The Merger Nobody Saw Coming (But Maybe Should Have)

Something quietly shifted in Elon Musk's empire on January 21, 2025. Two new corporate entities appeared in Nevada filing records—K2 Merger Sub Inc. and K2 Merger Sub 2 LLC. Nobody announced anything. No press release. No blog post. Just bureaucratic breadcrumbs that Reuters picked up and connected into something massive: SpaceX and xAI are exploring a merger.

Let that sink in for a second. We're potentially talking about combining a company that launches rockets and controls a satellite internet constellation with a company building the Grok chatbot and has acquisition rights to the X platform. One corporation. All of it.

This isn't just corporate consolidation theater. This is architectural. Musk has always thought in systems, not silos. SpaceX needs computational power. xAI needs infrastructure. X needs distribution. Starlink needs content. It's like watching someone build a technological organism where every limb serves every other limb.

I'll be honest—this move caught people off guard, but it shouldn't have. If you've been paying attention to how Musk structures his companies, the logic becomes obvious once you see it. Which is why I spent the last week digging into what this actually means, who it benefits, what could go wrong, and whether we're watching the most audacious tech consolidation play in a decade.

Here's what matters: the implications are massive, the mechanics are complex, and the timing might be the most important variable of all.

TL; DR

- Massive consolidation: SpaceX and xAI could merge into a single entity before SpaceX's planned June 2025 IPO

- Space-based AI infrastructure: Musk wants to position AI data centers in orbit using Starlink satellites

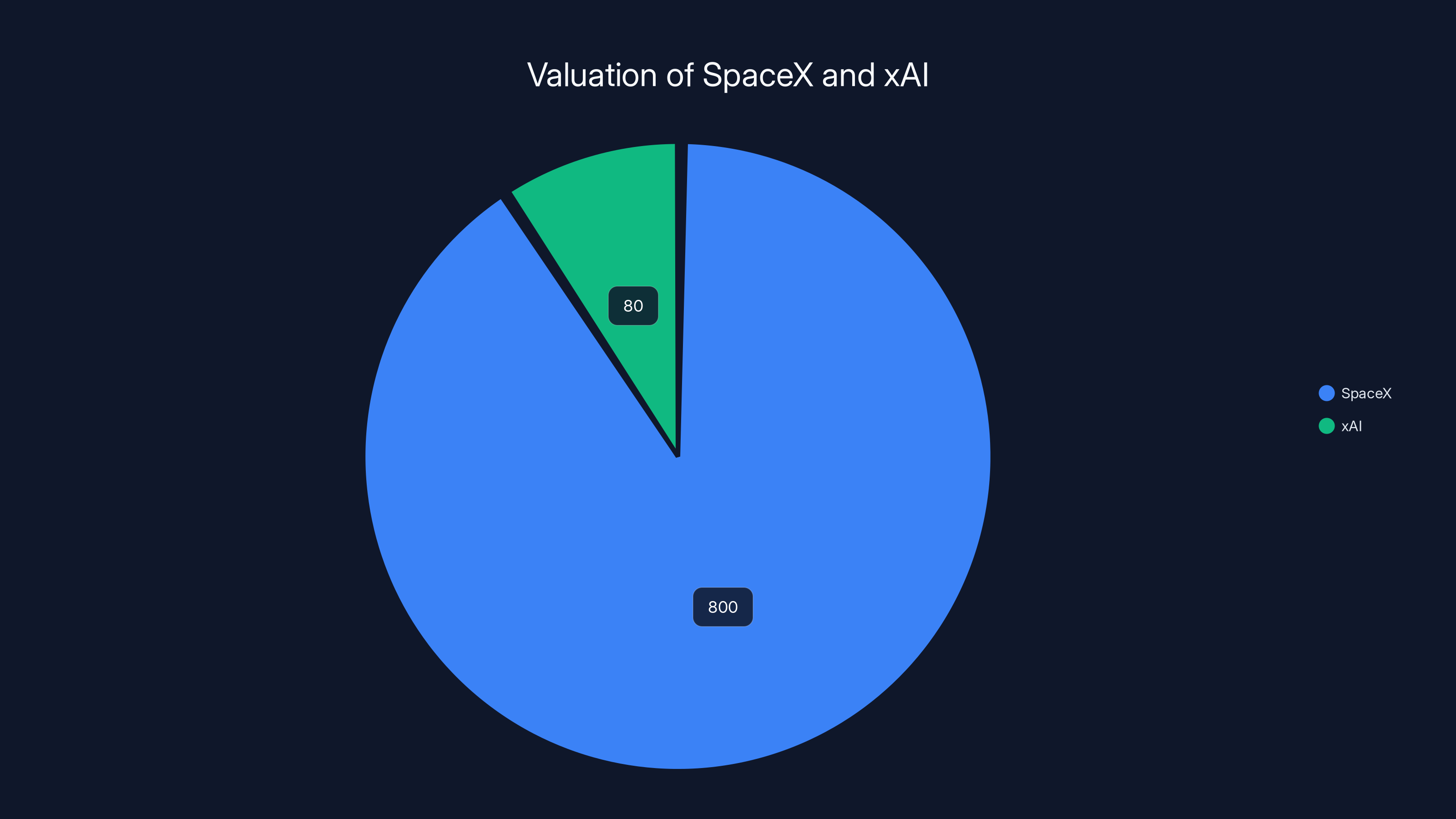

- Valuation stacking: SpaceX is valued at 80 billion

- Strategic investment: Both Tesla and SpaceX have invested $2 billion each in xAI

- Integration play: The move combines Grok chatbot, X platform, Starlink satellites, and space technology under one corporation

- IPO implications: A merged entity could reshape how Wall Street values both companies and the AI-infrastructure hybrid sector

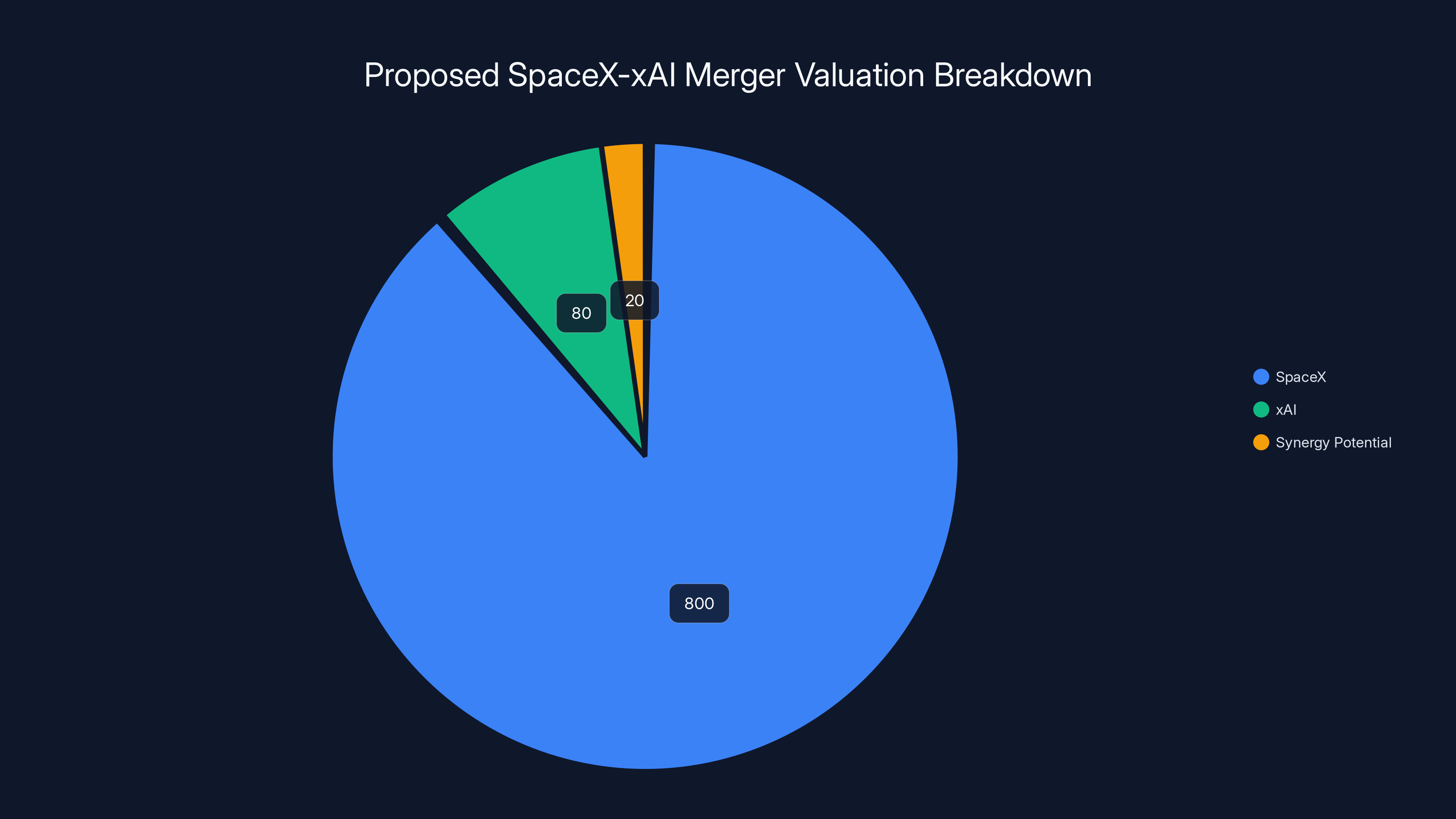

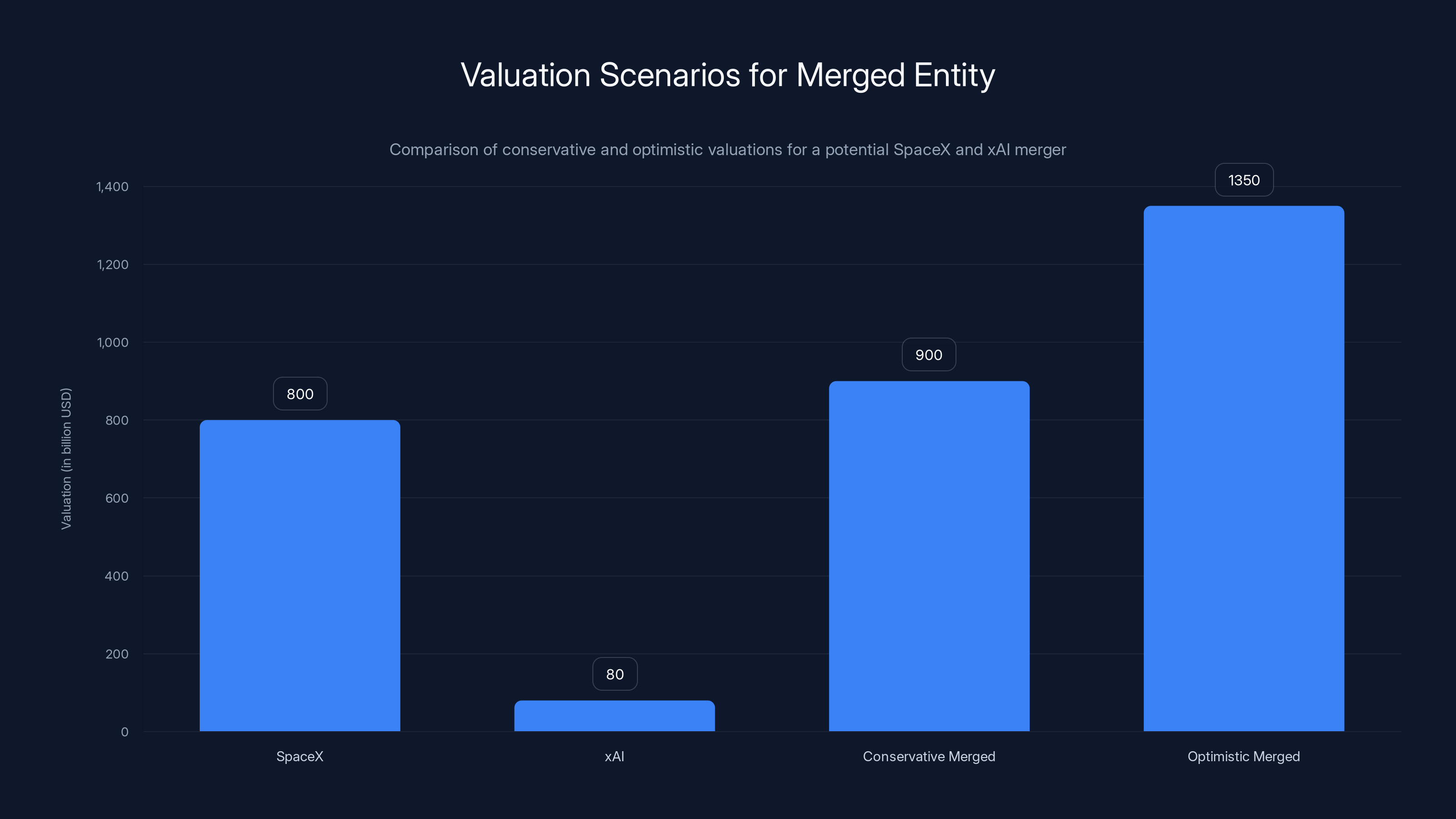

The proposed SpaceX-xAI merger could result in a combined valuation of approximately $900 billion, with SpaceX contributing the majority. Estimated data includes potential synergy value.

Understanding the Corporate Entities: What K2 Actually Is

Corporate filings can seem like alphabet soup to most people, but they're actually a sophisticated language. When two blank corporate shells appear simultaneously in Nevada, that's not random—that's scaffolding for something specific.

K2 Merger Sub Inc. and K2 Merger Sub 2 LLC are what's called "merger vehicles" or "merger subs." Think of them as temporary containers. When you want to merge two complex companies while minimizing tax consequences and maintaining regulatory clarity, you don't just slam them together. You create these interim entities, use them as the legal mechanism for consolidation, then dissolve them once the structure is clean.

The "K2" naming is fascinating. In climbing circles, K2 is the second-highest mountain in the world—technically harder to summit than Everest. It's dangerous, requires extreme precision, and claiming it means something specific. That somebody chose that name suggests either confidence or metaphorical messaging. Or both.

These entities were established on January 21, which is worth noting because it's right before Musk's public appearances at CPAC and other venues where he's been discussing his grand consolidation strategy. These weren't filed quietly in December—they went in fresh, right before he started talking publicly about consolidating his holdings.

What we don't know yet is the exact structure the merger would take. Would xAI become a wholly-owned subsidiary of SpaceX? Would they create a new holding company? Would they maintain operational independence but share infrastructure and data? The documents don't say, which means the negotiations are still in flux.

The Strategic Logic: Why This Actually Makes Sense

On the surface, merging a space company with an AI company seems random. But it's not. It's actually a coherent strategy that reveals how Musk thinks about technology infrastructure.

Grok needs compute. Lots of it. Large language models require massive data centers with expensive GPUs, constant electricity, and sophisticated cooling systems. Every query costs electricity. Every model training run costs more. The margins get tight when you're running a public-facing AI service at scale.

Starlink has something compute needs badly: distributed global infrastructure and direct control over satellite capacity. Most AI companies are renting compute from cloud providers—AWS, Google Cloud, Azure. They're paying middle-men for access to hardware. Musk's approach is different. Why rent when you own the rockets that launch the satellites that carry the data?

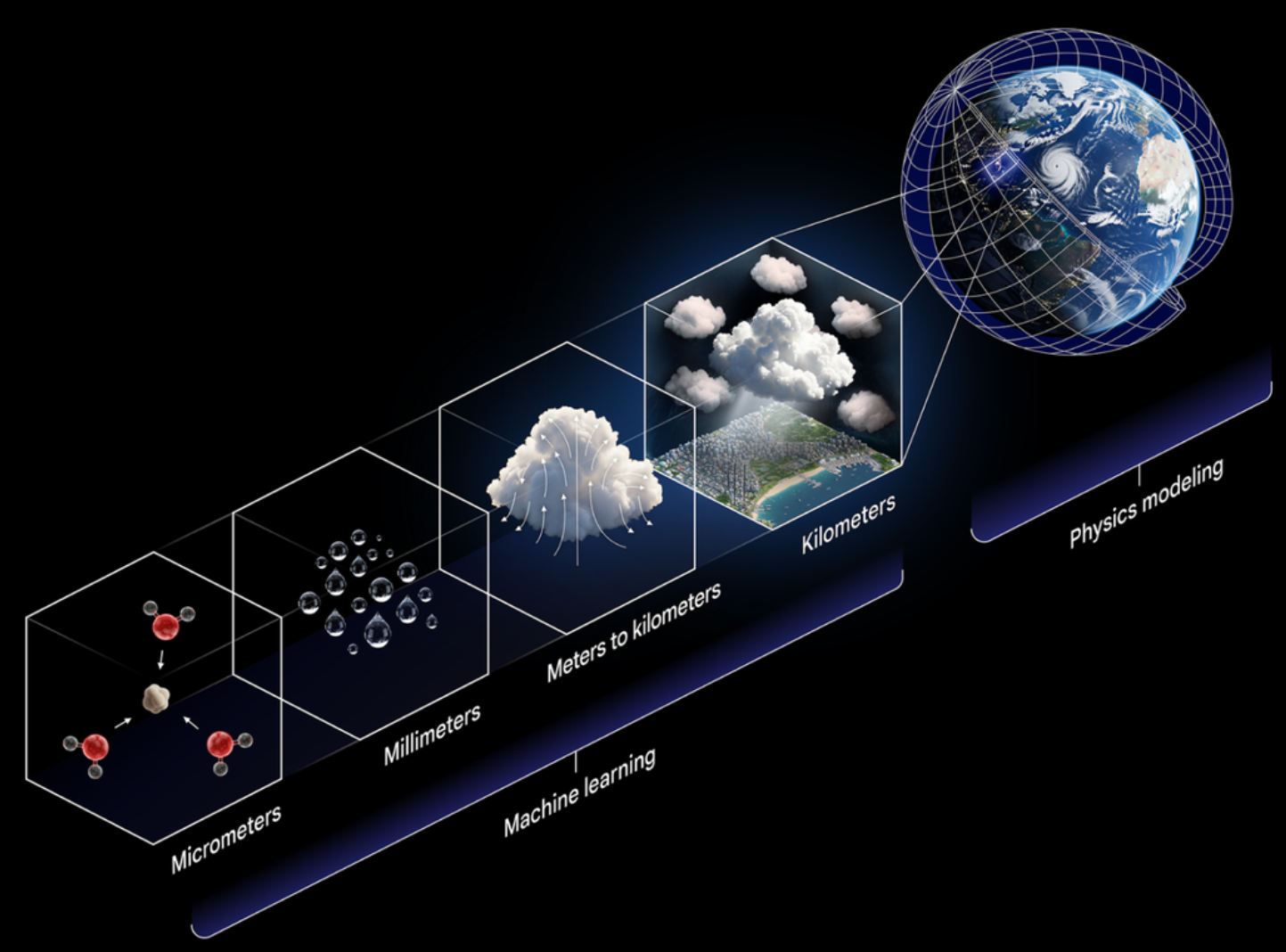

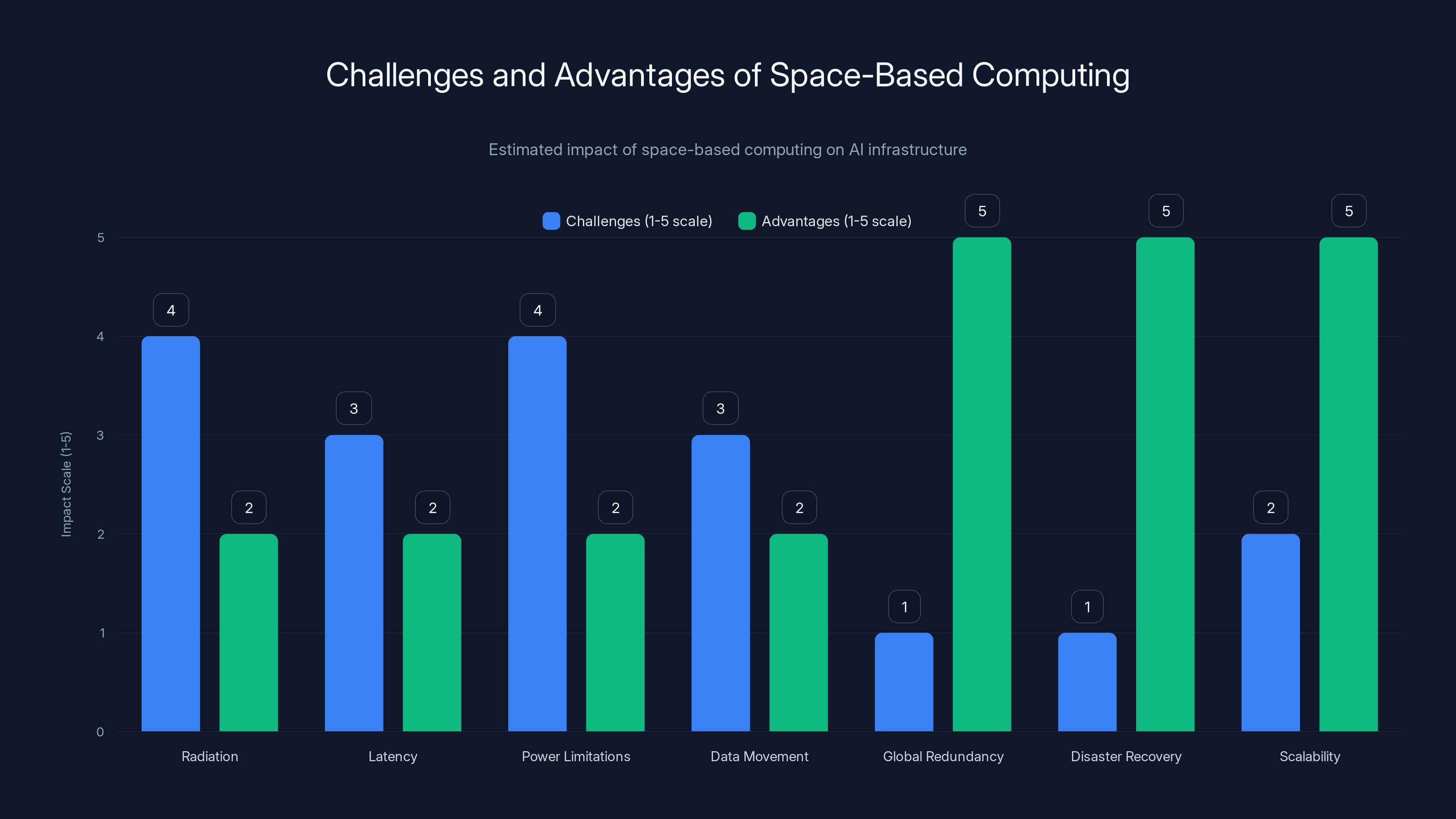

Here's the specific vision Musk has articulated: put data centers in space. Literally. Use Starlink satellites as a distributed computational network. Cool them with the vacuum of space. Eliminate the need for terrestrial real estate, power grid constraints, and cooling infrastructure that costs millions annually.

Is this feasible right now? Not entirely. Space-based computing faces challenges around radiation, latency, power limitations, and the physics of moving data at orbital speeds. But it's not impossible, and the advantage is enormous if you can solve it. You'd have global computational redundancy, built-in disaster recovery, and the ability to scale without buying more real estate.

Second, there's the content angle. X needs good products. Users leave X because the experience isn't compelling enough—no great reasons to open the app. But what if X became a native platform for Grok? What if interacting with an AI assistant was built into your timeline, your direct messages, your content creation tools? Suddenly X becomes stickier. Users spend more time there. Engagement increases. The product improves by integration.

Third, there's the talent and resource arbitrage. Both companies compete for top AI researchers, engineers, and infrastructure specialists. They're hiring from the same talent pool, paying competitive salaries, offering stock options. Merging reduces redundancy and makes each dollar spent more efficient. You don't need two CFOs, two legal teams, two investor relations departments.

Fourth, and this is important, there's the IPO angle. SpaceX has never been a public company. Neither has xAI. Wall Street doesn't really know how to value either one because they're operating in relatively uncharted territory. When you IPO a merged entity that combines proven space infrastructure with cutting-edge AI, you create a new category. You get to set the valuation narrative. Investors are often willing to pay a premium for companies that don't fit neatly into existing buckets because comparables don't exist. A "Space-AI Infrastructure" company might get a higher multiple than either company would separately.

SpaceX's valuation at

The Valuation Math: $800 Billion Plus Something

Let's talk numbers, because they reveal a lot about what's actually at stake.

SpaceX conducted a secondary share sale recently that valued the company at approximately $800 billion. For context, that makes it more valuable than every publicly-traded aerospace company in the US combined. It's worth more than Boeing. It's worth more than Lockheed Martin. It's worth more than Northrop Grumman. And it's a private company with no public shareholders.

How did SpaceX reach that valuation? Essentially through demonstrated execution. Starlink is profitable. They're launching rockets on a schedule nobody else can match. They've reduced the cost of space access by an order of magnitude. They have contracts with the US military, government agencies, and commercial customers. The cash flow is real.

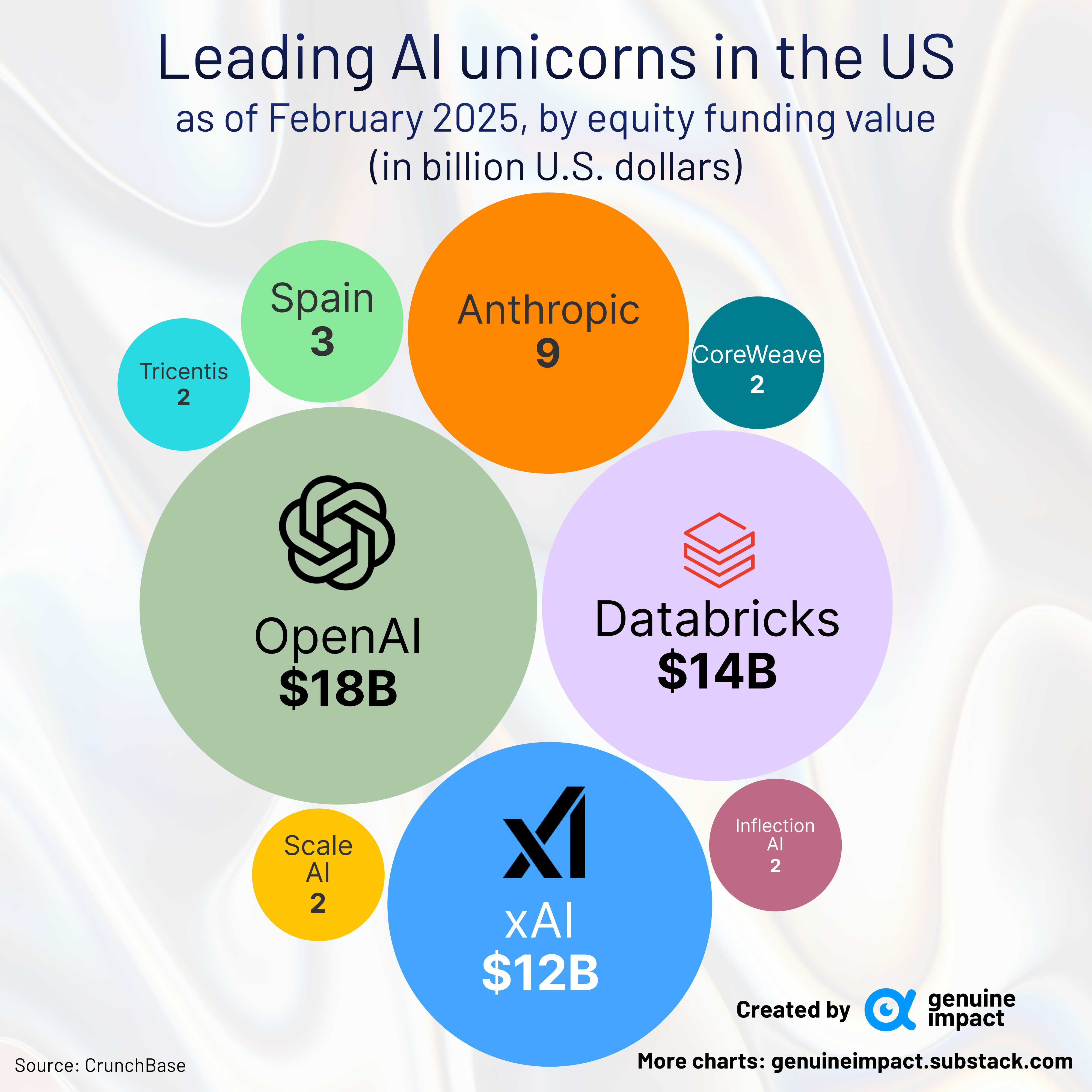

xAI is newer, so the valuation is more speculative. Reports suggest the company valued at somewhere around $80 billion after various funding rounds. But xAI doesn't have revenue in the way SpaceX does. It's based on potential—the potential of Grok to become a competitive AI product, the potential of leveraging the X platform for distribution, the potential of the space-based infrastructure advantage.

If you merged these two, you're looking at a combined entity worth roughly

But here's where the math gets interesting: the merged entity likely wouldn't be worth just $880 billion. If the integration works—if you actually achieve space-based AI infrastructure, if you actually increase X engagement through Grok integration, if you actually reduce operational costs through consolidation—the real value could be substantially higher.

Merger math isn't just addition. It's multiplication when synergies work.

The Investment Pattern: $4 Billion in Signals

If you want to understand what Musk's actually planning, watch where his money goes. Actions speak louder than press releases, and the recent investment pattern is loud.

Last year, SpaceX committed

So we have $4 billion flowing into xAI from Musk-controlled entities within months of each other. That's not passive investment. That's active positioning. When you invest billions into a company, you're signaling confidence, but you're also buying influence. You're saying "we're deeply committed to this company's success."

Why would SpaceX invest in xAI? Normally, space companies don't invest in AI companies. They're different industries, different risk profiles, different customer bases. But if SpaceX is betting on a future where it controls the AI computation infrastructure and the delivery mechanism (Starlink), then investing in the company that's developing the AI product makes strategic sense. You're not just investing money—you're aligning incentives.

What these investments also signal is confidence in xAI's valuation. If both Tesla and SpaceX thought xAI was overvalued, they wouldn't put

There's also a tax efficiency angle worth mentioning. If Musk owns shares in both SpaceX and xAI, and he's considering a merger, then making substantial investments beforehand can shift the ownership stakes in ways that matter for the merger consideration. He's essentially buying more chips before the poker hand is revealed.

The IPO Timing Question: June 2025 and Beyond

Financial Times reported that Musk wants to take SpaceX public in June 2025. That's approximately 5 months from the time those merger vehicles were established. That's not a lot of time to negotiate, finalize, and execute a merger of this magnitude. Usually, these things take 12-18 months minimum.

So here's the question: would SpaceX still IPO if xAI wasn't part of the deal? Or would the merged entity be the IPO candidate?

Argument 1: SpaceX IPOs alone in June, then xAI joins after. In this scenario, SpaceX goes public with existing valuations and operations, and the xAI integration becomes a future strategic move. It's lower risk because you're not trying to merge before you're public. But it's also less elegant strategically because you lose the opportunity to tell a unified story to IPO investors.

Argument 2: The merged entity IPOs in June or slightly after. This would require compressing the merger timeline significantly, but it's possible. You'd be telling a cleaner story to investors—"Here's the integrated space-AI infrastructure company." You'd avoid the complexity of having SpaceX IPO, then announcing a merger immediately after, which would tank the stock as investors reassess valuations.

Argument 3: SpaceX's IPO gets delayed while the merger completes, and both go public together as one entity. This removes the time pressure and gives you a proper 18-month window, but it means pushing the IPO into late 2026 or 2027. That's longer than Musk has publicly committed to.

I'd guess we're in Argument 2 territory, with some possibility of Argument 1. An October 2025 merged entity IPO seems more realistic than June, but stranger things have happened. Musk's timelines are notoriously optimistic.

The conservative valuation of the merged entity is estimated at

The Grok Problem: Can a Merger Actually Improve the Product?

Grok is real. It exists. You can use it. But it's not winning the AI wars right now. ChatGPT is more popular. Claude is considered more capable. Google's Gemini has integration advantages. Grok is... fine. It works. It's got personality. But it's not the clear winner in the AI assistant space.

Merging with SpaceX doesn't automatically fix product quality. You can't inherit rocket engineering expertise and apply it to language models. You can't launch Starlink satellites and suddenly have a smarter chatbot.

But you can use SpaceX's resources to fundamentally change how Grok operates. You can throw engineering talent at it. You can invest in compute in ways competitors can't. You can integrate it into X so millions of people use it daily. You can build features competitors can't build because you control both the platform and the AI.

Right now, Grok is on X, but it's kind of bolted-on. It's a feature. With a true merger and integration strategy, Grok becomes foundational. It becomes something that makes X work better, makes content discovery better, makes the whole platform smarter.

That's actually powerful. Millions of people use X daily. If even 10% of them use an integrated Grok experience, you've got a user base that dwarfs ChatGPT. You've got behavioral data that would let you train better models. You've got distribution that OpenAI would pay billions to have.

So the merger doesn't improve Grok directly. It improves Grok's competitive position by giving it advantages that standalone competitors can't match. And that's often more important than raw technical capability.

Starlink's Role: Infrastructure as Moat

Starlink is the secret weapon in this whole story. It's the reason the merger actually makes strategic sense in ways that might not be obvious at first.

Starlink has over 7,400 active satellites orbiting Earth right now. That number is growing. Every SpaceX launch adds more capacity. The stated goal is 40,000+ satellites eventually, creating a global network that provides high-speed internet access to anywhere on the planet.

This is infrastructure that no AI company owns. OpenAI doesn't own satellites. Anthropic doesn't own satellites. Google's cloud infrastructure is terrestrial, renting data centers in cities. But SpaceX owns an actual constellation that's continuously growing.

For an AI company, that's phenomenal. Here's why: latency matters. When you're running inference on a language model, every millisecond of delay between the user's input and the model's response matters. It affects user experience. Starlink can potentially serve as the delivery network for Grok, giving it latency advantages that terrestrial providers can't match because you're not going through intermediaries.

Better latency means better user experience. Better user experience means higher engagement. Higher engagement means better training data and user feedback. Better training data means better models. It's a positive feedback loop that competitive advantage builds on.

There's also the resilience angle. If all your AI inference is running in three or four massive data centers (like most cloud providers), then any major outage cascades across the whole system. But if your computation is distributed across satellite coverage with ground stations distributed globally, you've got built-in redundancy. One data center goes down? The load shifts. Network goes down? You've got another path. That's the kind of infrastructure resilience that large enterprises and governments pay premiums for.

For a national security angle (which matters to US regulators), having AI computation that doesn't rely on terrestrial infrastructure controlled by foreign governments or entities is strategically valuable. The US government cares about this. SpaceX already has deep relationships with DoD and national security agencies. A merged SpaceX-xAI would inherit those relationships and potentially unlock government contracts that pure-play AI companies never could.

The X Factor: Platform Integration and Distribution

X is the weird one in this equation. Musk acquired it in 2022 for approximately $44 billion. It's been a bumpy ride—advertiser exodus, content moderation drama, technical issues. But it still has hundreds of millions of users and remains a culturally important platform.

In the context of a SpaceX-xAI merger, X becomes a distribution channel. It becomes a testing ground. It becomes a native interface.

Imagine this: you're scrolling X and you see a post about something confusing. You tap a Grok icon. Grok explains the post, the context, the related information, without leaving X. You're still in the app. The experience is seamless. You interact with AI multiple times daily just as part of normal X usage.

That's the power of the merger for X users. Grok stops being a separate thing and becomes woven into the platform itself.

It also changes the competitive dynamics. Twitter's original value prop was being the "what's happening right now" platform. But it lost some of that value when engagement dropped and moderation became controversial. Merging with xAI gives X new value: "What's happening right now AND here's expert analysis and context immediately available."

For xAI, X provides something equally valuable: scale. You can't build a successful AI product without users. Grok is available to X users, yes, but if you could deep-integrate it into the X experience, suddenly Grok has monthly active users measured in the hundreds of millions. That's a fundamentally different position than competing as a standalone AI product.

The valuation of X in the Musk discussion was around $33 billion at the time of acquisition (though current valuations have been discussed as lower). In the context of a merged entity, X's value isn't its standalone worth—it's the synergy it creates with Grok and Starlink.

Space-based computing presents significant challenges, particularly with radiation and power limitations, but offers substantial advantages in scalability and disaster recovery. Estimated data.

Regulatory Challenges: The Obvious Ones

When you propose merging a company with orbital infrastructure, government contracts, and critical national communications capacity (Starlink) with a company developing advanced AI (xAI), regulators pay attention. Several angles matter here.

First, there's the FCC aspect. Starlink operates under FCC licensing. Those licenses have conditions. Substantially changing the ownership or control structure of Starlink might trigger FCC review. They'll want to ensure that the company remains solvent, continues serving its stated mission, and doesn't pose national security risks.

Second, there's the AI regulation question, which is nascent but emerging. Various proposals for AI oversight at the federal level have been floated. Some focus on algorithmic transparency, bias detection, and safety testing. A merged SpaceX-xAI would be significantly larger and more important than a standalone xAI, making it more likely to attract regulatory scrutiny.

Third, there's the antitrust angle. SpaceX-xAI merger by itself probably doesn't trigger major antitrust concerns because they're not in the same market. But if you include X in the analysis (which you should), then you're looking at a company that controls a social media platform and an AI product, and you're asking whether that creates concerning market concentration. Probably not an automatic block, but worth a deeper look from the FTC or DOJ.

Fourth, there's the foreign investment angle. Some of SpaceX's technology touches classified government work. There are rules about who can own or control companies with classified contracts. A merger would require them to certify that the merged entity remains in compliance with those requirements.

My guess is that regulators would probably approve the merger, but with conditions. Maybe requiring that Starlink maintains operational independence. Maybe requiring board seats or oversight mechanisms. Maybe requiring compliance audits. But a hard block seems unlikely unless something unexpected emerges.

The Operational Integration Challenge

Merging any two companies is hard. Merging two companies with completely different operational profiles is harder. SpaceX is hardware-heavy, capital-intensive, government-focused, and regulated like crazy. xAI is software-heavy, talent-intensive, consumer-focused, and less regulated.

Their cultures are different. SpaceX's narrative is about Mars, about expanding human civilization beyond Earth, about audacious engineering. xAI's narrative is about creating advanced AI, about safe AGI, about distributed computing. These aren't incompatible, but they're distinct.

Their business models are different. SpaceX makes money from launches and Starlink. xAI makes money from... well, it's not entirely clear yet. Grok is available to X premium subscribers, but that's not necessarily where the revenue model is going long-term.

Their operational rhythms are different. SpaceX works on launch cadences and satellite deployment timelines—things that take months to plan and minutes to execute. xAI works on model training cycles and feature releases—things that iterate weekly.

Integration requires solving for all of this. You need a unified executive team. You need aligned incentives. You need to figure out how many people you actually need if you eliminate duplicate functions. You need to solve for culture clash.

On the positive side, both companies are Musk-controlled, which actually simplifies things in some ways. He doesn't need to negotiate with a board or other shareholders. He can make decisions. That speed of decision-making is an advantage that typical corporate mergers don't have.

The IPO Mechanics: How Do You Even Value This?

Let's say the merger happens and the combined entity goes public. What's the valuation? How do you pitch this to investors?

SpaceX's valuation is anchored to hard numbers. They have launch revenue. Starlink has paying customers. You can forecast their cash flows. You can argue about margins, but you're working from real data.

xAI's valuation is more speculative. It's based on potential. Some investors might argue that the potential of an integrated AI-Starlink company is enormous. Others might argue that you're overpaying for unproven synergies.

Wall Street typically loves rollups—companies that consolidate fragmented industries. But this isn't a rollup in the traditional sense. It's a vertical integration of a platform company (X), an AI company (xAI), and an infrastructure company (SpaceX). That's unusual. Investors would need to understand the thesis, believe in it, and be willing to pay a premium for it.

Rough math: if SpaceX is worth

To put that in context, that would make it roughly equivalent to Apple's market cap. It would be one of the most valuable companies on Earth. That's a lot of value riding on execution.

The typical merger process takes 12-18 months, but an accelerated timeline for SpaceX and xAI could potentially reduce this to 8 months, given strategic alignment and Musk's influence. Estimated data.

The Standalone Alternative: What Happens If There's No Merger?

It's worth asking: what if the merger doesn't happen? What if these entities remain separate?

SpaceX probably IPOs eventually. It's profitable, it's valuable, it makes sense as a public company. But it IPOs as a space company, not as a space-AI-platform company. You get a different valuation story, probably still in the $600-800 billion range, but without the synergy uplift.

xAI continues as a private company or IPOs separately. It has funding from major investors. It can build Grok independently. But it's competing against OpenAI, Anthropic, and Google as a pure-play AI company without special infrastructure advantages. That's harder. That's slower. That's more competitive.

X remains a standalone platform. It continues struggling to find its identity post-acquisition. It remains a cash drain on Musk's other companies. It doesn't integrate with Grok in meaningful ways. It doesn't leverage Starlink. It's just a social media platform trying to compete with Meta.

Separately, these companies are fine. Together, they're potentially revolutionary. That's the argument for the merger. That's why it makes strategic sense.

But executing the integration would be the most complex corporate undertaking in recent tech history. It's not a guaranteed success. Plenty of mergers fail to achieve their promised synergies. But the potential upside is enormous enough that attempting it makes sense, at least from a strategic perspective.

The Grok Competitive Position After a Merger

Let's zoom in on what a SpaceX-xAI merger specifically means for Grok as an AI product competing in the broader AI landscape.

Right now, Grok is in third place or lower in consumer preference. People use ChatGPT because it's the default and it's good. They use Claude because it's more capable at certain tasks. Grok exists and it's available, but there's no compelling reason to switch to it over alternatives.

After a merger, Grok still needs to be a good product. But it would have advantages:

Scale of training data: X users generate enormous amounts of text data daily. That's valuable for training language models. With deeper integration, Grok could learn from X content in ways that competitors can't.

User feedback loop: Millions of X users could give feedback on Grok directly. That feedback could be collected, analyzed, and used to improve the product. Competitors have to rely on smaller user bases.

Infrastructure advantages: With Starlink-based compute, Grok could potentially offer faster response times, more reliable uptime, and better geographic distribution than cloud-based competitors.

Feature integration: Grok could be integrated into X's product in ways that make it indispensable. Content moderation? Grok helps. Content recommendations? Grok helps. Trending analysis? Spam detection? All things that AI can improve, all integrated into X.

Financial runway: SpaceX is profitable. xAI would inherit that profitability. You could outspend competitors on model training and development without worrying about path to profitability. That's an advantage.

None of this guarantees that Grok becomes the best AI. You still need great researchers, great product thinking, great execution. But it dramatically improves Grok's competitive position. It's the difference between a David with a slingshot and a David with an armored division.

The Space-Based AI Revolution: Technical Reality Check

Let me actually drill into the space-based AI data center concept, because it sounds amazing but it's also deeply challenging.

The idea: put AI compute in orbit. Cool it with the vacuum of space. Eliminate terrestrial real estate constraints. Scale globally with redundancy.

The reality check: space is hostile to electronics. Radiation damages circuits. Thermal cycling stresses components. Power is limited. Latency to ground stations adds overhead. And communication with satellites costs money—Starlink doesn't provide infinite bandwidth to every user.

But is it possible? Yes. Here's how:

Radiation shielding: You can shield spacecraft. Satellites do this now. It's not cheap, but it's doable.

Thermal management: Space is actually great for cooling if you understand radiative cooling. Satellites naturally radiate heat into space. For compute, this is actually advantageous compared to terrestrial data centers.

Power: Solar panels work in space. Satellites generate their own power. It's not unlimited, but it's sufficient for computational loads.

Latency: This is the hard problem. Every mile of electromagnetic signal travel takes time. Satellite to Earth to another satellite is slower than terrestrial fiberoptic cables. But if you're willing to accept millisecond-level latency increases, and if you optimize architecture, it's manageable.

Redundancy: This is actually where satellites excel. You have geographic diversity automatically. If one satellite fails, another handles the load. That's resilience that terrestrial data centers struggle with.

Is this going to replace terrestrial data centers? No. But could this become a serious architecture for certain workloads—especially inference, where latency tolerance is higher? Absolutely. Could SpaceX-xAI be the first company to seriously explore this? Yes. Could they find applications where it's genuinely superior? Probably.

It's not science fiction. It's engineering. Hard engineering, yes, but not impossible engineering.

SpaceX is valued at

International Implications: Starlink's Strategic Value

Starlink's global coverage has already become geopolitically important. Countries with less developed internet infrastructure love Starlink because it leapfrogs the need to build terrestrial networks. Ukraine used Starlink extensively during the conflict. Developing nations see it as a way to connect rural areas that terrestrial infrastructure won't reach.

Now add AI to the picture. A merged SpaceX-xAI would control both the delivery mechanism (Starlink) and the AI product (Grok). That creates different dynamics at the international level.

Some countries might see this as a strategic vulnerability. They might prefer to develop domestic AI capabilities rather than rely on a foreign company's AI accessed through a foreign company's satellites. That's probably why China and Russia are developing alternatives.

But many other countries would see it as an advantage. Get global AI access without needing to build their own infrastructure. Starlink provides the pipes. Grok provides the intelligence. It's a complete package.

For Musk's regulatory challenges, international context matters. The US government generally wants SpaceX to succeed because it's critical American infrastructure. But other governments might regulate differently. The EU has been aggressive about regulating both AI and tech platforms. They might impose conditions on how Grok operates in Europe or how Starlink integrates with xAI. That's something the merged company would need to navigate.

The Employment Impact: What Happens to Teams

When you merge two major tech companies, the employment question is significant. SpaceX and xAI combined probably employ a few thousand people (SpaceX is bigger, maybe 10,000+, xAI smaller, maybe 500-1,500).

Not all roles would be eliminated, but some would be. You don't need two CFOs. You don't need two CEOs (although Musk could appoint presidents to each major division). You don't need duplicate administrative functions.

But here's the thing: both companies are in growth mode. SpaceX is launching more rockets and expanding Starlink. xAI is hiring to build better models. So while some roles might be eliminated through consolidation, the merged company might also grow headcount because you're enabling new capabilities.

The real concern is cultural integration. SpaceX has a particular culture—intense, engineering-focused, deadline-driven, almost militaristic in execution style. xAI probably has a different culture—more research-oriented, more debate-driven, more aligned with typical AI lab culture. Merging these cultures is hard. People leave. Talent gets lost. Productivity dips during the transition.

Musk is aware of this. He's done significant organizational restructuring before. Tesla went through major internal reorganizations. Twitter went through massive layoffs and restructuring. SpaceX has itself done internal consolidations. Musk tends to move fast and make decisive cuts, which is efficient but can be disruptive.

The Timeline Question: Can This Actually Happen by June?

Earlier I mentioned that Financial Times reported a June 2025 IPO target for SpaceX. Now we're looking at a potential merger before that IPO. Is that realistic?

Typical merger timelines:

- Months 1-2: Negotiate terms, establish valuation, draft agreements

- Months 2-4: Regulatory review, antitrust analysis, government approvals

- Months 4-6: Integration planning, systems alignment, communication to stakeholders

- Months 6+: Actual execution, migration, operational integration

So a typical serious merger takes 12-18 months from announcement to close.

But this isn't a typical merger for several reasons:

-

Musk controls both companies. He doesn't need to negotiate with hostile boards or multiple shareholders. That saves months.

-

The companies are aligned strategically. They've already been investing in each other. Cultural integration might be smoother because the companies already have aligned interests.

-

The entities are already partially integrated. SpaceX satellites already support various uses. xAI could theoretically tap into that infrastructure. The groundwork is partially laid.

-

Musk has shown he can move fast. The Twitter acquisition closed in months, not years. The integration was chaotic, but it was fast.

On the other hand:

-

Regulatory complexity is high. FCC, FTC, potentially national security review—that's slow.

-

The merged entity is enormous. The larger the company, the more complex the integration.

-

IPO timing pressure. Trying to do a major merger AND go public in the same window is extremely difficult.

My assessment: a June 2025 IPO with a merged entity is ambitious but not impossible. More likely scenario is SpaceX IPOs in summer/fall 2025 standalone, then xAI joins as a major acquisition or subsidiary shortly after. But I wouldn't bet against Musk pushing for the faster timeline. He's done crazier things.

The Vision Beyond the Merger: Where This Goes

If the merger happens, if it works, where does this lead in five years? Ten years?

Musk's stated vision is Mars. Getting humanity to Mars as a multiplanetary species. SpaceX is the tool for that. Starlink provides income and infrastructure. But Mars colonization needs AI—autonomous systems, resource management, environmental monitoring, problem-solving in contexts where humans can't immediately help.

A merged SpaceX-xAI positions the companies to be the technological foundation for that vision. The rockets (SpaceX). The satellite infrastructure (Starlink). The AI system managing everything (xAI). It's a coherent architecture aligned to a singular goal.

For terrestrial applications, the merged company could become something like the "operating system for the digital world." X as the communication layer. Grok as the intelligence layer. Starlink as the infrastructure layer. Everything connected, everything integrated, everything optimized for speed and scale.

That's a huge vision. Probably too ambitious in its full form. But the directional arrow is clear: consolidation of multiple layers of technology into an integrated system that's harder for competitors to replicate because they don't control all the pieces.

Whether that vision succeeds depends on execution. Musk has proven he can execute at scale (Tesla, SpaceX). But he's also famous for timelines that slip and ambitious goals that don't fully materialize. The merger itself is the easy part. Making it work is the hard part.

What This Means for Competitors

If SpaceX and xAI merge, what does that mean for OpenAI, Anthropic, Google, and other competitors in the AI space?

It means the game just got harder. Suddenly there's a competitor with infrastructure advantages that they don't have. A competitor with distribution (X) that they don't have. A competitor with capital (SpaceX's profitability) that gives it runway to outspend others.

OpenAI is well-funded but it's still raised most of its money from external investors. They need to maintain their path to profitability. A merger between SpaceX-xAI that combines a profitable company (SpaceX) with an ambitious one (xAI) removes that pressure.

Anthropic is incredibly well-funded but it's still a venture-backed company dependent on investor confidence. Google has AI capability but it's fighting internal organizational constraints and the need to maintain its core search and ads business. Microsoft has its partnership with OpenAI, which is deep but not full ownership.

None of them control orbital infrastructure. None of them control a global social media platform. None of them have the capital available from a profitable space company. The merged entity, if it executes well, would be in a fundamentally different competitive position.

That doesn't mean competitors are doomed. OpenAI could still build better models. Google could still leverage its search advantage. Anthropic could still focus on AI safety and build competitive products. But they're starting from a different position.

The Antitrust Question: Should This Be Blocked?

Let me engage directly with the question some people are asking: should regulators block this merger? Is it dangerous to let one person control SpaceX, X, xAI, and Tesla?

Argument for blocking:

- Musk already wields enormous power across multiple industries

- Consolidating these companies increases that power

- X is a critical communication platform; combining it with AI and infrastructure raises concerns

- The merged entity would be too powerful in too many domains

- Antitrust doctrine is supposed to prevent consolidation that reduces competition

Argument against blocking:

- SpaceX and xAI don't compete in the same market, so horizontal consolidation concerns don't apply

- Vertical integration (infrastructure + AI) can be efficient and doesn't automatically harm competition

- The AI market is competitive with many players; one merged company doesn't create a monopoly

- X is declining in influence compared to other platforms; giving it AI integration doesn't create market dominance

- SpaceX is in a unique position (only private company with heavy lift capability); a merger doesn't create that position

My take: this would probably survive antitrust review, but it's not obvious. It depends on the specific regulatory framework and how regulators are thinking about AI and infrastructure regulation at the time of review. If the merger is proposed before new AI regulation is finalized, it might slide through. If it's proposed after stricter regulation is in place, it might face more challenges.

The key variable is whether the administration at the time sees this as a strategic advantage (which would favor approval) or as a dangerous consolidation (which would lead to scrutiny or rejection).

FAQ

What is the proposed SpaceX-xAI merger?

The proposed merger would combine SpaceX (Musk's rocket and satellite internet company) with xAI (his AI company developing the Grok chatbot) into a single corporation. Two blank corporate entities called K2 Merger Sub Inc. and K2 Merger Sub 2 LLC were established in Nevada in January 2025, suggesting the merger infrastructure is being constructed. If completed, the merged entity would combine space infrastructure, satellite internet, an AI chatbot, and the X platform under one parent company.

Why would SpaceX and xAI merge?

The merger makes strategic sense for several reasons: SpaceX could provide computational infrastructure for xAI's AI products using Starlink satellites; xAI could be distributed through X's user base, giving Grok tens of millions of instant users; operational consolidation would eliminate duplicate functions and reduce costs; and a merged entity could tell a more compelling story to IPO investors about integrated space-AI infrastructure. Both companies have been investing billions in each other, signaling strategic alignment.

When would the merger be completed?

A June 2025 IPO timeline for SpaceX (reported by Financial Times) suggests the merger could close around that time if the entities prioritize it, though more likely scenarios involve SpaceX IPOing in summer 2025 followed by xAI integration shortly after. Typical mergers take 12-18 months from announcement to close, but Musk has demonstrated an ability to move faster than typical corporate timelines when he controls both parties. A late 2025 or early 2026 completion is realistic.

What is the combined valuation of the merged entity?

SpaceX is valued at approximately

What would the merged company do with Starlink's satellite network?

The vision is to use Starlink's 7,400+ active satellites (with plans for 40,000+) to provide distributed computational infrastructure for xAI's AI services. This could include space-based data centers that use the vacuum for thermal cooling, global redundancy for AI inference, lower latency to end users through satellite delivery, and resilience against terrestrial infrastructure failures. While challenging technically, this would give xAI infrastructure advantages that terrestrial-only AI companies cannot match.

How would the merger affect X (formerly Twitter)?

X would become a native platform for Grok integration, allowing users to access AI-powered analysis, content recommendations, and fact-checking directly within the social media experience. This would improve X's user engagement and retention by adding valuable AI features, while giving Grok instant access to hundreds of millions of X users. Grok could provide X with competitive advantages against Meta and other platforms by offering integrated AI capabilities that competitors don't have.

Would regulators approve this merger?

Most likely yes, though with potential conditions. SpaceX and xAI operate in different markets (space vs. AI), so horizontal antitrust concerns don't apply. Starlink operates under FCC licensing that might require review, and various AI regulations might trigger scrutiny, but a hard block seems unlikely unless unexpected national security issues emerge. Regulators might impose conditions requiring operational independence of certain divisions or compliance audits.

What would this mean for competitors like OpenAI and Google?

Competitors would face a more formidable competitor with unique advantages: infrastructure control through Starlink, distribution through X's user base, capital from SpaceX's profitability, and integrated system advantages that competitors can't match without similar diversification. However, this doesn't eliminate competition, as OpenAI, Google, Anthropic, and others can still build competitive AI products and serve different market segments. The merged entity would be stronger, but not unbeatable.

Could the merger actually happen by June 2025?

While challenging, it's not impossible given that Musk controls both companies and can move quickly without shareholder negotiations. The Nevada corporate filings from January 2025 suggest serious preparation. More realistically, SpaceX likely IPOs independently in mid-2025, with xAI integration announced shortly after and completed by late 2025 or early 2026. Musk's timelines are often optimistic, so delays beyond the announced window should be expected.

What are the biggest risks to the merger succeeding?

Key risks include: regulatory delays or unexpected antitrust challenges; cultural integration failures between hardware-focused SpaceX and AI-focused xAI teams; technical challenges in implementing space-based AI infrastructure; product failures if Grok integration doesn't improve X's competitiveness; and execution risk given the complexity of merging two major companies while simultaneously preparing for a multi-billion dollar IPO. Musk has overcome similar challenges before, but this merger is one of the most complex tech consolidations attempted.

Looking Forward: The Real Implications of This Merger

If the SpaceX-xAI merger happens, we're not just looking at a corporate reorganization. We're looking at a fundamental shift in how technology infrastructure could be structured.

Right now, tech is layered: platforms provide services, but they depend on cloud infrastructure. Cloud providers sell computing power without owning the content. Social platforms own communities but depend on external infrastructure. AI companies train models but rely on others' infrastructure.

A merged SpaceX-xAI would be different. It would own the infrastructure (Starlink), the platform (X), and the AI (Grok). All integrated. All optimized together. That's a vertical integration that's uncommon in tech.

Does that make it powerful? Yes. Does it make it dangerous? Potentially, but not necessarily. Integrated companies can be more efficient, but they can also become bloated and slow. The question is whether Musk's leadership and the specific vision for this merger can actually execute on the promise of integration.

One thing's for sure: if this merger closes, the tech industry just got significantly more interesting, and definitely more complicated.

Right now, nobody knows exactly what the combined company will look like, what its rules will be, or how it will operate. That's because the details haven't been finalized. But the strategic logic is clear. Musk is consolidating his technology bets into a single entity that could become the most powerful integrated tech company since, well, maybe ever.

We're watching something unusual unfold. It might be brilliant. It might be chaos. But it's definitely not boring.

Key Takeaways

- SpaceX and xAI filed merger entity documents (K2 Merger Sub) in Nevada on January 21, 2025, signaling serious preparation for consolidation

- The merger would combine 900B-$1.5T integrated company

- Musk's strategic vision includes space-based AI data centers using Starlink for computation, thermal efficiency, and global redundancy

- X platform integration with Grok would provide instant AI distribution to hundreds of millions of users, dramatically improving Grok's competitive position

- SpaceX's June 2025 IPO timeline could accelerate the merger, though late 2025 or early 2026 completion is more realistic given regulatory complexity

Related Articles

- SpaceX's Starlink Broadband Grant Demands: What States Need to Know [2025]

- Tesla Kills Model S and X Production: The Shift to Humanoid Robots [2025]

- Tesla Discontinues Model S and X to Focus on Optimus Robots [2025]

- Microsoft's $7.6B OpenAI Windfall: Inside the AI Partnership [2025]

- Tesla's $2B xAI Investment: What It Means for AI and Robotics [2025]

- Tesla's 46% Profit Collapse in 2025: What Went Wrong [2026]

![SpaceX and xAI Merger: What It Means for AI and Space [2025]](https://tryrunable.com/blog/spacex-and-xai-merger-what-it-means-for-ai-and-space-2025/image-1-1769717325718.jpg)