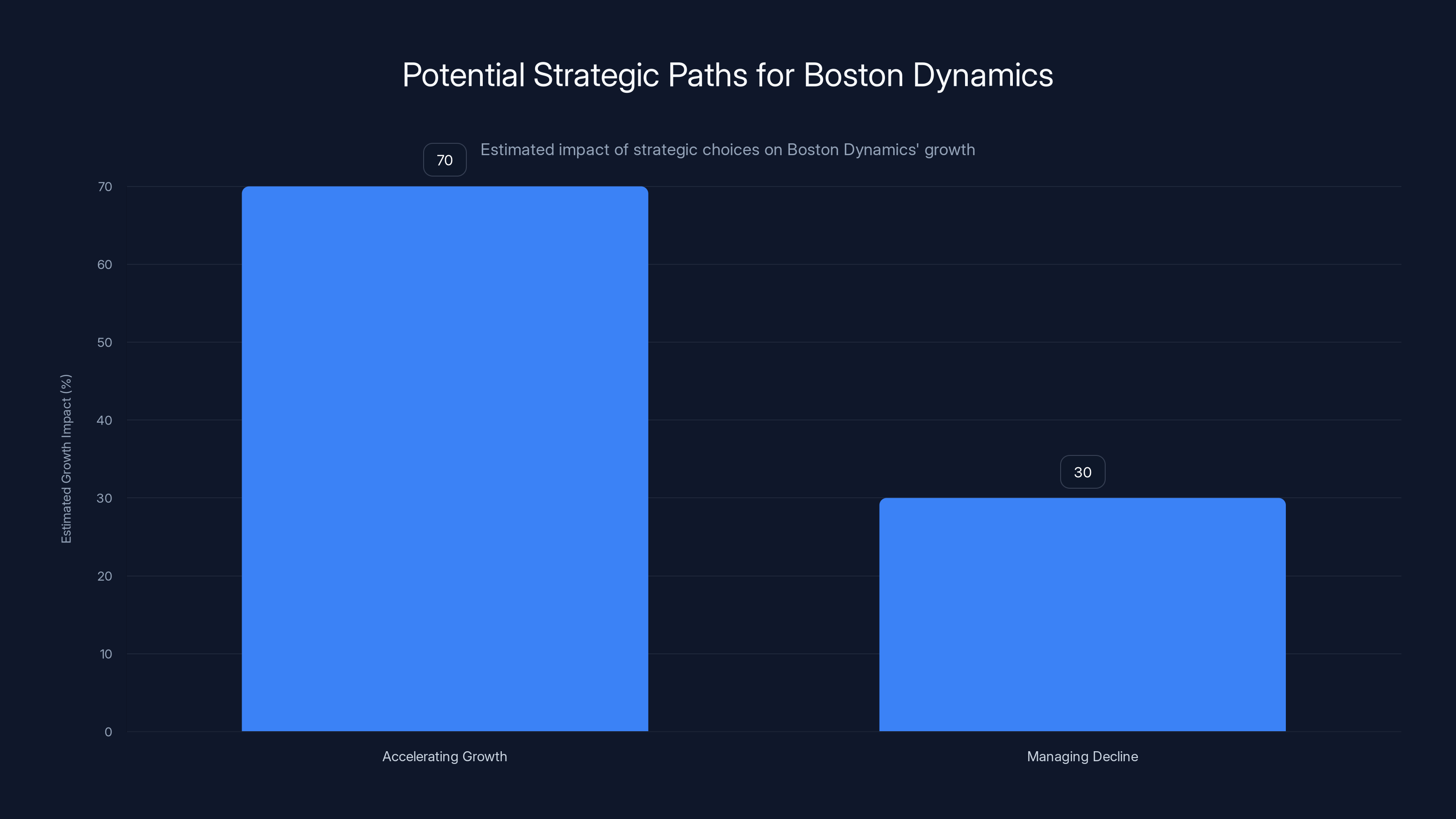

Boston Dynamics faces some real challenges under new leadership. The robotics market is growing but still small. Spot has found a niche but hasn't exploded. Atlas is impressive but not yet commercial. The company needs to either accelerate growth or manage decline. Those are the two paths ahead.

Accelerating growth means expanding beyond inspection and exploration. It means finding new applications for Spot. It means getting Atlas to market faster. It means competing with Tesla and other humanoid robot developers. It's possible but requires the right strategy and execution.

Managing decline is the quiet alternative that nobody talks about. Boston Dynamics could become a profitable but small company. They could focus on Spot, develop a loyal customer base, and accept that humanoid robots might take decades to become genuinely commercial. Some investors and engineers might prefer this path.

A new CEO will have to choose which path Boston Dynamics takes. That choice will define the company for years.

Accelerating growth could significantly enhance Boston Dynamics' market presence, while managing decline may stabilize the company at a smaller scale. (Estimated data)

The Human Side: Playter's Legacy

Beyond the business metrics and technical achievements, Playter's 30 years at Boston Dynamics represents something important about long-term commitment and technical leadership.

Playter didn't build Boston Dynamics from scratch. Marc Raibert gets that credit. But Playter helped transform it from a research lab into something approaching a real company. He made tough decisions. He advocated for commercialization when the company could have chased pure research. He managed through multiple ownership changes. He navigated the tension between innovation and profitability.

That's not glamorous work. It doesn't get headlines. But it's essential. Every hardware company that's successful has people like Playter behind the scenes, making sure the brilliant engineers stay grounded in commercial reality.

His departure reflects, perhaps, that he's accomplished what he set out to do. Spot is commercial. Atlas is practical. The company has a clear strategy under Hyundai's ownership. The foundations are solid. Someone else can take it from here.

There's also the possibility that after 30 years, Playter simply wanted to do something different. Leadership at a major robotics company is demanding. You're responsible for hundreds of employees, enormous budgets, and complex technology. You're managing expectations in an industry prone to hype. You're balancing near-term pressures with long-term vision.

After three decades of that, a break might sound attractive. Whether Playter takes time off, joins another company, or pursues a different role in robotics remains to be seen. But his departure creates an opening for different leadership and potentially different directions.

Lessons from Boston Dynamics' Journey

Playter's 30 years at Boston Dynamics offer lessons that extend beyond robotics.

First, deep expertise matters. Playter wasn't a charismatic startup founder. He was a technical expert who understood engineering at a deep level. That credibility gave him influence in decisions about product direction and priorities.

Second, patience is sometimes the right strategy. Boston Dynamics could have forced commercialization earlier or abandoned the research focus entirely. Instead, they balanced exploration with pragmatism. It took decades, but the results are real robots doing real work.

Third, ownership matters. The transitions from Google to SoftBank to Hyundai forced Boston Dynamics to adapt repeatedly. Each owner had different priorities. The company's strategy shifted accordingly. A new CEO will have to do the same.

Fourth, timing is critical. Boston Dynamics might have failed if founded a decade earlier (technology not ready) or struggled if founded a decade later (too much competition). They caught the wave at the right moment. Their successor CEO needs to maintain that advantage.

These lessons apply to other hardware companies, other ambitious projects, and other industries. Long-term commitment. Balance between research and commercialization. Flexibility with ownership and strategy. And awareness that timing, while partially luck, is also something you can influence through good decisions.

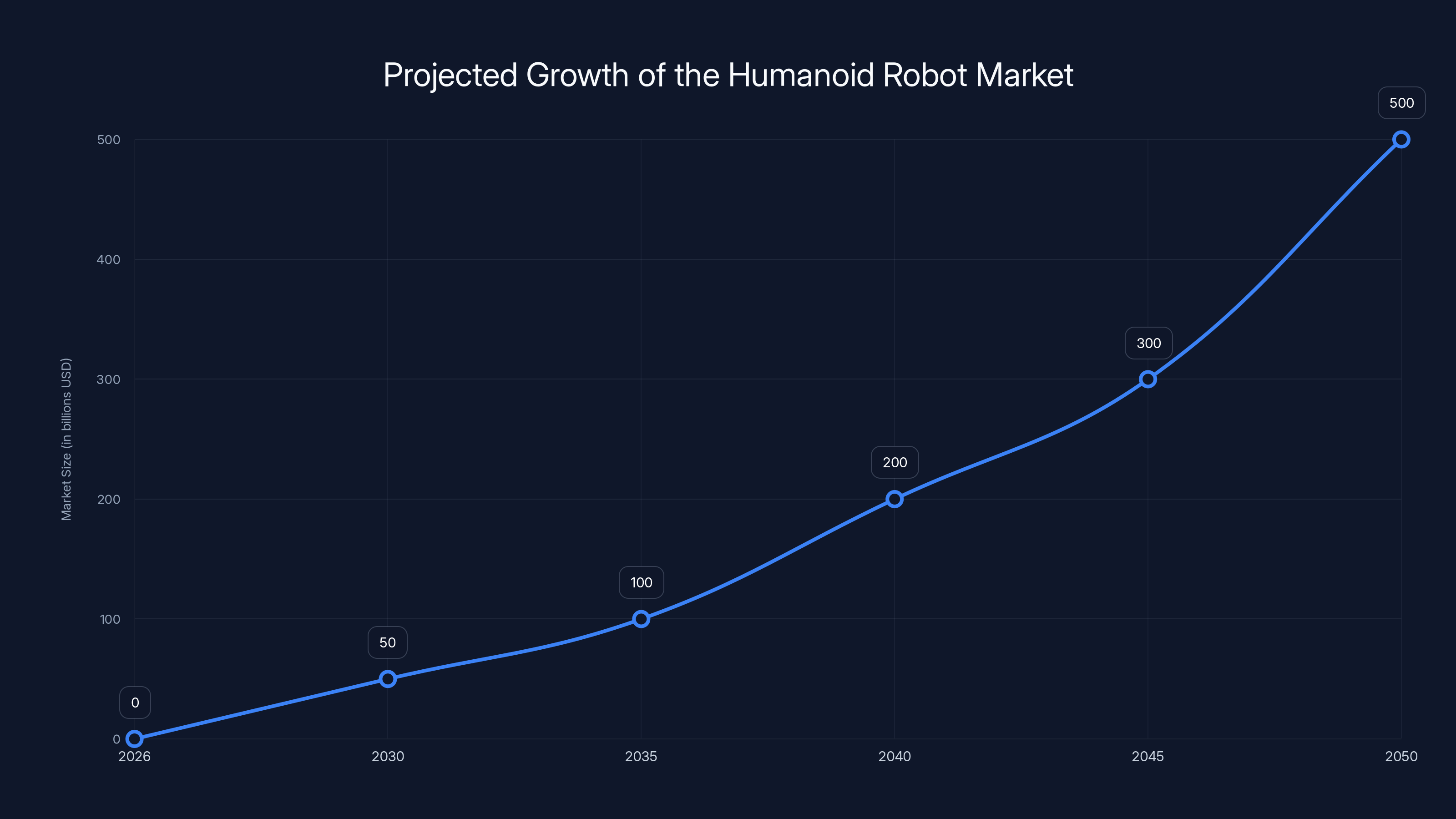

The humanoid robot market is expected to grow significantly, reaching potentially hundreds of billions of dollars by 2050. Estimated data based on industry projections.

Industry Implications: What This Means for Robotics

Playter's departure sends signals throughout the robotics industry.

First, it confirms that Boston Dynamics is serious about commercialization. A CEO departing after guiding a company toward commercial products is normal. If Boston Dynamics stayed purely in research mode, a long-tenured CEO might stay longer.

Second, it suggests that humanoid robots are taking longer than anyone hoped. If Atlas was on track to revolutionize factories within a few years, Playter might have stayed to see it through. His departure amid Atlas demonstrations implies the timeline is longer than hoped.

Third, it reflects the reality that hardware companies need different leadership at different stages. Playter was the right CEO for guiding commercialization. The next CEO might be the right person for accelerating market adoption. Different skills. Different experience. Different vision.

This cycle repeats across the industry. Tesla's transitions, Apple's transitions, even SpaceX's internal dynamics all reflect this reality. Hardware companies evolve as they mature, and leadership usually evolves with them.

Competitors like Tesla and Figure AI are watching Boston Dynamics' leadership transition closely. They're asking: what does this reveal about Boston Dynamics' confidence in their direction? Are they slowing down? Accelerating? Shifting priorities?

These questions matter because robotics is a capital-intensive, technically complex industry where competitive positioning can shift quickly. A new CEO at Boston Dynamics could change everything. Or they could maintain the current course. The industry waits to see.

The Future of Boston Dynamics Under New Leadership

What should we expect from Boston Dynamics in the years after Playter's departure?

Short-term, probably stability. Amanda Mc Master, the interim leader, will maintain current strategies. The company will continue developing Spot and Atlas. Customers won't see dramatic changes.

Mid-term, the question becomes: accelerate or optimize? Accelerating means pushing new products, new markets, more aggressive commercialization. Optimizing means improving Spot's capabilities, refining Atlas's designs, focusing on profit margins and customer satisfaction.

Long-term, the answer depends partly on where AI and robotics technology advance. If humanoid robots become practical within five years, Boston Dynamics needs aggressive leadership. If it takes ten or fifteen years, optimization might be wiser.

The industry consensus, if there is one, seems to be that humanoid robots are maybe five to ten years away from meaningful commercialization. Boston Dynamics likely has a similar timeline internally. That window is tight enough to justify some urgency but long enough to allow methodical development.

A new CEO will inherit tremendous resources (Hyundai's backing), proven technology (Spot), ambitious products (Atlas), and experienced teams. The question is what they do with these assets. That answer will define Boston Dynamics' future and, potentially, the robotics industry's path forward.

The Broader Robotics Market: Growth and Challenges

Boston Dynamics operates within a broader robotics market that's growing but facing real challenges.

Industrial robotics, the traditional market, is mature. Companies have been deploying robots in factories for decades. Growth is steady but not explosive. Most of the market is captured by established players like ABB, KUKA, and Fanuc.

Service robotics, the category Boston Dynamics operates in, is much smaller and younger. Cleaning robots are successful (Roomba). Delivery robots are emerging. Humanoid robots are still mostly experimental. This market has enormous potential but faces hurdles.

The primary hurdle is economics. A robot needs to be cheaper than human labor or do something humans can't do. In many scenarios, human labor still wins on cost. In scenarios where humans can't work (extreme environments, hazardous settings), robots have an advantage.

Spot has found its niche by doing things humans shouldn't do (enter dangerous environments). Humanoid robots might follow a similar path initially (handle toxic materials, work in extreme temperatures) before expanding to less hazardous applications.

The robotics market also faces technical challenges. Dexterous manipulation remains hard. Robots need to understand context. Vision systems need improvement. AI needs to advance further. These are being solved, but progress is slower than many hoped.

Playter managed Boston Dynamics through this challenging environment for six years as CEO. Under his leadership, the company stayed focused on realistic applications rather than chasing hype. That's probably the right approach, but it requires discipline and patience.

Risk Factors for Boston Dynamics Going Forward

While Boston Dynamics has advantages, they also face real risks.

First, execution risk. Building robots is hard. Every technical challenge requires months or years to solve. A wrong prioritization or missed milestone can derail plans. New leadership might make different choices that prove suboptimal.

Second, competitive risk. Tesla is well-funded and moving fast with Optimus. Figure AI is nimble and focused. Boston Dynamics is bigger and more established, which is usually an advantage. But in robotics, being established doesn't guarantee dominance. The market could surprise.

Third, market risk. If the market for humanoid robots develops more slowly than expected, Boston Dynamics' investments won't pay off on the timeline they need. They'd need to either accelerate development (expensive and risky) or accept slower growth (disappointing investors).

Fourth, organizational risk. Large leadership transitions sometimes create instability. Key people leave. Morale fluctuates. Decisions get delayed while waiting for a new CEO. Boston Dynamics needs to manage this carefully.

Fifth, technology risk. What if the humanoid robot approach is fundamentally flawed? What if specialized robots for specific tasks prove more practical? Boston Dynamics has bet heavily on humanoid robots. If that bet proves wrong, pivoting won't be easy.

These risks aren't unique to Boston Dynamics. Every ambitious robotics company faces them. But they're worth acknowledging. The path from research to commercial success isn't guaranteed, regardless of how brilliant the engineering is.

Lessons for Other Hardware Companies

Boston Dynamics' experience offers lessons for other companies building complex hardware.

First, patience pays. Building great robots takes time. Companies that rush to market with immature products often regret it. Boston Dynamics' willingness to spend years in development before commercializing Spot was the right call.

Second, focus matters. Spot succeeded partly because it solved a specific problem really well instead of trying to be everything. Hardware companies often fail by trying to serve too many markets. Narrow your focus.

Third, experienced leadership helps. Playter brought three decades of experience to his role. That credibility helped Boston Dynamics make strategic decisions. Other hardware companies underestimate the value of executives who truly understand the technical and operational challenges.

Fourth, multiple ownership transitions are survivable. Boston Dynamics went through three different owners in a decade and emerged stronger. The key is maintaining core technical culture while adapting to each owner's priorities.

Fifth, commercialization is its own discipline. Many hardware companies have brilliant engineers but struggle to commercialize. Boston Dynamics succeeded by treating commercialization as seriously as research. Playter understood this better than many CEOs.

These lessons extend beyond robotics. Any complex hardware company (EVs, drones, industrial equipment) needs similar approaches. Patience, focus, experienced leadership, flexibility, and a commitment to commercialization as a core discipline.

The Path Forward: What Happens Next?

Boston Dynamics faces an uncertain but potentially exciting future.

In the near term, expect stability. The company will continue executing on Spot development and Atlas demonstration. Revenue will grow modestly. The market will remain small but growing.

In the medium term, watch for new CEO announcements. The choice will signal direction. An external hire from a traditional manufacturing company signals Hyundai influence. An internal promotion signals stability. A hire from Tesla or a startup signals acceleration.

In the longer term, Boston Dynamics will either join the pantheon of successful robotics companies or find itself outpaced by competitors. That outcome depends on technology development, market timing, competition, and leadership decisions. All of those factors are partly in the company's control and partly beyond it.

Playter's 30 years created the foundation for either outcome. A new CEO will build on that foundation or rebuild it entirely. Either way, Boston Dynamics has proven that commercial robotics can exist. That's not a revolution, but it's real progress.

The robotics industry is at an inflection point. Humanoid robots might transform manufacturing, logistics, and countless other industries. Or they might remain expensive research projects for decades. Boston Dynamics, under new leadership, will help determine which future arrives.

FAQ

What is Boston Dynamics?

Boston Dynamics is a robotics company founded in 1992 as a spinoff from MIT. Known for developing Spot, a four-legged robot, and Atlas, a humanoid robot, the company focuses on creating advanced robots for inspection, exploration, and eventually, general-purpose automation. Boston Dynamics is currently owned by Hyundai.

Why did Robert Playter step down as CEO?

Playter announced his departure in February 2026 after six years as CEO and 30 years at the company. While specific reasons weren't detailed in the announcement, his departure follows a period where he successfully guided Boston Dynamics toward commercial robotics with Spot and demonstrated humanoid robot capabilities with Atlas. After three decades with the company, he may have felt his work was complete or preferred to pursue other interests.

Who is replacing Robert Playter as CEO?

Amanda Mc Master, Boston Dynamics' chief financial officer, is serving as interim CEO while the board searches for a permanent replacement. Mc Master brings financial expertise and deep knowledge of Boston Dynamics' business operations, making her well-suited for the temporary role while a permanent successor is selected.

What is Spot and what is it used for?

Spot is a four-legged robot developed by Boston Dynamics that can navigate complex terrain, climb stairs, and operate in hazardous environments. The company has commercialized Spot primarily for inspection work in dangerous settings like oil refineries, nuclear facilities, construction sites, and mining operations. It's one of Boston Dynamics' few revenue-generating products.

What is Atlas and when will it be commercially available?

Atlas is Boston Dynamics' humanoid robot platform designed to perform a wider range of tasks than Spot. The robot has demonstrated impressive capabilities in video demonstrations, including unpacking boxes and operating machinery. However, Atlas remains a research and development platform rather than a commercially available product. The timeline for commercial availability is unclear, though industry expectations suggest it could take five to ten years before humanoid robots achieve significant market adoption.

How has Boston Dynamics' ownership changed over time?

Boston Dynamics has had three major owners since its founding. Google's parent company Alphabet acquired it in 2013 for research purposes. SoftBank purchased Boston Dynamics in 2017, pushing for faster commercialization. Hyundai acquired the company in 2021, bringing manufacturing expertise and focusing robotics development on factory automation and logistics applications.

What does Playter's departure mean for the robotics industry?

Playter's departure signals that Boston Dynamics is transitioning toward a new phase of development. It suggests that commercialization efforts (like Spot's market entry) have reached a sustainable point, while also indicating that longer-term projects like humanoid robots still require significant development time. The departure also reflects the normal evolution of hardware companies, which often need different leadership at different stages of maturity.

Why is humanoid robot development taking so long?

Humanoid robots face extraordinary technical challenges. They must balance on two legs, manipulate objects with dexterous hands, understand context, operate safely near humans, and achieve all this with reasonable power consumption. These aren't simple problems to solve. Additionally, the market for humanoid robots is still developing, so there's uncertainty about where demand will actually exist. Boston Dynamics and other companies are proceeding methodically rather than rushing products that aren't ready.

How does Boston Dynamics compete with Tesla's Optimus and other humanoid robots?

Boston Dynamics competes through deep technical expertise, proven products like Spot, and backing from Hyundai. However, Tesla is moving aggressively with Optimus and has enormous resources. Figure AI is moving fast with a focused approach. The competitive landscape is fluid. Boston Dynamics' advantages include experience and proven commercialization with Spot, while disadvantages include higher legacy costs and a smaller organization than Tesla.

What's the timeline for commercial humanoid robots?

Industry consensus suggests humanoid robots could achieve meaningful market penetration within five to ten years, assuming current development progress continues. However, this is uncertain. Technical breakthroughs could accelerate the timeline, or unexpected challenges could delay it further. Economics also matter: humanoid robots need to be cheaper than human labor or do things humans can't, for significant market adoption to occur.

What should investors watch for regarding Boston Dynamics' future?

Key metrics include: whether Spot expands into new markets beyond inspection, whether Atlas demonstrates real-world factory capabilities, who the company hires as permanent CEO and what that signals about strategy, whether humanoid robot development stays on schedule, and whether Hyundai's ownership accelerates or constrains development. Revenue growth and customer adoption of existing products are also important indicators of progress.

Key Takeaways

- Robert Playter led Boston Dynamics for 30 years, with six years as CEO, guiding the company's transition from research lab to commercial robotics producer

- Spot, a four-legged robot, became Boston Dynamics' primary commercial product under Playter, finding profitable niches in infrastructure inspection and hazardous environment exploration

- Atlas, the humanoid robot platform, represents Boston Dynamics' longer-term vision but remains in development with uncertain commercialization timeline

- Boston Dynamics' three ownership transitions (Google, SoftBank, Hyundai) each shaped the company's strategic priorities, from moonshot research to commercialization focus

- The robotics industry stands at an inflection point where humanoid robots could transform manufacturing, but substantial technical and economic challenges remain unresolved

- New leadership at Boston Dynamics will determine whether the company accelerates development or optimizes existing products, with implications for the entire robotics sector

Related Articles

- Tesla Optimus Gen 3: The Humanoid Robot Reshaping Industry [2025]

- Biomimetic AI Robots: When Technology Crosses Into the Uncanny Valley [2025]

- Tesla is No Longer an EV Company: Elon Musk's Pivot to Robotics [2025]

- Humanoid Robots & Privacy: Redefining Trust in 2025

- Lidar & Vision Sensor Consolidation Boom [2025]

- Tesla Kills Model S and X Production: The Shift to Humanoid Robots [2025]

![Robert Playter Steps Down as Boston Dynamics CEO [2026]](https://tryrunable.com/blog/robert-playter-steps-down-as-boston-dynamics-ceo-2026/image-1-1770759646390.jpg)