Introduction: The End of Tesla's Legacy Sedans

Something fundamental shifted at Tesla on January 28, 2025, when the company announced during its earnings call that it's discontinuing the Model S and Model X, the sedans and SUVs that once defined what a premium electric vehicle could be. The decision didn't come as a press release or a carefully choreographed announcement. It emerged quietly during an investor call, almost offhandedly, as CEO Elon Musk explained that the company needs to repurpose manufacturing capacity for something he considers far more lucrative: humanoid robots.

Let that sink in for a moment. Tesla is walking away from two products that, a decade ago, were genuinely revolutionary. The Model S in 2013 wasn't just an electric car—it was a proof of concept that an EV could outperform, outpace, and out-impress traditional luxury sedans from Audi, BMW, and Mercedes-Benz. The Model X followed with an equally bold statement about what was possible in the electric SUV space. Yet here we are, in 2025, and Tesla is essentially abandoning both of them.

But this move isn't really about the vehicles themselves. It's about what Tesla has become under Musk's leadership and where the company's capital, attention, and ambitions are actually directed. It's about choosing a technology that doesn't exist yet (or barely exists) over products that have shipped millions of units. It's a calculated bet that humanoid robots will eventually be worth more than cars—and it's a bet that's already costing Tesla dearly.

The announcement landed during what was arguably the worst earnings report in Tesla's history. Profits collapsed. Revenues declined year-over-year for the first time ever. The company that was supposed to be inexorably marching toward total market dominance is instead watching Chinese competitors like BYD gain ground, watching legacy automakers catch up, and watching its own margins compress under the weight of price cuts and production inefficiency.

Yet instead of doubling down on profitability, Tesla is sacrificing one of its most iconic product lines to chase a vision of the future that may or may not materialize. This article explores what happened to the Model S and X, why Tesla made this decision, what it means for the company's future, and what it tells us about where automotive and robotics technology are actually headed.

TL; DR

- Tesla is discontinuing Model S and Model X production to reallocate factory space for Optimus humanoid robot manufacturing, shifting the company away from traditional EV production

- The Model S and X were once revolutionary but have stagnated under years of minimal updates while competitors like Porsche Taycan, Lucid Air, and Chinese EVs vastly improved their offerings

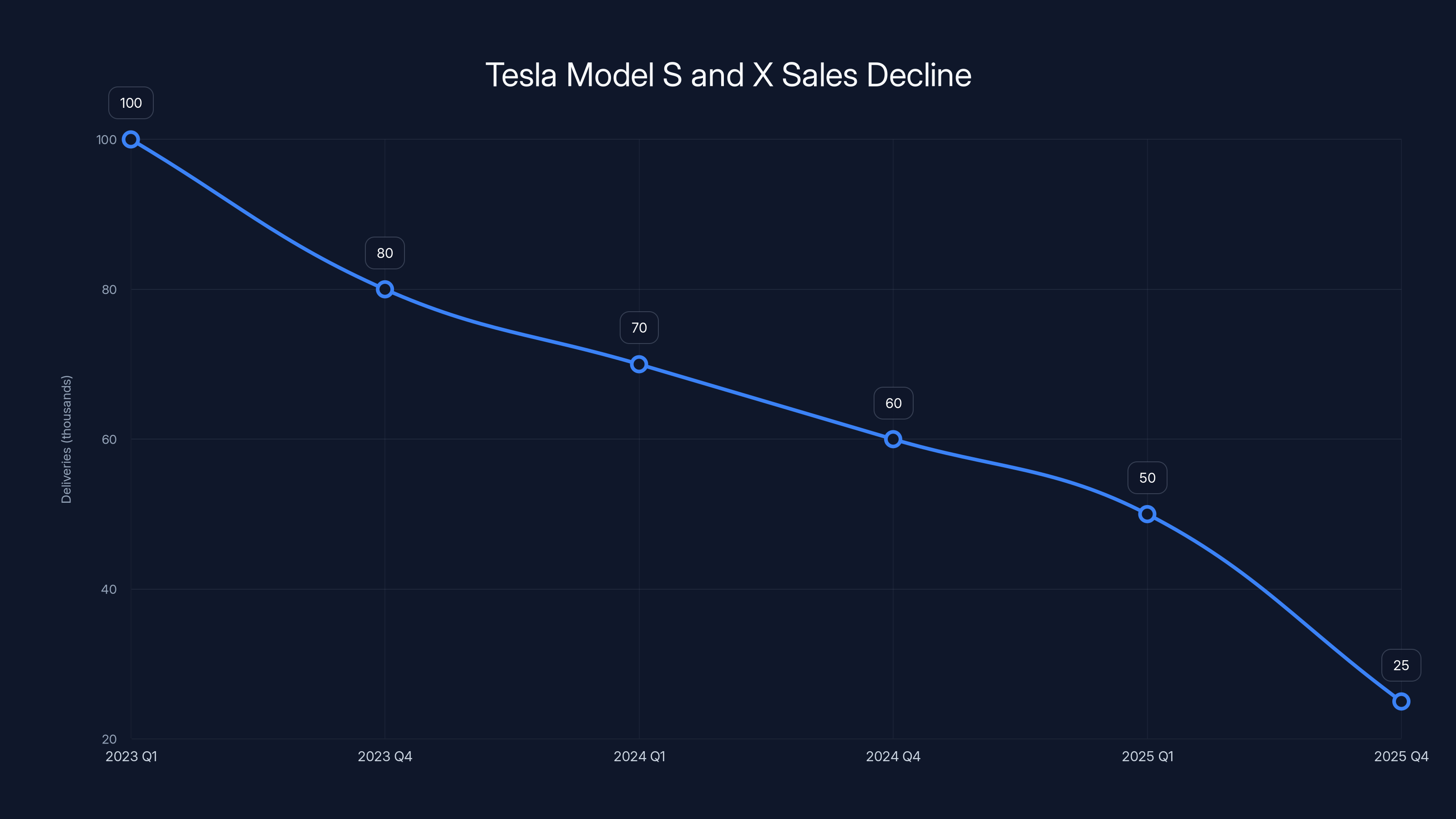

- Sales were already plummeting: Model S and X deliveries fell over 50% in Q4 2025 and 40% for the full year, making them increasingly marginal to Tesla's revenue

- The financial situation is dire: Tesla's 2025 profits were nearly halved, revenues declined year-over-year for the first time, marking the company's worst earnings in its history

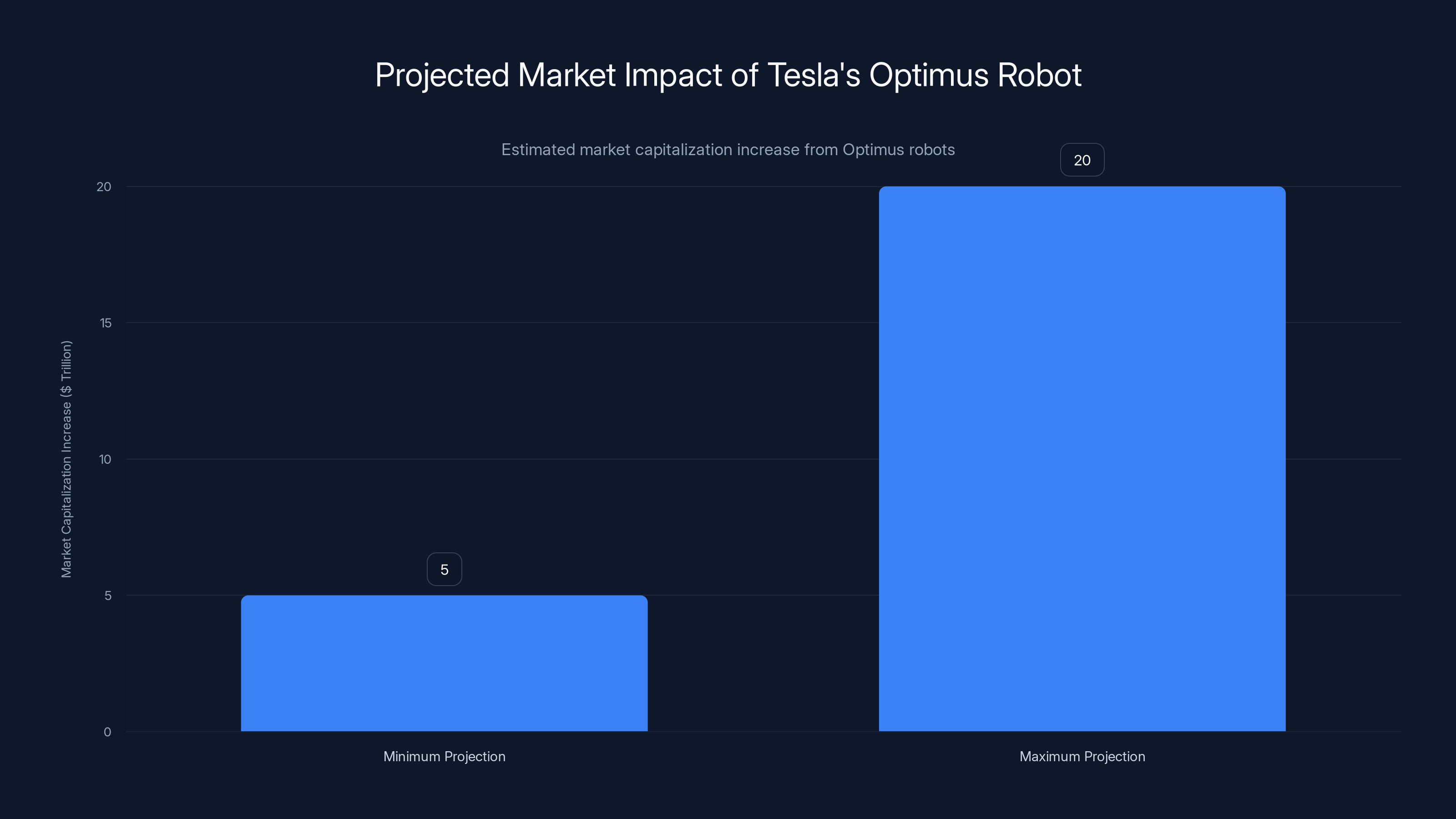

- The Optimus bet is enormous and risky: Musk claims these robots will eventually add $20 trillion to Tesla's market cap, but the company admits they're still "very much at the early stages" and "in the R&D phase"

Tesla's net income dropped by 45% from 2024 to 2025, while revenue remained flat. The significant price cut of the Model 3 from

The Rise and Fall of the Model S: How Tesla's Flagship Lost Its Way

The 2013 Moment: When the Model S Changed Everything

To understand what Tesla is losing, you have to understand what the Model S meant in 2013. At that time, electric vehicles from traditional automakers were something of a joke. They were compliance cars, built to satisfy emissions regulations in California and Europe, not because anyone actually wanted them. They were hasty conversions of gas-powered platforms. Nissan's Leaf was functional but slow and awkward. BMW's i3 was quirky. Audi's e-tron was years away. And everyone else wasn't even trying.

Then Tesla released the Model S.

It was designed from the ground up as an electric vehicle, not as a retrofit. The massive battery pack didn't get crammed under the hood where it didn't belong. Instead, Tesla positioned it along the floor of the car, which did two things: it lowered the center of gravity for better handling, and it freed up interior space for actual passengers. The design was clean, purposeful, and beautiful in a way that no electric vehicle had been before.

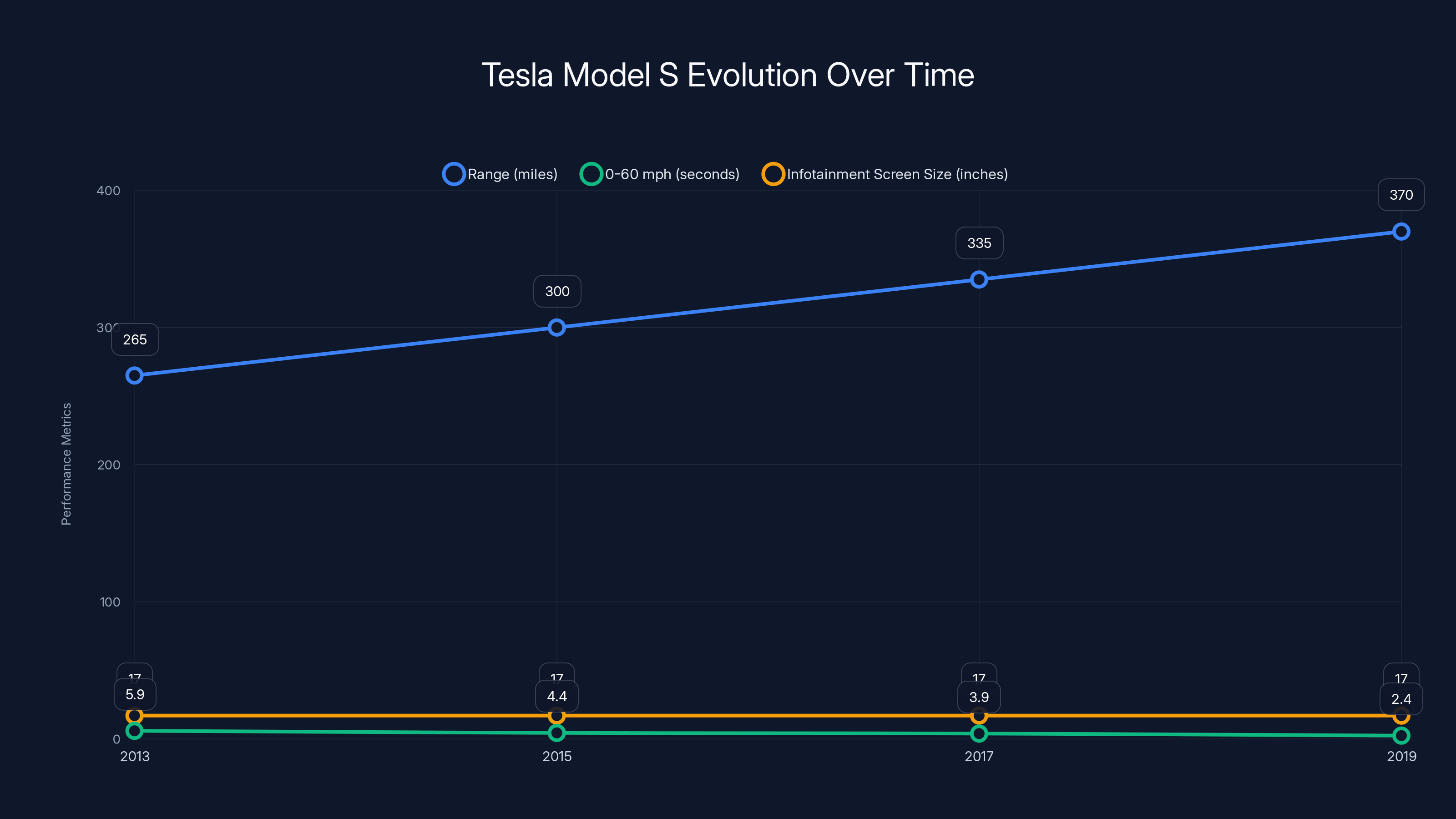

The numbers were shocking at the time. Two hundred sixty-five miles of range on a full charge. Zero to sixty in under six seconds. A touchscreen infotainment system that made everything else on the road look like it belonged in a museum. When journalists drove it, the reaction was unanimous: this changes everything.

Tesla had effectively announced to the world that the future didn't need to be cramped, slow, or ugly. Electric vehicles could be desirable. They could be fast. They could be practical. The Model S wasn't just a good car for an electric vehicle—it was a genuinely good car, period. It competed with the BMW 7-Series and Mercedes S-Class on actual merit, not just on the novelty of being electric.

The Stagnation Years: When Updates Stopped Coming

For the first five or six years of the Model S's existence, Tesla kept pushing. Power increased. Features added. The "Ludicrous" acceleration mode arrived, promising zero to sixty in under four seconds. Software updates came regularly. In 2017, I got to drive a Model S, and it was an entirely different machine from the 2013 version. Faster. Smarter. More refined.

But then something happened. Tesla stopped improving it seriously.

Oh, there were cosmetic refreshes. A facelift in 2021. Some interior tweaks. But the fundamental architecture remained unchanged. While the Model 3 and Model Y got constant attention—because they were the volume products where Tesla made its money—the Model S languished. Porsche released the Taycan in 2019, and suddenly there was a real competitor. Lucid released the Air in 2021, and suddenly there was another one. Both cars offered cutting-edge technology, superior build quality, and genuinely competitive performance. The Model S, by comparison, started to feel dated.

Worse, the competition didn't stop there. By 2023, premium electric sedans and SUVs were arriving from every direction. BYD's flagship models started appearing. XPeng's P7 challenged it in China. Xiaomi, the smartphone company, entered the EV market and immediately produced competitive vehicles. Mercedes, BMW, Audi, and even Lamborghini had electric offerings that could rival or exceed what the Model S offered.

Meanwhile, Tesla was busy dealing with the Model X, a vehicle that had its own set of problems.

The Model X Disaster: Ambition Undermined by Execution

If the Model S was Tesla's triumph, the Model X was its cautionary tale. The vision was bold: a luxury electric SUV with unconventional design, particularly the famous falcon wing doors that were supposed to be more practical than traditional side doors while also being visually striking.

Execution turned into a nightmare.

The falcon wing doors took years to perfect because they kept failing. Sensors malfunctioned. Motors burned out. The doors hit people (including, memorably, a journalist at their first test drive event). The entire project became what's now known in the automotive industry as a textbook example of engineering ambition outpacing manufacturing capability. Tesla had to completely redesign the doors, and then redesign them again.

The Model X finally arrived in 2015, three years late, already over budget, and immediately dealing with quality issues. Yet for a while, it still worked. The electric SUV market was even less developed than the sedan market. Everything about the Model X—the range, the performance, the seating for seven—was legitimately impressive compared to alternatives.

But a decade is a long time in the EV market. Rivian released the R1S, which did the whole premium electric SUV thing better. Lucid released the Gravity SUV. Mercedes released the EQS. BMW released the iX. Even Volkswagen got in on the action with the ID. Buzz, a retro-futuristic microbus that made the Model X look clunky and dated by comparison. The Model X's design was never winning any beauty contests, and its age started to show.

Sales of Tesla Model S and X declined significantly from 2022 to 2025, with a 50% drop in quarterly deliveries by Q4 2025 compared to the previous year. Estimated data based on narrative trends.

The Numbers Don't Lie: How Model S and X Sales Collapsed

The Quarterly Decline

If there's one thing that makes the case for Tesla's decision, it's the sales data. Because whatever the emotional attachment to these cars might be, the business reality is undeniable: nobody's buying them anymore.

In 2022, Tesla sold 564,743 Model S and X units combined (and yes, that includes Plaid and other variants). By 2024, that number had dropped to 363,307. By Q4 2025, quarterly deliveries for these models had fallen over 50% compared to the previous year. For the entire 2025 calendar year, Model S and X sales dropped 40% compared to 2024. Even accounting for the fact that production had already shifted toward the Model 3 and Model Y, which are more profitable volume products, these numbers represent a genuine market rejection.

The decline didn't happen because the cars got worse—they remained capable, fast, and fundamentally sound machines. It happened because the market moved on. Every quarter, more competitors arrived. Every quarter, those competitors offered more features, more range, better interior technology, more reliable delivery times, and superior build quality. The Model S and X were once ahead of the curve. By 2025, they were behind it.

Tesla executives were clearly aware of this. The company had already ended right-hand-drive production (which affected the UK, Australia, New Zealand, and Japan markets) back in 2023, essentially conceding those regions to competitors. The final years of Model S and X sales were characterized by discounting, trade-in incentives, and increasingly desperate marketing efforts.

Regional Collapse and Market Share Loss

Looking at the regional breakdown makes the situation even starker. In China, where Tesla once dominated the premium sedan market, Chinese EV makers have systematically taken market share. BYD's Qin line, Xiaomi's SU7, and XPeng's P7+ now compete directly with the Model S in terms of performance and features, often at lower price points. In Europe, the same pattern emerges: premium electric vehicles from legacy automakers now dominate the premium segment.

In the United States, Tesla's home market, the Model S and X were facing increased competition from established luxury brands that finally caught up. When the Porsche Taycan arrived, it immediately started winning awards that the Model S had previously dominated. When the Lucid Air arrived, automotive critics called it the best electric sedan ever made—a claim that directly undermined Tesla's flagship positioning.

The Model Y and Model 3, by contrast, continue selling in massive volumes. They're simpler, more affordable, and less dependent on cutting-edge technology to justify their purchase price. They're what actually kept Tesla's revenue alive during 2024 and 2025. The Model S and X became increasingly like appendages to the product line—expensive to manufacture, requiring engineering resources, taking up factory floor space, and generating declining returns.

From a purely business perspective, the decision to discontinue them almost makes sense. The factory space could be used for something newer. The engineering resources could be allocated to products that actually sell. The supply chain could be simplified. It's not crazy thinking.

But the opportunity cost of what Tesla is doing with that factory space—and what the company is sacrificing—tells a very different story.

The Pivot to Robotics: Why Musk Believes the Future Isn't Cars

The Long History of Musk's Shifting Obsessions

Elon Musk has never been particularly interested in just building and selling cars profitably. From the beginning of Tesla's existence, he's used cars as a stepping stone toward some grander vision. First, it was proving that electric vehicles could be desirable. Then it was creating a sustainable energy company (hence the solar acquisitions). Then it was autonomous driving, which Musk decided would transform every Tesla into an asset that would appreciate in value and generate income for its owner through Tesla's robotaxi network.

Each of these pivots involved diminishing attention to the actual cars themselves. As Tesla's autonomous driving technology fell further and further behind what was actually possible, Musk's attention drifted elsewhere. Last week, Tesla announced it would discontinue its Autopilot feature entirely in favor of a subscription-based approach to Full Self-Driving. This isn't a technical improvement—it's an admission that even the company's own partially autonomous driving system isn't delivering on its promises.

But rather than fix autonomous driving, Musk has decided the future belongs to humanoid robots. Specifically, Tesla's Optimus robot, which the company claims will be ready for public sale in 2027 and will eventually be manufactured in the billions. These robots, Musk has claimed, will add somewhere between

The Optimus Gamble: Promise and Reality

On the surface, the logic is seductive. Humanoid robots could theoretically replace human labor in manufacturing, construction, agriculture, and countless service industries. If Tesla could crack the problem of building a general-purpose humanoid robot that's cheap enough to mass-produce, durable enough to work reliably, and intelligent enough to adapt to different tasks, the market opportunity would indeed be staggering. Some estimates suggest a market for hundreds of millions of robots over the next two decades. At high margins, that's an enormous business.

The problem is that Optimus currently doesn't work. Not in any meaningful sense.

During the recent earnings call, Musk admitted something remarkable: the Optimus robots at Tesla's factory aren't actually doing any useful work. They're not assembling components. They're not performing real manufacturing tasks. They're essentially proof of concept, demonstrating that the basic idea of a humanoid robot is feasible, but not demonstrating that it's practical.

This is important context when evaluating Musk's claim that Tesla will manufacture 10,000 robots in 2025. The company simultaneously stated that Optimus remains "very much at the early stages" and "in the R&D phase." These statements are contradictory. You cannot mass-produce 10,000 units of something that's still in early R&D. You can't optimize manufacturing, reduce costs, or ensure quality on that timeline. What Musk is doing is making aspirational claims while simultaneously acknowledging they're unlikely to happen.

This pattern is familiar to anyone who's followed Tesla's history. The Model X falcon wing doors were supposedly going to be mass-produced. They spent years in development hell. The Cybertruck was supposed to ship in 2020 and cost

The Factory Space Problem

But here's where the Model S and X discontinuation makes sense within Musk's logic: he needs factory space. Tesla has limited manufacturing capacity, and every bit of it is spoken for. The Model 3 and Model Y print money. The Cybertruck is new and requires substantial investment in manufacturing optimization. If you want to produce Optimus robots, you need somewhere to build them.

Musk's solution? Stop building the products that don't move the needle anymore. The Model S and X, even combined, represent a small percentage of Tesla's total production. But the floor space they occupy is valuable. The equipment needed to build them could be repurposed. The supply chain complexity they create could be eliminated.

From a pure capital allocation perspective, this makes a certain kind of sense. If you believe—really believe, the way Musk apparently does—that humanoid robots represent the future, then investing factory resources there instead of in aging sedan and SUV platforms is rational.

The bet is whether Optimus actually emerges from R&D and becomes a real product before the lack of innovation in Tesla's existing vehicle lineup costs it market share that it can't recover.

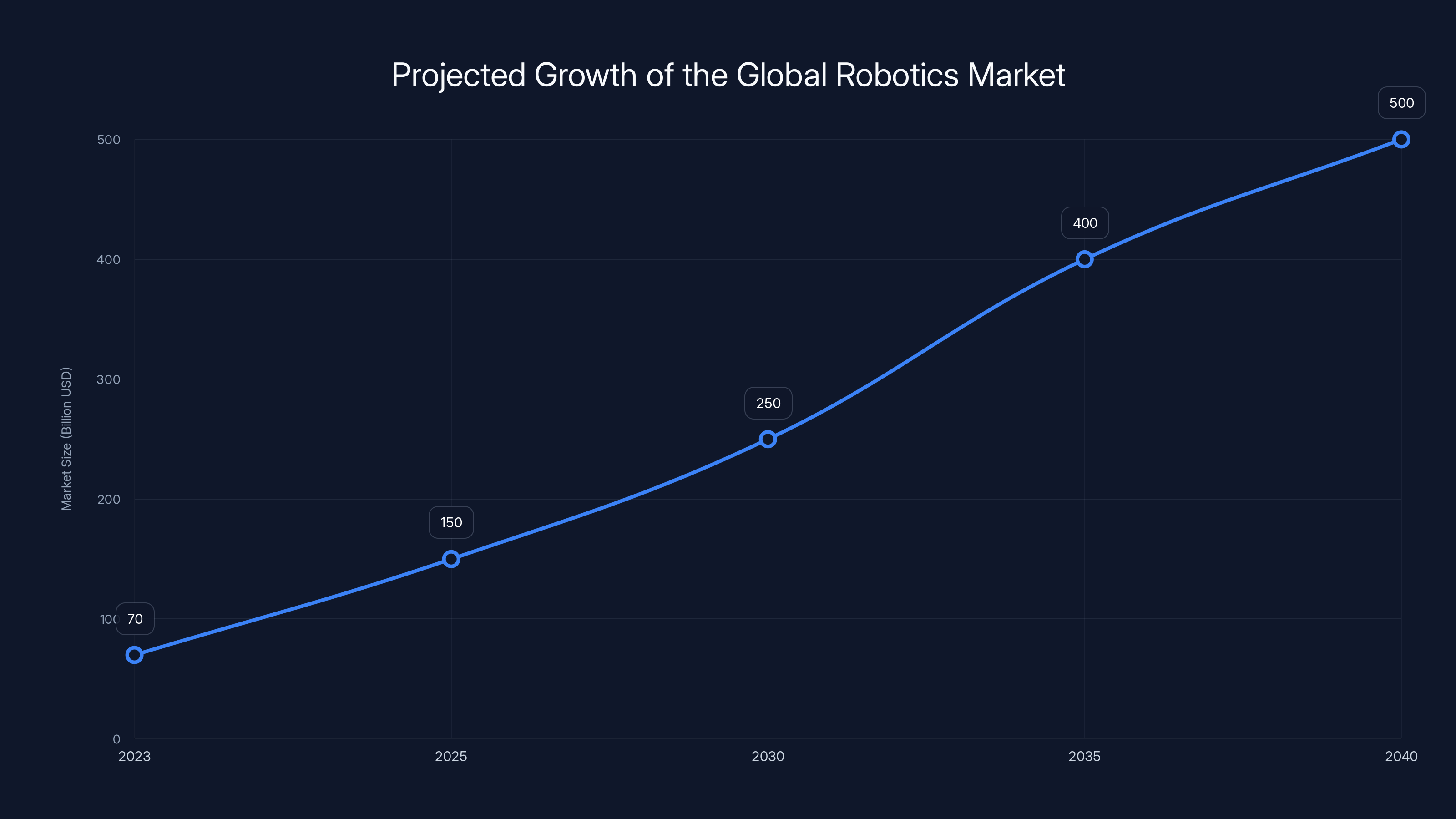

The global robotics market is projected to grow from

Tesla's Financial Crisis: The Real Driver Behind the Decision

The 2025 Earnings Report Nobody Wanted to Read

Understanding why Tesla discontinued the Model S and X requires understanding the company's dire financial position heading into 2025. The earnings report from January 28, 2025, was honestly devastating. Let's look at the actual numbers.

Tesla's net income in 2024 was approximately

Revenues also declined year-over-year for the first time in Tesla's existence. The company brought in roughly

Margins compressed across the board. Tesla had spent years depending on premium pricing for its vehicles. It had relied on supply constraints creating artificial demand. But by 2024 and 2025, supply constraints had evaporated. Demand softened. Competitors arrived with better products at competitive prices. Tesla's response was to cut prices, which worked in the short term for volume but devastated margins. A Model 3 that the company used to sell for

Meanwhile, operating costs remained stubbornly high. Musk's acquisition of Twitter (now X) had turned into a distraction that was consuming his time and attention. The company faced increasing regulatory scrutiny in multiple countries. Competition was intensifying. And the capital requirements for developing new products—especially something as audacious as a humanoid robot—were enormous.

Something had to give.

Why Existing Models Became Expendable

In this context, the Model S and X discontinuation makes sense as a survival move, not a growth move. Tesla was under pressure to maintain profitability. It needed to cut costs, reduce complexity, and focus resources on products that actually drove revenue growth.

The Model S and X, by this analysis, were net negatives. They required engineering attention that could be directed elsewhere. They tied up manufacturing capacity that could be allocated to higher-volume, more profitable products. They created supply chain complexity for components that fewer people wanted each year. From a pure operating efficiency standpoint, getting rid of them improved the business.

What's remarkable is that this is exactly backward from how Apple operates. When Apple discontinues a product, it's not to make room for something in R&D. It's because the product has reached the end of its life cycle and been replaced by something better that's already shipping and proven. Tesla is doing the opposite: it's discontinuing established products to make room for something that doesn't exist yet and may not exist for years.

That's a reflection of Musk's priorities and also of the desperation in Tesla's current situation. The company can't afford to develop new vehicles right now. It can barely afford to develop Optimus. So it's making a choice: bet everything on the robot, and cut away anything that doesn't contribute directly to that bet.

What Made the Model S Revolutionary in the First Place

The Design Philosophy: From the Ground Up

When Tesla designed the Model S, it had a fundamental advantage that most automakers didn't: the ability to think from first principles. Traditional car companies build cars around internal combustion engines, transmissions, exhaust systems, and fuel tanks. All of these components create constraints that shape every aspect of the vehicle design, from the location of the wheels to the height of the hood to the positioning of the interior.

Tesla didn't have those constraints. An electric motor is far simpler than an internal combustion engine. There's no transmission. There's no exhaust system. There's no fuel tank taking up space. This meant designers and engineers could approach the problem differently.

The battery pack, rather than being crammed into the trunk or under the hood where it didn't belong, became the foundation of the car. By mounting the battery pack flat along the floor between the wheels, Tesla accomplished several things at once. First, it lowered the center of gravity, improving handling characteristics. Second, it freed up enormous amounts of interior space. A Model S could offer the seating and cargo capacity of a large sedan while fitting into a package that looked sleeker and more efficient.

The result was a car that didn't just drive like a great electric vehicle. It drove like a great vehicle, period. It had performance that rivaled sports cars in acceleration tests. It had range that made long-distance travel practical. It had infotainment and autonomous driving features that were years ahead of what the traditional auto industry was offering.

The Performance Advantage: Why Numbers Mattered

When journalists and customers evaluated the Model S, they didn't have to make excuses. A 265-mile range in 2013 was genuinely remarkable. Zero to sixty in under six seconds was genuinely quick. The 0-60 time in under four seconds (in the later Ludicrous mode) was genuinely fast—comparable to actual sports cars.

These weren't advantages that existed only in the context of electric vehicles. They were advantages full stop. A Model S could out-accelerate most sports cars on the road. It could match or exceed the efficiency of luxury sedans from established automakers while offering better performance and more space. It could do all of this while being powered by electricity rather than gasoline.

This meant that early adopters of the Model S weren't making a compromise. They weren't choosing an electric car because they wanted to save the environment and were willing to accept lower performance as the trade-off. They were choosing it because it was actually better. It was faster. It was smarter. It was more efficient. The fact that it was also better for the environment was a bonus, not the main point.

This positioning—creating a product so good that people want it regardless of the category—is what made Tesla's early years so successful and created such fierce brand loyalty. People didn't just buy a Model S. They became evangelists for it. They converted friends and family. They stood in lines for hours to order new models. That cultural momentum is incredibly valuable, and it's something that dissipates quickly once the product stops being genuinely best-in-class.

The Tesla Model S saw significant improvements in range and acceleration from 2013 to 2019, making it a leader in electric vehicle performance. (Estimated data)

The Competition Caught Up: What Changed in Ten Years

Legacy Automakers Finally Got Serious About EVs

For the first five or six years of the Model S's existence, traditional car companies didn't take electric vehicles seriously. They made them because regulations required them to make them, but they didn't believe in them and didn't invest serious resources into making them competitive.

Then around 2019-2020, something shifted. Porsche, Mercedes-Benz, BMW, and Audi all decided that electric vehicles were actually the future and began investing like they meant it. Porsche released the Taycan, a genuine competitor to the Model S that offered superior build quality, more sophisticated technology, and better customer service. Mercedes released the EQS, which did many of the things the Model S did but with 70 years of automotive expertise baked into every detail. BMW released the iX, which offered a different approach but was similarly capable.

These companies had advantages that Tesla couldn't match. They had established relationships with dealers and service networks. They had customer loyalty from decades of building reliable, well-engineered vehicles. They had manufacturing expertise that meant fewer quality issues and more efficient production. When they finally decided to build electric vehicles properly, they built them really well.

The Model S didn't get worse, but suddenly there were multiple alternatives that were objectively better in various ways. The Taycan had superior ride quality. The EQS had a better interior. The Mercedes had better software integration with existing smart home ecosystems. The BMW had a more sophisticated infotainment system. None of these differences were massive, but they meant that the Model S was no longer the clear choice for someone shopping in the luxury sedan segment.

Chinese Competitors Disrupted the Entire Market

What really changed the game was the emergence of serious competition from China. Companies like BYD, NIO, XPeng, and Xiaomi didn't have the baggage of legacy manufacturing plants or gasoline-powered product lines that they were trying to protect. They could design electric vehicles from the ground up, the way Tesla had. But they had access to massive capital from the Chinese government and private investors who believed in electric vehicles as a category.

Moreover, they had access to battery technology and manufacturing capabilities that were competitive with or superior to what Tesla was using. BYD is the world's largest battery manufacturer, and controlling the supply chain meant controlling costs. NIO and XPeng focused on high-end vehicles with cutting-edge technology. Xiaomi entered the market with a car that had smartphone-level design and feature density.

These competitors weren't trying to port their existing designs to electric power. They were designing purpose-built electric vehicles with no baggage. And they were doing it faster and more cheaply than legacy automakers because they didn't have established manufacturing plants to convert. They could build new factories specifically optimized for electric vehicle production.

Suddenly, the Model S wasn't just competing with Porsche and Mercedes. It was competing with the BYD Qin, which offered similar performance at a much lower price point. It was competing with the XPeng P7+, which had features and technology that the Model S lacked. And in China especially, these competitors had the advantage of government support and cultural favor that Tesla, as a foreign company, couldn't match.

The Software Stalemate: When Technology Caught Up

One of the Model S's original advantages was its software and infotainment system. The massive touchscreen was revolutionary. The over-the-air update capability meant that the car could improve throughout its lifetime. The integration with a connected ecosystem was years ahead of what competitors offered.

But software advantages are temporary. Once competitors matched and then exceeded Tesla's capabilities, that advantage evaporated. By 2023, multiple automakers had sophisticated infotainment systems with better interfaces, more apps, and more seamless integration with smartphones. The simple reality is that software is more democratic—it's easier to copy and improve upon than fundamental engineering.

Meanwhile, Tesla's autonomous driving advantage had largely evaporated. Full Self-Driving remained a beta product with serious limitations. Competitors were developing their own autonomous capabilities, often in partnership with companies like Waymo or in-house teams with serious engineering resources. The magical advantage that Tesla had built its brand on—the idea that your car would become more valuable and autonomous over time—had been delayed so long that competitors had caught up.

The Humanoid Robot Bet: The Audacity and the Risk

What Tesla Claims Optimus Will Do

According to Musk and Tesla executives, the Optimus robot will be a general-purpose humanoid robot capable of performing a wide variety of tasks. The initial focus is on manufacturing and other labor-intensive tasks, but the long-term vision is much broader. The company has claimed that eventually, every household might have an Optimus robot, performing cooking, cleaning, childcare, elder care, and countless other functions.

The economic argument is straightforward. If a robot can be produced for

If Tesla can produce millions of these robots, the market opportunity is genuinely enormous. Industry analysis suggests that the global robotics market could grow from roughly

The Development Reality: Still in R&D

The problem is that none of this is shipping yet, and the company has explicitly acknowledged that Optimus is still "very much at the early stages" and "in the R&D phase." Musk claims the robots will go on sale in 2027, but given the company's historical pattern of missing timelines by multiple years, skepticism is warranted.

Current Optimus robots are in test phase at Tesla's factories. They can walk around, move objects, and perform very basic tasks. But they're not autonomously making decisions about how to optimize a manufacturing process. They're not troubleshooting problems. They're not adapting to new situations without human intervention. They're proof of concept, not proof of commercial viability.

The challenge ahead is absolutely massive. A humanoid robot needs to:

- Recognize objects and environments with superhuman precision

- Move with enough dexterity to handle delicate tasks

- Understand human language and intent

- Troubleshoot problems when something goes wrong

- Operate continuously for 8-16 hours on a single charge

- Be cheap enough to produce at scale

- Be reliable enough that failures are infrequent

- Have software that's safe and doesn't create liability issues

Not a single one of these challenges is trivial. Tesla has invested significant resources in AI and robotics, but so have companies like Boston Dynamics, which has been working on humanoid robots for decades and still doesn't have a commercial product. Google has invested in robotics. Amazon has invested in robotics. Every major tech company recognizes that robotics is the next frontier. Yet none of them have cracked the general-purpose humanoid robot problem.

Tesla believes it can solve this problem where everyone else has struggled because of its expertise in AI, its access to massive computing resources, and its manufacturing capabilities. Maybe that belief is justified. Or maybe Musk is repeating a pattern that's defined his recent years: making grandiose claims about timelines and capabilities that turn out to be wildly optimistic.

The $20 Trillion Question

Musk has claimed that Optimus robots could eventually add

For this claim to be true, several things would need to happen:

First, humanoid robots would need to become ubiquitous. Not just in manufacturing, but everywhere. In homes, in hospitals, in restaurants, in construction sites, in agriculture. They would need to displace human labor at a scale that's hard to even conceptualize.

Second, Tesla would need to dominate this market to a degree that makes Apple's dominance in smartphones look trivial. Tesla would need to capture the majority of global robot sales across every application.

Third, the profit margins on robots would need to be extraordinarily high. Tesla would need to achieve margins on robots that are comparable to or higher than the margins it currently achieves on vehicles, which are themselves exceptionally high.

None of these things are impossible. But they're all contingent on breakthrough technology arriving on schedule and staying ahead of competitors. Given Tesla's recent history of delays, setbacks, and missed timelines, betting the company's future on all three of these things coming true is a significant gamble.

The decision to discontinue the Model S and X is essentially Musk saying: "I'm so confident in this humanoid robot vision that I'm willing to sacrifice established, profitable product lines to pursue it." That's either visionary or catastrophically reckless. History will probably decide which.

Elon Musk claims that Tesla's Optimus robots could add between

The Parallel to Model X: A History of Development Hell

How Model X Presaged Future Problems

The Model X's troubled development should have been a warning. The falcon wing doors were Musk's great vision for the vehicle—a way to make getting kids in and out of an SUV easier while also creating a visually distinctive design element. But the doors didn't work. They had problems with sensors. They had problems with motors. They had problems with the mechanism itself. What was supposed to be a clever solution to a real problem instead became a joke within the automotive industry.

The entire Model X project ended up years late and millions of dollars over budget. And that was for something relatively simple—a set of fancy doors. If Tesla couldn't execute that competently, what does it say about the company's ability to execute on something as complex as a general-purpose humanoid robot?

The same pattern repeated with the Cybertruck. Musk's vision was audacious: a stainless steel exoskeleton, unprecedented angles and shapes, a revolutionary manufacturing process. The reality was a vehicle that took years longer to develop than planned, cost far more to manufacture than initially claimed, and arrived with numerous quality issues and design compromises.

The Model 3 was supposed to be the affordable Tesla, selling millions annually. Instead, its development consumed extraordinary resources, and the company nearly ran out of cash trying to scale production. By all accounts, Musk was personally involved in battery manufacturing, sleeping in the factory, obsessing over every detail. It was exhausting and not necessarily effective.

Pattern Recognition: Musk's Design Philosophy

There's a pattern here. Musk envisions something audacious. He pushes engineers to make it happen faster than physics and manufacturing reality allow. There are delays and cost overruns. Eventually, a product ships, often with compromises from the original vision. The market either embraces the product (Model 3, Model Y) or realizes it's not as revolutionary as promised (Model X, Cybertruck).

With Optimus, we're in the early stages of this pattern. The audacious vision exists. The claims are grandiose. The resources are being invested. The timeline is aggressive. The development is encountering challenges.

The question is whether humanoid robots follow the pattern of the Model 3 (market embraces it, massive success) or the Model X (market finds it interesting but flawed, modest adoption). Or worse, whether it ends up in development hell for so long that competitors pass Tesla by entirely.

Market Implications: What Happens to the Premium EV Segment

Who Buys the Model S Now?

With the Model S and X discontinued, what are the options for someone who wants a premium electric sedan or SUV? The market suddenly looks very different. For premium sedans, there's the Porsche Taycan, the Mercedes EQS, the BMW iX, the Audi e-tron GT, the Lucid Air, the XPeng P7+, the BYD Qin, and numerous others. The Taycan is the closest competitor to what the Model S was, and most reviewers consider it superior in most ways. The EQS is more luxurious. The Lucid Air is faster.

For premium SUVs, the Model X was one option among many. Now there's no Tesla option at all in that segment. Mercedes has the EQE SUV and EQS SUV. BMW has the iX. Audi has multiple electric SUVs. Porsche has the Macan Electric. Lucid has the Gravity. Rivian has the R1S. In China, BYD has multiple premium electric SUVs. Xiaomi just entered the market with a flagship SUV.

Tesla's departure from these segments is significant. For customers who were loyal to the brand and wanted a premium vehicle, there's no longer a Tesla option. Some will switch to Model Y variants, but the Y was always positioned more toward the mass market. Some will switch to competitors. This is market share that Tesla is voluntarily surrendering.

The argument from Tesla's perspective is that the Model Y is making far more money anyway, so why bother with the low-volume Model S and X? That's true from a purely financial perspective. But it cedes the premium market entirely.

The Strategic Vacuum

What's interesting from a competitive standpoint is the vacuum Tesla is creating. In the early days of the EV market, the existence of the Model S and Model X forced legacy automakers to take electric vehicles seriously. These cars were proof that you could build a premium electric vehicle that was genuinely desirable.

Now that Tesla is abandoning the premium segment, the onus shifts entirely to other manufacturers. Mercedes, Porsche, BMW, and Audi will continue developing premium electric vehicles because it's strategically important to them. Chinese competitors will continue pushing forward. But there's no longer a Tesla vehicle at the aspirational top of the market.

This is arguably a mistake. Every market has a premium segment. Creating a product at the top of the market that's undeniably excellent is an effective way to establish brand cachet. People buy a premium Model S or Model X and become convinced that Tesla is the future. They talk about it. They evangelize. They influence others' purchasing decisions. Then when they're ready for a more affordable vehicle, they buy a Model 3 or Model Y from the same brand because they're already convinced.

Sacrificing that position entirely to chase humanoid robots is a significant bet. It means ceding brand positioning to competitors and hoping that Optimus robots become important enough to compensate for the loss of prestige and influence that premium vehicles provide.

The Tesla Model S and X experienced a significant decline in deliveries, dropping over 50% by Q4 2025. Estimated data based on narrative context.

Robotics as the Future: Reality vs. Hype

What's Actually Happening in Robotics

Tesla isn't the only company investing in humanoid robots. The entire industry is convinced that robotics is important. Boston Dynamics has been working on bipedal robots for years and has a product called Spot that's already on the market for inspection tasks. Figure AI is developing a humanoid robot called Figure 01. Tesla is developing Optimus. Many other companies are working on narrower-purpose robots optimized for specific tasks.

The key insight is that specialized robots are achieving commercial success while general-purpose humanoid robots remain in R&D. A robot optimized for warehouse logistics is shipping and profitable. A robot optimized for agriculture is shipping and profitable. A robot optimized for surgery is shipping and profitable. Humanoid robots that can do anything remain elusive.

This matters because it suggests the path forward may not be general-purpose humanoid robots, but rather a proliferation of specialized robots, each optimized for specific tasks and environments. That's a very different market than what Musk is building toward. If true, it means humanoid robots might not be the massive value driver he's imagining.

The Technical Challenges Ahead

Building a humanoid robot that works reliably in real-world conditions is genuinely difficult. The robot needs to perceive its environment accurately. It needs to plan movements that are safe and efficient. It needs to adapt when something unexpected happens. It needs to do all of this while operating on battery power.

Tesla has certain advantages in this space. It has expertise in battery technology. It has expertise in electric motors. It has enormous amounts of data from its vehicles that could be useful for training AI systems. It has manufacturing expertise that could eventually reduce costs.

But it also faces challenges that other companies don't have to worry about as much. Tesla has been cutting costs on vehicles aggressively. That mindset—minimize cost while maintaining acceptable quality—is appropriate for consumer vehicles but potentially dangerous for robots that might work around people. A vehicle failure is inconvenient. A robot failure that causes injury could create massive liability.

Moreover, Musk's style of leadership has worked well for pushing vehicle development forward through force of will. But software and robotics development don't always respond to pushing. Sometimes they require patience, iteration, and acceptance that things take as long as they take.

The Financial Math: Can Tesla Afford This Bet?

Current Cash Position and Capital Burn

Tesla generated roughly

Developing a new vehicle from scratch typically costs

But the company also needs to maintain its core vehicle business. Model 3 and Model Y production need to be optimized and refreshed regularly. Gigafactories need to be expanded and updated. The Cybertruck production needs to be optimized. All of these things require investment.

From a pure capital allocation perspective, there's only so much bandwidth. Musk has essentially decided that Optimus development is the priority, and the way to create space for that is to stop investing in the Model S and X, which have declining returns anyway.

The Risk of the Bet

But what happens if Optimus doesn't deliver on the 2027 timeline? What happens if the robots need another five years of development? What happens if competitors beat Tesla to market with their own humanoid robots?

In that scenario, Tesla has sacrificed the premium sedan and SUV market to pursue a bet that didn't pay off. The company would need to quickly redevelop and relaunch premium vehicles to remain competitive, but the momentum would be lost, the manufacturing capacity would have been repurposed, and the design and engineering expertise might have moved on to other projects.

That's the real risk here. Not that humanoid robots are inherently a bad idea, but that betting the company's presence in the premium vehicle market on a product that's still in R&D is a fundamental strategic gamble. Musk is essentially saying: "I'm confident enough in Optimus that I'm willing to cede premium market segments entirely while we develop it."

It's a bold move. It's also a potentially catastrophic move if the bet doesn't pay off.

Global Implications: What This Means for the EV Market

Impact on Competition and Market Consolidation

Tesla's withdrawal from the premium sedan and SUV market changes the competitive landscape significantly. It means legacy automakers can focus on their premium electric vehicles without worrying about being disrupted by Tesla from above. It means Chinese competitors have a clearer path to dominating the premium electric segment globally.

For traditional automakers, this is actually good news in the short term. Mercedes, BMW, Porsche, and Audi can focus on making premium electric vehicles without needing to worry about Tesla. The market will become more balanced, with multiple serious competitors fighting for premium customers.

For Chinese manufacturers, this is also good news. BYD, Xiaomi, XPeng, and NIO can aggressively pursue premium segments knowing Tesla isn't there as a technological floor that they need to beat. This could accelerate the timeline for Chinese dominance in premium electric vehicles globally.

For Tesla, it's a withdrawal from segments where it was once dominant. The company is betting that dominance in humanoid robotics will eventually be worth more than dominance in premium electric vehicles. That's a very different company than Tesla has been historically.

Supply Chain Implications

Tesla's decision will also have implications throughout the supply chain. The company likely sources specific components for Model S and X production that it won't need anymore. Suppliers of premium leather seats, high-end audio systems, and other luxury components will lose Tesla as a customer. Some of these suppliers might specialize in serving Tesla, and they'll need to find other markets or downsize.

Meanwhile, the suppliers who support Optimus robot development will see increased demand. Battery suppliers, motor suppliers, AI chip suppliers, and manufacturing equipment suppliers will all benefit from increased investment in robot development.

This isn't just about Tesla—it's about the entire ecosystem reallocating resources based on what it thinks the future will be. If Optimus succeeds, this reallocation will prove prescient. If it fails, the resources will have been wasted and the supply chain will be out of balance.

Precedent and Pivot: Why Companies Abandon Established Products

Historical Examples of Product Discontinuation

Tesla isn't the first company to discontinue successful products to pursue new visions. Apple discontinued the iPhone's home button to create more screen space, disrupting decades of muscle memory but enabling new capabilities. Apple discontinued the MacBook's traditional ports to pursue a vision of wireless connectivity. Some of these moves worked out brilliantly. Some created friction that took years to resolve.

Microsoft discontinued Zune to pursue Xbox Game Pass and cloud gaming. The move made strategic sense, but the company exited the portable music market entirely. Nokia discontinued Symbian to pursue Windows Mobile, a bet that turned out to be catastrophically wrong. The company exited phones entirely as a result.

The difference between successful product discontinuation and catastrophic ones often comes down to timing and execution. If you discontinue a product at exactly the moment when the market is ready to move on, and you have a compelling successor ready to ship, it works. If you discontinue a product to make room for something that won't ship for years, and the market isn't ready to move on, it's a disaster.

The Risk of Being Too Early

Tesla's situation resembles the latter scenario more than the former. The Model S and X, while aging, still have genuine demand. The Optimus robot, while exciting as a concept, is still years away from commercial reality and still in R&D. The company is essentially ending supply of established products to make room for something speculative.

This works if Optimus arrives in 2027 and is genuinely revolutionary. It works if customers are willing to wait years for a product that will supposedly transform society. But customers don't have infinite patience, and markets don't stand still. By the time Optimus ships, competitors will have developed their own humanoid robots, or the market will have decided that specialized robots are the actual path forward.

Tesla's Credibility Crisis: Years of Missed Promises

The Autonomy Timeline: A Cautionary Tale

One reason to be skeptical of Tesla's Optimus timeline is the company's track record on autonomous vehicles. Musk has been promising a fully autonomous Tesla fleet for almost a decade. In 2016, he said autonomous vehicles were coming "in the next year or two." In 2020, he said the fleet would launch in 2021. In 2023, he said they were coming soon. In 2025, they're still not here, and the company just acknowledged that its Autopilot system isn't even close to full autonomy.

Instead of admitting that autonomous vehicle development is harder than expected and would take longer, Musk has shifted focus to robotaxis (a different product) and now to humanoid robots (yet another different product). The pattern is consistent: make big promises, miss the deadline, announce a new big promise, and move the goal posts.

This history is important context for evaluating claims about Optimus. If Musk says the robots will ship in 2027, the reasonable expectation based on historical evidence is that they'll actually ship in 2029 or 2030 at the earliest, with significant compromises from the original vision. If the robot still isn't shipping by 2028, he'll probably announce another exciting project and start talking about that instead.

The Pricing Promises That Didn't Materialize

Similarly, Tesla has a history of under-promising on costs. The Cybertruck was supposed to start at

When Musk claims that Optimus will eventually cost

What This Means for Tesla Customers and Employees

The Uncertainty for Current Model S and X Owners

For people who own a Model S or Model X, the discontinuation raises immediate concerns. Will Tesla still service these vehicles? Will parts availability remain adequate? Will software updates continue? The company will need to maintain a service infrastructure for millions of existing vehicles even though it's no longer building new ones.

Historically, Tesla has been responsibly maintaining its vehicle service networks, so this probably isn't a massive concern. But there's always some risk when a company stops building a product entirely. Parts suppliers might discontinue parts. Service technicians might be retrained for other work. The institutional knowledge about maintaining these vehicles might gradually disappear.

For someone thinking about buying a used Model S or X, discontinuation might actually make them more attractive as collectibles. Historical supply constraints might eventually make older Teslas more valuable. But it could also make them less valuable if parts become hard to find or if Tesla's service network shrinks.

The Workforce Transition

The discontinuation will also have implications for Tesla's workforce. Engineers who specialized in Model S and X development will need to be retrained or transitioned to other projects. Factory workers who assembled these vehicles will need to be retrained for Optimus robot production or reassigned to Model 3/Y production or other lines.

Tesla has a history of moving people around rapidly, and it typically has strong internal mobility. But any large transition creates some friction and inefficiency. People need to learn new systems. New teams need to establish workflows. Productivity temporarily decreases. These are manageable challenges, but they're real costs associated with the transition.

The Bigger Picture: What This Says About Musk's Vision for Tesla

From Cars to Robots to Energy to Mars

Over the years, Musk's vision for Tesla has evolved. Initially, it was just cars. Then it became sustainable energy (solar, batteries). Then it became autonomous driving. Then it became robotaxis. Then it became humanoid robots. At each step, Musk has shifted focus, often discontinuing or deprioritizing earlier commitments in the process.

This pattern reflects Musk's genuine interests and his belief about what will matter in the future. He's probably not wrong that humanoid robots will eventually be important. But the question is whether sacrificing established businesses to pursue emerging ones is the right strategic move.

There's an argument that Tesla should focus on being the best electric vehicle company in the world, dominate that market, and then use the profits to invest in robotics. There's another argument that the window of opportunity for humanoid robots is narrow, and Tesla needs to move fast now or lose the chance forever.

Musk has clearly chosen the latter. He's betting the company on the belief that humanoid robots matter more than being the world's premier premium vehicle manufacturer. History will judge whether that was a visionary decision or a catastrophic mistake.

Conclusion: The Gamble Musk Is Making

Tesla's decision to discontinue the Model S and Model X represents far more than simply eliminating two aging vehicle lines. It's a fundamental bet about where the future lies and what Tesla should become. It's an acknowledgment that the company can't do everything and must choose. It's a statement that Musk believes humanoid robots matter more than maintaining Tesla's dominance in premium electric vehicles.

Understanding this decision requires understanding the context. Tesla's financial situation deteriorated significantly in 2024 and 2025. Profits halved. Revenues declined for the first time. The company was under pressure to maintain profitability and reduce complexity. The Model S and X, once revolutionary, had become marginal to the business—expensive to produce, requiring engineering resources, selling in declining volumes to an increasingly crowded market.

From a pure operational perspective, discontinuing these vehicles and reallocating that manufacturing capacity and those resources to Optimus development made sense. The company would reduce costs, simplify operations, and focus on the future that Musk genuinely believes in.

But the decision also carries substantial risk. Humanoid robots remain in R&D. The timeline is uncertain. Competitors are working on similar technology. The market opportunity, while potentially enormous, is speculative. And by exiting the premium vehicle market entirely, Tesla cedes positioning and brand cachet to competitors.

The Model S was revolutionary when it launched. It proved that electric vehicles could be genuinely desirable, genuinely performant, and genuinely practical. The legacy of that achievement will outlast the car itself. But the decision to discontinue both the S and the X, premium vehicles that still have genuine demand, to pursue something that doesn't exist yet, is a high-stakes gamble.

If Optimus succeeds and ships as promised, Musk will be remembered as a visionary who saw the future and had the courage to bet the company on it. If Optimus fails to deliver, or if competitors beat Tesla to market with their own humanoid robots, he'll be remembered as the CEO who abandoned established, profitable businesses to chase a dream that didn't materialize.

For now, the decision is made. The Model S and X production is ending. The factory floors are being retooled. The engineering resources are being redirected. Tesla is all-in on humanoid robots. Whether that proves to be the smartest or the most foolish decision in the company's history will become clear in the next few years.

One thing is certain: Tesla will never be the same company after this. The question is whether that change makes it better or worse.

FAQ

Why did Tesla discontinue the Model S and X?

Tesla discontinued these vehicles primarily to free up manufacturing capacity and engineering resources for Optimus humanoid robot development. The Model S and X had seen declining sales for years—deliveries fell over 50% in Q4 2025 and 40% for the full year 2025. Combined with Tesla's financial challenges (halved profits and declining revenues in 2025), the company needed to simplify operations and focus resources on what it believed would be the future: humanoid robots.

What made the Model S and X so revolutionary?

The Model S was the first vehicle Tesla designed from the ground up as an electric car rather than converting a gas-powered platform. It featured a battery pack integrated into the floor, which lowered the center of gravity and freed up interior space. When it launched, it offered 265 miles of range, zero-to-sixty performance under six seconds, and sophisticated infotainment that rivaled or exceeded anything on the market. The Model X followed with similar innovation in the premium electric SUV segment.

How did the Model S and X fall behind competitors?

Both vehicles received minimal updates after their initial launches, while competitors caught up and surpassed them. Porsche's Taycan offered superior build quality. Mercedes' EQS provided more sophisticated technology and luxury. Chinese competitors like BYD and Xiaomi entered the premium segment with compelling offerings. By 2025, the Model S and X looked dated compared to these alternatives. Meanwhile, Tesla focused resources on the Model 3 and Model Y, which are higher-volume vehicles.

What is Optimus and when will it be available?

Optimus is Tesla's humanoid robot, currently in research and development. Musk claims it will be available for commercial sale in 2027, with Tesla eventually manufacturing billions of these robots. However, the company has acknowledged that Optimus is still "very much at the early stages" and "in the R&D phase." The robots currently aren't performing any useful work at Tesla factories, which suggests the timeline is optimistic.

What are the risks of Tesla's focus on robotics?

The primary risk is that Tesla is discontinuing established, profitable product lines to pursue technology that doesn't yet exist and may not materialize on the promised timeline. If humanoid robots face technical challenges or if competitors beat Tesla to market, the company will have sacrificed its premium vehicle positioning without gaining a compensatory advantage. Additionally, Tesla has a history of missing timelines and over-promising on capabilities.

How will the discontinuation affect Tesla owners and the service network?

Tesla will need to maintain service infrastructure for millions of existing Model S and X vehicles even though it's no longer producing them. Parts availability could become an issue over time as suppliers discontinue components. However, Tesla has historically maintained good service networks for discontinued models, so owners shouldn't face immediate problems. Used Model S and X values might become interesting as they become rarer and potentially more collectible.

What does this mean for the premium electric vehicle market?

Tesla's exit from the premium sedan and SUV segments creates opportunities for competitors. Legacy automakers like Mercedes, BMW, Porsche, and Audi can now focus on premium electric vehicles without Tesla at the top of the segment. Chinese competitors have a clearer path to dominating premium markets globally. The premium EV market will likely become more competitive with multiple serious contenders but without Tesla's presence at the aspirational top.

Is Tesla's humanoid robot bet too risky?

It depends on your perspective. If you believe humanoid robots will eventually be worth trillions of dollars and that Tesla's AI and manufacturing expertise give it a significant advantage, the bet is justified. If you're skeptical about the timeline or Tesla's ability to execute, the bet looks reckless. Musk is essentially saying Tesla's future is more dependent on robots than on being the world's premier electric vehicle manufacturer—a fundamental shift in strategy.

Key Takeaways

- Tesla discontinued Model S and Model X production to reallocate factory space for Optimus humanoid robot manufacturing, marking a fundamental strategic shift away from traditional EV production

- Both vehicles saw dramatic sales declines (over 50% in Q4 2025, 40% annually) as competitors caught up with superior technology and build quality

- Tesla's 2025 earnings were catastrophic—profits halved and revenues declined year-over-year for the first time, creating pressure to cut unprofitable product lines

- Optimus robots remain in R&D phase despite Musk's 2027 commercialization claims, creating risk that Tesla abandoned profitable vehicles for speculative technology

- Tesla's exit from premium EV segments cedes market share to Mercedes, Porsche, BMW, and Chinese competitors like BYD and Xiaomi

Related Articles

- Tesla Discontinuing Model S and Model X for Optimus Robots [2025]

- Tesla is No Longer an EV Company: Elon Musk's Pivot to Robotics [2025]

- Tesla's 2025 Revenue Decline: What Went Wrong [2025]

- Tesla Discontinues Model S and X to Focus on Optimus Robots [2025]

- Tesla's $2B xAI Investment: What It Means for AI and Robotics [2025]

- Elon Musk's Davos Predictions: Why They Keep Missing [2025]

![Tesla Kills Model S and X Production: The Shift to Humanoid Robots [2025]](https://tryrunable.com/blog/tesla-kills-model-s-and-x-production-the-shift-to-humanoid-r/image-1-1769699898303.jpg)