Amazon's 16,000 Job Cuts: What It Means for AWS, Tech Workers, and Enterprise Cloud

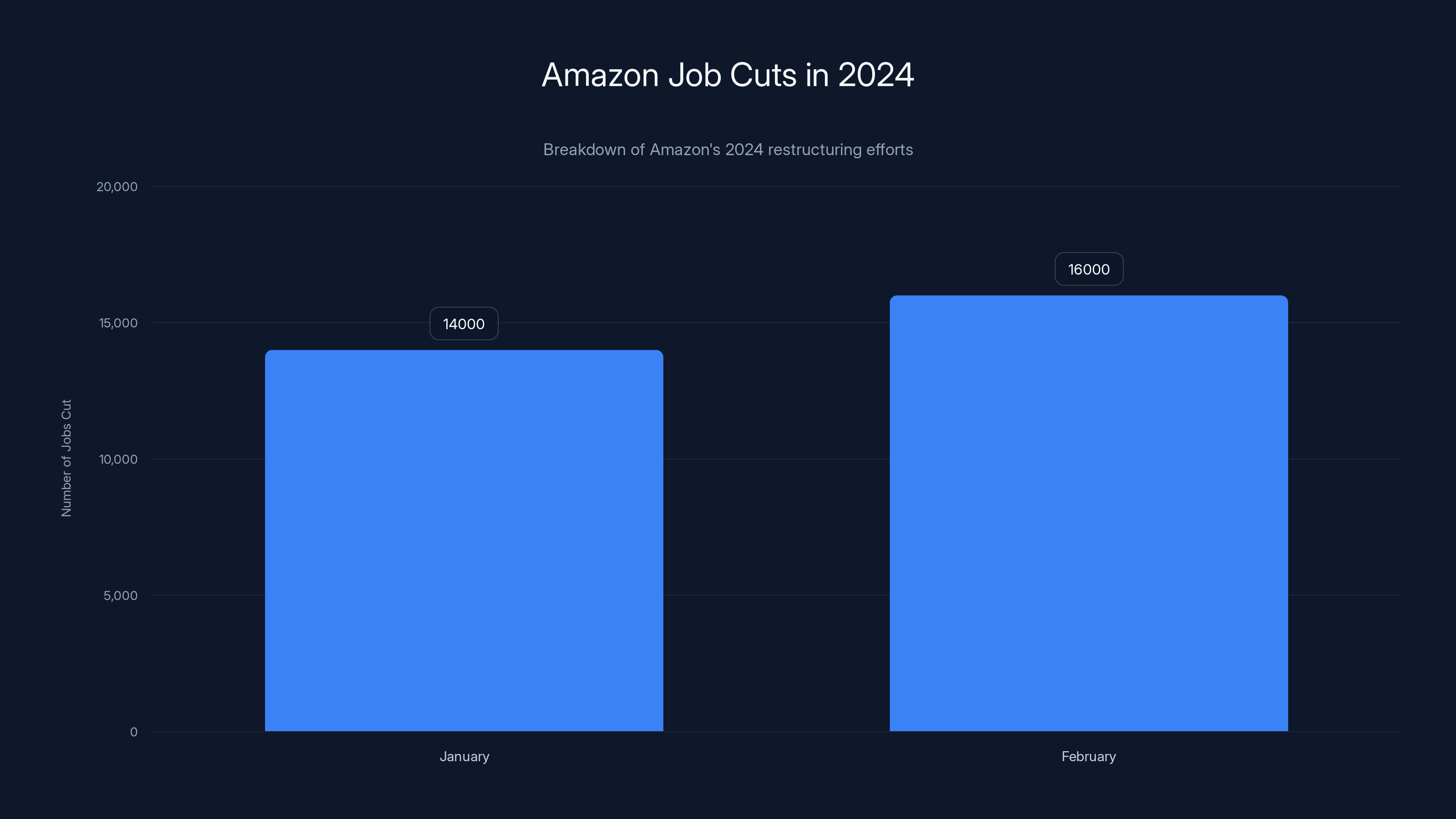

When Amazon's Senior Vice President of People Experience and Technology Beth Galetti hit send on that email to employees, the shockwave was immediate. Another 16,000 jobs eliminated globally. On top of the 14,000 cuts in October. That's 30,000 positions gone in less than six months.

This isn't your typical "economic adjustment." This is Amazon declaring war on its own organizational structure.

The company's justification sounds clean in a memo: "reducing layers, increasing ownership, and removing bureaucracy." But what does that actually mean? And more importantly, what does it signal about the state of Big Tech, enterprise cloud infrastructure, and the future of remote work?

I've spent the last decade watching tech companies reshape themselves during boom-and-bust cycles. Amazon's latest restructuring is different. It's bigger, more aggressive, and targets AWS specifically, the business that generates roughly $90 billion in annual revenue—the profit engine that keeps the entire company running.

Let's break down what's happening, why it matters, and what it means for the thousands of affected workers and the future of cloud computing.

TL; DR

- 30,000 total layoffs: Amazon cut 14,000 in October and announced 16,000 more, totaling 30,000 positions in six months

- AWS heavily impacted: Cloud division faces significant restructuring as Amazon prioritizes efficiency over expansion

- "Project Dawn" codename: Internal restructuring plan targeting around 30,000 jobs with potential rounds continuing through May 2026

- Affected workers get options: 90-day period to reapply internally, severance packages, health insurance extension, and job placement support

- Strategic pivot: Amazon framing cuts as organizational optimization to reduce management layers and increase individual ownership and accountability

Amazon announced a total of 30,000 job cuts in 2024, with 14,000 in January and 16,000 in February as part of Project Dawn.

Understanding Amazon's Massive Restructuring: The Context You Need

Amazon didn't wake up one morning and decide to cut 30,000 people. This is methodical. This is planned. And if you want to understand what's happening, you need to understand the past three years of tech industry chaos.

Back in 2021 and 2022, tech companies were hiring like their lives depended on it. Amazon, Meta, Google, Microsoft—they all hired thousands of engineers, sales professionals, support staff. The assumption was simple: growth goes up, revenue goes up, we need more people. But that assumption turned out to be spectacularly wrong.

By late 2022, the interest rate hikes started hitting. Cloud adoption slowed. Customer spending plateaued. And Amazon—which had hired over 200,000 people in two years—suddenly realized it had a bloated organization.

That's when the cuts started. October 2022 saw 10,000 positions eliminated. Then 8,000 more in early 2023. Then 9,000 in August 2023. Each round was framed as a "correction." Each round was painful. But nothing prepared anyone for the scale of what came next.

The January 2024 announcement of 14,000 cuts signaled something different. Amazon wasn't just trimming fat anymore. It was restructuring its entire organizational DNA. And the February 2024 announcement of 16,000 more cuts proves this is systematic, not reactive.

The real story isn't the numbers themselves. It's what the numbers reveal about Amazon's priorities.

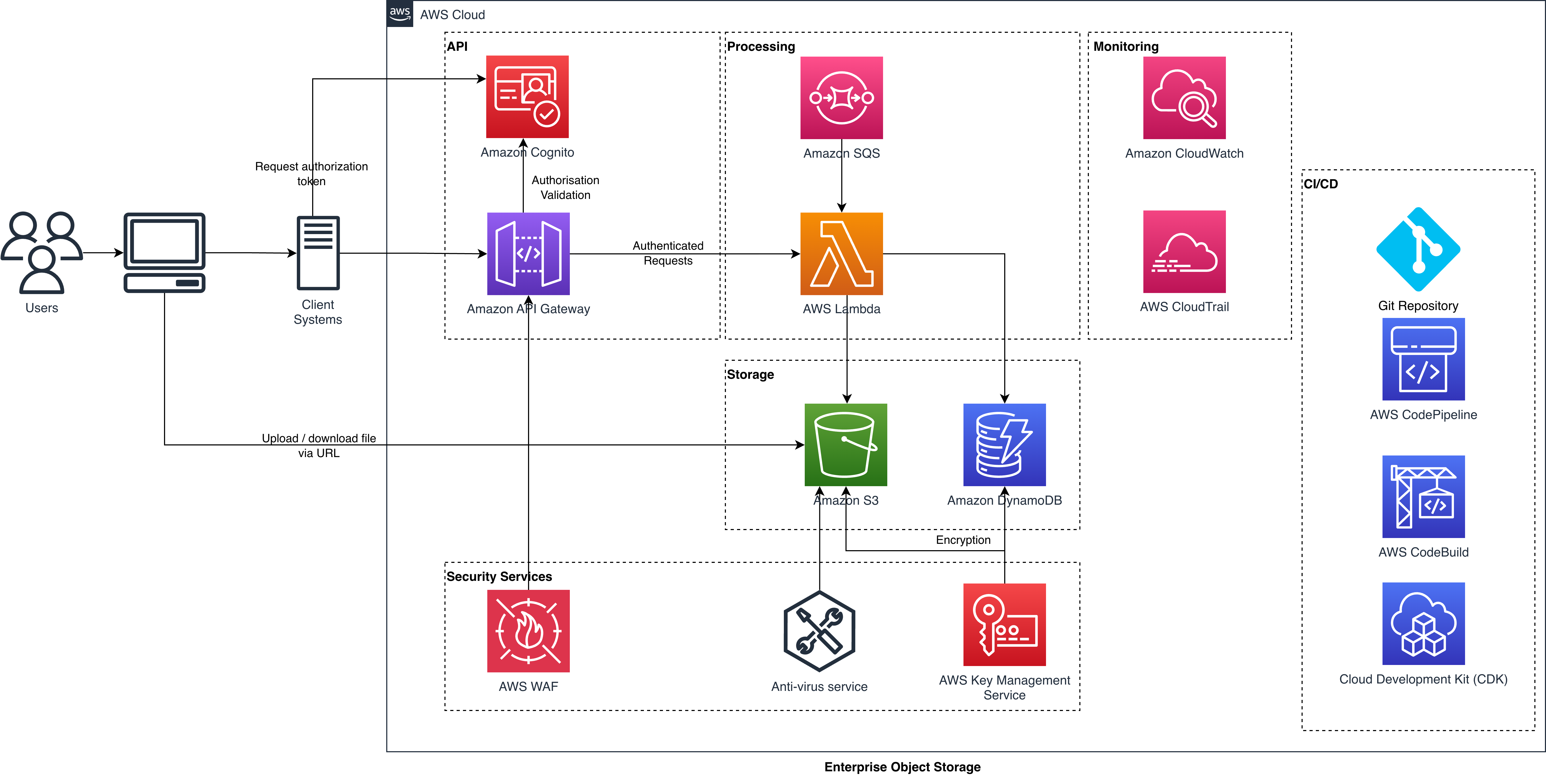

AWS—the division that Beth Galetti specifically cited as being restructured—is the profit center of the entire Amazon empire. Lose AWS, and the whole company starts to crumble. The fact that AWS roles are being eliminated suggests Amazon believes the division has bloated management and redundant functions. In other words, Amazon thinks it can deliver the same cloud services with significantly fewer people.

Is that true? Maybe. AWS has grown from a scrappy internal tool to a behemoth serving millions of customers. There's probably inefficiency baked in. Duplicate roles. Managers managing managers. Teams doing what other teams are already doing.

But there's a risk here. Cut too aggressively, and you lose institutional knowledge. You lose the people who actually know how to fix things when they break. You lose the engineers who've been with the company long enough to understand why decisions were made the way they were.

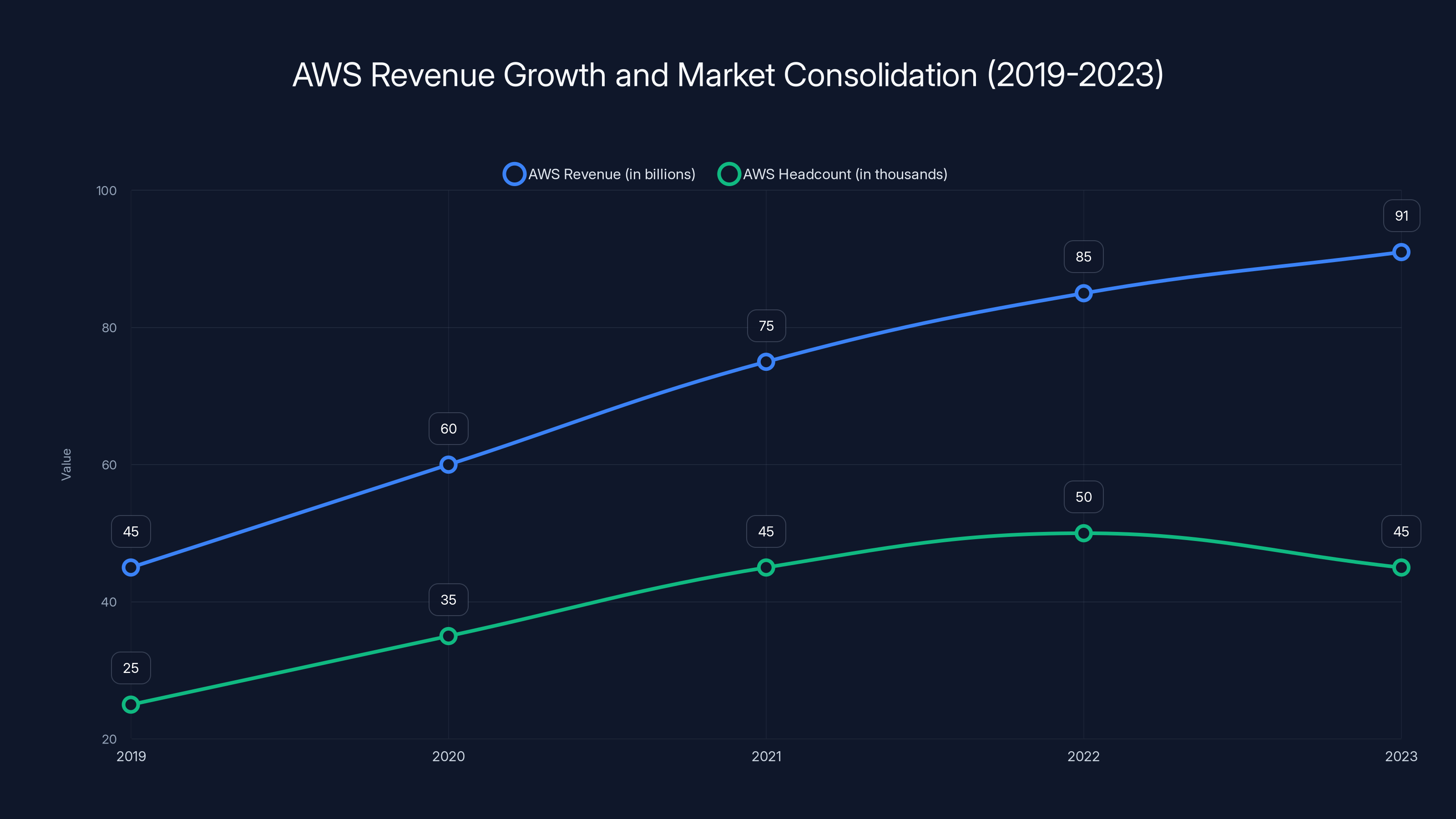

AWS revenue grew significantly from 2019 to 2023, but headcount peaked in 2022 before restructuring began. Estimated data shows AWS adapting to a mature market.

AWS and Cloud Services: Why This Division Got Hit Hardest

AWS SVP Colleen Aubrey's email was the buried lede in all of this. While the company-wide 16,000-job announcement grabbed headlines, her message about AWS restructuring told the real story.

"This is a continuation of the work we've been doing for more than a year to strengthen the company," she wrote, referencing something called Project Dawn—a codename linked to Amazon's planned redundancies.

Why focus on AWS? Because AWS is where the money is. The division generates roughly $91 billion in annual revenue, with operating margins sitting around 30%. Compare that to Amazon's retail business, which operates on margins of 3% to 5%. When you're looking to cut costs and improve profitability, AWS is where the impact matters most.

But here's what's really interesting: AWS doesn't need 30% of Amazon's total headcount to generate 30% of revenue. The division is incredibly efficient—it has to be. Cloud infrastructure is a margin business. You live or die on operational efficiency.

So why all the jobs in AWS in the first place?

The answer is growth. From 2019 to 2023, AWS was expanding like crazy. The cloud market was exploding. Companies were moving workloads from on-premise data centers to AWS. The money was flowing in. And AWS kept hiring to support that growth—support teams, sales engineers, product managers, customer success teams, professional services.

But growth has a limit. By 2023, the cloud market was consolidating. The easy wins were gone. The remaining customers were harder to move, required more negotiation, demanded more attention. And the big contracts—the mega-deals with enterprises—require fewer salespeople but larger deals.

So Amazon is restructuring AWS for a mature market, not a growth market. They're cutting support functions, consolidating teams, and pushing more responsibility onto individual engineers and managers. The message is clear: do more with fewer people.

Is this sustainable? That's the million-dollar question.

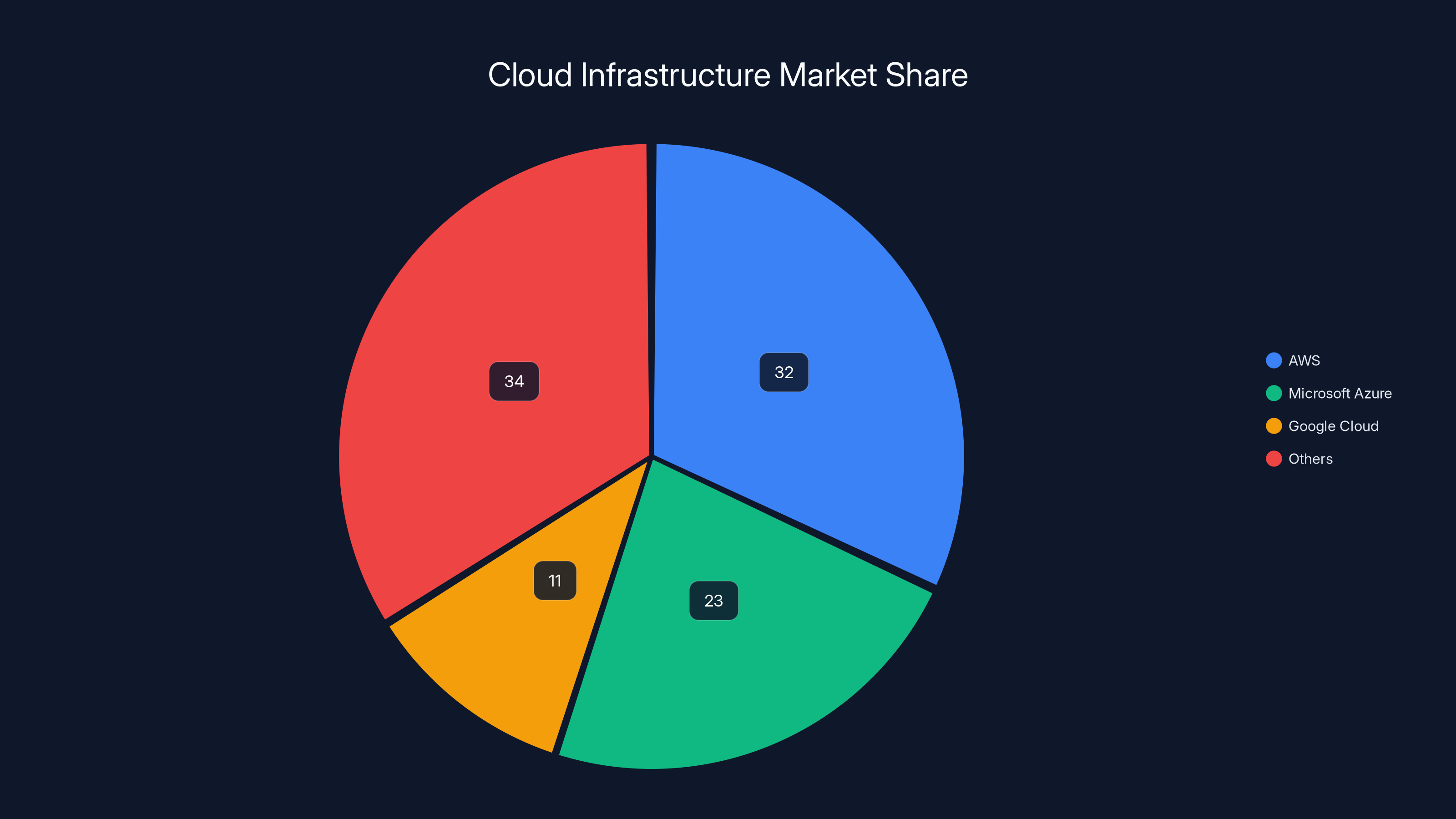

AWS has been losing market share to Azure (Microsoft's cloud division), particularly in enterprise accounts. Some of that loss is due to Microsoft's bundling strategy—selling Azure as part of broader Microsoft packages. Some of it is due to Azure's improved tooling and developer experience. But some of it is also due to AWS's bureaucracy and slower innovation compared to smaller, faster-moving cloud startups.

By cutting 16,000 people company-wide with emphasis on AWS, Amazon might be trying to move faster, reduce decision-making overhead, and get products to market quicker. Or they might be cutting so deeply that they actually damage AWS's ability to innovate and support customers.

Former workers cited by the BBC believe Amazon had been planning to eliminate around 30,000 jobs total, with more rounds coming between now and May 2026. That suggests there's more pain ahead. AWS employees might want to start updating their resumes now.

The "Project Dawn" Codename: What We Know About Amazon's Hidden Restructuring Plan

Project Dawn. It sounds like a movie about a dystopian future. In reality, it's the internal codename for Amazon's massive restructuring effort.

We don't know much about Project Dawn because it's intentionally secretive. But what we do know is revealing:

First, the project was planned for roughly 30,000 job eliminations. The January announcement covered 14,000. The February announcement covered 16,000. That's 30,000 total. Which means—if our math is right—the major announced cuts are complete. But inside Amazon, people are saying more rounds are coming through May 2026.

Second, the project is explicitly about "reducing layers." That's corporate speak for: cutting middle management. Amazon got too fat with managers. Now they're getting lean. Individual contributors and team leads will have more direct responsibility and less bureaucratic oversight. For some people, that'll be great—more autonomy, more impact. For others, it'll be exhausting.

Third, the project seems to be data-driven. Amazon didn't just pick numbers out of a hat. They analyzed which teams were duplicating work, which divisions were bloated, which roles were redundant. The company probably used internal metrics to identify which departments had the highest manager-to-individual-contributor ratios.

What's striking is that AWS appears to have been one of the highest-priority targets. This makes sense. AWS had rapid growth for over a decade. Rapid growth means layers get added. You hire more managers to manage the growth. You add support functions. You build out infrastructure. But then growth slows, and you realize you're carrying a lot of overhead.

Former AWS employees have told the BBC that layoffs came suddenly, without much warning. Some people came to work, attended a meeting, and were told they were laid off. Others got emails. It wasn't clean, and it wasn't kind. Which is standard for Amazon, but it doesn't make it less brutal.

The "Project Dawn" framing—a secretive internal project with a codename—suggests Amazon knew these cuts would be massive and wanted to manage messaging carefully. Instead of announcing "We're laying off 30,000 people," they've announced two tranches of cuts with a few months between them. It's a way of controlling the narrative and giving the market time to digest the news.

Here's what we still don't know:

- Which specific teams or functions are most affected

- Whether there will be additional cuts beyond the announced 30,000

- How severance is being calculated (varies by tenure, role, location)

- Whether Amazon plans to rehire people in "strategic areas" or just coast with reduced headcount

- The timeline for remaining Project Dawn cuts

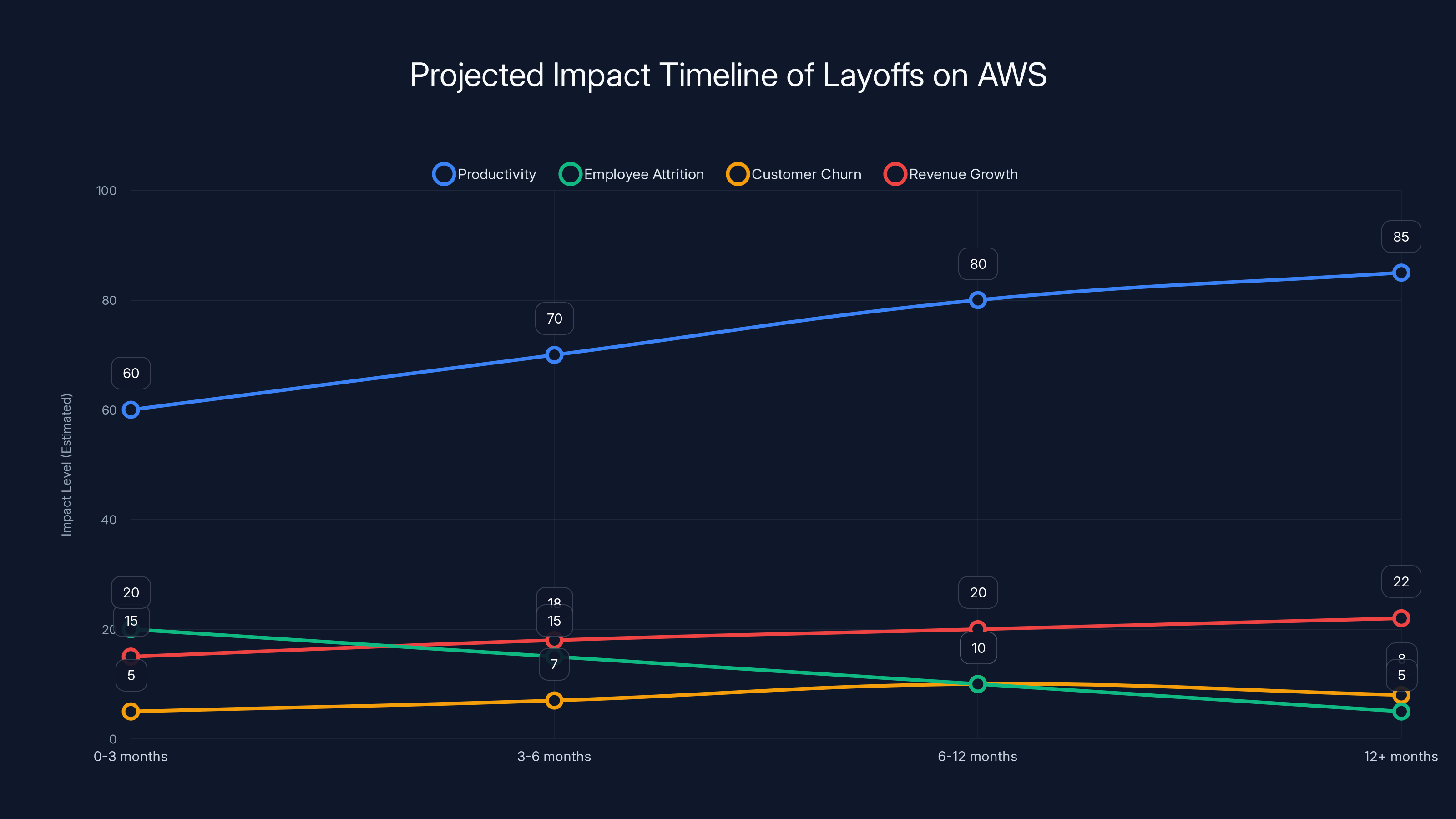

Estimated data suggests that initial productivity drops, but recovers over time, while employee attrition decreases and revenue growth potentially accelerates post-restructuring.

The Human Impact: What These Cuts Mean for Affected Workers

Let's be real. When you lose your job, corporate speak about "reducing layers" and "increasing ownership" doesn't pay your mortgage.

Amazon did announce some support for affected workers:

US-based workers get 90 days to reapply for other roles within Amazon. This is actually better than some companies offer. Ninety days is enough time to find another position if you're nimble and connected. You stay employed, you keep your health insurance, you don't have the traumatic experience of being terminated. But you also might not get the role you want, and you might end up in a position that's a step down from what you had.

Severance packages are available for people who don't find internal roles or who choose to leave. The amount depends on tenure, location, and role level. Someone who's been at Amazon for 5+ years probably gets a decent package. Someone who's been there for 1-2 years might get less. And the package varies dramatically by country—US severance is usually generous, but severance in some European countries is mandated by law and might actually be higher.

Health insurance continuation is promised for affected workers and their families. This is huge. Losing a job and losing health insurance simultaneously is a nightmare in the US healthcare system. Amazon extending health benefits removes one critical stressor.

Job placement support is offered. Amazon says they're helping people find roles at other companies. The quality and effectiveness of this support varies. Some companies are good at helping their laid-off employees. Others just hand you a list of recruiters and call it a day.

But here's the thing nobody talks about: the psychological impact of layoffs isn't captured in severance packages.

People at Amazon who survived the October cuts thought they were safe. They weren't. Now they're paranoid. Is the next round coming? Is my role at risk? Should I start looking elsewhere? This kind of uncertainty is corrosive to employee morale and productivity.

Moreover, people who were laid off are now competing for other jobs in a tech market that's been tough. The boom of 2021-2022 is long gone. Hiring has cooled. Interview processes are brutal. And having Amazon layoffs on your resume isn't stigmatizing anymore—it's become common—but it also doesn't help you stand out.

For AWS specifically, the layoffs are particularly brutal because AWS hired a lot of people from other cloud platforms (Azure, Google Cloud). These people left stable jobs at Microsoft or Google specifically because Amazon was offering more money and growth opportunities. Now they're laid off, and the job market has cooled. Some of them are in countries where severance laws are weak and reemployment is difficult.

Amazon's Restructuring Rationale: "Reducing Layers, Increasing Ownership"

Beth Galetti's email framed the cuts as organizational optimization, not cost-cutting. The language matters.

Instead of saying "We need to save money," Amazon said it wants to:

Reduce layers — Remove middle management and decision-making bottlenecks. In a 30-year-old company like Amazon, there's probably one manager managing another manager managing another manager. That's three layers when one would do. By cutting layers, Amazon wants to make decisions faster and give individual contributors more direct authority.

Increase ownership — Push responsibility down. Instead of a team of support engineers with a manager, maybe it's a smaller team where each engineer owns more customers and more systems. Ownership sounds positive in corporate speak, but it often means "you'll be expected to do more with no additional compensation."

Remove bureaucracy — Cut administrative overhead. Amazon has a lot of process. Request forms, approval cycles, architectural reviews, security audits. Bureaucracy keeps things safe but slow. Removing it might help speed things up.

Now, is there truth to this? Probably. Large companies do accumulate overhead. Amazon probably did have redundant functions. Removing them could improve efficiency.

But there's also a darker interpretation: Amazon is cutting costs, and it's just framing it as organizational optimization to make it palatable. The company needs to improve profitability, so it's cutting headcount. That's actually fine—companies make profit-maximizing decisions all the time. But saying "we're optimizing organizational structure" is more honest than saying "we're chasing quarterly earnings targets."

Galetti also wrote: "Just as we always have, every team will continue to evaluate the ownership, speed, and capacity to invent for customers, and make adjustments as appropriate." Translation: "This restructuring isn't a one-time thing. We'll keep cutting and restructuring until we hit our profit targets."

That's the message that should worry people at Amazon. There's no commitment that the cuts are done. There's just a promise that Amazon will keep optimizing. For employees, that means the sword of Damocles remains overhead.

The real question is whether Amazon's restructuring will actually work. Will removing layers make the company faster and more innovative? Or will it just mean that fewer people are doing more work, burning out, and leaving voluntarily?

History suggests both happen. Some companies successfully flatten their organizational structure and become faster and more competitive. Others just end up with exhausted employees and high attrition. Amazon's success probably depends on execution—which managers get cut, which functions are consolidated, how the company supports remaining employees through the transition.

AWS leads the cloud infrastructure market with a 32% share, followed by Microsoft Azure at 23% and Google Cloud at 11%. Despite potential headcount reductions, AWS's strong market position and mature customer base may help maintain its dominance.

AWS Market Position: Can Cloud Services Remain Dominant with Fewer People?

AWS is the market leader in cloud infrastructure. It has about 32% market share, ahead of Microsoft Azure (23%) and Google Cloud (11%). That leadership position exists because AWS hired great people, iterated quickly, and built a massive ecosystem of tools, services, and integrations.

Now Amazon is cutting people from AWS. Can the division maintain its dominance with a leaner team?

Maybe. Here's the case for why it could work:

AWS is probably overcomplicated. The division offers over 200 different services. Not all of them need the same level of support. Some services are mature and stable—they don't need much engineering attention. Others are new and fast-growing. By cutting overhead from mature services, AWS could reallocate resources to growth areas.

Automation and tooling might help. AWS has invested heavily in infrastructure-as-code, automated deployment, and observability tools. These tools might enable fewer engineers to support the same number of customers. Internal Dev Ops tooling, particularly for AWS teams, might be advanced enough that headcount reduction doesn't immediately impact service quality.

The customer base is also maturing. Early AWS customers needed a lot of hand-holding. They didn't understand cloud. They needed sales engineers, customer success managers, professional services. Modern AWS customers are sophisticated—they know what they want, they implement it themselves, they barely need support. Fewer support people might not hurt if customers need less support.

But there's also the case for why AWS might struggle:

Competition is fierce. Azure is gaining market share, partly because Microsoft bundles it with Office, Teams, and other products. Google Cloud is gaining ground with AI-focused customers and better data analytics tools. If AWS innovates slower because of headcount cuts, it might lose more market share to rivals.

Customer support quality might suffer. AWS is famous for having great documentation but mediocre support. Cut support headcount further, and the already-poor support experience gets worse. Enterprise customers might decide that Azure's bundled services and included support are worth the switch.

Key person risk. When you cut engineering headcount, you sometimes lose the people who've been with the company longest and know the most. AWS has critical systems that are held together by the accumulated knowledge of certain engineers. Lose those people, and you might face reliability issues, security vulnerabilities, or architectural problems that are expensive to fix.

Innovation might slow. AWS innovates by shipping new features and services continuously. If the same number of engineers have to support more customers and maintain more services, they'll ship fewer new features. This matters because AWS's competitive advantage is partially based on having more features than competitors.

Historically, companies that cut engineering headcount often struggle to maintain innovation. But Amazon is not a typical company. The company operates on different economics than most tech firms. AWS might actually be able to cut headcount without innovation suffering, depending on which jobs were cut.

The Broader Pattern: Why Big Tech Keeps Cutting Jobs

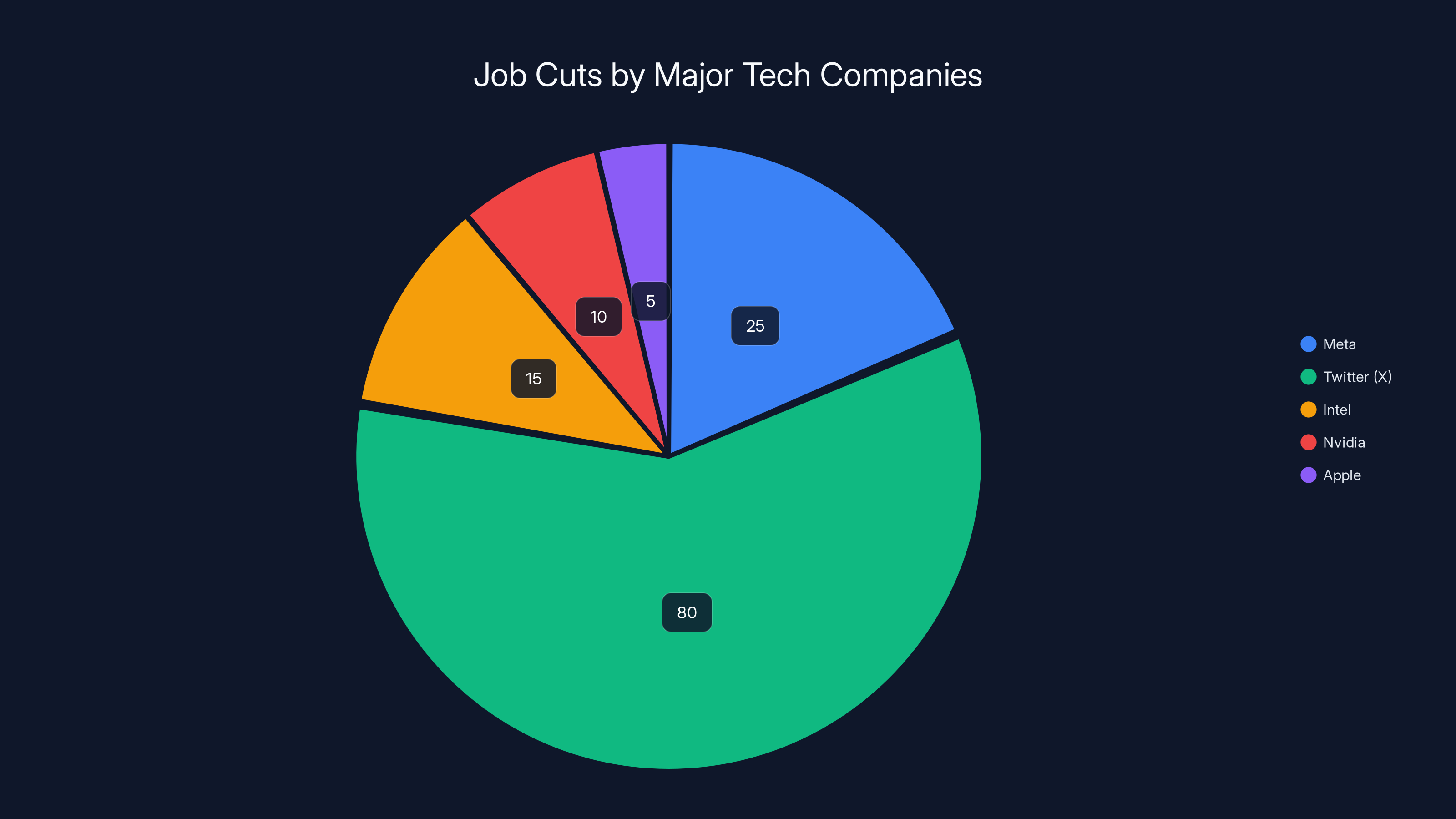

Amazon isn't alone. Meta has cut 25% of its headcount since 2022. Twitter (now X) cut about 80% of its staff. Intel cut 15%. Nvidia, despite being one of the most successful companies in the world right now, is exploring "strategic headcount optimization." Even Apple has cut thousands of jobs.

What's going on? Why is Big Tech in perennial cost-cutting mode?

Part of it is the interest rate environment. When interest rates were near zero (2020-2021), tech companies could borrow cheaply and hire aggressively. Growth was the priority. But when the Federal Reserve started raising rates in 2022, the economics changed. Borrowing became expensive. Growth-at-all-costs became untenable. Suddenly, profitability mattered.

Part of it is that tech companies massively overestimated demand. They hired for growth that didn't materialize. The pandemic accelerated cloud adoption, but adoption has limits. Once everyone's moved to the cloud, growth slows. AWS hired people assuming growth would continue at 30%+ annually. It didn't. Now they have too many people.

Part of it is also AI. Every tech company is convinced that AI is going to be huge. So they're cutting "less strategic" roles and trying to reallocate resources to AI. Amazon is betting on Anthropic (in which it invested $4 billion). Microsoft is betting on Open AI. Google is doubling down on Gemini. The thinking is: if we cut 30,000 jobs but reallocate the top 5,000 to AI, we come out ahead.

But there's a darker dynamic at play too: shareholder pressure. Tech companies that cut headcount aggressively see their stock prices rise, at least in the short term. Wall Street loves cost-cutting. Wall Street hates hiring and headcount growth. So CEOs cut people to appease investors, even if it's not strategically sound.

This cycle is destructive. Companies cut too aggressively, lose key talent, fall behind on innovation, then recover by hiring again a few years later. It's inefficient. But it's also the rhythm of modern capitalism.

For Amazon specifically, the company is trying to optimize for a different era. The era of explosive growth is over. The era of margin optimization is here. That means fewer people, more efficiency, and leaner operations. Whether that actually works for AWS is still an open question.

Meta, Twitter, and Intel have seen significant workforce reductions, with Twitter cutting the most at 80%. Nvidia and Apple have also reduced staff, albeit to a lesser extent. (Estimated data for Nvidia and Apple)

What This Means for Enterprise Cloud Strategy and Multi-Cloud Adoption

If you're an enterprise IT leader managing cloud infrastructure, Amazon's restructuring should concern you. Here's why:

Service quality risk. If AWS reduces headcount, support quality might suffer. You might face longer wait times for support tickets, slower response to incidents, or less technical expertise in customer success conversations. For enterprises that run mission-critical workloads on AWS, this is a problem.

Innovation risk. If AWS is cutting R&D headcount along with support headcount, the company might ship fewer new features and services. If you're relying on AWS to provide cutting-edge tools for AI, machine learning, or data analytics, slower innovation might force you to look at competitors like Azure or Google Cloud.

Relationship risk. AWS has a history of minimizing customer relationships once you're locked in. The company figures you've already migrated workloads, you're not leaving, so they can reduce customer success resources. If you're used to having a dedicated technical account manager at AWS, layoffs might mean losing that relationship and having your account folded into a lower-touch model.

Opportunity for negotiation. Companies that are unhappy with AWS service post-layoffs might actually have leverage to negotiate better pricing or contract terms. Tell your AWS account team that you're evaluating Azure or Google Cloud due to concerns about service quality. They might suddenly find budget for dedicated resources.

Multi-cloud acceleration. These layoffs might actually accelerate multi-cloud adoption. If enterprises become worried about AWS's ability to support them adequately, they might move some workloads to Azure or Google Cloud as a hedge. This would be ironic, given that AWS's goal was presumably to improve efficiency, not lose customers.

For builders and startups, the implications are different. Most startups run almost entirely on AWS because it's the default cloud. If AWS service quality doesn't noticeably decline, startups probably won't switch. But if AWS becomes less responsive and support becomes slower, startups might explore alternatives like Digital Ocean, Render, or Railway—platforms specifically designed to be easier than AWS.

Organizational Structure: Understanding Amazon's "Layers" Problem

To understand why Amazon is cutting so aggressively, you need to understand what "reducing layers" actually means in practice.

Let's use AWS as an example. Imagine you have a customer with a critical database issue. Here's what the organizational journey might look like:

- Customer contacts support

- Support engineer (Level 1) triage the issue, determines it needs escalation

- Support engineer submits ticket to engineering team

- Engineering manager reviews ticket, assigns to engineer

- Engineer investigates, finds root cause

- Engineer's manager reviews the fix before it's deployed

- Manager of that manager approves resource allocation

- Infrastructure team deploys the fix

- Results are communicated back through the chain

That's a lot of steps. Reduce the layers, and you might have:

- Customer contacts support

- Support engineer investigates AND has authority to deploy fixes

- Infrastructure team executes

- Results communicated back

Fewer steps means faster resolution. Fewer manager approvals means faster decision-making. Fewer people in the chain means fewer salaries to pay.

But here's the trade-off: individual contributors end up with more responsibility. The support engineer now needs to be senior enough to make infrastructure decisions. You need fewer, more skilled people instead of more, less skilled people. That's good for efficiency, but it's harder to hire and potentially riskier if key people leave.

Amazon is betting that it can restructure toward a model where individual contributors have more authority and less management oversight. This is especially true in engineering and technical roles.

For support and less technical roles, the bet is probably different: automate or eliminate. AWS probably figured out that many support tasks can be handled by documentation, self-service tools, or AI. So they cut support headcount and invested in better tooling instead.

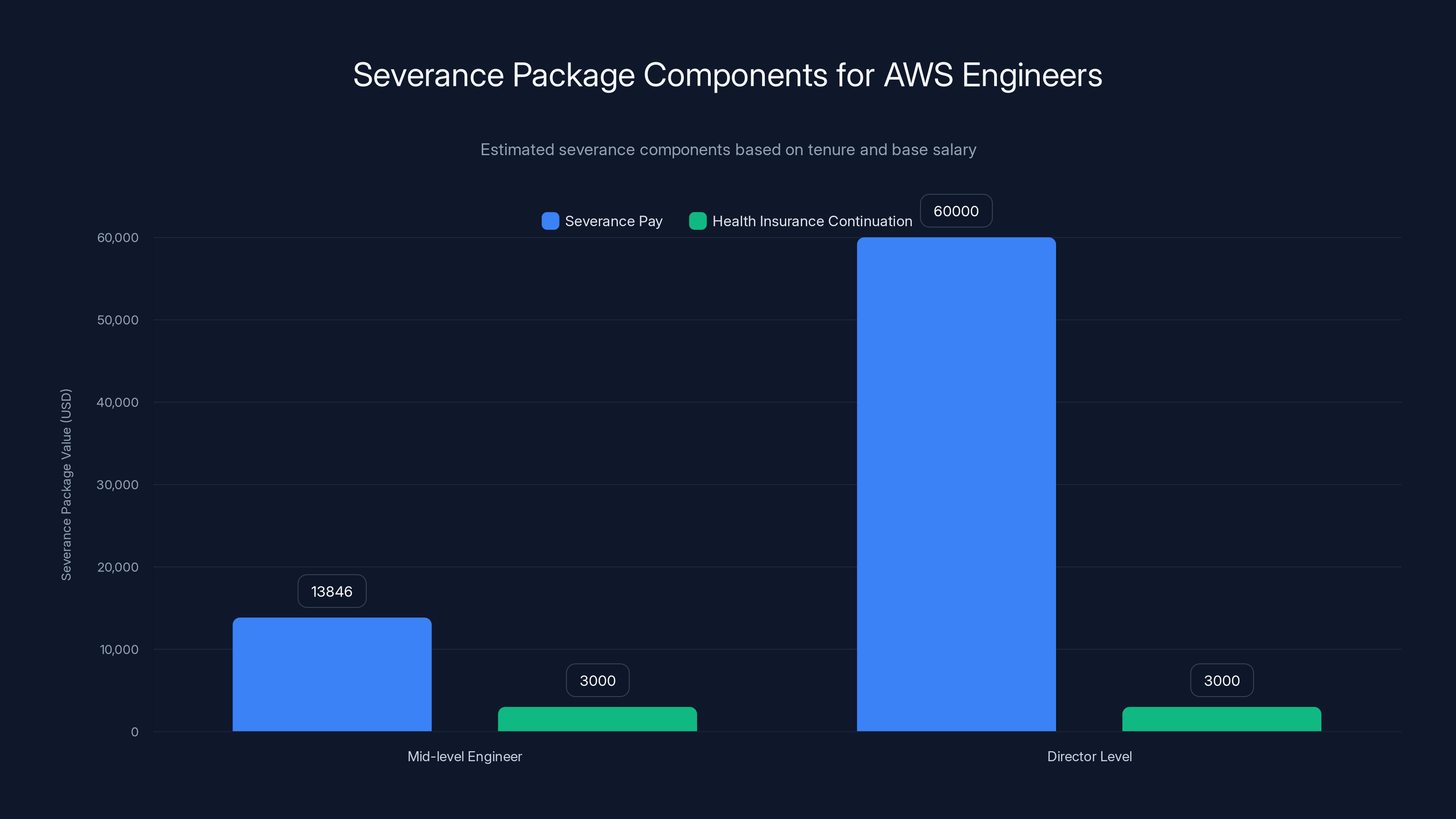

Estimated severance packages for AWS engineers show significant differences between mid-level and director-level positions, with directors receiving higher severance pay.

The Timeline: When Will We See the Impact of These Layoffs?

Layoffs take time to fully impact an organization. The changes don't happen overnight.

Immediate impact (0-3 months): Affected employees scramble to find internal roles or prepare for exit. Remaining employees are anxious and distracted. There might be a spike in voluntary departures as people decide they don't want to stick around. Productivity probably drops.

Short-term impact (3-6 months): The organization starts to stabilize. People who are staying settle into new roles. New organizational structure becomes clear. Support quality might start to degrade as teams are understaffed. But also, some inefficiencies get eliminated, and teams work faster because decision-making is quicker.

Medium-term impact (6-12 months): The real effects become visible. Is innovation slower or faster? Is service quality better or worse? Did customer churn increase? Did revenue growth accelerate or decelerate? By this point, the market will have a clear answer about whether the restructuring worked.

Long-term impact (12+ months): Culture is established. People either like the flatter structure or resent it. AWS either maintains market position or loses share to competitors. The company either benefits from the restructuring or regrets it.

For investors and customers, the key metrics to watch are:

- AWS revenue growth: Stays above 15-20% annually, or starts declining?

- AWS gross margins: Improve, stay flat, or decline?

- Customer churn: Increase or stay stable?

- Employee attrition: Is voluntary turnover rising?

- Support ticket response times: Getting better or worse?

- New feature releases: Accelerating or slowing?

We'll have visibility into some of these metrics through Amazon's quarterly earnings reports. But internal metrics—employee satisfaction, support quality, decision-making speed—will take longer to show up in public data.

The Severance Equation: What Numbers Mean What

When Amazon announces severance packages, the amounts vary dramatically. Let's break down how this actually works.

Tenure multiplier: Companies typically calculate severance as weeks of pay per year of tenure. A common formula is 1 week per year. So someone with 5 years of tenure gets 5 weeks of severance pay.

Base salary only: Severance is usually calculated on base salary, not total compensation. So if you're a senior engineer at AWS making

Location multiplier: Some countries mandate minimum severance by law. France, Germany, and other European nations require companies to pay higher severance amounts. So an AWS engineer in Frankfurt might get better severance than an engineer in Seattle, even with similar tenure.

Level multiplier: Director-level and above might get different formulas. Companies often negotiate severance individually for senior leadership. Individual contributors get standard formulas.

Let's do some math. Say you're a mid-level software engineer at AWS:

- Base salary: $180,000

- Tenure: 4 years

- Severance formula: 1 week per year

- Severance = 4 weeks × (13,846**

Plus health insurance continuation (might be 3-6 months worth) and job placement support. If you get 6 months of health insurance continuation (maybe

Now, that's not nothing. But it's also not a fortune. If you're in a high cost-of-living area like Seattle or San Francisco, $17,000 might cover 2-3 months of expenses. And that assumes you find a new job quickly. If you don't, you're burning through savings.

For people at the director level or above, severance multiples might be higher. A director with 10 years tenure might get 12+ weeks of severance, which could be $60,000+. But they also have different financial situations and might have been planning for this possibility.

For people at the IC (individual contributor) level with lower tenure, severance might be smaller than expected. This is why those 90 days to find an internal role are so important—it's better than waiting for severance to run out.

International considerations: AWS has offices worldwide. A layoff in India might carry different math than a layoff in the UK. UK employment law requires reasonable notice, severance calculations based on age and tenure, and other protections. India might have fewer legal requirements. Amazon's total cost for severance probably varies by 50-100% depending on geography.

What High-Performing Employees Are Thinking: The Burnout Risk

This is the part that Amazon probably doesn't want to talk about. After massive layoffs, the employees who remain are often burned out.

Here's what happens psychologically: You lose 30,000 colleagues. You realize the company could cut anyone. You assume more cuts are coming. But you also know the company is short-staffed. So you work harder to fill the gap. Your workload increases. Your stress increases. You start looking for other jobs as a hedge, even if you weren't planning to leave.

For technical talent at AWS, this is particularly acute because the job market for experienced cloud architects is competitive. If you've got 5+ years of AWS experience and strong reviews, you can probably find a job elsewhere at similar or better pay. The rational response to layoff uncertainty is to start interviewing.

This creates a secondary wave of attrition. The company loses people they didn't intend to lose. The remaining people are stretched thinner. Quality suffers. Customers notice.

Amazon's CEO Andy Jassy has publicly said the company intends to continue hiring in "strategic areas." But which areas? If AWS is being restructured and other divisions are also being cut, where is the hiring happening?

Likely answer: AI. Amazon is investing heavily in AI, both through internal development and through its $4 billion investment in Anthropic. The company probably wants to hire world-class AI researchers and engineers. But the market for top AI talent is insanely competitive. You can't outbid Open AI or Google on salary alone.

So Amazon probably hopes to retain high performers through a combination of:

- Interesting AI projects

- The potential for big payoffs if Amazon nails AI

- The brand and scale of Amazon

- Competitive salaries

But you're competing against Open AI, Google, Microsoft, Anthropic, and every other company that's betting on AI. Amazon's restructuring and layoffs don't help your recruiting narrative. "Come work at Amazon, we're cutting 30,000 people!" doesn't sound appealing.

For workers who remain in AWS (which isn't AI-focused), the narrative is even bleaker. "Come work at AWS, we're being restructured!" Doesn't inspire confidence.

Industry Precedent: What Happened to Other Companies That Did This

Amazon isn't the first company to cut massive headcount and claim it was about organizational optimization. Let's look at some precedents.

Yahoo (2013-2016): New CEO Marissa Mayer came in with a plan to fix Yahoo's massive organization. Over four years, the company cut 4,600 jobs (roughly 20% of workforce). The goal was to "flatten the organization" and move faster. The result? Yahoo became smaller, slower, and less competitive. The company was eventually sold for parts. Not a success.

IBM (2013-2023): IBM has been cutting workforce for over a decade, using early retirement incentives and layoffs to reduce headcount. The goal was similar—improve efficiency and margins. IBM succeeded in improving profitability metrics, but the company lost relevance in cloud (dominated by Amazon, Microsoft, Google) and spent a decade playing catch-up. The cuts might have been fiscally sound but strategically limiting.

Intel (2023): Intel cut 15% of workforce (25,000+ people) as part of a restructuring. The goal was to improve efficiency and refocus on core competencies. The market response? Skepticism. Intel is losing market share in CPUs to AMD and losing relevance in AI accelerators to Nvidia. The cuts might save money short-term but haven't fixed Intel's competitive problems. The jury's still out.

Meta (2022-2023): Meta cut 25% of workforce after over-hiring during the pandemic. CEO Mark Zuckerberg called it "The Year of Efficiency." The cuts happened largely in sales, operations, and support—not in engineering. Interestingly, Meta's product development didn't noticeably slow. The company continued shipping features. But employee satisfaction dropped, and Meta has dealt with ongoing talent retention challenges. The cuts were probably warranted but painful.

What's the pattern? Companies that cut aggressively often improve short-term profitability metrics but struggle with long-term innovation and market position. The cuts are usually necessary (the company probably was bloated), but they're also often too aggressive. The sweet spot is probably cutting 10-15% to remove true waste without damaging core functions. Amazon's 30,000 cuts (roughly 2% of total headcount, but much higher in office-based roles) might be in that range, or it might be too aggressive. We'll find out in the next 12-18 months.

Preparing for Uncertainty: What Should You Do If You Work in Tech

If you're working at Amazon, AWS, or any of the tech companies in "optimization mode," here's practical advice:

Document everything. Keep a record of your accomplishments, impact, and projects. If you're laid off, you'll want concrete examples for interviews. If you're not laid off, you have ammunition for promotion arguments.

Build your professional network. Don't just network inside Amazon. Go to conferences, join online communities, connect with people on Linked In outside the company. If you get laid off, you want to have people to reach out to immediately.

Keep your resume updated. Even if you're not looking for a job, have a polished resume ready to go. If layoffs hit, you don't want to spend two weeks getting your resume in shape.

Understand your severance. If you get laid off, you probably have choices. You might get severance + benefits continuation + job placement. Understand the math. Do the calculation on how long the severance covers your expenses.

Know your skills market value. Have a sense of what jobs at your level pay elsewhere. Use Levels.fyi, Blind, or Glassdoor to benchmark. If Amazon's layoff gives you severance, you might have time to shop around for the best opportunity, not just the first opportunity.

Evaluate your options carefully. If you're offered internal redeployment (transfer to another team), evaluate it critically. Is it a real opportunity or a temporary reprieve before the next layoff wave? Is the team you're being assigned to strategic or expendable?

Take care of your mental health. Layoffs are stressful. So is the anticipation of layoffs. Talk to people. See a therapist if you need to. Don't let work stress destroy your health.

Consider your long-term goals. Use layoff uncertainty as a chance to think about what you actually want to do. Do you want to keep working at massive corporations? Would you prefer a startup? Would you want to try contracting or freelancing? Sometimes a layoff is an unexpected opportunity to change direction.

The Future of AWS: Betting on Efficiency Over Growth

AWS faces a crucial juncture. The division has been the profit engine of Amazon for over a decade. But the cloud market is maturing. Growth is slowing. Competition from Azure and Google Cloud is fierce.

Amazon's bet is that by restructuring—reducing layers, increasing individual ownership, removing bureaucracy—the company can maintain AWS's leadership position while improving margins. It's a reasonable bet. Many mature businesses succeed by optimizing for efficiency rather than growth.

But there are risks. If the restructuring is too aggressive:

- Service quality might decline, driving customers to competitors

- Innovation might slow, making AWS less attractive to cutting-edge companies

- Employee attrition might accelerate, forcing expensive rehiring

- Customer support relationships might suffer, giving competitors an opening

If the restructuring is successful:

- AWS margins improve significantly

- Decision-making gets faster, enabling quicker feature releases

- The company maintains market leadership while improving profitability

- Amazon has more resources to invest in AI and future technologies

The market will have clarity on which scenario is happening by early 2025. If AWS maintains growth rates above 15% and margins remain strong, the restructuring was successful. If growth starts declining or margins compress, the cuts were too aggressive.

For customers and employees, the next 6-12 months are critical. This is when we'll see if Amazon's restructuring strategy actually works.

What This Means for the Broader Tech Industry

Amazon's massive restructuring is a signal to the entire tech industry. It says: "The growth era is over. The efficiency era is here."

Other tech companies are listening. They're all looking at AWS and thinking: "If Amazon can cut 30,000 people and still maintain AWS's dominance, maybe we should cut deeper too."

This creates a race to the bottom. Companies try to become leaner faster than competitors. They cut headcount aggressively. They reduce customer support. They slow innovation. And over time, the entire industry becomes less generous to employees and potentially less innovative.

For job seekers, this is terrible news. The tech industry will probably keep cutting until the next growth cycle happens (which might be AI-driven in 3-5 years). If you're looking for a tech job in the next 12 months, expect:

- Lower salaries

- Fewer job openings

- More competitive hiring processes

- Less flexibility on remote work

- Tougher negotiations on benefits

But for customers and the broader economy, periodic tech industry layoffs might actually be healthy. The excess hiring of 2021-2022 was inefficient and unsustainable. Cutting back to leaner operations might make tech companies less flashy but more viable long-term.

The question is whether the industry overshoots in the other direction. Cut too much, and you get Yahoo's fate. Cut too little, and you don't improve margins. Amazon's betting that it can find the sweet spot. Time will tell.

FAQ

How many total jobs has Amazon cut in recent restructuring efforts?

Amazon has announced 30,000 job cuts across two major tranches in 2024. The first wave eliminated 14,000 positions in January, followed by 16,000 additional positions in February. These represent the company's largest restructuring effort in recent years and are part of a broader organizational optimization plan referenced internally as Project Dawn.

Why is AWS specifically being targeted in these layoffs?

AWS is being targeted because it's Amazon's most profitable division, generating roughly $91 billion in annual revenue with operating margins around 30%. The division likely experienced bloated staffing from years of aggressive growth (2015-2022), with redundant management layers and duplicated functions. By restructuring AWS specifically, Amazon can improve margins while maintaining the division's core functionality and customer service. AWS SVP Colleen Aubrey noted the restructuring was a continuation of work being done for over a year to "strengthen the company."

What options do affected Amazon employees have?

Affected employees in the United States receive 90 days to reapply for other positions within Amazon while retaining employment and health benefits. Those who don't secure internal roles or choose to leave receive severance packages (calculated based on tenure and role level), extended health insurance coverage, and job placement support to find external opportunities. International employees' options vary based on local labor laws, which often mandate more generous severance and longer notice periods than the US requirements.

Will Amazon continue hiring new employees despite the massive layoffs?

Yes, Amazon has explicitly stated it will continue hiring in "strategic areas" that are critical to the company's future. These areas are likely focused on artificial intelligence and machine learning, as indicated by Amazon's $4 billion investment in Anthropic and its broader AI strategy. However, hiring in these strategic areas will be much more selective and competitive than historical Amazon hiring patterns, focusing on senior talent and specialized expertise rather than broad hiring across all divisions.

How does Amazon's restructuring compare to other tech companies' layoffs?

Amazon's restructuring is among the largest in recent tech history. Meta cut 25% of its workforce (approximately 11,000 employees), while Intel cut 15% (25,000+ employees), and Twitter cut roughly 80% under new ownership. Amazon's approach differs because it's framed as organizational optimization rather than pure cost-cutting, and affects roughly 2% of total headcount but a much higher percentage of office-based and AWS roles. The pace and scale of Amazon's cuts suggests the company is being more aggressive than typical, signaling confidence in its business model while operating in a lower-growth environment.

What is Project Dawn and when will it be complete?

Project Dawn is Amazon's internal codename for its comprehensive workforce restructuring initiative. Former employees cited by media outlets suggest the project was originally planned for around 30,000 job eliminations, with the announced cuts likely fulfilling that original target. However, internal communications suggest additional restructuring rounds could occur through May 2026, indicating that Project Dawn isn't entirely complete and further optimization could happen. The exact scope and timeline of any remaining restructuring hasn't been publicly confirmed by Amazon leadership.

How might AWS service quality be affected by these layoffs?

The impact on AWS service quality depends on which roles were eliminated. If cuts focused on redundant management and administrative functions, quality might remain stable or improve. If cuts affected engineering, support, or infrastructure teams, customers could experience longer support response times, slower issue resolution, and potentially reduced innovation velocity. The company has stated it's maintaining "capacity to invent for customers," but reduced headcount typically correlates with slower feature releases and potentially slower incident response. Enterprise customers should monitor their support SLA performance and response times closely over the next 6-12 months.

Should I be concerned about AWS stability as a cloud provider due to these cuts?

While restructuring introduces short-term risk, AWS's market dominance, $91 billion annual revenue, and 32% market share suggest the platform will remain stable for the foreseeable future. However, customers should consider reducing single-cloud dependency by evaluating multi-cloud strategies with Azure or Google Cloud as insurance against potential service degradation. Organizations running mission-critical workloads should also strengthen relationships with their AWS account teams and document support interactions to have baseline metrics if service quality changes post-restructuring.

How will the layoffs impact AWS employees' mental health and productivity?

Large-scale layoffs typically create survivor guilt and burnout among remaining employees. Survivors often work harder to fill gaps left by departed colleagues while simultaneously worrying about their own job security. The announcement that additional restructuring could continue through May 2026 intensifies this uncertainty. Organizations typically experience 15-20% additional voluntary attrition (beyond the formal layoffs) within 12 months as remaining employees seek more stable employment. Amazon should expect continued talent loss among high performers who have viable options elsewhere.

Conclusion: The Restructuring Bet Amazon Is Making

Amazon is placing a massive bet. The company is saying: "We can be leaner, faster, and more profitable without sacrificing our market position or customer service quality."

It's a reasonable bet. Most large companies carry overhead that's not essential. Most organizations can make decisions faster with fewer layers. Most teams can do more with better tools and clearer ownership.

But it's still a bet. The upside is AWS maintains dominance while margins improve. AWS becomes faster and more innovative. Amazon has resources to invest in AI and other future bets. The company thrives in the efficiency era.

The downside is the cuts are too aggressive. Service quality declines. Customers leave for Azure or Google Cloud. Employees burn out and leave. The company loses institutional knowledge and competitive advantage. AWS's dominance erodes.

The past decade of tech industry history suggests that massive restructurings are often necessary but often overshooting. Companies cut too much, suffer through a painful recovery period, then have to rehire and rebuild. Amazon might have learned from this pattern. Or Amazon might be repeating it on a larger scale.

What we know for certain: 30,000 people lost their jobs. Those people were not abstract concepts or redundant headcount. They were humans with mortgages, families, health insurance concerns, and career uncertainty. The corporate speak about "reducing layers" and "increasing ownership" doesn't change that reality.

For everyone else in tech, the message from Amazon's restructuring is clear: the era of abundance is over. The era of hiring-for-growth, unlimited benefits, and organizational expansion is finished. Welcome to the era of optimization, efficiency, and lean operations.

Whether that's good or bad for the tech industry long-term remains to be seen. But for right now, the disruption is real, and the impact is being felt across the entire ecosystem.

Watch how AWS performs over the next 12-18 months. That's going to tell you whether Amazon's restructuring strategy was brilliant or whether it was a painful mistake. The rest of the tech industry is watching too.

Key Takeaways

- Amazon cut 30,000 jobs across two major restructuring tranches (14,000 in January, 16,000 in February 2024), with AWS specifically impacted as the company prioritizes efficiency over growth

- AWS generates $91 billion in annual revenue with 30% operating margins, making it Amazon's most profitable division and primary target for restructuring to reduce organizational layers

- Affected US employees receive 90 days to find internal positions, severance packages calculated on base salary and tenure (typically 1 week per year worked), extended health insurance, and job placement support

- Internal codename 'Project Dawn' suggests original plan targeted roughly 30,000 total layoffs with potential additional restructuring rounds continuing through May 2026, indicating more cuts may be coming

- AWS maintains 32% cloud market share ahead of Azure (23%) and Google Cloud (11%), but service quality risks and innovation slowdown could emerge if restructuring is too aggressive or cuts institutional knowledge

Related Articles

- Amazon's 16,000 Layoffs: What It Means for Tech Workers [2025]

- Microsoft's $7.6B OpenAI Windfall: Inside the AI Partnership [2025]

- Vimeo Layoffs After Bending Spoons Acquisition: What Happened [2025]

- How Davos Became Silicon Valley's Mountain Summit [2025]

- Meta Quest Layoffs and VR's Future: Why Palmer Luckey's Optimism Might Be Misplaced [2025]

- Elon Musk's $134B OpenAI Lawsuit: What's Really at Stake [2025]

![Amazon's 16,000 Job Cuts: AWS Impact and Restructuring Strategy [2025]](https://tryrunable.com/blog/amazon-s-16-000-job-cuts-aws-impact-and-restructuring-strate/image-1-1769686938196.jpg)