VMware Migration Wave Accelerates as Customers Abandon Vendor Lock-in [2025]

There's this uncomfortable moment in business relationships when one party abruptly changes the terms. For many IT leaders managing VMware environments, that moment happened in November 2023 when Broadcom closed its acquisition. And more than two years later? The aftershocks are still rippling through enterprise data centers worldwide.

Here's what's happening right now. Eighty-six percent of VMware customers are actively reducing their VMware footprint. Not thinking about it. Not planning it. Actually doing it. That statistic doesn't come from a doomsday blog or activist group—it comes from Cloud Bolt Software, a legitimate hybrid cloud management platform provider that surveyed 302 IT decision-makers at major North American enterprises in January 2025.

The real story isn't just migration numbers. It's the quiet but determined shift happening across enterprises worldwide as organizations systematically rebuild their infrastructure to escape what many see as an untenable vendor relationship. After spending millions over decades on VMware platforms, these companies are making calculated bets on public cloud, Hyper-V, and alternative hypervisors. It's expensive, complicated, and necessary.

Broadcom knows this is happening. And according to Cloud Bolt's analysis, they've already done the math—and they're fine with losing customers. Their explicit strategy was never to retain every VMware customer. It was to maximize value extraction from those still locked in while the rest gradually diversify. That's not conspiracy thinking. That's the business model playing out in real time.

Let's dig into what's actually driving this exodus, what companies are moving to, and what this means for the future of enterprise virtualization.

The Broadcom Acquisition Shattered Customer Trust

When Broadcom announced the VMware acquisition in May 2023, the company promised continuity, innovation, and better integration. What actually happened was messier. The acquisition closed in November 2023, and within weeks, customers started receiving renewal quotes that looked like typos. Some reported price increases exceeding 1,000 percent. Others faced forced bundling of products they didn't want, sudden shifts to subscription licensing, and radical changes to support programs.

The disruption wasn't psychological. It was structural. Eighty-eight percent of survey respondents in January 2025 still described the Broadcom transition as "disruptive." That's remarkable. Fifteen months after the acquisition closed, nearly 9 in 10 customers still feel disrupted.

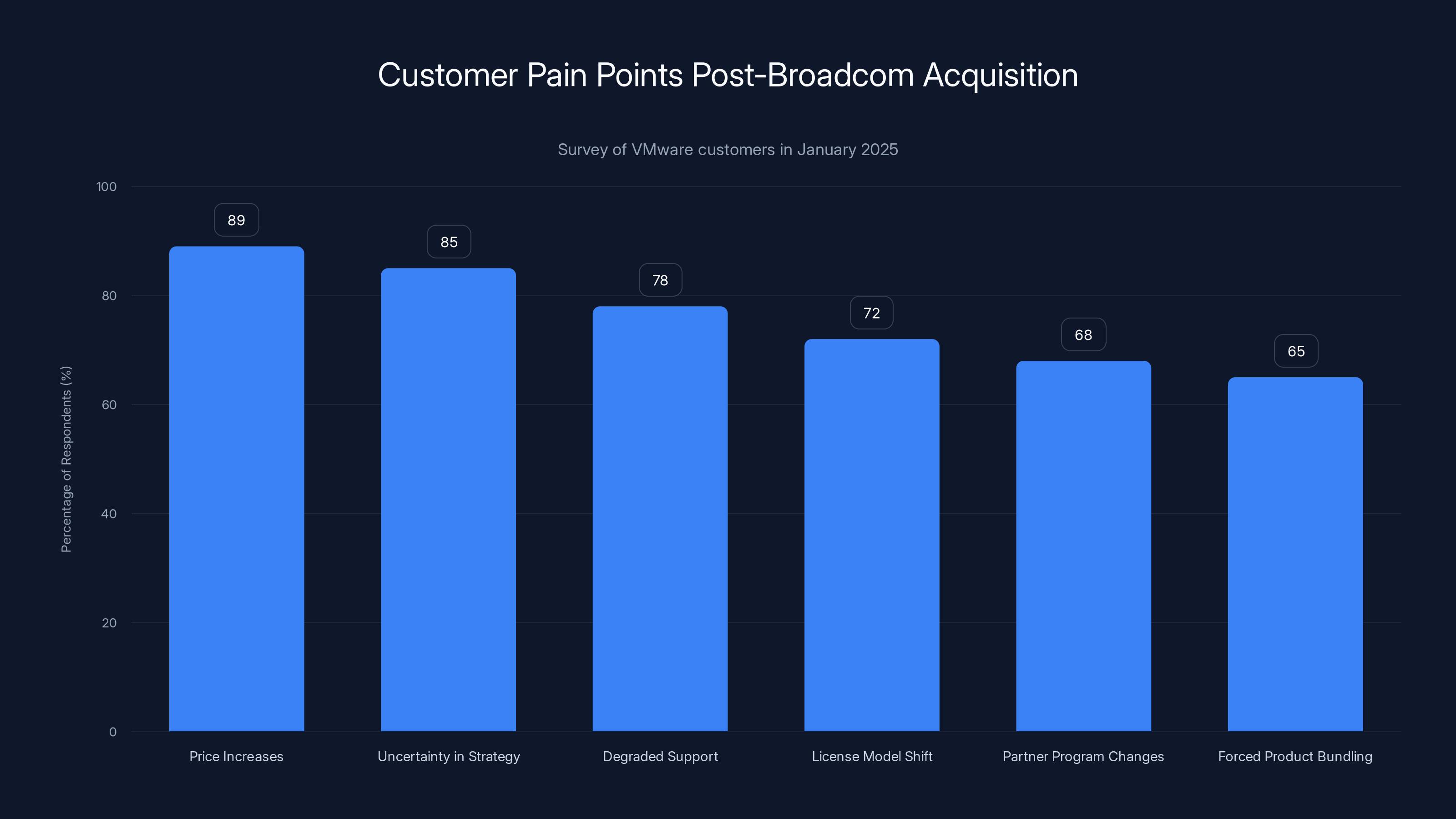

The specific pain points break down clearly. Price increases topped the list, cited by 89 percent of respondents. That's not mild frustration—that's nearly universal agreement that costs became unmanageable. Eighty-five percent cited uncertainty about Broadcom's strategic direction. Seventy-eight percent worried about degraded support quality. Seventy-two percent objected to the shift from perpetual licenses to subscriptions. Sixty-eight percent felt burned by partner program changes. Sixty-five percent resisted forced product bundling.

What's interesting here is that these problems compound. A company facing a 30 percent price increase might weather it. But combine that with support concerns, strategic uncertainty, forced bundling, and subscription models? Suddenly, the accumulated friction reaches a breaking point.

Mark Zembal, Cloud Bolt's chief marketing officer, captured the sentiment perfectly: "The fear has cooled, but the pressure hasn't—and most teams are now making practical moves to build leverage and optionality." Translation: organizations have moved from panic to pragmatism. They're taking action.

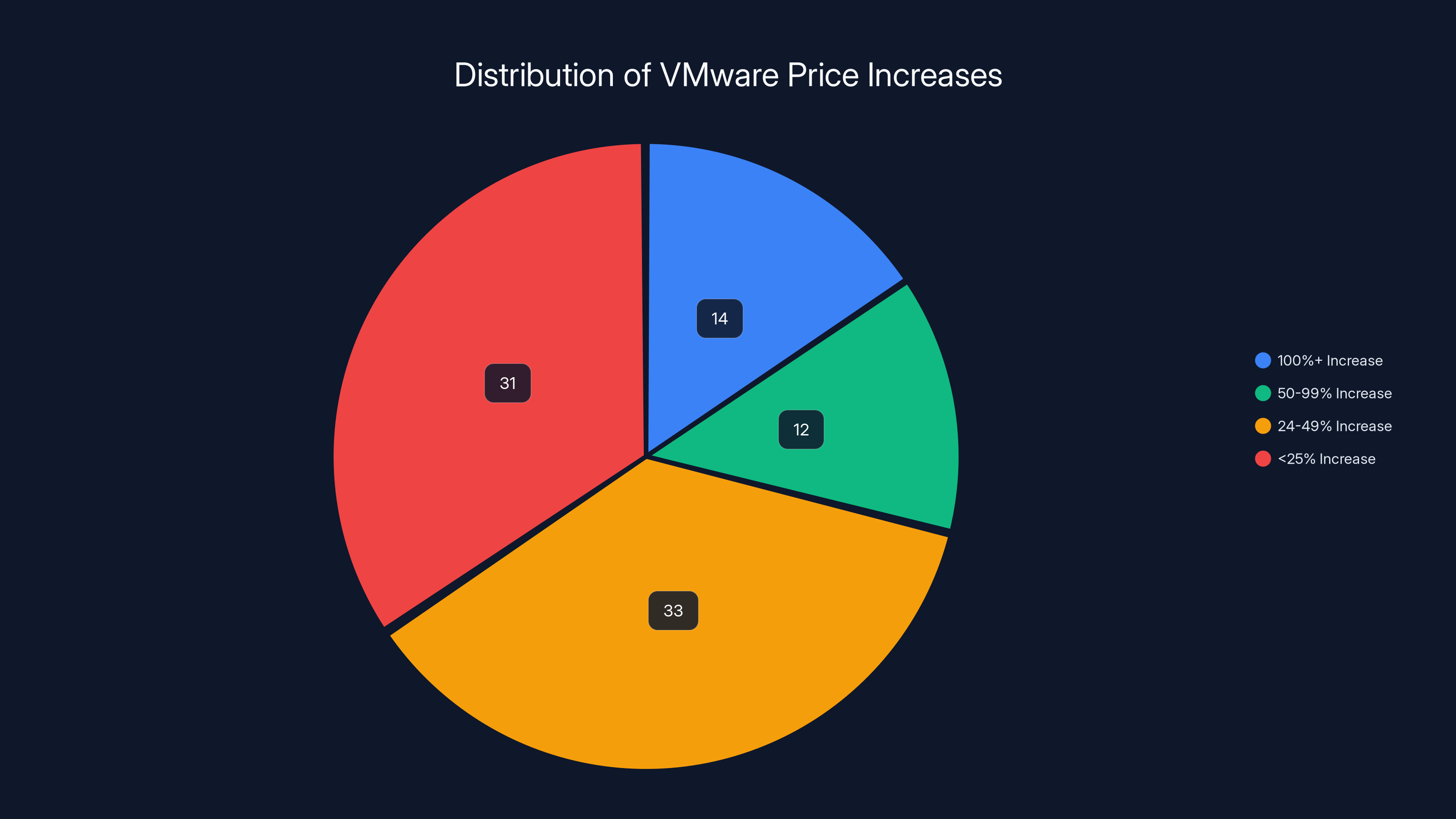

The majority of respondents (89%) reported experiencing some level of price increase, with 14% seeing costs double or more. Estimated data.

Price Increases: The Primary Migration Driver

Let's talk numbers, because perception and reality sometimes diverge. Early reports suggested apocalyptic price hikes. The Cloud Bolt survey paints a more nuanced picture, but it's still brutal.

Fourteen percent of respondents reported VMware costs that at least doubled (a 100+ percent increase). Twelve percent experienced 50-99 percent increases. Thirty-three percent faced 24-49 percent increases. And thirty-one percent absorbed increases of less than 25 percent. That means 89 percent faced some measurable price increase.

That's meaningful. If you're running a mid-sized VMware environment with

Here's the trap though. Even modest price increases wouldn't be catastrophic if they were predictable and customers felt confident in the relationship. But they're not. Eighty-five percent of survey respondents are concerned that VMware costs will increase further. That's not confidence. That's anticipatory anxiety.

When customers lose confidence in pricing stability, they start doing the math on alternatives. They model cloud migration costs. They evaluate Hyper-V environments. They investigate newer competitors. And critically, they start treating VMware as a transitional platform rather than core infrastructure.

Broadcom's pricing strategy effectively signaled, "We're extracting maximum value while we can." Customers received that signal. Now they're responding by reducing dependence.

The Subscription Model Shift Changed Customer Economics

One of Broadcom's most consequential moves was shifting VMware from perpetual licenses to subscription models. On the surface, this sounds reasonable. Companies adopt subscription models for software all the time. But for infrastructure software, it fundamentally changes economics and risk calculations.

With perpetual licenses, you own the software. You can run it indefinitely. Your costs are front-loaded (capital expense), but then you just pay maintenance. If you decide to leave VMware, you lose the license, but you stop paying annual fees.

With subscriptions, you rent the software. You pay continuously. If you leave, you stop paying. But if you want to leave, you've never built equity in the platform. There's no sunk cost that makes staying marginally cheaper than leaving.

Subscription models also eliminate the upgrade cycle choice. With perpetual licenses, you could run VMware 6.5 indefinitely if it met your needs. With subscriptions, you're always on the current version. That's great for Broadcom's support burden but increases customer operational risk.

Seventy-two percent of survey respondents specifically objected to this subscription shift. That's not incidental dissatisfaction. That's a structural concern about how they'll manage infrastructure costs long-term.

For many companies, especially mid-market organizations, this shift tipped the migration decision from "someday" to "this year." The subscription model meant they'd be paying Broadcom indefinitely. Migration costs—even substantial ones—suddenly looked like an investment in future savings.

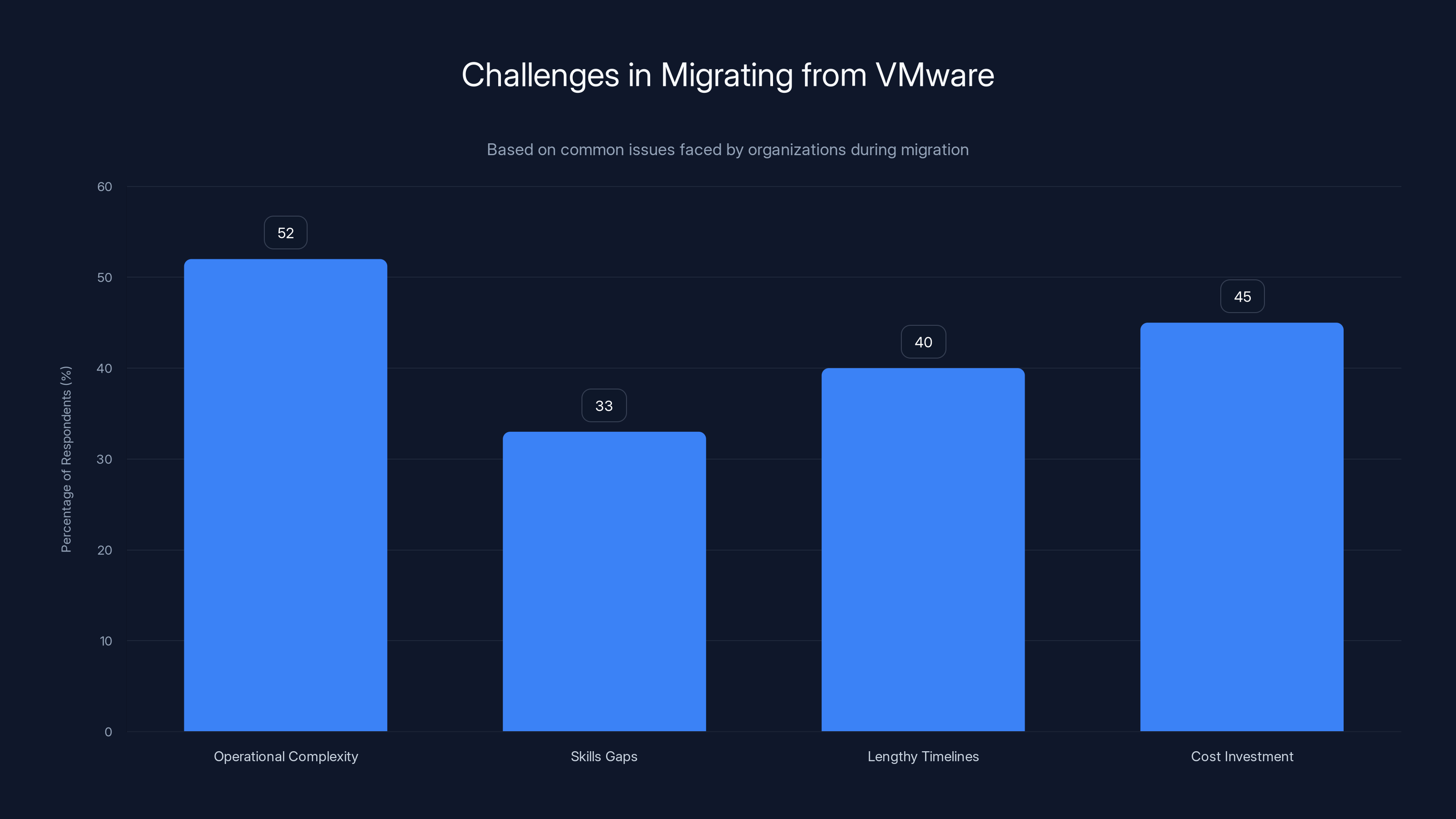

Operational complexity is the most cited challenge in migrating from VMware, affecting 52% of organizations, followed by cost investment and lengthy timelines.

Forced Product Bundling: The Ultimate Vendor Lock-in Move

Broadcom's decision to bundle products created immediate friction. Customers who only wanted vSphere suddenly had to consider NSX, vSAN, or other products bundled into new licensing tiers. This forced companies to either pay for products they didn't need or upgrade their licensing commitment.

Sixty-five percent of respondents objected to this bundling strategy. It's a classic vendor lock-in tactic, and enterprise customers recognize it immediately.

Here's why this matters strategically. Unbundled products give customers optionality. You can use vSphere with Cisco networking and NetApp storage. Bundled products trap you in the vendor ecosystem. If you want the core hypervisor, you might have to accept the networking layer too, even if you prefer an alternative.

For organizations that had meticulously built multi-vendor environments over years, forced bundling felt like betrayal. It eliminated architectural flexibility. It meant that staying with VMware would increasingly constrain other technology decisions.

This bundling move also accelerated a specific realization: staying with VMware meant committing to Broadcom's entire platform vision, not just hypervisor functionality. That's a fundamentally different decision than choosing a virtualization layer.

Partner Program Overhaul Eliminated Reseller Leverage

Broadcom restructured VMware's partner program, and sixty-eight percent of customers noticed negatively. This created indirect but meaningful friction.

Partner programs matter because resellers often provided negotiation leverage. They could offer bulk discounts, bundled services, and advocacy. When Broadcom changed these programs, resellers lost negotiating power. Customers lost intermediaries who could sometimes soften vendor demands.

Further, partner program changes often meant that companies' existing reseller relationships provided less value. Customers had to renegotiate with new partners under new terms. It was another friction point in an already-strained relationship.

Indirectly, this mattered because it removed one avenue for customers to negotiate better VMware pricing or terms. Everything now went directly through Broadcom.

The Migration Math: Where Workloads Are Actually Moving

Survey data shows specific migration patterns. Currently, thirty-six percent of respondents have migrated 1-24 percent of their VMware environment elsewhere. Thirty-two percent have migrated 25-49 percent. Ten percent have migrated 50-74 percent. And only 2 percent have migrated 75 percent or more.

That means only 7 percent (the 2 percent who've moved 75%+ plus the unmeasured percentage above 75%) have substantially completed VMware exits. The rest are mid-migration.

Only 5 percent haven't migrated any workloads at all. Everyone else is moving something.

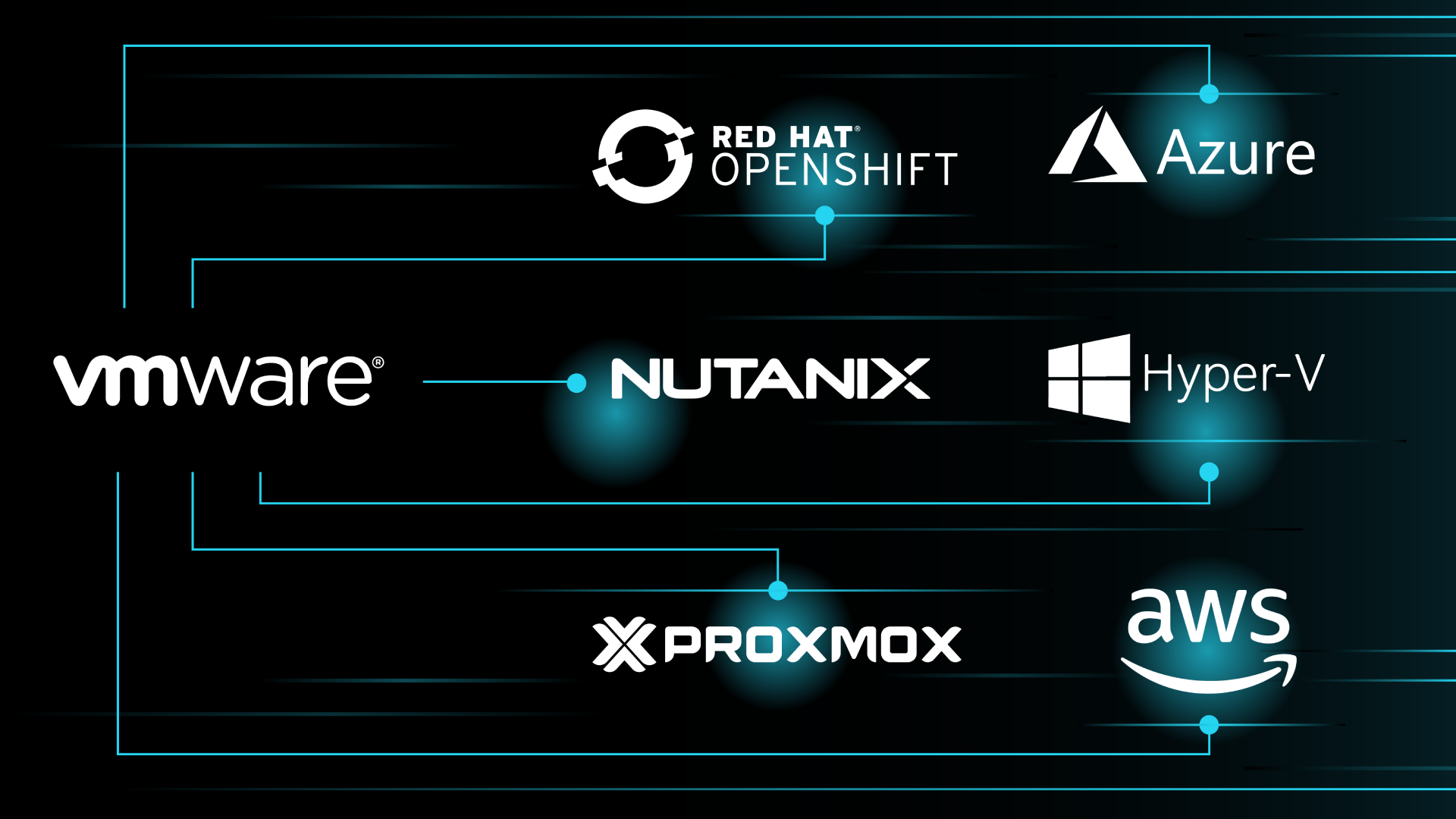

When it comes to destinations, seventy-two percent of migrating workloads moved to public cloud infrastructure (AWS, Google Cloud, Azure). That's the primary VMware escape route. Forty-three percent of respondents used Microsoft's Hyper-V or Azure stack. Some organizations multi-cloud, using several platforms simultaneously.

Notice what's missing from that list: other on-premises hypervisors. Nutanix, Proxmox, and other alternatives barely register in the migration data. The real story is off-premises migration. Customers aren't just switching hypervisors. They're shifting to fundamentally different infrastructure models.

This reflects a broader industry trend. On-premises virtualization is gradually becoming commodity infrastructure. The value-added layer increasingly sits in cloud services, orchestration, and application-level intelligence. Customers aren't looking to replace VMware with another on-premises hypervisor. They're looking to replace the entire on-premises paradigm with cloud-based alternatives.

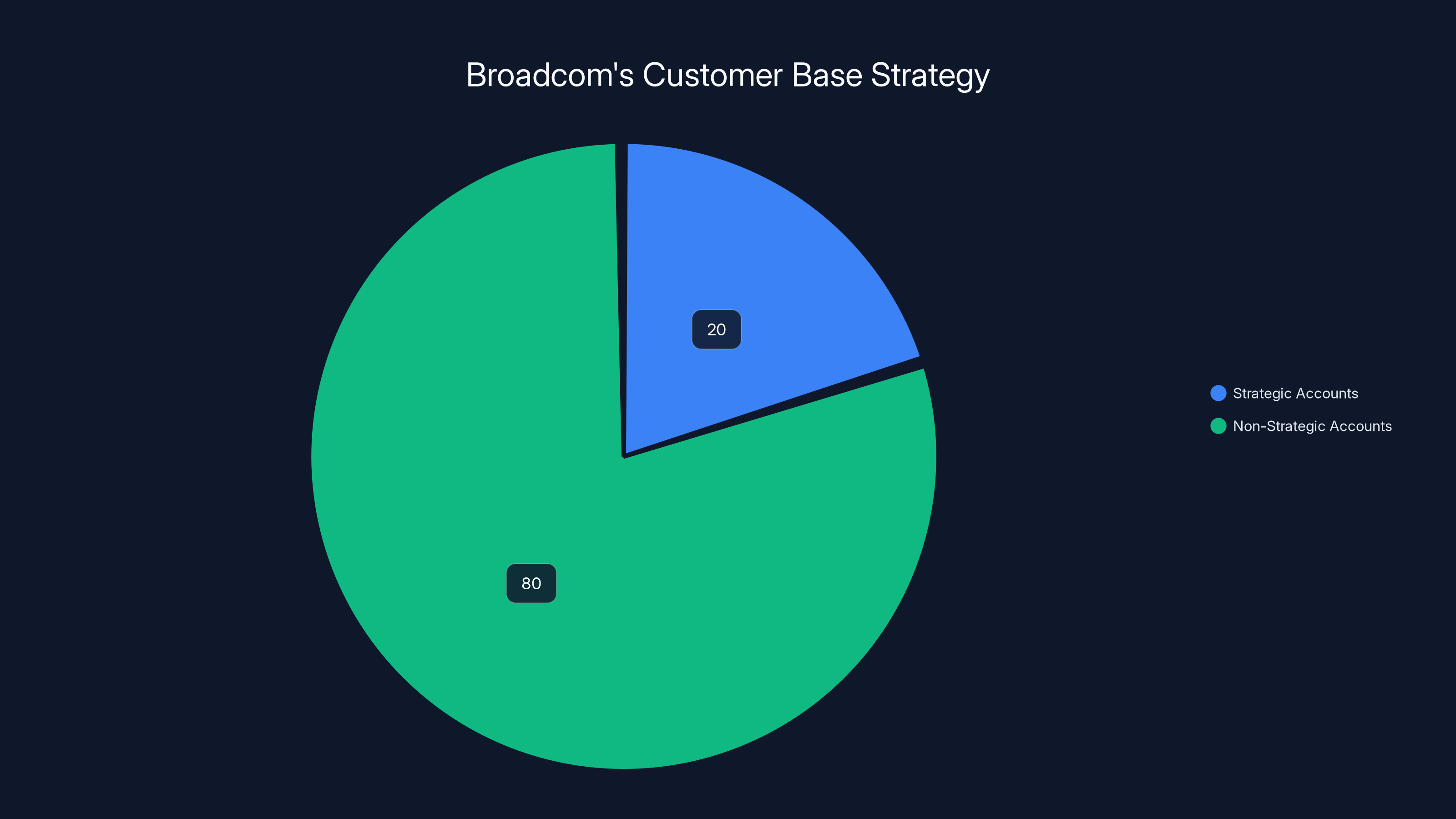

Broadcom focuses on extracting maximum value from 20% of its strategic accounts, accepting churn from the remaining 80% for long-term profitability. Estimated data.

Multi-Platform Complexity: The Hidden Migration Cost

As organizations diversify away from VMware, they inherit what Cloud Bolt calls "multi-platform complexity." Fifty-two percent of survey respondents cited this as a top migration challenge.

Here's what this means practically. Your ops team learned VMware over years. They understand vSphere resource allocation, vMotion mechanics, cluster management, and troubleshooting workflows. Moving workloads to AWS, Azure, and Hyper-V means they now manage three different platforms with incompatible operational models.

AWS uses EC2 instances with IAM permissions and security groups. Azure uses resource groups and managed identities. Hyper-V uses Cluster Shared Volumes and Live Migration. None of these map cleanly to each other. Your team has to learn three new operational paradigms, each with its own monitoring, security, and management tools.

This creates organizational debt. It's not just technical complexity. It's operational burden, knowledge fragmentation, and increased error risk because teams are managing multiple unfamiliar platforms simultaneously.

Furthermore, this complexity extends beyond hypervisors. Storage, networking, and identity management all vary between platforms. A vSAN cluster works differently from AWS EBS, which works differently from Azure Managed Disks. Your network architects now manage VMware networking, AWS VPCs, and Azure virtual networks.

This is why multi-platform complexity ranks so high as a migration challenge. It's not a theoretical problem. It's daily operational friction that compounds over time.

Skills Gaps: The Human Cost of Diversification

Thirty-three percent of respondents cited skills gaps as a major migration challenge. That's significant because it's fundamentally about people, not technology.

Your senior VMware administrator knows the platform inside and out. They've debugged resource contentions, optimized cluster configurations, and managed capacity planning for years. When you migrate to cloud platforms, some of that knowledge transfers, but much doesn't.

Cloud platforms require different skill sets. AWS expertise is different from Hyper-V expertise, which is different from Kubernetes expertise. An organization migrating to multiple cloud platforms needs to hire or train people across multiple technology stacks.

Skills gaps matter because they slow migration velocity. Teams can't confidently move workloads when they lack platform expertise. They move slower, more conservatively, which extends migration timelines and increases costs.

Furthermore, skills gaps create hiring pressure. Organizations need to recruit cloud architects, AWS specialists, and Azure experts in a competitive market. This increases labor costs and timeline uncertainty.

Many organizations are addressing this through training programs and hiring. But it takes time, and it costs money—real money that's part of the migration cost calculation.

The 86 Percent Actively Reducing VMware Footprint

Let's return to that headline statistic: eighty-six percent of survey respondents are "actively reducing their VMware footprint." What does "actively" mean here?

It means they're not passively waiting. They're making decisions, allocating budgets, and implementing changes. They're evaluating alternatives, planning migrations, and executing projects to reduce VMware dependence.

Eighty-six percent is a remarkable number because it represents near-unanimity among enterprises. There's no ambivalence. There's no fence-sitting. Organizations have made the decision to reduce VMware exposure.

This matters because it signals a tipping point. When 86 percent of major customers are actively exiting, you've crossed a threshold where the momentum becomes self-reinforcing. Tool vendors accelerate cloud migration tools. Consulting firms hire cloud specialists. Industry analysts shift recommendations. The ecosystem reorganizes around the new reality.

For Broadcom, this represents the successful extraction phase of their strategy. They've squeezed value from premium customers willing to pay increased prices. Everyone else is leaving. The revenue concentration shifts toward fewer, higher-value accounts while volume customers exit to cheaper alternatives.

Price increases were the most cited issue post-acquisition, with 89% of respondents indicating it as a major pain point. Other significant concerns included strategic uncertainty and degraded support quality.

Broadcom's Explicit Strategy: Extract, Don't Retain

This is where Cloud Bolt's analysis becomes interesting. According to their report, Broadcom's strategy was never to keep every customer. It was to maximize value from those still on the platform while the market slowly diversifies.

This isn't speculation. This is Broadcom's actual strategy, observable in their pricing, bundling, and partner program changes. They've optimized VMware for revenue extraction from locked-in accounts rather than customer retention across the portfolio.

The math is straightforward. Suppose Broadcom identifies 20 percent of their customer base as "strategic" accounts with high switching costs and deep VMware integration. These accounts will tolerate significant price increases because migration is extremely expensive. Broadcom focuses on maximizing value from these accounts.

The other 80 percent face a different calculation. For them, Broadcom pricing, subscription shifts, and bundling have made migration economically rational. Broadcom accepts this. The model assumes churn and builds economics around it.

This is sophisticated vendor strategy. Broadcom isn't making a mistake with aggressive pricing. They're executing a calculated strategy to maximize long-term value even as they lose market share.

Public Cloud Migration: The Path of Least Resistance

Seventy-two percent of migrating workloads moved to public cloud. Why? Because public cloud platforms have become mature, competitive, and increasingly cost-effective for enterprise workloads.

AWS, Azure, and Google Cloud have sophisticated VM offerings. They've closed capability gaps with on-premises virtualization. They offer better economies of scale. They provide native services (databases, analytics, AI) that on-premises environments can't match.

For many organizations, migrating from VMware to AWS means not just changing hypervisors but adopting cloud-native architecture patterns. You're not just lifting and shifting. You're rebuilding applications to leverage cloud services.

This is strategically significant. It means VMware migration isn't just about finding an alternative hypervisor. It's about adopting a different infrastructure paradigm. Organizations are moving from on-premises ownership to cloud consumption models.

Public cloud migration also addresses Broadcom's core problem: vendor lock-in. AWS has its own lock-in mechanisms, but they're different from VMware's. AWS lock-in comes through service integration and architectural decisions. VMware lock-in came through infrastructure ownership and years of operational knowledge. Organizations prefer AWS lock-in because it's more distributed across their application portfolio.

Hyper-V and Azure: The Microsoft Advantage

Forty-three percent of respondents used Microsoft's Hyper-V or Azure stack during migration. That's significant because it shows Microsoft capturing meaningful share of VMware's lost customers.

Microsoft has strategic advantages here. Organizations already using Windows Server have familiarity with Hyper-V. Organizations using Azure for cloud services can adopt Hyper-V for on-premises virtualization and integrate them through Azure Stack or Azure Hybrid Benefit licensing.

Furthermore, Microsoft's licensing strategy is more customer-friendly than Broadcom's. Organizations with existing Microsoft licenses can run Hyper-V at lower incremental cost. This appeals to enterprises that want to reduce total cost of ownership.

Hyper-V doesn't dominate the VMware replacement market, but it's meaningful. It captures organizations that prefer staying within the Microsoft ecosystem rather than fragmenting across multiple cloud providers.

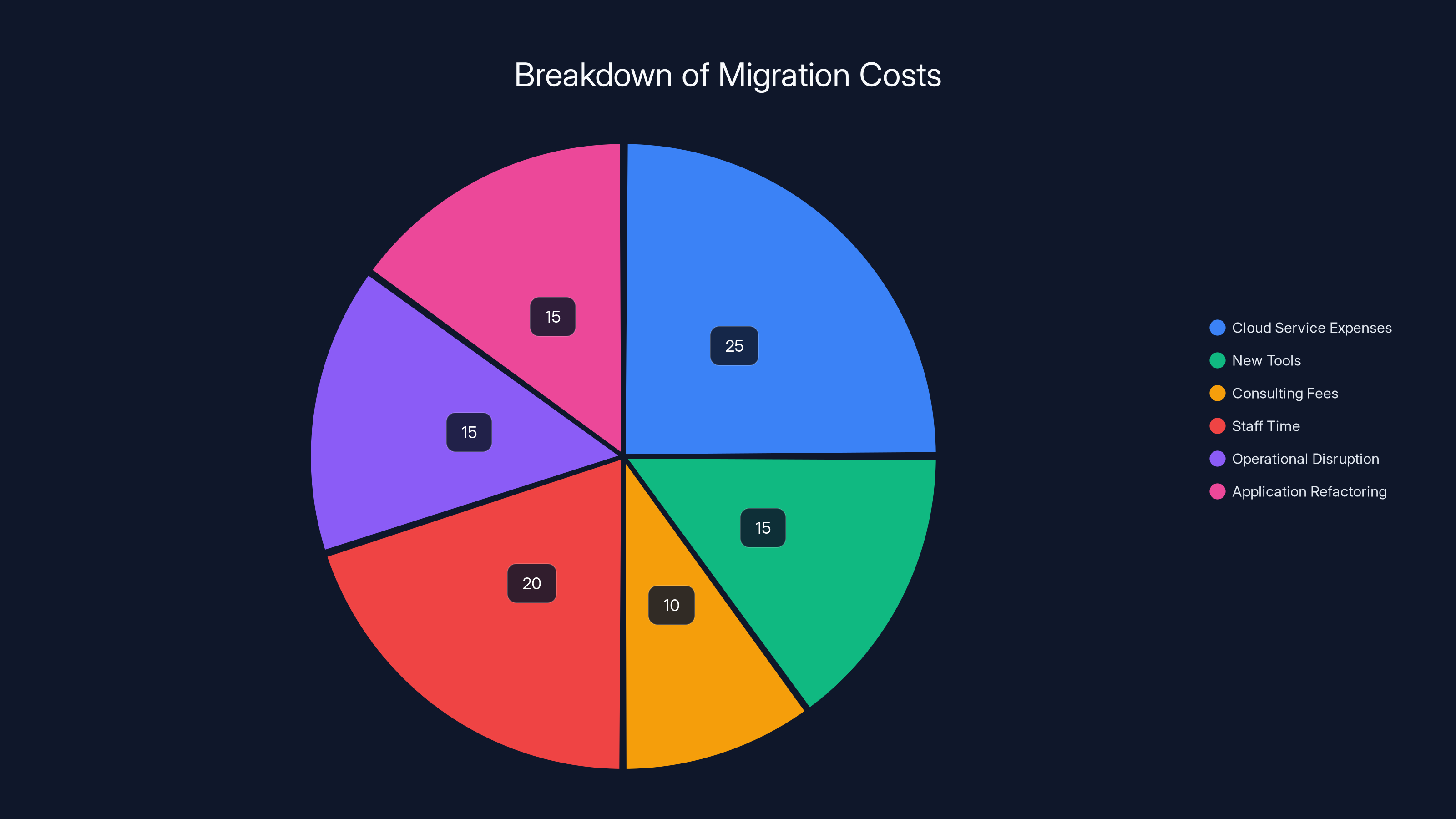

Estimated data shows cloud service expenses and staff time as major components of migration costs, emphasizing the need for comprehensive planning.

The Total Cost of Migration: The Real Barrier

Here's the uncomfortable truth that doesn't always make it into migration strategy discussions: leaving VMware is expensive.

Migration costs include obvious items like cloud service expenses, new tools, and consulting fees. But they also include hidden costs: staff time spent planning and executing migration, disruption to ongoing operations, application refactoring to work efficiently in cloud environments, and dual-platform operational costs during the transition period.

For a large enterprise with thousands of VMs and complex dependencies, a complete VMware migration might cost

Yet organizations are making this investment. The fact that 86 percent are actively reducing VMware footprint despite these substantial costs indicates the pain from Broadcom's strategy exceeds the pain of migration.

This also explains why only 7 percent have completed substantial migration (75%+ of workloads moved). Migration is a multi-year program. Organizations run VMware and alternative platforms in parallel, gradually shifting workloads as they build expertise and confidence in new environments.

The 5 Percent Who Didn't Migrate: Strategic Lock-in

Only 5 percent of survey respondents haven't migrated any VMware workloads. These are the strategic accounts Broadcom optimized for.

Who are they? Likely organizations with extremely complex, mission-critical infrastructure where VMware migration risk exceeds migration cost. Financial services firms with tightly coupled trading systems. Healthcare organizations with highly regulated applications. Large enterprises where VMware infrastructure is so foundational that alternatives seem impossible.

For these organizations, VMware has genuine strategic value. Migrating would require architectural changes with unacceptable risk. They'll tolerate high prices because they have few alternatives.

Broadcom's strategy explicitly targets these accounts. Higher pricing? They'll pay it rather than migrate. Forced bundling? They'll accept it. Subscription model? They can absorb it because the cost is acceptable relative to their IT budgets.

These accounts likely generate disproportionate revenue for Broadcom. Fewer customers, but higher spending per customer. From a financial perspective, Broadcom is perfectly happy with this outcome.

Looking Forward: The VMware Ecosystem After Mass Migration

What happens to VMware post-migration? Interestingly, the platform doesn't disappear. Organizations still running VMware become increasingly specialized.

VMware becomes infrastructure for edge computing, disaster recovery, and hybrid cloud scenarios where organizations maintain on-premises capacity. The total addressable market shrinks, but the remaining use cases become more specific and valuable.

Broadcom likely accepts this trajectory. They're not trying to maintain VMware's historical dominance. They're optimizing for profit from the installed base while accepting that new infrastructure decisions go elsewhere.

This represents a shift in virtualization philosophy. For 25 years, VMware was the default choice for on-premises virtualization. You evaluated alternatives, but VMware was the starting point. Post-Broadcom, VMware is one option among many, not the default.

That's a permanent shift in the market. Even if Broadcom reversed course on pricing and licensing, enterprises would still diversify because they've learned that putting all infrastructure eggs in one vendor's basket is risky.

Implications for Enterprise IT Strategy

This VMware story carries lessons beyond virtualization. It's a case study in how vendor decisions reshape technology landscapes.

First, it demonstrates that customer lock-in has limits. Broadcom believed (correctly) that many VMware customers were too locked in to exit quickly. But they underestimated how quickly alternatives matured and how willing enterprises were to undertake expensive migrations to avoid vendor control.

Second, it shows that trust matters in enterprise relationships. Broadcom didn't just change pricing. They signaled that they viewed customers as extractable value rather than partners. Customers received that signal and responded by reducing dependence.

Third, it illustrates how mature alternatives enable rapid market shifts. Ten years ago, VMware alternatives were inferior. Today, AWS and Azure are genuinely superior platforms for many workloads. When alternatives reach feature parity, vendor strategy becomes your primary decision factor. And Broadcom's strategy pushed customers toward alternatives.

For IT leaders, the lesson is to maintain architectural flexibility. Avoid putting critical infrastructure on any single vendor's platform if possible. Build the ability to run workloads on multiple platforms. This reduces your vulnerability to vendor strategy changes.

The Bottom Line: Disruption as Strategic Choice

Broadcom didn't accidentally disrupt its VMware customer base. The price increases, subscription shifts, and bundling were strategic choices optimizing for different outcomes than historical VMware strategy.

But choosing disruption for some customers implicitly accepts that others will leave. Broadcom made that calculation and decided it was acceptable.

From their perspective, generating

Customers, meanwhile, are responding rationally. When staying with a vendor requires accepting price increases, operational risk, and strategic constraints, leaving becomes economically sensible. That's what 86 percent of enterprises concluded.

The VMware story is far from over. The platform will persist, likely as specialized infrastructure for edge, disaster recovery, and hybrid scenarios. But its role as the default enterprise virtualization platform has ended. That's a permanent market shift.

For enterprises still running VMware workloads, the question isn't whether to migrate, but when and to where. The momentum is one direction: off VMware and toward cloud platforms that offer better economics, less vendor control, and greater architectural flexibility.

Broadcom accepted this trade-off. Enterprise IT leaders are responding by executing it.

FAQ

What is VMware, and why was it so dominant in enterprise infrastructure?

VMware is a virtualization platform that allows organizations to run multiple virtual machines on physical servers, abstracting applications from underlying hardware. For 25 years, VMware was the default choice because it offered superior stability, performance, and ecosystem support compared to alternatives, creating genuine vendor lock-in as enterprises built years of operational knowledge and complex integrations.

How did Broadcom's acquisition strategy differ from VMware's historical approach?

VMware's historical strategy emphasized customer retention through continuous innovation, competitive pricing, and ecosystem partnership. Broadcom's strategy explicitly optimized for revenue extraction from locked-in customers while accepting that price-sensitive customers would migrate elsewhere, fundamentally shifting VMware from a growth platform to a value extraction asset.

What makes cloud migration an attractive alternative to VMware despite the costs?

Cloud platforms like AWS and Azure have closed capability gaps with on-premises virtualization while offering better economies of scale, native services integration, and operational flexibility. For enterprises facing Broadcom's pricing and control strategies, cloud migration costs become economically justified as a pathway to reduce long-term vendor dependency and gain architectural flexibility.

What are the primary challenges organizations face when migrating from VMware?

Migration challenges include multi-platform operational complexity (52 percent of respondents cited this), skills gaps requiring new expertise in cloud platforms (33 percent), lengthy migration timelines extending 18-36 months, substantial cost investment, and the organizational disruption of running multiple infrastructure platforms in parallel during the transition period.

Why haven't more organizations completed their VMware migrations if 86 percent are reducing their footprint?

Migration is a multi-year program requiring substantial investment and planning. Organizations run VMware and alternative platforms in parallel, gradually building expertise and confidence before moving mission-critical workloads. Additionally, some workloads remain on VMware long-term due to application complexity, regulatory requirements, or integration constraints that make alternative platforms risky.

What percentage of VMware customers are likely to remain on the platform long-term?

Approximately 5 percent have migrated zero workloads and represent Broadcom's strategic lock-in accounts—organizations where VMware migration risk exceeds migration cost. These accounts likely generate disproportionate revenue for Broadcom despite representing a small percentage of the customer base, reflecting Broadcom's explicit strategy to maximize value from locked-in customers rather than maintain broad market dominance.

How does Microsoft's Hyper-V capture VMware migration demand?

Microsoft offers strategic advantages including existing Windows Server familiarity, Azure integration through Hybrid Benefit licensing, and customer-friendly licensing models that reduce incremental costs for organizations already in the Microsoft ecosystem. Forty-three percent of survey respondents used Hyper-V or Azure during migration, positioning Microsoft as a significant beneficiary of VMware customer departures.

What is the long-term viability of VMware as a platform post-Broadcom?

VMware will likely persist as specialized infrastructure for edge computing, disaster recovery, and hybrid scenarios, but its role as the default enterprise virtualization platform has ended. The total addressable market shrinks as new infrastructure decisions route to cloud platforms, but the remaining installed base provides concentrated revenue opportunities for Broadcom's revenue extraction strategy.

Key Takeaways

- 86% of enterprise VMware customers are actively reducing their footprint post-Broadcom acquisition, indicating a permanent market shift away from the platform

- Price increases affected 89% of customers, with 14% reporting cost doublings, driving economic justification for expensive cloud migrations

- 72% of migrating workloads move to public cloud platforms (AWS, Google Cloud), while 43% adopt Microsoft's Hyper-V/Azure stack, showing preference for cloud over on-premises alternatives

- Broadcom's explicit strategy accepts customer churn to maximize revenue from locked-in strategic accounts, fundamentally shifting VMware from growth platform to value extraction asset

- Multi-platform operational complexity and skills gaps represent 52% and 33% of migration challenges respectively, requiring significant organizational investment beyond direct cloud service costs

Related Articles

- HPE's AI-Driven Network Powers 2026 Winter Olympics [2025]

- Why AI Pilots Fail: The Gap Between Ambition and Execution [2025]

- EU Data Centers & AI Readiness: The Infrastructure Crisis [2025]

- Building AI Culture in Enterprise: From Adoption to Scale [2025]

- Who Owns Your Company's AI Layer? Enterprise Architecture Strategy [2025]

- Windows 11 26H1: The Exclusive Arm PC Release Changing Windows Updates [2025]

![VMware Migration Wave Accelerates as Customers Abandon Vendor Lock-in [2025]](https://tryrunable.com/blog/vmware-migration-wave-accelerates-as-customers-abandon-vendo/image-1-1771355152388.jpg)