Physical AI Is the New Frontier Investors Are Quietly Betting On

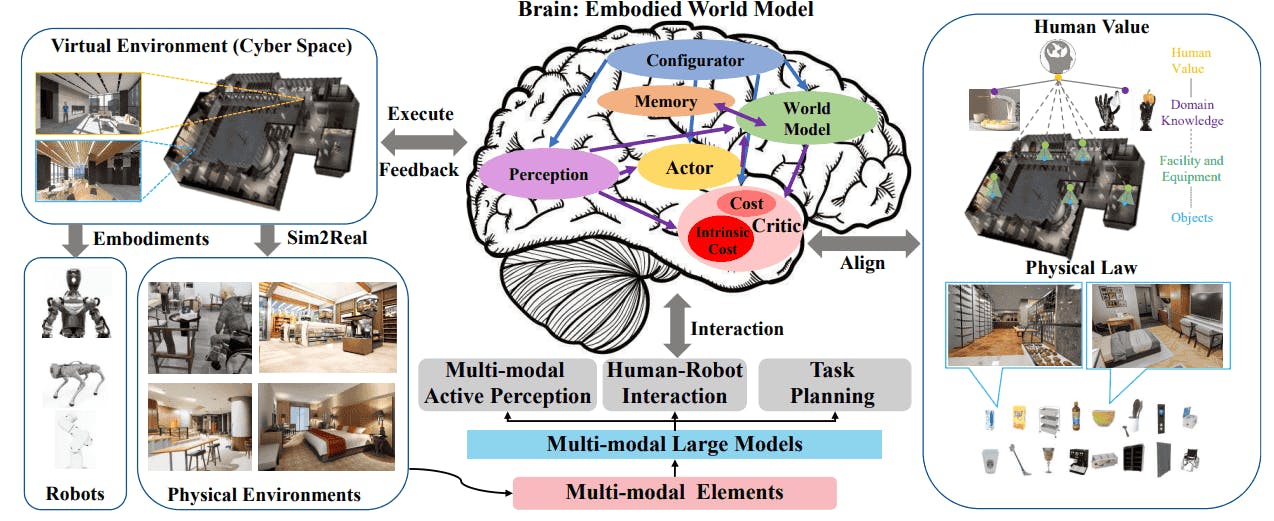

When you hear "AI," you probably think of Chat GPT or image generators. Software. Pixels on a screen. But there's a whole different beast emerging right now, and it's called Physical AI. It's the difference between a language model predicting text and a robot that actually picks up a coffee mug without crushing it.

The distinction matters because Physical AI requires fundamentally different infrastructure than the AI you know. While Chat GPT runs in data centers with expensive GPUs, Physical AI happens in real time, in real environments, on real hardware. That's why Ethernovia, a company you've probably never heard of, just raised $90 million in Series B funding. And that's why this matters more than you might think.

Here's the thing: when you have a robot arm in an autonomous vehicle collecting data from dozens of sensors simultaneously, you can't wait for that data to travel to a cloud server, get processed, and come back. The latency alone would make the vehicle crash. You need instant processing. You need specialized chips that can handle sensor fusion, real-time decision making, and coordination across multiple systems without the usual delays.

That's where Ethernovia comes in. The San Jose-based company builds Ethernet-based processors designed specifically for these kinds of distributed, real-time computing tasks. Think of their technology as the nervous system that lets autonomous vehicles and robots react instantly to their environment.

But here's what really signals the shift in the investment world: this round was led by Maverick Silicon, a new venture fund created in 2024 by Maverick Capital specifically focused on AI infrastructure. This was the first sector-specific fund that the 30-year-old hedge fund had launched in its entire history. They don't do this lightly. The fact that they created an AI infrastructure fund and one of its first big bets is on Ethernovia tells you something important: the money is flowing away from "AI as software" and toward "AI as hardware and physical systems."

The round also included backing from earlier investors like Porsche SE and Qualcomm Ventures. Translation: the automotive industry already knows they need this technology, and they're willing to back the companies building it.

But before we dive into why this matters, let's be clear about something. Physical AI isn't new. What's new is the realization that AI breakthroughs in vision, reasoning, and motor control have finally made Physical AI applications actually viable. For years, we had better AI algorithms but clunky hardware. Now we're getting to a point where the hardware can actually keep up with what the AI needs to do.

And that convergence is where the money is heading.

What Physical AI Actually Means (And Why It's Different)

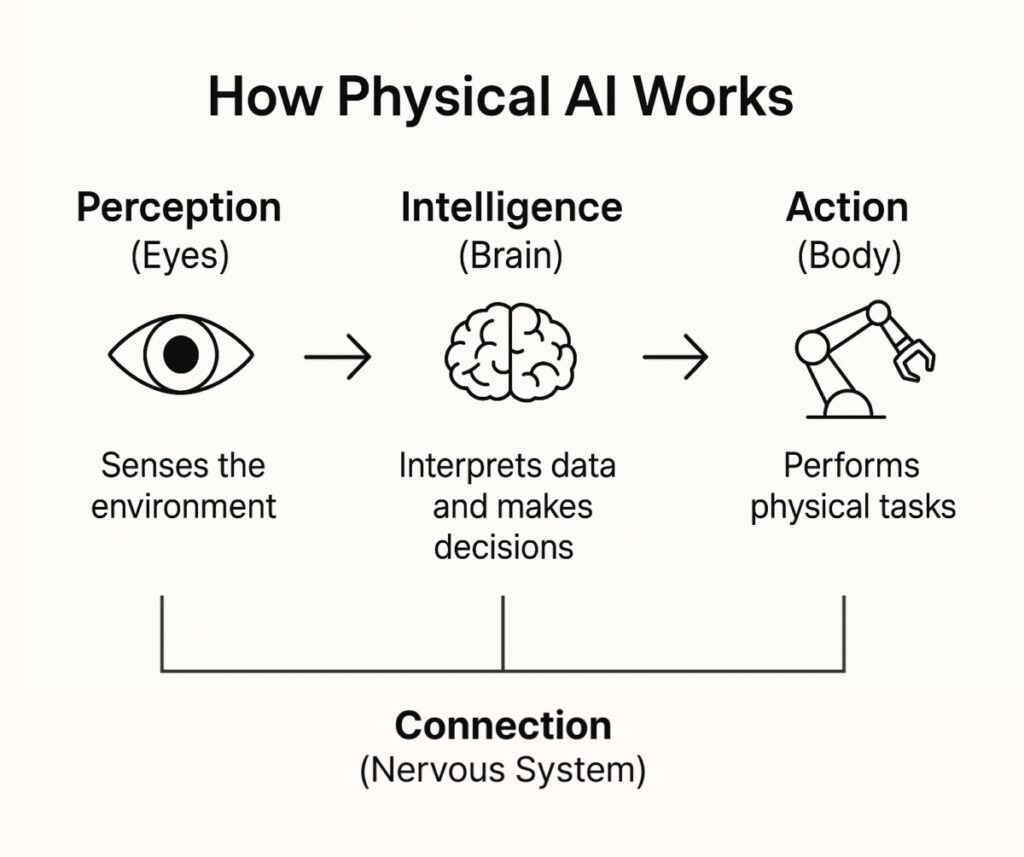

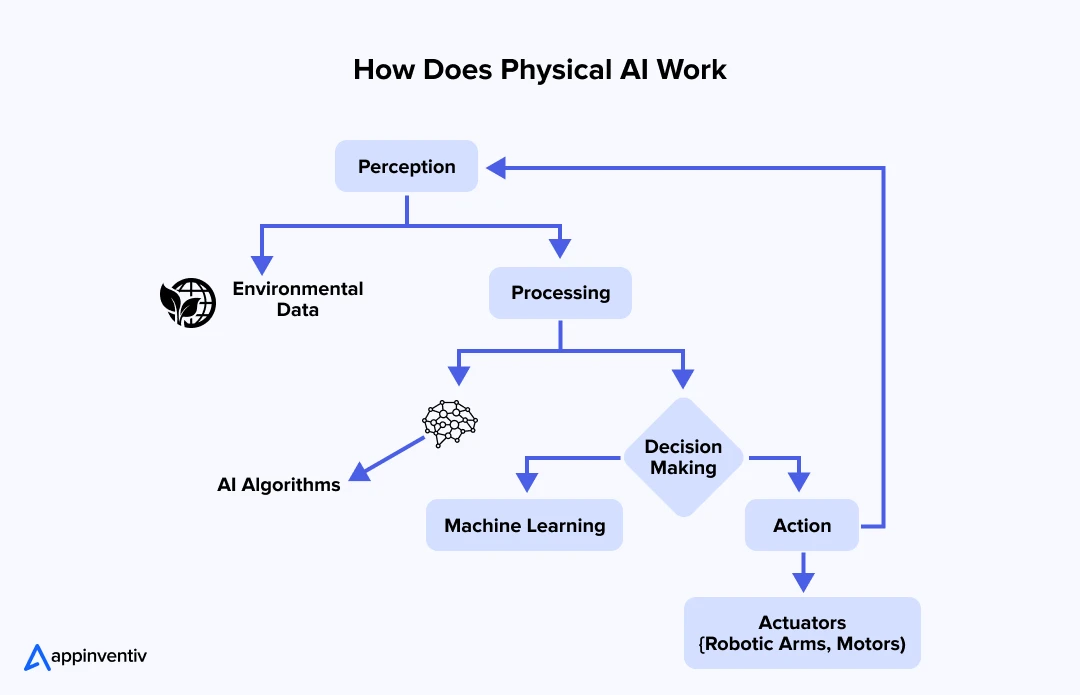

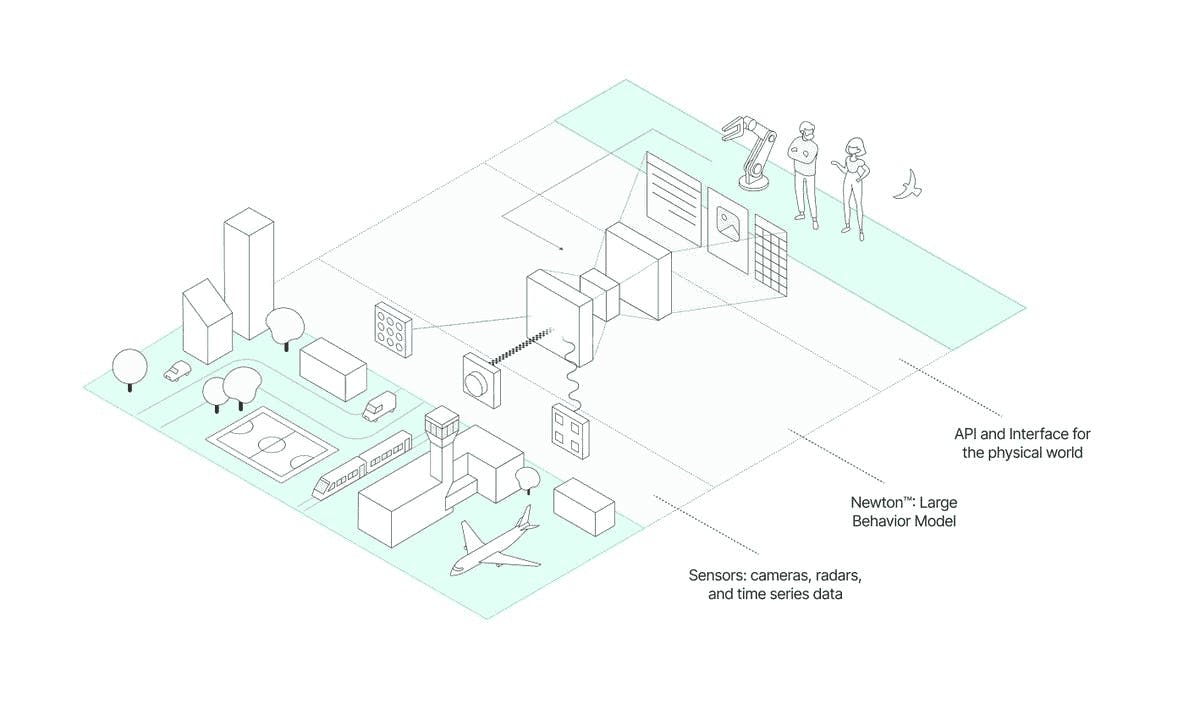

Physical AI is a term that sounds vague until you actually think about what it entails. It's not about building robots that can chat with you. It's about systems that can perceive their environment, reason about what they see, and take actions in the real world, all in real time.

Consider the difference between a language model and a robot that navigates a warehouse. The language model takes your input, processes it at its own pace, and spits out text. If it takes two seconds, nobody cares. A warehouse robot can't afford that delay. It needs to process camera feeds, lidar data, wheel encoders, and obstacle sensors simultaneously, make split-second decisions, and adjust its movements accordingly. All while other robots and humans are moving around it.

That's the fundamental challenge that Physical AI infrastructure addresses. It's about moving data from sensors to processing to actuators (motors, arms, etc.) with minimal delay. It's about handling massive amounts of sensor data without bottlenecking. It's about doing this reliably in noisy, unpredictable real-world environments.

Autonomous vehicles are the obvious example. A self-driving car has cameras, radar, lidar, ultrasonic sensors, and more. That's terabytes of data per hour. You can't send all of that to the cloud. You need to process it locally, make decisions locally, and only send the important stuff back for logging or learning.

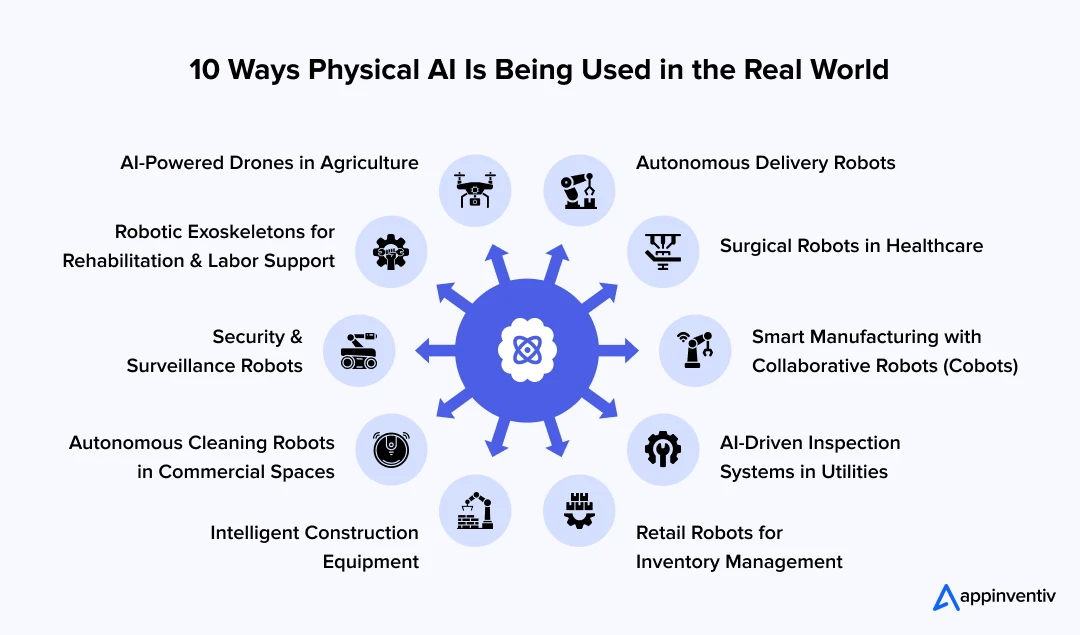

But vehicles are just the beginning. Robotics is where this gets interesting. We're talking about industrial robots in factories, humanoid robots in logistics, surgical robots in hospitals, autonomous drones in agriculture. Each of these needs to perceive, reason, and act in their specific environment. And each of these is a multi-billion-dollar market if you can build the infrastructure that makes them actually work reliably.

That's why Ethernovia's focus on Ethernet-based processing is so relevant. Ethernet is already ubiquitous. Most vehicles already have some Ethernet infrastructure. Adding specialized processors that can handle real-time sensor fusion and distributed computing is cheaper and faster than building entirely new hardware standards.

The funding surge around Physical AI reflects a simple realization: we've reached an inflection point. AI algorithms are good enough. Now the bottleneck is making those algorithms work in the physical world. And that requires specialized infrastructure.

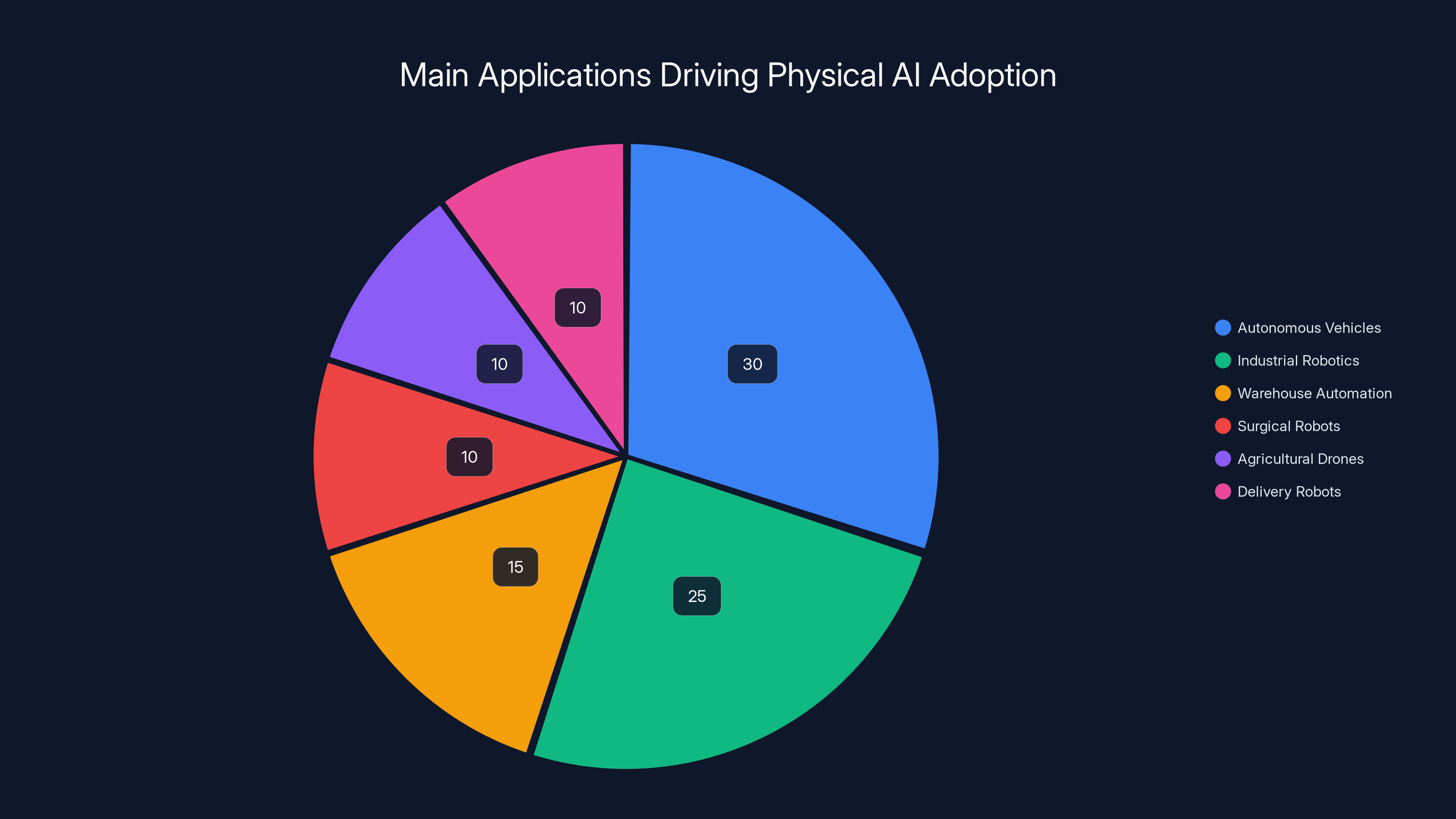

Autonomous vehicles and industrial robotics are the leading applications for Physical AI, together comprising over half of the current market. (Estimated data)

The Ethernovia Play: Why This Specific Company, Right Now

Ethernovia could have remained a quiet supplier to the automotive industry. Make good processors, sell them to Porsche and other luxury car makers, and that's a decent business. But the $90 million Series B signals that the investors believe Ethernovia can be much bigger than that.

The company's core value proposition is deceptively simple: they take data from sensors scattered across a system, move it quickly to a central computer, and enable that computer to make decisions and coordinate actions across the entire system. In the automotive world, this means connecting cameras, radar, lidar, GPS, and inertial sensors so that the vehicle can understand its surroundings and navigate safely.

But here's where it gets strategic. The same problem exists everywhere. A robot factory floor has sensors everywhere. A drone needs to fuse multiple sensor inputs. A surgical robot needs real-time feedback from cameras and position sensors. Any distributed physical system collecting data from multiple sources faces the same core challenge: how do you move and process that data fast enough to react to what's happening right now.

Ethernovia's Ethernet-based approach has several advantages. First, Ethernet is already the standard communication protocol in most vehicles and industrial systems. You don't need to convince people to use a new standard. Second, Ethernet-based processing can handle the bandwidth requirements of modern sensor arrays without custom silicon for every application. Third, because Ethernet is standardized, you can scale manufacturing quickly, which means costs come down fast.

The Series B funding enables Ethernovia to do a few things that transform it from a car-focused supplier into a platform company. First, they can invest in software that makes their hardware useful beyond the automotive world. Second, they can build relationships with robotics companies and other physical AI applications. Third, they can hire the talent needed to stay ahead of the curve as this market explodes.

Maverick Silicon's involvement is the real signal here. A venture fund created specifically to back AI infrastructure doesn't write a $90 million check casually. They've done the analysis. They've looked at the TAM (total addressable market) for real-time sensor processing infrastructure across all physical AI applications. They've looked at the competitive landscape. And they've concluded that Ethernovia has a shot at becoming a foundational infrastructure company.

That's the kind of vote of confidence that changes a company's trajectory.

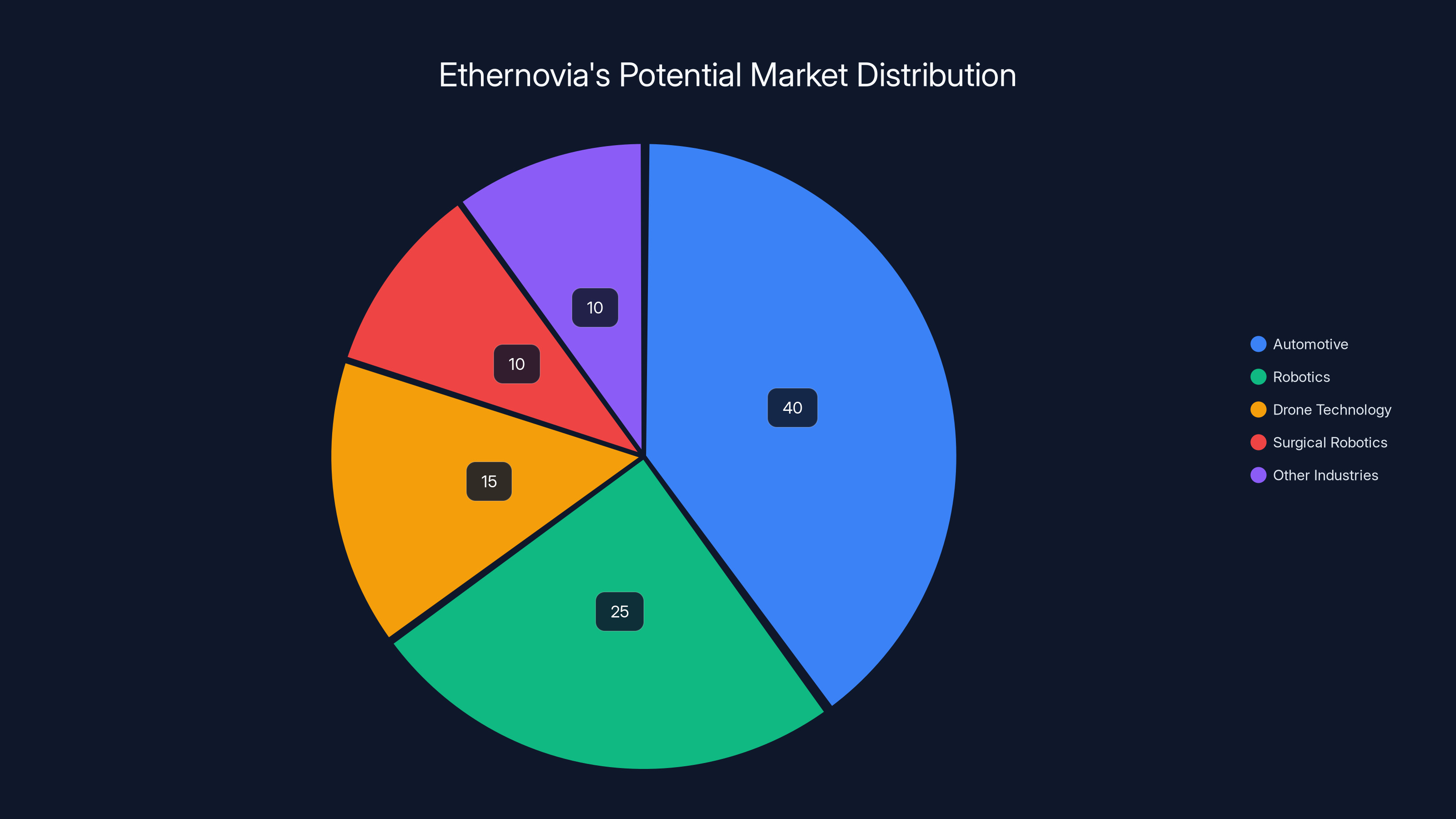

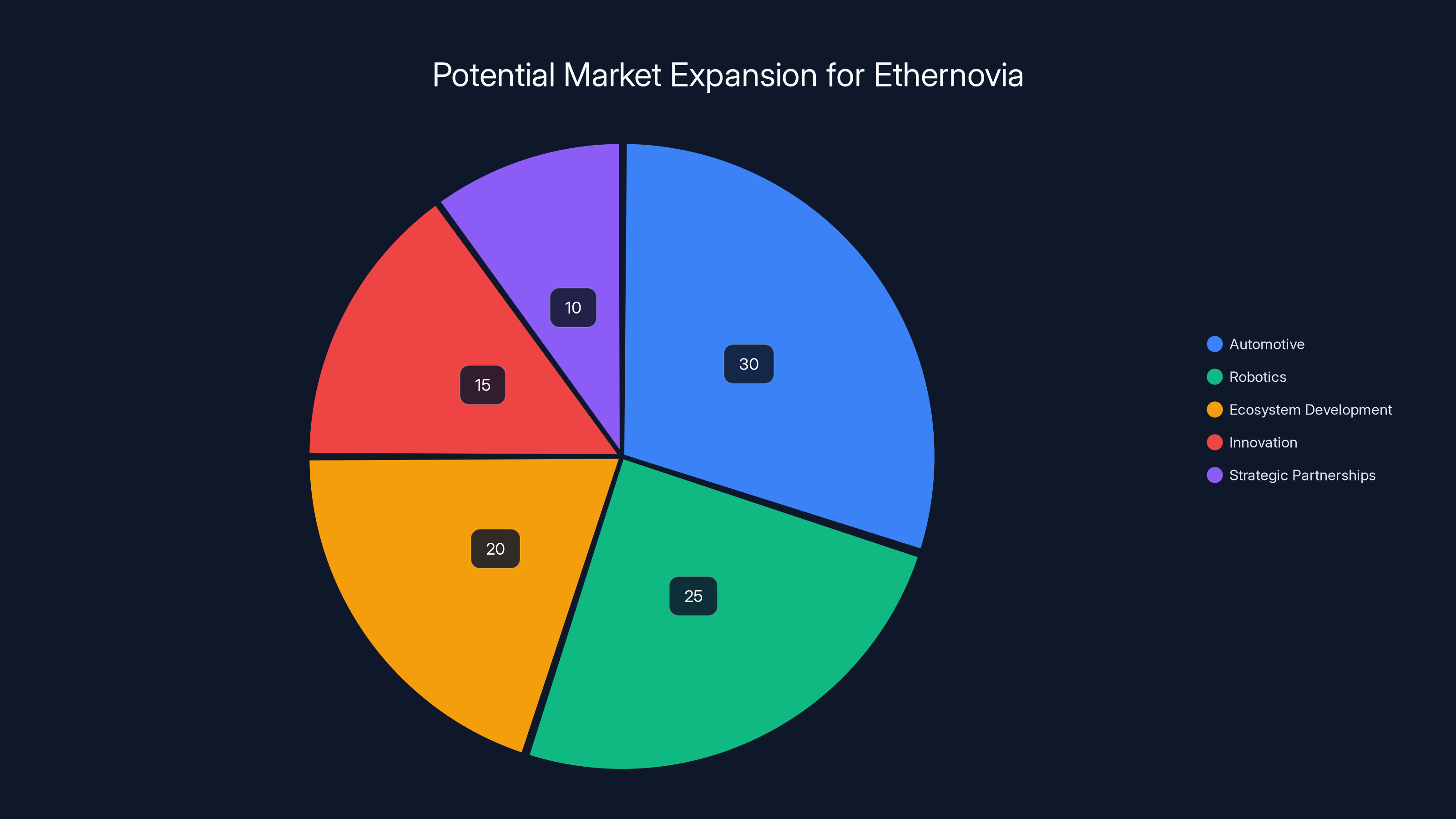

Estimated data shows that while automotive remains a significant focus, Ethernovia is diversifying into robotics and other industries, leveraging its Ethernet-based solutions.

The Broader Physical AI Funding Tsunami

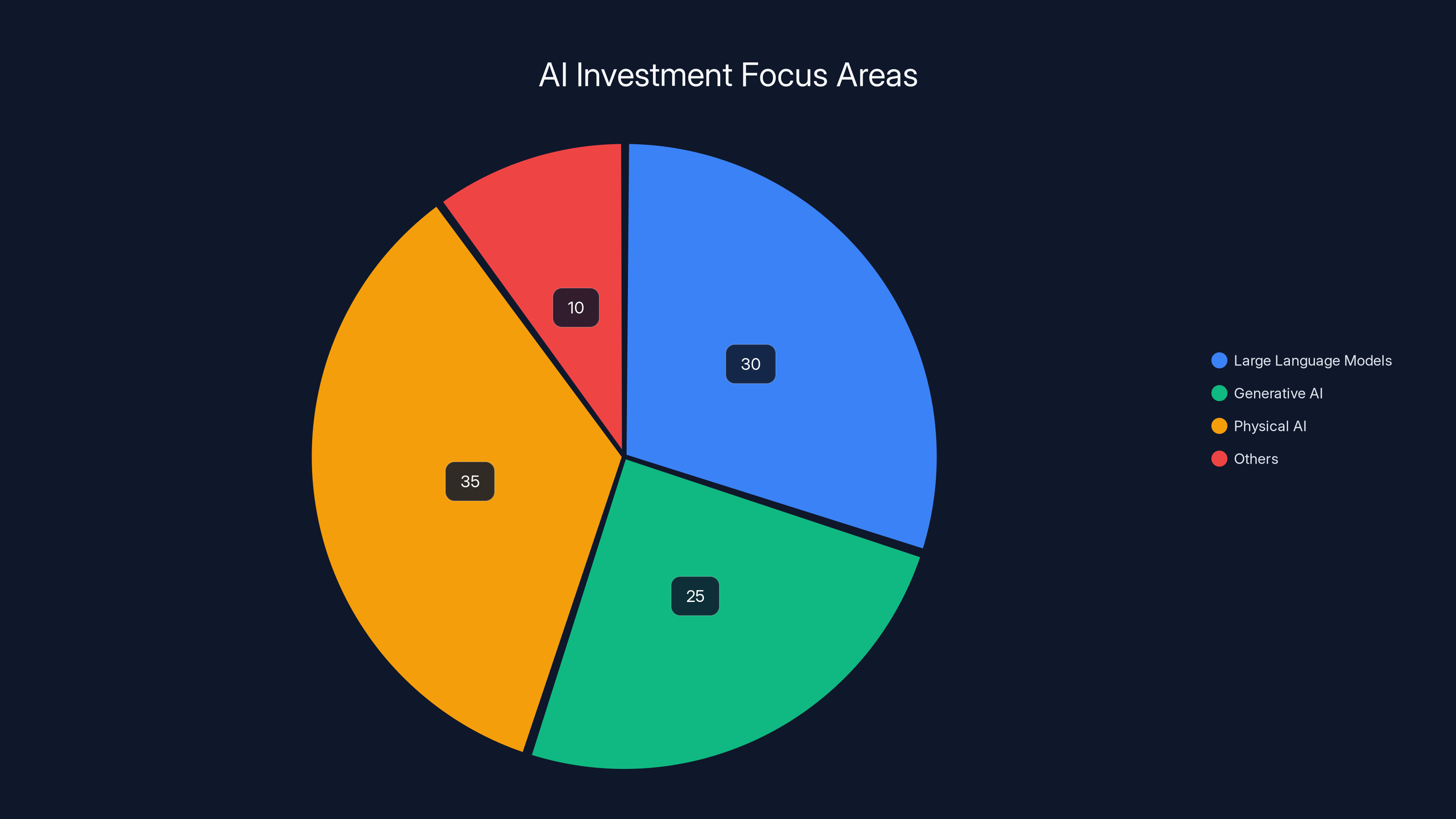

Ethernovia isn't an outlier. It's a signal of something much bigger happening in venture capital right now. For the past two years, AI funding has been dominated by large language models and generative AI applications. But that money has a limited number of places to go. There are only so many companies that can compete with Open AI and Anthropic at the frontier of large language models. So institutional capital is looking elsewhere.

Physical AI represents the most obvious "next frontier" for AI investment. Every trillion-dollar industry that involves moving physical goods or doing physical work can potentially be transformed by better perception, reasoning, and motor control. Manufacturing, logistics, agriculture, construction, healthcare, transportation. These are all massive markets where AI is currently underdeployed because the infrastructure doesn't exist yet.

The venture capital world is essentially asking: if AI transformed software, what happens when AI transforms the physical world? And the answer is: an enormous market opportunity. So the money is flowing to companies building the infrastructure that makes that possible.

You're seeing this across multiple categories. Companies building specialized chips for real-time processing. Companies making software stacks that let robotics teams build applications faster. Companies selling sensors and actuators. Companies handling the data and simulation needed to train physical AI systems. It's an entire ecosystem forming, and we're still in the very early innings.

Ethernovia's $90 million in this context is just one data point. But it's a significant one because it's coming from a tier-one hedge fund making their first venture bet specifically in this direction.

How Ethernet-Based Processing Actually Works (The Technical Reality)

If you're wondering how Ethernet-based processors actually handle the job of real-time sensor fusion, here's what's happening under the hood. Ethernet is fundamentally a networking protocol. It was designed to move data between computers quickly and reliably. Modern Ethernet can handle gigabits of throughput. In gigabit Ethernet, you can move about 125 megabytes of data per second. That's plenty for most sensor arrays.

The trick is timing. Regular Ethernet was designed for best-effort delivery. Your data might arrive in a few milliseconds or a few hundred milliseconds. For a robot or autonomous vehicle, that variance is unacceptable. You need to know that your data will arrive in a predictable time frame, usually measured in single-digit milliseconds.

That's where specialized processors come in. They implement what's called deterministic Ethernet. Various standards exist for this (TSN, AVB, and others), but the concept is the same: you reserve bandwidth for critical data paths, guarantee delivery times, and synchronize the whole system to a common clock. This turns Ethernet from a "best effort" network into a real-time bus suitable for controlling physical systems.

Ethernovia's approach is to build the processing capabilities directly into the Ethernet hardware. Instead of sending sensor data to a separate processor over Ethernet, you process the data as it flows through the network. This reduces latency and simplifies system architecture.

Consider a simple example: an autonomous vehicle with a forward-facing camera, a radar unit, and a lidar sensor. Each of these produces data at specific intervals. The camera might produce 30 frames per second. The radar might produce updates 10 times per second. The lidar might scan at 20 Hz. Your processing system needs to take the latest data from each sensor, fuse it into a coherent picture of the world, and make a decision about steering, acceleration, and braking. All of this needs to happen in under 100 milliseconds, ideally under 50 milliseconds.

With traditional cloud-based processing, you'd collect all the data, send it to the cloud, wait for processing, and send commands back. That's easily 500+ milliseconds of latency. Completely unacceptable for a moving vehicle.

With Ethernovia's approach, the processing happens as data flows through the network. The fusion algorithms run continuously. Decisions are made locally. Commands go to the actuators immediately. The whole loop closes in milliseconds instead of hundreds of milliseconds.

This is the fundamental advantage of edge processing in physical AI applications. Latency matters. Reliability matters. Traditional cloud processing can't guarantee either.

For most physical AI applications to work reliably, that equation needs to stay under 100 milliseconds, and often under 50 milliseconds. That's why the infrastructure matters so much.

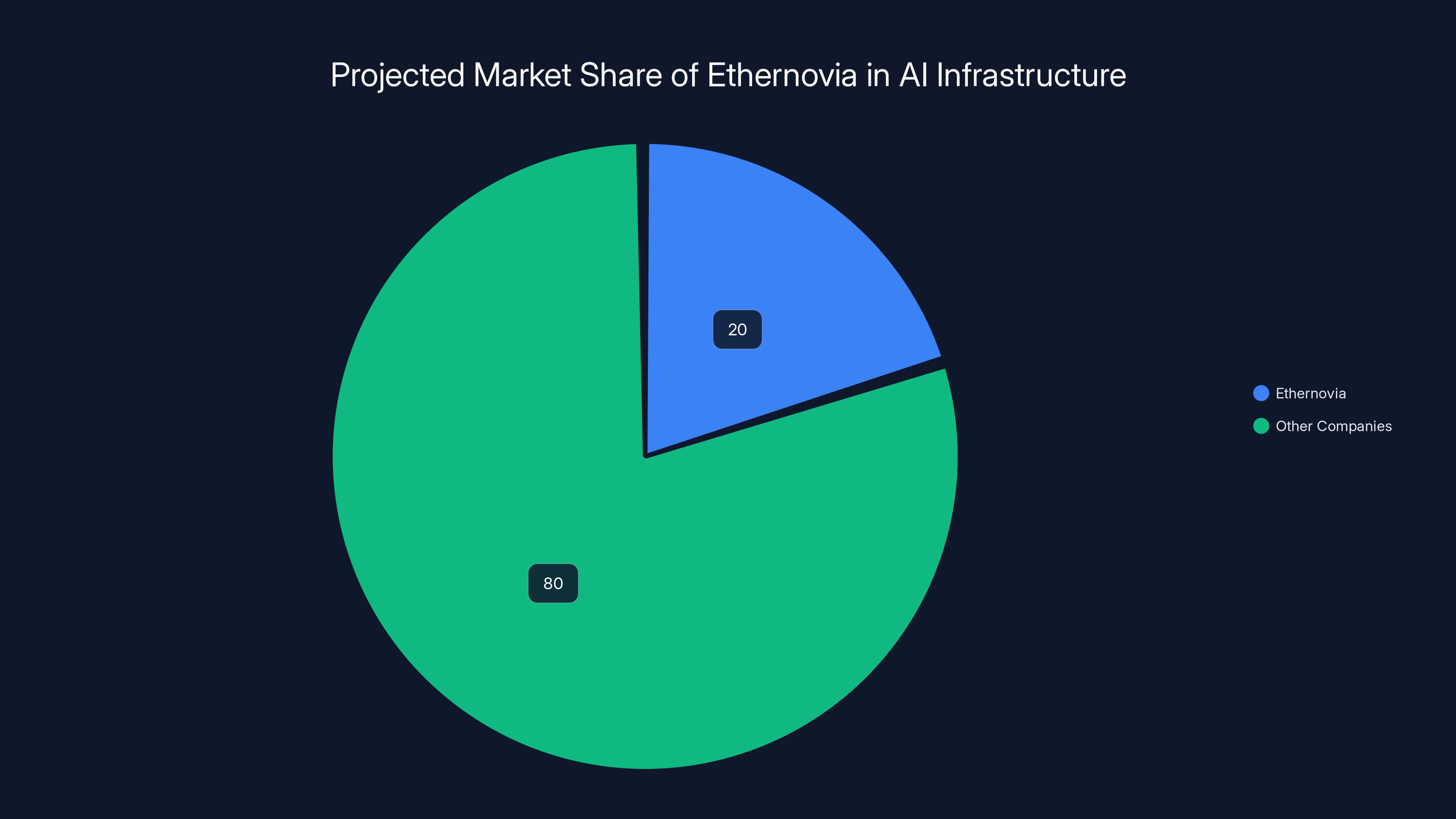

Ethernovia is projected to capture 20% of the AI infrastructure market by 2030, translating to $2 billion in revenue. Estimated data.

Why Automotive Giants Are Backing This

Porsche doesn't invest in random semiconductor startups. The fact that Porsche SE is backing Ethernovia tells you something about where automotive is heading. They're not betting on Ethernovia because they think the company will make a few million dollars. They're betting because they think Ethernovia's technology is going to become essential for the next generation of vehicles.

The automotive industry is in the middle of the biggest transformation in its 130-year history. Every major car company is building electric vehicles. Every major car company is racing toward autonomous driving. Neither of these is possible without the kind of real-time sensor processing that companies like Ethernovia provide.

Electric vehicles have different power and cooling constraints than traditional cars. They need to manage battery power carefully. Autonomous vehicles need to process massive amounts of sensor data. Both of these challenges require efficient, specialized processing. This is exactly where Ethernet-based processors have an advantage. They're more power-efficient than traditional approaches because they eliminate unnecessary copying and processing of data.

Qualcomm Ventures backing also tells you something important. Qualcomm makes processors. They could theoretically build Ethernet-based processing themselves. But they're investing in Ethernovia instead, which suggests they see a complementary opportunity. Qualcomm likely wants to integrate Ethernovia's approach into their own automotive chips, or they want to ensure they have a relationship with Ethernovia as a key supplier. Either way, it signals that Qualcomm thinks Ethernovia's technology is going to matter.

The automotive industry moves slowly. Decisions made today affect vehicles that will be on the road in five to ten years. The fact that major automotive players are committing capital to Ethernovia now suggests they've already decided that this technology is going to be necessary. Which means they've probably already decided on Ethernovia as a partner for upcoming vehicle platforms. That's not guaranteed, but it's a strong signal.

The Robotics Angle: Where Physical AI Becomes Really Valuable

While autonomous vehicles are the obvious application for real-time sensor processing, robotics is where the economics get really interesting. A self-driving car is valuable because it can transport humans or goods. But a robot is valuable because it can do work that humans currently do, which means it's competing against human wages. That's a much bigger market.

Consider what's happening in warehouse robotics right now. Companies like Amazon have millions of workers in fulfillment centers. These jobs are labor-intensive, repetitive, and face constant pressure from wage increases and labor shortages. A robot that can reliably pick items from shelves, pack them, and move them could save a company millions of dollars per year per facility. If you have hundreds of facilities, that's billions in potential savings.

But here's the catch: those robots need to work in dynamic environments. Shelves are packed differently every day. Items vary in size, shape, fragility, and texture. Other robots and humans are moving around. The robot needs to perceive all of this, reason about it, and act appropriately. All in real time. All reliably enough that you can trust it with your most valuable inventory.

That requires infrastructure. Specifically, infrastructure that lets the robot process visual data, understand its environment, and make decisions about what to grab and how to grab it. The robot needs to sense its gripper's position, feel when it's gripping an object correctly, and adjust if something goes wrong. All of this is computationally intensive and latency-sensitive.

Ethernovia's technology makes this cheaper and more feasible. Instead of building custom silicon for every robotics application, you use standardized Ethernet-based processing. This brings costs down. It makes integration easier. It lets robotics companies focus on the hard problems (understanding what to grab, figuring out how to grab it) instead of the infrastructure problems (how do I get data from my sensors to my processor fast enough).

This is where the market really opens up. Automotive is huge. But robotics across all industries (manufacturing, logistics, agriculture, healthcare, construction) is potentially bigger. And the infrastructure requirements are similar. This is why investors are excited about companies like Ethernovia. They're not just solving for autonomous vehicles. They're solving for an entire ecosystem of physical AI applications.

Estimated data suggests Ethernovia should diversify its focus with 30% on automotive, 25% on robotics, and 20% on ecosystem development to scale effectively.

How the Funding Landscape Has Shifted in 24 Months

To understand why a $90 million funding round for an infrastructure company matters, you need to understand how AI funding has evolved over the past couple of years. In 2023 and early 2024, venture capital was obsessed with large language models and generative AI applications. Every fund wanted to find the next Open AI. Every entrepreneur wanted to build an LLM or a wrapper around an LLM. Billions of dollars flowed into these categories.

But as the dust settled, investors realized something important: there are only so many ways to win in the LLM space. If you're not one of the top few companies (Open AI, Anthropic, Google, etc.), you're going to have a hard time competing. The winner-take-most dynamics are brutal. Most LLM startups are going to struggle or fail. The venture capitalists who bet big on LLMs are going to have a rough time with returns.

Meanwhile, the broader world looked around and realized: there's this massive opportunity in physical AI that nobody's really talking about. Sure, everyone knew robotics was a big market. But robotics had been stuck at the same level of sophistication for years. What changed is that AI got good enough to make robotics actually work at scale. And the realization is happening slowly, but it's happening.

Venture capital hates being late to trends. So you're seeing a pivot. The same funds that were betting on LLM startups are now looking for infrastructure plays in physical AI. They're backing companies building chips, software stacks, simulation tools, and anything else that enables physical AI. Maverick Capital creating a dedicated AI infrastructure fund is emblematic of this shift. It's the sign that serious money is starting to move in this direction.

The competition for deals in this space is starting to heat up. If you're building something fundamental that physical AI applications need, you have multiple funds ready to back you. That's good if you're the founder of Ethernovia. It's less good if you're a later-stage investor trying to find the next big thing, because valuations are climbing quickly.

The Competitive Landscape: Who Else Is Solving This Problem

Ethernovia isn't alone in this space, though they're further along than many competitors. Several other companies are working on real-time sensor processing and edge AI infrastructure.

On the chip side, you have traditional semiconductor companies like Nvidia building edge processors for robotics and autonomous vehicles. Nvidia's advantage is massive resources and an established customer base. Their disadvantage is that they're building general-purpose processors, not specifically optimized for deterministic real-time processing. Specialized companies like Ethernovia can potentially outperform Nvidia in specific applications because they're laser-focused on the latency problem.

You also have companies like Qualcomm, NXP, and Texas Instruments building automotive-grade processors. These companies have deep relationships with car makers and decades of experience in real-time systems. Their advantage is that they already have the trust and specifications embedded in vehicle designs. Their disadvantage is that they move slowly, and they're optimizing for yesterday's requirements, not tomorrow's.

On the software side, you have platforms like ROS (Robot Operating System) and specialized robotics platforms from companies like Boston Dynamics. These provide the algorithm and application layer. But they still need infrastructure to run on. That's where Ethernovia fits.

The competitive advantage for Ethernovia comes from focus and timing. They're focused on one specific problem: real-time sensor data processing. They're not trying to build the perfect general-purpose processor for everything. And they're timing their expansion into robotics at exactly the moment when robotics startups are scaling up and need reliable infrastructure.

One more thing to consider: there might not be room in this market for dozens of competitors. Sensor processing is foundational infrastructure. If Ethernovia becomes the standard, similar to how Nvidia became the standard for GPU computing, then Ethernovia wins big and competitors get squeezed. If the market fragments, then multiple companies survive. Right now, it's unclear which way this goes. But the fact that Ethernovia has first-mover advantage and major backing suggests they're in a good position to set the standard.

Physical AI is gaining traction, capturing an estimated 35% of AI venture capital as investors seek new opportunities beyond traditional AI sectors. (Estimated data)

What This Funding Round Means for the Broader Market

A $90 million Series B is significant, but it's not transformative for the venture capital world. Thousands of startups raise Series B funding every year. What makes this one interesting is what it signals about where capital is moving.

First, it signals that investors believe physical AI infrastructure is going to be a massive market. You don't write $90 million checks to niche suppliers. You write them when you believe the addressable market is huge. If investors thought Ethernovia was just going to be a supplier to a few automotive companies, they'd be sizing rounds smaller, or they'd be waiting for clearer market signals before committing this much capital.

Second, it signals that the infrastructure play is starting to separate from the application play. For years, robotics startups built their own processing infrastructure because nothing suitable existed. Now, as robotics startups scale, they're starting to use standardized infrastructure. This creates a flywheel where infrastructure companies benefit from scale, which allows them to invest more in improving their offerings, which makes them more attractive to the next set of robotics companies. Ethernovia is getting to the point where they can benefit from this flywheel.

Third, it signals that the automotive industry has already made decisions about what it needs. The backing from Porsche and Qualcomm Ventures suggests that major car makers have already looked at the options and concluded that real-time Ethernet-based processing is the way to go. Which means Ethernovia is probably already locked into some major design wins. The Series B is less about funding speculative R&D and more about scaling to meet demand that's already committed.

Fourth, it's a signal to the rest of the venture capital community that AI infrastructure, not AI applications, is where the money should flow. This will likely accelerate investment in other infrastructure plays. Companies making sensors, actuators, simulation software, data management platforms, and anything else that enables physical AI applications will start to see more attention from investors.

The Path to Scale: What Ethernovia Needs to Do Next

Ethernovia now has $90 million in new capital and probably significant existing revenue from automotive customers. The question is how they use that capital to become a much bigger company.

First, they need to expand beyond automotive. Automotive is a great anchor customer (cars are high-value, you only need to sell to a few OEMs, and they're committed for vehicle life cycles). But it's also constraining. Automotive moves slowly. Design cycles are long. Regulatory requirements are strict. If Ethernovia's success is entirely dependent on automotive, they're limited to how fast they can grow.

Robotics is the obvious expansion point. Robotics startups are moving faster than auto companies. They're more willing to experiment with new technology. And the robotics market is vast. Industrial robotics, collaborative robots, warehouse robots, delivery robots, surgical robots, inspection drones. Each of these is a substantial market, and each of these needs real-time processing infrastructure.

Second, they need to build an ecosystem around their technology. Chip companies don't win by selling chips. They win by enabling an entire ecosystem of application developers. Nvidia did this with CUDA and the AI developer community. Intel did this with x 86 and PCs. Ethernovia needs to do something similar. They need tools, libraries, software, documentation, and community that makes it easy for robotics companies to use Ethernovia's hardware. That's where a lot of the Series B capital will likely go.

Third, they need to stay ahead of the curve on innovation. Real-time processing is a competitive battleground. As other companies enter the space, Ethernovia needs to keep improving performance, reducing power consumption, and simplifying integration. Standing still means getting displaced. Moving fast means staying ahead.

Fourth, they probably need to consider strategic partnerships or acquisitions. There are complementary technologies and markets that Ethernovia could expand into. Software for sensor fusion, simulation tools for testing robotic systems, integration services for helping customers deploy solutions. They might build some of this themselves. They might acquire companies that already have it. Either way, they need to evolve from a processor company into a platform company.

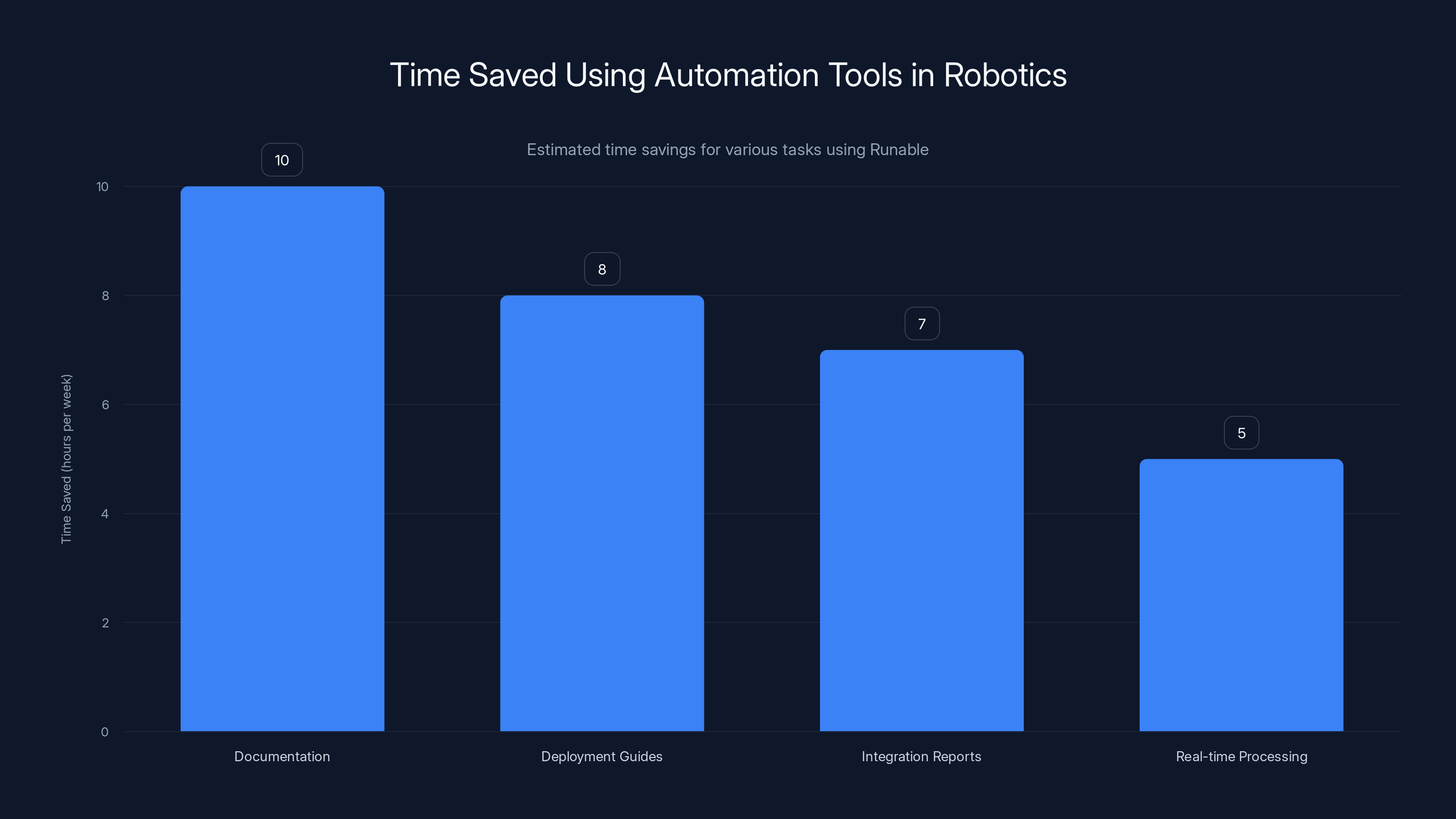

Using Runable can save robotics teams an estimated 30 hours per week across various tasks, allowing engineers to focus more on core challenges. Estimated data.

The Risk Factors Nobody Talks About

While the Physical AI opportunity is real and the funding is flowing, there are significant risks that could derail this narrative.

First, the robotics market could develop more slowly than investors expect. Robotics has been "the next big thing" for decades. Self-driving cars have been "coming soon" since 2015. It's possible that technical challenges prove harder to overcome than expected, or that economic conditions make it harder for customers to justify big capital investments in robotic systems. If the growth timeline slips by five to ten years, then Ethernovia's Series B investors are going to have a long wait for returns.

Second, the incumbent players could move faster than expected. Nvidia, Qualcomm, and other major semiconductor companies have vastly more resources than Ethernovia. They could decide to make real-time sensor processing a priority and invest heavily to catch up or surpass Ethernovia. Once that happens, Ethernovia's advantages disappear. Being an early mover is valuable only if incumbents move slowly. If they don't, being small and specialized becomes a disadvantage.

Third, open-source alternatives could emerge. If someone builds good-enough real-time processing software as an open-source project, it could reduce the value of proprietary solutions like Ethernovia's. This is less of a risk than it seems (proprietary advantages in hardware are more durable than in software), but it's worth considering.

Fourth, the regulatory environment could change in ways that benefit or harm Ethernovia. Autonomous vehicles are heavily regulated. If regulatory requirements shift, that could impact what hardware automotive companies need. Similarly, if robotics gets regulated heavily, that could slow adoption. Regulation is inherently unpredictable, which makes regulatory risk a permanent factor in the physical AI space.

Fifth, there's the talent risk. Ethernovia needs to hire world-class engineers in real-time systems, sensor fusion, and robotics. These people are in high demand. Paying them competitive salaries is expensive. If Ethernovia can't attract and retain top talent, their technology will fall behind quickly. For a company at Ethernovia's stage, talent is the primary risk factor.

The Macro Trend: Why Now, Why Physical AI

So why is all this happening now? Why didn't investors fund Physical AI companies five years ago? The answer has multiple parts.

First, AI algorithms got better. Over the past five years, computer vision, sensor fusion, and reinforcement learning all improved dramatically. Robots trained with modern AI techniques can do things that weren't possible a few years ago. This makes the market opportunity much larger.

Second, AI hardware got more capable. More powerful edge processors, better power efficiency, specialized processors for specific tasks. This makes it feasible to run sophisticated AI algorithms on robots and vehicles instead of requiring cloud processing.

Third, software tools matured. Libraries for sensor fusion, simulation tools for testing robotics systems, middleware that abstracts hardware differences. These tools didn't exist or weren't mature five years ago. Now they're at a level where you can actually build reliable systems with reasonable development effort.

Fourth, there's market pressure. Labor costs are rising. Supply chains are getting disrupted. Robots are starting to look economically viable compared to hiring workers. This creates customer demand. Where there's demand, venture capital appears.

Fifth, capital is chasing the next big thing. AI in the cloud is starting to look mature. Growth rates are slowing. Returns are compressing. Investors are looking for the next frontier. Physical AI is that frontier.

All of these factors together create the conditions for a massive funding wave in Physical AI infrastructure. Ethernovia is early, but they're not alone. Expect to see dozens more companies in this space raise funding over the next 12 to 24 months.

Looking Forward: The Next Five Years

If you're trying to predict what Physical AI infrastructure looks like in 2030, here's a few things to expect.

First, real-time sensor processing becomes table stakes. By 2030, every autonomous vehicle and most commercial robots will have deterministic real-time processing as a core capability. This won't be a differentiator anymore. It will be expected.

Second, the market consolidates. There will be a few dominant players in real-time processing hardware, maybe two to three depending on the market segment. Ethernovia could be one of them. Or they could get acquired by a larger company. Or they could fail to scale and get displaced. Right now, it's open.

Third, the stack becomes more integrated. Right now, real-time processing is relatively separate from AI training and cloud connectivity. Over time, you'll see more integration. Your robot processes data locally in real time, but also sends data to the cloud for training and learning. The infrastructure to connect these will become more mature.

Fourth, power consumption becomes the limiting factor. As robotics and autonomous vehicles scale to billions of units, power consumption becomes a major concern. Companies that figure out how to do real-time processing with minimal power will have a huge advantage. This favors specialists like Ethernovia over generalists like Nvidia.

Fifth, the software ecosystem matures significantly. Right now, building a robot or autonomous vehicle requires deep understanding of the hardware and software layers. In five years, there will be high-level tools and libraries that abstract away these details. This will enable more entrepreneurs to build Physical AI applications, which will increase demand for infrastructure.

The bottom line: the Ethernovia funding is just the beginning. Over the next five years, you're going to see enormous capital flow into Physical AI infrastructure. Some of that capital will be wasted on bad bets. But some of it will create genuinely valuable companies. Ethernovia, with their Series B backing and their early-mover advantage, is in a position to be one of the winners. But nothing is guaranteed.

Runable: Automating the Automation Infrastructure

If you're building robotics or autonomous systems, you're going to need to manage a lot of infrastructure complexity. Real-time sensor processing is just one piece. You also need to manage configuration, monitoring, logging, and deployment. This is where automation tools become essential.

Runable offers AI-powered automation for documentation, reports, and workflow generation that can significantly streamline how robotics teams manage infrastructure complexity. For instance, instead of spending hours writing deployment documentation or system reports, you can use Runable to auto-generate these based on your system configuration. This is particularly valuable for Physical AI companies scaling rapidly.

Since robotics and autonomous vehicle teams are often under time pressure to integrate new hardware and refine their systems, using automation tools like Runable ($9/month) can save significant engineering hours that are better spent on core robotics challenges.

Use Case: Robotics teams can auto-generate system documentation, deployment guides, and integration reports in minutes, freeing engineers to focus on real-time processing optimization.

Try Runable For Free

The Economic Math: Why Physical AI Infrastructure Works

For investors, the appeal of physical AI infrastructure comes down to economics. Let's do some basic math.

Assume the global robotics market reaches

Now, infrastructure businesses typically have better margins than applications. Gross margins of 70-80% are not uncommon. Operating margins of 30-40% are achievable for mature, well-run companies. So

But this requires Ethernovia to:

- Successfully expand beyond automotive into broader robotics markets

- Maintain technical advantages against larger competitors

- Build a software ecosystem that makes their hardware valuable

- Scale manufacturing to meet demand

- Execute well on sales and partnerships

Each of these is non-trivial. But if Ethernovia pulls it off, the returns for Series B investors will be massive. This is why serious investors are willing to fund the company.

What Customers Actually Need (Beyond the Tech)

There's a gap between what companies like Ethernovia build and what customers actually need. This gap is where real opportunities lie.

Beyond the processor itself, robotics and autonomous vehicle teams need:

Integration support. Taking your existing sensor and actuator hardware and making it work with Ethernovia's processor requires engineering work. Companies that can do this smoothly gain market share.

Software tools. Easy-to-use libraries, simulation environments, debugging tools. These make it fast and cheap to build applications on top of the hardware.

Technical support. When something goes wrong (and it will), you need expert help diagnosing the issue. Companies that provide good technical support retain customers.

Community. Developers want to learn from each other. Companies that foster active developer communities gain momentum.

Standards and certifications. If you're building safety-critical systems (autonomous vehicles, surgical robots), you need hardware that's certified to relevant standards. This is expensive to achieve but becomes a moat once you have it.

Ethernovia can't do all of this themselves. They'll need partners. System integrators, software vendors, consultants. The ecosystem around Ethernovia might be as valuable as Ethernovia itself. This is something investors will be watching closely over the next few years.

The Broader Implications for Innovation

What's happening with Ethernovia and Physical AI reflects a broader pattern in how innovation works. The entrepreneurs who get massive funding aren't necessarily building the consumer-facing products. They're building the infrastructure that enables other companies to build products.

This has huge implications for where you should focus your attention if you're thinking about the future. The obvious bets (self-driving cars, humanoid robots) are getting saturated with funding and attention. But the infrastructure enabling those bets is still wide open. There are companies being founded right now that will become the picks-and-shovels providers for Physical AI. These companies will likely outperform the flashier application companies.

For entrepreneurs, this means: if you're thinking about starting a company in the Physical AI space, don't build another robot company. Build infrastructure that robot companies need. You'll have less competition, better unit economics, and a more defensible moat.

For investors, this means: look for the boring infrastructure plays, not the flashy applications. Infrastructure companies have better margins, longer customer lifespans, and more predictable revenue. This is where the best returns come from.

For everyone else, this means: understand the infrastructure layer of Physical AI. These are the companies that will power the robotics revolution, even if they never make the news the way a cool robot does.

Making Sense of the Hype

When you read about Physical AI, it's easy to get caught up in the hype. Robots are cool. Autonomous vehicles are cool. Billions of dollars flowing into these areas create a sense of inevitability. But it's important to separate the hype from the reality.

The reality is: real-time sensor processing is a genuine technical challenge that needs to be solved. Companies like Ethernovia are solving it. The capital flowing into this space is rational because the market opportunity is genuinely large.

The hype is: everything moving faster than it actually will, timelines being off by years, applications being more capable than they actually are.

Historically, infrastructure plays end up being more valuable than the hyped applications, because they're less crowded and have more durable advantages. But they also require patience. You don't get the exciting announcements and headlines that application companies get. You just get steady progress, revenue growth, and profit expansion.

This is why Maverick Silicon's decision to create an infrastructure-focused fund is significant. Serious money is starting to move away from the hype and toward the infrastructure reality. Over the next five years, this trend will likely continue. The companies winning in this space will be the ones that focus on real problems and real customer needs, not on sounding cool.

Conclusion: Infrastructure Powers Everything

The Ethernovia Series B is significant not because Ethernovia is getting $90 million (that happens regularly), but because it signals a shift in where capital thinks the value is. For the past couple of years, AI funding has been concentrated on large language models and consumer applications. That's beginning to change. Capital is realizing that the much larger opportunity is in physical systems: robots, autonomous vehicles, and everything in between.

But here's the thing that matters for you: physical systems need infrastructure. They need processors that handle real-time sensor fusion. They need software stacks that abstract away complexity. They need standards and tools that let developers focus on the applications, not the plumbing. This is where Ethernovia fits, and this is why they're attracting massive funding.

Over the next five years, expect more companies like Ethernovia to raise large funding rounds. Expect the venture capital community to pour billions into Physical AI infrastructure. And expect the long-term winners to be companies that solve the unsexy infrastructure problems, not the flashy application companies that everyone is talking about.

If you're trying to understand where technology is actually going (as opposed to where the hype says it's going), focus on infrastructure. That's where the real value gets created. That's where the most interesting problems need to be solved. And that's where the best businesses will be built.

The robotics revolution is coming. But first, we need to build the infrastructure to make it possible. Ethernovia and companies like them are doing exactly that.

FAQ

What is Physical AI and how is it different from regular AI?

Physical AI refers to AI systems that perceive and operate in the real world with actual robots, autonomous vehicles, and other physical devices. Unlike regular AI like Chat GPT that processes text in data centers, Physical AI requires real-time processing of sensor data, making split-second decisions, and controlling physical actuators in actual environments. The key difference is that Physical AI can't tolerate the latency and delays of cloud processing because actions need to happen immediately in response to physical world changes.

Why do physical AI systems need specialized processors like Ethernovia's?

Physical AI systems need specialized processors because they require deterministic real-time performance. When an autonomous vehicle or robot collects data from dozens of sensors simultaneously, that data needs to be processed and decisions made within milliseconds, not seconds. Traditional cloud-based processing introduces too much latency. Ethernovia's Ethernet-based processors handle sensor fusion locally with guaranteed timing, enabling systems to react quickly and safely. This specialized approach is more power-efficient and reliable than general-purpose processors for these specific real-time requirements.

What are the main applications driving Physical AI adoption right now?

Autonomous vehicles and industrial robotics are the primary drivers of Physical AI adoption. In autonomous vehicles, real-time sensor processing enables vehicles to understand their surroundings and make driving decisions instantly. In industrial robotics, it enables robots to perceive objects, understand task requirements, and perform complex manipulation safely alongside humans. Other applications include warehouse automation, surgical robots, agricultural drones, and delivery robots. Each of these applications requires infrastructure that can process sensor data quickly and reliably in real-world environments.

How much of the robotics market depends on infrastructure companies like Ethernovia?

Infrastructure companies like Ethernovia provide foundational technology that virtually all physical AI systems need. While the robotics market is projected to reach

What makes Ethernovia's approach better than alternatives from companies like Nvidia or Qualcomm?

Ethernovia's focus on Ethernet-based deterministic processing gives them specific advantages in real-time latency guarantees and power efficiency. While Nvidia builds general-purpose processors suitable for various applications, Ethernovia specializes in sensor fusion and real-time control specifically. Qualcomm and other incumbents have established relationships with automotive companies but move slowly due to their size and legacy commitments. Ethernovia's advantage is focus and agility, though this advantage is durable only if they execute well and larger competitors don't make this a priority. Early-mover advantage matters significantly in infrastructure.

How long before Physical AI becomes mainstream in consumer robotics and autonomous vehicles?

The timeline varies by application. Autonomous vehicles are likely to see significant deployment over the next 5-10 years, though widespread consumer adoption may take longer. Industrial and commercial robotics will likely see faster adoption because the economics work immediately in high-labor-cost applications. Robots in warehouses, factories, and logistics are likely to scale rapidly once they prove cost-effective. Consumer robotics adoption will be slower, perhaps 10-15 years out. The infrastructure being built now by companies like Ethernovia will be essential for all of these, regardless of timing.

What risks could derail the Physical AI funding wave?

Several risks could impact Physical AI adoption. First, technical challenges might prove harder than expected, slowing down applications beyond the current timeline. Second, incumbent companies like Nvidia could move faster than expected and dominate the market. Third, the economics of deploying robotics at scale might be worse than anticipated, reducing customer demand. Fourth, regulatory changes could impact autonomous vehicles and robotics deployment. Fifth, the venture capital cycle could shift away from physical AI before returns materialize. Infrastructure companies succeed only if the applications they enable actually get built at scale.

How should I evaluate Physical AI infrastructure companies as potential investments or customers?

Focus on three key areas: technical depth of the team (talent is the limiting factor), clarity of customer traction (are real companies actually using the technology), and ecosystem strength (are partners building tools and integrations around the platform). Be skeptical of companies that sound great on paper but haven't proven they can attract and retain world-class engineers. Pay attention to whether major customers have committed to the technology through design wins or long-term contracts. Look at the software ecosystem developing around the infrastructure. Finally, consider whether the company can scale manufacturing to meet demand without becoming bottlenecked by supply chain constraints.

Key Takeaways

- Ethernovia's $90M Series B signals venture capital is shifting from AI applications to Physical AI infrastructure

- Real-time sensor processing is a genuine technical challenge essential for autonomous vehicles and robotics to operate reliably

- Infrastructure companies solving physical AI problems have better margins and more defensible competitive advantages than application companies

- The robotics and autonomous vehicle markets are projected to exceed $300B combined by 2030, creating enormous infrastructure opportunities

- Early-mover companies like Ethernovia that establish ecosystem standards could capture significant long-term value

Related Articles

- Humans&: The $480M AI Startup Redefining Human-Centric AI [2025]

- Emergent Raises $70M Series B: Inside the AI Vibe-Coding Boom [2025]

- OpenAI's 2026 'Practical Adoption' Strategy: Closing the AI Gap [2025]

- 55 US AI Startups That Raised $100M+ in 2025: Complete Analysis

- Why Agentic AI Pilots Stall & How to Fix Them [2025]

- Silicon Valley's Real Exodus: Why the Wealth Tax Terrifies Founders [2025]

![Physical AI: The $90M Ethernovia Bet Reshaping Robotics [2025]](https://tryrunable.com/blog/physical-ai-the-90m-ethernovia-bet-reshaping-robotics-2025/image-1-1768941591224.jpg)