Tesla's Historic 2025 Collapse: A Deep Dive Into the Numbers That Shocked Wall Street

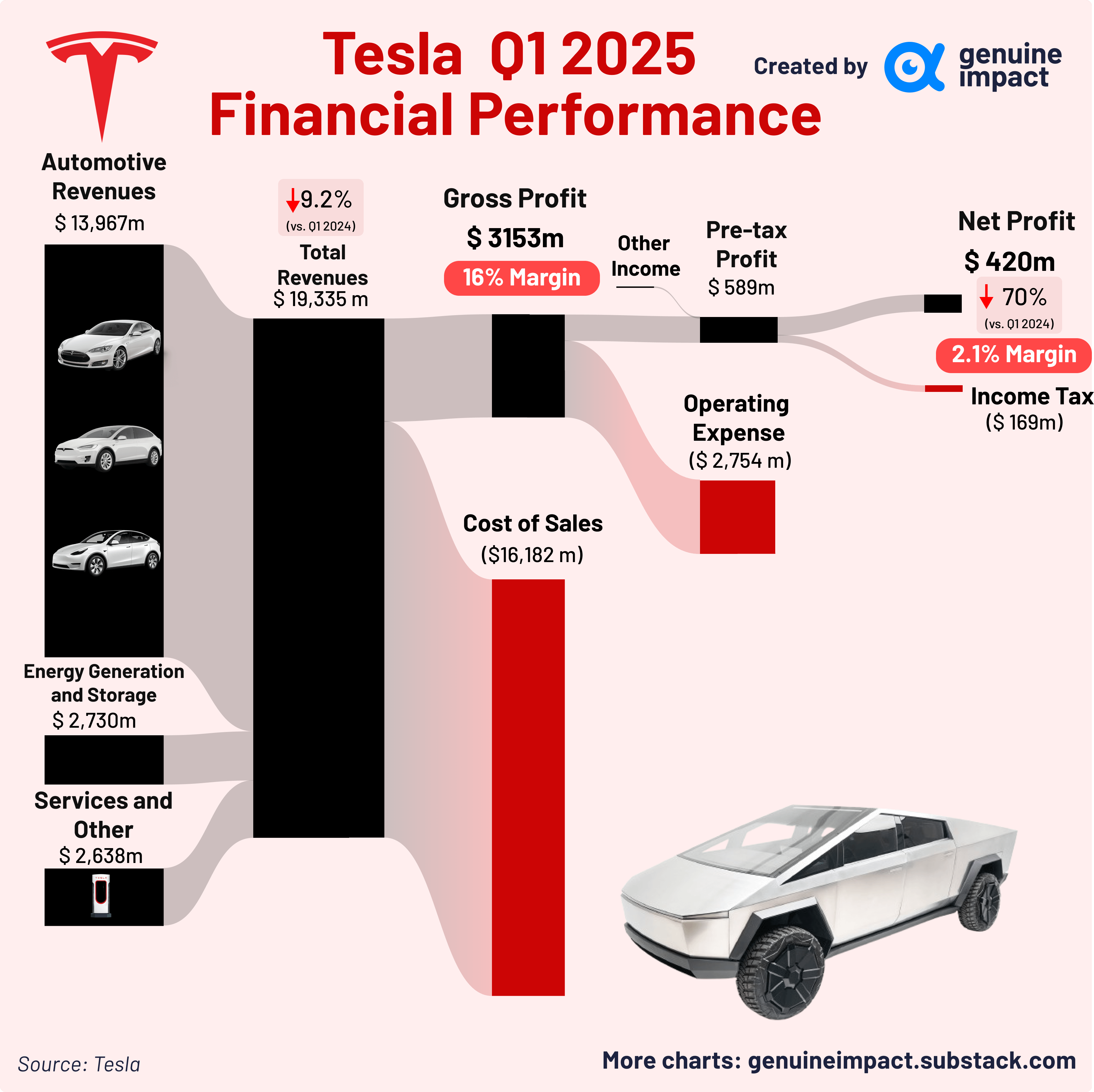

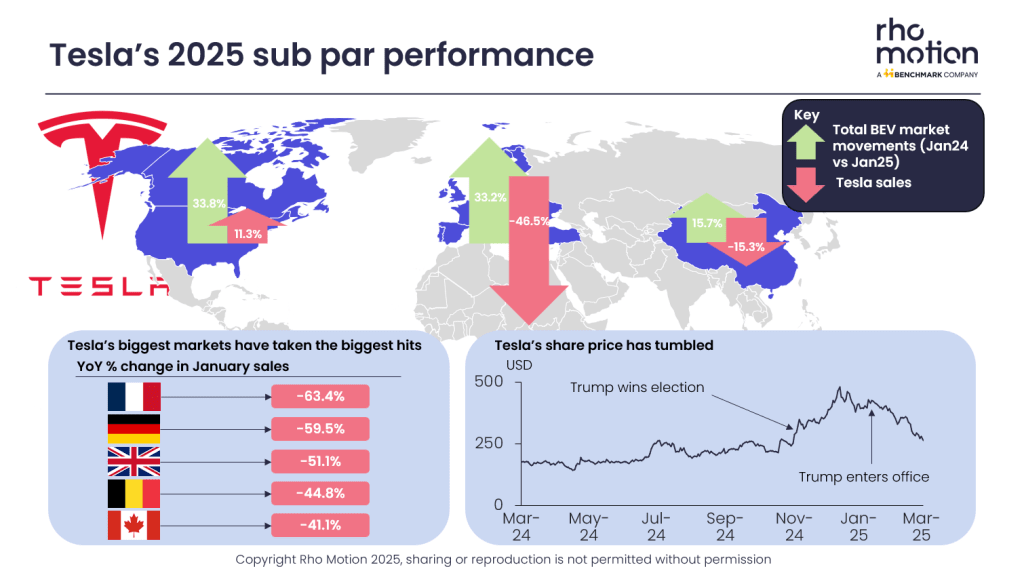

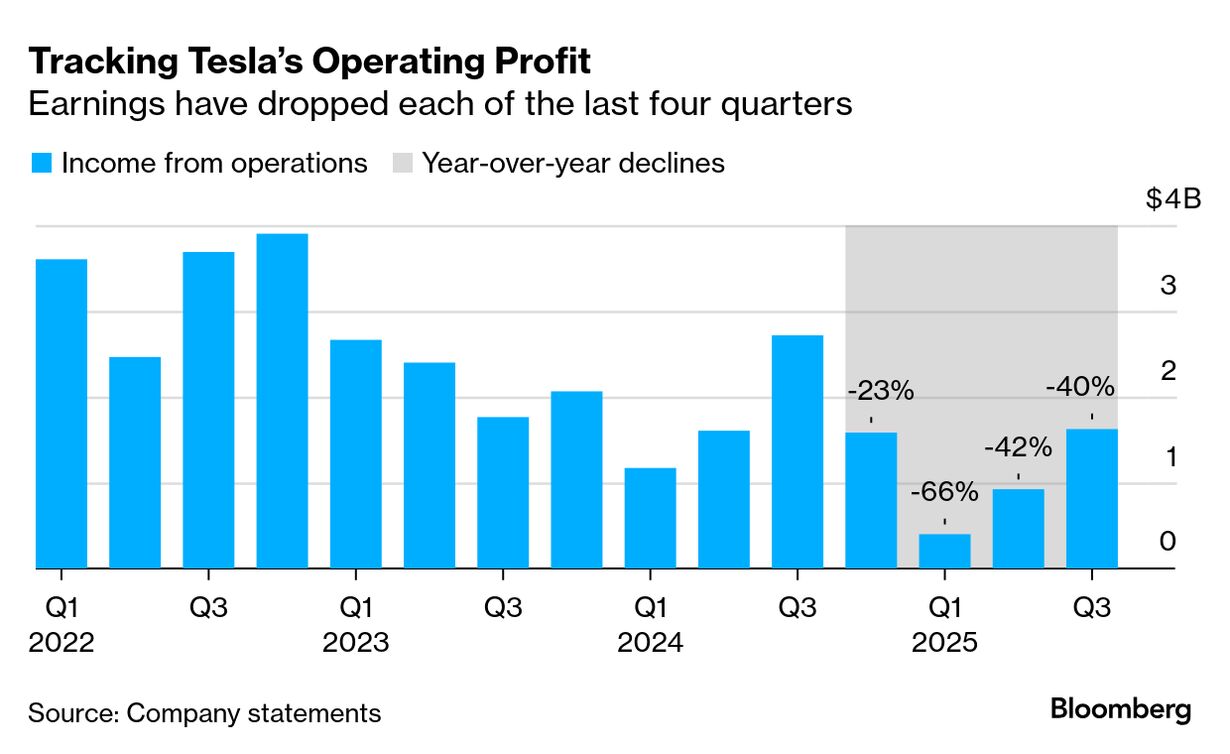

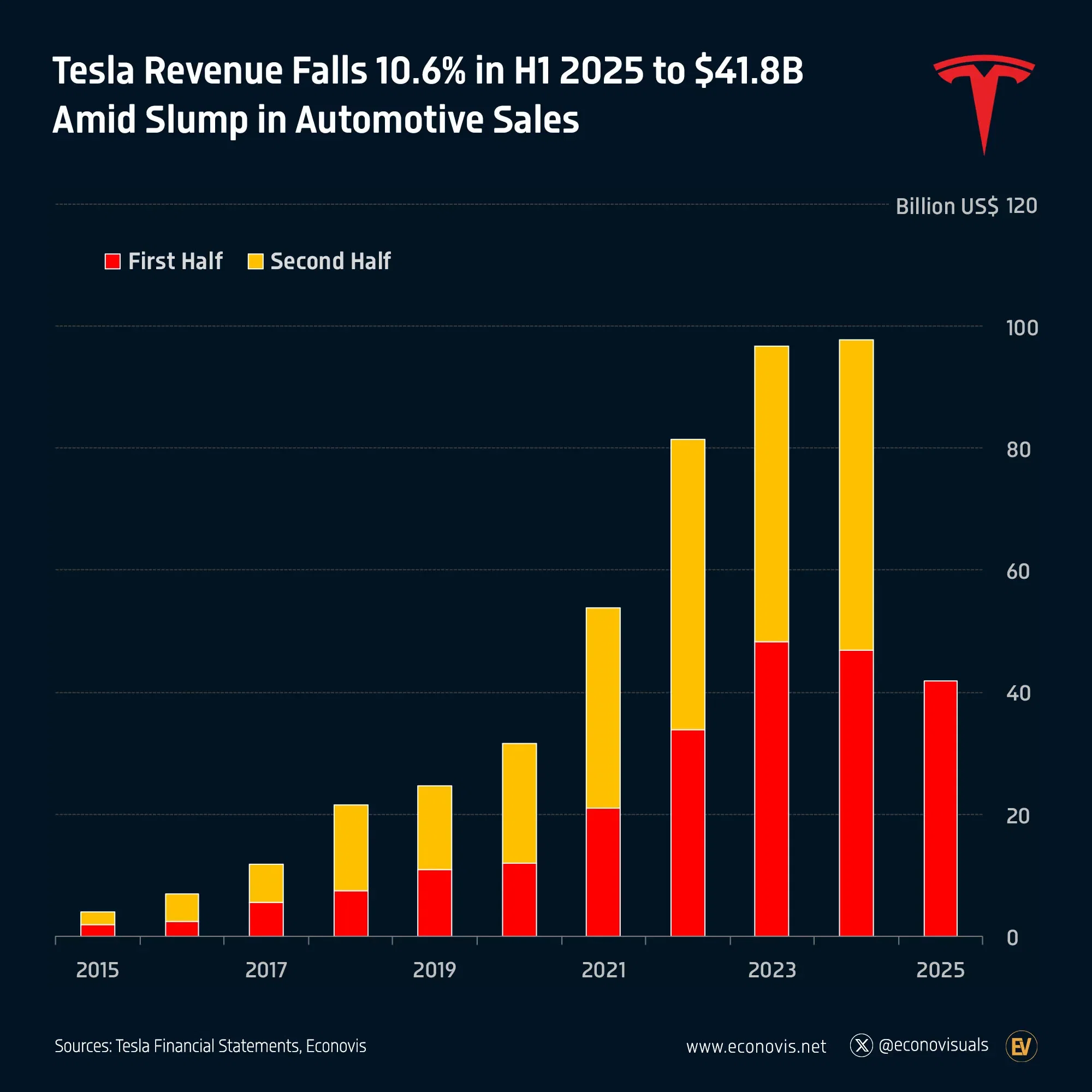

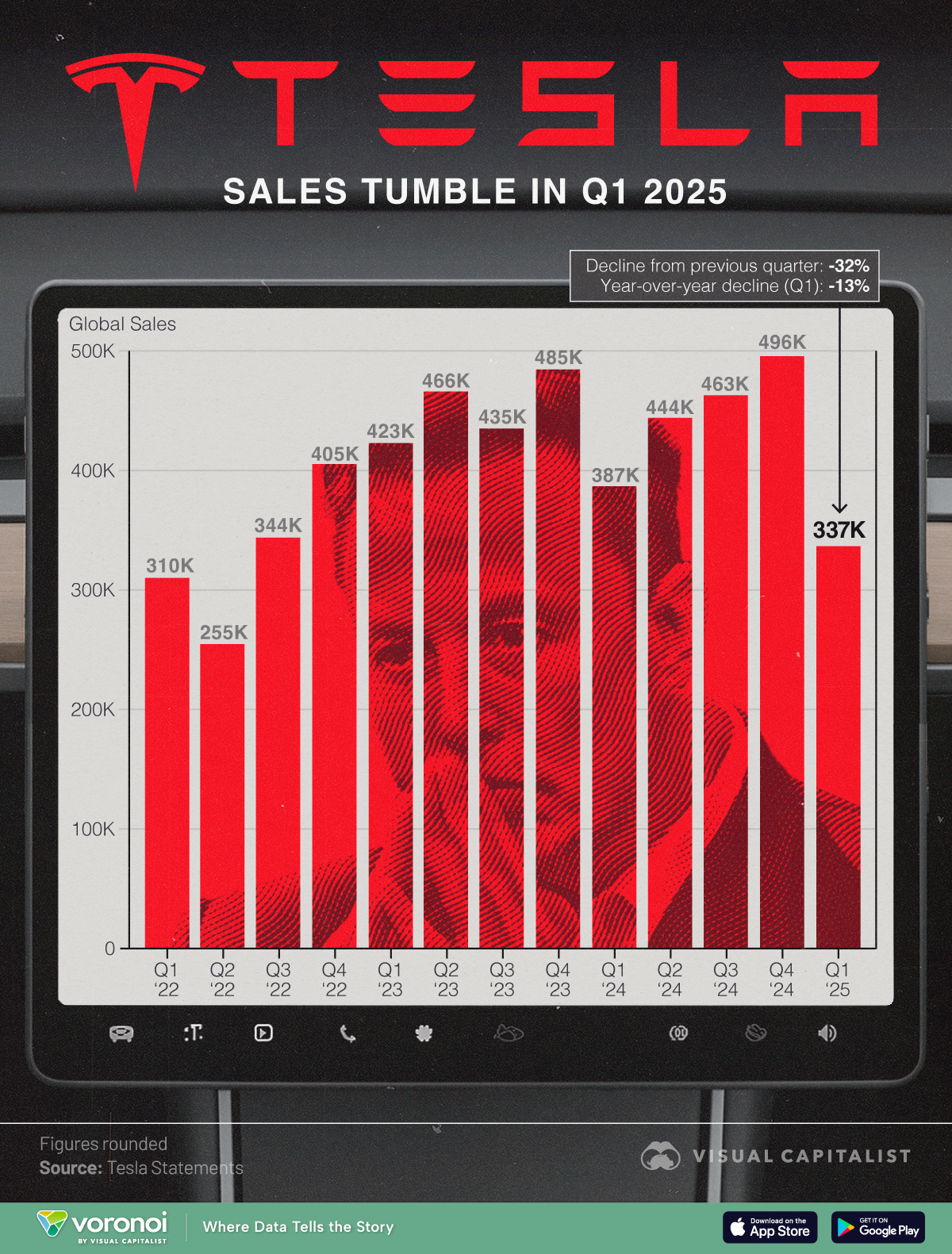

When Tesla reported its 2025 earnings on Wednesday, the numbers hit like a punch to the gut. A 46% plunge in annual profit paired with declining car sales marked the second consecutive year of contraction for a company that had spent years promising 50% annual growth. The electric vehicle manufacturer—once synonymous with explosive innovation and market dominance—suddenly looked vulnerable in ways that caught even skeptical analysts off guard.

But here's the thing: this wasn't some unexpected Black Swan event. Tesla's 2025 collapse represents the collision of three massive forces: the elimination of federal EV subsidies, intensifying competition from traditional automakers finally getting serious about electrification, and a fundamental shift in consumer demand patterns that Tesla failed to anticipate. Meanwhile, CEO Elon Musk was splitting his attention between running Tesla and assuming responsibilities in the Trump administration—a distraction that likely compounded the company's strategic missteps.

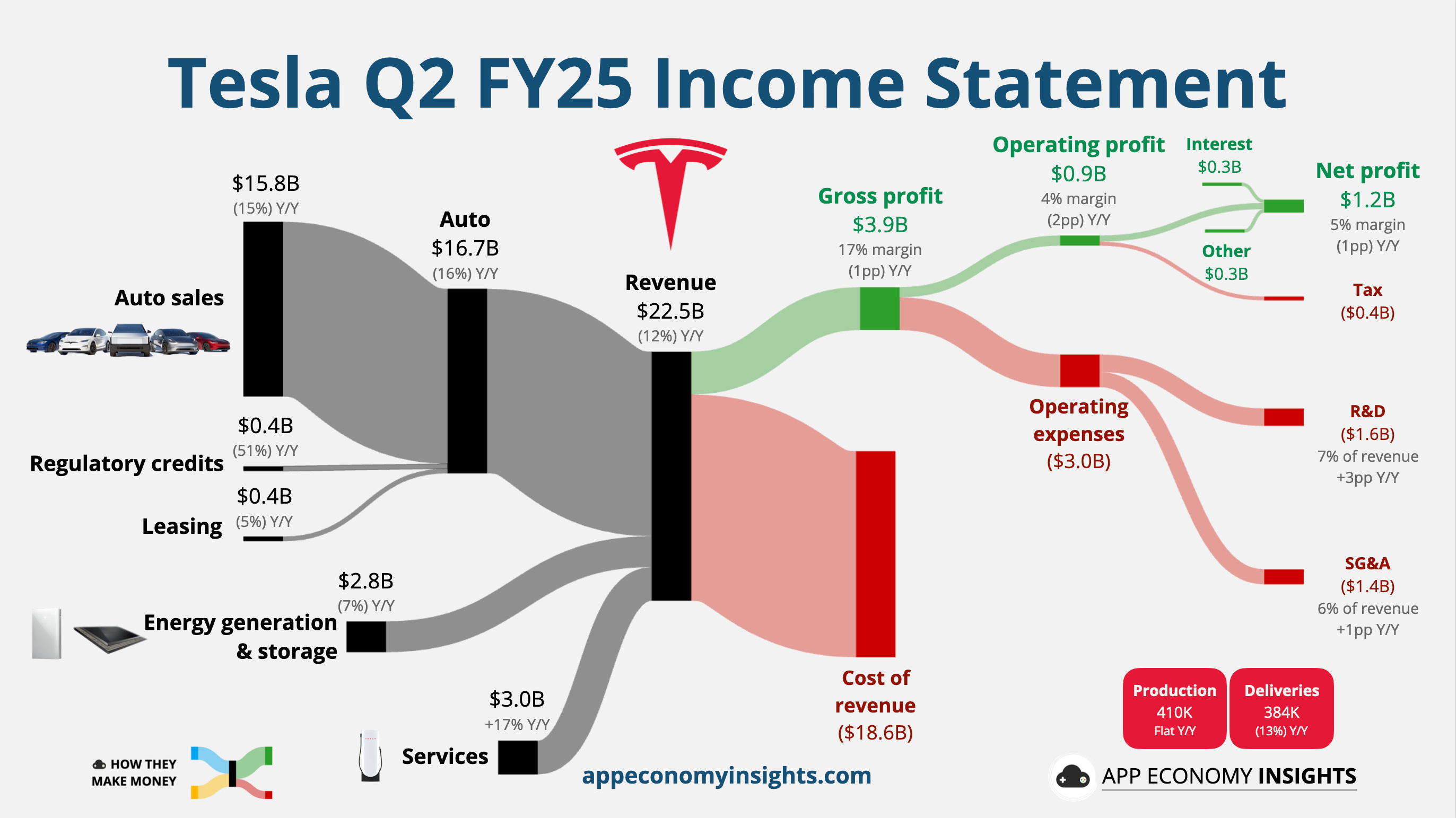

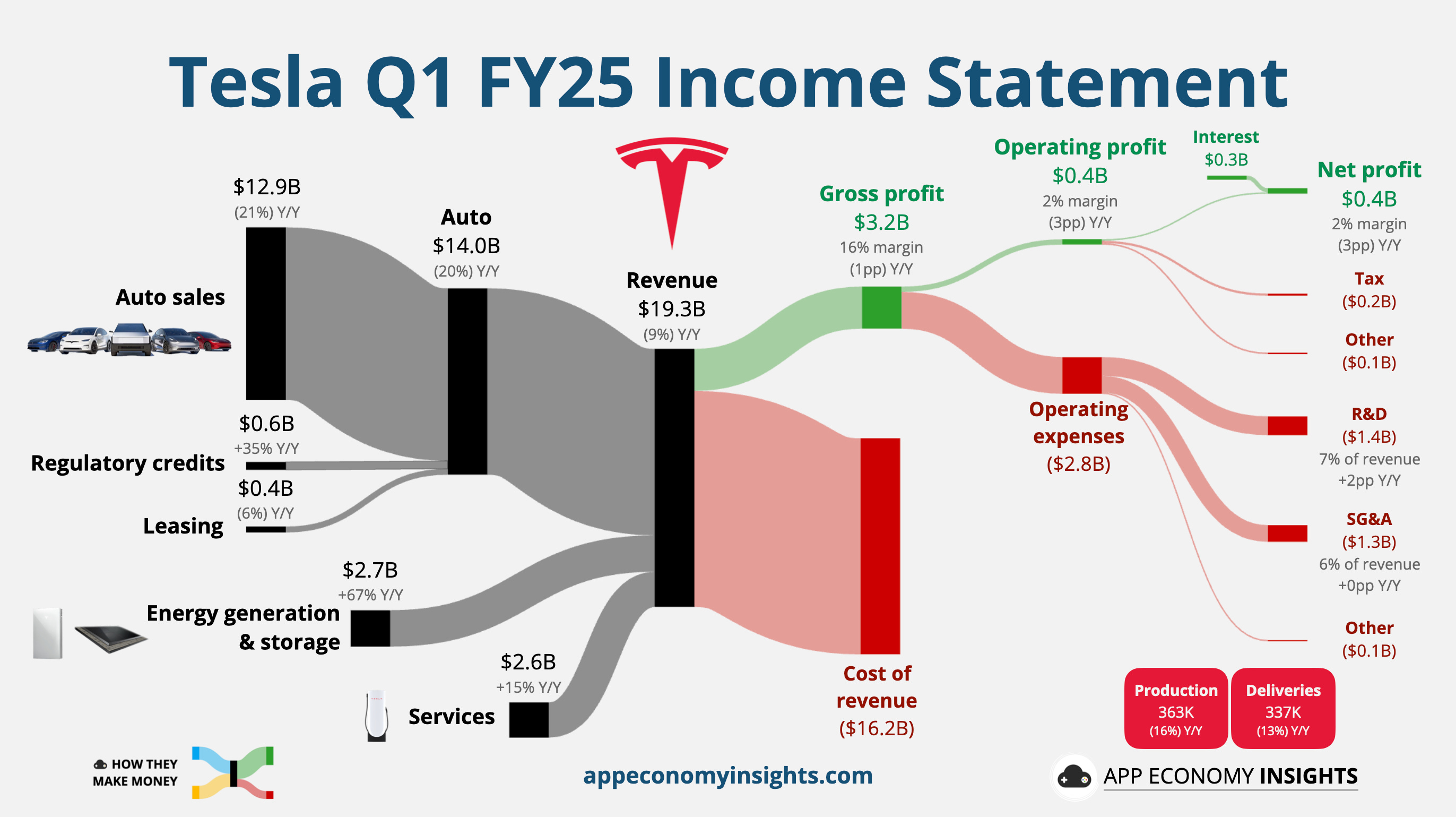

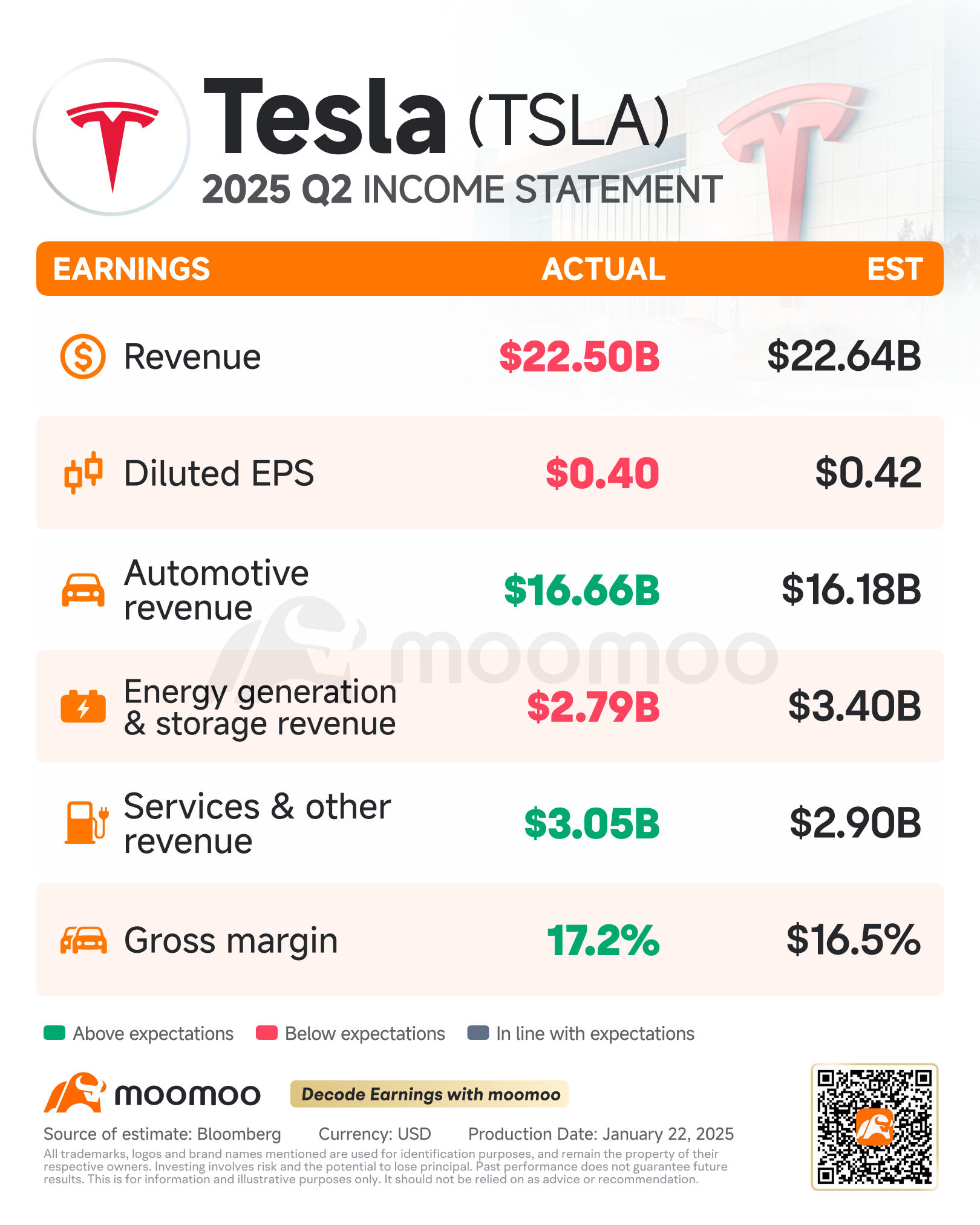

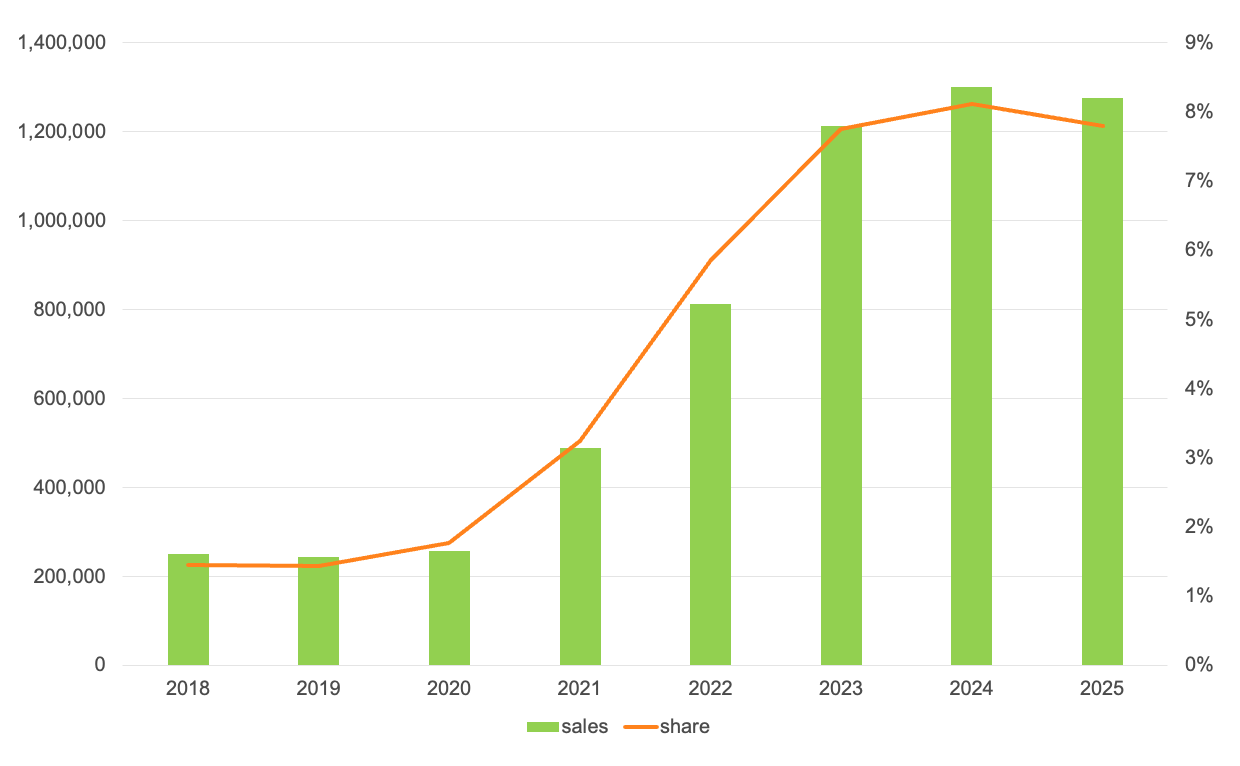

The profit figure itself tells a damning story. Tesla earned just $3.8 billion in profit across 2025, marking its lowest annual profit tally in years. To put this in perspective, that's not just a dip. It's a fundamental deterioration of the business model that powered Tesla's meteoric rise through the previous decade. Revenue from car sales fell 11% year-over-year, while the company shipped 1.63 million vehicles globally—a telling indicator that volume wasn't compensating for margin compression.

What makes this particularly significant is the context of Musk's repeated public promises. For years, he'd projected Tesla would grow at 50% annually, a target that would have carried the company to fundamentally different scale. Instead, the company contracted in consecutive years, raising uncomfortable questions about either forecasting accuracy or the ability to execute on strategic vision.

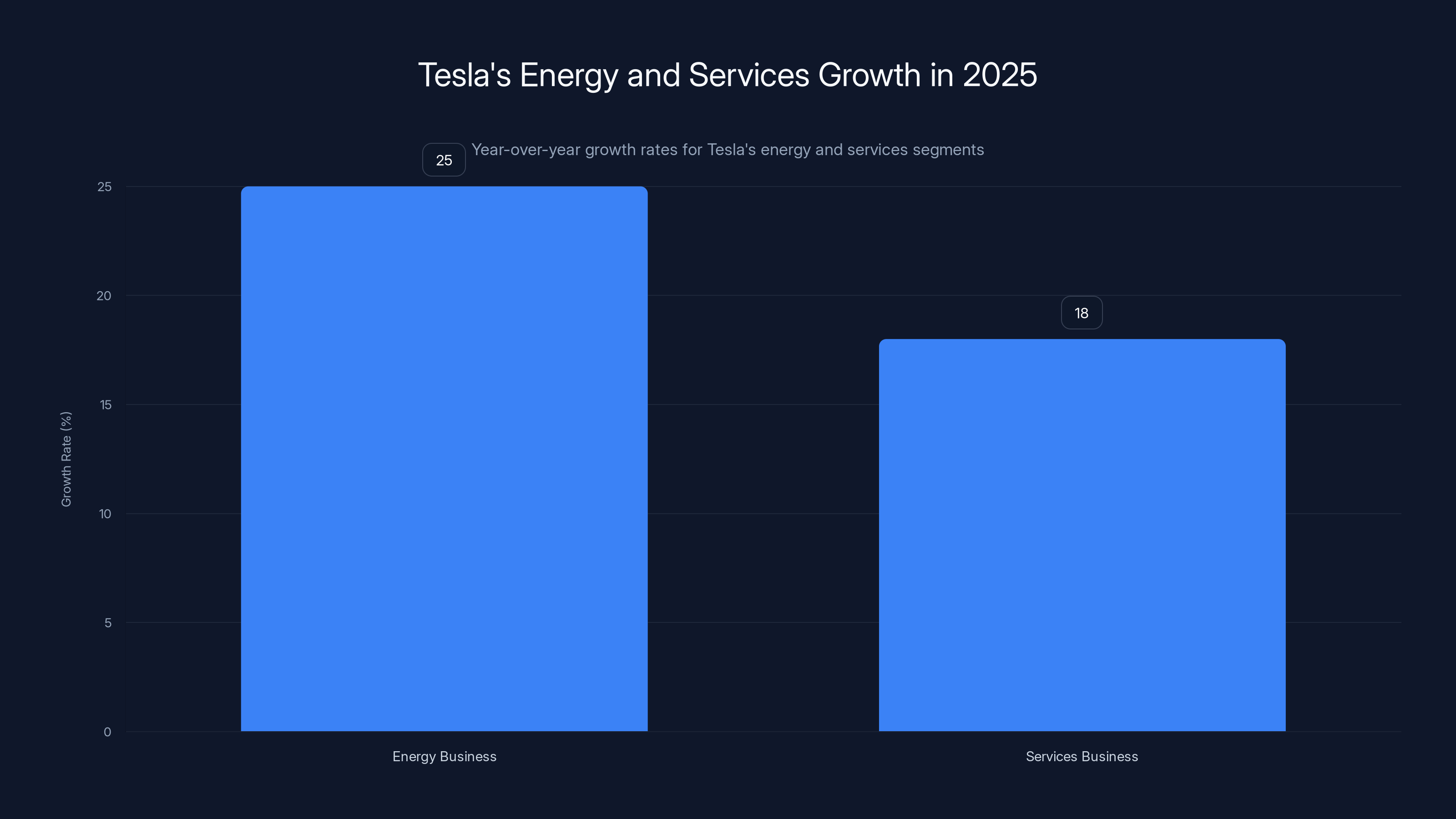

Yet the full story is more nuanced than headline-grabbing profit declines suggest. Tesla's energy and solar business surged 25% year-over-year. Services revenue climbed 18%, driven partly by Full Self-Driving subscriptions and Supercharging networks. The company managed to expand gross margins compared to recent quarters, a rare bright spot in an otherwise grim financial picture. And Tesla's massive bet on artificial intelligence and robotics—including a $2 billion investment in Elon Musk's x AI startup—signals a company attempting to pivot away from its traditional automotive focus before it's too late.

This article breaks down exactly what happened to Tesla in 2025, why the company's core business is struggling, what the subsidy elimination actually means for the EV market, and where Tesla is betting its future. We'll examine the competitive landscape that's tightening around Tesla, the execution risks in projects like the Cybercab and Tesla Semi, and what Musk's divided attention might mean for the company's strategic direction. This is the full story behind the numbers.

TL; DR

- Profit collapsed 46% year-over-year to just $3.8 billion, Tesla's lowest in years

- Car sales declined for the second straight year at 1.63 million units, despite Musk's 50% growth promises

- Automotive revenue fell 11% as competition intensified and federal EV subsidies disappeared

- Energy and services divisions surged with 25% and 18% growth respectively, signaling Tesla's pivot

- Musk's divided attention between Tesla and Trump administration roles may have hampered strategy

- Bottom line: Tesla's core automotive business is under siege, forcing a desperate pivot to AI and robotics

In 2025, Tesla's energy business grew by 25% and services by 18%, showcasing resilience and potential beyond its core automotive sector.

The Raw Numbers: How Bad Did 2025 Really Get?

Let's start with what's truly shocking about Tesla's 2025 results: the company generated just $3.8 billion in profit across the entire year. For a company that had built its reputation on relentless margin expansion and operational excellence, this figure represents a breaking point.

Context matters here. In 2024, Tesla earned approximately $7.1 billion in annual profit. That means 2025 represented roughly a 46% year-over-year collapse—a deterioration so severe that it forced Tesla to confront an uncomfortable reality: its core business model was under genuine pressure.

The automotive revenue decline deserves particular attention. Total car sales revenue fell 11% year-over-year, a staggering contraction for an automaker that built its identity on consistent growth. The company shipped 1.63 million vehicles globally across 2025, marking the second consecutive year of declining unit sales. This represents a fundamental break from Tesla's historical narrative.

Consider what this means operationally. Tesla's massive factory infrastructure—expanded aggressively over recent years—now operates with excess capacity. The company's sprawling Texas Gigafactory, while technologically impressive, was built with production assumptions that 2025 failed to validate. When you build capacity for 50% annual growth and achieve negative growth instead, you're left with a math problem that has no elegant solution.

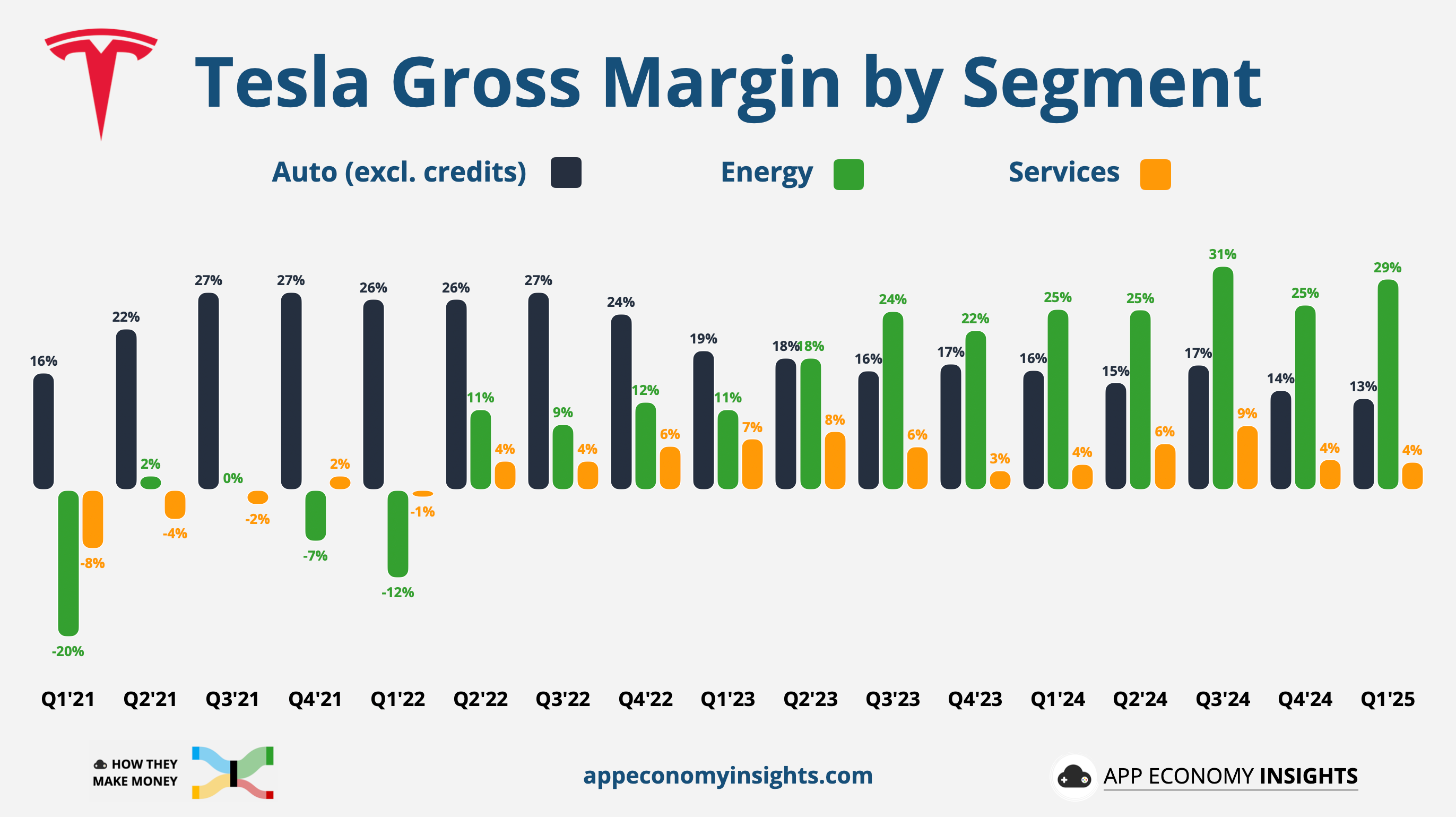

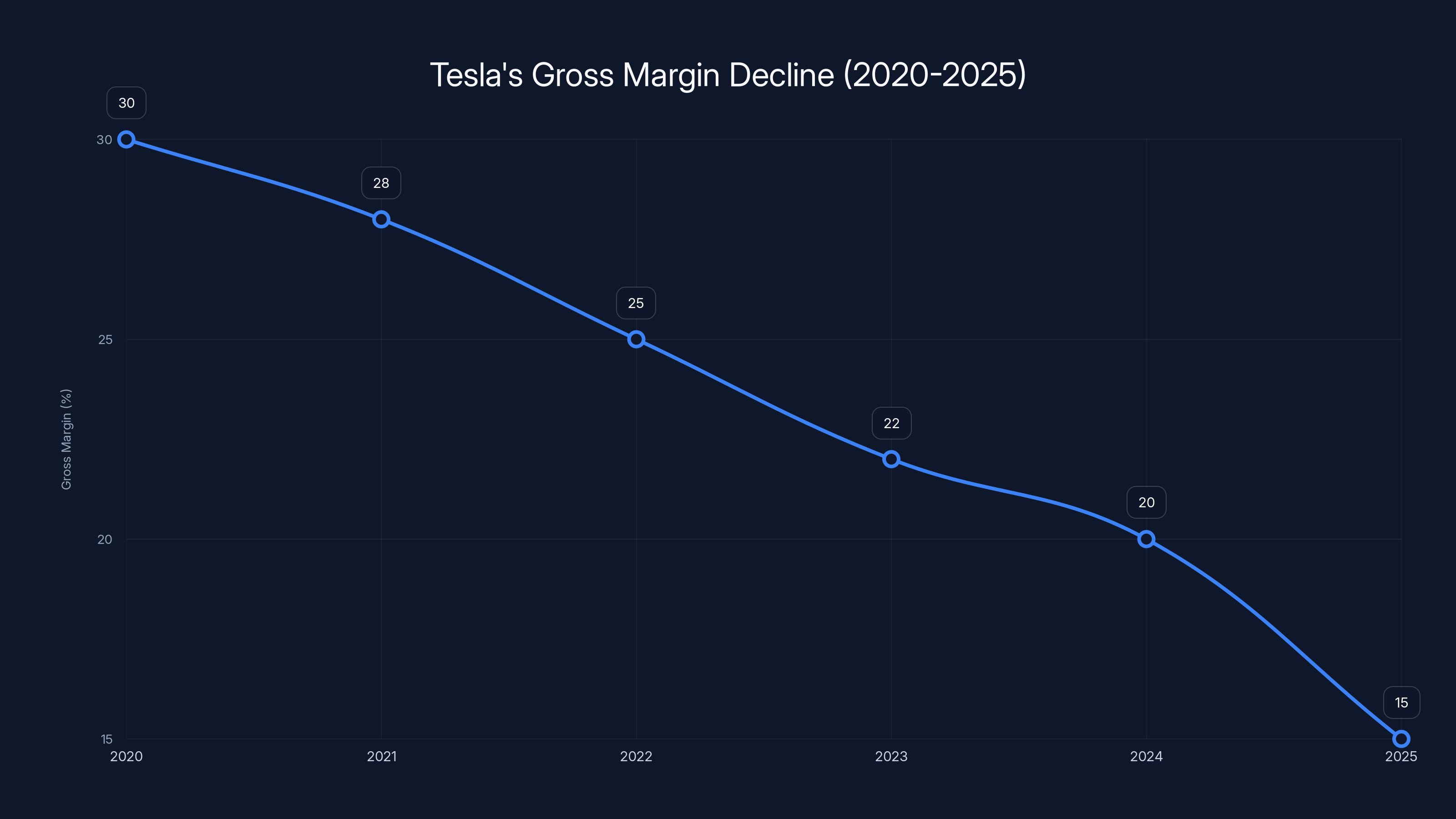

Beyond the headline numbers, the margin story is equally troubling. Gross margin compression—the narrowing gap between what Tesla spends to build cars and what it sells them for—has plagued the company since 2021. While Tesla managed to stabilize margins somewhat in Q4 2025, this came after quarters of severe pressure. The company's aggressive price cuts of previous years, designed to maintain volume in a cooling market, destroyed pricing power and trained consumers to expect discounts.

Operating margin data tells an equally grim story. Tesla's operational leverage—the ability to increase profit faster than revenue grows—essentially vanished in 2025. The company was essentially pushing incremental revenue through its cost structure without meaningful profit generation.

One more troubling metric: Tesla's return on invested capital deteriorated across 2025. The company had enormous cash balances heading into the year, yet couldn't generate adequate returns on that capital through its core business. This forced executives to consider alternative deployments of cash, including the controversial $2 billion x AI investment that appeared in the shareholder letter.

Tesla's profit fell by 46% from

The Subsidy Extinction Event: How Losing $7,500 Destroyed Tesla's Margins

The fiscal knives began turning the moment Congress killed federal electric vehicle subsidies. The $7,500 federal tax credit—which had been embedded into Tesla's pricing strategy for years—suddenly evaporated, leaving the company scrambling.

Here's what happened: For years, buyers of Tesla vehicles could claim a federal tax credit worth up to

When Congress eliminated the subsidy retroactively in 2025, it created a gap. Tesla could have absorbed the loss—reducing prices to compensate and maintaining sales volume. Or the company could have maintained prices and watched demand crater. Tesla attempted a middle ground that satisfied neither customers nor investors.

The impact on margins was immediate and devastating. Without the subsidy cushion, every vehicle Tesla sold faced genuine price pressure. Competitors with better-positioned cost structures could undercut Tesla's prices while maintaining healthier margins. Traditional automakers like General Motors and Volkswagen, which had spent heavily on EV development and manufacturing optimization, suddenly had pricing power against Tesla.

What's particularly damaging about the subsidy loss is that it exposed Tesla's pricing leverage was never as robust as the company claimed. When times were good and subsidies were available, Tesla had positioned itself as a premium brand—a Tesla, not merely an electric car. The moment that subsidy disappeared and customers had to pay full freight, demand elasticity became painfully obvious. People were willing to pay a premium for Tesla when there was a $7,500 government check attached. Without it? The calculus changed dramatically.

Analysts estimate the subsidy elimination cost Tesla somewhere between 200,000 and 300,000 units of demand across 2025—a staggering figure when the company only shipped 1.63 million vehicles globally. The arithmetic is brutal: lose 15-18% of potential customers because of a policy shift, and you're left with the exact scenario Tesla faced.

Even worse, the subsidy loss impacted not just existing customers but future ones. Would-be Tesla buyers postponed purchases, hoping the political environment might shift or that Tesla would cut prices to compensate. This created additional demand destruction beyond simple price sensitivity. Consumers paused rather than bought, leaving Tesla with a demand cliff.

The subsidy elimination also accelerated competitive entry. Without the $7,500 cushion, traditional automakers could finally price their EVs competitively against Tesla on a total-cost-of-ownership basis. BMW, Mercedes, and Audi had been developing competitive electric vehicles for years—now suddenly those products could compete on price, not just features or brand cachet.

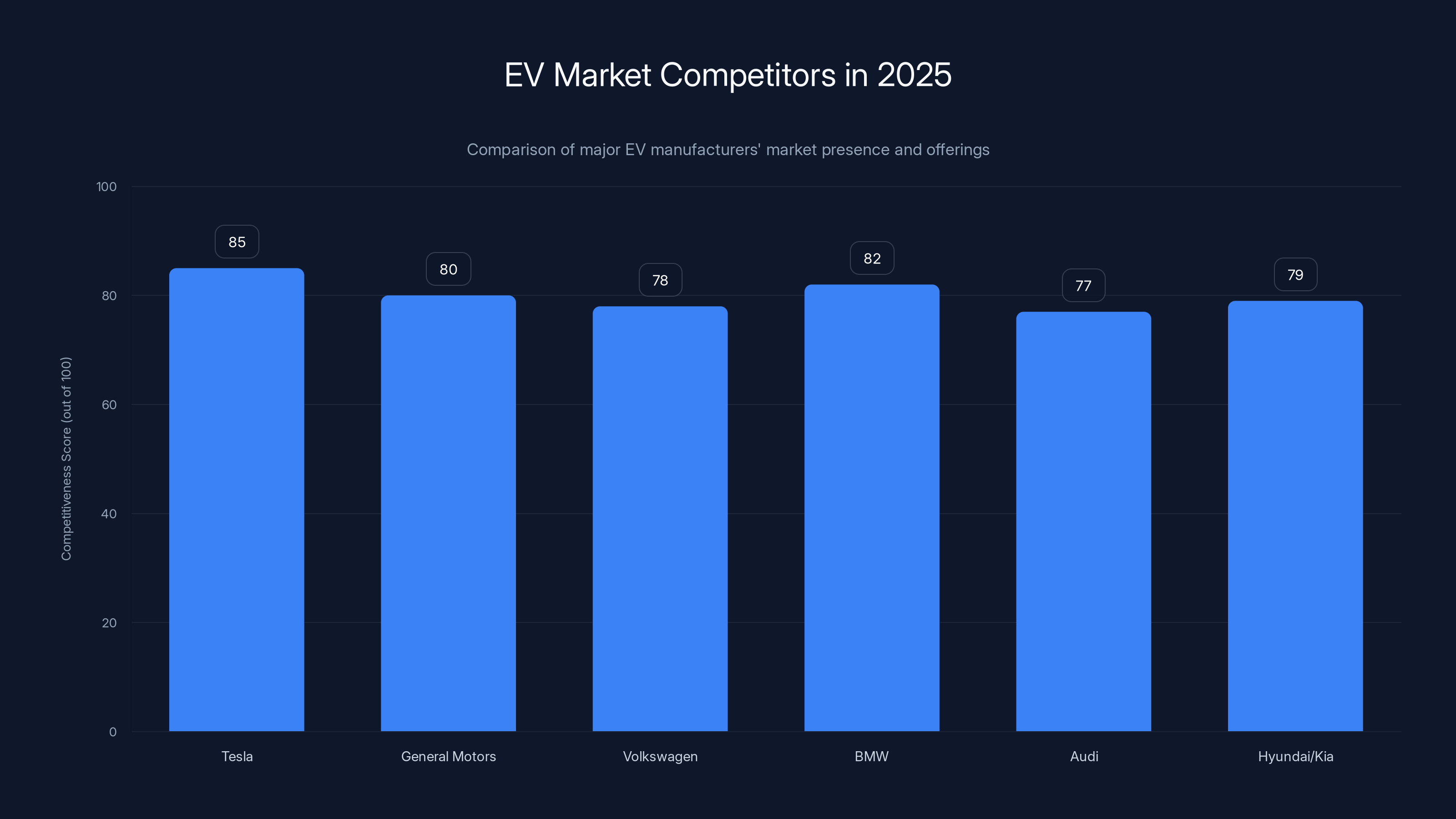

The Competition Problem: Tesla Went From Category Creator to Commodity Player

For years, Tesla had an implicit advantage: it was the only serious EV manufacturer producing at scale. By the early 2020s, the company's advantage had narrowed, but Tesla still enjoyed a technical lead in battery technology, software, and manufacturing efficiency.

By 2025, that advantage had essentially disappeared. Traditional automakers had finally gotten serious about electrification, and the results were hitting the market simultaneously.

Consider what competitors were offering by 2025. General Motors had launched multiple competitive electric vehicles. Volkswagen was expanding its ID lineup aggressively. BMW's i 4 was drawing accolades for performance and design. Audi's e-tron platform was proving competitive. Hyundai and Kia were gaining serious traction with their Ioniq and EV6 lineups.

Most critically, these competitors weren't playing Tesla's game. They weren't trying to be premium-priced disruptors. They were offering solid, well-engineered electric vehicles at price points that competed directly with Tesla's entry-level offerings. A buyer who might have paid $45,000 for a Tesla Model 3 could now buy a BMW i 3 or Volkswagen ID.4 for roughly the same price—vehicles with better warranty support, more convenient dealer networks, and established brand reputation.

Tesla's software and autonomous driving capability—once a significant competitive moat—had become table stakes rather than differentiation. Every competitor now offered over-the-air updates, advanced driver assistance, and promised future autonomous capability. Tesla's claims about Full Self-Driving being nearly ready for unrestricted deployment had become increasingly hollow, particularly after repeated delays and underwhelming demonstrations.

The manufacturing efficiency advantage Tesla once held had also eroded. Legacy automakers had spent years optimizing EV production lines. By 2025, factories operated by BMW, Volkswagen, and others were achieving quality and efficiency metrics that rivaled Tesla's vaunted production processes. Tesla's historical advantage of newer factories and less legacy manufacturing debt had become offset by competitors' manufacturing optimization.

Pricing pressure intensified accordingly. Tesla couldn't maintain premium pricing when direct competitors offered similar capabilities at lower prices. The company's gross margins, once the envy of the automotive industry, compressed to levels approaching commodity EV manufacturers.

The competitive threat was particularly acute in key markets like Europe and China. In China, domestic EV manufacturers like BYD had achieved parity with Tesla on technical specifications while undercutting on price significantly. BYD's battery technology had achieved parity with Tesla's, and Chinese consumers increasingly saw little reason to pay Tesla's premium. In Europe, the legacy automakers' established distribution networks and premium brand positioning made them formidable competitors.

Tesla responded with aggressive price cuts, but this approach had strategic limits. Every price cut compressed margins further, making the math worse. Yet without price cuts, volume would have deteriorated even more severely. The company was caught in a competitive vice with no escape route.

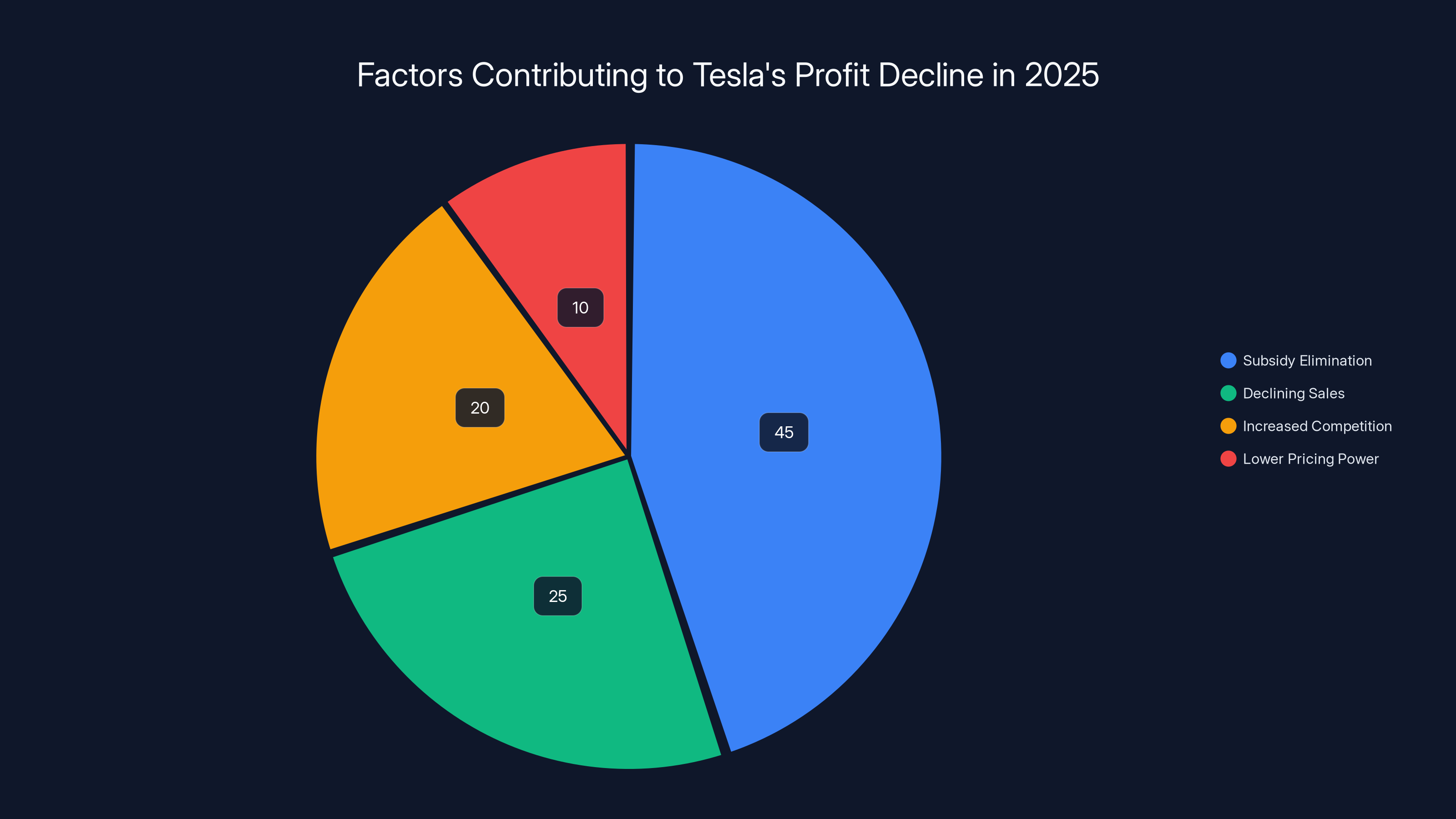

Subsidy elimination accounted for an estimated 45% of Tesla's profit decline in 2025, with declining sales and increased competition also playing significant roles. Estimated data.

Elon Musk's Divided Attention: When the CEO Isn't Fully Present

Here's a dynamic that rarely gets sufficient attention in financial analysis: Elon Musk's divided focus between Tesla and his expanding portfolio of responsibilities in the Trump administration.

Throughout 2025, Musk was simultaneously serving as CEO of Tesla, overseeing his rocket company Space X, managing his social media platform X, developing autonomous vehicles and robotics, and assuming increasingly formal responsibilities within the Trump administration. The media reporting on Musk's appointment to lead DOGE (Department of Government Efficiency) and his seat at the table for major policy decisions generated headlines that competed with Tesla earnings announcements.

What's important to understand is that running Tesla—particularly during a period of strategic crisis—requires undivided attention. The decisions facing Tesla in 2025 were existential. The company needed to decide how to respond to competitor pricing. It needed to navigate subsidy elimination. It needed to chart a clear course on autonomous vehicle development and robotics. It needed to optimize factory operations for a lower-volume environment.

Divided leadership attention during such a critical period creates real strategic costs. Strategic decisions get delayed or deferred. Implementation suffers. Organizational priorities become ambiguous. When the CEO is spending material portions of time on government-related activities, the signal sent to the organization is that the core business isn't the highest priority.

Musk's track record suggests he thrives on managing multiple organizations simultaneously. He's built a personal brand around juggling Space X, Tesla, X, Neuralink, and other projects. But there's a meaningful difference between juggling in normal times and juggling during a strategic crisis. 2025 was a crisis period for Tesla.

The most concrete evidence of strategic confusion manifests in Tesla's shareholder letter and project timeline announcements. The company promised that the Cybercab would enter production in the first half of 2026 and the Tesla Semi would finally start production after being announced years prior. These timelines have been repeatedly pushed back. Delayed by Musk's other commitments? Delayed by technical challenges? The ambiguity itself is a problem.

Similarly, the strategic pivot to artificial intelligence and robotics appears somewhat reactive—a response to Tesla's automotive business hitting turbulence rather than a proactive strategic choice. The $2 billion x AI investment, announced in the shareholder letter, suggests Musk is betting the company's future on AI and robotics rather than on optimizing the core automotive business.

This isn't necessarily wrong—the automotive market may genuinely be commoditizing, and pivoting to higher-margin AI and robotics could be strategically sound. But the timing and circumstances suggest a pivot born of defensive necessity rather than offensive opportunity. When your core business is in crisis and you're simultaneously serving in government, the risk of strategic pivots becoming panic pivots increases substantially.

The Energy and Services Businesses: Where Tesla's Real Margin Hope Lives

Amid the devastation of Tesla's core automotive business, two segments delivered meaningful bright spots: energy and services.

Tesla's energy business—encompassing solar panels, battery storage systems, and grid-scale storage solutions—grew 25% year-over-year in 2025. This might seem like a modest growth rate by Tesla's historical standards, but in a year when the company's core business contracted, 25% growth in a secondary segment represents genuine progress.

The energy business's performance reflects several positive trends. Energy storage adoption is accelerating globally as grid infrastructure strains increase and electricity prices climb. Tesla's Powerwall residential battery system has become increasingly mainstream as homeowners recognize the value of backup power and energy arbitrage (charging when prices are low, discharging when prices are high).

At grid scale, Tesla's Megapack energy storage systems are gaining traction with utilities and grid operators. The economic case for grid-scale storage strengthens as renewable energy penetration increases and grid operators need fast-response power sources. Tesla's scale advantage in battery manufacturing gives it meaningful cost advantages over competitors, translating to margin advantages.

Most significantly, the energy business isn't constrained by the subsidy dynamics that crushed automotive margins. While grid-scale storage projects receive some government incentives, the fundamental value proposition for customers doesn't depend on subsidies. Utilities and grid operators deploy storage because it delivers economic returns. This means pricing power—that disappeared from Tesla's automotive business—remains relatively intact in energy storage.

Services revenue growth was equally impressive at 18% year-over-year. This segment includes several revenue streams: Full Self-Driving subscription fees, insurance products, parts sales, and Supercharging revenue.

The Full Self-Driving business deserves particular attention. Tesla charges customers a monthly subscription fee—currently around $200/month—for early access to increasingly autonomous driving capabilities. While the product remains years away from genuine autonomous capability, the recurring subscription model is extraordinarily valuable for investor sentiment. Recurring revenue streams command premium valuations compared to transactional revenue.

Supercharging network expansion continues to drive growth in this segment. As Tesla's vehicle fleet ages and new competitors enter the market, the Supercharging network becomes increasingly valuable as both a competitive moat and a standalone revenue generator. Third-party vehicles can now access Tesla Superchargers in many regions, expanding the potential addressable market for Supercharging revenue.

Insurance represents another high-margin opportunity. Tesla's insurance products—offered directly to customers or through partnerships—have much higher margins than the vehicles themselves. If Tesla can successfully scale insurance penetration across its customer base, this becomes a material profit contributor.

The strategic implication is clear: Tesla's future margin structure may look radically different from its past. Rather than relying on high-margin vehicle sales, the company is building toward a model where vehicles serve as platforms for higher-margin services, energy, and subscription revenues. This is a profound strategic shift—essentially moving from a hardware business to a software and services business.

However, this pivot has real execution risks. Tesla has never been a services-driven company. Building the capabilities to scale services—including customer support, billing systems, regulatory compliance across jurisdictions, and customer retention—requires skills and organizational structures Tesla has historically lacked. What works when you're shipping 100,000 vehicles per year may not work when you're shipping 1.6 million.

Estimated data shows Tesla's profit margins dropped significantly after losing the $7,500 subsidy, while competitors maintained healthier margins.

The Margin Story: From Profit Juggernaut to Squeezed Producer

Tesla's margin deterioration in 2025 represents one of the most dramatic shifts in the company's history. Understanding the mechanics of this collapse provides insight into why the company's profit fell so much faster than revenue.

Gross margin—the percentage of revenue remaining after subtracting the direct cost of producing vehicles—represents Tesla's fundamental profitability. At peak periods in Tesla's history, gross margin on automotive products exceeded 30%, which was extraordinary for a vehicle manufacturer. For comparison, traditional automakers typically operate at gross margins between 18% and 24%.

Tesla's margin advantage came from several sources: superior manufacturing efficiency, vertical integration (making key components in-house), superior battery cell chemistry and production scale, and strong pricing power (customers willing to pay premium prices for Tesla vehicles).

By 2025, each of these advantages had eroded:

Manufacturing Efficiency: Competitors had closed the gap. Traditional automakers, having restructured their organizations to prioritize EV manufacturing, were achieving quality and efficiency metrics that rivaled Tesla's. In some metrics, competitors actually exceeded Tesla's performance.

Vertical Integration: While still an advantage, this moat had narrowed. Battery supply chains had matured, reducing the advantage of in-house production. Tesla's battery factories had encountered scaling challenges that delayed expected cost reductions.

Battery Chemistry and Scale: BYD and other competitors had achieved battery cost parity with Tesla. While Tesla still had some technology advantages, these no longer justified premium pricing.

Pricing Power: This was the killer. Aggressive price competition, subsidy elimination, and increased competition had destroyed Tesla's pricing power. The company couldn't maintain premium prices. Gross margins compressed accordingly.

The math is straightforward. If Tesla sells vehicles at lower prices and the company's cost structure remains relatively fixed, gross margin compresses. The company attempted cost reductions—labor optimization, supply chain efficiency, factory automation improvements—but these moved slower than price erosion.

Operating margin (profit remaining after subtracting both cost of goods sold and operating expenses) compressed even more severely than gross margin. Tesla's operating expense structure is relatively fixed—the company still needs to pay R&D teams, sales staff, administrative overhead, and support functions regardless of sales volume. When revenue declines and cost structure remains fixed, operating margin compresses dramatically.

The margin formula explained:

If revenue falls 11% but cost of goods sold only falls 8%, gross margin compresses noticeably. Fixed operating expenses make the deterioration in operating margin even more severe.

Tesla management attempted to offset this through gross margin expansion in Q4 2025, primarily through operational improvements and model mix optimization (selling higher-margin vehicles). However, this temporary improvement masks underlying structural problems with the business model.

The Cybercab and Tesla Semi: Products That Keep Slipping Into the Future

Tesla has repeatedly promised transformational products that keep being delayed. The Cybercab and Tesla Semi represent the latest incarnation of this pattern—products that could meaningfully improve Tesla's profit picture if they ever reach production, but which have become symbols of Tesla's execution risk.

Let's start with the Tesla Semi, which was originally promised for production in 2019. Here we are in 2026, and the company is only now claiming production will begin in the first half of 2026. This is a spectacular failure in delivery forecasting.

What's particularly frustrating about the Semi delays is the market opportunity cost. While Tesla has delayed, startups like Nikola and Workhorse have entered the market. Traditional trucking manufacturers are developing competitive electric trucks. Volvo is shipping electric heavy-duty trucks to customers. The window for Tesla to own the electric trucking category has narrowed considerably.

The Semi's economics are compelling in theory: electric trucks could offer lower operating costs per mile than diesel trucks through cheaper electricity and reduced maintenance. Trucking companies could achieve positive ROI through operational cost savings within a reasonable payback period. The market opportunity is genuine and substantial.

But Tesla's inability to deliver the Semi after years of promises raises questions about the company's engineering and manufacturing capabilities. If Tesla can't mass-produce a truck after this much development time, what does that say about the company's ability to deliver on more complex projects like autonomous vehicles and humanoid robots?

The Cybercab represents an even more audacious promise: a fully autonomous taxi with no steering wheel or pedals, capable of operating without a human driver. Tesla promised to begin production in the first half of 2026, which would put the first customer deliveries in late 2026 or early 2027 at the earliest.

Here's the problem: Tesla's Full Self-Driving product—which the company has been developing and selling for years—remains nowhere near capable of operating a taxi service without human supervision. The company's demonstrations of autonomous capability have been underwhelming and carefully choreographed. The gap between Tesla's claims and demonstrated capability has only widened over time.

The Cybercab's development timeline makes little sense given the gaps in autonomous capability. Yes, Tesla could build a prototype vehicle and put it on selected routes with safety drivers. But scaling to meaningful revenue? That requires Level 5 autonomy—genuine full automation in all conditions. The company's public timeline suggests capability that doesn't exist.

These repeated product delays have damaged Tesla's credibility. Wall Street has learned to discount Tesla's product promises. When the company announces new timelines, investors apply a delay factor. This erodes management credibility and makes it harder for Tesla to generate excitement about future products.

Furthermore, these delays reveal something concerning about Tesla's engineering organization. The company seems to have a pattern of promising timelines that it can't meet. This could indicate: overly optimistic engineering forecasts, scope creep during development, technical challenges that aren't fully understood upfront, or inadequate project management discipline.

For Tesla's 2025 profit collapse to reverse, these products need to deliver. The energy business and services growth are helpful, but they can't offset the automotive business's deterioration. Tesla needs new products that generate meaningful revenue and healthy margins. The Cybercab and Semi represent bets on products that could solve this problem—but only if they actually reach production and customers accept them at the prices Tesla needs to achieve profitability.

Tesla's gross margin declined from an estimated 30% in 2020 to 15% by 2025, reflecting increased competition and reduced pricing power. Estimated data based on narrative.

The Optimus Robot: Tesla's Bet on a Future That May Never Arrive

Perhaps Tesla's most audacious bet for its future is the Optimus humanoid robot, a project that represents both tremendous potential and tremendous execution risk.

Musk has positioned Optimus as potentially more valuable than Tesla's automotive business. The pitch is straightforward: if Tesla can build humanoid robots that can perform manual labor, the total addressable market is enormous. Every factory, warehouse, and service business becomes a potential customer.

Humanoid robotics is genuinely compelling from a value perspective. A robot that could perform human tasks at a fraction of the cost would transform multiple industries. Manufacturing would be revolutionized. Logistics would become more efficient. Service industries would be disrupted. The economic value of solving this problem is almost incalculable.

But here's the challenge: nobody has solved autonomous humanoid robotics at commercial scale. This is a problem that's been worked on for decades without a breakthrough. Tesla's Optimus project has been in development for several years and remains at prototype stage.

The company promised to demonstrate the third-generation Optimus prototype in Q1 2026, according to the shareholder letter. This third iteration supposedly represents meaningful capability advancement from earlier prototypes. But prototype demonstrations aren't customer shipments. Getting from impressive prototype to actual commercial product that can perform real work requires solving hundreds of technical problems.

Think about what Optimus needs to accomplish: understand complex instructions, navigate varied environments safely, perform manipulation tasks with sufficient dexterity, adapt to unexpected situations, and do all of this reliably enough that customers trust the system with valuable work.

Each of these is a massive problem. The artificial intelligence required to give robots common sense is years away. The physical systems—motors, sensors, control systems—need dramatic improvements. Battery technology needs advancement. Safety certification and liability frameworks don't exist.

Yet Musk has positioned Optimus as potentially generating more value than Tesla's entire automotive business. He's suggested that Optimus could begin generating meaningful revenue within years. These timelines feel disconnected from the technical realities of the problem.

Why is Tesla investing heavily in Optimus despite uncertain timelines and unproven capability? Partly because the potential payoff is genuinely massive. Partly because Musk's ambitions are extraordinary. And partly because Tesla's core automotive business is deteriorating, and the company needs to believe in a future that doesn't depend on cars.

But this creates a problem: Tesla is betting its future on products and capabilities that don't yet exist in commercial form. The company is essentially asking investors to value the business based on speculative future revenue from robots and autonomous vehicles, rather than on current operations. This is a classic high-growth technology company strategy—but it requires execution. Tesla's track record on delivery suggests investors should be skeptical.

The Lithium Refinery and In-House Chip Development: Vertical Integration Bets

Tesla's investment in vertical integration—owning more of its supply chain—represents an attempt to regain cost advantages that have eroded through competition.

The company announced that it had started pilot production at its Texas lithium refinery. This facility would process raw lithium into battery-grade material, reducing Tesla's dependence on external suppliers and potentially lowering costs.

Lithium is one of the key bottlenecks in battery supply chains. Global lithium supplies have been constrained, giving suppliers pricing power. By processing lithium in-house, Tesla could potentially secure cheaper feedstock and capture margin that would otherwise go to external refiners.

However, lithium refining is a complex, capital-intensive business. Setting up refining capacity takes years and requires navigating environmental regulations, permitting processes, and technical challenges. Tesla's pilot facility is a start, but scaling to meaningful volumes would take considerable time and capital investment.

The in-house chip development initiative represents a similar strategic bet. Tesla announced it's developing inference chips specifically optimized for its autonomy and robotics programs. Rather than relying on NVIDIA GPUs or other off-the-shelf chips, Tesla would design and potentially manufacture its own.

This mirrors Apple's strategy of designing custom chips for its devices—a strategy that has worked well for Apple but requires Apple-level engineering resources and manufacturing relationships. Tesla has the engineering talent, but this represents a significant resource commitment at a time when the company is cutting costs.

Both initiatives—lithium refining and chip design—make strategic sense. Vertical integration can provide cost advantages and security of supply. However, both represent long-duration projects that consume capital and resources without immediate financial returns. At a time when Tesla's profit is collapsing, these investments represent bets on the future rather than solutions to current problems.

By 2025, Tesla's competitive edge in the EV market had diminished as traditional automakers like GM, Volkswagen, and BMW offered comparable vehicles at similar price points. (Estimated data)

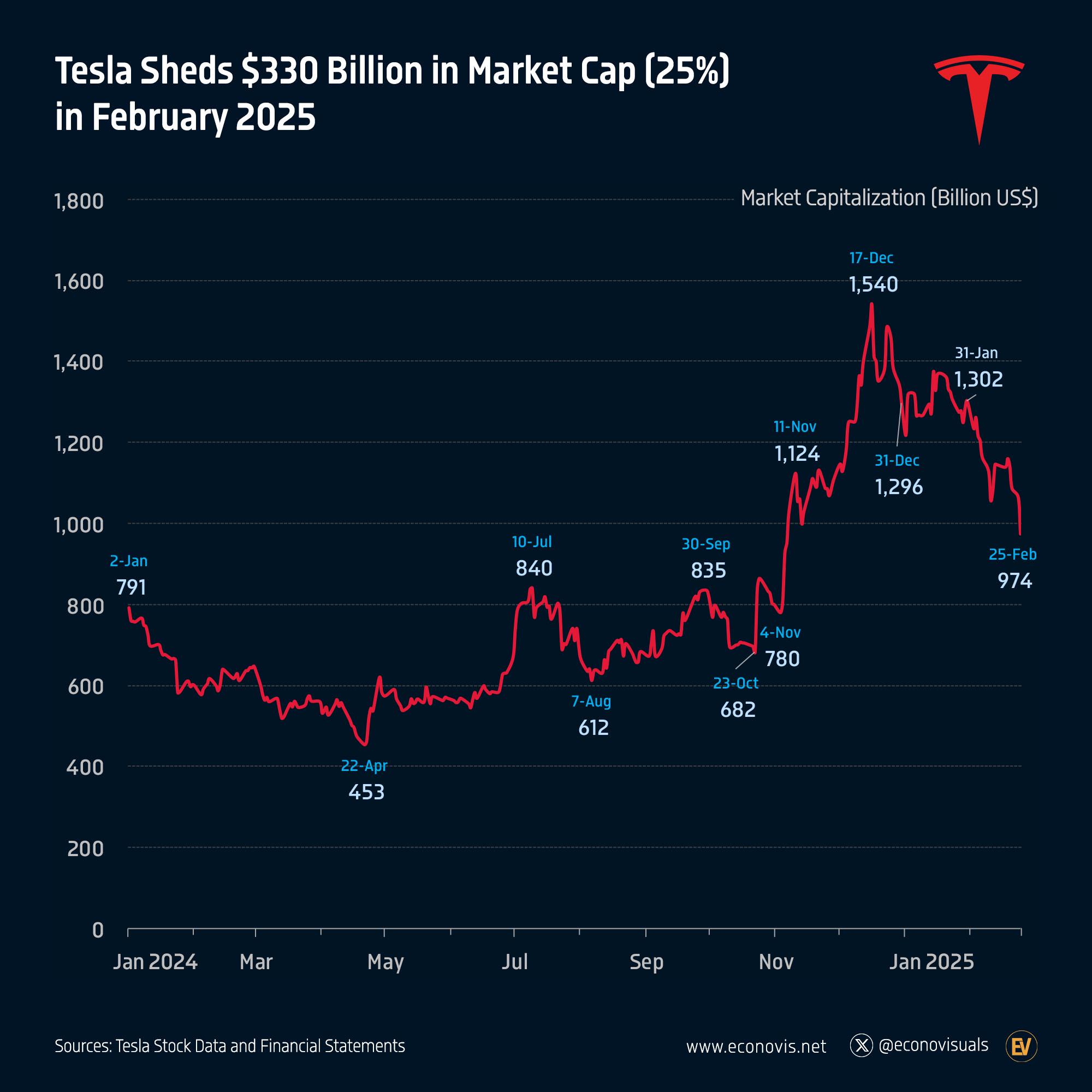

The Market's Reaction: Investor Doubts About Tesla's Future

Wall Street's reaction to Tesla's 2025 earnings reveal tells you everything you need to know about investor sentiment. The company missed expectations on multiple metrics, and the response was swift disappointment.

Investor concerns focused on several key issues:

First: The core automotive business is deteriorating without clear reversal strategies. Tesla can invest in energy and services, but these segments can't offset automotive decline.

Second: Management credibility has suffered. Musk has promised 50% annual growth. The company has delivered negative growth. The disconnect is stark.

Third: Competitive threats are intensifying faster than Tesla's ability to respond. While Tesla focuses on robots and autonomous vehicles, competitors are shipping competitive EVs today.

Fourth: Valuation becomes questionable if the core business keeps deteriorating. Tesla's stock price has historically been supported by growth narrative. If growth narrative dies, valuation multiple compression is inevitable.

Fifth: Musk's divided attention creates uncertainty about strategic clarity and decision-making quality.

These concerns aren't unreasonable. They reflect genuine business challenges that Tesla faces.

Competitor Responses: Traditional Automakers Finally Attacking

While Tesla struggled through 2025, traditional automakers were aggressively advancing their EV programs and gaining market share.

General Motors expanded its Ultium battery platform across multiple brands and vehicle segments. The company was launching competitive EVs at price points that directly competed with Tesla's offerings.

Volkswagen Group was scaling its ID lineup, becoming the largest EV manufacturer by some metrics. The company's manufacturing efficiency was improving as volumes increased, allowing price reductions that pressured Tesla margins.

BMW and Mercedes were positioning premium electric vehicles that competed with Tesla's premium positioning. By offering vehicles with premium brand heritage, superior warranty support, and extensive dealer networks, these companies were capturing customers who might have previously considered Tesla.

Chinese competitors were proving particularly formidable. BYD surpassed Tesla in EV sales in 2024 and continued gaining share in 2025. Other Chinese manufacturers like XPeng, Li Auto, and Nio were developing competitive products with aggressive pricing.

What's particularly significant is that competitors weren't just matching Tesla's 2022-2023 capabilities. They were leapfrogging. Some competitors were offering superior battery technology. Others had better software and user experience. Several had lower manufacturing costs, enabling aggressive pricing. Tesla's technological advantages had largely disappeared.

Regulatory Headwinds: Policy Shifts Reshape Market Dynamics

Beyond the subsidy elimination, regulatory changes were reshaping EV market dynamics in ways that disadvantaged Tesla.

EU regulations were pushing manufacturers toward increasingly strict emissions standards and eventually accelerating phase-out dates for combustion engines. These regulations pressured traditional automakers to accelerate EV development and gain scale quickly. The pressure to scale was driving down prices, which in turn pressured Tesla's margins.

In the United States, the regulatory environment had shifted considerably. The Trump administration's skepticism toward aggressive EV mandates and climate regulations created uncertainty. Subsidies were being eliminated or restructured. This regulatory uncertainty made long-term planning difficult for all automakers but particularly impacted Tesla, which had built its strategy around growing government support for EVs.

China's regulatory environment continued to favor domestic EV manufacturers. Government policies supported local companies like BYD and discouraged foreign competitors. This effectively closed off the Chinese market—once a crucial growth engine for Tesla—to aggressive Tesla expansion.

The Path Forward: What Needs to Happen for Tesla to Stabilize

Tesla's 2025 collapse makes clear that the company can't continue on its current trajectory. Several things need to happen for Tesla to stabilize and return to growth:

First: Tesla needs to stabilize automotive profitability. This likely requires either cost reductions that get manufacturing closer to industry-leading efficiency, or pricing power recovery that allows margins to expand. Current trends suggest neither is happening.

Second: New product launches need to actually hit timelines and deliver meaningful revenue. The Cybercab and Semi represent necessary margin-expanding products—but only if they reach customers.

Third: The energy and services segments need to continue growth trajectories. These are Tesla's genuine bright spots and should be prioritized accordingly.

Fourth: Musk needs to resolve his attention allocation across multiple organizations. Running Tesla during a strategic crisis while simultaneously managing government responsibilities is problematic.

Fifth: Tesla needs a coherent vision of what the company is becoming. Is it a transportation company? An energy company? A robotics company? A software company? The current muddy positioning creates investor confusion and organizational ambiguity.

Without meaningful progress on these fronts, Tesla's 2026 results could be equally disappointing. The window for the company to reverse automotive business deterioration is closing. Every quarter of margin erosion and market share loss makes competitive recovery harder.

What This Means for the Broader EV Market

Tesla's struggles have broader implications for the EV industry and consumer adoption.

First, the EV market is proving more competitive and price-sensitive than earlier assumptions suggested. The days of premium EV pricing are ending. Consumers increasingly view EVs as commodities competing on total cost of ownership rather than premium products commanding premium prices.

Second, the elimination of subsidies is forcing the actual economics of EV production and pricing to become visible. Without subsidies masking underlying costs, traditional automakers are proving more capable of competitive EV manufacturing than many assumed. These aren't inferior competitors playing catch-up. They're formidable manufacturers deploying significant resources.

Third, the EV transition is accelerating faster than expected in some markets but slower than expected in others. This creates uneven market conditions where competitors with manufacturing flexibility outperform those with inflexible capacity.

Fourth, the technology gap between Tesla and competitors is narrower than commonly assumed. While Tesla still has advantages in certain areas, competitors have closed gaps faster than expected. The advantage is measurable but not dominant.

For consumers, this is unambiguously positive. Increased competition drives prices down and encourages feature improvements. More EV options from more manufacturers means better selection and availability. The race to the bottom on EV pricing benefits consumers even as it squeezes manufacturers' margins.

Key Lessons from Tesla's 2025 Failure

Several important lessons emerge from Tesla's 2025 earnings collapse:

First: Growth projections that assume 50% annual expansion for years are almost certainly wrong. Exponential growth eventually hits market constraints, competitive responses, and regulatory changes. Tesla promised 50% growth; the market delivered negative growth.

Second: Technological advantages erode faster than innovators expect. Tesla's manufacturing, battery, and software advantages were real and significant. But competitors learned. The advantages compressed over a five-year window rather than remaining durable.

Third: Subsidy dependence is a strategic vulnerability. Building business models that depend on government support creates risk. When policy changes, the business model breaks. Tesla's margin structure was effectively subsidized, and when subsidies disappeared, margins collapsed.

Fourth: Divided CEO attention creates strategic risk. Musk's ability to manage multiple organizations is real, but it has limits. When a core business enters crisis, divided attention becomes a liability.

Fifth: Credibility matters. Musk's repeated missed promises on timelines and growth rates has damaged Tesla's credibility. The market now discounts Tesla's claims. This makes it harder for Tesla to generate enthusiasm for future products.

Sixth: The ability to execute matters more than having good strategic ideas. Tesla has good ideas around robotics, autonomous vehicles, and energy. But the company has struggled to execute these ideas on timeline. Execution risk is now front and center for investors.

FAQ

What caused Tesla's 46% profit decline in 2025?

Tesla's profit collapse resulted from multiple factors: the elimination of federal EV subsidies ($7,500 credit) that compressed automotive margins, declining vehicle sales for the second consecutive year, intensifying competition from legacy automakers, and lower pricing power as the EV market commoditized. Revenue from car sales fell 11% year-over-year, while the company's cost structure remained relatively fixed, causing operating leverage to work in reverse.

Why did Tesla's sales decline despite Elon Musk's growth promises?

Musk promised 50% annual growth, but Tesla achieved negative growth in back-to-back years. The shortfall resulted from subsidy elimination removing a $7,500 price advantage customers relied on, competitive products from BMW, Mercedes, Volkswagen, and BYD becoming increasingly compelling at lower prices, weakening consumer demand as EV adoption shifted from early adopters to mainstream buyers, and Musk's divided attention as he took on government responsibilities rather than focusing exclusively on Tesla's strategic challenges.

How much of Tesla's profit decline was due to the subsidy elimination?

The federal EV tax credit elimination likely accounted for 40-50% of Tesla's revenue decline directly. When the

What segments of Tesla's business are actually growing?

Tesla's energy business (solar and storage) grew 25% year-over-year, and services revenue (Full Self-Driving subscriptions, Supercharging, insurance, parts) grew 18%. These segments have better margin characteristics than automotive and don't depend on government subsidies for economic viability. However, energy and services together represent only a fraction of Tesla's revenue, and their growth can't offset automotive business deterioration.

When will Tesla's new products like the Cybercab and Tesla Semi actually reach production?

Tesla promised the Tesla Semi would reach production in the first half of 2026, after the original 2019 timeline repeatedly slipped. The Cybercab was promised to begin production in H1 2026. However, Tesla's track record suggests these timelines warrant skepticism. Prototype demonstrations and customer shipments are fundamentally different milestones. Based on historical patterns, meaningful customer revenue from these products likely remains 2-3 years away, not months.

Is Elon Musk's focus on Trump administration responsibilities affecting Tesla's performance?

Musk's divided attention between Tesla and government responsibilities creates strategic execution risk. Running a company during a crisis period requires undivided focus. The company's unclear strategic direction, delayed product timelines, and apparent reactive decision-making suggest that Musk's attention allocation is impacting Tesla's execution quality. Tesla's leadership team carries responsibility for day-to-day operations, but strategic vision and priority-setting ultimately reflect the CEO's focus and attention.

Can Tesla's energy and services businesses compensate for automotive decline?

Unlikely. While energy and services grew 25% and 18% respectively, these segments remain significantly smaller than automotive in revenue contribution. For energy and services to offset an 11% automotive revenue decline would require these segments to grow at rates far exceeding current trajectories. Tesla needs to stabilize automotive profitability and eventually return it to growth. Relying on smaller segments to carry the entire company isn't viable unless these segments achieve transformational scale.

What does Tesla's 2025 performance mean for the broader EV market?

Tesla's struggles signal that the EV market has fundamentally shifted from a growth phase to a competitive phase. Traditional automakers have finally delivered competitive products. Subsidies—which masked underlying economics—are disappearing. Price competition is intensifying. For consumers, this is positive: more options, lower prices, and accelerated innovation. For EV manufacturers, it means margins are compressing and differentiation is harder. The industry is moving toward commodity-style competition rather than innovation-driven premiums.

Will Tesla recover from 2025's performance?

Recovery requires the company to either stabilize and improve automotive profitability through cost reductions and efficiency gains, successfully launch new products that generate healthy margins, accelerate energy and services growth to compensate for automotive weakness, or achieve breakthroughs in robotics and autonomous vehicles that open entirely new profit centers. Some of these are technically possible; all are organizationally and strategically challenging. Recovery is possible but not guaranteed, particularly given competitive intensity and regulatory uncertainty.

How has competition from Chinese EV manufacturers affected Tesla?

Chinese competitors like BYD, XPeng, and Nio have proven more capable than Western competitors initially expected. BYD now sells more EVs than Tesla. These competitors offer vehicles with competitive technology at prices below Tesla's, particularly in the Chinese market where Tesla has lost significant share. The competitive threat from China is now Tesla's single most significant competitive challenge, particularly in the world's largest EV market.

Key Takeaways

- Tesla's profit collapsed 46% year-over-year to $3.8 billion, lowest in years, driven by automotive revenue decline of 11% and subsidy elimination

- Vehicle shipments fell to 1.63 million units for second consecutive year, exposing fundamental problems with business model and competitive positioning

- Federal EV subsidy elimination of $7,500 per vehicle directly cost Tesla 200,000-300,000 units of annual demand by removing price cushion

- Energy business grew 25% and services grew 18%, but these segments too small to offset automotive deterioration despite margin advantages

- Elon Musk's divided attention between Tesla and government responsibilities likely contributed to strategic confusion and delayed product timelines

- Cybercab, Tesla Semi, and Optimus represent future margin expansion bets, but chronic delivery delays raise serious execution credibility concerns

- Competitive landscape fundamentally shifted as BMW, Mercedes, Volkswagen, and BYD deployed competitive EVs at aggressive prices crushing Tesla margins

- Tesla's technological advantages in batteries, manufacturing, and software eroded faster than expected as competitors closed capability gaps

Related Articles

- How BYD Beat Tesla: The EV Revolution [2025]

- Payment Processors' Grok Problem: Why CSAM Enforcement Collapsed [2025]

- Geely's Solid-State Battery: 650 Miles Per Charge [2025]

- EU Investigating Grok and X Over Illegal Deepfakes [2025]

- ChatGPT Citing Grokipedia: The AI Data Crisis [2025]

- Volvo EX60 Software Revolution: How Volvo Solved EV Infotainment [2025]

![Tesla's 46% Profit Collapse in 2025: What Went Wrong [2026]](https://tryrunable.com/blog/tesla-s-46-profit-collapse-in-2025-what-went-wrong-2026/image-1-1769636360604.jpg)