Shadowfax's Stumbling IPO Debut: What Actually Happened

Something rare happened in January 2026. A major Indian logistics company went public and immediately disappointed the market. Shadowfax, a third-party logistics provider that's become essential to India's e-commerce infrastructure, raised roughly $208 million in its IPO but watched shares plummet 9% on day one.

This wasn't a spectacular collapse. It wasn't a total disaster either. But it was telling. Investors had concerns. Real ones. And the market made that abundantly clear within hours of the opening bell.

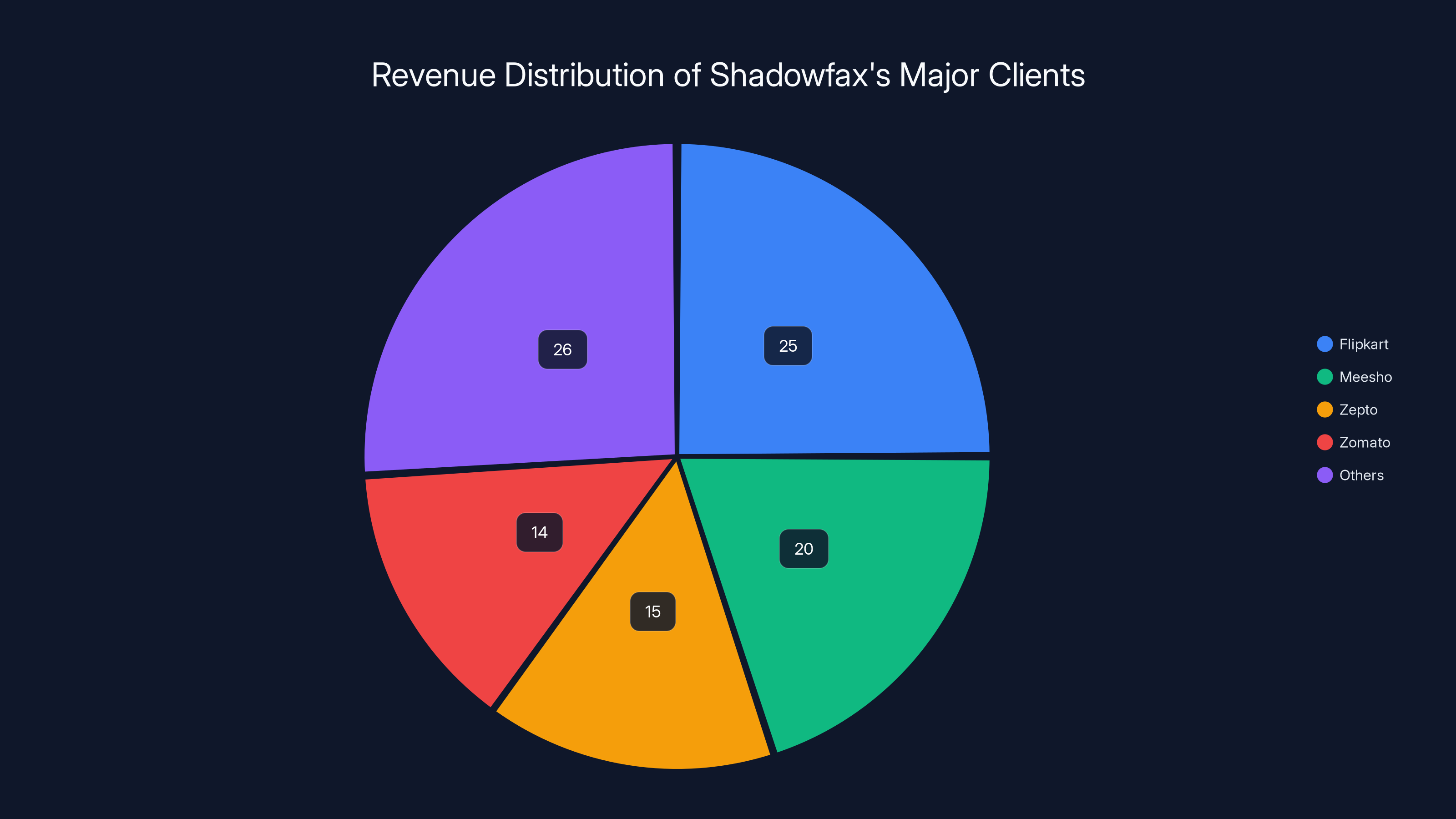

The headline reason? Client concentration. Nearly three-quarters of Shadowfax's revenue comes from just four companies: Flipkart, Meesho, Zepto, and Zomato. That's not diversification. That's dependency. And in the eyes of institutional investors evaluating a company for the long term, dependency is risk.

But there's a lot more to unpack here than just one concerning statistic. Understanding what happened with Shadowfax's listing requires understanding the Indian logistics market, the e-commerce explosion that created Shadowfax's opportunity, the structural vulnerabilities that define its business model, and what this means for the broader ecosystem of third-party logistics providers across India.

Let's dig in.

The Numbers Behind the Stumble

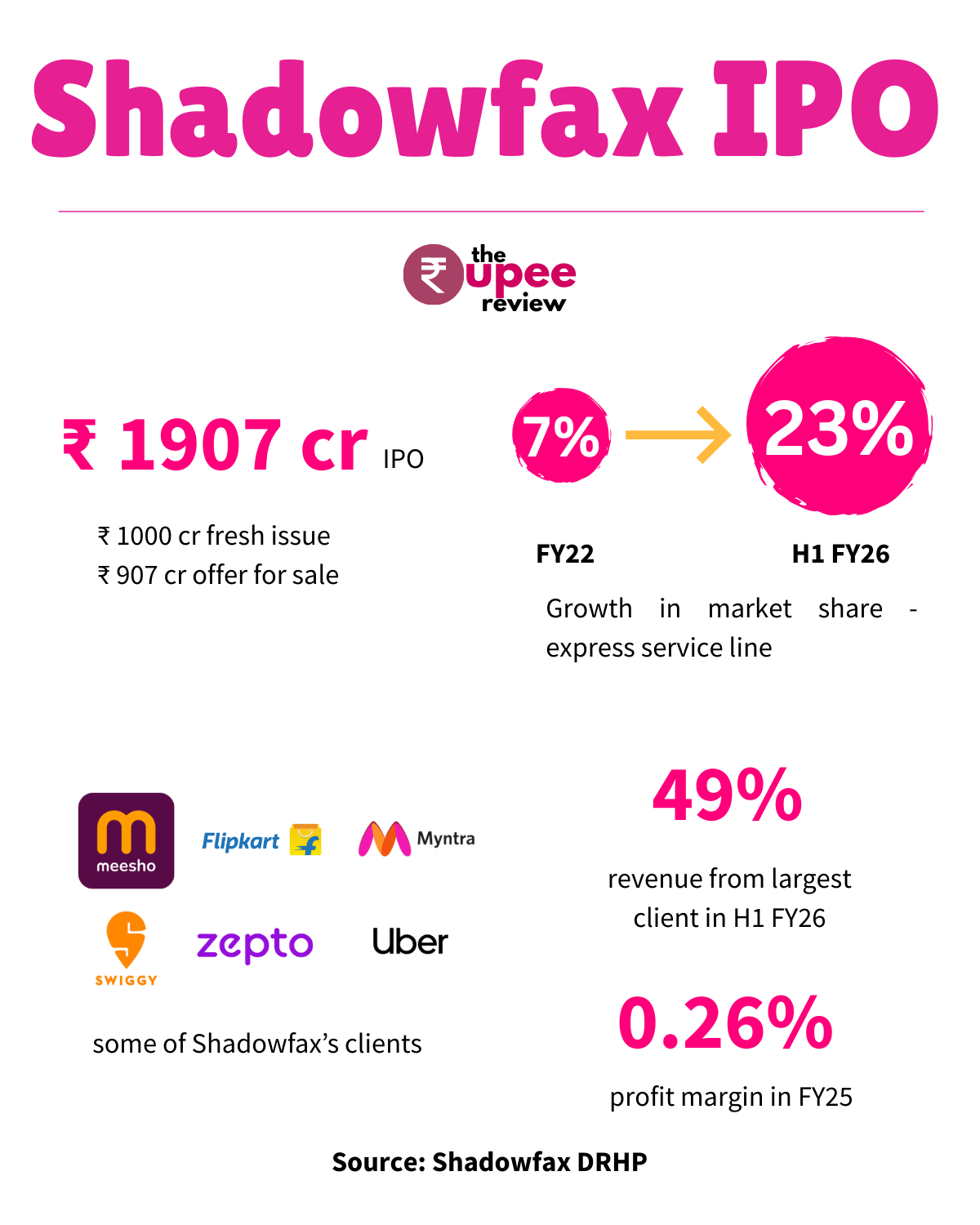

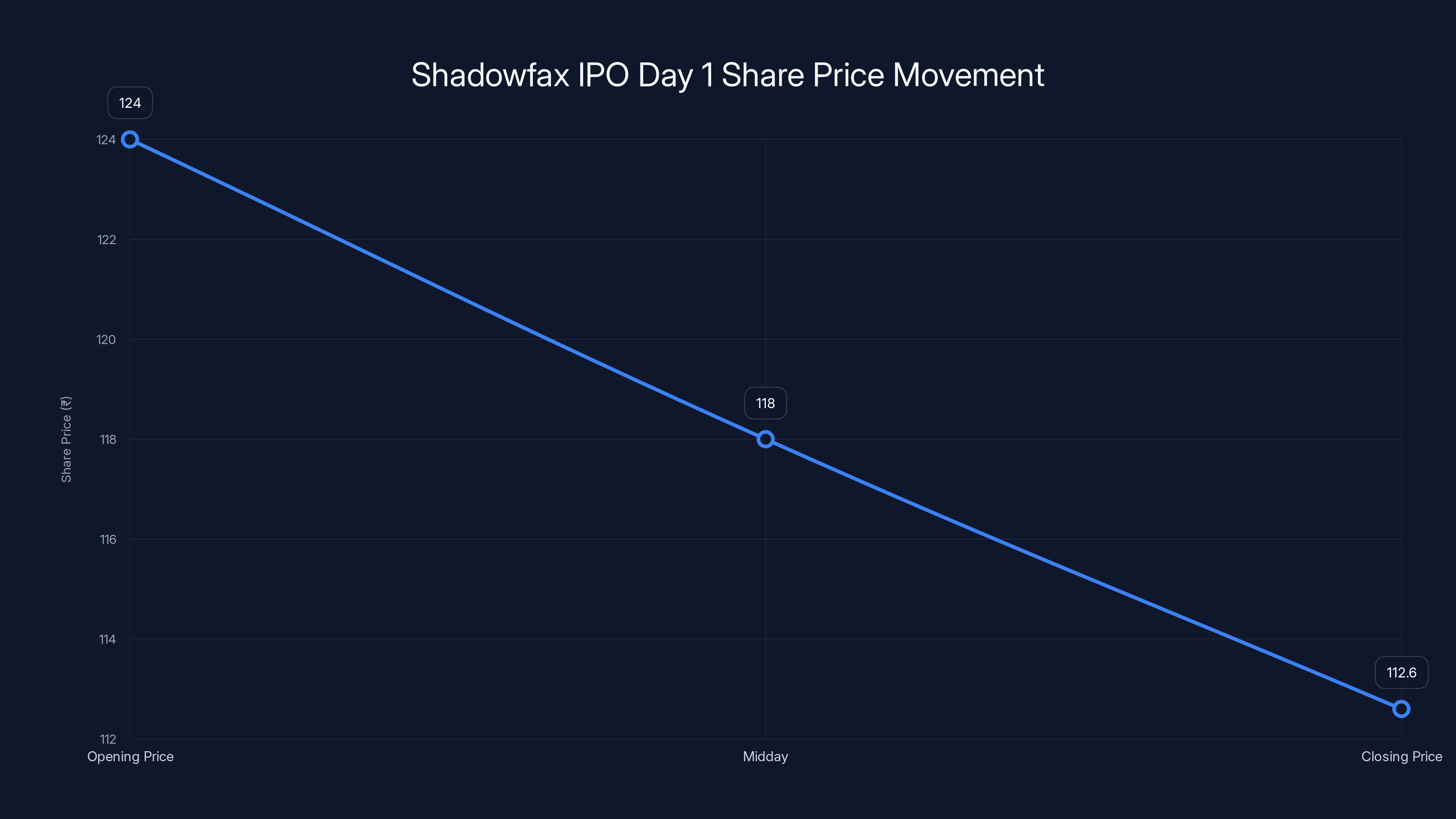

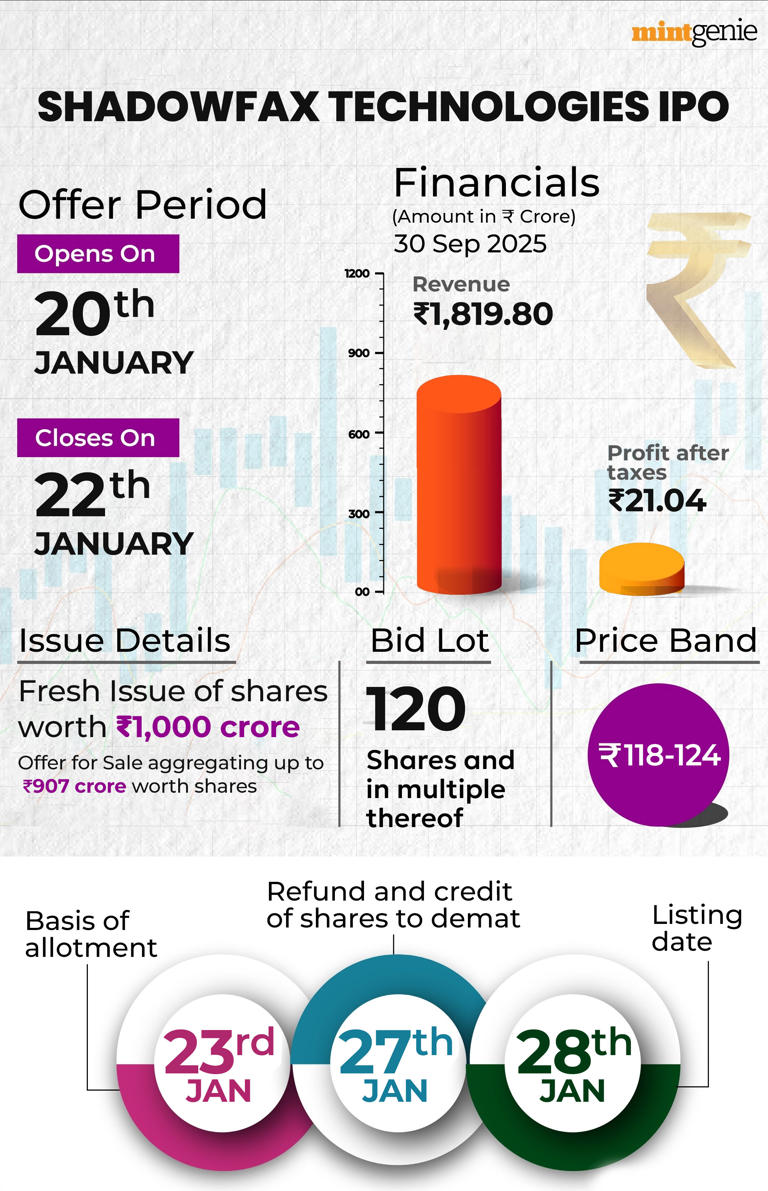

Shadowfax raised ₹19.07 billion (approximately $208.24 million) in its IPO. That's substantial capital. The company had priced its offering at ₹118 to ₹124 per share, and when the books opened, investors subscribed nearly three times over. That's investor appetite on paper.

But the real offer price settled at ₹124. When trading opened on the first day, shares fell to ₹112.60. That 9% drop put the company's market valuation at roughly ₹64.7 billion (about $706.58 million). Here's the kicker: that's nearly identical to the company's last private valuation from early 2025, which had valued it at approximately ₹60 billion.

What does that mean? IPO investors got essentially zero premium for taking public company risk. The founders and early investors who'd exited during the offering saw real gains. But new retail and institutional investors who bought at the offer price? They were immediately underwater.

The subscription being nearly 3x wasn't actually a sign of strength. In India's retail investor culture, heavy subscriptions are common even for mediocre offerings. The real signal came from price performance. Institutional investors—the ones with the analytical resources and long-term horizons—weren't willing to pay a premium.

Understanding Shadowfax's Business Model

Shadowfax was founded in 2015 by Abhishek Bansal and Vaibhav Khandelwal. It operates as a third-party logistics (3PL) provider, meaning it doesn't own inventory or sell goods directly. Instead, it handles the last-mile delivery and intra-city movement of packages for other platforms.

The company powers the supply chain for India's e-commerce and quick-commerce boom. When you order something on Flipkart and it arrives the next day, there's a solid chance Shadowfax coordinated that delivery. When you use Zepto for same-hour delivery, Shadowfax likely handled the logistics.

This is essential infrastructure. You can't scale rapid e-commerce in India without reliable logistics. And Shadowfax positioned itself right in the middle of that value chain.

The business model is theoretically simple: charge per delivery, add operational efficiency, and scale volumes. In practice, it's complex. Logistics is capital-intensive. Shadowfax operates 3.5 million square feet of infrastructure across 14,700 pin codes nationwide. That's warehouses, sorting centers, delivery hubs, and a fleet you have to maintain. Capital spending is relentless.

Shadowfax's growth metrics look compelling on the surface. In the six months ended September 2025, the company reported revenue of ₹18.06 billion, up 68% year-over-year. Profit more than doubled to ₹210.37 million. The growth trajectory is real.

But here's what matters more: the source of that growth. 74% of revenue comes from four clients. That's not a diversified revenue base. That's a customer concentration problem that makes every seasoned investor nervous.

The Client Concentration Problem Explained

Let's be specific about what the concentration risk actually means.

Flipkart is Shadowfax's largest client. Meesho is growing rapidly. Zepto is expanding its same-day delivery footprint aggressively. Zomato dominates food delivery with growing quick-commerce ambitions. Together, these four account for 74% of Shadowfax's revenue.

Now ask yourself: what if Flipkart decides to bring logistics in-house? What if Zepto signs an exclusive deal with a competing logistics provider to cut costs? What if Zomato pivots strategy and reduces reliance on third-party delivery partners? These aren't hypothetical scenarios. These are business decisions that happen routinely in the logistics space.

Each of these clients has massive bargaining power. They're not just customers—they're the reason Shadowfax exists. If you remove the top four, Shadowfax becomes a significantly smaller, less attractive business.

This creates a fundamental asymmetry in negotiations. Flipkart can credibly threaten to shift volume elsewhere. Meesho knows it has options. Zepto and Zomato can develop alternative logistics strategies. Shadowfax, meanwhile, is dependent on these relationships.

The financial impact is real too. If even one of these clients reduced volume by 20%, Shadowfax's financial model would fracture. Margins would compress. Growth would slow. The company would need to immediately restructure operations and reduce costs. Shareholders would suffer.

Investors pricing Shadowfax's shares at IPO were acutely aware of this dynamic. And that awareness showed up in the ask prices they were willing to offer.

Why This Matters for Indian E-Commerce Infrastructure

Shadowfax's client concentration problem isn't unique to Shadowfax. It's structural to the 3PL industry in India. The e-commerce platforms have immense leverage because they generate the volume that makes 3PL companies viable.

Consider the growth pattern: Indian e-commerce platforms (Flipkart, Amazon India, Myntra, Nykaa) needed reliable logistics partners to scale. They couldn't build their own delivery networks at first. So they partnered with 3PL providers like Shadowfax, Delhivery, and others.

As the platforms grew, they developed supply chain sophistication. Some began hybrid models: use partners for unpredictable demand, build internal capability for predictable flows. Others negotiated harder, demanding better rates as their volumes grew.

The 3PL providers, meanwhile, became increasingly dependent on maintaining those relationships. Building scale elsewhere is slow and risky. Growth comes from deepening platform relationships, not from diversifying customer bases.

This dynamic is exactly what happened with Shadowfax. The company optimized to be the logistics partner of choice for India's fastest-growing e-commerce and quick-commerce platforms. That was the right strategic choice at the time. It drove growth. It attracted capital.

But that strategy created a dependency that's now a valuation drag.

Comparing Shadowfax to Delhivery: The Incumbent's Advantage

Shadowfax's IPO came more than three years after its larger rival, Delhivery, went public in May 2022. That timing matters for understanding investor sentiment.

Delhivery reported revenue of ₹89.3 billion (roughly $974.84 million) in the year ended March 2025. Compare that to Shadowfax's annualized revenue (based on the six-month figures), which would be around ₹36 billion. Delhivery is about 2.5x larger.

But here's what's interesting: Delhivery's growth is in the low teens year-over-year, while Shadowfax is growing at 68%. Shadowfax is expanding much faster. In a vacuum, faster growth is valuable.

However, Delhivery went public at a different time in the investment cycle, with different growth metrics and different risk profiles. The comparison isn't perfect. But it does show that the logistics market has moved beyond rewarding simple growth stories.

Delhivery's challenge since going public has been margin compression and operational scaling. The company hasn't been a stock market darling. Growth is steady but uninspiring. The investment case has been about market position and eventual profitability, not explosive expansion.

Shadowfax entered the market as a faster-growing competitor, but with the structural weakness of client concentration. The market essentially said: we'll price you where Delhivery was at a similar growth rate, but we won't pay more because you're dependent on four clients.

That's a rational calculation from investors who've watched this sector for years.

The Capital Expenditure Reality

One critical context for Shadowfax's IPO is what the company plans to do with the proceeds.

Shadowfax raised capital explicitly to fund capital expenditure. The company is spending on network infrastructure, including new first-mile, last-mile, and sorting centers. It's also allocating funds for branding, marketing, and communication—essential investments to diversify beyond being a logistics backend for four platforms.

The company operates 3.5 million square feet of logistics infrastructure. Every expansion of that footprint requires capital. Every new pin code entry requires facilities investment. Every service enhancement requires technology and equipment spending.

This is where logistics companies differ from software companies. Software companies raise capital, achieve profitability, and generate cash. Logistics companies raise capital, spend it on infrastructure, and then operate that infrastructure. Capital is constantly needed to stay competitive.

For Shadowfax, the IPO capital is essential for the next phase of growth. But it's also why the valuation matters so much. A lower valuation at IPO means more dilution for founders when converting the IPO capital into operational assets.

Investors, understanding this dynamic, were unwilling to pay a significant premium. They priced Shadowfax at its previous private valuation, essentially saying: your growth is real, but your risk profile doesn't justify a higher multiple.

The E-Commerce Boom and Logistics Timing

Understanding Shadowfax requires understanding when the company was founded and what market conditions it emerged into.

Shadowfax started in 2015. At that time, Indian e-commerce was entering a period of explosive growth. Flipkart was battling Amazon for market dominance. Myntra was growing. Nykaa was emerging. Quick-commerce didn't even exist yet.

The logistics bottleneck was real. Platforms needed delivery partners. Shadowfax emerged as a specialized player focused on speed and efficiency in delivery, particularly for time-sensitive segments like quick-commerce (which didn't exist yet).

The company's early growth came from being in the right place at the right time. As quick-commerce exploded (Zepto's growth is a case study in this), Shadowfax became essential infrastructure. The company scaled rapidly by being the logistics partner of choice for fast-delivery platforms.

But this created path dependency. Shadowfax optimized for the platforms that needed it most, and those platforms became the company's largest customers. The company's entire network architecture was built around serving these specific clients efficiently.

Ten years later, that optimization has become a constraint. To reduce client concentration, Shadowfax would need to invest heavily in serving other customer segments (small businesses, SME e-commerce, etc.), different geographic markets, or different service models. Each of these requires capital and operational focus.

The IPO capital is partly going toward that diversification. But investors are skeptical about how quickly or successfully that can happen.

Shareholder Structure and the Offer-for-Sale

Shadowfax's IPO included both a fresh issue (new shares) and an offer-for-sale (existing shareholders selling their stakes). Understanding who was selling provides insight into investor confidence.

The offer-for-sale included shares from Flipkart, Eight Roads Ventures, Nokia Growth Partners, Qualcomm, and Mirae Asset. These are primarily early-stage and growth investors taking chips off the table.

Flipkart's participation is particularly notable. Flipkart is both a major shareholder and the company's largest customer. Flipkart partially exited at IPO, presumably realizing that a public Shadowfax creates different dynamics than a private one. As a public company, Shadowfax must serve shareholders as well as clients.

Founders Abhishek Bansal and Vaibhav Khandelwal retained about 20% of the company after listing and didn't participate in the offer-for-sale. That's a signal of ongoing commitment, though 20% retention is fairly modest for founders exiting a company they built over a decade.

The World Bank-backed International Finance Corporation (IFC) also held shares through Shadowfax's journey. IFC's presence signals that the company has strong fundamentals and development impact, but IFC's stakes are typically not as market-return focused as venture or growth investors.

The Macro Context: Indian Logistics and Quick-Commerce Evolution

Shadowfax's IPO doesn't happen in a vacuum. It happens in the context of a specific moment in Indian e-commerce and logistics evolution.

Quick-commerce (delivery in 10-30 minutes) is a defining trend. Platforms like Zepto, Blinkit (owned by Zomato), and others have exploded in funding and user adoption. These platforms depend entirely on efficient, fast logistics. Shadowfax powers much of this.

However, quick-commerce platforms are also increasingly building internal logistics capabilities. Zepto and Blinkit are investing in micro-fulfillment centers and their own delivery networks. This reduces their dependency on third-party partners and improves margins.

Meanwhile, traditional e-commerce (Flipkart, Amazon) is investing in hybrid logistics. They use third-party partners for unpredictable demand and their own networks for predictable flows.

For Shadowfax, both trends are pressure points. Quick-commerce clients are becoming more capable of doing logistics in-house. Traditional e-commerce clients are doing more logistics internally. Neither trend helps Shadowfax's dependency.

The company's growth in the near term is still likely to be strong. The volumes generated by these platforms are massive. But long-term, Shadowfax's value proposition is under pressure.

What the Stock Price Actually Tells Us

The 9% first-day decline is being framed as a stumble. It's being characterized as disappointing. But what does it actually mean?

First, it means the offering was fairly priced, maybe even slightly aggressive. If Shadowfax had priced below the market-clearing level, shares would've popped significantly. They didn't. The market was willing to buy, but not at a premium to the offer price.

Second, it means sophisticated investors (who dominate IPO day buying) had reservations. Retail investors might subscribe heavily to any IPO because they don't have the analytical resources of institutions. But institutions do their homework. They priced in the risk.

Third, it means the market is uncertain about Shadowfax's path to reducing client concentration. If investors believed the company could rapidly diversify its customer base, they would've priced in a growth premium. They didn't.

Fourth, it suggests that the logistics narrative in India is shifting. A few years ago, any 3PL provider with high growth was attractive. Now, investors are focused on unit economics, customer concentration, and pathway to profitability. Shadowfax checks some boxes but fails on others.

Fifth, and perhaps most important, it shows that IPO investors and public market investors have different risk preferences. IPO investors are often euphoric and willing to overpay for growth stories. Public market investors are more rational and focused on sustainable competitive advantage.

The Broader Implications for Indian Logistics

Shadowfax's IPO performance has ripple effects across the Indian logistics and e-commerce ecosystem.

For other 3PL providers considering IPOs (and there are several waiting in the wings), Shadowfax's reception is a cautionary tale. Client concentration is a real valuation drag. Investors won't ignore it.

For the platforms that use logistics partners, Shadowfax's IPO is a reminder of the leverage they hold. They can now point to the public market and say: investors have concerns about your business model. That translates into harder negotiations and more pressure on rates.

For founders of logistics startups still in private markets, the Shadowfax outcome suggests that growing revenue quickly is only part of the value creation story. Building a defensible, diversified business model matters as much as growth metrics.

For the Indian e-commerce ecosystem broadly, Shadowfax's IPO raises questions about whether third-party logistics providers can ever achieve the independence and valuation multiples of true platform companies.

Understanding the Prospectus Red Flags

Shadowfax's IPO prospectus, filed with regulators before the offering, included explicit disclosures about client concentration. This isn't new information that surprised the market. Investors knew about it.

What changed was perspective. In private markets, a funding round might overlook concentration risk if growth is explosive. In public markets, concentration risk is priced in immediately. The prospectus converts suspicion into concrete regulatory disclosure.

The prospectus also outlined specific risks: dependence on key clients, pricing pressure from large customers, risk of contract termination, and exposure to e-commerce and quick-commerce market cycles.

Each of these is material. Investors who read the prospectus carefully were essentially pricing in a base case where at least one of these risks materializes. The 9% decline reflects that conservative positioning.

The IPO Use of Proceeds: A Window Into Strategy

Shadowfax explicitly told investors how it planned to use IPO capital: infrastructure capex, center expansion, branding and marketing, inorganic acquisitions, and general corporate purposes.

This tells us something important about Shadowfax's strategy. The company isn't using IPO capital to diversify dramatically. It's not building a platform. It's not pivoting into new service categories. It's improving its existing business: building more infrastructure, expanding footprint, and investing in brand.

All of this is reasonable and necessary. But from an investor perspective, it signals that Shadowfax is doubling down on being a 3PL provider for e-commerce platforms, not pivoting into something fundamentally different.

Investors who were hoping for a dramatic shift in business model were disappointed by these plans. And that disappointment showed up in the stock price.

Lessons From Delhivery's Public Market Journey

Delhivery went public in May 2022 at a valuation around ₹48,000 crore (roughly $5.8 billion at the time). The stock performed modestly in the months after IPO, with typical IPO volatility but no sustained momentum.

What happened to Delhivery provides lessons for how Shadowfax might perform.

Delhivery's challenge has been that public market investors expect logistics companies to achieve certain margin profiles and return metrics. Delhivery grew, but margins compressed. The stock price reflected this tension between revenue growth and profitability.

For Shadowfax, the parallel is clear. The company can grow revenue rapidly, but if margins don't expand, the stock won't outperform. And margins won't expand if the company is stuck in a price war with clients that hold all the bargaining power.

Delhivery's journey suggests that Shadowfax should expect a stock price that reflects growth skepticism rather than growth enthusiasm. The market has seen this movie before.

The Role of Quick-Commerce in Shadowfax's Future

Quick-commerce is both Shadowfax's greatest opportunity and greatest threat.

Opportunity: Zepto, Blinkit, and other quick-commerce platforms have exploded. They generate enormous volumes. That volume needs logistics. Shadowfax is a critical partner for these platforms.

Threat: Quick-commerce companies are increasingly capable of handling their own logistics. They have the capital, the growth incentive, and the operational sophistication to build internal networks. As they do, their reliance on third-party logistics decreases.

This is already happening. Zepto and Blinkit are both investing significantly in internal logistics. They're building micro-fulfillment centers. They're hiring logistics talent. They're developing delivery networks.

For Shadowfax, this creates a strategic dilemma. The company needs quick-commerce volume to maintain growth. But it also knows that quick-commerce clients are becoming less dependent on it.

The resolution of this dilemma will determine Shadowfax's long-term value. If the company can't diversify beyond quick-commerce clients, it will become a niche player in a rapidly changing market.

Strategic Options for Shadowfax Post-IPO

Now that Shadowfax is public, the company faces strategic choices about how to address its client concentration problem.

Option 1: Double down on e-commerce and quick-commerce. Maintain relationships, improve service, become more efficient. Accept that these clients will gradually internalize logistics and focus on the margin opportunity while it exists.

Option 2: Diversify aggressively. Invest capital to serve small businesses, SME e-commerce, D2C brands, and international markets. This requires different operational models and capital allocation.

Option 3: Acquire competitors. Use IPO capital and stock as currency to acquire other 3PL providers and consolidate the market. This reduces competition and potentially improves bargaining power with clients.

Option 4: Pivot into adjacent services. Add value-added services like warehousing, fulfillment, data analytics, or supply chain optimization. This deepens client relationships and creates new revenue streams.

Each option has tradeoffs. Option 1 accepts slow decline. Option 2 requires massive capital and uncertain returns. Option 3 faces regulatory and integration challenges. Option 4 requires new capabilities.

Investors will be watching which path Shadowfax chooses. The stock price will reflect their confidence in the strategy.

The Broader Context: India's E-Commerce Inflation

Shadowfax's IPO happens in a moment of inflection for Indian e-commerce. Growth is still strong, but it's moderating from the explosive rates of the early 2020s.

E-commerce penetration in India is still relatively low compared to developed markets. That means there's still substantial runway for growth. But the easy growth (early adopters, urbanization, first-time internet users) is being captured. Future growth requires serving smaller cities, lower-income segments, and new categories.

For logistics providers, this means the growth model of the past decade is ending. Scaling delivery to new geographies and customer segments requires different operational models and cost structures.

Shadowfax, optimized for high-velocity delivery to large platforms in metro areas, may not be the best-positioned player for this next phase. The company's infrastructure, culture, and capabilities were built for a specific segment of the market.

This structural shift in the market is part of why investors were cautious at IPO. They see a company built for the previous phase of market growth, now facing a market that's shifting.

Investor Sentiment and the Role of Retail vs. Institutional Capital

One interesting dynamic in Shadowfax's IPO was the disconnect between retail investor enthusiasm (reflected in the 3x subscription) and institutional investor caution (reflected in the stock decline).

Retail investors in India are often more optimistic and less analytical than institutional investors. They see a company in a growing sector (logistics, e-commerce) and want to participate. They subscribe aggressively.

Institutional investors, by contrast, have systematic frameworks for evaluating companies. They model multiple scenarios, assess management quality, and size positions based on expected risk-adjusted returns.

For Shadowfax, retail investors were willing to buy at the offer price. Institutional investors were not. This created a demand curve mismatch where shares could only clear at a discount.

This pattern (high retail subscription, institutional indifference or selling) is a reliable indicator that the IPO was not favorably received by sophisticated capital. It's a signal that merits taking seriously.

What Happens Next: Shadowfax's Path Forward

Shadowfax is now a public company. The 9% first-day decline is in the rearview mirror. What matters now is execution.

The company has raised capital. It has a clear mandate from IPO investors: reduce client concentration, improve profitability, and build a sustainable logistics business.

The next two years are critical. Shadowfax needs to show meaningful progress on customer diversification. The company needs to demonstrate that it can serve customers beyond Flipkart, Zepto, Meesho, and Zomato profitably.

If Shadowfax achieves this, the stock could perform well. Investors would revalue the company at a lower-risk multiple, and the share price could recover and exceed IPO levels.

If Shadowfax fails to diversify, the stock will likely perform poorly. Investors would see a company slowly losing relevance as its major clients internalize logistics. The share price would decline, and the company would face pressure to restructure or sell.

The outcome will depend on execution, market conditions, and luck. But the trajectory is now clear: Shadowfax must change or face structural decline.

The Valuation Question: Is Shadowfax Cheap or Fair?

At its IPO valuation of ₹64.7 billion, is Shadowfax cheap or fair?

The company is valued at approximately 6.5x revenue (based on annualized revenue of roughly ₹36 billion). That's reasonable for a logistics company in a growth market. By comparison, Delhivery trades at lower multiples despite being larger, reflecting mature market positioning.

But valuation multiples should reflect growth rate and risk. Shadowfax grows faster than Delhivery, which justifies a premium. However, Shadowfax also has higher concentration risk, which demands a discount.

When you net out the premium for growth and the discount for risk, you get a valuation around the IPO level. The market, in other words, got the valuation roughly right.

This is actually a crucial insight. The stock didn't decline because it was overpriced. It declined because it was fairly priced, and investors realized there was no margin of safety built into the valuation. At fair value, there's no upside surprise available.

Understanding Market Timing and IPO Cycles

Shadowfax's IPO timing (January 2026) reflects broader patterns in the IPO market. After a period of IPO scarcity, companies are starting to test public markets again. Shadowfax was one of the first major Indian tech/logistics IPOs of the year.

Market timing matters enormously for IPO performance. Companies that go public when sentiment is euphoric tend to have better first-day pops. Companies that go public during periods of rational skepticism tend to have muted performance.

Shadowfax's timing suggests a market that's recovered from 2024's tech downturn but remains cautious about growth-at-all-costs narratives. Investors are more selective, more focused on fundamentals, and less willing to overpay for growth.

In this environment, a company with client concentration risk gets scrutinized carefully. And if it passes scrutiny, it gets valued fairly, not richly.

The Regulatory and Compliance Angle

As a public company, Shadowfax now operates under significantly more regulatory oversight. The company must disclose material information, file regular reports, and comply with stock exchange rules.

One area of potential concern is the company's existing relationships with Flipkart (both a shareholder and a client). Regulatory bodies scrutinize related-party transactions carefully. As Shadowfax negotiates terms with Flipkart, there will be questions about whether the terms are market-based and fair.

This adds complexity to what were previously opaque private negotiations. It could result in higher rates for Flipkart (to demonstrate fairness to other shareholders) or more stringent contractual terms.

Either way, the shift to public company status makes the relationship more complicated.

Capital Allocation and Return Expectations

Now that Shadowfax is public, management faces different pressures around capital allocation. Private companies can reinvest all earnings into growth. Public companies face expectations around dividends, share buybacks, or return on invested capital.

For a capital-intensive business like logistics, returning capital to shareholders creates a tension. The business needs constant reinvestment to maintain and expand infrastructure. But shareholders want returns.

Shadowfax will need to strike a balance. The company likely won't pay dividends for several years (it's still growing). But over time, if profitability improves, there will be pressure to return capital.

How management handles this tension will signal to investors whether they're oriented toward long-term value creation or short-term stock price appreciation.

Competitive Dynamics in Indian Logistics

Shadowfax's IPO doesn't exist in isolation. It's part of a competitive landscape that includes Delhivery (public), a host of smaller 3PL providers (private), and internal logistics efforts by the platforms themselves.

Quick-commerce companies are fragmenting the market. Traditional e-commerce is centralizing logistics. D2C and SME e-commerce is creating new demand segments. The competitive landscape is complex and fragmenting.

For Shadowfax, this means the company is fighting on multiple fronts simultaneously. The company is competing with Delhivery for platform business. It's competing with internal logistics for market share. It's trying to develop new customer segments in a market where it currently has no scale.

It's a difficult position. But it's the position Shadowfax is in now that it's public.

Conclusion: What Shadowfax's IPO Tells Us About Indian Logistics and the Market

Shadowfax's IPO stumble—a 9% first-day decline to a valuation matching the company's last private round—tells us several important things about Indian logistics, capital markets, and the state of e-commerce infrastructure.

First, the market has matured past the point where growth alone drives valuation. Shadowfax is growing at 68%, which is exceptional. But that growth isn't enough to overcome questions about client concentration, sustainable margins, and long-term competitive positioning. Investors want growth plus sustainable fundamentals.

Second, the logistics industry faces structural challenges around customer leverage and margin sustainability. Shadowfax's four largest clients could shift logistics strategies overnight, and the company would struggle. This structural weakness is now priced into the stock. It's not a hidden risk—it's explicit.

Third, public markets are more rational than venture markets. In venture, a company growing 68% with real revenue and a clear market opportunity would command premium valuations. In public markets, that same company faces skeptical investors who ask hard questions about defensibility and competitive advantage. The reality is that Shadowfax lacks both.

Fourth, the IPO cycle is still somewhat fragile. Companies that come to market expecting to be embraced as growth stories are facing measured responses. Investors are being selective. They're requiring companies to prove not just growth, but also sustainable business models.

For Shadowfax specifically, the company has real opportunities and real challenges. The IPO capital will be deployed toward infrastructure and customer diversification. Whether that diversification succeeds will determine whether the stock recovers from its opening-day decline.

For the broader Indian logistics ecosystem, Shadowfax's IPO marks a moment of inflection. Third-party logistics providers can no longer rely solely on growing volumes from their largest clients. They need to build diversified customer bases, develop sustainable margins, and create defensible competitive advantages.

Shadowfax's path to success—reducing client concentration, serving new customer segments, and improving profitability—is the path every 3PL provider in India will need to walk. How successfully Shadowfax walks it will determine whether third-party logistics remains an attractive investment category or becomes a low-margin, structurally challenged industry.

The company now has the capital to try. The question is execution.

Shadowfax's share price dropped 9% from ₹124 to ₹112.60 on its IPO debut, reflecting market concerns over client concentration.

FAQ

What is Shadowfax and what does the company do?

Shadowfax is a third-party logistics (3PL) provider founded in 2015 that handles last-mile delivery and intra-city movement of packages for e-commerce, quick-commerce, and food delivery platforms across India. The company operates 3.5 million square feet of logistics infrastructure across 14,700 pin codes and is a critical infrastructure provider for platforms like Flipkart, Zepto, Meesho, and Zomato.

Why did Shadowfax's IPO stock price fall on its first day of trading?

Shadowfax's shares declined approximately 9% from the IPO offer price of ₹124 to ₹112.60 on the first day of trading. This decline primarily reflected investor concerns about the company's heavy client concentration, with 74% of revenue coming from just four clients (Flipkart, Meesho, Zepto, and Zomato), creating significant dependency risk that sophisticated institutional investors were unwilling to pay a premium for.

How much capital did Shadowfax raise in its IPO?

Shadowfax raised approximately ₹19.07 billion (about

What is client concentration risk and why did it concern IPO investors?

Client concentration risk refers to the dependency a company has on a small number of customers for the majority of its revenue. In Shadowfax's case, 74% of revenue comes from four clients, meaning that if any of these platforms significantly reduced volume, shifted to competing logistics providers, or developed internal logistics capabilities, Shadowfax would face severe financial stress. Public market investors price in this risk by requiring lower valuation multiples for companies with high concentration.

How does Shadowfax's growth compare to Delhivery, its larger competitor?

Shadowfax is growing much faster than Delhivery, with 68% year-over-year revenue growth compared to Delhivery's low-teens growth rate. However, Delhivery is approximately 2.5x larger by revenue (₹89.3 billion compared to Shadowfax's annualized ₹36 billion). Delhivery went public in 2022 and has faced challenges with margin compression despite strong market position, a pattern that may repeat with Shadowfax if the company doesn't address its concentration risk.

What are the main risks to Shadowfax's business model going forward?

The primary risks include client concentration (dependency on four major clients), pricing pressure from large customers who control significant volume, risk of contract termination or reduced volumes as clients develop internal logistics, exposure to e-commerce and quick-commerce market cycles, and competitive pressure from both larger logistics providers like Delhivery and internal logistics efforts by the platforms themselves. Additionally, quick-commerce companies like Zepto and Blinkit are increasingly building their own micro-fulfillment centers and delivery networks, reducing their reliance on third-party logistics partners.

How does Shadowfax plan to use the IPO capital it raised?

Shadowfax plans to deploy IPO proceeds toward capital expenditure for network infrastructure (new first-mile, last-mile, and sorting centers), lease costs for facility expansion across India's 14,700 pin codes, branding and marketing investments, inorganic acquisitions, and general corporate purposes. These investments are aimed at expanding the company's operational footprint and supporting customer diversification, though the strategy remains focused on strengthening the core 3PL business rather than pivoting into fundamentally different service categories.

What would need to happen for Shadowfax's stock price to recover from its IPO decline?

For meaningful stock price appreciation, Shadowfax would need to demonstrate progress on several fronts: diversifying its customer base to reduce concentration risk, expanding into new customer segments (SMEs, D2C brands, smaller e-commerce platforms), improving unit economics and profit margins, maintaining or accelerating revenue growth, and building competitive advantages beyond simply being a low-cost logistics provider. Investors will monitor quarterly results for signs that the company is succeeding at these strategic imperatives.

How does Shadowfax's IPO timing (January 2026) reflect broader market conditions?

Shadowfax's IPO comes after a period of IPO scarcity and represents early testing of public markets in 2026. The market sentiment appears to be one of measured skepticism rather than enthusiasm—investors are selective, focused on fundamentals, and less willing to overpay for growth-at-all-costs narratives. In this environment, a company with client concentration risk and unproven path to diversification gets valued fairly rather than richly, which is exactly what happened with Shadowfax's 9% first-day decline.

Estimated data shows that Flipkart, Meesho, Zepto, and Zomato collectively contribute to 74% of Shadowfax's revenue, highlighting significant client concentration risk.

Key Takeaways

- Shadowfax's 9% first-day IPO decline reflected investor concerns about client concentration, not overvaluation—74% of revenue comes from four clients

- Public market investors distinguished between growth rate (68%, impressive) and business model defensibility (weak), resulting in fair valuation with no premium

- Quick-commerce platforms that drove Shadowfax's growth are now building internal logistics, creating structural pressure on the company's dependency relationships

- Shadowfax's strategic challenge is diversifying beyond Flipkart, Zepto, Meesho, and Zomato while maintaining profitability—equivalent to rebooting its entire go-to-market strategy

- The IPO outcome signals that Indian logistics companies face a maturation moment where scale and growth alone don't justify premium valuations without defensible advantages

Related Articles

- DDR5 RAM Price Crisis Explained: Why Prices Surged 150% [2025]

- Data Center Backlash Meets Factory Support: The Supply Chain Paradox [2025]

- Intel Core Ultra Series 3 Launch Delayed by Supply Crunch [2025]

- How Trump's Tariffs Are Creeping Into Amazon Prices [2025]

- Why Apple's Move Away From Titanium Was a Design Mistake [2025]

- Micron Kills Crucial Brand: What It Means for RAM Consumers [2025]

![Shadowfax IPO Listing: Why Client Concentration Spooked Investors [2025]](https://tryrunable.com/blog/shadowfax-ipo-listing-why-client-concentration-spooked-inves/image-1-1769580373691.jpg)