Introduction: The Grid's Biggest Untouched Problem

The electrical grid is one of humanity's greatest engineering achievements. It's also one of the oldest. While we've witnessed the internet transform overnight and renewable energy explode in capacity, one critical piece of infrastructure has barely budged: the transformer. These unassuming devices have done the same job since Edison's era, quietly stepping voltage up and down so electricity can flow from power plants to your home.

But there's a problem brewing. The grid is aging rapidly. Over half of America's 180 million transformers are older than 35 years. Demand is surging thanks to data centers, electric vehicles, and renewable energy integration. The existing infrastructure simply wasn't designed for what we're asking it to do.

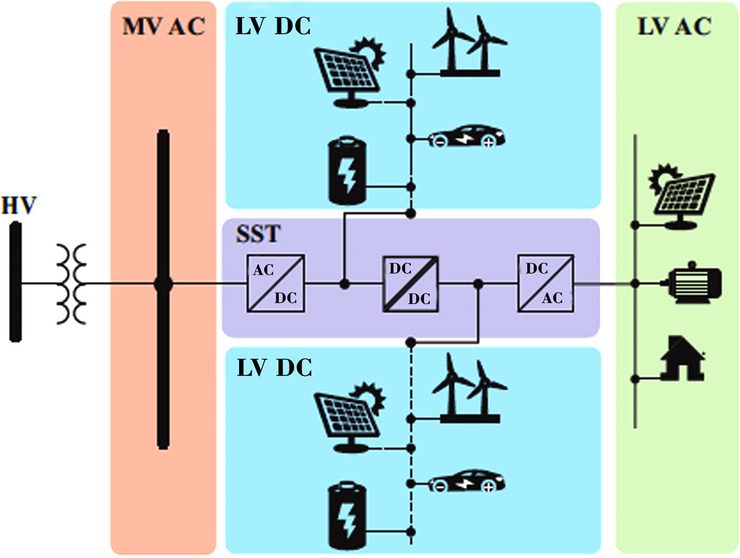

Enter solid-state transformers. They're not just incremental improvements. They're a fundamental reimagining of what a transformer can be. Instead of passive copper coils and iron cores, they use semiconductors to actively manage power flow, adapt to changes in real-time, and integrate seamlessly with modern grid challenges.

The startup world has noticed. In just a few months in 2026, three companies raised over

What makes this moment different is the convergence of three forces: aging infrastructure demanding replacement, surging demand for power requiring grid modernization, and technology finally mature enough to deliver a better solution. We're looking at a supercycle. The kind that creates multi-billion dollar companies.

This article digs into what solid-state transformers actually do, why they matter, how the technology works, and why this moment represents a genuine inflection point for global power infrastructure.

TL; DR

- $280M+ raised in 2026 alone: Startups are funding massive scale-up efforts for solid-state transformer production

- Grid infrastructure crisis: Over 50% of transformers are 35+ years old, with power demand expected to double by 2050

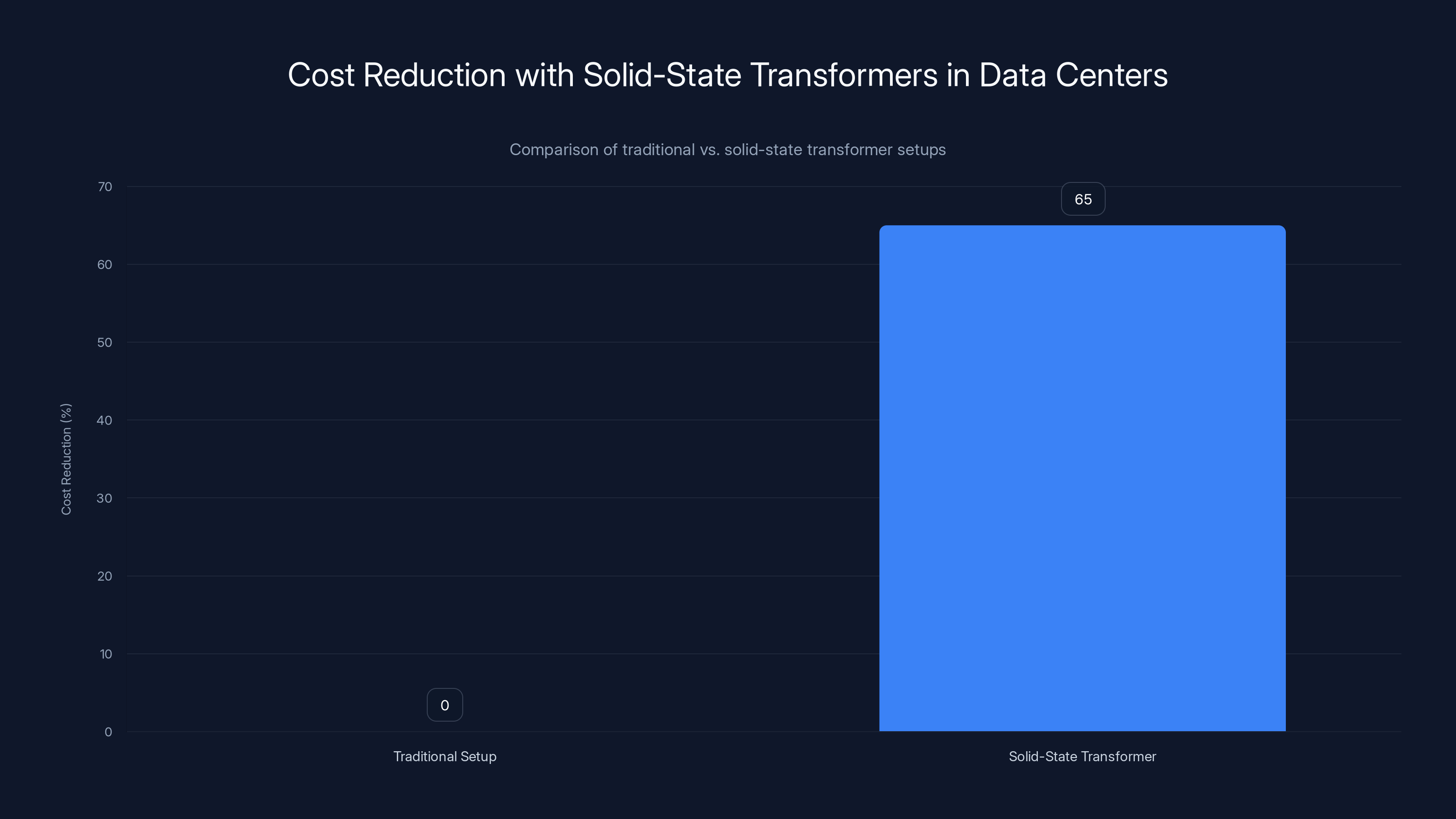

- Technology breakthrough: Solid-state transformers replace multiple devices with one software-updatable unit, offering 60-70% cost savings in data centers

- Semiconductor advantage: Built from silicon-based materials that follow Moore's Law cost curves, unlike copper and steel

- Dual market opportunity: Data centers offer near-term revenue while the electrical grid represents a multi-trillion dollar long-term addressable market

Solid-state transformers can reduce costs by approximately 65% compared to traditional setups, due to reduced equipment and space requirements. Estimated data based on industry insights.

Why the Traditional Transformer Can't Keep Up

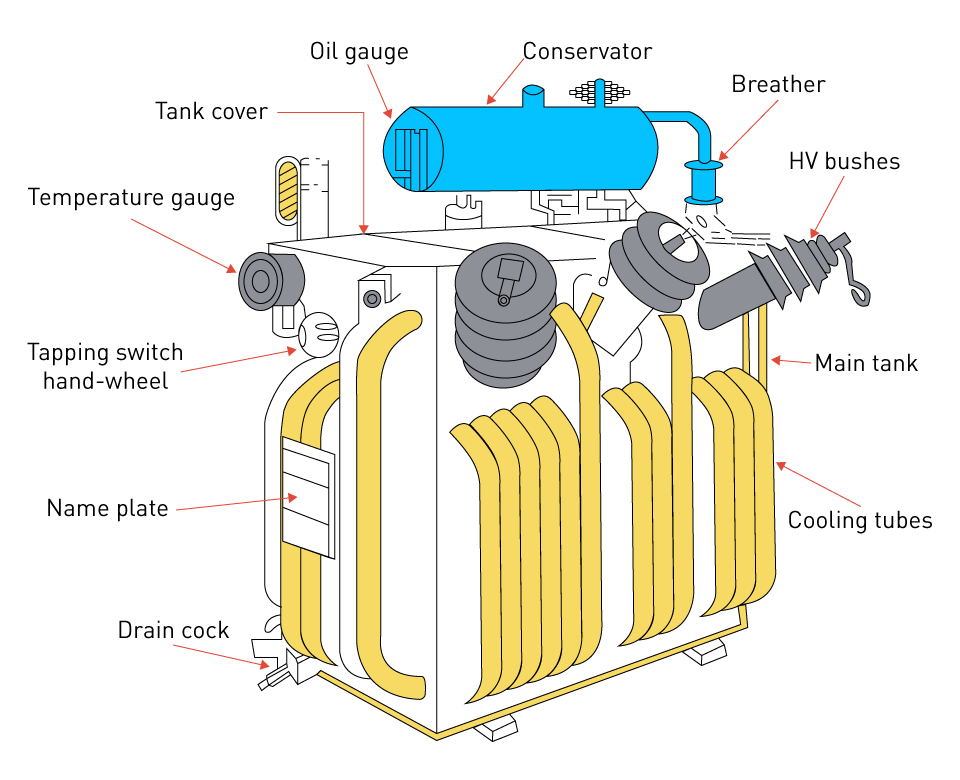

Imagine a device that hasn't meaningfully changed since 1890. A transformer from the 1950s would be utterly familiar to an engineer today. You've got copper wire coiled around an iron core. Electricity flows in one side, creates a magnetic field, induces current in the other side. The ratio of coils determines voltage transformation. That's it. That's the whole thing.

This simplicity is actually its greatest strength. Transformers are incredibly reliable. They're efficient, losing only about 1-2% of energy in transmission. They're dirt cheap to manufacture. A utility can install one and forget about it for 50 years. Which is exactly what happened across the North American grid.

But passive devices have passive limitations. A traditional transformer reacts to grid conditions; it doesn't manage them. When electricity surges, when a power plant trips offline, when renewable sources intermittently supply power, the transformer just sits there. It can't adapt. It can't optimize. It can't even report what's happening on its internals to grid operators.

This becomes a real problem when you try to integrate modern power sources. Renewable energy doesn't play nicely with passive infrastructure. Solar and wind output fluctuates by the minute. Grid operators need devices that can smooth those fluctuations, route power intelligently, and provide real-time visibility into what's happening.

Data centers make this problem even more acute. Modern hyperscale data centers can draw 100-500 megawatts of power. They need reliable, clean power with zero interruptions. They also increasingly want to integrate their own solar arrays, wind turbines, or battery systems. This creates a complex power management problem that a passive transformer simply can't handle.

The aging problem compounds everything. As transformers age, they become less efficient and more prone to failure. Replace them with traditional technology and you're spending billions to deploy the same 1950s solution. That's not a path forward. It's just deferring the problem.

Grid operators are starting to think differently. What if transformers could be intelligent? What if they could monitor themselves, route power dynamically, integrate multiple power sources, and improve over time through software updates? What if they could be managed like routers, not like static industrial equipment?

That's the promise solid-state transformers represent. They're not just replacement parts. They're a complete rethinking of how power infrastructure operates.

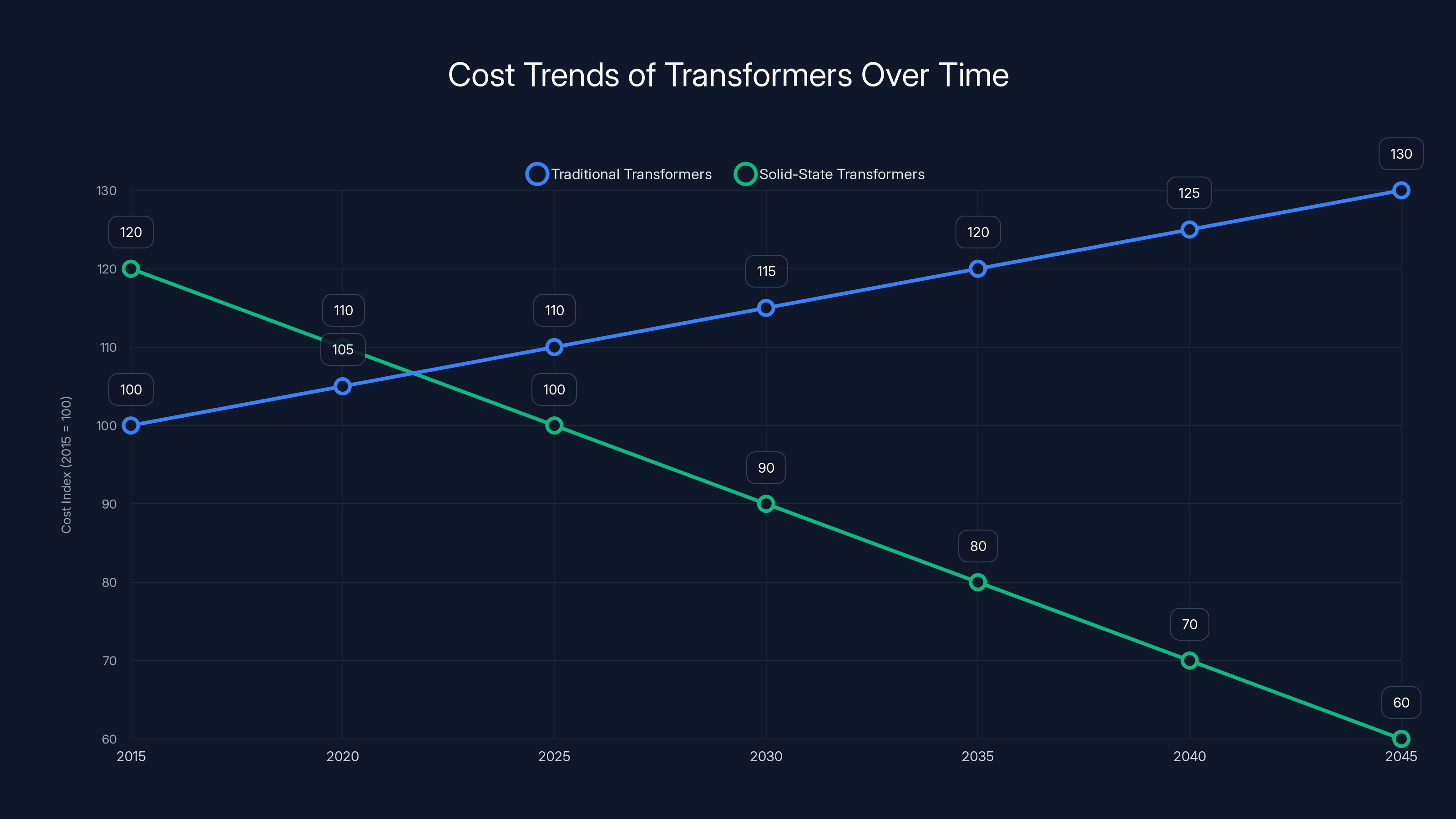

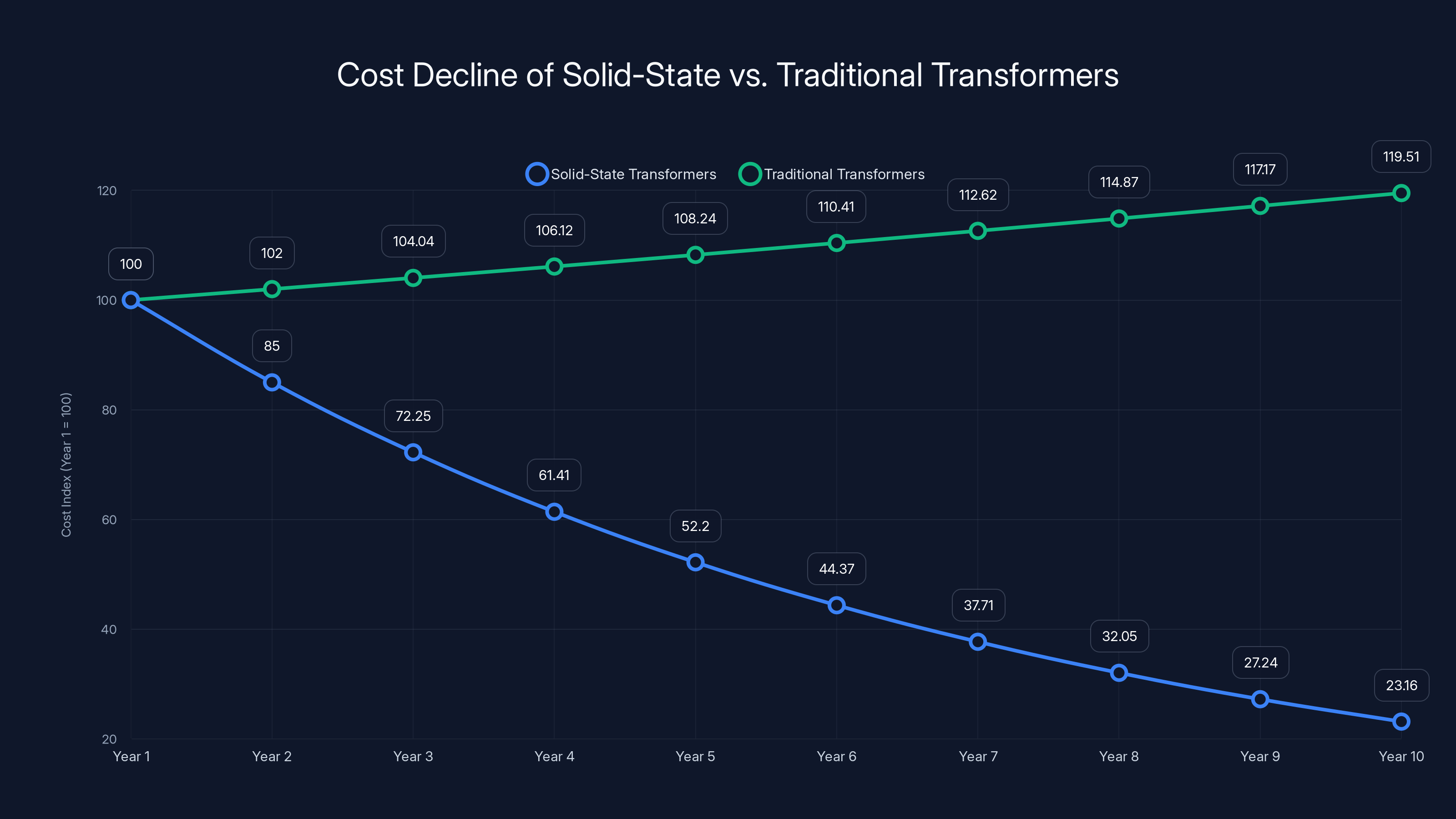

Over a 30-year period, solid-state transformers become increasingly cost-effective compared to traditional transformers, with costs projected to be 20-30% lower by 2045. Estimated data.

Understanding Solid-State Transformers: The Core Technology

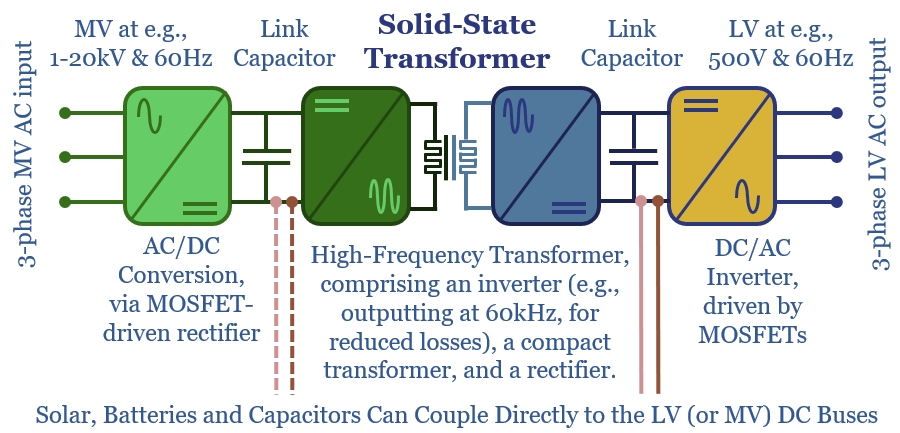

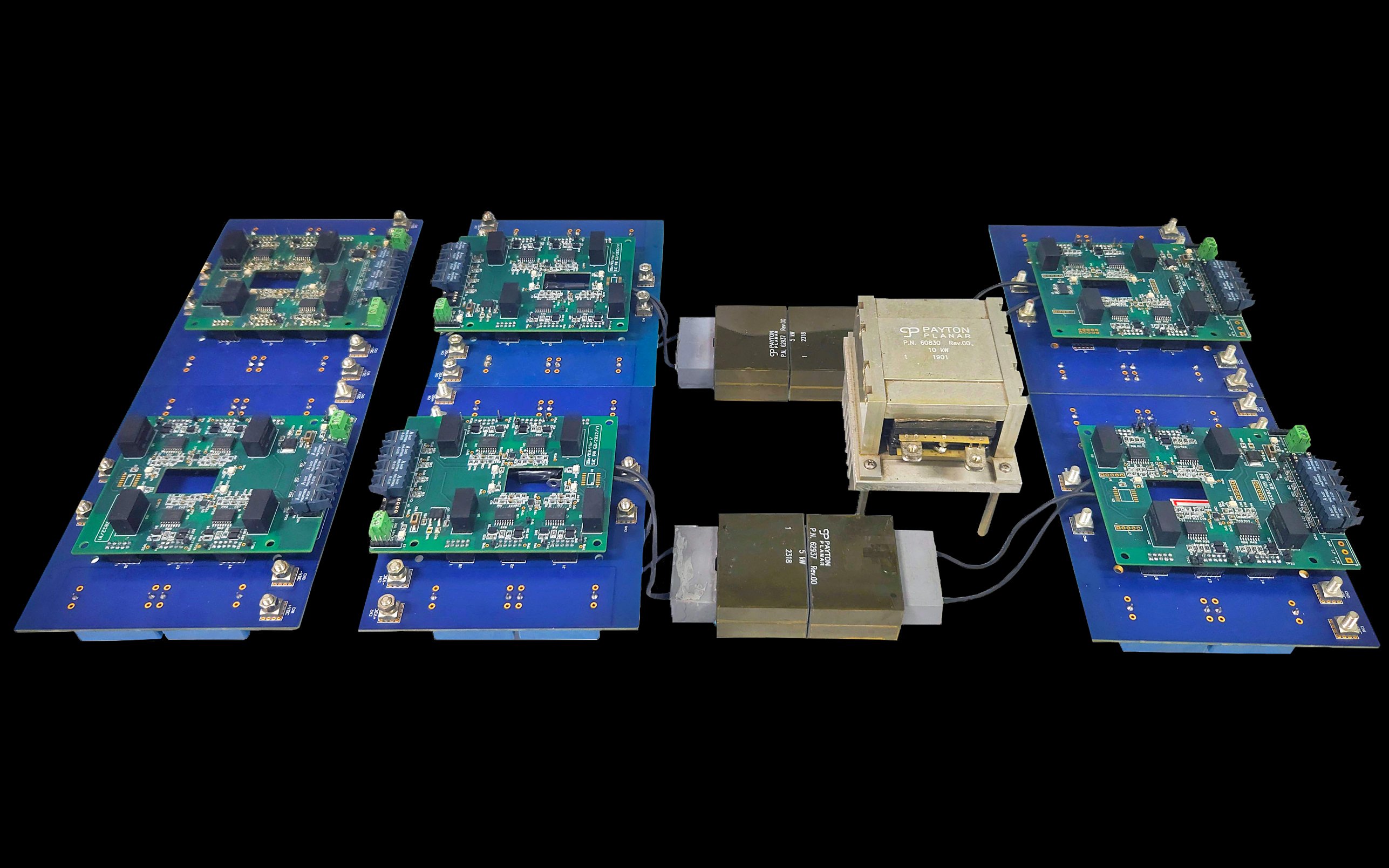

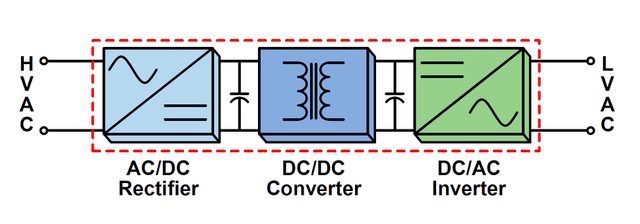

A solid-state transformer abandons the copper-and-iron approach entirely. Instead, it uses semiconductors to convert and manage electrical power. Think of it as a power inverter on steroids, capable of handling massive amounts of electricity while providing granular control.

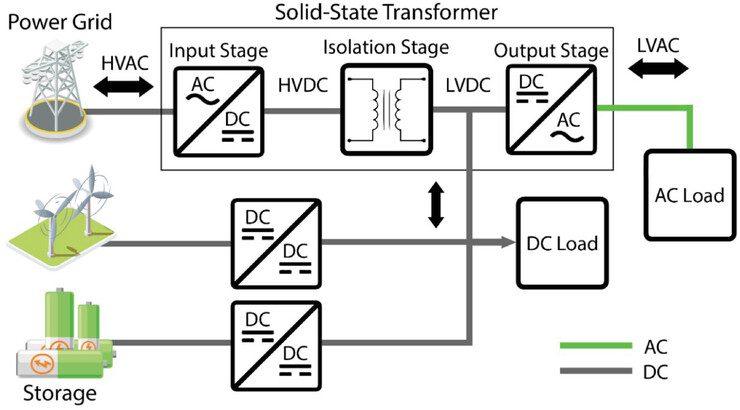

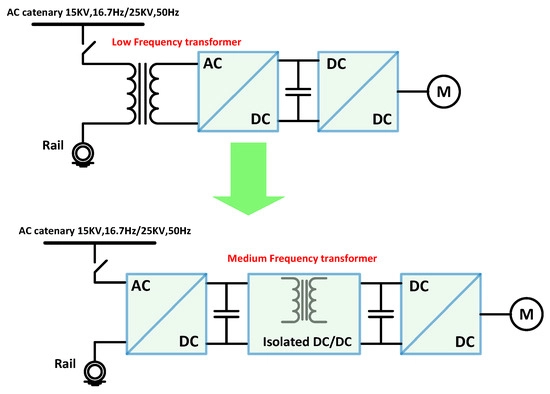

The basic architecture consists of three main components working in concert. First, a rectifier converts incoming alternating current (AC) to direct current (DC). AC is what comes from the grid and most power sources. But DC is easier to manipulate, measure, and control. Second, a voltage converter modifies that DC to whatever voltage is needed. This is where the magic happens, using silicon carbide or gallium nitride semiconductors that switch on and off millions of times per second, precisely controlling voltage output. Third, an inverter converts the DC back to AC for grid connection.

But here's where solid-state transformers genuinely diverge from traditional technology. They can operate bidirectionally. Power doesn't have to flow one way. If you've got a battery system or backup generator, power can flow from your facility back to the grid or to another load. This flexibility is impossible with traditional iron-core transformers.

The semiconductors used in modern solid-state transformers are incredibly efficient. Silicon carbide and gallium nitride materials can handle high voltages, high currents, and switch at extremely high frequencies with minimal energy loss. They're also incredibly durable. No oil cooling needed. No moving parts. No components that degrade like copper windings do.

One crucial advantage separates solid-state transformers from traditional technology: they're made from materials that follow Moore's Law cost curves. Silicon and gallium nitride semiconductors get cheaper and better every year as manufacturing scales. Copper and steel? They're commodities traded globally, subject to mining cycles and geopolitical disruptions. Over a 20-year infrastructure lifecycle, the cost advantage of semiconductors compounds dramatically.

This also means solid-state transformers can be updated via software. New capabilities, bug fixes, efficiency improvements can be deployed remotely, just like updating your router's firmware. A traditional transformer installed in 2005 still operates exactly like a 2005 transformer. A solid-state transformer from 2025 can be continuously improved throughout its operational life. This is transformative for grid operators managing thousands of devices.

The technology does have limits. Current implementations handle lower voltages than large grid transformers. The highest voltage solid-state transformers on the market handle around 35 kilovolts. Traditional grid transformers go much higher. This means the near-term market is distribution transformers and data center applications, not massive high-voltage transmission. But that's still a multi-trillion dollar opportunity.

The Data Center Supercycle: First Market to Explode

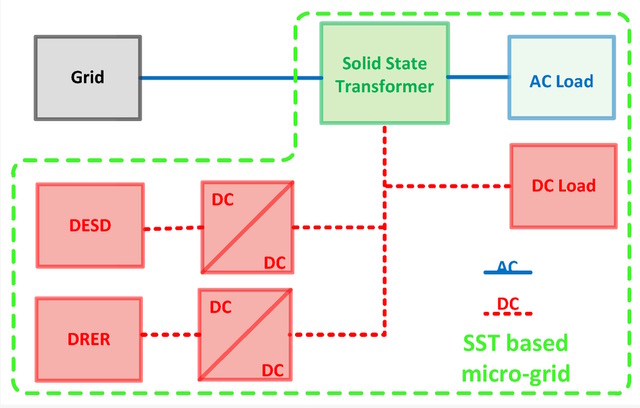

Data centers are the obvious initial customer for solid-state transformers. These facilities have specific needs that solid-state technology addresses perfectly. They consume massive amounts of power but in localized facilities. They need reliability measured in nines (99.99% or better uptime). They're increasingly building renewable energy infrastructure. And they're willing to spend premium pricing for solutions that reduce their footprint and improve efficiency.

Traditionally, bringing power into a data center requires a cascade of devices. First, a substation transformer steps voltage down from the grid transmission level. Then you need a secondary transformer for facility-specific needs. Add in backup power requirements: an Uninterruptible Power Supply (UPS) that keeps systems running during grid outages, typically using batteries or flywheels. Add isolation transformers. Add converters if you're working with multiple voltage standards. Add more equipment for backend power systems.

It's a surprisingly complex power path for something that should be straightforward: take grid power, ensure it's clean and stable, distribute it to thousands of servers.

A single solid-state transformer can collapse this entire stack. One unit handles voltage transformation from the grid, provides UPS functionality, manages power from backup generators or batteries, and can even handle bidirectional power flow if the data center has its own generation capacity. Multiple functions, one device.

The space savings alone justify the capital cost. Data centers measure real estate in dollars per square foot. Power equipment takes up floor space. Replacing ten devices with one dramatically reduces the physical footprint. DG Matrix's co-founder claims they've achieved 60-70% cost reduction when you sum up all the equipment they've eliminated. That's not a marginal improvement. That's a fundamental architecture shift.

Hyperscale data center operators are increasingly building behind-the-meter power generation. Google builds solar arrays next to their data centers. Microsoft is investing heavily in nuclear reactors. Meta is constructing wind farms. They want to generate power on-site, not buy it entirely from the grid. This creates a new complexity: you've got multiple power sources with different voltage outputs and characteristics, and you need to blend them seamlessly.

Traditional transformers can't do this. Each different power source needs its own transformer and conversion equipment. Solid-state transformers handle all of it. One unit can receive power from the grid, a solar array, and a battery system, blend them intelligently, and output stable power at whatever voltage the data center needs.

This is why investors see data centers as the beachhead market. The economics are compelling, the technical fit is excellent, and the customers are sophisticated buyers who understand the value proposition. Deploy successfully in data centers, prove the reliability, build scale, and you've got a platform to attack larger markets.

The timeline is also favorable. Most major cloud providers are building new data centers right now, adding millions of square feet of capacity to handle AI workload growth. These new facilities are installing power systems today. Being in the power stack of Google's or Microsoft's next generation of data centers means embedding yourself into infrastructure built to last 20-30 years. That's the kind of market position venture capital dreams about.

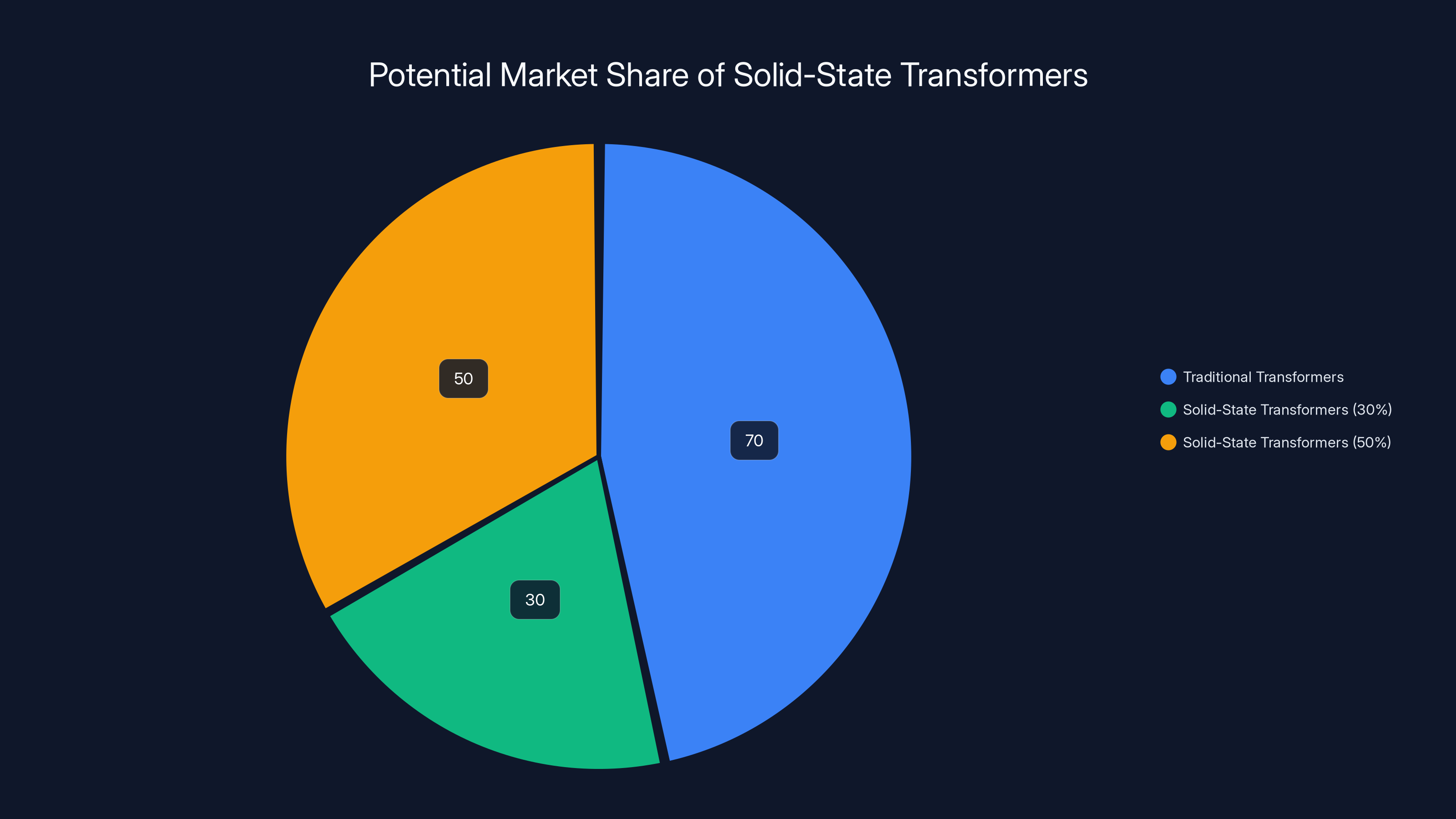

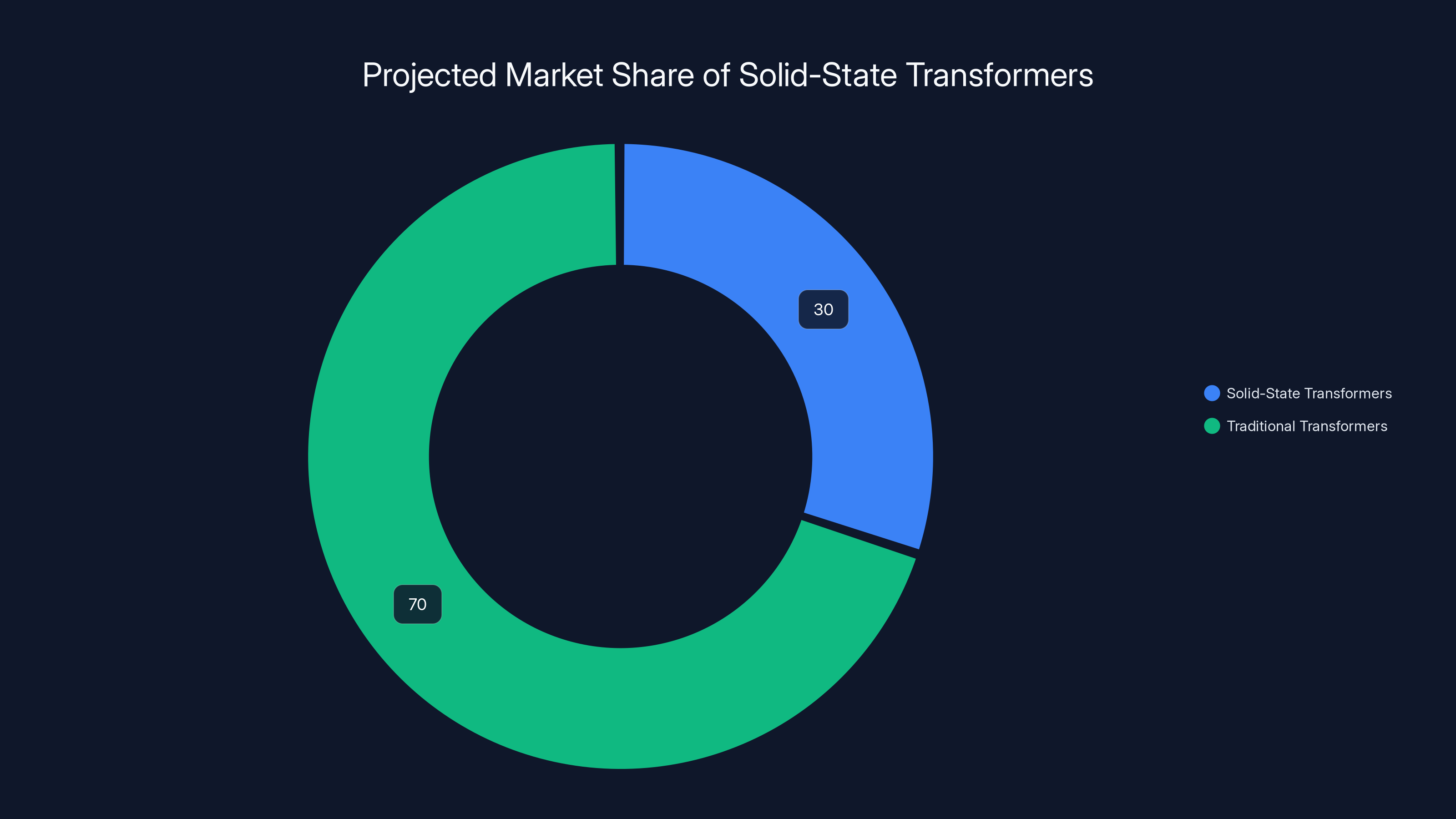

Solid-state transformers could capture 30-50% of the

Why Investors Are Actually Getting Gaga: The Infrastructure Supercycle

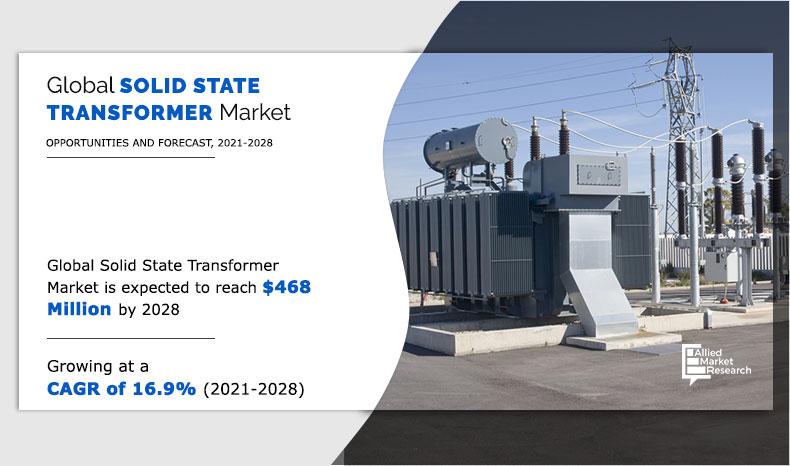

Investment enthusiasm around solid-state transformers isn't hype. It's mathematical. Three separate market forces are converging simultaneously, creating what's genuinely a supercycle opportunity.

First, the installed base is ancient and mandatory replacement is starting. You can't just keep running 1960s transformers forever. They fail. Failures cause blackouts. Utilities have regulatory obligations to replace aging equipment. The National Laboratories project that power demand will double by 2050. That doubling has to flow through transformers. You can't flow twice as much power through fifty-year-old passive devices. It's physically impossible.

Second, demand from new applications is exploding. AI data centers are growing at 20-30% annually. EV charging infrastructure needs are ramping exponentially. Renewable energy integration requires more sophisticated grid management. These aren't theoretical future scenarios. They're happening now. Grid operators aren't asking "will we need more transformer capacity?" They're asking "how do we find enough transformer capacity and grid investment to keep up?"

Third, the technology is finally ready. Semiconductor materials, switching frequencies, heat management, and cost curves have all reached the inflection point. Five years ago, solid-state transformers were interesting research projects. Today, they're production-ready systems being deployed commercially. The engineering roadmap is clear for continuous improvement.

Investors see this convergence and recognize it as one of the biggest infrastructure opportunities of the next decade. The addressable market is enormous. Globally, thousands of transformers need replacement every year. In the U. S. alone, 80 million transformers exist on the grid. Even if solid-state transformers capture 10% of replacement volume, that's 8 million units. At tens of thousands of dollars per unit, that's hundreds of billions in revenue over two decades.

Data center demand is the accelerant that makes this supercycle appear real and near-term. Cloud providers will spend hundreds of billions on new data centers over the next five years. If solid-state transformers can achieve cost parity with traditional transformers while offering 60-70% facility cost savings, they become the default choice. Data centers are where these companies will achieve scale, build operational expertise, develop supply chains, and drive manufacturing costs down.

Once manufacturing is scaled and costs are down, the grid replacement cycle becomes incredibly attractive. Utilities will standardize on solid-state transformers for new installations and replacements. The installed base problem becomes an opportunity.

Investors also recognize that whoever wins the solid-state transformer market gets to participate in the most critical infrastructure refresh of the coming decades. Grid operators aren't going to switch after deployment. Once you've standardized on solid-state transformers, you're built into mission-critical infrastructure. That's recurring revenue, service contracts, software licensing, and hardware upgrades for decades.

How Solid-State Transformers Replace Multiple Devices

To understand the real value proposition, you need to understand what a data center's power system actually looks like today. It's not just a transformer. It's a complex stack of equipment, each performing specific functions, each requiring space, maintenance, and capital investment.

When power comes into a modern data center from the grid, it typically arrives at a substation transformer that steps it down from transmission voltages (hundreds of kilovolts) to distribution voltages (10-35 kilovolts). That's job one. Then you need another transformer that steps it down further for facility use (usually 480V or similar). That's job two.

But you also need backup power capability. When the grid fails, the data center needs to keep running long enough to switch to backup generators or batteries. This requires an Uninterruptible Power Supply (UPS). Most UPS systems use large battery banks or flywheels to provide bridging power for seconds to minutes while backup generators spin up. UPS equipment takes up significant floor space. It's also expensive, often several hundred thousand dollars for a facility.

You might also need isolation transformers for sensitive equipment, or converters to handle multiple voltage standards if your facility draws power from multiple sources. Each of these adds equipment, space, complexity, and cost.

A solid-state transformer can consolidate many of these functions into a single unit. In the most sophisticated implementations, it can handle voltage stepping down from grid levels, provide UPS functionality, manage power from multiple sources, and output at whatever voltages the facility needs.

This consolidation creates genuine value. Fewer devices mean less maintenance. Less equipment means more floor space for revenue-generating servers. One software-updatable system instead of multiple independent pieces of hardware.

Heron Power's CEO draws a specific analogy: "It becomes a very powerful device, equivalent to your internet router." Your network router today does what took an entire rack of networking equipment 15 years ago. It's more capable, more manageable, and cheaper than the sum of its predecessors. Solid-state transformers represent a similar shift for power management.

This functional consolidation is particularly valuable for data centers integrating their own power generation. If you're running solar arrays, wind turbines, or battery systems alongside grid power, you need equipment that can seamlessly blend these sources, manage their different voltages and characteristics, and ensure power quality downstream. Traditional transformers require separate equipment for each source. Solid-state transformers handle it as a unified system.

Behind-the-meter power systems are becoming standard for large data center operators. Being able to manage multiple generation sources with a single integrated device instead of a complex patchwork of equipment is genuinely transformative. It's the kind of architectural simplification that creates cost advantages and operational reliability improvements that compound over time.

Solid-state transformer costs are projected to decline 15-20% annually, achieving cost parity with traditional transformers within 10-15 years. Estimated data.

The Semiconductor Cost Advantage: Economics Over the Long Term

One of the most underrated advantages of solid-state transformers is something that plays out over years: semiconductor economics versus commodity markets.

Traditional transformers are made from copper and steel. These are global commodities. Copper prices are set on the London Metal Exchange. Steel prices fluctuate based on global supply and demand. Over the past decade, copper has swung from lows of

For manufacturers building transformers or utilities operating them, this volatility is a genuine problem. If copper prices spike, transformer costs spike. If you've already bought equipment, you're stuck with it. There's no way to take advantage of lower prices later.

Semiconductors follow a completely different economic pattern. Semiconductor manufacturing costs decline predictably over time. This is Moore's Law made manifest. You get better performance, lower cost, and higher reliability as manufacturing processes improve and scale increases. Silicon carbide and gallium nitride semiconductors show even better scaling than conventional silicon.

This creates a unique advantage for solid-state transformers. A unit installed in 2025 will likely be cheaper than the equivalent transformer installed in 2015. Future versions will be cheaper still. A traditional transformer installed in 2025 will be identical to one installed in 2010. Just the same copper and steel, same manufacturing process.

Over a 30-year infrastructure lifespan, this cost advantage compounds. Early solid-state transformers might be 20-30% more expensive than traditional units. By 2045, the cost differential has reversed. You're paying 20-30% less for superior technology.

This economic argument is crucial to investor logic. Yes, utilities and data centers might pay a premium for the first solid-state transformers. But they're locking in cost structures that will improve over time. Traditional transformers lock you into commodity cost volatility that trends upward. The math eventually becomes overwhelming.

Utility companies, which think on 30-50 year timescales, understand this. They see semiconductor cost curves and recognize that deploying solid-state transformers early positions them advantageously for decades of operations.

Manufacturers also recognize the advantage. Once you're building solid-state transformers at scale, your cost structure improves quarterly. Equipment efficiency improves, manufacturing processes refine, yield increases. A company that wins the data center market first and scales manufacturing will be nearly unassailable in the grid replacement market that follows. The cost advantage compounds their market position.

The Addressable Market: Size, Scope, and Scale

Why are investors committing hundreds of millions? Because the addressable market is genuinely enormous, and solid-state transformers offer a superior solution to an unavoidable replacement cycle.

Start with data centers. Globally, data center capital expenditure runs around $100+ billion annually and growing. Power infrastructure represents roughly 20-30% of that capex. If solid-state transformers achieve cost parity and offer the facility savings that early implementations suggest, they become the default choice. Companies planning data centers right now are the first wave of deployment.

But data centers are just the beachhead. The grid replacement opportunity dwarfs it. The U. S. electrical grid contains roughly 180 million transformers. Most are aging. All will eventually need replacement. Globally, the number is in the billions.

In the U. S. alone, grid operators typically replace 5-10 million transformers annually. Not all of these can immediately transition to solid-state technology, but as costs decline and volume increases, solid-state transformers will capture growing market share. Within 20 years, they'll likely become the default choice for new installations and replacements.

Even capturing modest market share is extraordinarily lucrative. If solid-state transformers reach 30% of new grid transformer deployments globally, and an average transformer sells for

Investors see this math and recognize that the companies winning this transition will be extraordinarily valuable. These aren't small businesses. These are foundational infrastructure companies that will operate for decades, selling to utilities, cloud providers, and grid operators with regulatory obligations to modernize infrastructure.

The timeline matters too. Investors aren't betting on someday. Data centers are buying solid-state transformers now. Manufacturing is ramping now. Grid deployments are starting now. This isn't a 10-year-out opportunity. It's happening in 2025-2027. That's why venture capital is deploying capital at scale.

Estimated data: Solid-state transformers are projected to capture 30% of new grid transformer deployments globally, representing a significant market opportunity.

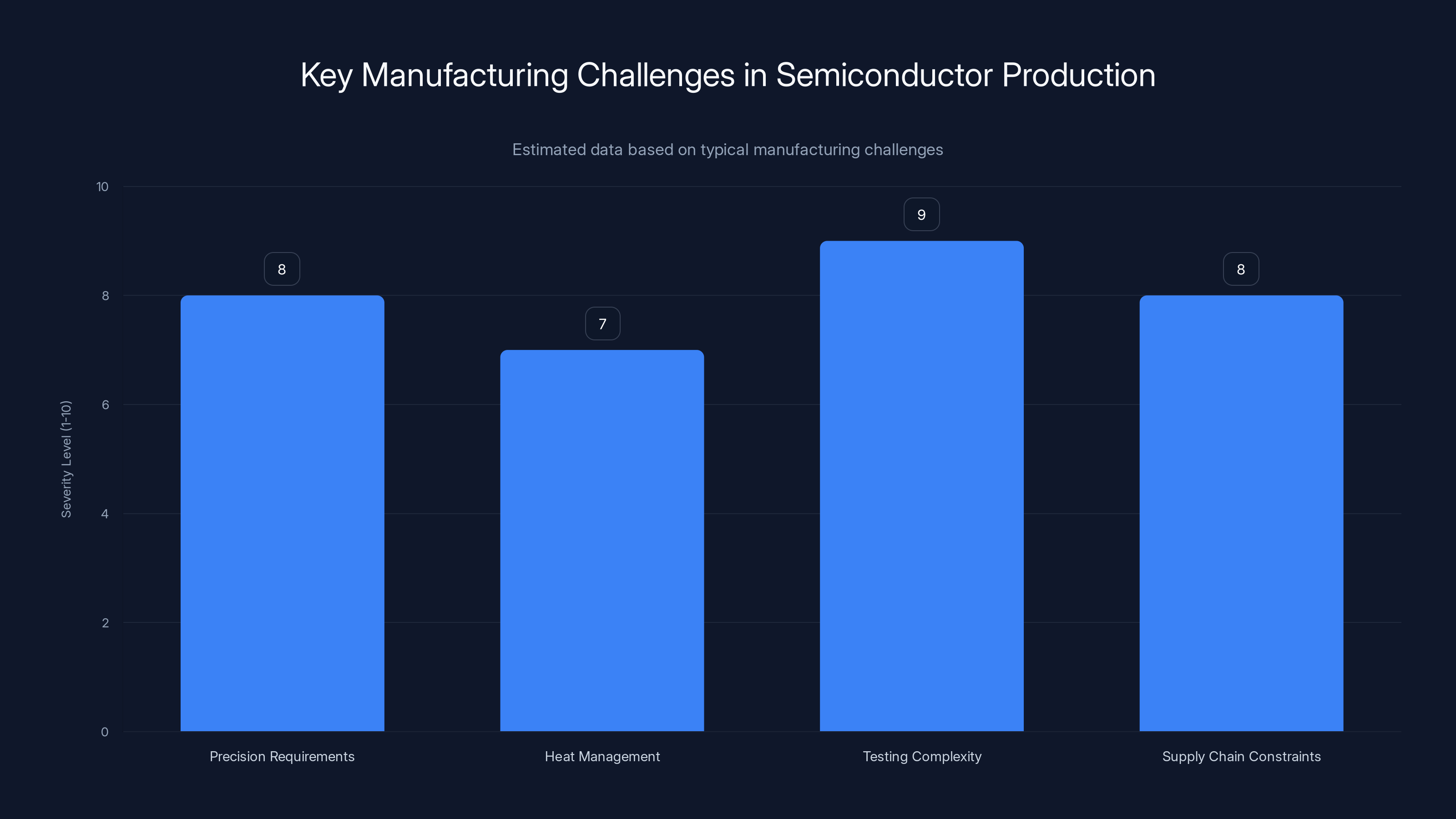

Manufacturing Challenges and Supply Chain Reality

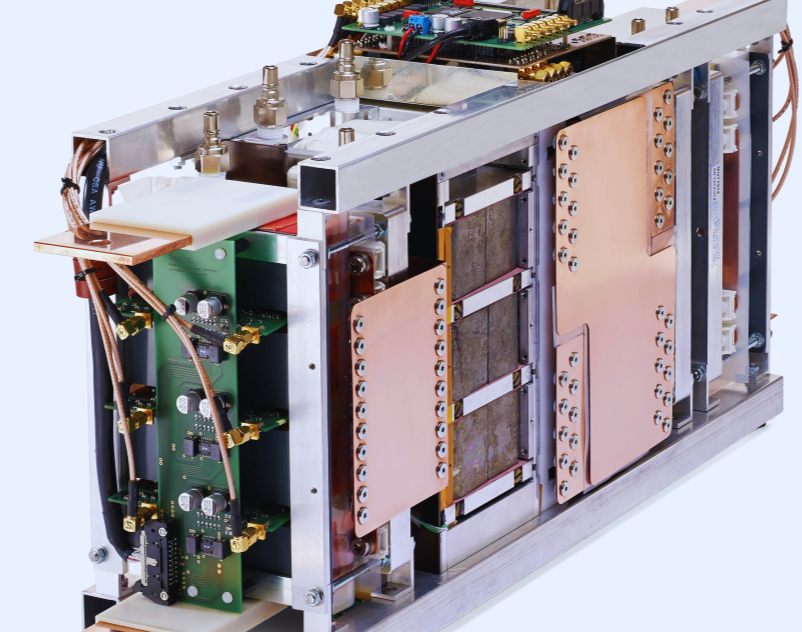

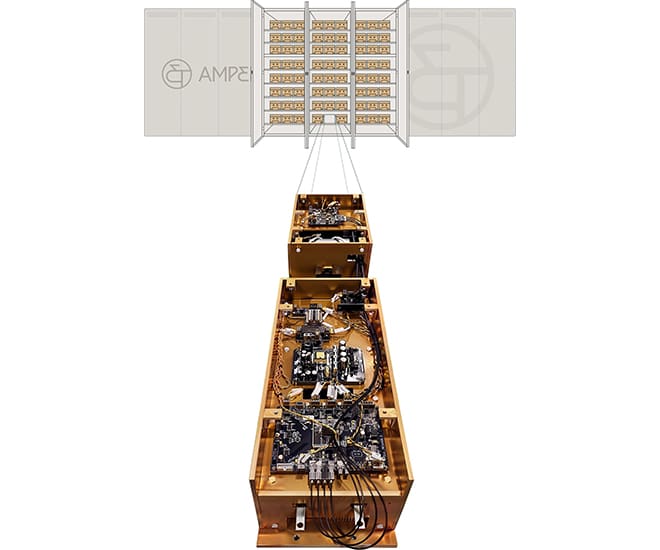

Investment enthusiasm notwithstanding, companies actually have to manufacture these units at scale. That's where the real challenge lies. It's one thing to build 100 solid-state transformers in a fab. It's another to build 100,000 annually while maintaining quality and hitting cost targets.

Semiconductor manufacturing requires precision. Silicon carbide and gallium nitride semiconductors need specific conditions during manufacturing. Even small deviations in process conditions can cause failures. The devices also generate heat when switching at high frequencies. Heat management through design, thermal interfaces, and cooling systems is critical.

Testing is another complexity. You can't ship a defective power transformer. It could fail catastrophically in the field, destroying equipment or causing safety issues. Testing procedures need to verify performance under a wide range of conditions, load levels, and operating scenarios. Mature manufacturing processes have testing down to minutes per unit. New processes might require hours.

Supply chain is also non-trivial. Silicon carbide semiconductors aren't commodity items. Cree and a few other manufacturers supply most of the global inventory. Growing solid-state transformer production means securing increasing allocations from semiconductor manufacturers. Early companies might struggle with supply constraints as they scale.

But here's the key insight: all of these are solvable problems. They're not physics limitations or fundamental obstacles. They're engineering and manufacturing challenges that every hardware company solves. The companies raising capital are explicitly doing so to build manufacturing capacity.

This is also why the raised capital amounts make sense. DG Matrix's

Given typical capital costs for manufacturing facilities and equipment, those amounts translate to meaningful production capacity. They're not building garage operations. They're building industrial-scale manufacturing to serve a global market.

Grid Integration and Resilience: The Utility Perspective

Utility companies think differently than venture capitalists. They're focused on reliability, regulation, cost, and long-term infrastructure strategy. Solid-state transformers offer compelling advantages from all these angles.

First, reliability and control. Modern grids are complex systems with power flowing from traditional power plants, renewable sources, storage systems, and distributed generation. Utilities need sophisticated tools to manage these flows and maintain stability. Solid-state transformers provide visibility and control that traditional devices simply don't offer.

A utility operating solid-state transformers can monitor voltage, current, power factor, and other electrical parameters in real-time at every device. They can adjust transformer settings remotely, optimizing power flow based on current conditions. They can integrate data from hundreds or thousands of transformers into control systems that manage grid stability at scale.

This visibility and control is increasingly critical as renewable energy becomes a larger portion of grid supply. Wind and solar output is inherently variable and weather-dependent. The grid needs devices that can smooth these variations and route power efficiently as conditions change. Solid-state transformers excel at this. Traditional transformers can't do it at all.

Second, regulatory and financial incentives. Grid modernization is a regulatory imperative in most jurisdictions. Utilities get to include grid investments in their rate base, earning a regulated return on capital. Deploying solid-state transformers counts as grid modernization. Utilities can invest billions in this transition and earn returns on invested capital.

Third, operational efficiency. As transformers age, they become less efficient. They also require more maintenance. Solid-state transformers are more efficient, require less maintenance, and can report problems before they become failures. Over a 30-year lifespan, these advantages compound.

Utilities also recognize that solid-state transformers enable new capabilities. Bidirectional power flow means utility-scale batteries and distributed generation can connect more easily. Dynamic voltage control means the grid can accommodate more variable renewable sources. Software updates mean the infrastructure can improve without hardware replacement.

From a utility perspective, solid-state transformers aren't just replacement equipment. They're an upgrade to grid capabilities, offering control, efficiency, and flexibility that aligns with where electricity systems are heading.

Estimated data shows that testing complexity and supply chain constraints are the most severe challenges in semiconductor manufacturing.

Environmental and Efficiency Impact

Solid-state transformers offer genuine environmental benefits, both operational and over their complete lifecycle. Utilities increasingly need to justify capital investments based on sustainability metrics, so this matters in commercial decisions.

First, operational efficiency. Transformers are always-on infrastructure converting power 24/7. Even 1-2% efficiency improvements compound to significant energy savings over decades. At global scale, transformers handle virtually all electricity. A 1% efficiency improvement means 1% less generation capacity needed to serve the same load.

Using the U. S. as a reference point, total electricity consumption is roughly 4 trillion kilowatt-hours annually. A 1% loss reduction is 40 billion kilowatt-hours saved. At typical generation sources, this is equivalent to taking millions of cars off the road.

Second, manufacturing and materials. Traditional transformers require millions of tons of copper and steel annually. Solid-state transformers use semiconductors and other materials more efficiently. They're also more recyclable. Old transformers often contain oil cooling systems that require careful handling. Solid-state transformers eliminate that.

Third, lifecycle impact. A solid-state transformer that lasts 40 years and operates at 99% efficiency is dramatically better for the environment than a traditional transformer lasting 30 years at 98% efficiency.

Utilities and regulators increasingly factor environmental impact into infrastructure decisions. Solid-state transformers offer measurable advantages here. This doesn't drive the business case alone, but it's a beneficial tailwind in an increasingly sustainability-conscious environment.

The Competitive Landscape: Who's Building What

The solid-state transformer space is attracting multiple well-funded competitors, each taking slightly different technical and market approaches. Understanding the landscape helps contextualize the investment activity.

DG Matrix has built expertise in what they call Interport technology, capable of handling power from multiple sources at different voltages and combining them intelligently. This direct addresses the behind-the-meter power integration challenge. Their focus is initially on data centers, with a clear path to grid deployments.

Heron Power positions itself as focused on reliable, scalable production and grid applications. Their larger Series B funding suggests confidence in manufacturing scale-up. They're also pursuing grid operator partnerships earlier in their development cycle.

Amperesand is explicitly targeting the data center market, recognizing it as the near-term revenue opportunity. Their $80 million suggests focused execution on one market rather than trying to serve grid and data centers simultaneously.

Other players in the space include traditional transformer manufacturers like Siemens and ABB, which are investing in solid-state technology alongside traditional products. They have distribution networks, customer relationships, and manufacturing expertise that pure startups lack. But startups often move faster and can optimize for new technology in ways incumbents struggle with.

International players are also emerging. Chinese manufacturers are investing heavily in power electronics and solid-state technology. European companies are pursuing advanced grid integration approaches. The competitive landscape is global and intensifying.

Regulatory Framework and Path to Deployment

Technology doesn't just get deployed because it's better. It needs regulatory acceptance, certification, and integration into existing standards. The regulatory path for solid-state transformers is actually fairly straightforward, but understanding it matters for timeline expectations.

In the U. S., transformers are primarily regulated by ANSI (American National Standards Institute) and IEEE (Institute of Electrical and Electronics Engineers) standards. Manufacturers need to demonstrate that their solid-state transformers meet performance standards for voltage regulation, load handling, efficiency, and safety.

This is different from certification for new drugs or vehicles where the regulatory bar is incredibly high. Transformer standards are technical specifications about performance. If a solid-state transformer meets voltage regulation specs, handles expected loads, operates safely, and maintains required efficiency, it's approvable.

In fact, several solid-state transformers have already cleared major regulatory hurdles. This isn't speculative technology awaiting approval. It's deployable technology starting to see real-world implementation.

Data centers also benefit from simpler regulatory paths. A data center operator can deploy solid-state transformers in their private facility with fewer regulatory constraints than a utility deploying them on the public grid. This is another reason data centers are the logical first market.

Grid deployment requires utility coordination, more extensive testing, and regulatory filings. But the path exists. Utilities can begin deploying solid-state transformers in pilot programs now, gathering operational data that supports broader deployment.

Real-World Implementation: Data Center Case Studies

Theory is great. Real deployments matter more. Several major data center operators have begun deploying solid-state transformers in new facilities or retrofit projects. The results are validating the value proposition.

When a hyperscale cloud provider implements solid-state transformers in a 200-megawatt data center, the scale is enormous. We're talking about managing hundreds of megawatts of power through sophisticated semiconductor-based systems. Early deployments have shown that solid-state transformers can reliably handle these loads.

More importantly, early deployments are hitting the projected efficiency and cost savings. The 60-70% facility cost reduction that DG Matrix claims maps to real dollars. If a data center's power system typically costs

Operational experience is also validating software updatability claims. Being able to refine control algorithms, improve efficiency, and add capabilities without deploying a physical technician is genuinely valuable. Large facilities have thousands of pieces of critical equipment. Each one being remotely updatable simplifies operations.

Failure rates in early deployments appear acceptably low. Semiconductors are inherently reliable, and modern manufacturing processes are robust. Early units are showing the kind of reliability that utilities and cloud providers require.

This operational validation is crucial. It moves solid-state transformers from interesting technology to deployable infrastructure. Companies have real operational experience, not just lab results. This is why investors are comfortable deploying capital. They're not betting on "maybe this works." They're betting on "this works, now scale it up."

The Path Forward: Timeline and Expectations

When will solid-state transformers become standard? That depends on how you define "standard," but the trajectory is clear.

For data centers, solid-state transformers are becoming default today. New hyperscale facilities designed in 2025-2026 will increasingly incorporate them. Within 2-3 years, most major cloud providers will have deployed them in multiple facilities. Within 5 years, they'll be standard architecture.

For grid-connected applications, the timeline is longer but still measurable. Utilities will begin pilot programs deploying solid-state transformers in specific areas. If pilots succeed, wider deployment will follow. Given that utilities plan on 30-year timescales, early decisions made in 2025-2026 will determine deployment patterns for decades.

Conservatively, solid-state transformers will likely represent 20-30% of new transformer deployments globally within 10 years. Within 20 years, they'll be the dominant technology for new installations.

Cost is the key variable. Manufacturing scale drives cost down. Cost reduction drives adoption. Companies that achieve scale first will see costs decline fastest, creating a virtuous cycle where early leaders pull further ahead.

Investors are betting on companies that can achieve that scale quickly. The capital they're deploying isn't for R&D. It's for manufacturing capacity and market deployment. That's why the investment timing makes sense.

Challenges Remain: What Could Go Wrong

For all the enthusiasm, solid-state transformers face genuine challenges that could slow adoption or favor certain competitors.

Manufacturing complexity is real. Semiconductors are temperamental to manufacture at scale. Even companies with decades of experience struggle with yield issues when pushing into new products. Companies betting on solid-state transformers are betting they can solve manufacturing challenges faster and cheaper than competitors.

Cost targets might not materialize as quickly as expected. If semiconductor prices don't decline as projected, if manufacturing yields remain lower than traditional transformers, if quality issues emerge in the field, costs could stay elevated longer than investors anticipate.

Technology lock-in is both a feature and a risk. Being built into critical infrastructure means being there for 30 years. If a technology proves problematic, changing it is expensive. First movers take on technology risk. If solid-state transformers have unexpected failure modes that don't emerge until heavy deployment, early adopters suffer.

Regulatory changes could affect deployment. New efficiency standards, safety requirements, or integration rules could slow adoption or favor different technical approaches.

Competition from incumbents is real. Traditional transformer manufacturers have massive resources, existing customer relationships, and manufacturing expertise. They're not sitting idle. They're investing in solid-state technology themselves. Pure startups are faster but have fewer resources.

Despite these challenges, the fundamentals remain compelling. Infrastructure replacement is mandatory. Technology is ready. Economics are favorable. The market is massive. Risks are real but manageable. That's why investors are deploying capital at scale.

Investment Thesis: Why This Matters for Venture Capital

Venture capital typically focuses on high-growth, high-margin businesses with winner-take-most dynamics. Solid-state transformers seem like an odd fit. Infrastructure is capital-intensive, competitively intense, and often heavily regulated. Margins are typically lower than software.

But solid-state transformers actually check venture boxes in ways that matter. First, there's a genuine supercycle driving adoption. Data center buildout is accelerating. Grid modernization is mandatory. These aren't speculative growth vectors. They're happening now, with billions in capex committed.

Second, early winners will consolidate enormous market share. Once a data center operator or utility deploys solid-state transformers, they're unlikely to switch. Being embedded in critical infrastructure creates stickiness. Companies that win data centers early will have references, operational data, and cost advantages that make them nearly unassailable in subsequent grid markets.

Third, the addressable market is genuinely enormous. We're talking about hundreds of billions in potential revenue at maturity. Even if solid-state transformer companies end up with lower margins than software companies, the absolute market size makes these potentially multi-billion dollar businesses.

Fourth, there are genuine technical and manufacturing moats. Building reliable solid-state transformers at scale is hard. Getting semiconductor supply secured, achieving high manufacturing yields, serving utility customers, building the operational expertise—these create sustainable advantages for early leaders.

Investors also recognize that infrastructure transitions are rare but enormous when they happen. The shift from telephone poles to fiber optic cables. The deployment of cellular networks. The transition from incandescent to LED lighting. These created multi-billion dollar companies that operated for decades.

Solid-state transformers represent another such transition. It's not speculative. It's happening now. The companies that win this transition will be extraordinarily valuable.

Conclusion: The Grid's Next Generation

The electrical grid is one of humanity's greatest engineering achievements, but it's also one of the oldest and most stagnant. Transformers haven't meaningfully evolved in over a century. That's about to change dramatically.

Solid-state transformers represent a genuine discontinuity in infrastructure technology. They're not incremental improvements to traditional transformers. They're a complete rethinking of how power is managed and distributed. Built from semiconductors instead of copper and steel, they're controllable, updatable, and intelligent in ways that passive transformers simply cannot be.

The timing is perfect. Infrastructure aged beyond its design life demands replacement. Data centers and renewable energy create new requirements that traditional equipment cannot satisfy. Semiconductor costs follow Moore's Law, favoring technology built from silicon rather than commodity metals.

Investors see this convergence and recognize it as one of the biggest infrastructure opportunities of the coming decades. Hundreds of millions in capital deployed over a few months isn't hype. It's mathematical confidence in a genuine market transformation.

Over the next five years, expect to see solid-state transformers become standard in new data centers. Over the next 10-15 years, expect to see significant grid deployment. Within 30 years, most transformers on electrical systems will be solid-state. This transition will create multi-billion dollar companies and reshape how electricity is managed globally.

The companies executing well on this opportunity will build enduring businesses embedded in mission-critical infrastructure. The grid depends on transformers. Next-generation grids depend on intelligent, software-updatable transformers. We're watching that transition unfold in real time.

FAQ

What exactly is a solid-state transformer?

A solid-state transformer is a power electronics device that uses semiconductors (typically silicon carbide or gallium nitride) to convert and manage electrical power instead of traditional copper coils and iron cores. It can convert between alternating current (AC) and direct current (DC), adjust voltage levels, and route power bidirectionally, all with software control and real-time monitoring capabilities.

How is a solid-state transformer different from traditional transformers?

Traditional transformers are passive devices that react to grid conditions but cannot adapt or manage power flow. Solid-state transformers actively control power distribution, provide bidirectional flow, enable remote software updates, operate with higher efficiency, and can consolidate multiple devices into one unit. They also feature built-in monitoring and can be updated continuously without physical hardware replacement.

Why are data centers the first market for solid-state transformers?

Data centers benefit immediately from solid-state transformers because they can replace multiple pieces of equipment (transformers, UPS systems, converters) with a single integrated unit. This saves 60-70% in power infrastructure costs, frees up valuable floor space in expensive facilities, simplifies management of behind-the-meter generation, and provides the control needed for modern hybrid power sources. These economic benefits justify the premium cost.

How much faster can manufacturing costs decline compared to traditional transformers?

Solid-state transformer costs follow semiconductor industry curves, typically declining 15-20% annually as production scales and manufacturing processes improve. Traditional transformer costs depend on commodity prices for copper and steel, which are volatile and generally trend upward over time. This divergence means solid-state transformers will achieve cost parity within 10-15 years and become 30-50% cheaper than traditional transformers within 20 years.

Can solid-state transformers handle the same power levels as grid transformers?

Current solid-state transformers effectively handle distribution-level voltages (10-35 kilovolts) and can manage hundreds of megawatts. High-voltage transmission transformers (over 100 kilovolts) require larger semiconductor devices and additional engineering work, but are technically feasible. Near-term deployments focus on distribution transformers and data center equipment, which represent the majority of the replacement market by volume.

What is the regulatory path for deploying solid-state transformers?

Solid-state transformers must meet existing ANSI and IEEE performance standards for voltage regulation, efficiency, and safety. Several manufacturers have already achieved regulatory approval for specific applications. Data center deployments face fewer regulatory barriers than grid deployments. Utilities can deploy in pilot programs to gather operational data supporting broader adoption, with regulatory pathways already established in most jurisdictions.

How reliable are solid-state transformers in real-world operation?

Early deployments in data centers and utility pilot programs show failure rates comparable to traditional transformers (100-500 failures per million hours). Semiconductor devices are inherently reliable, and modern manufacturing processes produce consistent quality. The bigger reliability question is whether control software and thermal management systems perform as expected at scale, which early deployments are validating successfully.

What happens if a solid-state transformer fails in the field?

Solid-state transformers typically fail more gracefully than traditional transformers due to semiconductor design. Rather than catastrophic failures, they typically experience gradual degradation or controlled shutdowns. They can also provide remote diagnostics before failure occurs, allowing preventive maintenance. For critical applications like data centers, redundant systems or bypass paths ensure continued operation during unit replacement.

How do solid-state transformers handle variable renewable energy sources?

Solid-state transformers can dynamically adjust voltage and power flow in response to changing input conditions. This allows them to smooth fluctuations from solar and wind sources, route power efficiently as generation varies, and integrate battery storage seamlessly. Traditional transformers cannot adapt to these variations, making solid-state transformers essential for grids with high renewable penetration.

What's the total addressable market for solid-state transformers?

The global transformer market is roughly

Key Takeaways

- Solid-state transformers replace passive copper-and-iron devices with semiconductor-based active power management systems capable of real-time control and software updates

- Three startups raised over $280 million in 2026 to scale manufacturing, validating a genuine infrastructure supercycle driven by aging grid and data center demand

- Data centers can achieve 60-70% power infrastructure cost savings by consolidating multiple devices into single solid-state transformer units

- Semiconductor cost curves give solid-state transformers long-term economic advantage over traditional transformers tied to volatile copper and steel commodity prices

- Grid replacement opportunity spans billions of units globally with addressable market potentially reaching $40-50 billion annually at maturity within 20-30 years

Related Articles

- Heron Power's $140M Bet on Grid-Altering Solid-State Transformers [2025]

- DG Matrix Raises $60M: Solid-State Transformers Transform Data Center Power [2025]

- AI Data Centers & Energy Storage: The Redwood Materials Revolution [2025]

- Meta, NVIDIA Confidential Computing & WhatsApp AI [2025]

- AI Data Centers Hit Power Limits: How C2i is Solving the Energy Crisis [2025]

- StreamFast SSD Technology: The Future of Storage Without FTL [2025]

![Solid-State Transformers: The Grid's Digital Revolution [2025]](https://tryrunable.com/blog/solid-state-transformers-the-grid-s-digital-revolution-2025/image-1-1771598375739.jpg)