Did Apple Really Invest in Intel? Unraveling Trump's Controversial Claims

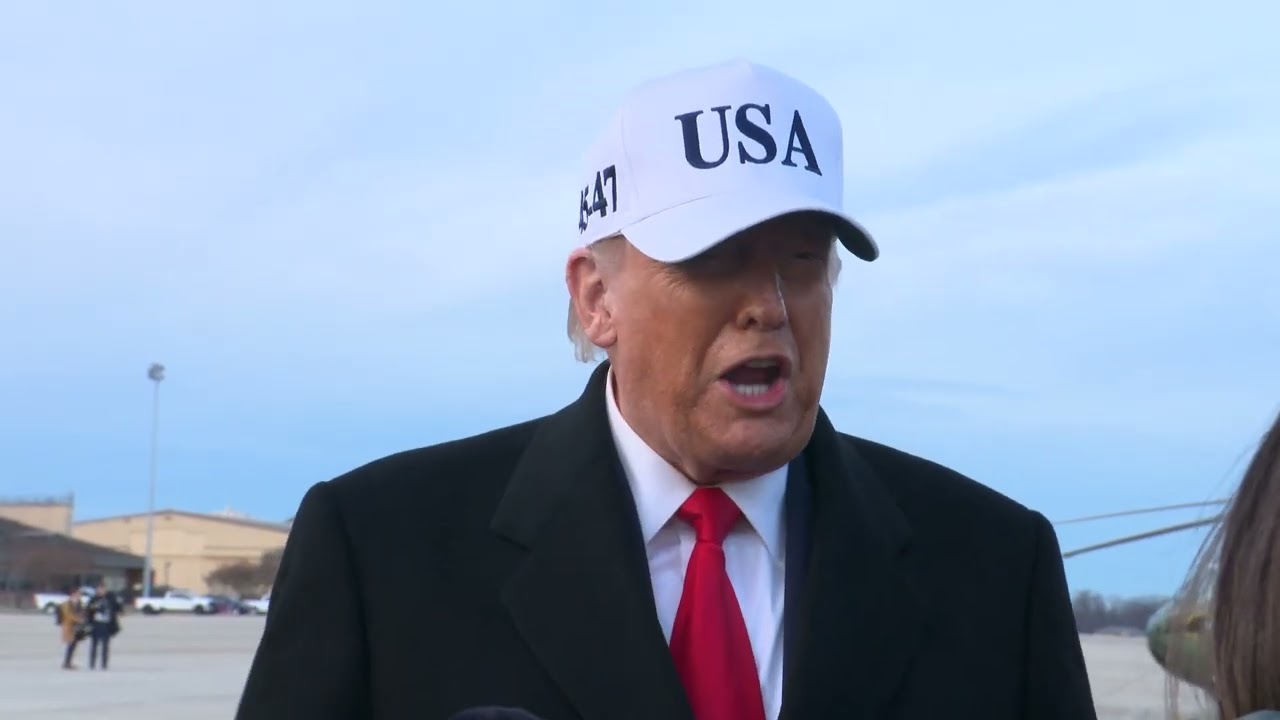

President Trump dropped a bombshell during a press briefing at Joint Base Andrews. He casually mentioned that Apple had jumped into Intel investments right alongside Nvidia, following the government's own stake in the chipmaker. The statement was short, almost throwaway: "As soon as we went in, Apple went in, Nvidia went in, a lot of smart people went in—they followed us."

That one sentence set off a wildfire of speculation across Wall Street, tech forums, and analyst desks worldwide. Did Apple actually buy equity stakes in Intel? Is this a strategic repositioning that nobody announced? Or did the president simply mix up facts, conflate different business relationships, or misremember a briefing?

Here's the thing: no official confirmation exists. Not from Apple. Not from Intel. Not from regulatory filings. Yet the claim is fascinating precisely because it touches on real, documented business between these companies. Apple has genuine, active relationships with Intel technology. Job postings suggest they're exploring Intel's advanced packaging methods. Reports indicate they've acquired design kits for Intel's cutting-edge manufacturing nodes.

So what's actually happening behind the scenes? And more importantly, does Trump's comment reflect real investment activity, or is it a case of political theater mixing up different types of corporate relationships?

This article digs deep into the facts, the fiction, and everything in between. We'll examine Trump's exact statement, analyze what official sources say (or don't say), explore the legitimate business connections already confirmed between Apple and Intel, and break down what industry analysts actually believe is going on. By the end, you'll understand not just what probably happened, but why it matters for the semiconductor industry's future.

TL; DR

- Trump's Claim: The president suggested Apple invested in Intel after the US government took a 10% stake, but no official confirmation exists

- What's Confirmed: Apple and Intel have real business relationships including potential chip production and technology acquisition

- Missing Evidence: No SEC filings, official statements, or regulatory documentation supports an equity investment by Apple

- The Reality: Apple likely pursued business partnerships and technology deals with Intel rather than stock purchases

- Bottom Line: Trump may have conflated different business activities or misspoken about the nature of Apple's Intel involvement

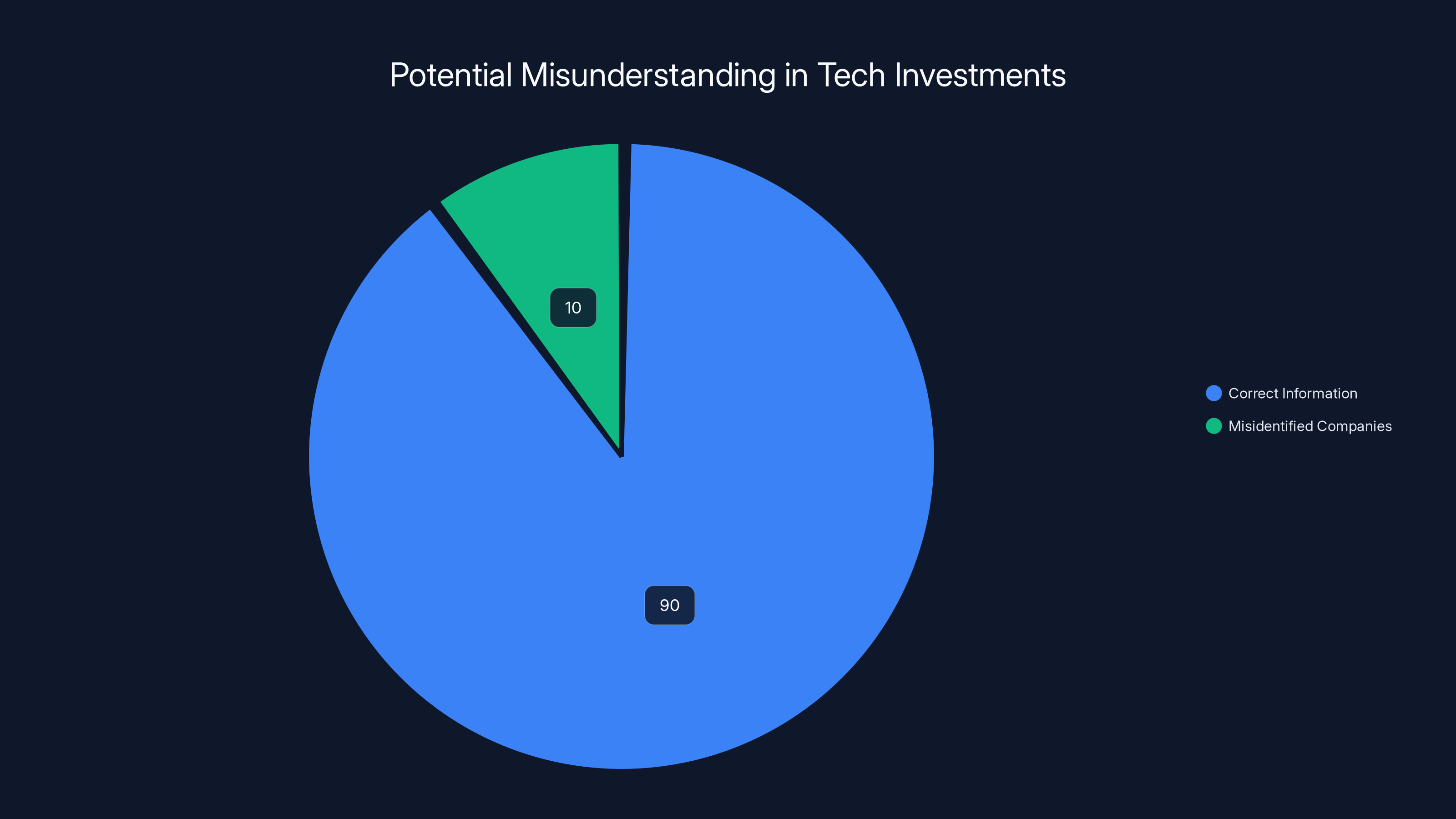

Estimated data suggests Trump's statement might be largely accurate but with a small portion of company misidentification.

What Trump Actually Said: The Exact Statement and Context

Let's start with precision. Trump didn't casually mention this in a tweet or social media post. He stated it during a formal press briefing, which means it came with at least some level of deliberation, though not necessarily accuracy.

The full quote gives important context: "As soon as we went in, Apple went in, Nvidia went in, a lot of smart people went in—they followed us." Trump was discussing the government's decision to take a 10% equity stake in Intel, a move designed to prop up the struggling chipmaker and ensure US semiconductor sovereignty.

The casual language matters here. "Followed us" suggests mimicry or agreement with government strategy. The phrasing doesn't explicitly say Apple bought stock. It could mean business relationships, partnerships, production contracts, or technology acquisitions. But most people who heard it interpreted it as equity investment.

Why does the exact wording matter? Because Trump's statement is genuinely ambiguous. In business, "going in" typically means making an investment. But it could also mean entering into a supply contract, joining a partnership, or committing resources to a joint venture. The ambiguity created space for wild speculation.

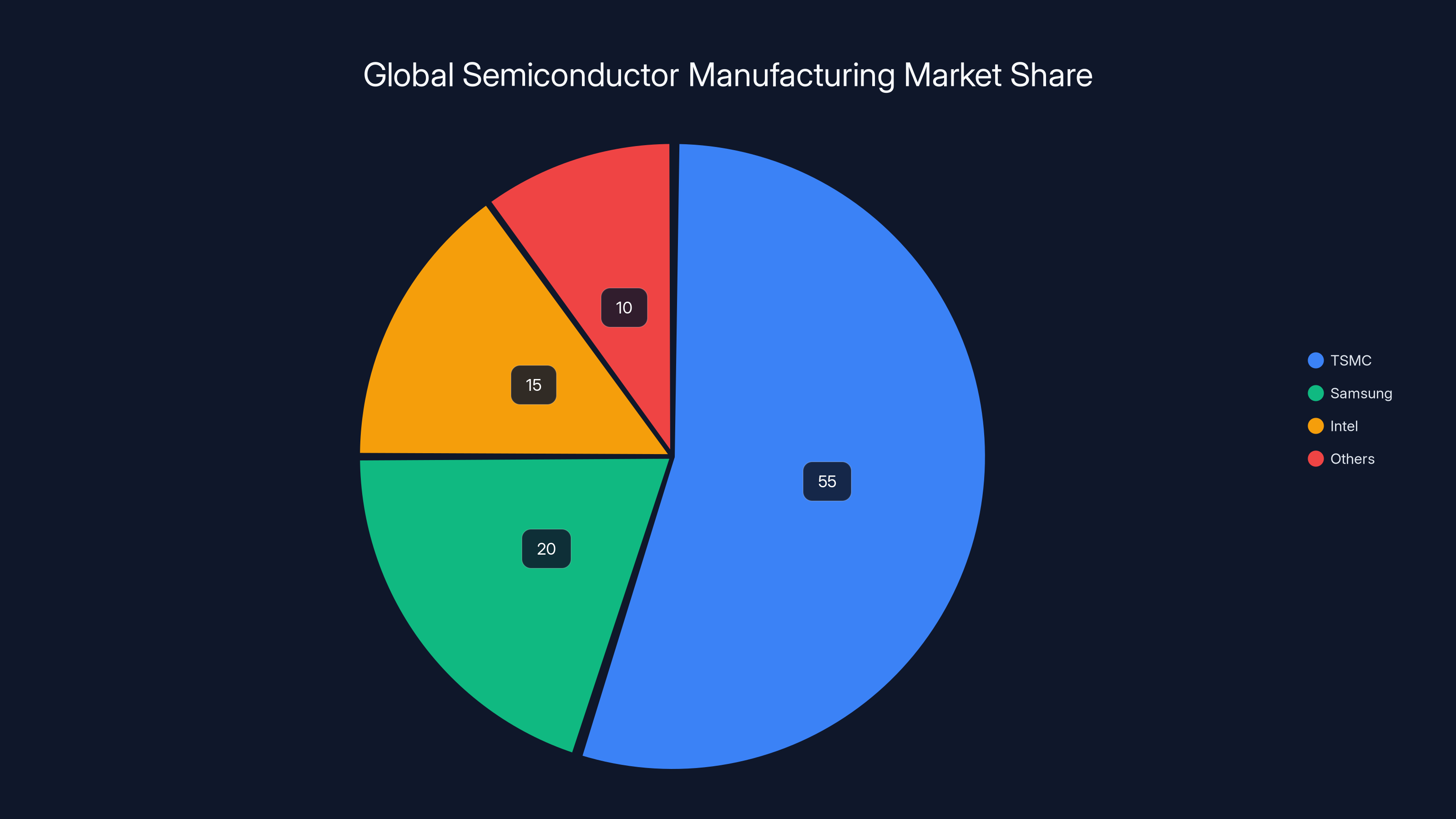

The timing also matters. Trump made these comments as Intel faced existential pressure. The chipmaker had fallen catastrophically behind competitors like TSMC and Samsung in manufacturing technology. Its recent process node improvements hadn't materialized on schedule. Wall Street had lost faith. The government intervention was partly desperation, partly strategic thinking about American chip independence.

In that environment, any suggestion that major tech companies were lining up to support Intel would be huge news. It would signal confidence in Intel's turnaround. It would validate government intervention. So analysts immediately asked: is this real, or is Trump oversimplifying?

The Missing Evidence: Why Official Confirmation Never Materialized

If Apple had actually made a material equity investment in Intel, the financial world would know about it immediately. Here's why:

Publicly traded companies live under regulatory scrutiny. Apple's quarterly and annual SEC filings detail all significant investments. If Apple acquired even a few hundred million dollars in Intel stock, it would appear in their official financial statements. Not maybe. Not probably. Definitely.

The Securities and Exchange Commission requires disclosure of material positions. For a company Apple's size, that threshold is surprisingly low. Any investment that could reasonably affect shareholders' decisions must be disclosed. An Intel stake would almost certainly cross that threshold.

Weeks passed after Trump's comment. Months passed. No SEC filing emerged. No Apple investor call mentioned an Intel investment. No Intel earnings presentation announced a major strategic investor. None of the official channels that would carry this news ever confirmed it.

Intel's own investor presentations would have highlighted Apple's involvement. Finding a tech giant endorsing your business plan through equity investment is the kind of validation struggling companies advertise aggressively. Yet Intel never mentioned it.

Moreover, market analysts watch every move these companies make. Dozens of firms employ people whose entire job is tracking tech sector investments and partnerships. If Apple had secretly bought Intel stock, someone would have caught it in SEC filings, derivatives markets, or simple observation of trading patterns.

The absence of evidence isn't definitive proof that the investment never happened. But in a heavily regulated, heavily monitored sector like technology finance, the absence of evidence becomes pretty strong evidence of absence.

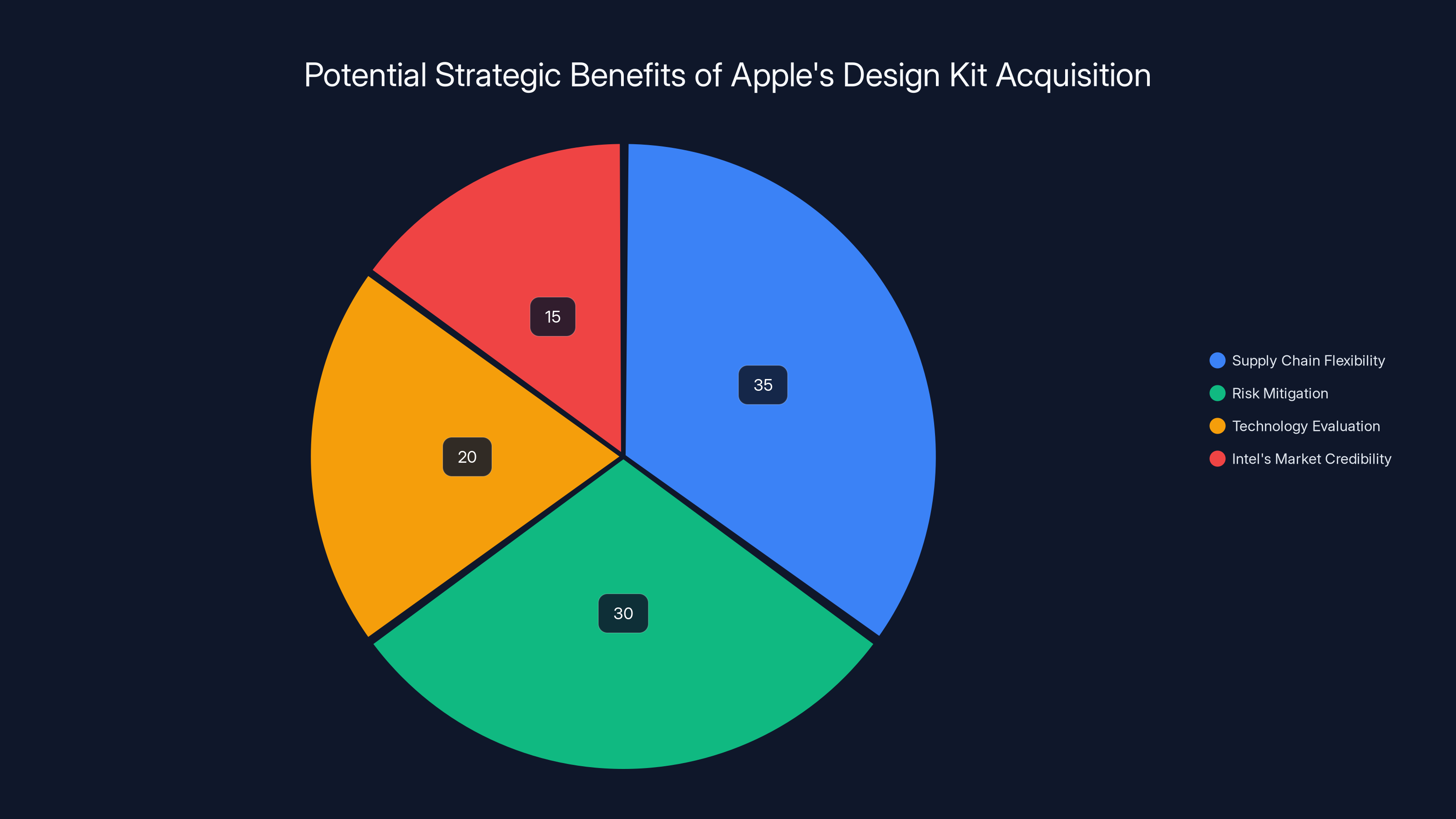

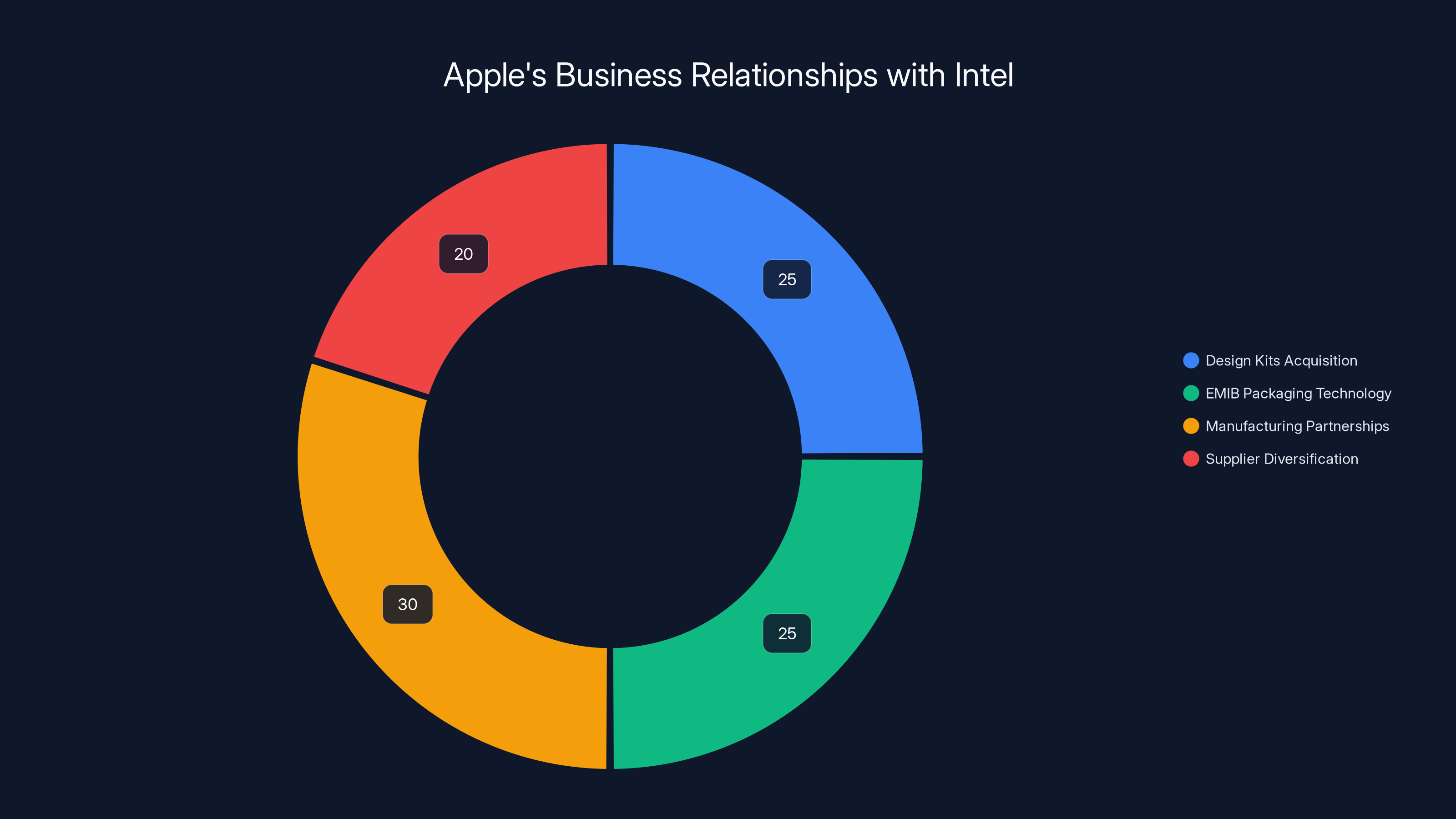

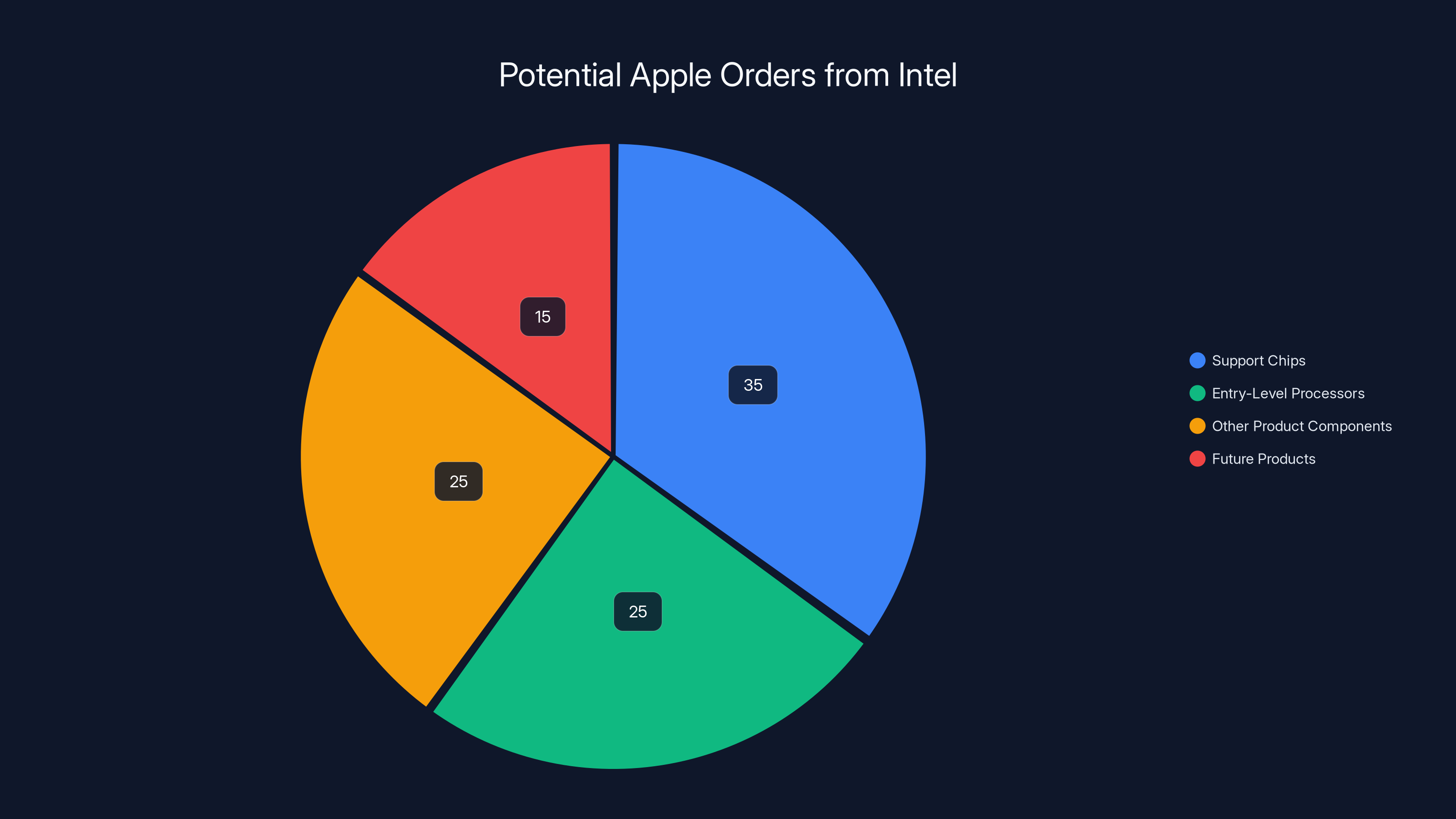

Acquiring Intel's design kit provides Apple with supply chain flexibility (35%) and risk mitigation (30%), while also allowing technology evaluation (20%) and boosting Intel's market credibility (15%). Estimated data.

What's Actually Happening: The Real Intel-Apple Connections

Here's where the story gets interesting. While no equity investment appears to exist, Apple and Intel definitely have multiple business relationships unfolding right now. These are documented, confirmed, and significant.

First, let's talk manufacturing partnerships. Intel's most advanced manufacturing nodes (the numbers like 18A and 14A that refer to transistor density) could theoretically produce Apple's future chips. Apple's current chips—the M-series processors powering Macs, the A-series powering iPhones—come from TSMC, not Intel.

But Intel is aggressively trying to capture advanced chip production work from companies that currently rely on TSMC. Apple represents the ultimate prize. If Intel could land even a portion of Apple's future chip production, it would be a watershed moment for the company. So naturally, Intel would pitch hard.

Second, there's the technology acquisition side. Intel developed something called EMIB (Embedded Multi-die Interconnect Bridge), which is essentially a clever way to package multiple semiconductor dies together on a single chip. This technology has real value for producing complex processors. Job listings from both Apple and Broadcom (Apple's manufacturing partner) showed they were actively recruiting people with EMIB expertise.

This wasn't casual interest. These postings indicated serious investigation into whether EMIB technology could improve Apple's future chip designs. That's due diligence. That's potential acquisition or licensing of technology.

Third, there's the supply chain positioning. Reports suggested Apple had large orders waiting for Intel—potentially 15 to 20 million units. If true, these numbers would be absolutely massive and would normally trigger manufacturing capacity discussions in Intel's public filings.

Why would Apple suddenly need millions of units of Intel-produced chips? The most logical explanation: Apple is testing whether Intel can reliably produce commodity components or future processors. It's hedging against TSMC dependency. It's exploring alternatives in case geopolitical tensions with China escalate further.

These are all business relationships that make sense. They align with documented patterns. They don't require equity investment to explain. They're partnerships, not stakes.

The Soft Bank Confusion: Could Trump Have Mixed Up Companies?

Here's a theory that deserves serious consideration: what if Trump confused Apple with Soft Bank?

Soft Bank Group announced in August 2025 that it would acquire $2 billion in Intel shares. This is a real, confirmed equity investment by a major technology conglomerate. The investment was public, announced, and documented.

Now, Trump's administration has worked extensively with various tech companies and investors. It's plausible—maybe even likely—that briefings about Intel investment mentioned Soft Bank prominently. What if Trump simply misremembered which tech company was investing?

It's worth noting that Soft Bank's CEO Masayoshi Son actually met with Trump to discuss technology investments and AI policy. There were genuine interactions between this administration and Soft Bank leadership. In the fog of briefings and conversations, it's easy to see how details could blur.

This isn't an insult to Trump specifically. Anyone processing information about tech investments from multiple sources could mix up details. The point is that Trump's statement might be 90% accurate ("major companies are investing in Intel following government leadership") while being 10% wrong on the specific company names.

Industry Analysis: What Experts Actually Believe

When Trump's statement broke, it went viral among tech analysts and journalists. The reactions fell into clear camps:

Camp One: The Skeptics believed Trump simply misspoke or overstated what he knew. This group noted the complete absence of official confirmation and argued that major equity investments in publicly traded companies simply don't happen in secret.

Camp Two: The Optimists thought Trump was accurately reporting preliminary discussions or agreements that hadn't been formally documented yet. In their view, deals don't always appear in SEC filings immediately—sometimes negotiations conclude before the paperwork.

Camp Three: The Realists suggested Trump was conflating different types of business relationships. In this interpretation, Apple's genuine involvement with Intel (design kits, manufacturing discussions, technology evaluation) got characterized as equity investment when really it's partnership exploration.

Most seasoned analysts landed in Camp Three. Why? Because it explains all the available evidence. Apple's job postings for EMIB expertise are real. Apple's design kit acquisition is plausible. Apple's potential large orders from Intel make business sense. None of this requires equity investment.

One analyst quoted in industry publications made a key observation: if Apple had invested equity in Intel, it would fundamentally signal a major strategic shift. It would mean Apple believes Intel can achieve technical leadership again. It would mean Apple is diversifying away from TSMC. It would be headline news that Apple couldn't possibly keep secret.

The fact that Apple continued making public statements about its TSMC relationship without mentioning any Intel investment is telling. Companies don't stay silent about material strategic partnerships. They use them in investor presentations, earnings calls, and marketing.

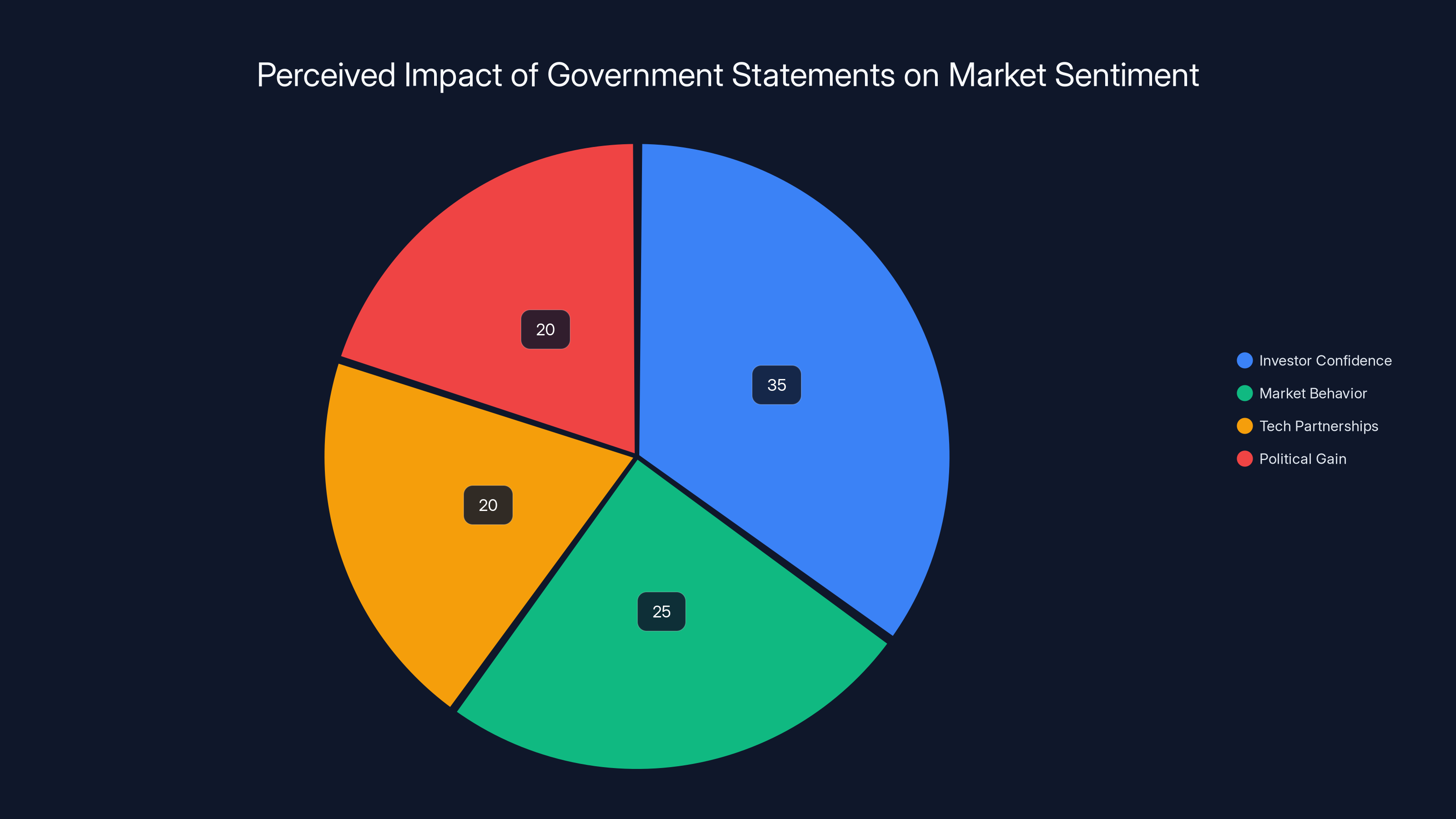

Estimated data suggests government statements primarily boost investor confidence (35%) and influence market behavior (25%), with additional effects on tech partnerships and political gain.

The Geopolitical Angle: Why America Cares About Intel

To fully understand the context here, you need to grasp why the US government got so interested in Intel's survival in the first place.

The semiconductor industry is the foundation of everything modern. Military systems, AI research, consumer devices, cloud infrastructure—it all depends on advanced chips. For decades, America dominated this space. But that dominance eroded.

TSMC, the Taiwanese company, became the world's most advanced chip manufacturer. Samsung in South Korea developed competing capabilities. Intel, which once ruled the industry, fell behind. The company that invented x86 processors, that powered the PC revolution, couldn't keep pace with manufacturing improvements.

From Washington's perspective, this is a national security crisis. Taiwan might face military pressure from China. TSMC could become unreachable. America's most advanced technology would then depend on foreign manufacturing.

So the government implemented CHIPS Act funding, subsidies, and strategic investment. Intel became a focus because it's still an American company with American facilities. Revitalizing Intel means building semiconductor capacity on US soil.

In this context, Trump's comments about major companies following government leadership into Intel investments make sense. The administration wanted to signal that Intel's turnaround was a safe bet. If Apple and Nvidia were investing, other companies would follow.

But here's the thing: you don't necessarily need equity investment to send that signal. You need partnership announcements, supply contracts, and public statements of confidence. Those matter just as much for boosting investor sentiment.

What Intel Actually Needs (And Whether Apple Investing Would Help)

Let's think strategically about what would actually help Intel recover from its crisis.

Intel's fundamental problem is manufacturing. Their chip designs are respectable, but their fabrication process lags competitors by 2-3 years in some metrics. They promised improvements that haven't materialized. Customers don't trust Intel's timelines anymore.

What would actually help? First, equity investment provides capital, but Intel has access to cheap capital. Second, contracts for chip production provide revenue, which Intel desperately needs. Third, validation from major customers (like Apple) provides confidence that builds market share.

From this perspective, Apple's involvement with Intel—whether it's design kit acquisition, manufacturing discussions, or even just job hiring for EMIB expertise—provides more real value than an equity stake would.

Why? Because what Intel truly needs is customers willing to bet on its future manufacturing capabilities. Apple bet on TSMC and has been enormously successful. If Apple started sending production to Intel, it would signal that Intel's quality and reliability have improved enough for the world's most demanding chip customer.

That's worth more than a few billion dollars in equity investment. That's worth market credibility. That's worth customer confidence propagating through the entire industry.

So even if Apple hasn't invested equity capital, the business relationships that do exist could be more strategically valuable to Intel than Trump's equity investment suggestion would imply.

The Intel Chip Production Angle: Could Apple Really Switch Suppliers?

Let's explore the specific scenario where Apple might start using Intel-produced chips.

Apple's M-series processors (M1, M2, M3, M4, etc.) are produced by TSMC. These chips power MacBooks, Mac Minis, and other Apple devices. The relationship is deep, tested, and trusted. Switching producers for such critical components would be extraordinarily complex.

However, Apple produces thousands of different chips for different purposes. Some are flagship high-performance processors. Others are support chips, security processors, AI accelerators, or commodity components. Apple doesn't need to move all production to Intel. Moving even a small slice would be strategically significant.

For example, Apple might produce entry-level M-series chips at Intel's facilities while keeping flagship models at TSMC. Entry-level chips have less demanding specifications, making them better candidates for switching suppliers during Intel's recovery phase.

Or Apple might produce companion chips—perhaps the neural engine that handles AI tasks, or the security processor—at Intel while keeping the main CPU cores at TSMC. This would let Apple test Intel's capabilities on less critical components before trusting them with flagship products.

These scenarios make business sense. They align with the job postings Apple and Broadcom posted. They explain why Apple would acquire Intel's design kits. They're the kind of strategic moves that would happen during confidential business discussions before any public announcement.

Apple's engagements with Intel are diversified, focusing on technology acquisition and potential manufacturing partnerships. Estimated data.

Nvidia's Investment: The Real Confirmation and What It Tells Us

Trump mentioned Nvidia alongside Apple in his statement. Unlike Apple, Nvidia actually has confirmed significant involvement with Intel.

Nvidia doesn't own Intel shares in any material quantity that would be disclosed. But Nvidia does have clear strategic interest in Intel's success. Why? Because Nvidia's GPUs need CPU partners. If Intel regains competitive positioning in CPUs, it becomes a more valuable partner for Nvidia's data center business.

Moreover, Nvidia and Intel have discussed joint development efforts. Intel's chips paired with Nvidia's GPUs create powerful combinations for AI and data center applications. If Intel's manufacturing improves, these partnerships become more viable.

Nvidia's involvement with Intel isn't about equity investment. It's about business ecosystem development. Nvidia makes money when more computing happens. If Intel-based systems compete effectively with alternatives, Nvidia sells more GPUs for those systems.

This pattern—strategic partnership without equity stake—likely describes Apple's involvement too. Apple benefits from competitive CPU and GPU suppliers. If Intel provides real competition to TSMC, it strengthens Apple's negotiating position and gives them alternative sourcing options.

But none of this requires equity investment. It requires business relationships, partnerships, and technology sharing.

The Timing Question: When Would Apple Have Invested?

If Trump's statement were true, when would this investment have occurred?

The government's Intel investment happened in recent months preceding Trump's statement. Trump said companies "followed" government leadership, which implies they invested afterward, not before.

But Apple doesn't make major financial decisions quickly. Any equity investment would follow extensive board discussion, SEC filings, investor notification, and strategic planning. We'd see evidence of this process.

Alternatively, maybe Trump meant that discussions or agreements happened around the same time as government involvement, even if they weren't finalized into actual share purchases yet. This would fit with the business partnership theory.

The timing doesn't support a secret investment that somehow avoided all documentation. SEC filings are quarterly events. If Apple had invested in Q3, it would appear in Q4 filings. If Q4, it would appear in year-end filings. We've now passed multiple reporting periods without confirmation.

What Job Postings Actually Reveal About Apple's Intel Plans

Job postings are corporate honesty in disguise. Companies post positions for skills they genuinely need.

Both Apple and Broadcom posted positions for engineers with EMIB experience. EMIB is Intel's advanced packaging technology. Posting these jobs signals that Apple is seriously evaluating whether EMIB could improve future product designs.

This isn't casual interest. This is "we might actually use this technology" level of engagement. Engineering teams don't hire specialists in obscure packaging technologies unless they're considering real implementation.

What else do these jobs tell us? That Apple is building internal expertise in Intel's design methodologies. That Apple wants people who understand Intel's current manufacturing capabilities and roadmap. That Apple is preparing to potentially design chips optimized for Intel fabrication.

These are the precursors to actual manufacturing partnerships. This is the due diligence phase. This is companies exploring whether collaborating makes technical and business sense.

But jobs don't equal investment. Jobs equal investigation.

TSMC leads the semiconductor manufacturing market with an estimated 55% share, followed by Samsung at 20%. Intel holds a 15% share, highlighting the need for strategic investment to boost domestic capabilities. Estimated data.

Design Kit Acquisition: What It Means Strategically

Reports suggesting Apple acquired Intel's 18A design kit deserve serious attention. If confirmed, this would be significant.

A design kit is essentially the technical foundation for building chips on a specific manufacturing process. It includes specifications, standards, testing methodologies, optimization guidelines, and manufacturing constraints. It's how chip designers learn the nuances of a particular fabrication technology.

If Apple has Intel's 18A design kit, it means Apple's engineers are learning how to design for Intel's upcoming manufacturing process. It means they're evaluating whether 18A meets their needs. It means they're preparing the possibility of actually using Intel for future chips.

Again, this isn't investment. This is exploration. But it's much more serious exploration than casual interest.

The strategic logic makes sense. Apple currently depends heavily on TSMC. That dependency creates risks. Geopolitical tensions, manufacturing bottlenecks, or simply TSMC's other commitments could create supply constraints. Apple wants alternatives.

By acquiring design kit access and hiring EMIB specialists, Apple is building optionality. They're creating a genuine alternative to TSMC that they could activate if needed. This is prudent supply chain management.

It's also valuable to Intel, because it gives Intel confidence that at least one potential customer is seriously evaluating their technology. This signal matters for Intel's credibility and investor sentiment.

The Supply Chain Implications: 15-20 Million Units of What?

Reports mentioned potential Apple orders for 15 to 20 million units from Intel. These numbers, if accurate, would be enormous.

What component could these represent? It's probably not flagship M-series processors. Apple doesn't need 15-20 million of those annually. The entire Mac market is smaller than that.

More likely scenarios:

First, support chips. The T-series security processors, the neural engines handling AI computation, or the various controllers managing different functions. Apple uses thousands of different chips, many in smaller volumes. Support chip production could easily reach these volumes.

Second, entry-level processors. If Apple decides to have Intel produce M-series chips for budget MacBooks, those could reach high volumes globally.

Third, components for other products. Apple makes not just computers, but watches, tablets, various accessories, and services hardware. Aggregating across all products, 15-20 million units annually becomes plausible.

Fourth, potential future products. Maybe Apple is planning new product categories that would require high-volume chip production. Intel could be positioned as the manufacturing partner for these new initiatives.

Large orders would absolutely appear in Intel's SEC filings. When significant revenue commitments materialize, companies disclose them. The absence of such disclosure in Intel's recent filings suggests either the orders are still preliminary, or they're smaller than reports suggested, or they don't exist yet.

Historical Precedent: Has Apple Ever Made Strategic Tech Investments Like This?

Looking at Apple's history provides useful context for evaluating whether equity investment in Intel makes sense strategically.

Apple occasionally makes strategic acquisitions. When they acquire companies, they typically buy entire firms, integrate them, and use the technology internally. They've acquired music services, mapping companies, chip design firms, and various AI/ML startups.

But Apple rarely makes minority equity stakes in other companies. When they invest capital, they either acquire wholly, or they make small strategic venture investments in startups working on technologies relevant to Apple's future.

Equity stakes in major competitors or suppliers? This isn't Apple's historical pattern. Apple prefers control, integration, and long-term capability building through acquisitions. Or they build everything internally.

A significant Intel equity investment would break pattern. It would suggest Apple is treating Intel as a financial investment, expecting stock appreciation, rather than as a technology partner or supplier.

This pattern analysis doesn't prove Trump was wrong. But it makes his claim less likely given Apple's historical behavior. Apple would be more likely to acquire Intel technology (like design kits), hire Intel expertise, or enter supply agreements than to buy equity stakes.

Estimated data suggests support chips might constitute the largest share of potential Apple orders from Intel, followed by entry-level processors and components for other products.

Regulatory and Market Response: The Absence of Reaction

If Apple had made a material investment in Intel, the market would have reacted.

Apple stock would move. Intel stock would move. Announcements would appear in financial media. Analysts would update research. Options markets would respond. Institutional investors would adjust positions.

Instead, after Trump's comments, markets largely shrugged. Intel stock didn't spike on the news. Apple stock wasn't affected. Financial media covered it as speculation, not as confirmed news.

This market indifference is telling. Professional traders and investors clearly didn't believe the claim. They didn't expect confirmation. They didn't position for related announcements.

Markets are remarkably efficient at pricing in new information about publicly traded companies. The fact that markets showed minimal reaction suggests sophisticated investors assessed Trump's claim as unreliable.

The Regulatory Filing Question: What Would Actually Appear?

Let's talk specifically about what would be documented if Apple truly invested in Intel.

Apple would file a Form 13F quarterly report with the SEC listing all holdings above certain thresholds. Any Intel position substantial enough to matter would be disclosed here.

Intel would mention major investors in SEC filings and investor presentations. Material shareholders get recognition.

Apple's 10-K annual report and 10-Q quarterly reports would detail significant investments in the "Financial Condition and Results" section.

Investor conference calls might mention the investment as part of capital allocation strategy discussion.

Press releases would be issued. Both companies would announce the partnership.

Multiple disclosure requirements would make complete secrecy virtually impossible for a material investment. Yet none of these disclosures appeared.

This is the strongest evidence against Trump's claim. Not market speculation, not analyst skepticism, but the simple regulatory reality that material investments in publicly traded companies get documented.

The Political Context: Why This Statement Matters Despite Doubt

Regardless of accuracy, Trump's statement carries significance.

It signals administration optimism about Intel's recovery. It indicates government confidence in its own $10 billion Intel investment. It attempts to build market confidence through celebrity endorsement of the sort.

If tech leaders are "following" government investment in Intel, it creates herd mentality. Investors see government backing, see company validation, and gain confidence. This is intentional perception management.

Whether the statement is literally accurate matters less than whether it achieves its goals. If major tech companies subsequently announce Intel partnerships (which some might do anyway), Trump can claim vindication. If they don't, he can claim they're waiting for better conditions.

Politically, the statement costs nothing. It creates no liability. But it potentially provides enormous value by boosting sentiment around Intel and semiconductor reshoring. That's why even unsourced claims get repeated.

The Future: What Actually Matters for Intel's Survival

Whether Apple invested equity capital in Intel is ultimately a sideshow.

What actually matters is whether Apple and other major tech companies design chips for Intel's future manufacturing processes. Will TSMC-dependent companies diversify their supply chains? Will major OEMs test Intel's quality and reliability?

These practical partnerships matter infinitely more than equity stakes. A single Apple order for millions of Intel-produced chips would be worth more to Intel than a couple billion dollars in equity investment.

So the real question isn't "did Apple invest?" It's "will Apple manufacture with Intel?" That's the measure of Intel's potential recovery.

Trump's comments, accurate or not, might actually be moving needle toward the real outcome. If major tech companies believe government and other leaders are aligning behind Intel, they're more willing to take the risk of manufacturing there.

The investment question might have mattered in 2020. But in 2025, Intel's survival depends on manufacturing credibility, not cash infusions. And on that front, real partnership announcements matter infinitely more than equity deals.

What Experts Say: The Consensus View

Among semiconductor industry analysts and technology observers, a rough consensus has formed about Trump's claim.

Most experts believe Trump conflated multiple concepts: actual equity investment by some companies (probably Soft Bank), business partnerships being discussed between Apple and Intel, potential future manufacturing commitments that aren't finalized, and general industry momentum around Intel's potential recovery.

Few experts believe Apple made a straightforward, material equity investment in Intel that somehow avoided all regulatory disclosure. The evidence simply doesn't support it.

But nearly all experts acknowledge Apple has legitimate involvement with Intel. Whether through design kit acquisition, EMIB technology evaluation, manufacturing exploration, or supply chain diversification, something real is happening.

They also acknowledge the strategic logic. Apple betting on Intel's recovery makes sense given geopolitical supply chain concerns. Intel would benefit enormously from diversified customers beyond TSMC dependence.

The consensus, then, is that Trump's statement reflects real underlying trends but overstates the formality or completion of Apple's involvement. It's political communication using imprecise language about complex business relationships.

FAQ

Did Apple actually invest in Intel?

No official SEC filing, regulatory disclosure, or corporate announcement confirms that Apple made an equity investment in Intel. While President Trump suggested this occurred, neither Apple nor Intel has provided documentation supporting the claim. The absence of regulatory disclosure in SEC filings and quarterly earnings reports makes a material investment highly unlikely, despite Trump's statements suggesting involvement.

What business relationships does Apple actually have with Intel?

Apple has confirmed or reported interest in several Intel technologies and partnerships, including acquisition of Intel's design kits for advanced manufacturing processes (18A node), job postings seeking expertise in Intel's EMIB packaging technology, potential manufacturing partnerships for future chip production, and evaluations of Intel as an alternative to TSMC for supplier diversification. These represent genuine business exploration rather than equity investment.

Why would Apple invest in Intel anyway?

Apple faces concentration risk by relying almost exclusively on TSMC for advanced chip manufacturing. Investing in or partnering with Intel provides supply chain diversification, reduces geopolitical exposure (Taiwan tensions), and strengthens Apple's negotiating position with both suppliers. Equity investment would signal confidence in Intel's ability to produce advanced chips competitively, though partnerships achieve similar strategic goals without ownership.

What did Trump mean by companies "following" government investment in Intel?

Trump's language likely referenced companies entering into business partnerships or supply arrangements with Intel following the US government's $10 billion strategic investment. The term "following" suggests mimicking government confidence in Intel's recovery potential rather than specifically purchasing equity. This could include manufacturing commitments, technology partnerships, or supplier diversification without requiring literal stock purchases.

Could Trump have confused Apple with Soft Bank?

Yes, this is plausible. Soft Bank Group announced a confirmed $2 billion equity investment in Intel in August 2025, and this investment received public confirmation and disclosure. Trump may have misremembered which tech company was investing, conflating Soft Bank's confirmed equity stake with Apple's business partnerships. Such confusion in briefings about multiple corporate actions is relatively common.

What would happen if Apple actually invested in Intel?

If Apple made a material investment in Intel, the investment would be documented in Apple's SEC filings (Form 13F, 10-K, and 10-Q reports), disclosed in quarterly earnings presentations, mentioned in investor calls, and announced via press release. The absence of any such documentation across multiple quarters and reporting periods provides strong evidence that no material equity investment occurred.

Does the absence of SEC filing confirmation mean the investment didn't happen?

For a publicly traded company like Apple, SEC filing confirmation is essentially mandatory for material investments. The Securities and Exchange Commission requires disclosure of all positions that could reasonably affect shareholder decision-making. Any Intel equity position substantial enough to matter would have already appeared in regulatory filings by now, given multiple quarterly and annual reporting cycles have passed since Trump's statement.

What do the Intel job postings from Apple tell us?

Apple and Broadcom job postings specifically seeking EMIB expertise signal serious investigation into Intel's advanced packaging technology. These postings indicate Apple is building internal capabilities to design chips that could be manufactured using Intel's processes. This represents preliminary due diligence for potential manufacturing partnerships rather than evidence of completed investment or formal agreements.

How important is this investment claim compared to actual partnerships?

Equity investment matters less than actual manufacturing partnerships. If Apple started producing chips at Intel facilities, that would signal far greater confidence in Intel's recovery than any financial investment could. Manufacturing commitments represent concrete votes of confidence in Intel's manufacturing quality and reliability, which is what Intel actually needs to survive and thrive competitively.

Will Apple likely manufacture with Intel in the future?

No official announcements confirm future Apple manufacturing at Intel. However, Apple's exploration of Intel design kits and EMIB technology suggests serious evaluation of this possibility. Apple might start with non-critical components or entry-level products while maintaining flagship chip production at TSMC. Any such shift would likely be announced publicly and documented in regulatory filings once finalized.

Conclusion: Separating Claims From Evidence

Trump's statement created a perfect storm of speculation. Major tech companies, semiconductor strategy, government investment, and a casual presidential comment combined to spark headlines worldwide. But headlines don't equal facts.

The evidence strongly suggests Trump conflated different business relationships into a single investment claim. Apple is definitely involved with Intel in multiple ways: exploring design kits, hiring EMIB expertise, potentially planning future manufacturing partnerships. These are genuine, important business activities.

But equity investment? The regulatory record, SEC filings, and corporate announcements simply don't support it. No material disclosure appeared where law requires it. Markets didn't price in new information because sophisticated investors didn't believe the claim.

What actually matters going forward isn't whether Apple bought Intel shares. It's whether Apple will manufacture advanced processors at Intel facilities. Will Nvidia deepen partnerships with Intel? Will other major tech companies diversify away from TSMC concentration? These practical business relationships determine Intel's future far more than stock purchases.

Trump's statement, accurate or not, served a political purpose: signaling government confidence in Intel's recovery and attempting to build investor momentum around semiconductor reshoring. Whether that momentum translates into actual manufacturing partnerships will determine whether Intel survives and thrives.

The investment question was a sideshow. The real story is whether Intel can regain manufacturing credibility and convince the world's biggest tech companies to trust them with advanced production. No equity stake is necessary for that outcome. Only competitive products, reliable execution, and successful partnerships.

Time will tell whether Apple and Intel actually collaborate on manufacturing. Until then, Trump's comments remain intriguing speculation based on misunderstanding, conflation, or simply casual imprecision about complex business relationships. The truth, as usual, is less dramatic than the headlines suggested.

Key Takeaways

- Trump suggested Apple invested in Intel, but no SEC filing confirms an equity stake despite regulatory requirements for disclosure

- Apple has confirmed business relationships with Intel including design kit acquisition and EMIB technology evaluation, but these are partnerships not equity investments

- SoftBank announced a real $2 billion Intel investment, which Trump may have confused with Apple's more limited involvement

- Job postings from Apple and Broadcom seeking EMIB expertise signal serious exploration of Intel manufacturing partnerships

- What matters for Intel's recovery isn't equity investment but actual manufacturing commitments from major tech companies like Apple

Related Articles

- Gate-All-Around Transistors: How AI is Reshaping Chip Design [2025]

- US 25% Tariff on Nvidia H200 AI Chips to China [2025]

- Trump's 25% Advanced Chip Tariff: Impact on Tech Giants and AI [2025]

- RAM Price Hikes & Global Memory Shortage [2025]

- OpenAI's $10B Cerebras Deal: What It Means for AI Compute [2025]

- AMD at CES 2026: Lisa Su's AI Revolution & Ryzen Announcements [2026]

![Did Apple Invest in Intel? Trump's Claims Analyzed [2025]](https://tryrunable.com/blog/did-apple-invest-in-intel-trump-s-claims-analyzed-2025/image-1-1768766783296.jpg)