TSMC's AI Chip Demand 'Endless': What Record Earnings Mean for Tech [2025]

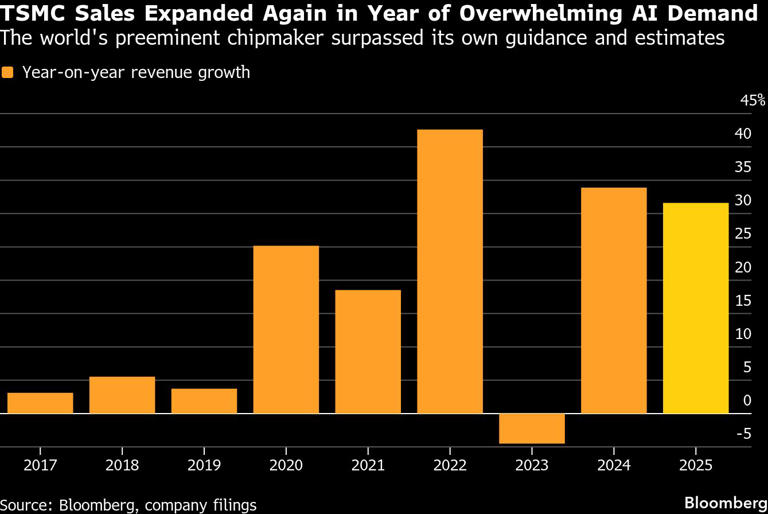

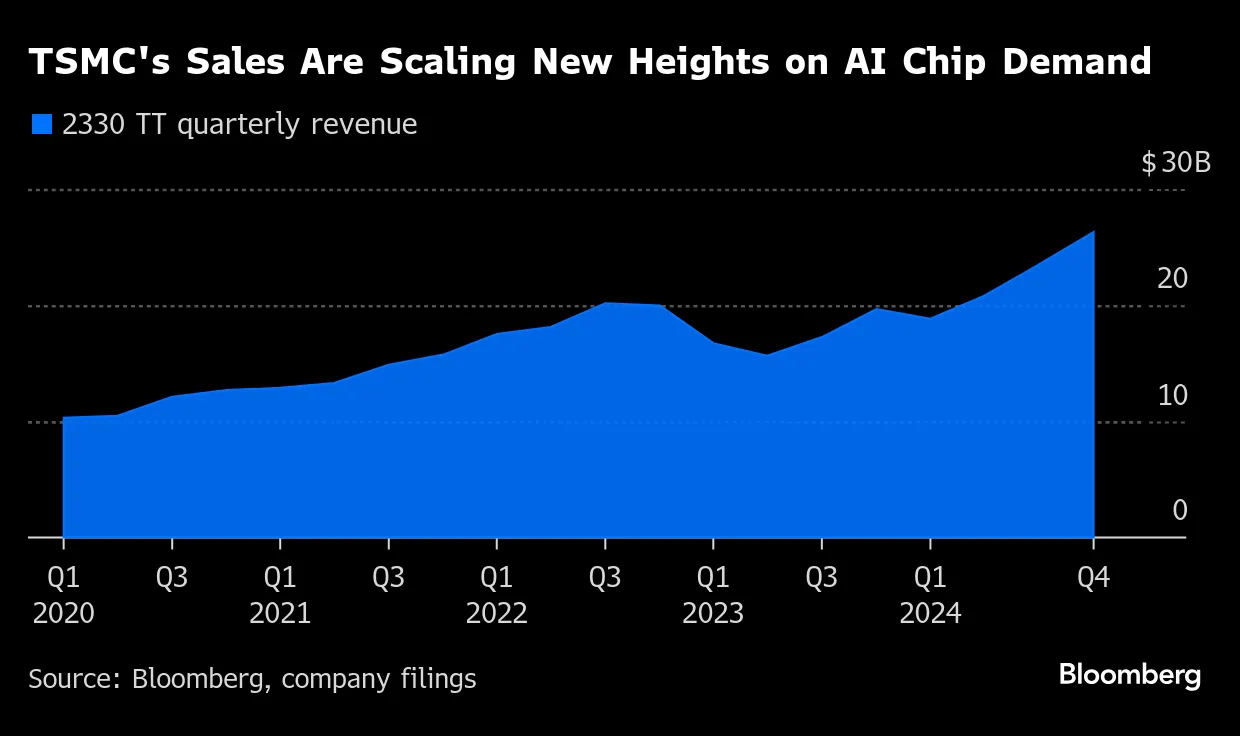

There's a moment that happens right before a major industry shift. The skeptics are still predicting collapse while the people closest to reality are quietly ramping up production by 30 percent. TSMC just had that moment.

On a Thursday earnings call in early 2026, Taiwan Semiconductor Manufacturing Company reported numbers that stopped the bubble-burst narrative cold. The world's most important chipmaker posted net income of

Wei didn't hedge. He didn't use corporate language. He told investors the AI demand looks "endless." More than that, he explained exactly how he knew it was real: he'd talked to every major cloud provider directly. He'd seen their proof. He'd watched them show him how AI was already transforming their bottom line.

That confidence matters more than any earnings report. TSMC manufactures chips for Apple, Nvidia, AMD, and Qualcomm. It produces the vast majority of the world's most advanced semiconductors. When TSMC commits to spending

And right now, every customer it talks to says the same thing: "We need more chips. We need them faster. Keep building."

That's not a bubble. That's the sound of demand meeting reality.

TL; DR

- TSMC posted record Q4 earnings: $16 billion net income, 35% Yo Y growth, signaling sustained AI chip demand

- CEO's confidence is concrete: Wei verified demand directly with cloud providers, not through market signals

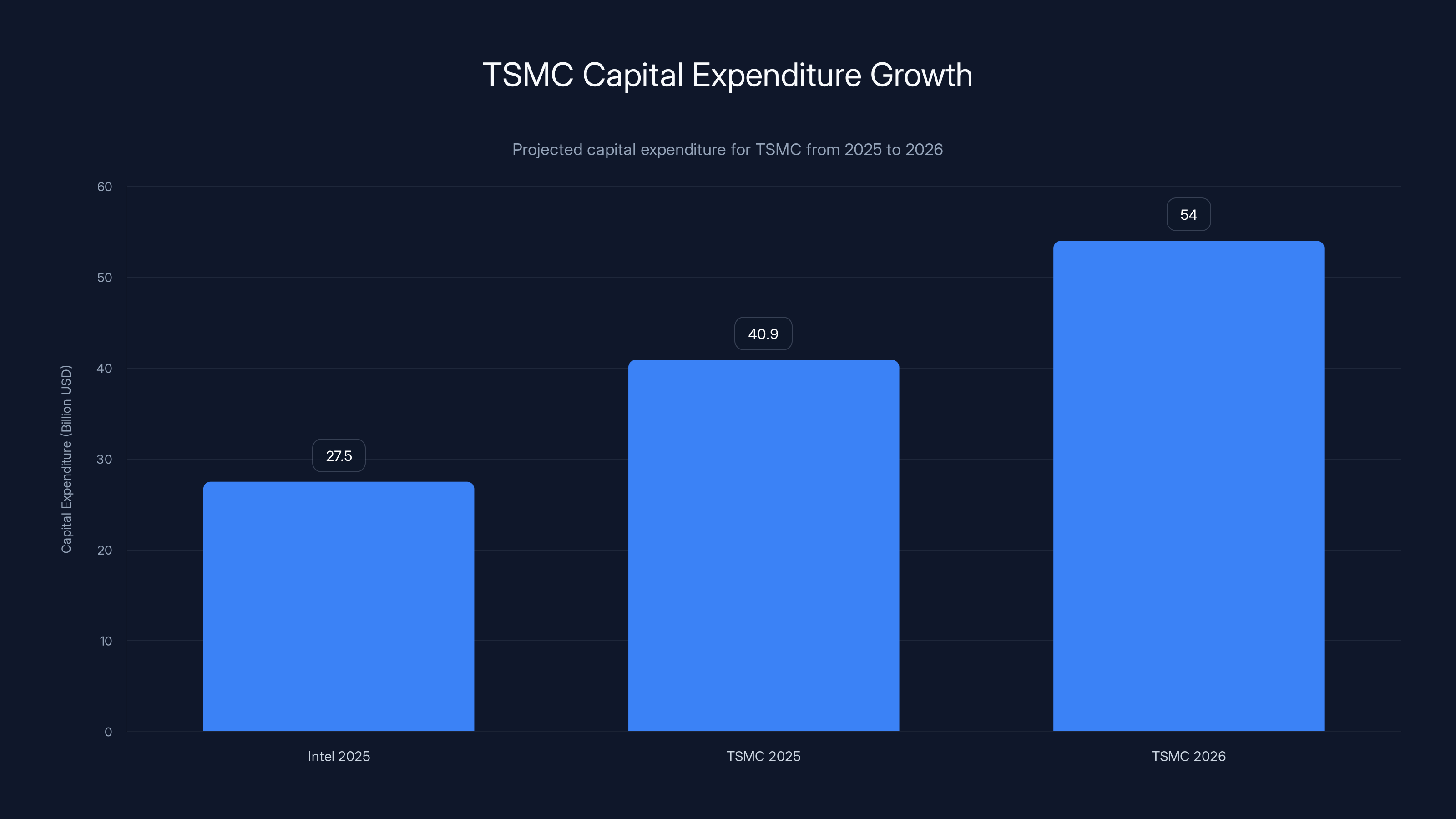

- Massive capex increase planned: 40.9 billion in 2025, a 27-37% increase

- 30% revenue growth forecast: TSMC expects revenue to grow nearly 30% in 2026, driven by AI chip orders

- Bubble fears are overstated: Unlike previous tech cycles, this demand is tied to real business value, not speculation

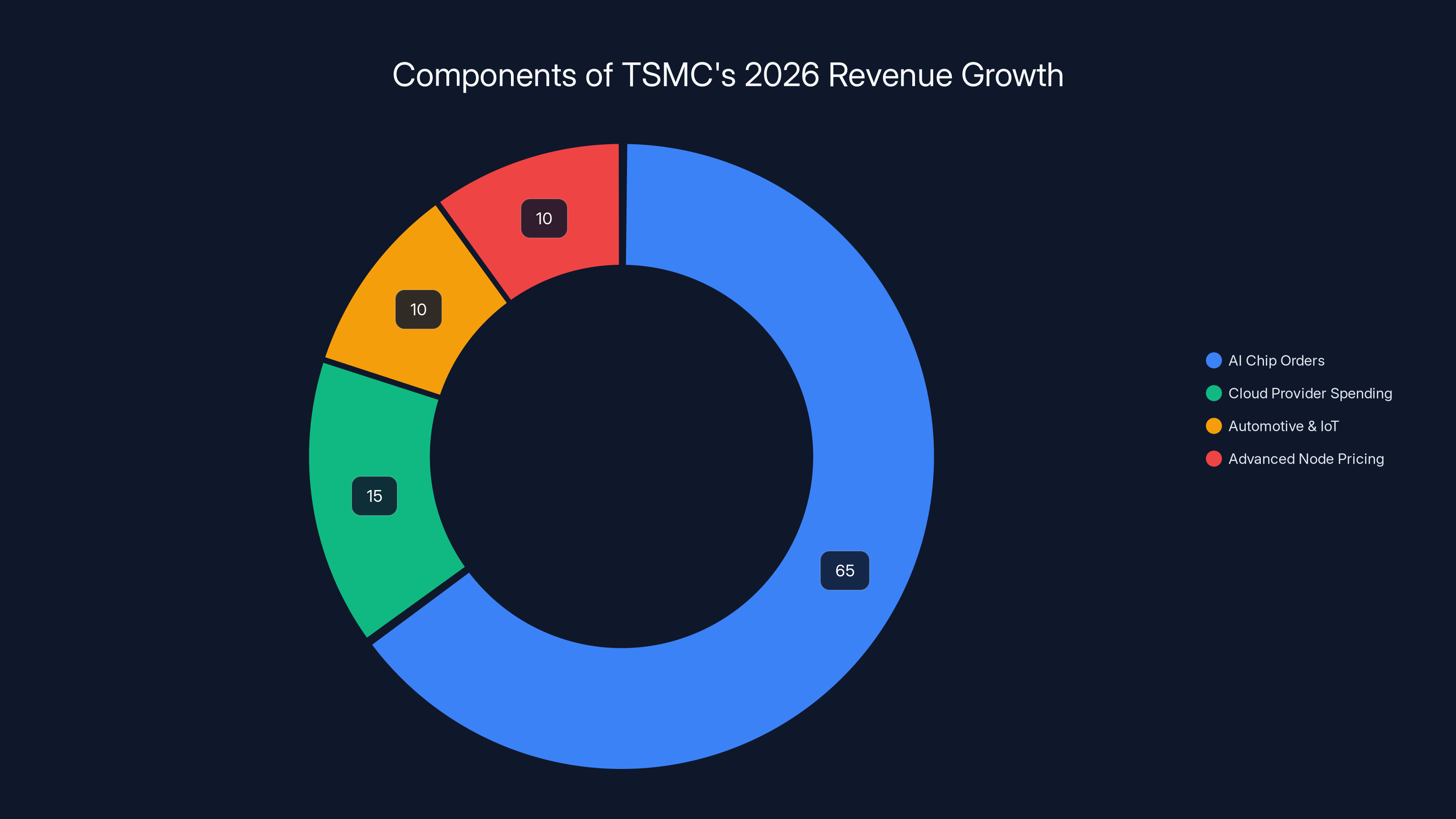

TSMC's revenue is projected to grow nearly 30% by 2026, supported by an increase in capital expenditure to $54 billion, reflecting confidence in sustained AI demand. Estimated data based on company projections.

The Earnings Report That Changed the Conversation

When a semiconductor company reports "record earnings," the first instinct is to check if it's real or if accounting games made the numbers prettier. TSMC doesn't play those games. The company reports results in New Taiwan Dollars (NT$) and US dollars (USD) separately, maintains transparent production metrics, and discloses customer concentration to the SEC.

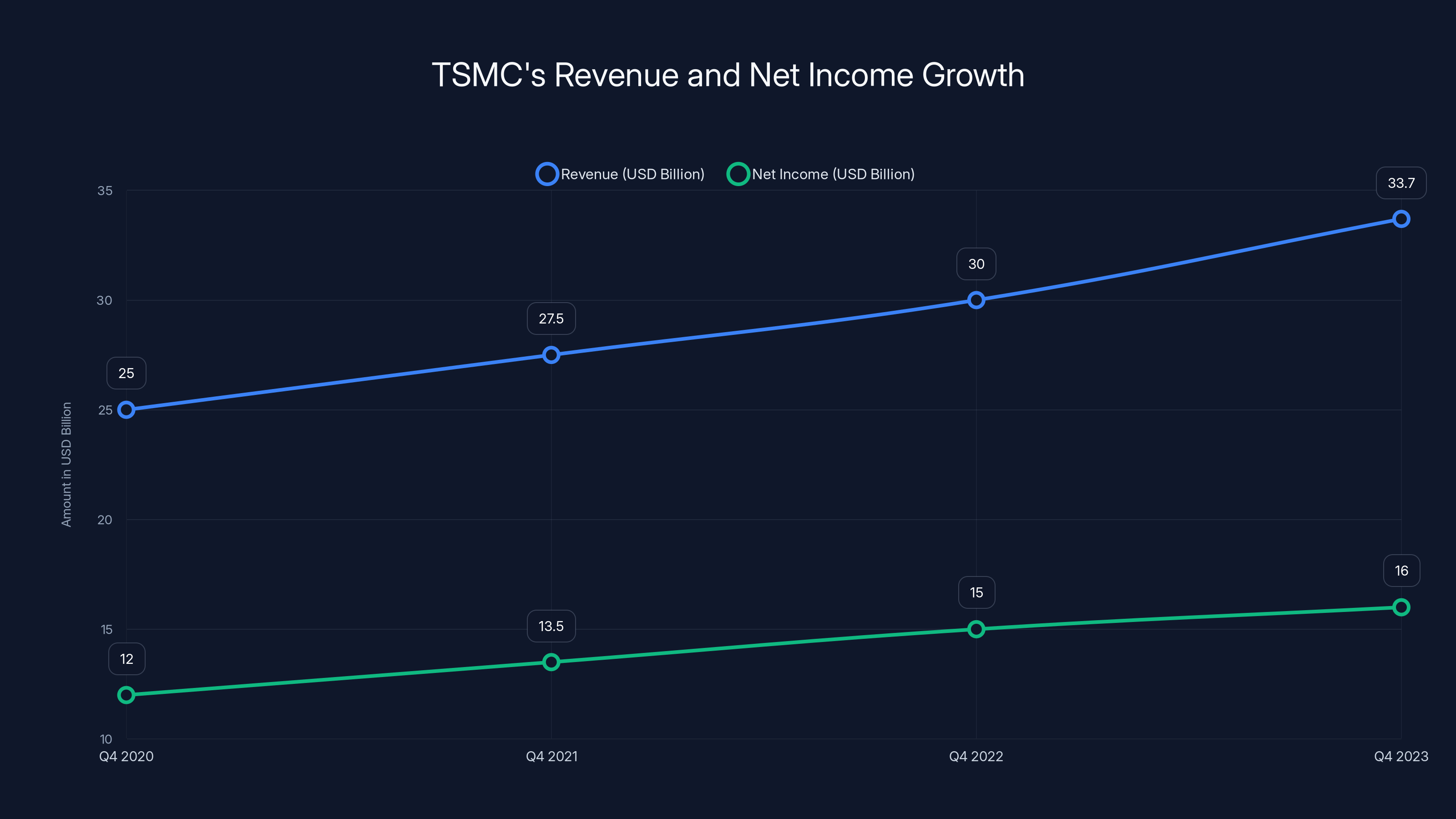

The Q4 numbers were unambiguously strong. Net income of NT

Revenue of $33.7 billion represents a 25.5 percent year-over-year increase. But here's what made analysts sit up: the gross margin. TSMC reported strong gross margins despite the massive spending increase investors feared would dilute profitability. The company is simultaneously printing money and spending a historic amount on new fabs (manufacturing plants). That only happens when you're certain demand will sustain the investment.

Wei's language during the call was unusually direct for a semiconductor executive. He didn't say "we expect AI to remain strong." He didn't hedge with "barring unexpected market disruptions." He said the demand "looks like it's going to be like an endless... I mean, that for many years to come."

That's the CEO of the world's most critical chipmaker saying: this isn't temporary. This is a multi-year phenomenon.

Why TSMC's Confidence Matters More Than Market Surveys

Every analyst firm, every market research company, every consulting outfit publishes forecasts about AI demand. Most of them extrapolate from customer surveys, public statements, and historical trends. They're educated guesses.

TSMC's confidence is different. The company manufactures the physical chips that power the AI boom. It doesn't estimate demand from afar. It negotiates supply contracts with the companies burning through compute capacity. It talks to cloud providers that are literally building out data centers right now.

Wei explained this explicitly during the earnings call. He said he wanted to verify that demand was real before committing to the capex increase. So what did he do? "I talked to those cloud service providers, all of them," Wei said. "The answer is that I'm quite satisfied with the answer. Actually, they show me the evidence that the AI really helps their business."

That's not confidence based on market sentiment. That's confidence based on direct observation. Cloud providers aren't speculating about whether AI workloads will generate revenue. They're running the workloads. They're seeing the results. They're coming back to TSMC saying: "Build more capacity. We'll fill it."

The distinction is crucial because it directly addresses the elephant in the room: the AI bubble narrative. Starting in mid-2025, prominent tech leaders began publicly questioning whether the AI industry was running ahead of actual utility. Google CEO Sundar Pichai warned of "irrationality" in the AI market. Open AI's Sam Altman acknowledged that investors were "overexcited." Industry insiders began asking if companies were spending billions on AI infrastructure that wouldn't generate proportional returns.

That skepticism wasn't unreasonable. Tech cycles have crashed before. Massive capex spending has resulted in stranded assets before. Irrational exuberance has destroyed shareholder value before.

But TSMC's position is unique. The company sits at the intersection of supply and demand. It sees both sides. And what it's seeing is asymmetric: customers are asking for more capacity than TSMC can build. That's not a signal of oversupply. That's the opposite.

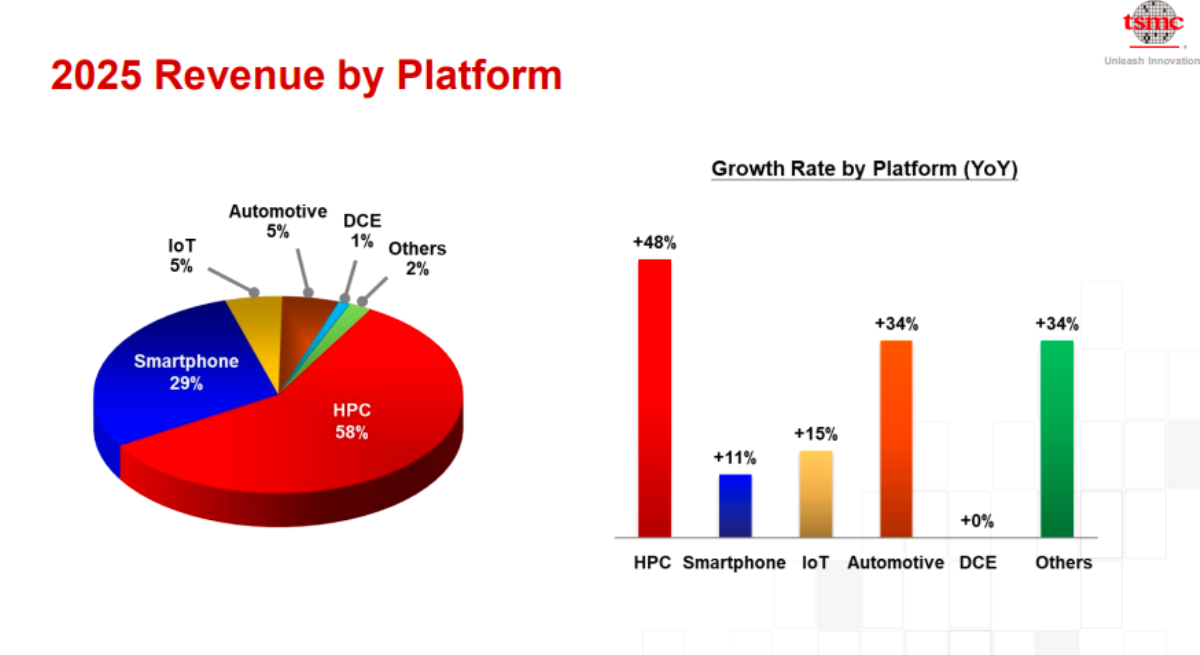

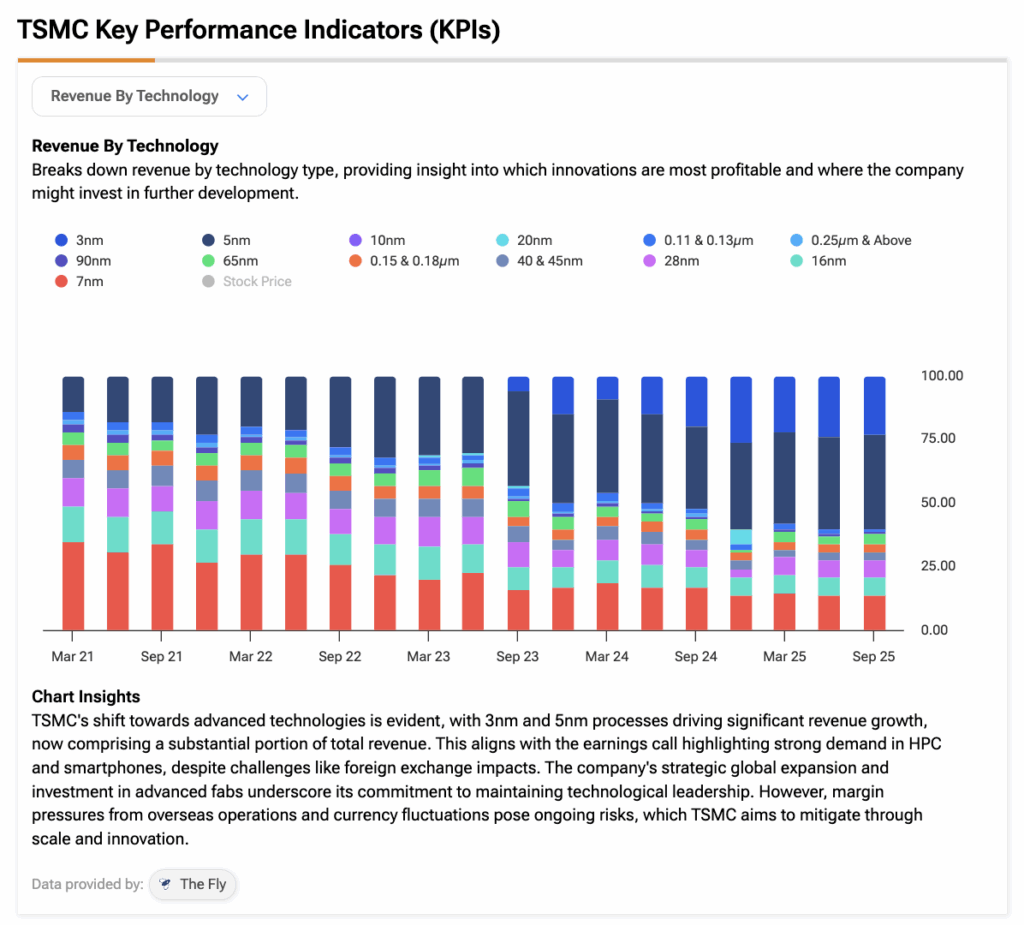

AI chip orders are projected to account for 65% of TSMC's revenue growth in 2026, driven by strong demand from data center and AI infrastructure expansions. (Estimated data)

The Capital Expenditure Surge: $52-56 Billion in 2026

Here's what really matters about TSMC's 2026 spending plan: it's not marginal growth. It's historically aggressive expansion.

In 2025, TSMC spent

TSMC's 2026 guidance of $52-56 billion represents a 27 to 37 percent increase in a single year. That's not a growth rate that executives commit to unless they've verified demand out multiple years. When you're spending that kind of money on fab construction and equipment, you're making 3-5 year bets.

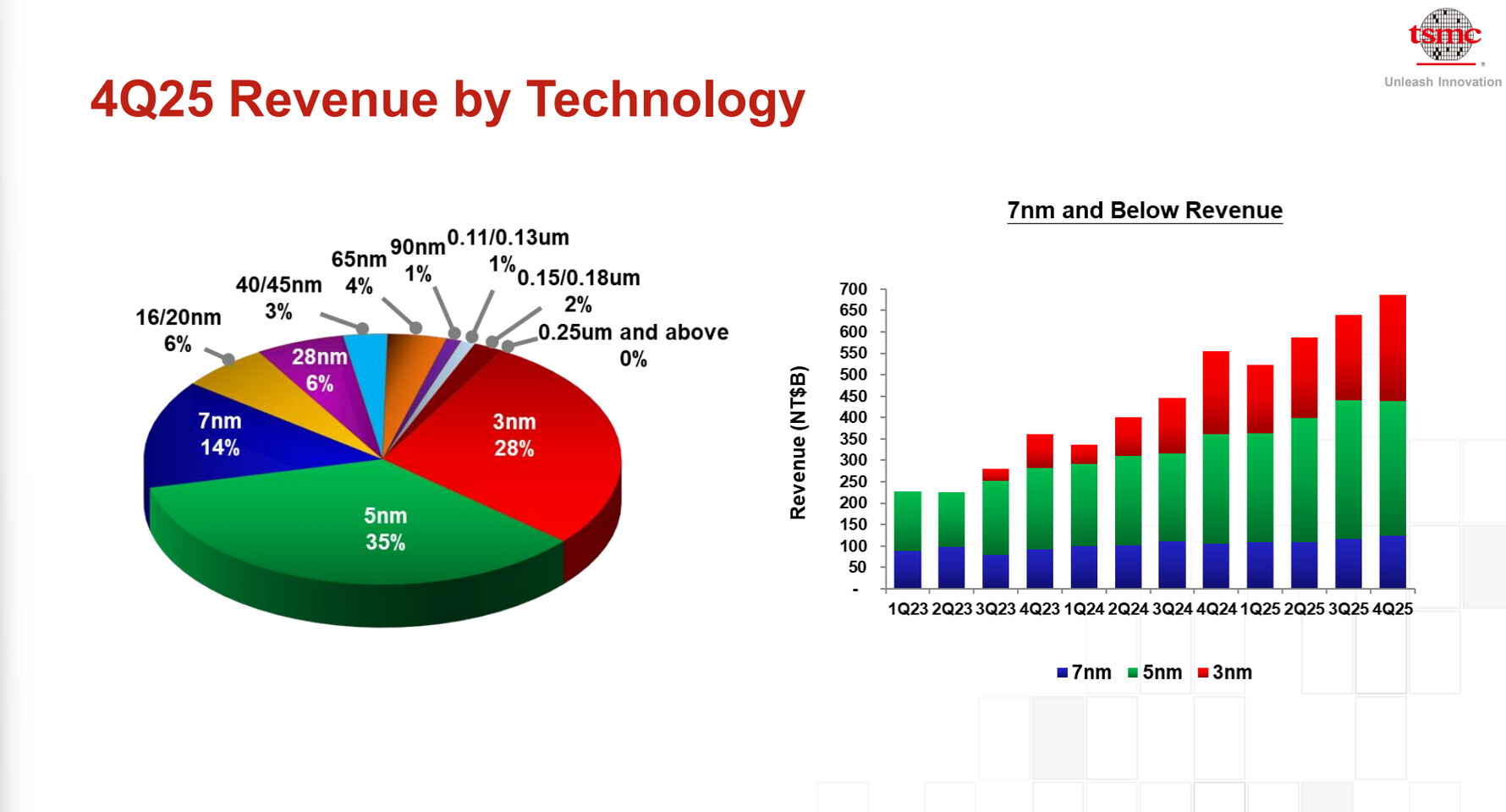

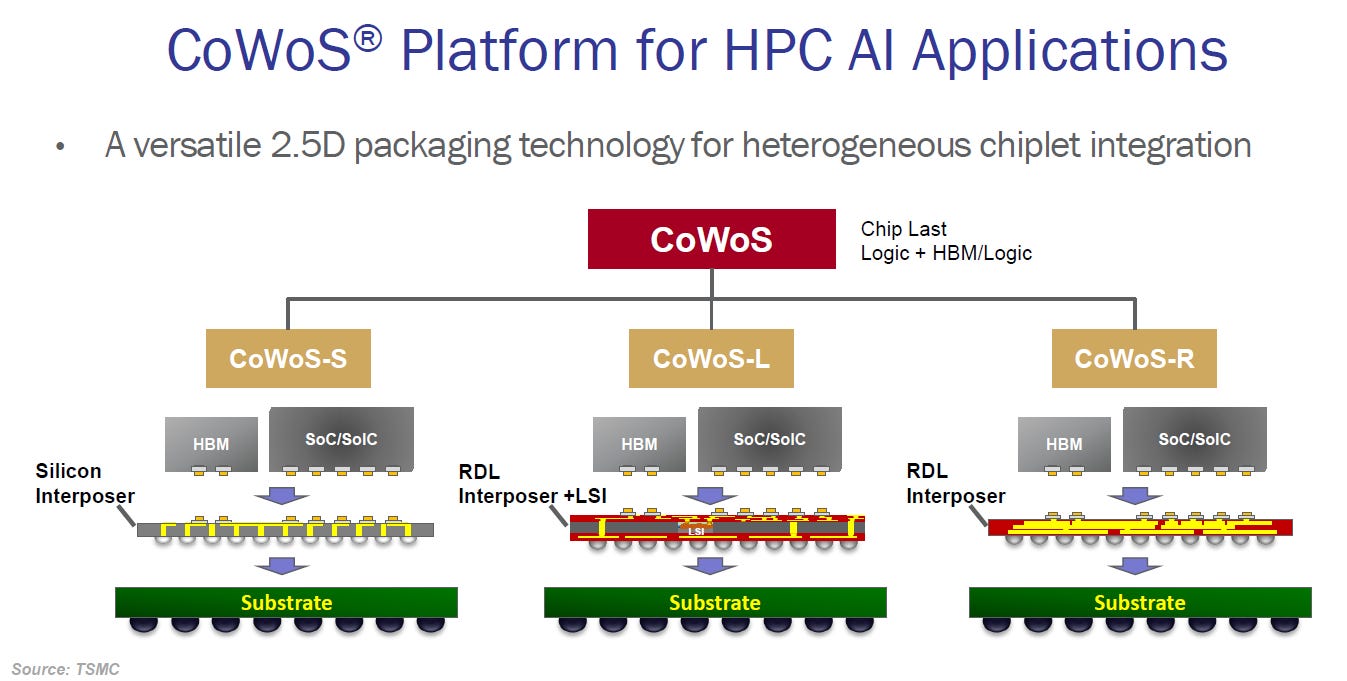

What does that $52-56 billion buy? Primarily, it funds new fabrication plants and the latest chip-making equipment. TSMC is expanding capacity across multiple nodes (5nm, 3nm, 2nm) and geographic locations. The company is simultaneously accelerating its Arizona facilities expansion to support the US-Taiwan trade agreement finalized on the same day as earnings.

The spending breakdown matters:

- Advanced process node expansion: Adding 3nm and 2nm capacity to serve Nvidia, Apple, AMD, and Qualcomm

- Geographic diversification: US and Japan facilities funded to reduce single-country dependency

- Equipment procurement: Latest lithography, etching, and testing equipment from vendors like ASML

- Specialty nodes: Support for automotive, Io T, and analog chip demand

The mathematics of this spending are instructive. TSMC's typical fab construction takes 18-24 months from groundbreaking to production. Equipment procurement happens in advance. So when TSMC commits to $52-56 billion in 2026 spending, it's essentially locking in production capacity for 2027-2028.

That's the company betting that in 2027-2028, AI chip demand will still be strong enough to justify the investment. Not "will probably be strong." Not "we hope it remains strong." Wei's language suggests TSMC has visibility into customer roadmaps that extends at least 24 months out.

That's the growth rate of the global AI infrastructure expansion, quantified in terms of silicon manufacturing capacity.

Revenue Growth Forecast: 30% in 2026

TSMC's stated expectation of nearly 30 percent revenue growth in 2026 is remarkable for a company of its scale. TSMC is the world's largest independent semiconductor foundry. It's not a startup. It's a $600+ billion market cap company.

Mature companies don't grow 30 percent year-over-year without a major market inflection. That kind of growth typically happens during the early stages of a new technology wave, or when an existing market goes parabolic.

AI chip demand is driving both.

The 30 percent growth forecast breaks down into several components:

AI chip orders account for roughly 60-70 percent of incremental growth. Nvidia, AMD, and other AI chip designers are ramping orders as customers build data centers and AI infrastructure. These orders are concrete. They're in contracts. They're not speculative.

Cloud provider spending remains elevated. Amazon Web Services, Google Cloud, Microsoft Azure, and other hyperscalers are in the middle of multi-year AI infrastructure buildouts. These investments are capital-intensive and require constant chip supply.

Automotive and Io T continue growing. TSMC's non-AI business is still healthy. Legacy nodes (28nm, 40nm, etc.) are still generating steady demand from automotive chips, Io T devices, and industrial applications.

Advanced node pricing remains strong. When demand exceeds supply, pricing power increases. TSMC can charge premium prices for 3nm and 2nm capacity, improving margins.

The revenue growth forecast is particularly significant because it's paired with strong margin expectations. TSMC isn't growing revenue by competing on price. It's growing by producing advanced chips that customers can't get elsewhere.

That's a differentiated position. When you're the only supplier of a critical input, and demand exceeds supply, you can grow both revenue and profitability simultaneously.

Verifying Demand: Direct Conversations with Cloud Providers

Wei's statement that he'd spoken directly with cloud service providers wasn't throwaway language. It was the crux of TSMC's bullish outlook. Understanding why reveals how TSMC actually validates demand signals.

In semiconductor cycles past, companies relied on indirect signals: order backlogs, equipment sales, analyst surveys, and economic data. TSMC still watches all of those. But the company also has direct access to the largest customers making AI infrastructure decisions.

When Wei says he talked to "those cloud service providers, all of them," he's referring to:

- Amazon Web Services: Building AI infrastructure across multiple AWS regions

- Google Cloud: Competing with AWS on AI model serving and processing

- Microsoft Azure: Supporting Open AI and other generative AI applications

- Meta: Running inference at scale for recommendation systems and content moderation

- Apple: Embedding AI models into devices and cloud infrastructure

- Oracle Cloud: Servicing enterprise AI workloads

- Others: Regional providers and enterprise customers

Each of these companies has committed billions to AI infrastructure. They have multi-year capital budgets. They have visibility into customer demand for AI services. When they tell TSMC "we need more chips," it's not market speculation. It's matched demand from their own customers.

Wei's mention of seeing "evidence that the AI really helps their business" is the kicker. He's not just seeing order volume. He's seeing proof that AI services are generating revenue for cloud providers. That's the difference between a bubble and a real infrastructure buildout.

In a bubble:

- Companies invest speculatively

- There's no clear ROI measurement

- Spending accelerates ahead of demand

- Customers are uncertain about actual use cases

In a real infrastructure wave:

- Spending is tied to measurable customer demand

- ROI is demonstrated and tracked

- Customers show up with concrete demand signals

- Use cases are already generating revenue

Wei's statement puts the AI cycle in the second category.

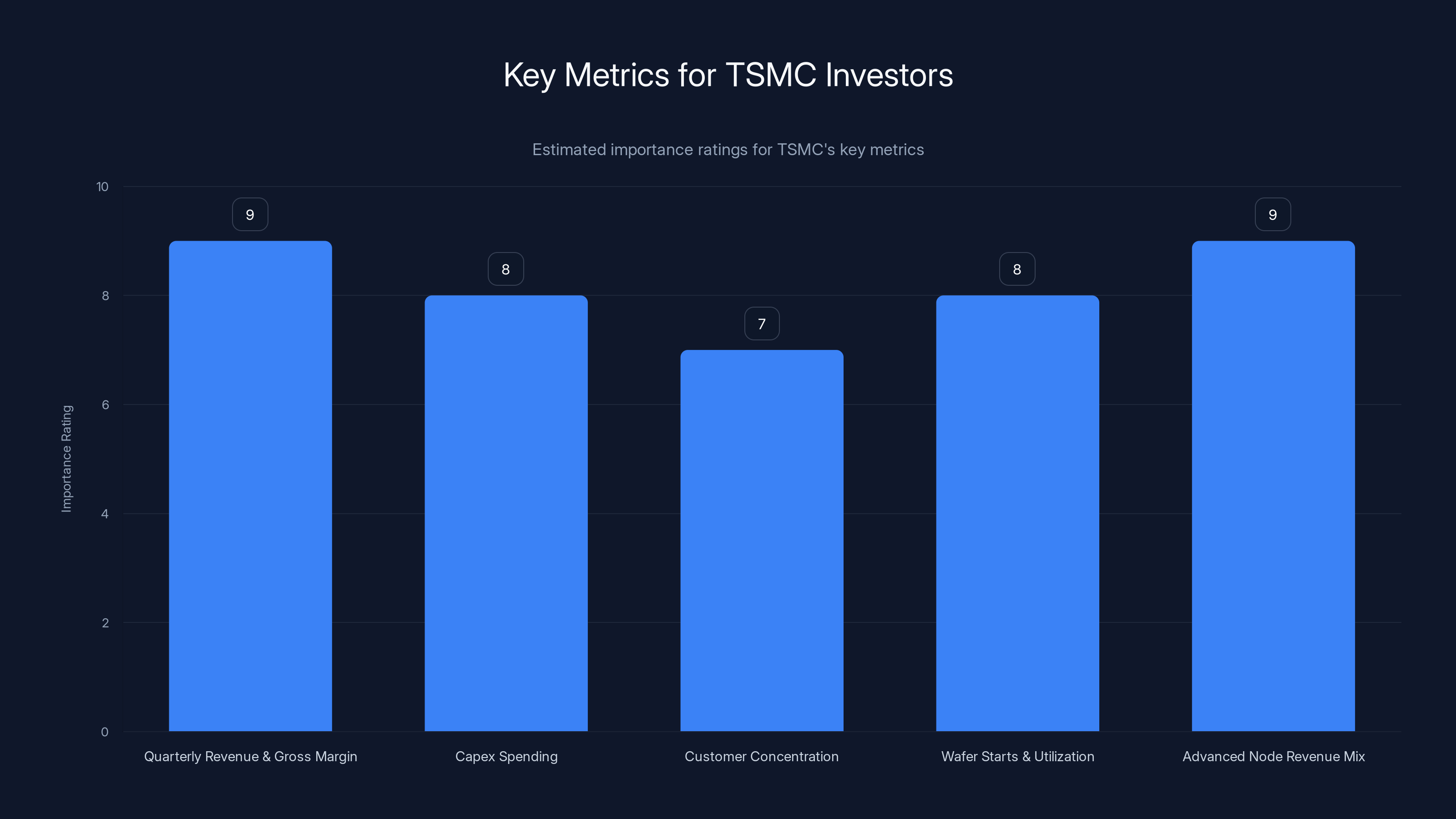

Estimated importance ratings show that quarterly revenue, gross margin, and advanced node revenue mix are critical for investors to monitor TSMC's performance.

The Timing: US-Taiwan Trade Agreement and Arizona Expansion

TSMC's earnings announcement landed the same day the US and Taiwan finalized a major trade agreement. The timing wasn't coincidental. The deal cuts tariffs on Taiwanese goods to 15 percent, down from 20 percent, and commits Taiwanese companies to $250 billion in direct US investment.

For TSMC specifically, this unlocked acceleration of Arizona fab expansion. The company is building multiple manufacturing plants in Phoenix to serve US-based customers and reduce supply chain vulnerability. The trade agreement reduces uncertainty around these investments.

The geopolitical context matters enormously. Taiwan sits at the center of US-China tech competition. TSMC manufactures chips for American companies but operates from Taiwan. The US government has made clear that it wants advanced semiconductor manufacturing diversified away from Taiwan as a single point of failure.

TSMC's Arizona expansion serves multiple purposes:

- Reduces supply chain risk: If something happens to Taiwan (military tensions, natural disaster), the US still has advanced chip manufacturing

- Satisfies US policy goals: The CHIPS Act explicitly funds domestic semiconductor manufacturing

- Opens US government contracts: Some defense and government applications require domestically produced chips

- Improves customer confidence: Companies like Apple and Intel see diversification as risk reduction

When Wei announced accelerating the Arizona expansion alongside the record earnings, it sent a signal to investors: we're so confident in demand that we're making $10+ billion bets on new geographies.

The trade agreement is also notable because it locks in favorable tariff treatment for Taiwanese tech exports. This reduces the cost of TSMC's global expansion and makes the capex investments more economically attractive.

Why Previous Bubble Predictions Missed the Mark

Starting in late 2025, prominent tech leaders and observers began questioning whether the AI industry was experiencing unsustainable hype. The skepticism was articulated by people with credibility:

Sundar Pichai, Google CEO: "There's a lot of irrationality in the market around AI." Pichai noted that no company would be immune if a bubble burst.

Sam Altman, Open AI: "Investors are overexcited" about AI, Altman said, and "someone" will lose a "phenomenal amount of money."

Venture capitalists: Some prominent VCs began questioning whether AI companies could justify their valuations if capital spending on AI infrastructure kept accelerating without proportional revenue growth.

The skepticism centered on a specific concern: companies were spending billions on AI infrastructure before proven business models existed to justify the spend. If cloud providers couldn't monetize AI services fast enough, capex spending would eventually stop. Stranded fabs would follow.

TSMC's earnings call directly addressed this fear. Wei's confidence wasn't based on market sentiment or investor enthusiasm. It was based on the fact that cloud providers are already monetizing AI. They're already seeing returns on their infrastructure investments. They're already coming back asking for more capacity.

That's qualitatively different from previous bubbles. In the 2000s internet bubble, companies invested in bandwidth infrastructure before customers actually existed to use it. In the 2010s VC bubble, startups raised billions based on growth metrics that never translated to profitability.

In the current AI cycle, infrastructure spending is following actual demand from paying customers. Cloud providers wouldn't keep ordering chips if they weren't seeing revenue.

The Semiconductor Supply Chain and Single-Point-of-Failure Risk

TSMC's dominance in advanced chip manufacturing creates a unique supply chain vulnerability. The company produces roughly 54 percent of the world's semiconductor foundry revenue. That concentration is historically unprecedented for a critical industrial input.

This creates several dynamics relevant to the AI infrastructure buildout:

Capacity constraints drive pricing power: When TSMC is the only source of 3nm and 2nm chips, and demand exceeds supply, TSMC can charge premium prices. Customers have no alternatives. This is good for TSMC's profitability but creates risk for customers.

Geopolitical risk is real: TSMC operates entirely from Taiwan. If cross-strait tensions escalate or military conflict occurs, global chip supply vanishes. This isn't paranoia—it's why the US, EU, and other regions are funding domestic manufacturing.

Expansion takes years: Even with $50+ billion annual spending, TSMC needs 3-5 years to bring new fabs online and ramp production. Demand can shift faster than manufacturing capacity can adjust.

Competition is slowly emerging: Samsung and Intel are building advanced fabs, but they're years behind TSMC in process technology. Intel's foundry ambitions haven't shipped commercial volumes yet. Samsung's 3nm production is ramping slowly.

For AI infrastructure, these dynamics mean:

- Companies building data centers are betting their architecture will work with TSMC's roadmap

- If TSMC faces unexpected challenges, entire data center deployments could be delayed

- Chip pricing will remain elevated until competitors catch up to TSMC's technology

- Supply allocation becomes a negotiation between TSMC and its largest customers

Wei's confidence in sustained demand is partly confidence in TSMC's ability to serve that demand. If the company couldn't expand fast enough, demand would get rationed and growth would slow. The capex increase and revenue forecast implicitly assume TSMC can build enough fabs to serve all customers who want chips.

TSMC's capital expenditure is projected to increase by 27-37% from 2025 to 2026, reaching $52-56 billion, significantly outpacing Intel's typical annual capex.

The Math of Semiconductor Manufacturing and ROI

Understanding why TSMC is committing so aggressively to capex requires understanding the economics of fab operations.

A modern semiconductor fab costs $15-20 billion to build. It employs 3,000-5,000 people. It requires 2-3 years to construct and another 1-2 years to ramp production. Once running, a fab generates:

- Revenue: $3-5 billion annually (depending on utilization and mix)

- Gross margin: 50-60% (in TSMC's case, higher due to advanced processes)

- Operating expenses: $400-600 million annually

- Payback period: 4-6 years

The math works only if fabs run at high utilization rates for sustained periods. If demand drops suddenly, fabs become stranded assets generating negative returns.

TSMC's willingness to spend $52-56 billion in 2026 is a bet that it can build 3-4 new fabs and still run them above 80 percent utilization within 2-3 years. That requires confidence in sustained demand.

Let's model the downside risk:

If TSMC builds 3 new fabs at

- Optimistic case: 85% utilization, generating 6.6 billion gross profit, 25% ROI

- Base case: 75% utilization, generating 5.5 billion gross profit, 18% ROI

- Pessimistic case: 60% utilization, generating 4.2 billion gross profit, 10% ROI

The base case requires sustained demand from multiple customers. The pessimistic case still generates acceptable returns but represents significant underutilization. The optimistic case is what TSMC is projecting.

Wei's confidence is essentially a bet that even in the base case scenario, the ROI justifies the spending.

Growth Drivers Beyond AI: Diversification Matters

While AI demand gets headlines, TSMC's growth in 2026 isn't entirely driven by AI chips. The company serves multiple end markets, and several are expanding simultaneously.

Data center and AI infrastructure (the headline): Nvidia, AMD, Broadcom, and others designing chips for AI inference, training, and networking. This segment is growing 50%+ year-over-year.

Advanced computing: Apple, Qualcomm, and others designing chips for smartphones, PCs, and tablets. These are more mature markets growing 5-10% annually, but the volumes are enormous.

Automotive: Electric vehicles and autonomous driving require vastly more semiconductors than traditional cars. TSMC produces chips for Tesla, NIO, BYD, and other EV makers. This segment is growing 20%+ annually.

Io T and industrial: Smart devices, industrial sensors, and edge computing devices. Lower volumes but stable demand.

Specialty and legacy nodes: 28nm, 40nm, and older nodes still generate significant revenue from mature applications. These are mature and stable.

The diversification matters because it reduces TSMC's dependency on any single market. Even if AI demand moderates, the company still has solid growth from automotive, computing, and specialty applications.

Wei's confidence likely encompasses all of these markets. AI is the growth accelerant, but it's not the entire story.

What This Means for Equipment Vendors, Materials Suppliers, and Customers

When TSMC commits to $50+ billion annual capex, it creates ripple effects across the entire semiconductor ecosystem.

Equipment vendors: ASML, Applied Materials, Lam Research, and others that build lithography, etching, and deposition tools see increased orders. These companies are already at capacity. TSMC's spending accelerates their growth.

Materials suppliers: Specialty chemical companies producing photoresists, gases, and other materials see increased demand. These suppliers are working overtime to support TSMC's expansion.

Construction and logistics: Fab construction requires massive amounts of infrastructure investment. Local Arizona communities benefit from construction spending. Equipment logistics operators handle increased transportation volumes.

Chip customers: Nvidia, AMD, Apple, and others benefit from improved chip availability. However, they also face tighter supply allocation during peak demand periods. TSMC can choose which customers get priority when supply is constrained.

Geopolitics: TSMC's Arizona expansion signals confidence in US-Taiwan relationships. Other countries (EU, Japan, Singapore) are also pursuing domestic chip manufacturing, creating a more distributed global manufacturing landscape.

The capex spending is essentially TSMC's way of signaling to the entire ecosystem: "We believe in sustained demand. Invest accordingly."

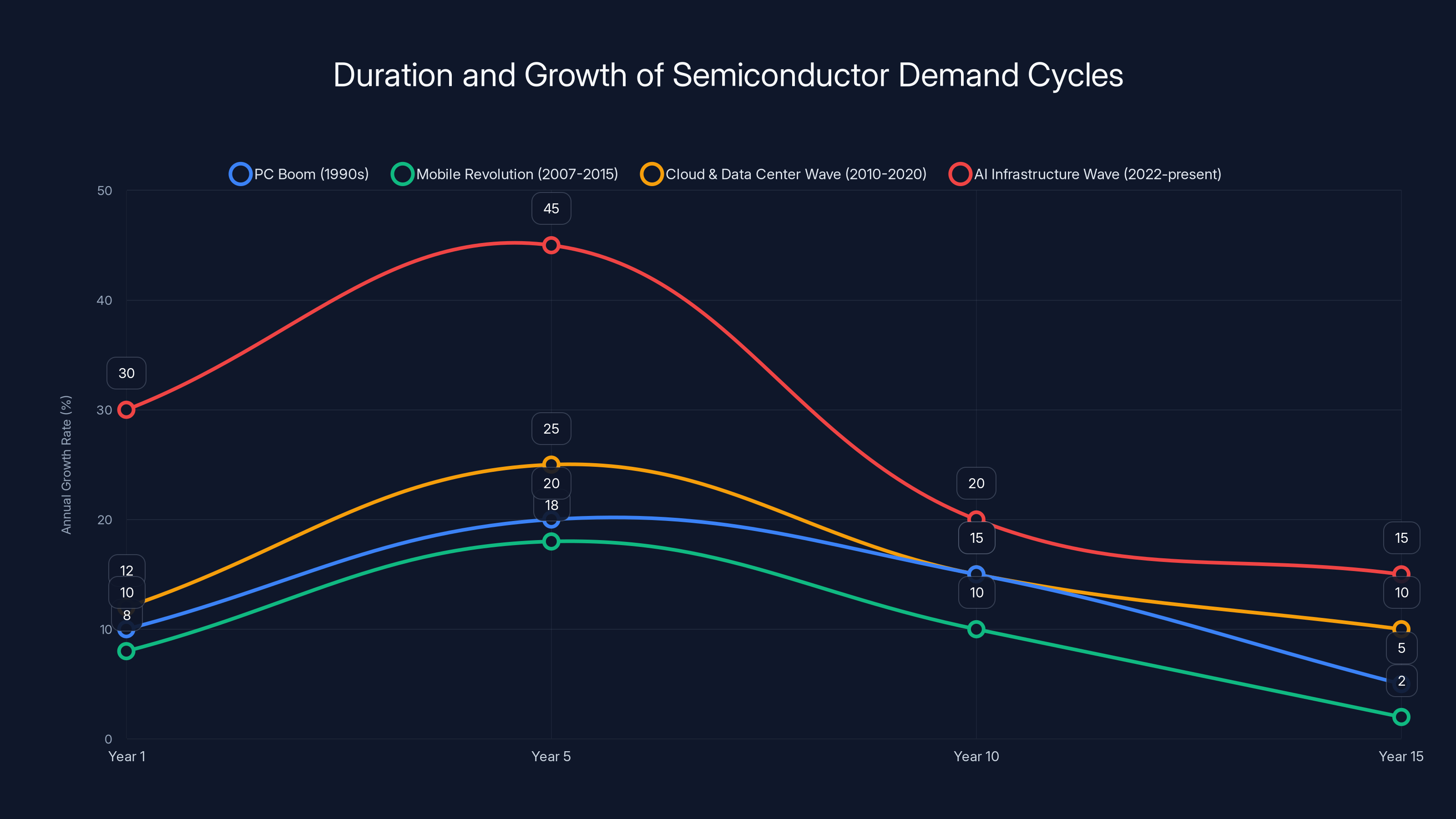

The AI infrastructure wave shows the highest initial growth rate, projected to moderate but sustain over many years. Estimated data based on historical trends.

The Bubble vs. Reality Debate, Settled

This is the moment where the bubble narrative breaks.

Bubbles are defined by a disconnect between investment and fundamental value. Companies invest speculatively. Infrastructure gets built ahead of demand. Prices rise based on expectation, not utility.

AI infrastructure spending doesn't fit that pattern anymore.

Three years ago (2023), it was reasonable to be skeptical. Generative AI was new. Business models were unproven. Spending looked speculative. Companies were investing in AI without clear ROI.

In 2025-2026, the narrative has shifted. Cloud providers are running AI services. They're charging customers for AI capabilities. They're seeing revenue. They're coming back asking for more chips.

That's not speculation. That's infrastructure meeting real demand.

Wei's confidence isn't marketing language. It's backed by:

- Direct customer conversations where cloud providers show evidence of revenue generation

- Multi-year contracts that lock in chip supply at agreed quantities and prices

- Capital planning that assumes sustained demand over 3-5 years

- Company actions (building $50+ billion in new capacity) that bet the entire organization on sustained growth

That combination of evidence is compelling.

What Happens if Demand Moderates: Risk Scenarios

No forecast is certain. Even with TSMC's confidence, several scenarios could moderates demand:

Consolidation of cloud providers: If AWS, Google Cloud, and Azure reach market saturation and stop building new data centers, chip demand drops significantly.

AI model efficiency improvements: If new AI models require fewer compute resources, demand for chips flattens even as AI adoption continues.

Economic slowdown: If a recession hits, corporate IT spending on AI infrastructure gets cut. Companies delay projects.

Competitive pressure: If new AI chip designers (custom chips from Amazon Trainium, Google TPU) capture significant market share, TSMC's AI revenue might grow slower than expected.

Regulatory restrictions: If governments restrict AI compute for national security reasons, demand gets throttled.

Geopolitical escalation: If US-China tensions worsen, TSMC could face export restrictions or operational challenges.

None of these scenarios is likely in the next 12-24 months. TSMC's customers have multi-year commitments. Infrastructure projects are underway. But they're not impossible.

The company's willingness to increase capex to $50+ billion despite these risks suggests management believes the upside significantly outweighs the downside.

The Comparison to Previous Semiconductor Cycles

TSMC has lived through multiple semiconductor demand cycles. Each one teaches lessons about what drives sustained growth versus cyclical booms.

The PC boom (1990s): Computers became consumer products. Demand for processors, memory, and chipsets exploded. Manufacturers built aggressively. The boom lasted 10+ years because new use cases kept emerging. Downside: the market eventually saturated. Growth moderated.

The mobile revolution (2007-2015): Smartphones created demand for processors, memory, and specialty chips. Every company wanted high-end phones. Manufacturers expanded capacity. The boom lasted 8+ years. Downside: market maturity and competition eventually slowed growth.

The cloud and data center wave (2010-2020): Cloud computing required massive server infrastructure. Hyperscalers (AWS, Google, Microsoft, Facebook) built data centers at unprecedented scale. This drove demand for processors, memory, storage, and networking chips. The boom lasted 10+ years and is still ongoing. Growth has moderated to 10-15% annually because the market is mature, but it's stable.

The AI infrastructure wave (2022-present): Generative AI and large language models require unprecedented compute. Cloud providers are building specialized infrastructure for AI workloads. This is driving demand for GPUs, custom processors, and networking chips. Growth is 30-50% annually.

The question is: how long does the AI wave last? Wei's answer is "many years to come," and he has visibility the rest of us lack.

Historically, new technology waves last 10-15 years from initial adoption to market maturity. The PC boom lasted 15+ years. The mobile revolution lasted 10+ years. The cloud data center wave is in year 15 and still growing.

The AI infrastructure wave is in year 2-3. Even if growth moderates from 30%+ annually to 15-20% annually, the cycle has many years to run.

Wei's "endless" comment likely means 5-10 years of sustained demand, not literally infinite growth. That's the pattern TSMC has observed in previous cycles.

TSMC's Q4 2023 revenue reached

Investment Implications: What Investors Should Watch

TSMC's earnings call and forward guidance create several monitoring points for investors:

Key metrics to track:

- Quarterly revenue and gross margin: These numbers indicate whether TSMC's capacity additions are generating expected returns

- Capex spending actual vs. guided: If TSMC spends less than guided, it signals demand weakness

- Customer concentration: If a single customer (Nvidia, Apple, etc.) drops below normal levels, it signals demand pressure

- Wafer starts and utilization: These production metrics are early indicators of demand trends

- Advanced node revenue mix: Growing share of 3nm/2nm revenue indicates sustained AI chip demand

Watch for inflection points:

- When capex growth drops below 15% year-over-year

- When gross margin starts declining despite stable pricing

- When management guidance becomes cautious about multi-year demand

- When customer commentary shifts from "supply is constrained" to "we'll wait for prices to drop"

Red flags that would suggest demand moderation:

- Delayed fab completion timelines

- Reduced wafer starts

- Rising inventory at customers

- Management commentary about "market normalization"

- Capex guidance reversals

Investors should track these metrics quarterly to assess whether TSMC's confidence remains justified.

The Broader AI Ecosystem Implications

TSMC's bullish outlook has implications for the entire AI industry:

Chip designers (Nvidia, AMD, Broadcom, etc.) can confidently design new architectures knowing TSMC has committed to manufacturing capacity. This accelerates innovation cycles.

Cloud providers can plan data center expansion knowing they'll have reliable access to chips. This enables more aggressive customer acquisition and infrastructure investment.

AI software companies can build applications and services knowing the underlying compute infrastructure is expanding. This enables more ambitious projects.

Edge AI companies benefit from improved chip availability at lower price points as commodity AI chips mature.

Startups and smaller companies face the challenge of competing for limited high-end chip allocation. TSMC and its customers (Nvidia, etc.) will prioritize large hyperscalers.

The ecosystem effect is self-reinforcing: more capacity enables more applications, which drives more demand, which justifies more capacity.

Regional Manufacturing and Geopolitical Decentralization

TSMC's Arizona expansion is part of a larger trend: decentralizing advanced semiconductor manufacturing away from Taiwan.

The geopolitical context:

- US policy: The CHIPS Act provides subsidies for domestic manufacturing

- EU policy: The EU Chips Act funds manufacturing in Europe

- Japan: The government supports Sony and other fabs

- China: Building capacity despite export controls

TSMC's Arizona facilities serve multiple purposes:

- Risk reduction: Diversify away from Taiwan single-point-of-failure

- Customer satisfaction: Companies like Apple and Intel prefer geographically diverse supply

- Government relations: Building in the US improves political relationships

- Cost optimization: Arizona has favorable electricity rates and tax incentives

The long-term implication is that advanced semiconductor manufacturing will become more geographically distributed. TSMC will maintain leadership, but competitors will slowly catch up.

For AI infrastructure, this means supply chain risk moderates over time, which reduces future pricing power but increases stability.

Addressing the Counterargument: Why Skeptics Still Doubt

For all of TSMC's confidence, smart people still question whether the AI buildout will sustain as long as Wei predicts. Their skepticism is worth taking seriously:

AI model efficiency is improving fast: Each generation of AI models (GPT-3 to GPT-4 to GPT-5) requires more parameters but can be served more efficiently. If efficiency improves faster than usage grows, total compute demand could plateau.

Market consolidation is real: AWS, Google Cloud, and Azure collectively control ~65% of cloud market. If they reach saturation, chip demand moderates significantly.

Regulatory risk is underestimated: If governments restrict AI compute capacity for safety/security reasons, demand drops.

Alternative compute architectures: Quantum computing, optical computing, or other non-traditional architectures could disrupt chip demand.

Recession risk: Economic slowdown would reduce corporate IT spending on AI projects.

These are legitimate concerns. They don't invalidate TSMC's confidence, but they highlight that no forecast is certain.

Wei's approach to addressing this was direct: "can the semiconductor industry be good for 3, 4, 5 years in a row? I'll tell you the truth, I don't know. But I look at the AI, it looks like...that for many years to come."

That's honest uncertainty paired with observed evidence. It's not a guarantee. It's a bet.

The Bottom Line: Demand Appears Real, But Verification Matters

TSMC's record earnings and bullish guidance are significant because they come from a company with unique visibility into AI infrastructure demand. The CEO's direct conversations with cloud providers provide concrete evidence that demand is real, not speculative.

The $50+ billion capex commitment and 30% revenue growth forecast represent bets that multi-year demand will sustain. These aren't margin-of-safety bets. They're aggressive commitments that assume continued growth.

Wei's use of the word "endless" is likely hyperbole, but the underlying message is clear: this isn't a 2-year cycle. It's a multi-year infrastructure buildout that will drive semiconductor demand for the foreseeable future.

For investors, customers, and industry observers, TSMC's confidence provides reassurance that the AI infrastructure boom isn't entirely speculative. Real companies are making real investments and seeing real returns. That's the difference between a bubble and a legitimate technology wave.

The remaining question isn't whether demand is real. It's whether it lasts as long as TSMC believes. That answer will emerge over 3-5 years as the company's fab expansion pays off and customer demand either continues accelerating or moderates.

For now, TSMC is betting its entire company on the belief that it will continue. That's confidence worth taking seriously.

FAQ

What does TSMC's Q4 earnings report tell us about AI demand?

TSMC reported record Q4 earnings with

How confident is TSMC about sustained AI demand?

Wei expressed confidence that AI demand will continue "for many years to come," and the company is backing this confidence with a planned capex increase from

What is TSMC's revenue growth forecast for 2026?

TSMC expects nearly 30% revenue growth in 2026, driven primarily by AI infrastructure demand from cloud providers building data centers. This growth rate is significant for a company of TSMC's scale and reflects the accelerated capex spending on manufacturing capacity.

Why does TSMC's verification of demand matter more than analyst forecasts?

TSMC sits at the intersection of chip supply and customer demand. The company manufactures chips for Nvidia, AMD, Apple, Qualcomm, and other major chip designers, and it negotiates directly with the largest cloud providers (AWS, Google Cloud, Microsoft Azure). Wei's direct conversations with cloud providers provide concrete evidence that AI workloads are generating revenue, not just consuming capital speculatively.

What are the risks to TSMC's bullish outlook?

Potential risks include: AI model efficiency improvements reducing compute demands, cloud provider market saturation slowing new data center construction, economic recession reducing corporate IT spending, regulatory restrictions on AI compute, or geopolitical escalation affecting Taiwan. However, TSMC believes these risks are outweighed by sustained multi-year demand.

How does TSMC's confidence address the AI bubble narrative?

Wei's confidence directly addresses bubble concerns by emphasizing that demand is tied to real business value. Cloud providers aren't speculating—they're showing evidence that AI services generate revenue. This is qualitatively different from previous tech bubbles where infrastructure investment preceded proven business models.

What does the US-Taiwan trade agreement mean for TSMC?

The trade agreement cuts tariffs on Taiwanese goods and commits Taiwan to $250 billion in US investment. For TSMC specifically, it enables acceleration of Arizona fab expansion without tariff uncertainty, reducing investment risk and strengthening the company's US presence for both customer service and geopolitical diversification.

How long could AI infrastructure demand sustain?

Based on historical technology cycles, major infrastructure waves typically last 10-15 years from initial adoption to market maturity. The AI infrastructure wave is in years 2-3. Even accounting for eventual moderation, the cycle likely has 5-10 years of significant growth remaining before reaching maturity.

What should investors monitor to verify TSMC's demand assumptions?

Investors should track: quarterly revenue and gross margin trends, actual capex spending versus guidance, customer concentration metrics, wafer starts and utilization rates, and management commentary. Key inflection points include capex growth dropping below 15% Yo Y or management guidance becoming cautious about multi-year demand sustainability.

How does TSMC's capex compare to historical levels?

TSMC's planned

Conclusion

When the world's most important chipmaker says demand looks "endless," and backs that statement with $50+ billion in capital spending, the AI infrastructure narrative shifts from speculation to infrastructure reality.

TSMC's Q4 earnings report did more than deliver strong financial results. It provided clarity on a question that has haunted the AI industry: Is this a bubble, or is this real?

Wei's answer, delivered through direct conversations with cloud providers and backed by aggressive capex commitments, suggests the latter. Cloud providers aren't speculating about AI infrastructure. They're building it. They're selling services on top of it. They're seeing returns. They're coming back asking for more chips.

That's the signature pattern of a real infrastructure cycle, not a bubble. The PC revolution, the mobile revolution, and the cloud computing revolution all followed this exact trajectory: initial skepticism, followed by proof of concept, followed by massive capital investment to scale.

The AI infrastructure cycle is now in the scaling phase. TSMC's confidence suggests it will remain there for years to come.

For investors, employees, entrepreneurs, and technologists, this clarity matters. You can now make decisions based on the assumption that AI infrastructure is a real, multi-year buildout, not a temporary speculative bubble. That changes which startups are fundable, which companies are worth joining, and which technologies are worth learning.

It also explains why TSMC is betting its entire company on sustained demand. The company has lived through multiple technology cycles. Its management team knows the difference between hype and infrastructure buildout. When Wei says the demand looks endless, he's likely extrapolating from what he's observed in previous cycles and what he's seeing directly from customers today.

The bet might not work out perfectly. Demand could moderate faster than TSMC expects. Some of the company's new fabs could underutilize. But the foundational case—that AI infrastructure is real and will sustain for years—appears increasingly solid.

TSMC's confidence gives permission for the rest of the industry to invest aggressively. And when the company that manufactures the chips for the entire AI ecosystem expresses that confidence explicitly, it's news worth taking seriously.

Key Takeaways

- TSMC reported record Q4 earnings with 33.7 billion revenue (25.5% growth), signaling sustained AI chip demand

- CEO C.C. Wei verified demand is real by speaking directly with major cloud providers who demonstrated AI services are generating revenue, not just consuming capital

- Company plans to spend 40.9 billion in 2025, representing confidence in 3-5 year visibility into customer demand

- Expected 30% revenue growth in 2026 is driven by AI infrastructure demand, but diversified revenue from computing, automotive, and IoT provides stability

- TSMC's confidence directly addresses AI bubble concerns by showing demand is tied to proven business value from cloud providers, not speculation

Related Articles

- Taiwan's $250B US Semiconductor Deal Reshapes Global Supply Chains [2025]

- Meta Compute: The AI Infrastructure Strategy Reshaping Gigawatt-Scale Operations [2025]

- AI's Real Bottleneck: Why Storage, Not GPUs, Limits AI Models [2025]

- Why Retrieval Quality Beats Model Size in Enterprise AI [2025]

- Micron's AI Memory Pivot: What It Means for Consumers and PC Builders [2025]

- Taiwan's $250B US Semiconductor Investment: What It Means [2026]

![TSMC's AI Chip Demand 'Endless': What Record Earnings Mean for Tech [2025]](https://tryrunable.com/blog/tsmc-s-ai-chip-demand-endless-what-record-earnings-mean-for-/image-1-1768583248607.jpg)