Tesla's 2025 Revenue Decline: What Went Wrong [2025]

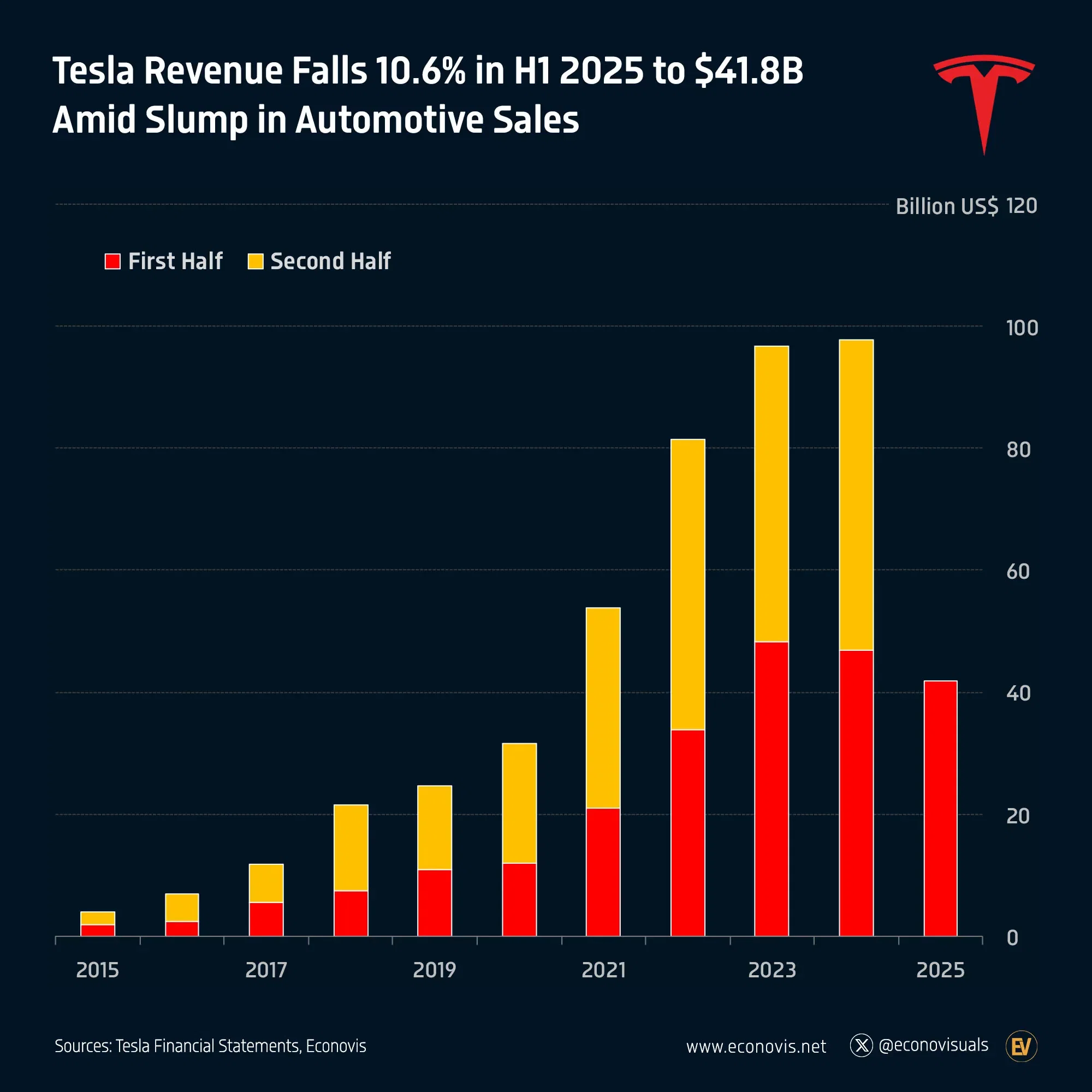

For nearly two decades, Tesla operated like a financial machine that only knew one direction: up. The company grew revenue year after year, defied skeptics at every turn, and became the most valuable automaker on the planet despite building far fewer cars than traditional competitors. But 2025 changed everything.

On January 29, 2026, Tesla released its full-year 2025 financial results, and the headlines told a story nobody expected: for the first time in the company's 22-year history, annual revenues fell year over year. This wasn't a minor dip or a single quarter's stumble. This was a fundamental shift.

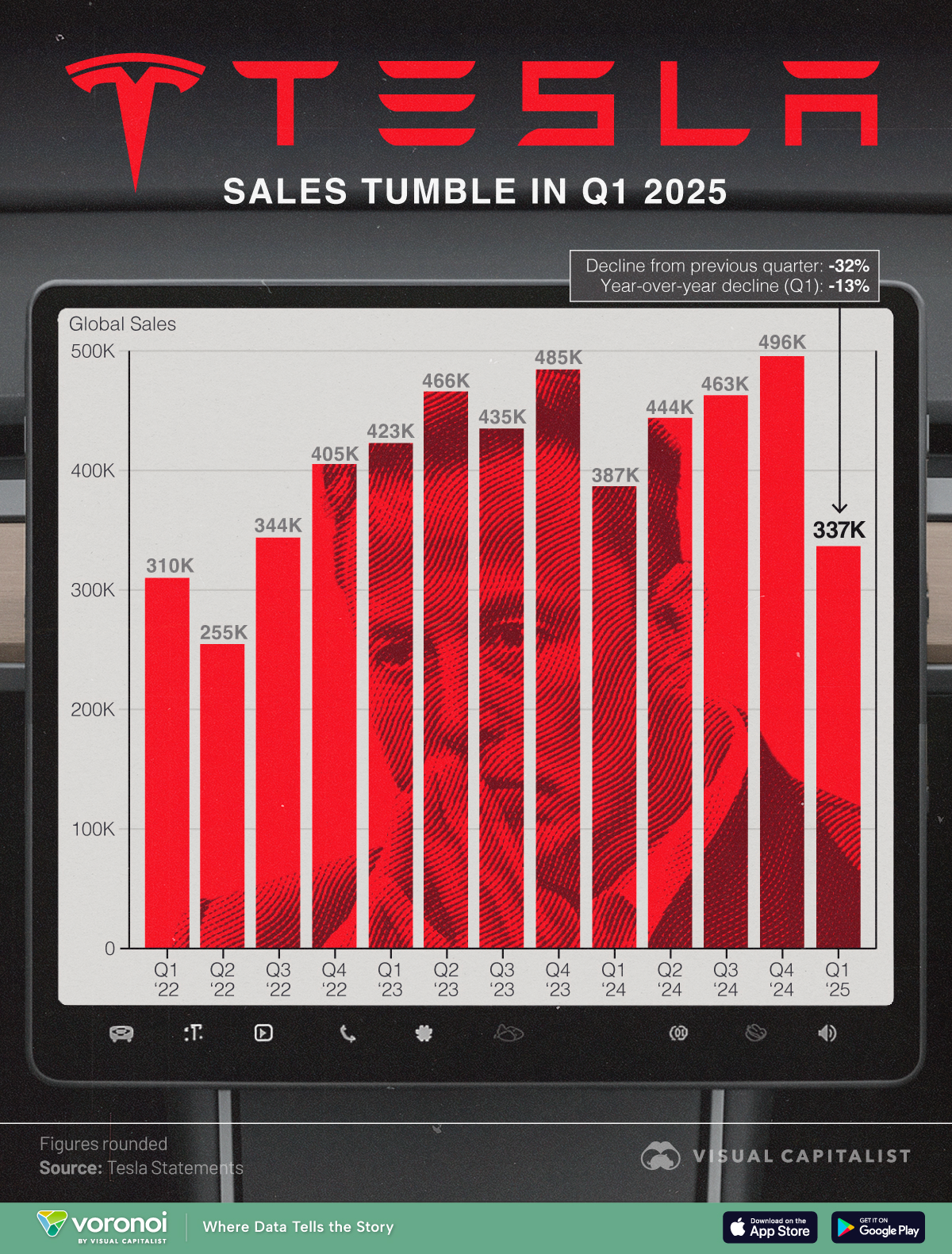

The numbers were stark. Tesla sold 418,227 vehicles in 2025, down from 463,371 in 2024. That 9.7% decline in unit sales translated to automotive revenues plummeting 11% to

And then came the revelation that changed how investors and analysts looked at the company's future. Of that

This moment represents a critical inflection point for Tesla. Not a death knell, but a genuine reckoning. The company faces pressure from all sides: Chinese competitors crushing prices, traditional automakers finally bringing competitive electric vehicles to market, consumer demand softening globally, and a massive pivot toward an unproven robotaxi business model that's years behind schedule.

So what went wrong? How did the world's most innovative automaker fall into its first revenue decline? And what does this mean for Tesla's future? Let's dig deep.

TL; DR

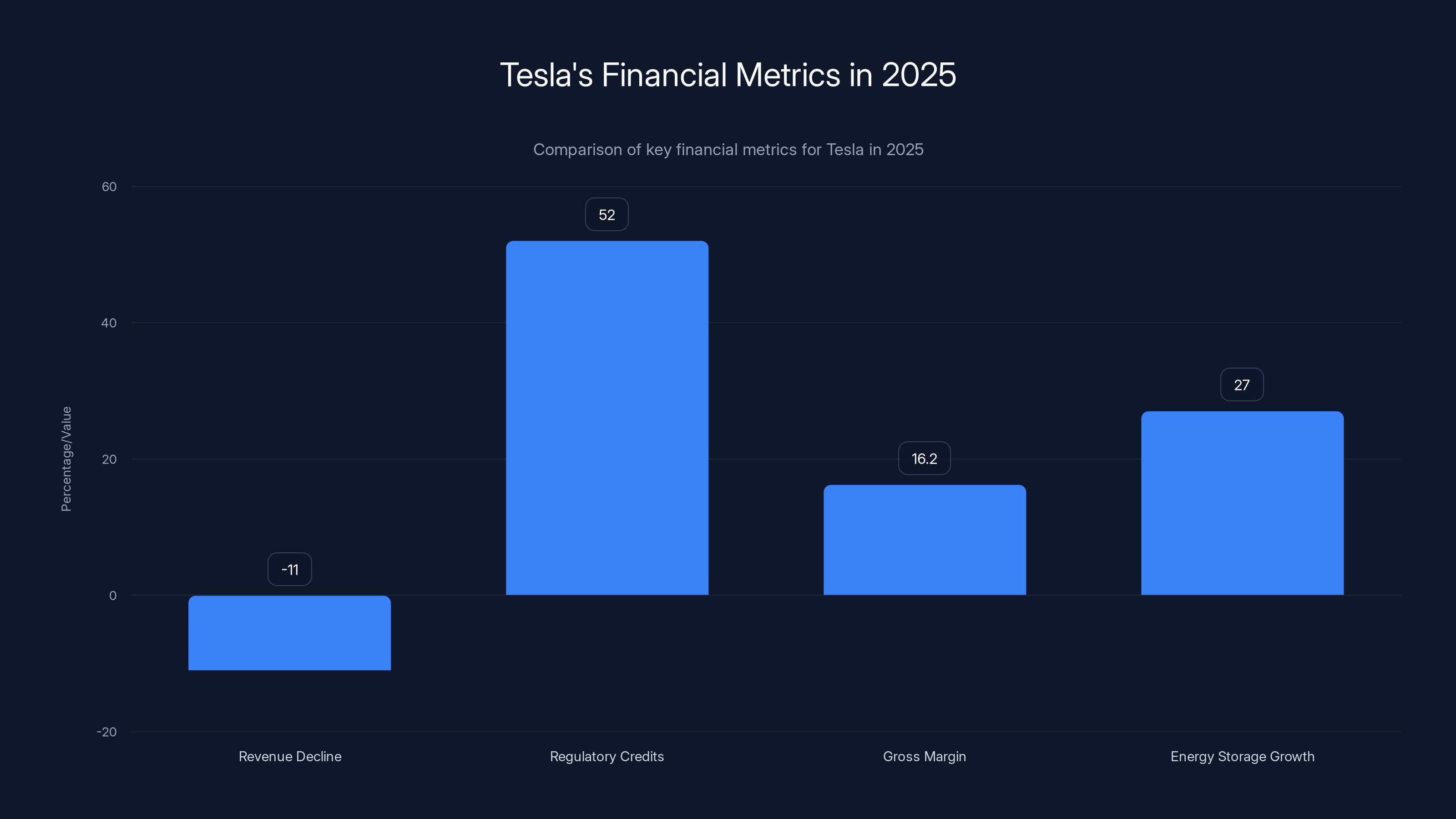

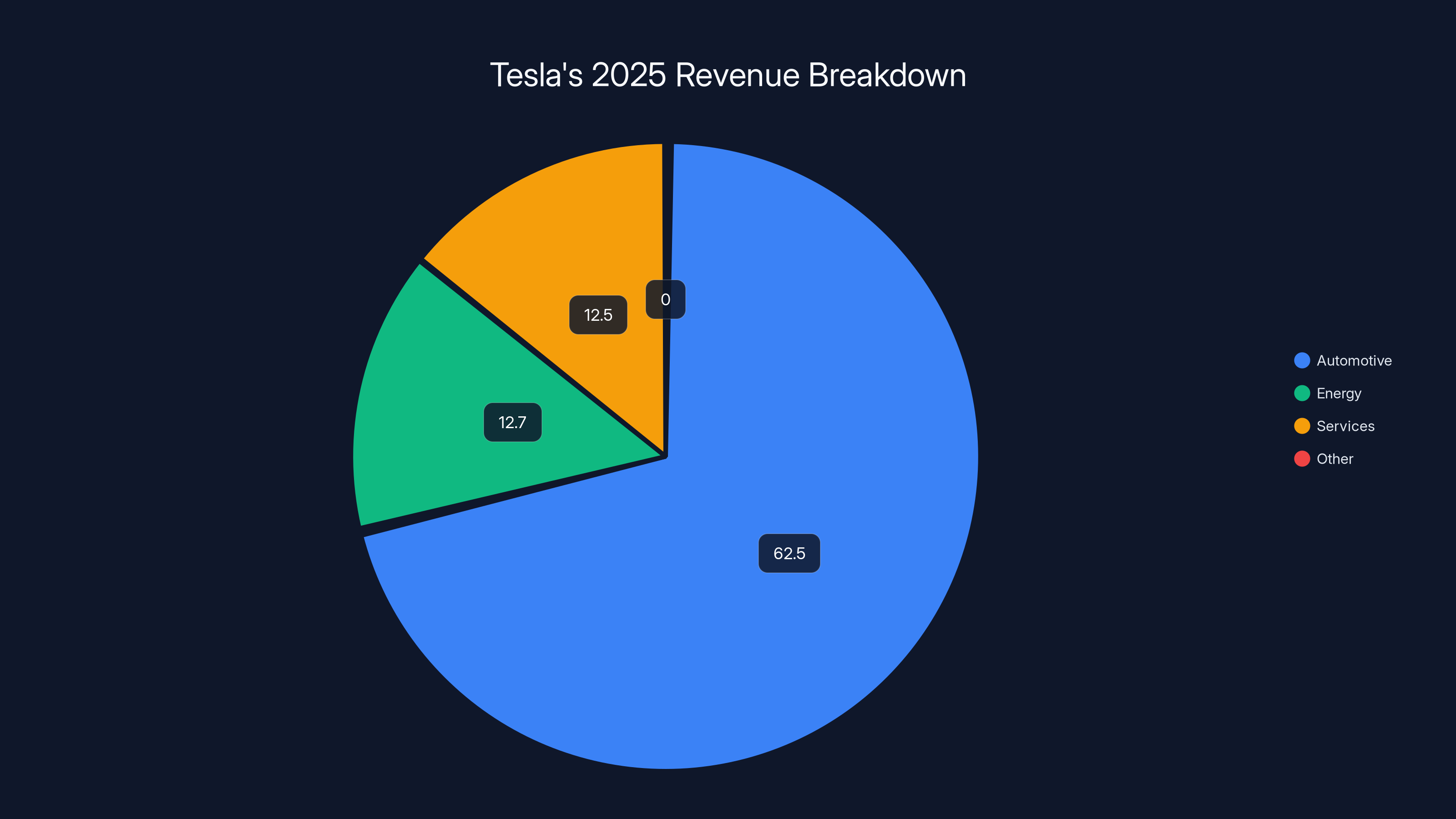

- Tesla's first revenue decline: Total revenues fell 3% to $87.7 billion in 2025, with automotive sales down 11%

- Massive profit collapse: Net profit dropped 46% to $3.8 billion, with regulatory credits accounting for 52% of profits

- Vehicle sales weakness: Tesla sold 418,227 cars in 2025, a 9.7% decline from 2024's 463,371 units

- Margin compression crisis: Operating margin fell to 4.9% in 2025 from 7.2% in 2024, and just 23.8% in 2022

- Bright spot in storage: Energy business surged 27% to $12.7 billion, becoming an increasingly important revenue driver

- Bottom line: Tesla faces structural headwinds requiring either aggressive price increases, dramatic cost cuts, or a successful pivot to robotaxi and autonomous driving

Tesla's revenue declined by 11% in 2025, with regulatory credits making up 52% of net profit. Gross margin fell to 16.2%, while energy storage grew by 27%.

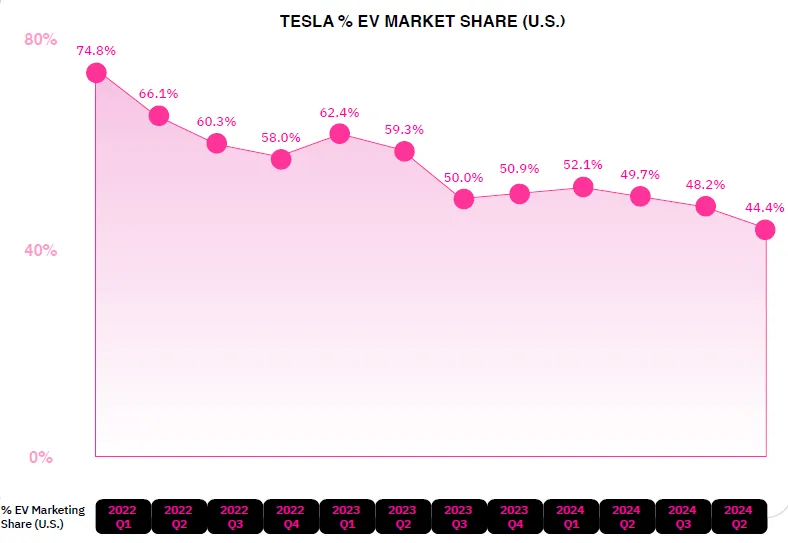

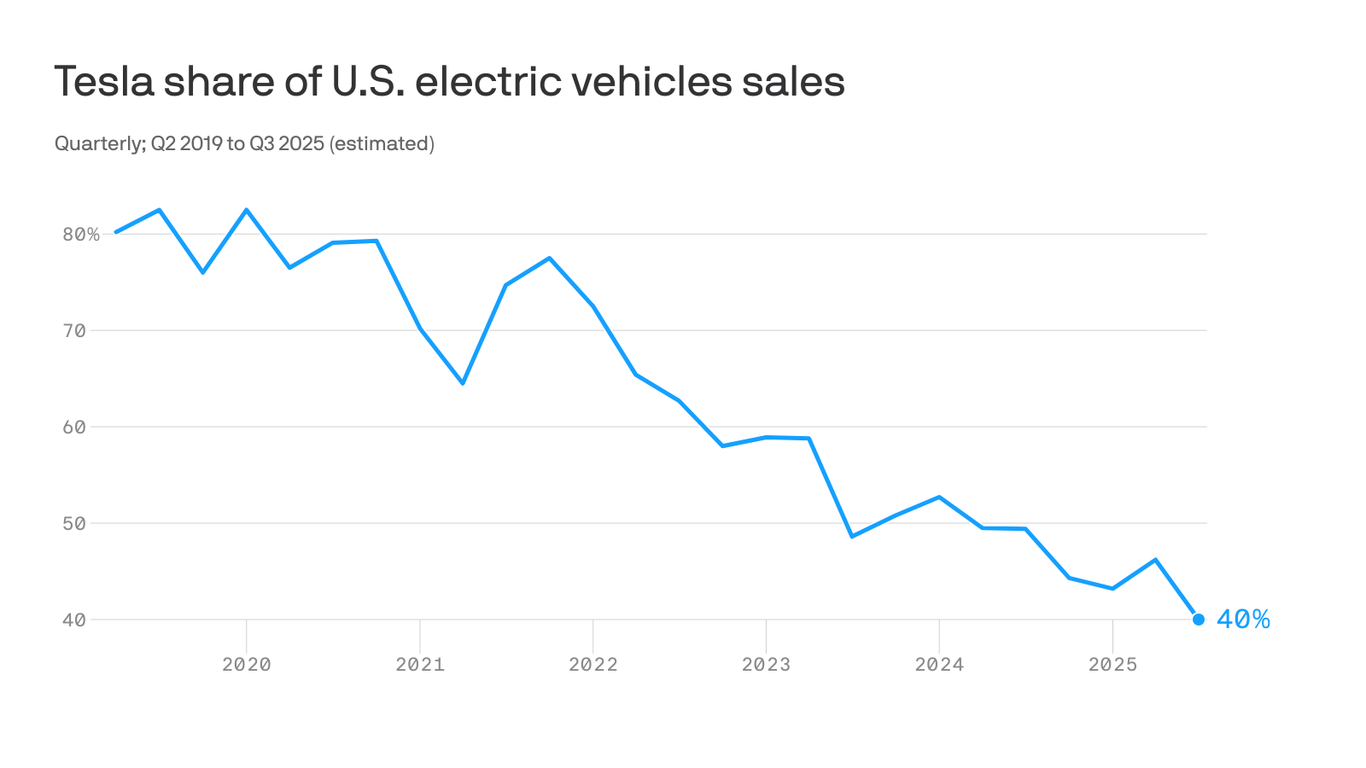

The Fundamental Problem: Tesla Lost Market Share at the Worst Time

Here's what happened in 2025, explained in the simplest terms: the electric vehicle market stopped growing at the pace Tesla needed to keep its growth story alive.

Global EV sales continued climbing in 2025, reaching roughly 17 million vehicles sold worldwide. But Tesla's slice of that pie shrank. The company went from selling 1.81 million vehicles in 2023 to 1.81 million in 2024, then fell to just 1.47 million in 2025. Wait—those first two numbers look similar because they were essentially flat. Tesla's real crisis isn't 2025; it started in 2024 when the company stopped growing altogether.

Why? Competition, for one. BYD, the Chinese automaker, sold more electric vehicles than Tesla starting in 2023, and that gap widened in 2025. BYD's strategy was straightforward: build decent EVs at prices that undercut Tesla by 30-50%, capture market share, and ignore profit margins for now. Tesla couldn't compete on price without destroying margins, and it couldn't maintain high prices without losing volume.

Traditional automakers finally shipped competitive products. Ford launched the Mustang Mach-E, General Motors released the Chevy Blazer EV and Equinox EV, Volkswagen ramped up ID.4 production, and even premium brands like BMW and Lexus introduced serious EV competitors. Suddenly, buying a Tesla wasn't the only choice for someone who wanted an electric vehicle. It wasn't even the most prestigious choice anymore.

Consumer sentiment shifted too. The initial EV boom—driven by early adopters willing to pay premium prices for the privilege of owning something new—matured. Buyers became more rational. They compared specs, price, warranty, and dealer networks the way they'd always done for gas cars. Tesla's advantages in battery tech and acceleration looked less impressive when competitors offered more cargo space, better build quality, or superior infotainment systems.

The numbers tell the story. In Q4 2025, Tesla delivered 1.64 million units for the full year—down 1.8% from 2024. Fourth quarter specifically saw a 16% decline compared to Q4 2024. This wasn't seasonal weakness; it was structural decline.

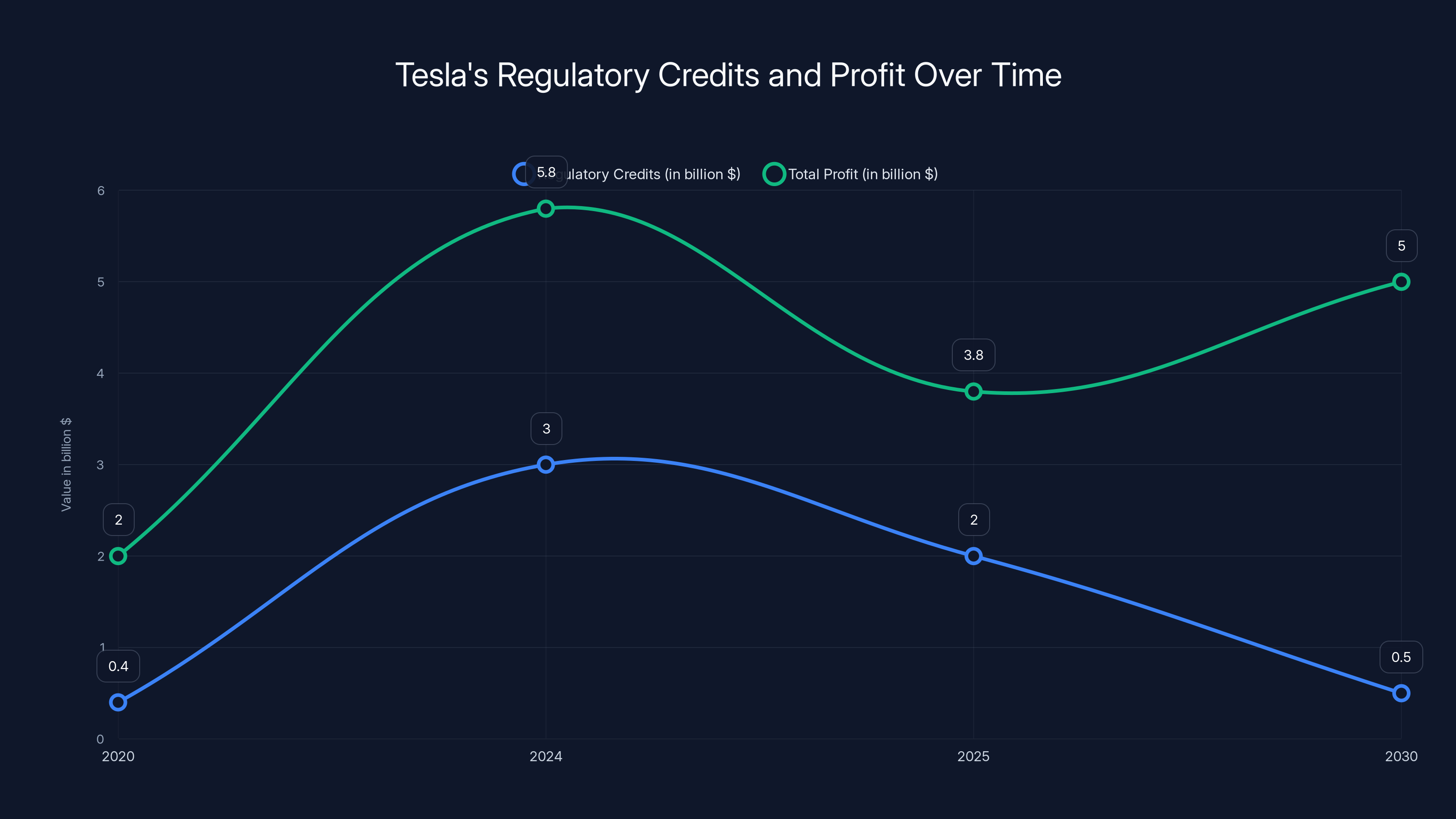

Tesla's reliance on regulatory credits peaked in 2024 but is expected to decline as the market shifts towards electric vehicles. Estimated data for 2030 suggests a significant drop in credit value.

How Pricing Power Evaporated

For years, Tesla maintained industry-leading gross margins by charging premium prices for premium products. The Model 3 started at $35,000 in 2020 and slowly crept upward. The Model Y became the world's best-selling car by volume, and consumers paid willingly.

Then everything changed. Starting in late 2023, Tesla began cutting prices aggressively. A Model 3 that sold for

The problem: once you cut prices, you can't easily raise them back. Consumer expectations reset. Early buyers felt cheated. Wall Street saw the writing on the wall.

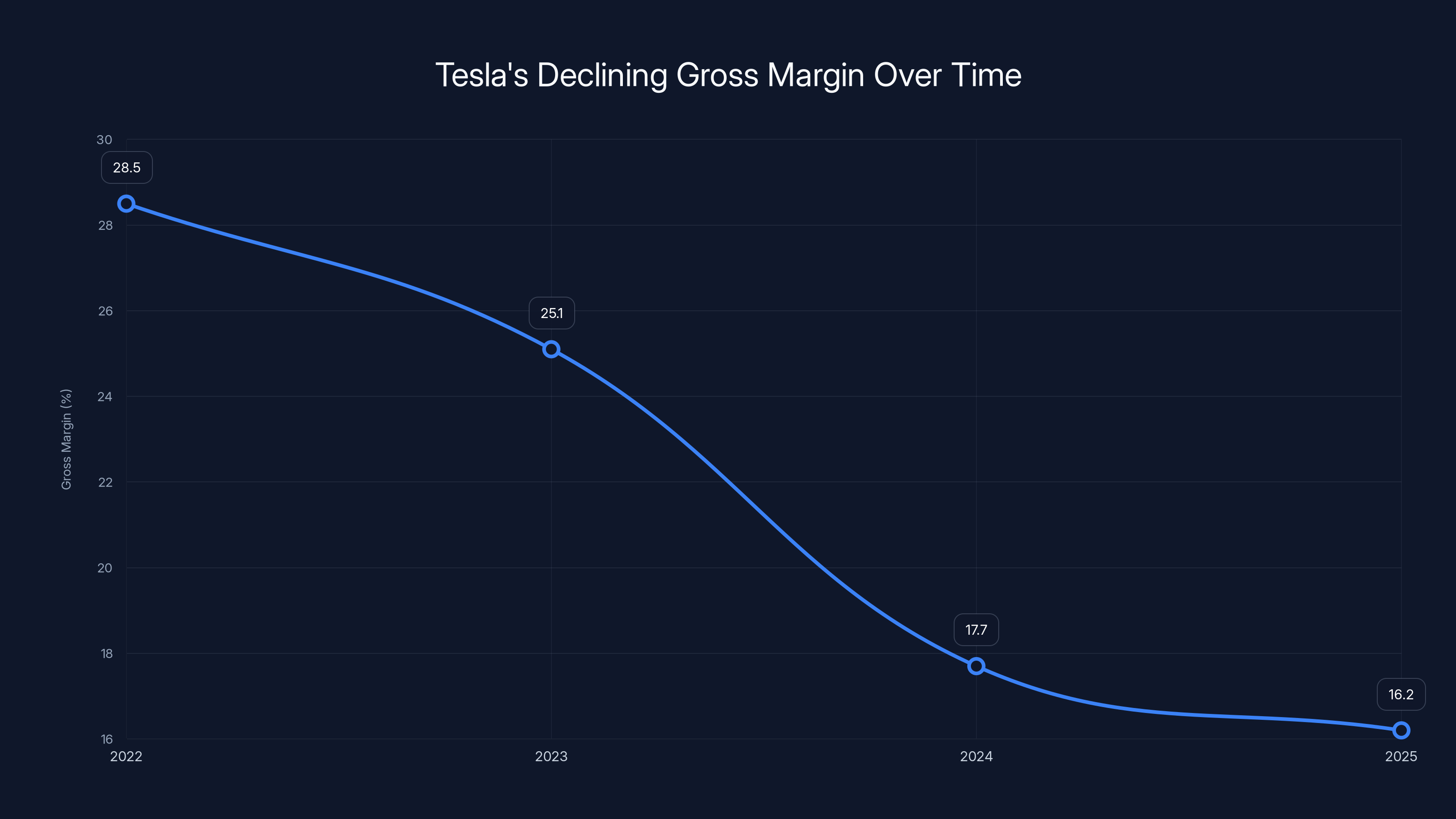

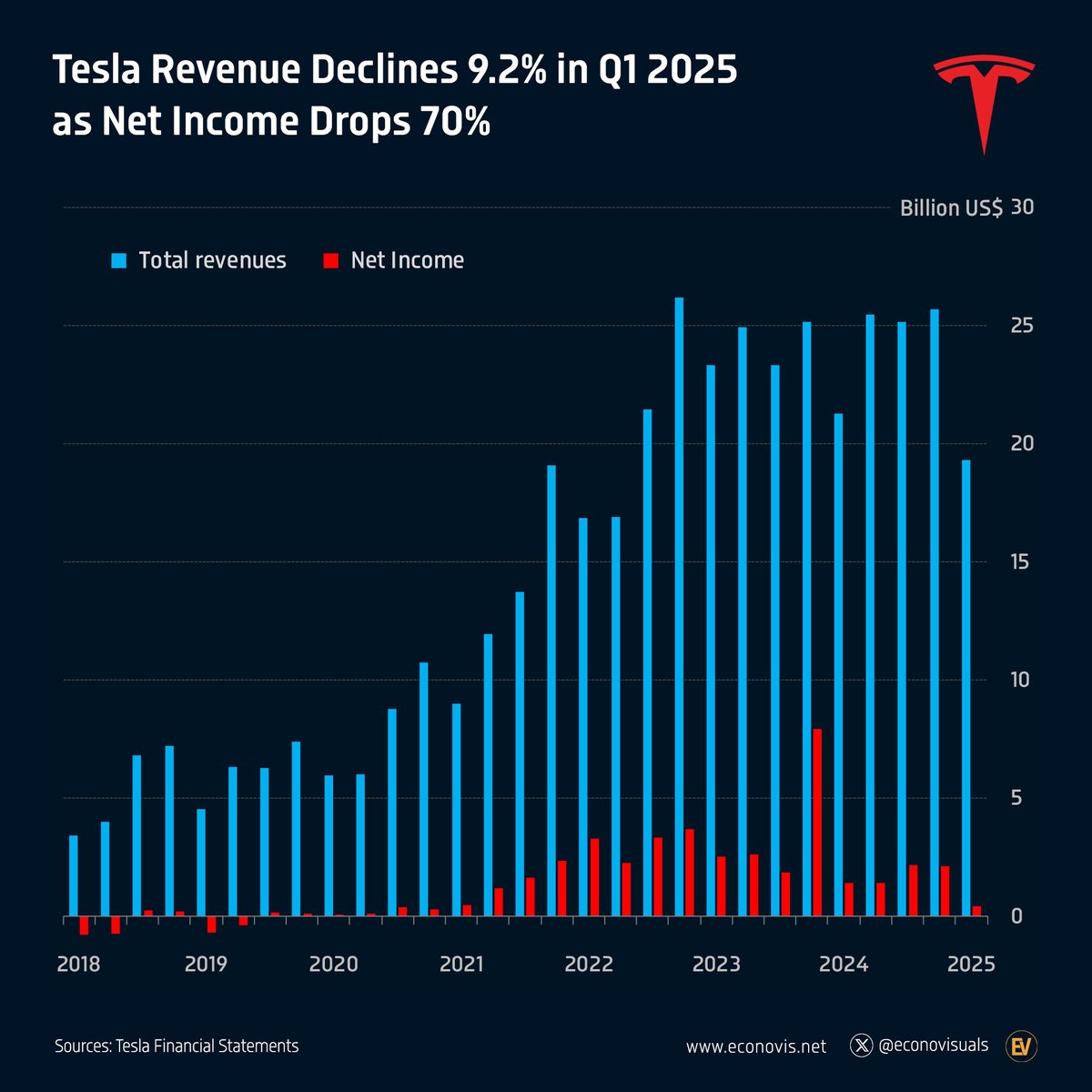

Tesla's gross margin (automotive gross margin specifically) tells this story with brutal clarity:

- 2022: 28.5% gross margin

- 2023: 25.1% gross margin

- 2024: 17.7% gross margin

- 2025: 16.2% gross margin

That collapse from 28.5% to 16.2% in just three years is catastrophic. To put it in perspective, Toyota typically operates at 9-11% gross margins and still crushes quarterly earnings. But Tesla built its entire valuation around being worth 10x traditional automakers because of superior margins. Losing half your margin advantage is existential.

The math doesn't work anymore. Selling more cars at lower prices doesn't create sustainable profits when competitors have lower manufacturing costs. Tesla's Gigafactories are marvels of engineering, but they're still expensive to build and operate. Chinese factories have lower labor costs. Traditional automakers have supply chain relationships developed over decades.

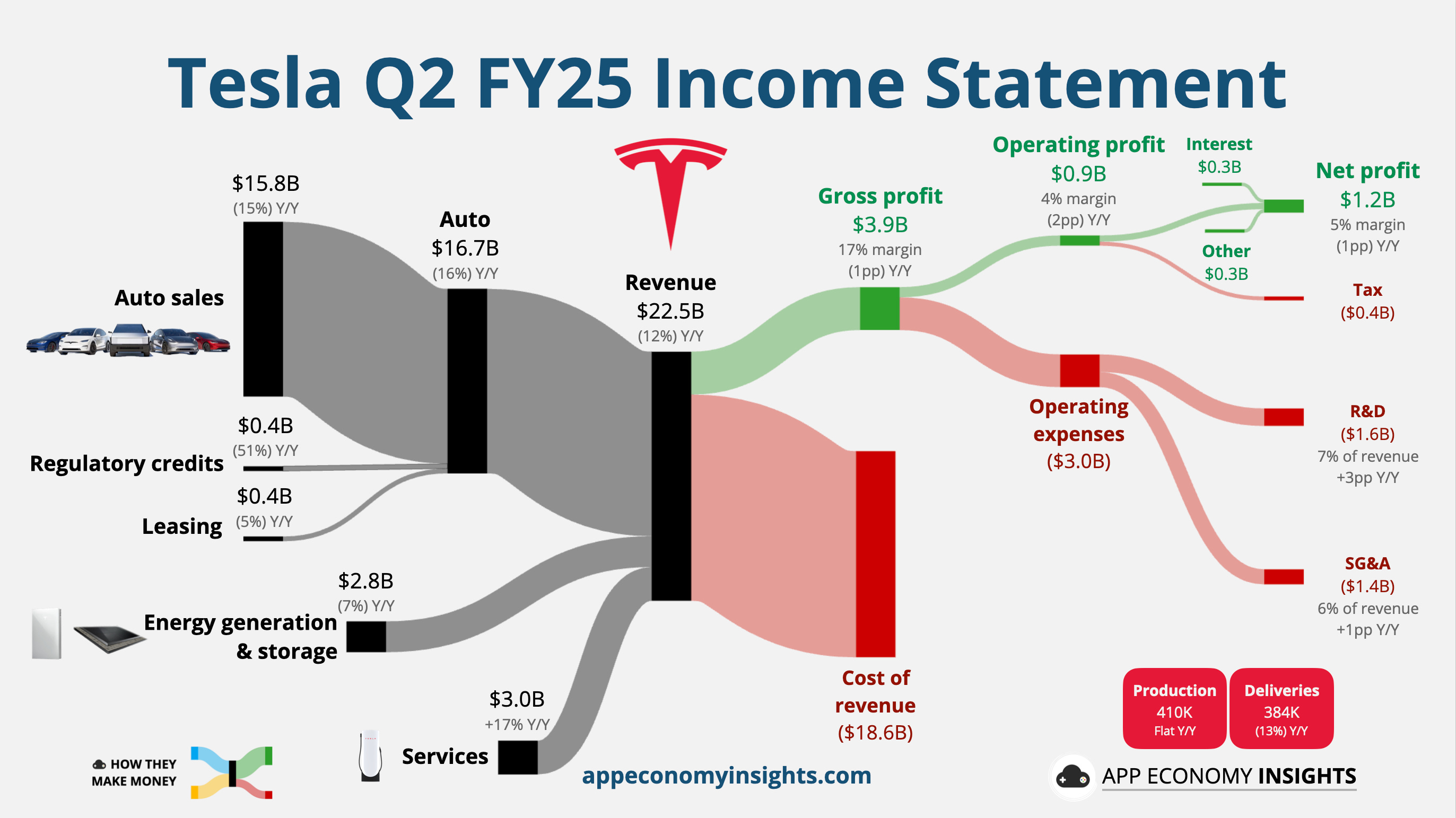

The Regulatory Credits Trap: Half of Profits from Government Handouts

This is the detail that should terrify Tesla investors: the company sold $2 billion in environmental regulatory credits in 2025, and those credits represented 52% of its total net profit.

Let's be clear about what this means. Tesla didn't invent anything special or sell a product that commanded premium pricing. It earned credits because governments mandate that automakers achieve certain emissions standards. Those credits can be bought and sold. Tesla, by selling primarily electric vehicles, generates excess credits that other automakers—especially those still producing gas cars—need to buy to stay compliant.

It's a brilliant arbitrage opportunity, and Tesla should absolutely exploit it. But relying on $2 billion from regulatory credits is a symptom of a broken business model, not a feature.

Here's the problem: these credits are temporary. As EPA emissions standards tighten and more traditional automakers shift to electric vehicles, the value of these credits will decline. By 2030 or 2035, when EVs become the majority of sales globally, nobody will be paying a premium for credits. The business model evaporates.

Historically, Tesla earned far fewer credits. In 2020, regulatory credits were less than

If Tesla's core automotive business can only generate

Tesla's inability to earn real operating profit without regulatory credits is deeply concerning. It suggests the company either needs to radically cut costs, dramatically raise prices (which it can't do without losing more share), or find new revenue sources.

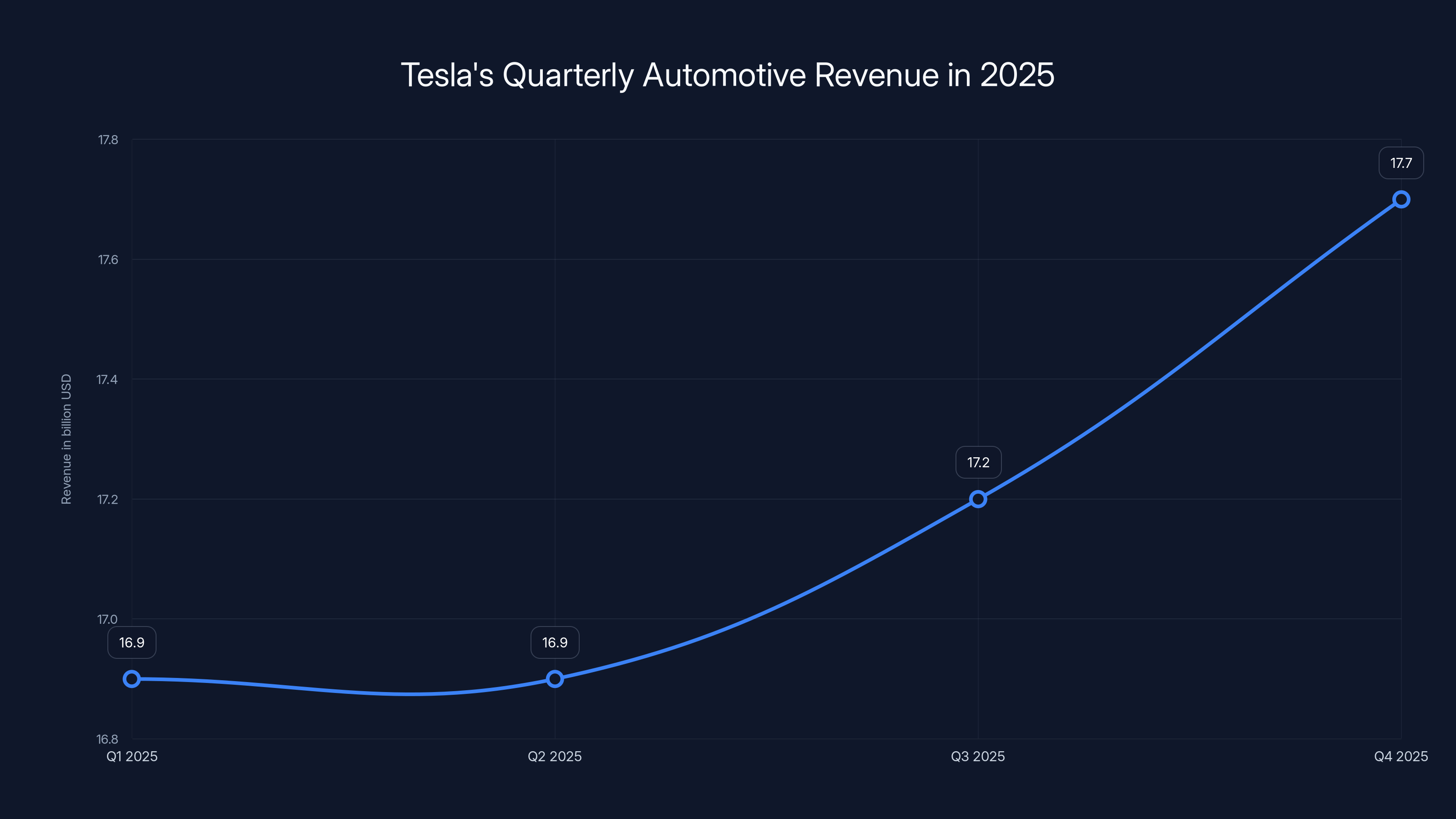

Tesla's automotive revenue showed slight improvement in Q3 and Q4 2025, but the significant drop in unit sales in Q4 highlighted a deeper demand issue.

Quarterly Performance: When Did Things Get Bad?

Tesla's 2025 weakness wasn't evenly distributed. The company's quarterly performance reveals when the crisis accelerated.

Q1 2025: Automotive revenues $16.9 billion, down 9% from Q1 2024. This was the warning shot. Analysts noticed but didn't panic; they figured Q1 was seasonally weak.

Q2 2025: Automotive revenues $16.9 billion, roughly flat with Q1. This was alarming. The company missed guidance. Bloomberg and mainstream media started questioning the growth narrative.

Q3 2025: Automotive revenues $17.2 billion, a slight improvement. Hope returned briefly. Some analysts argued Tesla had stabilized.

Q4 2025: Automotive revenues $17.7 billion, but unit sales fell 16% compared to Q4 2024. This was the disaster. Despite higher revenue per vehicle (due to price increases and higher-priced models), absolute unit volume collapsed.

The Q4 decline is crucial to understand. It shows that in the final quarter—when Tesla typically has its strongest sales due to year-end push and inventory management—the company couldn't maintain momentum. Demand was genuinely soft, not just a timing issue.

Operating profit told an even darker story:

- Full year operating profit: 9.27 billion in 2024

- Operating margin: 6.5%, down from 9.2% in 2024

- Net profit: 7.1 billion in 2024

The gap between operating profit and net profit (

The Energy Business: Tesla's Unexpected Savior

In a year when automotive sales fell, one division surged: energy storage.

Tesla sold

Why does this matter? First, energy margins are higher than automotive margins. Gross margins on storage products are in the 30%+ range compared to 16% on cars. Second, this business is less mature, meaning room for growth still exists. Third, the energy transition is real and accelerating.

Governments worldwide are mandating grid-level battery storage to support renewable energy. Utilities are building massive battery facilities. Commercial and residential customers want backup power and cost savings. Bloomberg NEF projects the energy storage market will grow 20-25% annually through 2030.

Tesla's Powerwall for residential customers and Megapack for utility-scale applications have become industry standards. The company has waiting lists in many markets. Margins are healthy. Growth is real. This division alone is worth more than most publicly traded companies.

The services division also grew, reaching $12.5 billion in 2025, up 19% from 2024. This includes warranty work, repairs, charging network revenue, and software services. Like energy, services have higher margins than automotive sales.

Together, energy (

But here's the trap: nobody values Tesla as an energy company or a services company. The market values it as a growth automotive company. Once that narrative breaks, the multiple investors pay collapses.

Tesla experienced a significant decline in 2025 with vehicle sales dropping by 9.7%, automotive revenue by 11%, total revenue by 3%, and net profit by 46%.

Why Tesla's Manufacturing Advantage Disappeared

When Elon Musk took over as CEO, Tesla had a massive advantage: the company could manufacture vehicles at lower cost than almost anyone. The Gigafactories revolutionized production by automating steps that traditional automakers still did manually.

But that advantage is gone. Not completely gone, but greatly diminished.

Here's what happened: traditional automakers studied Tesla's factories and copied what worked. They invested billions upgrading their own plants. Labor costs in those plants are contractually locked in at higher levels (union contracts), but the capital efficiency gap closed. Meanwhile, Tesla's Gigafactories are incredibly expensive to build and operate. The Berlin factory cost

Chinese competitors like BYD built factories faster and cheaper using different approaches. BYD's new factories can produce vehicles at lower cost because labor is cheaper in China and BYD owns the entire battery supply chain vertically. Tesla had to buy batteries from suppliers or build battery factories alongside car factories, adding cost.

The competitive landscape shifted:

BYD's advantages: Lower labor costs, integrated battery supply chain, massive domestic market, government support

Traditional automakers' advantages: Established supply chains, union labor committed long-term (predictable cost), massive capital reserves, existing distribution networks, brand loyalty

Tesla's remaining advantages: Brand recognition, Supercharger network, battery technology, software/OTA updates

But manufacturing advantage? Gone. Tesla's cost per vehicle isn't lower anymore. That's why margins collapsed.

The Robotaxi Distraction: Promises vs. Reality

In the face of declining automotive profitability, Tesla is betting the company's future on robotaxis. The Cybercab (a two-seat autonomous vehicle) is supposed to launch in "volume production" in 2025. Spoiler alert: it hasn't.

Tesla announced the robotaxi with great fanfare in 2023, projecting production and deployment starting in 2024. Then 2025 came and went with zero public information about actual production. The company now claims volume production will start in 2026, but that's what they said about 2024.

This is a critical problem because the robotaxi narrative is the only story that justifies Tesla's premium valuation. If the company is just another EV manufacturer with declining margins, it should trade at a 0.8x-1.2x price-to-sales multiple like traditional automakers. But investors pay 4-8x sales multiple because they believe the robotaxi opportunity is enormous.

Here's the reality: robotaxis are hard. Really hard. You need:

-

Hardware: A vehicle capable of driving itself, with sufficient redundancy and safety systems. Tesla is working on this.

-

Software: Autonomous driving software good enough to operate without human intervention in complex urban environments. Tesla's Full Self-Driving is in "beta" after over a decade of development.

-

Regulatory approval: Federal, state, and local governments need to approve autonomous vehicle operations. This is a multi-year process.

-

Insurance and liability: The legal framework for who's responsible when a robotaxi crashes is still being figured out.

-

Fleet operations: Running a fleet of thousands of vehicles across multiple cities requires entirely new logistics and maintenance operations.

Waymo, the Google-backed autonomous vehicle company, has been working on this for nearly 15 years. They operate robotaxi services in Phoenix and San Francisco but only in limited areas and weather conditions. They still employ safety drivers in most deployments. Cruise, the General Motors robotaxi company, suspended operations in 2024 after safety concerns.

Tesla's Full Self-Driving software still requires driver attention and hasn't been approved for true autonomous operation in most jurisdictions. The company has hinted at removing steering wheels and pedals from the Cybercab, but that's only possible if regulators permit true autonomous operation. That hasn't happened and likely won't in 2026.

Yet Tesla is betting the farm on this. The company is investing billions in AI development, hiring autonomous driving talent from competitors, and making vague promises to investors. But actual robotaxis remain years away from reality.

Tesla's automotive gross margin dropped significantly from 28.5% in 2022 to 16.2% in 2025, highlighting the impact of aggressive price cuts and increased competition.

Expense Growth: The Cost of Ambition

Here's something most people miss: Tesla's expenses grew 23% in 2025 while revenues fell 3%. That's a recipe for profit collapse.

Where did the money go? Research and development primarily. Tesla is spending heavily on:

- Full Self-Driving algorithm development

- Next-generation platform (cheaper vehicles, new designs)

- Energy product development

- Manufacturing efficiency improvements

- AI infrastructure and training

The company also committed $2 billion in new investment to x AI, Elon Musk's AI company, which has nothing to do with Tesla's core business but Musk controls both companies and makes unilateral decisions about capital allocation.

Selling, general, and administrative expenses also rose. The company is spending more on marketing as competition intensifies. Service centers are expanding to match the growing vehicle fleet.

But here's the real problem: expenses grew while margins contracted. That's the opposite of what should happen. You grow expenses to capture new growth or defend market share temporarily. But if you're growing expenses while losing market share (Tesla's units fell even as total EV market grew), something's wrong with capital allocation.

A well-run company would cut costs aggressively when revenues fall. Tesla did the opposite. That suggests leadership believes the near-term sacrifices are necessary for long-term positioning. Maybe that's correct. But it's also consistent with a company in denial about structural headwinds.

Capital Structure: How Much Cash Does Tesla Actually Have?

Tesla generated

That's still substantial. Tesla has tens of billions in cash on the balance sheet and can raise more capital if needed. The company isn't in financial distress.

But cash generation is slowing. If free cash flow continues declining at the rate it has (down 31% year-over-year), the company's war chest will diminish quickly. Tesla can't spend $50 billion+ on new factories, AI development, and shareholder buybacks indefinitely while generating declining profits.

The question becomes: what's the maximum amount of capital Tesla can invest before shareholders revolt? Traditional automakers generate 5-8% free cash flow margins. Tesla generated 11% in 2025, which is still strong, but the trend is concerning.

Capital intensity in the EV business is brutal. Building a new factory costs

In 2025, Tesla's energy and services divisions together accounted for 29% of the total revenue, highlighting their growing significance compared to the automotive sector.

Geographic Challenges: China Is No Longer Friendly Territory

China is Tesla's second-largest market by revenue. The company's Shanghai Gigafactory is one of the most profitable manufacturing facilities in the world. But 2025 was brutal there.

Tesla's China sales fell sharply as BYD and other Chinese competitors accelerated market share gains. The Model 3 and Model Y still sell well, but at lower prices and lower margins than before.

The Chinese government, meanwhile, is increasingly nationalistic. BYD is a national champion receiving government support. Tariffs and policies favor Chinese companies. Tesla, as a foreign company, operates in an increasingly challenging environment.

Europe presented similar challenges. Traditional automakers like Volkswagen and BMW launched competitive EVs. Tesla's European prices fell sharply. Factory ramp-ups in Berlin took longer than expected and consumed more capital.

The United States remains Tesla's strongest market, but EV adoption has plateaued. Federal tax credits and incentives masked weak demand for years, but the market is saturated. Everyone who wants an EV already has one. New buyers are choosing competitors.

Competitive Dynamics: The EV Market Became Normal

For a decade, the EV market was a nascent niche. Tesla could command premium pricing because alternatives didn't exist. Early adopters paid willingly for cutting-edge technology.

Then the market matured. EV became normal. Not every EV buyer is an enthusiast anymore. They're regular consumers comparing specs, price, warranty, and brand reputation like they would for gas cars.

Suddenly, Tesla's advantages looked less compelling:

What Tesla does well: Acceleration, technology, Supercharger network, brand

What competitors now do well: Interior quality, cargo space, traditional infotainment interfaces, established service networks, value pricing

Volkswagen's ID.4 offers more interior space than the Model Y. Ford's Mustang Mach-E feels more premium. Hyundai's Ioniq 5 has better design. Chevy's Equinox EV costs less. BYD's Seagull costs half as much.

Tesla responded by cutting prices, which destroyed margins. But price cuts didn't stop the share loss. That's the death trap: once you lose pricing power, lowering prices doesn't recover it.

The Supply Chain Problem Nobody Talks About

Tesla's reliance on a small number of suppliers is a hidden vulnerability. Semiconductors are sourced from NVIDIA, Qualcomm, and a few others. Battery cells come from a handful of producers. Raw materials like lithium and cobalt are concentrated among a few suppliers.

When supply chain problems occur—geopolitical tensions, natural disasters, capacity constraints—Tesla's just-in-time manufacturing can grind to a halt. Traditional automakers have more diversified supplier networks.

Tesla built its cost advantage partly through aggressive negotiations with suppliers. Now, as Tesla's growth slows and profitability declines, suppliers have less incentive to offer preferential pricing. Suppliers are also less dependent on Tesla than they were when the company was the only large EV customer.

This shifts leverage. Traditional automakers can play suppliers against each other, driving costs down. Tesla's leverage is diminishing.

What Musk Says vs. What the Numbers Show

Elon Musk's public statements have become increasingly disconnected from financial reality. In late 2024 and early 2025, Musk made sweeping claims about the robotaxi program, promising "volume production" by 2025 and revolutionary margins from autonomous vehicles.

Meanwhile, the company's actual 2025 results show declining revenue, collapsing profit, and a business model increasingly dependent on government credits.

Musk also announced that Tesla will invest $2 billion in x AI, his separate AI company focused on training large language models. This capital is being pulled from Tesla, where it could be used for manufacturing investments or R&D. Instead, it's funding Musk's other company.

The gap between narrative and reality is widening. Musk claims Tesla is an AI company, a robotaxi company, and an autonomous driving company. Investors are paying for those narratives. But Tesla remains, for now, a car company with declining automotive profitability.

At some point, reality catches up. 2025 was the beginning of that reckoning.

Looking Forward: The Paths Available to Tesla

Tesla has three strategic paths forward. Let's examine each.

Path 1: Cost Reduction

Tesla could accept lower margins as permanent and focus on volume. The company would need to cut manufacturing costs by 20-30% to be competitive with BYD at Chinese price points. This means:

- Simplifying vehicle designs (fewer options, fewer variants)

- Automating more manufacturing steps

- Moving production to lower-cost countries

- Reducing per-unit R&D allocation

This strategy would stabilize volume but accept 8-12% net margins forever. Tesla would become a normal automaker. Shareholders would hate it.

Path 2: Premium Positioning

Tesla could double down on premium positioning, targeting luxury buyers willing to pay for technology and performance. The company would abandon the mass market and focus on models like the Model S, Model X, and future high-end variants.

This strategy maintains margins but accepts that Tesla becomes a luxury niche player, not a mass-market manufacturer. Volume would fall further, but per-unit profit could rise. Revenues would shrink, but margins might stay healthy.

Investors would hate this too, because it abandons the "Tesla is worth $1 trillion" narrative based on dominating global automotive.

Path 3: Technology Pivot

Tesla could successfully launch robotaxis and autonomous driving software, creating new revenue streams that offset automotive decline. If the Cybercab launches profitably and becomes a legitimate robotaxi platform, it could generate unprecedented margins.

But this path requires everything to work: software that's actually safe, regulatory approval, scaling operations to thousands of vehicles, profitability in fleet operations. The history of autonomous vehicle development suggests this is wildly optimistic.

Reality: Tesla will probably attempt some combination of all three. Cost reduction to remain competitive, premium positioning for existing loyalists, and robotaxi investment hoping something breaks through. But half-measures in all three areas might satisfy nobody.

What This Means for EV Adoption and Climate Change

Here's the irony: Tesla's decline might actually be good for climate change.

For years, Tesla's premium pricing and profits meant only wealthy people bought EVs. That slowed overall EV adoption. As Tesla's dominance fades and traditional automakers gain share with affordable EV options, more people can transition to electric vehicles.

BYD's strategy of building cheap EVs accessible to ordinary consumers in developing countries is probably more valuable to climate goals than Tesla's premium vehicles for rich people.

The subsidy situation is also important. As traditional automakers scale EV production, they become less dependent on government credits. That means the subsidy burden on governments decreases. Subsidies can then be redirected to charging infrastructure and grid improvements, which help the entire EV ecosystem.

Tesla's decline signals that EV manufacturing is becoming commoditized. That's actually healthy for the transition away from fossil fuels.

The Historical Precedent: When IBM Lost Control

There's a useful historical parallel. IBM dominated the computer industry for decades. The company had enormous profit margins, loyal customers, and a commanding market position. Then the personal computer revolution happened. Faster, cheaper competitors emerged. IBM's mainframe business, which had been the company's crown jewel, became less relevant.

IBM adapted by becoming a services and solutions company. The company still exists, still profitable, but it never regained dominance. The narrative changed from "IBM owns computers" to "IBM solves problems."

Tesla faces a similar moment. The company could remain profitable and important long-term. But the narrative of Tesla as the undisputed leader dominating the automotive future is over. The company will need to adapt to a world where it's one of several major EV players, not the dominant force.

Regulatory Headwinds Getting Worse, Not Better

While regulatory credits helped Tesla's 2025 profits, other regulatory pressures are tightening. The SEC is investigating Tesla's autonomous driving claims. Safety regulators are scrutinizing Autopilot and Full Self-Driving. Class action lawsuits about performance claims are pending.

China is tightening data privacy regulations affecting how Tesla can operate factories and collect vehicle data. The EU is imposing stricter tariffs on imported vehicles. The US under new administration policies may alter EV incentive structures.

None of this is catastrophic individually, but cumulatively it's a headwind. Tesla used to be the company that benefited from favorable regulatory changes. Now the company faces more regulatory friction.

Key Lessons from 2025: The Takeaways

Tesla's 2025 results reveal several uncomfortable truths about the company and the EV industry:

-

Growth can't last forever: Tesla grew for nearly 20 years. All growth ends. The company failed to prepare for this moment.

-

Manufacturing advantage is temporary: Tesla's Gigafactory edge lasted about a decade. That advantage is now competed away. Manufacturing is becoming a commodity business.

-

Regulatory credits are a crutch: When you need government subsidies to keep 52% of your profits, your core business is broken.

-

Pricing power can evaporate quickly: Tesla lost its ability to charge premium prices in less than two years. Once lost, it's hard to recover.

-

Promises need delivery: Tesla promised robotaxis in 2024. It's now 2026. Credibility is eroding.

-

Energy and services are real businesses: These divisions saved 2025 from being a complete disaster. Focus on them could be transformative.

-

Capital discipline matters: Spending 23% more while revenue falls 3% doesn't work long-term. Hard choices about capital allocation are necessary.

FAQ

Why did Tesla's revenue decline for the first time in 2025?

Tesla's revenue fell due to a combination of factors: unit sales declined 9.7% as competition intensified from BYD and traditional automakers, the company had already cut prices aggressively in 2023-2024 leaving little room for further reductions, and global EV market saturation hit key markets like the United States. The company sold 418,227 vehicles in 2025 versus 463,371 in 2024, translating to automotive revenue falling 11% to $17.7 billion.

How much of Tesla's profit came from regulatory credits in 2025?

Regulatory credits accounted for

What is Tesla's gross margin now compared to previous years?

Tesla's automotive gross margin has collapsed from 28.5% in 2022 to just 16.2% in 2025. This dramatic compression reflects aggressive price cuts used to maintain market share against cheaper competitors. The company's gross margin is now comparable to traditional automakers rather than the technology premium it once commanded. Operating margin fell to 4.9% in 2025 from 7.2% in 2024.

Why is the energy storage business important to Tesla?

Energy storage grew 27% to $12.7 billion in 2025, now representing 14.5% of total revenue and increasingly offsetting declining automotive profitability. Energy margins exceed 30%, far higher than the 16% automotive margins. The energy storage market is projected to grow 20-25% annually through 2030, providing Tesla with an alternative revenue driver as automotive competition intensifies. This division has become essential to the company's overall financial health.

When will Tesla's robotaxi actually launch in volume production?

Tesla has repeatedly missed robotaxi timelines. The company promised volume production in 2024, then 2025, and now claims 2026. Waymo, backed by Google with 15 years of development, still operates limited robotaxi services in only two cities with restricted operating conditions. Tesla's Full Self-Driving software remains in beta and hasn't received regulatory approval for true autonomous operation. Skepticism about near-term deployment is warranted based on the complexity of autonomous driving development.

How does Tesla's cost structure compare to competitors?

Tesla's manufacturing costs per vehicle have risen as margins compressed, eliminating much of the company's previous cost advantage. BYD manufactures at lower cost due to vertical integration of battery production and lower labor expenses in China. Traditional automakers have established supply chains and committed labor costs that, while higher in some cases, provide predictability. Tesla's advantage in manufacturing efficiency, once a differentiator, has largely disappeared as competitors upgraded their facilities.

Is Tesla in financial distress?

No, Tesla remains financially healthy with $13.3 billion in operating cash flow in 2025 and substantial cash reserves. However, free cash flow declined 31% year-over-year, and the trend is concerning. The company can continue funding expansion and development, but the declining generation of cash relative to capital expenditure requirements means Tesla cannot sustain its current spending rate indefinitely without addressing profitability or raising capital.

What does Tesla's acquisition of x AI mean for the company?

Tesla recently committed $2 billion to x AI, Elon Musk's AI company, representing a significant capital allocation decision unrelated to Tesla's core business. This suggests Musk believes AI development will be transformative for Tesla's autonomous driving and robotaxi ambitions. However, the investment diverts capital from Tesla's struggling automotive business and raises questions about prioritization when the company's margins are collapsing.

Can Tesla recover its pricing power?

Recovering premium pricing power would require Tesla to reestablish a meaningful competitive advantage over rivals. This could happen if the company successfully launches robotaxis or achieves breakthroughs in autonomous driving. Without such differentiation, pricing power in a competitive mass market remains difficult to recover. Traditional automakers and Chinese competitors now offer acceptable alternatives, eliminating Tesla's monopoly position.

What's Tesla's most realistic path to profitability recovery?

Tesla's most achievable near-term path involves: (1) Stabilizing automotive margins through cost reduction and manufacturing efficiency, (2) Expanding energy storage and services revenue which have healthier margins, and (3) Maintaining investment in autonomous driving with realistic timelines. Attempting all three simultaneously with 23% expense growth while revenues fall is unsustainable. The company will need to make hard choices about capital allocation and strategic focus.

Key Takeaways

- Tesla experienced its first annual revenue decline in 22-year history, falling 3% to $87.7 billion in 2025 as automotive sales dropped 9.7%

- Net profit collapsed 46% to 2 billion (52%) of total profitability

- Gross margins compressed from 28.5% in 2022 to just 16.2% in 2025 due to aggressive price cuts losing effectiveness against competition

- BYD and traditional automakers captured market share as EV market shifted from niche to mainstream commodity with price-sensitive buyers

- Energy storage business (+27% growth) and services (+19% growth) became essential profit drivers, now representing 29% of total revenue

- Robotaxi launch repeatedly delayed with actual production still years away despite being crucial to investor narrative justifying premium valuation

Related Articles

- How BYD Beat Tesla: The EV Revolution [2025]

- Tesla's 46% Profit Collapse in 2025: What Went Wrong [2026]

- Waymo Launches Miami Robotaxi Service: What You Need to Know [2026]

- UK Electric Car Campaign: 5 Critical Roadblocks the Government Ignores [2025]

- How Chinese EV Batteries Conquered the World [2025]

- Tesla's Second Year of Revenue Decline: Market Analysis & Implications [2025]

![Tesla's 2025 Revenue Decline: What Went Wrong [2025]](https://tryrunable.com/blog/tesla-s-2025-revenue-decline-what-went-wrong-2025/image-1-1769639818611.jpg)