Chat GPT Ads at NFL Rates: Is Open AI's $60 CPM Justifiable? [2025]

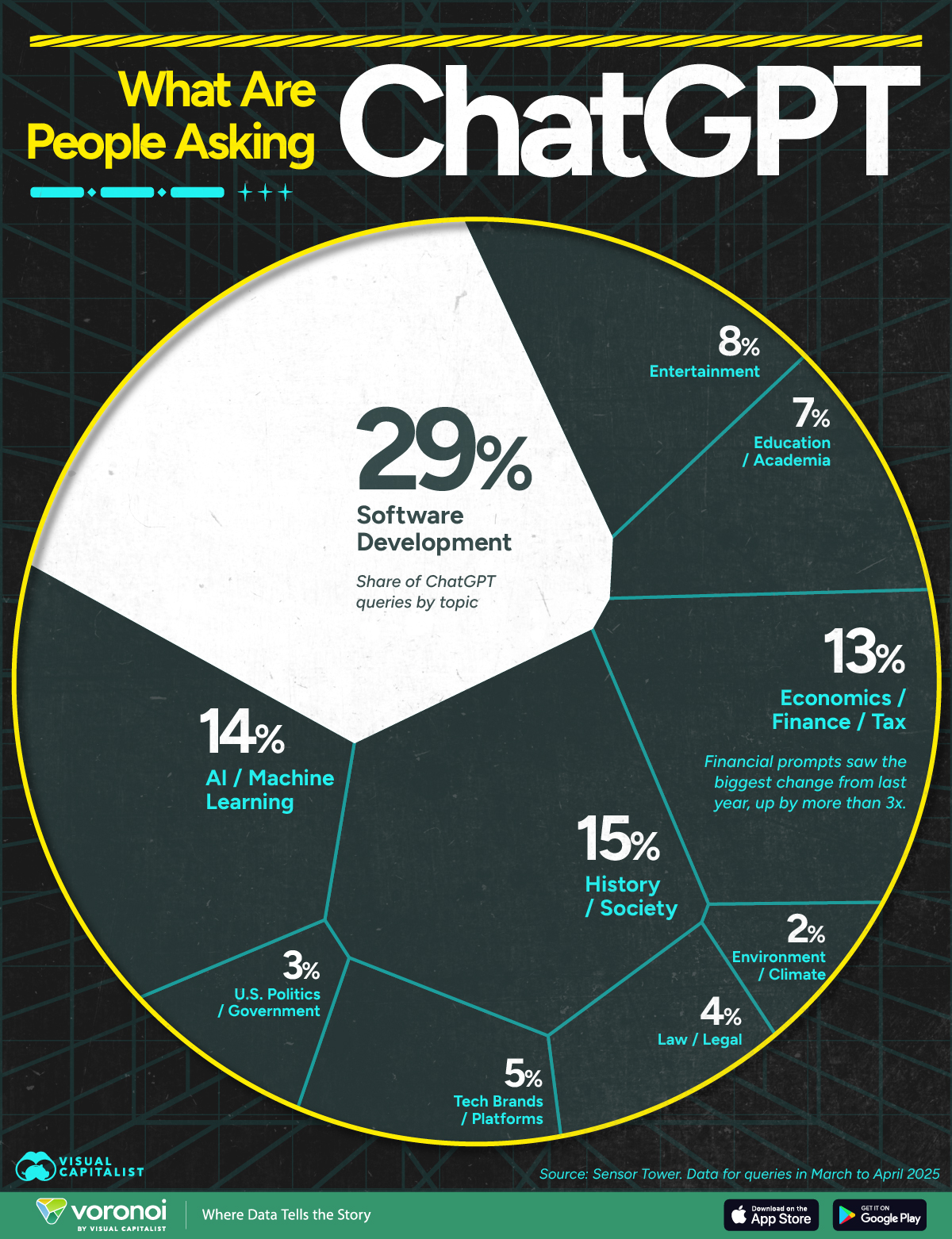

Open AI is about to enter the advertising business, and they're not playing around with pricing.

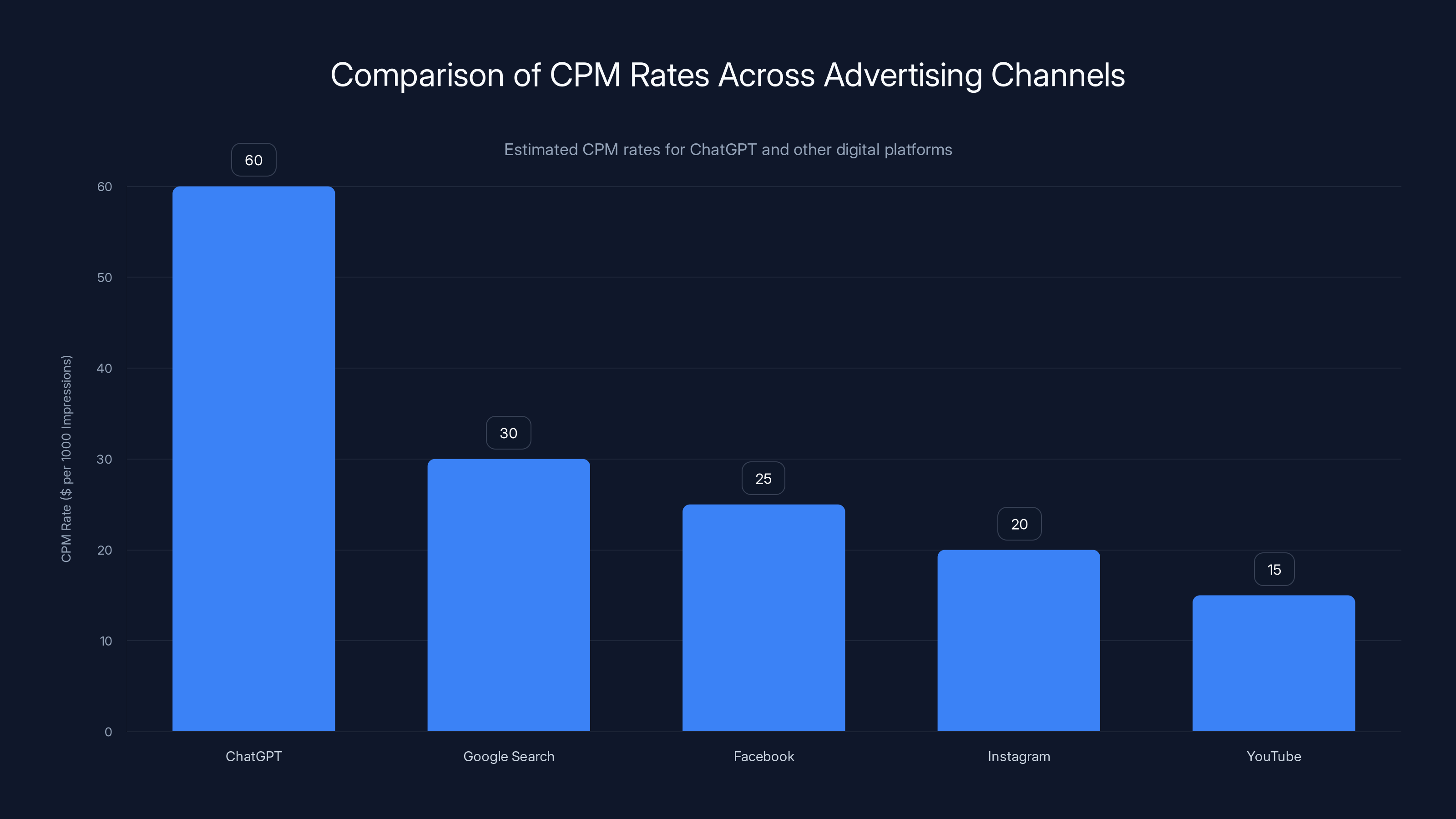

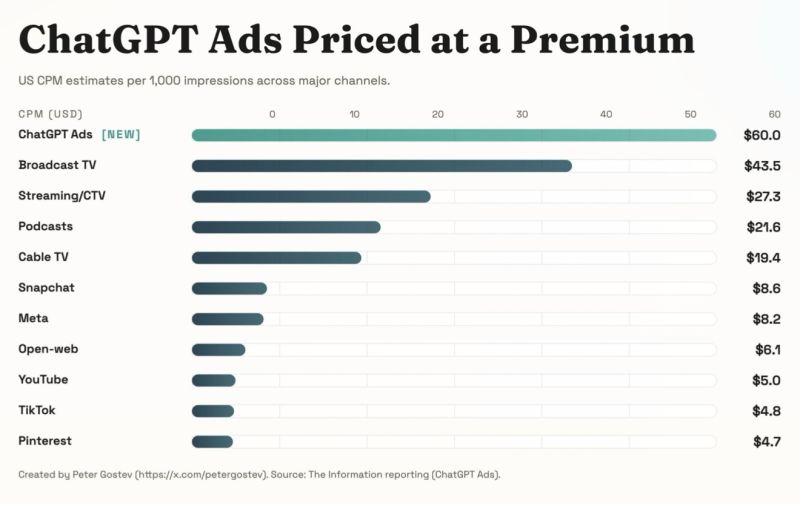

The company is considering charging $60 per thousand impressions (CPM) for ads that appear in Chat GPT. That's the same ballpark as live NFL broadcasts, including some of the priciest real estate in American media: Super Bowl ad slots.

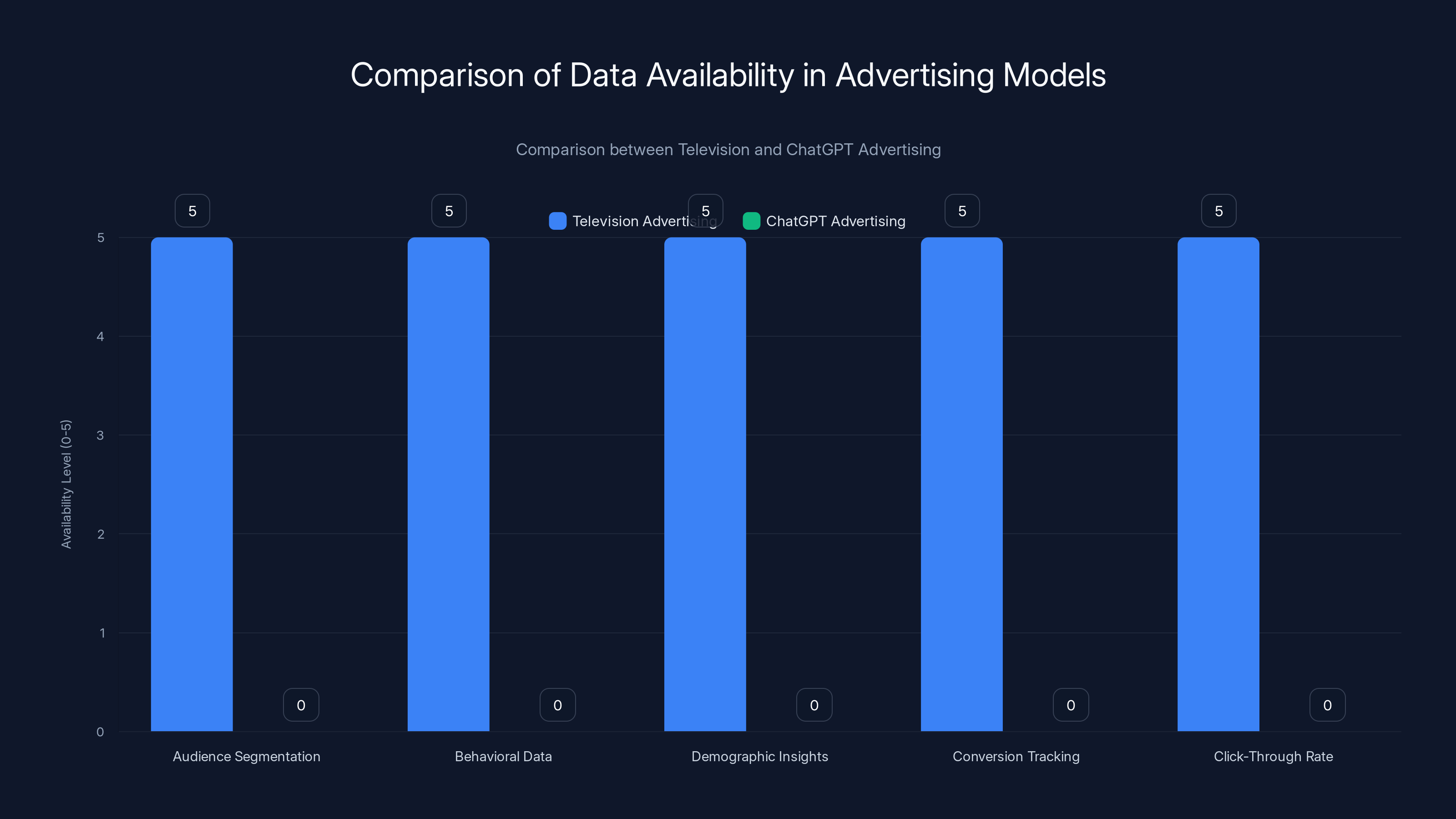

Here's the catch: Chat GPT ads come with almost none of the transparency, performance data, or engagement metrics that traditional digital advertising provides. No click-through rates broken down by audience segment. No conversion data. No behavioral targeting insights. Just total impressions and total clicks, reported at a high level.

So we're looking at a situation where Open AI wants to charge premium sports broadcast rates for an ad format that sits below AI-generated answers, with no clear evidence that users are actually clicking on them or acting on them.

It's a fascinating—and arguably controversial—monetization strategy. And it raises serious questions about whether impression-based pricing makes sense in an AI-first world, where traditional advertising metrics don't necessarily apply.

Let's dig into what's actually happening here, why Open AI is pursuing this pricing model, and whether it's actually worth what they're asking.

TL; DR

- Open AI's proposed Chat GPT ad rates: $60 CPM (cost per thousand impressions), matching NFL broadcast pricing

- Key limitation: Pricing based on impressions only, without detailed engagement data or click-through metrics

- Who sees ads: Free tier and 20/month Plus subscribers avoid ads entirely

- Rollout timeline: Expected within weeks in the United States as Open AI's first major monetization push

- The core problem: No transparent performance standards for advertisers, making ROI assessment nearly impossible

Television advertising offers comprehensive data availability across various metrics, unlike ChatGPT advertising, which currently lacks detailed performance insights. Estimated data based on industry standards.

The $60 CPM Question: What Open AI Is Actually Charging

Let's start with what we know, and it's limited.

According to reporting from The Information, Open AI is internally considering ad rates of $60 per thousand impressions. That's not a confirmed public number—Open AI hasn't officially announced pricing. But it's the figure that's been circulating among early advertisers and media buyers.

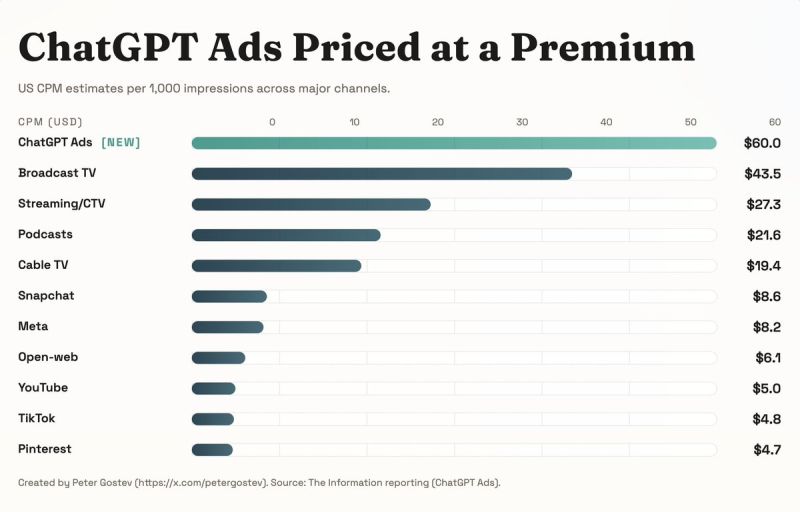

To put that in perspective, $60 CPM is expensive. Really expensive.

Here's how it breaks down across different advertising channels:

Premium digital display advertising typically runs

Search advertising (like Google Ads) varies wildly, from

Social media advertising ranges from

Live television, particularly premium sports broadcasts, runs

Super Bowl advertising hits the extreme end:

At $60 CPM, Chat GPT ads would sit between premium cable television and Super Bowl territory. That's a bold positioning for a format that doesn't yet have established engagement metrics.

The question is: do those longer engagement windows justify a seven-to-eight-fold increase in price?

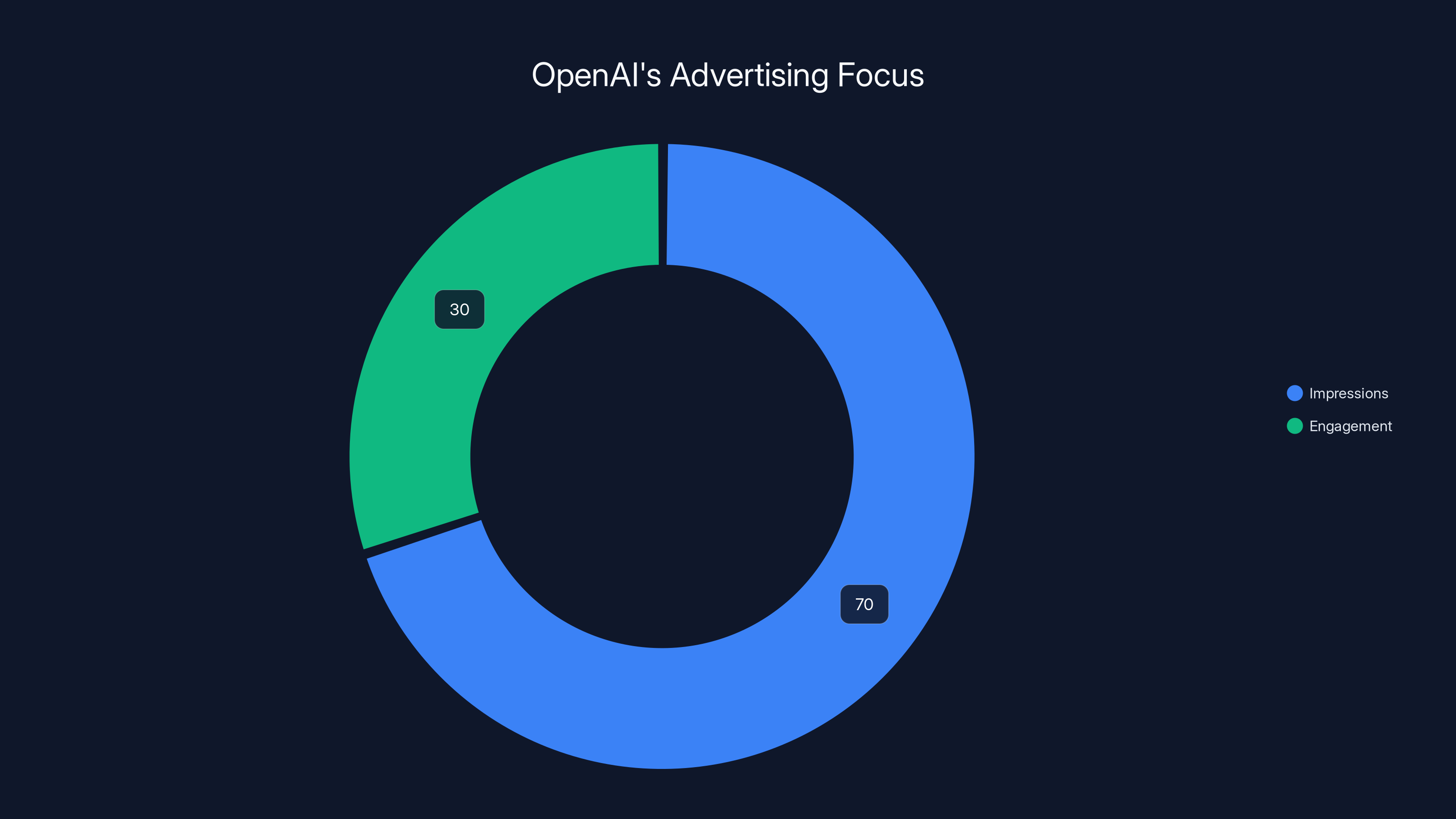

Open AI seems to think so. But the company's justification is borrowed directly from traditional television advertising logic: impressions matter more than clicks.

Impression-Based Pricing vs. Performance Metrics: The Missing Data Problem

Here's where things get murky.

Open AI has explicitly stated that Chat GPT ads will rely entirely on impression-based pricing, not click-based or conversion-based models. In other words, you pay for the ad showing up, regardless of whether anyone actually clicks it.

That works fine in television advertising because we've spent decades building trust in audience measurement standards. Nielsen ratings are industry-standard. Cable box data is reliable. Viewership numbers are predictable.

Chat GPT has none of that infrastructure.

According to early reports from media buyers, Open AI plans to provide only high-level performance reporting:

- Total impressions served

- Total clicks received

- No audience segmentation data

- No behavioral breakdowns

- No demographic insights

- No conversion tracking

- No click-through rate variations by user type

That's it. Two numbers.

An Open AI spokesperson compared this approach to television advertising, arguing that exposure and attention matter more than direct interaction. But that comparison breaks down almost immediately when you consider the differences between Chat GPT and a TV broadcast.

Television advertising has a 70-year history of audience research, established CPM benchmarks, and cultural momentum. When a company advertises during a major sporting event, they're buying access to a guaranteed, massive audience.

Chat GPT advertising has none of that established track record. The platform is only a year and a half old. No one knows what the actual engagement rates are. No advertiser has run a major campaign yet. There are no benchmarks.

The lack of detailed performance data creates a specific problem for advertisers: they can't assess ROI with any precision.

If you're a software company and you spend

- Which types of users clicked

- What they clicked toward

- Whether those clicks converted to trials or customers

- How Chat GPT ad clicks compared to your Google Ads clicks

- Whether the traffic quality was high, medium, or worthless

You're essentially buying blind.

ChatGPT's estimated CPM rate of $60 is notably higher than typical rates for other digital platforms, positioning it in a premium category. Estimated data.

Why Open AI Is Prioritizing Impressions Over Engagement Data

This is where we need to think about Open AI's actual incentives.

The company has been aggressive about monetization. They've launched paid tiers (Chat GPT Plus at

But here's the thing: detailed performance tracking costs money to build, maintain, and report on. It requires infrastructure. It opens Open AI to liability for user privacy concerns. It invites scrutiny from advertisers who might question the metrics.

Simple impression-based reporting? That's easy. That's what TV networks have been doing for decades. Count how many times an ad displays, report it, move on.

There's also a privacy angle. Open AI has been careful about not using personal data (health information, browsing history, etc.) for ad targeting. Detailed engagement tracking could raise questions about what data they're collecting and how. Staying vague helps them sidestep that conversation.

From a business standpoint, impression-based pricing also protects Open AI's margins. If they were forced to refund advertisers for low-click campaigns, or if click-through rates turned out to be significantly lower than expected, the company would face pressure to lower CPM rates. By avoiding that comparison entirely, Open AI can maintain premium pricing indefinitely.

But this creates an asymmetric relationship: Open AI captures the risk of poor engagement, advertisers capture the risk of wasted spend. That's a bad trade for the advertisers.

Who Actually Sees Chat GPT Ads, and When

Open AI's ad rollout has a specific targeting strategy, and understanding it is crucial.

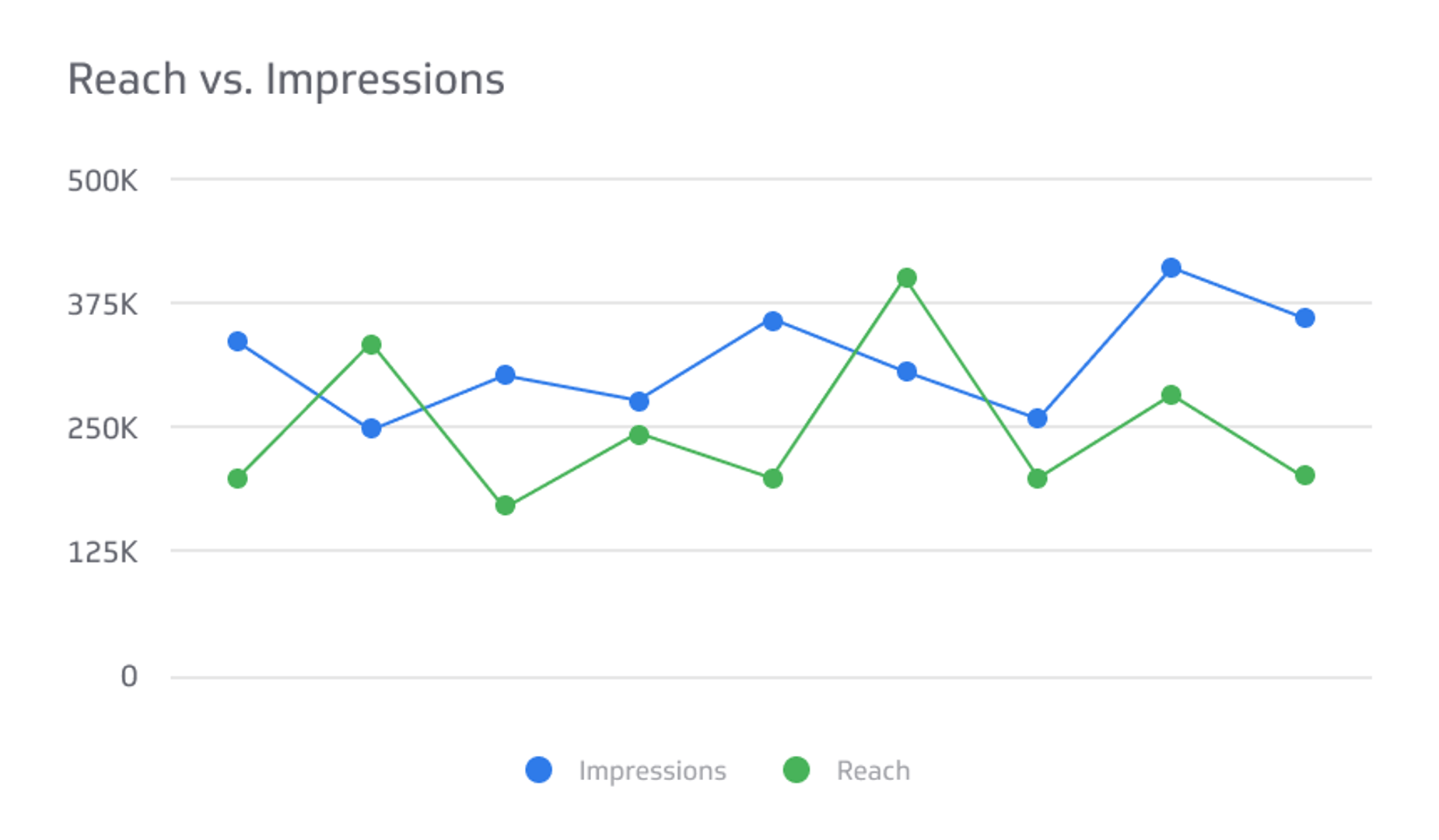

Free Chat GPT users will see ads. These are people who want to use Chat GPT but aren't willing to pay anything. They represent a massive audience—potentially tens of millions of people.

Chat GPT Go subscribers ($8/month) will also see ads. This is the new budget tier that Open AI launched to capture price-sensitive users who still want faster responses and more capability than the free tier. This tier is significant because it shows Open AI's willingness to monetize users who are already paying, just at a lower price point than Plus.

Chat GPT Plus subscribers ($20/month) will NOT see ads. This is a crucial segment, because it creates a clear hierarchy: pay more, avoid ads entirely. It also means that highly engaged, high-value users will opt out of the ad experience, which could impact advertiser ROI indirectly.

This three-tier system raises an interesting question: who are the people seeing ads?

They're either:

- People who can't afford the paid tiers

- People who don't use Chat GPT frequently enough to justify paid access

- People who are testing the platform for the first time

None of these categories immediately screams "high-value advertising audience" to most B2B software companies. If you're selling enterprise software, you probably want to reach decision-makers who are willing to pay for Chat GPT Plus. You don't want to reach free-tier users who are just experimenting.

That mismatch between advertiser goals and free-tier audience characteristics could be a major issue with Chat GPT's ad model.

The rollout is expected within weeks in the United States. International markets will follow later. This means we're about to get our first real-world data on how users react to ads in Chat GPT, and whether the ad experience actually works as a monetization vehicle.

How Chat GPT Ads Are Positioned: Below Answers, Not Influencing Them

One thing Open AI has been explicit about: ads won't be baked into Chat GPT's responses.

They're not going to show an ad and then answer your question. They're not going to slip an ad into the middle of a response. They're not going to influence the generated text based on advertiser interests.

Instead, ads will appear beneath the AI response, as a separate element in the interface.

This is actually important for user experience and trust. If Open AI started inserting ads into responses or letting advertiser relationships influence answers, users would rightfully lose confidence in Chat GPT as a neutral information source. It would be catastrophic for the brand.

By placing ads below the response, Open AI maintains a clear separation between content and commerce. Users get their answer first. Then they see an ad if it's relevant.

But here's the practical question: are users going to scroll down to see ads that appear below their answer?

Usability research on web design consistently shows that below-the-fold content (content that appears after you need to scroll) gets significantly less engagement than above-the-fold content. People often don't scroll. They take their information and move on.

Open AI hasn't published data on how many users scroll past the response to see ads. They haven't shared click-through rates. They haven't disclosed whether ads in Chat GPT perform like below-the-fold display ads on websites (where CTR can drop to 0.1-0.5%) or whether Chat GPT's context creates different engagement dynamics.

This is a critical gap in understanding whether $60 CPM is actually justifiable.

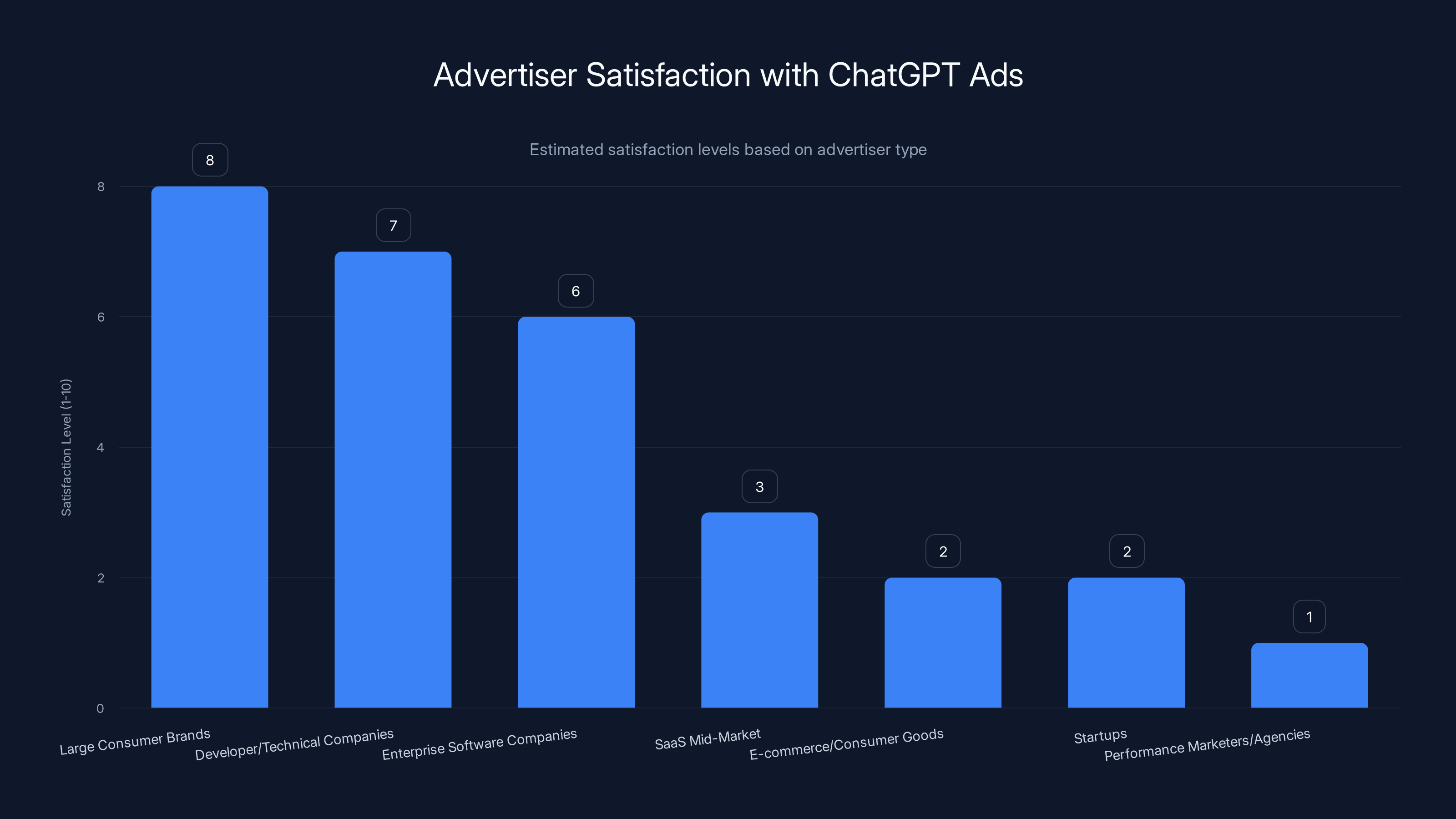

Estimated satisfaction levels show large consumer brands and developer-focused companies are most likely to benefit from ChatGPT ads, while performance marketers and agencies are least satisfied.

Comparison: Chat GPT Ads vs. NFL Broadcasts (The Apples and Oranges Problem)

The headline comparison—Chat GPT ads costing as much as Super Bowl ads—is catchy. But it's also deeply misleading.

Let's break down the differences:

Super Bowl advertising:

- Guaranteed audience of 100+ million viewers

- Demographic data on every viewer

- Cultural phenomenon status (people watch Super Bowl ads intentionally)

- Captive audience (you can't skip or ignore Super Bowl ads)

- Decades of ROI data and case studies

- Massive brand lift and earned media coverage

- $7 million for 30 seconds

- Effective CPM: roughly $233,000+ per thousand impressions (if we break it down by actual engagement)

Chat GPT ads:

- Unknown total audience (Open AI hasn't disclosed DAU or MAU)

- No demographic data provided to advertisers

- Not intentionally sought out (users come for the AI, not the ads)

- Easy to ignore (scroll past, dismiss, or close)

- Zero historical ROI data

- No brand lift or earned media (nobody talks about Chat GPT ads)

- Proposed $60 per thousand impressions

- Effective CPM: completely unknown

When you look at it this way, the $60 CPM comparison is actually kind of absurd. You're getting a fraction of the audience, a fraction of the engagement, none of the brand lift, and no historical performance data. Yet you're paying almost the same rate as you would for one of the most coveted advertising slots in the world.

A Super Bowl ad at

Click-Through Rates: The Missing Variable

Here's what we don't know, and it matters enormously: what are Chat GPT click-through rates actually like?

Open AI has not disclosed this information. No media buyer has published it. No advertiser has gone public with results.

We can make educated guesses based on where ads are positioned and how users interact with Chat GPT, but guesses aren't good enough for a $50,000+ advertising commitment.

Traditional display advertising click-through rates vary widely:

- Premium website display ads (above the fold): 0.5-1.5% CTR

- Below-the-fold display ads: 0.1-0.5% CTR

- Google Search ads (highly intent-driven): 2-5% CTR

- Facebook/Instagram ads (with targeting): 0.5-2% CTR

- Newsletter ads (audience is captive): 1-3% CTR

Chat GPT ads will probably fall somewhere in that range, but we genuinely don't know where.

If Chat GPT ads achieve a 1% CTR, that means for every

If Chat GPT ads achieve a 0.1% CTR (which is plausible for below-the-fold content), you're paying $60 per click. That's expensive for most verticals.

This enormous range of possibility is why impression-based pricing without engagement data is so problematic. Advertisers are being asked to commit budget with potentially a 60-fold range of actual cost-per-click.

The Privacy Angle: Why Open AI Isn't Sharing Detailed Engagement Data

There's a secondary reason why Open AI might be reluctant to provide granular engagement metrics, and it relates to privacy.

Detailed performance reporting on ads requires detailed tracking of user behavior. That means knowing which users clicked, what they clicked on, what their characteristics were, whether they converted, and so on.

Open AI has made explicit commitments about not using personal data (health information, browsing history) to train AI models or power advertising. The company wants to position itself as privacy-first, especially in contrast to Meta or Google.

But the moment you start providing detailed ad performance metrics—clicks by user type, engagement rates by time of day, conversion tracking, audience segmentation—you're now tracking personal behavior at a level that could be controversial.

It's easier for Open AI to stay vague. They can point to impressions and total clicks (both of which require minimal user tracking) and avoid the privacy questions that would come with detailed behavioral reporting.

This creates an interesting tension: Open AI gets privacy benefits, but advertisers lose transparency. The company has made a choice about where the trade-off lies.

Whether that trade-off is acceptable to advertisers is an open question.

OpenAI is estimated to prioritize impressions (70%) over engagement (30%) due to cost efficiency and privacy concerns. Estimated data.

Advertiser Concerns: Who Wins, Who Loses

Let's think through who benefits and who doesn't in this model.

Who might be happy with Chat GPT ads at $60 CPM:

Large consumer brands with massive budgets and brand awareness goals. If you're Nike, Apple, or Coca-Cola, you don't necessarily care about click-through rates. You care about impressions and brand awareness. Hitting millions of Chat GPT users with your brand message has value, even if CTR is low.

Companies selling to developers and technical audiences. If your product is an API, a developer tool, or technical software, Chat GPT users are a good demographic. Developers use Chat GPT frequently, and they make purchasing decisions.

Enterprise software companies with high price points. If your product costs $10,000+ per month, you don't need high CTRs. You just need to reach a few qualified prospects. Chat GPT's audience might be small enough to make this viable.

Who's probably going to be unhappy:

Saa S companies with mid-market pricing. If you're selling a $100/month product, you need significant conversion volume to break even. Unverified CTRs at high CPM rates are a nightmare.

E-commerce and consumer goods companies. These rely on cost-per-acquisition metrics. If you can't track conversions with precision, you can't optimize spend. Chat GPT ads would be too risky.

Startups with limited budgets. $50,000 to test a new channel is a lot for a startup. They need proven performance metrics before committing that kind of spend.

Performance marketers and agencies. These folks live and die by measurable ROI. The lack of detailed engagement data makes Chat GPT advertising nearly impossible to justify to clients.

The net result is that Chat GPT advertising will probably attract companies that can afford to buy impressions without guaranteed ROI. That's a real market, but it's not the biggest market in digital advertising.

How Chat GPT Ads Compare to Search, Social, and Display Advertising

Let's put Chat GPT ads in context with other major advertising channels, using actual metrics where available.

Google Search Ads:

- CPM equivalent: 50 depending on keyword competitiveness

- CTR: 2-5%

- Engagement: Highly intent-driven (user is searching for a solution)

- ROI tracking: Comprehensive, including conversion tracking

- Publisher relationship: Transparent, standardized

Facebook/Instagram Display Ads:

- CPM: 5 depending on audience targeting

- CTR: 0.5-2%

- Engagement: Passive (user is scrolling, not actively seeking)

- ROI tracking: Good, Facebook pixel enables detailed conversion tracking

- Publisher relationship: Audience data sharing, sophisticated targeting

Linked In Ads (B2B focus):

- CPM: 10

- CTR: 0.4-1%

- Engagement: Semi-intent-driven (user is on a professional network)

- ROI tracking: Good for lead generation, can track job titles and companies

- Publisher relationship: Professional audience data, corporate accounts

You Tube Pre-roll Ads:

- CPM: 20

- CTR: 1-5% (varies widely by content)

- Engagement: Passive initially (unskippable), can be skipped after 5 seconds

- ROI tracking: Moderate, You Tube tracks views and clicks but not conversions

- Publisher relationship: Content-based, CPM determined by video quality

Chat GPT Ads (Proposed):

- CPM: $60

- CTR: Unknown

- Engagement: Unknown (below-the-fold content, competing with generated answer)

- ROI tracking: Minimal (impressions and total clicks only)

- Publisher relationship: No transparency, no engagement metrics, no benchmarks

When you line them up like this, Chat GPT's positioning is striking. It's the most expensive channel with the least transparency and the most unknown engagement dynamics.

The Monetization Context: Why Open AI Needs Ad Revenue

Understanding why Open AI is pursuing ads requires understanding the company's financial situation.

Open AI has been burning through money at an alarming rate. The company has spent billions building infrastructure to run Chat GPT and other models. It's raised about $13 billion in funding (as of mid-2024) from investors like Microsoft, Thrive Capital, and others.

But here's the issue: running Chat GPT is expensive. Every query costs Open AI money in compute, storage, and infrastructure. The company has to pay for servers, electricity, bandwidth, model training, and more.

So far, Open AI's revenue has come from:

- Chat GPT Plus subscriptions (240 million annually)

- Chat GPT Team (enterprise subscriptions, smaller revenue base)

- API access (businesses integrating Chat GPT into products)

- Enterprise contracts (large companies licensing Chat GPT internally)

But these revenue streams don't cover the operating costs. Open AI reportedly loses money on each Chat GPT query because inference (running the model) is expensive.

That's why ads are attractive: they're basically free money. Open AI doesn't have to build new infrastructure or significantly change the product. They just slot in ads and collect CPM revenue.

The problem is that $60 CPM might sound good in theory, but if Chat GPT click-through rates are low, the actual revenue per user might not cover operating costs either.

Open AI is betting that premium pricing ($60 CPM) plus ad volume (millions of free-tier and Go-tier users) will generate enough revenue to meaningfully offset infrastructure costs. Whether that bet pays off depends entirely on whether advertisers stick around after realizing the engagement data is sparse.

Estimated data suggests varying levels of advertiser engagement, with commitment potentially high but renewal rates lower due to performance uncertainties.

What Users Actually Think About Chat GPT Ads

Here's where it gets interesting: user sentiment on Chat GPT ads is decidedly negative.

When the news of Chat GPT ads broke, the response from the community was overwhelming skepticism and frustration. People were upset for several reasons:

Free-tier users feel trapped. They want to use Chat GPT but can't afford Plus. Now they'll have to deal with ads. There's a sense of "we're the product being sold to advertisers."

Go-tier subscribers are annoyed. Even at $8/month, some users thought they were getting a paid experience. Instead, they're finding out they'll still see ads. That feels like bait-and-switch.

Privacy concerns exist. Even though Open AI says it won't use personal data for ads, users are skeptical. They're thinking, "If you're showing me ads, you must be tracking something."

Quality concerns. Users worry that ads will degrade the Chat GPT experience. They came for useful AI, not a billboard.

Plus subscribers are smugly satisfied. The only group genuinely happy with ads are Chat GPT Plus users who can opt out. For them, ads are proof that the free tier exists to monetize non-paying users, which makes their paid tier feel more valuable.

None of this is surprising, but it's worth noting because user sentiment affects advertiser ROI. If users actively dislike ads, they'll skip them, ignore them, or develop ad blindness (unconsciously ignoring ads entirely). All of those things tank CTR and reduce campaign effectiveness.

Alternative Revenue Models Open AI Could Have Pursued

It's worth considering whether $60 CPM impression-based ads are actually the best monetization approach, or whether Open AI had better options.

Freemium Tier Upgrade Model:

Instead of ads, Open AI could have made the free tier significantly more limited (say, 10 queries per day instead of unlimited) and pushed more users to the $8 Go tier. This increases revenue from subscriptions rather than advertising. It's less annoying for users who do decide to go free, and it creates clearer value differentiation.

Query-Based Pricing:

Open AI could charge per query for free-tier users (pay-as-you-go model).

Premium Features Model:

Instead of ads, Open AI could unlock specific premium features (file uploads, image generation, web access, etc.) behind paywalls for free-tier users. The free tier gets basic chat; paid tiers get advanced features. This is how many Saa S products work.

Sponsored Responses:

Open AI could partner with specific brands or services and integrate them into responses naturally. For example, if someone asks about coffee makers, Chat GPT could mention a sponsored product. This is similar to Google's sponsored links, but more integrated. It's less intrusive than banner ads.

API Bundling:

Open AI could create a "Chat GPT Plus with API credits" tier that gives users both chat access and API credits, encouraging them to build on top of Chat GPT. This drives ecosystem lock-in and higher ARPU (average revenue per user).

None of these are inherently better than ads, but they illustrate that Open AI had choices. They chose ads because ads are easy to implement, don't require changing the core product, and generate revenue with minimal incremental cost.

Whether that choice is right for users or advertisers is debatable.

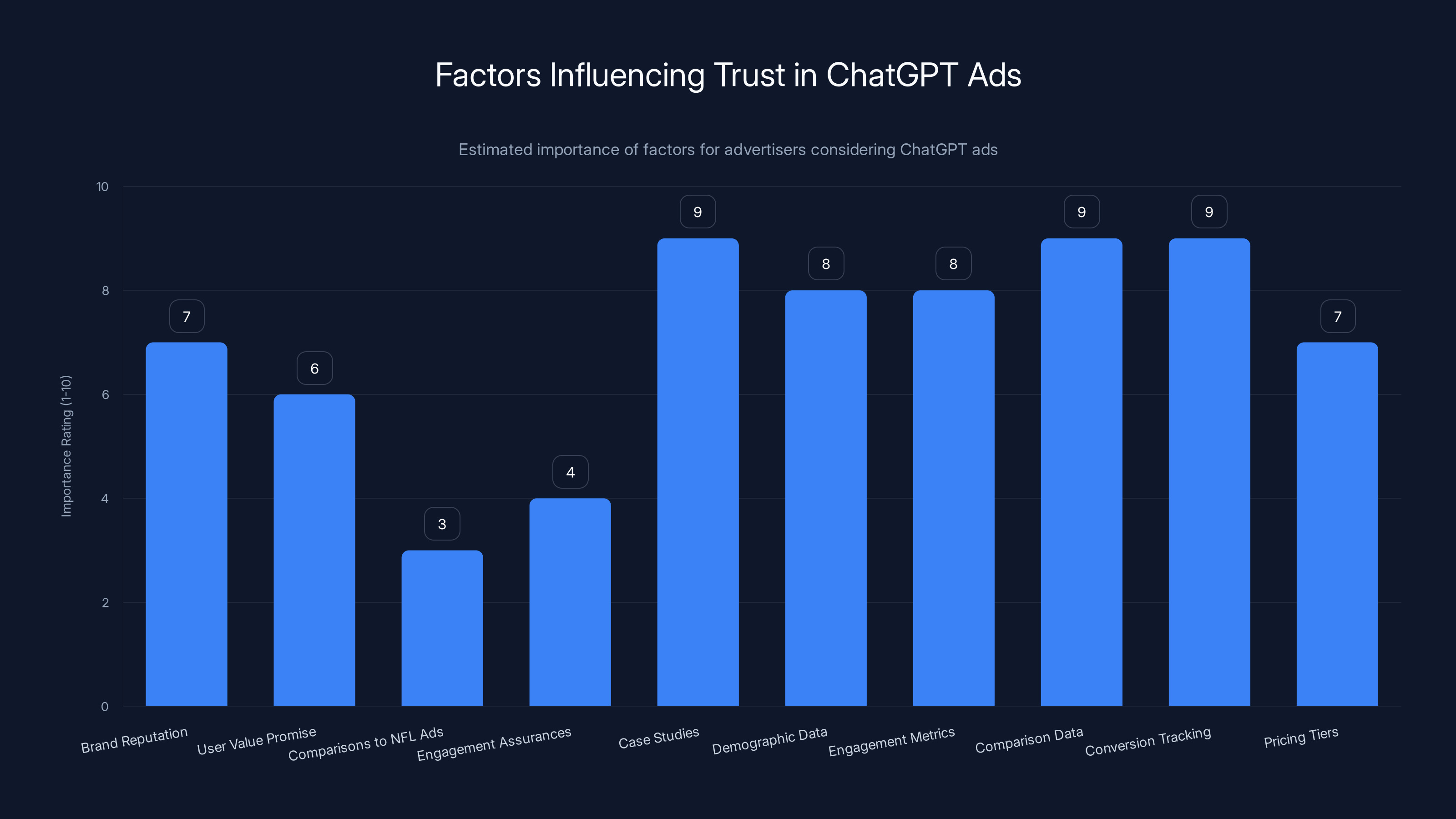

The Real Problem: Establishing Trust and Benchmarks

Here's the fundamental issue with Chat GPT ads at $60 CPM: there are no benchmarks.

When you buy Google Search ads, you know the baseline. You know that commercial intent keywords perform better than informational keywords. You know that higher quality scores lead to better positioning. You have a decade of data and case studies to draw from.

When you buy Facebook ads, you know how audience targeting works, what creative best practices look like, and approximately what CTR and conversion rates to expect.

Chat GPT ads? There's nothing. No one has done this before. No one knows if $60 CPM is a good deal or a ripoff.

Open AI is asking advertisers to trust them based on:

- The company's brand reputation and credibility

- The promise that Chat GPT users are valuable

- Comparisons to NFL broadcast advertising (which is not actually comparable)

- Vague assurances that engagement will be "sufficient"

That's not enough for most sophisticated advertisers.

What would establish trust:

- Case studies from beta partners showing CTR, CPL, or CPA

- Demographic data on the audience seeing ads

- Engagement metrics showing how many users scroll past ads vs. ignore them

- Comparison data against other channels (e.g., "Chat GPT ads achieve X% CTR vs. Y% for search ads")

- Conversion tracking enabling partners to measure actual ROI

- Pricing tiers offering lower CPM rates for unproven channels to incentivize early adoption

Open AI has provided none of these things. They've just set a price and asked advertisers to pay it.

That's a negotiating position, not a partnership. And it suggests Open AI's primary goal is extracting maximum CPM revenue from the first wave of advertisers, regardless of whether those advertisers see positive ROI.

Case studies, demographic data, and conversion tracking are crucial for establishing trust in ChatGPT ads. Estimated data based on typical advertiser priorities.

When Ads Might Actually Work Well in Chat GPT

Despite the skepticism, there are specific scenarios where Chat GPT ads could actually deliver value.

Scenario 1: B2B Enterprise Software

Imagine you sell enterprise project management software for $500+ per month. Your customer is a team lead or engineering manager who uses Chat GPT to debug code and generate documentation.

An ad targeting them in Chat GPT about your project management tool could be relevant and valuable. The person seeing it is exactly your target demographic, actively working, and solving problems. If your ad can connect to a problem they're facing right then, it could drive conversions despite modest CTR.

For this use case, $60 CPM might be acceptable because the customer lifetime value is high and the audience is specifically targeted by job role.

Scenario 2: Developer Tools and APIs

Similar logic applies to developer-focused products: programming languages, code editors, cloud infrastructure, monitoring tools, and so on.

Developers are heavy Chat GPT users. If you're selling a tool to developers, you want to reach them while they're actively coding and problem-solving. Chat GPT ads could be an effective placement because the audience is self-selected and engaged in development work.

Scenario 3: Educational Services

Companies offering coding courses, bootcamps, or technical certifications could use Chat GPT ads to reach people actively learning and improving their skills. The audience is motivated (they're using Chat GPT to learn), and educational products often have decent conversion rates.

Scenario 4: AI-Native Products

Companies selling AI-native tools (prompt libraries, fine-tuning services, custom AI model builders, etc.) have natural appeal to Chat GPT users. Someone already using Chat GPT for productivity gains might be interested in tools that extend AI capabilities. This creates natural product affinity.

Scenario 5: Recruitment and Talent

Tech companies looking to hire engineers or technical talent could use Chat GPT ads to reach active developers. This is a proven use case (Linked In does this effectively), and Chat GPT's developer audience is valuable for hiring.

In all of these scenarios, the key factor is alignment between the advertiser's target customer and Chat GPT's actual user base. When there's strong alignment, ads can work even at premium CPM rates.

But the inverse is also true: for most consumer products, e-commerce, or verticals not heavily represented in Chat GPT's user base, $60 CPM would be terrible value.

Looking Ahead: Will Advertisers Actually Buy?

The real test of Chat GPT's ad pricing will come in the next 90 days.

Open AI has said ads will roll out within weeks in the United States. Within a few months, we'll have initial data:

- How many advertisers commit budget?

- What CPM rates do they actually negotiate?

- What are the actual click-through rates and conversion rates?

- Do advertisers renew campaigns or do they pull back?

- Do user complaints force Open AI to modify the ad format or targeting?

I suspect what will actually happen is more nuanced than the $60 CPM headline suggests. Open AI will likely:

-

Price discriminate aggressively. Large brands and direct relationships might get premium rates. Smaller advertisers running through self-serve systems might get discounted rates or performance-based pricing.

-

Build in performance guarantees. Faced with advertiser skepticism, Open AI might quietly offer refunds or credits if CTR falls below certain thresholds. This isn't the same as transparent performance reporting, but it's a safety valve.

-

Develop audience insights over time. As more ads run, Open AI will accumulate data on engagement, demographics, and conversion patterns. They might gradually become more transparent as they have data to back up premium pricing.

-

Create premium ad products. Beyond basic text ads, Open AI might develop higher-value placements (like above-the-fold ad slots, search-adjacent placements, or sponsored responses) that command even higher CPM rates from high-value advertisers.

-

Face pressure to lower rates. If CTR and conversion rates turn out to be lower than advertiser expectations, Open AI will face downward pressure on CPM rates. They might resist this, but market forces usually win.

The honest truth is that we won't know if $60 CPM is actually justified until we have real performance data. Open AI is asking advertisers to trust them based on reputation and comparisons to TV advertising, both of which are soft justifications.

A good business relationship is built on mutual interest and transparent outcomes. Right now, Open AI is structuring Chat GPT ads in a way that maximizes their upside (collect CPM revenue) while minimizing their accountability (provide minimal engagement data).

That's not a partnership. It's a take-it-or-leave-it offer.

Whether advertisers take it will determine whether Chat GPT ads become a viable advertising channel or a cautionary tale about what happens when companies try to monetize without providing value to all stakeholders.

The Bigger Picture: AI and Advertising in 2025

Chat GPT ads are just the beginning of a much larger trend: AI companies figuring out how to monetize through advertising.

Perplexity is launching ads in search results. Google is integrating more generative AI into search and monetizing it differently. Meta is building AI-powered ad targeting tools. Every AI company is exploring advertising as a revenue stream.

But Chat GPT's approach is particularly revealing because it shows what happens when a company prioritizes extraction over value creation.

Open AI is saying: "We have your attention. We're going to sell that attention to advertisers. We won't tell you exactly what we're selling, and we won't track outcomes, but we're charging premium rates anyway."

That's not sustainable long-term. Advertisers will eventually demand better data. Users will eventually demand better ad experiences (or no ads at all). Open AI will eventually have to choose between being an advertising company and being a trusted AI assistant.

You can't really be both.

The Missing Perspective: What Chat GPT Users Actually Want

There's one perspective that's been almost completely missing from this conversation: the users' perspective.

Chat GPT has been successful in large part because it's been free and ad-free. People love using it precisely because they can ask questions without interference, without being tracked, and without being sold to.

Now Open AI is introducing ads, and the user experience is fundamentally changing.

Users aren't employees of Open AI. They don't care about the company's infrastructure costs or revenue problems. They're using Chat GPT because it's useful, and they expect that utility to be preserved or improved, not degraded for profit.

Every ad that appears in Chat GPT is a degradation of the user experience. It's noise. It's distraction. It's a company choosing to optimize for advertiser value rather than user value.

Open AI's Plus subscription offering ($20/month) partially solves this: users who want an ad-free experience can pay for it. That's a legitimate choice, and it's what most successful digital products do.

But by advertising at NFL rates and providing minimal engagement data, Open AI is signaling that they're optimizing for advertiser value, not user value. They're betting that free-tier users will tolerate ads because the product is still free, and Go-tier subscribers will tolerate ads because they're only paying $8/month.

That bet might work. Or it might backfire as users migrate to ad-free alternatives or complain loudly enough that Open AI is forced to change the model.

Either way, the precedent is concerning. It suggests that as AI companies mature and face pressure to monetize, they'll increasingly prioritize advertising over user experience. And that's bad for everyone except the advertisers.

Final Verdict: Is $60 CPM Actually Justifiable?

Let's cut to the chase.

Is $60 CPM a fair price for Chat GPT ads? The honest answer is: it depends entirely on the actual engagement metrics, and Open AI hasn't shared those metrics.

If Chat GPT ads achieve 3-5% CTR (which seems unlikely for below-the-fold content, but possible depending on context), then $60 CPM might be reasonable when compared to search advertising.

If Chat GPT ads achieve 0.5% CTR (which is more likely), then $60 CPM is expensive compared to social media advertising, which averages 0.5-2% CTR at a fraction of the price.

If Chat GPT ads achieve 0.1% CTR (which is possible), then $60 CPM is absurdly expensive—more expensive than Super Bowl ads on a per-click basis.

Without that data, we're just guessing. And Open AI is counting on advertisers guessing in their favor.

Here's what I think will actually happen: Open AI will publish some advertisers' case studies in 90 days showing positive ROI. This will encourage more spending. Within a year, Open AI will have accumulated enough data to lower the published CPM rate by 20-40% as they improve targeting and ad formats. They'll frame this as "democratizing access" rather than admitting the original rate was too high.

Meanwhile, some early advertisers will make money. Others will waste money. Most will discover that Chat GPT's audience isn't actually their audience and will reduce spend.

The long-term health of Chat GPT as an advertising medium depends on Open AI eventually providing the transparency that sophisticated advertisers demand. If they don't, Chat GPT ads will remain a niche channel for brand awareness and developer-focused products.

That's not necessarily bad for Open AI—even a niche channel can generate meaningful revenue. But it's less good than the hype suggests, and far less good than Open AI's $60 CPM pricing implies.

The most important thing to understand is that you're not actually buying Chat GPT ads at $60 CPM. You're buying a mystery box and being asked to trust Open AI's pricing. Whether that's a good deal depends entirely on what's actually in the box.

And we won't know until we open it.

FAQ

What does CPM mean in advertising?

CPM stands for Cost Per Thousand Impressions (the "M" comes from the Roman numeral for 1,000). It's a pricing model where advertisers pay a fixed rate for every thousand times their ad is displayed, regardless of whether anyone clicks it or takes action. CPM is common in traditional media (TV, radio, print) and display advertising on websites, but less common in digital channels where engagement metrics are easily measurable.

How much is Open AI charging for Chat GPT ads?

According to reporting from The Information, Open AI is internally considering ad rates of $60 per thousand impressions (CPM). This is equivalent to pricing in the Super Bowl advertising range, though Open AI has not officially confirmed these figures publicly. Actual negotiated rates may differ depending on advertiser size, contract terms, and other factors.

Why isn't Open AI providing click-through rate data or engagement metrics?

Open AI has stated it will provide only high-level performance reporting (total impressions and total clicks) without detailed engagement breakdowns. The company likely avoids detailed tracking to protect user privacy and reduce infrastructure costs, but this creates a significant transparency gap for advertisers who need to measure ROI. The company has compared its approach to television advertising, where impressions matter more than individual clicks.

Who will see Chat GPT ads?

Ads will appear to free-tier Chat GPT users and Chat GPT Go (

How do Chat GPT ad rates compare to other advertising channels?

At

Can I track conversions from Chat GPT ads?

No, Open AI has not indicated it will provide conversion tracking, audience segmentation, or detailed performance analytics. Advertisers will only receive total impression counts and total click counts. This makes it extremely difficult to calculate cost-per-acquisition (CPA) or determine actual return on ad spend (ROAS), which sophisticated advertisers require before committing significant budget.

Why is Chat GPT introducing ads?

Open AI is introducing ads because running Chat GPT is expensive, and the company needs additional revenue sources beyond subscriptions and API access. Advertising allows Open AI to monetize the free-tier and Go-tier user base without changing the product. Ads are relatively easy to implement and generate revenue with minimal incremental infrastructure cost, making them an attractive monetization mechanism for a cash-hungry AI company.

When will Chat GPT ads launch?

Open AI has indicated ads will roll out within weeks in the United States, with international markets following later. The company has not announced a specific launch date, but the feature is expected in 2025. Early rollout may be limited to a subset of users or advertisers as Open AI tests the system.

Are Chat GPT ads placed within AI responses or below them?

Open AI has stated that ads will appear below Chat GPT responses, not within them. This means users get their answer first, then see an ad below. Open AI emphasized that ads will not influence the generated responses themselves, maintaining separation between content and commerce. However, ads appearing below responses may achieve lower engagement since users often don't scroll past their answers.

What happens if Chat GPT ads don't perform well?

If click-through rates or conversion rates turn out to be lower than advertiser expectations, Open AI will likely face downward pressure on CPM rates. The company may eventually offer performance guarantees, negotiate lower rates with larger advertisers, or develop premium ad products at higher rates to offset declining CPM pricing. Early advertiser feedback will determine whether the $60 CPM rate holds or gets revised downward.

Conclusion: The Verdict on Open AI's AI Advertising Gambit

Open AI's decision to charge $60 CPM for Chat GPT ads is bold, ambitious, and deeply uncertain.

On one hand, the company has legitimate reasons to monetize its user base. Running Chat GPT is genuinely expensive, and advertising is an established revenue model that doesn't require fundamental changes to the product.

On the other hand, Open AI is asking advertisers to pay premium pricing (equivalent to Super Bowl rates) for an unproven channel with minimal engagement transparency. They're essentially saying: "Trust us that this works, but we won't give you the data to verify it."

That's a hard sell to sophisticated advertisers who live and die by measurable ROI.

The most likely outcome is a bifurcated market: some advertisers (particularly large brands and developer-focused companies) will find Chat GPT ads valuable and stick around. Others will discover the engagement rates don't justify the cost and will reallocate budget elsewhere.

Open AI will eventually be forced to provide better data and potentially lower rates to stay competitive with other AI advertising channels that are launching right now.

But the precedent is already set: AI companies are starting to view users as products to be monetized, not customers to be served. That shift, more than any specific CPM rate, is the real story.

The question isn't whether $60 CPM is fair. The question is whether Open AI can maintain user trust and advertiser confidence while simultaneously optimizing for profit over user experience.

History suggests that's harder than it looks.

Key Takeaways

- OpenAI's proposed $60 CPM for ChatGPT ads matches NFL broadcast pricing but lacks transparency on actual engagement metrics or click-through rates.

- The company provides only high-level impression and click data—no demographic breakdowns, behavioral insights, or conversion tracking that sophisticated advertisers need.

- ChatGPT ads will appear below responses (below-the-fold placement), likely resulting in CTRs similar to traditional display ads (0.1-0.5%) despite premium pricing.

- Only free-tier and 20/month Plus subscribers avoid ads entirely, potentially skewing the audience quality for advertisers.

- Without transparent performance standards, advertisers face extreme uncertainty in actual cost-per-click, ranging from 600 depending on unknown engagement.

- ChatGPT ads may work well for B2B software, developer tools, and enterprise products targeting highly-engaged technical audiences, but will struggle for e-commerce and consumer products.

Related Articles

- AI Labs' Reputation War at Davos: The Real Competition Behind the Scenes [2025]

- OpenAI's 2026 'Practical Adoption' Strategy: Closing the AI Gap [2025]

- ChatGPT Advertising Strategy: Premium Pricing vs. Data Limitations [2025]

- The AI Lab Monetization Scale: Rating Which AI Companies Actually Want Money [2025]

- Claude Code Is Reshaping Software Development [2025]

- Threads Ads Global Rollout: What It Means for Users and Creators [2025]

![ChatGPT Ads at NFL Rates: Is OpenAI's $60 CPM Justifiable? [2025]](https://tryrunable.com/blog/chatgpt-ads-at-nfl-rates-is-openai-s-60-cpm-justifiable-2025/image-1-1769895384397.jpg)